Online Posted Pricing with Unknown Time-Discounted Valuations

Abstract

We study the problem of designing posted-price mechanisms in order to sell a single unit of a single item within a finite period of time. Motivated by real-world problems, such as, e.g., long-term rental of rooms and apartments, we assume that customers arrive online according to a Poisson process, and their valuations are drawn from an unknown distribution and discounted over time. We evaluate our mechanisms in terms of competitive ratio, measuring the worst-case ratio between their revenue and that of an optimal mechanism that knows the distribution of valuations. First, we focus on the identical valuation setting, where all the customers value the item for the same amount. In this setting, we provide a mechanism that achieves the best possible competitive ratio, discussing its dependency on the parameters in the case of linear discount. Then, we switch to the random valuation setting. We show that, if we restrict the attention to distributions of valuations with a monotone hazard rate, then the competitive ratio of is lower bounded by a strictly positive constant that does not depend on the distribution. Moreover, we provide another mechanism, called , which is defined by a piecewise constant pricing strategy and reaches performances comparable to those obtained with . This mechanism is useful when the seller cannot change the posted price too often. Finally, we empirically evaluate the performances of our mechanisms in a number of experimental settings.

Introduction

Posted-price mechanisms try to sell an item by proposing a take-it-or-leave-it price to each arriving agent, who then decides whether to buy the item or not (Chawla et al. 2010). If an agent opts for purchasing the item, then the mechanism terminates; otherwise, the agent leaves without any further possibility of buying the item, and the mechanism goes on by proposing prices to upcoming agents. Over the last years, growing attention has been devoted to the analysis of posted-price mechanisms, both in the classical economic literature (Seifert 2006) and in computer science (Babaioff et al. 2015, 2017; Adamczyk et al. 2017; Correa et al. 2017), within artificial intelligence and machine learning in particular (Kleinberg and Leighton 2003; Shah, Johari, and Blanchet 2019). This is mainly motivated by the overwhelming number of online economic transactions carried out by posted-price mechanisms. This happens, for example, in online travel agencies (e.g., Expedia), accommodation websites (e.g., Booking.com), and e-commerce platforms (e.g., Amazon, eBay). As studied by Einav et al. (2018), an increasing number of eBay users prefer buying goods via posted prices rather than participating in auctions.

Posted-price mechanisms provide many advantages over traditional auction-style mechanisms. From the designer’s perspective, posting prices requires a much lower effort than running an auction, since it avoids the burden of first eliciting information (the bids) from the agents, and then collecting the payments. At the same time, posted-price mechanisms retain most of the desirable properties of classical auctions, such as truthfulness. Indeed, even though the agents are not required to report their valuations for the item, they are always better off deciding whether to buy the item or not on the basis of their true valuations, without acting strategically (Babaioff et al. 2017). From the agents’ perspective, participating in a posted-price mechanism is preferable over competing in an auction, for several reasons. For instance, agents may prefer revealing minimal information about their true preferences if they plan to participate in similar markets in the future. Moreover, in some real-world settings, requiring the agents to figure out their true valuations for the item might need some additional efforts on their behalf, while answering a take-it-or-leave-it offer is usually much easier.

In this work, we study posted-price mechanisms for selling a single unit of a single item within a finite period of time, when the value of the item is discounted over time according to an arbitrary continuous and non-increasing discount function. Discounting is common in many real-world applications and widely studied for a number of economic situations, such, e.g., bargaining (Rubinstein 1982; Gatti, Di Giunta, and Marino 2008) and auctions (Mao et al. 2018). We tackle settings in which agents arrive sequentially—a common assumptions in online mechanism design (Lavi and Nisan 2004; Parkes 2007)—and the number of agents is unknown a priori. In particular, following a mainstream approach in economics (see, e.g., (Mason and Välimäki 2011; Rosenthal 2011)), we assume that agents’ arrivals are governed by a Poisson process. Remarkably, posted pricing with Poisson arrivals has been previously investigated by Wang (1993) and Rong, Qin, and An (2018) for undiscounted settings, though without providing any theoretical result.

We assume that each agent arriving at the mechanism has a different initial (i.e., undiscounted) valuation for the item, which is independently drawn according to a common probability distribution. This leads to a fundamental trade-off between setting high prices so as to achieve high revenue and, on the other side, progressively lowering posted prices so as to increase the probability of selling the item. Our assumption is that the mechanism is only aware of the range of valuations, while it does not know anything about the shape of the distribution. This is reasonable since, differently from the actual distribution, the range of valuations can be estimated from previous data or market surveys.

Lavi and Nisan (2004) and Babaioff et al. (2017) provide the main state-of-the-art results on posted-price mechanisms for single-item single-unit scenarios. However, their models do not fit to our setting, since the agents’ valuations are not discounted over time and the number of agents is known a priori. As a result, these models do not embed an explicit time representation and the proposed pricing strategies are only driven by the number of agents arrived.

Our model encompasses many real-world scenarios, such as, e.g., long-term rental of rooms and apartments. Think of a website renting rooms to students for fixed periods of one year. The value of a room naturally decreases over time, reflecting the fact that a future tenant will benefit from the room for a period shorter than one year. Moreover, the potential customers arrive at the renting website according to a stochastic process, which can be reasonably modeled by a Poisson process whose rate parameter can be easily estimated by looking at traffic logs of the website.

Original Contributions

We adopt the perspective of competitive analysis (Borodin and El-Yaniv 2005) and evaluate our mechanisms in terms of competitive ratio, measuring the worst-case ratio between their revenue and that of an optimal mechanism that knows the distribution of valuations. As it is customary in the literature (see, e.g., (Babaioff et al. 2017; Kleinberg and Leighton 2003)), we first focus on the identical valuation setting in which all the agents share the same initial valuation for the item. Then, we extend our results to the random valuation setting where the agents’ valuations are drawn i.i.d. from the same distribution satisfying the monotone hazard rate condition (when the distributions of valuations are unrestricted, Lavi and Nisan (2004) and Babaioff et al. (2017) show that then there is no algorithm with good performances). In the identical valuation setting, we design a posted-price mechanism and prove that it is optimal, i.e., it provides the best possible competitive ratio. In order to derive the ratio, we first identify two crucial properties that characterize optimal mechanisms: their undiscounted price is non-increasing in time and they always guarantee the same fraction of the expected revenue of an optimal mechanism that knows the agents’ valuation, independently of its actual value. For the specific case of linear discount, we discuss how the competitive ratio depends on the parameters. In the random valuation setting, we first show that mechanism still provides good performances by proving that its competitive ratio is lower bounded by a constant, which does not depend on the distribution of agents’ valuations. Then, motivated by real-world scenarios in which the seller is constrained not to change the posted prices too often, we propose a new mechanism defined by a piecewise constant pricing strategy and prove that its performances in terms of competitive ratio are comparable with those obtained by . In conclusion, we empirically compare with a natural adaption of the mechanism proposed by Babaioff et al. (2017) to our setting, showing that the latter is inefficient even without time discounting. We also empirically evaluate the performances of and as the frequency with which prices are allowed to change decreases, showing that, when this is not too low, then the performances of and are comparable.

Other Related Works

As showed by Hajiaghayi, Kleinberg, and Sandholm (2007) for single-item settings, posted pricing is strictly related to the secretary problem and to prophet inequalities; see also the work by Babaioff et al. (2009) for single-item settings and that of Lucier (2017) for multi-item scenarios. Differently from our model, these works assume that the mechanism knows the probability distribution of agents’ valuations and that the agents reveal their actual valuation for the item upon arrival. When multiple units of the same item are available, learning approaches based on bandit techniques are customarily adopted. In particular, Kleinberg and Leighton (2003) study an unlimited-supply setting where the number of buyers is fixed, and derive upper bounds on the regret. Several recent works extend the results in (Kleinberg and Leighton 2003). Shah, Johari, and Blanchet (2019) study a contextual setting, providing a semi-parametric model that learns from the observation of a binary outcome which stands for acceptance or rejection of the offered price. Mohri and Munoz (2014) study revenue-maximizing learning algorithms for posted pricing with strategic buyers. They consider a repeated game in which, at each round, the seller offers the item at a certain price and a strategic buyer accepts or rejects it. In that work, the goal is to learn the buyers’ valuation for the item by minimizing the strategic-regret of the algorithm.

Preliminaries

We study a model in which a seller is interested in selling a single unit of an item within a finite time period of length . The seller implements a posted-price mechanism by setting a take-it-or-leave-it price at each time . We denote by the pricing strategy adopted by the seller, with being the price offered at time . The agents (i.e., the buyers) arrive sequentially over time, according to a Poisson process with rate parameter .

We label agents according to their order of arrival (i.e., agent is the -th agent arriving in ). Each agent has a private valuation for the item, drawn from a distribution with finite support , where denote the maximum and minimum valuation, respectively. In the following, for the ease of presentation, we normalize agents’ valuations in the range , where we define . Accordingly, we scale the support of to . Then, we denote by the probability density function of .

The value of the item for sale decreases over time. In particular, is agent ’s initial valuation at time . We model decreasing values by introducing a continuous non-increasing discount function such that and . By letting be the random variable representing the arrival time of agent , we define the agent ’s discounted valuation as , which represents how much agent is willing to pay upon her arrival. As a result, whenever agent arrives, she buys the item if and only if , i.e., her discounted valuation is at least as large as the price offered by the mechanism.

We introduce the following additional notation. We denote by the time interval of length starting from time . The number of agents arriving in is a random variable denoted by . Given , the random variables are equally distributed for all , as the arrivals are generated by a Poisson process. For the sake of presentation, we omit in , denoting by the random variable of the number of agents arriving in any time interval of length , which follows a Poisson distribution with parameter . 111By definition of Poisson distribution, . Thus, is the random variable of the total number of agents arriving in the overall time period. In the following, we sometimes focus on the linear discount function, denoted as with . In this case, each agent ’s discounted valuation is .

Performances of Posted-Price Mechanisms

Given a deterministic posted-price mechanism defined by a price function , we denote by the expected revenue that the mechanism provides to the seller. The expectation is calculated with respect to both the Poisson arrivals and the distribution of agents’ initial valuations. We made explicit the dependence on , as we will frequently refer to it along the paper.

We adopt the perspective of competitive analysis and measure the performances of a mechanism by comparing the seller’s expected revenue with that of a benchmark mechanism , which is optimal having knowledge of the distribution . Notice that the benchmark has no information on the actual realizations of agents’ initial valuations, but only on their distribution, whereas the mechanisms we propose operate having knowledge of their range only.

Our goal is to bound the performances of our mechanisms w.r.t. those of the benchmark by looking at the worst case over the set of possible distributions , i.e., all those with support . This is captured by the following:

Definition 1.

The competitive ratio of a deterministic posted-price mechanism is defined as:

Moreover, we say that a mechanism is optimal when its competitive ratio is the highest possible among all the deterministic posted-price mechanisms.

Notice that and, for every possible distribution , we are guaranteed that the seller’s expected revenue provided by mechanisms is at least a fraction of that achieved by , i.e., it holds .

As previously showed by Babaioff et al. (2017) in similar settings, we can safely restrict our analysis to mechanisms maintaining the bottom price for a non-negligible period of time. Indeed, in the case in which places all the probability mass on , then any mechanism providing a non-null seller’s expected revenue must set the minimum price during some time interval, otherwise no agent would buy the item.

Proposition 1.

Every deterministic posted-price mechanism such that must set the minimum price for every in a time interval of length .

Identical Valuation Setting

We start studying the identical valuation (IV) setting, where all the agents share the same initial valuation for the item, i.e., it holds and for every agent . The IV setting is a special case of the general random valuation model where one restricts the attention to distributions placing all the probability mass on a single valuation in . In the following, we adjust notation for expected revenues and competitive ratios accordingly, writing and instead of and .

Our main result (Theorem 1) is to provide a deterministic posted-price mechanism, called , which is optimal for the IV setting for every discount function . We also study the specific case of a linear discount function , where we design an optimal mechanism (Theorem 2) that enjoys an easily interpretable analytical description. All the proofs are in the Appendix.

First, we describe the shape of the benchmark mechanism for the IV setting. Indeed, since knows the actual initial valuation , its price function is such that for . Therefore, we can compute the expected revenue of as follows:

| (1) |

where does not depend on , but only on the problem parameters , , and the discount function . Let us remark that the expected revenue of the benchmark defined in Equation (1) is expressed as a linear function of .

Optimal Mechanism for a General Discount

We start proving two lemmas that highlight two crucial properties which characterize optimal posted-price mechanisms for the IV setting. Lemma 1 implies that the pricing strategy of an optimal mechanism must be such that the undiscounted price defined as is non-increasing in , whereas Lemma 2 shows that any mechanism which always provides a constant fraction of the expected revenue of the benchmark, independently of the agents’ initial valuation , is an optimal mechanism.

Lemma 1.

In the IV setting, given any deterministic posted-price mechanism , there always exists a deterministic posted-price mechanism with undiscounted price non-increasing in such that for every possible agents’ initial valuation .

Notice that, since is continuous and non-increasing by definition, Lemma 1 also shows that there is always an optimal mechanism whose pricing strategy is non-increasing. Moreover, by recalling Proposition 1, we can conclude that any optimal mechanism must set the minimum price at the end of the overall time period, i.e., during a time interval defined for some . This result is exploited to prove the following lemma.

Lemma 2.

In the IV setting, let be a deterministic posted-price mechanism whose pricing strategy satisfies for with . If the ratio for does not depend on the agents’ initial valuation , then is an optimal mechanism.

By Lemma 2, in order to find an optimal mechanism for the IV setting, we can restrict the attention to mechanisms whose ratios do not depend on the initial valuation . Therefore, since the expected revenue of the benchmark is a linear function of (see Equation (1)), we can search for an optimal mechanism among those having an expected revenue which linearly depends on . This crucial observation allows us to design the optimal mechanism in Theorem 1 by leveraging the condition for every , with being a suitably defined constant independent of . The key insight that allows us to derive an expression for is that we can always find the desired pricing strategy among the continuous price functions such that is non-increasing in . Intuitively, using Lemma 1, we can always express the expected revenue as a function of the time , which is the first time in which intersects . The reason is that it holds if and only if , and, thus, only agents arriving after are willing to buy the item. By using the relation among and , we can find the desired pricing strategy as a solution to a suitably defined differential equation. This leads to the following theorem.

Theorem 1.

In the IV setting, there exists an optimal deterministic posted-price mechanism whose pricing strategy is defined as follows:

where is a function such that with , whereas , , are suitably defined constants that do not depend on the agents’ initial valuation .

As a byproduct of the proof of Theorem 1, we also get an expression for the competitive ratio of the mechanism , as stated by the following corollary.

Corollary 1.

In the IV setting, mechanism achieves:

Optimal Mechanism for a Linear Discount

The pricing strategy of the optimal mechanism defined in Theorem 1 still depends on some parameters, namely , , and , which do not admit an easy analytical formula for a general discount function . Nevertheless, they can be expressed analytically if we restrict the attention to functions having a particular shape. In the following Theorem 2 and Corollary 2, we analyze the case of a linear discount function , defining an optimal mechanism for such setting.

Theorem 2.

In the IV setting with linear discount function , there exists an optimal deterministic posted-price mechanism whose pricing strategy is defined as:

where and the time is defined as the unique positive real root of the following equation: .

The prices posted by decrease as a linearly discounted exponential function until , starting, at time , by setting the price equal to the maximum agents’ initial valuations . Then, during the time interval , the price function linearly decreases and equals zero in .

Corollary 2.

In the IV setting with linear discount function , achieves a competitive ratio:

| 1 | 1 | 0 |

The asymptotic values of and as go to infinity are in Table 1 (see the Appendix for more details). In particular, goes asymptotically to as or increases. This corresponds to having an infinite number of agents and, thus, selling the item with certainty. Instead, decreases as increases, going asymptotically to as . The range represents the degree of uncertainty that the mechanism has on the agents’ valuation. Therefore, decreases as the uncertainty increases and it cannot be lower bounded by any strictly positive constant if no finite upper bound on is known (i.e., when ). However, the dependency of on the degree of uncertainty is logarithmic. Instead, notice that a trivial mechanism setting the price equal to for would have a competitive ration of , which depends linearly on the degree of uncertainty.

Random Valuation Setting

We now switch to the random valuation (RV) setting, where agents’ initial valuations are i.i.d. random variables defined by a cumulative distribution function with support . We focus on distributions satisfying the monotone hazard rate (MHR) condition. Formally, a distribution is MHR if the hazard rate is non-decreasing in . This assumption is common when studying posted-price mechanisms that operate without knowing the shape of the distribution of valuations (see (Babaioff et al. 2015, 2017)) and many distributions used in practice satisfy it (such as, e.g., uniform, normal, and exponential distributions). Moreover, the MHR condition is necessary for proving our main results (Theorems 3 and 4). Indeed, when the family of possible distributions is unrestricted, one cannot design posted-price mechanisms guaranteeing a constant fraction of the revenue of independently of the distribution , as shown by Babaioff et al. (2017) for the easier setting in which agents do not arrive stochastically. All the proofs are provided in the Appendix.

Auxiliary Definitions and Results

We introduce the random variable as the maximum initial valuation of agents arriving in an interval of length . Formally:

is the first order statistic of samples drawn from and, since agents’ arrivals are governed by a Poisson process, its cumulative distribution function is defined as:

We also define as the random variable representing the maximum discounted valuation of agents arriving in an interval of length starting at :

The cumulative distribution function of is:

where is the cumulative distribution function of conditioned on the event . Let us remark that, by definition, depends on distribution . In the following, we also let be the random variable representing the maximum discounted valuation of agents arriving in the overall time period . In the Supplemental Material, for the specific case of a linear discount function, we show how to exploit some useful properties of Poisson processes so as to find an analytical expression for . In particular, by letting , where and are independent random variables distributed according to and , respectively, we obtain:

where

Bounding in the RV Setting

We show that mechanism (see definition in Theorem 1), which is optimal in the IV setting, provides good performances also in the RV setting. Our main result (Theorem 3) is a lower bound on the competitive ratio of the mechanism, which is obtained by showing that always provides at least a constant fraction of the seller’s expected revenue achieved by the benchmark , independently of the distribution of agents’ initial valuations . 333To prove the lower bound, we follow an approach similar to that used by Babaioff et al. (2017) to bound the competitive ratio of their Equal-Sample-of-Every-Scale mechanism. However, our setting introduces additional challenges, since the agents’ arrivals are stochastic and the valuations are discounted. Thus, our proofs require different techniques w.r.t. those of Babaioff et al. (2017). This is surprising since, differently from , our mechanism works without having knowledge about (except for its range).

We first need some definitions and lemmas.

Definition 2.

Let be any interval of length starting at . Then, the ratio between the prices posted by at the endpoints of is defined as:

Intuitively, bounds the slope of the price function of in the time interval , which depends on both the starting time and the length of the interval. Moreover, notice that since is non-increasing by Lemma 1. Next, we introduce an upper bound on the price ratios of all the time intervals of length , which is useful in deriving our main result.

Definition 3.

The maximum price ratio of over intervals of length is denoted by:

The following lemma establishes a relation between the price function of and the expected value of the random variable representing the maximum initial valuation of agents arriving in the overall time period. This is crucial to prove Theorem 3.

Lemma 3.

In the RV setting with agents’ initial valuations drawn from a distribution , given and , there exists at least an interval of length starting at such that the prices posted by mechanism during the time instants lie in the range .

The following two lemmas are the final pieces that we need to prove Theorem 3. Lemma 4 establishes that, if the distribution is MHR, then the same holds for the distribution of . Lemma 5, given two intervals of length and with , provides a lower bound on the expected value of which depends on the expected value of and the logarithms of the expected number of agents’ arrivals in the two intervals, respectively and .

Lemma 4.

has non-decreasing monotone hazard rate.

Lemma 5.

For every with , it holds:

Theorem 3.

Consider the RV setting with for some and . Then, restricted to the set of distributions satisfying the MHR condition, mechanism has a competitive ratio that can be lower bounded as follows:

The idea of the proof is to use , following from the fact that cannot be larger than , which is the expected revenue achieved by an optimal mechanism that knows the realization of agents’ initial valuations and arrivals. Then, is lower bounded by the revenue that achieves in a suitably defined interval , whose existence is guaranteed by Lemma 3. Moreover, Lemmas 3, 4, and 5, together with the properties of MHR distributions, allow us to write , giving the result as .

A Mechanism with a Piecewise Constant Price

We introduce a new mechanism whose pricing strategy is a piecewise constant function. This turns out to be useful in all the situations in which the seller is constrained not to change the posted price too often, e.g., when the mechanism is required to set prices for time intervals having a given minimum length. Our main result (Theorem 4) is a lower bound on the competitive ratio of in the RV setting, which is comparable to that obtained for in Theorem 3. Thus, we show that, even in presence of constraints on the allowed pricing strategies, we are still able to design mechanisms with good performances in terms of competitive ratio. Clearly, depends on the minimum length requirement, which influences the resulting lower bound. In particular, is tuned by a parameter related to the number of time intervals in which the price must be constant.

Mechanism works by evenly partitioning the time interval into sub-intervals of length , where and are suitably defined parameters. Then, the remaining time is organized in other sub-intervals of length . As a result, is partitioned into sub-intervals, which, overloading notation, we denote by for . Notice that , and, thus, parameters and can be tuned to match the required minimum length . The pricing strategy of is defined in such a way that the price is constant in each interval . By letting be the price posted during , we define the function as follows: 444Whenever is not divisible by , then the last time interval is shorter than . Thus, in order to satisfy the minimum length constraint, we set its price equal to the one in the preceeding interval.

We compare in Figure 1 the prices of and (i.e., with a linear discount) in a specific setting for two values of . Notice that can be thought of as an extension of the Equal-Sample-of-Every-Scale (ESoES) mechanism by Babaioff et al. (2017) to the more general setting in which agents arrive stochastically according to a Poisson process and agents’ valuations are discounted over time.

Before proving our main result, we need the following lemma, which is the analogous of Lemma 3 working for mechanism instead of .

Lemma 6.

In the RV setting with agents’ initial valuations drawn from a distribution , given , there exists such that the price posted by during the interval lies in the range , where .

Now, we provide our main result. The idea behind its proof is similar to the one used for Theorem 3.

Theorem 4.

Consider the RV setting with for some and . Then, restricted to the set of distributions satisfying the MHR condition, mechanism has a competitive ratio that can be lower bounded as follows:

Empirical Evaluation

We evaluate mechanisms , , and a natural adaption of the ESoES mechanism by Babaioff et al. (2017) to stochastic settings with no time discounting (called ESoES-SS). The pricing strategy of ESoES-SS is defined as follows. First, we compute the prices of ESoES by setting the number of agents equal to the expected number of agents arriving in according to a Poisson process of parameter . Then, ESoES-SS proposes the price that ESoES would propose to the -th agent arrived if and otherwise.

We use the following parameters values for the experiments: , and . The following results do not consider time discounting so as to have a fair comparison between our mechanisms and ESoES-SS. Further results with a linear discount function are provided in the Appendix.

Result #1

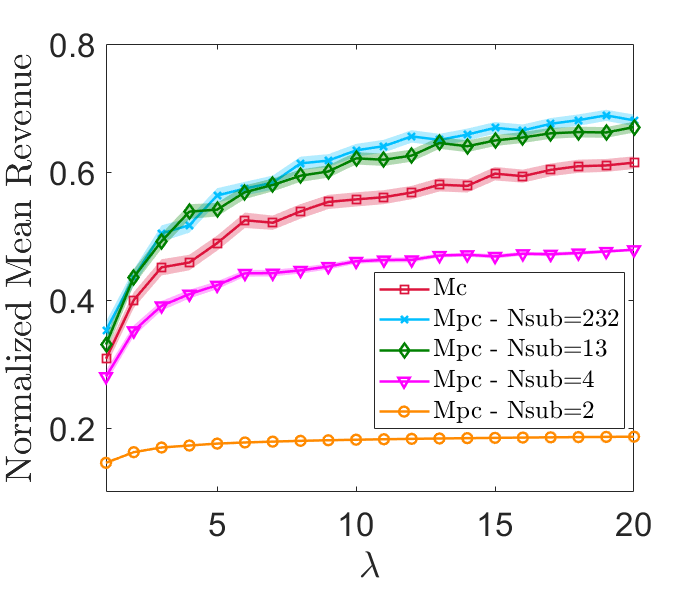

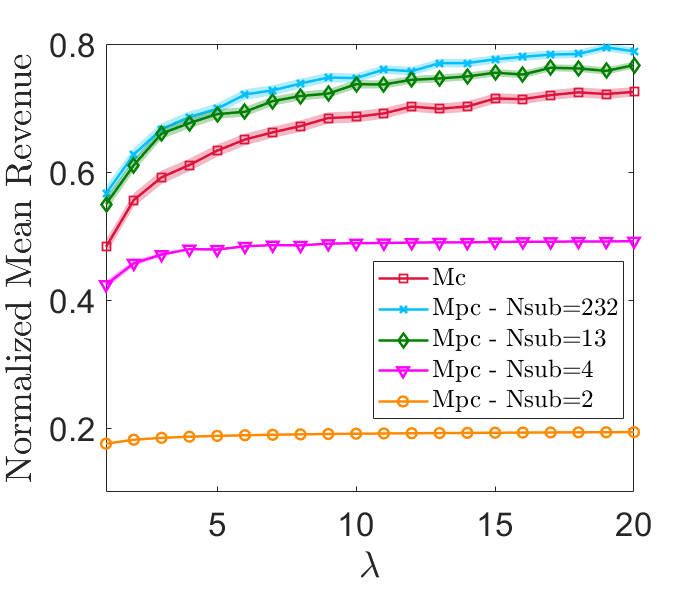

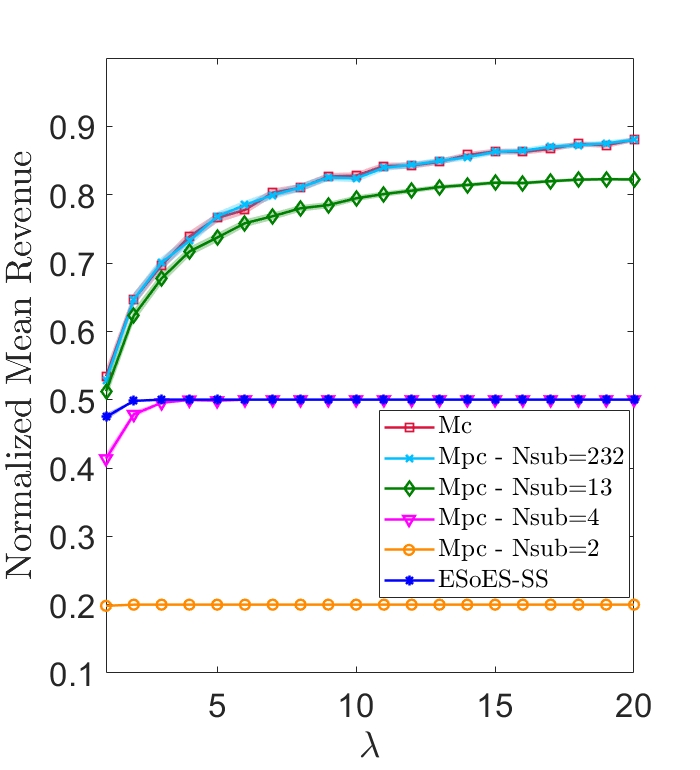

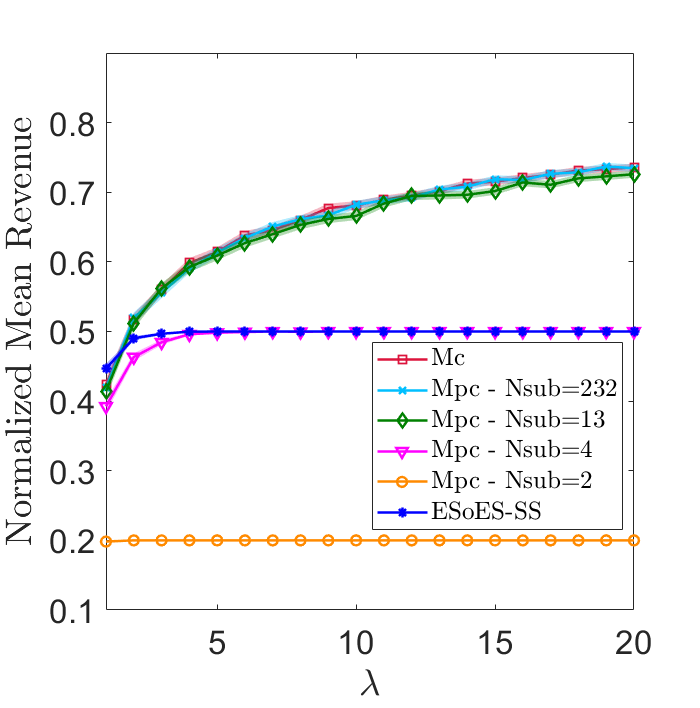

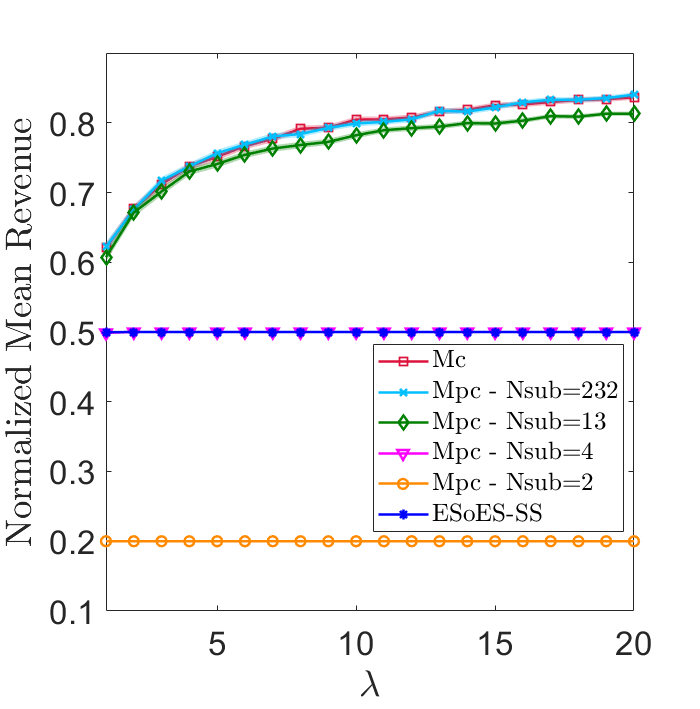

We study a RV setting with a uniform probability distribution over . For every combination of values of , we run Monte Carlo simulations, evaluating the revenue provided by mechanisms ESoES-SS, , and . In particular, we analyze some variants of mechanisms differing for the number of subintervals (i.e., ) in which is partitioned. Furthermore, we normalize the revenue provided by the mechanisms in each simulation with respect to . We report the results in Figure 2 for and , when . The results obtained for different values of are similar. and with have overlapping performances that beat those of the other mechanisms. with has a performance close to that of the previous two mechanisms, showing that mechanism provides good performances even with few subintervals. with and ESoES-SS have almost overlapping performances, showing that very few subintervals are sufficient to to match the performances of ESoES-SS. The worst mechanism is with . The loss of ESoES-SS w.r.t. averaged over the values of is about when , and when . Surprisingly, the performances of ESoES-SS seem to do not strictly depend on and .

Result #2

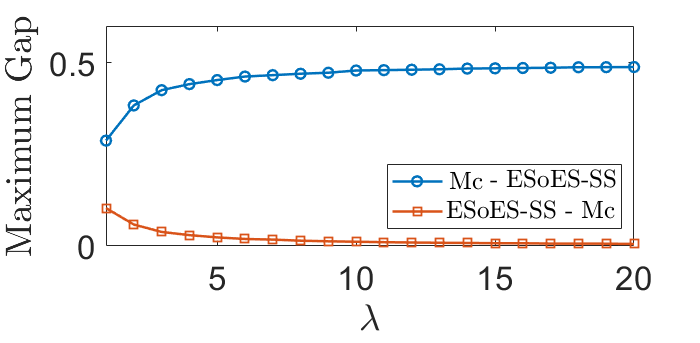

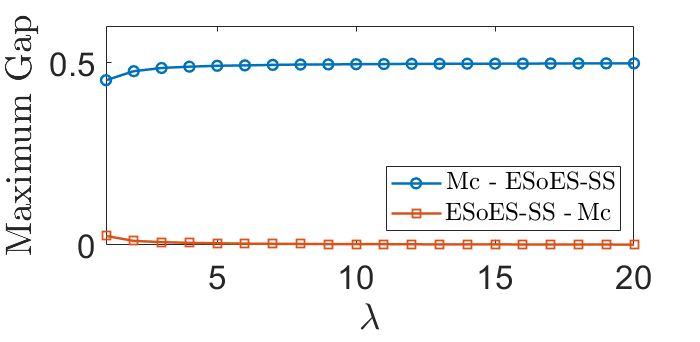

We study an IV setting. For every combination of values of , and for every , we run Monte Carlo simulations, evaluating the normalized revenue provided by mechanisms ESoES-SS and . For every combination of values of , we calculate , corresponding to the maximum normalized loss of ESoES-SS w.r.t. over all valuations , and , corresponding to the maximum normalized loss of w.r.t. ESoES-SS over all valuations . These two indexes are shown in Figure 3 for and , when . The results obtained for different values of are similar. The loss of ESoES-SS w.r.t. is always larger than except when both and assume small values, while the loss of w.r.t. ESoES-SS is negligible. Furthermore, the two losses converge to two constants as and increase. This shows that, even if there are some special settings where ESoES-SS performs better than , the improvement is negligible. Instead, mechanism , which is designed to deal with stochastic arrivals, provides a very significant improvement. In particular, we observe that the difference between the revenue provided by ESoES-SS and that provided by is maximized for small values of close to 1, while between and ESoES-SS for large values of close to .

Conclusion and Future Works

We study distribution-free posted-price mechanisms in order to sell a unique item within a finite time period. In our model, the agents arrive online according to a Poisson process, and their valuations for the item are discounted over time. Following a worst-case competitive analysis, we design a mechanism providing an optimal competitive ratio in the identical valuation setting. Then, as for the random valuation setting, we analyze the performances of and of a new mechanism that is constrained to set constant prices during time intervals having a given minimum length. We prove that both mechanisms achieve a competitive ratio that is constant with respect to the actual valuation when the distribution of the valuations has a monotone hazard rate. This shows that our mechanisms are robust even in non-stationary markets subject to arbitrary distribution changes preserving the same support.

In future, we will investigate hybrid settings in which our robust mechanisms can be combined with machine learning tools. For instance, data could be used to learn a class of distributions, and we could design a mechanism robust with respect to all the distributions of that class.

Ethical Impact

Posted-price mechanisms are widely adopted in real-world economic transactions, thanks to their simplicity: a seller posts prices and buyers arrive sequentially, deciding whether to accept the offer or not. Nowadays, most e-commerce websites implement this form of interaction with their users. Our mechanisms apply to concrete scenarios where the probability distribution of buyers’ valuations is unknown, the value of item for sale may decrease over time, and buyers’ arrivals are stochastic. In these settings, our mechanisms can make economic transactions more efficient and robust, allowing agents (buyers and sellers) to find better economic agreements. As we argued in the paper, our mechanisms provide theoretical guarantees in terms of online worst-case performance. This could have an arguably positive societal impact when applied to real-world economic problems. However, further research in this direction is required to prevent scenarios with an unbalanced reward structure, where agreements may just award one side (buyers or sellers) with the largest utilities at the expense of the others.

References

- Adamczyk et al. (2017) Adamczyk, M.; Borodin, A.; Ferraioli, D.; Keijzer, B. D.; and Leonardi, S. 2017. Sequential posted-price mechanisms with correlated valuations. ACM Transactions on Economics and Computation (TEAC) 5(4): 1–39.

- Babaioff et al. (2017) Babaioff, M.; Blumrosen, L.; Dughmi, S.; and Singer, Y. 2017. Posting prices with unknown distributions. ACM Transactions on Economics and Computation (TEAC) 5(2): 1–20.

- Babaioff et al. (2009) Babaioff, M.; Dinitz, M.; Gupta, A.; Immorlica, N.; and Talwar, K. 2009. Secretary problems: weights and discounts. In Proceedings of the twentieth annual ACM-SIAM symposium on Discrete algorithms, 1245–1254. SIAM.

- Babaioff et al. (2015) Babaioff, M.; Dughmi, S.; Kleinberg, R.; and Slivkins, A. 2015. Dynamic pricing with limited supply. ACM Transactions on Economics and Computation (TEAC) 3(1): 1–26.

- Barlow and Marshall (1964) Barlow, R. E.; and Marshall, A. W. 1964. Bounds for Distributions with Monotone Hazard Rate, II. Annals of Mathematical Statistics 35(3): 1258–1274.

- Borodin and El-Yaniv (2005) Borodin, A.; and El-Yaniv, R. 2005. Online computation and competitive analysis. Cambridge University Press.

- Chawla et al. (2010) Chawla, S.; Hartline, J. D.; Malec, D. L.; and Sivan, B. 2010. Multi-parameter mechanism design and sequential posted pricing. In Proceedings of the forty-second ACM symposium on Theory of computing, 311–320.

- Correa et al. (2017) Correa, J.; Foncea, P.; Hoeksma, R.; Oosterwijk, T.; and Vredeveld, T. 2017. Posted price mechanisms for a random stream of customers. In Proceedings of the 2017 ACM Conference on Economics and Computation, 169–186.

- Einav et al. (2018) Einav, L.; Farronato, C.; Levin, J.; and Sundaresan, N. 2018. Auctions versus posted prices in online markets. Journal of Political Economy 126(1): 178–215.

- Gatti, Di Giunta, and Marino (2008) Gatti, N.; Di Giunta, F.; and Marino, S. 2008. Alternating-offers bargaining with one-sided uncertain deadlines: an efficient algorithm. Artificial Intelligence 172(8-9): 1119–1157.

- Hajiaghayi, Kleinberg, and Sandholm (2007) Hajiaghayi, M. T.; Kleinberg, R.; and Sandholm, T. 2007. Automated online mechanism design and prophet inequalities. In Proceedings of the Twenty-Second AAAI Conference on Artificial Intelligence, 58–65.

- Kleinberg and Leighton (2003) Kleinberg, R.; and Leighton, T. 2003. The value of knowing a demand curve: Bounds on regret for online posted-price auctions. In 44th Annual IEEE Symposium on Foundations of Computer Science, 2003. Proceedings., 594–605. IEEE.

- Lavi and Nisan (2004) Lavi, R.; and Nisan, N. 2004. Competitive analysis of incentive compatible on-line auctions. Theoretical Computer Science 310(1-3): 159–180.

- Lucier (2017) Lucier, B. 2017. An economic view of prophet inequalities. ACM SIGecom Exchanges 16(1): 24–47.

- Mao et al. (2018) Mao, W.; Zheng, Z.; Wu, F.; and Chen, G. 2018. Online Pricing for Revenue Maximization with Unknown Time Discounting Valuations. In Proceedings of the Twenty-Seventh International Joint Conference on Artificial Intelligence, 440–446.

- Mason and Välimäki (2011) Mason, R.; and Välimäki, J. 2011. Learning about the arrival of sales. Journal of Economic Theory 146(4): 1699 – 1711.

- Mitrinovic, Pecaric, and Fink (2013) Mitrinovic, D. S.; Pecaric, J.; and Fink, A. M. 2013. Classical and new inequalities in analysis, volume 61. Springer Science & Business Media.

- Mohri and Munoz (2014) Mohri, M.; and Munoz, A. 2014. Optimal regret minimization in posted-price auctions with strategic buyers. In Advances in Neural Information Processing Systems, 1871–1879.

- Parkes (2007) Parkes, D. C. 2007. Online mechanisms. Cambridge University Press.

- Pinsky and Karlin (2010) Pinsky, M.; and Karlin, S. 2010. An introduction to stochastic modeling. Academic press.

- Rong, Qin, and An (2018) Rong, J.; Qin, T.; and An, B. 2018. Dynamic pricing for reusable resources in competitive market with stochastic demand. In Proceedings of the Thirty-Second AAAI Conference on Artificial Intelligence, 4718–4726.

- Rosenthal (2011) Rosenthal, E. C. 2011. A Pricing Model for Residential Homes with Poisson Arrivals and a Sales Deadline. The Journal of Real Estate Finance and Economics 42(2): 143–161.

- Ross et al. (1996) Ross, S. M.; Kelly, J. J.; Sullivan, R. J.; Perry, W. J.; Mercer, D.; Davis, R. M.; Washburn, T. D.; Sager, E. V.; Boyce, J. B.; and Bristow, V. L. 1996. Stochastic processes, volume 2. Wiley New York.

- Rubinstein (1982) Rubinstein, A. 1982. Perfect Equilibrium in a Bargaining Model. Econometrica 50(1): 97–109.

- Seifert (2006) Seifert, S. 2006. Posted price offers in internet auction markets, volume 580. Springer Science & Business Media.

- Shah, Johari, and Blanchet (2019) Shah, V.; Johari, R.; and Blanchet, J. 2019. Semi-Parametric Dynamic Contextual Pricing. In Advances in Neural Information Processing Systems, 2363–2373.

- Wang (1993) Wang, R. 1993. Auctions versus posted-price selling. The American Economic Review 838–851.

Appendix

Appendix A Omitted Proofs for the IV Setting

See 1

Proof.

We only need to prove the result for mechanisms whose undiscounted price is not non-increasing in , otherwise the statement of the lemma is trivially true. The main idea of the proof is to let the time period be evenly partitioned into time intervals of length such that the undiscounted price function of is constant in each interval. This is w.lo.g. if we take . Then, there must be two consecutive time intervals, namely and for some starting time , such that there exist with and during and , respectively (otherwise the undiscounted price would be non-increasing). Now, let us define a mechanism whose undiscounted price function is the same as that of , except for the fact that during and during (i.e., intuitively, we exchange the values in the two intervals so as to make the undiscounted price non-increasing in that window of time).

We show that the expected revenue provided by is always greater than or equal to that achieved by , as long as . In order to compare the expected revenues of the two mechanisms, it is sufficient to focus on the window of time , where their price functions differ. Given and , we can partition the agents’ valuations into three different subsets, as follows:

-

•

, implying that and for every time instant ;

-

•

, implying that for every time instant and for every time instant ;

-

•

, implying that and for every time instant .

In the first case, , since both and achieve an expected revenue equal to during the time window , given that the item is never sold in that window (as both and are always higher than the agents’ discounted valuation ). As for the second case, let us assume (since the cases and are analogous). Then, can sell the item only during the interval , while can sell the item only during the other interval . Thus, we have the following:

which goes to as long as , given that is continuous. Finally, in the third case, we can compute the difference between the expected revenues of the two mechanisms as follows:

which is less than or equal to as , by continuity of .

By re-iterating the procedure on all the pairs of consecutive infinitesimal intervals (since ) defined as and (each time using the last mechanism as the new ), we can render the undiscounted price function non-increasing, obtaining a final mechanism such that for every possible agents’ valuation . ∎

See 2

Proof.

By contradiction, suppose that is not optimal, i.e., there exists another deterministic posted-price mechanism such that . According to Proposition 1 and Lemma 1, must be defined by a pricing strategy such that the undiscounted price is non-increasing in and the minimum price is selected for a time interval having non-zero length (recall that does not depend on and ).

Case . Let us consider the valuation . Then, we have that the expected revenue of mechanism is (accounting for the case in which an agent arrives at and buys the item at price ), which is greater than or equal to the expected revenue of mechanism , defined as . Intuitively, since posts the minimum price for a period of time shorter than that of . Therefore, it holds , which is a contradiction.

Case . First, suppose that there exists a time instant defined as , i.e., the last time instant in which changes from being less than to being larger than or equal to . Clearly, it holds for every . Moreover, let us consider the agents’ valuation such that and focus on the case in which (as the other cases are analogous). Notice that, for every time instant , mechanism cannot sell the item, since, by using Lemma 1, we get:

Additionally, with an analogous reasoning we can show that, for all the times , both mechanisms may sell the item, but the price posted by is always less than or equal to that chosen by , with a non-empty time interval in which the former is strictly less than the latter (as ). Thus, in this case, it holds , which implies that , a contradiction. Finally, it remains to analyze the case in which a time instant defined above does not exist. Since the undiscounted price functions are non-increasing by Lemma 2 and , it must be the case that there is no intersection point between the two functions. Hence, it must be for all , which implies that by taking . This leads to a contradiction. ∎

See 1

Proof.

By Lemma 2 and using , it is sufficient to search for an optimal mechanism whose pricing strategy is such that the expected revenue of the mechanism is linearly dependent in , i.e., for every valuation , it must be the case that:

where is a suitably defined constant that does depend on . In the following, for the ease of presentation, we omit the index from as the mechanism is clear from the context.

From Proposition 1, there must be a such that for every , otherwise for the valuation . Thus, it remains to define for .

For any valuation , by letting , we can express the expected revenue of the mechanism as a function of . First, notice that, it holds . Moreover, by using Lemma 1, it must be the case that for every , since:

As a result, the item is never sold before time , which allows us to write the following:

Thus, since we want , by using and letting , we get:

| (2) |

By deriving the left-hand side of Equation (2) with respect to , we get:

where , with . By applying the fundamental theorem of calculus, we have that . Thus, the last equality is readily obtained by noticing that the term in the squared brackets is exactly equal to the expected revenue , which, in turn, must be equal to . Furthermore, by deriving the right-hand side of Equation (2) with respect to , we get:

By equating the derivatives of the two sides of Equation (2), we get the following differential equation:

| (3) |

By solving Equation (3) for , we obtain the function:

and, from the boundaries conditions and , we can derive constants and . Notice that the condition can be derived from the fact that, if , then the expected revenue is the same for all the valuations such that , which is not possible since we want that linearly depends on .

We recall that for all . Thus, we can use this in order to find as a function of the problem parameters , , , and function . Using , we get:

| (4) |

which gives after replacing with the expression we got from the boundaries conditions. ∎

See 1

Proof.

See 2

Proof.

We follow the line of the proof of Theorem 1, i.e., we look for a mechanism such that for every , where is suitably defined constant that does not depend on . For the ease of presentation, we omit the subscript from the pricing strategy .

Let us fix . By defining as in the proof of Theorem 1, since in this case the discount is for , we have , which allows us to write the following:

| (6) |

where the left-hand side is the expected revenue and the right-hand side is . By deriving with respect to the left-hand side of the Equation (6), we get:

where is defined as in the proof of Theorem 1. Now, we derive the right-hand side of Equation (6) with respect to :

By equating the derivatives of the two sides of Equation (6), we get the following differential equation:

| (7) |

After solving Equation (7) for , we obtain the general solution:

where, using boundary conditions and , we can derive the expressions and .

Since for all , we can use the equation in order to define with respect to the problem parameters , and . For :

| (8) |

and, by replacing with the expression we got from the boundary conditions, we obtain:

| (9) |

Finally, we can define as the unique positive real root of Equation (9). In particular, it is easy to show that Equation (9) always admits a positive real root in the range . Indeed, we call . We observe that is continuous on the interval and that and , therefore, for Bolzano’s theorem, there exists al least a such that . The uniqueness can be derived as consequence of Lemma 2. ∎

See 2

Appendix B Examples of Mechanisms and and Competitive Ratio Analysis

In order to ease the reader in the understanding of our mechanisms, we provide their graphical representation for the case of a linear discount function . In particular, we focus on mechanisms and , where the latter is the linear-discount version of the general-discount mechanism . The price function of can be easily obtained from that of by using the specific definition of the discount function. We report it below for completeness.

We tune the parameters , , and so as to simulate real-world scenarios representing the long-term rental of a single room. In particular, we fix the parameter values by analyzing data from a real-world co-living company operating on the web, counting over 7000 rooms. 555We cannot disclose the name of the company for privacy reasons. In this scenario, the goal is to rent a single room to students for a fixed period of one year. We set , assuming that each time interval of length corresponds to a period of one month, and we fix the starting time as the time in which the contract of the previous tenant ends. Therefore, the room value is discounted over time as an effect of the ever shorter period of stay of the future tenant. We also set , which means that the highest valuation for the room is around three times the lowest one.

Figure 4 shows how the shape of mechanism changes by varying the arrival rate , which is the expected number of agents arriving in a time interval of one month. We observe that the price function decreases as a linearly discounted exponential function in the time interval , and, then, as a linear function in . Notice that, by comparing Figure 4(a) and Figure 4(b), it is easy to see that the time instant gets closer to zero as the arrival rate increases. This can be explained by recalling that the mechanism has to deal with the trade-off between setting high prices so as to achieve high revenues and posting lower prices in order to increase the probability of selling the item. In the first period of time, the seller posts high prices hoping for the arrival of an agent having an high valuation. This phase cannot be too long, otherwise the item risks to remain unsold, and, on the other hand, it cannot even be too short, otherwise the probability of encountering such an high-valuation agent becomes too small. Therefore, when the arrival rate decreases, the high-price phase must be enlarged in order to still have some chance of concluding the purchase for an high price (Figure 4(b)), while, if increases, it suffices to post high prices for a shorter time period (Figure 4(a)).

Figure 5 represents the behavior of mechanism when we impose different constraints on the minimum time in which the price must be constant. In particular, Figure 5(a) and Figure 5(b) show the shape of when the posted price does not change for time intervals of length equal to one month (i.e., ) and one week (i.e., ), respectively.

Analysis of the Competitive Ratio

From Corollary 2, we know that, in the IV setting with linear discount function , mechanism achieves a competitive ratio:

where is defined in Theorem 2 as the unique positive real root of the equation:

| (10) |

We analyze the behavior of the competitive ratio when the problem parameters and vary. We summarize our results in the following table:

| 1 | 1 | 0 |

By using Equation (10), we can conclude that is asymptotically equivalent to when . Then, the limit of the competitive ratio is:

Similarly, is asymptotically equivalent to when . Thus:

Moreover, it is easy to see that when . Indeed, in this case we have that is the unique positive real root of the equation:

Since , the limit of the competitive ratio is:

Therefore, having a valuation function with finite support is fundamental in order to achieve a certain fraction of the expected revenue of an optimal mechanism. There are no guarantees for valuation functions with unbounded support. In the following we analyze how goes to . We first observe that is proportional to when . Indeed, the numerator of depends on through :

where as , and the Taylor series is used to expand function at . Notice that the competitive ratio is decreasing in . We compute , which is an upper bound for , by solving Equation (10) with the exponential term substituted by parameter a . We impose and to have the same domain, hence . Thus, we obtain the following equation:

| (11) |

The solution

is increasing in , being its first partial derivative positive for all :

Hence, by setting , we get the following upper bound on :

Notice that is a lower bound for . By asymptotic analysis, as we have:

where is constant with respect to and depends on parameters and . Hence, as :

where is a constant with respect to and depends on parameters and . We conclude that, as , the competitive ratio converges to slower than or the same as the function .

Appendix C Omitted Proofs for the RV Setting

See 3

Proof.

Given how the function is defined, we can always define a time interval as desired by selecting its starting time in such a way that . From Definition 3 we know that . Hence,

Since is non-increasing by Lemma 1, for every we have:

Notice that the inequality involving holds with equality if . If this is the case, then there exists a unique interval verifying the statement. ∎

See 4

Proof.

Let us recall that the cumulative distribution function of is such that:

We compute the hazard rate of and show it is non-decreasing, as follows:

Since is MHR, the hazard rate is non-decreasing. Notice that is non-decreasing, and, thus, in non-increasing. As a result, proving that is non-decreasing in is equivalent to show that is non-increasing in . We study the first derivative of :

This implies that is non-increasing in ; hence, is non-decreasing in . We conclude that is monotone non-decreasing. ∎

In order to prove Lemma 5, we first state the following variant of the Chebyshev inequality Mitrinovic, Pecaric, and Fink (2013), where the adopted notation is specific for the proposition.

Proposition 2 ((Mitrinovic, Pecaric, and Fink 2013)).

Suppose function is positive and non-decreasing on , function is non-decreasing on , and function is continuous on , then the following inequality holds:

See 5

Proof.

Recall that . Then, we can write the following:

Now, we apply Lemma 2. having non-decreasing monotone hazard rate implies that is a non-decreasing function of . Hence, is non-decreasing and positive on . is non-decreasing on and is continuous on . Thus,

where is the entire exponential integral function, is the exponential integral function, and is the Euler’s constant. ∎

See 3

Proof.

By hypothesis, we have for some and , which implies that . Moreover, let us fix a distribution satisfying the MHR condition. From Lemma 3, there exists a time interval with starting time such that for every . We distinguish two cases, depending on whether the starting time of the interval is before or after the time characterizing mechanism (as defined in Theorem 1).

Case . By using the fact that the seller’s expected revenue for the overall time period is at least that achieved during the interval , we have:

| (12) | ||||

| (13) | ||||

| (14) | ||||

Equation (12) holds since is a random variable representing the maximum initial valuation of agents arriving in a time interval of length weighted by the maximum possible discount, and, thus, it is always smaller than or equal to . Equation (13) follows from Lemma 5. Equation (14) follows from a result by Barlow and Marshall (1964), which implies that, for any MHR distribution, the probability of exceeding its expectation is at least .

Case . In this case, we can lower bound the seller’s expected revenue for the overall time period with that obtained during the the interval , as follows:

where for the first inequality we used the fact that the expected revenue in is at least the lowest price posted during the interval times the probability that at least one agent arrives in , the second inequality holds since when , while the last inequality follows from the fact that . Indeed, by Lemma 3, we can write the following:

which implies that .

We can now compute a lower bound on the ratio of mechanism , as follows:

where the first inequality holds since is the expected revenue of a mechanism that knows the actual realization of agents’ initial valuations and arrival times, i.e., the realization of variable .- This mechanism achieves an expected revenue greater than or equal to that obtained by the benchmark , since the latter only knows the distribution of valuations. As for the second inequality, it is easy to see that . Finally, by recalling the condition , we have , which allows us to write the following bound:

This concludes the proof. ∎

See 6

Proof.

In the following, for the ease of presentation, we let for any . By contradiction, suppose that there is no such that . Notice that is a lower bound on and belongs to the range .

We reach a contradiction by employing an iterated reasoning. As a first step, we observe that either or . If , then is in the range . Hence, it must hold . Then, as a second step, we can conclude that either or . If , then is in the range . Hence, it must hold . By iterating the reasoning until the -th step, we obtain that either or .

Let us first consider the case in which it holds . If , then since:

Hence, it must hold . Then, belongs to the range , which leads to a contradiction.

Now, suppose that . Then, in the -th step of the iterated reasoning, we can conclude that and is in the range , which leads to the final contradiction. ∎

See 4

Proof.

By hypothesis we have for . We distinguish two cases, depending on whether is greater or lower than one. Note that is a lower bound for and that one is the minimum value that can assume. In particular when is the point distribution such that .

Case . For Lemma 6, there exists an such that the price lies in the range . By using the fact that the seller’s expected revenue for the overall time period is at least that achieved during the interval , we have:

| (15) | ||||

| (16) | ||||

| (17) | ||||

| (18) | ||||

Equation (15) holds since is a random variable representing the maximum initial valuation of agents arriving in a time interval of length weighted by the maximum possible discount, thus it is always smaller than or equal to . Equation (16) follows from Lemma 5. Equation (17) follows from a result by Barlow and Marshall (1964), which implies that, for any MHR distribution, the probability of exceeding its expectation is at least .

Case . In this case we can lower bound the seller’s expected revenue for the overall time period with that obtained during the interval , as follows:

where for the first inequality we used the fact that the expected revenue in is the price posted during the interval times the probability that at least one agent arrives in , the second inequality holds since when , while the last inequality follows from the fact that and .

We can now compute a lower bound on the ratio of the mechanism , as follows:

where it is easy to see that . By recalling the condition , we have , which allows us to write the following bound:

This concludes the proof. ∎

Appendix D An Analytical Expression of for the RV Setting with Linear Discount

We study the cumulative distribution function of the random variable so as to unveil its dependence on . We perform our analysis for the specific case of a linear discount function; thus:

The results presented in the following crucially rely on some properties of Poisson processes.

First, we introduce some auxiliary definitions and results.

Proposition 3 (Ross et al. (1996)).

The random variable representing the arrival time of agent has a Gamma distribution , with shape parameter and rate parameter , whose probability density function is defined as follows:

Theorem 5 (Pinsky and Karlin (2010)).

Let be random variables representing the arrival times in a Poisson process with rate parameter . Conditioned on the event , the variables have a joint probability density function defined as follows:

Intuitively, as discussed in (Ross et al. 1996), a consequence of Theorem 5 is that, conditioned on the event , the times at which the arrivals occur, considered as unordered random variables, are distributed uniformly and independently in the interval . This is the crucial observation that allows to derive the following theorem.

Theorem 6.

The random variable representing the maximum discounted valuation of agents arriving in the overall time period conditioned on the event that is defined as follows:

Proof.

Given the symmetry of the functional and Theorem 5, we can write the following:

where is a random variable distributed according to , which is a continuous uniform distribution with support . Letting , it is easy to show that . Formally, for every , the cumulative distribution function of is defined as follows:

Moreover, for it holds , while for it holds . Thus, is the cumulative distribution function of a random variable drawn from a uniform with support . ∎

In the following, we denote by a product variable , where and are random variables distributed according to and , respectively. Moreover, we let be the variable referred to a specific agent . Theorem 6 allows us to express as follows:

Hence, we can write as:

where

| (19) |

Thus, it is easy to see that depends on and , which are the cumulative distribution function and the probability density function of agents’ initial valuations, respectively.

It remains to show how to derive the expression of in Equation (19). Notice that, since , the probability density function of is defined as , while its cumulative distribution function is . The support of is , being defined on .

where the domains of integration and are defined as:

See also Figure 6 for a graphical representation of the domains.

Appendix E Additional Experiments

We provide other empirical evaluations of our mechanisms in the RV setting. We compare , , and ESoES-SS when the distribution of the agents’ valuations is not MHR. Then, we show the performances of and when valuations are linearly discounted over time.

Result #3

We perform an experiment similar to that of Result #1. Here, agents’ valuations are drawn from a truncated normal distribution with , , and support . Figure 7 is similar to Figure 2. Observe that, in this setting, the performances of with and with are analogous. This means that, tuning the parameters in a suitable way, we can impose a time constraint with almost no loss in the normalized mean revenue. Moreover, the truncated normal distribution is not MHR, hence, all the bounds on the competitive ratio of the mechanism do not hold. Despite this fact, we see that, in this scenario, the behavior of the mean normalized revenue is comparable to that of Result #1. In particular, the loss of ESoES-SS w.r.t. averaged over the values of is about when , and slightly larger when .

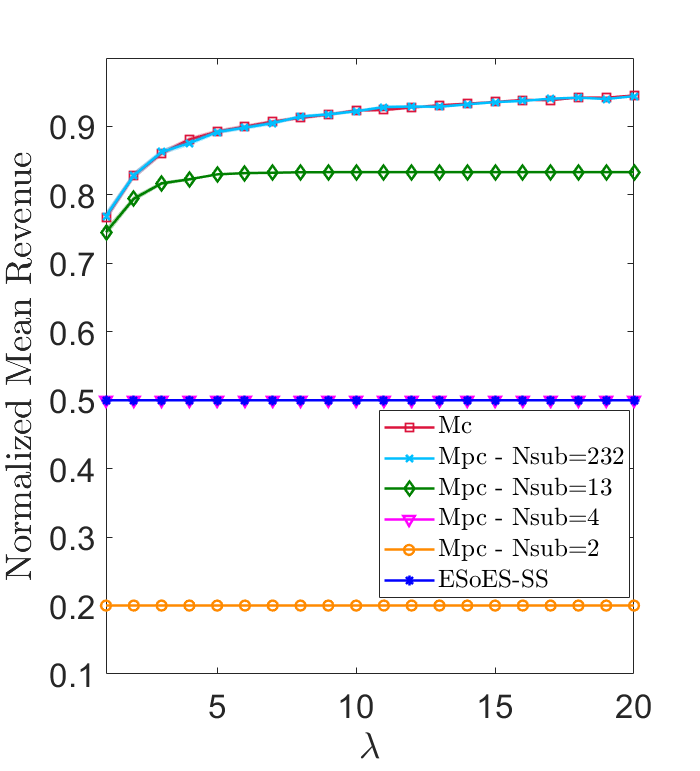

Result #4

We analyze mechanisms and with different values when the valuations of the agents are linearly discounted. For every we run Monte Carlo simulations, with . Given parameters and , we simulated the arrivals of agents drawn from a uniform distribution with support and we computed the revenue of the mechanisms. We normalized the results by and, for each value of , we average by the simulations. Then, for each value of , we plot in Figure 8 the normalized mean revenues of the mechanisms, for and . We observe that is no longer the best mechanism in terms of normalized mean revenue. The interesting fact is that, a suitably tuned mechanism can reach a better average revenue than in some IV scenarios.