High dimensional PCA: a new model selection criterion

Abstract

Suppose we have a random sample from a multivariate population consisting of many variables. Estimating the number of dominant/large eigenvalues of the population covariance matrix based on the sample information is an important question arising in Statistics with wide applications in many areas. In the context of Principal Components Analysis (PCA), the linear combinations of the original variables having the largest amounts of variation are determined by this number. In this paper, we study the high dimensional asymptotic setting where the number of variables grows at the same rate as the number of observations. We work in the framework where the population covariance matrix is assumed to have the spiked structure proposed in Johnstone, (2001)). In this setup, the problem of interest becomes essentially one of model selection and has attracted a lot of interest from researchers. Our focus is on the Akaike Information Criterion (AIC) which is known to be strongly consistent from the work of Bai et al., (2018). The result of Bai et al., (2018) requires a certain “gap condition” ensuring that the dominant eigenvalues of the covariance matrix are all above a level which is strictly larger than a threshold discovered by Baik, Ben Arous and Peche (called the BBP threshold), both quantities depending on the limiting ratio of the number of variables and observations.

It is well-known in the literature that, below this threshold, a spiked covariance structure becomes indistinguishable from one with no spikes. Thus the strong consistency of AIC requires in a sense some extra “signal strength” than what the BBP threshold corresponds to.

In this paper, our aim is to investigate whether consistency continues to hold even if the “gap” is made smaller. In this regard, we make two novel theoretical contributions. Firstly, we show that strong consistency under arbitrarily small gap is achievable if we alter the penalty term of AIC suitably depending on the target gap. Inspired by this result, we are able to show that a further intuitive alteration of the penalty can indeed make the gap exactly zero, although we can only achieve weak consistency in this case. We compare the two newly-proposed estimators with other existing estimators in the literature via extensive simulation studies, and show, by suitably calibrating our proposals, that a significant improvement in terms of mean-squared error is achievable.

AMS 2010 Mathematics Subject Classifications: 62H12, 62H25 Keywords: Spiked model; model selection; high dimensional PCA

1 Introduction

Suppose we have a sample of observations from a multivariate population with variables. Estimating the number of dominant/significant eigenvalues of the population covariance matrix in such a scenario is an important question arising in Statistics with wide applications in many areas. In the context of Principal Components Analysis (PCA), a very popular method of dimension reduction for multivariate data, the individual principal components having the largest variability are determined by this number.

Let be the eigenvalues of the population covariance matrix. We further assume that the covariance matrix has a spiked structure proposed by Johnstone, (2001). In this framework, the number of dominant eigenvalues is denoted by and all the eigenvalues except the first are all assumed equal, i.e. . This is called the true number of dominant/significant components in this framework.

The spiked covariance model finds wide applications in many scientific fields. In wireless communications, for example, a signal emitted by a source is modulated and received by several antennas, and the quality of reconstruction of the original signal is directly linked to the “inference” of spikes. The spiked model is also used in different areas of Artificial Intelligence such as face, handwriting and speech recognition and statistical learning. See Johnstone and Paul, (2018) for more applications.

The number of significant components is usually unknown, and we need to estimate it, which in turn becomes essentially a problem of model selection in the spiked covariance framework. This will be explained clearly in the next section. Many estimators have been developed in the literature, mostly based on information theoretic criteria, such as the minimum description length (MDL), Bayesian Information Criterion (BIC) and Akaike Information Criterion (AIC) (see, e.g., Wax and Kailath, (1985)). However, these applications have been focused on the large sample size and low dimensional regimes and arguments in support of these estimators may not carry over to the high dimensional setup. In the recent past, several works have appeared in the area of signal processing for high dimensional data, where techniques from random matrix theory (RMT) it have been used (see, for example, Kritchman and Nadler, (2009) and Nadler, (2010)). More recent papers in the literature include Passemier and Yao, (2014) and Bai et al., (2018).

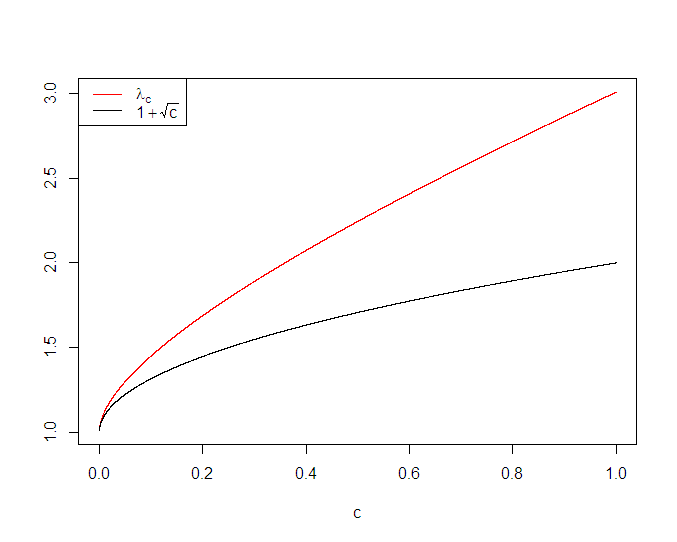

Our work is inspired by Bai et al., (2018), where the authors consider the Akaike Information Criterion (AIC) (Akaike, (1998)) and the Bayesian Information Criterion (BIC) (Schwarz et al., (1978)) as their estimation criterion in a high dimensional setting. They studied the consistency of the estimators based on the AIC and BIC criteria under an asymptotic framework where such that , where refers to the sample size. They showed that unlike AIC, the BIC criterion is not consistent when the signal strength is bounded (Bai et al., (2018)); in other words BIC requires much more signal strength for signal detection. Their main result shows consistency of AIC for estimating , when a certain “gap condition” is satisfied, i.e. when is above a certain level above the BBP threshold (Baik et al., (2005)) of (see Section 2.2). More precisely, they showed that AIC is consistent if and only if . Figure 1 shows the “gap” between and . We want to highlight the fact that if , then there is no hope for estimating , (see, for example, Baik et al., (2005) and Section 2.1.1 for more details).

The primary aim our work is to investigate if we can improve upon the results of Bai et al., (2018) by suitably modifying the AIC criterion to give consistent estimates of under weakening of the “gap condition”. Towards this, our main contributions are as follows. We have shown that, given any , we can develop an estimator (depending on ) which is strongly consistent when the gap between and the BBP threshold is at least (see Section 3.1). We can also make the gap exactly zero by modifying our estimator, but then we have to part with strong consistency-we can only prove weak consistency of the modified estimator (see Section 3.2). We note that there is another weakly-consistent estimator due to Passemier and Yao, (2014) that is known in the literature and which also works under zero gap.

The inspection of the proof of strong consistency in Bai et al., (2018) reveals that for any arbitrary , a modification (based on and ratio of dimension and sample size) of the penalty of AIC will make the asymptotic argument work when the gap between and the BBP threshold is above . A further modification of the penalty term by letting that go to zero at appropriate rate depending on gives us an estimator that is weakly consistency under ‘zero gap’. This proof is obtained by employing novel arguments aided by some deep Random Matrix Theory results on the asymptotic behavior of sample covariance matrices.

After finishing this work, it came to our notice that a similar problem has been studied independently by Hu et al., (2020). However, their motivations, results and methods of proof are different from ours.

The rest of the paper is organised as follows. In Section 2, we discuss the problem setup, review some key results of Random Matrix Theory (RMT) and the literature on estimating the number of spikes. Section 3 introduces the main idea and results behind our modified AIC criterion. In Section 4 we compare our proposed estimator with other estimators available in the literature via extensive simulation studies. Conclusions then follow and the Appendix collects all the proofs.

2 Problem setup and a review of relevant literature

We first describe our setup and main problem in the first few paragraphs of this section. We follow the same notations as used in Bai et al., (2018). Suppose we have a random sample of size from a population of dimension and let denote the full data matrix. Let the population mean be and population covariance matrix is denoted by . Our interest here is in the spiked covariance structure described before which can be succinctly described through models , where

We consider models starting from a configuration of zero spikes (i.e. ) to one with spikes. We want to estimate, using the available data, the true value of . So our main problem is thus reduced to one of model selection from the pool of the above candidate models.

Our focus in this paper will be the high dimensional asymptotic setting where and grow proportionately, i.e. we assume that

| (C1) |

To avoid notational clutter, we suppress the dependence of on , and of , on . For the estimation of , we will be interested in the study (to be explained later in this section) of the distributional properties of the eigenvalues of the sample covariance matrix of the ’. We can assume without any loss of generality that . Then the sample covariance matrix is given by

Denoting by , we may also assume, as in Bai et al., (2018), that for , where , and is a double array of i.i.d. random variables with mean , variance . We further assume, as in Bai et al., (2018), that the ’s have finite with finite fourth moment.

For the rest of the paper we assume that the eigenvalues of population covariance matrix are 1 except the first which are and has the form

| (C2) |

where has non-null and non-unit eigenvalues . We also assume, as in Bai et al., (2018) that is unknown but a fixed finite number and does not change with .

We will now summarize in the next few subsections, the concepts, issues and results from the literature which are relevant in this study. We will first touch upon some fundamental results on the properties of the eigenstructure of the sample covariance matrix and the high dimensional phenomenon. This will be followed by review of some specific works in the literature on the topic of our interest.

2.1 Basic results on the eigen-structure of sample covariance matrix

We start this section by briefly describing Principal Components Analysis (PCA) since the eigenstructure of the sample covariance matrix is intrinsically related to this. We recall that in PCA (see, e.g., Anderson, (1958); Jolliffe, (1986)), one sequentially finds orthogonal directions to produce uncorrelated (normalized) linear combinations of the original variables with maximum variance. In the standard approach to this, this is obtained from the eigen-decomposition of the (sample)covariance matrix. Consider the eigen-decomposition of :

where is a orthogonal matrix whose columns are the eigenvector and is a diagonal matrix with entries being the eigenvalues of . The sample analogue of this is

where now the orthogonal matrix has columns which are the sample eigenvectors and is a diagonal matrix consisting of the eigenvalues of . If denotes a generic random observation from the distribution, then the vector of the population principal components is given by . The sample principal components are defined as , for . It may be noted that for each , the variance of is . So larger the , larger is the variance of random variable . Thus the number of dominant/large eigenvalues of correspond to the number of principal components having the largest amount of information. In the traditional fixed dimensional setting where is fixed, and is large, the sample eigenvalues and eigenvectors converge to their population counterparts, i.e. as , we have that and , for each (see, for example, Anderson, (1958)). The situation is more subtle in the high dimensional case where grows with and it is well-known in the literature (Silverstein, (1995)) that the consistency of the sample eigenvalues and eigenvectors do not carry over in this case. In the next part of this section we focus on the high-dimensional aspect with special emphasis on results from random matrix theory under the spiked covariance framework.

2.1.1 The high dimensional phenomenon and Random Matrix Theory results

Many of the things described below are classically well-known facts from Random Matrix Theory (RMT) and some are more recent interesting discoveries. The notational convention is similar to Bai et al., (2018). Recall that the eigenvalues of are denoted by ( again suppressing their dependence on and/or ). Let us define the Empirical Spectral Distribution (ESD) of by

By a result of Silverstein, (1995) we have that under condition (C2) the ESD of , i.e. converges to almost surely, where is the Marčhenco-Pastur law/distribution. Here, for , is given by

The support of this distribution is where and .

If , has a point mass at the origin, i.e.

where and are the same as in the case .

The previous result characterizes the bulk behaviour of the sample eigenvalues. Now we state results characterizing convergence of individual eigenvalues of . As in Bai et al., (2018), we define to be a “distant spiked eigenvalue” if . We also define the function for as

This next result is the same as Lemma 2.1 in Bai et al., (2018).

Lemma 2.1.

Let denote the i-th largest eigenvalue of the covariance matrix in our setup. Suppose that , conditions and hold, and that is bounded.

-

(i)

If is distant-spiked, then .

-

(ii)

If is not distant-spiked and , then , where is the -quantile of the MP distribution. In particular, if , then .

The results in the above lemma are examples of a general high dimensional “phase transition” phenomenon observed by many authors (e.g., Bai and Yao, (2012), Baik et al., (2005)), and often referred as the BBP phase transition phenomenon after Baik et al., (2005). In a nutshell, as summarized in Paul, (2007), this refers to the fact that if the non-unit eigenvalues of a spiked model are close to one, then their sample counterparts would asymptotically behave as if the true covariance matrix were the identity matrix. However, the asymptotics would change critically if the dominant eigenvalues are larger than the threshold of . We describe its details and the implications on our assumptions.

For understanding its effect on distributional convergence, we assume now for simplicity that is diagonal with a single spike (), so that . When , the largest sample eigenvalue is located near the upper edge of the MP distribution and fluctuates on the (small) scale approximately according to the real valued Tracy-Widom distribution:

where and and is a random variable following real valued TW distribution (see Johnstone, (2001) for more details). For , the largest sample eigenvalue has the same limiting Tracy-Widom distribution-the small spike in the top population eigenvalue has no limiting effect on the distribution of sample top eigenvalue. Put in another way, asymptotically the largest sample eigenvalue is of no use in detecting a subcritical spike in the largest population eigenvalue. A phase transition occurs at : for larger values of , the largest sample eigenvalue now has a limiting Gaussian distribution (See Paul, (2007)), with scale on the usual order of . The mean of this Gaussian distribution (=) shows a significant upward bias, being significantly larger than the true value of . We now come back briefly to the manifestation of the phase transition in the issue of pointwise convergence as in Lemma 2.1, where we consider a spiked model of spikes. For the non spiked eigenvalue , the sample counterpart converges a.s. to (by the Lemma 2.1 (ii)). If then also converges a.s. to . So asymptotically it becomes difficult to distinguish and (i.e. model and respectively). This is not the case if as seen in Lemma 2.1 (i)). Keeping in mind this phase transition behaviour, we have assumed for our results presented later that the first eigenvalues are “distant spiked eigenvalues”

2.2 Strongly consistent estimators based on AIC

This section is mainly based on the paper by Bai et al., (2018). They consider the spiked covariance structure mentioned before which is expressed by models denoted by ’s for varying depending on the value of the true number of spikes . To estimate , they propose using the traditional AIC criterion to select a model from among the pool of candidate models and thereby obtain an estimator which is strongly consistent. We shall discuss the case first. Defining

it has been noted in in Fujikoshi et al., (2011) that the criterion value under model is given by

where are the sample eigenvalues of and for , is the arithmetic mean of , that is,

Furthermore, denotes the number of independent model parameters under model and is given by

The expression of is obtained by looking at the eigen-decomposition of the covariance matrix which can be written as:

where ’s are mutually orthogonal unit vectors. It is evident that degrees of freedom are accounted for by , by ’s and , and by the orthonormal eigen-vectors. The AIC criterion selects the model where

The estimator of proposed by Bai et al., (2018) is . When we are interested in only the first models , then the criteria is defined by considering the minimum only with respect to . We call the number of candidate models. Denoting , the model selection rule of AIC can be equivalently obtained as

Note that is given by

We are now going to state main results of Bai et al., (2018) regarding consistency of . A criterion for estimating is said to be consistent (strongly consistent) if [ .

We will first state the result for the case . Before stating the result, we state condition (C3) referred to as the “gap condition”. Recalling the function and quantities defined earlier, the “gap condition” is given by

| (C3) |

The next result is proved as Theorem 3.1(i) of Bai et al., (2018).

Theorem 2.2.

Next we consider the case where , such that and . Clearly in this setup the smallest eigenvalues of are zero, that is,

Thus, as noted in Bai et al., (2018), it is impossible to infer about the smallest population eigenvalues using the sample eigenvalues. Therefore, these authors additionally assume in this setup that (C4) holds where

| (C4) |

Under this new assumption, for , it follows that

In order to describe the model selection criterion proposed in this setup in Bai et al., (2018), first has to be redefined as below:

Using this modification, a new criterion is then introduced as

by replacing the and in by and , respectively. Note that . The “quasi-AIC” rule, henceforth abbreviated as the qAIC rule, selects the model defined as

The strong consistency result of qAIC for the case is proved under the modified “gap condition”

| (C5) |

We now state the result regarding consistency of proved as Theorem 3.3(i) in Bai et al., (2018).

Theorem 2.3.

Next we will discuss another type of estimators available in the literature which are weakly consistent, i.e. if is an estimator of then as .

2.3 Weak consistency

This section is based on the work of Passemier and Yao, (2014) where they proposed a weakly consistent estimator of under the “zero gap” condition. Suppose we have observed a random sample from a -dimensional population. These authors additionally assumed that the ’s can be expressed as , where is a zero-mean random vector of i.i.d. components, is an orthogonal matrix and

where has non-null and non-unit eigenvalues . The sample covariance matrix is taken to be

The proposed estimator in Passemier and Yao, (2014) is based on the differences between consecutive eigenvalues of . The main idea behind that is explained next. Define as

The authors then observe that under certain assumptions it can be shown that if then at a fast rate, whereas if and ’s are different then tends to a positive limit. Even if ’s are same, for , the convergence of to zero is slow. Thus a possible estimate of can be the index where becomes small for the first time. The estimator of proposed in Passemier and Yao, (2014) is denoted by and is given by

where is a fixed number big enough, and is an appropriately chosen small number. In practice, the integer should be thought as a preliminary bound on the number of possible spikes. Before stating the main theorem on weak consistency of this estimator, we state one of the main assumptions which is required to prove their theorem. Assumption 1: The entries of the random vector have a symmetric law and a sub-exponential decay, that is there exists positive constants such that, for all

Theorem 2.4.

Let be i.i.d. of , where is a zero-mean random vector of i.i.d. components which satisfies Assumption 1. Assume that is of the form described before where has non null, non unit eigenvalues satisfying . Assume further that (C1) holds. Let be a real sequence such that and , then the estimator is a weakly consistent estimator, i.e. as .

3 Main ideas and results

In this section we will motivate and describe the main results of this article. We will first discuss our work on strong consistency followed by that on weak consistency.

3.1 Strong consistency for modified AIC criterion

The idea for developing a modification of the AIC criterion comes from a careful study of the proof of strong consistency of the traditional AIC in Bai et al., (2018). The “gap condition” mentioned before is a crucial requirement in their proof. This makes AIC inadequate for consistent estimation of when is close to the BBP threshold (). We show in this paper that by suitably modifying the penalty term in the AIC criterion, this problem can be taken care of, in that the modified criterion is strong consistent even when is arbitrarily close to . In this section We will informally sketch how to get this modified criterion and also the proof of its strong consistency. Towards that, let us first recall the functions we defined earlier

| () |

3.1.1 Case:

Assume that . Note that is strictly increasing on , and is strictly increasing on , with . Therefore is also strictly increasing on .

Next we break down the proof of consistency by Bai et al., (2018) in two main steps. This gives us the important clue on how to modify the penalty of AIC.

-

(i)

For showing a.s., Bai et al., (2018) needed the condition that

i.e. , which is true for any (as can be verified directly).

- (ii)

Clearly . Let

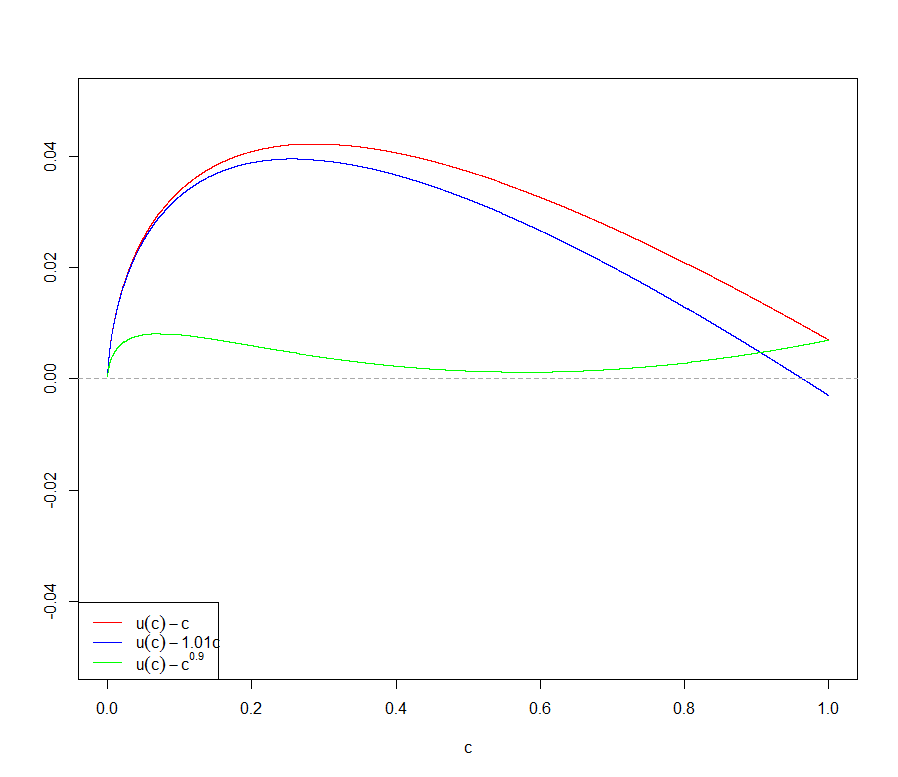

Let denote the gap between the BBP threshold and the consistency threshold for AIC. A natural question is, how large is the gap as a function of ? It is displayed in Figure 2. The numerical calculation below shows that ; in fact, .

Our aim here is to investigate if we can develop a criterion that will be strongly consistent even when is closer to than . The inequalities in (i) and (ii) above appear in the final asymptotic limits in the argument of Bai et al., (2018). Placed together, for every , it is required that the inequalities hold, where the factor 2 appears unchanged from the per parameter penalty 2 in AIC and from the limiting ratio of and . Our modified AIC criterion is based on the crucial analytic observation we now make. From the monotonicity of of , the second inequality above also holds if 2 is replaced by any such that . Evidently, for any fixed , there is whole interval of such choices of , and for that matter, one can choose to make arbitrarily close of . For any such , a modified first inequality will be satisfied by any larger than , the latter being smaller than by monotonicity of . Clearly . Smaller the choice of , closer is to . We derive our modified AIC criterion by formally using this basic observation as described below.

Suppose we modify the original penalty of AIC with , for some continuous function , then the same arguments as in Bai et al., (2018) lead to the following conditions:

-

(iii)

For showing a.s.,

i.e. .

-

(iv)

For showing a.s.,

where is the minimizer of this new criterion over the model space. Thus if we want to get a modified criterion that is strongly consistent for any “gap” , all we need is that

The monotonicity of will ensure that the ineualities in (iii) and (iv) will be satisfied for this choice of which assures strong consistency of as long as . Thus we can reach arbitrarily close to the BBP threshold and still achieve strong consistency. In fact, since , we may choose . For example, if we choose , then with

we have consistency of as long as . This is a better estimator than AIC because it can consistently estimate even when GAP condition (C3) fails to hold. In particular if we want our gap between and to be , where is any arbitrarily small constant we can choose such that

and we would have strong consistency of our estimator as long as .

We now describe in detail the new model selection criterion which we discussed above. The model selection criterion being a modification of AIC is being called . Do describe this, we first fix a constant . We shall discuss the case first. With as defined before, the criterion value for for the model is defined as

where, as before, are the sample eigenvalues of and for , is the arithmetic mean of , that is,

and, denotes the number of independent parameters in the model under . Furthermore the function is defined as in (3.1). Then the selects according to the rule

where the minimum has been taken over the model space.

Now we state our main result regarding consistency of our estimator whose proof can be found in Appendix Section 7.3.

Theorem 3.1.

Suppose the conditions (C1) with , and (C2) hold, and that the number of candidate models, , satisfies . Assume that is bounded. We have the following results on the consistency of the estimation criterion

based on :

-

(i)

If , then is not consistent.

-

(ii)

If , then is strongly consistent.

3.1.2 Case:

Next we consider the case where . Let

Recall that is strictly increasing on , and is strictly increasing on , Therefore is increasing in . We have . Therefore is also strictly increasing on .

-

(i)

For showing a.s., Bai et al., (2018) needed the condition

i.e. , which is true for any (as can be verified directly).

- (ii)

Note that . Let

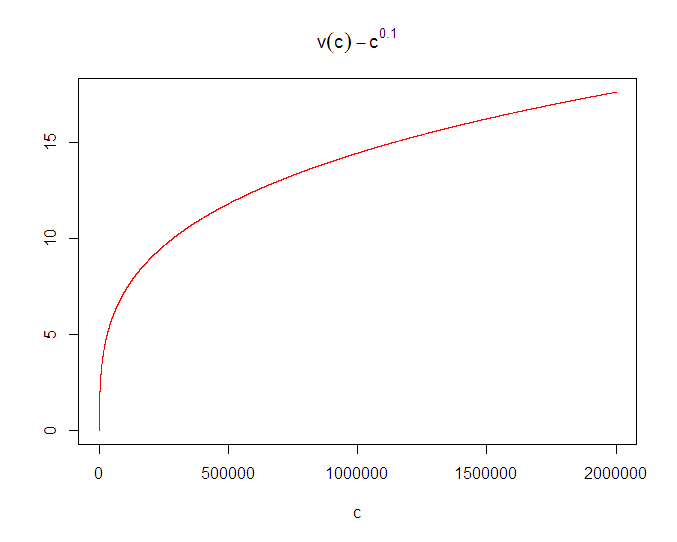

is the gap between the BBP threshold and the consistency threshold for qAIC. Our aim as in the previous case is to investigate if a new criterion can be derived with is strongly consistent even when the “gap” is reduced as much as possible. So firstly we look at how large is the gap as a function of ? Figure 3 shows that .

Following similar intuition as in the case of , if we penalize by replacing the in qAIC with for some function , then the same arguments as in Bai et al., (2018) lead to the following conditions:

-

(iii)

For showing a.s.,

i.e. .

-

(iv)

For showing a.s.,

Thus for any , if we take the function

then using the monotonicity of we have consistency of as long as . Thus we can reach arbitrarily close to the BBP threshold .

Our model selection criterion is a modification of the criterion proposed by Bai et al., (2018) as discussed in Section 2.2. We define our criterion using , which for model is given by

where is defined as in Bai et al., (2018) for case which is

and is as defined in (3.1.2). The model selection rule estimates by defined as

the minimum. as before, being taken over the model space.

The following result shows the consistency of our estimator .

3.2 Weak Consistency for a modified AIC criterion

We have seen in the previous section that for any given , however small, we can appropriately modify the penalty term (using among other things) of the usual AIC to produce an estimator of which is strongly consistent when the gap between and the BBP threshold is larger than . But ideally we would aim to develop consistent estimators of which would be consistent if , i.e. the we can afford to have the “gap” equal to zero. A natural thing is to first investigate what happens when we choose the gap to be , where as in the definition of the modified AIC criterion described before.

We first discuss the case . We mofify the penalty term in AIC criterion as instead of where

We define as the index that minimizes this modified criterion. Observe that

Let us check if is strongly consistent. Following the arguments of Bai et al., (2018), we find the following.

-

(i)

For showing a.s. we need,

This is true since we have that .

-

(i)

For showing a.s. we need,

i.e. , which is not true.

Clearly the arguments given by Bai et al., (2018) doesn’t give us our desired result for the above intuitive modification of our previous criterion. We however have been able to come up with a novel argument that gives us our desired result. The argument is described in detail in Section 7.2 of the Appendix and carefully exploits some deep results available from Random Matrix Theory regarding the rate of convergence of certain functionals of the sample covariance matrix. Ultimately it turns out that has to converge to zero in such a rate that the new penalty satisfies certain convergence properties. The only downside is that we cannot prove strong consistency of the new criterion using this method, but we can show weak consistency of the estimator under some assumptions (see Theorem 3.3 and 3.4).

As mentioned above, the basic idea for developing the estimator which would be consistent under the “zero” gap condition was to use our previous modified AIC criterion with instead of , where . We describe below the model selection rule. This The being a modification of , we call it . We discuss the case first. With defined as before, the criterion value under model is defined as

Furthermore, is as defined before. Defining

we have

Then the criterion selects model with index obtained as

or equivalently

The criteria above is defined by considering the minimum only with respect to . where is a fixed number big enough. In practice, the integer should be thought as a preliminary bound on the number of possible spikes. We have the following theorem regarding consistency of the proposed estimator whose proof can be found in Appendix Section 7.2.

Theorem 3.3.

Suppose the condition (C1) holds for and (C2) hold, and that that the number of candidate models is , where is a fixed number. Suppose that Assumption 1 holds true, is bounded and . Let be a real sequence going to 0 such that

where is as defined in (3.1), then the estimator is a weakly consistent estimator of , i.e. as .

We have the similar result for the case , i.e. . Our modified model selection criterion is defined using , which is defined as

Then selects the number of significant components according to

The criteria above is defined by considering the minimum only with respect to . where is a fixed number big enough. In practice, the integer should be thought as a preliminary bound on the number of possible spikes. We have the following theorem regarding consistency of the proposed estimator whose proof can be found in Appendix Section 7.2.

Theorem 3.4.

Suppose the condition (C1) with and (C2) hold, and that that the number of candidate models is , where is a fixed number. Suppose that Assumption 1 holds true, is bounded and . We also assume that .

Let be a real sequence going to 0 such that

where is as defined in (3.1.2), then the estimator is a weakly consistent estimator of , i.e. as .

4 Simulation studies

4.1 The choice of

Consistency of our estimator holds for a wide variety of sequences. For instance, if is a sequence satisfying the condition of our theorem, then so does any where and . In this section we provide an automatic calibration of this parameter. The main idea is to look at the null case (), i.e. . Given a and a , we propose to select as

where is our strongly consistent estimator dependent on as proposed in Theorem 3.1 or 3.2 and RMSE or Relative Mean Square Error is given by

As we do not know the precise expression of RMSE for the null case we approximately calculate it by simulation under independent replications and call it SRMSE (Sample RMSE). Using the SMRSE in place of RMSE above we find our choice of .

Table 1 lists the values of chosen according to our proposal for a few different values of .

| (200,200) | (400,400) | (1000,1000) | (200,400) | (500,1000) | (400,500) | |

| 0.52 | 0.34 | 0.25 | 0.28 | 0.20 | 0.32 |

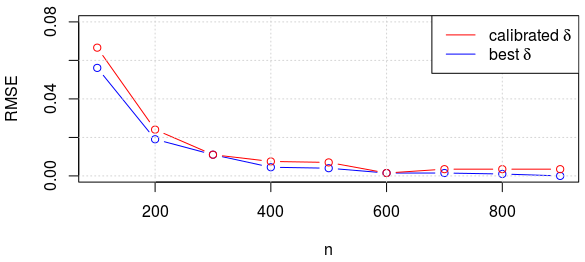

Let us now illustrate with the help of two models how our method of choosing compares with manually choosing (i.e. by choosing the which gives the “lowest” RMSE).

are generated from where . After fixing a , and are varied such that . We compute the RMSE (by replications) for our estimator, for the two different choices of , first one is automatic calibration, and the second one by manual tuning (to get the best performance). We compare both these method for the following two models.

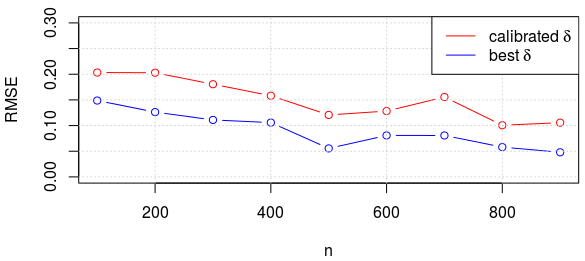

-

•

Model 1: . In this case our calibrated has performance really close to the “ideal” as can be seen by the Figure 4-(a).

-

•

Model 2: . In this case the gap between BBP threshold and is very small . Here the difference between the two choice of is more prominent. The RMSE corresponding to the “best” is about lower than that of our calibrated (See Figure 4-(b)).

|

|

| (a) | (b) |

The main takeaway here is that when the gap is not too small then our calibrated has performance very close to the “best” , but when the “gap” is very small, further study needs to be done to be able to adaptively choose based on the “gap”. Nevertheless in either case (gap: small/big) our modified AIC criterion (with calibrated ) works better than the other estimators in the literature as shown in the next two sections.

4.2 Comparison study I

In this section we compare our modified AIC estimator against the estimator by Passemier and Yao, (2014) (abbreviated as PY), see section 2.3 for details.

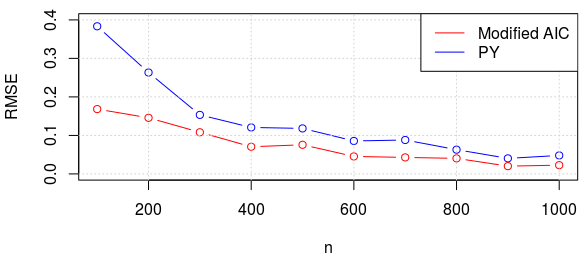

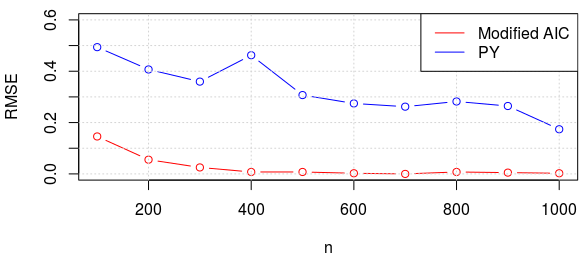

are generated from a -variate Gaussian distribution with mean 0 and a spiked variance-covariance matrix . After fixing a , and are varied such that . We compute the RMSE for our estimator (with calibrated ) and for PY estimator (as proposed in their paper with automatic calibration) by conducting independent replications. We compare both these method for the following models.

-

•

Model A: , , . Our method performs uniformly better than PY (see Figure 5-(a)), though the advantage seems to decrease as increases.

-

•

Model B: , , . In this case the gap between BBP threshold and is very small . Our method is still the better one (see Figure 5-(b)).

-

•

Model C: , , (equal spikes). Our Method is clearly better than PY’s (see Figure 5-(c)) and the advantage gained is significant especially in case of equal spikes.

| , , | , , |

|

|

| (a) | (b) |

| , , | |

|

|

| (c) |

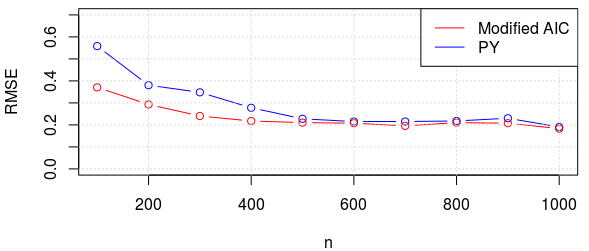

4.3 Comparison study II

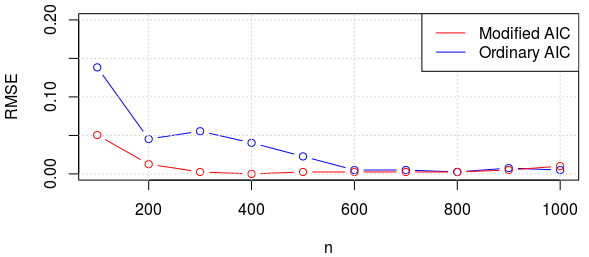

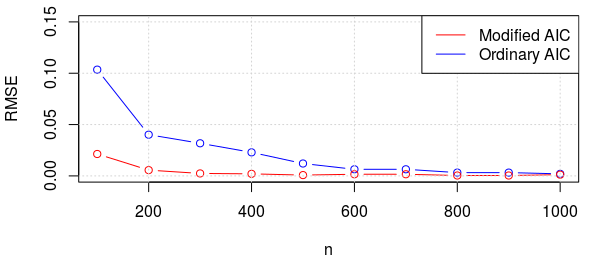

In this section we compare our estimator against the ordinary AIC criterion as proposed by Bai et al., (2018), see section 2.2 for details.

are generated from a -variate Gaussian distribution with mean 0, with spiked variance-covariance matrix . After fixing a , and are varied such that . We compute the RMSE for our estimator (with calibrated ) and for ordinary AIC criterion by conducting independent replications. We compare both these method for the following models.

- •

- •

| , | , |

|

|

| (a) | (b) |

4.4 The choice of

Observe that we can reach arbitrary close to , by suitably choosing the penalty term in AIC criterion (). Motivated by our estimators where we have chosen our gap to be where can be arbitrarily small, or even (in case of weak consistency), we present an estimator where is exactly zero, i.e. choose

We now present a simulation study about this estimator.

-

•

Simulation setup: is fixed, is varied, are generated from a -variate Gaussian distribution with mean with spiked variance-covariance matrix (i.e. a diagonal matrix with first entries as and rest diagonal entries are 1). Here we fixed and .

-

•

Results: We varied from to and iterated times each. Table 2 shows the accuracy (i.e. proportion of times is equal to true ) and the average value of over iterations.

100 200 400 800 1200 1500 2000 2500 3200 accuracy 0.02 0.04 0.04 0.26 0.48 0.76 0.94 0.96 0.94 avg 5.56 7.08 7.82 8.98 9.50 9.82 10.06 10.00 10.06 Table 2: The behaviour of our estimator with the choice .

The results suggest that the estimator is consistent. We leave the theoretical analysis of this case to future work.

5 Conclusion

In this article, we have considered the AIC cirterion for high dimensional model selection. Bai et al., (2018) have shown strong consistency of AIC under a “gap” condition, requiring more signal than what the BBP threshold demands. We have modified the penalty term in AIC suitably and proposed a criterion that achieves strong consistency under arbitrarily small gap. We have also proposed another modification that achieves weak consistency under exactly zero gap. We have made a detailed empirical study of the performance of the proposed criteria. Furthermore, we have compared our second proposal with the estimator of Passemier and Yao, (2014) which also achieves weak consistency under zero gap.

6 Acknowledgements

This article is based on the Masters dissertation Chakraborty, (2020) of the first author under the supervision of the second and the third authors. The authors thank Professors Gopal K. Basak and Tapas Samanta for their insightful comments. The second author is supported by an INSPIRE Faculty Fellowship, Department of Science and Technology, Government of India.

References

- Akaike, (1998) Akaike, H. (1998). Information theory and an extension of the maximum likelihood principle. In Selected papers of hirotugu akaike, pages 199–213. Springer.

- Anderson, (1958) Anderson, T. W. (1958). An introduction to multivariate statistical analysis. Technical report.

- Bai et al., (2018) Bai, Z., Choi, K. P., Fujikoshi, Y., et al. (2018). Consistency of aic and bic in estimating the number of significant components in high-dimensional principal component analysis. The Annals of Statistics, 46(3):1050–1076.

- Bai and Yao, (2012) Bai, Z. and Yao, J. (2012). On sample eigenvalues in a generalized spiked population model. Journal of Multivariate Analysis, 106:167–177.

- Baik et al., (2005) Baik, J., Arous, G. B., Péché, S., et al. (2005). Phase transition of the largest eigenvalue for nonnull complex sample covariance matrices. The Annals of Probability, 33(5):1643–1697.

- Benaych-Georges et al., (2011) Benaych-Georges, F., Guionnet, A., Maida, M., et al. (2011). Fluctuations of the extreme eigenvalues of finite rank deformations of random matrices. Electronic Journal of Probability, 16:1621–1662.

- Chakraborty, (2020) Chakraborty, A. (2020). Some Contributions to High Dimensional Principal Component Analysis. Master’s thesis, Indian Statistical Institute, Kolkata.

- Fujikoshi et al., (2011) Fujikoshi, Y., Ulyanov, V. V., and Shimizu, R. (2011). Multivariate statistics: High-dimensional and large-sample approximations, volume 760. John Wiley & Sons.

- Hu et al., (2020) Hu, J., Zhang, J., and Zhu, J. (2020). Detection of the number of principal components by extended aic-type method.

- Johnstone, (2001) Johnstone, I. M. (2001). On the distribution of the largest eigenvalue in principal components analysis. Annals of statistics, pages 295–327.

- Johnstone and Paul, (2018) Johnstone, I. M. and Paul, D. (2018). Pca in high dimensions: An orientation. Proceedings of the IEEE, 106(8):1277–1292.

- Jolliffe, (1986) Jolliffe, I. T. (1986). Principal components in regression analysis. In Principal component analysis, pages 129–155. Springer.

- Kritchman and Nadler, (2009) Kritchman, S. and Nadler, B. (2009). Non-parametric detection of the number of signals: Hypothesis testing and random matrix theory. IEEE Transactions on Signal Processing, 57(10):3930–3941.

- Li et al., (2019) Li, Z., Han, F., and Yao, J. (2019). Asymptotic joint distribution of extreme eigenvalues and trace of large sample covariance matrix in a generalized spiked population model. arXiv preprint arXiv:1906.09639.

- Nadler, (2010) Nadler, B. (2010). Nonparametric detection of signals by information theoretic criteria: performance analysis and an improved estimator. IEEE Transactions on Signal Processing, 58(5):2746–2756.

- Passemier and Yao, (2014) Passemier, D. and Yao, J. (2014). Estimation of the number of spikes, possibly equal, in the high-dimensional case. Journal of Multivariate Analysis, 127:173–183.

- Paul, (2007) Paul, D. (2007). Asymptotics of sample eigenstructure for a large dimensional spiked covariance model. Statistica Sinica, pages 1617–1642.

- Schwarz et al., (1978) Schwarz, G. et al. (1978). Estimating the dimension of a model. The annals of statistics, 6(2):461–464.

- Silverstein, (1995) Silverstein, J. W. (1995). Strong convergence of the empirical distribution of eigenvalues of large dimensional random matrices. Journal of Multivariate Analysis, 55(2):331–339.

- Wax and Kailath, (1985) Wax, M. and Kailath, T. (1985). Detection of signals by information theoretic criteria. IEEE Transactions on acoustics, speech, and signal processing, 33(2):387–392.

7 Appendix

7.1 Preparatory Lemmas

The proof of Theorem 3.1, 3.3 and 3.4 rely on several additional lemmas which are organised in this section. We first recall a lemma stated earlier in Section 2.1.1 as Lemma 2.1.

Lemma 7.1.

Let denote the ith largest eigenvalue of the covariance matrix in our setup. Suppose that , condition and hold, and that is bounded.

-

(i)

If , then .

-

(ii)

and , then (where is the -quantile of MP distribution). In particular if i is bounded .

The next lemma is a direct consequence of Theorem 3.1 of, Li et al., (2019).

Lemma 7.2.

Next lemma is a direct consequence of Proposition from Benaych-Georges et al., (2011).

Lemma 7.3.

Assume that the entries of have a symmetric law and a sub-exponential decay, that means positive constants such that, for all , we have . Then, for all with a prefixed range L,

7.2 Weak Consistency Proof

Proof of the Theorem 3.3. We will show that as . We will show that by breaking the problem into two cases and , in both these cases we will show that as .

Case I: When ,

Only step that needs to be justified is the third step , specifically

Claim:

Observe that,

+

Result:(Taylor series theorem) For a twice differentiable on with continuous on . Assume that . Then for every , there exists point in such that

Using the above theorem we get under prescribed conditions on we have

Choose

and observe that

We have that

where

.

So we have

Hence

Lets look at the R.H.S, we know from Lemma 2.1 that and from the MP-law that , where is the mean of the MP distribution.

Using these we infer that

Now using sandwich theorem we have that as

so, we have that .

Therefore,

So,

As coupled with previous fact, we can conclude that

Next using Lemma 2.1 observe that and which implies that

Hence the claim is proved.

Next using the monotonicity of and ’s we have

We know that so we have that hence this implies that or a weaker condition that .

Case II: When and is bounded, i.e. ,

Lets look at where as , pick the term, we divide the expression into sum of four parts as follows

-

1.

-

2.

-

3.

-

4.

Here .

Let us begin analysing each of these terms one by one

-

1.

We know that if otherwise when and is finite.

This along with the previous fact implies that

So

coupled with the fact that and Slutsky’s theorem we have that

Next by mean value theorem we have that:

Using the above we can infer that

As . Using sandwich theorem we have:

Therefore using Slutsky’s Theorem we have that:

-

2.

By mean value theorem we have that:Therefore

Using Lemma 7.3

Also as so using sandwich theorem we have . Therefore we have that:

so using the above fact we have that

which implies

-

3.

Observe that,

+Using the taylors series theorem we get under some conditions on we have

Choose

As in case I we finally have that

where

So we have thatWhich is equal to

Lets look at the R.H.S, we already know that and

Using these we infer thatNow using sandwich theorem we have that as so, we have that .

Therefore,So,

As coupled with previous fact, we can conclude that

Next let us deal with

Using Lemma 7.3

Therefore

We have already observed that

Therefore

Hence

So finally we have that

-

4.

Looking at the last term

Call

therefore the last term can be written as

Observe that

Therefore asymptotically only the first term matters, which is

Now is chosen such that this term above goes to .

As a result we have that

Now combining both the cases we have

As there are finitely many ’s this implies that

Hence .

Proof of the Theorem 3.4:

We will show that as . We will show that by breaking the problem into two cases as before and , in both these cases we will show that as .

Case I: When ,

Only step that needs to be justified is the third step , specifically

Claim:

Observe that,

+

Using Taylor’s Series theorem with

We have that

where

So we have

Hence

Lets look at the R.H.S, we know from Lemma 2.1 that .

Next we look at

We already know by M-P law that

where is the mean of the Marcenko-Pastur distribution. Therefore

Using these we infer that

Now using sandwich theorem we have that as

so, we have that .

Therefore,

So,

As coupled with previous fact, we can conclude that

As already observed and which implies that

Hence the claim is proved.

Next using the monotonicity of and ’s

We know that so we have that hence this implies that or a weaker condition that .

Case II: When and is bounded, i.e. ,

Lets look at where as , pick the term, we divide the expression into sum of four parts as follows

-

1.

-

2.

-

3.

-

4.

Here .

Let us begin analysing each of these terms one by one

-

1.

From the proof of Theorem 3.3 we have already shown that

Using which we infer that

As , we have that:

This implies

i.e.

We have that

As a result

Next by mean value theorem we have that:

Using the above we can infer that

As already observed during the proof of Theorem 3.3 . Using sandwich theorem we have:

Therefore using Slutsky’s Theorem we have that:

-

2.

The proof of this part is exactly the same as that of Theorem 3.3, where we showed that -

3.

Observe that,

+Using the taylors series theorem we get under some conditions on we have

Choose

As in case I we finally have that

where

So we have thatLets look at the R.H.S, we already know that and

Using these we infer thatNow using sandwich theorem we have that as so, we have that .

Therefore,So,

As coupled with previous fact, we can conclude that

Next let us deal with

Using Lemma 7.3

Therefore

We have already observed that

Therefore

Hence

So finally we have that

-

4.

Looking at the last term

Call

therefore the last term can be written as

Observe that

Therefore asymptotically only the first term matters, which is

as

As a result we have that

Now combining both the cases we have

As there are finitely many ’s this implies that

Hence .

7.3 Strong Consistency Proof

Proof of Theorem 3.1 (Strong Consistency): Here again as for weak consistency we look for two cases and and compare and . Proof of Case I, i.e. is along the similar lines as in Theorem 3.3 (weak consistency proof) where we have shown that

Case I: When ,

Using the monotonicity of and ’s

Now suppose then we have that . So we have that

i.e. almost surely implying that is not consistent.

On the other hand if we have that so we have that hence this implies that .

Case II: When ,

For, . From Lemma 2.1, we have that and as so it implies that a.s.

The last line is true because and because is a monotonically increasing function.

Therefore we have that this implies that .

Combining Case I and II we have that .