suppSupplementary References

Identification and Estimation of Unconditional Policy Effects of an Endogenous Binary Treatment: an Unconditional MTE Approach††thanks: For helpful and constructive comments, we thank Xinwei Ma, Augusto Nieto-Barthaburu, Vitor Possebom, Christoph Rothe, Kaspar Wuthrich, and seminar participants at UC Berkeley, UC Davis, UC San Diego, LACEA 2021, NAMES 2022, and SEA 2022. This research was conducted with restricted access to Bureau of Labor Statistics (BLS) data. The views expressed here do not necessarily reflect the views of the BLS.

Abstract

This paper studies the identification and estimation of policy effects when treatment status is binary and endogenous. We introduce a new class of unconditional marginal treatment effects (MTE) based on the influence function of the functional underlying the policy target. We show that an unconditional policy effect can be represented as a weighted average of the newly defined unconditional MTEs over the individuals who are indifferent about their treatment status. We provide conditions for point identification of the unconditional policy effects. When a quantile is the functional of interest, we introduce the UNconditional Instrumental Quantile Estimator (UNIQUE) and establish its consistency and asymptotic distribution. In the empirical application, we estimate the effect of changing college enrollment status, induced by higher tuition subsidy, on the quantiles of the wage distribution.

Keywords: marginal treatment effect, marginal policy-relevant treatment effect, selection model, instrumental variable, unconditional policy effect, unconditional quantile regression.

JEL: C14, C31, C36.

1 Introduction

An unconditional policy effect is the effect of a change in a target covariate on the unconditional distribution of an outcome variable of interest.111There are several groups of variables in this framework. The target covariate is the variable a policy maker aims to change. We often refer to the target covariate as the treatment or treatment variable. The outcome variable is the variable that a policy maker ultimately cares about. A policy maker hopes to change the target covariate in order to achieve a desired effect on the distribution of the outcome variable. Sometimes, a policy maker can not change the treatment variable directly and has to change it via intervening some other covariates, which may be referred to as the policy covariates. There may also be covariates that will not be intervened. When the target covariate has a continuous distribution, we may be interested in shifting its location and evaluating the effect of such a shift on the distribution of the outcome variable. For example, we may consider increasing the number of years of education for every worker in order to improve the median of the wage distribution. When the change in the covariate distribution is small, such an effect may be referred to as the marginal unconditional policy effect.

In this paper, we consider a binary target covariate that indicates the treatment status. In this case, a location shift is not possible, and the only way to change its distribution is to change the proportion of treated individuals. We analyze the impact of such a marginal change on a general functional of the distribution of the outcome. For example, when the functional of interest is the mean of the outcome, this corresponds to the marginal policy-relevant treatment effect (MPRTE) of Carneiro, Heckman and Vytlacil (2010, 2011). For the case of quantiles, we obtain an unconditional quantile effect (UQE). Previously, in a seminal contribution, Firpo, Fortin and Lemieux (2009) proposed using an unconditional quantile regression (UQR) to estimate the UQE.222Mukhin (2019) generalizes Firpo, Fortin and Lemieux (2009) to allow for non-marginal changes in continuous covariates. Other recent studies in the case of continuous covariates include Sasaki, Ura and Zhang (2020) who allow for a high-dimensional setting, Inoue, Li and Xu (2021) who tackle the two-sample problem, Martinez-Iriarte, Montes-Rojas and Sun (2022) who analyze location-scale and compensated shifts, and Alejo et al. (2022) who propose an alternative estimation method based on the slopes of (conditional) quantile regression. However, we show that their identification strategy can break down under endogeneity. An extensive analysis of the resulting asymptotic bias of the UQR estimator is provided.

The first contribution of this paper is to introduce a new class of unconditional marginal treatment effects (MTEs) and show that the corresponding unconditional policy effect can be represented as a weighted average of these unconditional MTEs. The new MTEs are based on the influence function of the functional of the outcome distribution that we care about. This allows us to show that the MPRTE and UQE belong to the same family of parameters. To the best of our knowledge, this was not previously recognized in either the literature on MTEs or the literature on unconditional policy effects.

To illustrate the usefulness of this general approach, we provide an extensive analysis of the unconditional quantile effects. This is empirically important since the UQR estimator proposed by Firpo, Fortin and Lemieux (2009) is consistent for the UQE only if a certain distributional invariance assumption holds. Such an assumption is unlikely to hold when the treatment status is endogenous. We note that treatment endogeneity is the rule rather than the exception in economic applications.

The second contribution of this paper is to provide a closed-form expression for the asymptotic bias of the UQR estimator when endogeneity is neglected. We show that if selection into treatment follows a threshold-crossing model, even if the treatment status is exogenous, the UQR estimator can still be inconsistent. This intriguing result cautions the use of the UQR without careful consideration. The asymptotic bias can be traced back to two sources. First, the subpopulation of the individuals at the margin of indifference might have different characteristics than the whole population. We refer to this source of bias as the marginal heterogeneity bias. Second, the treatment effect for a marginal individual might be different from an apparent effect obtained by comparing the treatment group with the control group. It is the marginal subpopulation, not the whole population or any other subpopulation, that contributes to the UQE. We refer to the second source of bias as the marginal selection bias.

The third contribution of this paper is to show that if assumptions similar to instrument validity are imposed on the policy variables under intervention, the resulting UQE can be point identified using the local instrumental variable approach as in Carneiro and Lee (2009). Based on this, we introduce the UNconditional Instrumental QUantile Estimator (UNIQUE) and develop methods of statistical inference based on the UNIQUE when the binary treatment is endogeneous. We take a nonparametric approach but allow for the propensity score function to be either parametric or nonparametric. We establish the asymptotic distribution of the UNIQUE. This is a formidable task, as the UNIQUE is a four-step estimator, and we have to pin down the estimation error from each step.

Related Literature. This paper is related to the literature on marginal treatment effects. Introduced by Bjorklund and Moffitt (1987), MTEs can be used as a building block for many different causal parameters of interest as shown in Heckman and Vytlacil (2001a). For an excellent review, the reader is referred to Mogstad and Torgovitsky (2018). As a main departure from this literature, this paper introduces unconditional MTEs targeted at studying unconditional policy effects. As mentioned above, if we focus on the mean, the unconditional marginal policy effect we study corresponds to the MPRTE of Carneiro, Heckman and Vytlacil (2010). In this case, the unconditional MTE is the same as the usual MTE. For quantiles, the unconditional marginal policy effect is studied by Firpo, Fortin and Lemieux (2009), but under a setting that does not allow for endogeneity.333For the case of continuous endogenous covariates, Rothe (2010) shows that the control function approach of Imbens and Newey (2009) can be used to achieve identification. This paper considers a binary endogenous covariate. The unconditional MTE is novel in this case, as well as in the case with a more general nonlinear functional of interest. In our setting that allows some covariates to enter both the outcome equation and the selection equation, conditioning on the propensity score is not enough, but we show that the propensity score plays a key role in averaging the unconditional MTEs to obtain the unconditional policy effect. This is in contrast with Zhou and Xie (2019) where the marginal treatment effect parameter is defined based on conditioning on the propensity score. Among other contributions, Mogstad, Torgovitsky and Walters (2020) provide an extensive list of applications for MTEs, many of which can also be applied to the unconditional MTEs introduced in this paper.

Our general treatment of the problem using functionals is closely related to that of Rothe (2012). Rothe (2012) analyzes the effect of an arbitrary change in the distribution of a target covariate, either continuous or discrete, on some feature of the distribution of the outcome variable. By assuming a form of conditional independence, for the case of continuous target covariates, Rothe (2012) generalizes the approach of Firpo, Fortin and Lemieux (2009). However, for the case of a discrete treatment, instead of point identifying the effect as we do here, bounds are obtained by assuming that either the highest-ranked or lowest-ranked individuals enter the program under the new policy.

We are not the first to consider unconditional quantile regressions under endogeneity. Kasy (2016) focuses on ranking counterfactual policies and, for the case of discrete regressors, allows for endogeneity. However, a key difference from our approach is that the counterfactual policies analyzed in Kasy (2016) are randomly assigned conditional on a covariate vector. In our setting, selection into treatment follows a threshold-crossing model, where we use the exogenous variation of an instrument to obtain different counterfactual scenarios. Martinez-Iriarte (2020) introduces the quantile breakdown frontier in order to perform a sensitivity analysis to departures from the distributional invariance assumption employed by Firpo, Fortin and Lemieux (2009).

Estimation of the MTE and parameters derived from the MTE curve is discussed in Heckman, Urzua and Vytlacil (2006), Carneiro and Lee (2009), Carneiro, Heckman and Vytlacil (2010, 2011), and, more recently, Sasaki and Ura (2021). All of these studies make a linear-in-parameters assumption regarding the conditional means of the potential outcomes, which yields a tractable partially-linear model for the MTE curve. This strategy is not very helpful in our case because our newly defined unconditional MTE might involve a nonlinear function of the potential outcomes. For example, in the case of quantiles, there is an indicator function involved. Using our expression for the weights, we can write the UQE as a quotient of two average derivatives. One of them, however, involves as a regressor the estimated propensity score as in the setting of Hahn and Ridder (2013). We provide conditions, different from those in Hahn and Ridder (2013), under which the error from estimating the propensity score function, either parametrically or nonparametrically, does not affect the asymptotic variance of the UNIQUE. This may be of independent interest.

Outline. Section 2 introduces the new MTE curve and shows how it relates to the unconditional policy effect. Section 3 presents a model for studying the UQE under endogeneity. Section 4 considers intervening an instrumental variable in order to change the treatment status and establishes the identification of the corresponding UQE. Section 5 introduces and studies the UNIQUE under a parametric specification of the propensity score. Section 6 provides simulation evidence. In Section 7 we revisit the empirical application of Carneiro, Heckman and Vytlacil (2011) and focus on the unconditional quantile effect. Section 8 concludes. An appendix contains the proof of the main results. A supplementary appendix provides the technical conditions for two lemmas, the proof of all lemmas and a proposition, the estimation of the asymptotic variance for the UNIQUE, and its asymptotic properties under a nonparametric specification of the propensity score.

Notation. For any generic random variable , we denote its CDF and pdf by and respectively. We denote its conditional CDF and pdf conditional on a second random variable by and respectively.

2 Unconditional Policy Effects under Endogeneity

2.1 Policy Intervention

We employ the potential outcomes framework. For each individual, there are two potential outcomes: and , where is the outcome had she received no treatment and is the outcome had she received treatment. We assume that the potential outcomes are given by

for a pair of unknown functions and . The vector consists of observables and consists of unobservables. Depending on the individual’s actual choice of treatment, denoted by we observe either or , but we can never observe both. The observed outcome is denoted by :

| (1) |

Following Heckman and Vytlacil (1999, 2001a, 2005), we assume that selection into treatment is determined by a threshold-crossing equation

| (2) |

where and consists of covariates that do not affect the potential outcomes directly. In the above, the unknown function can be regarded as the benefit from the treatment and as the cost of the treatment. Individuals decide to take up the treatment if and only if its benefit outweighs its cost. While we observe , we observe neither nor Also, we do not restrict the dependence among and . Hence, they can be mutually dependent and could be endogenous.

The propensity score is . In view of (2), we can represent it as

If the conditional CDF is a strictly increasing function for all , the support of , we have

where measures an individual’s relative resistance to the treatment. It can be shown that is uniform on and is independent of

To change the treatment take-up rate, we manipulate More specifically, we assume that is a random vector with at least one continuous component and consider a policy intervention that changes into for a vector of smooth functions . We assume that so that the status quo policy corresponds to

When we induce the covariate to change, the distribution of this covariate will change. However, we do not specify the new distribution a priori. Instead, we specify the policy rule that pins down how the value of the covariate will be changed for each individual in the population. Our intervention may then be regarded as a value intervention. This is in contrast to a distribution intervention that stipulates a new covariate distribution directly. An advantage of our policy rule is that it is directly implementable in practice while a hypothetical distribution intervention is not. The latter intervention may still have to be implemented via a value intervention, which is our focus here.444For a similar comment in the continuous case, see Section 3 in Martinez-Iriarte, Montes-Rojas and Sun (2022).

With the induced change in the selection equation becomes

| (3) |

The outcome equation, in turn, is now

| (4) |

These two equations are the same as the status quo equations; the only exception is that has been replaced by We have maintained the structural forms of the outcome equation and the treatment selection equation. Importantly, we have also maintained the stochastic dependence among and which is manifested through the use of the same notation and in equations (3) and (4) as in equations (1) and (2). Our policy intervention has a ceteris paribus interpretation at the population level: we apply the same form of intervention on for all individuals in the population but hold all else, including the causal mechanism and the stochastic dependence among the status quo variables, constant.

Note that the model described by (3) and (4) coincides with the model given in (1) and (2) if we set . For notational convenience, when , we drop the subscript, and we write and for and respectively. It may be useful to reiterate that, regardless of the value of the pattern of stochastic dependence among and is the same. In particular, the conditional distribution of given is invariant to the value of

Under the counterfactual policy regime, becomes , and

| (5) |

where

is a function of and Note that in (5) is still defined as , and so it does not change under the counterfactual policy regime. This is to say that relative to others, an individual’s resistance to the treatment is maintained across the two policy regimes. In particular, is still uniform on and independent of Under the new policy regime, the propensity score is then equal to

and the treatment take-up rate becomes As a result of the policy change, the treatment take-up rate moves from to

We allow to take a general form but some examples may be helpful. Consider the case that for a univariate We may also take . Under such a policy, we change the value of by for each individual in the population so that the location of the distribution of is shifted by We may also take , in which case, there is a scale change in the value of for all individuals. Both cases have been studied by Carneiro, Heckman and Vytlacil (2010). More general location and scale changes such as those given in Martinez-Iriarte, Montes-Rojas and Sun (2022) are allowed. In fact, any policy function that satisfies Assumption 2 in the next subsection is permitted.

2.2 Unconditional Policy Effects

To define an unconditional policy effect, we first describe the space of distributions and the functional of interest on this space. Let be the space of finite signed measures on with distribution function for . We endow with the usual supremum norm: for two distribution functions and associated with the respective signed measures and on , we define With some abuse of notation, denote as the distribution of where is the measure induced by the distribution of Define similarly. Clearly, both and belong to We consider a general functional and study the general unconditional policy effect.

Definition 1.

General Unconditional Policy Effect

The general unconditional policy effect for the functional is defined as

whenever this limit exists.

In this paper, we consider a Hadamard differentiable functional.555An earlier working paper Martinez-Iriarte and Sun (2022) considers the mean functional under different assumptions since the mean functional is not Hadamard differentiable. For completeness, we provide the definition of Hadamard differentiability below.

Definition 2.

is Hadamard differentiable at if there exists a linear and continuous functional such that for any and with

we have

To see how we can use the Hadamard differentiability to obtain , we write

for

| (6) |

As long as we can show that for some then, we obtain

Next, we provide sufficient conditions for , starting with a support assumption.

Assumption 1.

Support Assumption For , the support of given does not depend on .

Assumption 2.

Regularity Conditions 666In Assumption 2 “for all ” can be replaced by “for almost all ”, and the supremum over can be replaced by the essential supremum over .

-

(a)

For the random variables are absolutely continuous with joint density given by

-

(b)

(i) For is continuous for all and all . (ii) For where for some

-

(c)

(i) (ii) For all , the map is continuously differentiable on (iii)

Assumption 3.

Domination Conditions For

Under Assumption 2(b, c), we have

as , where

So, under the new policy regime , the participation rate in the treatment is increased by approximately Note that depends on the policy function . For notational simplicity, such dependence has been suppressed.

Theorem 1.

Theorem 1 reveals that the general unconditional policy effect is composed of two key elements: the unconditional evaluated at and the weighting function To understand the first element, consider the group of individuals with the same value of Within this group, those for whom are indifferent between participating and not participating. A small incentive will induce a change in the treatment status for and only for this subgroup of individuals. It is the change in their treatment status, and hence the change in the composition of and in the observed outcome that changes its unconditional characteristics such as the quantiles. We refer to the individuals for whom as the marginal subpopulation.

To understand the weighting function consider the case and for all , and let be a small positive number. Then, measures the proportion of individuals for whom is in Note that for the propensity scores under and are approximately and . The proportion of the individuals for whom and who have switched their treatment status from to is then equal to Scaling this by , which is the overall proportion of the individuals who have switched the treatment status, we obtain

Thus, we can regard as the density function of among those who have switched their treatment status from to as a result of the policy intervention. On the one hand, when the set of individuals who change their treatment status are the individuals on the margin, namely, those for whom On the other hand, when the density function approaches So the weighting function is the probability density function of the distribution of over the marginal subpopulation.

It is now clear that the general unconditional policy effect is equal to the average of the unconditional over the marginal subpopulation. Such an interpretation is still valid even if is not positive for all . In this case, we only need to view the distribution with density (with respect to the Lesbegue measure) as a signed measure.

2.3 Understanding the Unconditional MTE

To gain a deeper understanding of the unconditional MTE, we will explore another perspective here. Note that this subsection will only provide heuristics, as the formal developments have already been covered in the previous subsections.

Heckman and Vytlacil (2001b, 2005) focus on the mean functional and consider the policy-relevant treatment effect defined as

| (8) |

Taking the limit yields the marginal policy-relevant treatment effect (MPRTE) of Carneiro, Heckman and Vytlacil (2010): Carneiro, Heckman and Vytlacil (2010, 2011) show that can be represented in terms of the conventional marginal treatment effect defined by . These results are applicable to the mean functional.

For a general functional we can expect

where is the continuous derivative of at . One way to represent the limit on the right-hand side is to replace and in (8) by and respectively. So, for a given ,

| (9) |

In the spirit of Heckman and Vytlacil (2001b, 2005), we may then regard the above as a policy-relevant treatment effect: it is the effect of the policy on the percentage of individuals whose value of is less than The effect is tied to a particular value , and we obtain a continuum of policy-relevant effects indexed by if is allowed to vary over . The limit

can then be regarded as a continuum of marginal policy-relevant treatment effects indexed by . By the results of Carneiro and Lee (2009), for each , the marginal policy-relevant treatment effect can be represented as a weighted integral of the following policy-relevant “distributional” MTE:

The composition , defined as is then

This shows that is exactly the unconditional MTE defined in (7). The unconditional MTE is therefore a composition of the underlying influence function with the policy-relevant distributional MTE.

2.4 Unconditional quantile effect

Throughout the rest of this paper, we consider the case that is a quantile functional at the quantile level , that is, . Here we have added a subscript to to signify the quantile level under consideration. We are interested in how an improvement in the treatment take-up rate affects the -quantile of the outcome distribution.

Definition 3.

Unconditional Quantile Effect

The unconditional quantile effect (UQE) is defined as

whenever this limit exists.

Let be the -quantile of Then the influence function of the -quantile functional is

Plugging this influence function into (7), we obtain the unconditional marginal treatment effect for the -quantile.

Definition 4.

The unconditional marginal treatment effect for the -quantile is

The defined above is a basic building block for the unconditional quantile effect. It is different from the quantile analogue of the marginal treatment effect of Carneiro and Lee (2009) and Yu (2014), which is defined as . An unconditional quantile effect can not be represented as an integrated version of the latter.

To understand we define which underlies the above definition of The random variable can take three values:

For a given individual, when the treatment induces the individual to “cross” the -quantile of from below, and when the treatment induces the individual to “cross” the -quantile of from above. In the first case, the individual benefits from the treatment while in the second case the treatment harms her. The intermediate case, occurs when the treatment induces no quantile crossing of any type. Thus, the unconditional expected value equals the difference between the proportion of individuals who benefit from the treatment and the proportion of individuals who are harmed by it. For the UQE, whether the treatment is beneficial or harmful is measured in terms of quantile crossing. Among the individuals with characteristics and , is then equal to the rescaled (by ) difference between the proportion of individuals who benefit from the treatment and the proportion of individuals who are harmed by it. Thus, is positive if more individuals increase their outcome above , and it is negative if more individuals decrease their outcome below .

3 UQR with a Threshold-crossing Model

In this section, we study whether the UQR proposed by Firpo, Fortin and Lemieux (2009) can provide a consistent estimator of UQE. When it is inconsistent, we investigate the sources of asymptotic bias in the UQR estimator and show that it is asymptotically biased, even when is exogenous. As a result, the UQR is not suitable for studying unconditional policy effects when the treatment variable is an endogenous binary variable that follows a threshold-crossing model. In Section 5, we will present a consistent estimator of the unconditional policy effect for such a model.

3.1 UQR with a Binary Regressor

We provide a quick review of the UQR. Let be the -quantile of and let be the -quantile of . That is, By definition, we have

When is not present, Corollary 3 in the working paper Firpo, Fortin and Lemieux (2007) makes the following assumption to achieve identification:

| (11) |

We refer to this as distributional invariance, and it readily identifies the counterfactual distribution:

Under some mild conditions, we can follow Firpo, Fortin and Lemieux (2007) to show that

| (12) | |||||

Hence, under the distributional invariance assumption, the UQE can be consistently estimated by regressing on a constant and Such a regression with no additional regressor is a special case of more general unconditional quantile regressions.

3.2 Asymptotic Bias of the UQR Estimator

The distributional invariance assumption given in equation (11) is crucial for achieving the identification result in (12). It states that the conditional distribution of the outcome variable given the treatment status remains the same across the two policy regimes. If treatments are randomly assigned under both policy regimes (e.g., and is independent of then is clearly independent of . In this case, both and are equal to and the distributional invariance assumption is satisfied. However, when is allowed to be correlated with , the distributional invariance assumption does not hold in general. For example, when

and These two conditional probabilities are different under the general dependence of

To allow for the endogeneity of , we have dropped the distributional invariance assumption and assumed a threshold-crossing model as in (2). The next corollary decomposes the unconditional quantile effect given in Corollary 1 into two components. The decomposition reveals that the UQR estimator of Firpo, Fortin and Lemieux (2009) is asymptotically biased under a wide range of conditions, including when is exogenous.

Corollary 2.

Let the assumptions in Corollary 1 hold. Then777We use “A” to denote the Apparent component and use “B” to denote the Bias component.

where

| (13) | |||||

and , for

and

To facilitate understanding of Corollary 2, we define and organize the average influence functions (AIF) in a table:

|

where is short for , the influence function of the quantile functional. In the above, stands for the conditional mean operator given For example, stands for Let

The unconditional quantile effect is the average of the difference with respect to the distribution of over the marginal subpopulation. The average apparent effect is the average of the difference with respect to the distribution of over the whole population distribution. It is also equal to the limit of the UQR estimator of Firpo, Fortin and Lemieux (2009), where the endogeneity of the treatment selection is ignored.888To see why this is the case, we note that, in its simplest form, the UQR involves regressing the “influence function” on and by OLS and using the estimated coefficient on as the estimator of the unconditional quantile effect. Here is a consistent estimator of and is a consistent estimator of It is now easy to see that the UQR estimator converges in probability to if the conditional expectations in ( are linear in Note that if our model contains no covariate then

| (14) | |||||

This is identical to the unconditional quantile effect given in (12).

The discrepancy between and gives rise to the asymptotic bias of the UQR estimator:

| (15) | |||||

It is easy to see that and given above are identical to those given in Corollary 2.

The decomposition in Equation (15) traces the asymptotic bias back to two sources. The first one, , captures the heterogeneity of the averaged apparent effects averaged over two different subpopulations. For every is the average effect of on for the individuals with These effects are averaged over two different distributions of : the distribution of for the marginal subpopulation (i.e., and the distribution of for the whole population (i.e., . is equal to the difference between these two average effects. If the effect does not depend on , then . If is a constant function that always equals 1, then the distribution of over the whole population is the same as that over the marginal subpopulation, and hence as well. For it is necessary that there is an effect heterogeneity (i.e., depends on ) and a distributional heterogeneity (i.e., does not always equal , and as a result, the distribution of over the marginal subpopulation is different from that over the whole population). To highlight the necessary conditions for a nonzero we refer to as the marginal heterogeneity bias.

The second bias component, embodies the second source of the bias and has a difference-in-differences interpretation. Each of and is the difference in the average influence functions associated with the counterfactual outcomes and However, is the difference over the two subpopulations who actually choose and , while is the difference over the marginal subpopulation. So is a difference in differences. is simply the average of this difference in differences with respect to the distribution of over the marginal subpopulation. This term arises because the change in the distributions of for those with and those with is different from that for those whose is just above and those whose is just below . Thus we can label as a marginal selection bias.

If for almost all then The condition is the same as

Equivalently,

The condition resembles the parallel-paths assumption or the constant-bias assumption in a difference-in-differences analysis. If is independent of given then this condition holds, and

In general, when is not independent of given , and enters the selection equation, we have and hence If is not identified, then is not identified. In general, is not identified without additional assumptions. Therefore, in the absence of additional assumptions, the asymptotic bias can not be eliminated, and is not identified.

It is not surprising that in the presence of endogeneity, the UQR estimator is asymptotically biased. The virtue of Corollary 2 is that it provides a closed-form characterization and clear interpretations of the asymptotic bias. To the best of our knowledge, this bias formula is new in the literature. If point identification can not be achieved, then the bias formula can be used in a bound analysis or sensitivity analysis. From a broad perspective, the asymptotic bias is the unconditional quantile counterpart of the endogenous bias of the OLS estimator in a linear regression framework.999The bias decomposition is not unique. Corollary 2 gives only one possibility. We can also write The interpretations of and are similar to those of and with obvious and minor modifications. In this case, it is even more revealing to call the marginal heterogeneity bias, because a necessary condition for a nonzero is that there is an effect heterogeneity among the marginal subpopulation.

Remark 1.

Consider a setting of full independence: (i.e., every subset of these variables is independent of the rest). In this case, and by equation (10), the UQE is

Following (13), the apparent effect is

In general, therefore, we will still have a marginal heterogeneity bias term given by unless is a constant function or the difference does not depend on In general, both conditions fail if some covariate (i.e., in enters both the outcome equations and the selection equation nontrivially. In this case, the unconditional quantile regression estimator, which converges to will be asymptotically biased even though there is no endogeneity.

In the presence of endogeneity, it is not easy to evaluate or even sign the asymptotic bias. In general, the joint distribution of given the covariate is needed for this purpose. This is not atypical. For a nonlinear estimator such as the unconditional quantile estimator, its asymptotic properties often depend on the full data-generating process in a nontrivial way. This is in sharp contrast with a linear estimator such as the OLS in a linear regression model whose properties depend on only the first few moments of the data.

4 Unconditional Quantile Effect under Instrumental Intervention

In the previous section, we have shown that the UQR estimator is asymptotically biased under endogeneity or marginal heterogeneity, and the UQE is, in general, unidentified. In this section, we consider the class of instrumental interventions and show that the UQE for this type of intervention is point identified. We discuss how this result can be used to identify the UQEs of other policy interventions.

4.1 Instrumental Intervention

To introduce the instrumental intervention, we partition into two parts and write where is a univariate continuous policy variable and consists of other variables. If there is only one variable in then and is not present. We consider the intervention

| (16) |

where is a measurable function and is a smooth function satisfying . That is, we intervene to change the first component of Note that while is the same for all individuals, depends on the value of and hence it is individual-specific. Thus, we allow the intervention to be heterogeneous. In empirical applications, may consist of a few variables, and is the continuous target variable that we consider to change. There are no continuity requirements for the other elements of

To present our identification assumptions, we write where is the first element of and consists of other elements of Since the first element of is also the first element of , and hence . By definition, we have We maintain the following assumptions, which are similar to the corresponding assumptions in Heckman and Vytlacil (1999, 2001a, 2005).

Assumption 4.

Relevance and Exogeneity

-

(a)

Conditional on is a non-degenerate random variable.

-

(b)

Conditional on is independent of

Assumption 4(a) is a relevance assumption: for any given level of , can induce some variation in . Assumption 4(b) is a conditional exogeneity assumption: for any given level of , is independent of the unobservables. These two assumptions are essentially the conditions for to be a valid instrumental variable, hence we will refer to as the instrumental variable, and the intervention in (16) as the instrumental intervention.

If conditioning on is not enough to ensure the conditional exogeneity in Assumption 4(b), we may augment the conditioning set to include additional control variables, say The control variables in do not enter , , or . However, we can think that enters , , and trivially so that with some abuse of notation we can write

where is the structural variable that enters and nontrivially and is the control variable that enters and trivially (i.e., and are constant functions of given other variables). Letting and the above model then takes the same form as the model in (1) and (2). With this conceptual change, our results remain valid for the case with additional controls.

If all variables in satisfy the conditional exogeneity assumption, we may replace Assumption 4 by the following: (a) Conditional on is a non-degenerate random variable, and (b) Conditional on is independent of . With minor modifications, our results will remain valid. More specifically, in the statement of each result, we only need to replace “conditioning on ” by “conditioning on ”. The working paper Martinez-Iriarte and Sun (2022) is based on this alternative assumption. Here we will work with Assumption 4, which appears to be more plausible.

Let Under Assumption 4(b), the unconditional MTE for the quantile functional becomes

| (17) | |||||

where in the second line above, conditioning on is not necessary and has been dropped.

Next, we present a lemma that characterizes the weighting function for the instrumental intervention in (16).

Lemma 1.

Assume that (i) are absolutely continuous random variables with joint density given by ; (ii) is differentiable in for almost all with derivative such that is well defined and is not equal to zero; (iii) is a differentiable function in a neighborhood of zero. Then

| (18) |

The lemma shows that the weighting function does not depend on the function form of Hence, the unconditional policy effect does not depend on

4.2 Identification of the UQE

To investigate the identifiability of given in Corollary 3, we study the identifiability of the unconditional and the weighting function separately. The proposition below shows that is identified for every for some .

For a more general functional we can show that

for every equal to for some .

Now we turn to the identification of the weighting function given in Corollary 3. Under Assumption 4(b), the propensity score becomes

Therefore,

It is now clear that can be represented using and We formalize this in the following proposition.

Since is known and is identified, is also identified. As in the case of , Assumption 4(b) plays a key role in identifying Without the assumption that is independent of conditional on we can have only that

The presence of the second term in the above equation invalidates the identification result in (19).

Using Propositions 1 and 2, we can represent as

| (20) |

All objects in the above are point identified, hence is point identified.

Identifying the unconditional effect of an instrumental intervention may be of interest in its own right. We can use the identification result to identify the unconditional policy effect of another intervention. Theorem 1 has shown that the unconditional effects of two interventions will be the same if their weighting functions coincide. Given a counterfactual policy with a target weighting function we can choose in such a way that the weighting function under the policy intervention in (16) is the same as In other words, with appropriate choices of the unconditional effect of intervening is the same as the unconditional effect of another counterfactual policy. If the former is identified, then the latter is also identified.

As an example, consider intervening the second element of with

| (21) |

for some and Under conditions similar to those in Lemma 1, the weighting function for this intervention is

Letting for given in Lemma 1 and solving for yields

So the unconditional effect of the intervention given in (21) is the same as that of the intervention given in (16) when is chosen appropriately. It is important to point out that may not be a valid instrument, and its unconditional effect is identified via “intervention matching.”

5 Unconditional Instrumental Quantile Estimation

This section is devoted to the estimation and inference of the UQE under the instrumental intervention in (16). We assume that the propensity score function is parametric, and we leave the case with a nonparametric propensity score to Section D of the supplementary appendix. In order to simplify the notation, we set for the remainder of this paper.101010The presence of amounts to a change of measure: from a measure with density to a measure with density . When is not equal to a constant function, we only need to change the population expectation operator that involves the distribution of into and the empirical average operator into All of our results will remain valid.

Letting

and using (20), we have

consists of two average derivatives and a density evaluated at a point, some of which depend on the unconditional -quantile . Altogether depends on four unknown quantities.

The method of unconditional instrumental quantile estimation involves first estimating the four quantities separately and then plugging these estimates into to obtain the estimator See (29) in Subsection 5.3 for the formula of

We consider estimating the four quantities in the next few subsections. For a given sample , we will use to denote the empirical measure. The expectation of a function with respect to is then .

5.1 Estimating the Quantile and Density

For a given , we estimate using the (generalized) inverse of the empirical distribution function of : , where

The following asymptotic result can be found in Section 2.5.1 of Serfling (1980).

Lemma 2.

If the density of is positive and continuous at , then where

We use a kernel density estimator to estimate . We maintain the following assumptions on the kernel function and the bandwidth.

Assumption 5.

Kernel Assumption

The kernel function satisfies (i) , (ii) , and (iii) , and it is twice differentiable with Lipschitz continuous second-order derivative satisfying (i) and there exist positive constants and such that for

Assumption 6.

Rate Assumption and such that but .

The non-standard condition is due to the estimation of . Since we need to expand , which involves the derivative of we have to impose a slower rate of decay for to control the remainder. The details can be found in the proof of Lemma 3. We note, however, that implies the usual rate condition .

The estimator of is then given by

where

Lemma 3.

In order to isolate the contributions of and , we can use Lemma 3 to write

| (22) |

The first pair of terms on the right-hand side of (22) represents the dominant term and reflects the uncertainty in the estimation of . The second pair of terms reflects the error from estimating . In order to ensure that , we need as stated in Assumption 6.

5.2 Estimating the Average Derivatives

To estimate the two average derivatives, we make a parametric assumption on the propensity score, leaving the nonparametric specification to the supplementary appendix.

Assumption 7.

The propensity score is known up to a finite-dimensional vector .

First, we estimate the mean of the derivative of the propensity score, by

where is an estimator of . To save space, we slightly abuse notation and write

We adopt this convention in the rest of the paper.

Lemma 4.

Suppose that

-

(a)

admits the representation where is a mean-zero random vector with , and denotes the Euclidean norm;

-

(b)

the variance of is finite;

-

(c)

the derivative vector exists for all and and for in an open neighborhood around

-

(d)

for , the map is continuous, and a uniform law of large numbers holds: .

Then, has the following stochastic approximation

where

We can rewrite the main result of Lemma 4 as

| (24) | |||||

Equation (24) has the same interpretation as equation (22). It consists of a pair of leading terms that ignores the estimation uncertainty in but accounts for the variability of the sample mean, and another pair that accounts for the uncertainty in but ignores the variability of the sample mean.

We estimate the second average derivative by

| (25) |

see (26) for an explicit construction. We can regard as a four-step estimator. The first step estimates , the second step estimates , the third step estimates the conditional expectation using the generated regressor , and the fourth step averages the derivative (with respect to over the generated regressor and .

We use the series method to estimate . To alleviate notation, define the vector We write and to suppress their dependence on the true parameter value Both and are in Let be a vector of basis functions of with finite second moments. Here, each is a differentiable basis function. Then, the series estimator of is where is:

The estimator of the average derivative is then

| (26) |

We use the path derivative approach of Newey (1994) to obtain a decomposition of which is similar to that in Section 2.1 of Hahn and Ridder (2013). To describe the idea, let be a path of distributions indexed by such that is the true distribution of . The parametric assumption on the propensity score does not need to be imposed on the path.111111As we show later, the error from estimating the propensity score does not affect the asymptotic variance of The score of the parametric submodel is For any we define

where and are the probability limits of and respectively, when the distribution of is . Note that when we have Suppose the set of scores for all parametric submodels can approximate any zero-mean, finite-variance function of in the mean square sense.121212This is the “generality” requirement of the family of distributions in Newey (1994). If the function is differentiable at and we can write

| (27) |

for some mean-zero and finite second-moment function and any path then, by Theorem 2.1 of Newey (1994), the asymptotic variance of is .

In the next lemma, we will show that is differentiable at . Suppose, for the moment, this is the case. Then, by the chain rule, we can write

To use Theorem 2.1 of Newey (1994), we need to write all these terms in an outer-product form, namely the form of the right-hand side of (27). To search for the required function , we follow Newey (1994) and examine one component of at a time by treating the remaining components as known.

The next lemma shows that under some conditions we can ignore the error from estimating the propensity score in our asymptotic analysis.

Lemma 5.

Under Assumption 8 given in the supplementary appendix,

The next lemma establishes a stochastic approximation of and provides the influence function as well. The assumption of the lemma is adapted from Newey (1994) which is not necessarily the weakest possible.

5.3 Estimating the UQE

With given in the previous subsections, we estimate the UQE by

| (29) |

This is our unconditional instrumental quantile estimator (UNIQUE). With the asymptotic linear representations of all three components and we can obtain the asymptotic linear representation of The next theorem follows from combining Lemmas 3, 4, 5, and 6.

Theorem 2.

Furthermore, under Assumption 6,

Equation (2) consists of six influence functions and a bias term. The bias term arises from estimating the density and is of order . The six influence functions reflect the impact of each estimation stage. The rate of convergence of is slowed down through , which is of order . We can summarize the results of Theorem 2 in a single equation:

where collects all the influence functions in (2) except for the bias, and

If then the bias term is . The following corollary provides the asymptotic distribution of .

Corollary 4.

From the perspective of asymptotic theory, all of the following terms are all of order and hence can be ignored in large samples: and . The asymptotic variance is then given by

However, ignores all estimation uncertainties except that in , and we do not expect it to reflect the finite-sample variability of well. To improve the finite-sample performances, we keep the dominating term from each source of estimation errors and employ a sample counterpart of to estimate The details can be found in Section C of the supplementary appendix.

5.4 Testing the Null of No Effect

We can use Corollary 4 for hypothesis testing on . Since converges to at a nonparametric rate, in general, the test will have power only against a local departure of a nonparametric rate. However, if we are interested in testing the null of a zero effect, that is, vs. we can detect a parametric rate of departure from the null. The reason is that, by (23), if and only if and can be estimated at the usual parametric rate. Hence, instead of testing vs. we can test the equivalent hypotheses vs.

6 Simulation Evidence

For our simulation, we consider the following model: , , and where . By Corollary 3, and assuming that , we have131313Detailed calculations are available from Appendix B of an earlier working paper Martinez-Iriarte and Sun (2022).

| (33) |

where

In order to compute numerically, we assume that is standard normal and independent of , which is jointly normal with mean and variance-covariance matrix

Here, is the correlation between and , and between and . It is also the parameter that governs the endogeneity of .

Estimation of requires estimating , , , and . The quantiles are estimated in the usual way. To estimate , we use a Gaussian Kernel with bandwidth , where is the sample standard deviation of . This is Silverman’s rule of thumb. To estimate , we use a probit model. To estimate , we run a cubic series regression.

6.1 Testing the Null Hypothesis of No Effect

If we set , and by (33), and so the null hypothesis of a zero effect holds. The test statistic is constructed following equation (32). Because the test statistic does not involve estimating the density (or ), the test has nontrivial power again -departures (i.e., for some from the null.

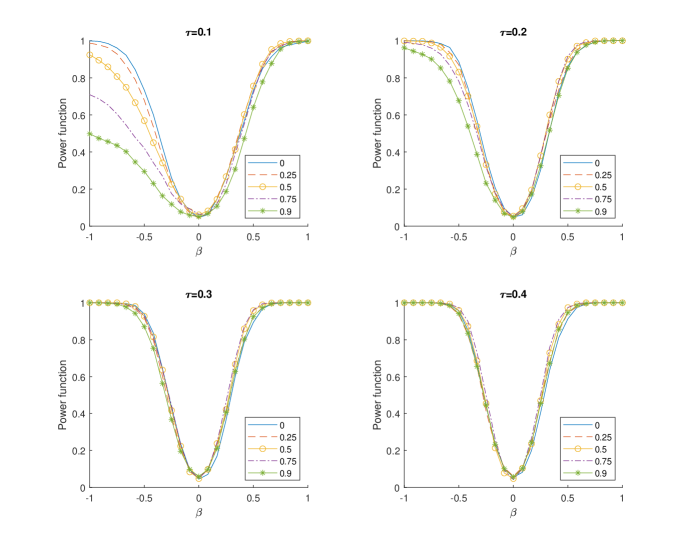

To simulate the power function of the nominal 5% test, we consider a range of 25 values of between and . The endogeneity, governed by the parameter , takes five values: 0, 0.25, 0.5, 0.75, and 0.9. We perform 1,000 simulations with 1,000 observations. For different values of , the power functions are shown below in Figure 1. The test has the desired null rejection probability, except for the extreme quantile , where under high endogeneity, the rejection probability does not increase fast enough. The power function for the median, , is not shown here as it is almost identical to that of . Furthermore, simulation results not reported here show that the power functions for are very similar to those of respectively.

6.2 Empirical Coverage of Confidence Intervals

In this subsection, we investigate the empirical coverage of confidence intervals built using , the variance estimator given in (S.8). Since a 95% confidence interval for can be constructed using

We use a grid of that takes values and . For the endogeneity parameter, , we take the values and . Finally, takes the values from to with an increment of 0.1. We note that, for values of , where the effect is not 0, we need to numerically compute the value of . We perform 1,000 simulations with 1,000 observations each. The results are reported in the tables below for and . It is clear that the confidence intervals have reasonable coverage accuracy in almost all cases.

| 0 | 0.25 | 0.5 | 0.75 | 0.9 | |

|---|---|---|---|---|---|

| -1 | 0.978 | 0.982 | 0.974 | 0.973 | 0.948 |

| -0.5 | 0.955 | 0.958 | 0.969 | 0.977 | 0.947 |

| -0.25 | 0.962 | 0.961 | 0.969 | 0.957 | 0.969 |

| 0 | 0.952 | 0.961 | 0.958 | 0.949 | 0.964 |

| 0.25 | 0.958 | 0.962 | 0.966 | 0.965 | 0.958 |

| 0.5 | 0.967 | 0.969 | 0.972 | 0.965 | 0.963 |

| 1 | 0.979 | 0.974 | 0.974 | 0.979 | 0.97 |

| 0 | 0.25 | 0.5 | 0.75 | 0.9 | |

|---|---|---|---|---|---|

| -1 | 0.94 | 0.911 | 0.916 | 0.91 | 0.692 |

| -0.5 | 0.939 | 0.942 | 0.944 | 0.944 | 0.921 |

| -0.25 | 0.955 | 0.941 | 0.943 | 0.946 | 0.955 |

| 0 | 0.941 | 0.957 | 0.959 | 0.945 | 0.953 |

| 0.25 | 0.949 | 0.942 | 0.942 | 0.967 | 0.954 |

| 0.5 | 0.946 | 0.942 | 0.941 | 0.957 | 0.951 |

| 1 | 0.905 | 0.934 | 0.922 | 0.921 | 0.955 |

7 Empirical Application

We estimate the unconditional quantile effect of expanding college enrollment on (log) wages. The outcome variable is the log wage, and the binary treatment is the college enrollment status. Thus is the proportion of individuals who ever enrolled in a college. Arguably, the cost of tuition , assumed to be continuous, is an important factor that affects the college enrollment status but not the wage. In order to alter the proportion of enrolled individuals, we consider a policy that subsidizes tuition by a certain amount. The UQE is the effect of this policy on the different quantiles of the unconditional distribution of wages when the subsidy is small. This policy shifts , the tuition, to for some , which is the same for all individuals, and induces a small change in college enrollment. Note that we do not need to specify because we look at the limiting version as . In practice, we may set equal to a small percentage of the total tuition, say 1%.

We use the same data as in Carneiro, Heckman and Vytlacil (2010) and Carneiro, Heckman and Vytlacil (2011): a sample of white males from the 1979 National Longitudinal Survey of Youth (NLSY1979). The web appendix to Carneiro, Heckman and Vytlacil (2011) contains a detailed description of the variables. The outcome variable is the log wage in 1991. The treatment indicator is equal to if the individual ever enrolled in college by 1991, and otherwise. The other covariates are AFQT score, mother’s education, number of siblings, average log earnings 1979–2000 in the county of residence at age 17, average unemployment 1979–2000 in the state of residence at age 17, urban residence dummy at age 14, cohort dummies, years of experience in 1991, average local log earnings in 1991, and local unemployment in 1991. We collect these variables into a vector and denote it by .

We assume that the following four variables (denoted by ) enter the selection equation but not the outcome equation: tuition at local public four-year colleges at age 17, presence of a four-year college in the county of residence at age 14, local earnings at age 17, and local unemployment at age 17. The total sample size is 1747, of which 882 individuals had never enrolled in a college () by 1991, and 865 individuals had enrolled in a college by 1991 (. We compute the UQE of a marginal shift in the tuition at local public four-year colleges at age 17.

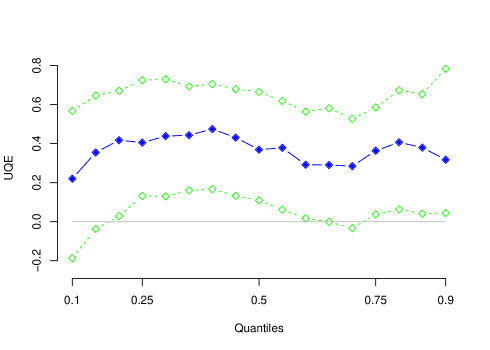

To estimate the propensity score, we use a parametric logistic specification. To estimate the conditional expectation function , we use a series regression using both the estimated propensity score and the covariates and as the regressors. Due to the large number of variables involved, a penalization of was imposed on the -norm of the coefficients, excluding the constant term as in ridge regressions. We compute the UQE at the quantile level . For each we also construct the 95% (pointwise) confidence interval.

Figure 2 presents the results. The UQE ranges between 0.22 and 0.47 across the quantiles with an average of 0.37. When we estimate the unconditional mean effect, we obtain an estimate of 0.21, which is somewhat consistent with the quantile cases. We interpret these estimates in the following way: the effect of a (small) increase in college enrollment induced by an additive change in tuition increases (log) wages between and across quantiles. For example, for , we obtain an increase in the quantiles of the wage distribution between and .

8 Conclusion

In this paper we study the unconditional policy effect with an endogenous binary treatment. Framing the selection equation as a threshold-crossing model allows us to introduce a novel class of unconditional marginal treatment effects and represent the unconditional effect as a weighted average of these unconditional marginal treatment effects. When the policy variable used to change the participation rate satisfies a conditional exogeneity condition, it is possible to recover the unconditional policy effect using the proposed UNIQUE method.

To illustrate the usefulness of unconditional MTEs, we focus on the unconditional quantile effect. We find that the unconditional quantile regression estimator that neglects endogeneity can be severely biased. The bias may not be uniform across quantiles. Any attempt to sign the bias a priori requires very strong assumptions on the data-generating process. More intriguingly, the unconditional quantile regression estimator can be inconsistent even if the treatment status is exogenously determined. This happens when the treatment selection is partly determined by some covariates that also influence the outcome variable.

We find that the unconditional quantile effect and the marginal policy-relevant treatment effect can be seen as part of the same family of policy effects. It is possible to view the latter as a robust version of the former. Both of them are examples of a general unconditional policy effect. To the best of our knowledge, this connection has not been established in either literature.

Appendix: Proof of the Main Results

To prove Theorem 1, we first present an auxiliary proposition with some remarks.

Remark 2.

Proposition 3 provides a linear approximation to , the CDF of the outcome variable under Essentially, it says that the proportion of individuals with outcome below under the new policy regime, that is, , will be equal to the proportion of individuals with outcome below under the existing policy regime, that is, , plus an adjustment given by the marginal entrants. Consider and for all as an example. In this case, because of the policy intervention, the individuals who are on the margin, namely those with , will switch their treatment status from to . Such a switch contributes to by the amount , averaged over the distribution of for the marginal subpopulation

Remark 3.

The linear approximation to is uniform over as . We need the uniform approximation because we consider a general Hadamard differentiable In the special case when does not depend on the whole distribution, the uniformity of the approximation over the whole support may not be necessary. In the quantile case, we maintain the uniformity because we consider all quantile levels in

Proof of Theorem 1. Define

| (A.1) |

Then, by Proposition 3, we have for defined in (6). Hence, under the Hadamard differentiability of we obtain where

| (A.2) |

and is the influence function of at By definition,

where is the probability measure that assigns mass 1 to the single point

It remains to show that is differentiable with

To this end, we consider the limit

But

This and Assumptions 2(b.iii) and 2(c.iii) allow us to use the dominated convergence theorem to obtain

and hence is indeed differentiable with derivative given above. Therefore, is

To represent in an alternative form, recall that the unconditional marginal treatment effect for the functional is

By changing the order of integration, we can write as

Proof of Proposition 3. Using the selection equation we have

where the order of integration can be switched because the integrands are non-negative. It then follows that

| (A.3) | |||||

So,

| (A.4) |

Under Assumptions 2(b) and 2(c), we can differentiate both sides of (A.4) with respect to under the integral sign to get

| (A.5) |

Under Assumptions 2(b.i) and 2(c.ii), is continuous in for each and . In view of Assumptions 2(b.ii) and 2(c.iii), we can invoke the dominated convergence theorem to show that the map is continuous for each .

The same argument can be used to show the continuous differentiability of . More specifically, under Assumption 2(a), we have

where the orders of integrations can be switched because the integrands are non-negative. Therefore,

| (A.6) |

Using Assumptions 2(b) and 2(c), we have

| (A.7) | |||||

The continuity of follows from the same arguments as those for the continuity of .

For any in , we have

The continuous differentiability of and around for each allows us to take the first-order Taylor expansion of the terms in the above expression. Using (A.5), we have

| (A.8) | |||||

where

| (A.9) |

and . The middle point depends on . For the case of , we use (A.7) to obtain a similar expansion:

| (A.10) |

where

| (A.11) |

and . The middle point depends on .

Hence

| (A.12) | |||||

where the remainder is

| (A.13) |

The next step is to show that the remainder in (A.13) is uniformly over as , that is, Using (A.9) and (A.11), we get

Note that Assumption 2(c.iii) implies that

This and 3 allow us to take the limit under the integral signs. Also, we have shown that, both and are continuous in Therefore, So, uniformly over as

Proof of Theorem 2. Consider the following difference

| (A.14) | |||||

We can rearrange (A.14) as

| (A.15) | |||||

By appropriately defining the remainders, we can express (A.15) as

| (A.16) | |||||

The definitions of , and can be found below. Now we are ready to separate the contribution of each stage of the estimation. We shall use equations (22), (24), and (6).

| (A.17) | |||||

Finally, we establish the rate for the remainders , and in (A.16). We deal with each component of the remainder separately. The first remainder is

| (A.18) | |||||

The second remainder is

| (A.19) | |||||

The third remainder is

| (A.20) | |||||

because it has the same denominator as in (A.19). Finally, we compute the rate for . To do so, we use the results in Lemma 3. Equation (22) tells us

| (A.21) | |||||

The remainder is defined as

So,

| (A.22) | |||||

where we have used the rate conditions maintained in Assumption 6.

References

- (1)

- Alejo et al. (2022) Alejo, Javier, Antonio F. Galvao, Julian Martinez-Iriarte, and Gabriel Montes-Rojas. 2022. “Unconditional Quantile Partial Effects via Conditional Quantile Regression.” Working Paper.

- Bjorklund and Moffitt (1987) Bjorklund, Anders, and Robert Moffitt. 1987. “The Estimation of Wage Gains and Welfare Gains in Self-Selection.” The Review of Economics and Statistics, 69(1): 42–49.

- Carneiro and Lee (2009) Carneiro, Pedro, and Sokbae Lee. 2009. “Estimating Distributions of Potential Outcomes Using Local Instrumental Variables with an Application to Changes in College Enrollment and Wage Inequality.” Journal of Econometrics, 149(2): 191–208.

- Carneiro, Heckman and Vytlacil (2010) Carneiro, Pedro, James J. Heckman, and Edward Vytlacil. 2010. “Evaluating Marginal Policy Changes and the Average Effect of Treatment for Individuals at the Margin.” Econometrica, 78(1): 377–394.

- Carneiro, Heckman and Vytlacil (2011) Carneiro, Pedro, James J. Heckman, and Edward Vytlacil. 2011. “Estimating Marginal Returns to Education.” American Economic Review, 101(6): 2754–2781.

- Firpo, Fortin and Lemieux (2007) Firpo, Sergio, Nicole M. Fortin, and Thomas Lemieux. 2007. “Unconditional Quantile Regressions.” NBER Technical Working Paper 339.

- Firpo, Fortin and Lemieux (2009) Firpo, Sergio, Nicole M. Fortin, and Thomas Lemieux. 2009. “Unconditional Quantile Regressions.” Econometrica, 77(3): 953–973.

- Hahn and Ridder (2013) Hahn, Jinyong, and Geert Ridder. 2013. “Asymptotic Variance of Semiparametric Estimators with Generated Regressors.” Econometrica, 81(1): 315–340.

- Heckman and Vytlacil (1999) Heckman, James J., and Edward Vytlacil. 1999. “Local Instrumental Variables and Latent Variable Models for Identifying and Bounding Treatment Effects.” Proceedings of the National Academy of Sciences of the United States of America, 96(8): 4730–4734.

- Heckman and Vytlacil (2001a) Heckman, James J., and Edward Vytlacil. 2001a. “Local Instrumental Variables.” In Nonlinear Statistical Modeling: Proceedings of the Thirteenth International Symposium in Economic Theory and Econometrics: Essays in Honor of Takeshi Amemiya. , ed. C. Hsiao, K. Morimune and J. Powell, 1–46. Cambridge, UK:Cambridge University Press.

- Heckman and Vytlacil (2001b) Heckman, James J., and Edward Vytlacil. 2001b. “Policy Relevant Treatment Effects.” American Economic Review, 91(2): 107–111.

- Heckman and Vytlacil (2005) Heckman, James J., and Edward Vytlacil. 2005. “Structural Equations, Treatment Effects, and Econometric Policy Evaluation.” Econometrica, 73(3): 669–738.

- Heckman, Urzua and Vytlacil (2006) Heckman, James J., Sergio Urzua, and Edward Vytlacil. 2006. “Understanding Instrumental Variables in Models with Essential Heterogeneity.” The Review of Economics and Statistics, 88(3): 389–432.

- Imbens and Newey (2009) Imbens, Guido W., and Whitney K. Newey. 2009. “Identification and Estimation of Triangular Simultaneous Equations Models Without Additivity.” Econometrica, 77(5): 1481–1512.

- Inoue, Li and Xu (2021) Inoue, Atsushi, Tong Li, and Qi Xu. 2021. “Two Sample Unconditional Quantile Effect.” https://arxiv.org/pdf/2105.09445.pdf.

- Kasy (2016) Kasy, Maximilian. 2016. “Partial Identification, Distributional Preferences, and The Welfare Ranking of Policies.” The Review of Economics and Statistics, 98(March): 111–131.

- Martinez-Iriarte (2020) Martinez-Iriarte, Julian. 2020. “Sensitivity Analysis in Unconditional Quantile Effects.” Working Paper.

- Martinez-Iriarte and Sun (2022) Martinez-Iriarte, Julian, and Yixiao Sun. 2022. “Identification and Estimation of Unconditional Policy Effects of an Endogenous Binary Treatment.” https://arxiv.org/abs/2010.15864, v3.

- Martinez-Iriarte, Montes-Rojas and Sun (2022) Martinez-Iriarte, Julian, Gabriel Montes-Rojas, and Yixiao Sun. 2022. “Unconditional Effects of General Policy Interventions.” Working Paper.

- Mogstad, Torgovitsky and Walters (2020) Mogstad, Magne, Alexander Torgovitsky, and Christopher R. Walters. 2020. “Policy Evaluation with Multiple Instrumental Variables.” Working Paper.

- Mogstad and Torgovitsky (2018) Mogstad, Magne, and Alexander Torgovitsky. 2018. “Identification and Extrapolation of Causal Effects with Instrumental Variables.” Annual Review of Economics, 10: 577–613.

- Mukhin (2019) Mukhin, Yaroslav. 2019. “On Counterfactual Analysis of Differentiable Functionals.” Working Paper.

- Newey (1994) Newey, Whitney K. 1994. “The Asymptotic Variance of Semiparametric Estimators.” Econometrica, 62(6): 1349–1382.

- Rothe (2010) Rothe, Christoph. 2010. “Identification of Unconditional Partial Effects in Nonseparable Models.” Economics Letters, 109(3): 171–174.

- Rothe (2012) Rothe, Christoph. 2012. “Partial Distributional Policy Effects.” Econometrica, 80(5): 2269–2301.

- Sasaki and Ura (2021) Sasaki, Yuya, and Takuya Ura. 2021. “Estimation and Inference for Policy Relevant Treatment Effects.” Journal of Econometrics (Forthcoming).

- Sasaki, Ura and Zhang (2020) Sasaki, Yuya, Takuya Ura, and Yichong Zhang. 2020. “Unconditional Quantile Regression with High Dimensional Data.” Working Paper.

- Serfling (1980) Serfling, Robert J. 1980. Approximation Theorems of Mathematical Statistics. New York: Wiley.

- Yu (2014) Yu, Ping. 2014. “Marginal Quantile Treatment Effect.” Working Paper.

- Zhou and Xie (2019) Zhou, Xiang, and Yu Xie. 2019. “Marginal Treatment Effects from a Propensity Score Perspective.” Journal of Political Economy, 127(6): 3070–3084.

Online Supplementary Appendix

Title: Identification and Estimation of Unconditional Policy Effects of an Endogenous Binary Treatment:

an Unconditional MTE Approach

Authors: Julian Martinez-Iriarte and Yixiao Sun

A Technical Conditions for Lemmas 5 and 6

Recall that for and is the support of

Assumption 8.

Ignorability of propensity score errors

-

(a)

is absolutely continuous with density and

-

(i)

is continuously differentiable with respect to in ,

-

(ii)

for each , for any on the boundary of the support of conditional on

-

(i)

-

(b)

is continuously differentiable with respect to for all orders, and for a neighborhood of the following holds:

Assumption 9.

Expansion of

-

(a)

(i) the support of is (ii) for is bounded below by for some (iii) (iv) for

-

(b)

there is a constant such that for all

-

(c)

the number of series terms, satisfies for some , and

-

(d)

for each the map is differentiable, and

-

(e)

the following stochastic equicontinuity conditions hold:

-

(f)

Assumption 8 holds.

B Proof of Lemmas and Proposition 1

Proof of Proposition 1. Recall that where and . For any bounded function we have, for

But, using we have

because is independent of . So,

where the last line follows because is independent of given and .

Now

where the first equality uses the law of iterated expectations, the second equality uses the independence of from and the last equality uses uniform on . Similarly,

So we have

By taking , we have

Under Assumptions 2(a) and 2(b), we can invoke the fundamental theorem of calculus to obtain

| (S.1) | |||||

That is,

for any such that there is a satisfying

Proof of Lemma 3. We have

where

We write this concisely as

where

This completes the proof of the first result.

We now prove the second result of the lemma. Since is twice continuously differentiable, we use a Taylor expansion to obtain

| (S.2) |

for some between and The first and second derivatives are

To find the order of we calculate its mean and variance. We have

Therefore, when

for any That is, for any there exists an such that

when is large enough.

Suppose we choose so large that we also have

when is large enough. Then, when is large enough,

| (S.3) | |||||

We split into two cases. When we have

by the Lipschitz continuity of with Lipschitz constant When we have

Using the second condition on we have, for

and

Hence, in both cases, As a result,

Combining this with (S.3), we obtain

In view of (S.2), we then have

Now, using Lemma 2, we can write

where

and the term is the error of the linear asymptotic representation of

In order to obtain the order of , we use the following results:

The rate of convergence of can be found on page 56 of \citesupppagan1999. Therefore,

because, since by Assumption 6, , so We need to show that . We do this term by term. First,

because Second,

as long as which is guaranteed by Assumption 6, since it is implied by . Finally,

since by Assumption 6 . Therefore, .

Proof of Lemma 4. We have the following decomposition:

Under Condition (b) of the lemma, we have

where

For the first term, we have, by applying the mean value theorem coordinate-wise,

where is a vector with (not necessarily equal) coordinates between and . Under Conditions (c) and (d) of the lemma, we have

| (S.4) |

Using (S.4) together with the linear representation of in Condition (a), we obtain

We can then write

Proof of Lemma 5. Recall that

In order to emphasize the dual roles of , we define

Since is fixed, we regard as a function of that depends on the function Then

As in \citesupphahn2013, we employ as an expositional device only.

The functional of interest is

Under Assumption 8(b.i), we can exchange with and obtain

where

Under Assumption 8(a), we can use integration by parts. Letting and be the support of given we have

Define

By the law of iterated expectations, we have

| (S.5) | |||||

This holds because

where is the sub- algebra generated by and is a function of and is thus -measurable.

Differentiating (S.5) with respect to and evaluating the resulting equation at we have

| (S.6) | |||||

where we have used Assumption 8(b.ii,b.iii) to exchange the differentiation with the expectation.

Using (S.6) and the law of iterated expectations, we then have

Note that is a measurable function of , and . Also,

because contains only information on and is independent of given These imply that

Hence,

Proof of Lemma 6. First, we prove that the decomposition in (6) is valid. We start by showing that

is differentiable at . For this, it suffices to show that each of the four derivatives below exists at

| (S.7) |

By Lemma 5, the last derivative exists and is equal to zero at . We deal with the rest three derivatives in ( S.7) one at a time. Consider the first derivative. Under Assumption 9(a.iii) and (b) with , we have

So is differentiable in and

Hence, the contribution associated with the first derivative is simply the influence function of .

Now, for the second derivative in (S.7), Theorem 7.2 in \citesuppnewey1994 shows that Assumption 9 implies the following:

-

1.

There is a function and a measure such that , , and for all such that is small enough,

-

2.

The following approximation holds

It can be shown that equals defined in the lemma (c.f., Proposition 5 of \citesuppnewey1994).

For a parametric submodel , we then have, when is close enough to

where we have used . Under Assumption 9 (a.iv), for . Then, by Lemma 7.2 in \citesuppibragimov1981, the second derivative in (S.7) exists and satisfies

This shows that is the influence function of . That is,

This, combined with the stochastic equicontinuity in Assumption 9(e), implies that

Now, the dominating condition in Assumption 9(d) ensures that the third derivative in (S.7) exists and

Given the approximation

from Lemma 2, we have

Hence,

This gives us the contribution from the estimation of . Alternatively, this expression gives us the influence function of

because

Using the stochastic equicontinuity assumption in Assumption 9(e), we then get that

To sum up, we have shown that

C Estimation of the Asymptotic Variance of the UNIQUE

The asymptotic variance in (31) can be estimated by the plug-in estimator

| (S.8) |

where, by Theorem 2,

In this equation,

and

Most of these plug-in estimates are self-explanatory. For example, is the estimated influence function for the MLE when and If the propensity score function does not take a linear index form, then we need to make some adjustment to . We only need to find the influence function for the MLE, which is an easy task, and then plug into the influence function.

The only remaining quantity that needs some explanation is which involves a nonparametric regression of on We let

To see why this may be consistent for we note that using integration by parts, the above is just a series approximation to .

The consistency of can be established by using the uniform law of large numbers. The arguments are standard but tedious. We omit the details here.

D Unconditional Instrumental Quantile Estimation under Nonparametric Propensity Score

We drop the parametric specification of the propensity score in Assumption 7 and estimate the propensity score non-parametrically using the series method. With respect to the results in Section 5, we only need to modify Lemma 4, since Lemma 6 shows that we do not need to account for the error from estimating the propensity score.

Let denote the nonparametric series estimator of . The estimator of is now

The estimator of is the same as in (25) but with replaced by

| (S.9) |

where, as in (25), is the series estimator of The formula is the same as before, and we only need to replace by . The nonparametric UNIQUE becomes

| (S.10) | |||||

The following lemma follows directly from Theorem 7.2 of \citesuppnewey1994.

Lemma 7.

Using a proof similar to that of Lemma 6, we can show that and have the same influence function. That is, we have

where

and

Given the asymptotic linear representations of and we can directly use Lemma 6, together with Lemma 3, to obtain an asymptotic linear representation of .

Theorem 3.

Furthermore, under Assumption 6,

We summarize the results of Theorem 3 in a single equation:

where collects all the influence functions in (S.11) except for the bias, is absorbed in the term, and

The bias term is by Assumption 6. The following corollary provides the asymptotic distribution of .