A Game-Theoretic Analysis of the Empirical Revenue Maximization Algorithm with Endogenous Sampling

Abstract

The Empirical Revenue Maximization (ERM) is one of the most important price learning algorithms in auction design: as the literature shows it can learn approximately optimal reserve prices for revenue-maximizing auctioneers in both repeated auctions and uniform-price auctions. However, in these applications the agents who provide inputs to ERM have incentives to manipulate the inputs to lower the outputted price. We generalize the definition of an incentive-awareness measure proposed by Lavi et al (2019), to quantify the reduction of ERM’s outputted price due to a change of out of input samples, and provide specific convergence rates of this measure to zero as goes to infinity for different types of input distributions. By adopting this measure, we construct an efficient, approximately incentive-compatible, and revenue-optimal learning algorithm using ERM in repeated auctions against non-myopic bidders, and show approximate group incentive-compatibility in uniform-price auctions.

1 Introduction

In auction theory, it is well-known [31] that, when all buyers have values that are independently and identically drawn from a regular distribution , the revenue-maximizing auction is simply the second price auction with anonymous reserve price : if the highest bid is at least , then the highest bidder wins the item and pays the maximum between the second highest bid and . The computation of requires the exact knowledge of the underlying value distribution, which is unrealistic because the value distribution is often unavailable in practice. Many works (e.g., [12, 16, 24]) on sample complexity in auctions have studied how to obtain a near-optimal reserve price based on samples from the distribution instead of knowing the exact . One of the most important (and most fundamental) price learning algorithms in those works is the Empirical Revenue Maximization (ERM) algorithm, which simply outputs the reserve price that is optimal on the uniform distribution over samples (plus some regularization to prevent overfitting).

Definition 1.1 (-Guarded Empirical Revenue Maximization, ).

Draw samples from a distribution and sort them non-increasingly, denoted by . Given some regularization parameter , choose:

Assume that the smaller sample (with the larger index) is chosen in case of ties.

was first proposed by Dhangwatnotai et al. [16] and then extensively studied by Huang et al. [24]. They show that the reserve price outputted by is asymptotically optimal on the underlying distribution as the number of samples increases if is bounded or has monotone hazard rate, with an appropriate choice of . Other papers [5, 26] have continued to study .

However, when ERM is put into practice, it is unclear how the samples can be obtained since many times there is no impartial sampling source. A natural solution is endogenous sampling. For example, in repeated second price auctions, the auctioneer can use the bids in previous auctions as samples and run ERM to set a reserve price at each round. But this solution has a challenge of strategic issue: since bidders can affect the determination of future reserve prices, they might have an incentive to underbid in order to increase utility in future auctions.

Another example of endogenous sampling is the uniform-price auction. In a uniform-price auction the auctioneer sells copies of a good at some price to bidders with i.i.d. values from who submit bids . Bidders who bid at least obtain one copy and pay . The auctioneer can set the price to be to maximize revenue if bids are equal to values. But Goldberg et al. [18] show that this auction is not incentive-compatible as bidders can lower the price by strategic bidding. Therefore, the main question we consider in this paper is: To what extent the presence of strategic agents undermines ERM with endogenous sampling?

To formally answer the question, we adopt a notion called “incentive-awareness measure” originally proposed by Lavi et al. [27] under bitcoin’s fee market context, which measures the reduction of a price learning function due to a change of at most samples out of the input samples.

Definition 1.2 (Incentive-awareness measures).

Let be a function (e.g., ) that maps samples to a reserve price. Draw i.i.d. values from a distribution . Let be an index set of size , and , . A bidder can change to any non-negative bids , hence change the price from to . Define the incentive-awareness measure:

and worst-case incentive-awareness measures:

A smaller incentive-awareness measure means that the reserve price is decreased by a less amount when a bidder bids strategically. Since the reduction of reserve price usually increases bidders’ utility, a smaller incentive-awareness measure implies that a bidder cannot benefit a lot from strategic bidding, hence the name “incentive-awareness measure”.111Lavi et al. [27] use the name “discount ratio” which we feel can be confused with the standard meaning of a discount ratio in repeated games.

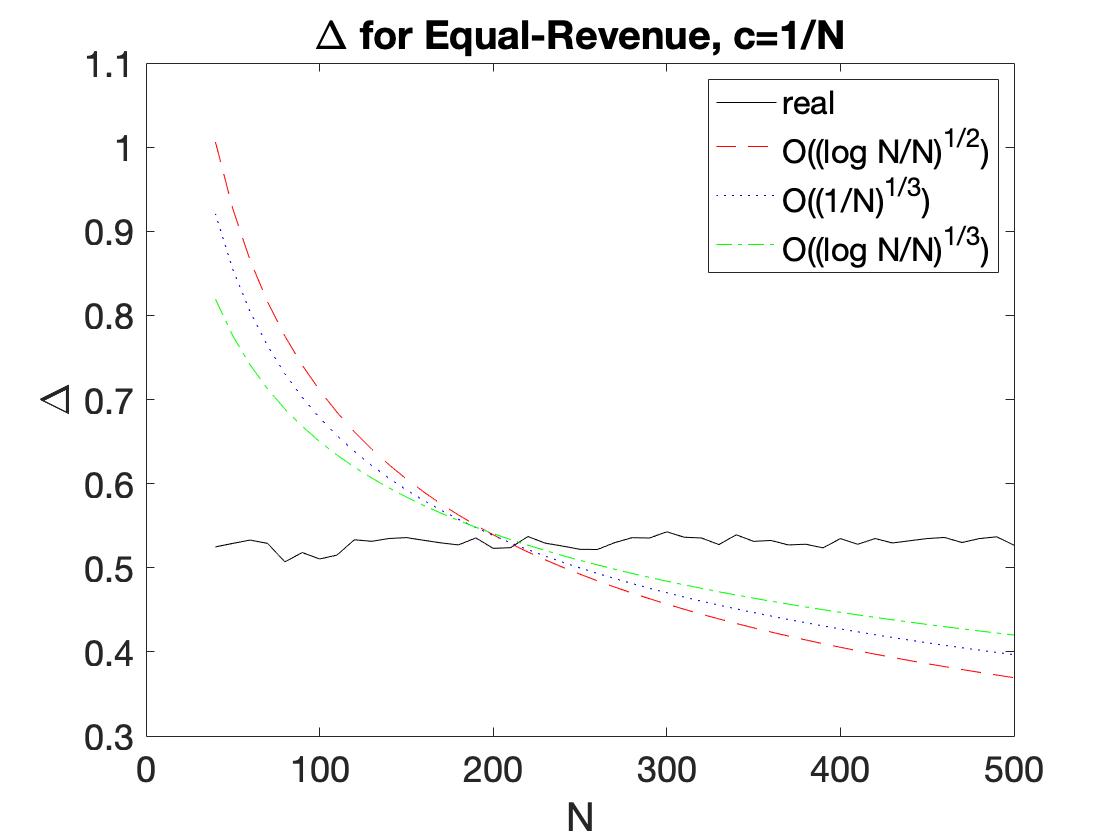

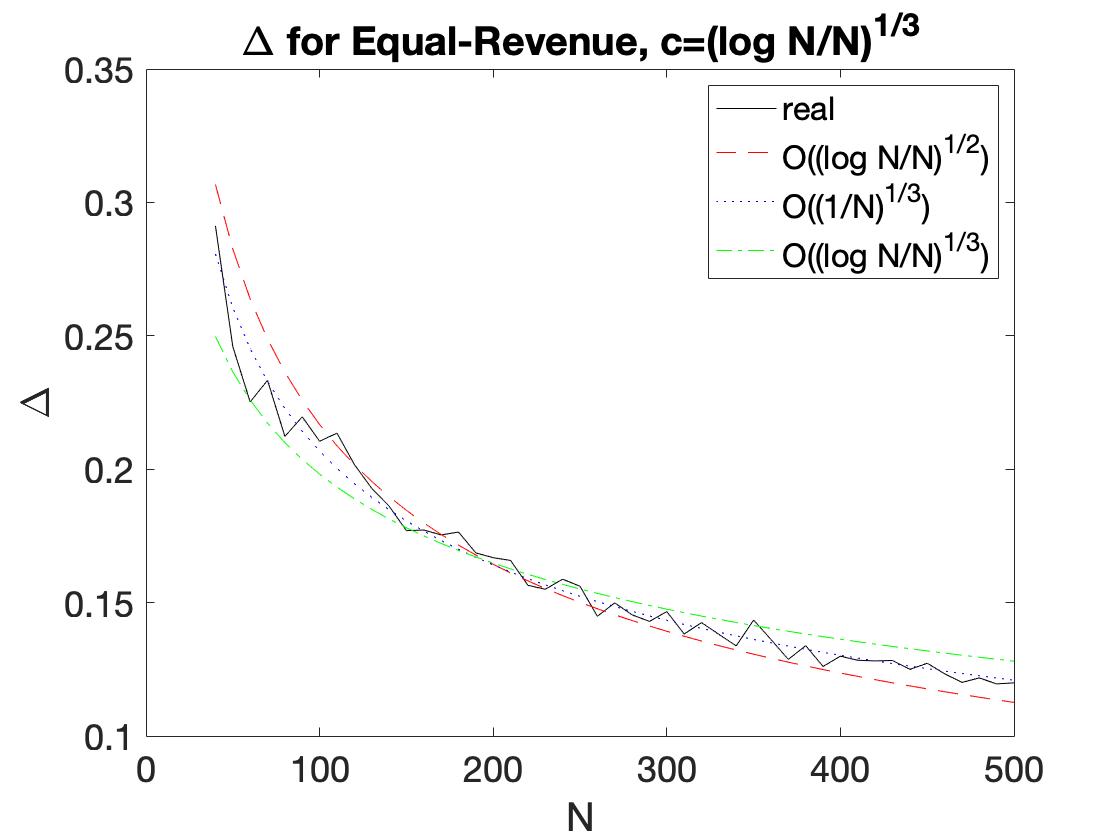

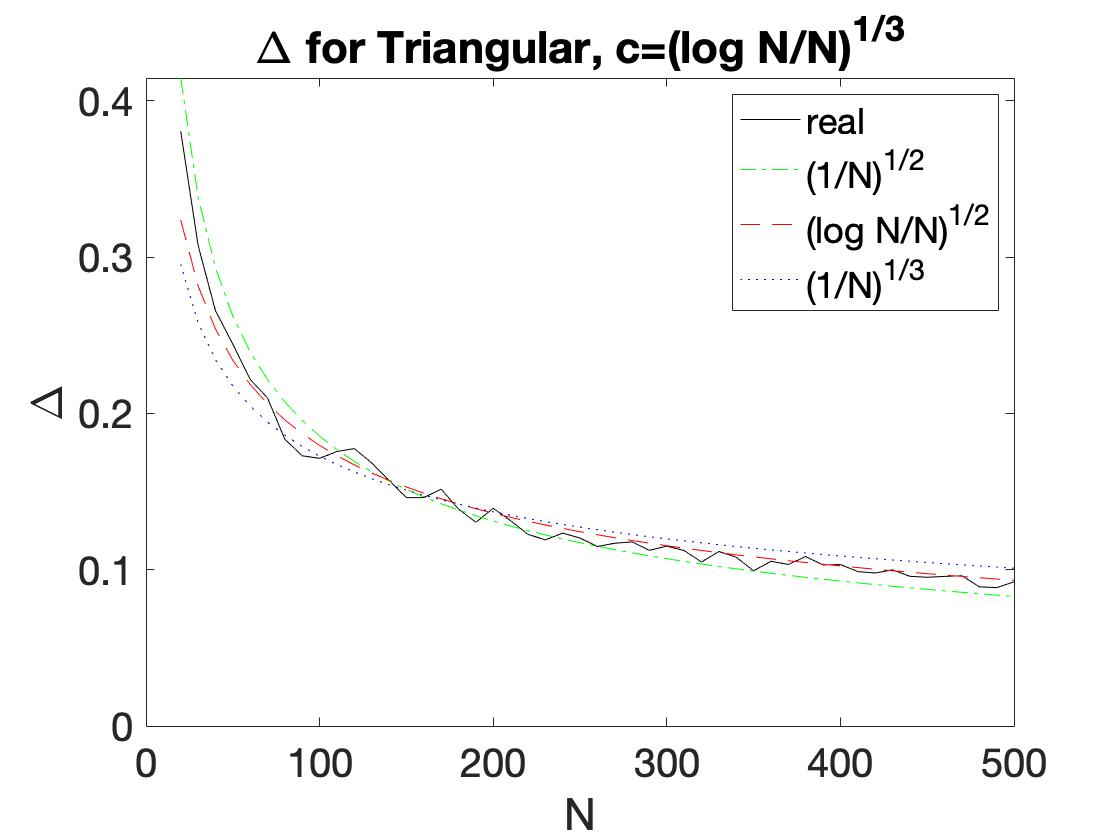

Lavi et al. [27] defined incentive-awareness measures only for and showed that for any distribution with a finite support size, as . Later, Yao [32] showed that for any continuous distribution with support included in . They did not provide specific convergent rates of . We generalize their definition to allow , which is crucial in our two applications to be discussed. Our main theoretical contribution is to provide upper bounds on for two types of value distributions : the class of Monotone Hazard Rate (MHR) distributions where is non-decreasing over the support of the distribution (we use to denote the CDF and for PDF) and the class of bounded distributions which consists of all (continuous and discontinuous) distributions with support included in . MHR distribution can be unbounded so we are the first to consider incentive-awareness measures for unbounded distributions.

Theorem 1.3 (Main).

Let . The worst-case incentive-awareness measure is bounded by

-

•

for MHR , , if and .222We use to denote .

-

•

for bounded , , if and .

The constants in the two big ’s are independent of and .

This theorem implies that as long as the fraction of samples controlled by a bidder is relatively small, the strategic behavior of each bidder has little impact on ERM provided that other bidders are truthful. Meanwhile, if more than one bidder bid non-truthfully, no bidder can benefit a lot from lying as long as the total number of bids of all non-truthful bidders does not exceed . We will discuss intuitions and difficulties of the proof later and give an overview in Section 4.

Repeated auctions against non-myopic bidders.

Besides theoretical analysis, we apply the incentive-awareness measure to real-world scenarios to demonstrate the effect of strategic bidding on ERM. The main application we consider is repeated auctions where bidders participate in multiple auctions and have incentives to bid strategically to affect the auctions the seller will use in the future (Section 2). We consider a two-phase learning algorithm: the seller first runs second price auctions with no reserve for some time to collect samples, and then use these samples to set reserve prices by ERM in the second phase. The upper bound on the incentive-awareness measure of ERM implies that this algorithm is approximately incentive-compatible.

Kanoria and Nazerzadeh [26], Liu et al. [28], and Abernethy et al. [1] consider repeated auctions scenarios similar to ours. Kanoria and Nazerzadeh [26] set personalized reserve prices by ERM in repeated second-price auctions, so at least two bidders are needed in each auction and they will face different reserve prices. We use anonymous reserve price so we allow only one bidder to participate in the auctions and when there are more than one bidder they face the same price, thus preventing discrimination. Liu et al. [28] and Abernethy et al. [1] design approximately incentive-compatible algorithms using differential privacy techniques rather than pure ERM. Comparing with them, our two-phase ERM algorithm is more practical as it is much simpler, and their algorithms rely on the boundedness of value distributions while we allow unbounded distributions. Moreover, their results require a large number of auctions while ours need a large number of samples in the first phase which can be obtained by either few bids in many auctions, many bids in few auctions, or combined.

Uniform-price auctions and incentive-compatibility in the large. Another scenario to which we apply the incentive-awareness measure of ERM is uniform-price auctions (Section 3). Azevedo and Budish [4] show that, uniform-price auctions are incentive-compatible in the large in the sense that truthful bidding is an approximate equilibrium when there are many bidders in the auction. In fact, incentive-compatibility in the large is the intuition of Theorem 1.3: when is large, no bidders can influence the learned price by much. The proof in [4] directly makes use of this intuition, showing that the bid of one bidder can affect the empirical distribution consisting of the bids only by a little. However, their argument, which crucially relies on the assumption that bidders’ value distribution has a finite support and bids must be chosen from this finite support as well, fails when the value distribution is continuous or bids can be any real numbers, as what we allow. We instead, appeal to some specific properties of ERM to show that it is incentive-compatible in the large.

Additional related works. Previous works on ERM mainly focus on its sample complexity, started by Cole and Roughgarden [12]. While ERM is suitable for the case of i.i.d. values (e.g., [24]), the literature on sample complexity has expanded to more general cases of non-i.i.d. values and multi-dimensional values, e.g. [30, 15, 20, 21], or considering non-truthful auctions, e.g. [22]. Babaioff et al. [5] study the performance of ERM with just two samples. While this literature assumes that samples are exogenous, our main contribution is to consider endogenous samples that are collected from bidders who are affected by the outcome of the learning algorithm.

Some works study repeated auctions but with myopic bidders [7, 29, 11, 10]. Existing works about non-myopic bidders focus on designing various learning algorithms to maximize revenue assuming bidders playing best responds [2, 3, 13, 19] or using no-regret learning algorithm [8]. We complement that line of works by showing that ERM, the most fundamental algorithm we believe, also has good performance in repeated auctions against strategic bidders.

Other works about incentive-aware learning (e.g., [14, 25, 6, 17]) consider settings different from ours. For example, [14] and [25] study repeated auctions where buyers’ values are drawn from some distribution at first and then fixed throughout. The seller knows the distribution and tries to learn the exact values, which is different from our assumption that the distribution is unknown to the seller.

2 Main Application: A Two-Phase Model

Here we consider a two-phase model as a real-world scenario where strategic bidding affects ERM: the seller first runs second price auctions with no reserve for some time to collect samples, and then use these samples to set reserve prices by ERM in the second phase. This model can be regarded as an “exploration and exploitation” learning algorithm in repeated auctions, and we will show that this algorithm can be approximately incentive-compatible and revenue-optimal.

2.1 The Model

A two-phase model is denoted by , where is a truthful, prior-independent mechanism, is a price learning function, and are the numbers of auctions in the two phases. We do not assume that every bidder participates in all auctions. Instead, we assume that each bidder participates in no more than auctions in the two phases, respectively; . We use to denote the numbers of bidders in the auctions of the two phases.333 It is well-known that when there are bidders with i.i.d. regular value distributions in one auction, a second price auction as a prior-independent mechanism is ()-revenue optimal. But in our two-phase model, the numbers of bidders in each auction, and , can be small, e.g., 1 or 2. With few bidders, prior-independent mechanisms do not have good revenue. is the strategy space, where is a strategy of bidder . The procedure is:

-

•

At the beginning, each bidder realizes i.i.d. drawn from . Let denote the values of bidders other than . Bidder knows but does not know .

-

•

In the exploration phase, auctions are run using and bidders bid according to some strategy . Each auction has bidders and each bidder participants in auctions. The auctioneer observes a random vector of bids with the following distribution: let be an index set corresponding to bidder , with size ; then , where , and .

-

•

In the exploitation phase, second price auctions () or posted price auctions () are run, with reserve price . Each auction has bidders and each bidder participants in auctions. The auctions in this phase are truthful because has been fixed.

Utilities. Denote the utility of bidder as:

| (1) |

where is the utility of bidder in the first phase, and is the interim utility of a bidder with value in a second price auction with reserve price among bidders:

| (2) |

The interim utility of bidder in the two-phase model is .

Approximate Bayesian incentive-compatibility. We use the additive version of the solution concept of an -Bayesian-Nash equilibrium (-BNE), i.e., in such a solution concept, no player can improve her utility by more than by deviating from the equilibrium strategy. We say a mechanism is -approximately Bayesian incentive-compatible (-BIC) if truthful bidding is an -BNE, i.e., if for any , any ,

If a mechanism is -BIC and , then each bidder knows that if all other bidders are bidding truthfully then the gain from any deviation from truthful bidding is negligible for her. To realize that strategic bidding cannot benefit them much, bidders do not need to know the underlying distribution, but only the fact that the mechanism is -BIC. We are therefore going to assume in this paper that, in such a case, all bidders will bid truthfully.

Approximate revenue optimality. We say that a mechanism is revenue optimal, for some , if its expected revenue is at least times the expected revenue of Myerson auction.444 One may take the optimal -BIC auction rather than the exact BIC Myerson auction as the revenue benchmark. However, as shown by e.g., Lemma 1 of Brustle et al. [9], the revenue of the optimal -BIC auction is at most greater than that of Myerson auction; so all our revenue approximation results hold for this stronger benchmark except for an additive term. Huang et al. [24] show that a one-bidder auction with posted price set by (for an appropriate ) and with samples from the value distribution is revenue optimal with for MHR distributions and for bounded distributions.

The i.i.d. assumption. Our assumption of i.i.d. values is reasonable because in our scenario there is a large population of bidders, and we can regard this population as a distribution and each bidder as a sample from it. So from each bidder’s perspective, the values of other bidders are i.i.d. samples from this distribution. Then the -BIC notion implies that when others bid truthfully, it is approximately optimal for bidder to bid truthfully no matter what her value is.

2.2 Incentive-Compatibility and Revenue Optimality

Now we show that, as the incentive-awareness measure of becomes lower, the price learning function becomes more incentive-aware in the sense that bidders gain less from non-truthful bidding:

Theorem 2.1.

In , truthful bidding is an -BNE, where,

-

•

for any and any bounded , , and

-

•

for any MHR , if we fix with and , then , where .

The constants in big ’s are independent of and .

Combined with Theorem 1.3 which upper bounds the incentive-awareness measure, we can obtain explicit bounds on truthfulness of the two-phase model by plugging in and . Precisely, for any bounded , if and . For any MHR , if and . Thus, for both cases, keeping all the parameters except constant (in particular and are constants) implies that at a rate which is not slower than as .

To simultaneously obtain both approximate BIC and approximate revenue optimality, a certain balance between the number of auctions in the two phases must be maintained. Few auctions in the first phase and many auctions in the second phase hurt truthfulness as the loss from non-truthful bidding (i.e., losing in the first phase) is small compared to the gain from manipulating the reserve price in the second phase. Many auctions in the first phase are problematic as we do not have any good revenue guarantees in the first phase (since we allow any truthful ). Thus, a certain balance must be maintained, as expressed formally in the following theorem:

Theorem 2.2.

Assume that and let . In , to simultaneously obtain -BIC and revenue optimality (assuming truthful bidding), it suffices to set the parameters as follows:

-

•

If is an MHR distribution, , , then

, and . -

•

If is bounded and regular, , , then

, and .555The requirement that is regular in addition to being bounded comes from the fact that approximates the optimal revenue in an auction with many bidders only for regular distributions. In fact, the sample complexity literature on only studies the case of one bidder (which is, in our notation, ). In this case, i.e., if the second phase uses posted price auctions, we do not need the regularity assumption. To capture the case of general , we make a technical observation that for regular distributions revenue optimality for a single buyer implies revenue optimality for many buyers (Lemma C.1). We do not know if this is true without the regularity assumption or if this observation – which may be of independent interest – was previously known.

The proof is given in Appendix C.2. This theorem makes explicit the fact that in order to simultaneously obtain approximate BIC and approximate revenue optimality, cannot be too small nor too large: for approximate revenue optimality we need and for approximate BIC we need, e.g., for MHR distributions, and for bounded distributions. When setting the parameters in this way, both and go to as .

2.3 Multi-Unit Extension

The auction in the exploitation phase can be generalized to a multi-unit Vickrey auction with anonymous reserve, where identical units of an item are sold to unit-demand bidders and among those bidders whose bids are greater than the reserve price , at most bidders with largest bids win the units and pay the maximum between and the -th largest bid. The multi-unit Vickrey auction with an anonymous reserve price is revenue-optimal when the value distribution is regular, and the optimal reserve price does not depend on or according to Myerson [31]. Thus the optimal reserve price can also be found by . All our results concerning truthfulness, e.g., Theorem 2.1, still hold for the multi-unit extension with any . Moreover, Theorem 2.2 also holds because we have already considered the multi-unit extension in its proof in Appendix C.2.

2.4 Two-Phase ERM Algorithm in Repeated Auctions

The two-phase model with ERM as the price learning function can be seen as a learning algorithm in the following setting of repeated auctions against strategic bidders: there are rounds of auctions, there are bidders in each auction, and each bidder participates in at most auctions. The algorithm, which we call “two-phase ERM”, works as follows: in the first rounds, run any truthful, prior-independent auction (e.g., the second price auction with no reserve); in the later rounds, run second price auction with reserve where are the bids from the first auctions. and are adjustable parameters.

In repeated games, one may also consider -perfect Bayesian equilibrium (-PBE) as the solution concept besides -BNE. A formal definition is given in Appendix C.4 but roughly speaking, -PBE requires that the bidding of each bidder at each round of auction -approximately maximizes the total expected utility in all future rounds, conditioning on any observed history of allocations and payments. Note that the history may leak some information about the historical bids of other buyers and these bids will affect the seller’s choice of mechanisms in future rounds. Similar to the -BNE notion, we can show that the two-phase ERM algorithm satisfies: (1) truthful bidding is an -PBE; (2) revenue optimality, for bounded distributions; and similar results for MHR distributions. Choosing , which maximizes the revenue, we obtain -truthfulness and revenue optimality, where we assume , , and to be constant.666The notation omits polylogarithmic terms.

Under the same setting, Liu et al. [28] and Abernethy et al. [1] design approximately truthful and revenue optimal learning algorithms using differential privacy techniques. We can compare two-phase ERM and their algorithms. Firstly, they make a similar assumption as ours that , in order to obtain approximate truthfulness and revenue optimality at the same time. In terms of truthfulness notion, Liu et al. [28] assume that bidders play an exact PBE instead of -PBE, so their quantitative result is incomparable with ours. Their notion of exact PBE is too strong to be practical because bidders need to collect a lot of information about other bidders and do a large amount of computation to find the exact equilibrium, while our notion guarantees bidders of approximately optimal utility as long as they bid truthfully. Although our truthfulness bound is worse than the bound of [1], which is , we emphasize that their -truthfulness notion is weaker than ours: in their definition, each bidder cannot gain more than in current and future rounds if she deviates from truthful bidding only in the current round, given any fixed future strategy. But in our definition, each bidder cannot gain more than if she deviates in current and all future rounds. Our algorithm is easier to implement and more time-efficient than theirs, and works for unbounded distribution while theirs only support bounded distributions because they need to discretize the value space.

3 A Second Application: Uniform-Price Auctions

The notion of an incentive-awareness measure (recall Definition 1.2) has implications regarding the classic uniform-price auction model, which we believe are of independent interest. In a static uniform-price auction we have copies of a good and unit-demand bidders with i.i.d. values from that submit bids . The auctioneer then sets a price . Each bidder whose value is above or equal to receives a copy of the good and pays , obtaining a utility of ; otherwise the utility is zero. Azevedo and Budish [4] show that this auction is “incentive-compatible in the large” which means that truthfulness is an -BNE and goes to zero as goes to infinity. They assume bidders’ value distribution has a finite support and their bids must be chosen from this finite support as well. They mention that allowing continuous supports and arbitrary bids is challenging.

In this context, taking is very natural when the auctioneer aims to maximize revenue. Indeed, Goldberg et al. [18] suggest to use the uniform-price auction with , where , as a revenue benchmark for evaluating other truthful auctions they design.

When the price function is , our analysis of the incentive-awareness measure generalizes the result of [4] to bounded and to MHR distributions. Moreover, we generalize their result to the case where coalitions of at most bidders can coordinate bids and jointly deviate from truthfulness.

Theorem 3.1.

In the uniform-price auction, suppose that any bidders can jointly deviate from truthful bidding, then no bidder can obtain more utility (we call this -group BIC), where,

-

•

for any and any bounded , , and

-

•

for any MHR distribution , if we fix with and , then , where .

The constants in big ’s are independent of and .

Proof of Theorem 3.1 for bounded distributions.

Denote a coalition of bidders by an index set , and the true values of all bidders by . When other bidders bid truthfully, and the coalition bids instead of , the reduction of price is at most

by Definition 1.2 and by the fact that all values are upper-bounded by . Then for each bidder , the increase of her utility by such a joint deviation is no larger than the reduction of price, i.e.

∎

The proof of this theorem for MHR distributions is similar to the proof of Theorem 2.1, thus omitted.

Combining with Theorem 1.3, we conclude that the uniform-price auction with (for the ’s mentioned there) is -group BIC with converging to zero at a rate not slower than for bounded distributions and for MHR distributions (constants in these big ’s depend on distributions).

4 More Discussions on Incentive-awareness Measures

4.1 Overview of the Proof for Upper Bounds on

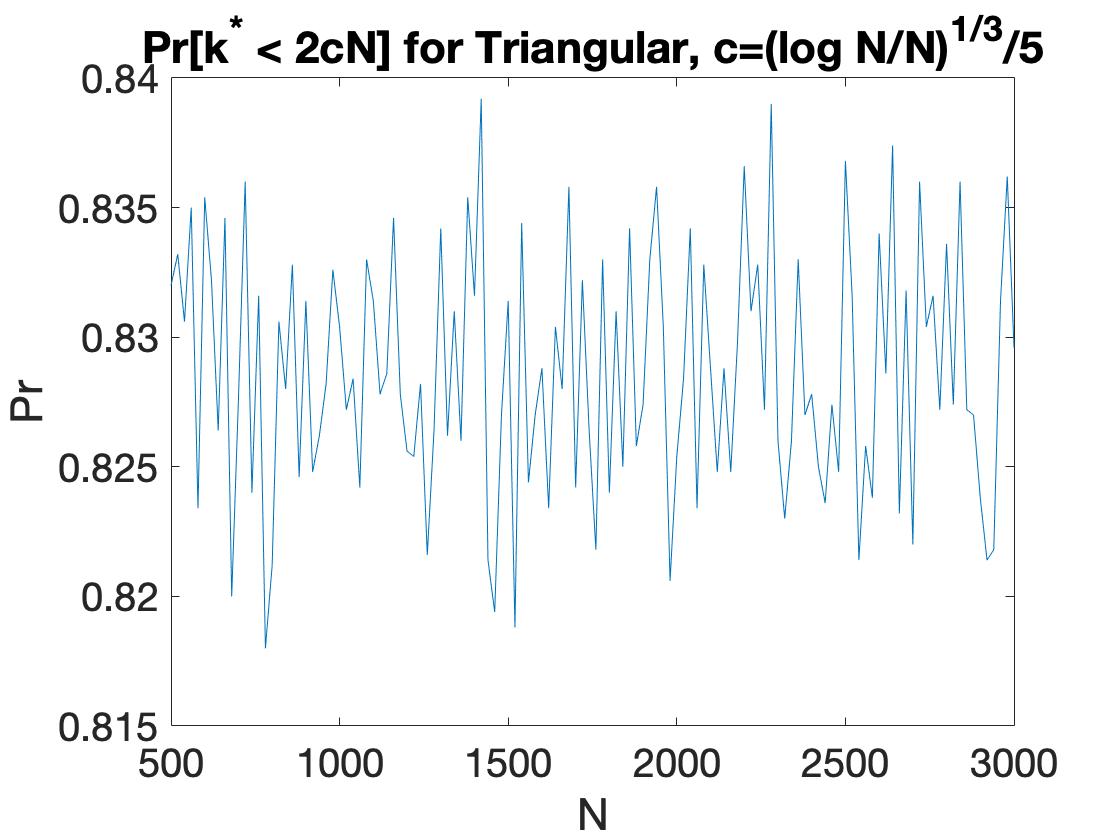

Firstly, we show an important property of : suppose , for any values , any values , and any values that are greater than or equal to the maximum value in , we have . As a consequence, .

Based on this property, we transfer the expectation in the incentive-awareness measure in the following way:

where denotes the event that the index (which is the index selected by ) satisfies , denotes the complement of , and the probability in is taken over the random draw of i.i.d. samples from , with other samples fixed to be the upper bound (can be ) of the distribution. For any value distribution, we prove that the first part

with some constructions of auxiliary events and involved probabilistic argument. And we further tighten this bound to for MHR distribution by leveraging its properties.

The final part of the proof is to bound . For bounded distribution, we choose . Since the support of the distribution is bounded by , , while for any , . therefore never chooses an index (recall that in case of a tie, picks the larger index). This implies for bounded distribution. For MHR distribution, we choose and show . As the corresponding proof is quite complicated, we omit it here.

4.2 Lower Bounds on and on the Approximate BIC Parameter,

Theorem 1.3 gives an upper bound on for bounded and MHR distributions and for a specific range of ’s. Here we briefly discuss the lower bound, with details given in Appendix F.

Lavi et al. [27] show that for the two-point distribution and , each w.p. 0.5, , when . We adopt their analysis to provide a similar lower bound for -bounded distributions and the corresponding range of ’s. Let be a two-point distribution where for , and .

Theorem 4.1.

For the above , for any , gives where the constant in depends on .

Note that only upper bounds the -BIC parameter in the two-phase model: a lower bound on does not immediately implies a lower bound on . Still, a direct argument will show that the above distribution gives the same lower bound on . For simplicity let and suppose bidder participates in and auctions in the two phases, respectively. Let and assume . Suppose the first-phase mechanism is the second price auction with no reserve price. Then in the two-phase model with , must be to guarantee -BIC.

It remains open to prove a lower bound for MHR distributions, and to close the gap between our upper bound and the lower bound for bounded distributions.

4.3 Unbounded Regular Distributions

Theorem 2.2 shows that, in the two-phase model, approximate incentive-compatibility and revenue optimality can be obtained simultaneously for bounded (regular) distributions and for MHR distributions. A natural question would then be: what is the largest class of value distribution we can consider? Note that for non-regular distributions, Myerson [31] shows that revenue optimality cannot be guaranteed by anonymous reserve price, so ERM is not a correct choice. Thus we generalize our results to the class of regular distributions that are unbounded and not MHR. Here we provide a sketch, with details given in Appendix G.

Our results can be generalized to -strongly regular distributions with . As defined in [12], a distribution with positive density function on its support where is -strongly regular if the virtual value function satisfies whenever (or if is differentiable). As special cases, regular and MHR distributions are -strongly and -strongly regular distributions, respectively. For any , we obtain bounds similar to MHR distributions on and on approximate incentive-compatibility in the two-phase model and the uniform-price auction. Specifically, if is -strongly regular then , if and .

It remains an open problem for future research whether is incentive-compatible in the large for regular but not -strongly regular distributions for any . For these distributions the choice of must be more sophisticated since it creates a clash between approximate incentive-compatibility and approximate revenue optimality. Intuitively, a large (for example, a constant) will hurt revenue optimality and a too small will hurt incentive-compatibility. In Appendix G, we provide examples and proofs to formally illustrate such a fact, and further discuss our conjecture that some intermediate can maintain the balance between incentive-compatibility and revenue optimality.

Broader Impact

This work is mainly theoretical. It provides some intuitions and guidelines for potential practices, but does not have immediate societal consequences. A possible positive consequence is: the auction we consider uses an anonymous reserve price, while most of the related works on repeated auctions use unfair personalized prices. We do not see negative consequences.

References

- Abernethy et al. [2019] Jacob D Abernethy, Rachel Cummings, Bhuvesh Kumar, Sam Taggart, and Jamie H Morgenstern. Learning Auctions with Robust Incentive Guarantees. In Advances in Neural Information Processing Systems 32, pages 11587–11597. Curran Associates, Inc., 2019. URL http://papers.nips.cc/paper/9334-learning-auctions-with-robust-incentive-guarantees.pdf.

- Amin et al. [2013] Kareem Amin, Afshin Rostamizadeh, and Umar Syed. Learning prices for repeated auctions with strategic buyers. In Advances in Neural Information Processing Systems, pages 1169–1177, 2013.

- Amin et al. [2014] Kareem Amin, Afshin Rostamizadeh, and Umar Syed. Repeated contextual auctions with strategic buyers. In Advances in Neural Information Processing Systems, pages 622–630, 2014.

- Azevedo and Budish [2018] Eduardo M Azevedo and Eric Budish. Strategy-proofness in the large. The Review of Economic Studies, 86(1):81–116, 2018.

- Babaioff et al. [2018] Moshe Babaioff, Yannai A. Gonczarowski, Yishay Mansour, and Shay Moran. Are two (samples) really better than one? In Proceedings of the 2018 ACM Conference on Economics and Computation, EC ’18, pages 175–175, New York, NY, USA, 2018. ACM. ISBN 978-1-4503-5829-3. doi: 10.1145/3219166.3219187. URL http://doi.acm.org/10.1145/3219166.3219187.

- Balcan et al. [2008] Maria-Florina Balcan, Avrim Blum, Jason D Hartline, and Yishay Mansour. Reducing mechanism design to algorithm design via machine learning. Journal of Computer and System Sciences, 74(8):1245–1270, 2008.

- Blum and Hartline [2005] Avrim Blum and Jason D Hartline. Near-optimal online auctions. In Proceedings of the sixteenth annual ACM-SIAM symposium on Discrete algorithms, pages 1156–1163. Society for Industrial and Applied Mathematics, 2005.

- [8] Mark Braverman, Jieming Mao, Jon Schneider, and Matt Weinberg. Selling to a no-regret buyer. In Proceedings of the 2018 ACM Conference on Economics and Computation, pages 523–538. ACM. ISBN 978-1-4503-5829-3. doi: 10.1145/3219166.3219233. URL https://dl.acm.org/doi/10.1145/3219166.3219233.

- Brustle et al. [2020] Johannes Brustle, Yang Cai, and Constantinos Daskalakis. Multi-Item Mechanisms without Item-Independence: Learnability via Robustness. In Proceedings of the 21st ACM Conference on Economics and Computation, pages 715–761, Virtual Event Hungary, July 2020. ACM. ISBN 978-1-4503-7975-5. doi: 10.1145/3391403.3399541. URL https://dl.acm.org/doi/10.1145/3391403.3399541.

- Bubeck et al. [2017] Sebastien Bubeck, Nikhil R Devanur, Zhiyi Huang, and Rad Niazadeh. Online auctions and multi-scale online learning. In Proceedings of the 2017 ACM Conference on Economics and Computation, pages 497–514. ACM, 2017.

- Cesa-Bianchi et al. [2015] Nicolo Cesa-Bianchi, Claudio Gentile, and Yishay Mansour. Regret minimization for reserve prices in second-price auctions. IEEE Transactions on Information Theory, 61(1):549–564, 2015.

- Cole and Roughgarden [2014] Richard Cole and Tim Roughgarden. The sample complexity of revenue maximization. symposium on the theory of computing, pages 243–252, 2014.

- Deng et al. [2019] Yuan Deng, Sébastien Lahaie, and Vahab Mirrokni. A Robust Non-Clairvoyant Dynamic Mechanism for Contextual Auctions. In Advances in Neural Information Processing Systems 32, pages 8654–8664. Curran Associates, Inc., 2019. URL http://papers.nips.cc/paper/9071-a-robust-non-clairvoyant-dynamic-mechanism-for-contextual-auctions.pdf.

- [14] Nikhil R. Devanur, Yuval Peres, and Balasubramanian Sivan. Perfect bayesian equilibria in repeated sales. In Proceedings of the Twenty-Sixth Annual ACM-SIAM Symposium on Discrete Algorithms, SODA ’15, pages 983–1002. Society for Industrial and Applied Mathematics. event-place: San Diego, California.

- Devanur et al. [2016] Nikhil R Devanur, Zhiyi Huang, and Christos-Alexandros Psomas. The sample complexity of auctions with side information. In Proceedings of the forty-eighth annual ACM symposium on Theory of Computing, pages 426–439. ACM, 2016.

- Dhangwatnotai et al. [2015] Peerapong Dhangwatnotai, Tim Roughgarden, and Qiqi Yan. Revenue maximization with a single sample. Games and Economic Behavior, 91:318–333, 2015.

- Epasto et al. [2018] Alessandro Epasto, Mohammad Mahdian, Vahab Mirrokni, and Song Zuo. Incentive-aware learning for large markets. In Proceedings of the 2018 World Wide Web Conference on World Wide Web, pages 1369–1378. International World Wide Web Conferences Steering Committee, 2018.

- Goldberg et al. [2006] Andrew V Goldberg, Jason D Hartline, Anna R Karlin, Michael Saks, and Andrew Wright. Competitive auctions. Games and Economic Behavior, 55(2):242–269, 2006.

- Golrezaei et al. [2019] Negin Golrezaei, Adel Javanmard, and Vahab Mirrokni. Dynamic Incentive-Aware Learning: Robust Pricing in Contextual Auctions. In Advances in Neural Information Processing Systems 32, pages 9756–9766. Curran Associates, Inc., 2019. URL http://papers.nips.cc/paper/9169-dynamic-incentive-aware-learning-robust-pricing-in-contextual-auctions.pdf.

- Gonczarowski and Weinberg [2018] Yannai A Gonczarowski and S Matthew Weinberg. The sample complexity of up-to- multi-dimensional revenue maximization. In 2018 IEEE 59th Annual Symposium on Foundations of Computer Science (FOCS), pages 416–426. IEEE, 2018.

- Guo et al. [2019] Chenghao Guo, Zhiyi Huang, and Xinzhi Zhang. Settling the sample complexity of single-parameter revenue maximization. In Proceedings of the 51st Annual ACM SIGACT Symposium on Theory of Computing, pages 662–673. ACM, 2019.

- Hartline and Taggart [2019] Jason Hartline and Samuel Taggart. Sample complexity for non-truthful mechanisms. In Proceedings of the 20th ACM Conference on Economics and Computation, pages 399–416. ACM, 2019.

- Hartline et al. [2008] Jason Hartline, Vahab Mirrokni, and Mukund Sundararajan. Optimal marketing strategies over social networks. In Proceedings of the 17th international conference on World Wide Web, pages 189–198. ACM, 2008.

- Huang et al. [2018] Zhiyi Huang, Yishay Mansour, and Tim Roughgarden. Making the most of your samples. SIAM Journal on Computing, 47(3):651–674, 2018.

- Immorlica et al. [2017] Nicole Immorlica, Brendan Lucier, Emmanouil Pountourakis, and Samuel Taggart. Repeated sales with multiple strategic buyers. In Proceedings of the 2017 ACM Conference on Economics and Computation, pages 167–168. ACM, 2017.

- Kanoria and Nazerzadeh [2019] Yash Kanoria and Hamid Nazerzadeh. Incentive-compatible learning of reserve prices for repeated auctions. In Companion Proceedings of The 2019 World Wide Web Conference, pages 932–933. ACM, 2019.

- Lavi et al. [2019] Ron Lavi, Or Sattath, and Aviv Zohar. Redesigning bitcoin’s fee market. In The World Wide Web Conference, pages 2950–2956. ACM, 2019.

- Liu et al. [2018] Jinyan Liu, Zhiyi Huang, and Xiangning Wang. Learning optimal reserve price against non-myopic bidders. In Advances in Neural Information Processing Systems, pages 2042–2052, 2018.

- Medina and Mohri [2014] Andres M Medina and Mehryar Mohri. Learning theory and algorithms for revenue optimization in second price auctions with reserve. In Proceedings of the 31st International Conference on Machine Learning (ICML-14), pages 262–270, 2014.

- Morgenstern and Roughgarden [2015] Jamie H Morgenstern and Tim Roughgarden. On the pseudo-dimension of nearly optimal auctions. In Advances in Neural Information Processing Systems, pages 136–144, 2015.

- Myerson [1981] Roger B Myerson. Optimal auction design. Mathematics of operations research, 6(1):58–73, 1981.

- Yao [2018] Andrew Chi-Chih Yao. An incentive analysis of some bitcoin fee design. arXiv preprint arXiv:1811.02351, 2018.

Appendix A Useful Facts

In this section we present some facts about and incentive-awareness measures, some definitions about value distributions, and some useful lemmas that will be used throughout.

A.1 Facts about and Incentive-Awareness Measures

Claim A.1.

Let , where . For any , , let denote values such that . Then we have .

Proof.

Let be the largest value in and be copies of . It suffices to show that since ignores the largest samples, given . If for each , then we have directly. If there exists some such that , then we increase to and show that for any such and , . Let , then one can verify (assuming picks the smaller value when there are ties) that (1) , and (2) , implying . ∎

Claim A.2.

Let , where . For any , , let be any values that are greater than or equal to the maximal value in . Then .

Proof.

Recall the definition

A.1 immediately implies . Moreover, since ignores the highest values, we have as long as both and are greater than or equal to , no matter what they are exactly. Thus . ∎

Therefore, we will use to denote any values that are greater than or equal to , for example, copies of or copies of “”. We always have .

A.2 Quantiles and Revenue Curves of Value Distributions

For a distribution , define the quantile as a mapping from value space to quantile space. Inversely, is the mapping from quantile space to value space (i.e., w.p. a buyer’s value will be at least ). Define the revenue curve as the expected revenue for the seller by posting price . Let denote the optimal revenue the seller can obtain with one bidder, and . When there are several i.i.d. bidders with a regular value distribution, is the optimal reserve price in a second price auction, and such an auction is revenue optimal [31]. Any bounded distribution satisfies because for any , . Any MHR distribution has a unique and [23].

A.3 Concentration Inequality

For a distribution , draw samples and sort them non-increasingly, . Let denote their quantiles. The ratio is the empirical quantile of value since is the quantile of in the uniform distribution over . The following concentration inequality shows that for each value , its empirical quantile is close to its true quantile with high probability, when samples are fixed to be while other samples are i.i.d. drawn from .

Lemma A.3.

Draw i.i.d. samples from a distribution , and fix samples to be . Sort these samples non-increasingly: . With probability at least over the random draw of samples, we have for any ,

Proof.

The value () is the th largest value in i.i.d. samples from , by using Bernstein inequality (see e.g., Lemma 5 in Guo et al. [21]), we know that with probability at least , . Also note that . By triangular inequality, . ∎

Appendix B Main Proof: Upper Bounds on Incentive-Awareness Measures

B.1 Proof of Theorem 1.3

Recall the setting of Definition 1.2: we draw i.i.d. values from , and we have an additional parameter which is the number of bids that can be changed in the input of the price learning function. Theorem 1.3 then states an upper bound on for . For bounded distributions, the theorem follows immediately from the next lemma which is our main technical lemma. Note that this lemma is useful in establishing the bound on not only for bounded distributions but also for all other distributions. Throughout, we assume that are sorted, so that .

Lemma B.1 (Main Lemma).

Suppose . Let be a constant, . Suppose . Let be the event that the index (which is the index selected by ) satisfies . For any non-negative distribution ,

where the probability in is taken over the random draw of i.i.d. samples from , with other samples fixed to be .

To see that this lemma immediately implies the theorem for bounded distribution, choose . Since the support of the distribution is bounded by , while for any ,

therefore never chooses an index (recall that in case of a tie, picks the larger index). This implies and we have the bound in the theorem.

B.2 Proof of the Main Lemma (Lemma B.1)

Let be any values that are greater than the maximal value in . By A.2, . Thus,

| (3) |

where denotes the complement of . Then the main effort is to upper-bound . After the random draw of , we sort all values non-increasingly, denoted by , and let be their quantiles, where . We use a concentration inequality (Lemma A.3) to argue that for each value , its empirical quantile should be close to its true quantile with high probability, as follows:

Claim B.2.

Define event :

then , where the probability is over the random draw of the samples .

Proof.

Set in Lemma A.3. ∎

Now, define for . We have

| (4) |

Lemma B.3.

There exists a constant such that

Finally we upper-bound the integral in (3):

B.3 Proof of Lemma B.3

Recall that we need to upper-bound by . We do this via a union bound of events, where is a number to be chosen later. Each event is parameterized by for which are chosen to satisfy the following conditions:

-

•

.

-

•

For , can be chosen arbitrarily, as long as .

-

•

.

-

•

.

Define the following events , where :

| (5) |

The next lemma shows that the union of these events contains the event .

Lemma B.4.

Suppose and that the parameters satisfy the above conditions. If and , then there exists such that the event holds.

The proof of this lemma is given in Section B.4. Moreover, the next lemma upper-bounds the probability of each of these bad events, when assuming that holds as well.

Lemma B.5.

If and are at least (for some constant in to be detailed in the proof), then .

The proof of Lemma B.5 is in Section B.5. Now,

| Lemma B.4 | ||||

| Lemma B.5 | ||||

Note that because , the condition of Lemma B.5 is satisfied under the assumption that in Lemma B.3. Finally, we choose a sequence of to make the above summation small enough:

Claim B.6.

There exist an integer and parameters that satisfy the conditions described above, such that

assuming .

The proof of this claim is given in Appendix B.7. To conclude the proof,

Remark. This proof is inspired by a proof in Yao [32]. We improve upon that proof in two aspects: (1) Our definition of a sequence of bad events (Lemma B.4) improves upon similar single bad events defined in Yao [32] and Lavi et al. [27]; (2) Yao [32] only considers bounded and continuous distributions, while our proof works for arbitrary distributions. This is because Yao [32] works in the value space when upper-bounding the probability of bad events over the random draw of values (Lemma B.5), but we work in the quantile space, which circumvents the boundedness assumption and deals with discontinuity. To argue in the quantile space, we need to show that approximates in the proof of Lemma B.5.

B.4 Proof of Lemma B.4

Suppose and . By definition, there exist bids such that . Without loss of generality, we can assume that all bids are identical, as shown in the following claim:

Claim B.7.

For any sorted . Let , let

then .

Proof.

We will show that for any vector of bids that minimizes , we can construct another vector such that . Because minimizes , we can assume that there is a bid such that (otherwise, we can decrease the bids in without increasing the price). Let . For any , decrease to , then the price does not change. For any , increase to , then the price does not increase; and if the price decreases, then it contradicts the fact that is minimized. In this way, we change all bids in to , without affecting the price. ∎

By B.7, there exists which equals and satisfies

| (6) |

Choose index for which . Assume for now , we will postpone the analysis for to the end. Now we show that setting or will satisfy the lemma. Clearly . The change of the bids vector caused by is:

Note that , so will not be ignored by after the change of bids. Then in order for to be chosen by , we need:

| (7) |

We will choose depending on how large is:

-

(a)

If , we set and . Clearly, .

-

(b)

If , then we set and choose the () such that

(8) To see why holds, first we write as a convex combination of and : . From (6) and (7), we immediately get

(9) (10) Equation (10) further implies . Divide by ,

Then it remains to lower-bound by . Intuitively, since is larger than but , the coefficient of cannot be too small. Formally, from (9) and (8), we have:

concluding the proof of this case.

B.5 Proof of Lemma B.5

For convenience we drop the subscript and just write . Recall that we need to upper-bound where:

-

•

implies that there exists such that and .

-

•

is .

-

•

requires that for any .

Define

Assume , which can be satisfied when and are at least .

Claim B.8.

The event implies that there exists which satisfies:

-

1.

;

-

2.

.

Proof of B.8.

Choose the in which satisfies . To see why the first inequality holds, note that , subtracting the first and forth term, we get , further implying , which is the first inequality.

Now consider the second inequality. Since requires and , we have

and dividing by ,

Using the condition on and , we can derive the relationship between and by simple calculation:

∎

Divide the quantile space into and equal-length intervals with length ,

| (11) |

where . Thus a uniformly random draw of quantile falls into with probability . Define and :

And . Moreover, define event for each ,

where is the upper bound on the values with quantiles in . We argue that if the event holds then there must exist an index such that holds. To see this, consider the index that is promised to exist in and choose the index such that . Note that implies , so both and must fall in . To see why must hold, note that:

-

•

since , implying and .

-

•

since .

Therefore, a union bound over suffices to prove that is small. The idea to bound is a refinement of Yao [32]: Note that there is an interval with length between and and consider the number of quantiles falling into . There is enough randomness in as its variance is , implying that the difference between the rankings of any pair of quantiles in and varies broadly. As a result, it’s unlikely that will fall in the short interval . Formally, we will prove that

Lemma B.9.

For any , .

B.6 Proof of Lemma B.9

We need to upper-bound over the random draw of , or in quantile space, , which are i.i.d. random draws from . Let be the number of quantile draws that are in . Suppose we draw the quantiles in the following procedure: first determine , then draw quantiles that are not in ; finally draw quantiles that are in .

Note that follows a binomial distribution, and a Chernoff bound implies that

| (12) |

We thus assume .

Then draw quantiles from , so and are determined. Suppose ; otherwise, does not hold.

Now we draw quantiles, from . Consider the increment of , as a sequence . After the time when , the index is no longer . When one more sample is generated, there are three cases:

-

1.

If , increases by at least . This is because each term increases to , for any such that .

-

2.

If , then does not decrease.

-

3.

If , does not change.

Let be the number of quantiles that are not in , and be those steps, and write for . We have . Then our task is to analyze the probability that .

We can think of the generation of as follows: regardless of , first generate an infinite sequence , where at each step the value is increased by with probability at least . Then pick an index by a binomial distribution . Then the -th value in the infinite sequence is chosen as . Note that is dominated by , so the probability that takes on any one of the values in the sequence is at most .

Then we consider the length of the sub-sequence where . Intuitively, the expected number of steps for to increase by , is at most . The probability that it takes more than steps implies that the sum of i.i.d. Bernoulli variables whose success probability is at least does not reach , which can be bounded by a Chernoff bound:

Assuming , the probability that can be bounded by a union bound:

Therefore,

| By (12) | ||||

B.7 Proof of Claim B.6

We need to show that there exist an integer and parameters , such that

We start with:

| (13) |

Let for any . We can recursively compute until the maximum step which satisfies . Then (13) is upper-bounded by . By our construction of , we have

Thus,

where the last equality follows from the assumption that . Thus, the summation becomes

as required.

Appendix C Missing Proofs From Section 2

C.1 Proof of Theorem 2.1 (for Bounded Distributions)

Proof of Theorem 2.1 for bounded Distributions.

First consider the reduction of reserve price caused by the deviation of bidder . The true values of all bidders in the first phase are , where bidder ’s true values are . When other bidders bid truthfully, and bidder bids instead, the reserve price changes from to and the change is at most

by Definition 1.2 and by the fact that all values are upper-bounded by . Consider the increase of utility in the second phase. We claim that for any two possible reserve prices , for any , for any , we have

| (14) |

To see this, first re-write in (2) as

where and . Note that , thus

Remark. The proof for MHR distributions is trickier since the difference can be unbounded. Intuitively, the probability that will be higher than ( is defined in the statement of the lemma) is exponentially small, and the main effort is to show that the expected difference multiplied by this exponentially small probability is negligible. Full details are given Section D.2.

C.2 Proof of Theorem 2.2

The bound on approximate truthfulness, i.e., , follows from Theorem 2.1 and Theorem 1.3, where we first obtain the bound on from Theorem 1.3 by setting and and then replace with for MHR distribution and replacing with for bounded distribution.

It remains to consider revenue, where we will use sample complexity results to obtain the convergence rate of the revenue loss, i.e., . Let be the expected revenues of the two phases in , and be the revenue obtained by using Myerson’s auction in all rounds, i.e., where is the revenue of Myerson’s auction with i.i.d. bidders from . For , we only have since we do not any revenue guarantee for the arbitrary first-phase mechanism . Now consider , let denote the expected revenue of a second price auction with reserve price . Since the values in the two phases are independent, we have

We need to compare with . Since bidders have i.i.d. regular value distributions, Myerson’s auction is exactly the second price auction with reserve price . When , Myerson’s auction becomes a post-price auction. Let be the inverse function of the required number of samples for to guarantee -optimal revenue (as obtained in Huang et al. [24]) in the posted-price auction, i.e., the expected revenue of a one-bidder auction with a posted price determined by with samples is at least times the optimal expected revenue. Then for the one-bidder case, we have

For general , while the sample complexity literature does not analyze the revenue of the same reserve price in a second price auction with bidders, we are able to generalize the existing revenue guarantee to the case of multiple bidders (and multiple units) under the assumption that the distribution is regular. The generalization is made by the following lemma, which we believe is of independent interest:

Lemma C.1.

For any regular distribution , if the expected revenue of a posted price auction with price and with one bidder whose value is drawn from is -optimal, then the revenue of a Vickrey auction with reserve price selling at most units of a item to i.i.d. unit-demand bidders with values from is also -optimal.

The proof is in Section C.3. Thus for , we also have:

Finally,

| ( since ) | ||||

From Huang et al. [24], we know that for bounded distributions, when , and for MHR distributions (MHR implies regularity), when . This implies the bounds on as stated in the theorem, and concludes the proof.

C.3 Proof of Lemma C.1

It’s more convenient to work in the quantile space. Let , be the value curve and revenue curve of . It’s well-known that the derivative equals to the virtual value and by Myerson’s Lemma, the expected revenue with allocation rule equals to the virtual surplus:

Let be the allocation to (the probability of winning of) a bidder whose value has quantile in a Vickrey auction selling units to bidders without reserve price. Specifically, ; for general , ; for general , . With reserve price , let , then the allocation becomes for and otherwise. So the revenue of is

and the optimal revenue is:

where satisfies: and . And define:

Since is -optimal with (the posted-price auction), we have:

Now for general :

-

•

If . The loss:

since is non-increasing in (actually, the monotonicity of is the only property that is used throughout the proof), and the optimal revenue:

which gives: .

-

•

If . The loss:

and the optimal revenue:

which gives:

C.4 Perfect Bayesian Equilibrium

Here we consider the setting of -round repeated auctions where each auction contains bidders and each bidder participates in at most rounds of auctions. We use to denote bidder ’s profile of values, where is her value at round if she participates in that round. Similarly denote by the bids of bidder . Values are i.i.d. samples from some distribution .

In repeated auctions, the seller can adjust the mechanism dynamically based on the bidding history of buyers, and buyers can use historical information to adjust their bidding strategies. The solution concept of an -perfect Bayesian equilibrium (-PBE) captures this dynamic nature. For each bidder , we use to denote the history she can observe at the start of round . For example, includes her bid , whether she receives the item, how much she pays, etc, at round if she participates in round . We assume that bidder cannot observe the bids in the auctions she does not participate in. We allow bidder to anticipate her values in future rounds, so she can make decision on her entire value profile . Bidder ’s strategy is thus denoted by where maps and to a bid . Let be the total expected utility of bidder in rounds , given her value profile , the history at round , and bidders playing .

Definition C.2.

A profile of strategy is an -perfect Bayesian equilibrium (-PBE) if for each bidder , each round , any history , any values , the strategy approximately maximizes bidder ’s expected utility from round to round up to error, i.e., for any alternative strategy .

Definition C.3.

The seller’s mechanism (or auction learning algorithm) is -perfect Bayesian incentive-compatible (-PBIC) if truthful bidding (i.e., ) is an -PBE.

We emphasize that the expected utility is conditioned on . This is because, the history which includes the allocation of item and the payment of bidder can leak information about other bidders’ bids (or values). Other bidders’ bids will influence the mechanism the seller will use in future rounds. Thus, based on this information, bidder can update her belief about other bidders’ bids and the seller’s choice of mechanisms by Bayesian rule, then she can compute her expected utility on her updated belief.

PBIC of the two-phase ERM algorithm.

As discussed, the two-phase ERM algorithm is a learning algorithm that learns approximately revenue-optimal auctions in an approximately incentive-compatible way against strategic bidders in repeated auctions. The algorithm, obtained by adopting the two-phase model with ERM as the price learning function and setting , works as follows:

-

•

in the first rounds, run any truthful, prior-independent auction , e.g., the second price auction with no reserve;

-

•

in the later rounds, run second price auction with reserve where are the bids from the first auctions.

and are adjustable parameters of the two-phase ERM algorithm.

Theorem C.4.

The two-phase ERM algorithm is -PBIC, where,

-

•

for any bounded , , and

-

•

for any MHR , if and , then , where .

The constants in big ’s are independent of and .

Combining with the bounds on in Theorem 1.3, we have

Corollary C.5.

The two-phase ERM algorithm is -PBIC, where,

-

•

for any bounded ,

if and ;

-

•

for any MHR ,

if and .

The constants in big ’s are independent of and .

The guarantee of revenue optimality is the same as Theorem 2.2:

-

•

For bounded and regular distribution, .

-

•

For MHR distribution, .

In the rest of this section we prove Theorem C.4 for bounded distributions. The proof is similar to that of Theorem 2.1 except that we need to consider the effect of history on the conditional distribution of the values of other bidders when considering perfect Bayesian equilibrium. The extension to MHR distributions is similar to the extension of Theorem 2.1 to MHR distributions (discussed in Section D.2) and hence omitted.

Proof of Theorem C.4 for bounded distributions.

Assume that other bidders bid truthfully and bidder deviates from truthful bidding to other strategy, consider the increase of bidder ’s total expected utility from round to , for each , given any history and any values . If , then the auctions in and later rounds are in the second phase and never change due to the deviation of bidder , thus deviation does not increase her utility.

Then we consider . Strategic bidding does not increase bidder ’s utility in rounds because these rounds are in the first phase and the mechanism in the first phase is truthful. Thus, strategic bidding can increase her utility only in the second phase. Let be a second-phase round in which she participates. The auction at round is a second-price auction with reserve price determined by from bids in rounds to . Denote by the values of all bidders in rounds to . If bidder bid truthfully, then the reserve price at round is . Let be the set of rounds in which bidder participates from round to round . Then we can partition into two parts: and , where denotes bidders’ values in the rounds in , and denotes the values in the rounds not in . There are values in , of which are bidder ’s values. By deviating, bidder can change her values in to some arbitrary bids. We denote by the bids of bidder and the values of other bidders in . After deviation, the reserve price is changed to . By (14), the increase of bidder ’s utility due to the change of reserve price is at most , which is further upper-bounded by

We then argue that given any history , are still i.i.d. samples from , from bidder ’s perspective. Note that bidder does not participate in the auctions in rounds , and the auctions she does participate in before round is prior-independent, which implies that the allocation of item and the payments of bidders in any round depend only on the bids of bidders in that round but not on any information like bids from other rounds. Moreover, other bidders’ values across different rounds are independent. Therefore, the auctions bidder participates in leaks no information about other bidders’ values in rounds .

Therefore, the increase of bidder ’s expected utility at round is at most

where the last inequality is because and for .

Since bidder participates in at most auctions, the sum of increases of expected utility from round to is at most . ∎

Appendix D Analysis for MHR Distributions

Recall that a distribution is MHR if its hazard rate is monotone non-decreasing.

D.1 Properties of MHR Distributions

Recall that is the revenue curve of distribution , where . And is the quantile of the optimal reserve price .

For MHR distributions, we first introduce a lemma which says that is bounded away from 0 by a constant.

Lemma D.1 (Hartline et al. [23]).

Any MHR distribution has a unique , and .

Moreover, the revenue curve decreases quadratically from .

Lemma D.2 (Huang et al. [24], Lemma 3.3).

For any MHR , for any , .

The following lemma shows that samples from an MHR distribution are rarely too large.

Lemma D.3.

Let be an MHR distribution. Let where are i.i.d. samples from . For any , we have .

Proof.

Note that . By the definition of we know , or . By the definition of MHR, we have for any , thus

Then the lemma follows from a simple union bound:

∎

We will use above lemmas to prove some further lemmas which characterize the behavior of on samples from a MHR distribution, where can be any value between and . The samples we consider consist of copies of , denoted by , and random draws from . We sort the samples non-increasingly and use

to denote the random draws. Let denote their quantiles where .

Lemma D.4.

Let be an MHR distribution. Suppose . Fix values to be , and randomly draw values from . Let , i.e., the index selected by , where . Then we have

with probability at least .

Proof.

Let as in B.2. We have for any with probability at least . We thus assume .

The intuition is follows: The product divided by approximates up to an error. Our proof consists of three steps: The first step is to show that with high probability, there must be some sample with quantile that is very close to so its revenue . The second step is to argue that all samples with quantile are unlikely to be chosen by because is too small and the gap between and leads to a large loss in revenue, roughly speaking, . The final step is to show that if a quantile is to be chosen by , then it must have equally good revenue as .

Formally:

-

1.

Firstly, consider the quantile interval . Each random draw , if falling into this interval, will satisfy:

(15) where the last but one inequality is because and the last one follows from . The probability that no quantile falls into is at most

-

2.

For the second step, first note that the in the first step will be considered by since . Then suppose chooses another quantile instead of , we must have

(16) We will show that such probability is small if . Pick a threshold quantile where . Consider two cases:

- •

- •

-

3.

Finally, if . We argue that if picks instead of , then approximates well, satisfying the conclusion in the lemma. This is because

Combining above three steps and the event in the beginning of the proof, we have except with probability at most

∎

Lemma D.5.

Let be an MHR distribution. Suppose . Fix values to be , and randomly draw values from . Let , i.e., the index selected by , where . Let . Then with probability at least , the following inequalities hold:

-

1.

;

-

2.

;

-

3.

.

D.2 Detailed Proof of Theorem 2.1 for MHR Distributions

Let . Similar to the proof for bounded distributions, we have for any ,

By A.2, we have where can be any values (e.g., ) that are greater than the maximal value in , when .

Let , define two threshold prices and where as in Lemma D.5. Note that for sufficiently large , . With the random draw of from , denote the random variable by , we have:

| (20) |

-

1.

For the first term ,

-

2.

For the second term, we claim that .

By Lemma D.5, we have . Therefore,

-

3.

For the third term, we claim that .

Let be the upper bound on the support of ( can be ). Let be the distribution of . For convenience, suppose it is continuous and has density . We have:

Combining the three items,

D.3 An Improved Bound on Incentive-Awareness Measure for MHR Distributions

Here we improve the upper bound on for MHR distributions by proving:

Lemma D.6 (Tigher bound for MHR distributions).

Moreover, if is MHR, let , and suppose , we have

The main idea is to limit the range of the quantile of the “bad value” in in Lemma B.5. Recall that in the proof of Lemma B.5 we assume can take any value in , divide into intervals (as in (11)), and take a union bound to upper-bound the probability that a bad exists. For MHR distributions, however, we will show that is a approximation to , thus we can use Lemma D.2 to reduce the possible range of from 1 to .

D.3.1 Proof of Lemma D.6

Let be the upper bound on in . With the random draw of samples from (and assume other samples are equal to ), we have for any with probability at least . Moreover, by Lemma D.4 and Lemma D.5, with probability at least we have and , where . Combine the above two inequalities with and denote the combined event by , i.e.,

We have . Re-define , and re-write (4):

| (22) |

The following steps of bounding are the same as before (in particular, Lemma B.4 in Lemma B.3), until upper-bounding (Lemma B.5), where we improve the bound by a factor of .

Lemma D.7 (Improved Lemma B.5 for MHR distributions).

Let . If and are at least , then .

Proof.

The proof is the same as that of Lemma B.5 (in Section B.5), except that before dividing the quantile space , we argue that the space to be divided can be shortened to .

Consider the index that is promised to exist in ,

| and | ||||

| and in | ||||

By Lemma D.2, we have

Now we modify the analysis after B.8. Consider those intervals ’s with length in (11) that intersect with

There are at most such intervals and we denote the set of (indices of) those intervals by . The definitions of , , , , and remain unchanged. By choosing the index such that , we know that if the event holds then must hold for some such that . By Lemma B.9 we have . Taking a union bound over , we obtain

where the last equality is because and under the assumption that and are at least . ∎

Lemma D.8 (Improved Lemma B.3).

If is at least , then .

Proof.

Modify the end of Section B.3,

| Lemma B.4 | ||||

| Lemma D.7 | ||||

Note that because , the condition of Lemma D.7 is satisfied when .

Appendix E Analysis for -Strongly Regular Distributions

E.1 Useful Lemmas

Lemma E.1 (Cole and Roughgarden [12]).

Any -strongly regular distribution has a unique , and .

Lemma E.2 (Huang et al. [24], Lemma 3.5).

For any -strongly regular distribution , for any , .

Lemma E.3.

Let be an -strongly regular distribution. Let where are i.i.d. samples from . For any , we have .

Proof.

Note that . By the definition of we know , or . By the definition of -strong regularity, we have

and

Thus

and

Then the lemma follows from a simple union bound:

∎

Claim E.4.

Proof.

Set in Lemma A.3. ∎

Lemma E.5.

Let be an -strongly regular distribution. Suppose . Fix values to be , and randomly draw values from . Let , i.e., the index selected by , where . Then we have

with probability at least . The constants in the big ’s depend on .

Proof.

Let as in E.4. We have for any with probability at least . We thus assume . For simplicity, we define , and Lemma E.1 implies .

The intuition is follows: The product divided by approximates up to an error. Our proof consists of three steps: The first step is to show that with high probability, there must be some sample with quantile that is very close to so its revenue . The second step is to argue that all samples with quantile are unlikely to be chosen by because is too small and the gap between and leads to a large loss in revenue, roughly speaking, . The final step is to show that if a quantile is to be chosen by , then it must have equally good revenue as .

Formally:

-

1.

Firstly, consider the quantile interval . Each random draw , if falling into this interval, will satisfy:

(23) where the last but one inequality is because and the last one follows from . The probability that no quantile falls into is at most

-

2.

For the second step, first note that the in the first step will be considered by since . Then suppose chooses another quantile instead of , we must have

(24) We will show that such does not exist.

Suppose chooses , then must satisfy , and as a result, .

-

3.

Finally, if . We argue that if picks instead of , then approximates well, satisfying the conclusion in the lemma. This is because

Combining above three steps and the event in the beginning of the proof, we have except with probability at most

∎

Lemma E.6.

Let be an -strongly regular distribution. Suppose . Fix values to be , and randomly draw values from . Let , i.e., the index selected by , where . Let . Then with probability at least , the following three inequalities hold:

-

1.

;

-

2.

;

-

3.

.

The constants in the big ’s depend on .

E.2 Detailed Proof of Theorem 2.1 for -Strongly Regular Distributions

Let . Similar to the proof for bounded distributions, we have for any ,

By A.2, we have where can be any values (e.g., ) that are greater than the maximal value in , when .

Let , define two threshold prices and where as in Lemma E.6.

Note that for sufficiently large , . With the random draw of from , denote the random variable by , we have:

| (27) |

-

1.

For the first term ,

-

2.

For the second term, we claim that .

By Lemma E.6, we have . Therefore,

-

3.

For the third term, we claim that .

Let be the upper bound on the support of ( can be ). Let be the distribution of . For convenience, suppose it is continuous and has density . We have:

Combining the three items,

where the constants in ’s depend on .

Appendix F Lower Bounds

F.1 Discussion

A lower bound on . Theorem 1.3 gives an upper bound on for a specific range of ’s. When one considers respective lower bounds, a preliminary question would be: how does the choice of affect the possible lower bound? The following result shows that it is enough to prove a lower bound for one specific in the range of allowed ’s. The same lower bound will then hold for all ’s in that range.

Proposition F.1.

Let denote the worst-case incentive-awareness measure of . Suppose .

-

•

For bounded distributions, , for any .

-

•

For MHR distributions, is bounded by , for any .

Proof.

Fix any and any . Recall that , where, letting be a vector of identical values that are equal to , then by Claim A.2,

Let where , i.e. the index of in . We show that, if for , then

-

•

for any . To see this, note that

where the second equality follow from our assumption that and the third equality is because .

-

•

for any . Fix and consider any . Let be any bids such that . Let . Consider , we have , so must be greater than the index of in . The index of in is at least , thus . We claim that . To see this, note that

where the second equality is because , and the third equality follows from .

Thus, for any . Define , then

For bounded distributions, consider and . We have proved in Theorem 1.3 that for any . Thus .

For MHR distributions, let , as proved in Lemma D.5, for . Then . Thus for any .

∎

Lavi et al. [27] show a lower bound that can be compared to our upper bounds in Theorem 1.3. Specifically, they show that for the two-point distribution and , each w.p. 0.5, . It is easy to adopt their analysis to any two-point distribution with and . Since this is a bounded distribution, we obtain the following corollary:

Corollary F.2.

For the class of bounded distribution with support in , and any choice of , gives where the constant in depends on .

It remains open to prove other lower bounds on , especially for MHR distributions.

A lower bound on the approximate truthfulness parameter, . Since only upper bounds the approximate truthfulness parameter , a lower bound on does not immediately implies a lower bound on . However, an argument similar to above shows the same lower bound directly on . Consider the two-point distribution where for , and . For simplicity let and suppose bidder participates in and auctions in the two phases, respectively. Let and assume . Suppose the first-phase mechanism is the second price auction with no reserve price. Then,

Proposition F.3.

In the above setting, for any , where the constant in depends on .

The proof is in Section F.2. Once again, it remains open (and interesting, we believe) to prove a lower bound for MHR distributions, and to close the gap between our upper bound for bounded distributions which is .

F.2 Proof of Proposition F.3: Lower Bound for the Two-Phase Model

Consider the two-point distribution where for , and . For simplicity let , and suppose bidder participates in and auctions in the two phases, respectively. Let and assume . Suppose the first-phase mechanism is the second price auction with no reserve price. We argue that to satisfy -approximate truthfulness, must be , for .

Suppose the values of bidder across two phases are all ’s, i.e.,

and bidder bids ’s with in the first phase (assume ),

Recall the definition of the interim utility of bidder :

-

•

First consider the increase of interim utility in the second phase. If the reserve price is , then bidder ’s utility is

(28) If the reserve price is , then her utility becomes

(29) We then consider the probability that the reserve price is decreased from to because bidder deviates from to . This probability is over the random draw of values . Suppose there are exactly ’s in . Then when bidder bids truthfully, there are ’s in in total, which results in because . However, if bidder deviates to , then becomes , because

Thus, the reserve price is decreased from to with probability at least:

(30) Combining (30), (29) and , we obtain

(31) -

•

Then we upper bound the utility loss due to non-truthful bidding in the first phase for bidder . Note that since is the second price auction with no reserve price, no matter bidder bids or , her interim utility is the same:

Thus

(32)

Finally, by (31) and (32), we have

which gives a lower bound on .

Appendix G Unbounded Regular Distributions

G.1 Discussion

Theorem 2.2 shows that approximate truthfulness and revenue optimality can be obtained simultaneously for bounded (regular) distributions and for MHR distributions. A natural question would then be: what is the largest class of value distribution that we can consider? If or (i.e., each auction includes multiple bidders, at least ), then running a second price auction with an anonymous reserve price may not be optimal if the distribution is non-regular [31]. Moreover, even in the one-bidder case, the sample complexity literature analyzes the ERM algorithm only for regular or for non-regular and bounded distributions. For other classes of distributions, ERM does not seem to be the correct choice. Thus, the class of general unbounded regular distributions is the largest class we can consider. Still, our results do not cover this entire class since MHR distributions is a strict sub-class of regular distributions and for regular but non-MHR distributions we assume boundedness.

Our results can be generalized to the class of -strongly regular distributions with . As defined in [12], a distribution with positive density function on its support where is -strongly regular if the virtual value function satisfies whenever (or if is differentiable). As special cases, regular and MHR distributions are -strongly and -strongly regular distributions, respectively. For , we obtain bounds similar to MHR distributions on and approximate incentive-compatibility in the two-phase model and the uniform-price auction. Specifically, Theorem 1.3 can be extended to any -strongly regular distribution with as follows:

Theorem G.1.

If is -strongly regular for , then , when and . The constants in and depend on .

Note that this bound holds only for large enough ’s since as . However, for any fixed there exists a large enough such that the relevant range for appropriate ’s will be non-empty.777The constant in the big depends on , so it is constant only if the distribution function is fixed. However, it goes to infinity as . The proof of the upper bound on is similar to the proof for MHR distributions (Lemma D.6), except that, we need to guarantee (Lemma E.6); thus we omit the proof.