Optimal Order Execution in Intraday Markets: Minimizing Costs in Trade Trajectories

Abstract

Optimal execution, i.e., the determination of the most cost-effective way to trade volumes in continuous trading sessions, has been a topic of interest in the equity trading world for years. Electricity intraday trading slowly follows this trend but is far from being well-researched. The underlying problem is a very complex one. Energy traders, producers, and electricity wholesale companies receive various position updates from customer businesses, renewable energy production, or plant outages and need to trade these positions in intraday markets. They have a variety of options when it comes to position sizing or timing. Is it better to trade all amounts at once? Should they split orders into smaller pieces? Taking the German continuous hourly intraday market as an example, this paper derives an appropriate model for electricity trading. We present our results from an out-of-sample study and differentiate between simple benchmark models and our more refined optimization approach that takes into account order book depth, time to delivery, and different trading regimes like XBID (Cross-Border Intraday Project) trading. Our paper is highly relevant as it contributes further insight into the academic discussion of algorithmic execution in continuous intraday markets and serves as an orientation for practitioners. Our initial results suggest that optimal execution strategies have a considerable monetary impact.

keywords:

Intraday electricity market, Market Microstructure, Optimal Execution, Algorithmic Trading1 Introduction

Intraday markets are of tremendous importance in German electricity

trading. Traded volumes rise from year to year and set a new record

in 2019 (EPEX Spot SE [9]). The growing share of renewable energy

requires market participants to balance their positions in very short-term

intraday markets and causes more traded volume close before delivery

(Koch and Hirth [27]). Intraday trading is usually used for rebalancing

after power plant outages, updated consumption forecasts, or speculative

trading approaches, as demonstrated by Maciejowska et al. [29].

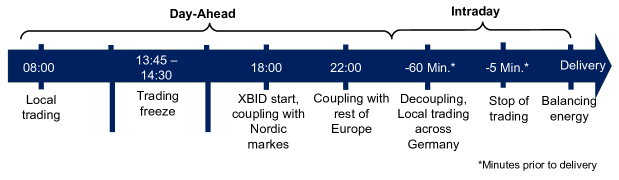

This paper refers to hourly continuous intraday trading, leaving quarter-hourly

trading and intraday auctions aside. The German market allowed for

trading up to five minutes before delivery in mid-2020 coupled with

other European intraday markets, as Kath [24] analyzed

and worked on a pay-as-bid basis, meaning that orders were continuously

matched and executed at their respective prices. Figure 1 displays

the different time lines of German hourly intraday trading, including

the coupling among markets under the Cross-border intraday project

(XBID). More information on the German market is also provided by

Viehmann [42].

While the German intraday market itself has develoed

into a central market-place, its many simultaneously traded hours

have also brought another topic to the agenda: automated and algorithmic

trading. The term describes the algorithm-aided execution of trades

or liquidity provision strategies, as mentioned by Hendershott and Riordan [20].

Herein, we will drill down our focus to optimal execution and leave

liquidity provision strategies aside. The continuous matching process

is crucial in understanding the main issue of optimal execution. Energy

companies face a practical problem: Their trading books are flooded

with volumes, which may stem from outages, renewable generation, or

trading decisions. But how can they execute the volumes in an optimal

way? A market participant could trade the entire volume at once, wait

for a better point in time with more favorable prices, or even slice

the volume into many small portions to be traded. The slicing aspect,

or the determination of an optimal trading trajectory, is what optimal

execution aims to identify.

There is a rich body of literature on analytical aspects that discuss

market determinants, such as Kiesel and Paraschiv [26], Hagemann [18], Narajewski and Ziel [33], Pape et al. [35],

and forecasting approaches, like Uniejewski et al. [41], Janke and Steinke [23], Kath and Ziel [25],

and [25]. From a practical perspective, these papers

only discuss reasons for the price movements and predictability of

intraday trading but leave the question of ’how to trade’ open. The

problem of executing orders in the most optimal way was referred to

by Garnier and Madlener [12] and Aïd et al. [1] with

a strict focus on renewable energy source (RES) generation. However,

what the current academic discussion misses is a more generic discussion

of optimal execution strategies in the German electricity intraday

market. While there are many stochastic models under the umbrella

of equity trading (e.g., Almgren and Chriss [2], Almgren [3], Bertsimas and Lo [4]),

there were only three electricity trading approaches present when

this paper was written. The first one, provided by von Luckner et al. [43],

discusses optimal market-making strategies in the context of the German

intraday market. Meanwhile, Glas et al. [14] and Glas et al. [15]

addressed a more general numerical execution approach for both renewable

and conventional generation output. Finally, Coulon and Ströjby [7] presented

a preliminary model on executing volumes of renewable generation in

an optimal manner.

We aim to position the topic of optimal execution

more prominently in the current discussion of German intraday markets

and analyze various approaches in the remainder of this paper. Our

work is structured as follows: Section 2

takes a deeper look at order books and the underlying data. Most of

the time, actual trades are analyzed in the context of intraday trading

which is why we need to address what distinguishes order book data

from trades. In the course of the data discussion, we will derive

the problem of optimal execution in a more formal way. Section 3

introduces execution approaches and discusses, which weaknesses they

exhibit in the context of electricity markets. Leaving the theoretical

part aside, we compute trading trajectories under different scenarios

and evaluate the results in an empirical out-of-sample study in Section

4 and summarize our findings

and the contributions of this paper in Section 5.

2 Order Book Data and the Problem of Optimal Execution

2.1 Why Order Book Data are Different

If one takes a historic view of intraday papers, the evolution of

complexity and availability in the research data becomes evident.

Early articles like Hagemann [18] solely used volume-weighted

average prices of the entire trading period. This modus operandi ignores

the characteristics of continuous trading and takes a more time series-oriented

approach. Later papers dealt with individual intraday trade data (e.g.,

Janke and Steinke [23]). They focused on individual transactions

and derived partial averages. However, this is only one side of the

coin since these papers focused on trades, i.e., the buying and selling

of orders that could be matched. Better availability of data has allowed

researchers to analyze order book data. These data-sets comprise not

only trades but also unmatched orders. Orders grant new insight into

continuous trading and the market microstructure behind it.

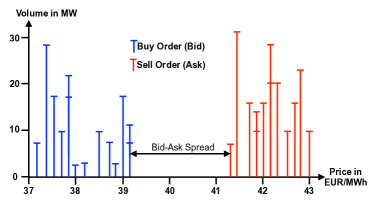

In a limit order book (LOB), orders are continuously

sorted based on the price per buying and selling direction for each

delivery hour. Thus, a typical LOB for one delivery hour can be imagined

like a t-account with buy and sell sides. Figure 2 represents an order

book in a graphical manner. All buy orders, or the "bid"

side, are sorted in descending order, while all sell orders, or the

"ask" side, are ordered in ascending order,

such that the best sell order in the market is the one with the lowest

price.

The next crucial aspect of understanding LOB data is timing. Figure

2 displays a snapshot of one specific second. However, we need to

define a describing element that discretizes countless snapshots and

aggregates the information. The bid-ask spread (BAS) serves this aspect

well as it compresses buy and sell orders into one numerical figure.

However, LOB data are not one-dimensional. Figure 2 reveals the connection

of volumes available at different price levels. It makes no sense

to focus on the best bid and ask for the BAS computation if the volume

sums up to 0.1 MWh. Therefore, we aggregate the BAS into different

volume buckets, i.e., BAS per first 1 MW traded, BAS for the volume

between 1 and 5 MW, and so on (see Section 2.2 for the mathematical

formulation). Last but not least, we need a second level of discretization

to cover the aspect of time. We can aggregate our data into minute

buckets such that we can identify the best 1 MW BAS over an interval

of one minute of trading, for instance.

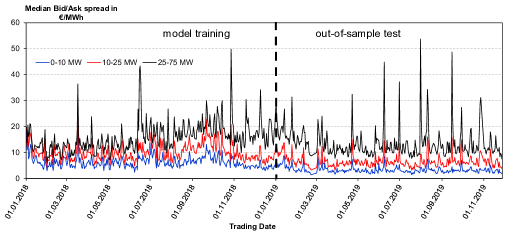

We used LOB data from 01.01.2019 to 27.11.2019 provided

by EPEX Spot SE. The data can be purchased from EPEX Spot SE. For

more information on EPEX order book data and the required data preparation,

refer to Martin and Otterson [32]. Unfortunately, the data are not

completely available for the year 2019, which is why Figure 3 ends

in late November 2019. We also split the data into training (year

2018) and out-of-sample testing (year 2019). Some execution algorithms

require historic data for model training. We used the entire year

of 2018 for model training. All data of 2019 were used to benchmark

the models in an out-of-sample manner.

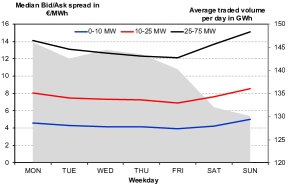

The series of median BAS data, as shown in Figure

3, does not suggest any yearly seasonality. There are some spikes,

but, all in all, the spreads seem to be stable across the year. Figure

4 zooms in and shows the median BAS per weekday and delivery hour

as well as the corresponding traded volume. A similar pattern evolves

for both the weekly and hourly bid-ask series. They appear to be stable

no matter the day or delivery hour. The market participants seem to

have similar order quoting behavior. This is an important first observation

as it leads to a conclusion on execution algorithms. If quoting is

stable, considering seasonality is not a major concern. The picture

changes with the trading volume. Saturdays and Sundays feature lower

trading volumes. Figure 4 delivers evidence for hourly patterns: The

delivery hours 1—7 show signs of less trading volume.

Last but not least, we want to analyze the continuous

trading character of German intraday markets. Figure 5 shows how the

median BAS behaves with respect to time to delivery. Its level is

constant over time but changes 60 and 30 minutes before delivery.

This effect is connected to the local coupling of markets. One hour

before delivery, no European orders are coupled under XBID with the

German market anymore, and 30 minutes before delivery, local within-grid

area trading starts (see Kath [24]). Consequently,

volumes sharply drop at 60 and 30 minutes to recover later. Figure

5 is also a good summary of the problem of optimal execution itself.

How should volumes be distributed over the available trading time

up to delivery? Moreover, how should volumes be sliced to ensure that

a minimum spread is paid?

2.2 Discretization Methodology

The amount of data with LOB requires different handling than that with trade data. Our dataset is around 60 GB, it does not allow for simple calculation on an order basis anymore but demands an aggregation approach. Orders need to be aggregated by time and trading volume. We will start with time. To understand the concept of time aggregation, a few notations need to be introduced. Imagine one line in our data frame as

| (1) |

Let this be the set of all buy and sell orders at delivery time comprising its price , the volume of an order denoted as , its start , and expiry time stamp in seconds from the start of the observation. We divide the difference between the reception of any position to be traded at and the delivery at time in equidistant steps , where . Thus, we have buckets of one minute in length. The parameter is a dynamic one depending on the arrival of the position at . That means that if the time of arrival changes, the computation of the optimal execution likewise differs, as the length of is different. Based on , it is possible to define time discretization buckets

| (2) |

which comprise all active orders111Note that we need to remove cancellations from the set of all active

orders in order to avoid counting any orders twice. in the -th minute interval bucket for each delivery time stamp

and direction . Note that this automatically filters out

unnecessary information present before the position arrival at ,

which reduces the memory space used. The choice of minute buckets

seems suitable for the EPEX intraday market as with lower granularity,

one faces many instances with missing data as there are simply no

new activities, e.g., one will face many buckets with no trades every

second. However, decreasing the resolution to 15-minute buckets lessens

the trading abilities of the algorithms and might turn out to be a

poor choice, as the volume is split on fewer buckets with less trades

but more volume per trade and, as a consequence, higher spreads. Therefore,

one-minute buckets appear to be a good compromise. Other approaches

like Glas et al. [15] use five minute intervals, but we believe

that a finer grid causes the results to be more realistic.

As a next step, we need to filter by cumulative sum

of volume ordered by price in an ascending

(in the case of buy orders) or descending manner (in the case of sell

orders). First, we define auxiliary volume buckets with

for our aggregation logic as ,

, ,

,

and . This leads to a refined version of Eq.

(2) that allocates not only based on the -th time bucket but also

on the -th volume bucket in

| (3) |

The buckets serve as separators for the cumulative volume.

Obviously, trading costs vary over time. However, they also change

with the designated trading volume, as depicted in Figure 5. The LOB

is ordered by price in the case of both buying and selling. Unless

all orders are entered with identical prices, a price ladder will

emerge. The best buy and sell prices might feature only a small share

of the total volume. As a consequence, trading usually gets more expensive

with large quantities. We can take this aspect into consideration

by aggregating buckets by volume as well.

One could argue that the aspect of time-weighted orders is missing in this approach. It makes a difference if an order exists for a few seconds or for the entire bucket range of 60 seconds. We have neglected this aspect, as the additional volume weighting ensures that small orders that just exist for a few seconds do not count too much. A limited simulation showed that there were no substantial differences if we added another time weighting component, which is why we have left it out for the sake of a faster computational time.

2.3 Underlying Market Assumptions and Problem Formulation

The market microstructure of intraday markets requires more consideration as well. Therefore, we assume the following for our optimal execution analysis:

-

1.

The algorithms can only accept existing orders in the LOB and actively pay the BAS. To understand this concept, we need to discuss the two execution alternatives. A market player can initiate an order by quoting a price and volume pair. Say, for instance, the best buy order is at 50 €/MWh, and the best sell order is at 51 €/MWh. A trader can initiate another buy at 50.10 €/MWh and wait for execution, Or they can actively accept an existing order by entering a buy at 51 €/MWh, which results in immediate execution as there is a corresponding sell order available. Technically speaking, the latter can be seen as an active click in the LOB. We assume it as the only way to trade, since waiting for other traders to accept the order is very complex to depict. It requires modeling other traders who are willing to accept the order.

-

2.

We ignore further trading costs (such as fees), as they are usually constant in time and volume and should not influence our optimal execution path. In addition, they are counter-party specific and vary based on bilateral agreements between traders, the exchange, and clearing banks.

-

3.

The optimal execution is probed for a fixed trading volume. This is, for instance, the case for plant outages that need to be covered in the intraday market. Generation updates for renewable energy sources imply uncertainty in forecasts and changing position sizes, which add another dimension of complexity and are ignored in this paper.

-

4.

Following Narajewski and Ziel [33], the intraday market is considered as efficient in this paper. Thus, we do not have any view or opinion on price developments and only focus on execution.

-

5.

All algorithms stop their activities 30 minutes before delivery. Kath [24] showed that this is the time when intra-control area trading starts. Therefore, it makes sense to see this threshold as an operational barrier, as no Germany-wide trading is possible anymore. Apart from that, the EPEX indices ID3 and ID1 stop 30 minutes before delivery (for an ID3 example, see Uniejewski et al. [41]), which makes our approach time-congruent with the EPEX data. This implies that, for instance, means 180 minutes of trading starting from 210 minutes222It is important to understand the chronological differences. The trading time stops 30 minutes before delivery. Thus, we can define trading time=lead-time minus 30 minutes. before delivery up to 30 minutes before delivery.

-

6.

We round all volumes stemming from the trading trajectories to one digit whenever possible since this is the minimum tick size at the exchange.

3 Optimal Execution Strategies

3.1 Proposed Execution Model Approach

3.1.1 Determinants of Optimal Execution

The first model on optimal execution was provided by Bertsimas and Lo [4].

Their contribution was a consideration of market impact, meaning the

temporary and constant change of prices due to own trading activity.

Almgren and Chriss [2] expanded the idea by taking into account

the traders’ risk appetite. They proposed a mean-variance-based approach

that locates an optimum between minimizing the trading costs and minimizing

the variance of costs. Later on, Almgren [3] expanded

the existing model with a non-linear market impact function. All models

share that they were applied on equity markets and have not been fully

tested in electricity intraday markets for optimal execution yet.

Herein, we borrow basic principles from the above mentioned papers

and derive a suitable model for intraday power markets.

First, we need to introduce some further notations

that are important for our model (see Table 1 for a detailed description

of the model parameters). We have

-

1.

a price (meaning a more general notation of prices here than the one of Section 2.2, where we referred to the prices of individual orders),

-

2.

an overall amount of we need to sell or buy in the continuous intraday market before its physical delivery at time ,

-

3.

the volumes traded in each time step denoted as and s.t. and

-

4.

the trade inventory position describing how much volume is still to be traded at each time bucket (it follows that and ), and

-

5.

the volatility of given by .

In the case of buying positions, shall be positive and in

the case of selling positions shall be negative. This assumption

allows us to have a position-neutral notation, as buying and selling

changes with the positive or negative position input of .

Another very important concept is the idea of market

impact. A common approach (e.g., in Almgren and Chriss [2]) is

to divide it into two parts such that the market impact is

denoted by

| (4) |

where is the temporary component that is due to the order book depth and less favorable prices that market participants receive for large volumes; describes the permanent change in market prices after trading has happened. It is important to note that the permanent market impact is only observable in the following epoch after the liquidity providers have re-entered their orders, which is

| Determinant | Description | Value | Calculation/Derivation |

|---|---|---|---|

| Initial price of electricity [€/MWh] | 47.22 | Average price of all 2018 trades | |

| Total position to trade [MWh] | changing | To be adjusted per scenario | |

| Daily volatility [€/MWh] | 20.57 | Yearly volatility | |

| Annual growth [€/MWh] | 0 | No price growth/drift is assumed | |

| Risk aversion [no specific unit] | 2x10^(—5) | Slightly less risk averse than Almgren and Chriss [2] |

why its determinants and are lagged in Eq. (4). The underlying price model, based on Almgren and Chriss [2], is assumed to follow

| (5) |

where is an independent random variable with

and i.i.d. as well as . We acknowledge that these

assumptions are not totally perfect, as Narajewski and Ziel [34]

showed, but they seem to be reasonable for our application.

The permanent market impact refers to the most recent

time lag as the latest order is assumed to influence the current prices

in the form of its permanent market impact function. Note that we

have left out any drift term in Eq. (5). However, since electricity

tends to be mean-reverting, a drift term does not seem to be suitable

for intraday markets. We define the formal cost function as

| (6) |

The costs are given by the volatility of prices and the two market impacts. In addition to just optimizing costs, Almgren and Chriss [2] proposed a mean-variance approach to execute volume under the constraint of risk aversion. Based on the idea of a mean-variance optimum such as the one in the modern portfolio theory of Markowitz [31], one can compute the expected costs and its variance from Eq. (6) and derive a mean-variance optimization in

| (7) |

where is the risk aversion parameter. The solution of Eq. (7) yields our two novel execution approaches OptiC and Optiς, whereas the first model only optimizes costs and sets while the second assumes a certain level of risk aversion333Our choice of lambda shall ensure an appropriate level of risk aversion. We tried more aggressive levels and found that they do not cause large differences as more traded volume means much higher costs. The algorithm always tries to balance the costs, even if less volatility in costs is desired. Hence, we believe the current selection is appropriate, as the other values do not change the path too much. with . Thus, we present two different models suitable for different levels of risk appetite. However, to finally compute a solution for Eq. (7), we need to determine the market impact model in the next sub-section.

3.1.2 The Choice of Market Impact Models

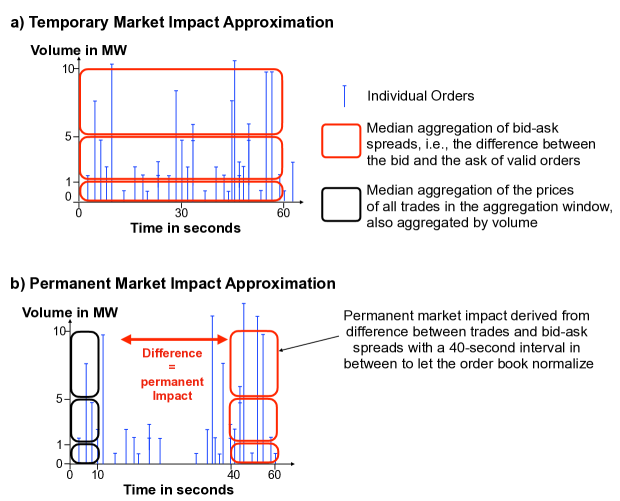

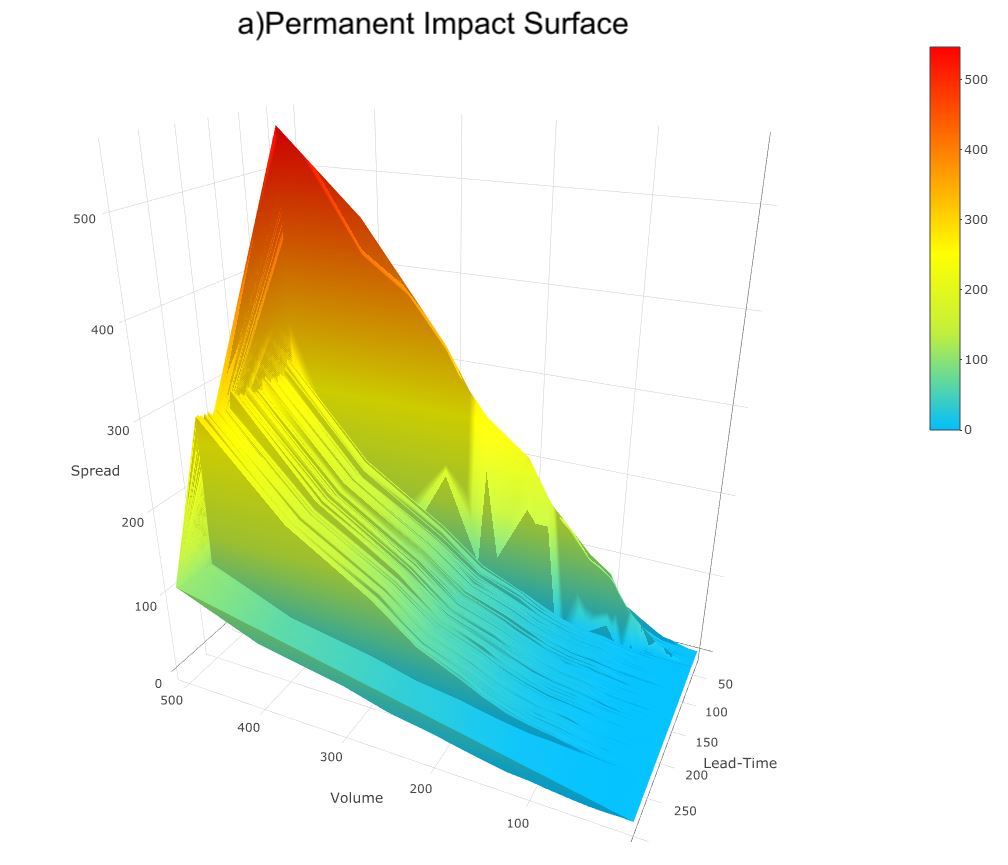

Market impact models determine the mathematical complexity of Eq. (6) to a great extent but are also the core of the execution approach as they determine the costs. Financial markets often assume less repercussions from individual trading and imply a linear influence, as done by Almgren and Chriss [2]. Exponential approaches are also utilized (see Almgren [3]). Another frequently applied approach is the square-root impact model. It is versatile and works in many diverse markets such as crypto or options trading as Tóth et al. [40] pointed out. Gatheral et al. [13] proposed a transient yet linear price impact model that decays over time. However, there is no blueprint ready for intraday electricity markets, which is why we follow a data-driven approach herein and derive a numerical model based on the intraday data of the year 2018. But how can we measure permanent and temporary market impact based on an LOB? Permanent market impact is that which evolves after a trade and is often caused by liquidity providers that adjust their price levels after the arrival of transactions. As an approximation, we first compute the mean of all trades happening within a range of 10 seconds, as shown in Figure 6.

After another 40 seconds of time delay, assuming that the order book

normalizes again, we compute the median BAS averaged over 20 seconds

and compare its level to the aggregated BAS before the arrival of

trades. We also group the output in volume buckets to reflect that

the market impact depends on the traded volume. The resulting data

derivation is also shown in Figure 6.

Temporary market impact vanishes immediately after

trading and can be described as a liquidity premium that is demanded

for higher volumes in the current order book. Traders are less willing

to quote at the best possible price if the volumes are very large.

The impact is temporary, as one pays a volume premium and, afterward,

the order book volumes normalize again. Here, we derive the temporary

impact by means of the BAS per volume bucket. Based on the year 2018,

the median BAS per volume is used to derive a cost curve per minute

bucket , delivery hour, and weekday (see Figure 7). As mentioned

above, we receive two cost structures that increase with higher volumes

of and less time to delivery based on the minute buckets

and—minding the seasonality of electricity prices—vary

slightly across delivery hours and weekdays (see Wolff and Feuerriegel [44]

for seasonality). We model the evolving relationship between impact

in euros/MWh and the mentioned determinants as a distribution in

| (8) | ||||

| (9) |

where (specifically for

| (10) | ||||

| (11) |

for . If , the impact function’s result has

to be zero, as no costs occur. The above is the generalized additive

model (GAM) of Hastie and Tibshirani [19] and tries to model the

parameters of a distribution—in our case the normal distribution—with

a linear model that consists of an intercept coefficient

and additional functions depending on the

input factors Other applications of GAMs were supplied

by Wood [45] and Gaillard et al. [11].

In general, a GAM tries to model distribution parameters with a linear

model that is connected closely to the well-known ordinary least squares

model. However, instead of just adding linear input variables, it

is a linear model consisting of different functions. Thus, the functions

replace the usual linear coefficients. The functions can

take a variety of forms, from simple polynomials to more complex splines.

We have tried both and found that splines model the market impact

much more precisely than polynomials or linear functions. The model

itself is fitted with the R-package gamlss of Rigby and Stasinopoulos [37]

and the splines are computed using the pb function. We use

the log as a link function for both and

in our GAM. The model was determined in a limited tuning study on

2018 in-sample data using polynomials, cubic splines, and monotonic

p-splines.

The most simplistic form of splines are cubic ones,

meaning an ensemble of piecewise polynomials of order three that join

each other at different knots (see Stasinopoulos et al. [39]

for more insight into splines in the context of GAMs). The more knots

used, the more “fitted” the resulting curve is. Obviously, the

choice of an appropriate spline setting is not trivial and could lead

to overfitting. A way to overcome this issue is presented by Eilers and Marx [8].

Penalization removes unsuitable polynomial fits and helps to avoid

a misconstructed model. Let be a cubic spline

on input vector for time bucket and number of knots

. Penalized splines (or p-splines) try to minimize the smoothing

parameters in

| (12) |

In a limited backtest study, p-splines modeled the impact curves of

Figure 7 best. The general goodness of fit is also reflected by the

dashed lines in Figure 5.

The non-linear, complex modeling of market impact

distinguishes our approach from studies like Glas et al. [15],

which applied a simpler polynomial fit. The other novelty of our approach

is the explicit consideration of trading characteristics.

Figure 7 shows the relationship between impact in euros per MWh and its determinant volume (denoted as ) and lead-time (minute buckets ) in a three-dimensional way. Figure 5 plots the relationship in a more detailed way. Another important aspect to note is the striking increase around 60 minutes before delivery. This has to do with the lack of coupling afterward. Normally, XBID is only active until one hour before delivery, meaning that during the last 60 minutes of trading, orders are solely German ones in the German LOB. Due to system restrictions, most market players delete their orders and re-enter them at this specific point in time, leading to two minutes of low liquidity and high BAS levels. Both Figures 5 and 7 confirm that. Thus, we need to introduce a dependency of time until delivery to realistically model the market impact. Therefore, we split the trading session into three regimes (as shown in Figure 5 as well): XBID, cutover phase, and non-XBID trading in

with being the number of minute buckets. Note that we define the cutover phase as 2 minutes, starting from 59 to 60 minutes before delivery and ending in the minute bucket starting from 60 and ending 59 minutes prior to delivery. The data suggest that both minute aggregates feature a special impact behavior. Combining the formal definition of Eq. (8) as well as the timing separation from above leads to our approximation of the true parameter in (exemplarily for :

| (13) | ||||

| (14) | ||||

for . In the case of the permanent market impact function , we needs to consider the lagged relationship in ). If , we have and since no volume means no cost of trading and no variance of such. Thus, we have different functions for the three trading phases in our GAM model. The different functions themselves are given by

| (15) | ||||

| (16) | ||||

| (17) | ||||

Note that the variance of each model is also computed by the GAM model

in the form of estimated parameter Due to the separation

into the three regimes, we have three different sigmas per impact

function: one for XBID, one for local trading, and one for the cutover

phase.

The term denotes a penalized spline function

of the input variable discussed earlier in the context of Eq.

(12). The function does not depend on lead time in the case

of the cutover regime, as the model requires at least four distinct

values to compute a spline. During cutover, we only have two individual

values. The functions and of Eqs. (15)—(17)

extract peak/off-peak hours and weekend information out of delivery

time stamp and transform it into a binary dummy variable such

that the model separates between different times.

3.1.3 Solving the Optimization Problem

With Eqs. (12) and (14) in mind, we can compute the expected costs and variance of Eq. (6) in more detail:

| (18) | ||||

Note that we assume independence of the three cost components in Eq. (18) such that the covariance of the three terms is assumed to be zero. Since all components are deterministic and do not depend on a random variable, their expectation is simply the function itself. Minding the deterministic character leads to the variance given by

| (19) |

Putting this all together leaves the optimization problem in

| (20) | ||||

| (21) |

We tried a variety of different approaches such as simulated annealing or gradient-based non-linear optimizers and found that a genetic algorithm (see Holland [21] or Goldberg and Holland [16]) works well in our case. It is readily implemented in the R-package GA of Scrucca [38] and—inspired by genetic processes—mutates an initial population on a random basis. Only the parameter combinations that generate the best values for the objective function in Eq. (20) survive, and the process is repeated again until no more decrease of cost is reached given a certain amount of iterations—in our case 650.

3.2 Simple Benchmark Strategies

3.2.1 Instant Order Book Execution

The last section introduced our novel execution approach tailor-made for intraday markets. Section 3.2 will present more general execution strategies that serve as a performance benchmark. The first approach is not a strategy per se but the most simplistic form of trade execution. Instant order book execution (IOBE) does not require any computation or predefined trade trajectory. Instead, an energy trader just accepts existing orders in the order book and trades the full volume at once. In mathematical terms, this strategy is

| (22) |

with . From a technical perspective, this is equal to a click in the EPEX trading system on either the bid or the ask side. It implies a willingness to pay the BAS for the sake of instant execution. Figure 7 indicates the downside of such simplicity. The higher the volume, the higher the BAS is. Prices are less favorable, as the trader has to accept not only the first few orders on top of the order book but a number of deeper ones as well. This usually leads to prices being far from the surrounding small volume trades and implies a high degree of market impact of a singular and large volume order. Another associated risk is given by price developments. Since the trade is entered at a specific point in time, prices can develop adversely after the trade. This effect is less apparent with small slicing strategies that trade over the entire time window. As such, why do traders use IOBE? To start, its profitability is highly dependent on the traded volume. For small traders, IOBE might be a cost-effective way to cover open positions. More sophisticated approaches like the ones that follow require algorithms that allocate volumes and slice them down to multiple trades. An application programming interface (API) connection to the exchange as well as a designated software solution is needed, while with IOBE trades, trading can be done manually via any exchange trading system. Thus, there is a trade-off between trading costs occurring through IOBE versus the additional costs caused by API connections and IT systems.

3.2.2 Time-Weighted Average Price Execution

Another very common strategy is an equidistant allocation of the entire volume on each volume bucket. Almgren and Chriss [2] referred to this as a minimum-impact strategy, but in the world of trading, such algorithms are commonly denoted as time-weighted average price (TWAP) execution. The idea is very simple. Regardless of empirical volume distributions, volumes are equally distributed over time such that or

| (23) |

| (24) |

The term minimum impact might be correct at first sight since we slice the volume into as many small pieces as possible (depending on the number of trading buckets) and try to tackle the factor market influence with position size. However, the strategy does not need to be the one with the smallest market impact, as this disregards the distribution of the trading volume or lead time. If one trades equal amounts and the trading volume is distributed very unequally over time, an order can cause a larger market impact in a low-liquidity time frame, leading to an overall larger impact than desired. However, Figure 5 shows that the trading volume is constant for a long time and only changes substantially in the late trading phase, which is why we think the strategy can still be a simple enhancement to IOBE.

3.2.3 Volume-Weighted Average Price Execution

The thoughts of sub-section 3.2 bring us to a closely connected strategy. While TWAP approaches do not consider deviations in trading volumes, volume-weighted average price (VWAP) algorithms explicitly do. Papers like Konishi [28] propose a VWAP algorithm that tries to minimize the difference between the actual VWAP of all trades and the trader’s own VWAP. We deliberately deviate from this as our goal is not index replication but optimal execution. For more information on index replication strategies and pricing of such contracts, the interested reader might refer to Guéant and Royer [17], Humphery-Jenner [22] and Białkowski et al. [5]. Recall that the VWAP itself is given by

| (25) |

It describes the volume-weighted average price from reception of the position update until time of delivery It is impossible to achieve VWAPs if parts of the measured time lie in the past, i.e., you cannot replicate a VWAP of three hours of trading only by being active solely in the last hour. Some VWAPs do not comprise the full trading session, which is why they are sometimes called partial VWAPs as by Narajewski and Ziel [33] and Kath [24]. In order to trade near or equal to the VWAP, we assume

| (26) |

| (27) |

where is a volume reallocation factor that should ensure a distribution based on the traded volume per minute bucket in

| (28) |

The actual traded volume is not known ex ante which is why we assume , where is defined as an estimation for the true volume In our case, is simply the empirical volume per bucket of the year 2018. Hence, does not change per trading hour or day and is static throughout the entire out-of-sample test. Also, recall that index changes with the arrival time of each position to be traded. Thus, the allocation factor requires a new computation if the arrival time changes. The algorithm should ideally start to trade immediately, which is why it can be very useful to compute a set of factors for different choices of in advance. It also follows that

| (29) |

such that sufficient volume is traded. Since the strategy allocates higher volumes to trading phases with large traded volumes, it could be a profitable way to execute positions.

4 Intraday Market Execution Simulation

4.1 Resulting Trading Trajectories

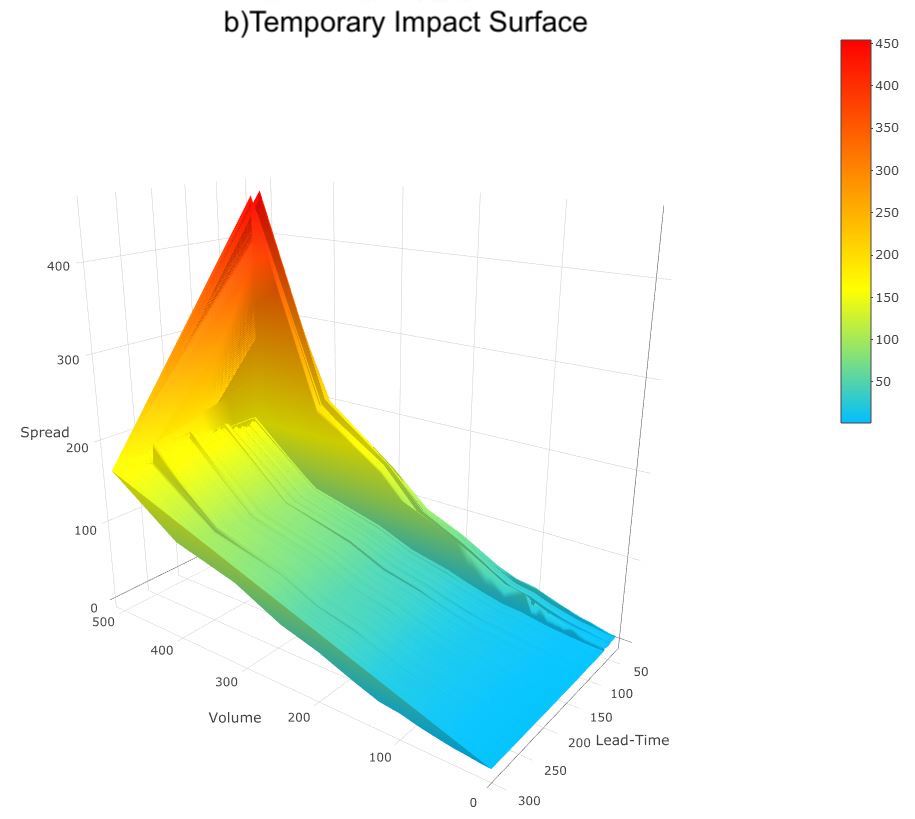

Different algorithms result in different trading trajectories. Section

3 focused on a mathematical formulation. In addition, we want to discuss

trading behavior to sharpen the understanding of the numerical results.

The easiest way to understand volume allocation behavior is by inspecting

a trade path plot. Figure 8 shows the trading trajectories of all

algorithms. It assumes a volume of 270 MW to be executed in 270 minute-buckets444We stop trading 30 minutes before delivery as there is only intra-grid

area trading allowed from this point onwards. However, this means

that a lead time (i.e., the nominal time to delivery) of 300 minutes

results in 270 minutes of trading.. The two optimization algorithms Optiς

and OptiC yield different paths per total position

to be executed. However, the differences are marginal, and only very

large positions lead to a slightly smoother curve. Therefore, we have

decided to plot 270 MWh as a compromise. Positions around 200—300

MWh apply to many market participants and depict an industry-wide

optimal execution problem.

Here, IOBE executes the entire volume in the first

minute bucket. This is arguably the simplest form of execution and

leads to one big trade. In contrast to that, the TWAP approach equally

splits the volume in equidistant steps, which yields a straight and

linear execution reflected by a black dashed line. It serves as a

good reference path to compare all other algorithms against. The TWAPs

try to minimize the impact by means of the smallest equidistant steps

possible. This sounds rather naive but could prove profitable if we

recap the sharp exponential growth of BAS with the higher volumes

depicted in Figure 5. Hence, it is interesting to see how other approaches

deviate from this. The VWAP algorithm allocates based on historic

volume distributions over time. This leads to an interesting pattern.

The trading volume increases with time to delivery, as shown in Figure

4. The VWAP algorithm shifts a bit of volume into later trading phases.

In the middle of the selected trading window, its inventory position

is around 10 MWh higher compared to the TWAP allocations. However,

the overall change is small and does not lead to a drastic change.

Another interesting pattern evolves with OptiC.

Recall that this algorithm purely optimizes costs based on a GAM trained

on 2018 data. The algorithm starts with slower trading rates than

all other approaches and leaves a higher position open in the early

and mid-trading phases. A striking behavior happens shortly before

the switch from pan-European XBID trading to local German trading.

Starting at around positions are closed more aggressively

compared to TWAP and all other models, which results in a smaller

open position when local trading starts. Taking a look at Figure 5,

this makes perfect sense as this decision avoids the high BAS levels

in local trading. Figure 8 makes it almost impossible to see, but

both optimization approaches avoid the very expensive cutover phase

entirely.

Optiς is closely connected

to the pure cost optimization but considers risk aversion in the form

of the volatility of prices and bid-ask spreads. If one recalls, that

this approach balances between expected trading costs (which means

equally sized small volumes per bucket) and the variance of expected

costs, it becomes evident that the algorithm tries to avoid additional

variance at the cost of slightly higher market impact. This leads

to an almost TWAP-like trading path. One could ask why there is no

remarkable change in the trajectories as shown by Almgren and Chriss [2],

wherein mean-variance approaches resulted in very different trade

trajectories. The answer is given by the market impact functions.

The mentioned paper assumed a linear impact. Thus, risk aversion does

not cause the trader to pay a large premium in the form of bid-ask

spreads for the sake of less variance in costs and execution prices.

An optimization algorithm could easily shift trading volumes into

early trading phases without causing an exponential cost increase.

This is different from intraday trading and our market impact models.

Every time trading is shifted away from a late trading point to an

early one, this causes an exponential growth in costs while reducing

volatility in an exponential way as well. Our parameter choice for

seems to be very conservative. Thus, Optiς

carefully balances between expected costs and volatility. However,

we found that even more aggressive choices for do not create

substantially different trading trajectories. This is interesting

as intraday markets feature price spikes and a generally high level

of volatility, as mentioned by Wolff and Feuerriegel [44]. Although there

is a high level of volatility, a mathematically optimized execution

seems to deviate only partially from the benchmark path of TWAP allocation.

![[Uncaptioned image]](/html/2009.07892/assets/x9.png)

Despite the fact that we have a diverse set of algorithmic trading models that differ in trading, computational complexity, and consideration of market impact, the trading trajectories are less heterogeneous than expected. In fact, this leads to the first interesting conclusion. In trading areas with sparse order books and exponential growth in the temporary and permanent market impact, the predominant strategy aspect is to trade as little as possible per aggregation step to reduce the impact and only partially deviate from that rule of thumb for the sake of risk aversion or additional knowledge about market regimes or volumes.

4.2 Realized Execution Costs and Variance

![[Uncaptioned image]](/html/2009.07892/assets/x10.png)

Section 4.1 demonstrated how considering different aspects such as

market coupling leads to different execution paths. It is important

to note that all models were solely trained on 2018 data. Thus, all

assumptions and optimizations might turn out to be incorrect for the

year 2019. Following the aggregation logic of section 2.2, we compare

how each algorithm trades volumes and benchmark the trades against

the aggregated BAS and prices of each individual minute bucket of

2019. The aggregation averages out all spikes and outliers while still

being very granular so that we have detailed results. Apart from that,

we analyze different trading volumes (100, 300, 1,000) and different

times to contract expiry, i.e., to reflect the behavior

under changing conditions. To our knowledge, this paper is the first

one that reports out-of-sample results for the German intraday market.

We want to first focus on realized execution costs

in the form of BAS, more formally defined as

| (30) |

Hence, the BAS is aggregated per delivery date , minute bucket

and accumulated volume . Using it as a benchmark also covers

the most important trade execution aspects mentioned by Perold [36].

Table 2 grants a first overview of our empirical simulation. Since

the mean is not a robust measure in the case of outliers, we have

decided to focus on the median and only report the mean in brackets

for the sake of completeness. The first striking observation is the

high level of BAS if IOBE execution is concerned. It becomes obvious

that actively “clicking away” the entire volume at once leads

to a dramatic cost level that no company should aim for. Simple approaches

like TWAP that do not require massive computation already beat IOBE

by far. The VWAP strategy is also much better than IOBE but stays

behind TWAP in most cases. This is somehow unexpected and shows that

a huge trading volume does not necessarily go hand in hand with low

spreads.

The dedicated optimization algorithm OptiC

performs as expected when the volumes per bucket are low and beats

all other approaches. However, this is only the case if there is lots

of time to close positions, i.e., when the lead time is 300 or when

there is less volume to be traded. But why is that so? We can think

of two reasons. Taking a closer look at Figure 5, we can see that

the dashed black line is below the actual spreads in the late trading

phases before XBID. That means that the costs in local trading are

slightly overestimated. Our choice of 60 minutes to trade seems to

underline the model limitations. The optimization model exhibits weaknesses

if applied in late trading and forced to trade large volumes. The

other explanation is more pragmatic. We have used 2018 data to train

the models, but that does not necessarily mean that identical patterns

will evolve for 2019. Parts of the differences might also be due to

the random noise that is present with all empirical approaches.

Optiς expands OptiC

by a certain level of risk aversion that flattens the trading volumes.

Consequently, there is a shift in performance. In phases where OptiC

performs well, a premium in the form of slightly lower performance

is paid. In the case of OptiC suffering from limitations,

the risk-averse approach Optiς loses

less. All models struggle to keep their spread level when volumes

increase. This observation makes sense, as the resulting orders hit

deep layers in the order book and more spread is paid. There is no

difference between the TWAP results in the cases of 100- and 300-MW

volume for a lead time of 90 minutes. While this is contradictory

at first, a deeper look gains more insight. We have aggregated into

time and volume buckets, and 300 MW/100 MW allocated into 60 time

buckets means trades of 5 MW and 1.1 MW each. It is important to note

that our second volume bucket spans from 1 to 5 MW, meaning that both

orders result in the same out-of-sample spread simply due to our aggregation

logic being too gross in that specific scenario. That is the reason

why some algorithms’ results equal each other.

We can see that the optimization approach makes sense

in many scenarios. However, does that postulation hold true under

a stricter statistical analysis? A one-sided t-test that checks for

the significance of OptiC BAS levels being lower

than the TWAP and VWAP brings more clarity (see results in Table 3).

All scenarios with 300-MW positions are clearly significant. The results

for 100 MW and 90 minutes of lead time are a bit better but do not

persist under our stricter framework. The differences could also be

random-based. Higher volumes and 90 minutes of lead time are clearly

not significant, which further underlines the inherent OptiC

model’s limitations. But what does that mean in terms of monetary

effects? Our optimization model outperforms all other models by around

15 ct/MWh if we stick to the more robust median BAS as our measure

of choice. Say a trader usually trades 100 MW per day and hour. As

an approximation for the premium on either a buy or sell trade, we

assume the half-spread, i.e., . We acknowledge that

this assumption requires symmetric savings for buy and sell trades,

but for simplification matters, this should suffice. The trader will

then save 100 MW*24 hours*365 days*8 ct, the latter value being

roughly the difference between OptiC and TWAP. The

approach saves 70,080 euros per year due to an optimized execution.

Assume a volume of 300 MW 300 minutes before delivery, the alternatives

being IOBE and the optimized model. This comparison results in savings

of 2,775 euros for each individual delivery hour and underlines that

optimal execution can be an important performance driver.

Last but not least, the variance of cost requires

discussion. Equations (19) and (20) reflect how Optiς

balances between minimizing cost and variance. Inevitably, mean-variance

approaches introduce subjectivity since the risk-aversion parameter

is chosen by the user. One could argue that with just a

few hours of trading, variance does not play a major role. If equity

trading is concerned, there are usually much longer holding periods

and daily volatility reports of open position, but in intraday trading,

positions are closed within minutes or hours. However, we want to

inspect if Optiς achieves the goal of

lower variance. Our measure of choice is the weighted standard deviation

of BAS, defined as

| (31) |

where equals the length of our backtest time series and the volume allocated by each algorithm per delivery date , minute bucket and accumulated volume . It is crucial to conduct a volume-weighting as the volumes are not distributed symmetrically. For instance, IOBE trades just once but with 100% of the position. Without taking volumes into consideration, the results would be biased. Table 4 demonstrates a mixed performance. In some cases, the variance of Optiς is low or even the lowest across all models. However, the difference is small and comes at the price of a higher BAS. The overall trade trajectory is smoother and volumes are split more equally if we compare Optiς with OptiC. Unfortunately, both models share the same shortcomings. Optiς does not deliver less variance in problematic scenarios (low lead time and large positions). All in all, the goal of lower variance is achieved. However, the trade-off between higher spreads and lower variance does not seem to be too convincing in intraday markets.

![[Uncaptioned image]](/html/2009.07892/assets/x11.png)

4.3 Trade Price Benchmarking and Randomization of Volumes

The median BAS is a suitable measure as it allows for a compressed

overview of performance. However, it features two drawbacks. First,

the BAS is a symmetrical measure and does not contain any information

on buy- or sell-side performance. If a company is a net seller, looking

at spreads has limited value. Second, spreads are not as easily interpretable

as prices, for instance. Many other papers utilize plain prices or

averages like the ID3 or ID1 as a reference. We want to exploit these

two aspects and, additionally, benchmark our algorithms against buy

and sell prices. One might argue that the BAS is a direct result of

prices, as shown in Eq. (29). This is basically true, but for this

second benchmark, we have computed the prices from scratch following

the logic of section 2.2. The findings of the price results in section

4.3 and BAS tables of section 4.2 might slightly differ due to different

roundings, i.e., a price result will not 1:1 add up to the BAS results.

While this could be perceived as confusing, we see it as an additional

layer of verification as we apply a newly computed measure.

Table 5

![[Uncaptioned image]](/html/2009.07892/assets/x12.png)

reports all findings separated into buy and sell as well as the known

scenarios with different trading volumes and lead times. In addition,

we report two volume-weighted reference prices published by EPEX Spot

SE. For a lead time of 300 minutes, that is, the ID3, for 90 minutes

until delivery, we apply the ID1. These indices do not comprise the

relevant time frames 1:1 but serve as an appropriate and reproducible

benchmark. Note that we only report the indices as a reference point

but not as a measure per se. For readers interested in index-tracking

or VWAP pricing, we refer to Frei and Westray [10] and Cartea and Jaimungal [6].

Unsurprisingly, Table 5 confirms the overall impression of our spread

analysis. OptiC yields convincing results with longer

lead times, or—if forced to liquidate positions with shorter

lead times—only in the case of small values. Moreover,

TWAP also shows favorable prices.

Taking a deeper look at buying and selling separately,

some interesting patterns emerge. In low-volume scenarios, the benefits

of our optimization approach are stronger when buying volumes. This

effect cancels out with higher volumes. In the case of medium volumes,

one can observe slightly better sell than buy prices (e.g., considering

the difference between OptiC and TWAP). However,

this effect is negligible. Overall, the LOB imbalance in terms of

prices is rather low. It does not seem to make a difference if one

is buying or selling, which delivers evidence to the fact that quoted

volumes and resulting execution prices are symmetrical. There might

be times where this conclusion does not hold anymore, such as large

plant outages or renewables forecast updates that cause the entire

market to sell generated power. However, these go beyond our considerations

and obviously seem to cancel out with a sample size of almost one

year of out-of-sample data.

Another interesting insight is connected to reference

prices. Many intraday papers like Kath and Ziel [25] just apply

index prices published by EPEX Spot. However, if we compare the realized

price levels to the reference price, the difference is striking. No

algorithm can trade at the reference price. Instead, an additional

mark-up (selling at lower prices or buying at higher ones) of around

0.70—1.20 €/MWh is required. But why is that so? We must

keep in mind that the reference price is a mid-price between buys

and sells. So, in order to trade at or near an ID3, a trader has to—at

least partially—earn the BAS. This contradicts one of our

core assumptions, namely the active trading of positions meaning accepting

orders directly in LOBs. Our algorithms explicitly pay the BAS as

they do not want to wait for execution and face the risk of non-trading

over a longer period of time. Additionally, earning the BAS, i.e.,

waiting for others to accept their own orders, requires one to be

always on top of the order book. This aspect is a trading strategy

on its own, as one needs to define price aggression, position sizes,

and inventory risks in a different way than is done in this paper.

However, the simple comparison with reference prices reveals a major

finding with large academic impact. Even complex execution algorithms

trade far from ID1 and ID3. Thus, the assumption of trading at index

prices is an unrealistic one or needs at least a proper discussion

of index replications algorithms and optimal execution. The topic

itself is beyond the scope of this paper, but the naive comparison

of our results and the reference prices emphasizes a core limitation

of the majority of papers on intraday trading.

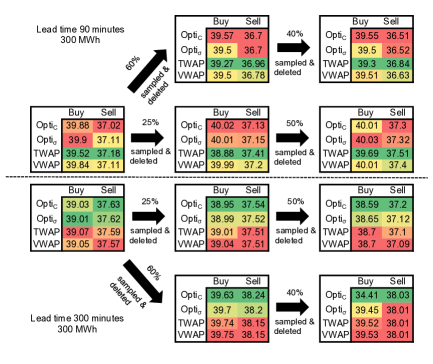

Last but not least, we want to examine if the results

persist under changing conditions. Assuming fixed positions amid all

days and hours of the year is a strong assumption that will only account

for a number of very large market players. However, what if smaller

traders utilize the execution algorithms only occasionally? In addition

to gaining more realistic results, we introduce an additional robustness

check by manipulating the sample. Do the algorithms deliver a constant

performance, or are the results of Table 5 only due to some very specific

events? Based on the described out-of-sample tests, we can erratically

remove days from the sample to find answers to these questions. Figure

9 plots the modus operandi. Based on 100% of the out-of-sample data,

we randomly delete 60% and then another 40% or, first, 25% followed

by 50%, which results in four different randomization paths for two

different lead-time and volume scenarios. Inspecting the results,

we find that the robustness check by sampling confirms the previous

results: TWAP and VWAP are generally more profitable in high-volume,

low-lead-time scenarios, while the optimization approaches show superior

performance if given more time to trade. Thus, we have delivered evidence

of the fact that the results of Tables 2 and 5 hold true under more

general conditions. They are valid for the entire data set as well

as randomly sampled parts of it, which renders them as a good line

of orientation for market players.

5 Contributions and Outlook

5.1 Conclusion

Optimal execution of positions in intraday markets, despite its importance

with regard to a trader’s performance, has only come to academic attention

recently. Recent papers like Glas et al. [15] use LOB data,

aggregate information into discrete time steps, and solve numerical

optimization problems, aiming for an appropriate trade trajectory

that minimizes bid-ask spreads. Equity markets supply a rich body

of literature but lack certain characteristics like different trading

regimes, short lead-times, and exponential growth of costs due to

liquidity restrictions. We provide a more refined optimization approach.

Our model minimizes expected costs as well as—if desired—expected

variance and outputs an optimal trading path per minute.

Based on aggregated minute buckets, we have fitted

two GAM models to consider permanent and temporary market impact.

Our calculations have shown that penalized splines work well for modeling

the relationship between spreads and lead time, trading volumes, and

times of trading in German continuous intraday markets. Thus, the

GAMs comprise multiple p-splines and model the exponential growth

of median bid-ask spreads depending on the aforementioned variables.

Another important thing unprecedentedly considered by our approach

is European market coupling. A simple lead time analysis showed that

BAS levels dramatically increase when the European coupling of intraday

orders under XBID stops one hour before delivery. Although trading

costs normalize shortly after this cut-over phase, their overall level

tends to be higher without coupling. Our approach takes this chronological

characteristic into account and models XBID trading, local German

trading, and the cut-over phase separately. To our knowledge, it is

the first optimization method to incorporate so many market-specific

determinants based on 60-second data.

But is it worth the effort? We compared the model

performance in an out-of-sample study based on the year 2019 data

against other simple benchmarks like immediate order-book execution

or time- and volume-weighted average approaches. Both measures of

choice, bid-ask spreads and plain buy and sell prices, suggest that

a more complex computation yields better execution performance in

the form of lower spreads and more favorable prices. Only in late

trading phases around 90 minutes before delivery and in the case of

large volumes to be traded in that phase does a limitation of the

GAM calculation become obvious. Costs are partially underestimated,

which causes the algorithm to trade more than is optimal in specific

time buckets. However, this only occurs when being forced to liquidate

large positions. In most scenarios, an additional saving of 10—15

cents median BAS and 15—20 cents/MWh in the form of favorable

prices can be realized. Apart from that, the study revealed how problematic

simple clicks in the order book can be. If volumes increase, this

form of execution can cause additional costs of over 100 euros/MWh

and should be avoided. That being said, even simple algorithms like

an equally sized split of volumes on all available time buckets performs

surprisingly well and highlight the importance of discussing the optimal

execution of trades.

Another crucial insight is connected to optimal execution

and average prices. The majority of current intraday trading papers

(e.g., Janke and Steinke [23] and Uniejewski et al. [41]

to name a few) utilize volume-weighted price averages as their measure

of choice. Our results suggest that this is problematic. All algorithms

trade around 1 euro/MWh away from those prices. Using them without

discussing the costs of trading in the form of market impact and paid

bid-ask spreads makes results appear less appealing. Additionally,

we believe that the discussion of optimal execution will play an important

role in the future of electricity intraday trading as markets mature

and margins shrink. It has a direct impact on each trader’s performance

and is applicable in almost every situation, whether it be a plant

outage, a large position update from customer load, or a proprietary

view on the market.

5.2 Outlook

The previous analysis has shown that optimal execution, whilst not

being extensively discussed in the literature yet, can be an interesting

value driver. However, what role will optimal execution play in the

future, and how could further research promote its importance? We

encourage trading-oriented forecasting approaches like that of Maciejowska et al. [30]

or Maciejowska et al. [29] to discuss execution as well. Benchmarks

like ID3 are a suitable first approximation but neglect the trading

character and the fact that a trader often has to pay bid-ask spreads.

Future research should steer backtests in that direction and use order

book data whenever possible instead of trades to have more realistic

results.

Concerning the methodology of this paper, there are

several extensions possible. We limited our model mostly to a fixed

volume that does not change over time. While this is convenient for

many cases, typical RES generation implies erratic position changes.

Thus, the algorithm and its underlying optimization problem might

be extended to consider the random character of volumes. Another interesting

direction for further research is given by the market impact functions.

They are crucial for volume allocation and determine trading behavior

to a great extent. We have derived a suitable implementation based

on data, but other approaches could prove to be even better. The empirical

study of Section 4 revealed model limitations with larger volumes

and less time to trade. The authors assumed that the market impact

functions generally work better with low volumes. The model underestimates

the exponential effects of high trading amounts per volume bucket

in late coupled trading. Therefore, it could turn out to be beneficial

to benchmark other impact models such as the transient one of Gatheral et al. [13]

or the well-known and often utilized square-root model (see Tóth et al. [40]).

A general comparison of different approaches would sharpen the understanding

of intraday market microstructure. Last but not least, the present

paper limited its focus to hourly trading. Quarter-hourly continuous

trading works similarly but is—due to missing European

sister markets—not as widely coupled as its hourly opponent.

An analysis and modeling of quarter hours would be novel and could

add further insight into how intraday markets work.

References

- Aïd et al. [2016] René Aïd, Pierre Gruet, and Huyên Pham. An optimal trading problem in intraday electricity markets. Mathematics and Financial Economics, 10(1):49–85, 2016.

- Almgren and Chriss [2001] Robert Almgren and Neil Chriss. Optimal execution of portfolio transactions. Journal of Risk, 3:5–40, 2001.

- Almgren [2003] Robert F Almgren. Optimal execution with nonlinear impact functions and trading-enhanced risk. Applied mathematical finance, 10(1):1–18, 2003.

- Bertsimas and Lo [1998] Dimitris Bertsimas and Andrew W Lo. Optimal control of execution costs. Journal of Financial Markets, 1(1):1–50, 1998.

- Białkowski et al. [2008] Jędrzej Białkowski, Serge Darolles, and Gaëlle Le Fol. Improving vwap strategies: A dynamic volume approach. Journal of Banking & Finance, 32(9):1709–1722, 2008.

- Cartea and Jaimungal [2016] Álvaro Cartea and Sebastian Jaimungal. A closed-form execution strategy to target volume weighted average price. SIAM Journal on Financial Mathematics, 7(1):760–785, 2016.

- Coulon and Ströjby [2020] M. Coulon and Jonas Ströjby. Wind park valuation and risk management in the german intraday power markets, January 2020. URL https://www.fime-lab.org/wp-content/uploads/2020/01/EDFParisCoulon.pdf. accessed on 23.08.2020.

- Eilers and Marx [1996] Paul HC Eilers and Brian D Marx. Flexible smoothing with b-splines and penalties. Statistical science, pages 89–102, 1996.

- EPEX Spot SE [2020] EPEX Spot SE. New trading record on epex spot in 2019, 2020. URL https://www.epexspot.com/en/news/new-trading-record-epex-spot-201926A. accessed on 26th January 2020.

- Frei and Westray [2015] Christoph Frei and Nicholas Westray. Optimal execution of a vwap order: a stochastic control approach. Mathematical Finance, 25(3):612–639, 2015.

- Gaillard et al. [2016] Pierre Gaillard, Yannig Goude, and Raphaël Nedellec. Additive models and robust aggregation for gefcom2014 probabilistic electric load and electricity price forecasting. International Journal of forecasting, 32(3):1038–1050, 2016.

- Garnier and Madlener [2015] Ernesto Garnier and Reinhard Madlener. Balancing forecast errors in continuous-trade intraday markets. Energy Systems, 6(3):361–388, 2015.

- Gatheral et al. [2012] Jim Gatheral, Alexander Schied, and Alla Slynko. Transient linear price impact and fredholm integral equations. Mathematical Finance: An International Journal of Mathematics, Statistics and Financial Economics, 22(3):445–474, 2012.

- Glas et al. [2019] Silke Glas, Rüdiger Kiesel, Sven Kolkmann, Marcel Kremer, Nikolaus Graf von Luckner, Lars Ostmeier, Karsten Urban, and Christoph Weber. Intraday renewable electricity trading: advanced modeling and optimal control. In Progress in industrial mathematics at ECMI 2018, pages 469–475. Springer, 2019.

- Glas et al. [2020] Silke Glas, Rüdiger Kiesel, Sven Kolkmann, Marcel Kremer, Nikolaus Graf von Luckner, Lars Ostmeier, Karsten Urban, and Christoph Weber. Intraday renewable electricity trading: advanced modeling and numerical optimal control. Journal of Mathematics in Industry, 10(1):3, 2020.

- Goldberg and Holland [1988] David E Goldberg and John Henry Holland. Genetic algorithms and machine learning. 1988.

- Guéant and Royer [2014] Olivier Guéant and Guillaume Royer. Vwap execution and guaranteed vwap. SIAM Journal on Financial Mathematics, 5(1):445–471, 2014.

- Hagemann [2015] Simon Hagemann. Price determinants in the german intraday market for electricity: an empirical analysis. Journal of Energy Markets, 8(2):21–45, 2015.

- Hastie and Tibshirani [1990] Trevor J Hastie and Robert J Tibshirani. Generalized additive models, volume 43. CRC press, 1990.

- Hendershott and Riordan [2013] Terrence Hendershott and Ryan Riordan. Algorithmic trading and the market for liquidity. Journal of Financial and Quantitative Analysis, 48(4):1001–1024, 2013.

- Holland [1992] John H Holland. Genetic algorithms. Scientific american, 267(1):66–73, 1992.

- Humphery-Jenner [2011] Mark L Humphery-Jenner. Optimal vwap trading under noisy conditions. Journal of Banking & Finance, 35(9):2319–2329, 2011.

- Janke and Steinke [2019] Tim Janke and Florian Steinke. Forecasting the price distribution of continuous intraday electricity trading. Energies, 12(22):4262, 2019.

- Kath [2019] Christopher Kath. Modeling intraday markets under the new advances of the cross-border intraday project (xbid): Evidence from the german intraday market. Energies, 12(22):4339, 2019.

- Kath and Ziel [2018] Christopher Kath and Florian Ziel. The value of forecasts: Quantifying the economic gains of accurate quarter-hourly electricity price forecasts. Energy Economics, 76:411–423, 2018.

- Kiesel and Paraschiv [2017] Rüdiger Kiesel and Florentina Paraschiv. Econometric analysis of 15-minute intraday electricity prices. Energy Economics, 64:77–90, 2017.

- Koch and Hirth [2019] Christopher Koch and Lion Hirth. Short-term electricity trading for system balancing: An empirical analysis of the role of intraday trading in balancing germany’s electricity system. Renewable and Sustainable Energy Reviews, 113:109275, 2019.

- Konishi [2002] Hizuru Konishi. Optimal slice of a vwap trade. Journal of Financial Markets, 5(2):197–221, 2002.

- Maciejowska et al. [2019] Katarzyna Maciejowska, Weronika Nitka, and Tomasz Weron. Day-ahead vs. intraday-forecasting the price spread to maximize economic benefits. Energies, 12(4):631, 2019.

- Maciejowska et al. [2020] Katarzyna Maciejowska, Bartosz Uniejewski, and Tomasz Serafin. Pca forecast averaging-predicting day-ahead and intraday electricity prices. Energies, 13(14):3530, 2020.

- Markowitz [1952] Harry Markowitz. Portfolio selection. The Journal of Finance, 7(1):77–91, March 1952.

- Martin and Otterson [2018] Henry Martin and Scott Otterson. German intraday electricity market analysis and modeling based on the limit order book. In 2018 15th International Conference on the European Energy Market (EEM), pages 1–6. IEEE, 2018.

- Narajewski and Ziel [2020a] Michał Narajewski and Florian Ziel. Econometric modelling and forecasting of intraday electricity prices. Journal of Commodity Markets, 19:100107, 2020a.

- Narajewski and Ziel [2020b] Michał Narajewski and Florian Ziel. Ensemble forecasting for intraday electricity prices: Simulating trajectories. Applied Energy, 279, December 2020b.

- Pape et al. [2016] Christian Pape, Simon Hagemann, and Christoph Weber. Are fundamentals enough? explaining price variations in the german day-ahead and intraday power market. Energy Economics, 54:376–387, 2016.

- Perold [1988] Andre F Perold. The implementation shortfall: Paper versus reality. Journal of Portfolio Management, 14(3):4, 1988.

- Rigby and Stasinopoulos [2005] R. A. Rigby and D. M. Stasinopoulos. Generalized additive models for location, scale and shape,(with discussion). Applied Statistics, 54:507–554, 2005.

- Scrucca [2013] L Scrucca. Ga: A package for genetic algorithms in r. journal of statistical software. Foundation for Open Access Statistics, 53(4), 2013.

- Stasinopoulos et al. [2017] Mikis D Stasinopoulos, Robert A Rigby, Gillian Z Heller, Vlasios Voudouris, and Fernanda De Bastiani. Flexible regression and smoothing: using GAMLSS in R. CRC Press, 2017.

- Tóth et al. [2016] Bence Tóth, Zoltán Eisler, and J-P Bouchaud. The square-root impace law also holds for option markets. Wilmott, 2016(85):70–73, 2016.

- Uniejewski et al. [2019] Bartosz Uniejewski, Grzegorz Marcjasz, and Rafał Weron. Understanding intraday electricity markets: Variable selection and very short-term price forecasting using lasso. International Journal of Forecasting, 35(4):1533 – 1547, 2019.

- Viehmann [2017] Johannes Viehmann. State of the german short-term power market. Zeitschrift für Energiewirtschaft, 41(2):87–103, 2017.

- von Luckner et al. [2017] Nikolaus Graf von Luckner, Álvaro Cartea, Sebastian Jaimungal, and Rüdiger Kiesel. Optimal market maker pricing in the german intraday power market. House of Energy Markets and Finance, Essen, Germany, 2017.

- Wolff and Feuerriegel [2017] Georg Wolff and Stefan Feuerriegel. Short-term dynamics of day-ahead and intraday electricity prices. International Journal of Energy Sector Management, 4(4):557–573, 2017.

- Wood [2017] Simon N Wood. Generalized additive models: an introduction with R. CRC press, 2017.