Efficiency of equilibria in games with random payoffs

Abstract.

We consider normal-form games with players and two strategies for each player, where the payoffs are i.i.d. random variables with some distribution and we consider issues related to the pure equilibria in the game as the number of players diverges. It is well-known that, if the distribution has no atoms, the random number of pure equilibria is asymptotically . In the presence of atoms, it diverges. For each strategy profile, we consider the (random) average payoff of the players, called average social utility. In particular, we examine the asymptotic behavior of the optimum average social utility and the one associated to the best and worst pure Nash equilibrium and we show that, although these quantities are random, they converge, as to some deterministic quantities.

1. Introduction

The concept of Nash equilibrium (NE) is central in game theory. Nash, (1950, 1951) proved that every finite game admits mixed Nash equilibria, but, in general, pure Nash equilibria may fail to exist. The concept of pure Nash equilibrium is epistemically better understood than the one of MNE, so it is important to understand how rare are games without PNE. One way to address the problem is to consider games with random payoffs. In a random game the number of PNE is also a random variable, whose distribution depends on the assumptions about the distribution of the random payoffs. The simplest case that has been considered in the literature deals with i.i.d. payoffs having a continuous distribution function. This implies that ties among payoffs have zero probability. Even in this simple case, although it is easy to compute the expected number of PNE, the characterization of their exact distribution is non-trivial. Asymptotic results exist as either the number of players or the number of strategies for each player diverges. In both cases the number of PNE converges to a Poisson distribution with parameter . Generalizations of the simple case have been considered, for instance either by removing the assumptions that all payoffs are independent or by allowing for discontinuities in their distribution functions. In both cases the number of PNE diverges and some central limit theorem (CLT) holds.

The literature on games with random payoffs has focused on the distribution of the number of PNE. To the best of our knowledge, the distribution of their average social utility (ASU), i.e., the average payoff of each player has never been studied.

The (in)efficiency of equilibria is a central topic in algorithmic game theory. In the case of positive payoffs, one way to measure this inefficiency is through the price of anarchy (PoA), i.e., the ratio of the optimal ASU over the ASU of the worst NE, or through the price of stability (PoS), i.e., the ratio of the optimal ASU over the ASU of the best NE. To analyze the efficiency of equilibria in games with random payoffs, it is then important to study the behavior of the random optimal ASU and the ASU of the best and worst PNE.

1.1. Our contribution

The goal of this paper is to study the asymptotic behavior of the ASU of the optimum and of the PNE of games with random payoffs when the number of players increases. We consider normal-form games with players and two strategies for each player, where payoffs are assumed to be i.i.d. random variables having common distribution . We first show that the optimal ASU converges in probability to a deterministic value that can be characterized in terms of the large deviation rate of .

Then we move to examine the asymptotic ASU of the PNE. We start by considering the case in which has no atoms. In this case, as shown in Rinott and Scarsini, (2000), asymptotically the number of PNE has a Poisson distribution with mean . This implies that we typically do not have many equilibria. We will show that, when equilibria exist, in the limit they all have the same ASU.

We then consider the case in which has some atoms, so that the number of equilibria grows exponentially in probability, as show in Amiet et al., 2021b . We will show that asymptotically all but a vanishingly small fraction of equilibria share the same ASU. On the other hand we show that the ASU of the best and the worst equilibrium, converge in probability to two values that depend on . These values can be characterized by means of a large deviation estimate of a modified distribution that depends on in an explicit way. In particular, given a random variable with distribution , is the distribution function of conditionally on being larger or equal than an independent copy . So, even if most PNE have the same asymptotic ASU, the ASU of the worst and best PNE can be quite different.

Finally, we consider the special case where is a Bernoulli distribution with parameter . We analyze the limit behavior of the ASU of the optimum, the best, and worst PNE, as a function of and study these functions.

1.2. Related literature

The distribution of the number of PNE in games with random payoffs has been studied for a number of years. Many papers assume the random payoffs to be i.i.d. from a continuous distribution and study the asymptotic behavior of random games, as the number of strategies grows. For instance, Goldman, (1957) showed that in zero-sum two-person games the probability of having a PNE goes to zero. He also briefly dealt with the case of payoffs having a Bernoulli distribution. Goldberg et al., (1968) studied general two-person games and showed that the probability of having at least one PNE converges to . Dresher, (1970) generalized this result to the case of an arbitrary finite number of players. Other papers have looked at the asymptotic distribution of the number of PNE, again when the number of strategies diverges. Powers, (1990) showed that, when the number of strategies of at least two players goes to infinity, the distribution of the number of PNE converges to a . She then compared the case of continuous and discontinuous distributions. Stanford, (1995) derived an exact formula for the distribution of PNE in random games and obtained the result in Powers, (1990) as a corollary. Stanford, (1996) dealt with the case of two-person symmetric games and obtained Poisson convergence for the number of both symmetric and asymmetric PNE.

In all the games with a continuous distribution of payoffs, the expected number of PNE is in fact for any fixed . Under different hypotheses, this expected number diverges. For instance, Stanford, (1997, 1999) showed that this is the case for games with vector payoffs and for games of common interest, respectively. Rinott and Scarsini, (2000) weakened the hypothesis of i.i.d. payoffs; that is, they assumed that payoff vectors corresponding to different strategy profiles are i.i.d., but they allowed some dependence within the same payoff vector. In this setting, they proved asymptotic results when either the number of players or the number of strategies diverges. More precisely, if each payoff vector has a multinormal exchangeable distribution with correlation coefficient , then, if is positive, the number of PNE diverges and a central limit theorem holds. Raič, (2003) used Chen-Stein method to bound the distance between the distribution of the normalized number of PNE and a normal distribution. His result is very general, since it does not assume continuity of the payoff distributions. Takahashi, (2008) considered the distribution of the number of PNE in a random game with two players, conditionally on the game having nondecreasing best-response functions. This assumption greatly increases the expected number of PNE. Daskalakis et al., (2011) extended the framework of games with random payoffs to graphical games. Players are vertices of a graph and their strategies are binary, like in our model. Moreover, their payoff depends only on their strategy and the strategies of their neighbors. The authors studied how the structure of the graph affects existence of PNE and they examined both deterministic and random graphs. Amiet et al., 2021b showed that in games with players and two actions for each player, the key quantity that determines the behavior of the number of PNE is the probability that two different payoffs assume the same value. They then studied the behavior of best-response dynamics in random games. Amiet et al., 2021a compared the asymptotic behavior of best-response and better-response dynamics in two-person games with random payoffs with a continuous distribution, as the number of strategies diverges. Properties of learning procedures in games with random payoffs have been studied by Durand and Gaujal, (2016), Galla and Farmer, (2013), Pangallo et al., (2019), Heinrich et al., (2021).

The issue of solution concepts in games with random payoffs has been explored by various authors in different directions. For instance, Cohen, (1998) studied the probability that Nash equilibria (both pure and mixed) in a finite random game maximize the sum of the players’ payoffs. This bears some relation with what we do in this paper.

The fact that selfish behavior of agents produces inefficiencies goes back at least to Pigou, (1920) and has been studied in various fashions in the economic literature. Measuring inefficiency of equilibria in games has attracted the interest of the algorithmic-game-theory community around the change of the millennium. Efficiency of equilibria is typically measured using either the PoA or the PoS. The PoA, i.e., the ratio of the optimum social utility (SU) over the SU of the worst equilibrium, was introduced by Koutsoupias and Papadimitriou, (1999) and given this name by Papadimitriou, (2001). The PoS, i.e., the ratio of the optimum SU over the SU of the best equilibrium, was introduced by Schulz and Stier Moses, (2003) and given this name by Anshelevich et al., (2008). The reader is referred for instance to Roughgarden and Tardos, (2007) for the basic concepts related to inefficiency of equilibria.

1.3. Organization of the paper

Section 2 introduces the model and the main results. Section 3 shows the convergence in probability of the socially optimum (SO), regardless the existence of atoms in the distribution of the payoffs. In Section 4 we provide an operative expression for the expected number of equilibria having ASU exceeding a given threshold. Sections 5 and 6 are devoted to the proof of the main results for the model with no ties and with ties, respectively. Finally, in Section 7, we study a specific instance of the model, in which the distribution is Bernoulli, providing more explicit results.

2. Model and main results

Throughout the paper we adopt the usual asymptotic notation. More precisely, for any two real sequences and

For a set , the symbol will denote its cardinality. In the background we will always have a probability space on which all the random quantities are defined. In particular, we will consider a sequence of normal form games where has players. The set of players of game is denoted by . Each player can choose one strategy in ; then, the set of strategy profiles is the Cartesian product . As in Daskalakis et al., (2011), the symbol will denote the binary XOR operator, defined as

| (2.1) |

Therefore, -adding changes one strategy into the other.

For , denotes player ’s payoff function. We further assume that all payoffs of all games are i.i.d. random variables with the same marginal distribution , i.e.,

| (2.2) |

A strategy profile is a pure Nash equilibrium if

where is the subprofiles of the strategies of all players except . Let denote the set of pure Nash equilibria. We will be interested in the asymptotic behavior, as , of the following quantities:

| (2.3) | average social utility (ASU) | ||||

| (2.4) | socially optimum (SO) | ||||

| (2.5) | best equilibrium (BEq) | ||||

| (2.6) | worst equilibrium (WEq) |

We say that a sequence of real random variables converges in probability to (denoted by ), if

| (2.7) |

Given the payoff distribution , and two independent random variables , let

Notice that if is continuous then and . In general, can be decomposed into a continuous and an atomic part. Call the set of atoms of . Then

| (2.8) |

For the sake of simplicity, we assume the existence of a density function such that

We will further assume that the distribution has exponential moments of all order, i.e., if ,

| (2.9) |

In other words, the moment generating function of is everywhere finite. Notice that, for fixed , the collection of random variables is i.i.d. and the random variable is the maximum of independent random variables with common distribution. Therefore, its behavior can be analyzed using classical tools in extreme value theory. In fact, for all possible , our analysis of relies on the study of the large deviations of the random variable

If we define the large deviation rate

| (2.10) |

then, under the assumption in Eq. 2.9, from Cramer’s large deviation theorem (see, e.g., den Hollander, (2000, Theorem 1.4)), it follows that,

Moreover, the function is lower semi-continuous and convex on , and

(see den Hollander,, 2000, Lemma 1.14).

The following proposition describes the asymptotic behavior of the SO. Notice that Proposition 1 does not require any assumption about , i.e., the asymptotic behavior of the SO does not depend on the presence of atoms in .

Proposition 1.

The intuition underlying Proposition 1 is that a deviation from the typical ASU, i.e., , is exponentially rare. In particular, given , the probability to have an ASU larger or equal than is roughly . Since the number of strategy profiles is as soon as the expected number of strategy profiles with ASU larger than tends to zero.

We now consider the asymptotic behavior of the best and worst PNE. This analysis is more complicated than what we had for the SO. In fact, the procedure requires an optimization of the random set of pure Nash equilibria. We will distinguish between the case where the payoffs have no ties () and when they can have ties (). Rinott and Scarsini, (2000) showed that, when ,

| (2.13) |

That is, if there are no ties, the number of pure equilibria converges weakly to a Poisson distribution of parameter . This implies that typically the equilibria are not numerous and, with positive probability, the set of equilibria can even be empty. In this scenario, we use a first moment argument to show that, if pure equilibria exist, then asymptotically they all share the same ASU.

The results about the asymptotic behavior of best equilibrium (BEq) and worst equilibrium (WEq) will require the following definition. For , let

| (2.14) |

Notice that, when , we have

| (2.15) |

The following theorem deals with the asymptotic behavior of the class of PNE.

Theorem 1 (Convergence (no ties)).

Let be such that and let

| (2.16) |

Then

| (2.17) |

Conversely, when , we know by Amiet et al., 2021b that the number of pure Nash equilibria is exponentially large in the number of players. In particular,

| (2.18) |

We cannot analyze the asymptotic behavior of BEq and WEq along the lines of Proposition 1 because of the stochastic dependence of the payoffs corresponding to different PNE. To be more precise, if is a PNE, and is a neighbor of , i.e., the two profiles differ only in one coordinate, say , then is not independent of . The proof of the following theorem it will be based on the fact that this dependence, although present, is weak.

Theorem 2 (Convergence (with ties)).

Let be such that . Let be defined as in Eq. 2.16 and let be the large deviation rate associated to .

-

\edefitn(i)

If

(2.19) (2.20) then

(2.21) -

\edefitn(ii)

If

(2.22) then

(2.23)

In other words, Theorem 2 states that most of the equilibria share the “typical” efficiency but, since they are exponentially many, some of them with a macroscopically larger ASU. Moreover, the efficiency of the best and worst equilibria do not fluctuate but converge to the solution of an explicit optimization problem.

Since we are interested in the asymptotic properties of a random game when , we usually neglect the dependence on (and on ) when it is clear from the context.

3. The Social Optimum

In this section we prove the convergence in probability of the SO, regardless of the value of . This result is an immediate consequence of Cramer’s large deviation theorem (see den Hollander, (2000)). Our proof will require the definition of the following sets:

| (3.1) |

In words, is the set of strategy profiles with an ASU at least and, similarly, is the set of strategy profiles with an ASU at most .

Proof of Proposition 1.

We start by noticing that the claim in Proposition 1 is equivalent to

| (3.2) | ||||

| and | ||||

| (3.3) | ||||

Recall that the ASU of any given strategy profile has law

where is a collection of i.i.d. random variables with law . Hence, by Cramer’s large deviation theorem (see den Hollander, (2000)),

| (3.4) |

Therefore, by Eq. 3.4 the expected size of is given by

| (3.5) |

It follows from the definition of in Eq. 2.12 that, for all , there exists some such that . Thus, by Eq. 3.5 and Markov’s inequality we conclude

which proves Eq. 3.2. On the other hand, since, by the definition of in Eq. 2.12, for all , we have, again by Eq. 3.5

| (3.6) |

Moreover, for every distinct , thanks to the independence of the payoffs across different profiles, we have

| (3.7) |

Therefore, for every choice of

| (3.8) | ||||

| (3.9) | ||||

| (3.10) |

Hence,

| (3.11) |

where the first inequality comes from Eq. 3.10 and the limit follows from Eq. 3.6. By the second moment method (see Alon and Spencer, (2016, Chapter 4)), Eq. 3.11 implies Eq. 3.3, since

4. First moment computation

In this section we explicitly compute the expected number of equilibria having an average social utility above/below a given threshold. As in the proof in Section 3, we define the sets

| (4.1) |

and

| (4.2) |

namely, () is the set of pure Nash equilibria with ASU at least (at most) .

Lemma 1.

Let be a family of i.i.d. random variables with law defined in Eq. 2.14. Then,

| (4.3) |

Proof.

We start by computing the probability that a given strategy profile is a PNE with ASU larger than a threshold . The computation for the case in which the ASU is smaller than is the same, since it is sufficient to switch the inequality sign when needed. Notice that, by conditioning,

| (4.4) |

Given two independent random variables with common distribution ,

| (4.5) |

Notice that

| (4.6) |

where is a collection of i.i.d. random variables with law , with

By explicit computation

Furthermore, notice that if is continuous we have

| (4.7) |

With Eq. 4.4, Eq. 4.5 and Eq. 4.6 at hand, we can easily compute the expected size of the set ,

| (4.8) |

5. The case

We now show that the first moment computation in Section 4 is enough to show the validity of Eq. 2.17.

Proof of Theorem 1.

Using the definitions in Eq. 4.1, the claim in Eq. 2.17 can be rephrased as

| (5.1) | ||||

| and | ||||

| (5.2) | ||||

In order to prove the desired result it is enough to use Lemma 1 and the law of large numbers applied to an i.i.d. sequence of random variables having law as in Eq. 2.15. Indeed,

| (5.3) |

where the inequality follows from Markov’s inequality, the last equality follows from Lemma 1 and the limit follows from the law of large numbers. Similarly,

| (5.4) |

6. The case

As in Sections 3 and 5, we start by rewriting the statement of Theorem 2i in terms of the sets in Eq. 4.1. Indeed, Eq. 2.21 is equivalent to the convergences

| (6.1) | ||||

| and | ||||

| (6.2) | ||||

We only present the proof of Eq. 6.1, since the proof of Eq. 6.2 follows the same steps. The proof is in line with the one in Section 3, and uses only the first two moments.

We start by estimating the second moment of the quantity when . Notice that the argument in Eq. 3.10 fails if the set is replaced by its subset . This is due to the fact that, in general,

| (6.3) |

Nonetheless, the next lemma shows that the analogue of Eq. 3.11 holds even in this case.

Lemma 2.

Let be such that

Then

| (6.4) |

Proof.

We claim that for every differing in at least two strategies, the events and are independent. Indeed, notice that the event is measurable with respect to the -field

| (6.5) |

We remark that if differs from in at least two strategies, then the events and are measurable with respect to independent -fields, hence they are independent. On the other hand, if differ in only one strategy, such -fields are not independent. When, for some , we will use the trivial bound

| (6.6) |

We now bound the second moment. Let denote the set of strategy profiles differing from in a single coordinate. By Eq. 6.6 we can conclude

We notice that, if the expected size of is exponentially large, then its square is asymptotically larger than , and therefore the second moment of coincides at first order with the first moment square. More precisely, if for some we have

| (6.7) |

which is the desired result. ∎

Using the results in Lemma 1 and Lemma 2 we now prove the convergence in Eq. 6.1. As in Section 3, the second case in Eq. 6.1 follows by Markov’s inequality. To show the first case in Eq. 6.1, we need to consider the large deviation rate for the distribution in Eq. 2.14, i.e.,

| (6.8) |

where . The fact that the rate in Eq. 6.8 is well defined follows from the next lemma.

Lemma 3.

Proof.

Let be two independent random variables with law . Recall that

| (6.9) |

Therefore

where in the first inequality we used the trivial bound for all , while in the last inequality we used the fact that . ∎

We are no left to show the validity of Eq. 2.23.

Proof of Theorem 2ii.

Using the notation adopted in the proofs, the convergence in Eq. 2.23 can be rephrased as

| (6.12) |

We now show that

| (6.13) |

and the result for follows from the same argument by reversing the signs.

Notice that, by Eq. 2.18,

| (6.14) |

Therefore, Eq. 6.13 is equivalent to that of the following statement

| (6.15) |

Fix some and consider the case when the expected size of is not exponentially large, i.e.,

| (6.16) |

In this case, by Markov’s inequality, for all

| (6.17) |

Consider now such that

| (6.18) |

where the first equality follows by Lemma 1 and Cramer’s large deviation theorem. Even if the expected size of is exponentially large, by Eq. 6.14 it is still smaller than the size of . Therefore, to prove that Eq. 6.15 holds it is enough to show that concentrates at first order around its expectation. By applying Chebyshev’s inequality we get that, for all ,

By Eq. 6.18 and Lemma 2 we know that

| (6.19) |

hence,

and, as a consequence,

Since, by Eq. 6.18, there exists some such that

Eq. 6.15 immediately follows. ∎

7. binary payoffs

In this section we study in detail the case in which is the distribution of a Bernoulli random variable with parameter , i.e.,

It follows that

and

so that

i.e., is the distribution of a Bernoulli random variable with parameter

| (7.1) |

For and consider the entropy function

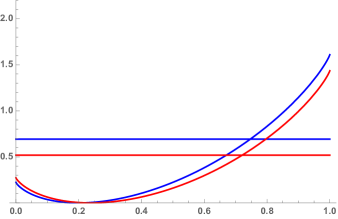

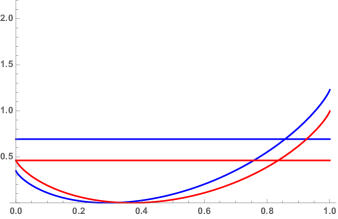

Then, the large deviation rates and in Eqs. 2.10 and 6.8 have the following form

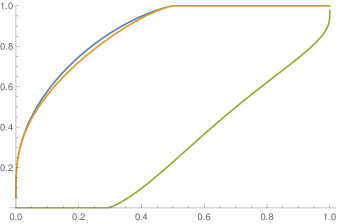

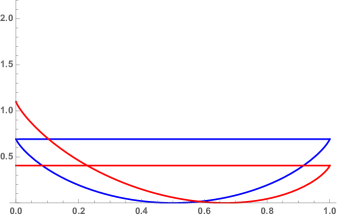

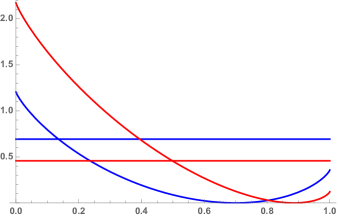

(see, e.g., Fischer,, 2013, page 3). Notice that is convex in for all , and assumes its minimum at , where .

Proposition 2.

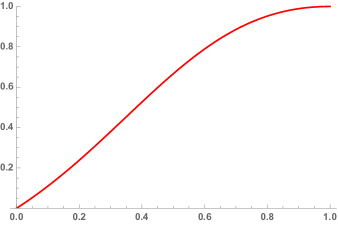

Let be the distribution of a Bernoulli random variable with parameter . Then there exists three continuous functions

| (7.2) |

such that

| (7.3) |

Moreover, the functions and are both increasing on the interval and are identically equal to on the interval . The function is identically on the interval and is increasing on the interval .

In words, the limit quantities for , and —seen as a functions of —display a peculiar behavior, namely, there exists some threshold for the value of before/after which the functions stay constant.

Proof of Proposition 2.

The convergence in Eq. 7.3 is a corollary of Proposition 1 and Theorem 2. More explicitly, the three limiting quantities can be defined as

| (7.4) | ||||

| (7.5) | ||||

| (7.6) |

where is defined as in Eq. 7.1. In order to prove the continuity and monotonicity of the functions as stated in Proposition 2 it is sufficient to recall that both and are continuous and convex in and they assume their minimum value, i.e., , only at and , respectively. See Fig. 2 for a plot of the two function for different choices of . Notice also that the function is increasing in and that, by definition of and ,

| (7.7) |

The latter implies that for all , while is strictly increasing for .

Similarly, the functions and are decreasing in and

| (7.8) |

while

| (7.9) |

In other words, for all , while they are increasing functions of in the interval . ∎

Notice that by choosing , the game is a drawn uniformly from the space of games with players and binary payoffs. In other words, claiming that some property holds with probability approaching in the model in Proposition 2 with , is equivalent to claim that the fraction of games with binary payoffs sharing that property approaches as grows to infinity. Therefore, choosing , we can rephrase Proposition 2 as a counting problem and obtain the following result.

Corollary 1.

Let be the set of all possible distinct games with players and binary payoff. For let

that is, the subset of games with , and at most far from , and . Then,

Roughly, Corollary 1 states that asymptotically almost every binary game has

| (7.10) |

where the approximation can be obtained numerically from the definition of in Eq. 7.6. In the language of PoA/PoS, the claim of Corollary 1 can be rephrased as follows: when the number of players grows to infinity for all but a vanishingly small fraction of games with binary payoffs it holds

Acknowledgments

Both authors are members of GNAMPA-INdAM and of COST Action GAMENET. This work was partially supported by the GNAMPA-INdAM Project 2020 “Random walks on random games” and PRIN 2017 project ALGADIMAR.

References

- Alon and Spencer, (2016) Alon, N. and Spencer, J. H. (2016). The Probabilistic Method. Wiley Series in Discrete Mathematics and Optimization. John Wiley & Sons, Inc., Hoboken, NJ, fourth edition.

- (2) Amiet, B., Collevecchio, A., and Hamza, K. (2021a). When “Better” is better than “Best”. Oper. Res. Lett., 49(2):260–264.

- (3) Amiet, B., Collevecchio, A., and Scarsini, M. (2021b). Pure Nash equilibria and best-response dynamics in random games. Math. Oper. Res., forthcoming.

- Anshelevich et al., (2008) Anshelevich, E., Dasgupta, A., Kleinberg, J., Tardos, E., Wexler, T., and Roughgarden, T. (2008). The price of stability for network design with fair cost allocation. SIAM J. Comput., 38(4):1602–1623.

- Cohen, (1998) Cohen, J. E. (1998). Cooperation and self-interest: Pareto-inefficiency of Nash equilibria in finite random games. Proc. Natl. Acad. Sci. USA, 95(17):9724–9731.

- Daskalakis et al., (2011) Daskalakis, C., Dimakis, A. G., and Mossel, E. (2011). Connectivity and equilibrium in random games. Ann. Appl. Probab., 21(3):987–1016.

- den Hollander, (2000) den Hollander, F. (2000). Large deviations, volume 14 of Fields Institute Monographs. American Mathematical Society, Providence, RI.

- Dresher, (1970) Dresher, M. (1970). Probability of a pure equilibrium point in -person games. J. Combinatorial Theory, 8:134–145.

- Durand and Gaujal, (2016) Durand, S. and Gaujal, B. (2016). Complexity and optimality of the best response algorithm in random potential games. In Algorithmic Game Theory, volume 9928 of Lecture Notes in Comput. Sci., pages 40–51. Springer, Berlin.

- Fischer, (2013) Fischer, M. (2013). Large deviations, weak convergence, and relative entropy. Technical report, Università di Padova.

- Galla and Farmer, (2013) Galla, T. and Farmer, J. D. (2013). Complex dynamics in learning complicated games. Proc. Natl. Acad. Sci. USA, 110(4):1232–1236.

- Goldberg et al., (1968) Goldberg, K., Goldman, A. J., and Newman, M. (1968). The probability of an equilibrium point. J. Res. Nat. Bur. Standards Sect. B, 72B:93–101.

- Goldman, (1957) Goldman, A. J. (1957). The probability of a saddlepoint. Amer. Math. Monthly, 64:729–730.

- Heinrich et al., (2021) Heinrich, T., Jang, Y., Mungo, L., Pangallo, M., Scott, A., Tarbush, B., and Wiese, S. (2021). Best-response dynamics, playing sequences, and convergence to equilibrium in random games. Technical report, arXiv:2101.04222.

- Koutsoupias and Papadimitriou, (1999) Koutsoupias, E. and Papadimitriou, C. (1999). Worst-case equilibria. In STACS 99 (Trier), volume 1563 of Lecture Notes in Comput. Sci., pages 404–413. Springer, Berlin.

- Nash, (1951) Nash, J. (1951). Non-cooperative games. Ann. of Math. (2), 54:286–295.

- Nash, (1950) Nash, Jr., J. F. (1950). Equilibrium points in -person games. Proc. Nat. Acad. Sci. U. S. A., 36:48–49.

- Pangallo et al., (2019) Pangallo, M., Heinrich, T., and Doyne Farmer, J. (2019). Best reply structure and equilibrium convergence in generic games. Science Advances, 5(2).

- Papadimitriou, (2001) Papadimitriou, C. (2001). Algorithms, games, and the Internet. In Proceedings of the Thirty-Third Annual ACM Symposium on Theory of Computing, pages 749–753, New York. ACM.

- Pigou, (1920) Pigou, A. C. (1920). The Economics of Welfare. Macmillan and Co., London.

- Powers, (1990) Powers, I. Y. (1990). Limiting distributions of the number of pure strategy Nash equilibria in -person games. Internat. J. Game Theory, 19(3):277–286.

- Raič, (2003) Raič, M. (2003). Normal approximation by Stein’s method. In Mrvar, A., editor, Proceedings of the Seventh Young Statisticians Meeting, pages 71–97.

- Rinott and Scarsini, (2000) Rinott, Y. and Scarsini, M. (2000). On the number of pure strategy Nash equilibria in random games. Games Econom. Behav., 33(2):274–293.

- Roughgarden and Tardos, (2007) Roughgarden, T. and Tardos, É. (2007). Introduction to the inefficiency of equilibria. In Algorithmic Game Theory, pages 443–459. Cambridge Univ. Press, Cambridge.

- Schulz and Stier Moses, (2003) Schulz, A. S. and Stier Moses, N. (2003). On the performance of user equilibria in traffic networks. In Proceedings of the Fourteenth Annual ACM-SIAM Symposium on Discrete Algorithms (Baltimore, MD, 2003), pages 86–87, New York. ACM.

- Stanford, (1995) Stanford, W. (1995). A note on the probability of pure Nash equilibria in matrix games. Games Econom. Behav., 9(2):238–246.

- Stanford, (1996) Stanford, W. (1996). The limit distribution of pure strategy Nash equilibria in symmetric bimatrix games. Math. Oper. Res., 21(3):726–733.

- Stanford, (1997) Stanford, W. (1997). On the distribution of pure strategy equilibria in finite games with vector payoffs. Math. Social Sci., 33(2):115–127.

- Stanford, (1999) Stanford, W. (1999). On the number of pure strategy Nash equilibria in finite common payoffs games. Econom. Lett., 62(1):29–34.

- Takahashi, (2008) Takahashi, S. (2008). The number of pure Nash equilibria in a random game with nondecreasing best responses. Games Econom. Behav., 63(1):328–340.