THEMIS: A Decentralized Privacy-Preserving

Ad Platform with Reporting Integrity

Abstract

Online advertising fuels the (seemingly) free internet. However, although users can access most websites free of charge, they need to pay a heavy cost on their privacy and blindly trust third parties and intermediaries that absorb great amounts of ad revenues and user data. This is one of the reasons users opt out from advertising by resorting ad blockers that in turn cost publishers millions of dollars in lost ad revenues.

Existing privacy-preserving advertising approaches (e.g., Adnostic, Privad, Brave Ads) from both industry and academia cannot guarantee the integrity of the performance analytics they provide to advertisers, while they also rely on centralized management that users have to trust without being able to audit.

In this paper, we propose THEMIS, a novel privacy-by-design ad platform that is decentralized and requires zero trust from users. THEMIS (i) provides auditability to all participants, (ii) rewards users for viewing ads, and (iii) allows advertisers to verify the performance and billing reports of their ad campaigns. To demonstrate the feasibility and practicability of our approach, we implemented a prototype of THEMIS using a combination of smart contracts and zero-knowledge schemes. Performance evaluation results show that during ad reward payouts, THEMIS can support more than 51M users on a single-sidechain setup or 153M users on a multi-sidechain setup, thus proving that THEMIS scales linearly.

Keywords:

Blockchain, Ad Platform, Trustless, Reporting Integrity, User Privacy, Zero KnowledgeI Introduction

Digital advertising is the most popular way of funding websites, despite the many other alternative monetization systems that have been proposed [1, 2, 3, 4]. However, web advertising has fundamental flaws, including market fragmentation [5, 6], rampant fraud [7, 8, 9, 10, 11, 12, 13], centralization around intermediaries (e.g., Supply/Demand-side platforms, Ad exchanges, Data Management Platforms) who absorb half of spent advertising dollars [14] and unprecedented privacy harm from the extensive tracking of users [15, 16, 17, 18]. Web advertising is increasingly being ignored or blocked by users, too. The average click-through-rate today is 2% [19], while at the same time 47% of Internet users globally use ad-blockers [20], thus costing publishers millions of dollars in ad revenues every year [21]

Alternative advertising strategies: Academia and industry have responded to some of these challenges by designing new monetization approaches. These systems generally emphasize end-user choice, privacy protections, fraud prevention, or performance improvements. Brave Ads [22], Privad [23], and Adnostic [24] are among the three most prominent such proposals. These systems, while promising, have limitations that prevent them from being compelling replacements for the existing web advertising system. Specifically, these systems either do not scale well, or require the user to trust central authorities within the system to process ad transactions. Additionally, these proposed systems lack auditability: users need to blindly trust the ad network that exclusively determines how much advertisers will be charged, as well as the revenue share the publishers will get [25]. Malicious ad networks can overcharge advertisers or underpay publishers, while malicious advertisers can deny actual views/clicks and ask for refunds, since bills frequently cannot be adequately justified by the ad network (non-repudiation).

Compensating ad viewing: The idea of compensating end-users to view ads is not so far-fetched: Brave Ads [22], in operation since 2019, is a browser-based advertising system that compensates users for their attention while viewing ads. As can be seen in Figure 1, a Brave browser user is shown an ad as an operating system notification, for which they are compensated in the form of a cryptocurrency in their built-in browser wallet.

Introducing THEMIS: To address these issues, in this paper, we propose THEMIS, the first decentralized, scalable, and privacy-preserving ad platform that provides auditability to its participants. Thus, users do not need to trust any protocol actor (e.g., to protect their privacy or handle payments). To increase the end-user engagement with ads and provide the advertisers with feedback regarding their campaigns, THEMIS (i) incentivizes users to interact with ads by rewarding them for their ad viewing and (ii) provides advertisers with verifiable and privacy-preserving campaign performance analytics. This way, advertisers can accurately learn how many users viewed their ads, but without learning which users.

To achieve the above, our system uses a sidechain design pattern and smart contracts to eliminate the centralized management and brokerage of the current ad ecosystem. To reward users for their ad viewing and perform reward payouts without revealing user interests, THEMIS leverages a partial homomorphic encryption scheme. According to existing proposals [26] paying users for viewing ads successfully motivates them to click on these ads (14% click-through-rate compared to the 2% of traditional ad ecosystem). THEMIS is privacy-preserving; it sends zero bits of behavioral user data outside of the user device, while at the same time, it serves ads relevant to user’s interests by matching these ads locally to the their profile. THEMIS leverages zero-knowledge schemes during ad operations, so every actor in the system can cryptographically verify at any time that everybody follows the protocol as expected. Finally, by using a multiparty computation protocol, THEMIS guarantees the computational integrity of the campaign performance analytics it provides to advertisers.

Contributions: In summary, we make the following contributions to the goal of a decentralized, privacy-respecting advertising system:

-

1.

We propose THEMIS, a novel privacy-preserving advertising platform that rewards users for viewing ads. Contrary to existing proposals, our system is decentralized and leverages smart contracts to orchestrate reward calculation and payments between users and advertisers. This way, our platform avoids relying on a single trusted central authority.

-

2.

To assess the feasibility of our approach, we implement a prototype of our system in Rust and Solidity. We provide the source code of THEMIS publicly [27].

-

3.

To evaluate the scalability and practicability of our system, we perform experiments on a single- and different multi-sidechain setups. We see that THEMIS can support reward payments of around 51M users per month on a single sidechain or 153M users on a parallel setup of three sidechains, thus proving that THEMIS scales linearly.

II Building Blocks

In this section, we introduce the techniques and mechanisms leveraged throughout the paper and describe why and how THEMIS uses them.

II-A Proof of Authority Blockchains

THEMIS relies on a blockchain with smart contract functionality to provide a decentralized ad platform. Smart contracts enable us to perform all payments without trusting a single central authority. Ethereum Mainnet [28] is a such popular smart contract-based blockchain. However, due to its low transaction throughput, the high gas costs, and the overall poor scalability, in THEMIS, we chose to use a Proof-of-Authority (PoA) blockchain instead.

Consensus protocols constitute the basis of any distributed system. The decision on which consensus mechanism to use affects the properties, scalability and assumptions of the services build on top of the distributed system [29]. A PoA blockchain consists of a distributed ledger that relies on consensus achieved by a permissioned pool of validator nodes. PoA validators can rely on fast consensus protocols such as IBFT/IBFT2.0 [30, 31] and Clique [32], which result in faster minted blocks and thus PoA can reach higher transaction throughput than traditional PoW based blockchains. As opposed to traditional, permissionless blockchains (such as Bitcoin [33] and Ethereum [28]), the number of nodes participating in the consensus is relatively small and all nodes are authenticated. In THEMIS, the set of validators may consist of publishers or foundations.

Private input transactions: THEMIS leverages private input transactions to maintain the privacy of the advertisers. More precisely, THEMIS uses the private input transactions as defined by the Quorum PoA sidechain [34]. Providing private input functionality in smart contracts requires the inputs to be encrypted with all validator’s public keys. By encrypting both inputs and outputs with validator’s public keys, the parameters are private from readers of the public information while, at the same time, validator nodes can decrypt the values and run the smart contracts correctly in order to achieve consensus. For simplicity, we refer to the public keys of validators as a single one throughout the paper, and denote it with . Projects like Quorum [34, 35] and Hyperledger Besu [36] are Ethereum-based distributed ledger implementations that implement private transaction inputs and outputs.

II-B Cryptographic Tools

Confidentiality: THEMIS uses an additively homomorphic encryption scheme to calculate the reward payouts for each user, while keeping the user behavior (e.g. ad clicks) private. Given a public-private key-pair , the encryption scheme is defined by three functions: first, the encrypt function, where given a public key and a message, it outputs a ciphertext, . Secondly, the decrypt function, that given a ciphertext and a private key, it outputs a decrypted message, . And finally, the signing function, where given a message and a secret key, it outputs a signature on the message, . The additive homomorphic property guarantees that the addition of two ciphertexts, encrypted under the same key, results in the addition of the encryption of its messages, more precisely,

Some examples of such encryption algorithms are ElGamal [37] or Paillier [38] encryption schemes. We run our experiments using ElGamal over elliptic curves.

Integrity: To prove correct decryption, THEMIS leverages zero knowledge proofs (ZPKs) [39] which allow an entity (the prover) to prove to a different entity (the verifier) that a certain statement is true over a private input. This proof does not disclose any other information from the input other than whether the statement is true or not. THEMIS leverages ZKPs to offload computation on the client-side, while maintaining integrity and privacy. More precisely, a user decrypts the earned reward payout, and proves that the decryption is correct. We denote proofs with the letter , and use to denote verification of a proof.

Distribution of trust: THEMIS distributes trust to generate a public-private key-pair for each ad campaign, under which sensitive user information is encrypted. For that end, THEMIS leverages a distributed key generation (DKG) protocol. This allows a group of participants to distributively generate the key-pair , where each participants has a share of the private key, , and no participant ever gains knowledge of the full private key, . The resulting key-pair is a threshold key-pair, which requires at least out of the participants that distributively generated the key, to interact during the decryption or signing protocols. There exists both synchronous [40] and asynchronous [41, 42] schemes. In our scenario, building on top of a synchronous scheme is acceptable, as the number of participants is small, and participants are incentivised to be online during the key generation procedure. Hence, we follow the protocol presented in [40] for the key generation as well as the decryption procedure.

In order to chose this selected group of key generation participants in a distributed way, THEMIS leverages verifiable random functions (VRFs) [43, 44]. In general, VRFs enable users to generate a random number and prove its randomness. In THEMIS, we use VRFs to select a random pool of users and generate the distributed keys. Given a public-private key-pair , VRFs are defined by one function: random number generation, which outputs a random number, VRF.Rand and a zero knowledge proof of correct generation, ,

where is a random seed.

Confidential payments for account-based blockchains: Confidential payments on account-based blockchains allow transfers of assets between accounts without disclosing the amount of assets being transferred or the balance of the accounts. Additionally, the sender can prove the correctness of the payment (i.e., prove that there was no double spending). Confidential payments have drawn a lot of interest in both academia [45, 46, 47] and industry [48, 49, 50] recently. We studied the throughput of two solutions, namely AZTEC [45] and the Zether [46] protocols for THEMIS.

The AZTEC protocol implements a toolkit and a set of smart contracts for building confidential assets on top of the Ethereum virtual machine [51]. The AZTEC protocol defines a commitment scheme and zero-knowledge proofs for verifying and validating transactions without disclosing the balance of the asset transaction. An important feature of AZTEC is that it enables the prover to generate proof of correct payments in batches, which amortizes the costs of multiple payments.

The Zether protocol uses Sigma-Bulletproofs and one-out-of-many proofs to achieve confidential and anonymous payments in account-based blockchains. Zether does not provide batching of payment proof validations, which means that the time for settling payments grows linearly with the number of payments issued. We this reason we selected AZTEC as our underlying private payment system. In Section V we show how AZTEC payments allow THEMIS to scale up to 50.9M payments per month.

III Threat Model and Goals

In this section, we introduce the participants of THEMIS and the threat model of the system. In addition, we describe the design principles of THEMIS and how existing systems compare with it.

III-A Main Actors

PoA validator nodes: THEMIS leverages a PoA sidechain that relies on consensus achieved by a pool of permissioned validator nodes. The role of the validators is to mine the blocks of the sidechain. In order to achieve this, each validator needs to evaluate the smart contract instructions against the user’s inputs and global state, achieve consensus among the consortium on what is the next stage of the blockchain and mine new blocks. To preserve independence and the zero-trust requirement of the sidechain, in THEMIS, validator nodes are maintained by non-colluding, independent third parties (e.g., the Electronic Frontier Foundation (EFF) [52], or a non-profit trade foundation of applications), similar to existing volunteer networks like Tor [53], Gnutella [54] or distributed VPNs [55, 56].

Campaign facilitator (CF): The CF is an entity authorized by the PoA consortium that helps running the THEMIS protocol. A CF interacts with advertisers to agree on an ad policy of their preference and deploys the smart contracts in the PoA sidechain. In addition, the CF is responsible for performing the confidential and verifiable payments to the users. The CF has the role of a facilitator; THEMIS requires an honest run of the protocol by the CF for completeness, but not for verifiability. The system can detect when the CF misbehaves.

Advertisers: The advertisers agree with the CF the policies for each ad campaign they want to launch in the context of THEMIS. They receive an anonymized feedback for the performance of their campaigns. Advertisers can verify the validity of the reporting. In addition, advertisers can interact with the PoA chain to verify that the amount charged for running campaigns corresponds to valid user interactions with campaign ads.

Users: The users interact with the ads through an advertising platform, which selects and distributes the ads. Users interact with the PoA sidechain so their rewards are computed and paid. THEMIS users may also participate in a consensus pool where they interact with other users in a peer-to-peer way. We refer to them as consensus participants (Con.Part).

III-B Goals and Comparison with Alternatives

The goal of this paper is to design (i) a decentralized and (ii) trustless ad platform that (iii) is private-by-design while, at the same time, (iv) rewards users for the attention they give while viewing ads and (v) provides metrics for the ad campaigns of the advertisers. The key system properties we focus on while designing THEMIS, include privacy (for both user interactions and advertiser policies), decentralization and auditability (by providing verifiable rewards billing and campaign reporting integrity) and scalability:

-

1.

Privacy. In the context of a sustainable ad ecosystem, we define privacy as the ability for not only users, but also advertisers to use our system without disclosing any critical information:

-

(a)

For the user, privacy means being able to interact (i.e., view, click) with ads without revealing their interests/preferences to any third party. In THEMIS, we preserve the privacy of the user not only when they are interacting with ads but also when they claim the corresponding rewards for these ads.

-

(b)

For the advertisers, privacy means that they are able to setup ad campaigns without revealing any policies (i.e., what is the reward of each of their ads) to the prying eyes of their competitors. To achieve that, THEMIS keeps these ad policies confidential throughout the whole process, while it enables users to provably claim rewards based on the ad policies.

-

(a)

-

2.

Decentralization and auditability. Existing ad platforms [22, 23, 24] require a single central authority to manage and orchestrate the execution of their protocols. Both privacy and billing is dependent on the correct behaviour of the single authorities.

However, as nicely pointed out in [25], what if this — considered as trusted — entity censors users by denying or transferring incorrect amount of rewards? What if it attempts to charge advertisers more than what they should pay based on users’ ad interactions? What if the advertising policies are not applied as agreed with the advertisers when setting up ad campaigns?

One of the primary goals of our system is to be decentralized and require no trust from users. To achieve this, THEMIS leverages a Proof-of-Authority (PoA) blockchain with smart contract functionality. To provide auditability, THEMIS leverages zero-knowledge proofs to ensure the correctness and validity of both billing and reporting thus allowing all actors to verify the authenticity of the statements and the performed operations.

-

3.

Scalability. Ad platforms need to be able to scale seamlessly and serve millions of users. However, important proposed systems fail to achieve this [23, 24]. In this paper, we consider scalability an important aspect affecting the practicability of a system. THEMIS needs to not only serve ads in a privacy preserving way to millions of users but also finalize the payments related to their ad rewards in a timely and resource efficient manner.

III-C Threat Model

In THEMIS, we assume computationally bounded adversaries capable of (i) snooping communications, (ii) performing replay attacks, or (iii) cheating by not following the protocol.

One such adversary may act as a CF aiming to collect more processing fees than agreed at the cost of user rewards or advertiser refunds. Another adversary may attempt to breach the user privacy and snoop their ad interactions. Such information could reveal interests, political/sexual/religious preferences, that can be later sold or used beyond the control of the user [57, 58, 59, 60]. Such an adversary may control at most of the (see Section II-B) randomly selected users that are part of the consensus pool. This adversary is an adaptive adversary, meaning that it can decide which participants to corrupt based on prior observations (e.g., once the consensus pool has been selected). We require that , which is optimal in the threshold encryption scenario [40]. Given that the consensus participants are chosen randomly, this means that, for ad interaction privacy, we assume that at most half of the consensus participants are malicious. Other adversaries may try to break the confidentiality of the advertisers’ agreed ad policies and disclose rewarding strategies to competitors. We assume that such an adversary may act as a user and/or advertiser in the protocol, but cannot control the campaign facilitators or the PoA validators.

Out-of-scope Attacks: We acknowledge that client-side fraud, together with malvertising and brand safety are important issues of the ad industry. However, similar to the related work [24, 61, 62, 23, 63], in this paper, we do not claim to address all issues of digital advertising. There is an abundance of papers aiming to detect and prevent cases of client-side fraud (i.e., bot clicks, click farms, sybil attacks), which can be also used in the context of THEMIS (e.g., distributed user reputation systems [64], anomaly detection, bluff ads [65], bio-metric systems [66], client puzzles [67], etc.).

IV System Overview

In this section, we describe in detail the THEMIS system. We begin with a straw-man approach to describe the basic principles of the system. We build on this straw-man approach and, step-by-step, we introduce the decentralized and trustless ad platform. For presentation purposes, in the rest of this paper, we assume that users interact with THEMIS through a web browser, although users may interact with it through a mobile app in the exact same way. For the construction of THEMIS, we assume the existence of privacy-preserving ad personalization and incentives for ad-viewing in the advertising platform. These are two techniques that have been successful in industry products.

IV-1 Privacy-preserving Ad Personalization

To perform privacy-preserving ad personalization, THEMIS adheres to the paradigm of Adnostic [24] and of Brave Ads [22], which has been in continuous operation since 2019 [68]. Similarly to these systems, users periodically download an ad catalog from the ad server (maintained by the CM). The ad catalog includes data and metadata for ads from all active campaigns.

The ad-matching happens locally based on a pre-trained model and the interests of the user are extracted their web browsing history, in a similar way as in [22, 23]. No data leaves the user’s device, thus creating a walled garden of browsing data that are used for recommending the best-matching ad while user privacy is guaranteed.

IV-2 Incentives for Ad-viewing

THEMIS, compensates users for the attention they pay to ad impressions, thus incentivizing them to interact with ads. Other academic and industry products use a similar user rewarding scheme [71, 72, 22]. Rewarding schemes in production have shown an increase in the user engagement, providing high click-through-rates (i.e., 14% on average [26]) on the ads shown to users.

In THEMIS, each viewed/clicked ad yields a reward, which can be fiat money, crypto-coins, coupons, etc.. Different ads may provide different amount of reward to the users. This amount is agreed by the corresponding ad creator (i.e., the advertiser) and the CM. Users claim the rewards periodically (e.g., every 2 days, every week or every month). The users must requests their reward for the ads they viewed and interacted with.

| Notation | Description |

|---|---|

| EncVec | Encrypted vector of ad clicks |

| Aggr.Res | Encrypted result of the aggregate calculated |

| over the EncVec vector | |

| Dec.Aggr.Res | Result of the decryption of Aggr.Res by the |

| user | |

| SignReward | Signature of the aggregate computation that |

| is used by TA to verify that the Dec.Aggr.Res | |

| is correct | |

| Proof of correct decryption of Aggr.Res | |

| Ephemeral public-private key pair for players | |

| to participate in the draw | |

| Random seed to generate random numbers | |

| MAX.DRAW | Boundary for selecting consensus participants |

| Random number | |

| Proof of randomness based on VRF | |

| Threshold public key generated in a distributed | |

| way by the consensus participants | |

| Share of the threshold private key | |

| Result of partial decryption using | |

| Aggr.Clicks | Value of the aggregate clicks by all users |

IV-A A Straw-man Approach

Our straw-man approach is the first step towards a privacy-preserving and trustless online advertising system. Our goal at this stage is to provide a mechanism for advertisers to create ad campaigns and to be correctly charged when their respective ads are delivered to users. In addition, the system aims at keeping track of the ads viewed by users, so that (i) advertisers can have feedback about the performance of the ad campaigns and (ii) users can be rewarded for interacting with ads. All these goals should be achieved while preserving ad policy privacy and user privacy.

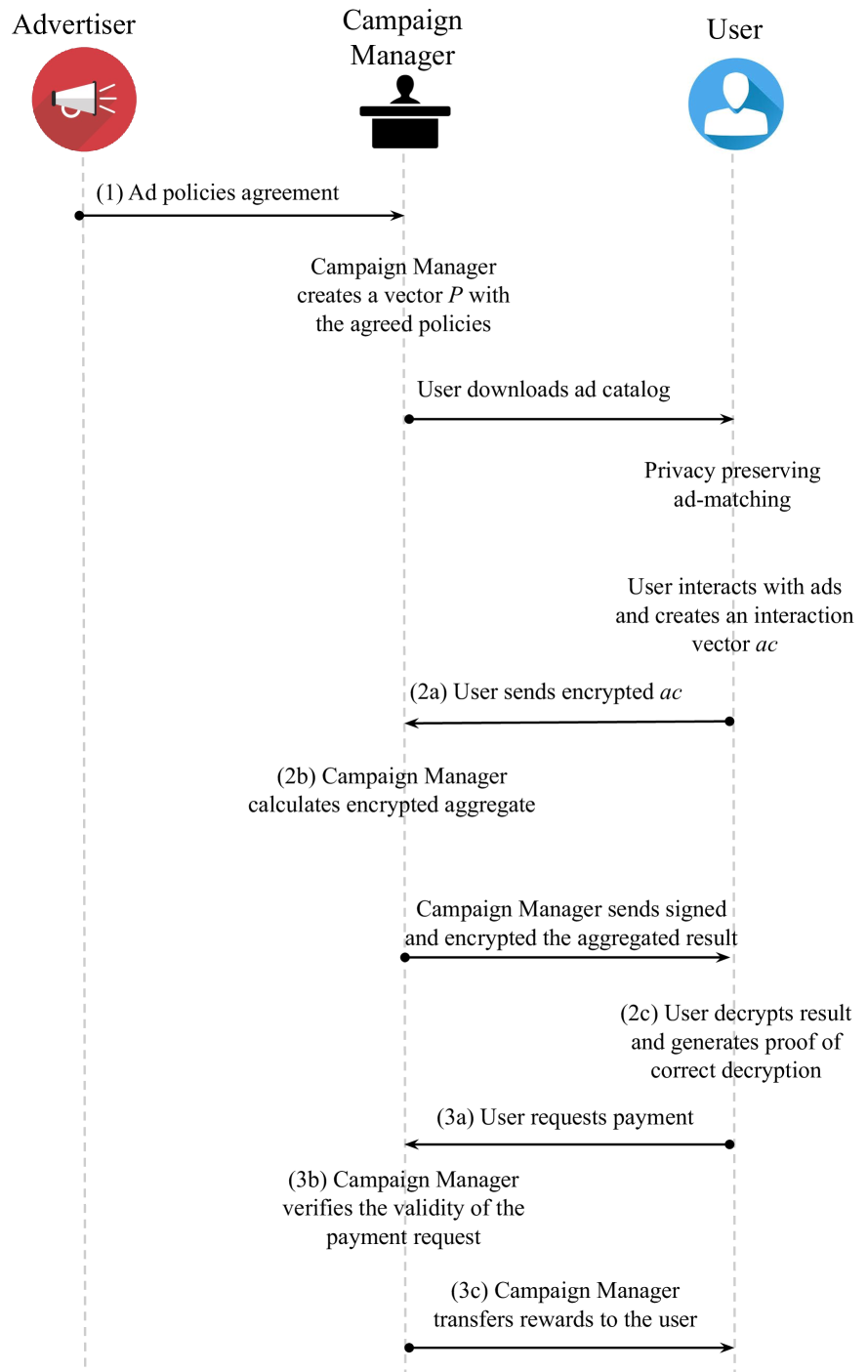

We assume three different roles in the straw-man version of THEMIS: (i) the users, (ii) the advertisers, and (iii) an ad campaigns manager (CM). The users are incentivized to view and interact with ads created by the advertisers. The CM is responsible (a) for orchestrating the protocol, (b) for handling the ad views reporting and finally (c) for calculating the rewards that need to be paid to users according to the policies defined by the advertisers. Figure 2 summarizes the notation used throughout this section.

Note that the straw-man version of THEMIS relies on an ad campaign manager, which is a single central authority required for orchestrating the protocol. In addition, users and advertisers must trust the CM. We use this simplified version to lay out the fundamental principles of the protocol. We present the improved – and decentralized – version of the protocol in Section IV-B.

In Figure 3, we present an overview of the reward and claiming procedure of the THEMIS straw-man.

Phase 1.

Defining Ad Rewards: In order for an advertiser to include their ads in the ad campaign running on THEMIS, they first need to agree with the CM on the policies of the given campaign. An ad policy consists of the rewards a user should earn per ad visualization and engagement (step 1 in Figure 3).

The CM encodes the ad policies from multiple advertisers as a vector , where each index corresponds to the amount of tokens that an ad yields when viewed/clicked (e.g., Ad 1: 4 coins, Ad 2: 20 coins, Ad 3: 12 coins). The CM stores this vector privately and the advertiser needs to trust that the policies are respected. Note, as referred earlier, the need for trust will be removed in the final version of THEMIS (Section IV-B). The indices used in are aligned with the ones of the ad catalog.

For the sake of simplicity, throughout this section, we consider one advertiser who participates in our ad platform and runs multiple ad campaigns. Of course, in a real world scenario many advertisers can participate and run many ad campaigns simultaneously. We also consider “agreed policies” as the amount of “coins” an ad provides as reward for a click by a user.

Phase 2.

Claiming Ad Rewards: The user locally creates an interaction vector, which encodes information about the number of times each ad of the catalog was viewed/clicked (e.g., Ad 1: was viewed 3 times, Ad 2: was viewed 0 times, Ad 3: was viewed 2 times).

In every payout period, the user encrypts the state of the interaction vector. More specifically, let

be the interaction vector containing the number of views/clicks of users with each ad, where element of vector ac represents the number of times ad was viewed/clicked. On every payout period, the user generates a new ephemeral key pair , to ensure the unlinkability of the payout requests. By using this key, they encrypt each entry of ac:

| (1) |

and send EncVec to the CM (step 2a in Figure 3). CM cannot decrypt the received vector and thus cannot learn the user’s ad interactions (and consequently their interests). Instead, they leverage the additive homomorphic property of the underlying encryption scheme (as described in Section II-B) to calculate the sum of all payouts based on the interactions encoded in EncVec (step 2b in Figure 3). More formally, the CM computes the aggregate payout for the user as follows:

where is the ad policy associated with the ad in the position of the vector. Then CM signs the computed aggregate result:

and sends the 2-tuple back to the user. Upon receiving this tuple (step 2c in Figure 3), the user verifies the signature of the result. If

the user repeats the request to the CM. If the signature is valid, the user proceeds with decrypting the result,

As a final step, it proves the correctness of the performed decryption by creating a zero knowledge proof of correct decryption, .

Phase 3.

Payment Request: Finally, the user generates the payment request and sends the following 4-tuple to the CM (step 3a in Figure 3):

As a next step (step 3b in Figure 3), the CM verifies that the payment request is valid. More specifically, the CM will reject the payment request of the user if

or

Otherwise, it proceeds with transferring the proper amount (equal to Dec.Aggr.Res) of rewards to the user.

In summary: As described, the straw-man THEMIS guarantees that:

-

A.

The user receives the rewards they earned by interacting with ads. This happens without requiring the user to disclose to any party their ad interactions.

-

B.

CM is able to correctly apply the pricing policy of each ad without disclosing any information regarding the ad policies to users or potential competitors of the advertisers.

IV-B THEMIS: A Decentralized Ad Platform

In Section IV-A, we presented the core functionality of our ad-platform. We described (i) how the users get rewarded for their ad interactions, and (ii) how the advertisers can access the performance report of their ad campaigns.

However, the centralization and the lack of auditability of straw-man THEMIS creates significant limitations with respect to the goals and threat model described in Section III:

-

•

Advertisers need to blindly trust the CM with the full custody of the rewards budget set for each ad campaign.

-

•

Users and advertisers have to trust that the CM respects the agreed policies during payouts and transfers the correct amount of rewards (step 3c in Figure 3).

-

•

Advertisers do not receive performance analytics of their ads (e.g. how many times an ad was viewed/clicked). Moreover, not even the CM is able to retrieve such information.

As a result, similarly to existing approaches [23, 24], the entire protocol relies on the trustworthiness of a the single central authority. Moreover, users and advertisers do not have any mechanism to verify that the protocol runs as expected.

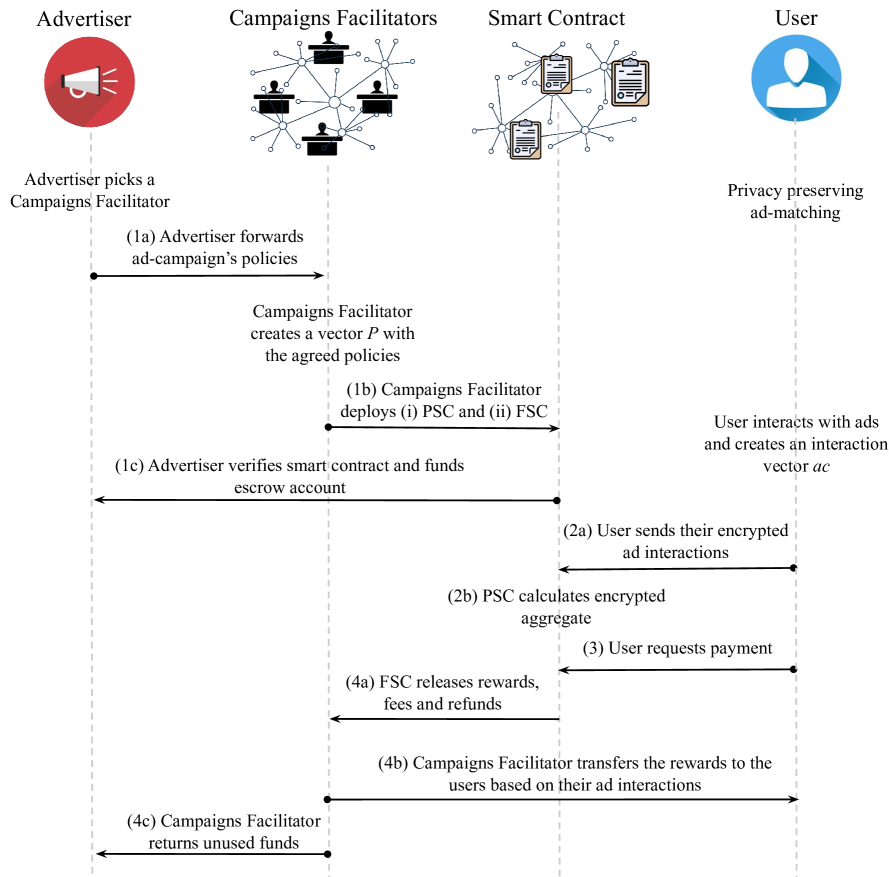

To address these issues, THEMIS leverages a distributed PoA ledger where business and payment logic are orchestrated by smart contracts. All participants of THEMIS can verify that everyone runs the protocol correctly, thus requiring zero trust from any player regarding verifiability. In particular, we define two smart contracts (See Appendix A for full details of the smart contracts structure):

-

A.

The Policy Smart Contract (PSC), which is responsible for the billing of users’ rewards and validating the payment requests. Furthermore, it is in this smart contract that is stored.

-

B.

The Fund Smart Contract (FSC), which receives and escrows the funds needed to run the campaign. The FSC is responsible for releasing (i) the funds needed for the user rewards, (ii) the advertiser refunds, and (iii) the processing fees for the CF.

In THEMIS, instead of the central trusted authority of the CM, we introduce the role of a Campaigns Facilitator (CF). The responsibilities of the CF are to (i) negotiate the policies (e.g., rewards per ad, impressions per ad) of the advertisers; (ii) deploy smart contracts in the PoA ledger; and, lastly, (iii) handle the on-chain payments. Our system ensures that everybody can audit and verify the behaviour of the different CFs, so advertisers can pick the CF they prefer to collaborate with based on their reputation. The CF is incentivized to perform the tasks required to facilitate the ad catalog, by receiving processing fees from advertisers.

Finally, to provide advertisers reports of performance of their ad campaigns, THEMIS incentivises users to perform a multiparty protocol to compute ad interaction analytics in a privacy preserving manner. These participating users are referrer to as the Consensus Pool.

Phase 1.

Defining ad rewards: In Figure 4, we present a high-level overview of the reward claiming procedure of THEMIS. Similar to the straw-man approach presented in Section IV-2, in order for an advertiser to include their ad campaign in the next ad-catalog facilitated by the CF of their preference, they need to transmit their policies (e.g., reward per ad) to the CF (step 1a in Figure 4). In order to achieve that, each advertiser exchanges a symmetric key111For the creation of this key, they follow the Diffie-Hellman key exchange protocol [73] for each ad campaign with the CF. It then encrypts the corresponding ad campaign and sends it together with their ad creatives to the CF. On their end, the CF (i) decrypt and check the policies are as agreed; (ii) merge the encrypted policies of the different advertisers into the encrypted policy vector, ; and (iii) deploy the two public smart contracts for this ad-catalog version (step 1b in Figure 4). In addition, the CF (iv) creates a vector with all the advertisers’ secret keys :

| (2) |

and (v) generates a vector, , that includes each of the elements in , encrypted with the public key () of the PoA validator nodes:

| (3) |

Then, the CF (vi) stores in PSC to allow the PoA validators to decrypt and apply the corresponding policies on users ad interaction vectors. The process of encrypting the policy vector with symmetric keys, and then encrypting the symmetric keys with the validators public key must be seen as Hybrid Public Key Encryption [74].

Once PSC is deployed, the advertisers must verify if encodes the policies agreed with CF (step 1c in Figure 4). More specifically:

-

A.

First, the advertisers fetch vector from the public storage of the PSC and decrypts the policy, , using the corresponding symmetric key, , and verifies it is the agreed value.

-

B.

Second, they fetch the escrow account address from FSC and transfer funds to the escrow account. The amount of funds needed is determined by the number of impressions they want per ad, its part of the agreed policy , and the processing fees to pay CF. Once the campaign is over, the advertisers may get a refund based to the final number of impressions viewed/clicked by users. By staking the campaign’s funds, the advertiser is implicitly validating the deployed ad policies.

Once the FSC verifies that advertisers have transferred to the escrow account the correct amount of funds, the campaign is initialized and verified.

Phase 2.

Claiming ad rewards: Similar to what illustrated in Section IV-A, in order to claim their ad rewards, each user creates an ephemeral key pair and obtains the public threshold key generated by the consensus pool (in Section IV-C, we describe in detail how the consensus pool is selected). By using these two keys, each user encrypts their ad interaction vector to generate two ciphertexts: (a) the EncVec that is used to claim ad rewards and (b) the EncVec’ that is used for the advertisers reporting.

Contrary to our centralized straw-man approach, in THEMIS, the aggregate calculation is performed via a PSC (as can be seen in step 2b in Figure 4). Thus, the user calls a public endpoint on PSC and transmits both ciphertexts. To calculate the encrypted sum of the rewards the user can claim (step 2b in Figure 4), a PoA validator runs PSC as follows:

-

1.

It decrypts each policy using (here, THEMIS leverages the private input transactions II-A).

-

2.

It applies on EncVec ciphertext the additively-homomorphic property of the underlying encryption scheme (as shown in Equation 2)

-

3.

It stores the result (i.e., Aggr.Res) in the smart contract public store222Given that the user’s public key was used for encrypting EncVec ciphertext, only them can decrypt Aggr.Res and retrieve ac..

Phase 3.

Payment request: Once the PSC calculated the aggregate result (step 3 in Figure 4), the user generates a payment request, , that, if valid, is published in FSC. More technically, the user (i) creates an ephemeral blockchain account (used only once per request) with address Addr and then (ii) fetches and decrypts Aggr.Res to get the decrypted reward, Dec.Aggr.Res, and generates the proof of correct decryption, . This way, the user (iii) generates the payment request which consists of the following 3-tuple:

| (4) |

Then, (iv) the user calls a public endpoint on PSC with the encrypted with the validators keys, as input. The function then fetches the user’s aggregate, Aggr.Res, decrypts the request, and verifies the zero knowledge proof, . If the proof is valid, it stores Addr in the FSC together with the amount to be payer to this address. This way, the FSC keeps a list of buffered user payments until marked as paid.

Phase 4.

Payment settlement: The final step of the protocol regards the settlement of the user payment and advertiser refund.

Specifically, the settlement of the user rewards in THEMIS needs to happen in a confidential way to preserve the privacy of the total of earned rewards. To achieve this, CF fetches the pending payments requests from FSC, and calculates the total amount of funds required to settle all pending payments.

As a next step (step 4a in Figure 4), the CF calls a public function of FSC requesting to transfer (to an operational account owned by CF) a given amount of tokens needed to cover the payments. If the CF misbehaves (by requesting an incorrect amount of tokens), it will be detected, and either advertisers or users will be able to prove its misbehaviour.

Finally, CF settles each of the pending reward payments by using a confidential payment scheme II-B. After finalizing the payments correctly (and if there are no complaints form either users or advertisers), the CF receives from FSC the processing fees.

In case of unused staked funds, the advertisers need to be refunded. To achieve this (step 4c in Figure 4), FSC utilizes the aggregate clicks per ad vector that the consensus pool has computed during the advertisers reporting (see Section IV-C). Based on this vector and the agreed rewards, the FSC proceeds with returning to the advertisers the unused funds.

IV-C Privacy-Preserving Performance Analytics

Apart from providing users the incentives to interact with ads, in order to make an ad-platform practical, the advertisers must be able to receive feedback about their ad campaigns performance. Moreover, advertisers need to verify that the funds charged are in line with the number of times an ad was viewed/clicked by the users. Based on these statistics, advertisers get charged depending on the times their corresponding ad was clicked throughout the campaign.

To achieve this, whenever a new version of the ad-catalog is online and retrieved from the users, a new threshold public key, , is generated. In order to generate such a key, a pool of multiple participating users, namely consensus pool, is created. To avoid cases where there are not enough participants available online, in THEMIS the participation in the consensus pool is incentivised333Users are incentivized to participate in this pool. Details on how to orchestrate the incentives are left outside the scope of this paper.. It consists of a number of selected users that have opted-in, and a smart contract responsible of the registration process and defining this pool. Any user can opt-in in the draw to become a consensus pool participant, and a random subset of all participating users is selected. Specifically, the smart contract keeps a time interval during which users who want to opt-in can register as participants for the draft. After that, the smart contract utilizes an external oracle to select a random seed, , which is used to generate random numbers.

Every registered user generates an ephemeral Verifiable Random Function key-pair, , and publishes the public key in the smart contract’s public store. Once the registration phase is closed, the smart contract calculates a threshold, MAX.DRAW, that will define the selected users

where L is the size of the drawing pool (formed by all opted-in users), the expected number of participants in the distributed key generation, and an integer such that is the space of random numbers outputted by .

Next, the participating users calculate their corresponding random number and a proof of correct generation using :

All participants with have won the draw, and proceed to publish in the smart contract. Next, the selected users, namely the consensus pool, run a distributed key generation (DKG) algorithm as defined in [75]. The result of running the DKG protocol is a consensus over the public key to use in the rest of the process, . In addition, each consensus pool participant owns a private key share . The distributed public key, , is published in PSC to make it accessible to all users.

This key is used to encrypt a copy of the ac vector (Step 2a in Figure 3). Hence, in addition to the EncVec illustrated in Equation (1), each user also sends EncVec’ to the PSC, where:

At the end of the ad campaign, the consensus pool generates the analytics report for the advertisers, showing how many times users interacted with each specific ad during the campaign. In order to generate the report, the consensus pool merges the reported EncVec’ of every user into a single vector. This vector consists of the total number of interactions that each ad received by all users during the campaign. In order to merge all EncVec’ of the campaign, the consensus pool performs the homomorphic addition of all reported encrypted vectors. This is possible due to the fact that every user used the same key for the encryption:

| (5) |

where is the set of users and is the vector corresponding to user . Then, the consensus pool proceeds with the decryption, and the proof of correctness. More precisely, each consensus participant partially decrypts Aggr.Clicks:

and proves it did so correctly. Finally, they post the encrypted aggregates of ads, the decrypted shares, and the proofs, to the FSC.

As soon as the FSC receives at least the threshold of such tuples, it combines the partial decryptions to compute the full decryption of the aggregates. This allows the advertisers to verify that the protocol ran successfully.

First, advertisers check that the encrypted aggregates, as posted by the consensus pool, does correspond with the addition of all encryptions submitted by users. To do this, each advertiser performs the homomorphic addition as described in Equation (5), but only with their respective ads, and verify it equals the posted ciphertext. Next, they verify the proofs of correct decryption for each of the received shares. Then, they fetch the full decryption of the aggregate, representing the number of clicks/interactions their ads received. Finally, advertisers can verify that the refund received by the FSC does correspond to the number of staked funds minus the number of views/clicks.

V Evaluation

In this section, we study the performance and scalability of our system. First we set out to explore the execution time of the client-side operations in THEMIS: (i) rewards claiming and (ii) payment claiming. Then, we study the end-to-end execution time when multiple participants request payments in THEMIS. Finally, we measure the overall scalability of our system and specifically, how many concurrent users claiming rewards it supports, on both single and multi-sidechain setups.

V-A Experimental Setup

To study the performance and scalability of THEMIS, we run both client-side and end-to-end measurements using the THEMIS prototype. In this section we outline specifications over which we run our experiments.

Client specifications: The client-side experiments were performed on a commodity device. The device is a MacBook Pro Catalina 10.15.5, running a 2.4GHz Qual-Core Intel Core i5 with 16GB LPDDR3 memory.

Campaign facilitator specifications: To study the resources necessary for campaign facilitators to participate in the network, we measured the resource and time overhead required to generate and prove the correctness of confidential payments (Phase 4 of THEMIS). In order to do so, we deployed an AWS ECS t2.2xlarge instance (8 vCPUs, 32 GB RAM).

Sidechain deployment: In order to measure the performance and scalability of the sidechain in the context of THEMIS, we used the Mjölnir tool [76] to deploy a Quorum [77] sidechain in a production-like environment. We deployed a 4x Quorum sidechain on AWS, each node running on an AWS EC2 t2.xlarge instance (4 vCPUs, 16 GB RAM). All nodes are deployed in the same AWS region and part of the same subnet. For the purpose of the measurements, the network communication is considered negligible. This setup can be easily reproduced in production by setting up peering connections among different AWS Virtual Private Clouds for each of the validator organizations. The consensus protocol used by the sidechain is the Istanbul Byzantine Fault Tolerant (IBFT) consensus protocol [30].

Concurrent users: A production-like environment requires multiple clients requesting rewards from the sidechain. In order to reproduce such environment, we deployed several AWS EC2 t2.large instances (2 vCPUs, 8 GB RAM). We performed measurements by running 10, 30, 60, and 100 concurrent clients which request rewards from the sidechain at roughly the same time. Using this setup, we measure the time it takes for individual clients to complete the reward calculation. In addition, we measure the end-to-end performance of the protocol, which includes the proof generation and verification.

| Ad Catalog | Interaction | Request |

|---|---|---|

| Size (ads) | Encryption (sec) | Generation (sec) |

| 64 | 0.027 | 0.136 |

| 128 | 0.054 | 0.303 |

| 256 | 0.105 | 0.706 |

V-B System performance

In multi-client services like ad platforms, time matters for the user experience. Therefore, as a first step, we set out to explore the execution time of the requests a client issues in THEMIS (i.e., rewards claiming and payment requests) and the time it takes for the CF to process these requests. Then, we measure the overall end-to-end time it takes for a reward request to be processed in our system.

In the case of users, we measure the time it takes for a client to generate locally a rewards claiming request for three different ad catalog sizes (64, 128 and 256 ads) and in Figure 5 we present the results. As described in Phase 2, this operation includes:

-

(i)

Interaction encryption: includes the encryption of the interaction array of the user, and

-

(ii)

Request generation: includes decryption of the payment aggregate, generation of the proof of correct decryption and recovery of plaintext.

As can be seen, the execution time to encrypt user interactions for an ad catalog of 256 ads is as low as 0.1 sec. Similarly, for the same ad catalog size, the request generation procedure takes around 0.7 sec, proving that the client computations for reward claiming can be done on a commodity laptop or mobile device, without significant impact on the user experience.

Apart from issuing reward claiming requests, a client also performs periodic rewards payment requests. However, such requests take place in relatively long intervals (e.g., monthly) and therefore the latency imposed to the user is practically negligible.

| Batched | Proof | Verification (sec) |

|---|---|---|

| proofs | generation (sec) | |

| 80 | 3,9 | 3 |

| 200 | 11,6 | 3 |

| 400 | 22,08 | 3 |

| 800 | 40,7 | 3 |

For the settlement of the rewards payment requests (Phase 4), the CF relies on a confidential transaction protocol to ensure the confidentiality and integrity of the payments. While implementing our system, we compared the performance of the two most popular such protocols in the context of THEMIS: AZTEC [45] and Zether [46]. The conclusion is that AZTEC outperforms Zether by enabling the batching of payments into a single on-chain proof verification of 3 seconds. This makes the verification time constant, independently of the number of batched payments. Our results, presented in Figure 6, show that the CF can achieve around 1.7M payments/day for a batch size of 800 proof payments. This results in a total of 50.9M payments.

As a next step, we measure the time required for the sidechain to process concurrent payment requests end-to-end. This includes the generation of the payment requests by the user, the network latency in the communication between the clients and the sidechain, and the time is takes for the sidechain to process the requests and mine the blocks.

In Figure 7, we show the results with respect to the different concurrent users claiming their rewards (10, 30, 60, 100 users) and different ad catalog sizes (yellow bar: 64 ads, blue bar: 128 ads, green bar: 256 ads). In red, we show the time it takes for the user to decrypt the aggregate, perform the plaintext recovery locally and submit the decrypted aggregate and proof of correct decryption. As we can see, in total for a user to claim and retrieve rewards even in the case of 100 concurrent users and a large ad catalog size of 256 ads444An ad catalog large enough handle all different ads delivered simultaneously in production systems currently in use (i.e., Brave Ads [78]):

-

A.

It takes roughly 4.69 seconds for the client to request the reward calculation and retrieve the encrypted aggregate from the smart contract.

-

B.

It takes an additional 0.35 sec for the client to decrypt the aggregate, perform the plaintext recovery locally and submit the decrypted aggregate and proof of correct decryption.

So it takes an overall of 5.04 seconds for THEMIS to process and verify up to 100 concurrent reward payment requests of users.

V-C System Scalability

One of the most important challenges of privacy-preserving ad platforms is scalability. In the case of THEMIS this related to how easy the system can scale with the increasing number of clients that simultaneously claim their rewards.

In Figure 7 we saw that for an ad catalog of 256 ads and 100 concurrent users performing a payment request, it takes around 5 seconds to complete 100 concurrent payment requests. This means, that under the same conditions, the sidechain can process around 1.7M concurrent payment requests per day, which translates to a total of 51M users per month555The specifications used by the validator nodes to achieve this throughput are outlined in Section V-A..

Horizontal scaling: The computations performed in smart contracts in the experiments above, are highly parallelizable. However, the one-threaded event loop of the Ethereum Virtual Machine (EVM)666The EVM is the run-time virtual machine where the smart contract instructions are executed in each of the validator’s machines. does not support parallel and concurrent computations. Therefore, the EVM run-time becomes the scalability bottleneck when it has to handle more than 100 concurrent user requests.

To overcome this shortcoming, we tested THEMIS on top of multiple parallel sidechains. Each sidechain is responsible for one or more ad catalogs each. Although this could increase coordination complexity, the scalability gains are considerable as the number of ads processed grows linearly with the number of sidechains. Thus, THEMIS can scale to support millions of concurrent users per day.

In order to explore how horizontal scaling performs in THEMIS, we started two and three parallel sidechains, each using the same settings as outlined in Section V-A. Note that, by running multiple parallel sidechains, we do not require additional or different validators. Instead, each validator is required to run three nodes, each node part of one single sidechain.

Figure 8 shows the number of users THEMIS can process by running on multiple sidechains. As seen, the number of users increases linearly with the number of sidechains. Assuming a setup with three parallel sidechains, THEMIS can handle a total of 153M users per month (5.1M users a day).

V-D Summary

In summary, evaluation results show that THEMIS scales linearly and seamlessly support user bases of existing centralised systems currently in production [78]. Specifically, our system can support payment requests of around 51M users on a single sidechain setup or 153M users on a parallel 3-sidechain setup.

In addition, we see that the latency users need to sustain while using THEMIS is negligible (less that 1 sec per request payment on commodity hardware) and we show that both the CF and sidechain validators can also rely on commodity hardware to participate in the network.

VI Discussion

In THEMIS a CF can cheat in two ways: (1) as it is the entity orchestrating the confidential payments, it may send incorrect rewards to users or, (2) it could use its power to send rewards not only to the user but to other accounts of their control. Both of these actions may be discovered by either users or advertisers.

-

A.

In case of scenario (1) The users can provably challenge CF for incorrect behaviour by proving that the payment received does not correspond to the payment request they generated. To do so, the user calls the FSC to prove that the amounts received by the private payment does not correspond to the decrypted aggregate in the payment request . We stress that in case a user must undergo such a scenario, only the aggregate amount of a single ad-catalog will be disclosed (and not its interaction with ads).

-

B.

In case of scenario (2), the escrow account will not have enough funds, resulting in some advertiser getting a smaller refund to what is stated in the performance report of their ad campaign (as described in Section IV-C). In this case, the advertiser can prove that the received refund does not correspond to the amount staked in Phase 1 of THEMIS, minus the rewards paid to users based on the numbers of clicks their ads received.

To claim misbehaviour, users and advertisers can file a complaint via a public function on FSC (that validates the complaint). If any complaints are filed, the FSC switches its state to “failed” and CF will not receive any processing fees, something that affects their reputation.

VII Related Work

The current advertising ecosystem abounds with issues associated with its performance, its transparency, the user’s privacy and the integrity of billing and reporting. These failures are already well studied and there are numerous works aiming to shed light on how digital advertising works [79, 80, 81, 82, 83, 84, 85].

Apart from the studies highlighting the failures of current ad delivery protocols there are also important novel ad systems proposed. In [61], Juels is the first to study private targeted advertising. Author proposes a privacy-preserving targeted ad delivery scheme based on PIR and Mixnets. In this scheme, advertisers choose a negotiant function that assigns the most fitting ads in their database for each type of profile. The proposed scheme relies on heavy cryptographic operations and therefore it suffers from intensive computation cost. Their approach focuses on the private distribution of ads and does not take into account other aspects such as view/click reporting.

In [24], authors propose Adnostic: an architecture to enable users to retrieve ads on the fly. Adnostic prefetches n ads before the user starts browsing and stores them locally. Aside from the performance benefits of this strategy, Adnostic does this prefetching also in order to preserve the privacy of the user. The parameter n is configurable: larger n means better ad matching, when smaller n means less overhead. In order for the ad-network to correctly charge the corresponding advertisers, Adnostic performs secure billing by using homomorphic encryption and zero-knowledge proofs.

In [86, 23, 87], authors propose Privad: an online ad system that aims to be faster and more private than today’s ad schema. Privad introduces an additional entity called Dealer. The Dealer is responsible for anonymizing the client so as to prevent the ad-network from identifying the client and also handle the billing. To prevent the Dealer from accessing user’s behavioral profile and activity it encrypts the communications between the client and the Dealer. A limitation of Privad is that Dealer is a centralized entity that needs to be always online.

In [88], authors propose ObliviAd: a provably secure and practical online behavioral advertising architecture that relies on a secure remote co-processor (SC) and Oblivious RAM (ORAM) to provide the so called secure hardware-based PIR. In ObliviAd, to fetch an ad, a user first sends their encrypted behavioral profile to the SC which securely selects the ads that match best based on the algorithm specified by the ad network. To prevent the ad-network from learning which ads are selected, they leverage an ORAM scheme. The selected ads are finally sent to the user encrypted, along with fresh tokens used to billing. User will send back one of these tokens as soon as they view/click on an ad.

In [25] authors point out that, in current advertising systems the ad-network exclusively determines the payment to get from advertisers and the revenue to share with publishers. This means that (i) a malicious ad-network can overcharge advertisers or underpay publishers. To make matters worse, as bills cannot be justified by the ad-network, malicious advertisers can deny actual views/clicks to ask for refund. On the other hand, (ii) malicious publishers may claim clicks that did not happen, in order to demand higher revenues. To address this problem of unfairness, authors propose a protocol where the ad click reports are encrypted by the user using the public key of the ad-network and signed by both publishers and advertisers.

In [63], authors use an additively encryption scheme to design a protocol that enables privacy-preserving advertising reporting at scale, without needing any trusted hardware. Performance evaluation results show that their protocol reduces the overhead of reporting by orders of magnitude compared to the ElGamal-based solution of Adnostic [24] (i.e., 1 MB of bandwidth per impression when handing 32,000 advertisements). Contrary to our approach, authors assume a Trusted Third Party (TTP) that owns the key for the homomorphic encryption.

In [62], authors propose CAMEO: a framework for mobile advertising that employs intelligent and proactive prefetching of advertisements. CAMEO uses context prediction, to significantly reduce the bandwidth and energy overheads, and provides a negotiation protocol that empowers applications to subsidize their data traffic costs by “bartering” their advertisement rights for access bandwidth from mobile ISPs. In [89], authors propose a location-aware, personalised and private advertising system for mobile platforms. In this system, ads are locally broadcast to users within mobile cells. The ad matching happens locally based on the user interests. Finally ad view and click reports are collected using a DTN system. In [90], authors propose a new ad protocol that uses homomorphic and searchable encryption to allow users transmit mobile sensor data to a cloud service that responds back with the best matching contextual advertisements.

In [91], authors present VEX, a protocol for ad exchanges to run low-latency and high-frequency ad auctions that are verifiable and auditable, in order to prevent fraud in a context where parties participating in the auction – bidders and ad exchanges – may not know each other. Based on their evaluation of the system, the authors claim that the additional storage required and latency imposed by VEX are low and practical in the context of ad auctions. In [92], authors present and implement PROTA, a privacy-preserving protocol for real-time advertising which uses keywords to match users interests with ads. By using bloom filters, the authors make the ad matching task efficient. The protocol relies on a trusted third party to cooperate with the ad exchange during the bidding and ad delivering phase. The authors implement and evaluate the protocol, and conclude that the time upper bond for matching ads is 200ms, which is considerable practical in the context of an ad matching system.

In [93], authors present and evaluate a system that aims at providing high-quality ad targeting in multiple scenarios, while giving the user the ability to control their privacy. The system consists of tailored extensions that mine the user behaviour locally with low overhead. The extensions generate user behavioural data that can be shared with advertisers without leaking undesirable user information. Similarly to THEMIS, the authors discuss how the system can be used by users and advertisers, and how it can be used as a replacement for the tracking-based business model in the online advertising industry.

In [94], authors set out to formalize the concept of privacy in the context of the online advertising ecosystem and to develop a provably secure privacy-preserving protocol for the online advertising ecosystem. While the authors claim that the definition of privacy presented in the paper is more useful compared to previous work in the online advertising context, their attempts to develop a provably secure privacy-preserving protocol has failed due to being hard to balance privacy with usefulness of the user data. The authors conjecture that cryptographic mechanisms have the potential to solve the privacy versus data usefulness conundrum. Using applying cryptography is the basis of how THEMIS proposes to preserve privacy when calculating ad rewards, providing advertisers with campaign metrics and performing confidential payments to users.

Towards a similar direction with the user rewarding schema of THEMIS, in [71], authors propose a privacy-aware framework to promote targeted advertising. In this framework, an ad broker responsible for handling ad targeting, sits between advertisers and users and provides certain amount of compensation to incentivize users to click ads that are interesting yet sensitive to them. In [72], authors propose a targeted advertising framework which enables users to get compensated based on the amount of user tracking they sustain and the privacy they lose. The authors analyze the interaction between the different parties in the online advertising context — advertisers, the ad broker and users — and propose a framework where the interactions between the different parties are a positive-sum game. In this game, all parties are incentivized to behave according to what other parties expect, achieving an equilibrium where everyone benefits. More specifically, the users determine their click behaviour based on their interested and their privacy leakage, which in turn will influence the advertisers and ad broker to provide less invasive and better ads. THEMIS relies on a similar game theoretical approach. By providing compensation for good behaviour while providing the verification mechanisms for all parties to audit whether everyone is behaving according to the protocol, the incentives to cheat and misbehave are lower.

VIII Conclusions

In this paper, we presented THEMIS, the first decentralized, scalable, and privacy-preserving ad platform that provides integrity and auditability to its participants, so users do not need to blindly trust any of the protocol actors. To increase the user engagement with ads and provide advertisers with the necessary performance feedback about their ad campaigns, THEMIS (i) rewards users for their ad viewing and (ii) provides advertisers with verifiable and privacy-preserving campaign performance analytics.

We implemented our approach by leveraging a permissioned blockchain with Solidity smart contracts as well as zero-knowledge techniques. We evaluate the scalability and performance of our prototype and show that THEMIS can support reward payments for more than 51M users per month on a single-sidechain setup and 153M users on a parallel multi-sidechain setup, proving linear scalability.

While many projects and companies have proposed the use of blockchain for online advertising, we believe that THEMIS is the first system that delivers on that promise. Given the practicality of the approach and the combination of security, privacy, and performance properties it delivers, THEMIS can be used as a foundation of a radically new approach to online advertising.

References

- [1] Panagiotis Papadopoulos, Peter Snyder, and Benjamin Livshits. Keeping out the masses: Understanding the popularity and implications of internet paywalls. In Proceedings of the The World Wide Web Conference, WWW’20. ACM, 2020.

- [2] Jeff Dunn. Wikipedia is asking for donations again — here’s how much cash it already has in the bank. https://www.businessinsider.com/wikipedia-donations-profit-money-chart-2016-11, 2016.

- [3] Panagiotis Papadopoulos, Panagiotis Ilia, and Evangelos P Markatos. Truth in web mining: Measuring the profitability and cost of cryptominers as a web monetization model. arXiv preprint arXiv:1806.01994, 2018.

- [4] Ghassan O. Karame, Aurélien Francillon, and Srdjan Čapkun. Pay as you browse: Microcomputations as micropayments in web-based services. In Proceedings of the 20th International Conference on World Wide Web, WWW ’11, page 307–316, New York, NY, USA, 2011. Association for Computing Machinery.

- [5] Muhammad Ahmad Bashir, Sajjad Arshad, William Robertson, and Christo Wilson. Tracing information flows between ad exchanges using retargeted ads. In Proceedings of the 25th USENIX Conference on Security Symposium, 2016.

- [6] Panagiotis Papadopoulos, Nicolas Kourtellis, and Evangelos P. Markatos. Cookie synchronization: Everything you always wanted to know but were afraid to ask. In Proceedings of The World Wide Web Conference, pages 1432–1442, 2019.

- [7] N. Kshetri. The economics of click fraud. IEEE Security Privacy, 8(3):45–53, May 2010.

- [8] S. Kumari, X. Yuan, J. Patterson, and H. Yu. Demystifying ad fraud. In 2017 IEEE Frontiers in Education Conference (FIE), 2017.

- [9] Michael Burgi. What’s being done to rein in $7 billion in ad fraud. https://www.adweek.com/brand-marketing/whats-being-done-rein-7-billion-ad-fraud-169743/, 2016.

- [10] Jessica Davies. Ghost sites, domain spoofing, fake apps: A guide to knowing your ad fraud. https://digiday.com/media/ghost-sites-domain-spoofing-fake-apps-guide-knowing-ad-fraud/, 2019.

- [11] Bin Liu, Suman Nath, Ramesh Govindan, and Jie Liu. Decaf: Detecting and characterizing ad fraud in mobile apps. In Proceedings of the 11th USENIX Conference on Networked Systems Design and Implementation, NSDI’14, 2014.

- [12] Apostolis Zarras, Alexandros Kapravelos, Gianluca Stringhini, Thorsten Holz, Christopher Kruegel, and Giovanni Vigna. The dark alleys of madison avenue: Understanding malicious advertisements. In Proceedings of the 2014 Conference on Internet Measurement Conference, IMC ’14, 2014.

- [13] Jerome Dangu. Uncovering 2017’s largest malvertising operation. https://blog.confiant.com/uncovering-2017s-largest-malvertising-operation-b84cd38d6b85, 2018.

- [14] Alex Barker. Half of online ad spending goes to industry middlemen. https://www.ft.com/content/9ee0ebd3-346f-45b1-8b92-aa5c597d4389, 2020.

- [15] Elias P Papadopoulos, Michalis Diamantaris, Panagiotis Papadopoulos, Thanasis Petsas, Sotiris Ioannidis, and Evangelos P Markatos. The long-standing privacy debate: Mobile websites vs mobile apps. In Proceedings of the 26th International Conference on World Wide Web, 2017.

- [16] Abbas Razaghpanah, Rishab Nithyanand, Narseo Vallina-Rodriguez, Srikanth Sundaresan, Mark Allman, and Christian Kreibich Phillipa Gill. Apps, trackers, privacy, and regulators. In Proceedings of the Network and Distributed System Security Symposium, NDSS’18, 2018.

- [17] Panagiotis Papadopoulos, Nicolas Kourtellis, and Evangelos P. Markatos. Exclusive: How the (synced) cookie monster breached my encrypted vpn session. In Proceedings of the 11th European Workshop on Systems Security, EuroSec, 2018.

- [18] Steven Englehardt and Arvind Narayanan. Online tracking: A 1-million-site measurement and analysis. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, 2016.

- [19] CXL. What is a “good” click-through rate? click-through rate benchmarks. https://cxl.com/guides/click-through-rate/benchmarks/, 2020.

- [20] Daniyal Malik. Global ad-blocking behaviors in 2019 - stats & consumer trends. https://www.digitalinformationworld.com/2019/04/global-ad-blocking-behaviors-infographic.html, 2019.

- [21] Dan Shewan. The rise of ad blockers: Should advertisers be panicking?(!!). https://www.wordstream.com/blog/ws/2015/10/02/ad-blockers, 2019.

- [22] Brave Software Inc. Brave - BAT - Whitepaper. https://basicattentiontoken.org/BasicAttentionTokenWhitePaper-4.pdf, 2017.

- [23] Saikat Guha, Alexey Reznichenko, Kevin Tang, Hamed Haddadi, and Paul Francis. Serving ads from localhost for performance, privacy, and profit. In HotNets, pages 1–6, 2009.

- [24] Vincent Toubiana, Arvind Narayanan, Dan Boneh, Helen Nissenbaum, and Solon Barocas. Adnostic: Privacy preserving targeted advertising. In Proceedings Network and Distributed System Symposium, 2010.

- [25] J. Hua, A. Tang, and S. Zhong. Advertiser and publisher-centric privacy aware online behavioral advertising. In 2015 IEEE 35th International Conference on Distributed Computing Systems, June 2015.

- [26] Brave Software Inc. Brave reaches 8 million monthly active users and delivers nearly 400 privacy-preserving ad campaigns. https://brave.com/brave-reaches-8-million-monthly-active-users-and-delivers-nearly-400-privacy-preserving-ad-campaigns/, 2019.

- [27] Github repo of themis implementation. https://github.com/themis-ads/prototype. Accessed: 07-2020.

- [28] Gavin Wood et al. Ethereum: A secure decentralised generalised transaction ledger. Ethereum project yellow paper, 2014.

- [29] Juan A. Garay and Aggelos Kiayias. Sok: A consensus taxonomy in the blockchain era. In Stanislaw Jarecki, editor, Topics in Cryptology - CT-RSA 2020 - The Cryptographers’ Track at the RSA Conference 2020, San Francisco, CA, USA, February 24-28, 2020, Proceedings, volume 12006 of Lecture Notes in Computer Science, pages 284–318. Springer, 2020.

- [30] Yu-Te Lin. Istanbul byzantine fault tolerance. https://github.com/ethereum/EIPs/issues/650, 2017.

- [31] Roberto Saltini. Correctness analysis of IBFT. CoRR, abs/1901.07160, 2019.

- [32] IBFT (Clique Consensus Mechanism). https://github.com/ethereum/go-ethereum/blob/master/consensus/clique/clique.go, 2018.

- [33] Satoshi Nakamoto et al. Bitcoin: A peer-to-peer electronic cash system. Working Paper, 2008.

- [34] Quorum PoA Network. https://www.goquorum.com/. Accessed: 07-2019.

- [35] Golang Implementation of Quorum Clients. https://github.com/jpmorganchase/quorum. Accessed: 07-2019.

- [36] Pegasys PoA. https://pegasys.tech/. Accessed: 07-2019.

- [37] T. Elgamal. A public key cryptosystem and a signature scheme based on discrete logarithms. IEEE Transactions on Information Theory, 1985.

- [38] Pascal Paillier. Public-key cryptosystems based on composite degree residuosity classes. In Advances in Cryptology — EUROCRYPT ’99, 1999.

- [39] S Goldwasser, S Micali, and C Rackoff. The Knowledge Complexity of Interactive Proof-systems. In STOC, 1985.

- [40] Rosario Gennaro, Stanislaw Jarecki, Hugo Krawczyk, and Tal Rabin. Secure distributed key generation for discrete-log based cryptosystems. J. Cryptology, 20(1):51–83, 2007.

- [41] Aniket Kate, Yizhou Huang, and Ian Goldberg. Distributed key generation in the wild. IACR Cryptol. ePrint Arch., 2012:377, 2012.

- [42] Aniket Kate and Ian Goldberg. Distributed key generation for the internet. In 29th IEEE International Conference on Distributed Computing Systems (ICDCS 2009), 22-26 June 2009, Montreal, Québec, Canada, pages 119–128. IEEE Computer Society, 2009.

- [43] Silvio Micali, Michael Rabin, and Salil Vadhan. Verifiable random functions. In 40th Annual Symposium on Foundations of Computer Science (Cat. No. 99CB37039), 1999.

- [44] Sharon Goldberg, Leonid Reyzin, Dimitrios Papadopoulos, and Jan Včelák. Verifiable Random Functions (VRFs). Internet-Draft draft-irtf-cfrg-vrf-05, Internet Engineering Task Force, August 2019. Work in Progress.

- [45] The AZTEC protocol white paper. https://github.com/AztecProtocol/AZTEC/blob/develop/AZTEC.pdf. Accessed: 07-2019.

- [46] Benedikt Bünz, Shashank Agrawal, Mahdi Zamani, and Dan Boneh. Zether: Towards privacy in a smart contract world. In Joseph Bonneau and Nadia Heninger, editors, Financial Cryptography and Data Security - 24th International Conference, FC 2020, Kota Kinabalu, Malaysia, February 10-14, 2020 Revised Selected Papers, volume 12059 of Lecture Notes in Computer Science, pages 423–443. Springer, 2020.

- [47] E. B. Sasson, A. Chiesa, C. Garman, M. Green, I. Miers, E. Tromer, and M. Virza. Zerocash: Decentralized anonymous payments from bitcoin. In IEEE Symposium on Security and Privacy, 2014.

- [48] Zcash website. https://z.cash/. Accessed: 07-2019.

- [49] Monero website. https://www.getmonero.org/. Accessed: 07-2019.

- [50] Anonymous Zether extension paper. https://github.com/jpmorganchase/anonymous-zether/blob/master/docs/AnonZether.pdf. Accessed: 07-2019.

- [51] Luit Hollander. The ethereum virtual machine — how does it work? https://medium.com/mycrypto/the-ethereum-virtual-machine-how-does-it-work-9abac2b7c9e, 2019.

- [52] John Gilmore Mitch Kapor, John Perry Barlow and Steve Wozniak. Electronic frontier foundation. https://www.eff.org/about, 1990.

- [53] Roger Dingledine, Nick Mathewson, and Paul Syverson. Tor: The second-generation onion router. Technical report, Naval Research Lab Washington DC, 2004.

- [54] Eytan Adar and Bernardo A Huberman. Free riding on gnutella. 2000.

- [55] Hola free vpn - unblock any website. https://hola.org/, 2020.

- [56] Matteo Varvello, Iñigo Querejeta Azurmendi, Antonio Nappa, Panagiotis Papadopoulos, Goncalo Pestana, and Ben Livshits. Vpn0: A privacy-preserving decentralized virtual private network. arXiv preprint arXiv:1910.00159, 2019.

- [57] Andrea Peterson. Bankrupt radioshack wants to sell off user data. but the bigger risk is if a facebook or google goes bust. https://www.washingtonpost.com/news/the-switch/wp/2015/03/26/bankrupt-radioshack-wants-to-sell-off-user-data-but-the-bigger-risk-is-if-a-facebook-or-google-goes-bust/, 2015.

- [58] Bernard Marr. Where can you buy big data? here are the biggest consumer data brokers. https://www.forbes.com/sites/bernardmarr/2017/ 09/07/where-can-you-buy-big-data-here-are-the-biggest-consumer-data-brokers/, 2017.

- [59] Matt Richtel. F.t.c. moves to halt sale of database at toysmart. http://www.nytimes.com/2000/07/11/business/ftc-moves-to-halt-sale-of-database-at-toysmart.html, 2000.

- [60] Phillipa Gill, Vijay Erramilli, Augustin Chaintreau, Balachander Krishnamurthy, Konstantina Papagiannaki, and Pablo Rodriguez. Follow the money: Understanding economics of online aggregation and advertising. In Proceedings of the ACM SIGCOMM Conference on Internet Measurement Conference, IMC ’13, 2013.

- [61] Ari Juels. Targeted advertising … and privacy too. In Proceedings of the Conference on Topics in Cryptology: The Cryptographer’s Track at RSA, 2001.

- [62] Azeem J. Khan, Kasthuri Jayarajah, Dongsu Han, Archan Misra, Rajesh Balan, and Srinivasan Seshan. Cameo: A middleware for mobile advertisement delivery. In Proceeding of the 11th Annual International Conference on Mobile Systems, Applications, and Services, MobiSys ’13, page 125–138, New York, NY, USA, 2013. Association for Computing Machinery.

- [63] Matthew Green, Watson Ladd, and Ian Miers. A protocol for privately reporting ad impressions at scale. In Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, pages 1591–1601, 2016.

- [64] Rupeng Yang, Man Ho Au, Qiuliang Xu, and Zuoxia Yu. Decentralized blacklistable anonymous credentials with reputation. Computers & Security, 85:353–371, 2019.

- [65] Hamed Haddadi. Fighting online click-fraud using bluff ads. ACM SIGCOMM Computer Communication Review, 40(2):21–25, 2010.

- [66] Panagiotis Papadopoulos, Inigo Querejeta Azurmendi, Jiexin Zhang, Matteo Varvello, Antonio Nappa, and Benjamin Livshits. ZKSENSE: a Privacy-Preserving Mechanism for Bot Detection in Mobile Devices, 2019.

- [67] H. Rowaihy, W. Enck, P. McDaniel, and T. La Porta. Limiting sybil attacks in structured p2p networks. In IEEE INFOCOM 2007 - 26th IEEE International Conference on Computer Communications, pages 2596–2600, 2007.

- [68] Emil Protalinski. Brave rolls out its own ads that pay users a 70% cut. https://venturebeat.com/2019/04/24/brave-rolls-out-its-own-ads-that-pay-users-a-70-cut/, 2019.

- [69] D Levin, B Bhattacharjee, JR Douceur, JR Lorch, J Mickens, and T Moscibroda. Nurikabe: Private yet accountable targeted advertising. Technical Report, 2009.

- [70] Prashanth Mohan, Suman Nath, and Oriana Riva. Prefetching mobile ads: Can advertising systems afford it? In Proceedings of the 8th ACM European Conference on Computer Systems, pages 267–280, 2013.

- [71] Wei Wang, Linlin Yang, Yanjiao Chen, and Qian Zhang. A privacy-aware framework for targeted advertising. Computer Networks, 79:17–29, 2015.

- [72] Javier Parra-Arnau. Pay-per-tracking: A collaborative masking model for web browsing. Information Sciences, 385:96–124, 2017.