The Competition for Partners in Matching Markets ††thanks: Y. Kanoria and P. Qian gratefully acknowledge the support of the National Science Foundation’s Division of Civil, Mechanical, and Manufacturing Innovation (Grant CMMI-1201045).

Abstract

We study the competition for partners in two-sided matching markets with heterogeneous agent preferences, with a focus on how the equilibrium outcomes depend on the connectivity in the market. We model random partially connected markets, with each agent having an average degree in a random (undirected) graph, and a uniformly random preference ranking over their neighbors in the graph. We formally characterize stable matchings in large markets random with small imbalance and find a threshold in the connectivity at (where is the number of agents on one side of the market) which separates a “weak competition” regime, where agents on both sides of the market do equally well, from a “strong competition” regime, where agents on the short (long) side of the market enjoy a significant advantage (disadvantage). Numerical simulations confirm and sharpen our theoretical predictions, and demonstrate robustness to our assumptions. We leverage our characterizations in two ways: First, we derive prescriptive insights into how to design the connectivity of the market to trade off optimally between the average agent welfare achieved and the number of agents who remain unmatched in the market. For most market primitives, we find that the optimal connectivity should lie in the weak competition regime or at the threshold between the regimes. Second, our analysis uncovers a new conceptual principle governing whether the short side enjoys a significant advantage in a given matching market, which can moreover be applied as a diagnostic tool given only basic summary statistics for the market. Counterfactual analyses using data on centralized high school admissions in a major USA city show the practical value of both our design insights and our diagnostic principle.

Keywords: matching markets, stable matching, competition, market design, diagnosis from summary statistics.

1 Introduction

In recent years, the use of matching platforms for various purposes such as dating, the labor market, and school and college admissions, has experienced rapid growth. Many of platforms feature agents with heterogeneous preferences for potential partners that include a significant idiosyncratic “beauty lies in the eye of the beholder” component, which varies significantly from one agent to the next. While the equilibrium notion of stable matchings is known to capture well the outcomes which arise in two-sided matching platforms (see, e.g., Hitsch et al. 2010), our understanding of the nature of these market equilibria which arise as a function of market characteristics remains partial at best. In turn, improving our understanding of market equilibria is essential to throw light on how a platform can be designed so as to maximize market performance.

A stable matching in a two-sided matching market with ordinal preferences on both sides is one in which there is no blocking pair, namely, a pair of agents who would prefer to be matched to each other over their outcome in the present matching. The structure of stable matchings which arises in a given two-sided matching market is determined by the two-sided competition for partners. To improve our understanding of stable matchings which arise in two-sided markets with idiosyncratic preferences, and to derive operational insights, the field has found it useful to investigate variants of the random matching markets model introduced by Knuth (1976), where agents have independent, complete and uniformly random preference lists over the other side of the market. One key finding from theoretical studies of random matching markets and real-world evidence is that in most two-sided matching markets, the stable matching is nearly unique (Ashlagi et al. 2017, Immorlica and Mahdian 2005, Roth and Peranson 1999, Kojima and Pathak 2009).111In matching contexts with specific structure, such as college admissions with financial aid (Biro et al. 2022), and markets with a “small-world network” preference structure (Rheingans-Yoo 2020), a large set of stable matchings has been found to be typical.

What is the structure of this (nearly unique) stable matching? Previous research has characterized stable matchings only for random matching markets at each of two extremes. (i) One line of papers studies markets which are fully connected, meaning that each agent’s preference list includes all agents on the other side of the market (e.g., Knuth 1976, Pittel 1992, Ashlagi et al. 2017). Ashlagi et al. (2017) finds that “matching markets are extremely competitive, with even the slightest imbalance greatly benefiting the short side”. Specifically, in a matching market with men and women, and uniformly randomly complete preference lists, independent across agents, there is a nearly unique stable matching, where the average rank of men for their wives is just , whereas the average rank of women for their husbands is . For example, with , men get matched to their seventh most desired woman, whereas women are matched to only their 145th most preferred man.222Of course the situation is completely reversed if, instead, there are women, while the number of men is still .(ii) Another line of papers studies random markets which are very sparsely connected, meaning that agents have preference lists of constant length regardless of market size (e.g., Immorlica and Mahdian 2005, Arnosti 2022, Ashlagi and Nikzad 2020), and finds that such markets exhibit only weak competition, namely, small changes in market composition only result in small changes in the resulting equilibrium outcome. Notably, the nature of competition and the structure of market equilibria remains largely unknown for markets with intermediate connectivity larger than a constant, despite the prevalence of real-world markets which fall in this regime.333 One example is centralized college admissions in China, where most provinces allow candidates to list up to 40 institutions and use a hybrid mechanism with resemblance to DA (Chen et al. 2020), and, anecdotally, most candidates rank between 10 and 40 of institutions (with candidates per province, so list lengths appear to be larger than a “constant” but smaller than ).

The present paper aims to develop a complete understanding of competition in partially connected random matching markets as a function of market connectivity, and to derive consequent guidance on how to design the connectivity of a matching market so as to maximize market performance. Our contribution is three-fold: we introduce a model of partially-connected random matching markets and explicitly characterize the equilibrium arising in these markets (by introducing new technical tools), we use our characterizations to derive guidance on the design of simple platform interventions which control the market connectivity, and we discover a new conceptual principle governing whether being on the short side confers a significant advantage in a given matching market, which can moreover be used as a diagnostic tool given only summary statistics for the market. We next discuss each of these contributions in turn.

Model.

Our model generalizes the random matching market model to allow “partially connected” markets with each agent having an average degree in a random (undirected) connectivity graph. Each agent has a preference ranking over only their neighbors in the connectivity graph. We assume there are men and women, where the “imbalance” may be positive or negative but we restrict to “small” imbalances for our theoretical analysis. For technical convenience, the random graph model we work with is one where each man is connected to a uniformly random subset of exactly women, independent of other men.444As a result, each woman has neighbors where denotes convergence in distribution. Throughout the paper we will restrict attention to , as a result of which , i.e., the degree of each woman is also very close to , and so the asymmetry between the two sides in the model is mainly technical.

Main theoretical findings.

We characterize stable matchings as a function of and the number of women for (small) market imbalance, and find that the short side enjoys a significant advantage only for exceeding : For moderately connected markets, specifically any such that and and large , we find that there is only a weak effect of competition, namely, the short and long sides of the market are almost equally well off, with agents on both sides getting a -ranked partner on average. On the other hand, for densely connected markets, specifically for any and large , we find that there is a strong effect of competition: assuming a small imbalance , the short side agents get a partner of rank on average, while the long side agents get a partner of (much larger) rank on average. A substantial technical challenge we overcome is the complexity in the way that Deferred Acceptance (DA) terminates when there is a positive (but vanishing) fraction of unmatched agents on both sides of the market; see Section 7 for an overview of our formal analysis.

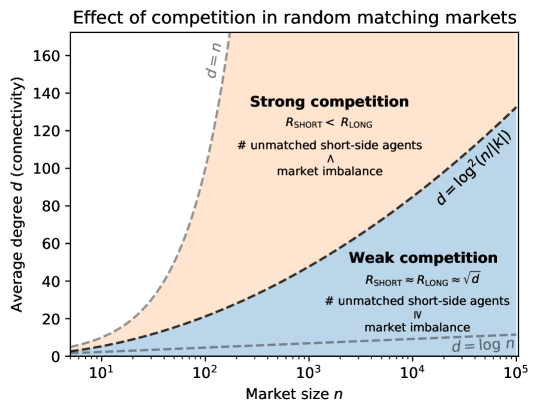

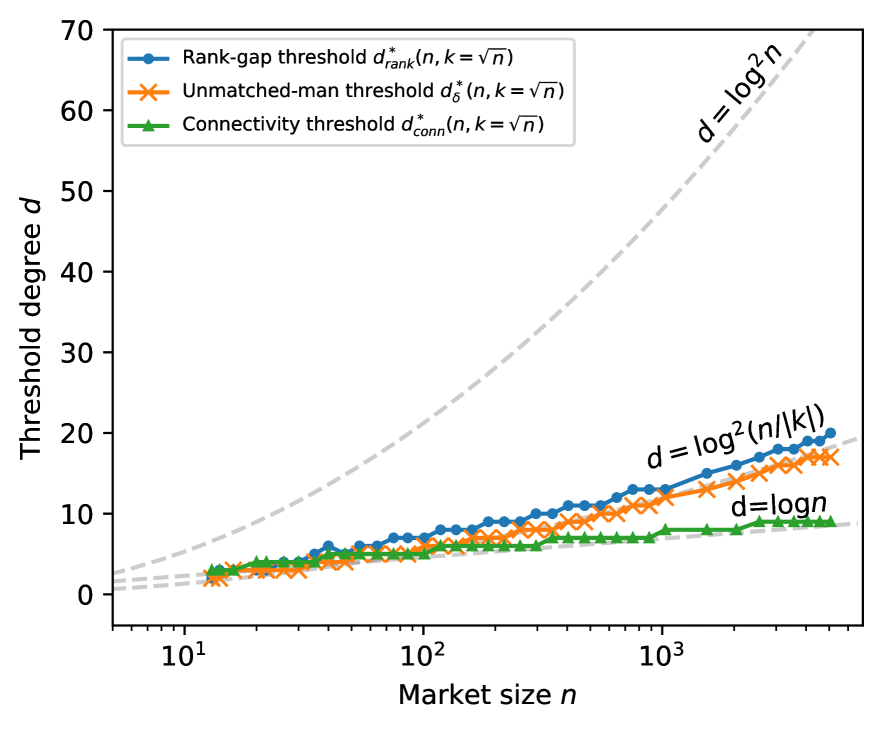

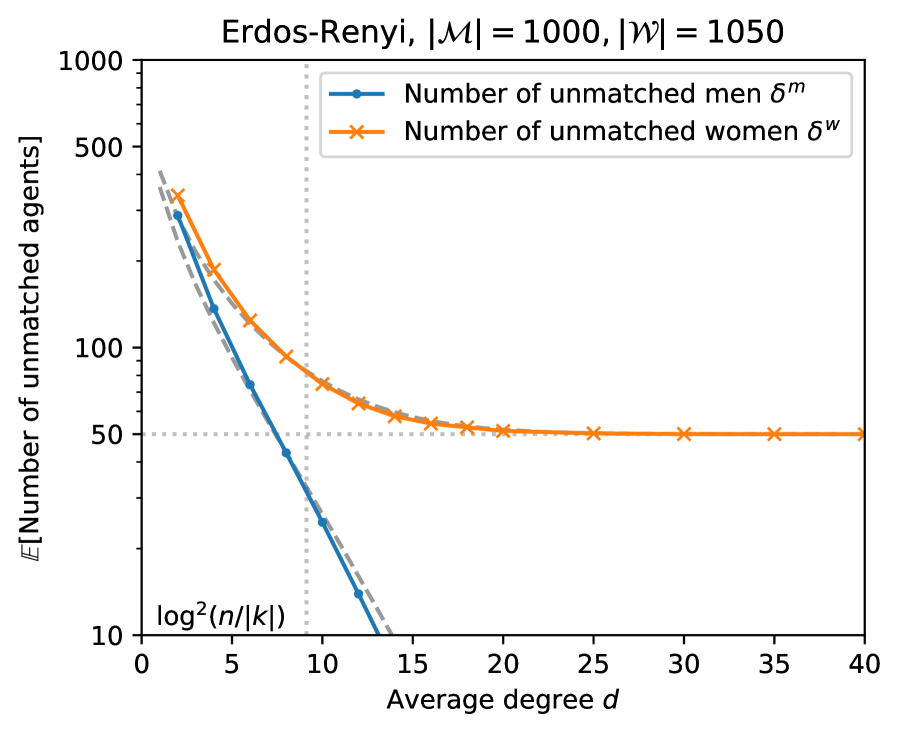

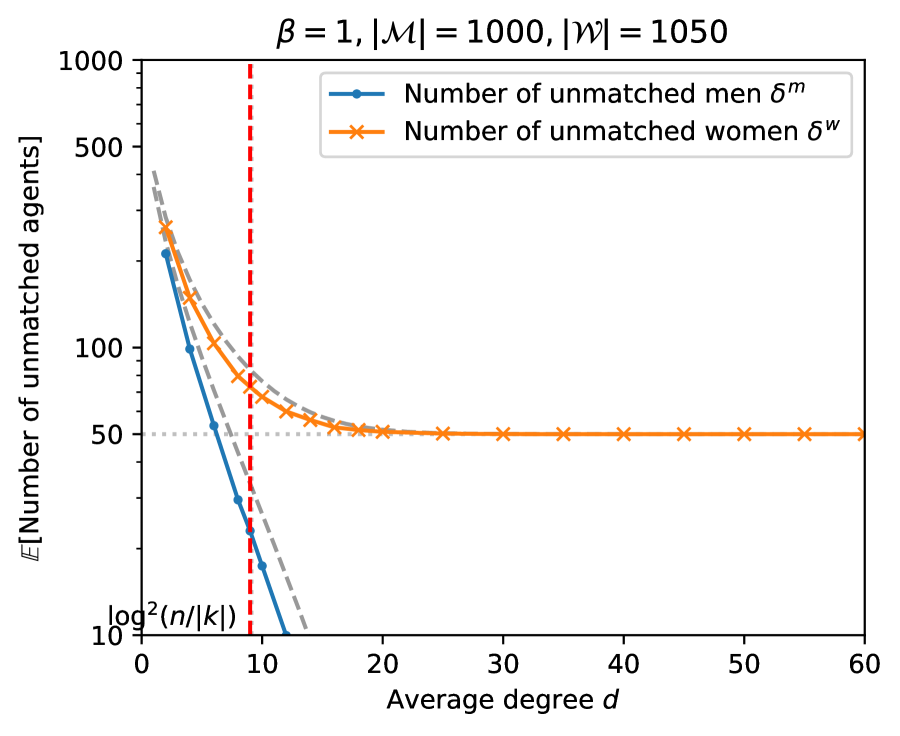

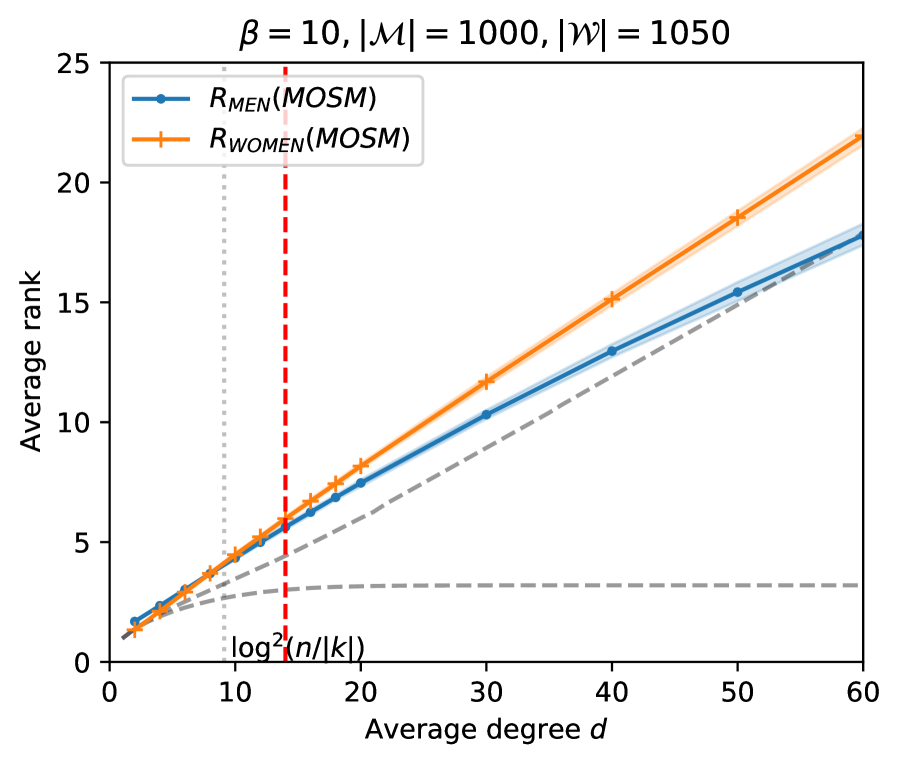

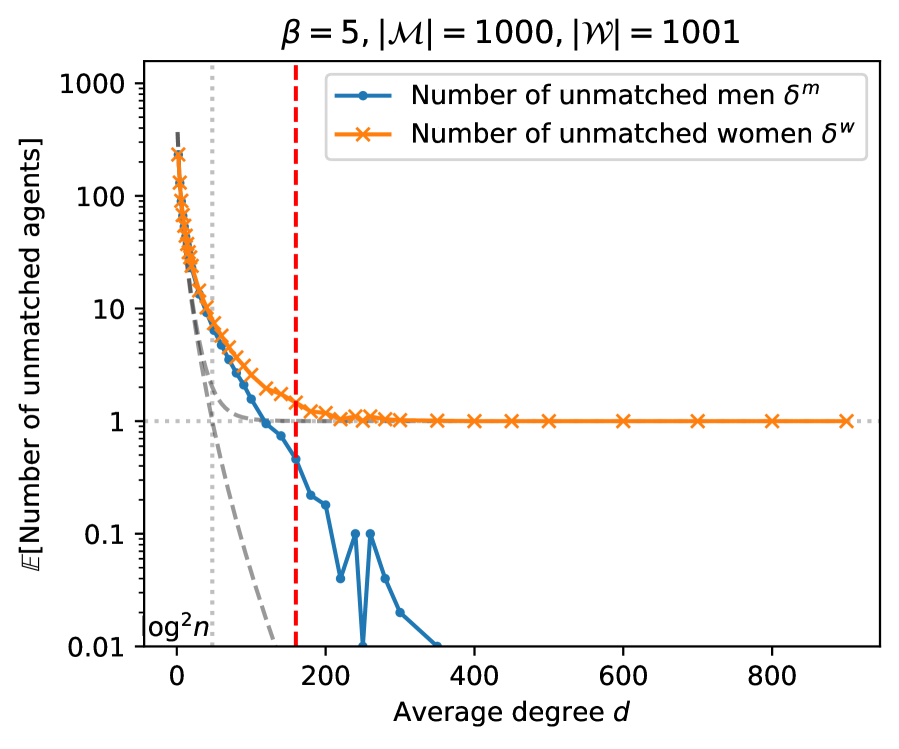

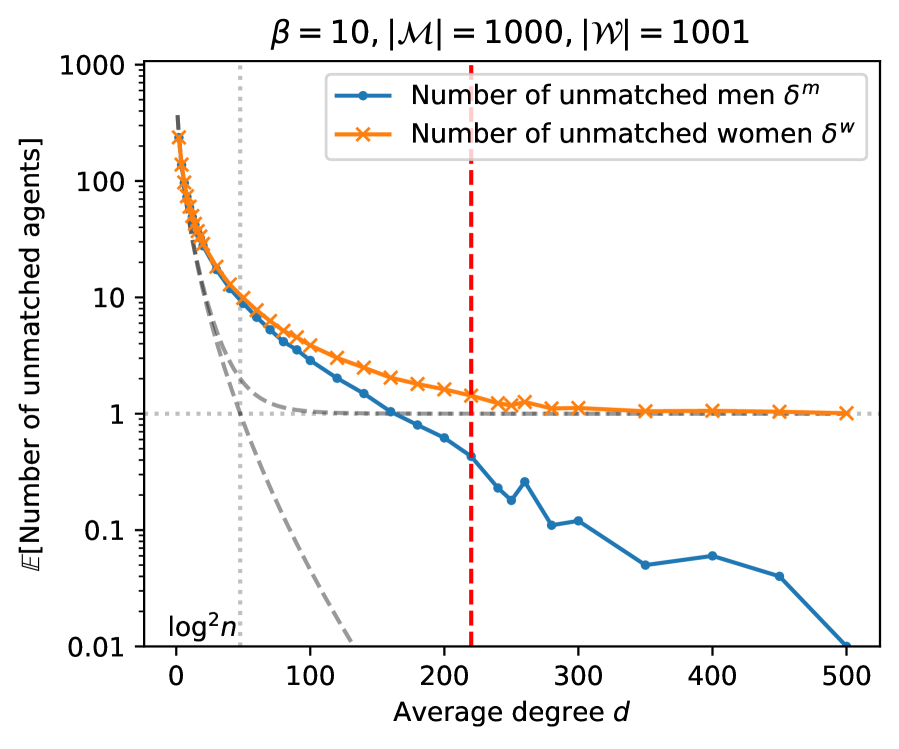

Numerical simulations of our model confirm the theoretical predictions, and in fact further refine our findings, including by capturing the dependence on the imbalance : they suggest a sharp threshold between the two regimes close to , where is the market imbalance, and that this holds even for small down to . We furthermore provide a heuristic detailed calculation which predicts the threshold being located at ; the calculation also predicts that the ranks of partners follow a truncated Geometric distribution. Figure 1 provides a schematic depicting our main findings.

Note that the weak competition regime includes a wide range of well connected markets with connectivity ; see Figure 1, is the threshold beyond which all agents becomes connected to each other with high probability. This is in sharp contrast to buyer-seller markets, where, roughly, connectedness of the consideration graph in the market implies strong competition where the short side of the market captures all the surplus (see Appendix A for a detailed description of this phenomenon). We return to the underlying driver governing strong versus weak competition in matching markets after summarizing our findings for market design.

Prescriptive insights: guidance for market design.

| Objectives | Platform Interventions | ||

|---|---|---|---|

| Optimal Consideration | Optimal Preference List Length | ||

| Set Size | Short side proposes | Long side proposes | |

| Short Side Welfare | |||

| Long Side Welfare | and | ||

| Unmatched Agents | Any | Any | Any |

| Efficient Frontier | Between and | ||

We analyze the effects of two platform interventions which allow to design the market connectivity: restricting the size of agents’ consideration sets and limiting the length of preference lists submitted by agents. The platform is assumed to have two objectives: maximizing the welfare of all agents (which equals to match value minus preference discovery cost), and minimizing the number of unmatched agents. Our analysis is not tied to these specific objectives and can be adapted to optimize alternate performance metrics. We emphasize that we are able to obtain our prescriptive insights only as a consequence of our novel equilibrium characterizations for moderate connectivity levels exceeding a constant.

The optimal level of connectivity we find in different situations and for different objectives (assuming small imbalance ) is summarized in Table 1; see Section 4 for a detailed discussion. In most situations, the welfare of agents is found to be maximized when the size of their consideration set/preference list (denoted by ) is small, specifically . However, the number of unmatched agents is minimized when is moderate or larger, specifically . This means that the range of values that achieve the efficient frontier is relatively small, namely , and lies in the weak competition regime. Intuitively, increasing beyond intensifies competition and reduces welfare, but does not help reduce the number of unmatched agents and is therefore dominated. Within the range , as the platform increases , it achieves fewer unmatched agents while also suffering lower agent welfare. Notably, our prescription to operate the market in the weak competition regime is the opposite of that resulting from Che and Tercieux (2019)’s analysis of only densely connected markets (and idiosyncratic utilities with finite support, e.g., Uniform), which suggests to operate the market in the strong competition regime. In Section 1.1, we provide a detailed comparison and argue that one should indeed operate real-world markets in the weak competition regime.

Our analysis also shows that, in typical cases, the platform should adopt the following policy when it has the ability to choose which side initiates contact: When the two sides have different costs associated with preference discovery, it is optimal to have the side with lower cost reach out. On the other hand, if the platform is more concerned with the well-being of one side of the market, it would be optimal to have the other side initiate contact.

In which matching markets does being on the short side confer an advantage?

Our analysis uncovers a new principle governing which random matching markets exhibit weak versus strong competition, which appears to generalize well beyond random markets.

Principle 1.

A market exhibits weak competition, i.e., being on the short (long) side does not confer a significant advantage (disadvantage) in terms of match quality, if and only if the number of unmatched agents on the short side the imbalance in the market.

Before discussing the practical usefulness of this simple principle, we provide some informal intuition for why it holds for random matching markets: Clearly, due to the matching constraint the number of unmatched men must be exactly plus the number of unmatched women. Hence, if and only if (i.f.f.) more than short side agents remain unmatched, the number of unmatched agents on the two sides must be within a factor two of each other. But, in a random market, the number of unmatched men should grow with (the more proposals men need to make in men-proposing DA, the larger the number of men that will reach the end of their preference list), whereas the number of unmatched women should similarly grow with (one can consider women-proposing DA, and assume that, as is typical, the WOSM is close to the MOSM). We then deduce that the average ranks are similar on the two sides of the market if and only if more than short side agents remain unmatched. In particular, using the geometric decay of partner ranks suggested by our analysis (see Section 3.1), we deduce, e.g., that under imbalance , we have more than agents remain unmatched on the short side i.f.f. # unmatched short side agents (# unmatched long side agents) i.f.f. .

Notably, the aforementioned intuition for Principle 1 would seem to extend beyond uniformly random preferences to more realistic preference structures, and we indeed find that simulation results for markets with correlated preferences confirm the predictions of the principle (see Section 5 and Appendix G). The attractiveness of Principle 1 as a diagnostic tool in a real-world context is that (while the number of unmatched agents on the short side is admittedly an endogeneous quantity) the market imbalance and the number of unmatched agents on each side of the market are basic summary statistics which are publicly known for many markets, so the principle allows an “outsider” who lacks access to preference data to nevertheless estimate whether being on the short side confers an advantage in that market.

In Section 6, we test the validity of Principle 1 in a real-world matching market. Using data from centralized high school admissions in a major US city, we conduct a counterfactual analysis studying the impact of varying the imbalance in the market on the resulting match quality for applicants. Encouragingly, we find that the prediction from the principle aligns well with our findings, both for the real market, as well as for counterfactual markets with other levels of imbalance. Specifically, we find that Principle 1 predicts strong competition for a given level of imbalance based on summary statistics alone, if and only if the detailed analysis uncovers a substantial impact of market imbalance on match quality, e.g., the percentage of applicants who get their top choice school changes by . Notably, whether applicants are on the short side or on the long side, Principle 1 is found to predict strong competition for markets exceeding nearly the same “cutoff” on match quality impact of imbalance (of course the sign of the change depends on the sign of the imbalance). Encouraged, we then leverage Principle 1 to make a conjecture about a different real-world market for which researchers have typically been denied access to detailed preference data. Namely, Principle 1 suggests that in the medical residency matching market in USA, being on the long (short) side only moderately degrades (improves) match quality for applicants (programs).

1.1 Related work

Our work belongs to a vast theoretical literature on matching markets, which began with the work of Gale and Shapley (1962) introducing stable matching and the deferred acceptance algorithm, and has developed over the last six decades with major contributions by Roth, Sotomayor, and a large number of other prominent researchers (see, e.g., Roth and Sotomayor 1990, David 2013). Closely related to our work are previous papers studying random matching markets with complete preference lists (Knuth 1976, Pittel 1989, Knuth et al. 1990, Pittel 1992, Ashlagi et al. 2017, Pittel 2019). Whereas the early papers focused on balanced random markets and found that the proposing side (in DA) has a substantial advantage, Ashlagi et al. (2017) and follow up papers found that in unbalanced markets, the short side has a substantial advantage, and the core (i.e., the set of stable matchings) is small. The main technical difficulty we face relative to these papers is that a positive number of agents remain unmatched on both sides of the market in moderately connected markets , preventing us from directly leveraging the analogy with the coupon collector problem as in previous works.

Notable papers by Immorlica and Mahdian and others (Immorlica and Mahdian 2005, Kojima and Pathak 2009) show a small core while working with short (constant-sized) preference lists, leading to a linear fraction of unmatched agents. Arnosti (2022) and Menzel (2015) characterize the (nearly unique) stable outcome in settings with constant-sized preference lists, and in particular, we expect their characterizations can be used to show that the outcome changes “smoothly” as a function of the market imbalance under short lists. In contrast to the aforementioned papers, our work restricts attention to the case and indeed identifies the existence of a threshold at , as a result of which the fraction of unmatched agents in our setting is vanishing. Technically, the consequence of this phenomenon is that “rejection chains” in the progress of DA are in length in our work, making them harder to analyze, and the (approximate) system “state” no longer has bounded dimension as in Arnosti (2022).

There is a robust and growing body of practical work on designing real world matching markets, especially in the contexts of school and college admissions (e.g., Rios et al. 2019, Abdulkadiroglu et al. 2005, Dur et al. 2018), and various labor markets (e.g., Roth and Peranson 1999, Hassidim et al. 2017). Stability, namely, that no two agents should prefer to match with each other rather than their current partners, has been found to be crucial in the design of centralized clearinghouses (Roth 1991) and predictive of outcomes in decentralized matching markets (Kagel and Roth 2000, Hitsch et al. 2010). In most real world matching datasets, the short side of the market does not benefit from being on the short side if the market imbalance is small, consistent with the weak competition regime we find.

Variants of the market design interventions we study (limiting preference list lengths and restricting the size of consideration sets) have previously been proposed and studied in a different context, namely, that of reducing congestion in decentralized matching markets. We find it convenient to employ labor market terminology in summarizing this line of work. Roth and Xing (1994) introduce the phenomenon of congestion, i.e., that it is impossible or costly for employers to make offers to many applicants and that employers compete for the same applicants. In such cases, a reasonable design choice is to enable applicants to signal their interest to employers; see, e.g., Lee and Niederle (2015) and Coles et al. (2010) for applications in online data markets and the academic job market, respectively, and Coles et al. (2013), Halaburda et al. (2018), and Jagadeesan and Wei (2018), for examples of how signaling can improve equilibrium outcomes. We emphasize that our market design insights are distinct from the aforementioned works, since we assume that a stable matching on the reported preferences will be implemented (e.g., using a centralized clearinghouse), and focus on gains in match quality from deploying these interventions.

We now discuss market design interventions previously proposed for improving match quality in centralized matching markets. Ashlagi et al. (2019) and Arnosti (2022) show that in school choice, single tie-breaking (the same lottery number being using by all programs to break ties between students) can produce higher quality match outcomes for students than multiple tie-breaking (different programs breaking ties independently). Ashlagi et al. (2019) also show that under multiple tie-breaking, when applicants are on the long side of a fully connected market, applicants do poorly under unrestricted preference lists, and suggest to impose a restriction on the length of applicant preference lists can improve average rank without significantly reducing the number of assigned students. Che and Tercieux (2019) obtain similar results, and find that restricting the length of the preference lists of applicants to a level which is but can produce asymptotic efficiency while preserving asymptotic stability. The latter paper proposes DA with a circuit breaker (a generalization of DA with restricted preference list length) as a mechanism to achieve a good tradeoff between efficiency and stability in object allocation problems. Notably, these papers provide sharp characterizations only in densely connected markets (i.e., in the “strong competition” regime we find) (Ashlagi et al. 2019, Che and Tercieux 2019), or in markets with constant-length preference lists (Arnosti 2022). We now make a more detailed comparison with the aforementioned finding of Che and Tercieux (2019), which notably suggests to operate the market in what we identify as the strong competition regime. This is both quantitatively and qualitatively different from our finding that the Pareto optimal list lengths (when the long side proposes, optimizing for the long-side match utility and the number of unmatched agents) are in and cause the market to lie in the weak competition regime. Why this striking difference in findings, and which guidance is more practically relevant? The dual platform objectives considered in the papers are similar (the stability objective in Che and Tercieux (2019) is closely related to our “number of unmatched agents” metric). The key difference lies in the way match utilities are modelled, which determines whether a non-trivial tradeoff arises between the two objectives. Che and Tercieux (2019) model the idiosyncratic part of agent match utilities as being uniform (or finite-support generalizations). As a result, any leads to asymptotically optimal long side welfare because almost all matched agents get match utility close to the maximum in the support of the idiosyncratic utility distribution. There is no real tradeoff between efficiency and stability (which may be viewed as unrealistic behavior of that model), and any asymptotically optimizes both objectives. In contrast, we model heavy-tailed idiosyncratic cardinal preferences (which are arguably more realistic than finite-support preferences). As a result, the long-side welfare is maximized for a preference list length restriction , and decays polynomially in in the strong competition regime. The number of unmatched agents is minimized for all larger than the threshold for strong competition , causing such to be Pareto dominated, and leading to a non-trivial tradeoff between the two objectives for in the weak competition regime. Our new, sharp characterization of stable outcomes in the weak competition regime allows us to quantify this tradeoff and prescribe an optimal list length restriction. Notably the data driven “field study” of Che and Tercieux (2019) indeed reveals a non-trivial tradeoff between stability and efficiency and ultimately arrives at a recommendation of relatively short lists (of length between 2 and 6), consistent with our theoretical findings.

Organization of the paper.

In Section 2, we introduce our model of partially connected random matching markets. In Section 3, we state our main theorems (Theorem 1 and 2) and discuss them. An overview of our proof of our characterization of moderately connected markets (Theorem 1) is provided in Section 7. In Section 4, we obtain market design insights based on our main results. In Section 5, we provide the simulation results that confirm and sharpen our theoretical predictions. In Section 6 we use real-world data to test our prescriptive and design insights. Formal proofs are relegated to the appendix.

Asymptotic notations.

For two sequences of positive real numbers and : We write as if ; We write as if ; We write as if ; We write as if ; We write as if and .

2 Model

We consider a two-sided market that consists of a set of men and a set of women . Here is a positive or negative integer, which we call the imbalance.

An undirected bipartite random graph connecting men to women . Given , each agent has a strict preference ranking (denoted by for agent ) over all his/her neighbors in and does not rank any other agents. Woman (man )’s neighbors in are denoted by (resp., ). A matching is a mapping from to itself such that for every , , and for every , , and for every , implies . We use to denote that agent is unmatched under . A matching is unstable if there is a man and a woman such that and (called a blocking pair). A matching is stable if there is no blocking pair.

A random matching market is generated by drawing:

-

•

An undirected bipartite random consideration graph connecting men with women , where each man is connected to neighboring women (denoted by for man ) selected uniformly at random and independently across men (from among the possibilities).

-

•

For each man , a uniformly random complete preference list over , and for each woman , a uniformly random complete preference list over , independently across agents.

A stable matching always exists. It can be found using the Deferred Acceptance (DA) algorithm by Gale and Shapley (Gale and Shapley 1962). They show that the men-proposing DA finds the men-optimal stable matching (MOSM), in which every man is matched with his most preferred stable woman. The MOSM matches every woman with her least preferred stable man. Likewise, the women-proposing DA produces the women-optimal stable matching (WOSM) with symmetric properties. All of our results will characterize the MOSM. Given the strong evidence from Immorlica and Mahdian (2005), Kojima and Pathak (2009), Ashlagi et al. (2017) and other works that the MOSM and WOSM are nearly the same in typical matching markets (with the exception of balanced and densely connected random markets, which we avoid by assuming in Theorem 2), we omit to formally show this fact for our setting though we believe it can be done, e.g., using the method developed in Cai and Thomas (2019) (the property is found to hold consistently in our numerical simulations of our model).

We are interested in how matched agents rank their assigned partners under stable matching, and in the number of agents who are left unmatched. Denote the rank of woman in the preference list of man by . Smaller ranks are preferred, and ’s most preferred woman has a rank of . Symmetrically, denote the rank of in the preference list of by .

Definition 1.

Given a matching , the men’s average rank of wives is given by

where is the set of men who are unmatched under , and the number of unmatched men is denoted by , i.e., .

Similarly, the women’s average rank of husbands is given by

where is the set of women who are unmatched under , and the number of unmatched women is denoted by , i.e., .

(Note here that if an agent is unmatched, we take the rank for the agent to be one more than the length of the agent’s preference list.) By the rural hospital theorem (Roth 1986), the set of unmatched agents ( and ) is the same in every stable matching , and therefore we simply represent the number of unmatched men and women under stable matching by and respectively throughout the remainder of paper.

We remark that the only asymmetry in our model is that the lengths of men’s preference lists are deterministically , whereas each woman has neighbors555The approximation is correct since we assume in our main result (Theorem 1) that . where denotes convergence in distribution. Since our theoretical analysis will assume , we have , i.e., the degree of each woman is also very close to , and so the asymmetry between the two sides in the model is a technical one.666We numerically tested the behavior of random markets with a bipartite Erdos-Renyi connectivity graph with edge probability (and hence average degree ), and found the behavior to be very similar to that under our formal model (if anything, the theoretical predictions were found to be even more accurate for the Erdos-Renyi model); see Appendix G. Note that the Erdos-Renyi connectivity model is symmetric in the two sides of the market.

3 Theoretical Results

In this section we state and discuss our main theoretical results, which characterize the average rank of partners and the number of unmatched agents in markets, as a function of market connectivity. In Section 3.1 we provide intuition leading informally to a detailed picture of the market equilibrium.

Moderately and sparsely connected markets.

In our first main result, we show that there is an insignificant advantage from being on the short side in partially connected markets with small imbalance whose connectivity parameter is .

Theorem 1 (Moderately Connected Markets).

Fix any . Consider a sequence of random matching markets indexed by , with men and women ( can be positive or negative or zero), and connectivity (average degree) , with and , and . Then with high probability,777Specifically, our characterization holds with probability at least . we have

Informally, in large random matching markets with average degree and a small imbalance , under stable matching we have irrespective of which side is the short side, and there are approximately unmatched agents on both sides of the market. Thus there is no short-side advantage and agents on both sides are matched to their -th ranked partner on average. A significant number of agents are left unmatched even on the short side, in contrast to a fully connected unbalanced matching market where all agents on the short side are matched. Though we only characterize the MOSM in the present version of the paper, we believe the same characterization extends to the WOSM as well. We give an overview of the proof of Theorem 1 in Section 7 and the formal proof in Appendix C. Note that under and hence the theorem can equivalently be stated for .

The main intuition for Theorem 1 is that for , more than men remain unmatched with high probability, because they reach the end of their preference lists in men-proposing DA (cf. Pittel (2019), who showed that some men need to go deep in their preference lists in the fully connected market). Clearly, the number of unmatched men must be exactly plus the number of unmatched women. Then, assuming a small imbalance , the number of unmatched agents on the two sides must be nearly the same (up to a factor less than 2). But the number of unmatched men should grow with (the more men need to propose, the larger the number that will reach the end of their preference lists), whereas the number of unmatched women should similarly grow with (e.g., one can consider women proposing DA, and assume that, as usual, the WOSM is close to the MOSM). We deduce that we should have in the regime. (Informal quantitative intuition leading to the precise estimates of and will be provided later in Section 3.1.)

We highlight that Theorem 1 encompasses a wide range of connectivity parameters (for ), which extends far beyond the connectedness threshold of the consideration graph (this is also the connectedness threshold for Erdős-Rényi random graphs). Thus our “weak competition regime” result does not require a disconnected or fragmented market. Rather, the result applies even to very well connected markets.888For example, with , . Taking (much less than 48), numerics tell us that 9.6% of pairs of men are within 1 hop of each other (i.e., there is woman who is ranked by both men), and 99.98% of pairs of men are within 2 hops of each other. This is in sharp contrast to buyer-seller markets, where, roughly, connectedness of the consideration graph implies a strong effect of competition. See Appendix A for a precise description of the latter behavior of buyer-seller markets.

Densely connected markets.

Our next result shows that for , the finding of Ashlagi et al. (2017) holds true, i.e., the short side is markedly better off even in (large) markets with a small imbalance (we note that the recent paper (Che and Tercieux 2019, Theorem 4) contains a related result). Moreover, this benefit of being on the short side arises in conjunction with the key property that most agents on the short side of the market are matched. (The theorem establishes a stronger property leveraging its strong assumption , namely, with high probability, all short side agents are matched.)

Theorem 2 (Densely Connected Markets).

Consider a sequence of random matching markets indexed by , with men and women, and connectivity (average degree) , with and , and . Then, with high probability, all men are matched under stable matching, and we have

This result shows that the short-side advantage emerges in densely connected markets even when the imbalance is small (including for an imbalance of one, i.e., ). More specifically, when , it predicts that the agents on the short side are matched to their -th ranked partner on average whereas the agents on the long side are matched to their -th ranked partner on average. Theorem 2 smoothly interpolates between the result in AKL (Ashlagi et al. 2017) and our Theorem 1 (though the extremes and are not covered by the formal statement in present form): as connectivity increases, a phase transition happens at , and the short side advantage starts to emerge for . The magnitude of the advantage increases as the market becomes denser. Combining Theorems 1 and 2, we conclude that, assuming a small imbalance, a short-side advantage exists if and only if a matching market is connected densely enough, and the threshold level of connectivity .

The analysis leading to Theorem 2 is similar to that leading to (Ashlagi et al. 2017, Theorem 2). The number of proposals in men-proposing DA remains unaffected; the only change is that women now have rank lists of approximate length (instead of length ), and so, receiving about proposals leads to an average rank of husband of about . The proof is in Appendix D.

3.1 Detailed heuristic picture of market equilibrium

In this section, we provide more detailed quantitative intuition which helps explain our estimates of and in Theorem 1, and also yields Principle 1 capturing which random markets exhibit strong competition. This intuition is based on a detailed heuristic picture of the stable outcome in a random matching market. We do not formally prove this detailed picture in this paper (Theorem 1 is instead proved via a “shortcut”).

Intuition for Theorem 1.

Consider the man-proposing deferred acceptance algorithm in a random market. Intuitively, both and the number of unmatched men should be governed by the (endogenous) probability that a neighboring woman (independently of other women) is “interested” in given man (the woman is said to be interested if she receives no proposal which she prefers to ): in particular, the rank of man for his wife (his most preferred woman who accepts his proposal) should be distributed as truncated at , leading to (assuming ) and . Analogously for women, letting denote the (endogeneous) probability that woman receives a proposal from each neighboring man , we expect and , with partner ranks distributed as Geometric truncated at the woman’s degree (which is random but concentrated around ). For small, in moderately connected markets where many short side agents are unmatched , we have that both sides must have nearly the same number of unmatched agents and hence and . But we can further get quantitative estimates: the average number of proposals received by women is nearly the same as the average number of proposals made by men , and since . We deduce that and so and .

Principle 1 and the threshold level of connectivity.

In Appendix F, we refine the detailed heuristic picture above, and deduce a conjecture which amounts to a detailed version of Principle 1 for random markets. The conjecture (stated in Appendix F) may be informally summarized as follows: Fix any and assume with men on the short side. Then there is a threshold connectivity , and a rank ratio threshold such that:

-

•

If , with high probability, and .

-

•

If , with high probability, and .

In particular, few agents are unmatched on the short side (relative to the imbalance) if and only if the short side is significantly better off. We find that produces high quality numerical estimates in finite random markets, and hence use that choice of in deploying our insights in Sections 5 and 6. Note that the sharp estimate of the boundary between the strong and weak competition regimes is consistent with our (weaker) formal results, Theorems 1 and 2. Theorem 2 establishes strong competition for . Theorem 1, under the assumption of small imbalance , shows weak competition under .

Distribution of agents’ ranks of partners.

In order to understand how market connectivity impacts the welfare of agents, one needs to consider the distribution (rather than the average) of agents’ ranks of partners. Reassuringly, our market design insights, obtained in Section 4, are not sensitive to the specifics of these distributions as long as they have a subexponential tail, which we conjecture is indeed the case. For example, the insights hold when men’s ranks of wives follow a (truncated) Geometric distribution as conjectured above, and the number of proposals a woman receives follows a Poisson distribution (as one may analogously conjecture).

4 Implications for the Design of Matching Platforms

In this section, we demonstrate how to use the theoretical findings made in Section 3 to tackle market design questions. We discuss the following platform interventions which allow to control the market connectivity, and how to optimally deploy them in random markets:

-

•

Limiting consideration sets (Section 4.2). The platform constructs a random consideration graph and only presents to each agent their neighbors in the consideration graph (consideration sets) as potential partners. We denote the average cardinality of each consideration set by , which is chosen by the platform. Agents provide a preference ranking over their consideration sets and the platform then implements a stable matching.

-

•

Limiting preference list lengths (Section 4.3). We assume that contacts are always initiated by one side of the market, which we call the proposing side. The platform sets a limit on the length of preference lists of the agents on the proposing side. The other (“receiving”) side of the market is asked to construct a preference ranking over proposing-side agents who reached out to them. Agents provide their preference lists and the platform then implements a stable matching.

We quantify market performance in terms of two metrics: the utilitarian welfare of agents, and the number of unmatched agents. For both interventions, we reach similar high-level conclusions regarding the impact of on market performance:

-

1

Typically, utilitarian welfare of the agents is maximized for a consideration set size/allowed preference list length (both denoted by ) which is small (i.e., ).

-

2

The number of unmatched agents is minimized for moderate-sized or larger ; specifically, . While the number of unmatched agents is (weakly) decreasing in , there is no further reduction in the number of unmatched agents from increasing above .

-

3

As a result, the set of that are Pareto optimal is small to moderate, in particular, between and . This provides theoretical evidence that supports the case of using small to moderate in real-world applications. Large leads to wasteful competition among agents which decreases utilitarian welfare without reducing the number of unmatched agents.

When the platform has the flexibility to choose which side initiates contact, we find that in typical cases the following policy is optimal: When the two sides have different costs associated with preference discovery, it is optimal to have the side with lower cost reach out. On the other hand, if the platform is more concerned with the well-being of one side of the market (and preference discovery costs are similar across the two sides), it is optimal to have the other side initiate contact. We discuss this finding in more detail at the end of Section 4.3 and compare it with results in previous works, e.g., Kanoria and Saban (2021).

We conclude our summary by comparing the efficacy of the two interventions studied: For the same , we find that limiting list lengths provides higher match quality for the proposing side, while achieving the same number of unmatched agents and the same utility for the receiving side. The caveat is that the limiting list length option inherently requires more “preference discovery” effort from proposing agents in constructing their preferences over the receiving side of the market, relative to the intervention of limiting consideration set size. This tradeoff governs the appropriate choice between the interventions for a given market, if either intervention is feasible a priori.999We do not formally study this tradeoff in this paper.

4.1 Metrics for evaluating matchings

We study how different platform interventions perform according to the following two objectives:

-

•

Utilitarian welfare. Intuitively, the utility obtained by each agent should have two components: the value derived from matching with another agent, and the cost of discovering their own preferences. We will define them formally below.

-

•

Number of unmatched agents. In many applications, the platform also cares about how many agents are left unmatched. We use the number of unmatched short-side agents as the second performance metric (note that the number of unmatched long-side agents is simply plus the market imbalance ).

Match value through random utility.

In this section, we think of the ordinal preferences in the random matching market model defined in Section 2 can be generated by the following cardinal random utility model: the value agent obtains when matched with agent is drawn i.i.d. from distribution101010The analysis extends immediately to more general value distributions, e.g., depends on which side the agent belongs, though at a significant notational burden. We reason that the cost of carrying the reader through this generalization exceeds the benefit of doing so, and hence assume the same value distribution for both sides throughout the paper. . Note that the ordinal preference ranking resulting from such random utility draws is uniformly distributed among all permutations, and independent across agents. We assume that unmatched agents receive a match value of zero.

A particular family of value distributions of interest is the power-law family, i.e., the Pareto distributions. These distributions capture the phenomenon that the value differential near the top of an agents’ preference list (e.g., the difference in value between the -st and -rd ranked choices) is typically much larger than the value differential lower in the agents’ preference list (e.g., the difference in value between the -th and -th ranked choices). Such heavy-tailed valuations have been fruitfully modelled in other contexts such as bundling of products (Ibragimov and Walden 2010), and more generally, heavy-tailed distributions have been observed and studied in a wide variety of contexts in finance, economics, marketing, and operations, among other fields (see, e.g., Ibragimov et al. 2015, Resnick 2007, Shapiro et al. 1999, Anderson 2006, Taleb 2007). In this section, we assume that follows a Pareto distribution with parameters , i.e., the probability density function of is . Here we assume since otherwise has unbounded mean.

Cost of preference discovery.

We model the cost incurred by an agent in determining their preference ranking over a given set of potential partners as , where . This cost structure is based on the idea that the marginal cost of considering an additional potential partner tends to decrease as the number of partners increases. It is worth noting that if an agent needs to report their top preferences among a larger pool of options, the cost is modelled as (as the agent presumably evaluates all of the available choices).

Preliminaries: random order statistics.

If an agent gets matched to their -th most preferred partner among choices, the match value they obtain is distributed as the -th largest order statistic out of independent samples from , denoted by . As a result, order statistics play a key role in our analysis, and we provide below a technical result that will come in handy later.

To make the presentation easier to understand, it is helpful to introduce additional asymptotic notation. For two positive real-valued sequences and : We use the notation if as , and the notation if as .

The following lemma (proved in Appendix E) specifies the scaling behavior of the relevant random order statistics.

Lemma 1.

We have the following results:

-

1

Let be a sub-exponential random variable which is the -th largest order statistic out of samples from Pareto distribution with scale parameter and shape parameter . Here is a sub-exponential random variable with mean . Assume that as . We have

-

2

Let be a random variable which is the largest order statistic out of samples from a Pareto distribution with scale parameter and shape parameter . Here is a sub-exponential random variable with mean . We have .

Roughly speaking, Lemma 1 states that if an agent’s rank distribution has a light tail, the stochasticity in the distribution can be disregarded when determining the order of magnitude of the average match value. We make use of Theorem 1, in conjunction with Lemma 1 and our assumption that rank distributions are truncated Geometric (and hence subexponential), to obtain the estimates of welfare and the number of unmatched agents presented in the rest of this section.

4.2 Limiting consideration sets

We first study the effect of limiting the size of agents’ considerations sets. Throughout this subsection, we denote the consideration set size by . Let ( is short for onsideration set) be the utility of a representative agent on the short side of the market, and is defined similarly for an agent on the long side. Let be the number of unmatched short-side agents. Note that the match value of short-side (long-side) agents has the same distribution as () defined in Lemma 1, where and other estimates come from Theorem 1.

Assuming the rank distributions of agents are sub-exponential and small market imbalance satisfying for some fixed , we obtain the following approximations of and (using the asymptotic notation we introduced in Section 4.1):

-

•

Short-side agents’ average utility is .

-

•

Long-side agents’ average utility is .

-

•

The average number of unmatched (short-side) agents is .

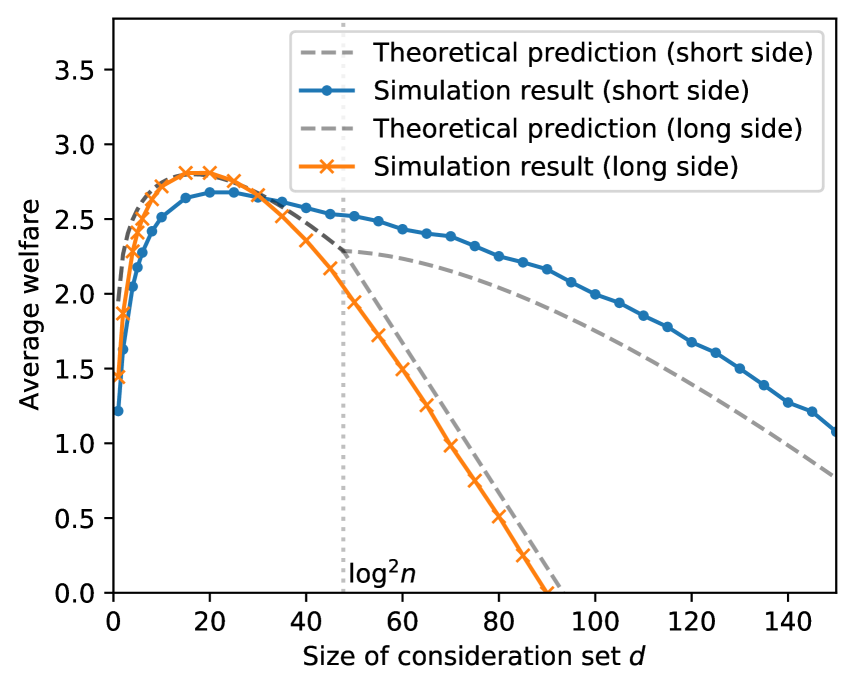

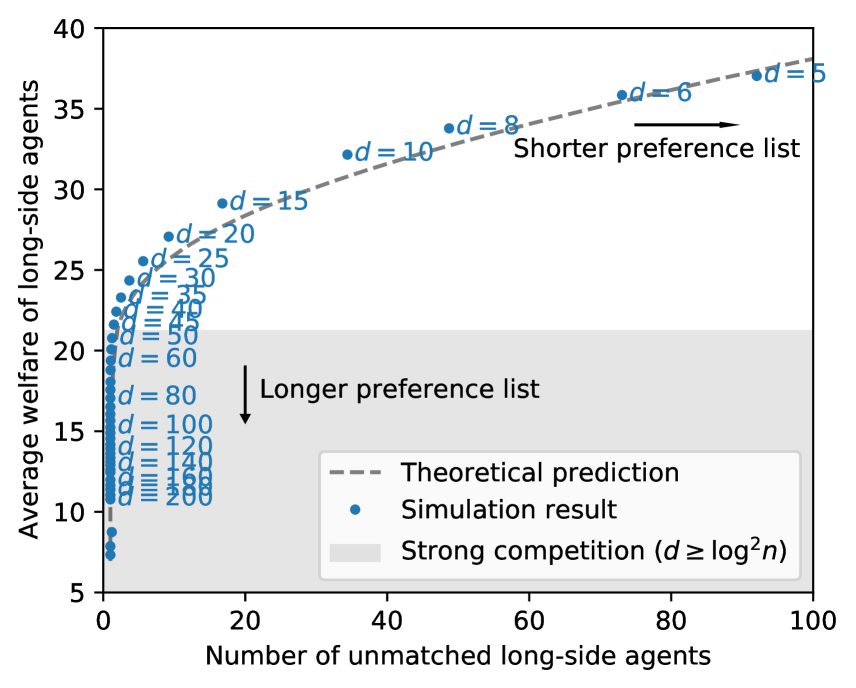

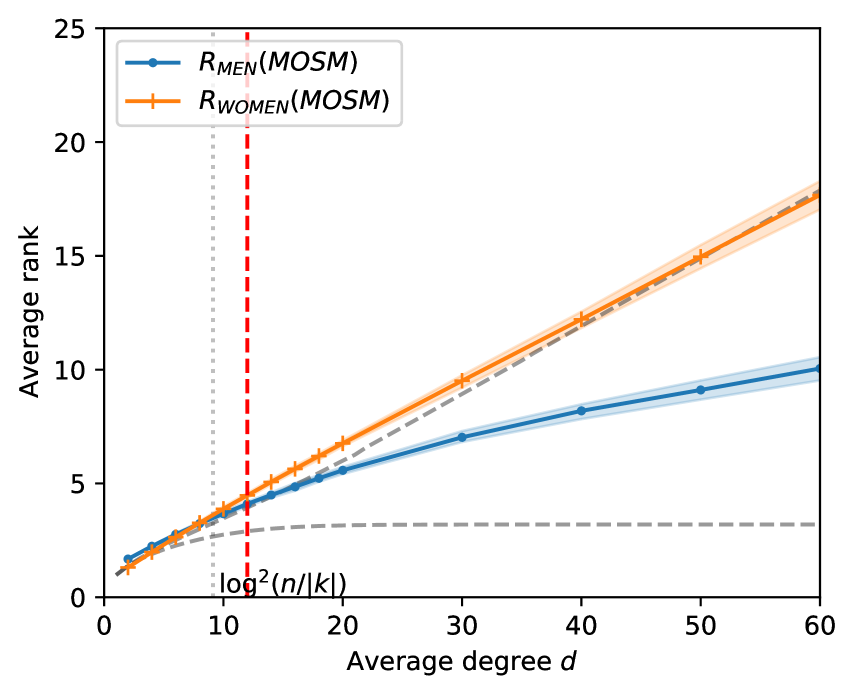

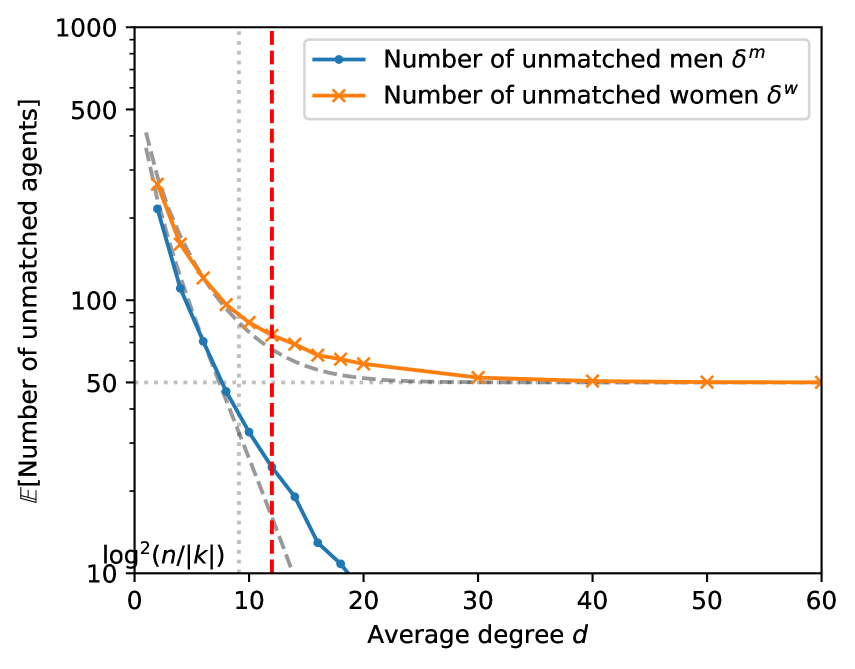

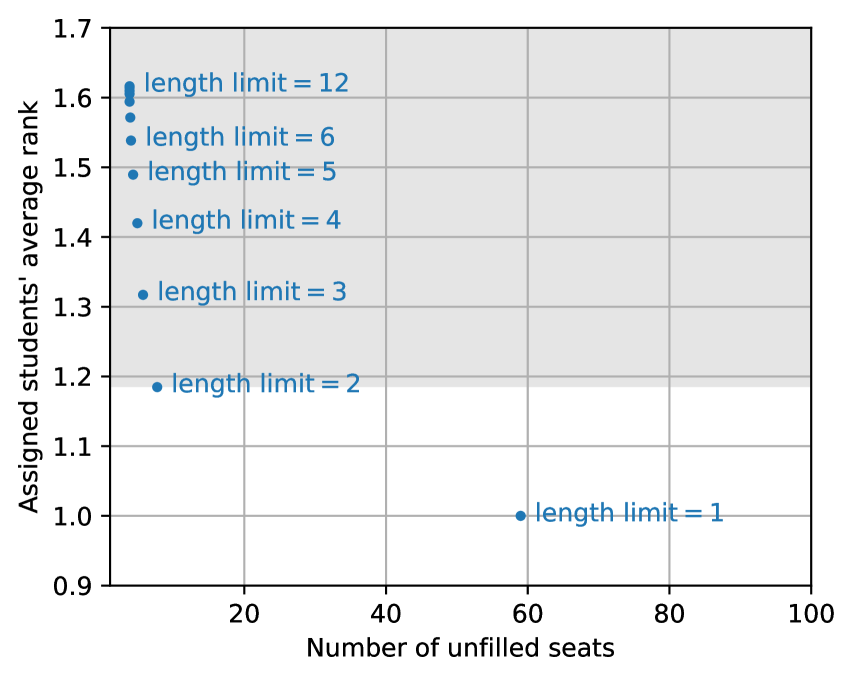

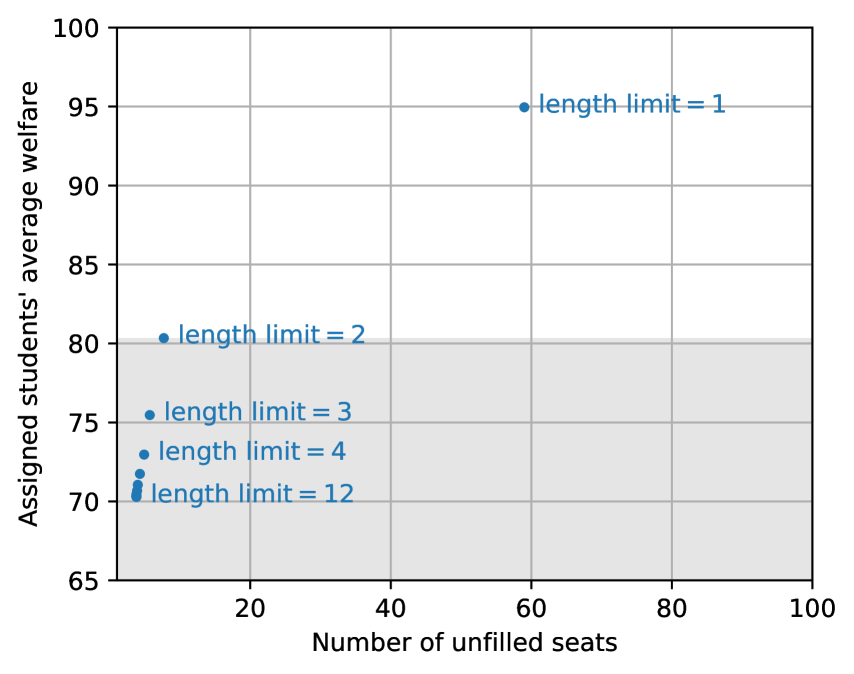

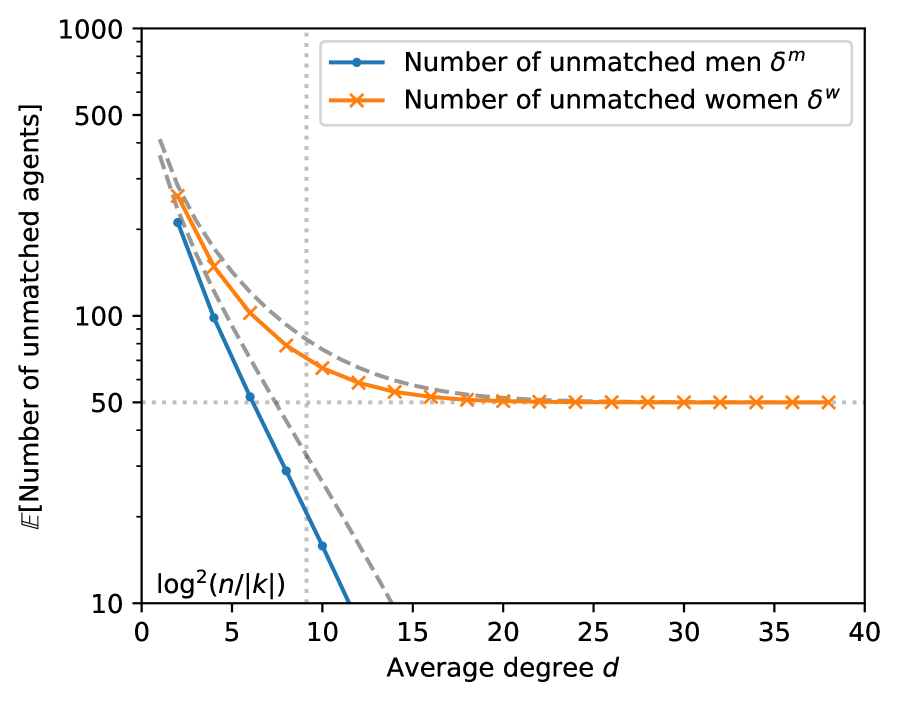

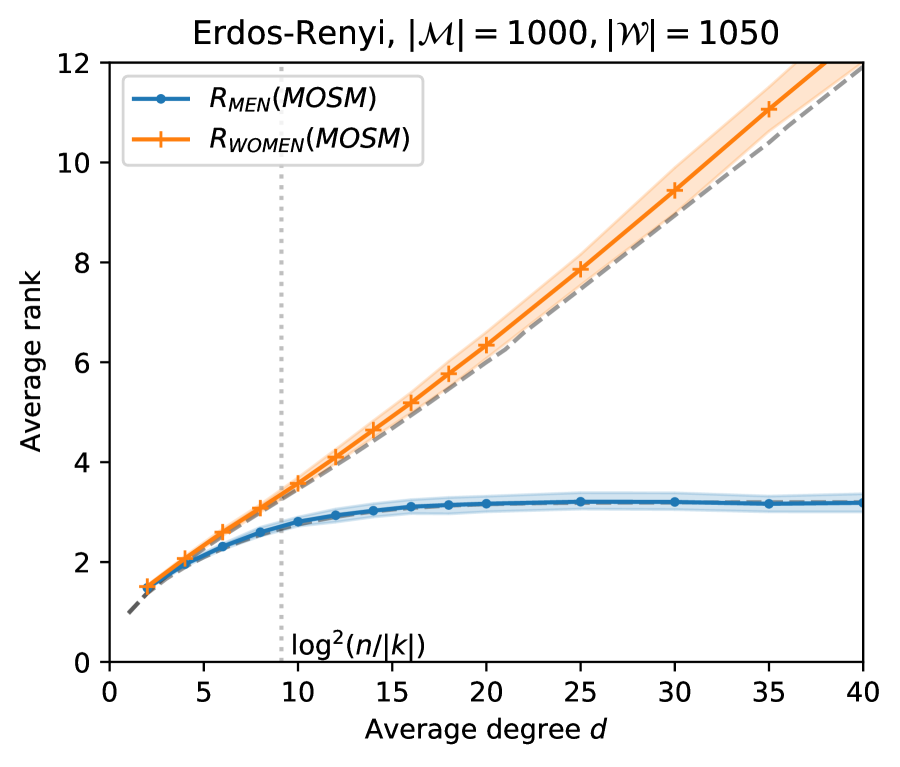

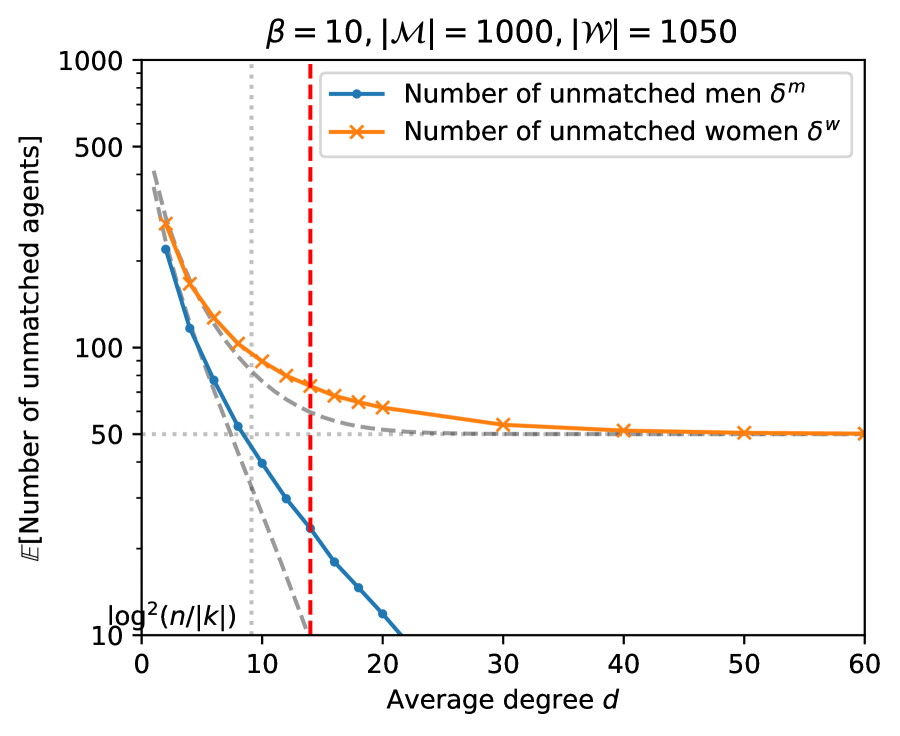

Simulation results (see Figure 2) confirm that the above predictions approximate well the stable matching in random matching markets. The estimates above establish that two regimes arise in the planner’s problem.

-

•

If the preference learning cost grows slowly in , in particular if , it is optimal to set , as there is no trade-off between welfare and number of matches formed, and it is best to have a fully connected market.

-

•

If the preference learning cost grows quickly in , in particular if , the Pareto optimal lie in the range . In this case, there is a trade-off between the two objectives: Utilitarian welfare is maximized at since the preference learning cost dominates the match value so smaller is preferred. The number of unmatched agents is minimized for any . Therefore, the Pareto optimal .

We expect that the preference learning cost grows quickly in in most real world markets, i.e., the second regime above is typical. The finding above suggests that a platform should deploy small to moderate-sized consideration sets () in such markets. This insight is corroborated by our simulation results: Figure 2 illustrates that increasing within the range can significantly reduce the number of unmatched agents (this finding applies to both interventions we study), whereas increasing beyond does not reduce this number by much. Meanwhile, the average welfare of agents is maximized for a smaller () value of . The Pareto frontier between the two objectives is generated by between these values.

4.3 Limiting preference list length

We now study the optimal preference list length restriction. Let ( is short for reference list) be the utility of a representative agent on the short side of the market, and is defined similarly for an agent on the long side. Let be the number of unmatched short-side agents. Note that it matters which side proposes: The preference discovery cost is on the proposing side of the market, and only on the receiving side of the market. On the other hand, proposing allows the proposing side to obtain higher match utility. Therefore we present the findings in two cases. We assume subexponential rank distributions and small imbalance throughout.

Short side proposes.

We have the following approximations of and :

-

•

Short-side agents’ average utility is .

-

•

Long-side agents’ average utility is .

-

•

The average number of unmatched (short-side) agents is: .

We find that it is optimal to set . The short-side agents’ utility is non-increasing in hence it is maximized at . The long-side agents’ utility is non-increasing in for , hence it is maximized between and . The number of unmatched agents is minimized for any . Therefore, the Pareto optimal lie between and . This finding suggests that a platform should deploy a short to moderate-length preference list length restriction ().

Long side proposes.

Given consideration set size , we have the following approximations:

-

•

Short-side agents’ average utility is .

-

•

Long-side agents’ average utility is .

-

•

The number of unmatched (short-side) agents is .

Two regimes arise from the planner’s problem, but we find that it is optimal to set in both cases. The utility of long-side agents is maximized at in both cases since it is decreasing in . Regarding the utility of short-side agents:

-

•

If the preference learning cost grows slowly in , in particular if : The utility of short-side agents is maximized at . However, the total welfare of all agents is maximized by .

-

•

If the preference learning cost grows quickly in , in particular if : The utility of short-side agents is maximized at since the preference learning cost dominates the match value so smaller is preferred.

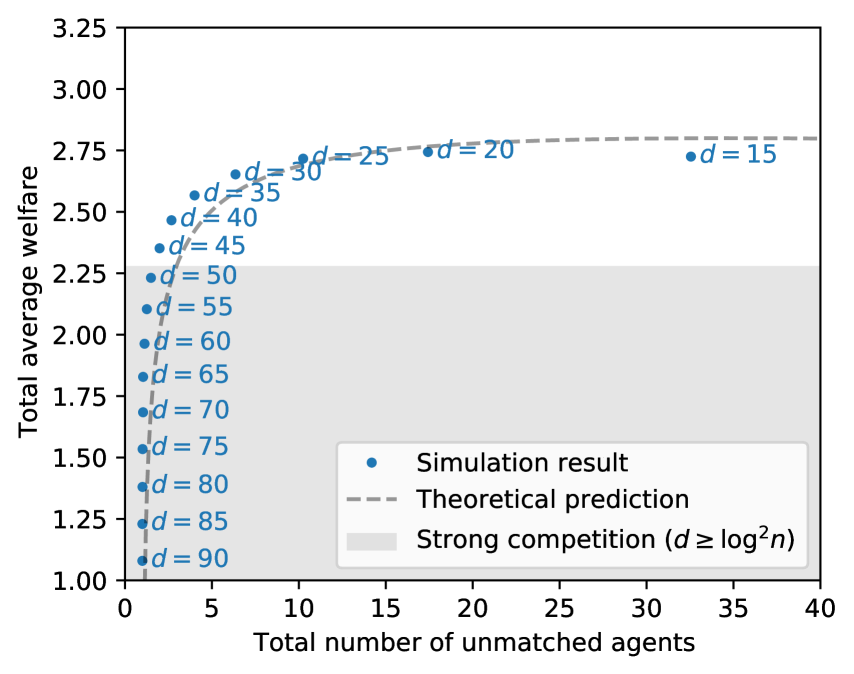

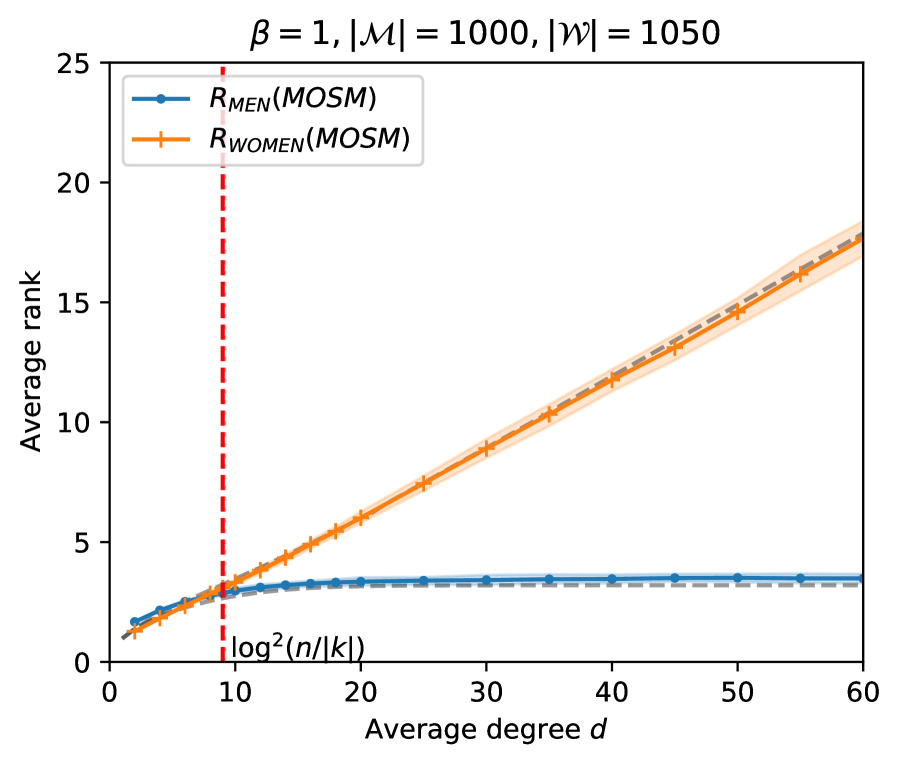

Therefore, the platform achieves maximum welfare by choosing . The number of unmatched agents is minimized for any . As a result, the Pareto optimal lie between and , and the platform should set a preference length restriction within this range. The Pareto frontier is shown in Figure 3.

Which side should propose.

In some applications, the platform can choose which side initiates contact. An example of this is the dating app Bumble, where only women are allowed to send the first message. Recent works have studied how to make this design decision (see, e.g., Kanoria and Saban 2021). Our analysis above can also shed light on which side should propose (in our model, which is distinct from those in the existing literature). Assuming the preference learning cost grows quickly in (i.e., , which may be typical in real world applications), we find that:

-

•

If the cost of discovering preferences differs between the two sides, it is optimal for the side with the lower discovery cost to initiate contact. This is because the side that initiates contact needs to screen (a lot) more potential partners than the other side. Specifically, if one side’s preference learning cost has an exponent of while the other side’s costs have an exponent of , it is optimal for the side with the exponent to initiate contact.

-

•

If a platform’s primary concern is the welfare of a particular side of the market, it is optimal for that side to be the receiving side rather than the initiating side. Similar to the case above, this is because the initiating side typically bears a higher preference discovery cost, as they need to screen more potential partners. By allowing the side that the platform is concerned with to be the receiving side, the platform can reduce the cost burden on that side and potentially improve their experience on the platform.

We want to comment that the above messages align qualitatively with the findings obtained in Kanoria and Saban (2021) (in a different, decentralized search and matching setting). Kanoria and Saban (2021) suggests that the platform should let the short side initiate contact, because the long side agents need to screen more potential partners than the short side agents do if being on the initiating side, which lead to high screening costs and system inefficiency.

5 Numerical Simulations for Random Matching Markets

This section provides simulation results for random markets that confirm and sharpen the theoretical predictions made in Section 3. Our simulations reveal that (i) our theoretical findings are valid for a wide range of market size , average degree , and imbalance , (ii) the predicted sharp threshold between the strong and weak competition regimes at connectivity is confirmed to hold, and (iii) Principle 1 appears to be robust even to strong correlations in preferences (our quantitative are inaccurate under strong correlations, as expected).

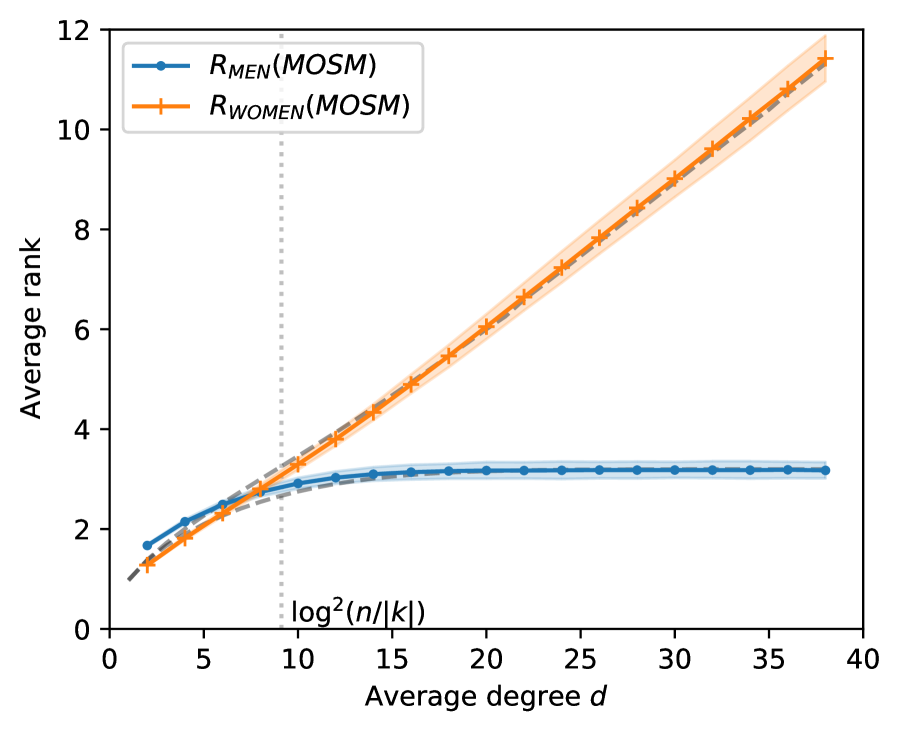

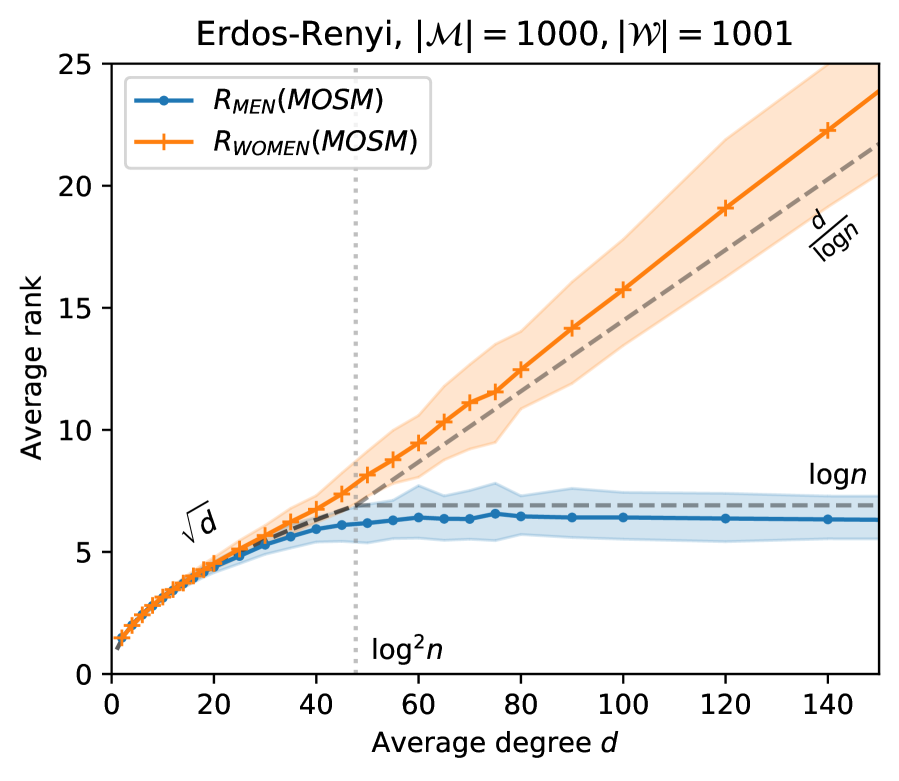

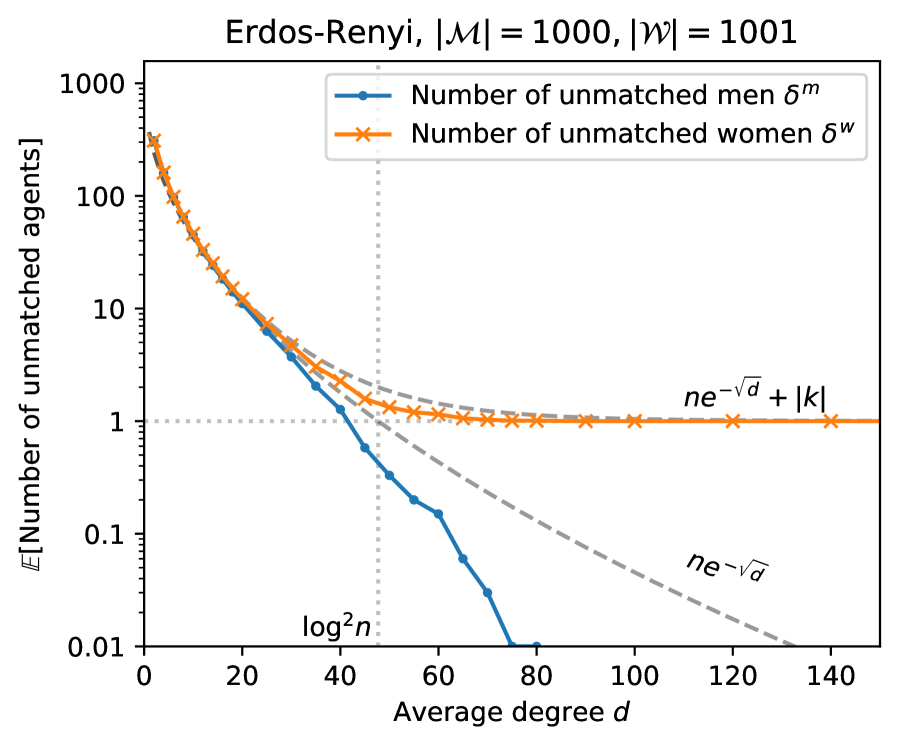

Numerical verification of Theorem 1 and 2.

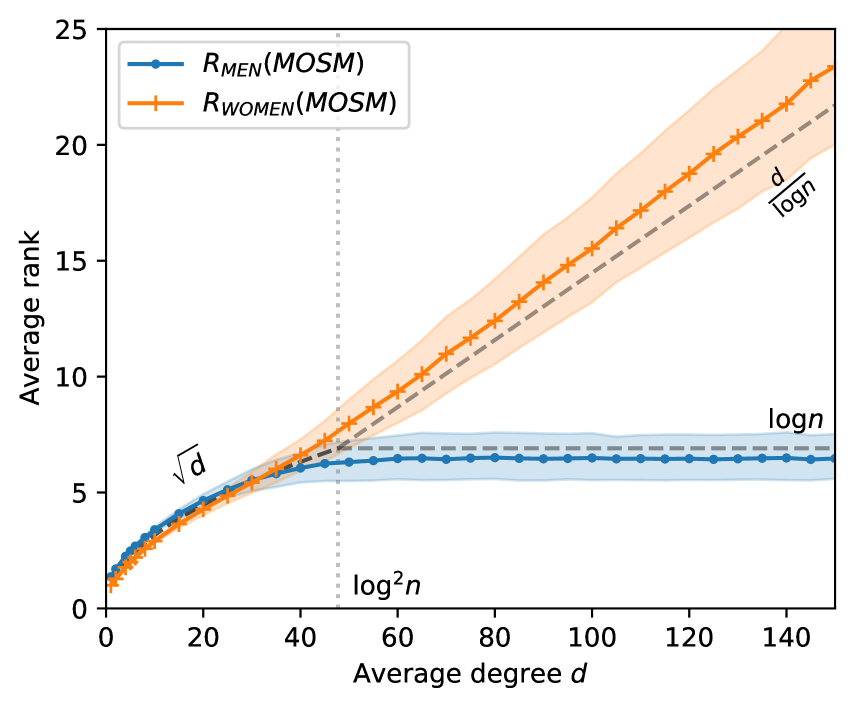

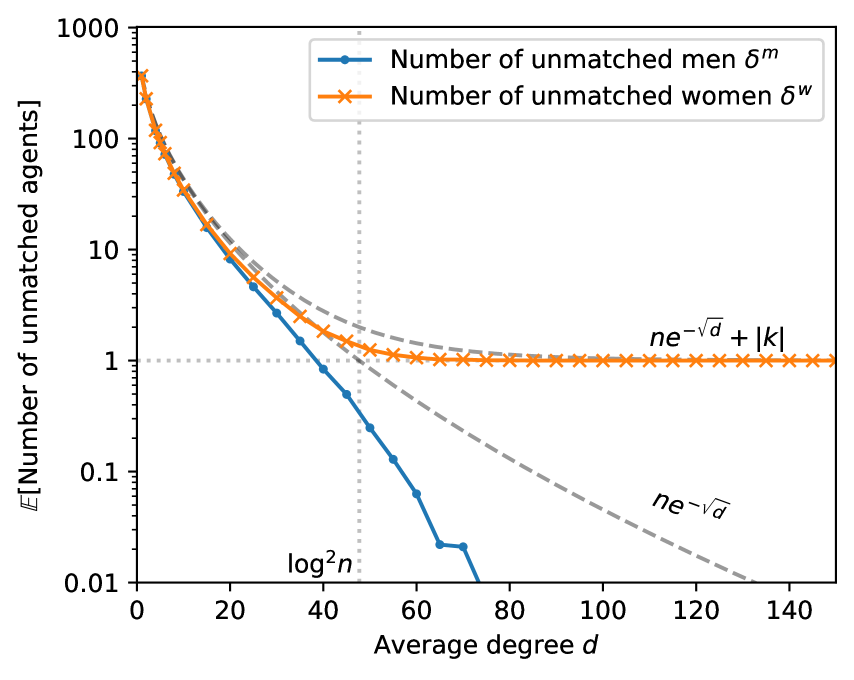

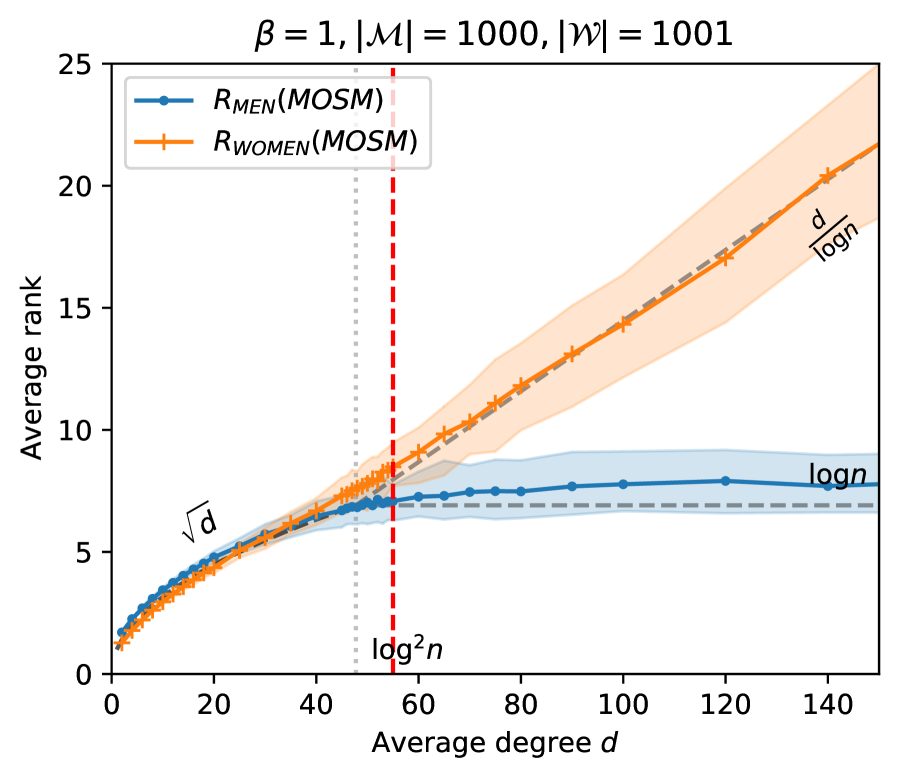

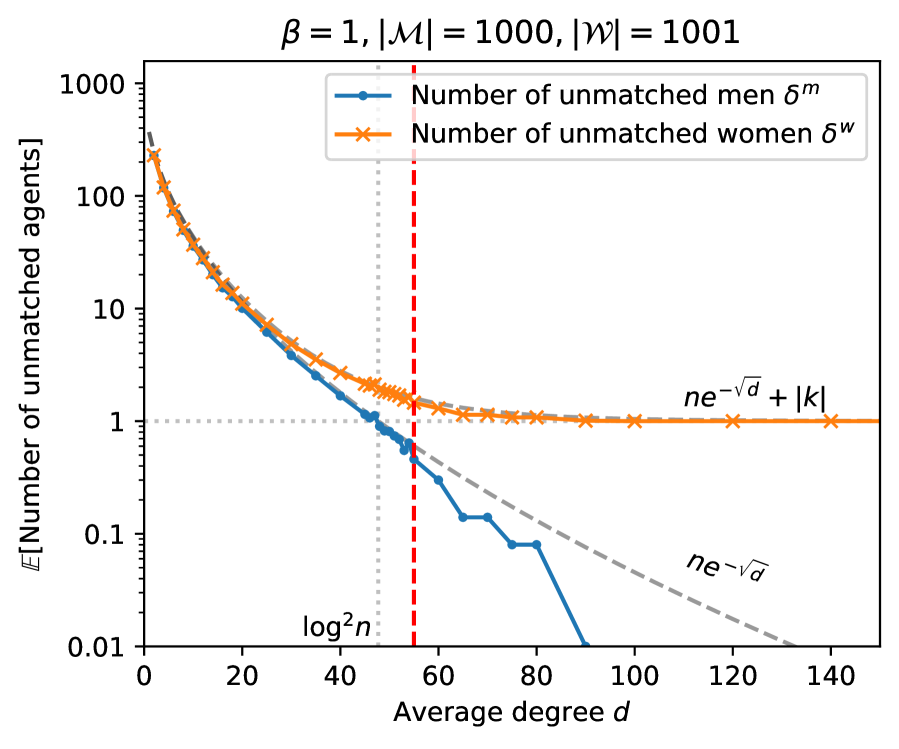

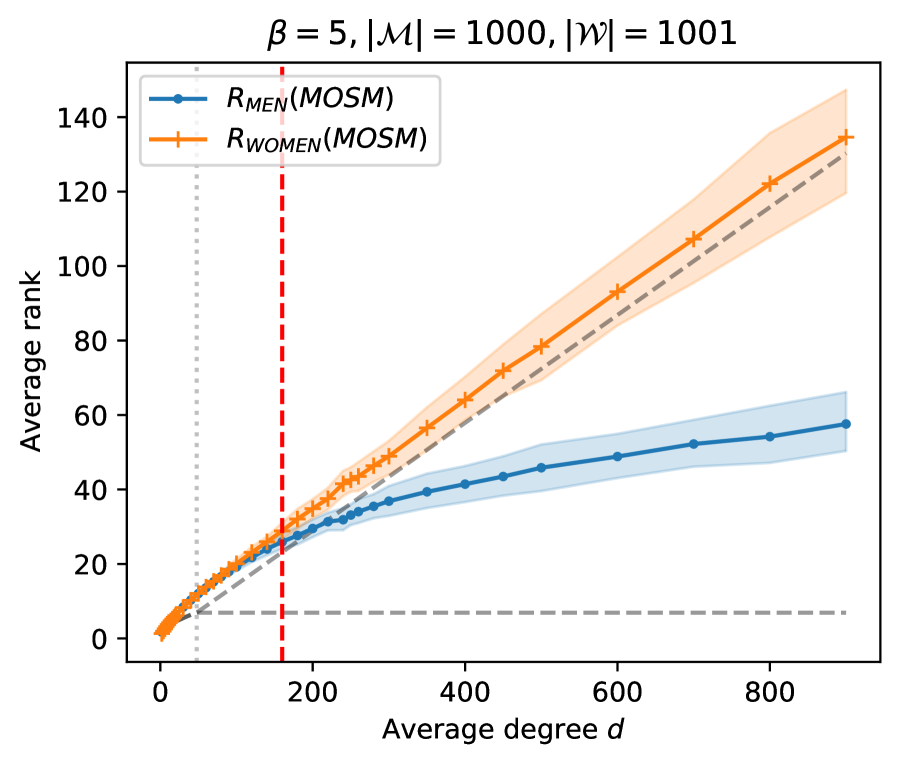

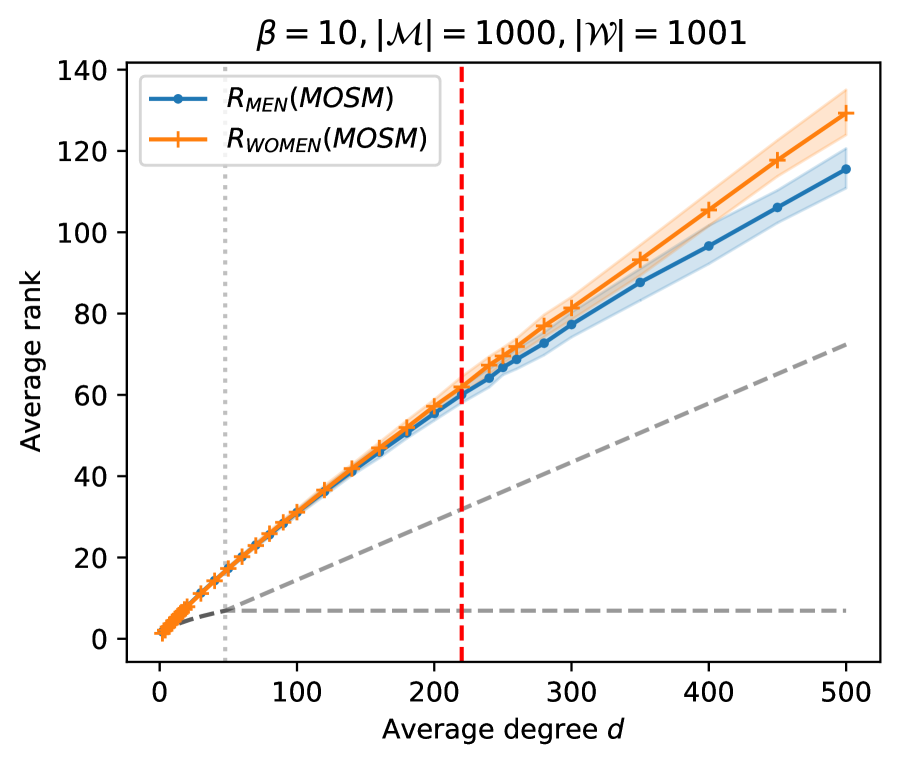

We first verify our main theoretical findings, Theorem 1 and 2, which express four market statistics , , and in terms of market size and average degree when imbalance is small. Specifically, we consider a market with 1,000 men and 1,001 women (, ) where the length of each man’s preference list varies from 5 to 150. For each degree we generate 1,000 realizations of random matching markets according to the generative model described in Section 2, and for each realization we compute the man optimal stable matching (MOSM) by running the men-proposing DA algorithm.

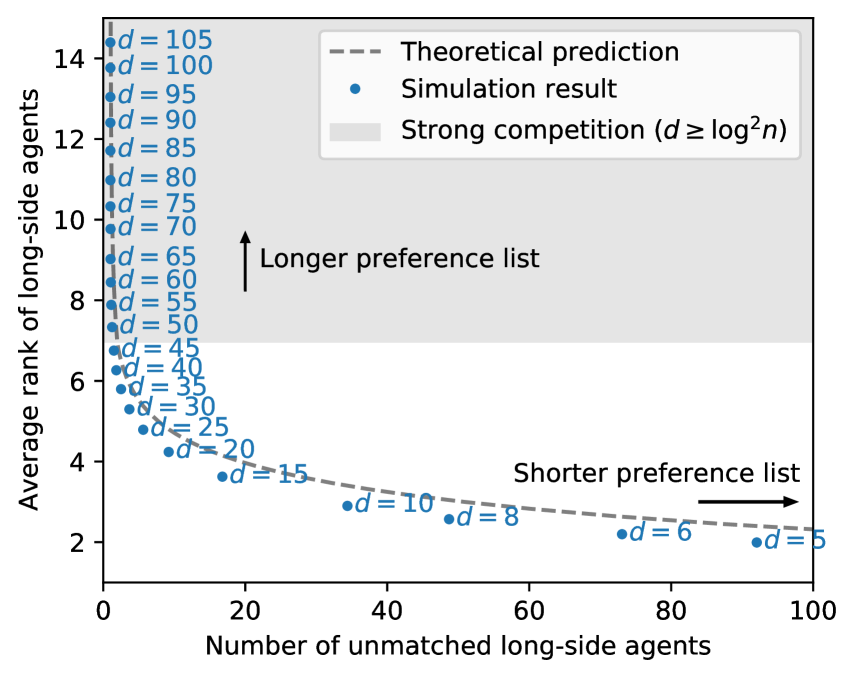

Figure 4 reports the men’s average rank of wives and the women’s average rank of husbands (left) and the number of unmatched men and women (right) at each . While not reported here to avoid cluttering the figures, we observe almost identical results for the WOSM. Observe that when both men’s average rank and women’s average rank are highly concentrated at and both the number of unmatched men and the number of unmatched women are close to , which confirms the estimates in Theorem 1. As grows past , the average rank of men and women start to deviate from each other, and specifically, the average rank of short side (men) stops increasing whereas the average rank of long side (women) increases linearly: i.e., and when , confirming Theorem 2. We also remark that the expected number of unmatched men quickly vanishes as increases beyond (note that the -axis of the plot has a log-scale).

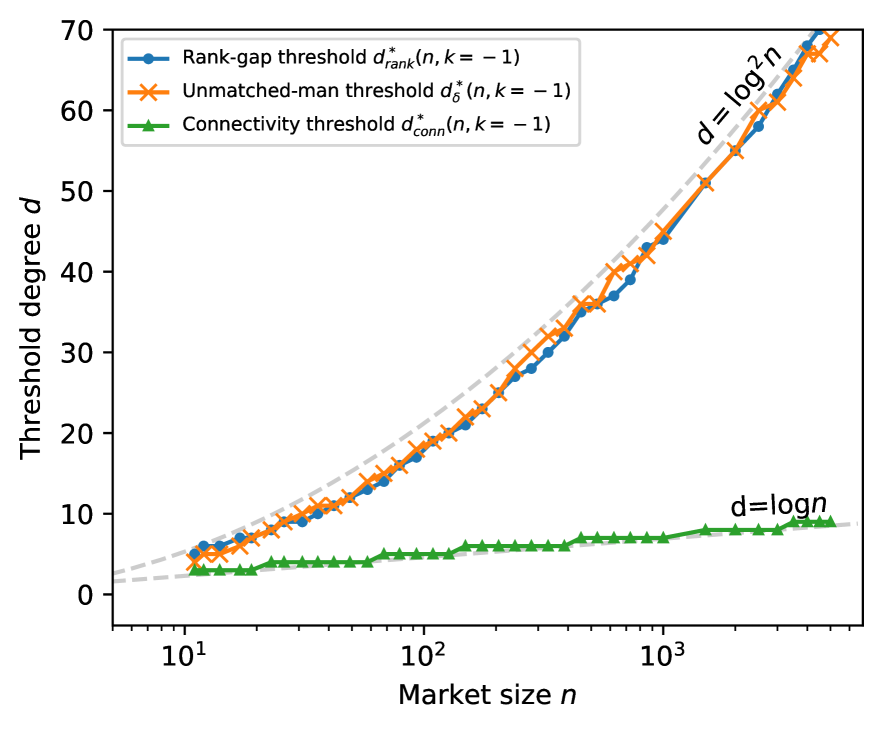

Numerical verification of connectivity threshold.

The above observation extends to a wide range of market size (even for small ). To better illustrate, we investigate three kinds of threshold degree levels , , and that sharply characterize the phase transitions that occur when degree varies in random matching markets of size . We define these thresholds as follows: given and ,

| (1) | ||||

| (2) | ||||

| (3) |

where represents the expected value of some random variable in a random matching market with men each of whose degree is and women. The rank-gap threshold indicates the degree value beyond which men’s average rank and women’s average rank start to deviate from each other (in particular, we require a 15% or larger difference in the average ranks on the two sides of the market); the unmatched-man threshold is the degree value beyond which all men are (typically) matched; and the connected-component threshold is the degree value beyond which the entire market becomes a single giant connected component. Regarding the factor in the definition (2) of , recall that our statement of Principle 1 for random markets (see Section 3.1) is an asymptotic one which holds for any constant factor in place of the here. We employ the factor because it provides the best numerical fit in finite random markets.

We consider two regimes: one with (fixed, small imbalance) and one with (varying, large imbalance). For each regime, we quantify these threshold values based on numerical simulations: given and , we use bisection method with a varying to find the threshold degrees, where the expected values are approximated with sample averages across 500 random realizations.

Figure 5 plots the measured threshold degrees. The thresholds and are found to be close to for all tested values of . This suggests that our predicted threshold is fairly sharp and consistent with Principle 1: the strong competition takes place i.f.f. the number of unmatched agents on the short side the imbalance in the market i.f.f. . Also note that this threshold is much larger than the connected-component threshold .

Behavior under correlated preferences.

Our theoretical analysis heavily relies on the assumption that the preferences are independent across agents, which may not be true in real-world matching markets. We test robustness of our findings to correlated preferences by introducing a modified generative model, partly adopted from Hitsch et al. (2010). After generating a connectivity graph as done in the previous experiments, we construct the preference lists according to the following random utility model: for each edge in the graph, the value agent obtains when matched with agent is given by (the value of for is symmetrically defined with independent )

| (4) |

where is an idiosyncratic term independently drawn from a standard logistic distribution, is a vertical quality of agent independently drawn from , and is the sensitivity to quality component, which determines the level of correlation. When , the model reduces to our main model in Section 2. When , all agents share the same preference ranking over the other side of the market.

Figure 6 summarizes the simulation results for random matching markets with , and . Note that represents strong correlations where the quality term is 5 times larger than the idiosyncratic term. The red vertical line represents the threshold degree , defined in (2), which turns out to be . Remarkably, we observe that and deviate from each other starting from this threshold , confirming Principle 1 (Principle 1 predicts whether a particular side of the market does better/worse than they would have in the corresponding balanced market. Since the setting here is symmetric across sides except for the market imbalance, we can instead compare average ranks across the two sides of the market.) As expected, our detailed quantitative predictions (shown via gray dashed lines) are inaccurate under such strong correlations. See Appendix G for additional numerical studies of moderately correlated preferences () and very strongly correlated preferences (), and different market imbalances, which similarly confirm Principle 1 and moreover show that our quantitative predictions are surprisingly accurate under moderate correlations . Appendix G also demonstrates robustness of our findings to a bipartite Erdos-Renyi connectivity graph (which exhibits heterogeneity in men’s degree).

6 Counterfactual Analyses on High School Admissions Data

In this section, we perform counterfactual analyses on public high school admissions data from a major city in the U.S., and test our descriptive/prescriptive insights obtained from our theoretical investigation of random matching markets. Our data-driven investigation shows that our theoretical findings are useful both to estimate the level of competition in a real-world matching market, and to provide design guidelines for improving market performance.

Data description.

The admissions “market” in this city is cleared via a centralized deferred acceptance (DA)-based clearinghouse which collects preference data from applicants and priority rankings from schools. The data contains the preference lists over programs provided by nearly 75,000 applicants, 700 programs with a total capacity of 73,000, and the priorities of schools over applicants. The applicant preference lists have average length 6.92, median length 7, and maximum allowed length 12. Since DA-based mechanism used here is incentive compatible,111111Incentive compatibility of DA for the proposing side was established by Dubins and Freedman (1981). The only caveat for this particular market is that preference lists are not permitted to exceed a length of 12, however, only 16.6% of students are found to reach this maximum list length, and 94.5% of students are allocated to one of their top 5 programs. the preference rankings collected may be assumed to reflect the true underlying preferences. We assume DA employs the widely used single-tie breaking approach to break ties between applicants within the same priority class, namely, the same uniformly random permutation over applicants is used by all programs. The algorithm is applicant-proposing deferred acceptance (DA).121212We observe that program-proposing DA algorithm yields almost identical results: in our series of simulations, typically less than five students (and at most 20 students) are assigned to different programs under program-proposing DA. We find that about 6,000 seats remain unfilled in the resulting allocation, which is substantially larger than the market imbalance of about 2,000.

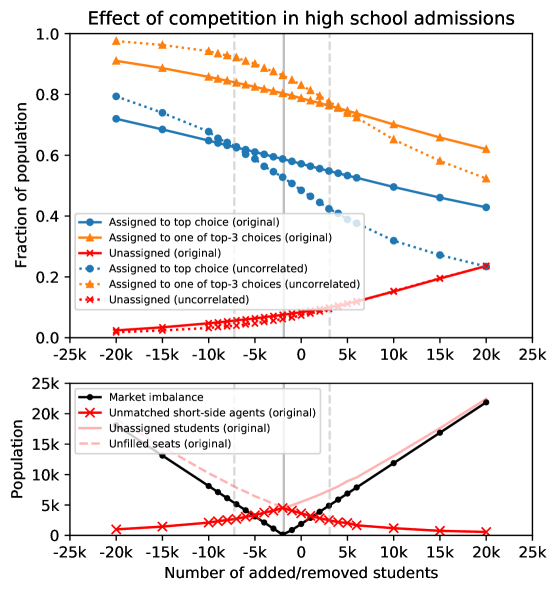

Descriptive insights: Testing the competition regime prediction coming from Principle 1.

Applying Principle 1 to these summary statistics yields the prediction that the market is in the weak competition regime, i.e., that being on the long side should not be significantly hurting the rank of the allocation obtained by applicants.

To check this prediction and to study the effect of competition in the real market, we vary the market imbalance across a wide range by dropping up to 20,000 applicants from the data (uniformly at random) at one extreme, and duplicating up to 20,000 applicants (uniformly at random) at the other extreme, while holding the set of programs and their capacities fixed, and study the resulting change in the outcomes for applicants. As per the usual practice, we summarize the allocation in terms of the fraction of students who are allotted to one of their top- most preferred programs (for ) and the fraction who are unassigned; see the solid lines in Figure 7. Observe that the quality of the allocation from the perspective of applicants is little changed (the aforementioned fractions each increase by less than 2%) from the original under the counterfactual of a balanced market (which corresponds to randomly dropping 2000 applicants from the dataset). This confirms the correctness of the prediction from Principle 1 for this market.

We now subject our principle to a broader test in this environment. For which counterfactual markets would Principle 1 have predicted that they exhibit strong competition, based on just the summary statistics? These turn out to be the markets where we add 3500 or more students, or subtract 8700 or more students (see the dashed gray vertical lines of Figure 7; here, the factor is chosen to be consistent with the definition of (2) in Section 5). We see from the figure that for the markets predicted to exhibit strong competition, the fraction assigned to top choice or one of top-3 choices is different from that under the balanced market, whereas for the markets predicted to exhibit weak competition, this difference is . It is notable and very encouraging that nearly the same “threshold” for predicting strong competition emerges both when applicants are on the short side, and when applicants are on the long side, despite multiple asymmetries across the two sides of this market including its many-to-one nature. (For the uncorrelated version of the admissions market, described and tracked in the same figure, a similar phenomenon is observed, although for the markets predicted to exhibit strong competition the allocated fractions are now different from those under the balanced market.) Overall, we find the quality and consistency of predictions coming from Principle 1 for this real-world market to be very encouraging, with the obvious caveats that the principle does not quantify the threshold beyond which it deems a short-side advantage to be significant, and that it remains to systematically incorporate the impact of correlations in preferences.

We now briefly discuss the National Residency Matching Program (NRMP) which matches medical residents to residency programs once a year, again via a centralized DA-based clearinghouse. Like many real-world clearinghouses, the NRMP has typically not allowed market-design researchers to access preference ranking data. However, the NRMP does publish an annual report each year, which includes the summary statistics needed to apply Principle 1. For the 2022 match year, there were 42,549 active applicants vying for 39,205 residency positions, and 93.9% positions were filled in the main match (i.e., about 2,390 positions went unfilled). Since the imbalance of 3,344 exceeded the number of unfilled positions but by a factor less than 2 (recall that we have been using a factor 2 in our application of Principle 1), Principle 1 predicts that the market imbalance had only a moderate impact on match quality, somewhat benefiting programs and hurting applicants.

Design insights: How can the platform control competition over popular programs?

Let us now restrict our attention to a submarket consisting of “popular” programs and the students who applied to those popular programs, in which students compete strongly for scarce seats. Our analysis in Section 4.3 suggest that we can alleviate such strong competition among applicants by reducing the connectivity of the market, i.e., by limiting the number of popular programs that a student can report in their preference list. We run simulations to estimate the effect of this intervention within the submarket, and observe that we can indeed increase the students’ welfare substantially while keeping almost all popular seats filled.

Following the work of Ashlagi and Nikzad (2020), we define popularity of program as the ratio between the number of students who had listed program on top of their preference lists and the capacity of program . In the actual data set, the popularity value ranges from to across 700 programs, e.g., the most popular program () has one available seat while it is the most preferred one for 12 students out of 75,000 students.

We conduct a stylized study on a submarket that only includes “popular” programs satisfying , which consists of nearly 300 programs with a total capacity of 33,000 seats. The preference lists of the students are refined accordingly, i.e., all the non-popular programs are removed from the preference lists so that they only contain these popular programs. The students with empty preference lists are removed from the submarket. As a result, the submarket includes around 71,000 students with average preference list length 4.43, median length 4, and maximum length 12.

When running the DA algorithm on this submarket without any intervention, we observe that only 3.8 seats ( of total capacity) are left unfilled on average, 38,000 students are left unassigned accordingly (in the actual matching process over the entire market, most of them will be assigned to one of non-popular programs), and the assigned students’ average rank of their matched (popular) program is 1.62. We find that the number of unfilled seats (i.e., the number of unmatched agents on the short side) is much smaller than the market imbalance, and applying Principle 1, we can expect that the students are suffering from the extremely strong competition in this submarket. Adopting a Pareto utility model with (see Section 4), the average welfare of the assigned students is found to be 70.3.131313In detail, the (expected) welfare of a student who get assigned to -ranked program is computed using the -th largest order statistics out of i.i.d. Pareto random samples where is the number of popular programs that are accessible for the student. We set assuming that 10% of popular programs are accessible for each student due to geographic considerations. The choice of was loosely guided by the discussion in (Ibragimov and Walden 2010, Appendix A); welfare gains were similar for , with larger improvement in welfare for closer to 1. In the current setting, the students assigned to their most preferred program get average utility 95.0, and those who are assigned to their second most preferred program get average utility 15.8.

We now consider the platform intervention of imposing a limit on the maximum number of popular programs that each student can list on his/her preference list. We investigate the consequence of this intervention by simulating the matching process after truncating all preference lists by the given length limit , where we vary from 12 to 1 ( corresponds to no intervention). Our counterfactual analysis assumes that the students will report their preference lists truthfully under the intervention, which may be violated in the case of students who respond strategically to the restriction on the number of popular programs they are allowed to list. Strategic agent responses should only increase the welfare gains resulting from our intervention (Abdulkadiroğlu et al. 2017, Che and Tercieux 2019), so our improvement estimates can be viewed as lower bounds.

Figure 8 summarizes the simulation results, visualized analogously to Figure 3. When , since every assigned student gets allocated to his/her most preferred program, their average rank becomes 1.0, and their average welfare attains its maximal value 95.0 ( improvement compared to no-intervention). This intervention incurs 59.0 (out of 33k) unfilled (popular) seats on average as a side effect. When , we obtain an average rank of 1.18 and the average welfare 80.3 ( improvement) while keeping almost all seats filled (7.70 seats are left unfilled on average). This improvement is driven is large part by an increase in the fraction of seats assigned to students who listed the program as their top choice, from to . We observe that there is no benefit from deploying , since it only degrades the match value while the reduction in the number of unfilled seats relative to is very marginal.

This experiment demonstrates that we can make a Pareto improvement by allowing the students to include at most two popular programs in their preference lists (or we may let the students to include only one popular program if we are willing to let a few popular program seats remain unfilled). This is consistent with our design insights obtained in Section 4: the level of competition among long-side agents can be controlled by adjusting the connectivity of market, and the optimal level connectivity lies in the weak competition regime.

7 Overview of the Proof of Theorem 1

This section provides an overview of the proof of Theorem 1, which is our characterization of moderately connected random matching markets. Our proof uses the well-known analogy between DA and the coupon collector problem to bound women’s average rank of their husbands, but also encounters and tackles the challenge of tracking the (strictly positive) number of men who have reached the bottom of their preference lists by constructing a novel bound using a tractable stochastic process. The latter challenge did not arise in the setting of Ashlagi et al. (2017) where all short side agents are matched under stable matching, and similarly doesn’t arise in our “densely connected markets” setting (Theorem 2). Following Ashlagi et al. (2017) and the majority of other theoretical papers on matching markets, we prove our characterizations for large (and then use numerics to demonstrate that they extend to small ; see Section 5). Alongside an overview of the proof this section provides parenthetical pointers to the relevant formal lemmas; their statements and proofs can be found in Appendix C.

Our analysis tracks the progress of the following McVitie-Wilson (McVitie and Wilson 1971) (sequential proposals) version of the men-proposing Deferred Acceptance algorithm that outputs MOSM (the final outcome is known to be the MOSM, independent of the sequence in which proposals are made). Under this algorithm, only one man proposes at a time, and “rejection chains” are run to completion before the next man is allowed to make his first proposal. The algorithm takes the preference rankings of the agents as its input.

Algorithm 1 (Man-proposing Deferred Acceptance).

Initialize “men who have entered” , unmatched women , the number of proposals , the number of unmatched men .

-

1

If is empty then terminate. Else, let be the man with the smallest index in . Add to .

-

2

If man has not reached the end of his preference list, do and man proposes to his most preferred woman whom he has not yet proposed. If he is at the end of his list, do go to Step 1.

- 3

Principle of deferred decisions.

As we are interested in the behavior of Algorithm 1 on a random matching market, we think of the deterministic algorithm on a random input as a randomized algorithm, which is easier to analyze. The randomized, or coin flipping, version of the algorithm does not receive preferences as input, but draws them through the process of the algorithm. This is often called the principle of deferred decisions. The algorithm reads the next woman in the preference of a man in step 2 and whether a woman prefers a man over her current proposal in step b. No man applies twice to the same woman during the algorithm, and therefore the algorithm never reads previously revealed preferences. In step 2 the randomized algorithm selects the woman uniformly at random from those to whom man has not yet proposed. In step b, the probability that prefers over her current match is where is the number of proposals previously received by woman .

Stopping time.

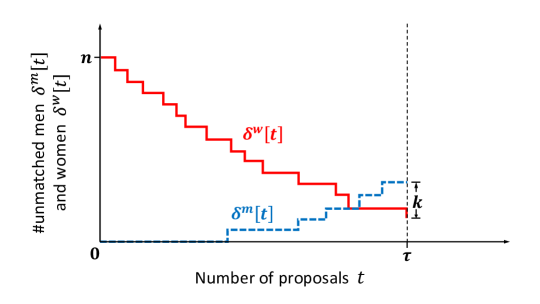

Algorithm 1 defines that “time” ticks whenever a man makes a proposal. First observe that the current number of unmatched men at time , i.e., men who have reached the bottom of their lists and are still unmatched, is non-decreasing over time, whereas the current number of unmatched women at time , i.e., women who have yet to receive their first proposal, is non-increasing over time. The MOSM is found when the number of unmatched men exactly equals the number of unmatched women plus . We view this total number of proposals when DA terminates as a stopping time:

| (5) |

This total number of proposals serves as a key quantity enabling our formal characterization of the MOSM (see Figure 9 for an illustration).

On the men’s side, the sum of men’s rank of wives is approximately the total number of proposals (more precisely, this sum is given that the rank for an unmatched agent is defined as one more than the length of the agent’s preference list, but is the dominant term). On women’s side, since each proposal goes approximately to a uniformly random woman, as a function of the total number of proposals we can tightly control the distribution of the number of proposals received by individual women (this distribution is close to Poisson and tightly concentrates around its average) and therefore their average rank of husbands (Propositions 5 and 6), as well as the number of unmatched women (Propositions 2 and141414In Proposition 4, we first upper bound the number of unmatched women, and then use the aforementioned observation to lower bound the number of proposals. 4).