Flood & Loot: A Systemic Attack On The Lightning Network

Abstract.

The Lightning Network promises to alleviate Bitcoin’s known scalability problems. The operation of such second layer approaches relies on the ability of participants to turn to the blockchain to claim funds at any time, which is assumed to happen rarely.

One of the risks that was identified early on is that of a wide systemic attack on the protocol, in which an attacker triggers the closure of many Lightning channels at once. The resulting high volume of transactions in the blockchain will not allow for the proper settlement of all debts, and attackers may get away with stealing some funds.

This paper explores the details of such an attack and evaluates its cost and overall impact on Bitcoin and the Lightning Network. Specifically, we show that an attacker is able to simultaneously cause victim nodes to overload the Bitcoin blockchain with requests and to steal funds that were locked in channels.

We go on to examine the interaction of Lightning nodes with the fee estimation mechanism and show that the attacker can continuously lower the fee of transactions that will later be used by the victim in its attempts to recover funds - eventually reaching a state in which only low fractions of the block are available for lightning transactions. Our attack is made easier even further as the Lightning protocol allows the attacker to increase the fee offered by his own transactions.

We continue to empirically show that the vast majority of nodes agree to channel opening requests from unknown sources and are therefore susceptible to this attack.

We highlight differences between various implementations of the Lightning Network protocol and review the susceptibility of each one to the attack. Finally, we propose mitigation strategies to lower the systemic attack risk of the network.

1. Introduction

The Lightning Network (Poon and Dryja, 2016) and other second layer solutions (Decker and Wattenhofer, 2015; Lind et al., 2016; Green and Miers, 2017; Heilman et al., 2017) have been suggested as a solution to Bitcoin’s long-known scalability issues (Decker and Wattenhofer, 2013; Croman et al., 2016; Zohar, 2017; Bagaria et al., 2018; Sompolinsky and Zohar, 2015). The Lightning Network promises to increase both the number of transactions that can be processed, and the latency per transaction. In contrast, Bitcoin’s transaction processing is bounded by its block creation rate, and its block size limit, which is currently 1MB (although a slightly more nuanced and widely adopted consensus rule has been introduced in SegWit (Lombrozo et al., 2015)).111SegWit defines a new concept of block weight and redefines the network rule to a maximum block weight of 4M units

The Lightning Network, along with other payment channel networks, aims to move the majority of transactions off-chain, with the guarantee that the state of channels can be committed back to the blockchain at any time, in a trustless fashion. It thus solves the problem of a limited transaction rate by limiting the communication on payments to a much smaller set of participants, and lowers the number of interactions with the blockchain.

A major assumption that underlies the trustless operation of the Lightning Network is that participants will be able to post transactions to the blockchain if they are faced with malicious or non-responding peers. A concern that was raised long-ago is that under conditions of blockchain congestion, this may not be the case: many transactions that are meant to secure the funds of participants will not be admitted promptly to the blockchain, which will allow attackers to steal money.

In this paper we explore and analyze this attack scenario. We lay concrete steps for executing a successful large-scale attack that both creates the congestion effect and exploits it to steal funds from victims. The reason that the attacker is guaranteed to steal funds with a large-scale attack is that victims have a limited amount of time (measured in blocks) to execute channel closures successfully before the attacker succeeds in claiming their money for himself.

We show that the attack does not need to be as widespread as it may initially appear. It can be executed on relatively few channels, without any significant costs to the attacker. Specifically, we show that even if the maximal number of victims’ transactions get into blocks (up to the block’s limit), attacking only 85 channels simultaneously guarantees the attacker will be able to steal some funds, and that each additional attacked channel will have its funds stolen as well.

In fact, it is rarely the case that Lightning participants pay sufficiently high fees to fill up entire blocks. We explore the fee determination mechanism and show that effectively a much smaller number of simultaneously attacked channels is required for the attacker to succeed.

Our attack technique leverages the way multi-hop payments are executed in the network to trigger several conditions that combine to assist the attacker:

-

•

We manage to greatly inflate the number of transactions needed to successfully close a channel by utilizing many multi-hop payments through the channel.

-

•

Honest nodes need to claim funds within a limited number of blocks, otherwise they become available to an attacker. The parameter ruling this is not set too high, otherwise funds are locked for long periods of time in other cases. The various implementations use different parameters for this timeout. For example, LND uses a value of 40 blocks.

-

•

All implementations do not make use of the full amount of time available to them to deploy closure transactions, making the attack substantially easier. For example, LND initiates the closure of channels only 10 blocks before the expiration time.

-

•

The timeout for retrieving funds is known in advance and thus attacks can be timed so all victims attempt to send transactions to the blockchain at the same time.

-

•

Fees offered by these transactions are pre-set and the timing for the attack can be chosen by the attacker (who will choose to attack at times when the blockchain is congested and high fees are required for acceptance).

-

•

Unlike the victims, the attacker can increase the fee on his transactions, and replace any remaining transactions made by the victims to claim their funds (after the timeout).

We now provide a brief description of the attack that we evaluated. A more detailed description appears in Section 3.

Outline of the attack:

I. Setup and Wait The attacker creates channels from a node we designate as his “source node” to many victim nodes, and locks funds into these channels. This step is preferably done when blockchain fees are low, both to save costs and to set the channel’s feerate to a low value. The attacker then prepares a node on the Lightning Network that is able to receive funds (i.e., making sure the other side of its channels has sufficient liquidity). We designate this node as the “target node”. This can be achieved by opening channels with other nodes (not necessarily victims) and sending money out to purchase goods or to deposit at exchanges. The attacker waits for an opportune moment to attack, predicting that blockchain congestion conditions will last for several dozens of blocks.

II. Initiating Payments The attack is then launched by sending multiple lightning HTLC payments from the source node to the target node using as much liquidity as possible and spreading it out over as many HTLC payments as it is allowed to use.

III. Accepting Payments Once all HTLCs have reached the target node, it accepts the payments and responds by sending back the secrets required to guarantee receipt of the funds. As a result, the target node’s channel is left without open HTLCs. HTLC secrets make their way back to the victims that attempt to send them back to the source node. The source node does not respond, leaving the channels with open HTLCs that the victims can only claim on the blockchain.

IV. Collect Expired HTLCs As the HTLCs’ timeout approaches, the victims attempt to close the channels with the source node and claim all HTLCs on the blockchain. This means they publish many blockchain transactions all at once. Some of these will fail to enter into blocks by the timeout due to congestion and high blockchain fees. The attacker claims any HTLCs that remain past expiration, using the replace-by-fee policy, and raises the fee of his own transactions to be higher than that of the victims’ transactions.

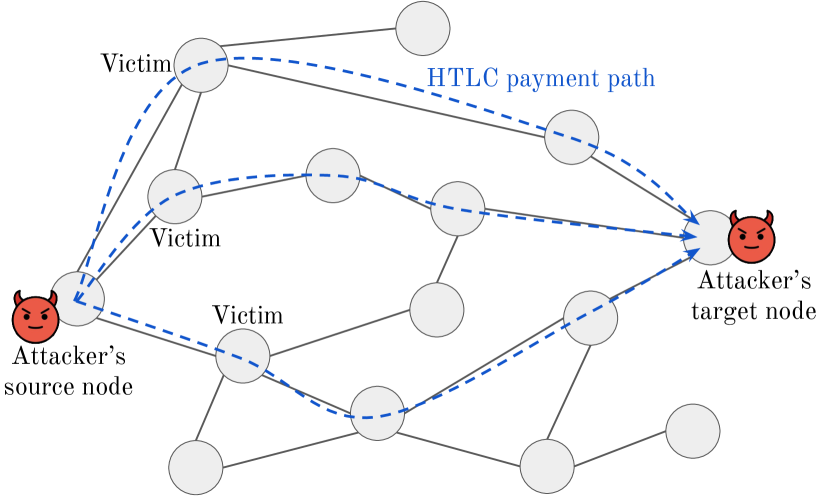

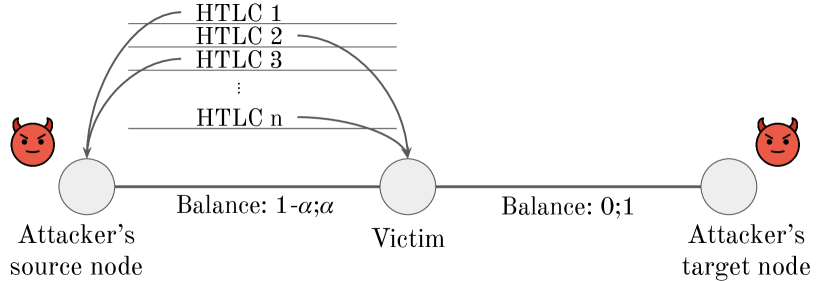

Figure 1 shows an example topology of Lightning channels. It emphasizes the paths of the HTLC payments and how victims are connected with the attacker. We note that whenever the attacker has failed, the only cost that he suffers is that of the blockchain fees involved with opening and closing channels with his victims. The funds locked in the channels are retained and can be reused.

Usually, attackers can reduce the minimal number of victims required for executing a successful attack, by exploiting fluctuations in blockchain fees. We thus go on to explore the feerate estimation mechanism used by the different lightning implementations. Using real estimation results collected over a period of over two months, we show that the fee used for the commitment and HTLC-claiming transactions fluctuates greatly and has significant influence on the success of the attack.

To demonstrate the steps of the attack outlined above, we report on our prototype implementation of an attacker node. Our prototype was evaluated on a locally established lightning network, running over a Bitcoin regnet, and demonstrates that we can exploit the actual clients running today’s Lightning Network.

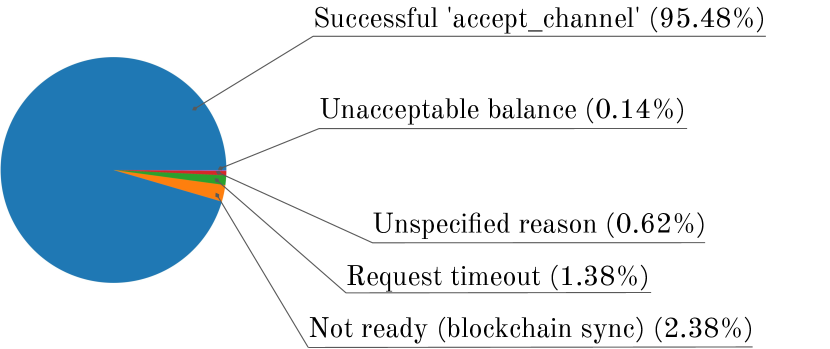

A Lightning node can become a victim in the attack if it agrees to open a channel jointly with the attacker. We go on to check which nodes in the Lightning Network are susceptible to be attacked by agreeing to open channels with us. We report on an experiment that attempted to connect to nodes on the network and show that a large majority (95%) of responding nodes agree to form such connections (other nodes refuse for often benign reasons, such as in-progress synching with the blockchain). We conclude that it is therefore easy for the attacker to find enough victims to perform a wide-scale attack. Since nodes are able to open more than one channel with each peer, attackers are able to steal more funds from each such victim.

A side-effect of the attack is that the blockchain is flooded with transactions made by lightning nodes, whose fees are not covered by the attacker, but rather by his victims. This can be leveraged as a tool in other attacks as well (e.g., preventing trade and other on-chain activity).

Our final contribution in this paper is proposing several mitigation techniques that can greatly reduce the chance and scope of a successful attack.

Ethical Concerns

The attack that we discuss here can be used to steal funds from users on the Lightning Network. While our specific technique for attacking is detailed here, the general attack vector was known ahead of time. We note that preprints of this paper have been shared with the developers of the three main Lightning implementations before submission.

The code we used for simulating the attack is available on GitHub222https://github.com/jonahar/lightning-systemic-attack, without the full prototype implementation of the attacker, so as not to provide attacking tools.

The remainder of this paper is structured as follows: Section 2 gives some background on the Lightning Network and the different transactions that are created as part of operating a payment channel. Section 3 describes in detail the execution of the attack. In Section 4 we analyze the attack, explore how effective it might be and show the minimal effort required to find potential victims. In Section 5 we study the fees used by nodes on the Lightning Network (for blockchain transactions) to learn how they affect the success of an attack. Section 6 discusses several potential ways to mitigate the attack. Section 7 discusses related work, and finally we conclude this work in Section 8.

2. Background on Lightning Channel Transactions

Each channel on the Lightning Network can be used for multiple transfers. Each transfer over the channel is executed by exchanging Bitcoin transactions between the two parties. These transactions, which are generally not sent to the blockchain are used as a fail-safe, allowing the two participants in the channel to claim their funds in case their peer misbehaves.

Under normal operating conditions, i.e, when both parties are honest, no more than 2 transactions should be published throughout a channel’s entire lifetime. Our attack however, takes the victim’s channel off of this “good path” and triggers the publication of possibly hundreds of Bitcoin transactions. In this section we provide background explaining which transactions are created and used to support a channel’s operation and outlining the conditions under which they are transmitted to the blockchain.

2.1. Channel Establishment

When two parties, Alice and Bob, wish to open a new lightning channel, they first need to lock some coins to fund it. This is done by creating and publishing a funding transaction. A funding transaction has one special output (possibly among other outputs) called the funding output, which sends funds to a 2-of-2 multisig script, corresponding to the private keys of the two parties. This means the funding output can only be spent by a transaction signed by both Alice and Bob. The value of the funding output determines the total liquidity in the channel. To guarantee funds can be extracted from the channel in case one side becomes uncooperative, another transaction called commitment is created and signed by both parties. A commitment spends the funding output and splits its value between Alice and Bob, according to the most recent allocation they agreed on (the commitment will have two outputs - one for Alice and another for Bob). Each of them can publish the commitment at any time to close the channel and claim their funds, without any action taken by the other party. For reasons we explain later, each side holds a slightly different version of a commitment transaction.

2.2. Balance Redistribution and Commitment Updates

Alice and Bob can agree on a new way to split the channel’s funds between them (e.g. if Alice purchases some goods from Bob). To do so, Alice and Bob create a new commitment that reflects the changes – the values of the outputs in the new commitment will match the new allocation between them.

Both sides must have an assurance that the other side

will not publish older commitments, especially if the allocation they represent awards that party more money than the last created commitment. This is achieved by the revocation

mechanism, that penalizes participants who publish old commitments.

In Alice’s commitment, the output that is destined for her can in fact

be spent not only by Alice, but also by anyone else who knows a special

revocation key. The revocation key can be constructed from two secrets,

held by Alice and Bob (the secrets are commitment-specific). When Alice and Bob

agree on a new commitment, Alice will provide Bob with her secret, allowing him to spend her output in the old commitment. This removes

any incentive Alice might have to publish the old commitment.

To prevent a race, and give Bob a fair chance of spending Alice’s output from

an older commitment, the output is time-locked for spend by Alice. Alice can

only spend her output after the commitment achieves a minimum number of

confirmations (determined by the channel-specific parameter

to_self_delay), while Bob can spend it immediately.

In a similar way, Bob will provide Alice with a secret, that would let her spend

Bob’s output in his old commitment transaction.

2.3. Multi-Hop Payments With HTLCs

An additional important property of the Lightning Network is its ability to route payments between participants that do not share a channel. This is achieved using Hash Time Locked Contracts (HTLC). HTLCs are conditional expiring payments, that can be routed through an untrusted intermediate node. HTLCs guarantee that no party is able to leave at any moment and stealing other node’s funds.

Suppose Alice wish to send funds to Carol via an intermediate node Bob, with whom they both share a channel. Alice will offer Bob the amount of payment (in addition to a small fee) if he would send that amount to Carol. The payment starts by Carol generating a secret (the preimage), computing its hash value and sending to Alice. Alice will then make a payment to Bob, of the amount she would like to send Carol plus an extra fee for Bob, subject to Bob revealing some secret that hashes to . The only (feasible) way for Bob to claim these funds, is to make a similar conditional payment to Carol - requesting her to reveal such in order to receive the payment. Since Carol holds , she will reveal it to Bob and claim the payment from him. Bob will then reveal to Alice, to claim the payment from her. Each conditional payment (by Alice to Bob and by Bob to Carol) has an expiration, after which the payment initiator can claim the offered funds back to himself.

How HTLCs affect the commitment

When a new HTLC payment is offered, the commitment must be updated to reflect the new state, and to enforce the details of the nodes’ agreement. This is done by creating a special output, corresponding to that HTLC, in the commitment transaction. The HTLC output is removed from the transaction only once it is resolved, either by the receiver returning the preimage or stating that he failed to obtain the secret. Since multiple HTLCs may be pending resolution at a given point in time, a commitment transaction may contain many HTLC outputs (in addition to its two primary outputs for the two sides), resulting in a very large commitment transaction.

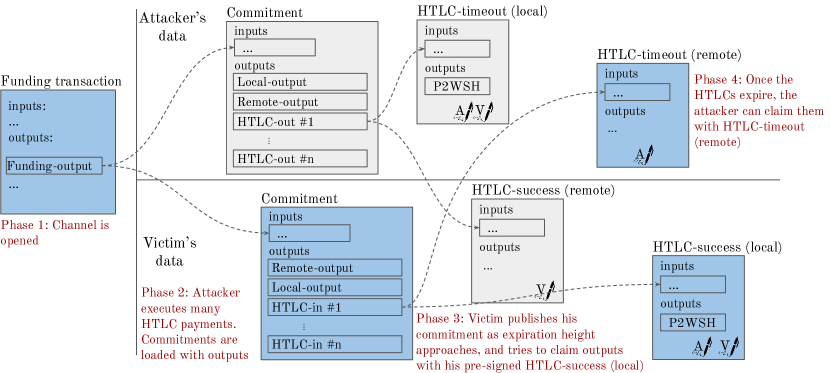

It is important to note that an HTLC output is mirrored in the commitment transactions of both sides of the channel (See the HTLC-out and HTLC-in outputs in the commitments in Figure 2). To facilitate revocation, these outputs, that correspond to the same HTLC, are slightly different.

In the context of a specific commitment transaction, we refer to the party holding this transaction as the local node, and the other party as the remote node.

We now drill deeper into the structure of the HTLC-in and HTLC-out outputs as these are relevant to our attack.

The HTLC-out output

HTLC-out is a commitment output corresponding to an HTLC payment offered by the local node (the one holding this commitment) to the remote node. This output enforces all the rules regarding the HTLC payment agreement. As such, it can be spent in one of the following ways:

-

•

By the remote node using the HTLC preimage333this output can also be claimed by the remote node using a revocation key, but we ignore this for brevity

-

•

By the local node, once the HTLC expired

The remote node can spend this output by issuing a transaction referred to as HTLC success (remote). This transaction should be signed only by the remote node, and can be published at any point in time.

The local node can spend this output by a transaction referred to as HTLC timeout (local). This transaction can be published only after the HTLC expired, and must be signed by both parties. Since the local node should not depend on the remote node, the HTLC-timeout (local) is created and pre-signed by the remote node when the HTLC is created.

The HTLC-in output

HTLC-in output is very similar to an HTLC-out, only that it represents a payment offered by the remote node. Conditions for spending this output are similar, and notably, here as well in order to spend HTLC-in using the preimage, the local node must use a transaction signed by both parties, denoted HTLC-success (local). The remote node can spend an HTLC-in after the timeout with a transaction referred to as HTLC-timeout (remote). Figure 2 depicts the different transactions held by each party when an HTLC payment is added to the channel.

We shall later see that the fact that HTLC-success (local) transactions require the signature of both parties will prevent the victim from raising the fees for its transactions. In contrast, HTLC-timeout (remote) transactions require only a signature by one node, which will allow the attacker to change its transactions’ fees at will.

2.4. Replace-By-Fee Policy

We now briefly explain the mechanism used in Bitcoin to replace unconfirmed mempool transactions that we use in the attack. Replace-By-Fee (RBF) is a policy that allows transactions to opt-in for replacement by other conflicting transactions if they offer higher fees. Replacing transactions in this manner can be useful for dealing with confirmation delays that were caused by setting fees too low.

As specified in the Replace-by-Fee improvement proposal (BIP-125 (Harding and Todd, 2015)), a transaction is replaceable (opts-in) either if it directly signals that it is replaceable, or if one of its unconfirmed ancestors is replaceable.

The Lightning Network specifications (Specifications, 2016a) define some transactions used by the protocol as replaceable. Specifically, HTLC-success (local) transactions are replaceable, a fact that we utilize in the attack to replace unconfirmed victims’ transactions and steal funds.

3. The Flood & Loot Attack

In this section we describe our attack in greater detail. During the attack, the attacker is able to steal funds from victims that agree to open channels with him. The attacker ensures that many channels, loaded with multiple unresolved HTLC payments, will all be closed at the same time, leading to a high volume of transactions simultaneously waiting to be confirmed on the blockchain. Inevitably, such congestion will result in some of the HTLC-claiming transactions published by the victims failing to confirm before they timeout. The attacker can claim any funds associated with HTLC payments that timed out in this manner.

We now detail the four concrete steps the attacker takes from the setup of the attack until the HTLCs are stolen, as well as the actions of the victims. The steps are also detailed in Figure 3 (with 1 victim for simplicity).

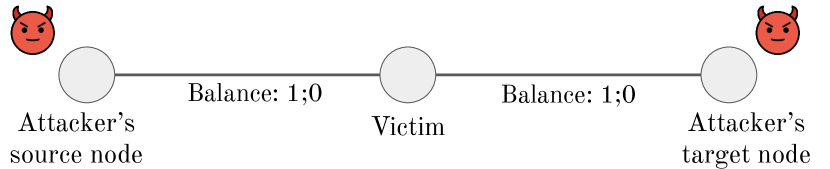

Step I: Setup - Establishing Channels The attacker controls two lightning nodes, denoted the source node and the target node. The target node should be able to receive a sufficient amount of funds. That means it has open channels with enough liquidity on its peers’ side (this can be achieved e.g. by buying some goods with a lightning payment or depositing coins to an exchange that accepts lightning payments). The source node opens many channels with different victims, possibly even multiple channels with each victim. All these channels are initiated and funded by the attacker.

Figure 3(a) shows a single victim and the channels involved in the attack. Note, that the attacker’s target node does not have to be directly connected to the victim (only the source node needs such a direct channel).

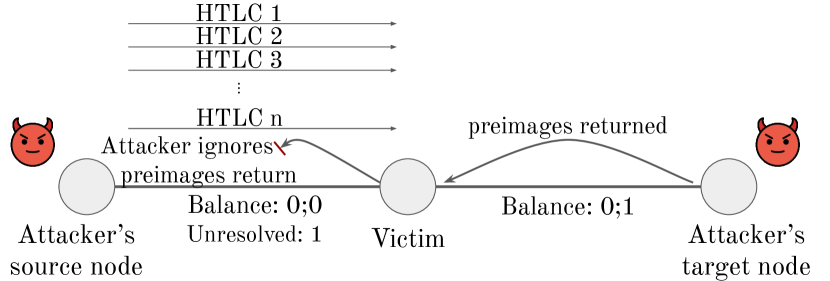

Step II: Loading Channels With HTLC Payments Once all channels are set up, the source node starts sending the maximum possible number of HTLC payments to the target node, through the victims’ channels.

Each channel’s side has parameters max_htlc_value_in_flight and

max_accepted_htlcs, which are a cap on the total value of outstanding

HTLCs and a limit on the number of HTLCs the other party can offer, respectively.

The attacker chooses the amount for each HTLC payment in a way that

utilizes the maximum funds that can be stolen.

This is done by spreading the maximum transferable amount (excluding fees)

equally across all HTLCs routed through the channel.

Formally, for a channel with balance , a max_htlc_value_in_flight

value of and a max_accepted_htlcs value of , the amount of each

payment will be

where is the fee paid by the commitment transaction. The exact fee is calculated from the channel’s feerate (we discuss the channel’s feerate in more detail in Section 5).

Every HTLC payment offered by the source node is given the same expiration height. This would result in all attacked channels closing at the same time.

At that point, the target node does not yet return the preimages to resolve the HTLC payments, and keeps them all in pending state. At the end of this stage, all the attacked channels are saturated with pending HTLCs.

Step III: Returning Preimages on Last Hop After all possible payments were made by the source node, the target node starts resolving all HTLC payments it received by returning the preimages. The target node now possesses the total amount of funds sent by the source node and may close all his channels cooperatively at any time, to use these funds anywhere else.

Once each victim receives the preimages, it asks the source node to resolve the HTLCs and move their amount to the victim’s side of the channel. The source node, however, stops any communication with his victims and refuses to resolve the HTLCs. Any further messages from the victims are ignored.

We note that if the target node does not have enough channels to allow a large enough number of unresolved incoming HTLCs to accommodate many victims at once, it could perform steps II and III of the attack one channel at a time, i.e., saturate a single channel of the source node with HTLCs, then return all preimages for that channel and proceed to the next victim channels. The key point is that preimages of HTLCs that are routed through the same victim channel must be delayed and then returned together in a single batch.

Step IV: Collecting Expired HTLCs Each attacked channel is now full with unresolved HTLC payments, and the victims have all the preimages required to claim them. Since the attacker is uncooperative, they cannot claim these payments through Lightning interactions, but will have to close their channels, publish their commitments and claim the HTLCs on the blockchain.

The time at which a victim will publish his commitment to unilaterally close his

channel, is determined by a safety parameter we denote

commitment_broadcast_delta.444This parameter was not named

in the specifications, but is described in (Specifications, 2016b)

The Lightning specifications suggest a value of 7 blocks before the HTLC expires,

but it is an implementation-dependent decision.

Among the 3 major implementations, LND uses the highest value of 10 blocks.

Since a significant majority of nodes on the network run LND, as suggested

in (Perez-Sola

et al., 2019; Mizrahi and Zohar, 2020), most victims will publish their

commitments at the same time (height). Along with the commitments, each victim

will also publish many HTLC-success (local) transactions to claim the HTLC

outputs from his commitment, leading to a high volume of transactions trying to

enter the blockchain all at once.

A sufficiently large number of attacked channels guarantees that some of the victims’ transactions will not be confirmed before the HTLCs expire, simply because of block space constraints. Once the expiration height was reached, the attacker can also spend any unspent HTLC output using HTLC-timeout (remote) transactions. These transactions conflict with any HTLC-success published by the victims, as they try to spend the same outputs. The attacker is able to replace any victim’s transactions already in mempools, since they are all replaceable using the Replace-By-Fee mechanism, as we explain in Section 2.4.

Although HTLC outputs can be claimed by the victims even after they expire, the attacker has a significant advantage at that point. In order to replace victims’ transactions, the attacker must publish his transactions with higher fees. The attacker knows exactly what fee is used by his victims (this is derived from the channel’s feerate) and can easily create transactions with the minimal fee required to outcome those of the victims. The HTLC-timeout used by the attacker should only be signed by him, and he can set the fee as he wishes. In contrast, the HTLC-success used by the victims must be signed by both parties (and was in fact already signed when the HTLC was added), and therefore cannot be changed by the victim to pay more fees, without the cooperation of the attacker.

The reason the attacker only needs his signature, while victims need both their signatures and that of the attacker, is that the published commitments are those of the victims. Contrarily, if the attacker’s commitment was the one to be published and confirmed, the attacker would have to use pre-signed transactions, while the victims could have claimed HTLC outputs without the attacker’s signature. Of course, in this attack, the victims have no choice but to publish their commitments before expiration, if they want to claim their funds.

Each HTLC output that is successfully claimed by the source node, is stolen from the recipient of that HTLC, as this HTLC was already forwarded, and claimed, by the attacker’s target node.

4. Evaluation

To show the feasibility of the attack we simulated it on a local Bitcoin’s regtest network. We implemented a prototype of an attacker’s node (a modified version of C-Lightning) that can stall the return of preimages and ignore peers’ requests. We chose LND as the client for the victims, as it is the most popular Lightning implementation used today.555as suggested by (Perez-Sola et al., 2019; Mizrahi and Zohar, 2020), more than 90% of the nodes on the Lightning Network runs LND

Each lightning node in our simulation, both the attacker’s and the victims’, is backed by its own full bitcoin node, running bitcoind, which are all connected to a central bitcoin node responsible for mining. Specifically, the attacker does not mine blocks and has no way to directly affect which transactions are confirmed, other than setting high fees for his own transactions.

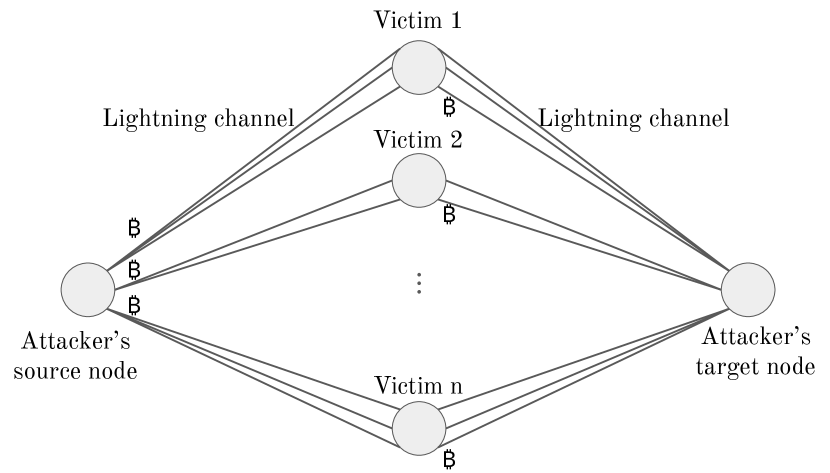

One set of channels is established between the attacker’s source node and all victims, and is funded by the attacker. Another set of channels is established between the attacker’s target node and all victims, and is funded by the victims, so there is liquidity on their side (in a real world attack, an attacker could fund these channels and then move liquidity to the other side e.g. by purchasing goods or depositing funds to an exchange with lightning payments). The topology used in the simulation is shown in Figure 4.

We then route 483 HTLC payments, which is LND’s default maximum number of unresolved HTLCs at a given moment, from the source node to the target node through each channel the source node has. All HTLCs are given the same expiration height. Once all payments went through, the target node releases all preimages to resolve the HTLCs, gracefully closes his channels and leaves with the total amount of HTLCs sent to him by the source node (closing the target node’s channels is not required for the attack to succeed, but we do it to show that it can be easily done and without a significant cost). The source node goes into “silent” mode and waits until the expiration height to claim any HTLC outputs that remained unspent. The victims have exactly 10 blocks for their transactions to be confirmed, from the moment they release their commitments, to the expiration, at which the attacker starts claiming HTLCs.

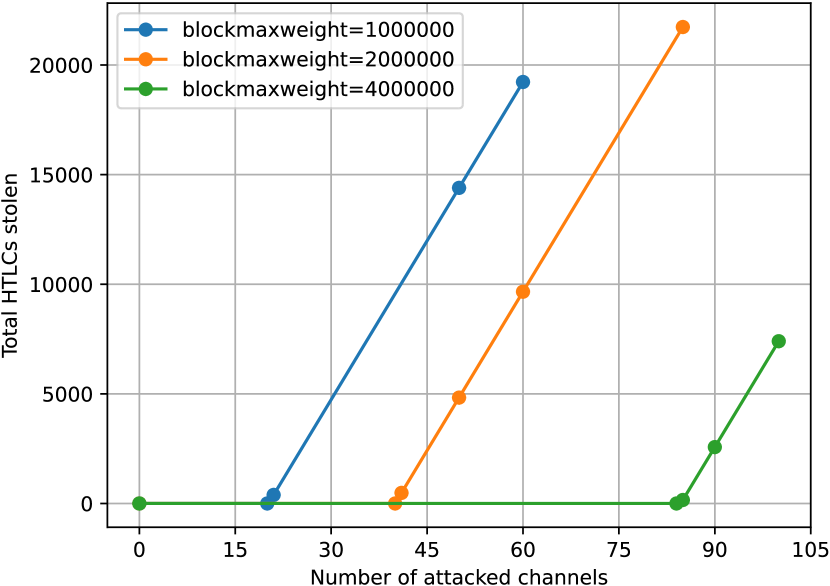

With 100 attacked channels, the attacker was able to successfully steal 7402

HTLC payments out of 48300 that were made in total. We repeat the simulation

multiple times with different number of attacked channels. The number of

successfully stolen HTLCs as a function of the number of attacked channels can

be seen in Figure 5. We learn that there is

a minimal number of channels, that when passed, the attacker starts to steal

funds, and funds of each additional channel will be stolen as well.

We also conduct more experiments with smaller maximum block weight

(smaller value of blockmaxweight666blockmaxweight is

the consensus parameter that defines the maximum weight for a valid block)

to represent times of congestion in the network. As we show in

Section 5.1, there are times in which the effective

block weight available for the victims can be smaller, due to insufficient fees.

4.1. Finding Potential Victims

The attack we present requires the attacker to establish channels with multiple victims. In this part we show that opening channels with unfamiliar nodes does not add a considerable effort to the attacker. Specifically, we show that most of the nodes on the network agree to open a channel with us upon our request.

According to the Lightning protocol (Specifications, 2016a), a node indicates its acceptance

to open a channel with another by replying with an accept_channel

message to an open_channel request. We try to perform this handshake

with many nodes on the network.

We start with two lists of the top 50 most connected nodes (nodes with highest

number of open channels) and top 50 nodes with most

liquidity.777downloaded from 1ml.com on 2020-06-07

Excluding duplicates, we remain with

addresses of 64 unique nodes. We connect and send an open_channel

message to each one of them, to which 63 reply with a successful

accept_channel.

We move on to find more potential victims. We extract all known IDs and addresses from the channels our node heard about and try to connect to all of them. Out of 4593 nodes, 2102 were responsive and communicating. Most of the failed attempts to connect were due to timeout or a refused connection (indicating that no process was listening at this address, i.e., the node was probably not active).

Out of the 2102 nodes we were able to communicate with, 2007 returned

a successful accept_channel message, indicating their willingness

to open a channel. The rest failed for several reasons, as shown in

Figure 6.

This shows that the vast majority of responsive nodes on the network, specifically more than 95%, are willing to establish a channel by request, and are therefore susceptible to becoming victims in our attack.

5. Lightning Channel Fees

To manage a lightning channel, the two parties must agree on the fee paid

by each of the transactions that they both sign. Specifically, the fee used for

commitments and HTLC success/timeout transactions.

When the channel is established for the first time, the parties agree on a

feerate (in Satoshi/KW), denoted the channel’s feerate, with which they calculate

the exact fee for each transaction. The Lightning

specifications define a deterministic way to calculate the fee for each

transaction based of the channel’s feerate and an estimated weight for the

transaction (a method for weight estimation is also described in the protocol).

After estimating the transaction weight, the exact fee that should be paid is

obtained by simply multiplying the feerate and the estimated weight.

The channel’s initiator is the one responsible for paying the fees (the fee is

deducted from his personal output) and is the one proposing the channel’s

feerate when the channel is open.

The other party may reject opening the channel if it thinks the proposed feerate

is unreasonable (too low or unnecessarily large).

Since fees may fluctuate in different times, the lightning protocol specifies a

way to update the channel’s feerate.

The channel’s initiator (responsible for paying the fees), and only him, could

propose a new channel feerate by sending an update_fee message with

a new proposed feerate, to which the other node must agree.

The protocol states that the other node (the one who did not initiate the

channel) cannot take any action to update the feerate if it thinks it became

unreasonable, with the rationale that this node is not responsible for paying the fees

(although the node should care about the feerate, as it affects the

node’s HTLC transactions).

Any request to update the channel’s feerate made by the node who is not the

channel’s initiator, would be considered a deviation from the protocol.

5.1. Feerate Estimations

To test how effective the feerates used in lightning channels are, we explore the estimation mechanism and see how it affects the confirmation time of lightning transactions that are published to the blockchain.

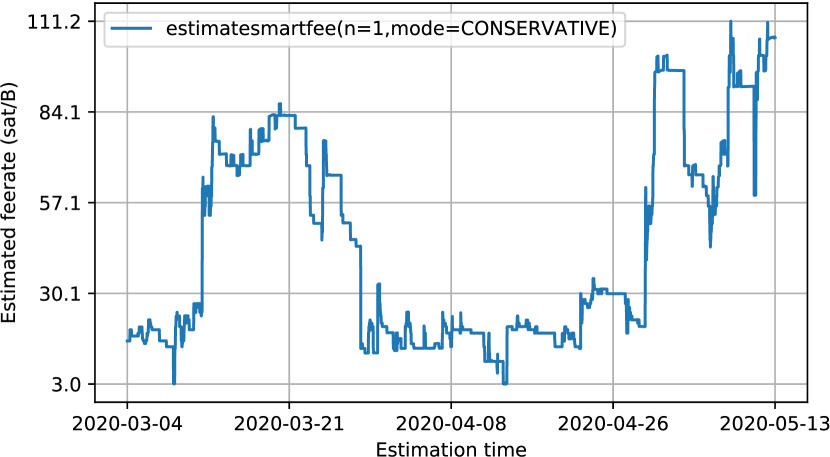

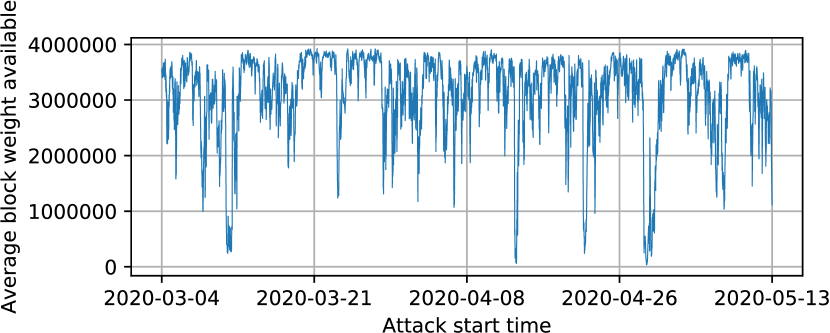

All 3 major implementations (C-lightning, LND, Eclair) rely on a bitcoin node to estimate feerates. This is achieved by querying the estimatesmartfee method of bitcoind.888LND also supports the EstimateFee method of btcd We continuously queried the estimatesmartfee method of bitcoind over a period of time and tried to understand how much block space can be used by transactions that pay such feerates. In Figure 7 we can see the feerate estimations made by bitcoind and how volatile these estimations could be in a relatively short period of time.

We try to estimate what part of blocks can potentially be claimed by victims’ transactions. Transactions are normally chosen to enter a block in a decreasing order of their feerate. We therefore define the available space of block under feerate as

Where is the feerate of transaction . In practice, some blocks are mined without utilizing their entire available weight (4M). The available space in such blocks will actually be smaller than this estimate, making it overly optimistic, i.e., in practice victims will not have this much available block space.

Next we estimate the average available block space that victims have in the limited time window between publishing the commitment and the HTLC expiration. Since most nodes on the network run LND, we use a window of 10 blocks (LND’s default commitment-broadcast-delta).

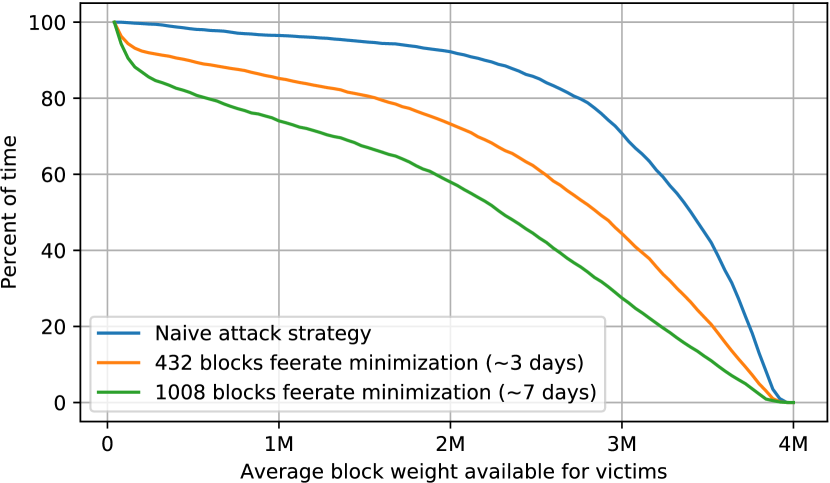

We first look at a simple attack strategy: The attacker opens channels with his victims and immediately makes all HTLC payments, with an expiration of 100 blocks. The feerate used on all his channels in this case is the one estimated by bitcoind at the moment the channels were opened. In our observed period of over 2 months, this simple strategy shows that victims have an average available block space of at least 2M weight units 92% of the time. Figure 8 shows different possible time points for starting the attack and the average block space available for victims’ transactions, and implies that rarely is it the case that victims can utilize the entire space of a block.

A less naive attack strategy can further reduce the available block space that victims will have, by reducing the channel’s feerate whenever possible. The strategy we employ proceeds as follows: The attacker opens channels with his victims and tries to reduce his channels’ feerates for some period of time before making all HTLC payments, again with an expiration of 100 blocks. As per the current Lightning protocol, the victims are not allowed to request any feerate changes, but do agree to any change proposed by the attacker, so long as the change matches bitcoind’s latest fee estimate. Therefore, the attacker can continuously update the feerate to lower values when the fee estimates allow it, but never raises the feerate when conditions change in the other direction.

Figure 9 shows the effects of using this feerate minimization strategy. When minimizing the fees over a period of 1008 blocks (approximately 7 days), victims have an average available block space of 2M (or more) weight units, only 58% of the time.

6. Mitigation Techniques

In this section we discuss several mitigation techniques that can help to reduce the severity of the attack. We start by emphasizing some of the key points that make the attack feasible.

An important part of a successful attack is the congestion in the underlying network when the victims close their channels. This of course is not controlled by the victims, but they can better prepare for it by choosing some parameters more carefully. These include the time at which the commitment is published, the maximum allowed number of unresolved HTLCs or the channel’s feerate.

Other key points that allow executing a successful attack cannot be controlled by the victims, and are in fact inherent to the protocol itself. The fact that the attacker can easily replace victims’ transactions after the HTLCs expire, is based on 3 protocol rules:

-

(i)

The victim can only claim the HTLCs using HTLC-success (local) transactions that must be signed by both parties. They therefore cannot modify their transactions when faced with an uncooperative attacker

-

(ii)

The HTLC-success transactions published by the victims are replaceable (as we explain in Section 2.4)

-

(iii)

The attacker’s HTLC-timeout transactions do not require the signatures of the victims, allowing the attacker to increase the fees

6.1. Bad Mitigation Strategies

Simplifying Incoming HTLCs First A possible mitigation that may come to mind (but is ill advised) is to enact the following change in the HTLC forwarding process: Once the secret preimage is propagated back from the target, HTLCs in each channel on the path are resolved. However, instead of having nodes agree to resolve an outgoing HTLC immediately upon receiving the preimage, one might be tempted to require that nodes forward the secret back towards the sender, and await for the corresponding incoming HTLC to be resolved first.

Such a process would seemingly raise difficulties for the attacker. Since the attacker does not intend to resolve any HTLCs within the first-hop channel, our current mode of attack will be harder to carry out: No HTLCs will be resolved on the last hop as well, and the attacker will be forced to publish many HTLC transactions, and claim them all in a limited amount of time. He will not be able to increase fees for his transactions, and will in fact find himself in a similar situation that the victims are in, when attacked. This could make the attacker lose funds he locked in channels, and thus disincentivize executing an attack.

The reason we do not recommend this change however, is that this mitigation introduces a new potential attack that could spam the blockchain with many more transactions without additional effort. An attacker could route many payments from and to his own lightning nodes (similarly to our attack), using as many intermediate nodes on the payment path. According to this mitigation, none of the HTLCs on the different channels involved in forwarding the payments could be resolved before they are resolved by the source node. If the attacker decides not to resolve HTLCs, all channels on the payment path, including ones the attacker is not part of, will be forced to close to the blockchain with all HTLCs unresolved.

In our attack, each victim’s channel generates a number of blockchain transactions that is proportionate to the number of HTLCs on that channel. In this new “spam attack”, this number is multiplied by the length of the payment path, that could include up to 20 intermediate nodes.

Increasing HTLC Fees Via Child Pays For Parent Another flawed solution is to try and increase the fee paid by the victim’s HTLC transaction using the Child Pays For Parent (CPFP) technique. To employ this method, the victim publishes his HTLC-success transaction (that pays low fees), denoted , along with another transaction, denoted . is set up so that it depends on (it spends one of its outputs), and so that it pays a higher fee that supplements that of . This incentivizes miners to include both transactions together.

However, since is replaceable, the rules state that transactions that depend on it are replaceable as well. is therefore replaceable as well, as long as remains unconfirmed. Thus, using CPFP does not prevent the attacker from replacing the transactions and increasing his own transaction’s fee, and would not prevent the theft. The only way to stop the attacker would be to pay fees that are higher than the amount being contested in the HTLC. In this case the attacker gains nothing from the attack, but the victim losses all as well, as the fees effectively burned away all the money that was to be gained.

6.2. Reducing the Maximum Number of Unresolved HTLCs

One of the main reasons this attack could work is that there are only so many HTLC-success transactions that could be confirmed from the moment the commitments are published until the HTLCs expire. Once an HTLC has expired, the victim has almost no chance of claiming it. Reducing the maximal number of unresolved HTLCs allowed at any moment, would lower the number of transactions that need to enter the blockchain in that time window. An attacker will then need more victims in order to steal funds from the same amount of HTLCs. However, finding an optimal value for the maximum allowed HTLCs is not trivial. As this value decreases, the potential of another attack increases. As shown in (Mizrahi and Zohar, 2020), a low value for the parameter would help an attacker execute a denial-of-service attack, by congesting many channels in the network.

6.3. Deciding When to Close Channels

Currently, the commitment broadcast delta defines the time (prior to HTLC expiration) that nodes begin to unilaterally close channels with unresolved incoming HTLCs. The commitment broadcast delta should be set high enough to allow the node to claim these soon-to-expire HTLCs, in case the other party is uncooperative. The Lightning Network specifications (Specifications, 2016a) suggest publishing the commitment 7 blocks before expiration.

Default parameters used by different implementations are shown in Table 1, from which we learn that nodes use a smaller time window (“Commitment broadcast delta”) to claim HTLCs than they potentially could (“HTLC expiry delta”).

| C-Lightning | LND | Eclair | |

|---|---|---|---|

| HTLC expiry delta | 14 | 40 | 144 |

| Commitment broadcast delta | 7 | 10 | 6 |

| Maximum accepted HTLCs | 30 | 483 | 30 |

Simply increasing the commitment broadcast delta, each attacked node will have more time (blocks) to claim the HTLCs on the blockchain before they expire and become spendable by the attacker, making it less probable to lose funds in an attempted attack.

Such change, however, could lead to premature closure of honest channels in case the previous node is honest but fails to respond in time. We believe such changes should not be too damaging, as they are unlikely to happen to honest nodes. A node that just forwarded an HTLC payment is usually responsive in the next few seconds, which is oftentimes enough to forward and completely resolve payments successfully.

A more extreme version of this mitigation is to initiate a closure of the channel if the previous hop fails to simplify an HTLC within a short period of time regardless of the HTLC’s expiration time (this timeout can be specified in seconds, since blocks may sometimes be created in bursts).

In short, the benefits from closing channels earlier when faced with misbehaving peers seem to surpass any downside.

Dynamic closing rules If a node has many pending incoming HTLCs that the other party does not resolve, it could raise the likelihood that the node is being attacked. In that case, the channel should be closed earlier, to avoid losing funds.

We therefore advocate for a more sophisticated policy that dynamically sets the commitment broadcast delta for each channel, based on the potential loss that this channel may incur in case of an attack. E.g. a commitment broadcast delta of a channel could increase as the number of concurrent unresolved HTLCs increases or if the total value of HTLCs is high.

6.4. Do Not Wait for Commitment Tx Confirmation

When a node decides to unilaterally close one of its channels to claim incoming HTLCs on the blockchain, it needs to publish its latest commitment transaction along with a collection of HTLC-success transactions. In practice, some implementations (e.g., LND and C-Lightning) wait until the commitment transaction is confirmed before releasing the HTLC-success transactions. This way, nodes lose precious time that can be used to get HTLC transactions accepted.

Since all of these transactions can be published to the network immediately, a simple fix would be to do so. This mitigation technique has no visible drawbacks and is relatively easy to implement (Eclair nodes already follow this practice).

6.5. Reputation-Based Behavior

As we have shown in our simulations, a high number of maximum allowed HTLCs helps an attacker to execute a successful attack. However, a high number is also desirable if we want to support greater throughput, and therefore a high transaction rate. Similarly, allowing HTLCs that transfer larger amounts also aids the attacker, but is desirable for the Lightning Network’s functionality.

We suggest setting the value of these parameters differently for each channel, and basing them on a reputation score we assign to the other party with whom we share the channel. A node will agree to route a greater number of high value HTLCs together with peers it considers “reputable”. We thus lower the node’s risk and the potential loss it may suffer in case of an attack.

For example, we can assign a higher reputation score to channels that we initiate (we chose who the other party is), and give a lower score to channels that were created based on requests from unknown counterparts. Reputation scores could grow over time, as a node proves its ability to “behave well”, which would imply that attackers would need to run longer-term (and thus more costly) attacks to have a similar effect.

6.6. Anchor Outputs

A new proposal was made recently (Specifications, 2019) that provides an

improvement to the way lightning transaction fees are paid.

The proposal introduces another type of commitment output, called an anchor

output. Such outputs may be used by each of the nodes to increase the fee of a

commitment, using the child-pays-for-parent method, allowing the

commitment to be confirmed sooner. Each party will have its own anchor output in

the commitment, which only it can spend.999In practice, once the

commitment is deeply confirmed, anchor outputs, whose value is low, will be spendable by anyone, to

prevent a burden on the utxo set

This proposal also changes the structure of HTLC-claiming transactions

by using SIGHASH_SINGLE|SIGHASH_ANYONECANPAY signature hash type,

allowing to add inputs and increase the fee. Regarding our attack, this method

would allow the victims to publish their HTLC-success with increased fee,

and therefore better compete with other transactions in the mempool,

which they are not able to do today.

Although the victims would be able to set high fees for their transactions, they still would not be able to compete with the attacker’s transactions once the HTLCs expire. Since the attacker constructs his transactions as he wishes (without needing the victims’ signatures), he could make them irreplaceable, preventing the victims from replacing them, regardless of how much fee they offer. The attacker’s transactions may now need to pay more fees (as the victims could have increased them), yet, since the expired HTLCs belong to the victims, the attacker loses nothing by paying them.

6.7. Non-Replaceable HTLC transactions

Another possible mitigation would be to prevent the attacker from replacing the victims’ HTLC-success transactions, by making them irreplaceable. It appears that replaceability is not strictly needed for the trustless nature of the protocol. Still, this attempt must be done carefully, and care should be taken not to break the revocation mechanisms.

6.8. A Recommendation For Exchanges & Other Payment Recipients

As we saw in the attack, adding an incoming HTLC to the commitment does not guarantee the receipt of the payment. The amount of an HTLC payment could be stolen if it is not resolved and the receiver has to claim it on the blockchain. Therefore, a payment recipient should not consider a payment as received when it is added to its channel, but only after the sender resolved it and committed to the new state (with the HTLC amount moved to the balance of the receiver). In particular, this applies to any exchange or ATM that accepts deposits through lightning payments and allows the sender to further transfer or withdraw cash or bitcoins.

7. Related Work

Many aspects of the Lightning Network have been extensively studied. A wide survey on second-layer solutions was done in (Gudgeon et al., 2019). A technical review of the building blocks of the Lightning Network is presented in (McCorry et al., 2016).

Some basic attack vectors were mentioned in the original Lightning Network paper (Poon and Dryja, 2016). One problem that was introduced was a potential blockchain spamming attack, caused by a malicious party that forces many channels to be closed at the same time. Yet, no concrete evaluation was done to see how severe such an attack might be.

The notion of Channel Exhaustion is discussed in (Rohrer et al., 2019). It describes a way to disrupt the normal operation of a channel as a bi-directional route, by pushing its entire balance to one side, making it impossible to route payments in one direction. A detailed channel exhaustion attack is described in (Perez-Sola et al., 2019).

A known attack technique called Griefing (Robinson, 2019) can be used to execute denial-of-service attacks on the network, by initiating a multi-hop payment that will be in pending mode for a long period of time, possibly until it expires entirely. One attack that makes use of griefing is described in (Mizrahi and Zohar, 2020), where they exploit the HTLC mechanism to block channels from routing payments in both directions while minimizing the cost of the attack far lower than a traditional channel exhaustion.

A new proposal has been discussed recently to mitigate griefing attacks (lightning-dev-griefing-attack-mitigation, 2020). The proposal tries to get an attacker’s channels closed if he uses griefing, which will impose additional costs to the attacker and prevent him from routing payments and earning fees. Yet another solution for griefing attacks is proposed in (Banerjee et al., 2020), where the authors suggest a way to penalize an attacker.

An attack shown in (Malavolta et al., 2019) can successfully steal payment fees if a malicious party controls two nodes on the payment route. This is achieved by excluding all nodes between the two malicious ones from the normal process of completing an HTLC transaction, and thus earning all the fees they should have received from forwarding the payment.

Another potential attack known as “RBF-pinning” exploits the HTLC mechanism along with the fact that some Lightning implementations do not monitor the mempool (Corallo, 2020). Here, an attacker releases transactions that claim HTLCs (which include the preimage), but does so using extremely low fees. This ensures that these transactions do not appear on the blockchain, but rather stay in mempools, where the lightning implementations do not detect them (and hence do not learn the published preimages). The transactions published by the attacker are irreplaceable, so they cannot be replaced by the victim.

Other works study the network from an economic point-of-view. In (Engelmann et al., 2017), the authors explore the relation between the cost of a lightning payment and the number of hops in its route, and argue that in some cases, lightning payments can be even more expensive than normal blockchain transactions. The incentives to participate in the Lightning Network were analyzed in (Béres et al., 2019). According to this work, participation is in fact irrational for most of today’s large nodes.

Payment routing was analyzed in (Prihodko et al., 2016; Tochner et al., 2019; Engelmann et al., 2017), and some improvements were proposed for choosing cheaper routes in a way that is also less prone to attacks.

The Lightning Network’s topology was studied in (Seres et al., 2020; Lin et al., 2020). It has been shown that the network is highly centralized, with a small number of hubs connecting large parts of the network together. Removing such hubs can partition the network into many components.

Other works focus on the privacy of participants in the network. The network aims to keep nodes’ balances private, and therefore a channel’s exact balance is never announced. Several methods to deduce the exact balance of a channel have been suggested (Herrera-Joancomartí et al., 2019; van Dam et al., 2019; Tikhomirov et al., 2020). The main technique is to request a payment via the channel, then, based on whether the payment succeeds to traverse the channel or not, the sender learns whether the balance is greater or smaller than the requested payment amount.

8. Conclusions

In this work we presented the Flood Loot attack, in which an attacker can successfully steal funds from nodes on the Lightning Network. We laid concrete steps for how this attack could be executed and evaluated it by simulating it locally.

We examined the mechanisms that are used by lightning nodes to determine blockchain fees and studied their influence on the success of the attack. We also pointed out ways an attacker could use to amplify the attack, based on the results of the fee estimation mechanisms, that would allow him to steal more funds for the same effort (initial investment and number of opened channels required for successful execution).

We continued with a discussion of multiple mitigation techniques that could reduce the scope of the attack, by taking into account the fundamental elements that contributed to its success. Still we believe that in many ways the vulnerabilities exploited by our attack are inherent to the way HTLCs work, and thus the attack cannot be avoided completely.

Acknowledgements.

We would like to thank Bastien Teinturier for his valuable feedback. This research was supported by the Israel Science Foundation (grant 1504/17) and by a grant from the HUJI Cyber Security Research Center in conjunction with the Israel National Cyber Bureau.References

- (1)

- Bagaria et al. (2018) Vivek Bagaria, Sreeram Kannan, David Tse, Giulia Fanti, and Pramod Viswanath. 2018. Deconstructing the blockchain to approach physical limits. arXiv preprint arXiv:1810.08092 (2018).

- Banerjee et al. (2020) Prabal Banerjee, Subhra Mazumdar, and Sushmita Ruj. 2020. Griefing-Penalty: Countermeasure for Griefing Attack in Bitcoin-compatible PCNs. arXiv preprint arXiv:2005.09327 (2020).

- Béres et al. (2019) Ferenc Béres, Istvan Andras Seres, and András A Benczúr. 2019. A cryptoeconomic traffic analysis of bitcoins lightning network. arXiv preprint arXiv:1911.09432 (2019).

- Corallo (2020) Matt Corallo. 2020. RBF Pinning with Counterparties and Competing Interest. Lightning-dev mailing list. https://lists.linuxfoundation.org/pipermail/lightning-dev/2020-April/002639.html.

- Croman et al. (2016) Kyle Croman, Christian Decker, Ittay Eyal, Adem Efe Gencer, Ari Juels, Ahmed Kosba, Andrew Miller, Prateek Saxena, Elaine Shi, Emin Gün Sirer, et al. 2016. On scaling decentralized blockchains. In International conference on financial cryptography and data security. Springer, 106–125.

- Decker and Wattenhofer (2013) Christian Decker and Roger Wattenhofer. 2013. Information propagation in the bitcoin network. In IEEE P2P 2013 Proceedings. IEEE, 1–10.

- Decker and Wattenhofer (2015) Christian Decker and Roger Wattenhofer. 2015. A fast and scalable payment network with bitcoin duplex micropayment channels. In Symposium on Self-Stabilizing Systems. Springer, 3–18.

- Engelmann et al. (2017) Felix Engelmann, Henning Kopp, Frank Kargl, Florian Glaser, and Christof Weinhardt. 2017. Towards an economic analysis of routing in payment channel networks. In Proceedings of the 1st Workshop on Scalable and Resilient Infrastructures for Distributed Ledgers. 1–6.

- Green and Miers (2017) Matthew Green and Ian Miers. 2017. Bolt: Anonymous payment channels for decentralized currencies. In Proceedings of the 2017 ACM SIGSAC Conference on Computer and Communications Security. 473–489.

- Gudgeon et al. (2019) Lewis Gudgeon, Pedro Moreno-Sanchez, Stefanie Roos, Patrick McCorry, and Arthur Gervais. 2019. SoK: Layer-Two Blockchain Protocols. Cryptology ePrint Archive, Report 2019/360. https://eprint.iacr.org/2019/360.

- Harding and Todd (2015) David A. Harding and Peter Todd. 2015. Opt-in Full Replace-by-Fee Signaling. Bitcoin Improvement Proposal. https://github.com/bitcoin/bips/blob/master/bip-0125.mediawiki.

- Heilman et al. (2017) Ethan Heilman, Leen Alshenibr, Foteini Baldimtsi, Alessandra Scafuro, and Sharon Goldberg. 2017. Tumblebit: An untrusted bitcoin-compatible anonymous payment hub. In Network and Distributed System Security Symposium.

- Herrera-Joancomartí et al. (2019) Jordi Herrera-Joancomartí, Guillermo Navarro-Arribas, Alejandro Ranchal-Pedrosa, Cristina Pérez-Solà, and Joaquin Garcia-Alfaro. 2019. On the difficulty of hiding the balance of lightning network channels. In Proceedings of the 2019 ACM Asia Conference on Computer and Communications Security. 602–612.

- lightning-dev-griefing-attack-mitigation (2020) lightning-dev-griefing-attack-mitigation 2020. Proof-of-closure as griefing attack mitigation. Lightning-dev mailing list. https://lists.linuxfoundation.org/pipermail/lightning-dev/2020-April/002608.html.

- Lin et al. (2020) Jian-Hong Lin, Kevin Primicerio, Tiziano Squartini, Christian Decker, and Claudio J Tessone. 2020. Lightning Network: a second path towards centralisation of the Bitcoin economy. arXiv preprint arXiv:2002.02819 (2020).

- Lind et al. (2016) Joshua Lind, Ittay Eyal, Peter Pietzuch, and Emin Gün Sirer. 2016. Teechan: Payment channels using trusted execution environments. arXiv preprint arXiv:1612.07766 (2016).

- Lombrozo et al. (2015) Eric Lombrozo, Johnson Lau, and Pieter Wuille. 2015. Segregated Witness (Consensus layer). Bitcoin Improvement Proposal. https://github.com/bitcoin/bips/blob/master/bip-0141.mediawiki.

- Malavolta et al. (2019) Giulio Malavolta, Pedro Moreno-Sanchez, Clara Schneidewind, Aniket Kate, and Matteo Maffei. 2019. Anonymous Multi-Hop Locks for Blockchain Scalability and Interoperability.. In NDSS.

- McCorry et al. (2016) Patrick McCorry, Malte Möser, Siamak F Shahandasti, and Feng Hao. 2016. Towards bitcoin payment networks. In Australasian Conference on Information Security and Privacy. Springer, 57–76.

- Mizrahi and Zohar (2020) Ayelet Mizrahi and Aviv Zohar. 2020. Congestion attacks in payment channel networks. arXiv preprint arXiv:2002.06564 (2020).

- Perez-Sola et al. (2019) Cristina Perez-Sola, Alejandro Ranchal-Pedrosa, Jordi Herrera-Joancomartí, Guillermo Navarro-Arribas, and Joaquin Garcia-Alfaro. 2019. LockDown: Balance Availability Attack against Lightning Network Channels. Cryptology ePrint Archive, Report 2019/1149. https://eprint.iacr.org/2019/1149.

- Poon and Dryja (2016) Joseph Poon and Thaddeus Dryja. 2016. The bitcoin lightning network: Scalable off-chain instant payments.

- Prihodko et al. (2016) Pavel Prihodko, Slava Zhigulin, Mykola Sahno, Aleksei Ostrovskiy, and Olaoluwa Osuntokun. 2016. Flare: An approach to routing in lightning network. White Paper (2016).

- Robinson (2019) Daniel Robinson. 2019. HTLCs Considered Harmful. Stanford Blockchain Conference 2019, Stanford University. https://cyber.stanford.edu/sbc19.

- Rohrer et al. (2019) Elias Rohrer, Julian Malliaris, and Florian Tschorsch. 2019. Discharged Payment Channels: Quantifying the Lightning Network’s Resilience to Topology-Based Attacks. In 2019 IEEE European Symposium on Security and Privacy Workshops (EuroS&PW). IEEE, 347–356.

- Seres et al. (2020) István András Seres, László Gulyás, Dániel A Nagy, and Péter Burcsi. 2020. Topological analysis of bitcoin’s lightning network. In Mathematical Research for Blockchain Economy. Springer, 1–12.

- Sompolinsky and Zohar (2015) Yonatan Sompolinsky and Aviv Zohar. 2015. Secure high-rate transaction processing in bitcoin. In International Conference on Financial Cryptography and Data Security. Springer, 507–527.

- Specifications (2016a) Lightning Network Specifications. 2016a. Basis of Lightning Technology (BOLT). https://github.com/lightningnetwork/lightning-rfc.

- Specifications (2016b) Lightning Network Specifications. 2016b. Deadline calculation for received HTLCs. https://github.com/lightningnetwork/lightning-rfc/blob/master/02-peer-protocol.md#cltv_expiry_delta-selection.

- Specifications (2019) Lightning Network Specifications. 2019. Anchor Outputs. https://github.com/lightningnetwork/lightning-rfc/pull/688.

- Tikhomirov et al. (2020) Sergei Tikhomirov, Rene Pickhardt, Alex Biryukov, and Mariusz Nowostawski. 2020. Probing Channel Balances in the Lightning Network. arXiv preprint arXiv:2004.00333 (2020).

- Tochner et al. (2019) Saar Tochner, Stefan Schmid, and Aviv Zohar. 2019. Hijacking Routes in Payment Channel Networks: A Predictability Tradeoff. arXiv preprint arXiv:1909.06890 (2019).

- van Dam et al. (2019) Gijs van Dam, Rabiah Abdul Kadir, Puteri N.E. Nohuddin, and Halimah Badioze Zaman. 2019. Improvements of the Balance Discovery Attack on Lightning Network Payment Channels. Cryptology ePrint Archive, Report 2019/1385. https://eprint.iacr.org/2019/1385.

- Zohar (2017) Aviv Zohar. 2017. Securing and scaling cryptocurrencies.. In IJCAI. 5161–5165.