Nonparametric Tests of Tail Behavior

in Stochastic Frontier Models

Abstract

This article studies tail behavior for the error components in the stochastic frontier model, where one component has bounded support on one side, and the other has unbounded support on both sides. Under weak assumptions on the error components, we derive nonparametric tests that the unbounded component distribution has thin tails and that the component tails are equivalent. The tests are useful diagnostic tools for stochastic frontier analysis. A simulation study and an application to a stochastic cost frontier for 6,100 US banks from 1998 to 2005 are provided. The new tests reject the normal or Laplace distributional assumptions, which are commonly imposed in the existing literature.

Keywords: Hypothesis tests, Production, Inefficiency, Extreme value theory.

JEL Codes: C12, C21, D24.

1 Introduction

Stochastic frontier analysis (SFA) has a vast literature, both methodological and applied, and empiricists have applied the methods to myriad industries, most notably agriculture, banking, education, healthcare, and energy. A common practice in SFA is to impose parametric assumptions on the error components, but the set of statistical tools to investigate the validity of these assumptions is still limited. This paper expands this set of tools by drawing on recently developed techniques in Extreme Value (EV) theory and by developing new diagnostic tests.

In particular, the parametric stochastic frontier model for cross-sectional data (Aigner et al. 1997) is a leading case of the error component regression model but with the unique feature that one error component () is a non-negative random variable (e.g., half-normal, exponential), while the other () is a random variable of unbounded support (e.g., normal, Laplace, Student-t). A common assumption in the stochastic frontier literature is that is drawn from a normal or Laplace distribution (both thin-tailed distributions). See Aigner et al. (1977) or Horrace and Parmeter (2018), respectively.111For other parametric specifications of the model see Li (1996), Carree (2002), Tsionas (2007), Kumbhakar et al. (2013), and Almanidis et al. (2014). However, heavy-tailed distributions are now also being considered. For example, the findings of Wheat et al. (2019) suggest that a cost inefficiency model of highway maintenance costs in England has Student-t errors.222There are semi-parametric estimators of the model that relax the distributional assumptions on one component and estimate the density of the other using kernel deconvolution techniques. See Kneip et al. (2015), Horrace and Parmeter (2011), Cai et al. (2020), Simar et al. 2017, Hall and Simar (2002), Florens et al. (2020). These parametric distributions, such as normal and Student-t, display similar patterns in the middle of their supports but exhibit substantially different tail behaviors. This observation motivates and plays an essential role in our diagnostic tests, which we believe are a timely and appropriate contribution to the literature.

The key idea of our test is as follows. Assuming independence of the error components, the largest order statistics of the composed error term () (approximately) arise from the tails of , because is one-sided. Also, assuming that is in the domain of attraction (DOA) of extreme value distributions, the asymptotic distribution of the largest order statistics of is the EV distribution, which may be fully characterized (after location and scale normalization) by a single parameter that captures its tail heaviness.333The assumption that is in the DOA of extreme value distributions is not restrictive, as we shall see. Then, likelihood ratio statistics for hypotheses on this single parameter can be derived based on the limiting EV distribution.

To be specific, consider the right tail of . If the DOA assumption is satisfied, then tail behavior may be entirely characterized by a tail index, . If , then has thin tails. If , then has thick tails. Otherwise, has bounded support. Under very weak assumptions on the error components, we derive a test that the tails of are thin (). We prove that this test is valid whether is observed or appended to a regression model (as it is in the stochastic frontier model). If we assume that is also in the DOA of extreme value distributions and that is symmetric (a common assumption), we also derive a test that the (right) tail of is thinner than the left tail of . If we further assume that is a member of the normal family, then we may test the hypotheses that the tails of and are both thin. Therefore, our nonparametric tests are useful diagnostic tools to help empiricists make parametric choices on the distributions of both and . This is particularly important for the stochastic frontier model for cross-sectional data, where distributional assumptions on the components are typically necessary for the identification of the model’s parameters.

The paper is organized as follows. The next section presents the tests. Section 3 provides a simulation study of the power and size of the test. Section 4 applies the tests to a stochastic cost function for a panel of US banks 1998-2005, revealing that the tails of are not thin. Therefore, a normal or Laplace assumption for is not justified, and perhaps a Student-t assumption may be appropriate. Section 5 concludes.

2 Tests of Tail Behavior

To fix ideas, we begin a review of the DOA assumption and present the test in the case where is directly observed in Section 2.1. Then in Section 2.2, we move to the case where is appended to a regression model and has to be estimated, which covers the linear regression stochastic frontier model. Additional tests under different sets of weak assumptions are also presented.444While the analyses that follow are for cross-sectional data, they can easily be applied to panel data, as long as one is willing to assume independence in both the time and cross-sectional dimensions.

2.1 The case with no covariates

Consider a random sample of for , where represents inefficiency, and is noise with unbounded support. We start with testing the shape of the right tail of in a nonparametric way.

The key assumption is that the distribution of is within the domain of attraction of EV distributions. In particular, a cumulative distribution function is in the domain of attraction of , denoted as , if there exist constants and such that

where is the generalized EV distribution,

| (1) |

and is the tail index, measuring the decay rate of the tail.

The domain of attraction condition is satisfied by a large range of commonly used distributions. If is positive, this condition is equivalent to regularly varying at infinity, i.e.,

| (2) |

This covers Pareto, Student-t555The tail index of the Student-t distribution with degrees of freedom is ., and F distributions, for example. The case with covers the normal family, and the case with corresponds to distributions with a bounded support.666The uniform distribution has , and the triangular distribution has . See de Haan and Ferreira (2007), Ch.1 for a complete review.

Note that the above notation is for the right tail of , which can be easily adapted to the left tail by considering . For expositional simplicity, we denote and as the tail indices for the left and right tails of , respectively. The same notation applies to other variables (e.g., and ) introduced later.

Returning to SFA, a common assumption is that is normal or Laplace, which implies that . So our hypothesis testing problem is as follows:

| (3) |

If the null hypothesis is rejected, we would then argue that some heavy-tailed distribution should be used to model the noise and maybe the inefficiency as well.

To obtain a feasible test, we argue that, since is bounded from below at zero, the largest order statistics of are approximately stemming from the right tail of . This is formalized in Proposition 1, which requires the following conditions. Let be the order statistics of by descend sorting. Denote

as the largest observations. From now on, we use bold letters to denote vectors. Denote and as the CDF and the quantile function of , respectively. Write as the right end-point of the support of . For a generic column vector and scalar , the notation means .

Assumption 1

-

(i) is i.i.d.

-

(ii) and are independent.

-

(iii) with and with .

-

(iv) with . In addition, is twice continuously differentiable with bounded derivatives, and the density satisfies that as on for some constant .

Assumptions 1(i)-(iii) are common in the SFA literature (see Horrace and Parmeter (2018) and the references therein). Assumption 1(iv) requires the tail of to be within the domain of attraction of EV distributions with an infinite upper bound. Moreover, it requires that the density derivative monotonically increases to zero. This is a mild assumption and is satisfied by many commonly used distributions. For example, the normal distribution is covered as seen by

and the Pareto distribution is covered as seen by

Under Assumption 1, the following proposition derives the asymptotic distribution of .

Proposition 1

Suppose Assumption 1 holds. Then, there exist sequences of constants and such that for any fixed

where the joint density of is given by on , and .

The proof is in Appendix A. This proposition implies that the distributions of and share the same (right) tail shape, which is entirely characterized by the tail index . Such tail equivalence does not hold, however, for the left tails due to the existence of . This is studied in Section 2.3 under the additional assumption that is symmetric.

If the constants and were known, is then approximately distributed as , and the limiting problem is reduced to the well-defined finite sample problem: constructing some inference method based on one draw whose density is known up to . However, and depend on and hence are unknown a priori.

To avoid the need for knowledge of and , we consider the following self-normalized statistic

It is easy to establish that is maximally invariant with respect to the group of location and scale transformations (cf., Lehmann and Romano (2005), Ch.6). In words, the estimator constructed as a function of remains unchanged if data are shifted and multiplied by any non-zero constant. This makes senses since the tail shape should be preserved no matter how data are linearly transformed. This invariance property allows us to construct nonparametric tests for a stochastic frontier model that is otherwise not identified without parametric assumptions on and .777In particular the non-zero expectation of precludes identification of unknown parameter in the model . As such, our tests do not reveal anything about the location or the scale of the error components.

The continuous mapping theorem and Proposition 1 imply that for any fixed , as ,

The CDF of can be calculated via change of variables as

| (5) |

where , if and otherwise, and is the gamma function. Note that the invariance restriction costs two degrees of freedom since the first and last elements of are always 1 and 0, respectively. We calculate this density by numerical quadrature.

Given , we can construct the generalized likelihood-ratio test for problem (3). Since the alternative hypothesis is composite, we follow Andrews and Ploberger (1994) and Elliott et al. (2015) to consider the weighted average alternative

where is a weighting function that reflects the importance of rejecting different alternative values. Then our test is constructed as 888In later sections, we set to be the standard uniform distribution over for simplicity.

| (6) |

where the critical value depends on and the level of significance . We can obtain it by simulation. By Proposition 1 and the continuous mapping theorem, this test controls size asymptotically as .

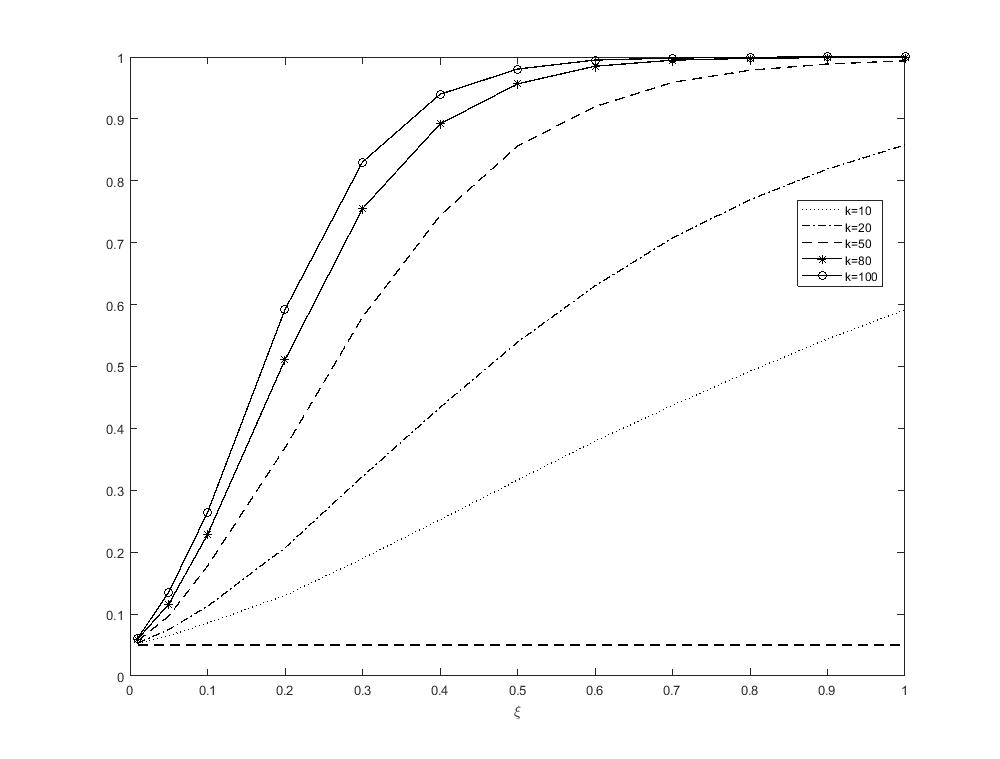

We end this subsection by briefly discussing the choice of , that is, the number of the largest order statistics used to approximate the EV distribution. On the one hand, larger means including more mid-sample observations, which induces a larger finite sample bias in the EV approximation. On the other hand, smaller provides a better asymptotic approximation but uses less sample information, leading to a lower power test. This trade-off leads to difficulty in theoretical justification of an optimal in standard EV theory literature (cf., Müller and Wang (2017)). It is even more difficult, if at all possible, in our case, since we only observe , and not . Nonetheless, our asymptotic arguments show that the test (6) controls size for any fixed , as long as is sufficiently large. Figure 1 depicts the asymptotic power of the test (6) with generated from the density (5) based on 10,000 simulation draws. The test controls size for all values of by construction and has reasonably large power when exceeds 20.

With ideas fixed, we now turn to the regression version of the test, with application to SFA.

2.2 The case with covariates: SFA

Now consider the linear regression with

where is as in the previous section, and is some pseudo-true parameter in some compact parameter space. This could be a Cobb-Douglas production function (in logarithms), where is productive output and is now called technical efficiency, which measures distance () from a stochastic frontier (). The slopes () are marginal products of the productive inputs, . It could also be a stochastic cost function if we multiply by . Suppose we have some estimator, of . The following assumption is imposed to construct our diagnostic test.

Assumption 2

-

(i) is i.i.d.

-

(ii) and are independent.

-

(iii) with and with .

-

(iv) with . In addition, is twice continuously differentiable with bounded derivatives, and the density satisfies that as on for some constant .

-

(v) , if . , otherwise.

Assumption 2 is similar to Assumption 1 with additional restrictions on the covariate . In particular, Assumption 2(v) bounds the norm of and . A sufficient condition when is positive is that and , which is easily satisfied in many applications.999Even though , ordinary least squares (OLS) will typically suffice for , because our test is invariant to relocation. When is zero, we need slightly stronger bounds. Straightforward calculations show that the normal distribution satisfies Assumption 2(v) for the case, if and for some . This is seen by (cf. Example 1.1.7 in de Haan and Ferreira (2007)).

Denote as the OLS residuals and

the largest order statistics. Then given Assumption 2, the following proposition derives the asymptotic distribution of

Proposition 2

Suppose Assumption 2 holds. Then, there exist sequences of constants and such that for any fixed

where the joint density of is the same as in Proposition 1.

The proof is in Appendix A. Proposition 2 implies that the largest order statistics of the regression residuals satisfy the same convergence as the no-covariate case. In other words, the estimation error from the OLS becomes negligible so that the largest order statistics are stemming from the right tail of asymptotically. This validates the construction of the test (6) by replacing with , where

Proposition 2 and the continuous mapping theorem, we similarly have .

2.3 Symmetry of noise

The previous analysis studies the right tail of (and equivalently ). Suppose we assume has a symmetric distribution, then the tail indices of both tails of become equivalent, and hence we can learn about the tail of using the left tail index of . To this end, we make the following additional assumption.

Assumption 3

-

(i) is symmetric at zero.

-

(ii) with .

Assumption 3(i) implies that , and the condition that implies its left tail index is negative. Therefore, in this subsection only, we simply denote and as the right tail indices of and , respectively. Now we can test if has a thinner or equal right tail than by specifying the following hypothesis testing problem,

| (7) |

Moreover, if is in the normal or Laplace family (), since we limit the tail indices to be non-negative, the null hypothesis then reduces to .

Under the null hypothesis of (7), is the leading term in in both the left and right tails. Then the DOA assumption for both and implies that , and Proposition 2 entails . Therefore, the above testing problem becomes equivalent to

| (8) |

We now construct a test for (8). Define as the smallest order statistics of the estimation residuals, that is,

and its self-normalized analogue as

The following proposition establishes that asymptotically has the EV distribution with tail index and is independent from .

Proposition 3

Suppose Assumptions 2 and 3 hold. Then, for any fixed ,

where and are independent and both EV distributed with density (5) and tail indices and , respectively.

The proof is in Appendix A. Given the above proposition, we aim to construct a generalized likelihood ratio test for (8) as follows,

| (9) |

where denotes the parameter space of the tail indices, and is the weighting function for the alternative hypothesis as in (6). We set to be to cover all distributions with a finite mean and to be uniform over the alternative space. The weight can be considered as the least favorable distribution, which we discuss more now.

Note that the null hypothesis of (8) is composite. We need to control size uniformly over all . To that end, we can transform the composite null into a simple one by considering the weighted average density with respect to the weight . Together with a suitably chosen the critical value, this test (9) maintains the uniform size control. Now the problem reduces to determining an appropriate weight . Elliott et al. (2015) study the generic hypothesis testing problem where a nuisance parameter exists in the null hypothesis. We tailor their argument for our test (9) and adopt their computational algorithm for implementation. In particular, and are numerically calculated only once by the authors instead of the empiricists who use our test. They only need to construct the order statistics and and numerically evaluate the density. We provide more computational details in the Appendix and the corresponding MATLAB code in the supplemental materials. By the continuous mapping theorem and Proposition 3, for any fixed , under the null hypothesis of (8).

As we discussed above, the hypothesis testing problem (8) simplifies to

if is assumed to be in the normal family (). Proposition 3 implies and are asymptotically independent and both of them are EV distributed. Then accordingly, our test (9) reduces to

which is identical to (6). This suggests that we can simply substitute into (6) for implementation.

3 Simulation Study

3.1 Hypothesis testing about noise

We set to be the uniform weight on to include all distributions with a finite mean and the level of significance to be . In Table 1, we report the small sample rejection probabilities of the test (6). We generate from the right half-standard normal and the right half-Laplace(0,1) distributions and from four distributions: standard normal, Laplace(0,1) (denoted La(0,1)) Student-t(2), Pareto(0.5) and F(4,4). The normal and Laplace distributions correspond to the null hypothesis, and the other three are alternative hypotheses. The results suggest that the test (6) has an excellent performance in size and power. Note that when and , we essentially include too many mid-sample observations so that the EV approximation is poor.

Now we consider the linear regression model that with and . We assume and independent from . Table 2 reports the rejection probabilities of our test (6). Findings are similar to those in Table 1.

3.2 Hypothesis testing about inefficiency and noise

Consider the hypothesis testing problem (8). We implement the test (9) with the same setup as above. Table 3 reports the rejection probabilities under the null and alternative hypotheses. We make the following observations. First, the test controls size well unless is too large relative to , as seen in the column with and . This is again because we are using too many mid-sample observations to approximate the tail so that the EV convergence in Propositions 1-3 provides poor approximations. Second, the test has good power properties as seen from the last five rows. In particular, using only the largest 50 order statistics from 1000 observations leads to the power of 0.94. Finally, the power decreases as the alternative hypothesis becomes closer to the null, as we move down along rows.

Now we consider the special case where is in the normal family. Then we implement (6) with as the input. Table 4 contains the rejection probabilities under the null and alternative hypotheses. The rows with being half-normal or Laplace correspond to the size under the null hypothesis, while other rows the power under the alternative hypothesis. The new test has excellent size and power properties.

4 Empirical illustration

We illustrate the new method using the US bank data collected by Feng and Serletis (2009). The data are a sample of US banks covering the period from 1998 to 2005 (inclusive). After deleting banks with negative or zero input prices, we are left with a balanced panel of 6,010 banks observed annually over the 8-year period. A more detailed description of the data may be found in Feng and Serletis (2009). Here we specify a stochastic cost function, letting , so is cost inefficiency, and more inefficient banks have higher total costs, . Since our tests are designed for cross-sectional data, we divide the original panel data into cross-sections (one for each year) and regress the logarithm of total bank cost on a constant and the logarithms of six control variables, including the wage rate for labor, the interest rate for borrowed funds, the price of physical capital, and the amounts of consumer loans, non-consumer loans, and securities. Since the object of interest is the cost function, we multiply the OLS residuals by and take the smallest and the largest order statistics, respectively, to implement the test (6). The p-values are reported in Table 5. Under the assumption that is symmetric101010The symmetry assumption is reasonable here and is imposed in Feng and Serletis (2009)., these small p-values suggest that has heavy tails on both sides, so a Student-t assumption (e.g., Wheat, Stead, and Greene, 2019) is more appropriate.

5 Concluding remarks

We derive several nonparametric tests of the tail behavior of the error components in the stochastic frontier model. The tests are easy to implement in MATLAB and are useful diagnostic tools for empiricists.

Often a first-step diagnostic tool for SFA is to calculate the skewness of the OLS residuals to see if they are properly skewed. See Waldman (1982), Simar and Wilson (2010), and Horrace and Wright (2020). If they are positively skewed, the maximum likelihood estimator of the variance of inefficiency is zero, and OLS is the maximum likelihood estimator of . If they are negatively skewed, then OLS is not a stationary point in the parameter space of the likelihood, and the stochastic frontier model is well-posed. After calculating negatively skewed OLS residuals, a useful second-step diagnostic tool is to implement our nonparametric tests to understand the tail behaviors of the error component distributions and to guide parametric choices subsequently .

References

- [1] Andrews, D. W. K. and W. Ploberger (1994). Optimal tests when a nuisance parameter is present only under the alternative, Econometrica, 62, 1383-1414.

- [2] Aigner, D., C. A. K. Lovell, and P. Schmidt (1977). Formulation and estimation of stochastic production frontier models, Journal of Econometrics, 6, 21-37.

- [3] Almanidis, P., J. Qian, and R. C. Sickles (2014). Stochastic frontiermodels with bounded inefficiency. In Sickles, R. C. and Horrace, W. C., eds. Festschrift in Honor of Peter Schmidt Econometric Methods and Applications, New York: Springer, pp. 47–82.

- [4] Arnold, B. C., N. Balakrishnan, and H. H. N. Nagaraja (1992). A First Course in Order Statistics, Siam.

- [5] Cai, J., W. C. Horrace, and C. F. Parmeter (2020). Density deconvolution with Laplace errors and unknown variance, Unpublished Manuscript, Syracuse University, Center for Policy Research.

- [6] Carree, M. A. (2002). Technological inefficiency and the skewness of the error component in stochastic frontier analysis, Economics Letters 77,101–107.

- [7] de Haan, L., and A. Ferreira (2007.) Extreme Value Theory: An Introduction, Springer Science and Business Media, New York.

- [8] Elliott, G., U. K. Müller, and M. W. Watson (2015). Nearly optimal tests when a nuisance parameter is present under the null hypothesis, Econometrica, 83, 771-811.

- [9] Feng, G., and A. Serletis (2009). Efficiency and productivity of the US banking industry, 1998-2005: Evidence from the Fourier cost function satisfying global regularity conditions, Journal of Applied Econometrics, 24, 105-138.

- [10] Lorens, J. P., L. Simar, and I. Van Keilegom (2020). Estimation of the boundary of a variable observed with symmetric error, Journal of the American Statistical Association, 115:529, 425-441.

- [11] Greene, W. H. (1990). A gamma-distributed stochastic frontier model, Journal of Econometrics, 46, 141-164.

- [12] Hall, P. and L. Simar (2002). Estimating a change point, boundary, or frontier in the presence of observation error, Journal of the American Statistical Association 97, 523-534.

- [13] Horrace, W. C. and C. F. Parmeter (2011). Semiparametric deconvolution with unknown error variance, Journal of Productivity Analysis, 35, 129-141

- [14] Horrace, W. C. and C. F. Parmeter (2018). A Laplace stochastic frontier model, Econometric Reviews, 37, 260-280.

- [15] Horrace, W. C. and I. A. Wright (2020). Stationary points for parametric stochastic frontier models, Journal of Business and Economic Statistics, forthcoming.

- [16] Kneip, A., L. Simar, and I. Van Keilegom (2015). Frontier estimation in the presence of measurement error with unknown variance, Journal of Econometrics, 2015, 184, 379-393.

- [17] Kumbhakar, S. C., Parmeter, C. F., and Tsionas, E. G. (2013). A zero inefficiency stochastic frontier model, Journal of Econometrics, 172, 66–76.

- [18] Li, Q. (1996). Estimating a stochastic production frontier when the adjusted error is symmetric, Economics Letters 52, 221–228.

- [19] Müller, U. K. and Y. Wang (2017) Fixed- asymptotic inference about tail properties, Journal of the American Statistical Association, 112, 1134-1143.

- [20] Simar, L., I, Van Keilegom, and V. Zelenyuk (2017). Nonparametric least squares methods for stochastic frontier models, Journal of Productivity Analysis, 47, 189-204.

- [21] Simar, L., and P. W. Wilson (2010), Inference from cross-sectional stochastic frontier models, Econometric Reviews, 29, 62–98.

- [22] Tsionas, E. G. (2007). Effciency measurement with the Weibull stochastic frontier, Oxford Bulletin of Economics and Statistics, 69, 693–706.

- [23] Waldman, D. M. (1982). A stationary point for the stochastic frontier likelihood, Journal of Econometrics, 18, 275–279.

- [24] Wheat, P., A. D. Stead, and W. H. Greene (2019). Robust stochastic frontier analysis: a Student’s t-half normal model with application to highway maintenance costs in England, Journal of Productivity Analysis, 51, 21–38.

Appendix

Appendix A Proofs

Proof of Proposition 1

Since only the right tail index of shows up in this proof, we simply denote in this proof.

We prove the case with first. By Corollary 1.2.4 and Remark 1.2.7 in de Haan and Ferreira (2007), the constants and can be chosen as follows. If , we choose and . If , we choose and . By construction, these constants satisfy that for any fixed in both cases (e.g., de Haan and Ferreira (2007), Ch.1.1.2).

By Assumption 1-(iv), we have that

where , and

By Assumption 1-(iv), for any constant . Then by the facts that and , it suffices to show that . To this end, we have

where eq.(1) is by Assumption 1-(ii) ( is independent from ), ineq.(2) is by the intermediate value theorem, ineq.(3) follows from Assumption 1-(iv) ( is non-increasing when for some constant ), and eq.(4) is seen by Assumption 1-(iii) ( and Assumption 1-(iv). In particular, the fact that is implied by the von Mises’ condition. See, for example, Corollary 1.1.10 in de Haan and Ferreira (2007) with .

Generalization to is as follows. Consider . Chapter 8.4 in Arnold et al. (1992) (p.219) gives that

The convergence that is established by Theorem 8.4.2 in Arnold et al. (1992). It now remains to show . First, the fact that

is shown by the same argument as above in the case. Second, for any

where applying Leibniz’s rule is permitted by Assumption 1-(iv), which implies that is uniformly continuous in . Then similarly as bounding above, we use the mean value expansion and Assumptions 1(ii)-(iv) to derive that for any and some constant ,

where the last inequality follows from the fact that , which is implied by the von Mises’s condition (cf. Theorem 1.1.8 in de Haan and Ferreira (2007)), and the last equality follows from the facts that and (see again Corollary 1.1.10 in de Haan and Ferreira (2007) with ). The proof is then complete.

Proof of Proposition 2

In this proof, we drop the subscript in since it is the only tail index here.

Proposition 1 implies that

| (10) |

where is jointly EV distributed with tail index , and the constants and are chosen in the proof of Proposition 1.

Let be the random indices such that , , and let be the corresponding indices such that . Then the convergence of follows from (10) once we establish for . We consider for simplicity and the argument for a general is very similar. Denote .

Consider the case with . the part in Assumption 2(v) for yields that

Given this, we have that, on the one hand, ; and on the other hand, . Therefore, since .

Consider the case with . Corollary 1.2.4 in de Haan and Ferreira (2007) implies that . Thus, the part in Condition 2.3 for implies that

Then the same argument as above yields that .

Proof of Proposition 3

Let denote the smallest order statistics of . Let and be the sequences of normalizing constants for the right and left tails of , respectively. Then by the same argument as in Proposition 2, we have and . Therefore, it suffices to establish and jointly converge to where and are independent and both EV distributed with indices and , respectively. To this end, note that the case with is established as Theorem 8.4.3 in Arnold et al. (1992). We now generalize their argument for .

By elementary calculation and the i.i.d. assumption, the joint density of the order statistics is for . Then by a change of variables, the joint density of satisfies that for

By the DOA assumption for both the left and right tails and equations (8.3.1) and (8.4.9) in Arnold et al. (1992),

By (8.4.4) in Arnold et al. (1992) and the fact that is fixed, and . The proof is then complete by combining for and the continuous mapping theorem.

Appendix B Computational details

This section provides more details for constructing the test (9), which is based on the limiting observations and . The density is given by (5), which is computed by Gaussian Quadrature. To construct the test (9), we specify the weight to be uniform over the alternative space for expositional simplicity, which can be easily changed. Then, it remains to determine a suitable candidate for the weight and the critical value cv. We do this by the generic algorithm provided by Elliott et al. (2015) and Müller and Wang (2017).

The idea of identifying a suitable choice of and cv is as follows. First, we can discretize into a grid and determine accordingly as the point masses. Then we can simulate random draws of and from and estimate the rejection probability by sample fractions. The subscript emphasizes that the rejection probability depends on the value of that generates the data. By iteratively increasing or decreasing the point masses as a function of whether the estimated is larger or smaller than the nominal level, we can always find a candidate together with cv that numerically satisfy the uniform size control.

In practice, we can determine the point masses by the following steps. Let be short for cv.

Algorithm:

-

1.

Simulate 10,000 i.i.d. random draws from some proposal density with drawn uniformly from , which is an equally spaced grid on with 50 points.

-

2.

Start with and . Calculate the (estimated) coverage probabilities for every using importance sampling. Denote them by

-

3.

Update and by setting with some step-length constant , so that the -th point mass in is increased/decreased if the coverage probability for is larger/smaller than the nominal level.

-

4.

Integrate for 500 times. Then, the resulting and are a valid candidate.

-

5.

Numerically check if with and indeed controls the size uniformly by simulating the rejection probabilities over a much finer grid on . If not, go back to step 2 with a finer .

| 100 | 1000 | |||||||

|---|---|---|---|---|---|---|---|---|

| 10 | 20 | 50 | 10 | 20 | 50 | |||

| Rejection Prob. under half-normal | ||||||||

| N(0,1) | 0.01 | 0.00 | 0.00 | 0.03 | 0.02 | 0.01 | ||

| La(0,1) | 0.05 | 0.04 | 0.02 | 0.05 | 0.05 | 0.05 | ||

| t(2) | 0.31 | 0.45 | 0.35 | 0.30 | 0.49 | 0.76 | ||

| Pa(0.5) | 0.31 | 0.52 | 0.12 | 0.30 | 0.48 | 0.78 | ||

| F(4,4) | 0.32 | 0.50 | 0.50 | 0.29 | 0.50 | 0.80 | ||

| Rejection Prob. under half-Laplace | ||||||||

| N(0,1) | 0.02 | 0.00 | 0.00 | 0.03 | 0.01 | 0.01 | ||

| La(0,1) | 0.05 | 0.04 | 0.050 | 0.06 | 0.06 | 0.04 | ||

| t(2) | 0.32 | 0.46 | 0.29 | 0.32 | 0.50 | 0.80 | ||

| Pa(0.5) | 0.31 | 0.52 | 0.06 | 0.30 | 0.49 | 0.79 | ||

| F(4,4) | 0.31 | 0.52 | 0.49 | 0.28 | 0.48 | 0.78 | ||

| 100 | 1000 | |||||||

|---|---|---|---|---|---|---|---|---|

| 10 | 20 | 50 | 10 | 20 | 50 | |||

| Rejection Prob. under half-normal | ||||||||

| N(0,1) | 0.01 | 0.00 | 0.00 | 0.03 | 0.02 | 0.01 | ||

| La(0,1) | 0.05 | 0.04 | 0.02 | 0.05 | 0.05 | 0.05 | ||

| t(2) | 0.30 | 0.44 | 0.33 | 0.30 | 0.49 | 0.80 | ||

| Pa(0.5) | 0.32 | 0.51 | 0.10 | 0.30 | 0.48 | 0.80 | ||

| F(4,4) | 0.32 | 0.50 | 0.47 | 0.29 | 0.50 | 0.80 | ||

| Rejection Prob. under half-Laplace | ||||||||

| N(0,1) | 0.01 | 0.00 | 0.00 | 0.03 | 0.01 | 0.01 | ||

| La(0,1) | 0.04 | 0.05 | 0.01 | 0.06 | 0.06 | 0.04 | ||

| t(2) | 0.32 | 0.46 | 0.28 | 0.31 | 0.50 | 0.80 | ||

| Pa(0.5) | 0.32 | 0.50 | 0.07 | 0.30 | 0.49 | 0.80 | ||

| F(4,4) | 0.31 | 0.51 | 0.47 | 0.28 | 0.48 | 0.78 | ||

| 100 | 1000 | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 10 | 20 | 50 | 10 | 20 | 50 | ||||

| Rejection Prob. under | |||||||||

| N(0,1) | half-N(0,1) | 0.06 | 0.06 | 0.03 | 0.05 | 0.05 | 0.05 | ||

| La(0,1) | half-La(0,1) | 0.04 | 0.05 | 0.07 | 0.05 | 0.04 | 0.04 | ||

| t(2) | half-t(2) | 0.04 | 0.06 | 0.24 | 0.06 | 0.06 | 0.05 | ||

| Pa(0.5) | Pa(0.5) | 0.05 | 0.06 | 0.67 | 0.05 | 0.06 | 0.05 | ||

| F(4,4) | F(4,4) | 0.04 | 0.05 | 0.24 | 0.04 | 0.06 | 0.03 | ||

| Rejection Prob. under | |||||||||

| N(0,1) | Pa(0.75) | 0.28 | 0.68 | 0.99 | 0.25 | 0.55 | 0.94 | ||

| Laplace(0,1) | Pa(0.75) | 0.25 | 0.46 | 0.89 | 0.21 | 0.44 | 0.82 | ||

| t(2) | Pa(0.75) | 0.13 | 0.21 | 0.62 | 0.09 | 0.09 | 0.19 | ||

| Pa(0.5) | Pa(0.75) | 0.10 | 0.23 | 0.87 | 0.07 | 0.12 | 0.17 | ||

| F(4,4) | Pa(0.75) | 0.09 | 0.14 | 0.46 | 0.07 | 0.09 | 0.15 | ||

| 100 | 1000 | |||||||

|---|---|---|---|---|---|---|---|---|

| 10 | 20 | 50 | 10 | 20 | 50 | |||

| Rejection Prob. under Normal | ||||||||

| half-N(0,1) | 0.02 | 0.01 | 0.00 | 0.02 | 0.02 | 0.00 | ||

| half-La(0,1) | 0.05 | 0.03 | 0.00 | 0.06 | 0.05 | 0.04 | ||

| half-t(2) | 0.31 | 0.45 | 0.46 | 0.34 | 0.54 | 0.88 | ||

| Pa(0.5) | 0.34 | 0.52 | 0.48 | 0.33 | 0.56 | 0.89 | ||

| F(4,4) | 0.31 | 0.52 | 0.70 | 0.32 | 0.52 | 0.86 | ||

| Rejection Prob. under Laplace | ||||||||

| half-N(0,1) | 0.05 | 0.03 | 0.01 | 0.05 | 0.05 | 0.05 | ||

| half-La(0,1) | 0.04 | 0.03 | 0.00 | 0.05 | 0.04 | 0.03 | ||

| half-t(2) | 0.28 | 0.37 | 0.38 | 0.35 | 0.58 | 0.89 | ||

| Pa(0.5) | 0.30 | 0.40 | 0.44 | 0.33 | 0.58 | 0.89 | ||

| F(4,4) | 0.30 | 0.49 | 0.59 | 0.33 | 0.52 | 0.86 | ||

| left tail | right tail | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| year | 25 | 50 | 75 | 100 | 25 | 50 | 75 | 100 | ||

| 1998 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 1999 | 0.00 | 0.00 | 0.00 | 0.00 | 0.05 | 0.00 | 0.00 | 0.00 | ||

| 2000 | 0.03 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 2001 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 2002 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||

| 2003 | 0.05 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||||

| 2004 | 0.04 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||

| 2005 | 0.09 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||