Explicit option valuation in the exponential NIG model

Abstract

We provide closed-form pricing formulas for a wide variety of path-independent options, in the exponential Lévy model driven by the Normal inverse Gaussian process. The results are obtained in both the symmetric and asymmetric model, and take the form of simple and quickly convergent series, under some condition involving the log-forward moneyness and the maturity of instruments. Proofs are based on a factorized representation in the Mellin space for the price of an arbitrary path-independent payoff, and on tools from complex analysis. The validity of the results is assessed thanks to several comparisons with standard numerical methods (Fourier and Fast Fourier transforms, Monte-Carlo simulations) for realistic sets of parameters. Precise bounds for the convergence speed and the truncation error are also provided.

Keywords: Lévy process; Normal inverse Gaussian process; Stochastic volatility; Option pricing.

AMS subject classifications (MSC 2020): 60E07, 60E10, 60H35, 65C30, 65T50, 91G20, 91G30.

JEL Classifications: C00, C02, G10, G13.

1 Introduction

Whether the dramatic COVID-19 events and the subsequent turmoils in global markets were unpredictable "black swan" events in the sense of Taleb (2010) or, on the contrary, could have been forecasted (or at least, following the terminology of Giannone & al. (2008), "nowcasted") will undoubtedly be the matter of intense debates. But what is already certain is that they demonstrate, yet again, that the kurtosis in the distribution of asset returns far exceeds the tails of the Normal one, and that market volatility is not constant over time; it should therefore be a minimal requirement for any reliable market model that they include (at least) these two stylized facts.

It has now long been known that exponential - sometimes also called geometrical - Lévy models fulfil these conditions. Such models have been introduced in quantitative finance during the late 1990s / early 2000s in several influential works, and make the assumption that asset log returns are driven by some drifted Lévy process: a Normal inverse Gaussian (NIG) process in Barndorff-Nielsen (1995, 1997), a Variance Gamma (VG) process in Madan et al. (1998), a hyperbolic or a generalized hyperbolic process in Eberlein and Keller (1995); Eberlein (2001), a CGMY process in Carr & al. (2002) or a stable (or -stable) process in Mittnik & Rachev (2000); Carr and Wu (2003). Stable distributions, in particular, may be noted for their historical importance, having been considered a credible candidate for the modelling of asset prices as early as in the 1960s by Mandelbrot (1963) in the context of the cotton market, thus paving the way to the more generic setup of exponential Lévy models. Readers who may be less familiar with the broad family of Lévy processes and their applications to finance are invited to refer to the classical references Bertoin (1996); Schoutens (20003); Cont & Tankov (2004); Rachev et al. (2011).

In the present work, we will be particularly interested in the class of exponential Lévy models whose Lévy process is distributed according to a NIG distribution, namely, the class of exponential NIG models. NIG distributions were originally introduced for physical purpose, more precisely to model the complex behavior of dunes and beach sands, in the seminal article Barndorff-Nielsen (1977); as noted above, they have subsequently been introduced for financial purpose approximately two decades later, because they feature several degrees of freedom that have a direct empirical interpretation in terms of financial time series. First, they possess fat tails, allowing for the presence of extreme variations of prices (positive or negative jumps); when the tail parameter goes to infinity, then the NIG distribution degenerates into the Normal distribution and the exponential NIG model recovers the Black-Scholes model (Black & Scholes (1973)). Second, NIG distributions can be skewed, allowing to capture the asymmetry that can be observed in the distribution of jumps (price drops occurring more often than raises). Last, but not least, a NIG process can be interpreted as a drifted Brownian motion whose time follows an inverse Gamma process - this is a consequence of the fact that the NIG distribution is actually a particular case of a so-called Normal variance-mean mixture, the mixing distribution being the inverse Gaussian (IG) distribution; the NIG process is therefore a time changed Lévy process, which allows for stochastic volatility modelling and related phenomena, such as clustering or negative correlation between the returns and their volatility (see details in Carr and Wu (2004)). Let us also mention that, as observed by Mechkov (2015) the NIG process is also deeply related to the Heston stochastic volatility model (Heston (1993)). Indeed, in the fast reversion limit, Heston log returns become NIG distributed, and the NIG parameters have a direct connection with the shape of the volatility surface. This allows for a simpler calibration to market data, and for the capture of a realistic smile in the short maturity region.

Of course, since it was introduced, the exponential NIG model has been proved to provide a very good fitting to financial data many times. Let us mention, among others, initial tests for daily returns on Danish and German markets in Barndorff-Nielsen (1995); Rydberg (1997) and subsequently on the FTSE All-share index (also known as "Actuaries index") in Venter & de Jongh (2002). More recently, the impact of high frequency trading has also been taken into account, and calibrations have been performed on intraday returns e.g. in Figueroa-López et al. (2012) for different sampling frequencies. Let us also mention that multivariate extensions of the exponential NIG model, i.e., featuring a different time change for different assets, have also been considered (see Luciano & Semeraro (2010) and references therein).

As one could expect, pricing contingent claims turns out to be a tougher task in the exponential NIG model than it is in the usual Black-Scholes framework. Numerical methods are largely favored, including Monte-Carlo valuation methods (Ribeiro and Webber (2003)), numerical evaluation of Fourier (Lewis (2001)) and Fast Fourier (Carr & Madan (1999)) transforms. The success of Fourier transform methods is strongly linked to the relative simplicity of the characteristic function of most exponential Lévy models, and has opened the way to a wide range of other transform based approaches: they include, among others, the COS method by Fang & Osterlee (2008), the Hilbert transform method (see notably a recent application to time-changed Lévy processes in Zeng and Kwok (2014)) or the local basis Frame PROJection (PROJ) method by Kirkby (2015). Efforts have also been made towards analytic evaluation or approximations: in Ivanov (2013), a closed-form formula (in terms of Appel functions) for the European call is derived in the particular case where the NIG distribution has a tail parameter of , and in Albrecher & Predota (2004) approximations and bounds are provided for Asian options.

In this paper, we would like to show that it is actually possible to obtain tractable closed-form pricing formulas in the exponential NIG model, for a broad range of path independent instruments. This is made possible by a remarkable property allowing to express the Mellin transform of an arbitrary path independent option as the product of the Mellin transforms of its payoff and of the NIG probability density. Inverting it by means of residue summation yields the option price, computed under the form of quick convergent residue series whose terms are directly expressed in terms of the model’s parameters. This Mellin residue summation method has been used very recently within the framework of other exponential Lévy models, namely in the Finite Moment Log Stable (FMLS) model in Aguilar & Korbel (2019) and in the exponential VG model in Aguilar (2020); in the present paper, we will therefore demonstrate that the technique is also well-suited to the exponential NIG model. Moreover, we will establish pricing formulas for both the symmetric and the asymmetric NIG processes, while the formulas in the VG case in Aguilar (2020) were mainly obtained for the symmetric VG process. Due to the nature of the residues series, however, we will need to introduce a restriction on the model parameters to ensure the convergence to the price. We will show that this condition is compliant with most of the implied parameters calibrated in the literature; moreover, when options are not far from the money, it is automatically satisfied.

The paper is organized as follows: in section 2, we start by recalling fundamental concepts on the NIG process and its implementation via exponential Lévy models. In section 3, we focus on the symmetric NIG process: after establishing the pricing formula in the Mellin space for an arbitrary path independent instrument, we evaluate, analytically, the price of the European and digital options, as well as payoffs featuring more exotic attributes (power options, log contracts, …). In section 4 we extend the pricing formula to the more general case of the asymmetric model, and provide analytic formulas for the digital and European prices. In section 5, practical implementation is discussed, and precise bounds for the convergence speed and the truncation errors of the series are obtained; we also assess the validity of the results by comparing them with classic numerical methods (Fourier inversion, Monte Carlo simulations). For the reader’s convenience, the paper is also equipped with two appendices: in appendix A we provide a short overview of the Mellin transform, and in appendix B we recall some important special function identities that are used throughout the paper.

2 Model definition

In this section we recall important concepts on NIG distributions and processes; more details can be found in the initial articles by Barndorff-Nielsen or in subsequent review articles like Hanssen & Øigård (2001); Papantolen (2008). We also introduce the exponential NIG model, following the classical setup of exponential Lévy models such as defined e.g. in Schoutens (20003); Tankov (2010).

2.1 The Normal inverse Gaussian process

The Normal inverse Gaussian (NIG) process can be defined by in several different ways: classically, it is defined either as a process whose increment follow a NIG distribution, in terms of its Lévy measure, or as a time-changed Lévy process. Let us also mention that, as remarked in Mechkov (2015), the NIG process can also be seen as the limit of a Fast Reverting Heston (FRH) process.

NIG density

The NIG distribution, denoted by , is a four-parameter distribution whose density function is:

| (1) |

The function is the modified Bessel function of the second kind and of index 1 (sometimes also called Macdonald function, see definitions and properties in appendix B). is a tail or steepness parameter controlling the kurtosis of the distribution; the large regime gives birth to light tails, while small corresponds to heavier tails. is the skewness parameter: (resp. ) implies that the distribution is skewed to the left (resp. the right), and that the distribution is symmetric around the location parameter . is the scale parameter and plays an analogue role to the variance term in the Normal distribution; when , the Normal distribution is itself recovered in the large steepness regime:

| (2) |

We say that a stochastic process is a NIG process if it has NIG distributed increments, that is if for all ; it follows from (1) that the density of the process conditionally to is (with a slight abuse of notations):

| (3) |

It is also possible to define the NIG process as a time-changed drifted Brownian motion: if is a process distributed according to an Inverse Gamma density of shape and mean rate 1 and if is a standard Wiener process, then the process

| (4) |

is a centered NIG process (). The process is a tempered stable subordinator; it has positive jumps, and therefore is interpreted as a business time that can differ from the operational time, the occurence of jumps corresponding to periods of intense business activity. A similar interpretation holds for instance in the case of the Variance Gamma process, which features another example of tempered stable subordination (via a Gamma process).

Lévy symbol

The NIG process is a (pure jump) Lévy process whose characteristic function can be written down as , where the characteristic exponent, or Lévy symbol, is known in exact form:

| (5) |

The process admits the Lévy-Khintchine triplet , where the drift and the Lévy measure are defined by

| (6) |

allowing to write down the characteristic exponent (5) in terms of its Lévy-Khintchine representation:

| (7) |

Let us observe that it follows from the definition of the Lévy measure that the NIG process has infinite variation and infinite intensity (i.e. ), and therefore possesses a very rich dynamics with infinite number of jumps on any time interval - this is why no Brownian component is even needed in the Lévy-Khintchine triplet. We should also note that the NIG process has all its moments finite, which is not the case with (double-sided) -stable processes for instance: this is because the Bessel function admits the asymptotic behavior (see (155))

| (8) |

and therefore the tails of the NIG measure are less heavy than the tails of the -stable measure (which has polynomial decrease in . In other words, the jumps in the NIG process are not as big as for -stable processes, but allow finiteness of moments and therefore of option prices; in the -stable case, this would be achieved only for spectrally negative processes (i.e., having negative jumps only).

Fast reverting Heston limit

Following Mechkov (2015), we choose the following formulation for the Heston dynamics:

| (9) |

where the two Brownian motions have correlation , and we consider the fast reversion limit in the CIR process driving the stochastic multiplier . Then, in this limit, the process is distributed according to a NIG distribution:

| (10) |

Let us mention that the NIG process is also associated to the long maturity asymptotic of the original (non fast reverting) Heston model (see e.g. Keller-Ressel (2008)).

2.2 The exponential NIG model

Model specification

Let and be the market price of some financial asset, seen as the realization of a time dependent random variable on the canonical space equipped with its natural filtration. We assume that there exists a risk-neutral measure under which the instantaneous variations of can be written down as:

| (11) |

where is the risk-free interest rate and is the dividend yield (both assumed to be deterministic and continuously compounded), and where is the NIG process. The solution to the stochastic differential equation it the exponential process

| (12) |

where is the time horizon and is the martingale adjustment (also called convexity adjustment, or compensator) determined by the martingale condition ; it follows from the definition of the Lévy symbol (5) that this adjustment is equal to:

| (13) |

It is interesting to note that, in the large steepness regime, (13) has the following asymptotic behavior:

| (14) |

Taking (centered process) and (symmetric process), (14) recovers the the Gaussian martingale adjustment , and the exponential NIG model (11) degenerates into the Black-Scholes model.

Contingent claim valuation

Given a path-independent payoff function , i.e., a positive function depending only on the terminal value of the market price and on some strike parameters , then the value at time of a contingent claim delivering a payoff at maturity is equal to the following risk-neutral expectation:

| (15) |

The conditional expectation (15) can be achieved by integrating all possible realizations for the payoff over the probability density of the NIG process, thus resulting in:

| (16) |

3 Option pricing in the symmetric model

In this section, we assume that , i.e., that the process in (11) is distributed according to the symmetric distribution . First, we establish a general pricing formula for an arbitrary path independent instrument; then, we apply this formula to the analytic evaluation of several options and contracts.

3.1 Pricing formula

Let us start by establishing a representation for the symmetric NIG density under the form of a Mellin-Barnes integal.

Lemma 3.1.

For any , the following holds true:

| (17) |

Proof.

Let us now introduce the double-sided Mellin transform of the payoff function:

| (20) |

and assume that it exists for for some real numbers . Then, as a consequence of the risk-neutral pricing formula (16) and of lemma 3.1, we immediately obtain:

Proposition 3.2 (Factorization in the Mellin space).

Let where is assumed to be nonempty. Then the value at time of a contingent claim delivering a payoff at its maturity is equal to:

| (21) |

Throughout the paper, our purpose will be to express the complex integral (21) as a sum of residues associated to the singularities of the integrand. Schematically, we will therefore be able to express the price of a contingent claim under the form of a series:

| (22) |

As we will see, the residues turn out to have to be computed in the multidimensional sense, because, depending on the payoff’s complexity, the evaluation of can call for the introduction of a second Mellin variable (in the asymmetric case, we will see that one even needs a third Mellin variable ). However, as only Gamma functions are involved, these residues are straightforward to compute, even in the sense.

Before proceeding to pricing itself, let us introduce the notation for the forward strike and the log forward moneyness :

| (23) |

It will also be useful to introduce ; taking in the definition of the martingale adjustment (13), we have:

| (24) |

Note that is independent of the location (in both the symmetric and asymmetric cases). Last, we need to introduce a restriction on the parameters, that will be fundamental for the series to converge:

Assumption 1.

In all of the following, and unless otherwise stated, we will assume that the model’s inputs are such that

| (25) |

3.2 Digital and European options

We start our applications of proposition 3.2 with the determination of the price of the digital (also called binary) options, and of the vanilla European option.

Digital option (asset-or-nothing)

The asset-or-nothing call option consists in receiving a unit of the underlying asset , on the condition that it exceeds a predetermined strike price . The payoff can therefore be written down as:

| (26) |

Formula 1 (Asset-or-nothing call).

The value at time of an asset-or-nothing call option is:

| (27) |

Proof.

Step 1: Let us first assume that . We remark that, using notations (23), we can write

| (28) |

Using a Mellin-Barnes representation for the exponential term (see table 7 in appendix A):

| (29) |

and inserting into (20), we get:

| (30) | ||||

| (31) |

where the -integral exists because by hypothesis. Using proposition 3.2 and the Legendre duplication formula (147), we obtain the price of the asset-or-nothing call:

| (32) |

which converges in the subset and can be analytically continued outside this polyhedron, except when the Gamma functions in the numerator are singular, that is, when their arguments equal a negative integer. If we consider the singularities induced by at , and by at , , then, the associated residues are straightforward to compute via the change of variables , , and via the singular behavior (137) for the Gamma functions; they read:

| (33) |

Simplifying and summing all residues (33) yields the announced series (27).

Step 2: Let us now assume that : in that case, the -integral on the interval in (30) does not converge. But, as is a -martingale, we can write:

| (34) |

To compute the expectation in the r.h.s., we apply exactly the same technique than in step 1 (in this case, the function exists, as an integral over ), resulting in the same residue formula than (33).

Step 3: Last, we have to examine the convergence of the series; to that extent let us denote the general term of the series (27) by:

| (35) |

Let us fix and let ; without loss of generality and to simplify the notations we can assume e.g. and study the behavior of

| (36) |

We may note also that, due to the presence of the function in the denominator, only odd terms survive when . Using the particular value of the Gamma function (145), we are left with:

| (37) |

Using the Stirling approximation (146) for and the large index behavior (153) for and simplifying, we get:

| (38) |

and therefore the series converge if and only if , which is equivalent to assumption 1. Last, if we fix , then the symmetry relation (151) for the modified Bessel function and similar arguments (special values of the Gamma function and Stirling approximation) show that the series converge for all parameter values when . ∎

European option

The European call pays at maturity, at the condition that the spot price is greater that the strike price. The payoff can therefore be written down as:

| (39) |

Formula 2 (European call).

The value at time of a European call option is:

| (40) |

Proof.

We remark that, using notations (23), we can write:

| (41) |

Then, we use the Mellin-Barnes representation (see table 7 in appendix A):

| (42) |

and we proceed exactly the same way than for proving Formula 1; note that the -summation in (40) now starts in instead of , because the strip of convergence of (42) is reduced to instead of in (29). ∎

Let us examine the series (40) in the large steepness regime (). It follows from the asymptotic behavior of the Bessel function for large arguments (155) that:

| (43) |

and from (14) that:

| (44) |

Therefore, denoting , we obtain

| (45) |

which is the series expansion of the Black-Scholes formula for the European call that was derived in Aguilar (2019).

Digital option (cash-or-nothing)

The payoff of the cash-or-nothing call option is

| (46) |

and therefore the option price itself is:

| (47) |

Formula 3 (Cash-or-nothing call).

The value at time of a cash-or-nothing call option is:

| (48) |

In (48), only terms for and , actually survive (because of the divergence of the Gamma function in the denominator when , ). Therefore, using the particular values of the Gamma function at negative half-integers (145) and of the Bessel function for (156), we can re-write formula 3 as:

| (49) |

The representation (49) is less compact than formula 3, however it allows for a direct computation of the put option: indeed, using

| (50) |

then it follows immediately from (49) that the cash-or-nothing put can be written down as:

| (51) |

3.3 At the money approximations

Let us assume throughout this subsection that options are at the money forward (ATMF), that is, ; retaining only the leading term of formula 2, we can approximate the European call by

| (52) |

Using the asymptotic behavior of the Bessel function for large arguments (155), we recover the fact that

| (53) |

where ; (53) is the well-known approximation by Brenner and Subrahmanyam (1994) for the ATMF Black-Scholes call. The approximation (52) is also useful for parameter estimation: denoting by the market price of an ATMF European call option at time t and using Hankel’s expansion (155) up to , we obtain the quadratic equation

| (54) |

where . The positive solution reads

| (55) |

and, therefore, using a Taylor expansion and turning back to the initial variables, we have

| (56) |

Taking only the first order term in (56), we recover the ATMF value for the implied volatility in the Black-Scholes model:

| (57) |

3.4 Miscellaneous payoffs

In this subsection, we provide other applications of proposition 3.2, by considering path-independent payoffs featuring some more exotic attributes.

Gap option

A gap (sometimes called pay-later) call has the following payoff:

| (58) |

and degenerates into the European call when trigger and strike prices coincide (). From the definition (58), it is immediate to see that the value at time of the Gap call is:

| (59) |

where the value of the asset-or-nothing and cash-or-nothing calls are given by formulas 1 and 3 for .

Power options

Power options deliver a non linear payoff and are an easy way to increase the leverage ratio of trading strategies; the payoffs of the digital power calls are

| (60) |

for some , and the power European call is:

| (61) |

Introducing the notation

| (62) |

then we can remark that:

| (63) |

Therefore, using the representations (see table 7 in appendix A)

| (64) |

and

| (65) |

and proceeding exactly the same way than for proving formulas 1, 2 and 3, we obtain:

Formula 4 (Power options).

The values at time of the power options are:

-

-

Asset-or-nothing power call:

(66) -

-

European power call:

(67) -

-

Cash-or-nothing power call:

(68)

Log options, log contract

Log options are, basically, options on the rate of return of the underlying (Wilmott (2006)). The payoff of a log call and of a log put are:

| (70) |

The log contract, introduced by Neuberger (1994), is a forward contract that is obtained by being long of a log call and short of a log put, resulting in

| (71) |

Note that a delta-hedged log contract with is actually a synthetic variance swap: indeed, by denoting the quadratic variation of by and using Itô’s lemma, it is well known that, in the Black-Scholes model,

| (72) |

In the more general framework of exponential Lévy models, the overall multipliers in the r.h.s. of (72) are different from 2 and have been determined in Carr & Wu (2012); for instance in the symmetric NIG models, it is equal to which, as expected, tends to when . Let us therefore show how to derive pricing formulas for the log options and the log contract in this model: remarking that, using notations (23),

| (73) |

it follows that the Mellin transform for the payoff function (20) reads, for the log call:

| (74) |

and, using proposition 3.2, that the log call price itself writes:

| (75) |

where . Similarly, the log put writes:

| (76) |

where . Summing all residues arising at , and , , grouping the terms and simplifying yields:

Formula 5 (Log options, log contract).

The value at time of a log option is:

-

-

Log call:

(77) -

-

Log put:

(78) -

-

Log contract:

(79)

Capped payoffs

Suppose that we wish introduce a cap to limit the exercise range of a digital option for example; in this case, the payoff of the cash-or-nothing call would read:

| (81) |

where is the strike price, and the cap. It is clear that (81) can be decomposed into the difference of two cash-or nothing calls with strike prices and . Therefore, introducing the notations

| (82) |

then it follows immediately from formula 3 that the value at time t of the capped cash-or-nothing call is given by

| (83) |

Of course, for (83) to converge, one needs assumption (1) to be satisfied for both and . Extension to the case of an option activated outside the interval is straightforward, by writing down:

| (84) |

and by using (83).

4 Option pricing in the asymmetric model

Let us now consider the case where the process in (11) is distributed according to the asymmetric distribution , . All notations defined in (23) remain valid, but we introduce the supplementary definition , such that can be written down as:

| (85) |

To simplify the notations, as multiple -integrals will be involved, we will denote the vectors in by , for , and we will use the notation

| (86) |

4.1 Pricing formula

Like in section 3, we start by establishing a representation for the NIG density under the form of a Mellin-Barnes integal, but this time in the asymmetric case.

Lemma 4.1.

For any , the following holds true:

| (87) |

Proof.

Like in the proof of lemma 3.1, we introduce the Mellin representation (19) for the Bessel function that holds for , and we introduce a supplementary representation for the exponential term (see table 7 in appendix A):

| (88) |

that holds for . Inserting (19) and (88) into the density (3) yields the reprensentation (87). ∎

Let us now introduce the asymmetric analogue to the function (20):

| (89) |

and assume that it exists for for a certain subset . Then, as a consequence of the risk-neutral pricing formula (16) and of lemma 4.1, we immediately obtain:

Proposition 4.2 (Factorization in the Mellin space).

Let where is assumed to be nonempty. Then the value at time of a contingent claim delivering a payoff at its maturity is equal to:

| (90) |

4.2 Digital and European options

To illustrate some applications of proposition 4.2, we compute the price of the digital and European options, whose payoffs were defined in subsection 3.2. We also recall the notation for the Pochhammer symbol .

Formula 6 (Asset-or-nothing call).

The value at time of an asset-or-nothing call option is:

| (91) |

Proof.

Step 1: The proof starts like the proof of formula 1, by assuming , by remarking that

| (92) |

and by introducing a Mellin-Barnes representation for the exponential term in the option’s payoff:

| (93) |

Therefore, the function (89) reads:

| (94) | ||||

| (95) |

where the -integral exists because . Using proposition 4.2, we obtain the price of the asset-or-nothing call:

| (96) |

which converges in the subset and can be analytically continued outside this polyhedron, except when the Gamma functions in the numerator are singular. If we consider the singularities induced by at , , by at , and by at , , then, the associated residues are straightforward to compute via the change of variables , , and via the singular behavior (137) for the Gamma functions; they read:

| (97) |

Using the Legendre duplication formula (147) and the definition of the Pochhammer symbol (148), we write:

| (98) |

Inserting into (97), simplifying and summing all residues for yields the series (91).

Step 2: Like in the proof of formula 1, extension to the case is performed thanks to the parity

| (99) |

Formula 7 (European call).

The value at time of a European call option is:

| (100) |

Proof.

Like in the proof of formula 2, we remark that we can write:

| (101) |

Then, we use the Mellin-Barnes representation (see table 7 in appendix A):

| (102) |

and we proceed exactly the same way than for proving Formula 6; the -summation in (100) starts in instead of , because the strip of convergence of (102) is reduced to instead of in (93). ∎

Formula 8 (Cash-or-nothing call).

The value at time of a cash-or-nothing call option is:

| (103) |

5 Applications and numerical tests

In this section, we show how to implement very simply the pricing formulas we derived, for instance in an Excel spreadsheet. we also determine what restriction is induced by assumption 1 in terms of accessible option maturities, and we provide some precise estimates for the convergence speed and the truncation errors of the series. Then, we compare the various pricing formulas established in the above with several numerical tools, and demonstrate the reliability and efficiency of the results.

5.1 Practical implementation

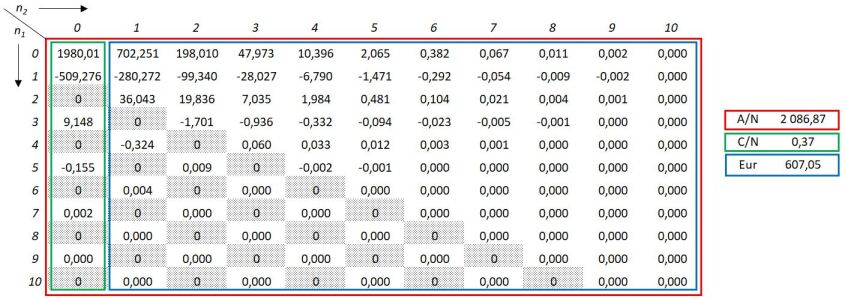

Let us show on some examples how our pricing formulas can be used in practice. In figure 1, we have implemented the formulas 1, 2 and 3 in an Excel spreadsheet, up to . This can be done in a straightforward way, thanks to the functions BESSELK(x,n) and GAMMA(x). The red square yields the price of the asset-or-nothing call , and the blue rectangle starting at yields the price of the European call ; the remaining green rectangle for represents the price of the cash-or-nothing call multiplied by the strike price, i.e. .

We may first note that the convergence is extremely fast; moreover, computations are even more accelerated by two properties:

-

-

The symmetry property of the Bessel function (151), , which reduces by two the number of Bessel functions to evaluate (but these evaluations are straightforward anyway);

-

-

The presence of several null series terms (in grey in fig. 1), due to the divergence of the Gamma function in the denominator when its argument is a negative integer. It is not complicated to see that, if e.g. is an even integer , then there are null terms. In fig. 1, we choose , corresponding to terms in the computation of the European call price, and an attained precision of ; but as there are null terms in the series, only terms are actually needed to attain this precision.

5.2 Accessible range of parameters

We start by remarking that the at the money (ATM) situation () is a favorable situation for satisfying assumption 1. Indeed, in that case, we have:

| (104) |

In the symmetric model in particular, it is clear that

| (105) |

and therefore assumption 1 is satisfied as soon as ; according to the implied parameters in table 1, the smallest calibrated value for is , therefore assumption 1 is satisfied (independently of and of other market parameters) as soon as the risk-free interest rate is smaller than , which is of course the case for most financial applications.

In the more general non at the money and non symmetric case, satisfying assumption 1 necessitates some restriction on the option’s maturities, depending on the moneyness situation. Assuming that (as option prices are not sensitive to ) and, introducing

| (106) |

then it is not hard to see that:

-

-

If (in the money (ITM) situation), then assumption 1 is satisfied if or ;

-

-

If (out of the money (OTM) situation), then assumption 1 is satisfied if or .

In table 1, we illustrate this rule on several implied NIG parameters, calibrated in the literature on various option markets: OBX options in Saebø (2009), S&P 500 options in Matsuda (2006); Albrecher & Schoutens (2005) or Euro Stoxx 50 (SX5E) options in Schoutens & al. (2004).

| NIG parameters | Accessible maturities | ||||

|---|---|---|---|---|---|

| OTM | ITM | ||||

| Saebø (2009) | 8.9932 | -4.5176 | 1.1528 | ||

| Matsuda (2006) | 20.7408 | -11.7308 | 0.2483 | ||

| Schoutens & al. (2004) | 16.1975 | -3.1804 | 1.0867 | ||

| Albrecher & Schoutens (2005) | 18.4815 | -4.8412 | 0.4685 | ||

5.3 Truncation error

In this subsection we estimate the rest of some series arising in our pricing formulas, in order to determine what truncation has to be applied to obtain a desired level of precision in option prices. For simplicity of notations, we perform the analysis in the symmetric model, but extension to the asymmetric case is straightforward.

Cash-or-nothing

Let us observe that the general term of the cash-or-nothing series (49) is the same than the term introduced in (37) in the proof of formula 1:

| (107) |

Using the bound (38), we therefore know that, for , there exists a rank such that the general term of the series in the cash-or-nothing formula (49) is bounded by

| (108) |

As a consequence of assumption 1, and therefore, denoting by the least integer greater or equal to a real number , it suffices to choose

| (109) |

to be sure that all terms of order are in the series (49). Turning back to the -variable (i.e. ), it follows from (109) that, definying

| (110) |

then all terms of order are in the series of formula 3, and that the error in the option price itself is bounded by

| (111) |

after the computation of terms.

Asset-or-nothing

Recall the notations introduced in the proof of formula 1 for the general term of the series:

| (112) |

and for the terms on the line :

| (113) |

Let us fix and consider

| (114) |

From the particular values of the Gamma functions (145), the ratio of Gamma functions in (114) is smaller or equal to , and the ratio of Bessel functions is smaller than 1, as a consequence of the symmetry and monotonicity relations (151) and (152). Hence,

| (115) |

and, consequently, for any in as soon as

| (116) |

Under this condition, all terms are therefore as soon as where is the one determined in (110), and, consequently, the error in the option price given formula 1 is bounded by

| (117) |

after the computation of terms. Note that if (116) is not satisfied, the series still converges but the maximum is not attained on the line , which complicates the estimation of the number of terms to compute. We may nevertheless observe that (116) is a very reasonable condition: for instance, using the implied parameters given in table 1 for SX5E options, we find , which is very close to the maximal expiry (10 years) quoted for options written on this underlying.

European

Exactly the same analysis can be performed on the European option, resulting in an error for the option price given by formula 2 bounded by

| (118) |

after the computation of terms (because the summation starts at ). To illustrate these observations, we summarize in table 2 the minimal rank, number of terms and price errors obtained for the digital and European options for some realistic market parameters.

| Asset-or-nothing (Formula 1) | |||

|---|---|---|---|

| Minimal rank | Number of terms | Price error | |

| 5 | 36 | 6.39064 | |

| 11 | 144 | 0.0639064 | |

| 15 | 256 | ||

| 21 | 484 | ||

| European (Formula 2) | |||

| Minimal rank | Number of terms | Price error | |

| 5 | 30 | 6.39064 | |

| 11 | 132 | 0.0639064 | |

| 15 | 240 | ||

| 21 | 462 | ||

| Cash-or-nothing (Formula 3) | |||

| Minimal rank | Number of terms | Price error | |

| 5 | 6 | 0.00159766 | |

| 11 | 12 | 0.0000159766 | |

| 15 | 16 | ||

| 21 | 22 | ||

5.4 Comparisons with Fourier techniques

Lewis formula

We recall that, following Lewis (2001), digital option prices admit convenient representation involving the risk-neutral characteristic function and the log-forward moneyness; the asset-or-nothing call can be written as

| (119) |

and the cash-or-nothing call as

| (120) |

where, here, , and where the characteristic function has been normalized by the martingale adjustment:

| (121) |

so that the martingale condition holds true. In table 3, we compare the asset-or-nothing prices obtained by an application of formula 1 (truncated at ) and of formula 6 (truncated at ), with a numerical evaluation of the Lewis formula (119) performed via a classical recursive algorithm on . Same comparison is made in table 4 for the cash-or-nothing prices. We observe the excellent agreement between our analytical result and numerical ones, as well as the fast convergence of the series. The convergence is particularly accelerated in the ATM situation (for instance in the symmetric model, only 3 terms are needed to obtain a precision of in the cash-or-nothing price). It is slightly slower for deep OTM options: this is because when , and therefore the positive powers of tend to slow down the overall convergence speed. Note also that the convergence is more rapid in the symmetric than in the asymmetric model, because we choose an implied parameter complying with the calibrations in table 1; if we had chosen , then the positive powers of would have accelerated the convergence of the asymmetric series.

| Symmetric model [] | |||||

|---|---|---|---|---|---|

| Formula 1 | Lewis (119) | ||||

| Deep OTM () | 861.9096 | 796.515 | 804.8118 | 804.9099 | 804.9097 |

| OTM () | 1495.76986 | 1493.3213 | 1493.5276 | 1493.5278 | 1493.5278 |

| ATM | 2309.8330 | 2313.6169 | 2313.7110 | 2313.7110 | 2313.7110 |

| ITM () | 3163.3516 | 3170.7414 | 3170.9431 | 3170.9431 | 3170.9431 |

| Deep ITM () | 3986.4269 | 3999.5086 | 3999.8854 | 3999.8852 | 3999.8852 |

| Asymmetric model [] | |||||

| Formula 6 | Lewis (119) | ||||

| Deep OTM () | 1084.9112 | 991.4964 | 990.8328 | 990.8302 | 990.8302 |

| OTM () | 1814.0381 | 1705.6678 | 1704.8935 | 1704.8905 | 1704.8905 |

| ATM | 2593.7092 | 2480.0154 | 2479.11828 | 2479.1149 | 2479.1149 |

| ITM () | 3310.5927 | 3252.0495 | 3250.4093 | 3250.4089 | 3250.4089 |

| Deep ITM () | 3777.9899 | 4003.6194 | 3989.4277 | 3989.7291 | 3989.7293 |

| Symmetric model [] | |||||

|---|---|---|---|---|---|

| Formula 3 | Lewis (120) | ||||

| Deep OTM () | 0.2127 | 0.2092 | 0.2095 | 0.2095 | 0.2095 |

| OTM () | 0.3076 | 0.3073 | 0.3073 | 0.3073 | 0.3073 |

| ATM | 0.4054 | 0.4054 | 0.4054 | 0.4054 | 0.4054 |

| ITM () | 0.4973 | 0.4973 | 0.4973 | 0.4973 | 0.4973 |

| Deep ITM () | 0.5793 | 0.5793 | 0.5793 | 0.5793 | 0.5793 |

| Asymmetric model [] | |||||

| Formula 8 | Lewis (120) | ||||

| Deep OTM () | 0.2579 | 0.2360 | 0.2357 | 0.2357 | 0.2357 |

| OTM () | 0.3523 | 0.3244 | 0.3240 | 0.3240 | 0.3240 |

| ATM | 0.4544 | 0.4077 | 0.4074 | 0.4074 | 0.4074 |

| ITM () | 0.5740 | 0.4823 | 0.4827 | 0.4827 | 0.4827 |

| Deep ITM () | 0.7634 | 0.7277 | 0.5733 | 0.5452 | 0.5489 |

Carr-Madan formula

Regarding European options, we recall the representation given in Carr & Madan (1999) based on the introduction of a dampling factor to avoid the divergence in ; namely, let

| (122) |

then the European call price admits the representation:

| (123) |

where , and is determined by the square integrability condition . In table 5 we compare the European prices obtained by formula 2 (truncated at ) and formula 7 (truncated at ), with a numerical evaluation of the Carr-Madan formula (123) on the interval . We also observe the excellent agreement between our analytical results and the numerical ones, as well as the accelerated convergence for very short term options. For instance, when 1 day, iterations are enough to obtain a precision of in the option price in the symmetric model; this is because, when is close to , then and therefore when the positive powers of arising in formulas 2 and 7 accelerate the convergence of the series. Note that, on the contrary, the short maturity case is not a favorable situation for a numerical evaluation of the Carr-Madan formula, because of the presence of oscillations of the integrand that considerably slow down the numerical Fourier inversion process.

| Symmetric model [] | |||||

|---|---|---|---|---|---|

| Formula 2 | Carr-Madan (123) | ||||

| Maturity | |||||

| 1 year | 576.6432 | 580.4319 | 580.5260 | 580.5260 | 580.5260 |

| 1 month | 150.8024 | 150.8651 | 150.8656 | 150.8656 | 150.8656 |

| 1 week | 60.9649 | 60.9746 | 60.9747 | 60.9747 | 60.9747 |

| 1 day | 15.4503 | 15.4515 | 15.4515 | 15.4515 | 15.4515 |

| Asymmetric model [] | |||||

| Formula 7 | Carr-Madan (123) | ||||

| Maturity | |||||

| 1 year | 790.330 | 679.6635 | 678.8152 | 678.8118 | 678.8118 |

| 1 month | 173.6275 | 173.5547 | 173.5546 | 173.5546 | 173.5546 |

| 1 week | 68.4327 | 68.4234 | 68.4234 | 68.4234 | 68.4234 |

| 1 day | 16.7801 | 16.7790 | 16.7790 | 16.7790 | 16.7790 |

Fast Fourier Transform

The Fast Fourier Transform (FFT) is an algorithm allowing to compute efficiently sums of the type

| (124) |

Such an algorithm can be successfully applied to provide numerical approximations of (123). Let ; following Carr & Madan (1999) we truncate the integral in (123) and evaluate it by a trapezoidal rule for equally spaced panels of length (i.e., the upper bound in (123) is truncated at ); for , we introduce the collection of log-strikes

| (125) |

generating log-strike prices located in the interval . Choosing allows to re-write (123) as:

| (126) |

where

| (127) |

We can observe that (126) is of the form (124); using Simpson’s rule weightings, Carr & Madan (1999) obtain the following approximation for the European call price:

| (128) |

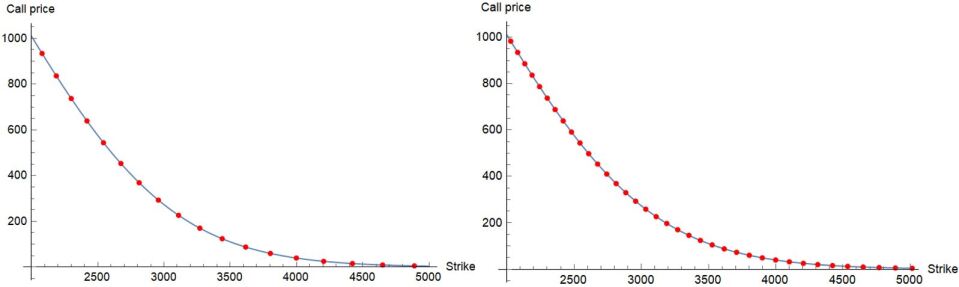

where denotes the Kronecker symbol. In figure 2, we fix , , , (one month expiry), , and we compare the results obtained by the FFT algorithm (128) and applications of the pricing formula 2 for the European call in the symmetric model:

- -

-

-

In the FFT algorithm we follow Carr & Madan (1999) and choose for the spacing parameter, and we choose (left graph) or (right graph) for the truncation parameter.

We observe that, in both cases, the pricing formula 2 and the FFT algorithm display excellent agreement. However, in the case , only strikes are attainable in the interval via the FFT method, and 36 when ; in the first (resp. second) case, strikes prices are separated by 100 to 200 (resp. 50 to 100) points. To get a collection of strikes separated by only 10 points (at least when one is not too far from the money), one would need to choose , and even to get consecutive prices. This is to be compared with the terms needed by the pricing formula 2 to provide a continuum of strikes across the whole interval.

5.5 Comparisons with Monte Carlo simulations

Let and define the family of independent and identically distributed random variables , , all distributed according to the symmetric NIG distribution , and define

| (129) |

as well as

| (130) |

We know from the strong law of large numbers that converges to the price of the log call option, more precisely that

| (131) |

almost surely when . Similarly, regarding power options, we define (in the European case):

| (132) |

and, for the capped digital option,

| (133) |

which converge to the European power call and to the capped cash-or-nothing call respectively. In table 6, we compare the results obtained via the Monte Carlo simulations (130), (132) and (133) for different number of paths, with truncations of the pricing formulas 5, 4 and of (83). As expected, the results display good agreement, but our series provide a far more precise price and a far more rapid convergence: for instance, only 2 to 4 terms are needed to obtain a level of precision of for the log call using formula 5, while the Monte Carlo price still features a relative error of 1% in the OTM case and even 4% in the ITM case. Note also that, defining the 95% confidence interval by where

| (134) |

then its length vary between (OTM case) and (ITM case) after paths. Of course the confidence interval could be reduced by increasing the number of paths (but then the Standard Monte Carlo becomes time and resource consuming) or by introducing variance reduction techniques, such as antithetic variates or importance sampling methods (see Su & Fu (2000) or the classical monograph Glasserman (2004)). On the contrary, with our series expansions, the results are quasi instantaneous and can easily be made as precise as one wishes, without introducing further sophistication.

| Log option (call) | ||||||

|---|---|---|---|---|---|---|

| Monte Carlo (130) | Formula 5 | |||||

| OTM ( | 0.0826 | 0.1034 | 0.1002 | 0.1012 | 0.1008 | 0.1008 |

| ATM ( | 0.1537 | 0.1508 | 0.1509 | 0.1483 | 0.1482 | 0.1482 |

| ITM ( | 0.2428 | 0.2255 | 0.1923 | 0.2014 | 0.2014 | 0.2014 |

| Power option (European) | ||||||

| Monte Carlo (132) | Formula 4 | |||||

| OTM ( | 12943.90 | 13976.71 | 14456.01 | 1429.53 | 14629.84 | 14629.84 |

| ATM ( | 17229.06 | 17263.31 | 17678.74 | 17843.79 | 17847.18 | 17847.18 |

| ITM ( | 20719.09 | 20310.75 | 21422.76 | 21126.01 | 21148.88 | 21148.89 |

| Capped option (digital) | ||||||

| Monte Carlo (133) | Series (83) | |||||

| OTM ( | 0.1764 | 0.1519 | 0.1262 | 0.1754 | 0.1355 | 0.1347 |

| ATM ( | 0.1862 | 0.1608 | 0.1598 | 0.1754 | 0.1575 | 0.1575 |

| ITM ( | 0.2058 | 0.1774 | 0.1672 | 0.1754 | 0.1702 | 0.1702 |

6 Concluding remarks

In this paper, we have proved two general formulas for pricing arbitrary path independent instruments in the exponential NIG model, in the symmetric and asymmetric cases. These formulas allow to express the Mellin transform of the instrument’s price as the product of the Mellin transform of the instrument’s payoff and of the NIG probability density. Inverting the formulas by means of residue theory in and has allowed us to derive practical closed-form pricing formulas for various path independent options and contracts, under the form of quickly convergent series. The convergence of the series is guaranteed as soon as a simple condition of the log forward moneyness and on the option’s maturity is fulfilled. We have tested our results by comparing them with classical numerical methods, and provided precise estimate for the convergence speed; notable feature is that a very reasonable number of terms is required to obtain an excellent level of precision, and that the convergence is particularly fast for short term and at the money options.

Future work should include, among others, an extension of the Mellin residue summation method to path independent instruments on several assets, and to path dependent instruments. Asian options with continuous geometric payoffs, in particular, should be investigated, because the characteristic function for the geometric average is known exactly in the exponential NIG model (see Fusai & Meucci (2008)), for both fixed and floating strikes.

Extension of the technique to Generalized Hyperbolic (GH) Lévy motions (see Prause (1999); Eberlein (2001)) should also be considered; indeed, the probability density of the GH distribution has a very similar form to the NIG density (1), which, at first sight, allows for the same convenient representation in terms of Mellin-Barnes integrals for the Bessel kernel. However, GH distributions are not convolution-closed, that is, the Lévy processes they generate are not necessarily distributed according to a GH distribution for increments of length (exceptions being the NIG process, which, as we know, is distributed according to a NIG distribution for all , as well as the generalized Laplace or Variance Gamma distribution). As a consequence, a Mellin-Barnes integral representation for the density of the GH process is not straightforward to derive, but could nevertheless be obtained from the moment generating function, after suitable transformations from the Laplace space to the Mellin space.

Acknowledgments

The author thanks Ryan McCrickerd for insightful comments and discussions. The author also thanks two anonymous Reviewers and the Managing Editor for their careful reading of the manuscript, and their valuable remarks and suggestions.

References

- Abramowitz & Stegun (1972) Abramowitz, M. and Stegun, I., Handbook of Mathematical Functions, Dover Publications, Mineola, NY (1972)

- Aguilar (2019) Aguilar, J. Ph., On expansions for the Black-Scholes prices and hedge parameters, Journal of Mathematical Analysis and Applications 478(2), 973-989 (2019)

- Aguilar & Korbel (2019) Aguilar, J. Ph. and Korbel, J., Simple Formulas for Pricing and Hedging European Options in the Finite Moment Log-Stable Model, Risks 7, 36 (2019)

- Aguilar (2020) Aguilar, J. Ph., Some pricing tools for the Variance Gamma model, International Journal of Theoretical and Applied Finance 23(4), 2050025 (2020)

- Albrecher & Predota (2004) Albrecher, H. and Predota, M., On Asian option pricing for NIG Lévy processes, Journal of Computational and Applied Mathematics 172, 153-168 (2004)

- Albrecher & Schoutens (2005) Albrecher, H. and Schoutens, W., Static hedging of Asian options under stochastic volatility models using Fast Fourier Transform. In: A. Kyprianou et al. (Eds), Exotic Options and Advanced Lévy models pp. 129-148, John Wiley & Sons, Hoboken, NJ (2005)

- Andrews (1992) Andrews, L.C., Special Functions of Mathematics for Engineers, McGraw-Hill Book Company, New York (1992)

- Barndorff-Nielsen (1977) Barndorff-Nielsen, O., Exponentially decreasing distributions for the logarithm of particle size, Proceedings of the Royal Society of London 353, 401-419 (1977)

- Barndorff-Nielsen (1995) Barndorff-Nielsen, O., Normal inverse Gaussian distributions and the modeling of stock returns, Research report no 300, Department of Theoretical Statistics, Aarhus University (1995)

- Barndorff-Nielsen (1997) Barndorff-Nielsen, O., Normal inverse Gaussian distributions and stochastic volatility models, Scandinavian Journal of Statistics 24(1), 1-133 (1997)

- Bateman (1954) Bateman, H., Tables of Integral Transforms (vol. I and II), McGraw-Hill Book Company, New York (1954)

- Bertoin (1996) Bertoin, J., Lévy Processes, Cambridge University Press, Cambridge, New York, Melbourne (1996)

- Black & Scholes (1973) Black, F. and Scholes, M., The Pricing of Options and Corporate Liabilities, Journal of Political Economy 81(3), 637-654 (1973)

- Brenner and Subrahmanyam (1994) Brenner, M. and Subrahmanyam, M.G., A simple approach to option valuation and hedging in the Black-Scholes Model, Financ. Anal. J. 50, 25–28 (1994)

- Carr & Madan (1999) Carr, P. and Madan, D., Option valuation using the Fast Fourier Transform, Journal of Computational Finance 2, 61-73 (1999)

- Carr & al. (2002) Carr, P., Geman, H., Madan, D., Yor, M., The Fine Structure of Asset Returns: An Empirical Investigation, Journal of Business 75(2), 305-332 (2002)

- Carr and Wu (2003) Carr, P. and Wu, L., The Finite Moment Log Stable Process and Option Pricing, The Journal of Finance 58(2), 753-777 (2003)

- Carr and Wu (2004) Carr, P. and Wu, L., Time-changed Lévy processes and option pricing, Journal of Financial Economics 71, 113-141 (2004)

- Carr & Wu (2012) Carr, P., Lee R. and Wu, L., Variance swaps on time-changed Lévy processes, Finance and Stochastics 16, 335-355 (2012)

- Cont & Tankov (2004) Cont, R. and Tankov, P., Financial Modelling with Jump Processes, Chapman & Hall, New York (2004)

- Eberlein and Keller (1995) Eberlein, E. and Keller,U., Hyperbolic distributions in finance, Bernoulli 1(3), 281-299 (1995)

- Eberlein (2001) Eberlein, E., Application of Generalized Hyperbolic Lévy Motions to Finance. In: Lévy Processes, Barndorff-Nielsen O.E., Resnick S.I., Mikosch T. (eds), Birkhauser, Boston, MA (2001)

- Fang & Osterlee (2008) Fang, F. and Oosterlee, C.W., A novel pricing method for European options based on Fourier cosine series expansions, SIAM Journal on Scientific Computing 31, 826-848 (2008)

- Figueroa-López et al. (2012) Figueroa-López, J.E., Lancette, S.R, , Lee, K. and Mi, Y., Estimation of NIG and VG models for high frequency financial data. In: Handbook of Modeling High-Frequency Data in Finance, F. Viens, M.C. Mariani, I. Florescu (eds.), John Wiley & Sons, Hoboken, NJ (2012)

- Flajolet et al. (1995) Flajolet, P., Gourdon, X. and Dumas, P., Mellin transforms and asymptotics: Harmonic sums, Theoretical Computer Science 144, 3-58 (1995)

- Fusai & Meucci (2008) Fusai, G. and Meucci, A., Pricing discretely monitored Asian options under Lévy processes, Journal of Banking & Finance 32(10), 2076–2088 (2008)

- Giannone & al. (2008) Giannone, D., Reichlin, L. and Small, D., Nowcasting: The real-time informational content of macroeconomic data, Journal of Monetary Economics 55(4), 665-676 (2008)

- Glasserman (2004) Glasserman, P., Monte Carlo methods in financial engineering, Springer Science & Business Media Vol.53, New York (2004)

- Hanssen & Øigård (2001) Hanssen, A. and Øigård, T.A., The Normal inverse Gaussian distribution: a versatile model for heavy-tailed stochastic processes, Proceedings - ICASSP, IEEE International Conference on Acoustics, Speech and Signal Processing 6, 3986-3988 (2001)

- Heston (1993) Heston, S., A Closed-Form Solution for Options with Stochastic Volatility with Applications to Bond and Currency Options, The Review of Financial Studies 6(2), 327-343 (1993)

- Ivanov (2013) Ivanov, R.V., Closed Form Pricing of European Options for a Family of Normal Inverse Gaussian Processes, Journal of Stochastic Models 29(4), 435-450 (2013)

- Keller-Ressel (2008) Keller-Ressel, M., Moment explosions and long-term behavior of affine stochastic volatility models, arXiv:0802.1823 (2008)

- Kirkby (2015) Kirkby, J. L., Efficient Option Pricing by Frame Duality with the Fast Fourier Transform, SIAM Journal on Financial Mathematics 6(1), 713-747 (2015)

- Lewis (2001) Lewis, A.L., A simple option formula for general jump-diffusion and other exponential Lévy processes, Available at SSRN: https://ssrn.com/abstract=282110 (2001)

- Luciano & Semeraro (2010) Luciano, E. and Semeraro, P., Multivariate time changes for Lévy asset models: Characterization and calibration, Journal of Computational and Applied Mathematics 223(8), 1937-1953 (2010)

- Madan et al. (1998) Madan, D., Carr, P. and Chang, E., The Variance Gamma Process and Option Pricing, European Finance Review 2, 79-105 (1998)

- Mandelbrot (1963) Mandelbrot, B., The Variation of Certain Speculative Prices, The Journal of Business 36(4), 384-419 (1963)

- Matsuda (2006) Matsuda, K., Calibration of Lévy Option Pricing Models: Applications to S& P 500 Futures option, PhD Thesis City University of New York (2006)

- Mechkov (2015) Mechkov, S., Fast-Reversion Limit of the Heston Model, Available at SSRN: https://ssrn.com/abstract=2418631 (2015)

- Mittnik & Rachev (2000) Mittnik, S. and Rachev, S., Stable Paretian models in finance, John Wiley & Sons, Hoboken, NJ (2000)

- Neuberger (1994) Neuberger, A., The log contract, Journal of Portfolio Management 20, 74-80 (1994)

- Papantolen (2008) Papantoleon, A., An introduction to Lévy Processes with applications in finance, arXiv:0804.0482 (2008)

- Prause (1999) Prause, K, The generalized hyperbolic model: estimation, financial derivatives and risk measures, PhD thesis, Institut für Mathematische Statistik, Albert-Ludwigs-Universität Freiburg (1999)

- Rachev et al. (2011) Rachev, S., Kim, Y., Bianchi, M., Fabozzi, F., Financial models with Lévy processes and volatility clustering, John Wiley & Sons, Hoboken, NJ (2011)

- Ribeiro and Webber (2003) Ribeiro, C. and Webber, N., A Monte Carlo Method for the Normal Inverse Gaussian Option Valuation Model using an Inverse Gaussian Bridge, City University preprint (2003)

- Rydberg (1997) Rydberg, T., The Normal inverse Gaussian Lévy process: simulation and approximation, Communications in Statistics. Stochastic Models 13, 887-910 (1997)

- Saebø (2009) Saebø, K., Pricing Exotic Options with the Normal Inverse Gaussian Market Model using Numerical Path Integration, Master’s Thesis Norwegian University of Science and Technology (2009)

- Schoutens (20003) Schoutens, W., Lévy processes in finance: pricing financial derivatives, John Wiley & Sons, Hoboken, NJ (2003)

- Schoutens & al. (2004) Schoutens, W., Simons, E., and Tistaert, J., A perfect calibration! Now what?, Wilmott magazine 2004(2) (2004)

- Su & Fu (2000) Su, Y., and Fu., M.C., Importance sampling in derivative securities pricing, 2000 Winter Simulation Conference Proceedings Vol. 1. (2000)

- Taleb (2010) Taleb, N.N., The Black Swan: The Impact of the Highly Improbable, Random House Publishing Group, New York (2010)

- Tankov (2010) Tankov, P., Pricing and Hedging in Exponential Lévy Models: Review of Recent Results. In: Paris-Princeton Lectures on Mathematical Finance. Lecture Notes in Mathematics, vol 2003, Springer, Berlin, Heidelberg (2010)

- Venter & de Jongh (2002) Venter, J. and de Jongh, P., Risk estimation using the Normal inverse Gaussian distribution, The Journal of Risks 2, 1-25 (2002)

- Wilmott (2006) Wilmott, P., Paul Wilmott on Quantitative Finance, Wiley & Sons, Hoboken, NJ, 2006

- Zeng and Kwok (2014) Zeng, P. and Kwok, Y.K., Pricing barrier and Bermudan style options under time-changed Lévy processes: fast Hilbert transform approach, SIAM Journal on Scientific Computing 36(3), B450-B485 (2014)

Appendix A Brief review of the Mellin transform

We present an overview of the one-dimensional Mellin transform; this theory is explained in full detail in Flajolet et al. (1995), and table of Mellin transforms can be found in any monograph on integral transforms (see e.g. Bateman (1954)).

1. The Mellin transform of a locally continuous function defined on is the function defined by

| (135) |

The region of convergence into which the integral (135) converges is often called the fundamental strip of the transform, and sometimes denoted .

2. The Mellin transform of the exponential function is, by definition, the Euler Gamma function:

| (136) |

with strip of convergence . Outside of this strip, it can be analytically continued, except at every negative integer where it admits the singular behavior

| (137) |

In table 7 we summarize the main Mellin transforms used in this paper, as well as their convergence strips.

| Convergence strip | ||

|---|---|---|

3. The inversion of the Mellin transform is performed via an integral along any vertical line in the strip of convergence:

| (138) |

and notably for the exponential function one gets the so-called Cahen-Mellin integral:

| (139) |

4. When is a ratio of products of Gamma functions of linear arguments:

| (140) |

then one speaks of a Mellin-Barnes integral, whose characteristic quantity is defined to be

| (141) |

governs the behavior of when and thus the possibility of computing (138) by summing the residues of the analytic continuation of right or left of the convergence strip:

| (142) |

For instance, in the case of the Cahen-Mellin integral one has and therefore:

| (143) |

as expected from the usual Taylor series of the exponential function.

Appendix B Some useful special functions identities

We list some properties of special functions that are used throughout the paper; more details can be found e.g. in Abramowitz & Stegun (1972); Andrews (1992).

B.1 Gamma function

Particular values

The Gamma function has been defined in (136) for ; integrating by parts shows that it satisfies the functional relation ; as , it follows that

| (144) |

and that the analytic continuation of to the negative half-plane is singular at every negative integer with residue . Other useful identities include and, more generally,

| (145) |

for .

Stirling approximation

We recall the well-known Stirling approximation for the factorial:

| (146) |

Legendre duplication formula

For any , we have:

| (147) |

Pochhammer symbol

The Pochhamer symbol , sometimes denoted by the Appel symbol , and also called rising factorial, is defined by

| (148) |

The definition (148) extends continuously to negative integers thans to the functional relation , thanks to the relation:

| (149) |

where .

B.2 Bessel functions

The modified Bessel function of the second kind, also called MacDonald function, can be defined by the Mellin integral

| (150) |

for . It follows that has the symmetry property:

| (151) |

and has monotonous absolute values:

| (152) |

Large index

When , one has the following behavior:

| (153) |

Large argument (Hankel’s expansion)

Define the following sequence:

| (154) |

Then, for large and fixed , we have:

| (155) |

In particular, when , i.e. when , all the are null in definition (154) when , and we are left with:

| (156) |

for all z.