Abstract

In this paper we

present a simple, but new, approximation methodology for pricing a call option in a Black & Scholes market characterized by stochastic interest rates. The method, based on a straightforward Gaussian moment matching technique applied to a conditional Black & Scholes formula, is quite general and it applies to various models, whether affine or not.

To check its accuracy and computational time, we implement it for the CIR interest rate model correlated with the underlying, using the Monte Carlo simulations as a benchmark. The method’s performance turns out to be quite remarkable, even when compared with analogous results obtained by the affine approximation technique presented in [9] and by the expansion formula introduced in [11], as we show in the last section.

Keywords: Option pricing, Stochastic interest rates, Moment matching, Non-affine models, Cox-Ingersoll-Ross model.

1 Introduction

Since the appearance of the seminal Black & Scholes/Merton option pricing fundamental formula, there has been an intensive effort to incorporate in the market model additional stochastic factors, such as the volatility and/or the interest rates, the latter already discussed by Merton himself in [15]. Along the years, a huge field of research developed,

leading to a very rich literature on stochastic volatility models, while fewer papers aimed at the inclusion of a dynamic term structure into the valuation of derivatives, e.g. [17], [1], [20], [19], [11], [7], [18].

Nowadays, the improvement in the performances of option pricing formulas obtained by adding these risk factors is widely recognized in the empirical literature (see e.g [2], [3]), indeed in ([12]) the author remarked that even including solely stochastic interest rates in the model does affect the pricing formula, especially for longer-dated options, in a noticeable manner.

Of course this generalization implies a higher degree of mathematical complexity and the search for efficient pricing techniques, able to provide accurate answers in a short computational time (as opposed to Monte Carlo methods) has been relentless, even more so in modern quantitative finance where a huge amount of data allows to consider strategies that call for on real-time model calibration. Hence, computational efficiency has become one of the primary concerns of risk managers and this requirement essentially restricted the choice of models to the affine class (see [7]).

Indeed, when the interest rates are modeled in a Gaussian processes framework, as in the very popular Hull-White / Vasicek models, even analytical prices can be obtained. These models are appropriate for modeling periods that admit positive probability of negative rates, such as the current one, but this feature becomes a drawback in usual periods of positive rates. The most popular model used to avoid this drawback is the Cox-Ingersoll-Ross (CIR) one, which guarantees the rate’s strict positivity under Feller’s condition. Its popularity comes from the fact that falls into the so called affine models, that can exploit a very efficient and fast Fourier transform technique to price the bonds.

Unfortunately, the affinity of the model is lost when the interest rate is coupled, with correlation, with a risky asset’s dynamics, making the search for efficient approximations of risk-neutral pricing formulas very challenging.

Here we present a simple, but new, approximation methodology for pricing a European call option in a market model given by a linear diffusion dynamics for the underlying (a Black & Scholes (BS) framework) coupled with a stochastic short term risk-free rate. The problem is a classical one and the novelty lies on the fact that we propose a quite straightforward moment matching (MM) technique, easy to implement and leading to very efficient approximations.

In building our procedure a few issues have to be addressed and we first provide, by appropriate conditioning, a representation formula for the claim’s price in terms of the BS formula, then we exploit a Gaussian approximation by properly matching the first two moments of the involved random variables, that allows to use the properties of the Normal cumulative distribution function (c.d.f.) (see Lemma (1)).

When applying the method to the affine models, we also employ a change-of-numeraire technique (introducing the -forward measure as in [5]) to partially disentangle the contributions due to the underlying and to the interest rate, exploiting the explicit expressions of the bond’s price in an affine framework. To keep computations as simple as possible, any time a quantity is computable, it is stored and treated as a constant in the sequel. This leads to an efficient mixed use of the risk free probability and the -forward measure to evaluate the separate quantities.

The paper is organized as follows. In Section 2 we derive a representation formula for the call option’s price in Black & Scholes market with stochastic risk-free short rates, while in Section 3 the Moment Matching method is fully described. Finally, in Section 4 we restrict to the affine models and we apply our technique with a CIR interest rate. In the same Section, we briefly introduce other two techniques, the affine approximation, inspired by Grzelak and Oosterlee [9] and the expansion method proposed by Kim and Kunimoto [11] alternative to prices obtained by Monte Carlo simulations. Hence we run a numerical study comparing those methods with ours, using Monte Carlo evaluation as a benchmark.

2 The price of a European call in the BS model with stochastic rates

The underlying problem we are concerned with is the pricing of a European call option, whose payoff is given by the function

for some , when stochastic interest rates come into play.

Thus, given a finite time interval and a complete probability space , endowed of a filtration satisfying the “usual hypotheses” (see [16]), the market model is defined by the log-price of a risky asset and a risk-free interest , whose joint dynamic for any initial condition and is given by

|

|

|

(1) |

where is a two dimensional standard Brownian motion and .

Moreover, we assume that the deterministic functions and are in a class that ensures the existence and uniqueness of a strong solution of (1) (see e.g. [10]) and that is some risk neutral probability selected by the market.

Under these assumptions, the pair is Markovian, whence

the arbitrage-free option’s price is a deterministic function of the state variables, given by

|

|

|

(2) |

provided that the coefficients and are chosen to guarantee the exponential integrability of and . Here we wrote , to stress the prices’ dependence on the correlation parameter.

If is regular enough in , Feymann-Kac’s formula implies that it is a classical solution of the following two-dimensional parabolic problem

|

|

|

(3) |

where , with

|

|

|

|

|

(4) |

|

|

|

|

|

(5) |

In what follows to keep notation easy, we take and we omit the dependence on in the pricing function. The general case may be readily obtained substituting in the final formulas with the time to maturity .

By conditioning internally with respect to , we have

|

|

|

(6) |

But , where

|

|

|

so we obtain

|

|

|

|

|

|

|

|

where we define

|

|

|

|

|

(7) |

|

|

|

|

|

(8) |

and denotes the cumulative distribution function of the standard Gaussian.

It is convenient to introduce the following notations

|

|

|

|

|

|

so that

|

|

|

(9) |

Setting , we can finally write

|

|

|

(10) |

In the forthcoming section we shall introduce the moment matching approximation procedure.

3 Option price approximation by moment matching

The main idea of this section is to replace the r.v.’s , , defined by (9), with Gaussian r.v.’s matching the first and second moments of .

We define

|

|

|

consequently

|

|

|

(11) |

and the new coefficient is fixed such that

|

|

|

|

(12) |

|

|

|

|

with

|

|

|

|

|

(13) |

|

|

|

|

|

(14) |

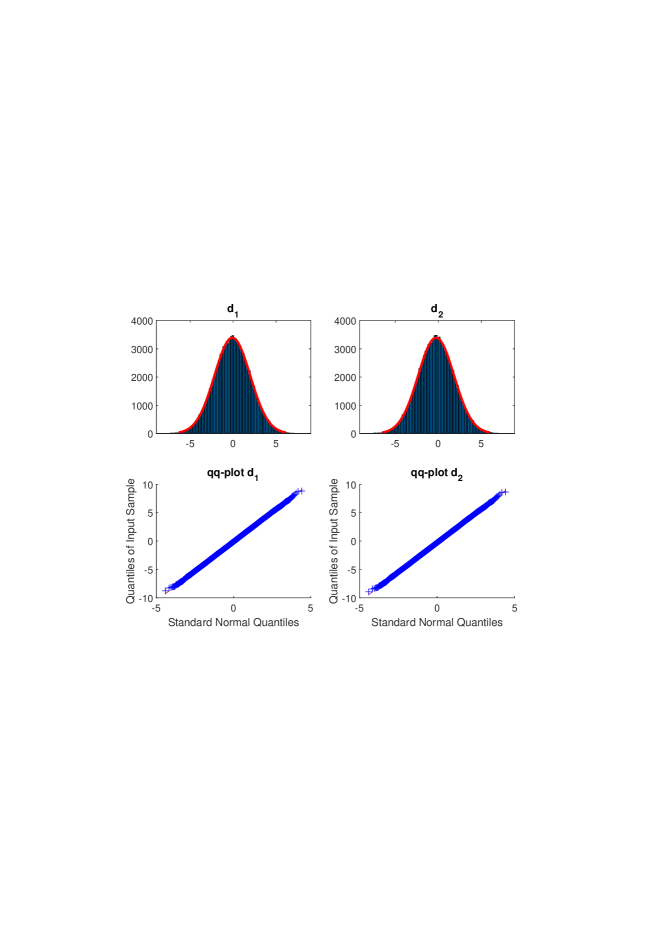

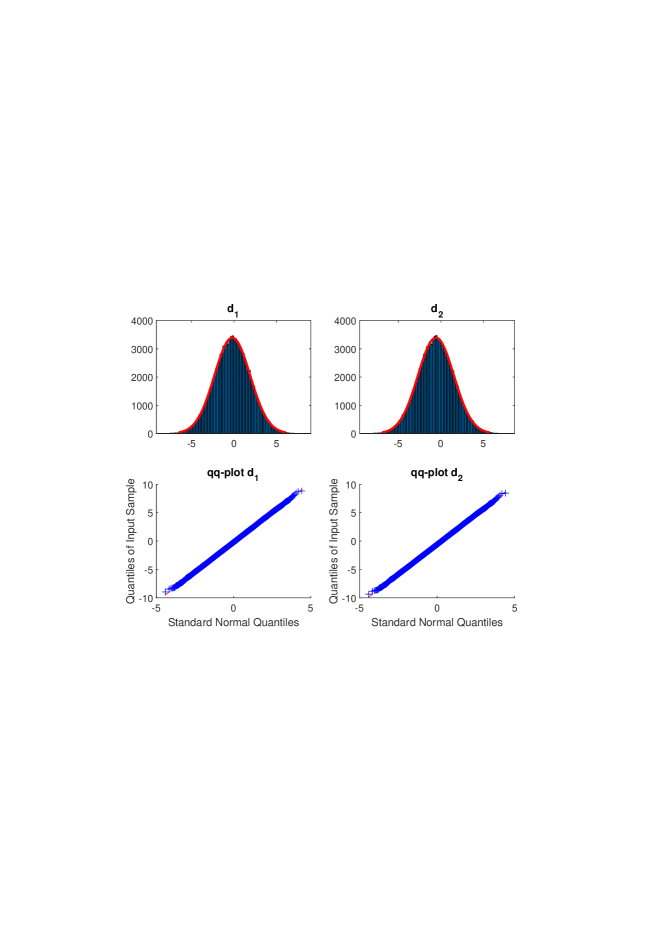

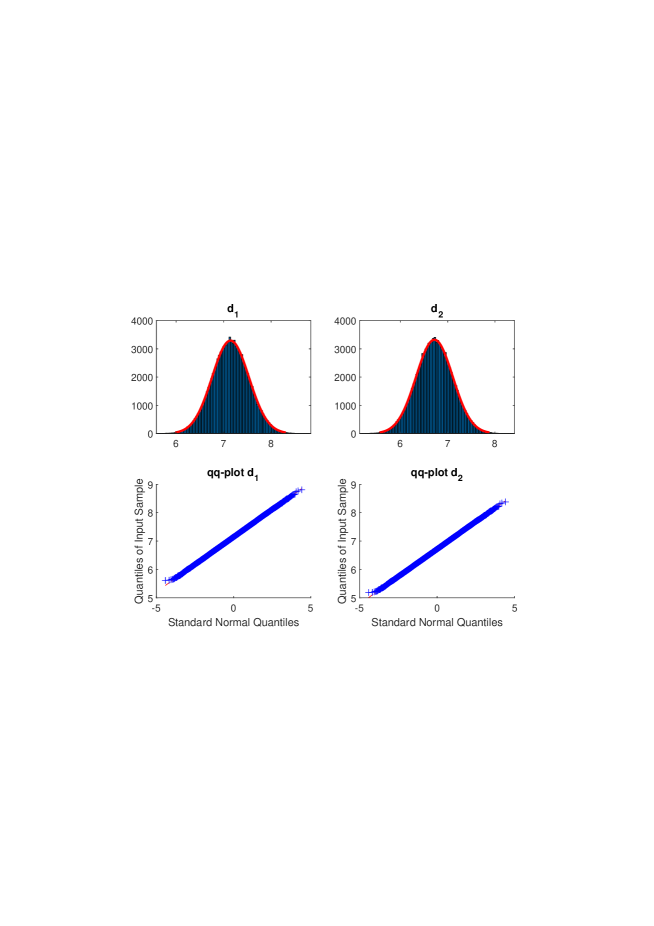

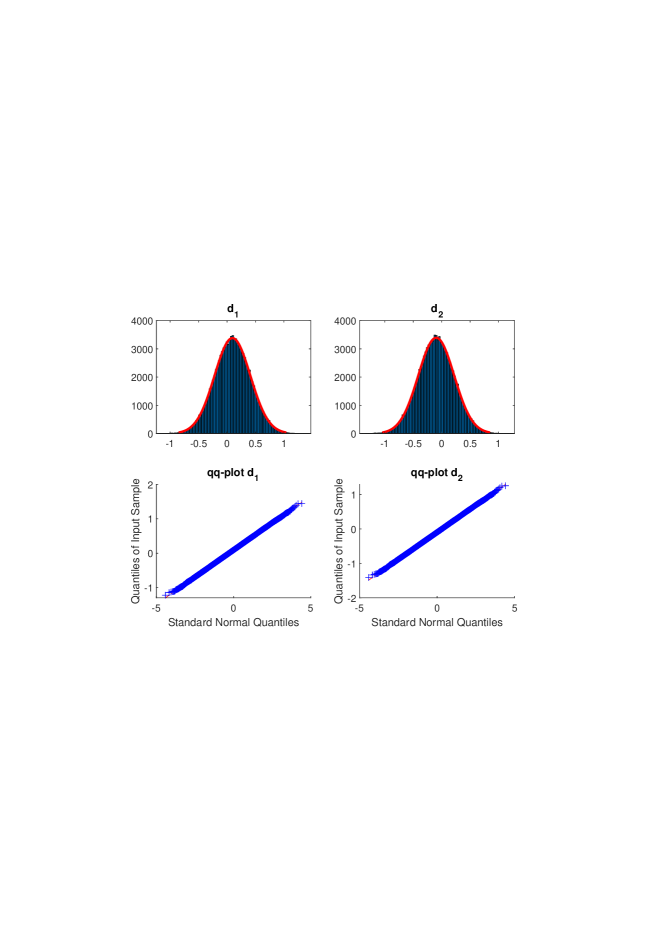

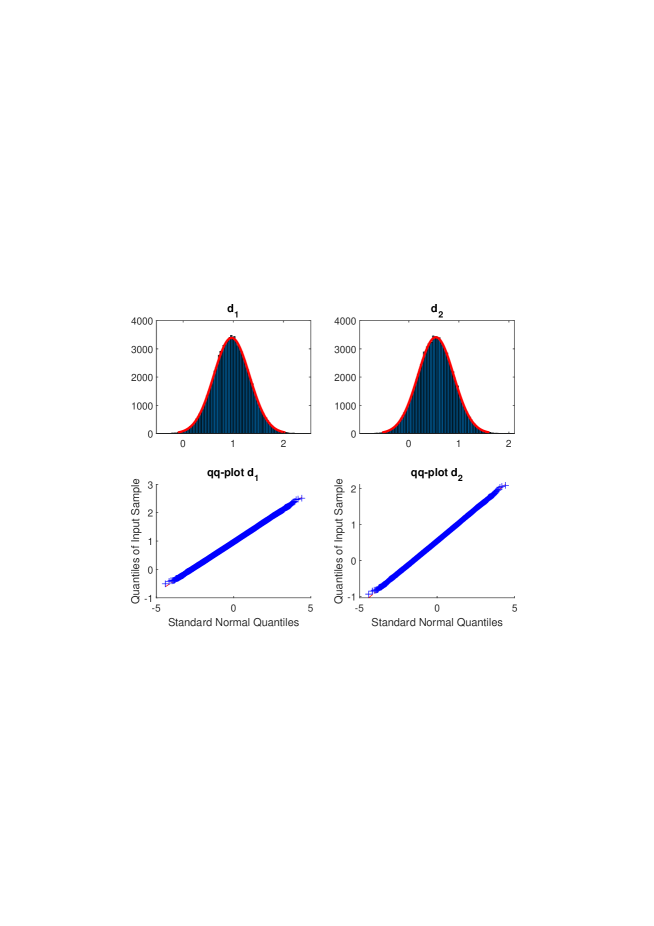

The moment matching method with Gaussian r.v’s may be motivated by looking at the empirical distributional properties of the random variables in some well-known rate models: see as examples Figs (1), (2) and (3).

We finally introduce a call price approximation

|

|

|

|

(15) |

|

|

|

|

The function can be evaluated in closed form by means of the following

Lemma 1

Let and , , then

|

|

|

Proof: See [21] for , the general case follows by a “completing the squares” argument.

Since

|

|

|

we may rewrite as

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From (11) and (12), we may conclude

|

|

|

(16) |

If and (13), (14) can be computed, then is totally explicit. From now on, we denote to point out this is a known constant.

On the contrary, the function cannot be evaluated in such a straightforward manner, as it involves a detailed knowledge of the joint distribution of and and not only of their moments and covariance. So, to represent , we suggest applying a

a change-of-numeraire technique that allows us to exploit the bond pricing theory.

Let us define

|

|

|

(17) |

the Zero Coupon Bond price. Again, since is a Markov process, is a deterministic function of the state variable, say , which we assume to be . For , we define the -martingale (we remark that is a true martingale thanks to the exponential integrability of )

|

|

|

(18) |

By applying Itô’s formula, we have the dynamic of

|

|

|

|

|

|

|

|

and we may define the -forward measure on every by (see [4] for the method and [6] for a similar application). Under , we get

|

|

|

(19) |

and by Girsanov theorem, by setting

|

|

|

we have that the process

is a Brownian motion. When choosing an interest rate model that allows an explicit expression of the bond’s price,

will be the last quantity to compute. Under , has the expression

|

|

|

whence its distribution is no longer known.

To compute the final expectation, we replace by the r.v.

|

|

|

where we are taking under the original probability , so that is a Gaussian r.v. and we may apply Lemma 1 once again to obtain

|

|

|

with

|

|

|

Hence we shall denote by

|

|

|

the approximation of and we may define the final approximation of the call option price as

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As a conclusion, we summarize the key requirements to make the approximation (3) explicitly computable and hopefully efficient

-

1.

the distributions of should be close to a Gaussian distribution;

-

2.

the bond price should be theoretically computable. Moreover one can exploit the observed (today) bond price for in (18) and for calibration purposes;

-

3.

the quantities , and and/or their approximations, should be easily computable;

-

4.

the change of numeraire technique (Girsanov’s theorem) should be applicable.

The performance of this approximation needs to be compared with Monte-Carlo simulated prices and then with other methods present in the literature. This will be done in the next section.

4 Numerics and comparison with other methodologies

In this section we employ an affine model for the interest rate. This choice provides an explicit expression for the the ZCB’s price (17). So our market model is given by

|

|

|

|

(21) |

|

|

|

|

where are bounded functions.

In this framework, we have for

|

|

|

for suitable deterministic functions and . Two very classical models fall into this setting

|

|

|

for which and are explicitly known ([5]), the same being true also for the Hull-White / Vasicek and Hull-White / CIR models, considering time dependent coefficients.

The functions and are usually characterized by the solution of a Riccati system of ODE’s. Unfortunately, when in presence of correlation, the same procedure cannot be applied to the pair , since its diffusion matrix

|

|

|

(22) |

may haves entries which are non-linear in the state variables, so that the joint diffusion is no longer affine, as it happens for the CIR model.

Hence, in this context it makes sense to apply the approximation procedure presented in the previous section. As before we consider .

In this case (see e.g. [5]), setting , we have

|

|

|

and let us proceed to the computation of , and .

-

1.

Computation of .

It is straightforward to see

|

|

|

-

2.

Computation of . Taking into account the first point, we only have to compute the second moment

|

|

|

|

|

|

|

|

|

|

|

|

By the independence of the increments of the process , for we have

|

|

|

|

|

|

|

|

|

|

|

|

Since , all the integrals appearing in the second moment can be calculated analytically.

-

3.

Computation of . By Itô’s integration-by-parts formula, we get

|

|

|

and again by integration by parts we have

|

|

|

|

|

|

|

|

so that

|

|

|

Solving this linear ODE for , since , we obtain

|

|

|

|

|

|

|

|

Thus the final crucial point is computing , which is rather delicate (see [8]). No explicit expression can be provided and we employ the approximation proposed in [9], that we are going to present in the next subsection

|

|

|

(23) |

where the parameters and are obtained by an ad hoc matching procedure, which proved to be numerically very efficient.

Finally, given the above three points, is easily computed from (12).

As a last step, we have to approximate , which is readily done, given the last remark, since

|

|

|

|

|

|

|

|

4.1 The Grzelak-Oosterlee (GO) approximation

Here and in the next subsection, for completeness, we briefly describe the two approximation techniques, we are going to compare with.

The GO approximation consists simply in modifying the operator given in (5) by replacing the state variable in the coefficient with a constant, namely we define

|

|

|

In the case of the CIR model, is time-homogeneous and this operator becomes

|

|

|

Once this replacement has been made then the Fourier transform methods apply, hence it is possible to compute approximated prices of the call option. We shall denote this approximation by . To evaluate the accuracy of this approximation a comparison with the prices of the (non-affine) true model, obtained by MC simulations, must be performed.

Once again we specialize the formulas for for a direct comparison with our results, so and .

The discounted transform, for , (see [7]) for the affine approximation is

|

|

|

where the functions satisfy a system of solvable ODE’s, that give

|

|

|

|

|

|

|

|

|

|

|

|

where is approximated as in (23).

Finally, by Lévy inversion formula as in [7] or Fourier inversion as in [13], one gets an integral representation for the price function: in our implementation we use the Fourier inversion

|

|

|

(24) |

where is a dumping factor and is the real part for .

4.2 The Kim-Kunimoto (KK) approximation

Kim and Kunimoto, in [11], consider a Taylor expansion of the process in powers of around . Considering the first order polynomial and setting , they obtain

|

|

|

(25) |

Inserting the approximation (25) in the evaluation formula for the call option, after some manipulations one can approximate the option’s price as

|

|

|

|

(26) |

|

|

|

|

where

|

|

|

|

|

|

|

|

being and .

4.3 Numerical results

We compare the results of the different approximations with the benchmark Monte Carlo method, applied to the price (10). In particular this means that we only have to simulate the rate process to get samples from and . The simulation was implemented by means of the Euler discretization with full truncation algorithm (see [14]). In our numerical experiments we generated sample paths with a time step discretization equal to for all the maturities. All the algorithms were implemented in MatLab (R2019b) and ran on an Intel Core i7 2.40GHZ with 8GB RAM, by using the available building-in functions, in particular for the computation of all the integrals involved. The average time to compute one price was (in secs) (MC), (GO), (KK) and (MM).

We chose different set of parameters and volatility scenarios: a low volatility and a high volatility ; hence we varied the correlation , the rate volatility and the maturity of the contract . The initial price of the underlying was set to as well as the strike price . Numerical results are summarized in Tables (1) - (8).

At least in the CIR model, the numerical results show that the MM method produces the best approximations with respect to the benchmark Monte Carlo evaluation in most scenarios.