Machine learning time series regressions with an application to nowcasting††thanks: We thank participants at the Financial Econometrics Conference at the TSE Toulouse, the JRC Big Data and Forecasting Conference, the Big Data and Machine Learning in Econometrics, Finance, and Statistics Conference at the University of Chicago, the Nontraditional Data, Machine Learning, and Natural Language Processing in Macroeconomics Conference at the Board of Governors, and the AI Innovations Forum organized by SAS and the Kenan-Flagler Business School as well as Jianqing Fan, Jonathan Hill, Michele Lenza, and Dacheng Xiu for comments. We are also grateful to the referees and the editor whose comments helped us to improve our paper significantly. All remaining errors are ours.

Abstract

This paper introduces structured machine learning regressions for high-dimensional time series data potentially sampled at different frequencies. The sparse-group LASSO estimator can take advantage of such time series data structures and outperforms the unstructured LASSO. We establish oracle inequalities for the sparse-group LASSO estimator within a framework that allows for the mixing processes and recognizes that the financial and the macroeconomic data may have heavier than exponential tails. An empirical application to nowcasting US GDP growth indicates that the estimator performs favorably compared to other alternatives and that the text data can be a useful addition to more traditional numerical data.

Keywords: high-dimensional time series, mixed frequency data, sparse-group LASSO, mixing processes, nowcasting, text data.

1 Introduction

The statistical imprecision of quarterly gross domestic product (GDP) estimates, along with the fact that the first estimate is available with a delay of nearly a month, pose a significant challenge to policy makers, market participants, and other observers with an interest in monitoring the state of the economy in real time; see, e.g., Ghysels, Horan, and Moench (2018) for a recent discussion of macroeconomic data revision and publication delays. A term originated in meteorology, nowcasting pertains to the prediction of the present and very near future. Nowcasting is intrinsically a mixed frequency data problem as the object of interest is a low-frequency data series (e.g., quarterly GDP), whereas the real-time information (e.g., daily, weekly, or monthly) can be used to update the state, or to put it differently, to nowcast the low-frequency series of interest. Traditional methods used for nowcasting rely on dynamic factor models that treat the underlying low frequency series of interest as a latent process with high frequency data noisy observations. These models are naturally cast in a state-space form and inference can be performed using likelihood-based methods and Kalman filtering techniques; see Bańbura, Giannone, Modugno, and Reichlin (2013) for a recent survey.

So far, nowcasting has mostly relied on the so-called standard macroeconomic data releases, one of the most prominent examples being the Employment Situation report released on the first Friday of every month by the US Bureau of Labor Statistics. This report includes the data on the nonfarm payroll employment, average hourly earnings, and other summary statistics of the labor market activity. Since most sectors of the economy move together over the business cycle, good news for the labor market is usually good news for the aggregate economy. In addition to the labor market data, the nowcasting models typically also rely on construction spending, (non-)manufacturing report, retail trade, price indices, etc., which we will call the traditional macroeconomic data. One prominent example of nowcast is produced by the Federal Reserve Bank of New York relying on a dynamic factor model with thirty-six predictors of different frequencies; see Bok, Caratelli, Giannone, Sbordone, and Tambalotti (2018) for more details.111The Federal Reserve Bank of New York Staff Nowcast is updated daily at 10 a.m. whenever the new data releases are issued with nowcasts published every week on Friday at 11:15 a.m.; see https://www.newyorkfed.org/research/policy/nowcast.

Thirty-six predictors of traditional macroeconomic series may be viewed as a small number compared to hundreds of other potentially available and useful non-traditional series. We could quickly reach the numerical complexities involved with estimating high-dimensional state space models, making the approach potentially computationally prohibitively complex and slow.222It should be noted that compared to the traditional Kalman Filter, a faster and more reliable alternative exists for the large data environments; see e.g., Chan and Jeliazkov (2009) and Delle Monache and Petrella (2019). For instance, macroeconomists increasingly rely on non-standard data such as textual analysis via machine learning, which means potentially hundreds of series. A textual analysis data set based on Wall Street Journal articles that has been recently made available features a taxonomy of 180 topics; see Bybee, Kelly, Manela, and Xiu (2020). Which topics are relevant? How should they be selected? Thorsrud (2020) constructs a daily business cycle index based on quarterly GDP growth and textual information contained in the daily business newspapers relying on a dynamic factor model where time-varying sparsity is enforced upon the factor loadings using a latent threshold mechanism. His work shows the feasibility of traditional state space setting, yet the challenges grow when we also start thinking about adding other potentially high-dimensional data sets, such as payment systems information or GPS tracking data.333Studies for Canada (Galbraith and Tkacz (2018)), Denmark (Carlsen and Storgaard (2010)), India (Raju and Balakrishnan (2019)), Italy (Aprigliano, Ardizzi, and Monteforte (2019)), Portugal (Duarte, Rodrigues, and Rua (2017)), and the United States (Barnett, Chauvet, Leiva-Leon, and Su (2016)) find that payment transactions can help to nowcast and to forecast GDP and private consumption in the short term; see also Moriwaki (2019) for nowcasting unemployment rates with smartphone GPS data, among others.

In this paper, we study nowcasting the low-frequency series – focusing on the key example of US GDP growth – in a data-rich environment, where our data not only includes conventional high-frequency series but also non-standard data generated by the textual analysis. We find that our nowcasts are either superior to or at par with those posted by the Federal Reserve Bank of New York (henceforth NY Fed). This is the case when (a) we compare our approach with the NY Fed using the same data, or (b) when we compare our approach using the high-dimensional data. The former is a comparison of methods, whereas the latter pertains to the value of the additional big data. To deal with such massive non-traditional datasets, instead of using the likelihood-based dynamic factor models, we rely on a different approach that involves machine learning methods based on the regularized empirical risk minimization principle and data sampled at different frequencies. We, therefore, adopt the MIDAS (Mixed Data Sampling) projection approach which is more amenable to the high-dimensional data environments. Our general framework also includes the standard same frequency time series regressions.

Several novel contributions are required to achieve our goal. First, we argue that the high-dimensional mixed frequency time series regressions involve certain data structures that once taken into account should improve the performance of unrestricted estimators in small samples. These structures are represented by groups covering lagged dependent variables and groups of lags for a single (high-frequency) covariate. To that end, we leverage on the sparse-group LASSO (sg-LASSO) regularization that accommodates conveniently such structures; see Simon, Friedman, Hastie, and Tibshirani (2013). The attractive feature of the sg-LASSO estimator is that it allows us to combine effectively the approximately sparse and dense signals; see e.g., Carrasco and Rossi (2016) for a comprehensive treatment of high-dimensional dense time series regressions as well as Mogliani and Simoni (2020) for a complementary to ours Bayesian view of penalized MIDAS regressions.

We recognize that the economic and financial time series data are persistent and often heavy-tailed, while the bulk of the machine learning methods assumes i.i.d. data and/or exponential tails for covariates and regression errors; see Belloni, Chernozhukov, Chetverikov, Hansen, and Kato (2020) for a comprehensive review of high-dimensional econometrics with i.i.d. data. There have been several recent attempts to expand the asymptotic theory to settings involving time series dependent data, mostly for the LASSO estimator. For instance, Kock and Callot (2015) and Uematsu and Tanaka (2019) establish oracle inequalities for regressions with i.i.d. errors with sub-Gaussian tails; Wong, Li, and Tewari (2019) consider -mixing series with exponential tails; Wu and Wu (2016), Han and Tsay (2017), and Chernozhukov, Härdle, Huang, and Wang (2020) establish oracle inequalities for causal Bernoulli shifts with independent innovations and polynomial tails under the functional dependence measure of Wu (2005); see also Medeiros and Mendes (2016) for results on the adaptive LASSO estimator, where the penalty function is weighted by the size of coefficients.

Despite these efforts, there is no complete estimation and prediction theory for high-dimensional time series regressions under the assumptions comparable to the classical GMM and QML estimators. For instance, the best currently available results are too restrictive for the MIDAS projection model, which is an example of a causal Bernoulli shift with dependent innovations. Moreover, the mixing processes with polynomial tails that are especially relevant for the financial and macroeconomic time series have not been properly treated due to the fact that the sharp Fuk-Nagaev inequality was not available in the relevant literature until recently. The Fuk-Nagaev inequality, see Fuk and Nagaev (1971), describes the concentration of sums of random variables with a mixture of the sub-Gaussian and the polynomial tails. It provides sharp estimates of tail probabilities unlike Markov’s bound in conjunction with the Marcinkiewicz-Zygmund or Rosenthal’s moment inequalities.

This paper fills this gap in the literature relying on the Fuk-Nagaev inequality for -mixing processes of Babii, Ghysels, and Striaukas (2020) and establishes the non-asymptotic and asymptotic estimation and prediction properties of the sg-LASSO projections under weak tail conditions and potential misspecification. The class of -mixing processes is sufficiently rich and includes the -mixing processes, causal Bernoulli shifts with infinitely many lags of -mixing processes, and nonlinear Markov processes; see Dedecker and Prieur (2004) and Dedecker and Prieur (2005) for more details, as well as Carrasco and Chen (2002) and Francq and Zakoian (2019) for mixing properties of various processes encountered in time series econometrics. Our weak tail conditions require at least finite moments for covariates, while the number of finite moments for the error process can be as low as , provided that covariates are sufficiently integrable. We also do not require the exact sparsity of projection coefficients and allow for other forms of misspecification. Lastly, we cover the LASSO and the group LASSO as special cases.

The rest of the paper is organized as follows. Section 2 presents the setting of (potentially mixed frequency) high-dimensional time series regressions. Section 3 characterizes non-asymptotic estimation and prediction accuracy of the sg-LASSO estimator for -mixing processes with polynomial tails. We report on a Monte Carlo study in Section 4 which provides further insights about the validity of our theoretical analysis in small sample settings typically encountered in empirical applications. Section 5 covers the empirical application. Conclusions appear in Section 6.

Notation:

For a random variable , let be its norm with . For , put . For a vec1tor and a subset , let be a vector in with the same coordinates as on and zero coordinates on . Let be a partition of defining the group structure, which is assumed to be known to the econometrician. For a vector , the sparse-group structure is described by a pair , where and are the support and respectively the group support of . We also use to denote the cardinality of arbitrary set . For , its norm is denoted as for and for . For , the empirical inner product is defined as with the induced empirical norm . For a symmetric matrix , let be its vectorization consisting of the lower triangular and the diagonal parts. For , we put and . Lastly, we write if there exists a (sufficiently large) absolute constant such that for all and if and .

2 High-dimensional mixed frequency regressions

Let be the target low frequency series observed at integer time points . Predictions of can involve its lags as well as a large set of covariates and lags thereof. In the interest of generality, but more importantly because of the empirical relevance we allow the covariates to be sampled at higher frequencies - with same frequency being a special case. More specifically, let there be covariates possibly measured at some higher frequency with observations every and consider the following regression model

where is a low-frequency lag polynomial and is a high-frequency lag polynomial. For = 1, we have a standard autoregressive distributed lag (ARDL) model, which is the workhorse regression model of the time series econometrics literature. Note that the polynomial involves a single low-frequency lag and the same number of high-frequency lags for each covariate , which is done for the sake of simplicity and can easily be relaxed; see Section 5.

The ARDL-MIDAS model (using the terminology of Andreou, Ghysels, and Kourtellos (2013)) features parameters. In the big data setting with a large number of covariates sampled at high-frequency, the total number of parameters may be large compared to the effective sample size or even exceed it. This leads to poor estimation and out-of-sample prediction accuracy in finite samples. For instance, with = 3 (quarterly/monthly setting) and 35 covariates at 4 lagged quarters, we need to estimate parameters. At the same time, say post-WWII quarterly GDP growth series has less than 300 observations.

The LASSO estimator, see Tibshirani (1996), offers an appealing convex relaxation of a difficult non-convex best subset selection problem. By construction, it produces sparse parsimonious models trading variance for the bias. The model selection is not free and comes at a price that can be high in the low signal-to-noise environment with heavy-tailed dependent data. In this paper, we focus on the structured sparsity with additional dimensionality reductions that aim to improve upon the unstructured LASSO estimator.

First, we parameterize the high-frequency lag polynomial following the MIDAS regression or the distributed lag econometric literatures (see Ghysels, Santa-Clara, and Valkanov (2006)) as

where is -dimensional vector of coefficients with and is some weight function. Second, we approximate the weight function as

| (1) |

where is a collection of functions, called the dictionary. The simplest example of the dictionary consists of algebraic power polynomials, also known as Almon (1965) polynomials in the time series analysis. More generally, the dictionary may consist of arbitrary approximating functions, including the classical orthonormal bases; see Appendix Section A.1 for more examples. Using orthogonal polynomials typically reduces the multicollinearity and leads to better finite sample performance. It is worth mentioning that the specification with dictionaries deviates from the standard MIDAS regressions and leads to a computationally attractive convex optimization problem, cf. Marsilli (2014).

The size of the dictionary and the number of covariates can still be large and the approximate sparsity is a key assumption imposed throughout the paper. With the approximate sparsity, we recognize that assuming that most of the estimated coefficients are zero is overly restrictive and that the approximation error should be taken into account. For instance, the weight function may have an infinite series expansion, nonetheless, most can be captured by a relatively small number of orthogonal basis functions. Similarly, there can be a large number of economically relevant predictors, nonetheless, it might be sufficient to select only a smaller number of the most relevant ones to achieve good out-of-sample forecasting performance. Both model selection goals can be achieved with the LASSO estimator. However, the LASSO does not recognize that covariates at different (high-frequency) lags are temporally related.

In the baseline model, all high-frequency lags (or approximating functions once we parametrize the lag polynomial) of a single covariate constitute a group. We can also assemble all lag dependent variables into a group. Other group structures could be considered, for instance combining various covariates into a single group, but we will work with the simplest group setting of the aforementioned baseline model. The sparse-group LASSO (sg-LASSO) allows us to incorporate such structure into the estimation procedure. In contrast to the group LASSO, see Yuan and Lin (2006), the sg-LASSO promotes sparsity between and within groups, and allows us to capture the predictive information from each group, such as approximating functions from the dictionary or specific covariates from each group.

To describe the estimation procedure, let = be a vector of dependent variable and let = be a design matrix, where is a vector of ones, , is a matrix of observations of the covariate , and is an matrix of weights. In addition, put = , where is a vector of parameters pertaining to the group of autoregressive coefficients and denotes parameters of the high-frequency lag polynomial pertaining to the covariate . Then, the sparse-group LASSO estimator, denoted , solves the penalized least-squares problem

| (2) |

with a penalty function that interpolates between the LASSO penalty and the group LASSO penalty

where is the group LASSO norm and is a group structure (partition of ) specified by the econometrician. Note that estimator in equation (2) is defined as a solution to the convex optimization problem and can be computed efficiently, e.g., using an appropriate coordinate descent algorithm; see Simon, Friedman, Hastie, and Tibshirani (2013).

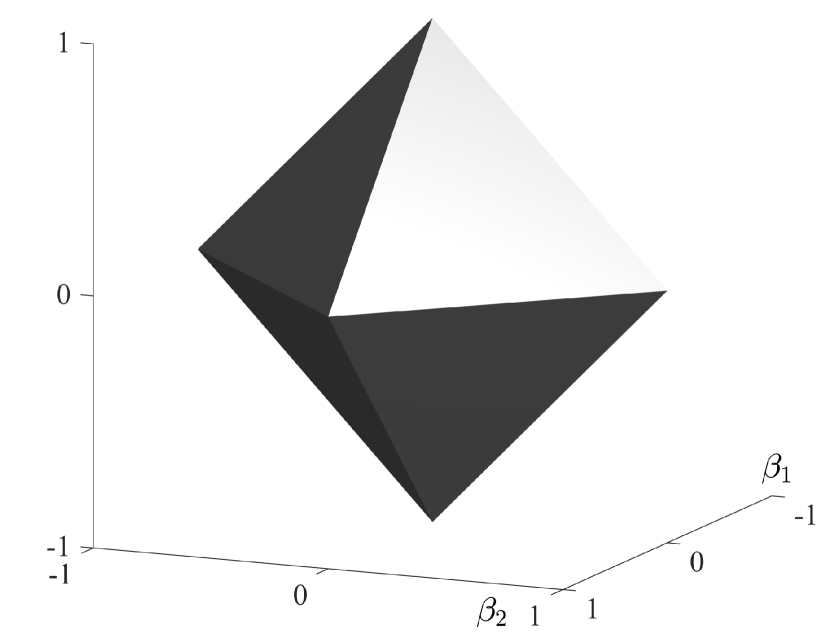

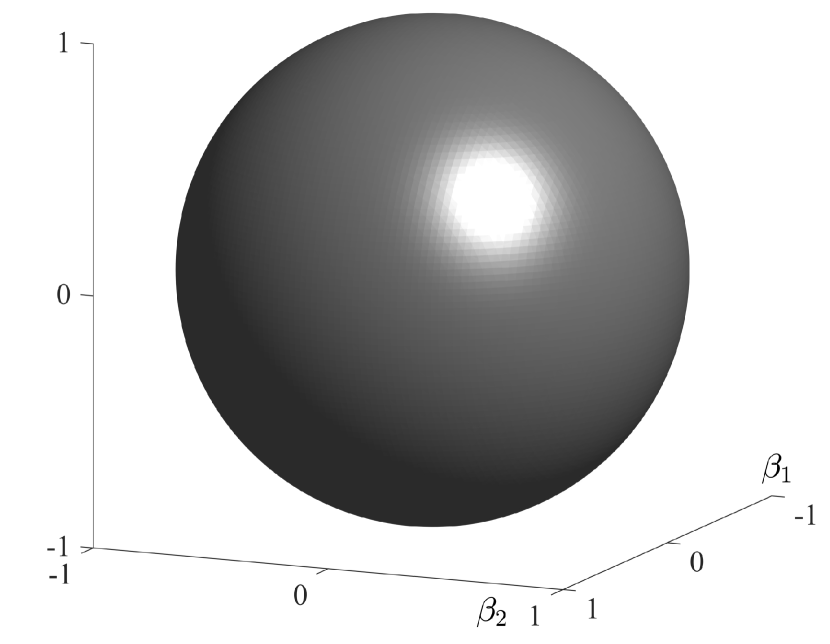

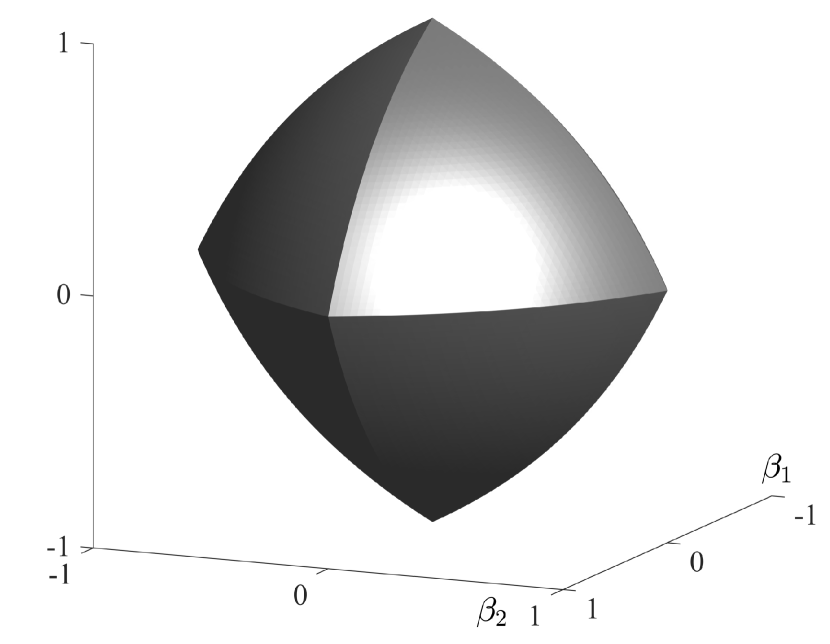

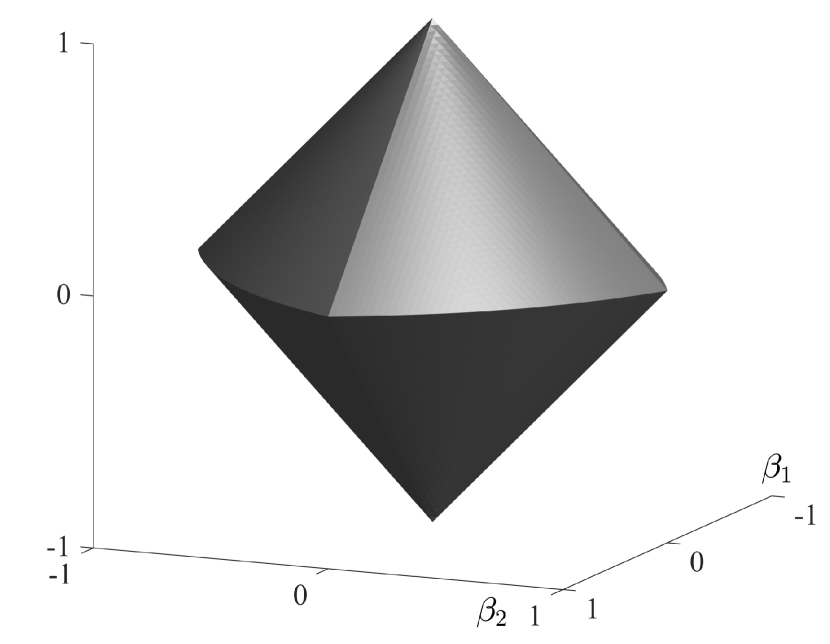

The amount of penalization is controlled by the regularization parameter while is a weight parameter that determines the relative importance of the sparsity and the group structure. Setting , we obtain the LASSO estimator while setting , leads to the group LASSO estimator, which is reminiscent of the elastic net; see Figure 1 for more details on the geometry of the penalty function for different groupings and different values of . In practice, groups are defined by a particular problem and are specified by the econometrician, while can be fixed or selected in a data-driven way, e.g., with the -fold cross-validation.

3 High-dimensional time series regressions

3.1 High-dimensional regressions and -mixing

We focus on a generic high-dimensional linear projection model with a countable number of regressors

| (3) |

where and is a well-defined random variable. In particular, to ensure that is a well-defined economic quantity, we need sufficiently fast, which is a form of the approximate sparsity condition, see Belloni, Chernozhukov, Chetverikov, Hansen, and Kato (2020). This setting nests the high-dimensional ARDL-MIDAS projections described in the previous section and more generally may allow for other high-dimensional time series models. In practice, given a (large) number of covariates, lags of thereof, as well as lags of the dependent variable, denoted , we would approximate with , where and the regression coefficient could be sparse. Importantly, our settings allows for the approximate sparsity as well as other forms of misspecification and the main result of the following section allows for .

Using the setting of equation (2), for a sample , write

where , , and . The approximation to is denoted , where is a matrix of covariates and is a vector of unknown regression coefficients.

We measure the time series dependence with -mixing coefficients. For a -algebra and a random vector , put

where is a set of -Lipschitz functions. Let be a stochastic process and let be its canonical filtration. The -mixing coefficient of is defined as

If as , then the process is called -mixing. The -mixing coefficients were introduced in Dedecker and Prieur (2004) as dependence measures weaker than mixing. Note that the commonly used - and -mixing conditions are too restrictive for the linear projection model with an ARDL-MIDAS process. Indeed, a causal linear process with dependent innovations can fail to be -mixing; see also Andrews (1984) for an example of AR(1) process which is not -mixing. Roughly speaking, -mixing processes are somewhere between mixingales and -mixing processes and can accommodate such counterexamples. At the same time, sharp Fuk-Nagaev inequalities are available for -mixing processes which to the best of our knowledge is not the case for the mixingales or near-epoch dependent processes; see Babii, Ghysels, and Striaukas (2020).

Dedecker and Prieur (2004) and Dedecker and Prieur (2005) discuss how to verify the -mixing property for causal Bernoulli shifts with dependent innovations and nonlinear Markov processes. It is also worth comparing the -mixing coefficient to other weak dependence coefficients. Suppose that is a real-valued stationary process and let be its mixingale coefficient. Then and it is known that

where is the generalized inverse of and is the generalized inverse of ; see Babii, Ghysels, and Striaukas (2020), Lemma A.1.1. Therefore, the -mixing coefficient provides a sharp control of autocovariances similarly to the mixingale coefficients, which in turn can be used to ensure that the long-run variance of exists. The -mixing coefficient is also bounded by the -mixing coefficient, denoted , as follows

where the first inequality follows by Dedecker and Prieur (2004), Lemma 7 and the second by Hölder’s inequality with such that . It is worth mentioning that the mixing properties for various time series models in econometrics, including GARCH, stochastic volatility, autoregressive conditional duration, and GAS models are well-known; see, e.g., Carrasco and Chen (2002), Francq and Zakoian (2019), Babii, Chen, and Ghysels (2019); see also Dedecker, Doukhan, Lang, Rafael, Louhichi, and Prieur (2007) for more examples and a comprehensive comparison of various weak dependence coefficients.

3.2 Estimation and prediction properties

In this section, we introduce the main assumptions for the high-dimensional time series regressions and study the estimation and prediction properties of the sg-LASSO estimator covering the LASSO and the group LASSO estimators as a special case. The following assumption imposes some mild restrictions on the stochastic processes in the high-dimensional regression equation (3).

Assumption 3.1 (Data).

for every , the processes and are stationary such that (i) and for some constants and ; (ii) the -mixing coefficients are and respectively for all and some , , , and .

It is worth mentioning that the stationarity condition is not essential and can be relaxed to the existence of the variance of partial sums at costs of heavier notations and proofs. (i) requires that covariates have at least finite moments, while the error process should have at least - finite moments, depending on the integrability of covariates. Therefore, (i) allows for heavy-tailed distributions commonly encountered in financial and economic time series, e.g., asset returns and volatilities. Given the integrability in (i), (ii) requires that the -mixing coefficients decrease to zero sufficiently fast; see Appendix, Section A.3 for moments and -mixing coefficients of ARDL-MIDAS. It is known that the -mixing coefficients decrease geometrically fast, e.g., for geometrically ergodic Markov chains, in which case (ii) holds for every . Therefore, (ii) allows for relatively persistent processes.

For the support and the group support of , put

For some , define . The following assumption generalizes the restricted eigenvalue condition of Bickel, Ritov, and Tsybakov (2009) to the sg-LASSO estimator and is imposed on the population covariance matrix .

Assumption 3.2 (Restricted eigenvalue).

There exists a universal constant such that for all , where for some .

Recall that if is a positive definite matrix, then for all , we have , where is the smallest eigenvalue of . Therefore, in this case Assumption 3.2 is trivially satisfied because . The positive definiteness of is also known as a completeness condition and Assumption 3.2 can be understood as its weak version; see Babii and Florens (2020) and references therein. It is worth emphasizing that in Assumption 3.2 is a universal constant independent of , which is the case, e.g., when is a Toeplitz matrix or a spiked identity matrix. Alternatively, we could allow for as , in which case the term would appear in our non-asymptotic bounds slowing down the speed of convergence, in which case we may interpret as a measure of ill-posedness in the spirit of econometrics literature on ill-posed inverse problems; see Carrasco, Florens, and Renault (2007).

The value of the regularization parameter is determined by the Fuk-Nagaev concentration inequality, appearing in the Appendix, see Theorem A.1.

Assumption 3.3 (Regularization).

The regularization parameter in Assumption 3.3 is determined by the persistence of the data, quantified by , and the tails, quantified by . This dependence is reflected in the dependence-tails exponent . The following result describes the non-asymptotic prediction and estimation bounds for the sg-LASSO estimator, see Appendix A.2 for the proof.

Theorem 3.1.

Theorem 3.1 provides non-asymptotic guarantees for the estimation and prediction with the sg-LASSO estimator reflecting potential misspecification. In the special case of the LASSO estimator (), we obtain the counterpart to the result of Belloni, Chen, Chernozhukov, and Hansen (2012) for the LASSO estimator with i.i.d. data taking into account that we may have . At another extreme, when , we obtain the non-asymptotic bounds for the group LASSO allowing for misspecification which to the best of our knowledge are new, cf. Negahban, Ravikumar, Wainwright, and Yu (2012). We call the effective sparsity constant. This constant reflects the benefits of the sparse-group structure for the sg-LASSO estimator that can not be deduced from the results currently available for the LASSO or the group LASSO.

Remark 3.1.

Since the -norm is equivalent to the -norm whenever groups have fixed size, we deduce from Theorem 3.1 that

Next, we consider the asymptotic regime, in which the misspecification error vanishes as the sample size increases as described in the following assumption.

Assumption 3.4.

Suppose that (i) ; (ii) and .

The following corollary is an immediate consequence of Theorem 3.1.

If the effective sparsity constant is fixed, then is a sufficient condition for the prediction and estimation errors to vanish, whenever . In this case Assumption 3.4 (ii) is vacuous. Convergence rates in Corollary 3.1 quantify the effect of tails and persistence of the data on the prediction and estimation accuracies of the sg-LASSO estimator. In particular, lighter tails and less persistence allow us to handle a larger number of covariates compared to the sample size . In particular can increase faster than , provided that .

Remark 3.2.

In the special case of the LASSO estimator with i.i.d. data, one can obtain from Theorem 1 in Caner and Kock (2018) the convergence rate for the estimation error of order , provided that and the sparsity constant is fixed. Since as , our rate can approach with , which is faster then the rate of Caner and Kock (2018). In particular, if the mixing coefficients decrease exponentially fast, then for every and . The dependence on is optimal in the sense that this rate coincides with what one would obtain using Corollary 4 of Fuk and Nagaev (1971) in the i.i.d. case directly. Note also that for sub-Gaussian data, moments of all order exist, in which case the polynomial term can be made arbitrary small compared to the term for a sufficiently large .

Remark 3.3.

In the special case of the LASSO estimator, if and are causal Bernoulli shifts with independent innovations and at least finite moments, one can deduce from Chernozhukov, Härdle, Huang, and Wang (2020), Lemma 5.1 and Corollary 5.1, the convergence rate for the estimation error of order , where , in the weakly dependent case and in the strongly dependent case, provided that certain physical dependence coefficients are of size . Note that for causal Bernoulli shifts with independent innovations, the physical dependence coefficients are not directly comparable to the -mixing coefficients; see Dedecker, Doukhan, Lang, Rafael, Louhichi, and Prieur (2007), Remark 3.1 on p.32. and that the ARDL-MIDAS process is an example of a causal Bernoulli shift with dependent innovations, see Appendix, Section A.3 for more details.

4 Monte Carlo experiments

In this section, we aim to assess the out-of-sample predictive performance (forecasting and nowcasting), and the MIDAS weights recovery of the sg-LASSO with dictionaries. We benchmark the performance of our novel sg-LASSO setup against two alternatives: (a) unstructured, meaning standard, LASSO with MIDAS, and (b) unstructured LASSO with the unrestricted lag polynomial. The former allows us to assess the benefits of exploiting group structures, whereas the latter focuses on the advantages of using dictionaries in a high-dimensional setting.

4.1 Simulation Design

To assess the predictive performance and the MIDAS weight recovery, we simulate the data from the following DGP:

where and the DGP for covariates is specified below. This corresponds to a target of interest driven by two autoregressive lags augmented with high frequency series, hence, the DGP is an ARDL-MIDAS model. We set , , , and take the number of relevant high frequency regressors = 3. In some scenarios we also decrease the signal-to-noise ratio setting = 5. We are interested in quarterly/monthly data, and use four quarters of data for the high frequency regressors so that = 12. We rely on a commonly used weighting scheme in the MIDAS literature, namely for = 1, 2 and 3 are determined by beta densities respectively equal to , and ; see Ghysels, Sinko, and Valkanov (2007) or Ghysels and Qian (2019), for further details.

The high frequency regressors are generated as either one of the following:

-

1.

i.i.d. realizations of the univariate autoregressive (AR) process where or and either , , or , where denotes the high-frequency sampling.

-

2.

Multivariate vector autoregressive (VAR) process where and is a block diagonal matrix described below.

For the AR simulation design, the initial values are drawn as and For the VAR, the initial value of is the same, while . In all cases, the first 200 observations are treated as burn-in. In the estimation procedure, we add 7 noisy covariates which are generated in the same way as the relevant covariates and use 5 low-frequency lags. The empirical models use a dictionary which consists of Legendre polynomials up to degree = shifted to interval with the MIDAS weight function approximated as in equation (1). The sample size is . Throughout the experiment, we use 5000 simulation replications and 10-fold cross-validation to select the tuning parameter.

We assess the performance of different methods by varying assumptions on error terms of the high-frequency process , considering multivariate high-frequency process, changing the degree of Legendre polynomials , increasing the noise level of the low-frequency process , using only half of the high-frequency lags in predictive regressions, and adding a larger number of noisy covariates. In the case of VAR high-frequency process, we set to be block-diagonal with the first block having entries and the remaining block(s) having entries .

We estimate three different LASSO-type regression models. In the first model, we keep the weighting function unconstrained, therefore, we estimate 12 coefficients per high-frequency covariate using the unstructured LASSO estimator. We denote this model LASSO-U-MIDAS (inspired by the U-MIDAS of Foroni, Marcellino, and Schumacher (2015a)). In the second model we use MIDAS weights together with the unstructured LASSO estimator; we call this model LASSO-MIDAS. In this case, we estimate number of coefficients per high-frequency covariate. The third model applies the sg-LASSO estimator together with MIDAS weights. Groups are defined as in Section 2; each low-frequency lag and high-frequency covariate is a group, therefore, we have K+5 number of groups. We select the value of tuning parameters and using the 5-fold cross-validation, defining folds as adjacent blocks over the time dimension to take into account the time series dependence. This model is denoted sg-LASSO-MIDAS.

For regressions with aggregated data, we consider: (a) Flow aggregation (FLOW): = , (b) Stock aggregation (STOCK): = , and (c) Middle high-frequency lag (MIDDLE): single middle value of the high-frequency lag with ties solved in favor of the most recent observation (i.e., we take a single lag if ). In these cases, the models are estimated using the OLS estimator, which is unfeasible when the number of covariates becomes equal to the sample size (we leave results blank in this case).

4.2 Simulation results

Detailed results are reported in the Appendix. Tables A.1–A.2, cover the average mean squared forecast errors for one-steahead forecasts and nowcasts. The sg-LASSO with MIDAS weighting (sg-LASSO-MIDAS) outperforms all other methods in the vast majority of simulation scenarios. Importantly, both sg-LASSO-MIDAS and unstructured LASSO-MIDAS with non-linear weight function approximation perform much better than all other methods in most of the scenarios when the sample size is small (). In this case, sg-LASSO-MIDAS yields the largest improvements over alternatives, in particular, with a large number of noisy covariates (bottom-right block). Results seem to be robust even if we increase the persistence parameter of covariates from 0.2 to 0.7. The LASSO without MIDAS weighting has typically large forecast errors. The method performs better when half of the high-frequency lags are included in the regression model. Lastly, forecasts using flow-aggregated covariates seem to perform better than other simple aggregation methods in all simulation scenarios, but significantly worse than the sg-LASSO-MIDAS.

In Table A.3–A.4 we report additional results for the estimation accuracy of the weight functions. In Figure A.1–A.3, we plot the estimated weight functions from several methods. The results indicate that the LASSO without MIDAS weighting can not recover accurately weights in small samples and/or low signal-to-noise ratio. Using Legendre polynomials improves the performance substantially and the sg-LASSO seems to improve even more over the unstructured LASSO.

5 Nowcasting US GDP with macro, financial and textual news data

We nowcast US GDP with macroeconomic, financial, and textual news data. Details regarding the data sources appear in Appendix Section A.5. Regarding the macro data, we rely on 34 series used in the Federal Reserve Bank of New York nowcast discarding two series (”PPI: Final demand” and ”Merchant wholesalers: Inventories”) due to very short samples; see Bok, Caratelli, Giannone, Sbordone, and Tambalotti (2018) for more details regarding this data.

For all macro data, we use real-time vintages, which effectively means that we take all macro series with a delay. For example, if we nowcast the first quarter of GDP one month before the quarter ends, we use data up to the end of February, and therefore all macro series with a delay of one month that enter the model are available up to the end of January. We use Legendre polynomials of degree three for all macro covariates to aggregate twelve lags of monthly macro data. In particular, let be covariate at quarter with months per quarter and months into the quarter (2 months into the quarter minus 1 month due to publication delay), where is the monthly lag. We then collect all lags in a vector

and aggregate using a dictionary consisting of Legendre polynomials, so that defines as a single group for the sg-LASSO estimator.

In addition to macro and financial data, we also use the textual analysis data. We take 76 news attention series from Bybee, Kelly, Manela, and Xiu (2020) and use Legendre polynomials of degree two to aggregate three monthly lags of each news attention series. Note that the news attention series are used without a publication delay, that is, for the one-month horizon, we take the series up to the end of the second month.

We compute the predictions using a rolling window scheme. The first nowcast is for 2002 Q1, for which we use fifteen years (sixty quarters) of data, and the prediction is computed using 2002 January (2-month horizon) February (1-month), and March (end of the quarter) data. We calculate predictions until the sample is exhausted, which is 2017 Q2, the last date for which news attention data is available. As indicated above, we report results for the 2-month, 1-month, and the end of quarter horizons. Our target variable is the first release, i.e., the advance estimate of real GDP growth. We tune sg-LASSO-MIDAS regularization parameters and using 5-fold cross-validation, defining folds as adjacent blocks over the time dimension to take into account the time series nature of the data. Finally, we follow the literature on nowcasting real GDP and define our target variable to be the annualized growth rate.

Let be the -th high-frequency covariate at time . The general ARDL-MIDAS predictive regression is

where is the low-frequency lag polynomial, is the regression intercept, and are lags of high-frequency covariates. Following Section 2, the high-frequency lag polynomial is defined as

where for covariate, indicates the number of leading months of available data in the quarter , is the number of quarters of covariate lags, and we approximate the weight function with the Legendre polynomial. For example, if and , then we have month of data into a quarter and use monthly lags for a covariate .

We benchmark our predictions against the simple AR(1) model, which is considered to be a reasonable starting point for short-term GDP growth predictions. We focus on predictions of our method, sg-LASSO-MIDAS, with and without financial data combined with series based on the textual analysis. One natural comparison is with the publicly available Federal Reserve Bank of New York, denoted NY Fed, model implied nowcasts.

| Rel-RMSE | DM-stat-1 | DM-stat-2 | |

| 2-month horizon | |||

| AR(1) | 2.056 | 0.612 | 2.985 |

| sg-LASSO-MIDAS | 0.739 | -2.481 | |

| NY Fed | 0.946 | 2.481 | |

| 1-month horizon | |||

| AR(1) | 2.056 | 2.025 | 2.556 |

| sg-LASSO-MIDAS | 0.725 | -0.818 | |

| NY Fed | 0.805 | 0.818 | |

| End of quarter | |||

| AR(1) | 2.056 | 2.992 | 3.000 |

| sg-LASSO-MIDAS | 0.701 | -0.077 | |

| NY Fed | 0.708 | 0.077 | |

| value of aSPA test | |||

| 0.046 | |||

We adopt the following strategy. First, we focus on the same series that were used to calculate the NY Fed nowcasts. The purpose here is to compare models since the data inputs are the same. This means that we compare the performance of dynamic factor models (NY Fed) with that of machine learning regularized regression methods (sg-LASSO-MIDAS). Next, we expand the data set to see whether additional financial and textual news series can improve the nowcast performance.

In Table 1, we report results based on real-time macro data that are typically used for the NY Fed model, see Bok, Caratelli, Giannone, Sbordone, and Tambalotti (2018). The results show that the sg-LASSO-MIDAS performs much better than the NY Fed nowcasts at the longer, i.e. 2-month, horizon. Our method significantly beats the benchmark AR(1) model for all the horizons, and the accuracy of the nowcasts improve with the horizon. End of quarter and 1-month horizon nowcasts of our approach compared to the NY Fed are similar with the sg-LASSO-MIDAS – slightly better numerically but not statistically. We also report the average Superior Predictive Ability test of Quaedvlieg (2019) over all three horizons and the result reveals that the improvement of the sg-LASSO-MIDAS model versus the NY Fed nowcasts is significant at the 5% significance level.

| Rel-RMSE | DM-stat-1 | DM-stat-2 | DM-stat-3 | DM-stat-4 | |

| 2-month horizon | |||||

| PCA-OLS | 0.982 | 0.416 | 2.772 | 0.350 | 2.978 |

| Ridge-U-MIDAS | 0.918 | -0.188 | 1.073 | -1.593 | 0.281 |

| LASSO-U-MIDAS | 0.996 | 0.275 | 1.280 | -1.983 | -0.294 |

| Elastic Net-U-MIDAS | 0.907 | -0.266 | 0.976 | -1.725 | 0.042 |

| sg-LASSO-MIDAS | 0.779 | -2.038 | -2.349 | ||

| NY Fed | 0.946 | 2.038 | 2.349 | ||

| 1-month horizon | |||||

| PCA-OLS | 1.028 | 2.296 | 3.668 | 2.010 | 3.399 |

| Ridge-U-MIDAS | 0.940 | 0.927 | 2.063 | -0.184 | 1.979 |

| LASSO-U-MIDAS | 1.044 | 1.286 | 1.996 | -0.397 | 1.498 |

| Elastic Net-U-MIDAS | 0.990 | 1.341 | 2.508 | 0.444 | 2.859 |

| sg-LASSO-MIDAS | 0.672 | -1.426 | -1.341 | ||

| NY Fed | 0.805 | 1.426 | 1.341 | ||

| SPF (median) | 0.639 | -2.317 | -0.490 | -1.743 | 0.282 |

| End of quarter | |||||

| PCA-OLS | 0.988 | 3.414 | 3.400 | 3.113 | 3.155 |

| Ridge-U-MIDAS | 0.939 | 1.918 | 1.952 | 0.867 | 1.200 |

| LASSO-U-MIDAS | 1.014 | 1.790 | 1.773 | 0.276 | 0.517 |

| Elastic Net-U-MIDAS | 0.947 | 2.045 | 2.034 | 1.198 | 1.400 |

| sg-LASSO-MIDAS | 0.696 | -0.156 | -0.159 | ||

| NY Fed | 0.707 | 0.156 | 0.159 | ||

| value of aSPA test | |||||

| 0.042 | 0.056 | ||||

The comparison in Table 1 does not fully exploit the potential of our methods, as it is easy to expand the data series beyond a small number of series used by the NY Fed nowcasting model. In Table 2 we report results with additional sets of covariates which are financial series, advocated by Andreou, Ghysels, and Kourtellos (2013), and textual analysis of news. In total, the models select from 118 series – 34 macro, 8 financial, and 76 news attention series. For the moment we focus only on the first three columns of the table. At the longer horizon of 2 months, the method seems to produce slightly worse nowcasts compared to the results reported in Table 1 using only macro data. However, we find significant improvements in prediction quality for the shorter 1-month and end of quarter horizons. In particular, a significant increase in accuracy relative to NY Fed nowcasts appears at the 1-month horizon. We report again the average Superior Predictive Ability test of Quaedvlieg (2019) over all three horizons with the same result that the improvement of sg-LASSO-MIDAS model versus the NY Fed nowcasts is significant at the 5% significance level. Lastly, we report results for several alternatives, namely, PCA-OLS, ridge, LASSO, and Elastic Net, using the unrestricted MIDAS scheme. Notably, our approach produces more accurate nowcasts compared to these alternatives.

Table 2 also features an entry called SPF (median), where we report results for the median survey of professional nowcasts for the 1-month horizon, and analyze how the model-based nowcasts compare with the predictions using the publicly available Survey of Professional Forecasters maintained by the Federal Reserve Bank of Philadelphia. We find that the sg-LASSO-MIDAS model-based nowcasts are similar to the SPF-implied nowcasts, however, we find that the NY Fed nowcasts are significantly worse than the SPF.

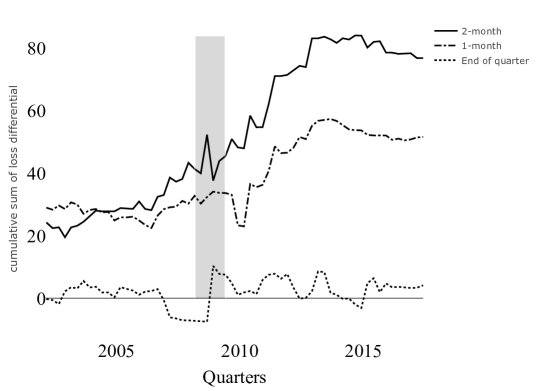

In Figure 2 we plot the cumulative sum of squared forecast error (CUMSFE) loss differential of sg-LASSO-MIDAS versus NY Fed nowcasts for the three horizons. The CUMSFE is computed as

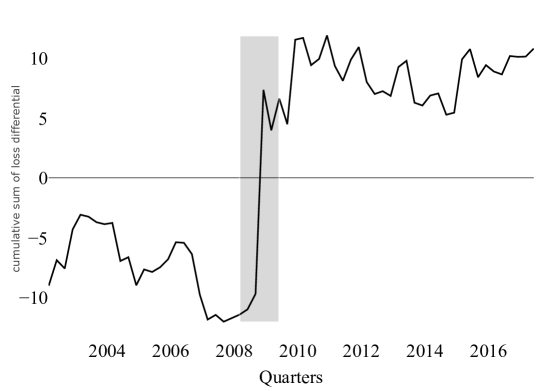

for model versus A positive value of means that the model has larger squared forecast errors compared to the model up to point, and negative value imply the opposite. In our case, is the New York Fed prediction error, while is the sg-LASSO-MIDAS model. We observe persistent gains for the 2- and 1-month horizons throughout the out-of-sample period. When comparing the sg-LASSO-MIDAS results with additional financial and textual news series versus those based on macro data only, we see a notable improvement at the 1-month horizon and a more modest one at the end of quarter horizons. In Figure 3, we plot the average CUMSFE for the 1-month and end of quarter horizons and observe that the largest gains of additional financial and textual news data are achieved during the financial crisis.

The result in Figure 3 prompts the question of whether our results are mostly driven by this unusual period in our out-of-sample data. To assess this, we turn our attention again to the last two columns of Table 2 reporting Diebold and Mariano (1995) test statistics which exclude the financial crisis period. Compared to the tests previously discussed, we find that the results largely remain the same, but some alternatives seem to slightly improve (e.g. LASSO or Elastic Net). Note that this also implies that our method performs better during periods with heavy-tailed observations, such as the financial crisis. It should also be noted that overall there is a slight deterioration of the average Superior Predictive Ability test over all three horizons when we remove the financial crisis.

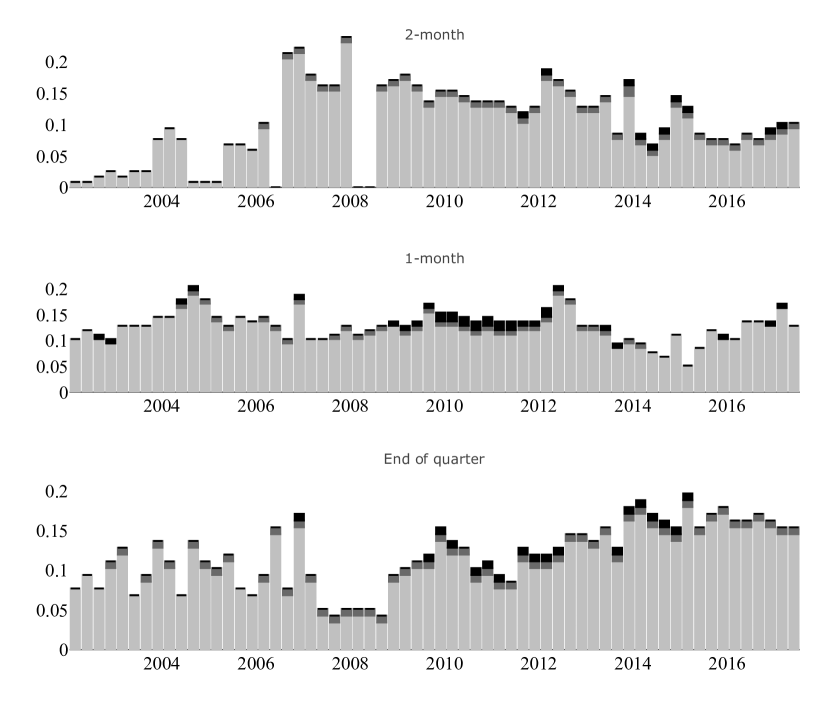

In Figure 4, we plot the fraction of selected covariates by the sg-LASSO-MIDAS model when we use the macro, financial, and textual analysis data. For each reference quarter, we compute the ratio of each group of variables relative to the total number of covariates. In each subfigure, we plot the three different horizons. For all horizons, the macro series are selected more often than financial and/or textual data. The number of selected series increases with the horizon, however, the pattern of denser macro series and sparser financial and textual series is visible for all three horizons. The results are in line with the literature – macro series tend to co-move, hence we see a denser pattern in the selection of such series, see e.g. Bok, Caratelli, Giannone, Sbordone, and Tambalotti (2018). On the other hand, the alternative textual analysis data appear to be very sparse, yet still important for nowcasting accuracy, see also Thorsrud (2020).

6 Conclusion

This paper offers a new perspective on the high-dimensional time series regressions with data sampled at the same or mixed frequencies and contributes more broadly to the rapidly growing literature on the estimation, inference, forecasting, and nowcasting with regularized machine learning methods. The first contribution of the paper is to introduce the sparse-group LASSO estimator for high-dimensional time series regressions. An attractive feature of the estimator is that it recognizes time series data structures and allows us to perform the hierarchical model selection within and between groups. The classical LASSO and the group LASSO are covered as special cases.

To recognize that the economic and financial time series have typically heavier than Gaussian tails, we use a new Fuk-Nagaev concentration inequality, from Babii, Ghysels, and Striaukas (2020), valid for a large class of -mixing processes, including -mixing processes commonly used in econometrics. Building on this inequality, we establish the non-asymptotic and asymptotic properties of the sparse-group LASSO estimator.

Our empirical application provides new perspectives on applying machine learning methods to real-time forecasting, nowcasting, and monitoring with time series data, including non-conventional data, sampled at different frequencies. To that end, we introduce a new class of MIDAS regressions with dictionaries linear in the parameters and based on orthogonal polynomials with lag selection performed by the sg-LASSO estimator. We find that the sg-LASSO outperforms the unstructured LASSO in small samples and conclude that incorporating specific data structures should be helpful in various applications.

Our empirical results also show that the sg-LASSO-MIDAS using only macro and survey data performs statistically better than NY Fed nowcasts at 2-month horizons and overall for the 1- and 2-month and end of quarter horizons. This is a comparison involving the same data and, therefore, pertains to models. This implies that machine learning models are, for this particular case, better than the state space dynamic factor models. When we add the financial data and the textual news data, a total of 118 series, we find significant improvements in prediction quality for the shorter 1-month and end of quarter horizons.

References

- (1)

- Almon (1965) Almon, S. (1965): “The distributed lag between capital appropriations and expenditures,” Econometrica, 33(1), 178–196.

- Andreou, Ghysels, and Kourtellos (2013) Andreou, E., E. Ghysels, and A. Kourtellos (2013): “Should macroeconomic forecasters use daily financial data and how?,” Journal of Business and Economic Statistics, 31, 240–251.

- Andrews (1984) Andrews, D. W. (1984): “Non-strong mixing autoregressive processes,” Journal of Applied Probability, 21(4), 930–934.

- Aprigliano, Ardizzi, and Monteforte (2019) Aprigliano, V., G. Ardizzi, and L. Monteforte (2019): “Using payment system data to forecast economic activity,” International Journal of Central Banking, 15(4), 55–80.

- Babii, Chen, and Ghysels (2019) Babii, A., X. Chen, and E. Ghysels (2019): “Commercial and residential mortgage defaults: Spatial dependence with frailty,” Journal of econometrics, 212(1), 47–77.

- Babii and Florens (2020) Babii, A., and J.-P. Florens (2020): “Is completeness necessary? Estimation in nonidentified linear models,” arXiv preprint arXiv:1709.03473v3.

- Babii, Ghysels, and Striaukas (2020) Babii, A., E. Ghysels, and J. Striaukas (2020): “Inference for high-dimensional regressions with heteroskedasticity and autocorrelation,” arXiv preprint arXiv:1912.06307v2.

- Bańbura, Giannone, Modugno, and Reichlin (2013) Bańbura, M., D. Giannone, M. Modugno, and L. Reichlin (2013): “Now-casting and the real-time data flow,” in Handbook of Economic Forecasting, Volume 2 Part A, ed. by G. Elliott, and A. Timmermann, pp. 195–237. Elsevier.

- Barnett, Chauvet, Leiva-Leon, and Su (2016) Barnett, W., M. Chauvet, D. Leiva-Leon, and L. Su (2016): “Nowcasting Nominal GDP with the Credit-Card Augmented Divisia Monetary Aggregates,” Working paper University of Kansas, Department of Economics.

- Belloni, Chen, Chernozhukov, and Hansen (2012) Belloni, A., D. Chen, V. Chernozhukov, and C. Hansen (2012): “Sparse models and methods for optimal instruments with an application to eminent domain,” Econometrica, 80(6), 2369–2429.

- Belloni, Chernozhukov, Chetverikov, Hansen, and Kato (2020) Belloni, A., V. Chernozhukov, D. Chetverikov, C. Hansen, and K. Kato (2020): “High-dimensional econometrics and generalized GMM,” Handbook of Econometrics (forthcoming).

- Bickel, Ritov, and Tsybakov (2009) Bickel, P. J., Y. Ritov, and A. B. Tsybakov (2009): “Simultaneous analysis of LASSO and Dantzig selector,” Annals of Statistics, 37(4), 1705–1732.

- Bok, Caratelli, Giannone, Sbordone, and Tambalotti (2018) Bok, B., D. Caratelli, D. Giannone, A. M. Sbordone, and A. Tambalotti (2018): “Macroeconomic nowcasting and forecasting with big data,” Annual Review of Economics, 10, 615–643.

- Brockwell and Davis (1991) Brockwell, P. J., and R. Davis (1991): Time series: theory and methods 2nd ed. Springer-Verlag New York.

- Bybee, Kelly, Manela, and Xiu (2020) Bybee, L., B. T. Kelly, A. Manela, and D. Xiu (2020): “The structure of economic news,” National Bureau of Economic Research, and http://structureofnews.com.

- Caner and Kock (2018) Caner, M., and A. B. Kock (2018): “Asymptotically honest confidence regions for high dimensional parameters by the desparsified conservative lasso,” Journal of Econometrics, 203(1), 143–168.

- Carlsen and Storgaard (2010) Carlsen, M., and P. E. Storgaard (2010): “Dankort payments as a timely indicator of retail sales in Denmark,” Danmarks Nationalbank Working Papers.

- Carrasco and Chen (2002) Carrasco, M., and X. Chen (2002): “Mixing and moment properties of various GARCH and stochastic volatility models,” Econometric Theory, pp. 17–39.

- Carrasco, Florens, and Renault (2007) Carrasco, M., J.-P. Florens, and E. Renault (2007): “Linear inverse problems in structural econometrics estimation based on spectral decomposition and regularization,” Handbook of Econometrics, 6, 5633–5751.

- Carrasco and Rossi (2016) Carrasco, M., and B. Rossi (2016): “In-sample inference and forecasting in misspecified factor models,” Journal of Business and Economic Statistics, 34(3), 313–338.

- Chan and Jeliazkov (2009) Chan, J. C., and I. Jeliazkov (2009): “Efficient simulation and integrated likelihood estimation in state space models,” International Journal of Mathematical Modelling and Numerical Optimisation, 1(1-2), 101–120.

- Chernozhukov, Härdle, Huang, and Wang (2020) Chernozhukov, V., W. K. Härdle, C. Huang, and W. Wang (2020): “Lasso-driven inference in time and space,” Annals of Statistics (forthcoming).

- Davydov (1973) Davydov, Y. A. (1973): “Mixing conditions for Markov chains (in Russian),” Teoriya Veroyatnostei i ee Primeneniya, 18(2), 321–338.

- Dedecker, Doukhan, Lang, Rafael, Louhichi, and Prieur (2007) Dedecker, J., P. Doukhan, G. Lang, L. R. J. Rafael, S. Louhichi, and C. Prieur (2007): “Weak dependence,” in Weak dependence: With examples and applications, pp. 9–20. Springer.

- Dedecker and Prieur (2004) Dedecker, J., and C. Prieur (2004): “Coupling for -dependent sequences and applications,” Journal of Theoretical Probability, 17(4), 861–885.

- Dedecker and Prieur (2005) (2005): “New dependence coefficients. Examples and applications to statistics,” Probability Theory and Related Fields, 132(2), 203–236.

- Delle Monache and Petrella (2019) Delle Monache, D., and I. Petrella (2019): “Efficient matrix approach for classical inference in state space models,” Economics Letters, 181, 22–27.

- Diebold and Mariano (1995) Diebold, F. X., and R. S. Mariano (1995): “Comparing predictive accuracy,” Journal of Business and Economic Statistics, 13(3), 253–263.

- Duarte, Rodrigues, and Rua (2017) Duarte, C., P. M. Rodrigues, and A. Rua (2017): “A mixed frequency approach to the forecasting of private consumption with ATM/POS data,” International Journal of Forecasting, 33(1), 61–75.

- Foroni, Marcellino, and Schumacher (2015a) Foroni, C., M. Marcellino, and C. Schumacher (2015a): “Unrestricted mixed data sampling (U-MIDAS): MIDAS regressions with unrestricted lag polynomials,” Journal of the Royal Statistical Society: Series A (Statistics in Society), 178(1), 57–82.

- Foroni, Marcellino, and Schumacher (2015b) (2015b): “Unrestricted mixed data sampling (U-MIDAS): MIDAS regressions with unrestricted lag polynomials,” Journal of the Royal Statistical Society: Series A (Statistics in Society), 178(1), 57–82.

- Francq and Zakoian (2019) Francq, C., and J.-M. Zakoian (2019): GARCH models: structure, statistical inference and financial applications. John Wiley & Sons.

- Fuk and Nagaev (1971) Fuk, D. K., and S. V. Nagaev (1971): “Probability inequalities for sums of independent random variables,” Theory of Probability and Its Applications, 16(4), 643–660.

- Galbraith and Tkacz (2018) Galbraith, J. W., and G. Tkacz (2018): “Nowcasting with payments system data,” International Journal of Forecasting, 34(2), 366–376.

- Ghysels, Horan, and Moench (2018) Ghysels, E., C. Horan, and E. Moench (2018): “Forecasting through the Rearview Mirror: Data Revisions and Bond Return Predictability.,” Review of Financial Studies, 31(2), 678–714.

- Ghysels and Qian (2019) Ghysels, E., and H. Qian (2019): “Estimating MIDAS regressions via OLS with polynomial parameter profiling,” Econometrics and Statistics, 9, 1–16.

- Ghysels, Santa-Clara, and Valkanov (2006) Ghysels, E., P. Santa-Clara, and R. Valkanov (2006): “Predicting volatility: getting the most out of return data sampled at different frequencies,” Journal of Econometrics, 131, 59–95.

- Ghysels, Sinko, and Valkanov (2007) Ghysels, E., A. Sinko, and R. Valkanov (2007): “MIDAS regressions: Further results and new directions,” Econometric Reviews, 26(1), 53–90.

- Han and Tsay (2017) Han, Y., and R. S. Tsay (2017): “High-dimensional linear regression for dependent observations with application to nowcasting,” arXiv preprint arXiv:1706.07899.

- Kock and Callot (2015) Kock, A. B., and L. Callot (2015): “Oracle inequalities for high dimensional vector autoregressions,” Journal of Econometrics, 186(2), 325–344.

- Marsilli (2014) Marsilli, C. (2014): “Variable selection in predictive MIDAS models,” Working papers 520, Banque de France.

- Medeiros and Mendes (2016) Medeiros, M. C., and E. F. Mendes (2016): “-regularization of high-dimensional time-series models with non-Gaussian and heteroskedastic errors,” Journal of Econometrics, 191(1), 255–271.

- Mogliani and Simoni (2020) Mogliani, M., and A. Simoni (2020): “Bayesian MIDAS penalized regressions: estimation, selection, and prediction,” Journal of Econometrics (forthcoming).

- Moriwaki (2019) Moriwaki, D. (2019): “Nowcasting Unemployment Rates with Smartphone GPS Data,” in International Workshop on Multiple-Aspect Analysis of Semantic Trajectories, pp. 21–33. Springer.

- Negahban, Ravikumar, Wainwright, and Yu (2012) Negahban, S. N., P. Ravikumar, M. J. Wainwright, and B. Yu (2012): “A unified framework for high-dimensional analysis of -estimators with decomposable regularizers,” Statistical Science, 27(4), 538–557.

- Quaedvlieg (2019) Quaedvlieg, R. (2019): “Multi-horizon forecast comparison,” Journal of Business & Economic Statistics, pp. 1–14.

- Raju and Balakrishnan (2019) Raju, S., and M. Balakrishnan (2019): “Nowcasting economic activity in India using payment systems data,” Journal of Payments Strategy and Systems, 13(1), 72–81.

- Siliverstovs (2017) Siliverstovs, B. (2017): “Short-term forecasting with mixed-frequency data: a MIDASSO approach,” Applied Economics, 49(13), 1326–1343.

- Simon, Friedman, Hastie, and Tibshirani (2013) Simon, N., J. Friedman, T. Hastie, and R. Tibshirani (2013): “A sparse-group LASSO,” Journal of Computational and Graphical Statistics, 22(2), 231–245.

- Thorsrud (2020) Thorsrud, L. A. (2020): “Words are the new numbers: A newsy coincident index of the business cycle,” Journal of Business and Economic Statistics, 38(2), 393–409.

- Tibshirani (1996) Tibshirani, R. (1996): “Regression shrinkage and selection via the lasso,” Journal of the Royal Statistical Society, Series B (Methodological), 58, 267–288.

- Uematsu and Tanaka (2019) Uematsu, Y., and S. Tanaka (2019): “High-dimensional macroeconomic forecasting and variable selection via penalized regression,” Econometrics Journal, 22, 34–56.

- Wong, Li, and Tewari (2019) Wong, K. C., Z. Li, and A. Tewari (2019): “LASSO guarantees for -mixing heavy tailed time series,” Annals of Statistics (forthcoming).

- Wu (2005) Wu, W. B. (2005): “Nonlinear system theory: Another look at dependence,” Proceedings of the National Academy of Sciences, 102(40), 14150–14154.

- Wu and Wu (2016) Wu, W.-B., and Y. N. Wu (2016): “Performance bounds for parameter estimates of high-dimensional linear models with correlated errors,” Electronic Journal of Statistics, 10(1), 352–379.

- Yuan and Lin (2006) Yuan, M., and Y. Lin (2006): “Model selection and estimation in regression with grouped variables,” Journal of the Royal Statistical Society: Series B (Statistical Methodology), 68(1), 49–67.

A.1 Dictionaries

In this section, we review the choice of dictionaries for the MIDAS weight function. It is possible to construct dictionaries using arbitrary sets of functions, including a mix of algebraic polynomials, trigonometric polynomials, B-splines, Haar basis, or wavelets. In this paper, we mostly focus on dictionaries generated by orthogonalized algebraic polynomials, though it might be interesting to tailor the dictionary for each particular application. The attractiveness of algebraic polynomials comes from their ability to generate a variety of shapes with a relatively low number of parameters, which is especially desirable in low signal-to-noise environments. The general family of appropriate orthogonal algebraic polynomials is given by Jacobi polynomials that nest Legendre, Gegenbauer, and Chebychev’s polynomials as a special case.

Example A.1.1 (Jacobi polynomials).

Applying the Gram-Schmidt orthogonalization to the power polynomials with respect to the measure

on , we obtain Jacobi polynomials. In practice Jacobi polynomials can be computed through the well-known tree-term recurrence relation for

with , , . To obtain the orthogonal basis on , we shift Jacobi polynomials with affine bijection .

For , we obtain Gegenbauer polynomials, for , we obtain Legendre polynomials, while for or , we obtain Chebychev’s polynomials of two kinds.

In the mixed frequency setting, non-orthogonalized polynomials, , are also called Almon polynomials. It is preferable to use orthogonal polynomials in practice due to reduced multicollinearity and better numerical properties. At the same time, orthogonal polynomials are available in Matlab, R, Python, and Julia packages. Legendre polynomials is our default recommendation, while other choices of and are preferable if we want to accommodate MIDAS weights with other integrability/tail properties.

We noted in the main body of the paper that the specification in equation (2) deviates from the standard MIDAS polynomial specification as it results in a linear regression model - a subtle but key innovation as it maps MIDAS regressions in the standard regression framework. Moreover, casting the MIDAS regressions in a linear regression framework renders the optimization problem convex, something only achieved by Siliverstovs (2017) using the U-MIDAS of Foroni, Marcellino, and Schumacher (2015b) which does not recognize the mixed frequency data structure, unlike our sg-LASSO.

A.2 Proofs of main results

Lemma A.2.1.

Consider , where is norm on . Then the dual norm of , denoted , satisfies

where is the dual norm of and is the dual norm of .

Proof.

Clearly, is a norm. By the convexity of on

∎

Proof of Theorem 3.1.

By Hölder’s inequality for every

with and . Therefore, under Assumption 3.1 (i), with . Recall also that , see equation (3), which in conjunction with Assumption 3.1 (ii) verifies conditions of Theorem A.1 and shows that there exists such that for every

| (A.1) |

Let be the size of the largest group in . Note that the sg-LASSO penalty is a norm. By Lemma A.2.1, its dual norm satisfies

| (A.2) | ||||

where the first inequality follows since and , the second by elementary computations, the third by equation (A.1) with probability at least for every , and the last from the definition of in Assumption 3.3, where is as in Assumption 3.2. By Fermat’s rule, the sg-LASSO satisfies

for some , where is the subdifferential of at . Taking the inner product with

where the inequality follows from the definition of the subdifferential. Using and rearranging this inequality

where the second line follows by the dual norm inequality and the last by as shown in equation (A.2). Therefore,

| (A.3) | ||||

with . Note that the sg-LASSO penalty can be decomposed as a sum of two seminorms with

Note also that and . Then by the triangle inequality

| (A.4) |

If , then it follows from the first inequality in equation (A.3) and equation (A.4) that

Since the left side of this equation is positive, this shows that with , and whence , cf., Assumption 3.2. Then

| (A.5) | ||||

where we use the Jensen’s inequality, Assumption 3.2, and the definition of . Next, note that

| (A.6) | ||||

where the first inequality follows from equation (A.3) and the dual norm inequality and the second by Lemma A.2.1 and elementary computations

Combining the inequalities obtained in equations (A.5 and A.6)

| (A.7) | ||||

where the second line holds on the event with . Therefore, inequalities in equation (A.3 and A.7) yield

On the other hand, if , then

Therefore, on the event we always have

| (A.8) |

with . This proves the first claim of Theorem 3.1 if we show that . To that end, by the Cauchy-Schwartz inequality under Assumptions 3.1 (i)

This in conjunction with Assumption 3.1 (ii) verifies assumptions of Babii, Ghysels, and Striaukas (2020), Theorem 3.1 and shows that

for some and . Lastly, under Assumption 3.1, by Babii, Ghysels, and Striaukas (2020), Lemma A.1.2 .

To prove the second claim of Theorem 3.1, suppose first that . Then on the event

where we use the inequality in equations (A.5, A.6, and A.8). Therefore,

| (A.9) |

On the other hand, if , then , which as we have already shown implies . In conjunction with equations (A.3 and A.4), this shows that

and whence

This shows that

Combining this with the inequality in equation (A.9), we obtain the second claim of Theorem 3.1. ∎

The following result is proven in Babii, Ghysels, and Striaukas (2020), see their Theorem 3.1.

Theorem A.1.

Let be a centered stationary stochastic process in such that (i) for some , ; (ii) for every , -mixing coefficients of satisfy for some constants and . Then there exists such that for every

with .

A.3 ARDL-MIDAS: moments and -mixing coefficients

The ARDL-MIDAS process is defined as

where is a lag polynomial and . The process is -mixing and has finite moments of order as illustrated below.

Assumption A.3.1.

Suppose that is a stationary process such that (i) for some ; (ii) -mixing coefficients satisfy for some and ; and (iii) for all such that .

Note that by Davydov (1973), (ii) holds if is a geometrically ergodic Markov process and that (iii) rules out the unit root process.

Proposition A.3.1.

Under Assumption A.3.1, the ARDL-MIDAS process has moments of order and -mixing coefficients for some , and .

Proof.

Under (iii) we can invert the autoregressive lag polynomial and obtain

for some . Note that has dependent innovations. Clearly, is stationary provided that is stationary, which is the case by the virtue of Assumption A.3.1. Next, since

and under (i), we verify that . Let be a stationary process distributed as and independent of . Then by Dedecker and Prieur (2005), Example 1, the -mixing coefficients of satisfy

where are -mixing coefficients of and the second line follows by Hölder’s inequality. Brockwell and Davis (1991), p.85 shows that there exist and such that . Therefore,

and under (ii)

This proves the second statement. ∎

A.4 Monte Carlo Simulations

| FLOW | STOCK | MIDDLE | LASSO-U | LASSO-M | SGL-M | FLOW | STOCK | MIDDLE | LASSO-U | LASSO-M | SGL-M | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| T | Baseline scenario | ||||||||||||

| 50 | 2.847 | 3.839 | 4.660 | 4.213 | 2.561 | 2.188 | 2.081 | 2.427 | 2.702 | 2.334 | 2.066 | 1.749 | |

| 0.059 | 0.077 | 0.090 | 0.087 | 0.054 | 0.044 | 0.042 | 0.053 | 0.062 | 0.056 | 0.051 | 0.041 | ||

| 100 | 2.110 | 2.912 | 3.814 | 2.244 | 1.579 | 1.473 | 1.504 | 1.900 | 2.155 | 1.761 | 1.535 | 1.343 | |

| 0.041 | 0.057 | 0.076 | 0.045 | 0.032 | 0.030 | 0.030 | 0.038 | 0.043 | 0.034 | 0.030 | 0.026 | ||

| 200 | 1.882 | 2.772 | 3.681 | 1.539 | 1.302 | 1.230 | 1.357 | 1.714 | 1.986 | 1.414 | 1.238 | 1.192 | |

| 0.037 | 0.056 | 0.072 | 0.031 | 0.026 | 0.025 | 0.027 | 0.035 | 0.040 | 0.029 | 0.025 | 0.024 | ||

| High-frequency process: VAR(1) | Legendre degree | ||||||||||||

| 50 | 1.869 | 2.645 | 2.863 | 2.135 | 1.726 | 1.533 | 2.847 | 3.839 | 4.660 | 4.213 | 2.339 | 1.979 | |

| 0.039 | 0.053 | 0.057 | 0.046 | 0.036 | 0.032 | 0.059 | 0.077 | 0.090 | 0.087 | 0.050 | 0.041 | ||

| 100 | 1.453 | 2.073 | 2.245 | 1.575 | 1.373 | 1.284 | 2.110 | 2.912 | 3.814 | 2.244 | 1.503 | 1.386 | |

| 0.028 | 0.042 | 0.046 | 0.031 | 0.028 | 0.025 | 0.041 | 0.057 | 0.076 | 0.045 | 0.031 | 0.029 | ||

| 200 | 1.283 | 1.921 | 2.040 | 1.348 | 1.240 | 1.201 | 1.882 | 2.772 | 3.681 | 1.539 | 1.277 | 1.196 | |

| 0.026 | 0.038 | 0.041 | 0.026 | 0.024 | 0.023 | 0.037 | 0.056 | 0.072 | 0.031 | 0.025 | 0.024 | ||

| Legendre degree | Low frequency noise level =5 | ||||||||||||

| 50 | 2.847 | 3.839 | 4.660 | 4.213 | 2.983 | 2.583 | 9.598 | 10.429 | 10.726 | 9.799 | 8.732 | 7.785 | |

| 0.059 | 0.077 | 0.090 | 0.087 | 0.063 | 0.053 | 0.196 | 0.211 | 0.213 | 0.198 | 0.180 | 0.159 | ||

| 100 | 2.110 | 2.912 | 3.814 | 2.244 | 1.719 | 1.633 | 7.319 | 8.177 | 8.880 | 8.928 | 7.359 | 6.606 | |

| 0.041 | 0.057 | 0.076 | 0.045 | 0.035 | 0.032 | 0.147 | 0.163 | 0.176 | 0.179 | 0.147 | 0.135 | ||

| 200 | 1.882 | 2.772 | 3.681 | 1.539 | 1.348 | 1.300 | 6.489 | 7.699 | 8.381 | 7.275 | 6.391 | 5.919 | |

| 0.037 | 0.056 | 0.072 | 0.031 | 0.027 | 0.026 | 0.127 | 0.154 | 0.165 | 0.146 | 0.126 | 0.117 | ||

| Half high-frequency lags | Number of covariates | ||||||||||||

| 50 | 2.750 | 2.730 | 3.562 | 2.455 | 2.344 | 1.905 | 5.189 | 3.610 | 2.658 | ||||

| 0.058 | 0.056 | 0.070 | 0.050 | 0.048 | 0.038 | 0.104 | 0.075 | 0.054 | |||||

| 100 | 2.134 | 2.167 | 3.082 | 1.899 | 1.718 | 1.468 | 5.582 | 5.633 | 6.298 | 3.527 | 2.034 | 1.753 | |

| 0.043 | 0.043 | 0.061 | 0.038 | 0.034 | 0.030 | 0.117 | 0.113 | 0.126 | 0.075 | 0.042 | 0.036 | ||

| 200 | 1.833 | 1.971 | 2.808 | 1.400 | 1.356 | 1.225 | 2.679 | 3.573 | 4.399 | 1.867 | 1.413 | 1.319 | |

| 0.036 | 0.039 | 0.055 | 0.028 | 0.027 | 0.024 | 0.053 | 0.071 | 0.090 | 0.038 | 0.028 | 0.026 | ||

| Baseline scenario, | Number of covariates , | ||||||||||||

| 50 | 1.985 | 2.139 | 2.144 | 1.858 | 1.786 | 1.535 | 2.132 | 2.000 | 1.654 | ||||

| 0.042 | 0.042 | 0.043 | 0.038 | 0.037 | 0.031 | 0.043 | 0.041 | 0.033 | |||||

| 100 | 1.462 | 1.660 | 1.821 | 1.483 | 1.417 | 1.293 | 4.260 | 3.495 | 2.966 | 1.714 | 1.613 | 1.385 | |

| 0.030 | 0.033 | 0.036 | 0.030 | 0.028 | 0.026 | 0.092 | 0.074 | 0.062 | 0.035 | 0.033 | 0.028 | ||

| 200 | 1.279 | 1.545 | 1.636 | 1.305 | 1.250 | 1.239 | 1.927 | 2.006 | 2.027 | 1.335 | 1.269 | 1.19 | |

| 0.025 | 0.031 | 0.032 | 0.026 | 0.025 | 0.025 | 0.039 | 0.041 | 0.040 | 0.027 | 0.025 | 0.024 | ||

| FLOW | STOCK | MIDDLE | LASSO-U | LASSO-M | SGL-M | FLOW | STOCK | MIDDLE | LASSO-U | LASSO-M | SGL-M | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| T | Baseline scenario | ||||||||||||

| 50 | 3.095 | 3.793 | 4.659 | 4.622 | 3.196 | 2.646 | 2.257 | 2.391 | 2.649 | 2.357 | 2.131 | 1.786 | |

| 0.067 | 0.078 | 0.094 | 0.094 | 0.064 | 0.055 | 0.046 | 0.054 | 0.057 | 0.050 | 0.047 | 0.038 | ||

| 100 | 2.393 | 2.948 | 3.860 | 2.805 | 2.113 | 1.888 | 1.598 | 1.840 | 2.068 | 1.824 | 1.653 | 1.433 | |

| 0.048 | 0.060 | 0.078 | 0.058 | 0.044 | 0.038 | 0.032 | 0.037 | 0.043 | 0.036 | 0.033 | 0.029 | ||

| 200 | 2.122 | 2.682 | 3.597 | 1.971 | 1.712 | 1.604 | 1.452 | 1.690 | 1.969 | 1.544 | 1.383 | 1.302 | |

| 0.042 | 0.055 | 0.072 | 0.039 | 0.034 | 0.032 | 0.030 | 0.035 | 0.041 | 0.032 | 0.028 | 0.026 | ||

| High-frequency process: VAR(1) | Legendre degree | ||||||||||||

| 50 | 2.086 | 2.418 | 2.856 | 2.208 | 1.828 | 1.612 | 3.095 | 3.793 | 4.659 | 4.622 | 2.987 | 2.451 | |

| 0.044 | 0.050 | 0.057 | 0.049 | 0.039 | 0.033 | 0.067 | 0.078 | 0.094 | 0.094 | 0.061 | 0.050 | ||

| 100 | 1.571 | 1.906 | 2.341 | 1.671 | 1.430 | 1.329 | 2.393 | 2.948 | 3.860 | 2.805 | 2.020 | 1.796 | |

| 0.031 | 0.039 | 0.047 | 0.033 | 0.028 | 0.026 | 0.048 | 0.060 | 0.078 | 0.058 | 0.042 | 0.037 | ||

| 200 | 1.397 | 1.720 | 2.168 | 1.428 | 1.307 | 1.248 | 2.122 | 2.682 | 3.597 | 1.971 | 1.680 | 1.560 | |

| 0.028 | 0.034 | 0.043 | 0.028 | 0.026 | 0.024 | 0.042 | 0.055 | 0.072 | 0.039 | 0.033 | 0.031 | ||

| Legendre degree | Low frequency noise level =5 | ||||||||||||

| 50 | 3.095 | 3.793 | 4.659 | 4.622 | 3.528 | 2.948 | 9.934 | 10.566 | 10.921 | 9.819 | 9.037 | 8.091 | |

| 0.067 | 0.078 | 0.094 | 0.094 | 0.071 | 0.059 | 0.213 | 0.212 | 0.216 | 0.198 | 0.184 | 0.168 | ||

| 100 | 2.393 | 2.948 | 3.860 | 2.805 | 2.271 | 2.079 | 7.576 | 8.130 | 8.854 | 9.190 | 7.743 | 6.876 | |

| 0.048 | 0.060 | 0.078 | 0.058 | 0.047 | 0.042 | 0.150 | 0.166 | 0.180 | 0.188 | 0.160 | 0.141 | ||

| 200 | 2.122 | 2.682 | 3.597 | 1.971 | 1.777 | 1.693 | 6.830 | 7.580 | 8.351 | 7.648 | 6.820 | 6.258 | |

| 0.042 | 0.055 | 0.072 | 0.039 | 0.035 | 0.034 | 0.135 | 0.152 | 0.168 | 0.156 | 0.136 | 0.124 | ||

| Half high-frequency lags | Number of covariates | ||||||||||||

| 50 | 3.014 | 2.773 | 3.638 | 2.455 | 2.509 | 2.201 | 5.222 | 3.919 | 3.002 | ||||

| 0.063 | 0.056 | 0.072 | 0.050 | 0.051 | 0.046 | 0.105 | 0.081 | 0.061 | |||||

| 100 | 2.344 | 2.087 | 3.116 | 1.899 | 2.101 | 1.774 | 5.978 | 5.556 | 6.536 | 3.948 | 2.665 | 2.232 | |

| 0.046 | 0.041 | 0.063 | 0.038 | 0.043 | 0.036 | 0.121 | 0.112 | 0.132 | 0.083 | 0.053 | 0.044 | ||

| 200 | 2.119 | 1.985 | 2.988 | 1.400 | 1.761 | 1.590 | 2.974 | 3.422 | 4.412 | 2.355 | 1.938 | 1.725 | |

| 0.041 | 0.040 | 0.061 | 0.028 | 0.035 | 0.032 | 0.059 | 0.070 | 0.087 | 0.048 | 0.040 | 0.035 | ||

| Baseline scenario, | Number of covariates , | ||||||||||||

| 50 | 2.070 | 2.107 | 2.235 | 2.088 | 1.910 | 1.587 | 2.354 | 2.127 | 1.667 | ||||

| 0.044 | 0.042 | 0.045 | 0.043 | 0.040 | 0.032 | 0.047 | 0.044 | 0.033 | |||||

| 100 | 1.525 | 1.586 | 1.828 | 1.605 | 1.471 | 1.303 | 4.179 | 3.337 | 3.029 | 1.961 | 1.679 | 1.411 | |

| 0.031 | 0.032 | 0.037 | 0.033 | 0.031 | 0.027 | 0.087 | 0.067 | 0.061 | 0.041 | 0.034 | 0.028 | ||

| 200 | 1.343 | 1.479 | 1.718 | 1.347 | 1.281 | 1.176 | 2.018 | 1.869 | 2.087 | 1.413 | 1.334 | 1.217 | |

| 0.026 | 0.029 | 0.034 | 0.027 | 0.025 | 0.023 | 0.041 | 0.037 | 0.042 | 0.029 | 0.027 | 0.025 | ||

The table reports simulation results for nowcasting accuracy. The baseline DGP (upper-left block) is with the low-frequency noise level , the degree of Legendre polynomial , and Gaussian high-frequency noise. All remaining blocks report results for deviations from the baseline DGP. In the upper-right block, the noise term of high-frequency covariates is student-. Each block reports results for LASSO-U-MIDAS (LASSO-U), LASSO-MIDAS (LASSO-M), and sg-LASSO-MIDAS (SGL-M) (the last three columns). We also report results for aggregated predictive regressions with flow aggregation (FLOW), stock aggregation (STOCK), and taking the middle value (MIDDLE). We vary the sample size from 50 to 200. Each entry in the odd row is the average mean squared forecast error, while each even row is the simulation standard error.

| LASSO-U | LASSO-M | SGL-M | LASSO-U | LASSO-M | SGL-M | LASSO-U | LASSO-M | SGL-M | |

|---|---|---|---|---|---|---|---|---|---|

| T=50 | T=100 | T=200 | |||||||

| Baseline scenario | |||||||||

| 1.955 | 0.887 | 0.652 | 1.846 | 0.287 | 0.247 | 1.804 | 0.138 | 0.106 | |

| 0.002 | 0.012 | 0.010 | 0.002 | 0.004 | 0.004 | 0.001 | 0.002 | 0.002 | |

| 1.211 | 0.739 | 0.625 | 1.157 | 0.351 | 0.268 | 1.128 | 0.199 | 0.118 | |

| 0.001 | 0.008 | 0.008 | 0.001 | 0.004 | 0.004 | 0.001 | 0.002 | 0.002 | |

| 1.062 | 0.593 | 0.537 | 1.019 | 0.231 | 0.216 | 0.995 | 0.106 | 0.092 | |

| 0.001 | 0.007 | 0.007 | 0.001 | 0.003 | 0.003 | 0.001 | 0.001 | 0.001 | |

| 2.005 | 1.688 | 1.290 | 1.953 | 1.064 | 0.624 | 1.885 | 0.471 | 0.401 | |

| 0.002 | 0.012 | 0.014 | 0.002 | 0.011 | 0.009 | 0.002 | 0.005 | 0.005 | |

| 1.237 | 1.126 | 0.993 | 1.218 | 0.848 | 0.614 | 1.185 | 0.506 | 0.440 | |

| 0.001 | 0.007 | 0.010 | 0.001 | 0.007 | 0.007 | 0.001 | 0.005 | 0.004 | |

| 1.084 | 0.969 | 0.874 | 1.070 | 0.691 | 0.518 | 1.047 | 0.369 | 0.356 | |

| 0.001 | 0.006 | 0.008 | 0.001 | 0.006 | 0.006 | 0.001 | 0.004 | 0.004 | |

| high-frequency process: VAR(1) | |||||||||

| 1.935 | 1.271 | 0.939 | 1.890 | 0.772 | 0.492 | 1.842 | 0.419 | 0.288 | |

| 0.003 | 0.016 | 0.015 | 0.002 | 0.010 | 0.008 | 0.002 | 0.005 | 0.004 | |

| 1.177 | 0.864 | 0.811 | 1.155 | 0.610 | 0.505 | 1.136 | 0.468 | 0.359 | |

| 0.002 | 0.011 | 0.012 | 0.002 | 0.008 | 0.008 | 0.001 | 0.005 | 0.005 | |

| 1.036 | 0.706 | 0.729 | 1.023 | 0.477 | 0.458 | 1.008 | 0.326 | 0.299 | |

| 0.002 | 0.009 | 0.011 | 0.002 | 0.007 | 0.007 | 0.001 | 0.004 | 0.004 | |

| Legendre degree | |||||||||

| 1.955 | 0.727 | 0.484 | 1.846 | 0.248 | 0.178 | 1.804 | 0.123 | 0.081 | |

| 0.002 | 0.010 | 0.008 | 0.002 | 0.004 | 0.003 | 0.001 | 0.002 | 0.001 | |

| 1.211 | 0.642 | 0.491 | 1.157 | 0.313 | 0.201 | 1.128 | 0.181 | 0.094 | |

| 0.001 | 0.008 | 0.007 | 0.001 | 0.004 | 0.003 | 0.001 | 0.002 | 0.001 | |

| 1.062 | 0.508 | 0.414 | 1.019 | 0.200 | 0.156 | 0.995 | 0.094 | 0.069 | |

| 0.001 | 0.007 | 0.006 | 0.001 | 0.003 | 0.003 | 0.001 | 0.001 | 0.001 | |

| Baseline scenario, | |||||||||

| 1.981 | 1.915 | 1.736 | 1.930 | 1.114 | 0.824 | 1.875 | 0.524 | 0.396 | |

| 0.002 | 0.030 | 0.033 | 0.003 | 0.020 | 0.018 | 0.002 | 0.010 | 0.009 | |

| 1.222 | 1.284 | 1.289 | 1.197 | 0.865 | 0.713 | 1.167 | 0.638 | 0.457 | |

| 0.002 | 0.022 | 0.027 | 0.002 | 0.016 | 0.015 | 0.002 | 0.009 | 0.008 | |

| 1.071 | 1.090 | 1.080 | 1.051 | 0.706 | 0.569 | 1.027 | 0.480 | 0.321 | |

| 0.001 | 0.020 | 0.024 | 0.002 | 0.014 | 0.012 | 0.002 | 0.007 | 0.006 | |