Pricing and hedging American-style options with deep learning

Abstract

In this paper we introduce a deep learning method for pricing and hedging

American-style options. It first computes a candidate optimal stopping policy.

From there it derives a lower bound for the price. Then it calculates

an upper bound, a point estimate and confidence intervals. Finally, it constructs an approximate

dynamic hedging strategy. We test the approach on different specifications of a

Bermudan max-call option. In all cases it produces highly accurate prices and dynamic hedging

strategies with small replication errors.

Keywords: American option, Bermudan option, optimal stopping, lower bound, upper bound,

hedging strategy, deep neural network

1 Introduction

Early exercise options are notoriously difficult to value. For up to three underlying risk factors, tree based and classical PDE approximation methods usually yield good numerical results; see, e.g., [20, 15, 28] and the references therein. To treat higher-dimensional problems, various simulation based methods have been developed; see, e.g., [32, 3, 12, 1, 27, 33, 16, 9, 2, 25, 14, 8, 6, 22]. [19, 24] have already used shallow444meaning feedforward networks with a single hidden layer neural networks to estimate continuation values. More recently, in [31] optimal stopping problems in continuous time have been solved by approximating the solutions of the corresponding free boundary PDEs with deep neural networks. In [4, 5] deep learning has been used to directly learn optimal stopping strategies. The main focus of these papers is to derive optimal stopping rules and accurate price estimates.

The goal of this article is to develop a deep learning method which learns the optimal exercise behavior, prices and hedging strategies from samples of the underlying risk factors. It first learns a candidate optimal stopping strategy by regressing continuation values on multilayer neural networks. Employing the learned stopping strategy on a new set of Monte Carlo samples gives a low-biased estimate of the price. Moreover, the candidate optimal stopping strategy can be used to construct an approximate solution to the dual martingale problem introduced by [29] and [19], yielding a high-biased estimate and confidence intervals for the price. In the last step, our method learns a dynamic hedging strategy in the spirit of [18] and [11]. But here, the continuation value approximations learned during the construction of the optimal stopping strategy can be used to break the hedging problem down into a sequence of smaller problems that learn the hedging portfolio only from one possible exercise date to the next. Alternative ways of computing hedging strategies consist in calculating sensitivities of option prices (see e.g., [2, 7, 22]) or approximating a solution to the dual martingale problem (see e.g., [29, 30]).

Our work is related to the preprints [26] and [13]. [26] also uses neural network regression to estimate continuation values. But the networks are slightly different. While [26] works with leaky ReLU activation functions, we use activation. Moreover, [26] studies the convergence of the pricing algorithm as the number of simulations and the size of the network go to infinity, whereas we calculate a posteriori guarantees for the prices and use the estimated continuation value functions to implement efficient hedging strategies. [13] proposes an alternative way of calculating prices and hedging strategies for American-style options by solving BSDEs.

The rest of the paper is organized as follows. In Section 2 we describe our neural network version of the Longstaff–Schwartz algorithm to estimate continuation values and construct a candidate optimal stopping strategy. In Section 3 the latter is used to derive lower and upper bounds as well as confidence intervals for the price. Section 4 discusses two different ways of computing dynamic hedging strategies. In Section 5 the results of the paper are applied to price and hedge a Bermudan call option on the maximum of different underlying assets. Section 6 concludes.

2 Calculating a candidate optimal stopping strategy

We consider an American-style option that can be exercised at any one of finitely555This covers Bermudan options as well as American options that can only be exercised at a given time each day. Continuously exercisable options must be approximated by discretizing time. many times . If exercised at time , it yields a discounted payoff given by a square-integrable random variable defined on a filtered probability space . We assume that describes the information available at time and is of the form for a measurable function and a -dimensional -Markov process666That is, is -measurable, and for all and every measurable function such that is integrable. . We assume to be deterministic and to be the pricing measure. So that the value of the option at time is given by

where is the set of all -stopping times . If the option has not been exercised before time , its discounted value at that time is

| (1) |

where is the set of all -stopping times satisfying .

Obviously, is optimal for . From there, one can recursively construct the stopping times

| (2) |

Clearly, belongs to , and it can be checked inductively that

In particular, is an optimizer of (1).

Recursion (2) is the theoretical basis of the Longstaff–Schwartz method [27]. Its main computational challenge is the approximation of the conditional expectations . It is well known that is of the form , where minimizes the mean squared distance over all Borel measurable functions from to ; see, e.g., [10]. The Longstaff–Schwartz algorithm approximates by projecting on the linear span of finitely many basis functions. But it is also possible to project on a different subset. If the subset is given by for a function family parametrized by , one can apply the following variant777The main difference between this algorithm and the one of Longstaff and Schwartz [27] is the use of neural networks instead of linear combinations of basis functions. In addition, the sum in (3) is over all simulated paths, whereas in [27], only in-the-money paths are considered to save computational effort. While it is enough to use in-the-money paths to determine a candidate optimal stopping rule, we need accurate approximate continuation values for all to construct good hedging strategies in Section 4. of the Longstaff–Schwartz algorithm:

-

(i)

Simulate888As usual, we simulate the paths , , independently of each other. paths , , of the underlying process .

-

(ii)

Set for all .

-

(iii)

For , approximate with by minimizing the sum

(3) -

(iv)

Set

-

(v)

Define , and set constantly equal to .

In this paper we specify as a feedforward neural network, which in general, is of the form

| (4) |

where

-

•

denotes the depth and the numbers of nodes in the different layers

-

•

are affine functions,

-

•

For , is of the form for a given activation function .

The components of the parameter consist of the entries of the matrices and vectors appearing in the representation of the affine functions , . So, lives in for . To minimize (3) we choose a network with and employ a stochastic gradient descent method.

3 Pricing

3.1 Lower bound

Once have been determined, we set and define

This defines a valid -stopping time. Therefore, is a lower bound for the optimal value . But typically, it is not possible to calculate the expectation exactly. Therefore, we generate simulations of based on independent sample paths999generated independently of , , , of and approximate with the Monte Carlo average

Denote by the quantile of the standard normal distribution and consider the sample standard deviation

Then one obtains from the central limit theorem that

| (5) |

is an asymptotically valid confidence interval for .

3.2 Upper bound, point estimate and confidence intervals

Our derivation of an upper bound is based on the duality results of [29, 19, 4]. By [29, 19], the optimal value can be written as

where is the martingale part of the smallest -supermartingale dominating the payoff process . We approximate with the -martingale obtained from the stopping decisions implied by the trained continuation value functions , , as in Section 3.2 of [4]. We know from Proposition 7 of [4] that if is a sequence of integrable random variables satisfying for all , then

is an upper bound for . As in [4], we use nested simulation101010The use of nested simulation ensures that are unbiased estimates of , which is crucial for the validity of the upper bound. In particular, we do not directly approximate with the estimated continuation value functions . to generate realizations of along independent realizations , , of sampled independently of , , and estimate as

Our point estimate of is

The sample standard deviation of the estimator , given by

can be used together with the one-sided confidence interval (5) to construct the asymptotically valid two-sided confidence interval

| (6) |

for the true value ; see Section 3.3 of [4].

4 Hedging

We now consider a savings account together with financial securities as hedging instruments. We fix a positive integer and introduce a time grid such that for all . We suppose that the information available at time is described by , where is a filtration satisfying for all . If any of the financial securities pay dividends, they are immediately reinvested. We assume that the resulting discounted111111Discounting is done with respect to the savings account. Then, the discounted value of money invested in the savings account stays constant. value processes are of the form for measurable functions and an -Markov process121212That is, is -measurable and for all and every measurable function such that is integrable. such that for all . A hedging strategy consists of a sequence of functions specifying the time- holdings in . As usual, money is dynamically deposited in or borrowed from the savings account to make the strategy self-financing. The resulting discounted gains at time are given by

4.1 Hedging until the first possible exercise date

For a typical Bermudan option, the time between two possible exercise dates might range between a week and several months. In case of an American option, we choose for a small amount of time such as a day. We assume does not stop at time . Otherwise, there is nothing to hedge. In a first step, we only compute the hedge until time . If the option is still alive at time , the hedge can then be computed until time and so on. To construct a hedge from time to , we approximate the time- value of the option with for the function , where is the time- continuation value function estimated in Section 2. Then we search for hedging positions , , that minimize the mean squared error

To do that we approximate the functions with neural networks of the form (4) and try to find parameters that minimize

| (7) |

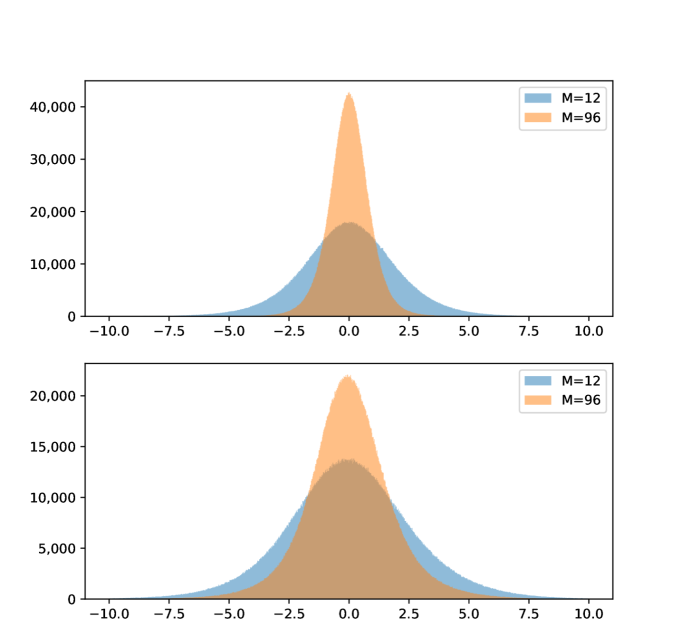

for independent realizations of , , of . We train the networks together, again using a stochastic gradient descent method. Instead of (7), one could also minimize a different deviation measure. But (7) has the advantage that it yields hedging strategies with an average hedging error close to zero131313see Table 2 and Figure 1 below.

Once have been determined, we assess the quality of the hedge by simulating new141414independent of , independent realizations , , of and calculating the average hedging error

| (8) |

and the empirical hedging shortfall

| (9) |

over the time interval .

4.2 Hedging until the exercise time

Alternatively, one can precompute the whole hedging strategy from time to and then use it until the option is exercised. In order to do that we introduce the functions

and hedge the difference on each of the time intervals , , separately. describes the approximate value of the option at time if it has not been exercised before, and the definition of takes into account that the true continuation values are non-negative due to the non-negativity of the payoff function . The hedging strategy can be computed as in Section 4.1, except that we now have to simulate complete paths of , , and then for all , find parameters which minimize

Once the hedging strategy has been trained, we simulate independent samples9 , , of and denote the realization of along each sample path by . The corresponding average hedging error is given by

| (10) |

and the empirical hedging shortfall by

| (11) |

5 Example

In this section we study151515The computations were performed on a NVIDIA GeForce RTX 2080 Ti GPU. The underlying system was an AMD Ryzen 9 3950X CPU with 64 GB DDR4 memory running Tensorflow 2.1 on Ubuntu 19.10. a Bermudan max-call option161616Bermudan max-call options are a benchmark example in the literature on numerical methods for high-dimensional American-style options; see, e.g., [27, 29, 16, 9, 19, 8, 6, 22, 4, 5]. on financial securities with risk-neutral price dynamics

for a risk-free interest rate , initial values , dividend yields , volatilities and a -dimensional Brownian motion with constant instantaneous correlations171717That is, for all and . between different components and . The option has time- payoff for a strike price and can be exercised at one of finitely many times . In addition, we suppose there is a savings account where money can be deposited and borrowed at rate .

For notational simplicity, we assume in the following that for , and all assets have the same181818Simulation based methods work for any price dynamics that can efficiently be simulated. Prices of max-call options on underlying assets with different price dynamics were calculated in [8] and [4]. characteristics; that is, , and for all .

5.1 Pricing results

Let us denote , . Then the price of the option is given by

where the supremum is over all stopping times with respect to the filtration generated by . The option payoff does not carry any information not already contained in . But the training of the continuation values worked more efficiently when we used it as an additional feature. So instead of we simulated the extended state process for

to train the continuation value functions , . The network was chosen of the form (4) with depth (two hidden layers), nodes in each hidden layer and activation function . For training we used stochastic gradient descent with mini-batches of size 8,192 and batch normalization [21]. At time we used Xavier [17] initialization and performed 6,000 Adam [23] updating steps191919The hyperparamters were chosen as in [23]. The stepsize was specified as , , and according to a deterministic schedule.. For , we started the gradient descent from the trained network parameters and made 3,500 Adam [23] updating steps16. To calculate we simulated 4,096,000 paths of . For we generated 2,048 outer and 2,048 2,048 inner simulations.

Our results for , , and 95% confidence intervals for different specifications of the model parameters are reported in Table 1. To achieve a pricing accuracy comparable to the more direct methods of [4] and [5], the networks used in the construction of the candidate optimal stopping strategy had to be trained for a longer time. But in exchange, the approach yields approximate continuation values that can be used to break down the hedging problem into a series of smaller problems.

| Point Est. | CI | DOS CI | ||||||

|---|---|---|---|---|---|---|---|---|

5.2 Hedging results

Suppose the hedging portfolio can be rebalanced at the times , , for a positive integer . We assume dividends paid by shares of held in the hedging portfolio are continuously reinvested in . This results in the adjusted discounted security prices

We set . To learn the hedging strategy, we trained neural networks , , of the form (4) with depth (two hidden layers), nodes in each hidden layer and activation function . As in Section 5.1, we used stochastic gradient descent with mini-batches of size 8,192 and batch normalization [21]. For , we initialized the networks according to Xavier [17] and performed 10,000 Adam [23] updating steps16, whereas for , we started the gradient trajectories from the trained network parameters and made 3,000 Adam [23] updating steps16.

Table 2 reports the average hedging errors (8) and (10) together with the empirical hedging shortfalls (9) and (11) for different numbers of rebalancing times between two consecutive exercise dates and . They were computed using 4,096,000 simulations of .

| IHE | IHS | IHS/ | T1 | HE | HS | HS/ | T2 | |||

|---|---|---|---|---|---|---|---|---|---|---|

6 Conclusion

In this article we used deep learning to price and hedge American-style options. In a first step our method employs a neural network version of the Longstaff–Schwartz algorithm to estimate continuation values and derive a candidate optimal stopping rule. The learned stopping rule immediately yields a low-biased estimate of the price. In addition, it can be used to construct an approximate solution of the dual martingale problem of [29, 19]. This gives a high-biased estimate and confidence intervals for the price. To achieve the same pricing accuracy as the more direct approaches of [4] and [5], we had to train the neural network approximations of the continuation values for a longer time. But computing approximate continuation values has the advantage that they can be used to break the hedging problem into a sequence of subproblems that compute the hedge only from one possible exercise date to the next.

References

- [1] L. Andersen. A simple approach to the pricing of Bermudan swaptions in the multifactor LIBOR market model. The Journal of Computational Finance 3(2):5–32, 2000.

- [2] V. Bally, G. Pagès and J. Printems. A quantization tree method for pricing and hedging multidimensional American options. Mathematical Finance 15(1):119–168, 2005.

- [3] J. Barraquand and D. Martineau. Numerical valuation of high dimensional multivariate American securities. The Journal of Financial and Quantitative Analysis 30(3):383–405, 1995.

- [4] S. Becker, P. Cheridito and A. Jentzen. Deep optimal stopping. Journal of Machine Learning Research 20(74): 1–25, 2019.

- [5] S. Becker, P. Cheridito, A. Jentzen and T. Welti. Solving high-dimensional optimal stopping problems using deep learning Arxiv Preprint, 2019.

- [6] S.J. Berridge and J.M. Schumacher. An irregular grid approach for pricing high-dimensional American options. Journal of Computational and Applied Mathematics 222(1):94–111, 2008.

- [7] B. Bouchard and X. Warin. Monte-Carlo valuation of American options: facts and new algorithms to improve existing methods. In Numerical Methods in Finance Vol. 12 of Springer Proc. Math., 215–255, 2012.

- [8] M. Broadie and M. Cao. Improved lower and upper bound algorithms for pricing American options by simulation. Quantitative Finance 8(8):845–861, 2008.

- [9] M. Broadie and P. Glasserman. A stochastic mesh method for pricing high-dimensional American options. Journal of Computational Finance 7(4):35–72, 2004.

- [10] B. Bru and H. Heinich. Meilleures approximations et médianes conditionnelles. Annales de l’I.H.P. Probabilités et Statistiques 21(3):197–224, 1985.

- [11] H. Buehler, L. Gonon, J. Teichmann and B. Wood. Deep hedging. Quantitative Finance 19(8):1271–1291, 2019.

- [12] J.F. Carriere. Valuation of the early-exercise price for options using simulations and nonparametric regression. Insurance: Mathematics and Economics 19(1):19–30, 1996.

- [13] Y. Chen and J.W.L. Wan. Deep neural network framework based on backward stochastic differential equations for pricing and hedging American options in high dimensions Arxiv Preprint, 2019.

- [14] D. Egloff, M. Kohler and N. Todorovic. A dynamic look-ahead Monte Carlo algorithm for pricing Bermudan options. Ann. Appl. Probability 17(4):1138–1171, 2007.

- [15] P.A. Forsyth and K.R. Vetzal. Quadratic convergence for valuing American options using a penalty method. SIAM J. Sci. Comput. 23(6):2095–2122, 2002.

- [16] D. García. Convergence and biases of Monte Carlo estimates of American option prices using a parametric exercise rule. Journal of Economic Dynamics and Control 27(10):1855–1879, 2003.

- [17] X. Glorot and Y. Bengio. Understanding the difficulty of training deep feedforward neural networks. In Proceedings of the Thirteenth International Conference on Artificial Intelligence and Statistics, PMLR 9:249–256, 2010.

- [18] J. Han, A. Jentzen and W. E. Solving high-dimensional partial differential equations using deep learning. PNAS 115(34):8505–8510, 2018.

- [19] M.B. Haugh and L. Kogan. Pricing American options: a duality approach. Operations Research 52(2):258–270, 2004.

- [20] J.C. Hull. Options, Futures and Other Derivatives. Pearson/Prentice Hall, 2003.

- [21] S. Ioffe and C. Szegedy. Batch normalization: accelerating deep network training by reducing internal covariate shift. In Proceedings of the 32nd International Conference on Machine Learning, PMLR 37:448–456, 2015.

- [22] S. Jain and C.W. Oosterlee. The stochastic grid bundling method: efficient pricing of Bermudan options and their Greeks. Applied Mathematics and Computation 269:412–431, 2015.

- [23] D.P. Kingma and J. Ba. Adam: A method for stochastic optimization. International Conference on Learning Representations, 2015.

- [24] M. Kohler, A. Krzyżak and N. Todorovic. Pricing of high-dimensional American options by neural networks. Mathematical Finance 20(3):383–410, 2010.

- [25] A. Kolodko and J. Schoenmakers. Iterative construction of the optimal Bermudan stopping time. Finance and Stochastics 10(1):27–49, 2006.

- [26] B. Lapeyre and J. Lelong. Neural network regression for Bermudan option pricing ArXiv Preprint, 2019.

- [27] F.A. Longstaff and E.S. Schwartz. Valuing American options by simulation: a simple least-squares approach. The Review of Financial Studies 14(1):113–147, 2001.

- [28] C. Reisinger and J.H. Witte. On the use of policy iteration as an easy way of pricing American options. SIAM J. Financial Math. 3(1):459–478, 2012.

- [29] L.C.G. Rogers. Monte Carlo valuation of American options. Mathematical Finance 12(3):271–286, 2002.

- [30] L.C.G Rogers. Dual valuation and hedging of Bermudan options. SIAM J. Financial Math. 1(1):604–608, 2010.

- [31] J. Sirignano and K. Spiliopoulos. DGM: A deep learning algorithm for solving partial differential equations. Journal of Computational Physics 375:1339–1364, 2018.

- [32] J.A. Tilley. Valuing American options in a path simulation model. Transactions of the Society of Actuaries 45:83–104, 1993.

- [33] J.N. Tsitsiklis and B. Van Roy. Regression methods for pricing complex American-style options. IEEE Transactions on Neural Networks 12(4):694–703, 2001.