Bidding in Smart Grid PDAs: Theory, Analysis and Strategy(Extended Version)

Abstract

Periodic Double Auctions (PDAs) are commonly used in the real world for trading, e.g. in stock markets to determine stock opening prices, and energy markets to trade energy in order to balance net demand in smart grids, involving trillions of dollars in the process. A bidder, participating in such PDAs, has to plan for bids in the current auction as well as for the future auctions, which highlights the necessity of good bidding strategies. In this paper, we perform an equilibrium analysis of single unit single-shot double auctions with a certain clearing price and payment rule, which we refer to as ACPR, and find it intractable to analyze as number of participating agents increase. We further derive the best response for a bidder with complete information in a single-shot double auction with ACPR. Leveraging the theory developed for single-shot double auction and taking the PowerTAC wholesale market PDA as our testbed, we proceed by modeling the PDA of PowerTAC as an MDP. We propose a novel bidding strategy, namely MDPLCPBS. We empirically show that MDPLCPBS follows the equilibrium strategy for double auctions that we previously analyze. In addition, we benchmark our strategy against the baseline and the state-of-the-art bidding strategies for the PowerTAC wholesale market PDAs, and show that MDPLCPBS outperforms most of them consistently.

1 Introduction

Auctions are mechanisms which facilitate buying and selling of goods or items amongst a group of agents. Double auctions are prevalent when both the sides of a market actively bid. For example, in the New York Stock Exchange, opening prices are determined using double auctions Parsons et al. (2011). In smart grids, multiple power generating companies and different distributing agencies (brokers) trade electricity in the wholesale markets using double auctions.

In this work, we focus primarily on electricity markets. In July 2019, approximately 1.2 Billion Euros worth electricity was traded in Nord Pool alone, with 52% of the volume being traded using APIs Nord Pool AS (2019). Any small improvement in cost optimization by deploying better bidding strategies can lead to significant improvements in the profits of the distributing agencies. Motivated by this, we take up a formal game-theoretic approach in this work for devising bidding strategies.

Typically, for double auctions, clearing price and payment rules differ from market to market. Equilibrium analysis of double auctions has been explored extensively with different payment and clearing price rules Wilson (1992). Specifically, for -double auctions, Satterthwaite and Williams (1989) proved the existence of multiple non-trivial equilibria for . They also focused on a class of well-behaved equilibria, by making generalist assumptions on buyer’s and seller’s bidding strategies. Our focus in this paper is Average Clearing Price Rule (ACPR) based Periodic Double Auctions (PDAs), commonly used in smart grids (Power TAC Ketter et al. (2017)). In ACPR, the clearing price set as the average of last executing bid and last executing ask (a special case of -double auction with = 0.5).

For ACPR, Chatterjee and Samuelson (1983) constructed a symmetric equilibrium for the case of one buyer and one seller with uniformly distributed valuations. However, in the vast literature of double auctions, a generic equilibrium analysis for ACPR with more buyers has not been well explored Wilson (1992). We take up a double auction with ACPR as a case study. We assume all the agents involved (buyers and sellers) deploy scaling based strategies, and identify the Nash Equilibrium (NE) of the induced game. Researchers have used fictitious play-based convergence to equilibrium (e.g., Shi et al. (2010)) in double auctions. However, such strategies are not useful in PDAs when the agents need to place bids in real-time for new auctions. In such settings, we believe scaling based strategies are easy to interpret and implement. The equilibrium analysis of non-linear or other complex forms are analytically difficult to compute; moreover may not be appealing to the real users of these markets.

We characterize NEs for One Buyer and One Seller (OBOS) and Two Buyer and One Seller (TBOS) analytically (Theorem 1 and 2). Given our assumption of scaling based bidding strategies and uniform type distributions, generic equilibrium analysis of double auctions, following ACPR, beyond these settings is challenging. To test our double auction strategies, we take the help of the PowerTAC simulation environment. PowerTAC is a simulation platform that replicates crucial elements of the smart grid, where multiple distributing agencies (brokers) compete across markets to generate the most profit. Note that, the double auctions in PowerTAC; for that matter actually in electricity markets; are PDAs. In PDAs, the market clears multiple times, each after a specific time interval.

Now, if a buyer knows all the bids in a double auction, we argue that it is a best response for the buyer to bid as close as possible to the last clearing bid in order to procure the full required energy (Proposition 1). However, in reality, buyers never have access to such information. To address this incomplete information, we model the bidding process in PowerTAC PDAs as a Markov Decision Process (MDP), and solve it using dynamic programming and Last Clearing Price (LCP) prediction. Motivated by Power TAC’s fast response time constraints, we propose a PDA bidding strategy MDPLCPBS (Algorithm 1). Though our MDP formulation is inspired by Urieli and Stone (2014), the novelty lies in the reward, solution, and application to place bids. First, we illustrate that the MDP based strategy indeed achieves the equilibrium strategy characterized for OBOS setting. Then, we conduct different experiments to compare MDPLCPBS with the following strategies: ZI Gode and Sunder (1993), ZIP Tesauro and Das (2001), TacTex Urieli and Stone (2014), and MCTS Chowdhury et al. (2018). Our analysis shows that MDPLCPBS outperforms ZI, TacTex, and ZIP in all the cases, and closely matches with MCTS. Simultaneously, we show that it predicts the LCP with minimal error. We used this bidding strategy to great effect during PowerTAC 2018 Finals Ghosh et al. (2019a) Ghosh et al. (2019b).

In summary, our contributions are as follows:

- •

-

•

We propose the best response in a complete information multi-unit double auction.

-

•

For bidding in PDAs such as PowerTAC, we design an algorithm MDPLCPBS (Algorithm 1). It is based on dynamic programming and LCP prediction.

-

•

Experimentally, we validate that MDPLCPBS achieves the equilibrium characterized for OBOS setting. Further, we demonstrate its efficacy against state of the art strategies for PowerTAC, and also show that it predicts the LCP with minimal error.

2 Definitions & Background

We first define all the required terms formally.

Definition 1.

(Periodic Double Auction (PDA)) A type of auction, for buying and selling some resource, with multiple discrete clearing periods i.e. clearing after a specific time interval. Potential buyers submit their bids and potential sellers simultaneously submit their asks to an auctioneer. Then the auctioneer matches the bids and asks, and chooses some clearing price, denoted as , that clears the auction Wurman et al. (1998). The allocation rule determines the quantity bought/sold by each buyer/seller, while the payment rule determines how much each buyer/seller pays/earns for buying/selling that quantity.

Definition 2.

(Last Clearing Bid/Ask (LCB/LCA)) Last Clearing Bid (Ask) of an auction refers to that partially or fully cleared bid (ask) which has the lowest (highest) limit-price. It is referred to as “last clearing” since it is the last bid (ask) to be cleared by the clearing mechanism of the auction.

Definition 3.

(Last Clearing Price (LCP)) Last Clearing Price (LCP) of bids (asks) refers to the limit-price of the Last Clearing Bid (Ask).

Definition 4.

(The k-Double Auction) If a buyer and seller participate in a double auction, and if the sealed bid by the buyer is higher than the sealed bid by the seller, then is given by for some fixed .

Definition 5.

(Average Clearing Price Rule (ACPR)) In a double auction, the clearing price and payment rule is ACPR if the clearing price is given by where is the last executed bid, and is the last executed ask. It is a special case of k-double auction, with .

Consider a game , , where is the set of players, is the strategy set of the player , and for are utility functions.

Definition 6.

(Best Response) Given a game , the best response correspondence for player is the mapping defined by . That is, given a profile of strategies of the other players, gives the set of all best response strategies of player .

Definition 7.

(Nash Equilibrium) Given a game , a strategy profile is said to be a Nash Equilibrium of if, . That is, each player’s Nash Equilibrium strategy is a best response to the Nash Equilibrium strategies of the other players.

Definition 8.

(Markov Decision Process (MDP) Puterman (1994)) A Markov Decision Process (MDP) is a tuple given by where is the set of states, is the set of actions, is the state transition probability function, where is the probability that action in state at time will lead to state at time , is the reward function, with denoting the reward obtained by taking action in state , and is the discount factor.

PowerTAC

In this work, we focus more on smart grids. The Power Trading Agent Competition (PowerTAC) Ketter et al. (2017) environment simulates a smart grid for approximately 60 days, where multiple brokers compete against each other across three markets - tariff, wholesale and balancing market - to generate the most profit. Each broker maintains a portfolio of consumers and producers, and buys and sells energy in the wholesale market. The broker with the highest bank balance at the end of the simulation, wins the game. We use the PowerTAC simulator to benchmark our bidding strategy.

The PowerTAC wholesale market employs PDAs for wholesale market energy trading. The clearing price and payment rule for the PowerTAC PDA, is given by . Three types of entities participate in these auctions - (1) Generating Companies (GenCos), (2) Miso Buyer, and (3) PowerTAC brokers. GenCos place only asks to sell energy, while the Meso Buyer places very low bid prices to buy energy. The PowerTAC brokers are free to place a bid or an ask depending on their requirement, or not place a bid at all.

The brokers can always participate in 24 auctions to trade energy, one auction for each of the next 24 timeslots. Each broker is notified about identity of other brokers participating in the PDAs at the beginning of the simulation. Each broker estimates its own energy requirement, and knows its own type. However, it does not know the types and requirements of the competing brokers. Every broker is allowed to submit an unlimited number of bids for each auction. After clearance, the clearing price and total cleared quantity of the auction is made public to all the brokers, while the last cleared bid or ask is not revealed. Additionally, each broker is privately notified about the cleared quantity and clearing price of any of its cleared bids/asks. The orderbook of the auction, which is the set of uncleared bids and asks without identity of the bidders, is also made public to all the brokers. If a broker fails to balance its retail demand portfolio after all the 24 auctions in the wholesale market, the balancing market automatically supplies the energy while charging the broker a for its imbalance. The is comparatively higher than the wholesale market price, and is meant to penalize the broker for having an imbalance. For more details about the PowerTAC simulation, we refer the reader to the Power TAC 2018 Game Specification Ketter et al. (2017).

3 Related Work

Most bidding strategies for double auctions are designed for Continuous Double Auctions (CDAs) and would need to be modified for PDAs. Bidding strategies for PDAs, outside PowerTAC, are very limited. Wah et al. (2016) showed that in equilibrium, slow traders have higher welfare compared to fast traders in PDAs. As for bidding strategies for the PowerTAC wholesale market, AstonTAC Kuate et al. (2013) uses Non-Homogeneous Hidden Markov Models (NHHMM) to predict energy demand and clearing price, which are then fed to an MDP to determine bid prices. TacTex Urieli and Stone (2014, 2016a, 2016b) uses an MDP and dynamic programming based strategy derived from Tesauro and Bredin’s bidding strategy to predict bid prices, which is the motivation for our MDP-based strategy. Chowdhury 2016 predicts bid prices for the wholesale market PDAs using REPTree, Linear Regression and NN with weather data, with the former being is used in the SPOT Chowdhury et al. (2017) broker. Chowdhury et al. 2018 use a Monte Carlo Tree Search (MCTS) based strategy coupled with a REPTree based price predictor Chowdhury (2016) and heuristics, to determine optimal bid prices. AgentUDE Özdemir and Unland (2015) uses an adaptive Q-learning based strategy in the wholesale market. None of these strategies are backed up by game theoretic analysis, where as our work is to build strategies derived from Nash Equilibrium.

4 Theoretical Approach and Proofs

In this section, we focus solely on the best response and Nash Equilibrium analysis of double auctions.

4.1 Nash Equilibrium analysis in single unit Double Auctions

Consider a single unit double auction, with the clearing price and payment rule given by ACPR. To find a generic Nash Equilibrium in this setting, we first try to simplify the double auction by restricting the number of buyers and sellers and their behavior. Upon doing so, we derive the following case-wise results.

4.1.1 One buyer and One Seller (OBOS)

Let’s assume that one buyer and one seller participate in the double auction, with their types as and respectively. We assume that both deploy scaling based strategies, i.e., a bid by a buyer is and an ask by the seller is where and are the scale factors by which the buyer and seller scale their true types while bidding, respectively. Motivated by the literature Rothkopf (1980) Vincent (1995) Narahari (2014), we choose scale based bidding strategies for this Nash Equilibrium analysis, as compared to additive bidding strategies.

We assume and and this is common knwoledge. We also assume Equation (1), which states that the buyer’s bid (seller’s ask) at any point will be less (higher) than or equal to the highest (lowest) possible seller’s ask (buyer’s bid).

| (1) |

Thus, the utility of the buyer if its bid gets cleared, is denoted by the difference of true valuation and clearing price. Given the true types are picked over a distribution, the expected utility is computed as:

| (2) | ||||

Now assuming that the buyer decides to fix its before even seeing its own type, then its utility is given by:

| (3) | ||||

Now, differentiating w.r.t. and equating to 0 to find maxima:

| (4) | ||||

Similarly, for the seller, the utility comes out to be:

| (5) | ||||

Again, assuming that the seller decides to fix its before even seeing its own type, then its utility is given by:

| (6) | ||||

Now, differentiating w.r.t and equating to 0 to find maxima

| (7) | ||||

Next, simplifying the expressions for and by letting = and = , we get

| (8) | ||||

| (9) | ||||

Putting = = and = = in Equations (8) and (9), we get = and = . The above discussion is summarized as the following theorem.

Theorem 1.

For a single unit double auction with ACPR, with only one buyer and one seller, whose true types are drawn from a uniform distribution, if they deploy scaling based bidding strategies and which satisfy Equation (1) and fix their scaling factors and before seeing their true types, then = and = constitute a Nash Equilibrium.

4.1.2 Two Buyers and One Seller (TBOS)

Let’s assume that two buyers B1 and B2, and one seller participate in the double auction, with types , and respectively. We assume that all deploy scaling based strategies, and both buyers have the same scaling factor . Thus, a bid by buyer B1 is and by buyer B2 is , while a bid by the seller is . We also assume Equation (10), which states that the first buyer’s (seller’s) bid at any point will be less than or equal to the highest possible seller’s (buyer’s) bid.

| (10) |

First, we find the utility of the first buyer. We consider the following cases:

-

1.

and

Let the utility in this case be denoted by .

(11) -

2.

and

Let the utility in this case be denoted by .

(12)

Now assuming that the first buyer decides to fix its before even seeing its own type, then we find the utility to be -

| (13) | ||||

Now, differentiating w.r.t and equating to 0 to find maxima

| (14) | ||||

Similarly, for the seller we find the utility. We again have 4 cases:

-

1.

and

Let the utility in this case be denoted by .

(15) -

2.

and

Let the utility in this case be denoted by . Since the two buyers are symmetric, the utility in this case comes to be same as in case 1.

(16) -

3.

and

Let the utility in this case be denoted by .

(17) -

4.

and

Let the utility in this case be denoted by . Since the two buyers are symmetric, the utility in this case comes to be same as in case 3.

(18)

Now assuming that the seller decides to fix its before even seeing its own type, then we find the utility to be -

| (19) | ||||

Now, differentiating w.r.t and equating to 0 to find maxima

| (20) | ||||

From Equation (14), we have a bi-variate cubic equation in and , and from Equation (20), we have a bi-variate quadratic equation in and .

Assuming and (non-zero bids), and putting = = and = = in Equation (14), we get

| (21) | ||||

| (22) | ||||

Since = (negative scaling factor), we ignore this solution.

The above discussion can be summarized as the following theorem.

Theorem 2.

For a single unit double auction with ACPR with two buyers and one seller, whose true types are drawn from a uniform distribution, if they deploy scaling based strategies , and , with buyers having the same scaling factor , which satisfy Equation (10) and fix their scaling factors and before seeing their true types, then and constitute a Nash Equilibrium.

As seen, with the increase in just one buyer, the complexity of the solution increases. It becomes increasingly difficult to extend and generalize the above results for a realistic market setting. Thus, moving forward, taking the PowerTAC wholesale market as testbed, we present a bidding strategy and experimentally show that it follows the theoretical results obtained in this section.

4.2 Best Response analysis in multi-unit Double Auctions with complete information

In practice, there are key differences between double auctions implemented in markets, and the theoretical results arrived above, stated as follows:

-

1.

Quantity may be involved in the trading market auctions, which is not considered above.

-

2.

The seller needs to use the same bidding strategy for one to achieve the above result, which may not the case.

So, considering a multi-unit double auction with , where bids are of the form . Let denote the quantity not cleared of the Last Cleared Ask if it is executed partially, and let denote the quantity not cleared of the Last Cleared Bid if it is executed partially.

Claim 1.

Upon clearance of an auction, either or , or both have to be zero.

Proof.

If the last bid partially clears, and , and if the last ask partially clears, and . If both clear fully, and . The last bid and last ask both can not clear partially, as, if they did, then more quantity can be cleared with last bid’s price higher than the last ask’s price. ∎

Next, we propose the best response if all the other bids are known to the bidder (i.e. complete information).

Proposition 1.

When a buyer (seller) has complete information about the auction, and it desires to procure (sell) entire energy it bids (asks) for, it’s a best response to bid as close as possible to the last clearing bid (ask).

Proof.

Let denote the bid placed in the auction, for amount of energy, at price. Similarly, let denote the ask placed in the auction, where and denote the asking price and quantity respectively. For simplicity, let us assume the ordering of bids to be in descending order of price, and ordering of asks to be in ascending order of price. Therefore, , and . The last clearing bid (LCB) is denoted by , while the last clearing ask (LCA) is denoted by . Thus, by ACPR, the clearing price is given as . Let denote the energy not cleared of the LCA if LCA is executed partially, and let denote the energy not cleared of the LCB if LCB is executed partially.

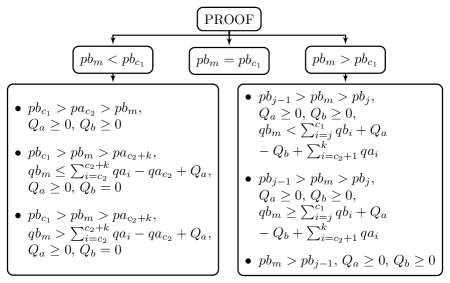

WLOG, let us consider the case of bids in the auction. Our claim essentially solves the optimization problem of minimizing the clearing price while procuring the full amount of energy. Assume a buyer wants to place a bid in such an auction. We define and denote the energy not cleared of last bid and last ask respectively, when the buyer doesn’t participate. Now if the buyer does participate in the auction, there are the following possibilities (depicted in Figure 1):

Case 1:

i.e. bid price is lower than price of the would-be cleared bid when the buyer doesn’t participate

-

1.

and , i.e. if the bidding price of is lower than the ask price of the last cleared ask (when buyer doesn’t participate). Under this condition, the bid doesn’t clear, and this is clearly not optimal, as the buyer doesn’t get it’s required energy.

-

2.

, and and is the smallest index with such that , i.e. if the last cleared bid is fully executed when buyer doesn’t participate, and buyer ’s bid price is higher than the next closest ask. In this case, clearly, becomes the last clearing bid, and it gets cleared fully. Thus, buyer gets energy at the lowest price possible by having the last cleared bid.

-

3.

, where and = and is the largest index with such that , i.e. if the last cleared bid is fully executed when buyer doesn’t participate, and buyer ’s bid price is higher than the next ask. In this case, clearly, becomes the last clearing bid, and it gets cleared partially. Although the buyer gets some energy at the lowest price possible by having the last cleared bid, it would’ve been better off bidding higher than the previous bid , in order to clear it’s entire bid energy .

Case 2:

i.e. bidding price same as the last cleared bid’s price (when buyer doesn’t participate). This is a probability zero event, and extremely unlikely to occur. Since it’s a tie, it’ll either be treated as Case 1 or Case 3, depending on the tiebreaker rule set by the auction.

Case 3:

i.e. bidding price is just higher than the last cleared bid’s price (when buyer doesn’t participate)

-

1.

and , , where is the largest index with such that and is the largest index such that . In this case, clears fully and becomes the second last bid to clear, and clears partially, or clears fully and becomes the last cleared bid. If the buyer decides to bid below , it’ll clear partially, which is not desirable, and thus supports our claim.

-

2.

and , , where is the smallest index such that and is the largest index such that . In this case, becomes the last clearing bid, and executes partially. The buyer is better off bidding higher than as it would’ve cleared fully.

-

3.

and , , where is the largest index such that and is the largest index such that . In this case, clears fully. But, the buyer would get the full amount of energy even if it bid between and , and would’ve then become close to the clearing bid.

∎

Given the above proposition in a complete information setting, we further propose a MDP-based bidding strategy, which uses the past auction trends and statistics, to achieve the best response with incomplete information in the PowerTAC wholesale market.

5 MDPLCPBS: PowerTAC Wholesale Market Bidding Strategy

We introduce the MDP and LCP based Bidding Strategy (MDPLCPBS) for the PowerTAC wholesale market. The PowerTAC wholesale market accepts bids of the form . With respect to a broker, let the energy amount being sold be positive, while the energy amount being bought be negative. Meanwhile, let negative price indicate a broker is earning revenue, while positive price indicate it is paying or losing revenue. Thus, from the viewpoint of a broker, a buy order is seen to have a negative and a positive , while a sell order (termed as an ask), is seen to have a positive and a negative .

At timeslot , assuming a broker has a predicted demand profile , where is the predicted net demand at timeslot . Also, let denote the amount of energy already procured by past energy contracts, where denotes the energy procured for timeslot . Thus, the remaining energy to be procured is given by , where is the net energy left to be procured for timeslot . The bidding strategy, MDPLCPBS, to procure the aforementioned energy requirements, comprises of three major submodules - (i) Limit Price Predictor, (ii) Quantity Predictor, and (iii) Last Cleared Price Predictor.

5.1 Limit Price Predictor (LPP)

At any given timeslot , the predictor computes 24 for 24 simultaneous PDAs in the PowerTAC wholesale market. Motivated by Tesauro and Bredin (2002) and Urieli and Stone (2014), the Limit Price Predictor uses the following MDP to place optimal for bids:

-

1.

States: ,

-

2.

Actions:

-

3.

Transition: The same state transition from Urieli and Stone (2014) is used. A state transitions to one of two states. If a bid is partially or fully cleared, it transitions to the terminal state . Otherwise, a state transitions to state . The clearing (i.e. transition) probability is initially unknown and is determined by Equation (24).

-

4.

Reward: At any state , the reward is . At terminal state , the reward is the negative of the balancing price per unit energy. At terminal state , the reward is the negative of the limit-price of the cleared bid. Since we take the price to be positive for bids and negative for asks, maximizing reward results in minimizing costs.

-

5.

Terminal States:

We solve the above MDP using a sequential bidding strategy, that computes the optimal bid that minimizes the expected procurement cost per unit energy. It uses the as the expected price at state , and recursively minimizes the expected cost by using the probability of clearance, . This solution is summarized as a value function, stated as follows:

| (23) |

Given that the and the values are different for bids and asks, we maintain two separate instances of the MDP, and solve them independently.

The value function in Equation (23) is solved recursively using dynamic programming. However, before doing so, the and the transition function need to be estimated, as they are both initially unknown. The is estimated by averaging the balancing-prices across past timeslots. On the other hand, the clearing probability, , is computed using past auction statistics as:

| (24) |

where is the set of all past auctions in the state , and LCP is the Last Clearing Price, which is estimated by the Last Cleared Price Predictor. The auction statistics for each state are re-used in the future for estimating , as we iterate over the same sequence of states S during the bidding process.

5.2 Quantity Predictor (QP)

The Quantity Predictor is primarily responsible for distributing the demand for a target timeslot across all the 24 auctions, in order to further reduce overall energy cost. The idea is to buy more and sell less at cheaper prices, and vice-versa. It essentially breaks down the demand for a target timeslot , across auctions in timeslots .

For each auction state at timeslot , it takes the corresponding energy requirement and uses the 24 limit-prices from the Limit Price Predictor to distribute the required energy. The energy quantity to bid/ask, for each state at timeslot , is given by:

| (25) |

where , is the limit-price for state determined by the Limit Price Predictor. The first case in Equation (25) refers to the situation where energy needs to sold, so the bid quantity is directly proportional to the predicted limit-price of that auction - essentially selling more energy at higher price. On the other hand, the second case occurs when the energy needs to be procured. So, the bid quantity is set to be inversely proportional to the predicted limit-price i.e. buying more energy at cheaper price. Thus, the final bid is of the form .

5.3 Last Cleared Price Predictor (LCPP)

First, one has to note that, in any auction, the LCP is greater than or equal to CP. Mostly, , as , i.e. LCP equal to CP is a probability zero event. In PowerTAC, the LCP is not known to any broker. In essence, one can place better bids if the LCP for each auction is known, as they can bid higher than a predicted LCP to become the last bid, and achieve best response according to Proposition 1. The Last Cleared Price Predictor essentially tries to determine the LCP for bids and asks for all executed auctions. It does so by probing the auctions with a set of dummy orders, which have the minimum tradeable energy as quantity (0.01 MwH), and equally spaced in the range . After execution, the LCP for bids for an auction in state is determined by:

| (26) |

where is the set of bid prices of all dummy bids which got cleared in the state , and is the limit-price for the cleared final bid made in state (taken to be infinity if final bid did not clear or does not exist). Similarly, the LCP for asks is given as:

| (27) |

where is the set of ask prices of all dummy asks which got cleared in the state , and is the limit-price for the cleared final ask made in state (taken to be infinity if final ask did not clear or does not exist). These LCP values are then used to update the clearing probability in Equation (24).

Algorithm 1 summarizes MDPLCPBS, which is executed every timeslot. It takes the energy requirement for the 24 auctions as input. First it collects the market statistics, which includes the LCP estimate and clearing amount from previous timeslots, and the balancing price (line 2). If the number of data points is suitable enough (taken to be 24 in our implementation), it proceeds to solve the MDP and generates a set of prices to bid (line 4). Using these set of prices, and the energy requirements, it generates a set of quantities to bid (line 5). If data points are not enough, the bidding policy given in the PowerTAC sample-broker is used to determine the bid prices (line 7), and the bid quantities are set as the full energy requirements (line 8). Using the determined bid prices and quantities, we place the actual bids (line 10), and a set of dummy bids in the market (line 11). The time complexity of Algorithm 1 comes out to be in the order of the number of past market data points.

6 Experimental Analysis

We first analyze if our proposed bidding strategy, MDPLCPBS, follows the Nash Equilibrium derived above, and then benchmark it against the baseline and competing state-of-the-art strategies.

6.1 Validation Experiments

| Fixed seller’s scale factor and corresponding buyer’s scale factor | Fixed buyer’s scale factor and corresponding seller’s scale factor | |||||||||

| Scaling Factor | 0.948689 (-0.1) | 0.998689 (-0.05) | 1.048689 (Theoretical Value) | 1.098689 (+0.05) | 1.148689 (+0.1) | 0.791386 (-0.1) | 0.841386 (-0.05) | 0.891386 (Theoretical Value) | 0.941386 (+0.05) | 0.991386 (+0.1) |

| Statistic | ||||||||||

| Average | 0.772435 | 0.804782 | 0.838087 | 0.863553 | 0.907389 | 0.989438 | 1.057427 | 1.113121 | 1.226423 | 1.616557 |

| Std. Dev. | 0.033287 | 0.037697 | 0.025127 | 0.020749 | 0.036637 | 0.033287 | 0.037697 | 0.025127 | 0.020749 | 0.036637 |

We take the Power TAC simulator and isolate the wholesale market, and remove all market simulator participants (GenCos, internal buyers) from the market. We test the one buyer one seller (OBOS) scenario by deploying only two agents in the isolated wholesale market - a buyer and a seller. These agents have a fixed energy demand that they need to buy (sell) from the market. In these experiments, we set the energy demand to be the previous slot’s tariff market net demand, which both the buyer and seller are notified about. We draw and , and compute the theoretical scale factors using Equation (9) and Equation (8). We run two batches of experiments, with 30 games in each set of the batch, for 5 sets per batch. During each batch, one of the agents has a fixed scaling based bidding strategy, while the other uses MDPLCPBS.

In the first (second) batch, we draw the seller’s (buyer’s) valuation (), and apply a fixed scale factor within of the theoretical value. The buyer (seller) generates its valuation (), and uses this valuation as the in MDPLCPBS to generate bids.

The experimental average scale factor and standard deviation, for cleared bids, for the buyer and the seller in the two batches of experiments are documented in Table 1. The table demonstrates that in a one buyer and one seller setting, MDPLCPBS approaches the Nash Equilibrium characterized for a single unit OBOS double auction. The values demonstrate that as the fixed scale factor for the seller is increased, the buyer’s scale factor increases slowly. On the contrary, when the fixed scale factor for the buyer is increased, the seller’s scale factor increases rapidly.

6.2 Benchmarks

| % of Market Demand | Statistic | State | ||||

|---|---|---|---|---|---|---|

| 24 | 23 | 22 | 21 | 20 | ||

| 100 | Wt. Avg. Relative Error (%) | 9.35 | 10.4 | 7.59 | 6.66 | 8.34 |

| Std. Dev. of % Error | 13.47 | 26.76 | 21.00 | 21.38 | 44.71 | |

| Avg. Cleared Quantity | 885.76 | 34.87 | 23.08 | 17.17 | 14.36 | |

| 50 | Wt. Avg. Relative Error (%) | 15.18 | 24.03 | 10.28 | 10.96 | 16.36 |

| Std. Dev. of % Error | 20.79 | 46.31 | 33.35 | 32.82 | 53.51 | |

| Avg. Cleared Quantity | 836.82 | 22.19 | 13.54 | 8.89 | 6.92 | |

We isolate the PowerTAC wholesale market from the full PowerTAC simulator while keeping the market simulator participants (GenCos, internal buyers) and weather simulator, and benchmark the performance of MDPLCPBS. The following agents/brokers are used in these benchmarks:

-

•

Zero Intelligence (ZI): The ZI agent Gode and Sunder (1993) uses a randomized bid strategy and ignores the market state. It generates random order prices, ignoring the state of the market. In our experiments, we derive its bids from a uniform distribution with mean and a standard deviation of $10. The mean taken from the limit price predicted by the MDP in TacTex Urieli and Stone (2014). The broker places one bid per auction, and the remaining required energy as the bid quantity. It continues to do the same for all the 24 bidding opportunities, or until the required energy is procured.

-

•

Zero Intelligence Plus (ZIP): The ZIP agent Tesauro and Das (2001) maintains a scalar variable denoting its desired profit margin, and it combines this with a unit’s limit price to compute a bid price . For each failed trade, the price is adjusted by small increments to beat the failed bid price . In our experiments, the initial limit price value is determined from the limit price predicted by the MDP in TacTex. The profit margin is set to of , resulting in the initial bid price to be . If the bid fails, the next bid price is incremented by of . Then, the new bid price is given by .

-

•

TacTex: The TacTex Urieli and Stone (2014) agent uses an MDP based model and dynamic programming to determine limit-prices for bids. The algorithm described in the paper was implemented and used in our experiments.

-

•

MCTS: The MCTS Chowdhury et al. (2018) agent uses a Monte Carlo Tree Search (MCTS) coupled with heuristics on top of the limit price derived from a REPTree based limit price predictor, to determine the optimal bid price. In our experiments, we used the MCTS-dyn-C2 version with 10000 iterations, which is shown to be the best performing variation of the MCTS bidding strategy.

For a timeslot in the future, having 24 bidding opportunities in timeslots , the energy to be procured is set to be same across all the brokers. This energy amount for is determined as some fraction of the net demand in timeslot in the PowerTAC simulation tariff market. Four sets of 10 games each are simulated, with each set having a different fraction of the net demand to be procured. The fraction set is given by .

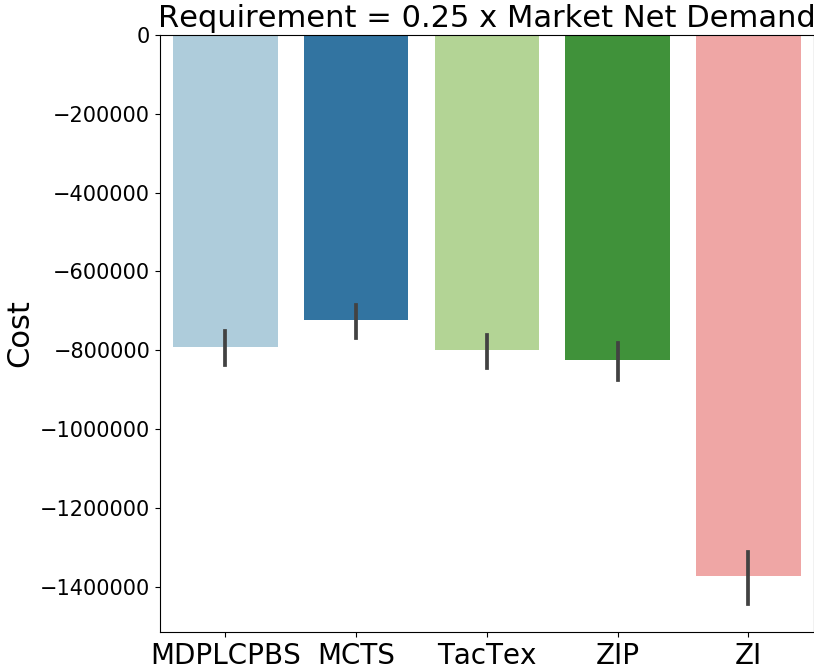

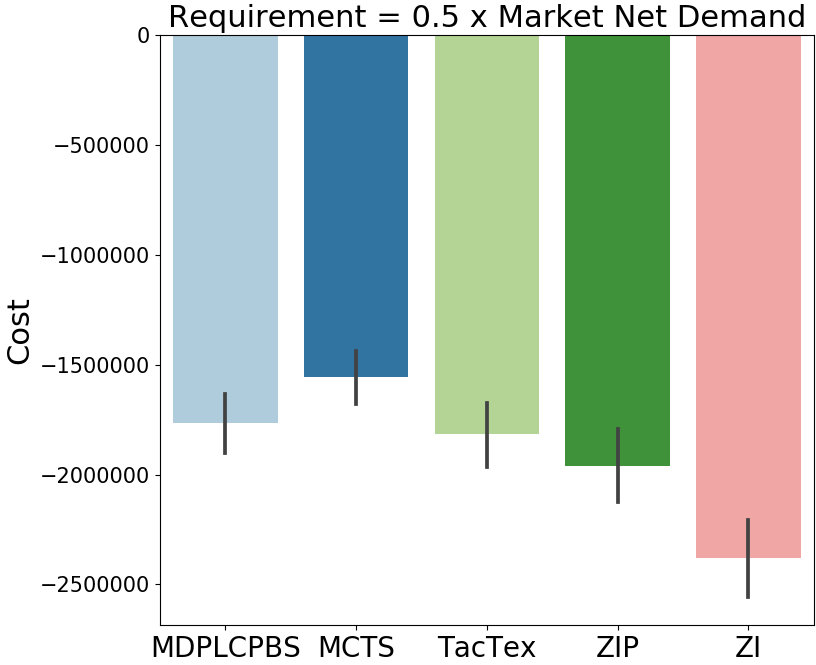

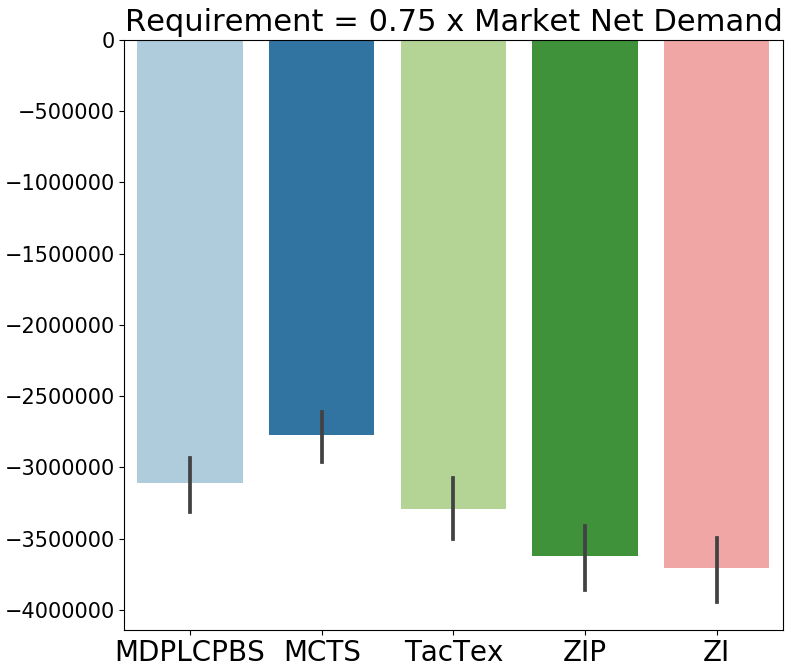

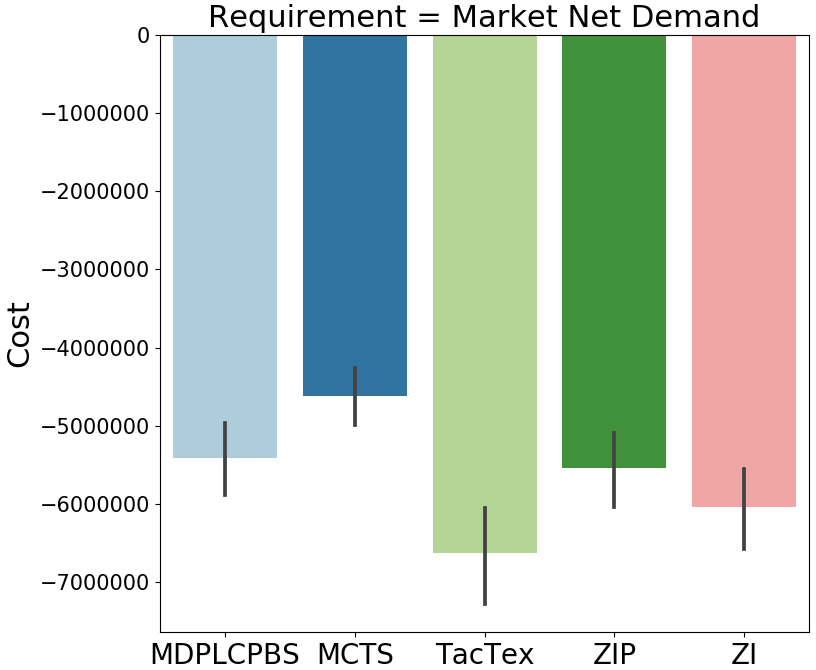

Figure 2 shows the net cost of all the agents across the four sets of games. In each case, MDPLCPBS outperforms ZI, ZIP and TacTex on a consistent basis, while losing out to MCTS. While ZIP may seem to perform reasonably well in some cases, it can be countered easily in strategic settings, like in single-shot single-unit auction setting, whereas MDPLCPBS follows the equilibrium. It is also to be noted that, while MCTS uses tailored heuristics, MDPLCPBS is derived from the game theoretic analysis of single shot double auction (Proposition 1). We leave the game theoretic analysis of MCTS for future work.

Table 2 summarizes the weighted relative error rates (weighed by cleared quantity) in predicting the LCP. 82% of the total cleared energy for a future timeslot is cleared in the first auction itself, with 91% of the total being cleared in the first five. Since the cleared energy of the other states is extremely low, their corresponding predicted LCPs have less impact on the calculation. Thus, we focus on the error rates of the states corresponding to the first five auctions for a target timeslot. We see that MDPLCPBS has a 10% and 15% error rate in the LCP prediction for the first auction of a timeslot (state 24), for 100% and 50% of the market demand as requirement. Moreover, the corresponding weighted average relative error across all states, comes out to be 12% and 18% respectively. The error rates increase as requirement decrease, as there are more low quantity bids by brokers and Miso buyer’s low bids often set the LCP. Thus, MDPLCPBS predicts the LCP with minimal error, during auctions where most of the energy gets traded.

7 Conclusion

In this paper, we first analytically characterized Nash Equilibrium strategies for a single unit double auction with the clearing price and payment rule as ACPR, for OBOS, and TBOS with scale based bidding strategies. We also proposed the best response in a complete information setting in a multi-unit double auction with ACPR. Based on these formulations, we presented MDPLCPBS, a bidding strategy for PDAs. Furthermore, we experimentally validated that MDPLCPBS achieves the Nash Equilibrium derived for single unit double auction with ACPR for OBOS. Finally, we benchmarked MDPLCPBS against the baseline and competing state-of-the-art strategies, and showed that it outperforms most of them consistently. Simultaneously, we showed that it predicts the LCP with minimal error.

References

- Chatterjee and Samuelson (1983) Kalyan Chatterjee and William Samuelson. Bargaining under incomplete information. Operations research, 31(5):835–851, 1983.

- Chowdhury et al. (2017) Moinul Morshed Porag Chowdhury, Russell Y. Folk, Ferdinando Fioretto, Christopher Kiekintveld, and William Yeoh. Investigation of learning strategies for the SPOT broker in Power TAC. In Sofia Ceppi, Esther David, Chen Hajaj, Valentin Robu, and Ioannis A. Vetsikas, editors, Agent-Mediated Electronic Commerce. Designing Trading Strategies and Mechanisms for Electronic Markets, pages 96–111, Cham, 2017. Springer International Publishing.

- Chowdhury et al. (2018) Moinul Morshed Porag Chowdhury, Christopher Kiekintveld, Tran Cao Son, and William Yeoh. Bidding strategy for periodic double auctions using Monte Carlo tree search. In Proceedings of the 17th International Conference on Autonomous Agents and Multiagent Systems, pages 1897–1899. International Foundation for Autonomous Agents and Multiagent Systems, 2018.

- Chowdhury (2016) Moinul Morshed Porag Chowdhury. Predicting prices in the Power TAC wholesale energy market. In AAAI, pages 4204–4205, 2016.

- Ghosh et al. (2019a) Susobhan Ghosh, Kritika Prakash, Sanjay Chandlekar, Easwar Subramanian, Sanjay Bhat, Sujit Gujar, and Praveen Paruchuri. Vidyutvanika: An autonomous broker agent for smart grid environment. Policy, Awareness, Sustainability and Systems (PASS) Workshop, 07 2019.

- Ghosh et al. (2019b) Susobhan Ghosh, Easwar Subramanian, Sanjay P. Bhat, Sujit Gujar, and Praveen Paruchuri. VidyutVanika: A reinforcement learning based broker agent for a power trading competition. Proceedings of the AAAI Conference on Artificial Intelligence, 33:914–921, July 2019.

- Gode and Sunder (1993) Dhananjay K Gode and Shyam Sunder. Allocative efficiency of markets with zero-intelligence traders: Market as a partial substitute for individual rationality. Journal of political economy, 101(1):119–137, 1993.

- Ketter et al. (2017) Wolfgang Ketter, John Collins, and Mathijs Weerdt. The 2018 power trading agent competition, 2017.

- Kuate et al. (2013) Rodrigue Talla Kuate, Minghua He, Maria Chli, and Hai H Wang. An intelligent broker agent for energy trading: an mdp approach. In Twenty-Third International Joint Conference on Artificial Intelligence, 2013.

- Narahari (2014) Yadati Narahari. Game theory and mechanism design, volume 4. World Scientific, 2014.

- Nord Pool AS (2019) Nord Pool AS. Nord Pool key statistics - July 2019. https://www.nordpoolgroup.com/message-center-container/newsroom/exchange-message-list/2019/q3/nord-pool-key-statistics---july-2019/, 2019. [Online; accessed 10-August-2019].

- Özdemir and Unland (2015) Serkan Özdemir and Rainer Unland. Autonomous power trading approaches of a winner broker. In AAMAS Workshop on Agent-Mediated Electronic Commerce and Trading Agents Design and Analysis (AMEC/TADA 2015), pages 143–156. Springer, 2015.

- Parsons et al. (2011) Simon Parsons, Juan A Rodriguez-Aguilar, and Mark Klein. Auctions and bidding: A guide for computer scientists. ACM Computing Surveys (CSUR), 43(2):10, 2011.

- Puterman (1994) Martin L Puterman. Markov decision processes. Wiley and Sons, 1994.

- Rothkopf (1980) Michael H Rothkopf. Equilibrium linear bidding strategies. Operations Research, 28(3-part-i):576–583, 1980.

- Satterthwaite and Williams (1989) Mark A Satterthwaite and Steven R Williams. Bilateral trade with the sealed bid k-double auction: Existence and efficiency. Journal of Economic Theory, 48(1):107–133, 1989.

- Shi et al. (2010) Bing Shi, Enrico Gerding, Perukrishnen Vytelingum, and Nick Jennings. An equilibrium analysis of competing double auction marketplaces using fictitious play. In 19th European Conference on Artificial Intelligence (ECAI) (01/08/10), pages 575–580, August 2010.

- Tesauro and Bredin (2002) Gerald Tesauro and Jonathan L. Bredin. Strategic sequential bidding in auctions using dynamic programming. In Proceedings of the First International Joint Conference on Autonomous Agents and Multiagent Systems: Part 2, AAMAS ’02, pages 591–598, New York, NY, USA, 2002. ACM.

- Tesauro and Das (2001) Gerald Tesauro and Rajarshi Das. High-performance bidding agents for the continuous double auction. In Proceedings of the 3rd ACM conference on Electronic Commerce, pages 206–209. ACM, 2001.

- Urieli and Stone (2014) Daniel Urieli and Peter Stone. TacTex’13: A champion adaptive power trading agent. In Proceedings of the Twenty-Eighth AAAI Conference on Artificial Intelligence, pages 465–471. Association for the Advancement of Artificial Intelligence, 2014.

- Urieli and Stone (2016a) Daniel Urieli and Peter Stone. Autonomous electricity trading using time-of-use tariffs in a competitive market. In Proceedings of the Thirtieth AAAI Conference on Artificial Intelligence (AAAI-16). Association for the Advancement of Artificial Intelligence, 2016.

- Urieli and Stone (2016b) Daniel Urieli and Peter Stone. An MDP-based winning approach to autonomous power trading: formalization and empirical analysis. In Proceedings of the 2016 International Conference on Autonomous Agents & Multiagent Systems, pages 827–835. International Foundation for Autonomous Agents and Multiagent Systems, 2016.

- Vincent (1995) Daniel R Vincent. Bidding off the wall: Why reserve prices may be kept secret. Journal of Economic theory, 65(2):575–584, 1995.

- Wah et al. (2016) Elaine Wah, Dylan Hurd, and Michael P Wellman. Strategic market choice: Frequent call markets vs. continuous double auctions for fast and slow traders. EAI Endorsed Trans. Serious Games, 3(10):e1, 2016.

- Wilson (1992) Robert Wilson. Strategic analysis of auctions. Handbook of game theory with economic applications, 1:227–279, 1992.

- Wurman et al. (1998) Peter R Wurman, William E Walsh, and Michael P Wellman. Flexible double auctions for electronic commerce: Theory and implementation. Decision Support Systems, 24(1):17–27, 1998.