Innovation and Strategic Network Formation

Abstract

We study a model of innovation with a large number of firms that create new technologies by combining several discrete ideas. These ideas are created via private investment and spread between firms. Firms face a choice between secrecy, which protects existing intellectual property, and openness, which facilitates learning from others. Their decisions determine interaction rates between firms, and these interaction rates enter our model as link probabilities in a learning network. Higher interaction rates impose both positive and negative externalities, as there is more learning but also more competition. We show that the equilibrium learning network is at a critical threshold between sparse and dense networks. At equilibrium, the positive externality from interaction dominates: the innovation rate and welfare would be dramatically higher if the network were denser. So there are large returns to increasing interaction rates above the critical threshold. Nevertheless, several natural types of interventions fail to move the equilibrium away from criticality. One effective policy solution is to introduce informational intermediaries, such as public innovators who do not have incentives to be secretive. These intermediaries can facilitate a high-innovation equilibrium by transmitting ideas from one private firm to another.

1 Introduction

A growing body of empirical research suggests that interactions between inventors are an important part of innovation.111The benefits from interactions between inventors and movement of inventors have been quantified empirically by Akcigit, Caicedo, Miguelez, Stantcheva, and Sterzi (2018), Kerr (2008), Samila and Sorenson (2011), among others. New technologies are often produced by combining individual insights with learning from peers, which confers large benefits on firms and inventors engaged in such learning. When highly-connected clusters of firms emerge in a location, as in the technology industry in Silicon Valley, inventors in these areas are much more productive.

But frequent collaboration and learning are not assured even when inventors in a given industry co-locate (Saxenian, 1996 gives a well-known example). Rather, interaction patterns depend on firms’ decisions, such as how much to encourage their employees to interact with employees from other firms. These interactions let a firm learn from other companies and inventors. There are also downsides for the firm, as employees may share valuable information. A more secretive approach allows firms to prevent potential competition by protecting intellectual property. In making these types of decisions, firms and inventors must choose between openness and secrecy.

We develop a theory of firms’ endogenous decisions about how much to interact with other firms, and the consequences for information flows and the rate of innovation. Firms’ choices determine the probabilities of links in a learning network; we thus contribute to a theoretical literature on network formation.222An important feature of these choices is that firms combine different ideas to create new technologies (see also Acemoglu and Azar, 2020 and Chen, Elliott, and Koh, 2021 for related combinatorial production functions). Strategic complementaries play a crucial role in many network games (e.g., Bramoullé, Kranton, and D’amours, 2014 and Ballester, Calvó-Armengol, and Zenou, 2006), and in our setting complementarities arise endogenously from this process of combining ideas. We show that at equilibrium, the learning network has a special structure that would be unlikely to arise exogenously: it is at a critical threshold between sparse and dense networks. This implies extreme inefficiencies arise at equilibrium, and we analyze the welfare and policy implications.

We study a framework where each firm chooses two intensities: how open to be as well as how much to invest in R&D. The choices of levels of openness determine interaction rates between firms, and the probability that one firm learns from another is equal to the interaction rate between the two firms. If a given firm is more open, that firm is more likely to learn ideas from other firms—but other firms are more likely to learn its ideas. These ideas are valuable because they can be combined to make new technologies, which are finite sets of ideas (as in Weitzman, 1998). Firms can generate profits by producing technologies, but the profits from a technology are erased by competition if another firm also knows the component ideas in that technology.

Our first contribution, which is methodological, is to develop a theory of endogenous formation of random networks in the context of our economic application. Learning opportunities are random events, and their realizations determine a learning network. We therefore consider link formation decisions with uncertainty in the matching process, while the leading approach in the literature on network-formation games focuses on deterministic models that allow agents to choose particular links (Jackson and Wolinsky, 1996 and Bala and Goyal, 2000). Since we take actions to be continuous choices that translate to interaction rates, optimal behavior satisfies first-order conditions rather than a high-dimensional system of combinatorial inequalities.

A key feature of our model is that ideas can spread several steps through this network: when one firm learns from another, the information transferred can include ideas learned from a third firm. We refer to this as indirect learning.333By contrast, existing work on strategic formation of random networks largely focuses on direct connections (see, e.g., Currarini, Jackson, and Pin, 2009). Under indirect learning, firms’ incentives depend on the global structure of the network. Each firm would like to learn many ideas, since then the firm could combine these ideas to produce a large number of new technologies, and much of this learning can be indirect.

Analyzing the global structure of the network leads to our second contribution, which is to establish the criticality of equilibrium. When there are many firms, learning outcomes depend dramatically on whether the learning network is sparsely connected or densely connected. If firms’ interaction rates are below a critical threshold, the learning network consists of many small clusters of firms who learn few ideas. Above the threshold, the learning network has a giant component asymptotically: a large group of firms who learn a large number of ideas and can incorporate these ideas into many new technologies. To determine where equilibrium lies with respect to this threshold, we analyze an individual firm’s decision problem in each of these two domains, i.e. when other firms form a sparse or dense network.

The main result is that the equilibrium interaction rates are at the critical threshold between sparse and dense networks. Firms would deviate to interact more if the network were likely to be sparse, and deviate to interact less if the network were likely to be dense. Intuitively, in sparse networks firms would increase interaction rates to fill central positions in the network, known in sociology as ‘structural holes’, which enable the firm to combine ideas learned via different interactions.444The concept of structural holes, introduced by Burt (1992), refers to network positions allowing agents to combine information from different connections or spread information between groups. As others interact more, these structural holes disappear, and indeed firms tend to learn the same ideas repeatedly from different interactions. So the incentives to be more open are weaker relative to the incentives to be secretive.

We next consider the implications of the main result for welfare and policy. Since equilibrium is at the critical threshold, a giant component would emerge if all firms shifted interaction rates slightly above equilibrium levels. Firms learn relatively few ideas at the threshold, but could learn many more with a bit more interaction. More learning has benefits but also leads to more competition, which may discourage private investment. We show there are still unboundedly large improvements in innovation and welfare (as the number of firms grows large) from interventions that increase interaction rates above equilibrium levels. A consequence is that increasing interaction rates is a first-order concern in designing policy. By contrast, policies targeting decisions about private investment rather than interaction, such as subsidies to R&D, have minimal effect at equilibrium—but can be valuable if paired with interventions to increase openness.

Intervening to improve equilibrium learning networks is difficult, and policies such as broadly subsidizing interaction will be undermined by firms’ equilibrium responses. We discuss one type of policy change that does induce more productive interaction patterns, which is to introduce public innovators who do not have incentives to be secretive. For example, governments could fund academic researchers who are especially willing to interact with other researchers, including those in industry. The key is that public innovators can serve as informational intermediaries, transmitting ideas between private firms. They play a valuable role even after considering the equilibrium response of the profit-maximizing firms, who may adjust to be more secretive.

We next explore which features of the baseline model are needed to obtain a critical equilibrium. One assumption is that learning probabilities are symmetric across pairs of firms. We show that equilibrium remains critical even when firms have different propensities to learn from others, which allows some firms to be better at protecting ideas than others. The key feature driving the main result is that there is a margin along which firms can acquire incoming links at the cost of a higher probability of outgoing links.

The criticality of equilibrium is robust to alternate specifications of the benefits from learning from others but more sensitive to the costs of outgoing links. The baseline model assumes firms’ profits are additive across technologies, but equilibrium remains critical if there are increasing or slightly decreasing returns to producing many technologies. Indeed, the crucial property is that payoffs are convex in the number of ideas learned by a firm. Equilibrium outcomes do depend, however, on how much firms stand to lose from outgoing links. In particular, the results described above assume zero profits in competitive markets. If profits under competition are instead positive (e.g., because of a first-mover advantage or markets with collusion between firms), then incentives toward secrecy will be weaker and so equilibria will be above the critical threshold. These results give testable predictions about the relationship between market structure and outcomes such as the innovation rate.

Our final results ask how formal intellectual property rights change the incentives to interact. Consider the consequences of granting patents to a positive fraction of ideas, e.g., allowing hardware but not software ideas to be patented. Patents mitigate firms’ incentives to be secretive, but can also discourage exchange of ideas. Firms with patents are more open but are also less desirable partners in interactions (at least when ideas are only transmitted directly). The resulting adverse selection in interaction can deter firms from collaborating with others. We show that patent rights can therefore prevent any productive interactions at equilibrium. If indirect learning is important, firms with patents will be informational intermediaries, like the public innovators above. In this case there are benefits to allowing patents, but it turns out that the optimal policy is often to only allow patents for a very small fraction of ideas.

At a technical level, this paper develops tools for studying incentives in random network settings. These tools are most applicable to analyzing decisions in network models with complementarities between indirect connections. Classical results in graph theory characterize the component structure of large random networks, and thus in our context the number of ideas firms will learn (Karp, 1990 and Łuczak, 1990). But due to the complementarities between ideas, firms’ incentives also depend on how these ideas are learned, e.g., via many interactions or a few interactions. To capture these complementarities, we prove a key lemma relating a firm’s equilibrium action to the extent to which technologies combine ideas from distinct interactions. An additional challenge is that to understand incentives, it is not enough to analyze “leading terms”. Vanishing-probability events and lower-order terms in link probabilities could substantially affect payoffs. Our analysis therefore requires careful treatment of the graph branching process governing the number of ideas learned from each interaction.

1.1 Related Literature

This paper relates to research in network theory, especially network formation, and to models of innovation.

At a methodological level, we develop a theory of strategic network formation with probabilistic links. A large literature since Jackson and Wolinsky (1996) and Bala and Goyal (2000) considers endogenous network formation assuming that agents can choose their links exactly.555The pairwise stability solution concept from Jackson and Wolinsky (1996) and variants have been applied to network formation in many settings, including innovation (Goyal and Moraga-Gonzalez, 2001, König, Battiston, Napoletano, and Schweitzer, 2011). Because equilibrium is then characterized by a large system of inequalities, these models illustrate key externalities in special cases but remain largely or entirely intractable in many others. By instead considering agents making a single choice about openness under uncertainty, we obtain a smooth model of link formation that can be solved via basic optimization techniques combined with analyses of random graphs.

Under this random-network model of network formation, incentives to form links depend on the ‘phase transitions’ between sparse and dense networks.666Golub and Livne (2010) also study network formation with phase transitions, and allow payoffs to depend on distance one and two connections. An important feature of our model is that firms’ decisions depend on the global network structure rather than only local connections. Economic models involving phase transitions have been recently explored in the context of diffusion processes by Campbell (2013), Akbarpour, Malladi, and Saberi (2018), and Sadler (2020). These models let adoption and/or seeding decisions depend on component structure in an underlying network. We instead study equilibria of a game in which agents endogenously make decisions about how much to interact with others, and find there is a subtle interplay between strategic incentives and the global network structure.

An alternate approach to smooth network formation is to consider weighted networks, so that each link has an intensity (as in Cabrales, Calvó-Armengol, and Zenou, 2011, Baumann, 2021, and Griffith, 2019).777Relatedly, Erol and García-Jimeno (2020) consider a continuum model where agents endogenously and randomly form links with a positive fraction of peers. In some settings with unweighted links, this approach yields a deterministic approximation of a game on the underlying random network. But for discrete processes such as the diffusion of an idea, the random and deterministic models can be very different. Indeed, we show that there is a critical threshold corresponding to important discontinuities in network structure and outcomes that do not arise in deterministic models such as Cabrales, Calvó-Armengol, and Zenou (2011).888Berliant and Fujita (2008) study a related deterministic model of knowledge creation with individuals choosing to producing knowledge alone or with a partner. Their analysis focuses on interaction patterns in small disconnected groups, while we find social networks can be more connected in important ways.

In existing literature on innovation, approaches incorporating interactions between firms generally model these interactions as either mechanical spillovers or learning via imitation. A common approach is to choose a convenient functional form for spillovers, usually motivated by tractability within a macroeconomic (e.g., Kortum, 1997) or network-theory (König, Battiston, Napoletano, and Schweitzer, 2012) framework.999In simulations, Baum, Cowan, and Jonard (2010) study the formation of innovation networks via a mechanical process. By microfounding these spillovers, which arise endogenously within the innovative process, we can study how spillovers respond to policy interventions.

In a different approach, which relies on a quality-ladders framework, interactions give firms a chance to catch up as innovation proceeds vertically through improvements in the quality of existing technologies (e.g., Perla and Tonetti, 2014, Akcigit, Caicedo, Miguelez, Stantcheva, and Sterzi, 2018, and König, Lorenz, and Zilibotti, 2016). We instead explicitly model innovation horizontally as a process of combining distinct ideas, which serve as building blocks for new technologies. Related models appear in Weitzman (1998) and Acemoglu and Azar (2020), which focus on the evolution of the total amount of innovation over time and do not involve learning or informational spillovers between firms. We find that when new technologies can be created in this way, changes in interaction patterns can have much larger consequences for the rate of innovation than in quality-ladders models.101010By assuming a continuum of firms, macroeconomic models of imitation often implicitly restrict to network structures without a giant component.

2 Model

We first describe our model formally and provide an example. We will then discuss interpretations of the model and its assumptions.

2.1 Basic Setup

The model includes two key concepts: ideas and technologies. Ideas are the components in technologies, and each technology combines several ideas. Firms will obtain profits from selling new technologies, and must acquire ideas to produce these technologies.

There are firms . Each firm can potentially discover a distinct idea, also denoted by . We assume each firm can discover a single idea for simplicity, and Appendix D allows firms to potentially discover multiple ideas. We let be the set of ideas that are discovered.

Each firm chooses a probability of discovering this idea and pays investment cost . We will assume that is continuously differentiable, increasing, and convex with and . The realizations of discoveries are independent.

A technology is a set of ideas , where is an exogenous parameter capturing the complexity of technologies.111111In the baseline model, the parameter is the same for all firms. Each idea must be discovered by the corresponding firm to be included in a technology. There are therefore potential technologies, and a firm can produce more than one technology. An equivalent interpretation, which we describe in Section 2.4, is that firms can explore many potential technologies and only a small fraction are feasible to bring to market.

Each firm chooses a level of openness . Given choices and , the interaction rate between and is . We will assume the multiplicative interaction rate

except when a more general interaction rate is explicitly stated (in Theorem 1′). The interaction rate determines the probability that firm learns from firm and vice versa, as described below.

The timing of the model is simultaneous: firms choose actions and and then all learning occurs. We denote the vectors of actions by . When actions are symmetric, we will refer to by and by .

Given actions and , we denote the set of ideas that firm learns from others by . This is a random set depending on realizations of learning and discoveries. We now describe how learning occurs.

With probability firm learns directly from firm . In this case, firm learns idea if . If firm learns directly from firm , then with probability , firm also learns indirectly through firm . In this case, firm also learns all ideas in . All realizations of direct and indirect learning are independent, and in particular, firm can learn from firm without learning from .

When there is only direct learning, while when indirect learning can also occur. When we define a directed network, which we call the indirect-learning network, with nodes and a link from node to node if firm learns indirectly through firm .

A firm receives payoff from each proprietary technology . A technology is proprietary for firm if (1) and (2) is the unique firm such that for all . In words, the technology contains firm ’s idea and firm is the unique firm that knows all ideas in the technology, so firm has a monopoly over the technology.

If is not a proprietary technology for firm , then firm receives payoff from the technology . In Section 5, we will consider more general payoff structures in which (1) payoffs are not additive across technologies and (2) firms can receive non-zero payoffs if other firms know all ideas contained in a technology.

2.2 Payoffs

Given actions and a firm , we define to be the set of technologies such that (1) and (2) firm knows all ideas . The proprietary technologies for are then the subset of technologies such that no other firm knows all ideas in . Note that these sets are random objects depending on link realizations. The expected payoff to firm is

To further illustrate payoffs, we write the cardinality of explicitly when . Recall that is the set of ideas learned by firm given actions . Like , this is also a random object.

When , the expected payoffs to firm are

A technology that profits from consists of ’s private idea, which is developed with probability , and a choice of other ideas known to . The firm faces competition if and only if some firm learns all of ’s ideas, and the probability that this does not occur is . Finally, the private investment cost is .

In general, a firm can face competition for a technology in two ways. First, a firm can learn all of firm ’s ideas via indirect learning. Second, a firm can learn ’s private idea directly and then the other ideas in the technology from links with firms other than . The probability of the second possibility is more difficult to express in closed form, and in general depends on the technology . We will show that when there is not too much interaction, most competition comes via the first channel.

2.3 Example

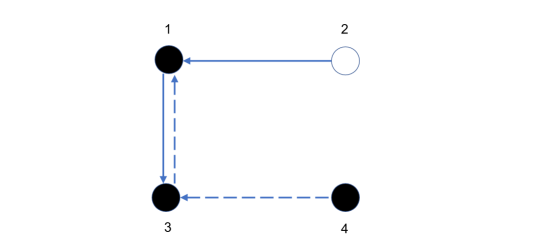

To illustrate the mechanics of the model, we describe a simple example with firms and complexity . Suppose that firms choose some actions . As an example, we consider the particular realizations such that (1) ideas are discovered by firms in and (2) firm learns indirectly through firm and directly from firm , firm 3 learns indirectly through firm , and firm learns directly from firm 4.

The network and ideas are shown in Figure 1. Black circles correspond to firms with ideas , i.e., firms that discover ideas, while white circles correspond to firms with ideas , i.e., firms that do not discover ideas. Solid arrows denote indirect learning links, while dashed arrows indicate only direct learning occurred.

Since , the unique technology consisting of ideas in is . The realizations of the sets of ideas learned from others are

Because firm is the unique firm such that and we have , firm produces the technology and receives monopoly profit of for that technology. There are no profits from any other technologies.

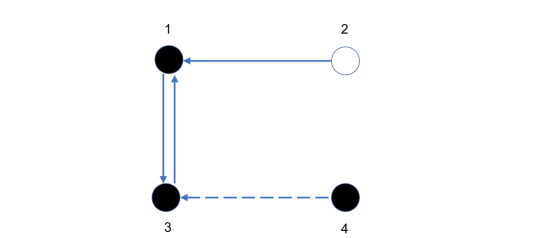

Suppose instead that firm also learns indirectly through firm , as shown in Figure 2. Then we have

The only potential technology remains . We now have for both firm and firm , so both receive the competitive profit of zero for that technology. There are also no profits from other technologies.

2.4 Interpretation and Discussion

Before expressing expected payoffs of firms and defining equilibrium, we discuss interpretation and assumptions in the model.

Actions: Firm actions are choices . The first component corresponds to a level of investment in R&D. A small probability of a discovery is cheap, while probabilities close to one are very expensive.

The second component corresponds to a level of openness or secrecy in interactions with other firms. As one example, consider a technology company’s decision about whether to locate in an area with many other technology firms. Locating near other firms will lead to more casual interactions between the employees of the firm making the choice and employees of other firms (e.g., at bars and restaurants), and information can be shared in either direction in these interactions.121212A large body of work describes the role of geographical proximity in driving innovation (e.g., Storper and Venables, 2004). Kelly (2009) considers the impact of geography on information-sharing and describes a phase transition in exogenously determined networks; our approach differs in that we model firm decisions including factors such as location as an endogenous choice. In addition to a firm’s choice of location, the action could include decisions such as whether to send employees to conferences and how much disclose ongoing R&D to employees.

An important feature of the model is that increasing increases the probability that firm learns from other firms but also increases the probability that other firms learn from .131313Stein (2008) gives a microfoundation for bilateral communication in the context of innovation. The baseline model assumes that learning probabilities are symmetric: firm learns from firm with the same probability that firm learns from firm . In Section 4, we allow firms to have heterogeneous propensities to learn across firms and find this symmetric structure does not drive results.

The downside to interaction for a firm is the increased probability of outgoing links, not an exogenous link-formation cost. Because the costs of links are an endogenous feature of the model, our equilibrium characterization does not depend on functional forms of costs, as it would with exogenous link costs separate from the innovation process.141414Acemoglu, Makhdoumi, Malekian, and Ozdaglar (2017) consider a similar link cost in a setting where the benefits depend only on direct connections and the network-formation game is deterministic. Outgoing links are undesirable in their model because of a primitive preference for privacy.

Formal and Informal Interactions: The model is meant to primarily describe informal interactions between employees or firms, rather than more formal arrangements such as licensing agreements or joint R&D ventures. As such, our results are most applicable to industries where formal property rights are imperfectly enforced (Section 6 discusses the interplay between informal interactions and more formal property rights). Because information transmitted via informal interactions can often spread several steps, an analysis considering global network structure is particularly relevant.

In Appendix D, we compare the payoffs to firms with different numbers of private ideas. This analysis can also be interpreted as measuring the value of formal contracting arrangements allowing multiple firms to share ideas frictionlessly. We find that as the number of firms grows large, the benefits to such an arrangement are a vanishing fraction of a firm’s expected profits.

Interaction Rate: The multiplicative interaction rate has the feature that firm ’s probability of learning from another firm and that firm’s probability of learning from are both proportional to . Thus, this is the (unique up to rescaling) interaction rate that arises from a random matching process in which all agents choose a search intensity and the probability of learning in each direction is proportional to that intensity.

We will show in Section 3 that under a symmetry assumption, the main result does not reply on the multiplicative functional form, and extends to any satisfying several mild properties.

Learning Network: A useful assumption is that if firm learns indirectly through firm , then firm learns all ideas known to . This ensures that there is a well-defined learning network, and this network is a central object in our analysis. If indirect learning were not perfectly correlated across ideas, there would be a separate learning network for each idea.

Firm Profits: The positive payoffs from producing proprietary technologies correspond to monopoly payoffs, which we normalize to . Formally, all technologies give the same monopoly profits and these profits are deterministic. It would be equivalent to take monopoly profits to be randomly drawn from any distribution with finite mean, as long as firms have no information about the realizations a priori. For example, only a small constant fraction of technologies could actually be profitable enough to produce.

If multiple firms know all ideas contained in , then there is a competitive market and firms receive zero profits. This baseline payoff structure, which we generalize in Section 5.2, corresponds to Bertrand competition.

Our setup requires that monopolist firms must have privately developed one of the ideas in a technology to produce that technology, but competitors need not. To start a new market, some expertise and/or confidence in the quality of the relevant idea is needed. Once a market exists, however, entrants do not require this expertise, perhaps because relevant details can be obtained from the competitor’s technology.

3 Equilibrium

In this section, we define and then characterize equilibrium in our model. The characterization first briefly describes investment equilibria under direct learning (). The remainder of the section shows that equilibria are at a critical threshold under indirect learning () and discusses implications for innovation and policy.

Two assumptions that simplify the initial analysis are that firms are homogeneous (which we will relax in several ways, including Section 4) and that profits are equal to the number of proprietary technologies (which we relax in Section 5).

3.1 Solution Concept

We begin by defining our solution concept:

Definition 1.

An equilibrium is a pure-strategy Nash equilibrium. An equilibrium is an investment equilibrium if for all .

Because all choices and are probabilities of discoveries or interactions, we restrict to pure strategies.

If for all , then any will give an equilibrium: if no other firms are investing, there is no reason to invest and so payoffs are zero. It is easy to see these trivial equilibria always exist, and we will focus on investment equilibria.

For some of our results, it will also be useful to make the stronger assumption that private investment is non-vanishing asymptotically. We consider a sequence of equilibria as the number of firms .

Definition 2.

A sequence of equilibria has non-vanishing investment if

Depending on , there may be equilibria at which all firms choose very low levels of private investment because others are investing very little. The definition excludes these partial coordination failures as well.

3.2 Direct Learning

We briefly summarize results with here, and give a full analysis in Appendix C. In this case, ideas can spread at most one step.

There exists a symmetric investment equilibrium for large, and at any sequence of symmetric investment equilibria the interaction rate is

Since the interaction rate is of order , the probability that a generic firm knows all the ideas in a given technology is of order . It follows that the probability that there exists competition on a given technology is constant.

For large, each firm learns from a large number of other firms with high probability. We will see that interaction rates are much lower in the indirect-learning case. With only direct learning much more interaction is needed to generate a substantial risk of competition, so the interaction rate must be higher for potential competition to meaningfully deter openness.

3.3 Main Result

Our main focus is the indirect learning case () in which ideas can spread multiple steps. We now show that when , equilibrium networks are at the critical threshold asymptotically.

We begin by defining this critical threshold. Let the number of firms and consider outcomes under a sequence of symmetric actions. We say that an event occurs a.a.s. (asymptotically almost surely) if the probability of this event converges to as . To simplify notation, we often omit the index (e.g., from the actions .)

Definition 3.

A sequence of symmetric actions with openness is:

-

•

Subcritical if

-

•

Critical if

-

•

Supercritical if

The expected number of firms with links to in the indirect-learning network is

so the three cases distinguish networks where each firm learns indirectly less than once, approximately once, and more than once in expectation. In the subcritical case, it follows that the expected number of firms that learn a given idea is a finite constant. In the supercritical case, there is a positive probability that a given idea is learned by a large number of firms (i.e., a number growing linearly in ).

This intuition is formalized by results from the theory of random directed graphs (Karp, 1990 and Łuczak, 1990). Adapting their results to this setting, we have the following result. A component of a directed network is a strongly-connected component, i.e., a maximal set of nodes such that there is a path from any node in the set to any other.

Lemma 1 (Theorem 1 of Łuczak (1990)).

Suppose is symmetric.

(i) If the indirect-learning network is subcritical, then a.a.s. every component has size .

(ii) If the indirect-learning network is supercritical, then a.a.s. there is a unique component of size at least for a constant depending on , and all other components have size .

These asymptotic results each imply that large finite graphs have the component structures described with high probability. It follows from the lemma that in a subcritical sequence of equilibria, all firms learn at most ideas a.a.s. In a supercritical sequence of equilibria, there is a positive fraction of firms learning a constant fraction of all ideas a.a.s. At a critical equilibrium, the number of ideas learned lies between the subcritical and supercritical cases.

To discuss asymmetric strategies and later heterogeneity in firms, we now generalize the notion of criticality to arbitrary strategies. Consider the matrix . The entry is equal to the probability that firm learns indirectly from firm . Let be the spectral radius of this matrix, i.e., the largest eigenvalue.

Definition 4.

A sequence of actions with openness is:

-

•

Subcritical if

-

•

Critical if

-

•

Supercritical if

We will see that, as in Lemma 1, the critical threshold corresponds to the emergence of a giant component. To show this, we will combine the results of Bloznelis, Götze, and Jaworski (2012) with analysis of multi-type branching processes.

Our existence result establishes that there are equilibria with non-zero investment and communication. Our characterization result shows that asymptotically, equilibrium is on the threshold between sparse and dense networks:

Theorem 1.

For sufficiently large, there exists a symmetric investment equilibrium. Any sequence of investment equilibria is critical.

Theorem 1 makes a sharp prediction about equilibrium. The theorem assumes symmetric firms and payoffs that are linear in the number of monopoly technologies produced by a firm. We will show that equilibrium remains critical with heterogeneity in firms (Section 4) and non-linear payoffs (Section 5.1), but does depend on the structure of competition (Section 5.2).

At a sequence of symmetric investment equilibria, the theorem implies that and in particular symmetric investment equilibria are asymptotically unique. While it is easy to see there must exist a symmetric equilibrium, a priori there need not be an equilibrium with non-zero interaction and investment. In fact, we show that there exists a sequence of symmetric equilibria with non-vanishing investment. The existence result relies on analysis of firms’ best responses in each region to show a fixed point theorem applies.

We are able to drop the assumption of symmetric strategies, which is standard in settings involving random networks (e.g., Currarini, Jackson, and Pin, 2009, Golub and Livne, 2010, and Sadler, 2020), and show any equilibrium is at the critical threshold. Asymmetric equilibria could feature firms with above and below .

The proof of Theorem 1 builds on existing mathematical results on large random graphs, and generalizes them to allow complementarities between ideas and endogenous link probabilities. The first obstacle to applying existing results is that the combinatorial structure of technologies generates complementarities between ideas, so payoffs and incentives do not simply depend on the expected number of ideas learned. A second issue is that link probabilities are endogenous, so lower-order terms in link probabilities and vanishing-probability events can matter asymptotically. We now discuss the key ideas in the proof, including how we address these challenges.

Proof Intuition.

We describe the basic idea of the proof in the case , and the general argument is similar. We also begin by discussing symmetric strategies.

The first-order condition for the action says that at any best response, the expected cost to firm of allowing a firm to learn from is equal to the expected benefit from learning from an additional firm . A key feature is that the cost and benefit both depend on the distribution of the number of ideas learned from a given link. The proof exploits this symmetry between costs and benefits to solve for . We are able to do so because of the endogenous downside to outgoing links, which depends on the number of ideas that firm learns.

We use the first-order condition at a symmetric equilibrium to obtain an expression for in terms of the number of incoming links used to learn the ideas in an average proprietary technology. Consider a technology such that produces and gets monopoly profits. This technology is a combination of ideas learned from different links. For example, if , an example technology could consist of ’s private idea, two ideas learned indirectly from firm , and one idea learned directly from firm . In this example, the technology would combine ideas from three different links.

More generally behavior will depend on the number of links utilized in learning the ideas in a technology . We refer to this number of links as , so that in the example in the previous paragraph. The key tool, which we state in the subcritical region, is:

Lemma 2.

Along any sequence of symmetric investment equilibria with ,

for all .151515The distribution over technologies is defined in Appendix A.

Lemma 2 says that the expected number of other firms from whom learns is equal to the expected value of for a random proprietary technology . We give a brief intuition for the lemma. If is higher, then there are stronger complementarities between links, because produced technologies combine ideas from more links. In this case, if a firm has a few existing links, an additional link will be more valuable than an existing link due to these complementarities. Since additional links are relatively more valuable, firms are willing to interact more.

Since is always at least one, Lemma 2 implies that so there cannot be a subcritical equilibrium.

In the supercritical region, almost all proprietary technologies are created by combining a private idea with ideas learned from observing the giant component. In particular, payoffs are determined up to lower order terms by whether firm has a link that provides a connection to the giant component. Given such a link, additional links add little value. Thus there are not complementarities between links; indeed, links are substitutes due to the potential redundancies.

But because firms have more to lose from an outgoing link in the supercritical region, complementarities between links are needed to sustain high interaction rates. Since these complementarities are not present, there is not a supercritical equilibrium either. We check this intuition formally by a computation.

Extending results to asymmetric equilibria presents several additional technical obstacles. One is that existing mathematical results, e.g., Bloznelis, Götze, and Jaworski (2012), prove the component structure has certain properties asymptotically almost surely. But this does not remove the possibility that vanishing-probability events distort incentives in an unknown direction. To rule this out, we show that an arbitrary subcritical sequence of equilibria, the asymptotic probability that firm learns ideas decays exponentially in . The proof bounds above with the number of nodes in a multi-type Poisson branching process and then analyzes this branching process. ∎

The analysis of the symmetric equilibria extends to more general interaction rates. The proof of Theorem 1 also shows:

Theorem 1′.

Suppose the interaction rate is a strictly increasing and continuously differentiable function satisfying for all and and for all .161616The same result holds, with minor modifications to the proof, for the additive interaction rate . We assume to avoid a technicality: for the additive interaction rate, the first-order condition for may not have a solution if other firms choose sufficiently large . Then for sufficiently large, there exists a symmetric investment equilibrium. Any sequence of symmetric investment equilibria is critical.

3.4 Discovery Rate and Policy Implications

We next discuss consequences of Theorem 1 for innovation and welfare. There are large gains to exogenously increasing interaction, but designing policies to realize these gains is subtle.

We first define a measure of the innovation rate, which is the fraction of possible technologies that are produced. Recall that is the set of technologies known to firm , so the set of potential technologies that are produced is the union This union is a subset of the possible technologies.

Definition 5.

Given actions , the discovery rate

is the expected fraction of potential technologies that are produced.

Given any subcritical or critical sequence of actions, each firm learns ideas asymptotically almost surely, so the discovery rate converges to zero. Along any sequence of supercritical actions, there are a positive fraction of firms learning some fraction of ideas, so the discovery rate is non-vanishing.

Theorem 1 therefore lets us characterize the discovery rate at and near equilibrium:

Corollary 1.

Let be a sequence of equilibria with non-vanishing investment. Then the discovery rate vanishes along this sequence: . For any , the discovery rate with openness is non-vanishing: .

The discovery rate is vanishing under equilibrium interaction patterns, but would be non-vanishing with slightly more interaction. An immediate consequence is that increasing openness by any multiplicative factor has a very large effect on payoffs asymptotically:

Corollary 1 relates to Saxenian (1996)’s study of the Route 128 and Silicon Valley technology industries, which found that Silicon Valley had much more open firms and grew faster. In the terminology of our model, Route 128’s secrecy corresponds to equilibrium behavior. But institutional features of Silicon Valley (including non-enforcement of non-compete clauses and common ownership of firms by venture capital firms) may have constrained firms’ actions to prevent high levels of secrecy (subcritical or critical choices of ). Such constraints would imply a much higher innovation rate.

A natural question is whether these gains can be realized via policy interventions other than directly restricting firms’ strategy spaces. One common policy approach is to subsidize private research and development. We find that increasing R&D spending has relatively little effect on its own, but can be effective given a collaborative culture:

Corollary 2.

Let be a sequence of equilibria with non-vanishing investment. Then the derivative of the equilibrium discovery rate in private investment vanishes along this sequence: . For any , the derivative of the discovery rate with openness in private investment is non-vanishing: .

Under equilibrium interaction patterns, a higher level of R&D does not increase the discovery rate. But if openness is already above equilibrium levels, then increasing R&D will have a much larger impact on the number of ideas discovered.

To summarize the implications of Corollaries 1 and 2, at or near equilibrium outcomes, there are large gains to policies (e.g., non-enforcement of non-compete clauses, establishing innovation clusters) that encourage or require more interaction between firms and thus shift outcomes to the supercritical region. Policies to increase private investment (e.g., subsidies for R&D), however, will not shift outcomes to the supercritical region, and thus have much smaller benefits at equilibrium. But once outcomes are in the supercritical region, policies to increase private investment will have large benefits.

| Subcritical | Critical | Supercritical | |

|---|---|---|---|

| Best Response | High | Intermediate | Low |

| Discovery Rate | Vanishing | Vanishing | Non-vanishing |

| Increasing | Large Benefit | Large Benefit | Ambiguous |

| Increasing | Small Benefit | Intermediate | Large Benefit |

3.5 Public Innovators

Corollary 1 showed there are large gains to increasing interaction rates above equilibrium levels. This section shows that these gains can be realized via targeted interventions that change interaction patterns.

We now show that introducing public innovators who are not concerned with secrecy leads to learning and innovation at the same rate as in the supercritical region. In particular, there exists a giant component of the learning network containing these public innovators. Public innovators could correspond to academics, government researchers, open-source software developers, or other researchers with incentives or motivations other than profiting from producing and selling technologies.

A public innovator pays investment cost and receives a payoff of one for each technology such that: (1) and (2) for all . We will rely on the fact that for public innovators there is no downside to interactions, but not on the exact incentive structure.

All firms have the same incentives as in the baseline model, and public innovators and firms interact as in the baseline model. We now call an equilibrium symmetric if all public innovators choose the same action and the same holds for all private firms.

Proposition 1.

Suppose a non-vanishing share of agents are public innovators. Then there exists a sequence of symmetric equilibria with non-vanishing investment, and at any sequence of equilibria with non-vanishing investment the discovery rate is non-vanishing: .

The proposition says that at equilibrium, a positive fraction of possible technologies are discovered. The ratio between the equilibrium discovery rates with and without public innovators grows unboundedly large as . The proof shows that a giant component forms around the public innovators. This holds for any positive share of public innovators, and indeed could be extended to a slowly vanishing share of public innovators.

Proposition 1 assumes that firms cannot direct interactions toward public innovators or private firms. In Appendix E, we show the same result holds when interactions can be directed toward public innovators or private firms. Because public innovators are more likely to be in the giant component, private firms are willing to interact with them.

Public innovators are valuable primarily as informational intermediaries rather than for their private ideas. Because public innovators do not face costs to interaction, they will choose at equilibrium. Therefore, public innovators can learn many ideas via interactions and transmit these ideas to other public innovators or to private firms (e.g, academics learning ideas from conferences and collaborations and then consulting for private industry). Conversely, the proposition would remain unchanged if all public innovators instead choose and .

Empirical research on collaboration between academia and industry supports the value of academic researchers as informational intermediaries between firms. Azoulay, Graff Zivin, and Sampat (2012) study movement of star academics, and find that moves increase patent-to-patent and patent-to-article citations locally. Federal funding for universities is also linked to higher entrepreneurship locally (Tartari and Stern, 2021).

3.6 Welfare

The preceding analysis focused on the discovery rate as an outcome measure. We now extend the results to a more general measure of welfare that allows for consumer and producer surplus. We take a reduced-form approach, assuming fixed consumer surplus from each technology sold by a monopolist and each technology sold in a competitive market.

For each , we define the competitive technologies for to be the set of technologies such that at least one other firm knows all ideas in . Thus each technology is either proprietary or competitive.

We define

where the weights and are positive. Welfare is the sum of producer surplus (monopoly profits minus R&D costs) and consumer surplus ( from each proprietary technology and from each competitive technology).

Proposition 2.

Fix a sequence of actions with and non-negative expected profits for each firm . The following are equivalent:

(1) There exists such that there is a unique component of the indirect-learning network of size at least a.a.s.,

(2) The discovery rate is non-vanishing: , and

(3) There exists such that for sufficiently large.

When there is a giant component, a positive fraction of ideas are discovered and welfare is within a constant factor of the social optimum. In the subcritical and critical regions, a vanishing share of ideas are discovered and welfare is only a vanishing share of the socially optimal level. The basic idea behind the proof is that consumer surplus grows at the same rate as the number of technologies discovered.

An immediate consequence is that Corollaries 1 and 2 and Proposition 1 imply similar statements about any welfare measure . For example, equilibrium welfare grows at rate in the baseline model but grows at a rate proportional to with a positive share of public innovators. Therefore, the ratio between equilibrium welfare with and without public innovators grows unboundedly large as .

4 Asymmetric Learning Probabilities

The baseline model assumes that information flows are symmetric across pairs of firms. In practice, firms may have heterogeneous probabilities of learning from others, even given a fixed interaction rate. We next show that equilibrium remains critical with heterogeneous propensities to learn.

Suppose that firms have propensities to learn , where there are finitely many propensities to learn and the fraction of firms with each propensity converges as the number of firms grows large. Firm now directly learns from firm with probability

Learning otherwise occurs as in the baseline model, including indirect learning.

It is straightforward to extend Definition 4 to allow heterogeneous secrecy. We now let be the spectral radius of the matrix . As before entry is equal to the probability that firm learns indirectly from firm . Given the modified definition of , Definition 4 continues to define a critical threshold and this threshold again corresponds to the emergence of a giant component.

Theorem 2.

Suppose firms have propensities to learn . There exists an investment equilibrium for large, and any sequence of investment equilibria is critical.

Equilibria remain critical even when the directed link probabilities are asymmetric across pairs. The characterization result extends immediately to the case in which are chosen endogenously at a cost , which can vary across firms.171717This choice can be made simultaneously with or prior to the choice of . In this case, firms can now control the likelihood of learning along two dimensions. First, higher interaction rates allow a firm to learn more from from others at the expense of a higher probability of its ideas leaking. Second, firms can pay an exogenous cost to increase the probability of learning from others at a given interaction rate, and some firms may be able to do so more cheaply than others.

The proof of Theorem 2 shows that decisions with asymmetric learning probabilities are similar to decisions in the baseline model. Recall that at equilibrium, the first-order condition for the openness relates the value of the ideas already known to firm with the value of increasing the interaction rate. Fixing , a higher increases both sides of this first-order condition because firms with higher propensities to learn have already learned more ideas but also will learn more from an additional interaction.

At potential equilibria in the subcritical region, these two forces cancel out and a firm’s optimal choice of openness is approximately independent of that firm’s propensity to learn . The proof of Theorem 1 used the symmetry between the value of existing links and an additional link to solve for . Even if each of these links only realizes with probability , the symmetry persists and so is unchanged.

The two opposing effects would not entirely cancel in the supercritical region, because there are potential redundancies between multiple links to the giant component. These redundancies matter more for firms with higher . Nevertheless, we can bound the average interaction rate when all firms choose to respond optimally to the giant component size.

5 Benefits and Costs of Links

In Sections 2 and 3, we studied equilibrium when expected payoffs were

Firms’ utility functions had two properties:

-

1.

Payoffs are linear in the number of proprietary technologies, and

-

2.

Payoffs do not depend on technologies for which the firm faces competition.

The first assumption determines the benefits from incoming links, while the second determines the costs of outgoing links.

We now relax each of these assumptions. We find that equilibrium remains critical when the returns to producing more technologies are increasing. More generally, we show that equilibrium is critical in a setting where profits are a convex function of the number of ideas learned. Changing the profit structure in competitive markets, however, leads to supercritical or subcritical equilibria. So outcomes depend on the specification of the costs of outgoing links, but are less sensitive to the specification of the gains from learning.

5.1 Concavity of Profits

The baseline model assumed that a firm’s profits are linear in the number of proprietary technologies. We now extend the main result to allow more general firm profits.

In practice, there may be increasing or decreasing returns to producing more technologies. Suppose that the payoffs to firm are instead

where .

The baseline model is the case . When , there are increasing returns to controlling more monopolies. When , there are decreasing returns to controlling more monopolies. Note that these increasing or decreasing returns to scale are not determined by the innovative process, but rather by production costs or other market conditions.

Proposition 3.

There exists such that for any , any sequence of symmetric investment equilibria is critical. When , we have .

The proposition shows that the prediction of critical equilibria is not knife-edge with respect to . In particular, increasing returns to scale cannot move interactions above the critical threshold. As long as , slightly decreasing returns to scale will not move interactions below the critical threshold either.

Consider a firm that does not face competition. We show that under the conditions of the proposition, the firm’s profits are convex in . As a result, learning additional ideas is more appealing relative to protecting existing ideas, so openness will not decrease below the critical region. Checking convexity is delicate when , because in this case firm profits are the composition of the binomial coefficient , which is convex, and the polynomial, , which is concave.

We also show that for any , openness will not increase enough to push equilibrium into the supercritical region either. At a potential supercritical sequence of symmetric investment equilibria, profits are driven by the event that firm learns ideas from the giant component and produces approximately proprietary technologies. Firm chooses to maximize the probability of this event. Asymptotically the optimal is independent of the payoffs from this event since these payoffs are very large, and therefore the optimal is independent of . Given this, the calculation is the same as in the case (Theorem 1), where there is no supercritical sequence of investment equilibria.

More generally, the proof shows that our criticality result relies on two features of the payoff function. First, payoffs for a firm that does not face competition are convex in the number of ideas learned by . Second, payoffs grow at a polynomial rate in the number of ideas learned by .

We can state this formally when , so that when firm learns from it will learn all ideas known to firm . In this case, we let the profits for firm be when firm discovers its private idea () and no firm learns from , and otherwise. We will assume that is strictly increasing and continuously differentiable.

Proposition 4.

Suppose and payoffs when no firm learns from and are equal to , where is convex and along any sequence of such that . Then any sequence of symmetric equilibria with non-vanishing investment is critical.

The assumption that along any sequence of such that bounds the rate of growth of . In particular, this assumption holds if for any and any real . If payoffs instead grow at an exponential rate in the number of ideas, then a supercritical equilibrium is possible because an additional idea may be very valuable (see Acemoglu and Azar, 2020 for a related effect).

A special case is that firms can produce technologies of multiple complexities , perhaps with different payoffs for technologies of different complexities. The growth condition will hold as long as the allowed complexities are bounded (independent of ). A consequence of the proposition in this case is that equilibrium profits are driven by technologies of the highest feasible complexity for large. At a critical equilibrium most profits come from rare events where a firm learns many ideas, and when this occurs the firm can produce many more technologies of higher complexities. This suggests that if firms can choose the complexity of their products, firms will produce more complex technologies (at least in large markets).

5.2 Profits Under Competition

We found in Theorem 1 that equilibrium lies on the critical threshold. This result is robust to different payoffs structures for monopolist firms. We now show that Theorem 1 does depend on the structure of competition, and altering the payoffs from competitive markets can lead to supercritical or subcritical outcomes.

To generalize the payoff from technologies, we will now assume that firm receives payoffs from a technology such that , firm learns all other ideas in , and other firms learn all ideas in . We assume is weakly decreasing and maintain the normalization .

A simple case is for all . The parameter represents the profits in competitive markets for firms such that the idea is included in the technology. These profits could correspond to a first-mover advantage or a higher quality product due to the firm’s expertise. For example, firms whose idea is included in a technology could bring the product to market first and obtain positive profits before competitors arrive (see Boldrin and Levine, 2008 for details). Alternately, these firms could produce higher quality technologies and make positive profits due to this product differentiation. The analysis in previous sections corresponded to the case .

We can also allow , which could correspond to a fixed cost of production that must be paid before competition is known. We assume that firms make a single decision about whether to produce the technologies that they learn.181818If firms can condition their production decision on the flow of ideas, the analysis becomes more complicated.

Proposition 5.

(i) If and for all , then any sequence of symmetric investment equilibria is supercritical.

(ii) If for all , then any sequence of symmetric investment equilibria is subcritical.

We can restate the proposition in terms of the discovery rate, and find that there is more innovation when there are positive profits under competition than in the Bertrand case:

Corollary 3.

(i) If and for all , then the discovery rate is non-vanishing along any sequence of symmetric equilibria with non-vanishing investment: .

(ii) If for all , then the discovery rate vanishes along any sequence of symmetric equilibria with non-vanishing investment: .

Part (i) of the proposition says that if the potential downside to enabling competitors is not as large, then firms will be more willing to interact. This pushes the equilibrium from the critical threshold into the supercritical region. Proposition 5(i) introduces an additional force to classic debates on whether firms are more innovative in more competitive markets (see Cohen and Levin, 1989 for a survey). While much of this literature considers how competition changes firms’ private incentives to conduct R&D, the proposition considers its effect on interaction and learning between firms.

Part (ii) of the proposition says that increasing the costs of competition discourages interaction, and pushes the equilibrium to the subcritical region. There need not be an investment equilibrium if payoffs under competition are sufficiently negative.

The proof of (ii) is more involved, as we must characterize payoffs at a potential critical sequence of equilibria. The key lemma shows that at the critical threshold, we have , i.e., most of a firm ’s proprietary technologies only include ideas learned from one other firm. To prove this lemma, we use a pair of coupling arguments to show that most profits come from rare events in which a single link (indirectly) lets a firm learn many ideas.

Proposition 5 describes how the equilibrium learning network depends on competition qualitatively, but we can also relate equilibrium outcomes to the innovation rate within the supercritical region. We now show that increasing the payoffs from competitive outcomes will increase the innovation rate even within the supercritical region.

Consider a function such that for all , is weakly decreasing in , and as . Set and for , so that monopoly payoffs are constant and competitive profits are weakly increasing in . For example, higher values of can correspond to a larger first-mover advantage.

Proposition 6.

There exists such that for , with payoffs :

(i) There exists an investment equilibrium for large;

(ii) The limit of the discovery rate along any sequence of symmetric equilibria with non-vanishing investment exists and does not depend on the sequence of equilibria;

(iii) The limit is weakly increasing in .

When payoffs are higher in competitive markets, the upside to learning from others is potentially higher and the downside of information leakage is lower. So individuals are willing to interact more, and thus the discovery rate is higher, as increases. The proposition shows this comparative static locally, because for small we can leverage our analysis of equilibrium under Bertrand payoffs to show that an investment equilibrium exists and is well-behaved.

6 Patent Rights

In the baseline model, technologies could only be protected via secrecy. We now consider the possibility that a positive fraction of firms receive patents on their ideas. As motivation, suppose that firms discover different types of ideas and patent law determines which types are patentable. For example, Bessen and Hunt (2007) discuss the boundaries of patent law in the software industry and how those boundaries have changed over time.

6.1 Equilibrium

Suppose a fraction , of firms receive a patent on their private ideas. In this case, other firms cannot use this private idea, either as monopolists or competitors. Formally, a firm receives payoff from each technology such that (1) idea ; (2) firm knows all and no other receive patents; and (3) either receives a patent or is the unique firm that knows all . Else the firm receives payoff from the technology .

To focus on how patents relate to informal interactions, we analyze model patents in a very simple way. In particular, the model will not include imperfect patent rights and/or licensing of patents, and licensing can increase the innovation rate.

A firm now chooses either a level of openness , which is the action without a patent, or , which is the action with a patent. We will refer to the choices at symmetric equilibria as and .

For the first part of the following result (), we will also assume that each firm pays cost for each realized link. The purpose of this cost is to break near-indifferences in favor of lower interaction rates. We observe in Appendix C that without patents, a small link cost has little effect on the equilibrium.

Proposition 7.

Suppose a fraction of firms receive patents. If , then with and any link cost , there does not exist an investment equilibrium for large. If , then is along any sequence of symmetric investment equilibria.

With only direct learning (), the proposition says that positive investment cannot be sustained at equilibrium for large. This is because of an adverse-selection effect that discourages social interactions.

Because firms receiving patents have no need for secrecy, firms with patents choose very high interaction rates . Thus, most interactions are with firms with patents. On the other hand, firms with patents are undesirable to interact with because their ideas cannot be used by others. Because of this adverse selection in the matching process, firms without patents will have much lower expected profits than in the model without patents. When and there is an arbitrarily small cost to links, this has the effect of shutting down all interaction and investment.

This contrasts with our results on direct learning with no patent rights (Section 3.2 and Appendix C), where there is an investment equilibrium with substantial interaction. With and patent rights, the adverse selection effect persists but no longer prevents any equilibrium investment. In this case, the interaction rate between firms without patents is much lower asymptotically than in the result with no patent rights (Appendix C.1).

The direct learning result also suggests a more general adverse-selection effect in strategic network formation. Suppose that agents with lower link formation costs are also less valuable partners for connections. If agents cannot discriminate in their link formation decisions, the composition of the pool of potential partners will discourage connections.

With indirect learning, firms with patents still do not provide private ideas to others, but can now serve as informational intermediaries (like the public innovators in Section 3.5). A giant component forms around the firms with patents. Firms without patents now have some interactions with firms without patents, who can transmit ideas from other firms without patents. Interactions between pairs of firms without patents, however, are rare.

Proposition 7 relates to literature on firms’ choices between formal and informal intellectual property protections, particularly patents versus secrecy (e.g., Anton and Yao, 2004 and Kultti, Takalo, and Toikka, 2006). We focus not on the choice between formal and intellectual property rights but on the interplay between the two.191919A second contrast is to theoretical findings on patents and follow-up innovation (e.g., Scotchmer, 1991, Scotchmer and Green, 1990, Bessen and Maskin, 2009). This literature investigates when granting patent rights for an idea decreases follow-up innovations involving that idea. In our random-interactions setting, patent rights can not only decrease follow-up innovations involving patented ideas but also decrease follow-up innovations involving other unprotected ideas.

The proposition assumes that firms cannot direct interaction toward or away from firms with patents, but we could also allow firms to choose separate interaction rates for peers with and without patents. Under direct learning (), firms without patents would only interact with each other and the adverse selection effect would disappear.202020The analysis of equilibrium interaction patterns among these firms would be the same as in Appendix C. Under indirect learning, firms with patents can still play a similar role as informational intermediaries when directed interaction is permitted. The analysis is very similar to Appendix E, so we omit details here.

6.2 Discovery Rate

We can use Theorem 1 and Proposition 7 to ask when patent rights produce more innovation and what the optimal share of patentable ideas would be. In the direct-learning case, the proposition gives conditions under which patents decrease innovation and welfare.

In the indirect-learning case, the equilibrium discovery rate and social welfare are higher (for large) with interior patent rights than without patent rights because firms with patents are valuable as intermediaries. Under indirect learning, we can ask what value of maximizes the discovery rate. Any positive provides the benefits of information intermediaries, and so there is a tradeoff between the higher private profits obtained by firms with patents and the social benefits provided by firms without patents, whose ideas can be used by others. For high the optimal value of converges to zero as grows large.

This is easiest to see when . In this case, we can compute that the share of firms without patents whose ideas are learned by the giant component is The number of technologies produced is

| (1) |

because approximately firms learn from the giant component and each learns approximately unpatented ideas. The leading term in expression (1) is maximized by , so the patent share maximizing the discovery rate converges to zero.

7 Conclusion

We have studied strategic network formation in large random graphs in the context of an economic application to innovation and social learning. The model is particularly suited to analysis of informal interactions, e.g., between employees of firms, which cannot be fully governed by formal contracts. We find that in these settings, if there are many firms and ideas can travel multiple steps, the global structure of the learning network has stark consequences for incentives and payoffs. In particular, expected payoffs and welfare are much higher when there is enough interaction to support a giant component.

The techniques developed in this paper could be extended or applied in several directions. For example, we have studied a static model, but in a dynamic version of the model past events would create new incentives toward openness or secrecy. More broadly, while we have focused on a network-formation game with a tradeoff between secrecy and learning, we have developed more widely applicable tools for questions in network economics, particularly those with complementarities between connections. Outside of network formation, the same techniques can also be applied to problems such as optimal seeding for diffusion processes or search and matching models where indirect connections are important.

References

- Acemoglu and Azar (2020) Acemoglu, D. and P. D. Azar (2020): “Endogenous production networks,” Econometrica, 88, 33–82.

- Acemoglu et al. (2017) Acemoglu, D., A. Makhdoumi, A. Malekian, and A. Ozdaglar (2017): “Privacy-constrained network formation,” Games and Economic Behavior, 105, 255–275.

- Akbarpour et al. (2018) Akbarpour, M., S. Malladi, and A. Saberi (2018): “Diffusion, Seeding, and the Value of Network Information,” Working paper.

- Akcigit et al. (2018) Akcigit, U., S. Caicedo, E. Miguelez, S. Stantcheva, and V. Sterzi (2018): “Dancing with the stars: Innovation through interactions,” Available at SSRN 2647049.

- Alon and Spencer (2004) Alon, N. and J. H. Spencer (2004): The Probabilistic Method, John Wiley & Sons.

- Anton and Yao (2004) Anton, J. J. and D. A. Yao (2004): “Little patents and big secrets: managing intellectual property,” RAND Journal of Economics, 1–22.

- Athreya and Ney (1972) Athreya, K. and P. Ney (1972): Branching Processes, Springer-Verlag.

- Azoulay et al. (2012) Azoulay, P., J. S. Graff Zivin, and B. N. Sampat (2012): “The Diffusion of Scientific Knowledge across Time and Space,” The Rate and Direction of Inventive Activity Revisited, 107.

- Bala and Goyal (2000) Bala, V. and S. Goyal (2000): “A noncooperative model of network formation,” Econometrica, 68, 1181–1229.

- Ballester et al. (2006) Ballester, C., A. Calvó-Armengol, and Y. Zenou (2006): “Who’s who in networks. Wanted: The key player,” Econometrica, 74, 1403–1417.

- Baum et al. (2010) Baum, J. A., R. Cowan, and N. Jonard (2010): “Network-independent partner selection and the evolution of innovation networks,” Management science, 56, 2094–2110.

- Baumann (2021) Baumann, L. (2021): “A model of weighted network formation,” Theoretical Economics, 16, 1–23.

- Berliant and Fujita (2008) Berliant, M. and M. Fujita (2008): “Knowledge creation as a square dance on the Hilbert cube,” International Economic Review, 49, 1251–1295.

- Bessen and Hunt (2007) Bessen, J. and R. M. Hunt (2007): “An empirical look at software patents,” Journal of Economics & Management Strategy, 16, 157–189.

- Bessen and Maskin (2009) Bessen, J. and E. Maskin (2009): “Sequential innovation, patents, and imitation,” The RAND Journal of Economics, 40, 611–635.

- Bloznelis et al. (2012) Bloznelis, M., F. Götze, and J. Jaworski (2012): “Birth of a strongly connected giant in an inhomogeneous random digraph,” Journal of Applied Probability, 49, 601–611.

- Boldrin and Levine (2008) Boldrin, M. and D. K. Levine (2008): “Perfectly competitive innovation,” Journal of Monetary Economics, 55, 435–453.

- Bramoullé et al. (2014) Bramoullé, Y., R. Kranton, and M. D’amours (2014): “Strategic interaction and networks,” American Economic Review, 104, 898–930.

- Burt (1992) Burt, R. S. (1992): Structural Holes: The Social Structure of Competition, Harvard University Press.

- Cabrales et al. (2011) Cabrales, A., A. Calvó-Armengol, and Y. Zenou (2011): “Social interactions and spillovers,” Games and Economic Behavior, 72, 339–360.

- Campbell (2013) Campbell, A. (2013): “Word-of-mouth communication and percolation in social networks,” American Economic Review, 103, 2466–98.

- Chen et al. (2021) Chen, J., M. Elliott, and A. Koh (2021): “Capability accumulation and conglomeratization in the information age,” Available at SSRN 2753566.

- Cohen and Levin (1989) Cohen, W. M. and R. C. Levin (1989): “Empirical studies of innovation and market structure,” Handbook of Industrial Organization, 2, 1059–1107.

- Currarini et al. (2009) Currarini, S., M. O. Jackson, and P. Pin (2009): “An economic model of friendship: Homophily, minorities, and segregation,” Econometrica, 77, 1003–1045.

- Erol and García-Jimeno (2020) Erol, S. and C. García-Jimeno (2020): “Civil Liberties and Social Structure,” Available at SSRN.

- Golub and Livne (2010) Golub, B. and Y. Livne (2010): “Strategic Random Networks,” Available at SSRN 1694310.

- Goyal and Moraga-Gonzalez (2001) Goyal, S. and J. L. Moraga-Gonzalez (2001): “R&d networks,” Rand Journal of Economics, 686–707.

- Griffith (2019) Griffith, A. (2019): “A Continuous Model of Strong and Weak Ties,” Working paper.

- Jackson and Wolinsky (1996) Jackson, M. O. and A. Wolinsky (1996): “A strategic model of social and economic networks,” Journal of Economic Theory, 71, 44–74.

- Karp (1990) Karp, R. M. (1990): “The transitive closure of a random digraph,” Random Structures & Algorithms, 1, 73–93.

- Kelly (2009) Kelly, M. (2009): “Technological progress under learning by imitation,” International Economic Review, 50, 397–414.

- Kerr (2008) Kerr, W. R. (2008): “Ethnic scientific communities and international technology diffusion,” The Review of Economics and Statistics, 90, 518–537.

- Klenke and Mattner (2010) Klenke, A. and L. Mattner (2010): “Stochastic ordering of classical discrete distributions,” Advances in Applied Probability, 42, 392–410.

- König et al. (2011) König, M. D., S. Battiston, M. Napoletano, and F. Schweitzer (2011): “Recombinant knowledge and the evolution of innovation networks,” Journal of Economic Behavior & Organization, 79, 145–164.

- König et al. (2012) ——— (2012): “The efficiency and stability of R&D networks,” Games and Economic Behavior, 75, 694–713.

- König et al. (2016) König, M. D., J. Lorenz, and F. Zilibotti (2016): “Innovation vs. imitation and the evolution of productivity distributions,” Theoretical Economics, 11, 1053–1102.

- Kortum (1997) Kortum, S. S. (1997): “Research, patenting, and technological change,” Econometrica, 1389–1419.

- Kultti et al. (2006) Kultti, K., T. Takalo, and J. Toikka (2006): “Simultaneous model of innovation, secrecy, and patent policy,” American Economic Review, 96, 82–86.

- Łuczak (1990) Łuczak, T. (1990): “The phase transition in the evolution of random digraphs,” Journal of Graph Theory, 14, 217–223.

- Perla and Tonetti (2014) Perla, J. and C. Tonetti (2014): “Equilibrium imitation and growth,” Journal of Political Economy, 122, 52–76.

- Rosenthal (1970) Rosenthal, H. P. (1970): “On the subspaces of () spanned by sequences of independent random variables,” Israel Journal of Mathematics, 8, 273–303.