Stochastic decompositions in bivariate risk and queueing models with mutual assistance

Abstract.

We consider two bivariate models with two-way interactions in context of risk and queueing theory. The two entities interact with each other by providing assistance but otherwise evolve independently. We focus on certain random quantities underlying the joint survival probability and the joint stationary workload, and show that these admit stochastic decomposition. Each one can be seen as an independent sum of respective quantities for the two models with one-way interaction. Additionally, we discuss a rather general method of establishing decompositions from a given kernel equation by identifying two independent random variables from their difference, which may be useful for other models. Finally, we point out that the same decomposition is true for uncorrelated Brownian motion reflected to stay in an orthant, and it concerns the face measures appearing in the basic adjoint relationship.

Key words and phrases:

Keywords: coupled processor, fluid network, reflection in orthant, kernel equation, basic adjoint relationship, stochastic decomposition, two-way interaction1. Introduction

Stochastic decomposition results abound in inventory management and queueing theory [2, 7, 10], but most of them concern models with vacations (switchover times) or a secondary jump input. Here we present stochastic decomposition results of a different nature. We consider a bivariate model with two-way interaction and show that a certain fundamental quantity can be decomposed into two independent parts corresponding to models with one-way interactions. In fact, we do so in two frameworks: (i) a risk model of [9] where each company covers the deficit of another and (ii) a queueing model with mutual assistance which can be seen as a coupled processor or a fluid network with two nodes.

Multivariate risk and queueing models are notoriously hard to analyze [4]. A classical example illustrating various difficulties is that of a Brownian motion reflected to stay in an orthant [5, 8]. In fact, our queueing model is a close relative. In Remark 3.1 we point out that our stochastic decomposition concerns the face measures appearing in the basic adjoint relationship. The focus here is not on defining complex models and establishing their properties which is known to be highly technical in general [8, 15], but rather on discovering structural results for some basic well-understood models. Thus we exclusively consider the case where the drivers are independent compound Poisson processes, so that without interactions we have (i) a pair of Cramér-Lundberg risk processes and (ii) a pair of M/G/1 workload processes.

The quantities of interest are the joint survival probability in (i) and the joint stationary workload in (ii). Our results are neater and easier to interpret in the former case and thus we mainly focus on the risk model. Furthermore, we assume that the second company starts with 0 capital, because the general case can be reduced in some sense to such boundary cases. Then the minimal initial capital of the first company leading to joint survival is the quantity admitting stochastic decomposition. This result may be useful when numerically evaluating survival probabilities for different strengths of interactions. In queueing model we consider the stationary workload in the first queue given that the second queue is empty. In fact, decomposition holds true for a slightly different distribution with increased point mass at 0.

The models are defined in §2 and the main results are stated in §3. §4 contains proofs based on the results of [9] and [3] for the risk and queueing model, respectively. In §5 we attempt to establish our decompositions directly from the kernel equation, which requires identification of two independent random variables from their difference, see §5.2. This latter approach may be useful in finding stochastic decompositions in other models.

2. The models

Throughout this work we assume that and are two independent drifted compound Poisson processes of the form

where and are positive iid random variables independent of the Poisson process . The respective means are denoted by and the Laplace exponents are given by

where is the rate of the Poisson process . Note that started in is the classic Cramér-Lundberg model in ruin theory, whereas reflected at is the workload process in M/G/1 queue [1].

Our bivariate coupled risk and queueing models are defined below in an iterative way using the independent processes as drivers of the two entities, whereas the constants parameterize certain interaction between the two. The interaction is of the type where one company/server helps the other and vice versa. Our focus is on the joint survival probability in risk model and the joint stationary workload in queueing model. It is noted that unlike classical models, where survival probability and stationary workload are closely related by time-reversal argument [1], we have no simple duality between the two quantities of interest. Nevertheless, some structural similarities on the level of kernel equations exist, which motivated looking at both models simultaneously.

2.1. Coupled risk processes

Let be the initial capital of the company . It is assumed that the capitals evolve according to until the first time when at least one of these processes becomes negative. Note that this happens because of a claim received by one of the companies, since can not jump at the same instant a.s. Letting be the current state, we restart the bivariate process from

unless or , in which case the ruin is declared.

In words, deficit of the company is instantaneously covered by the other company which pays for the unit of capital transferred. A standard scenario assumes that (think of taxation or transaction costs), whereas we allow for arbitrary rates in . In particular, means that the first company refills to 0 without participation of the second, and means that deficit in the first company causes ruin in our bivariate model. Hence the boundary values yield a simpler model with one-way interaction. This is not to say that latter models are easy to analyze.

Finally, we write for the probability of survival (no ruin) from the initial capitals on the infinite time interval . That is, the probability that companies manage to save each other at all times. Consider the bivariate transform

| (1) |

Throughout this work we assume that our risk model satisfies the natural safety loading assumption:

| (2) |

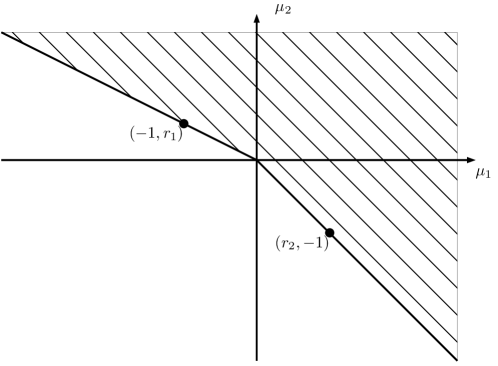

and that if , see Figure 1.

This guarantees that for , see [9]; for we have for any .

Importantly, there is a certain invariance under rescaling: for any the survival probability in the original risk model is the same as the survival probability in the model . In particular, the case of can be reduced to the trivial case , which is essentially one-dimensional: the risk problem reduces to the survival probability of the sum process.

2.2. Coupled queueing processes

We assume that workload processes evolve according to until at least one of these processes hits 0 (no work in the corresponding queue). That is, server works at speed and experiences customers bringing amount of work. After hitting the 0 the -th workload process stays at 0 until arrival of the next customer to server , but the other server works at speed during this time, where . One may view this model as a two-dimensional Skorokhod’s reflection (see [12] and references therein), but only when , because otherwise the local times can not cancel each other when both queues are empty. In words, the server , when idle, helps the other by providing ’proportion’ of his own service rate .

Our main quantity of interest is the pair of stationary workloads , when it exists, and its bivariate transform

| (3) |

The stability region is given by [4]

| (4) |

which corresponds to the parameter region of the risk model by letting for . Note that the regime is of the main interest and, moreover, it corresponds to a two-dimensional fluid network with an arbitrary legal routing matrix [3].

Finally observe that the stationary workload in the original queueing model has the same law as in the model . Unlike the risk model, the queueing model with is not trivial, see [4] for an in-depth study of this case.

3. Behavior at the boundary and stochastic decompositions

The first step in the analysis of the transforms (1) and (3) is to derive the corresponding so-called kernel equations, which identify the bivariate transform of interest in terms of two univariate functions relating to the behavior of the system at the boundaries. These derivations while being tedious follow some standard reasoning: application of the infinitesimal generator to in risk [9], and level-crossing [4] or martingale arguments [3] in queueing. A closely related basic adjoint relationship for the stationary distribution of Brownian motion reflected to stay in an orthant can be found in [5, 8]; it is derived using tools from stochastic calculus.

Additional motivation is provided by the following perspective in case of the risk model. Note that processes evolve independently and without knowledge of until one of the companies gets in trouble. The latter is then restarted from 0 at the cost of the other company, and so the system is at the boundary at this instant.

3.1. Kernel equations

The risk equation reads (with )

| (5) |

where

In the case of (or ) the kernel equation should be read in the limiting sense, where as .

The queueing equation for is

| (6) |

where

Note that by joining the two terms containing we may also state an equation for the case , but then the structure of that kernel equation is different and it does require another type of analysis, see [4].

Importantly, the original problem reduces to the problem of identification of the boundary functions and . In [3] and [9] these functions where expressed through the Wiener-Hopf factors of some auxiliary two-sided Lévy process, see Section 4.1 for the summary of the results. Here we establish certain stochastic decomposition results underlying these unknown functions, which is the main result of this work. We exclusively focus on and , since the treatment of the other functions is analogous.

3.2. Stochastic decompositions in risk

Integration by parts yields the following identity

where is a non-negative random variable with c.d.f. for . Note that, indeed, is an increasing function taking values in . Importantly, according to our assumptions and so the random variable is proper, unless . Finally, the distribution has an atom at 0, i.e. , which explains the left integration limit above.

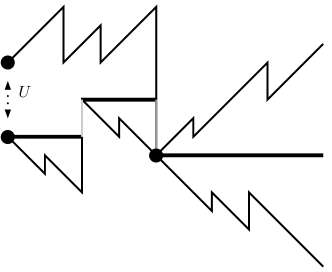

We define as a functional of the two sample paths : it is the minimal initial capital of the first company leading to survival when the second company starts at 0 (such a minimum is always achieved). Indeed, is the probability that there is survival in our model for the initial capitals . In the following we write to make the dependence on explicit, and note that all such random variables are defined on the original probability space. Observe that by construction is non-decreasing in both and .

A useful perspective is provided by Figure 2, where we depict the second path upside down and shift the ground level according to the model specification. In other words, the grey regions are scaled according to and . One can think of starting the first company with very large initial capital and then reducing it until the paths touch, so that no further decrease is possible. This procedure yields as the difference between the final starting points. Observe the complexity of the model: the sample paths of the resultant processes (as in the picture) may change dramatically with a change of the initial capital of the first company alone.

Finally, we let which is proper when , and note that

Moreover, has the distribution of the stationary workload in a single queue driven by process. In particular, its transform is given by the generalized Pollaczek-Khinchine formula:

Let us now formulate our main result reducing the original problem with two-way interactions to two simpler problems with one-way interactions.

Theorem 1.

For satisfying (2) it holds that

| (7) |

where denotes an independent copy of . Moreover, we also have

| (8) | |||||

| (9) |

This result will be proven later in §4. Let us briefly comment on the term in the case of . As mentioned before, the random variable is not proper, but it does become such upon conditioning on never becoming negative. Note that using (8) and (9) we may provide further decompositions. In particular, (9) leads to

| (10) |

Finally, observe that (7) can be restated in terms of a convolution equation for survival probabilities

3.3. Law invariance in risk

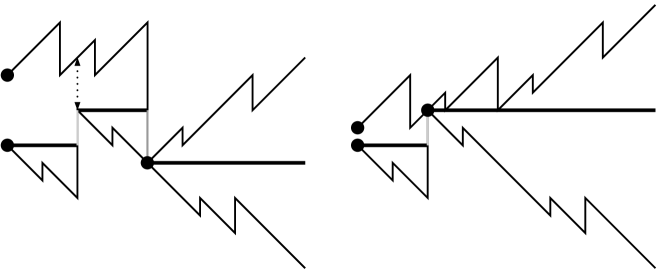

Importantly, there is another decomposition

| (11) |

which is not of the type presented in Theorem 1 as it contains on both sides. The proof is essentially given in Figure 3.

Consider (as in the right picture) and find the first time where the paths touch. It must be that both companies are at 0 at . The quantity depends only on the evolution of paths up to time and the fact that post- paths yield . Now splitting of the paths at yields the decomposition in (11). Furthermore, this decomposition also holds for two-sided processes , i.e., when jumps of both signs are present. Finally, note that one can not interchange the roles of above.

Comparing (11) and (7) we find that

| (12) |

It is noted that for independent real random variables does not imply [6, p. 479]. This implication is true, however, for non-negative random variables, since the Laplace transform can be 0 only at isolated points. Identity (12) states that is law-invariant in . This also extends to the boundary cases: for we simply obtain , and for (when ) we get which has the distribution of according to (8).

3.4. Stochastic decomposition in queueing

Here we assume that and that . Similarly to the risk problem, we need to focus on a random quantity underlying in some sense. Note that the kernel equation implies and ; to see this let , divide both sides by and let it decrease to 0. Hence and thus

| (13) |

Since under our assumptions both terms are positive, we see that is the transform of the mixture: and with obvious probabilities. Note that we put additional mass at 0 as compared to the distribution of .

Theorem 2.

For and it holds that

where is defined by the transform in (13) and, in particular, has the stationary distribution of the stand-alone first queue.

Let us comment on the assumed conditions. Stability of the system with rate pair implies that , and similarly we get , and so the assumption is necessary. Furthermore, for the first term in (13) becomes negative implying that can not be a transform of a random variable. Of course, there may exist decompositions for some other random quantity, which also works for , but we were not able to identify such.

Remark 3.1.

Exactly the same decomposition as in Theorem 2 is also true for the Brownian case, i.e., when and are two independent linear Brownian motions. The interpretation of is, however, different. Note that in this case. According to [3] we have

where is the regulator at 0 and signifies that the system is started in stationarity. Hence we see that is a transform of a positive random variable whose law is given by

Note that this is exactly the face measure in the basic adjoint relationship, see e.g. [5, (6)], rescaled to be a probability measure.

4. Proofs via reduction to Wiener-Hopf factors

Proofs given in this section are based on the expressions of and provided in [3] and [9], which are in terms of the Wiener-Hopf factors of some auxiliary two-sided Lévy process. We write for the positive/negative part of .

4.1. Auxiliary process and its Wiener-Hopf factors

Let be the unique positive inverse of , which can be analytically continued to all complex with non-negative real part. It is noted that is 0 or strictly positive according to and . One of the main observations in [3] is that for any

is the Lévy exponent of some Lévy process , i.e., . This auxiliary process is killed at rate

where the value at 0 is interpreted in the limiting sense. Hence we may define the corresponding Wiener-Hopf factors

satisfying for . In fact, in the following we will only need the first factor for .

Let us remark that we can write with independent and , where is the drift-less compound Poisson process with positive jumps characterized by , and so it is killed at rate . In fact, is the descending ladder time process of , see [14, §6.5.2].

4.2. Expressions of the unknown functions

The expressions for and appearing in the kernel equations (6) and (5) were identified in [3] and [9], respectively, using an educated-guess approach based on intuition from [4], see also the latter work for an alternative expression of based on the random walk theory. For the risk model with and satisfying (2) we have

| (14) |

For the queueing model with , and satisfying (4) we have

| (15) |

Note that in the case it must be that showing again that .

4.3. Proofs

Key observation is that the Wiener-Hopf factors defined in §4.1 have a very simple limiting form when and .

Lemma 3.

For any with it holds that

| (16) |

Moreover, for we also have

| (17) |

Proof.

If then as implying that the killing epoch approaches 0. Moreover, the supremum of is bounded by at the killing time and so . If then the killing rate stays constant, whereas a.s. for any implying the same result.

As the killing rate approaches , whereas for every . Thus for the supremum tends to yielding , and for the supremum becomes evaluated at its killing time of rate and so

Finally, consider the case and note that

where has infinite life-time and is killed at an independent exponential time of rate . Observe that and

A similar calculation shows that the transform of the lower bound has the same limit, which concludes the proof. ∎

Proof of Theorem 1.

First, consider the case . Writing to stress the dependence of the transform on the rates , we find from (14) and (16) that

for , where the continuity of at and at is straightforward to check. Thus we indeed have

| (18) |

proving (7). When we get with the help of (17)

whereas has the same form as above. Thus (18) holds and implies the required decomposition also when .

The identity (8) has been already proven in §3.3 assuming (7), but it also follows from

because as . It is left to note that is the transform of the defective random variable , where the probability of is .

Finally, with respect to (9) we have

and the result follows, because the latter factor is the transform of according to the generalized Pollaczek-Khinchine formula. ∎

Proof of Theorem 2.

Note that we have exactly the same factorization in the case , but then the probabilistic interpretation of is lost. Even more interestingly, , but the first term on the right can not be a transform of a random variable for any .

5. Observing decompositions directly

In this section we provide an alternative, more direct, way to establish the decompositions stated in Theorem 1 and Theorem 2, which avoids identification of the transforms in terms of Wiener-Hopf factors. This approach, however, relies on certain properties of the transforms and requires some additional theory. It is presented here mainly because of its methodological interest. Moreover, it can be seen as a simple heuristic tool for discovering stochastic decompositions in other models.

5.1. Distributional equality of differences

Note that the kernel equations (5) and (6) have a somewhat similar form:

where is the transform of interest or , and is

Proceeding as in [4, 3] we let with non-zero to annihilate the left hand side and to obtain the identity:

for the given choice of dependent on .

From now on we exclusively focus on the risk problem, because the queueing problem can be treated in a very similar way. Firstly, we have

Assuming that and we readily obtain the identity

| (19) |

because and the cancelled out factors must be non-zero. Importantly, (19) holds for all , which follows by continuity and the fact that the set of excluded must not contain an interval of , see e.g. [3] for the properties of .

It is well known that , where is the first passage time of the th process over . Hence is the transform of a non-negative random variable , and similarly is the transform of a non-positive random variable. Thus (19) translates into

| (20) |

where and are two pairs of independent non-negative random variables. It is left to show that since then the decomposition (7) follows immediately. It is not true in general, however, that (20) implies , and we address this question in the following.

5.2. Characterization of two independent non-negative random variables by their difference

The noteworthy result of [13] (see also [11]) states that the laws of three independent real random variables are characterized up to a change of location by the joint law of two differences , whenever the characteristic function of the latter pair does not vanish. This result extends to independent random variables but fails for . The obvious counter-examples are and with some constant and an independent . Importantly, by imposing some assumptions on which exclude the above types of examples, we may still obtain a characterization result.

Lemma 4.

Consider two independent non-negative random variables and for assume that the law of has a density on and a point mass at 0, and that for all with . Then the law of the difference characterizes the laws of in the sense that

assuming that satisfy the above conditions.

Proof.

Let us show that

| (21) |

It is sufficient to prove that for any density . We may assume that and , because the case is trivial. As in the case of characteristic functions [6, Lem. XV.5.3], it is enough to check that

for any and . This follows from the fact that

and the same argument concerning the function.

Assuming that and considering the transforms of both sides, we obtain

| (22) |

for purely imaginary . We see that the right hand side is analytic in the right-half of the complex plane, and the left hand side is analytic in the left-half of the complex plane. Moreover, both sides are continuous and coincide on the imaginary axis. Hence one is analytic continuation of the other [16]. According to (21) both sides are bounded in their respective half-planes, and so by Liouville’s theorem [16] this analytic function must be constant. By plugging in we find that the constant is and so concluding the proof.

∎

It is known that the set of zeros of the characteristic function of a non-negative random variable, say , has 0 Lebesgue measure. Thus it is impossible to modify the other characteristic functions in (22) on this set while preserving the continuity. In conclusion, the idea of constructing counterexamples from [13] would not work, and it seems very likely that the assumption of Lemma 4 that the transforms are non-vanishing is redundant.

Instead of considering non-negative random variables with a point mass at 0 and a density on , we may assume that the left-most point of the support is 0 and the right-most is . This again rules out the above mentioned obvious counterexamples, and it would be important to understand if this is sufficient (under minor further assumptions, say) for the characterization of the laws of by the law of their difference.

The main hurdle in applying Lemma 4 in the setting of (20) is checking the (possibly redundant) assumption that the transforms are non-vanishing. This is indeed true when , as can be seen from the reduction (14) to the Wiener-Hopf factors. With regard to the other assumptions, we clearly have the point mass at 0, and then it is sufficient to check that has a density on which is the same as being differentiable. In conclusion, one may use the direct approach as a heuristic tool in establishing stochastic decompositions, whereas its rigorous application requires verification of various technical details as well as availability of characterization results similar to Lemma 4.

6. Concluding remarks

The above presented approaches to proving stochastic decompositions are mainly analytic. Identities, as simple as (7), however, are asking for direct probabilistic arguments. Discovering such proofs would be highly important in understanding these and possibly other coupled models. The only such argument the author could find after a prolonged time is the one underlying (11). In this regard note that a probabilistic argument for the law invariance statement (12) would be sufficient as it and (11) imply (7). A related challenge concerns finding other multivariate models yielding stochastic decomposition results.

Acknowledgments

This work is dedicated to Peter Taylor in appreciation of his contributions in applied probability. The author is thankful to Stella Kapodistria and Offer Kella for their interest in the problem and insightful remarks. Support of Sapere Aude Starting grant is gratefully acknowledged.

References

- [1] S. Asmussen and H. Albrecher. Ruin probabilities, volume 14 of Advanced Series on Statistical Science & Applied Probability. World Scientific Publishing Co. Pte. Ltd., Hackensack, NJ, second edition, 2010.

- [2] S. Borst and O. Boxma. Polling: past, present, and perspective. TOP, 26(3):335–369, 2018.

- [3] O. Boxma and J. Ivanovs. Two coupled Lévy queues with independent input. Stoch. Syst., 3(2):574–590, 2013.

- [4] J. W. Cohen and O. J. Boxma. Boundary Value Problems in Queueing System Analysis, volume 79 of North-Holland Mathematics Studies. North-Holland Publishing Co., Amsterdam, 1983.

- [5] J. G. Dai and J. M. Harrison. Reflected Brownian motion in an orthant: numerical methods for steady-state analysis. Ann. Appl. Probab., 2(1):65–86, 1992.

- [6] W. Feller. An introduction to probability theory and its applications. Vol. II. John Wiley & Sons, Inc., New York-London-Sydney, 1966.

- [7] S. W. Fuhrmann and R. B. Cooper. Stochastic decompositions in the queue with generalized vacations. Oper. Res., 33(5):1117–1129, 1985.

- [8] J. M. Harrison and R. J. Williams. Brownian models of open queueing networks with homogeneous customer populations. Stochastics, 22(2):77–115, 1987.

- [9] J. Ivanovs and O. Boxma. A bivariate risk model with mutual deficit coverage. Insurance Math. Econom., 64:126–134, 2015.

- [10] J. Ivanovs and O. Kella. Another look into decomposition results. Queueing Syst., 75(1):19–28, 2013.

- [11] A. M. Kagan, Y. V. Linnik, and C. R. Rao. Characterization problems in mathematical statistics. John Wiley & Sons, New York-London-Sydney, 1973. Translated from the Russian by B. Ramachandran, Wiley Series in Probability and Mathematical Statistics.

- [12] O. Kella. Reflecting thoughts. Statist. Probab. Lett., 76(16):1808–1811, 2006.

- [13] I. Kotlarski. On characterizing the gamma and the normal distribution. Pacific J. Math., 20:69–76, 1967.

- [14] A. E. Kyprianou. Fluctuations of Lévy processes with applications. Universitext. Springer, Heidelberg, second edition, 2014. Introductory lectures.

- [15] P. Lakner, J. Reed, and B. Zwart. On the roughness of the paths of RBM in a wedge. Ann. Inst. Henri Poincaré Probab. Stat., 55(3):1566–1598, 2019.

- [16] S. Lang. Complex analysis, volume 103 of Graduate Texts in Mathematics. Springer-Verlag, New York, fourth edition, 1999.