Cheating with (Recursive) Models††thanks: Financial support from ERC Advanced Investigator grant no. 692995 is gratefully acknowledges. Eliaz and Spiegler thank Briq and the Economics Department at Columbia University for their generous hosptiality while this paper was written. We also thank Armin Falk, Xiaosheng Mu, Martin Weidner, seminar audiences and especially Heidi Thysen, for helpful comments.

Abstract

To what extent can agents with misspecified subjective models predict false

correlations? We study an “analyst” who

utilizes models that take the form of a recursive system of linear

regression equations. The analyst fits each equation to minimize the sum of

squared errors against an arbitrarily large sample. We characterize the

maximal pairwise correlation that the analyst can predict given a generic

objective covariance matrix, subject to the constraint that the estimated

model does not distort the mean and variance of individual variables. We

show that as the number of variables in the model grows, the false pairwise

correlation can become arbitrarily close to one, regardless of the true

correlation.

1 Introduction

Agents in economic models rely on mental models of their environment for quantifying correlations between variables, the most important of which describes the payoff consequences of their own actions. The vast majority of economic models assume rational expectations - i.e., the agent’s subjective models coincide with the modeler’s, such that the agent’s belief is consistent with the true data-generating process. Yet when the agent’s subjective model is misspecified, his predicted correlations may deviate from the truth. This difficulty is faced not only by agents in economic models but also by real-life researchers in physical and social sciences, who make use of statistical models. This paper poses a simple question: How far off can the correlations predicted by misspecified models get?

To make our question concrete, imagine an analyst who wishes to demonstrate to an audience that two variables, and , are strongly related. Direct evidence about the correlation between these variables is hard to come by. However, the analyst has access to data about the correlation of and with other variables. He therefore constructs a that involves , and a selection of auxiliary variables. He fits this model to a large sample and uses the estimated model to predict the correlation between and . The analyst is unable (or unwilling) to tamper with the data. However, he is free to choose the auxiliary variables and how they operate in the model. To what extent does this degree of freedom enable the analyst to attain his underlying objective?

This hypothetical scenario is inspired by a number of real-life situations. First, academic researchers often serve as consultants to policy makers or activist groups in pursuit of a particular agenda. E.g., consider an economist consulting a policy maker who pursues a tax-cutting agenda and seeks intellectual support for this position. The policy maker would therefore benefit from an academic study showing a strong quantitative relation between tax cuts and economic growth. Second, the analyst may be wedded to a particular stand regarding the relation between and because he staked his public reputation on this claim in the past. Finally, the analyst may want to make a splash with a counterintuitive finding and will stop exploring alternative model specifications once he obtains such a result.

We restrict the class of models that the analyst can employ to be recursive linear-regression models. A model in this familiar class consists of a list of linear-regression equations, such that an explanatory variable in one equation cannot appear as a dependent variable in another equation down the list. We assume that the recursive model includes the variables and , as well as a selection of up to additional variables. Thus, the total number of variables in the analyst’s model is , which is a natural measure of the model’s complexity. Each equation is estimated via Ordinary Least Squares (OLS) against an arbitrarily large (and unbiased) sample.

The following quote lucidly summarizes two attractions of recursive models:

“A system of equations is recursive rather than simultaneous if there is unidirectional dependency among the endogenous variables such that, for given values of exogenous variables, values for the endogenous variables can be determined sequentially rather than jointly. Due to the ease with which they can often be estimated and the temptation to interpret them in terms of causal chains, recursive systems were the earliest equation systems to be used in empirical work in the social sciences.”111The quote is taken from the International Encyclopedia of the Social Sciences, https://www.encyclopedia.com/social-sciences/applied-and-social-sciences-magazines/recursive-models.

The causal interpretation of recursive models is particularly resonant. If appears exclusively as an explanatory variable in the system of equations while appears exclusively as a dependent variable, the recursive model intuitively charts a causal explanation that pits as a primary cause of , such that the estimated correlation between and can be legitimately interpreted as an estimated effect of on .

A three-variable example

To illustrate our exercise, suppose that the analyst estimates the following three-variable recursive model:

| (1) | |||||

where all have zero mean and unit variance. The analyst assumes that all the ’s are mutually uncorrelated, and also that for every and , is uncorrelated with (for , this is mechanically implied by the OLS method).

For a real-life situation behind this example, consider a pharmaceutical company that introduces a new drug, and therefore has a vested interest in demonstrating a large correlation between the dosage of its active ingredient () and the ten-year survival rate associated with some disease. This correlation cannot be directly measured in the short run. However, past experience reveals the correlations between the ten-year survival rate and the levels of various bio-markers (which can serve as the intermediate variable ). The correlation between these markers and the drug dosage can be measured experimentally in the short run. Thus, on one hand the situation calls for a model in the manner of (1), yet on the other hand the pharmaceutical company’s R&D unit may select the bio-marker opportunistically, in order to get a large estimated effect. Of course, in reality there may be various checks and balances that will constrain this opportunism. However, it is interesting to know how badly it can get, in order to evaluate the importance for these checks and balances.

Let denote the correlation between and according to the data-generating process. Suppose that and are objectively uncorrelated - i.e. . The estimated correlation between these variables according to the model, given the analyst’s procedure and its underlying assumptions, is

It is easy to see from this expression how the model can generate spurious estimated correlation between and , even though none exists in reality. All the analyst has to do is select a variable that is positively correlated with both and , such that .

But how large can the false estimated correlation be? Intuitively, since and are objectively uncorrelated, if we choose such that it is highly correlated with , its correlation with will be low. In other words, increasing will come at the expense of decreasing . Formally, consider the true correlation matrix:

By definition, this matrix is positive semi-definite. This property is characterized by the inequality . The maximal value of subject to this constraint is , and therefore this is the maximal false correlation that the above recursive model can generate. This bound is tight: It can be attained if we define to be a deterministic function of and , given by . Thus, while a given misspecified recursive model may be able to generate spurious estimated correlation between objectively independent variables, there is a limit to how far it can go.

Our interest in the upper bound on is not purely mathematical. As the above “bio-marker” example implies, we have in mind situations in which the analyst can select from a large pool of potential auxiliary variable. In the current age of “big data”, analysts have access to datasets involving a huge number of covariates. As a result, they have considerable freedom when deciding which variables to incorporate into their models. This helps our analyst generate a false correlation that approaches the theoretical upper bound.

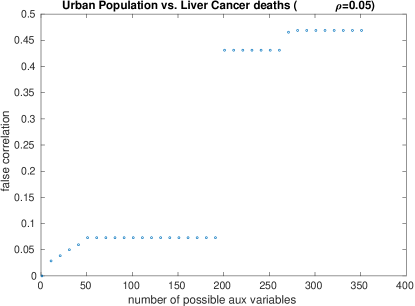

To give a concrete demonstration for this claim, consider Figure , which is extracted from a database compiled by the World Health Organization and collected by Reshef et al. (2011).222The variables are collected on all countries in the WHO database (see www.who.int/whosis/en/) for the year 2009. All the variables are taken from this database. The figure displays the maximal correlation that the model (1) can generate for two fixed pairs of variables and with close to zero, when the auxiliary variable is selected from a pool whose size is given by the horizontal axis (variables were added to the pool in some arbitrary order). When the analyst can choose from only ten possible auxiliary variables, the estimated correlation between and he can generate with (1) is still modest. In contrast, once the pool size is in the hundreds, the estimated correlation approaches the upper bound of .

For a specific variable that gets us near the theoretical upper bound, consider the figure’s R.H.S, where represents urban population and represents liver cancer deaths per 100,000 men. The true correlation between these variables is . If the analyst selects to be coal consumption (measured in tonnes oil equivalent), the estimated correlation between and is , far above the objective value. This selection of has the added advantage that the model suggests an intuitive causal mechanism: Urbanization causes cancer deaths via its effect on coal consumption.

Review of the results

We present our formal model in Section 2 and pose our main problem: What is the largest estimated correlation between and that a recursive, -variable linear-regression model can generate? We impose one constraint on this maximization problem: While the estimated model is allowed to distort correlations among variables, it must produce correct estimates of the individual variables’ mean and variance. The linearity of the analyst’s model implies that only the latter has bite.

To motivate this constraint, recall that the scenario behind our model involves a sophisticated analyst and a lay audience. Because the audience is relatively unsophisticated, it cannot be expected to discipline the analyst’s opportunistic model selection with elaborate tests for model misspecification that involve conditional or unconditional correlations. However, monitoring individual variables is a much simpler task than monitoring correlations between variables. E.g., it is relatively easy to disqualify an economic model that predicts highly volatile inflation if observed inflation is relatively stable. Likewise, a climatological model that underpredicts temperature volatility loses credibility, even for a lay audience.

Beyond this justification, we simply find it intrinsically interesting to know the extent to which misspecified recursive models can distort correlations between variables while preserving moments of individual variables. At any rate, we relax the constraint in Section 4, for the special case of models that consist of a single non-degenerate regression equation. We use this case to shed light on the analyst’s opportunistic use of “bad controls”.

In Section 3, we derive the following result. For a generic objective covariance matrix with , the maximal estimated correlation that a recursive model with up to variables can generate, subject to preserving the mean and variance of individual variables, is

| (2) |

The upper bound given by (2) is tight. Specifically, it is attained by the simplest recursive model that involves variables: For every , is regressed on only. This model is represented graphically by the chain . his chain has an intuitive causal interpretation, which enables the analyst to present as an estimated causal effect of on . The variables that are employed in this model have a simple definition, too: They are all deterministic linear functions of and .

Formula (2) reproduces the value that we derived in our illustrative example, and it is strictly increasing in . When , the expression converges to . That is, regardless of the true correlation between and , a sufficiently large recursive model can generate an arbitrarily large estimated correlation. The lesson is that when the analyst is free to select his model and the variables that inhabit it, he can deliver any conclusion about the effect of one variable on another - unless we impose constraints on his procedure, such as bounds on the complexity of his model or additional misspecification tests.

The formula (2) has a simple geometric interpretation, which also betrays the construction of the recursive model and objective covariance matrix that implement the upper bound. Take the angle that represents the objective correlation between and ; divide it into equal sub-angles; this sub-angle represents the correlation between adjacent variables along the above causal chain; the product of these correlations produces the estimated correlation between and .

The detailed proof of our main result is presented in Section 5. It relies on the graphical representation of recursive models and employs tools from the Bayesian-networks literature (Cowell et al. (1999), Koller and Friedman (2009)). In the Appendix, we present partial analysis of our question for a different class of models involving variables.

Related literature

There is a huge literature on misspecified models in various branches of economics and statistics, which is too vast to survey in detail here. A few recent references can serve as entry points for the interested reader: Esponda and Pouzo (2016), Bonhomme and Weidner (2018) and Molavi (2019). To our knowledge, our paper is the first to carry out a worst-case analysis of misspecified models’ predicted correlations.

The “analyst” story that motivated this exercise brings to mind the phenomenon of researcher bias. A few works in Economics have explicitly modeled this bias and its implications for statistical inference. (Of course, there is a larger literature on how econometricians should cope with researcher/publication bias, but here we only describe exercises that contain explicit models of the researcher’s behavior.) Leamer (1974) suggests a method of discounting evidence when linear regression models are constructed after some data have been partially analyzed. Lovell (1983) considers a researcher who chooses out of independent variables as explanatory variables in a single regression with the aim of maximizing the coefficient of correlation between the chosen variables and the dependent variable. He argues that a regression coefficient that appears to be significant at the level should be regarded as significant at only the level. Glaeser (2008) suggests a way of correcting for this form of data mining in the coefficient estimate.

More recently, Di-Tillio, Ottaviani and Sorensen (2017,2019) characterize data distributions for which strategic sample selection (e.g., selecting the highest observations out of ) benefits an evaluator who must take an action after observing the selected sample realizations. Finally, Spiess (2018) proposes a mechanism-design framework to align the preferences of the researcher with that of “society”: A social planner first chooses a menu of possible estimators, the investigator chooses an estimator from this set, and the estimator is then applied to the sampled observations.

The analyst in our model need not be a scientist - he could also be a politician or a pundit. Under this interpretation, constructing a model and fitting it to data is not an explicit, formal affair. Rather, it involves spinning a “narrative” about the effect of policy on consequences and using casual empirical evidence to substantiate it. Eliaz and Spiegler (2018) propose a model of political beliefs that is based on this idea. From this point of view, our exercise in this paper explores the extent to which false narratives can exaggerate the effect of policy.

2 The Model

Let be an objective probability measure over variables, . For every , denote . Assume that the marginal of on each of these variables has zero mean and unit variance. This will entail no loss of generality for our purposes. We use to denote the coefficient of correlation between the variables , according to . In particular, denote . The covariance matrix that characterizes is therefore .

An analyst estimates a recursive model that involves these variables. This model consists of a system of linear-regression equations. For every , the equation takes the form

where:

-

•

. This restriction captures the model’s recursive structure: An explanatory variable in one equation cannot appear as a dependent variable in a later equation.

-

•

In the equation, the ’s are parameters to be estimated against an infinitely large sample drawn from . The analyst assumes that each has zero mean and that it is uncorrelated with all other ’s, as well as with . The ’s are selected to minimize the mean squared error of the regression equation, which gives the standard Ordinary Least Squares estimate:

(3) where , denotes the row of correlations between and each of the explanatory variables , , and denotes the submatrix of the correlations among the explanatory variables.

We refer to such a system of regression equations as an -variable recursive model. The function effectively defines a directed acyclic graph (DAG) over the set of nodes , such that a link exists whenever . DAGs are often interpreted as causal models (see Pearl (2009)). We will make use of the DAG representation in the proof of our main result, as well as in the Appendix. We will also allude to the recursive model’s causal interpretation, but without addressing explicitly the question of causal inference. The analyst in our model engages in a problem of fitting a model to data. While the causal interpretation may help the analyst to “sell” the model to his audience, he does not engage in an explicit procedure for drawing causal inference from his model.

Note that in the analyst’s model, the equation for has no explanatory variables, and is not an explanatory variable in any equation. Furthermore, the partial ordering given by is consistent with the natural enumeration of variables (i.e., implies ). This restriction is made for notational convenience; relaxing it would not change our results. However, it has the additional advantage that the causal interpretation of the model-estimated correlation between and is sensible. Indeed, it is legitimate according to Pearl’s (2009) rules for causal inference based on DAG-represented models.

The analyst’s assumption that each is uncorrelated with is redundant, because it is an automatic consequence of his OLS procedure for estimating . In contrast, his assumption that is uncorrelated with all other , , is the basis for how he combines the individually estimated equations into a joint estimated distribution. It is fundamentally a conditional-independence assumption - namely, that is independent of conditional on . This assumption will typically be false - indeed, it is what makes his model misspecified and what enables him to “cheat” with his model.

Under this assumption, the analyst proceeds to estimate the correlation between and , which can be computed according to the following recursive procedure. Start with the equation. For every , replace with the R.H.S of the equation. This produces a new equation for , with a different set of explanatory variables. Repeat the substitution for each one of these variables, and continue doing so until the only remaining explanatory variable is .

The procedure’s final output is the thus the equation

The coefficients are combinations of parameters (which were obtained by OLS estimation of the individual equations). Likewise, the distribution of each error term is taken from the estimated equation.

The analyst uses this equation to estimate the variance of and its covariance with , implementing the (partly erroneous) assumptions that all the ’s have zero mean and unit variance, and that the ’s mean, mutual covariance and covariance with are all zero:

and

Therefore, the estimated coefficient of correlation between and is

| (4) |

We assume that the analyst faces the constraint that the estimated mean and variance of all individual variables must be correct (see the Introduction for a discussion of this constraint). The requirement that the estimated means of individual variables are undistorted has no bite: The OLS procedure for individual equations satisfies it. Thus, the constraint is reduced to the requirement that

for all (we can calculate this estimated variance for every , using the same recursive procedure we applied to ). This reduces (4) to

Our objective will be to examine how large this expression can be, given and a generic objective covariance matrix problem.

Comments on the analyst’s procedure

In our model, the analyst relies on a structural model to generate an estimate of the correlation between and , which he presents to a lay audience. The process by which he selects the model remains hidden from the audience. But why does the analyst use a model to estimate the correlation between and , rather than estimating it ? One answer may be that direct evidence on this correlation is hard to come by (as, for example, in the case of long-term health effects of nutritional choices). In this case, the analyst use a model to extrapolate an estimate of from observed data.

Another answer is that analysts use models as simplified representations of a complex reality, which they can consult for conditional-estimation tasks: Estimating the effect of on is only one of these tasks. This is illustrated by the following quote: “The economy is an extremely complicated mechanism, and every macroeconomic model is a vast simplification of reality…the large scale of FRB/US [a general equilibrium model employed by the Federal Reserve Bank - the authors] is an advantage in that it can perform a wide variety of computational ‘what if’ experiments.”333This quote is taken from a speech by Stanley Fisher: See https://www.federalreserve.gov/newsevents/speech/fischer20170211a.htm. From this point of view, our analysis concerns the maximal distortion of pairwise correlations that such models can produce.

Our treatment of the model accommodates both interpretations. In particular, we will allow for the possibility that , which means that the analyst does have data about the joint distribution of and . As we will see, our main result will not make use of this possibility.

3 The Main Result

For every , denote

We are now able to state our main result.

Theorem 1

For almost every true covariance matrix satisfying , if the estimated recursive model satisfies for all , then the estimated correlation between and satisfies

Moreover, this upper bound can be implemented by the following

pair:

(i) A recursive model defined by for every .

(ii) A multivariate Gaussian distribution satisfying, for every :

| (5) |

where are independent standard normal variables.

Let us illustrate the upper bound given by Theorem 1 numerically for the case of , as a function of :

As we can see, the marginal contribution of adding a variable to the false correlation that the analyst’s model can produce decays quickly. However, when , the upper bound converges to one. This is the case for any value of . That is, even if the true correlation between and is strongly negative, a sufficiently large model can produce a large positive correlation.

The recursive model that attains the upper bound has a simple structure. Its DAG representation is a single chain

Intuitively, this is the simplest connected DAG with nodes: It has the smallest number of links among this class of DAGs, and it has no junctions. The distribution over the auxiliary variables in the upper bound’s implementation has a simple structure, too: Every is a different linear combination of two independent “factors”, and . We can identify with , without loss of generality. The closer the variable lies to along the chain, the larger the weight it puts on .

General outline of the proof

The proof of Theorem 1 proceeds in three major steps. First, the constraint that the estimated model preserves the variance of individual variables for a generic objective distribution reduces the class of candidate recursive models to those that can be represented by perfect DAGs. Since perfect DAGs preserve marginals of individual variables for objective distribution (see Spiegler (2017)), the theorem can be stated more strongly for this subclass of recursive models.

Proposition 1

Consider a recursive model given by . Suppose that for every , if and , then . Then, for every true covariance matrix satisfying , .

That is, when the recursive model is represented by a perfect DAG, the upper bound on holds for objective covariance matrix, and the undistorted-variance constraint is redundant.

In the second step, we use the tool of junction trees in the Bayesian-networks literature (Cowell et al. (1999)) to perform a further reduction in the class of relevant recursive models. Consider a recursive model represented by a non-chain perfect DAG. We show that the analyst can generate the same with another objective distribution and a recursive model that takes the form of a simple chain . Furthermore, this chain will involve no more variables than the original model.

To illustrate this argument, consider the following recursive model with :

This recursive model has the following DAG representation:

Because depends on and only through their linear combination , we can replace with a scalar variable , such that the recursive model becomes

This model is represented by the DAG , which is a simple chain that consists of fewer nodes than the original DAG.

This means that in order to calculate the upper bound on , we can restrict attention to the chain model. But in this case, the analyst’s objective function has a simple explicit form:

Thus, in the third step, we derive the upper bound by finding the correlation matrix that maximizes the R.H.S of this formula, subject to the constraints that and that the matrix is positive semi-definite (which is the property that defines the class of covariance matrices). The solution to this problem has a simple geometric interpretation.

4 Single-Equation Models

Analysts often propose models that take the form of a linear-regression equation, consisting of a dependent variable (where ), an explanatory variable and “” variables . Using the language of Section 2, this corresponds to the specification for all and . That is, the only non-degenerate equation is the one for , hence the term “single-equation model”. Note that in this case, the OLS regression coefficient in the equation for coincides with , as defined in Section 2.

Using the graphical representation, the single-equation model corresponds to a DAG in which are all ancestral nodes that send links into . Since this DAG is imperfect, Lemma 1 in Section 5 implies that for almost all objective covariance matrices, the estimated variance of according to the single-equation model will differ from its true value.444All the other variables are represented by ancestral nodes, and therefore their marginals are not distorted (see Spiegler (2017)). However, given the particular interest in this class of models, we relax the correct-variance constraint in this section and look for the maximal false correlation that such models can generate. For expositional convenience, we focus on the case of .

Proposition 2

Let . Then, a single-equation model can generate an estimated coefficient of at most . This bound is tight, and can be approximated arbitrarily well with such that , where .

Proof. Because are Gaussian without loss of generality, we can replace their linear combination (where the ’s are determined by the objective ) by a single Gaussian variable that has mean zero, but its variance need not be one. Its objective distribution conditional on can be written as a linear equation . Since all variables on the R.H.S of this equation are independent (and since and are standardized normal variables), it follows that the objective variance of is

The analyst’s model can now be written as

| (6) |

Our objective is to find the values of , and that maximize

Because and are independent, standardized normal, . The analyst’s model does not distort the variance of .555The reason is that the node that represents in the DAG representation of the model is ancestral. By Spiegler (2017), the estimated model does not distort the marginals of such variables. Therefore, . And since the analyst’s model regards , and as independent,

It is clear from this expression that in order to maximize , we should set . It follows that

which is decreasing in and attains an upper bound of when .

Note that since without loss of generality we can set such that . Therefore, the upper bound is approximated to an arbitrarily fine degree when we set such that . As a result, the estimated variance of diverges.

Thus, to magnify the false correlation between and , the analyst would select the “control” variables such that a certain linear combination of them has strong negative correlation with . That is, the analyst will prefer his regression model to exhibit multicollinearity. This inflates the estimated variance of ; indeed, when . However, at the same time it increases the estimated covariance between and , which more than compensates for this increase in variance. As a result, the estimated correlation between and rises substantially.

The three-variable model that implements the upper bound is represented by the DAG . That is, it treats the variables and as independent, even though in reality they are correlated. In particular, the objective distribution may be consistent with a DAG that adds a link to the analyst’s DAG, such that adding to the regression means that we control for a “post-treatment” variable (where is viewed as the treatment). In other words, is a “bad control” (see Angrist and Pischke (2008), p. 64).666See also http://causality.cs.ucla.edu/blog/index.php/2019/08/14/a-crash-course-in-good-and-bad-control/.

The upper bound of in Proposition 2 is obtained with . Recall that under the undistorted-variance constraint, the upper bound on for is . This shows that the constraint has bite. However, when is sufficiently large, the single-equation model is outperformed by the multi-equation chain model, which does satisfy the undistorted-variance constraint.

5 Proof of Theorem 1

5.1 Preliminaries: Bayesian Networks

The proof relies on concepts and tools from the Bayesian-network literature (Cowell et al. (1999), Koller and Friedman (2009)). Therefore, we introduce a few definitions that will serve us in the proof.

A DAG is a pair , where is a set of nodes and is a pair of directed links. We assume throughout that . With some abuse of notation, is the set of nodes for which the DAG includes a link . A DAG is if whenever for some , it is the case that or .

A subset of nodes is a if for every , or . We say that a clique is maximal if it is not contained in another clique. We use to denote the collection of maximal cliques in a DAG.

A node is ancestral if is empty. A node is terminal if there is no such that . In line with our definition of recursive models in Section 2, we assume that is ancestral and is terminal. It is also easy to verify that we can restrict attention to DAGs in which is the terminal node - otherwise, we can remove the other terminal nodes from the DAG, without changing . We will take these restrictions for granted henceforth.

The analyst’s procedure for estimating , as described in Section 2, has an equivalent description in the language of Bayesian networks, which we now describe.

Because the analyst estimates a linear model, it is as if he believes that the underlying distribution is multivariate normal, where the estimated equation is a complete description of the conditional distribution . Therefore, from now, we will proceed as if were indeed a standardized multivariate normal with covariance matrix , such that the regression equation corresponds to measuring the correct distribution of conditional on . This is helpful expositionally and entails no loss of generality.

Given an objective distribution over and a DAG , define the Bayesian-network factorization formula:

We say that is consistent with if .

By Koller and Friedman (2009, Ch. 7), when is multivariate normal, is reduced to the estimated joint distribution as described in Section 2. In particular, we can use to calculate the estimated marginal of for any :

Likewise, the induced estimated distribution of conditional on is

| (7) |

This conditional distribution, together with the marginals and , induce the estimated correlation coefficient given by (4).

Because we take to be multivariate normal, the constraint that does not distort the mean and variance of individual variables is equivalent to the requirement that the estimated marginal distribution coincides with the objective marginal distribution of . This constraint necessarily holds if is perfect. Furthermore, when is perfect, for every clique in (see Spiegler (2017)).

5.2 The Proof

Our first step is to establish that for generic , perfection is necessary for the correct-marginal constraint.

Lemma 1

Let and suppose that is imperfect. Then, there exists such that for almost all correlation submatrices (and therefore, for almost all correlation matrices ).

Proof. Recall that we list the variables such that for every . Consider the lowest for which is not a clique. This means that there exist two nodes that are unlinked in , whereas for every and every , and are linked in .

Our goal is to show that for almost all correlation submatrices . Since none of the variables appear in the equations for , we can ignore them and treat as the terminal node in without loss of generality, such that is defined over the nodes , and is defined over the variables .

Let denote the correlation matrix over induced by - i.e., is the estimated correlation between and , whereas denotes their true correlation. By assumption, the estimated marginals of are correct, hence for all .

Furthermore, observe that in order to compute over , we do not need to know the value of (i.e. the true correlation between and ). To see why, note that is induced by . Each of the terms in the factorization formula for is of the form , . To compute this conditional probability, we only need to know . By the definition of , and , it is impossible for both and to be included in . Therefore, we can compute without knowing the true value of . We will make use of this observation toward the end of this proof.

The equation for is

| (8) |

Let denote the vector . Let denote the correlation sub-matrix that fully characterizes the objective joint distribution . Then, the objective variance of can be written as

| (9) |

where .

In contrast, the estimated variance of , denoted , obeys the equation

| (10) |

where denotes the correlation sub-matrix that characterizes . In other words, the estimated variance of is produced by replacing the true joint distributed of in the regression equation for with its estimated distribution (induced by ), without changing the values of and .

The undistorted-marginals constraint requires . This implies the equation

| (11) |

We now wish to show that this equation fails for generic .

For any subsets , use to denote the submatrix of in which the selected set of rows is and the selected set of columns is . By assumption, are unlinked. This means that according to , , where . Therefore, by Drton et al. (2008, p. 67),

| (12) |

Note that equation (12) is precisely where we use the assumption that is imperfect. If were perfect, then all nodes in would be linked and therefore we would be unable to find a pair of nodes that necessarily satisfies (12).

The L.H.S of (12) is simply . The R.H.S of (12) is induced by . As noted earlier, this distribution is pinned down by and the entries in except for . That is, if we are not informed of but we are informed of all the other entries in , we are able to pin down the R.H.S of (12).

Now, when we draw the objective correlation submatrix at random, we can think of it as a two-stage lottery. In the first stage, all the entries in this submatrix except are drawn. In the second stage, is drawn. The only constraint in each stage of the lottery is that has to be positive-semi-definite and have ’s on the diagonal. Fix the outcome of the first stage of this lottery. Then, it pins down the R.H.S of (12). In the lottery’s second stage, there is (for a generic outcome of the lottery’s first stage) a continuum of values that could take for which will be positive-semi-definite. However, there is only value of that will coincide with the value of that is given by the equation (12). We have thus established that for generic .

Recall once again that we can regards as a parameter of that is independent of (and therefore of as well), because describes whereas characterize . Then, since we can assume , (11) is a non-tautological quadratic equation of (because we can construct examples of that violate it). By Caron and Traynor (2005), it has a measure-zero set of solutions . We conclude that the constraint is violated by almost every .

Corollary 1

For almost every , if a DAG satisfies and for all , then is perfect.

Proof. By Lemma 1, for every imperfect DAG , the set of covariance matrices for which preserves the mean and variance of all individual variables has measure zero. The set of imperfect DAGs over is finite, and the finite union of measure-zero sets has measure zero as well. It follows that for almost all , the property that preserves the mean and variance of individual variables is violated unless is perfect.

The next step is based on the following definition.

Definition 1

A DAG is linear if is the unique ancestral node, is the unique terminal node, and is a singleton for every non-ancestral node.

A linear DAG is thus a causal chain . Every linear DAG is perfect by definition.

Lemma 2

For every Gaussian distribution with correlation matrix and non-linear perfect DAG with nodes, there exists a Gaussian distribution with correlation matrix and a linear DAG with weakly fewer nodes than , such that and the false correlation induced by on is exactly the same as the false correlation induced by on : .

Proof. The proof proceeds in two main steps.

Step 1: Deriving an explicit form for the false correlation using an auxiliary “cluster recursion” formula

The following is standard material in the Bayesian-network literature. For any distribution corresponding to a perfect DAG, we can rewrite the distribution as if it factorizes according to a tree graph, where the nodes in the tree are the maximal cliques of . This tree satisfies the running intersection property (Koller and Friedman (2009, p. 348)): If for two tree nodes, then for every along the unique tree path between and . Such a tree graph is known as the “junction tree” corresponding to and we can write the following “cluster recursion” formula (Koller and Friedman (2009, p. 363)):

where is an arbitrary selected root clique node and is the upstream neighbor of clique (the one in the unique path from to the root ). The second equality is due to the fact that is perfect, hence for every clique of .

Let be two cliques that include the nodes and , respectively. Furthermore, for a given junction tree representation of the DAG, select these cliques to be minimally distant from each other - i.e., for every along the junction-tree path between and . We now derive an upper bound on . Recall the running intersection property: If for some , then for every between and . Since the cliques are maximal, it follows that every along the sequence must introduce at least one new element (in particular, includes some ). As a result, it must be the case that . Furthermore, since is assumed to be non-linear, the inequality is , because at least one along the sequence must contain at least three elements and therefore introduce at least new elements. Thus, .

Since factorizes according to the junction tree, it follows that the distribution over the variables covered by the cliques along the path from to factorize according to a linear DAG , as follows:

| (13) |

where . The length of this linear DAG is . While this factorization formula superficially completes the proof, note that the variables are typically normal variables, whereas our objective is to show that we can replace them with scalar (i.e. univariate) normal variables without changing .

Recall that we can regard as a multivariate normal distribution without loss of generality. Furthermore, under such a distribution and any two subsets of variables , the distribution of conditional on can be written , where is a matrix that depends on the means and covariances of , and is a zero-mean vector that is uncorrelated with . Applying this property to the junction tree, we can describe via the following recursion:

| (14) | |||||

where each equation describes an objective conditional distribution - in particular, the equation for describes . The matrices are functions of the vectors in the original recursive model. The ’s are all zero mean and uncorrelated with the explanatory variables , such that . Furthermore, according to (i.e. the analyst’s estimated model), each (with ) is conditionally independent of given . Since the junction-tree factorization (13) represents exactly the same distribution , this means that every is uncorrelated with all other ’s as well as with . Therefore,

Since preserves the marginals of individual variables, for all . In particular Then,

Step 2: Defining a new distribution over scalar variables

For every , define the variable

Plugging the recursion (14), we obtain a recursion for :

Given that is taken to be multivariate normal, the equation for measures the objective conditional distribution . Since does not distort the objective distribution over cliques, coincides with . This means that an analyst who fits a recursive model given by the linear DAG will obtain the following estimated model, where every is a zero-mean scalar variable that is assumed by the analyst to be uncorrelated with the other ’s as well as with (and as before, the assumption holds automatically for but is typically erroneous for , ):

Therefore, is given by

Since is perfect, , hence

We have thus reduced our problem to finding the largest that can be attained by a linear DAG of length at most.

To solve the reduced problem we have arrived at, we first note that

| (15) |

Thus, the problem of maximizing is equivalent to maximizing the product of terms in a symmetric matrix, subject to the constraint that the matrix is positive semi-definite, all diagonal elements are equal to one, and the entry is equal to :

Note that the positive semi-definiteness constraint is what makes the problem nontrivial. We can arbitrarily increase the value of the objective function by raising off-diagonal terms of the matrix, but at some point this will violate positive semi-definiteness. Since positive semi-definiteness can be rephrased as the requirement that for some matrix , we can rewrite the constrained maximization problem as follows:

| (16) |

Denote . Since the solution to (16) is invariant to a rotation of all vectors , we can set

without loss of generality. Note that are both unit norm and have dot product . Thus, we have eliminated the constraint and reduced the variables in the maximization problem to .

Now consider some . Fix for all , and choose to maximize the objective function. As a first step, we show that must be a linear combination of . To show this, we write , where are orthogonal vectors, is in the subspace spanned by and is orthogonal to the subspace. Recall that is a unit-norm vector, which implies that

| (17) |

The terms in the objective function (16) that depend on are simply . All the other terms in the product do not depend on , whereas the dot product between and is invariant to : .

Suppose that is nonzero. Then, we can replace with another unit-norm vector , such that will be replaced by

By (17) and the assumption that is nonzero, , hence the replacement is an improvement. It follows that can be part of an optimal solution only if it lies in the subspace spanned by . Geometrically, this means that lies in the plane defined by the origin and .

Having established that are coplanar, let be the angle between and , let be the angle between and , and let be the (fixed) angle between and . Due to the coplanarity constraint, . Fixing for all and applying a logarithmic transformation to the objective function, the optimal must satisfy

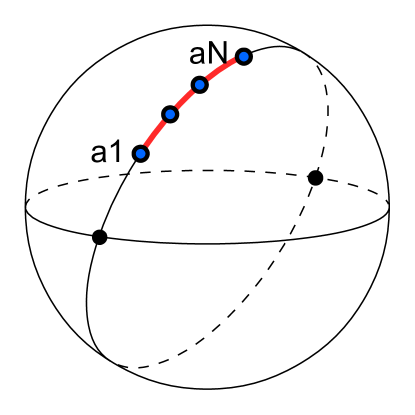

Differentiating this expression with respect to and setting the derivative to zero, we obtain . Since this must hold for any , we conclude that at the optimum, any lies on the plane defined by the origin and and is at the same angular distance from . That is, an optimum must be a set of equiangular unit vectors on a great circle, equally spaced between and . The explicit formulas for these vectors are given by (5).

The formula for the upper bound has a simple geometric interpretation (illustrated by Figure 2). We are given two points on the unit -dimensional sphere (representing and ) whose dot product is , and we seek additional points on the sphere such that the harmonic average of the successive points’ dot product is maximal. Since the dot product for points on the unit sphere decreases with the spherical distance between them, the problem is akin to minimizing the average distance between adjacent points. The solution is to place all the additional points equidistantly on the great circle that connects and .

Since by construction, every neighboring points and have a dot product of , we have , such that . This completes the proof.

6 Conclusion

This paper performed a worst-case analysis of misspecified recursive models. We showed that within this class, model selection is a very powerful tool in the hands of an opportunistic analyst: If we allow him to freely select a moderate number of variables from a large pool, he can produce a very large estimated correlation between two variables of interest. Furthermore, the structure of his model allows him to interpret this correlation as a causal effect. This is true even if the two variables are objectively independent, or if their correlation is in the opposite direction. Imposing a bound on the model’s complexity (measured by its number of auxiliary variables) is an important constraint on the analyst. However, the value of this bound decays quickly, as even with one or two auxiliary variables the analyst can greatly distort objective correlations.

Within our framework, several questions are left open. First, we do not know whether Theorem 1 would continue to hold if we replaced the quantifier “for almost every ” with “for every ”. Second, we do not know how much bite the undistorted-variance constraint has in models with more than one non-trivial equation. Third, we lack complete characterizations for recursive models outside the linear-regression family (see our partial characterization for models that involve binary variables in Appendix II). Finally, it would be interesting to devise a sparse collection of misspecification or robustness tests that would restrain our opportunistic analyst.

Taking a broader perspective into the last question, our exercise suggests a novel approach to the study of biased estimates due to misspecified models in Statistics and Econometric Theory (foreshadowed by Spiess (2018)). Under this approach, the analyst who employs a structural model for statistical or causal analysis is viewed as a player in a game with his audience. Researcher bias implies a conflict of interests between the two parties. This bias means that the analyst’s model selection is opportunistic. The question is which strategies the audience can play (in terms of robustness or misspecification tests it can demand) in order to mitigate errors due to researcher bias, without rejecting too many valuable models.

Appendix: Uniform Binary Variables

Suppose now that the variables all take values in , and restrict attention to the class of objective distributions whose marginal on each variable is uniform - i.e., for every . As in our main model, fix the correlation between and to be - that is,

The question of finding the distribution (in the above restricted domain) and the DAG that maximize the induced subject to is generally open. However, when we fix to be the linear DAG

we are able to find the maximal . It makes sense to consider this specific DAG, because it proved to be the one most conducive to generating false correlations in the case of linear-regression models.

Given the DAG and the objective distribution , the correlation between and that is induced by is

Let . Given the structure of the linear DAG, we can write

| (18) |

In particular,

Note that has the same expression that we would have if we dealt with a linear DAG of length , in which is the ancestral node: . This observation will enable us to apply an inductive proof to our result.

Lemma 3

For every ,

We can now derive an upper bound on for the environment of this appendix - i.e., the estimated model is a linear DAG, and the objective distribution has uniform marginals over binary variables.

Proposition 3

For every ,

Proof. The proof is by induction on . Let . Then, , and therefore , which confirms the formula.

Suppose that the claim holds for some . Now let . Consider the distribution of conditional on . Denote . We wish to derive a relation between and . Denote

Then,

Likewise,

The objective correlation between and is thus

| (20) |

Let us now turn to the joint distribution of and . Because the marginals on both and are uniform, . Therefore, we can obtain in the same manner that we obtained :

| (21) |

We have thus established a relation between and .

Recall that is the expression we would have for the linear DAG when . Therefore, by the inductive step,

Both and increase in and decrease in , such that we can set and without lowering the R.H.S of (6). This enables us to write

such that

Therefore, we can transform (6) into

The R.H.S is a straightforward maximization problem. Performing a logarithmic transformation and writing down the first-order condition, we obtain

and

such that

which completes the proof.

How does this upper bound compare with the Gaussian case? For illustration, let . Then, it is easy to see that for , we obtain , which is below the value of we were able to obtain in the Gaussian case. And as , . That is, unlike the Gaussian case, the maximal false correlation that the linear DAG can generate is bounded far away from one.

The upper bound obtained in this result is tight. The following is one way to implement it. For the case , take the exact same Gaussian distribution over that we used to implement the upper bound in Theorem 1, and now define the variable for each . Clearly, each and since each has zero mean. To find the correlations between different variables, we use the following lemma.

Lemma 4

Let be two unit vectors in and let be a multivariate Gaussian with zero mean and unit covariance. Then,

where is the angle between the two vectors.

Proof. This follows from the fact that the product is equal to whenever is on the same side of the two hyperplanes defined by and , and otherwise. Since the Gaussian distribution of is circularly symmetric, the probability that lies on the same side of the two hyperplanes depends only on the angle between them.

Returning to the definition of the Gaussian distribution over that we used to implement the upper bound in Theorem 1, we see that in the case of , the angle between and will be , so that by the above lemma, and will be uncorrelated. At the same time, the angle between any and is by construction because the vectors were chosen at equal angles along the great circle. Substituting this angle into the lemma, we obtain that the correlation between and is .

For the case where , the same argument holds, except that we need to choose the original vectors so that the correlation between and will be (these will not be the same vectors that give a correlation of between the Gaussian variables and ) and then choose the rest of the vectors at equal angles along the great circle. By applying the lemma again, we obtain that the angle between and is , which again attains the upper bound.

This method of implementing the upper bound also explains why false correlations are harder to generate in the uniform binary case, compared with the case of linear-regression models. The variable is a coarsening of the original Gaussian variable . It is well-known that when we coarsen Gaussian variables, we weaken their mutual correlation. Therefore, the correlation between any consecutive variables in the construction for the uniform binary case is lower than the corresponding correlation in the Gaussian case. As a result, the maximal correlation that the model generates is also lower.

The obvious open question is whether the restriction to linear DAGs entails in a loss of generality. We conjecture that in the case of uniform binary variables, a non-linear perfect DAG can generate larger false correlations for sufficiently large .

References

- [1] Angrist, J. and J. Pischke (2008), Mostly Harmless Econometrics: An Empiricist’s Companion, Princeton University Press.

- [2] Bonhomme, S. and M. Weidner (2018), Minimizing Sensitivity to Model Misspecification, arXiv preprint arXiv:1807.02161.

- [3] Caron, R. and T. Traynor (2005), The Zero Set of a Polynomial, WSMR Report: 05-02.

- [4] Cowell, R., P. Dawid, S. Lauritzen and D. Spiegelhalter (1999), Probabilistic Networks and Expert Systems, Springer, London.

- [5] Drton, M., B. Sturmfels and S. Sullivant (2008), Lectures on Algebraic Statistics, Vol. 39, Springer Science & Business Media.

- [6] Eliaz, K. and R. Spiegler (2018), A Model of Competing Narratives, mimeo.

- [7] Esponda, I. and D. Pouzo (2016), Berk–Nash Equilibrium: A Framework for Modeling Agents with Misspecified Models, Econometrica 84, 1093-1130.

- [8] Glaeser, E. (2008), Researcher Incentives and Empirical Methods, in The Foundations of Positive and Normative Economics (Andrew Caplin and Andrew Schotter, eds.), Oxford: Oxford University, 300-319.

- [9] Leamer, E. (1974), False Models and Post-Data Model Construction, Journal of the American Statistical Association, 69(345), 122-131.

- [10] Molavi, P. (2019), Macroeconomics with Learning and Misspecification: A General Theory and Applications, mimeo.

- [11] Lovell, M. (1983), Data Mining, The Review of Economics and Statistics, 65(1), 1-12.

- [12] Di Tillio, A., M. Ottaviani, and P. Sorensen (2017), Persuasion Bias in Science: Can Economics Help? Economic Journal 127, F266–F304.

- [13] Di Tillio, A., M. Ottaviani, and P. Sorensen (2019), Strategic Selection Bias, Working Paper.

- [14] Pearl, J. (2009), Causality: Models, Reasoning and Inference, Cambridge University Press, Cambridge.

- [15] Koller, D. and N. Friedman. (2009). Probabilistic Graphical Models: Principles and Techniques, MIT Press, Cambridge MA.

- [16] Reshef, D., Y. Reshef, H. Finucane, S. Grossman, G. McVean, P. Turnbaugh, E. Lander, M. Mitzenmacher and P. Sabeti (2011), Detecting Novel Associations in Large Data Sets, Science, 334(6062), 1518-1524.

- [17] Spiegler, R. (2017), “Data Monkeys”: A Procedural Model of Extrapolation From Partial Statistics, Review of Economic Studies 84, 1818-1841.

- [18] Spiess, J. (2018), Optimal Estimation when Researcher and Social Preferences are Misaligned, Working Paper.