High dimensional regression for regenerative time-series: an application to road traffic modeling

Abstract

A statistical predictive model in which a high-dimensional time-series regenerates at the end of each day is used to model road traffic. Due to the regeneration, prediction is based on a daily modeling using a vector autoregressive model that combines linearly the past observations of the day. Due to the high-dimension, the learning algorithm follows from an -penalization of the regression coefficients. Excess risk bounds are established under the high-dimensional framework in which the number of road sections goes to infinity with the number of observed days. Considering floating car data observed in an urban area, the approach is compared to state-of-the-art methods including neural networks. In addition of being highly competitive in terms of prediction, it enables the identification of the most determinant sections of the road network.

Keywords— MSC 2010 subject classifications: Primary 62J05, 62J07, ; secondary 62P30.

vector autoregressive model, Lasso, regenerative process, road traffic prediction

1 Introduction

As the world witnesses the negative effects of traffic congestion, including pollution and economically ineffective transportation (Bull, , 2003; Pellicer et al., , 2013; Harrison and Donnelly, , 2011), achieving smart mobility has become one of the leading challenges of emerging cities (Washburn et al., , 2009). In order to set up effective solutions, such as developing intelligent transportation management systems for urban planners, or extending the road network efficiently, smart cities first need to accurately understand road traffic. This paper investigates interpretable predictive models estimated from floating car data, allowing for the identification of road traffic determinants.

The proposed methodology addresses two important issues regarding floating car data. First, in contrast with a traditional time series analysis (Brockwell et al., , 1991), the number of vehicles using the network almost vanishes during the night. Hence, in terms of probabilistic dependency, the road traffic between the different days is assumed independent. Such a phenomenon is referred to as “regeneration” in the Markov chains literature (Meyn and Tweedie, , 2012) where the road network “regenerates” at the beginning of each new day. Second, the size of the road network, especially in urban areas, can be relatively large compared to the number of observed days. This implies that the algorithms employed must be robust to the well-known high-dimensional regression (Giraud, , 2014) setting in which the features are numerous.

For each time of day , we denote the vector of speeds registered in the road network by .

Hence , and stand for the number of sections in the network, the number of days in the study, and the number of time instants within each day. Inspired by the time series analysis, the proposed model is similar to the popular vector auto-regressive (VAR) model, as described in the econometric literature (Hamilton, , 1994). The one difference is that it only applies within each new day due to the regeneration property.

We therefore consider the following linear regression model, called regenerative VAR,

| (1) |

with and . This model is used to predict the next value . The parameter encodes for the influence between different road sections, and the parameters account for the daily (seasonal) variations.

The approach taken for estimating the parameters of the regenerative VAR, and , follows from applying ordinary least-squares (OLS) while penalizing the coefficients of using the -norm just as in the popular LASSO procedure (Tibshirani, , 1996); see also Bühlmann and Van De Geer, (2011); Giraud, (2014); Hastie et al., (2015) for reference textbooks. The estimator is computed by minimizing over and the following objective function

| (2) |

where and stands for the Frobenius norm. While the estimation of standard VAR models (without regeneration) has been well-documented for decades (Brockwell et al., , 1991), only recently has penalization been introduced to estimate the model coefficients; see, among others, (Valdés-Sosa et al., , 2005; Wang et al., , 2007; Haufe et al., , 2010; Song and Bickel, , 2011; Michailidis and d’Alché Buc, , 2013; Kock and Callot, , 2015; Basu et al., , 2015; Baek et al., , 2017). The aforementioned references advocate for the use of the LASSO or some of its variants in time-series prediction when the dimension of the time series is relatively large. Other variable selection approaches in VAR models, but without using the LASSO, are proposed in Davis et al., (2016).

The regeneration property differentiates the mathematical tools used in this paper from the time-series literature mentioned above. The independence between the days allows us to rely on standard results dealing with sums of independent random variables and therefore to build upon results dealing with the LASSO based on independent data (Bickel et al., , 2009). From an estimation point of view, two key aspects are related to the regenerative VAR model: (i) the regression output is a high-dimensional vector of size and (ii) the model is linear with random covariates. This last point makes our study related to random design analyses of the LASSO (Bunea et al., , 2007; Van De Geer and Bühlmann, , 2009). Another issue with regards to the regenerative VAR model is that of model switching, which occurs when the use of two different matrices , each within two different time periods, improve the prediction. This kind of variation in the predictive model might simply be caused by changes in the road traffic intensity. Therefore, a key objective with regards to the regenerative VAR model is detecting such change points based on observed data.

From a theoretical standpoint, we adopt an asymptotic framework which captures the nature of usual road traffic data in which and are growing to infinity ( might be larger than ) whereas is considered to be fixed. We first establish a bound on the predictive risk, defined as the normalized prediction error, for the case . This situation corresponds to ordinary least-squares. The order is in and therefore deteriorates when the value of increases. Moreover, the conditions for its validity are rather strong because they require the smallest eigenvalue of the Gram matrix to be large enough. Then, under a sparsity assumption on the matrix , claiming that each line of has a small number of a non-zero coefficient (each section is predicted based on a small number of sections), we study the regularized case when . In this case, even when is much larger than , we obtain a bound of order (up to a logarithmic factor), and the eigenvalue condition is alleviated as it concerns only the eigenvalues restricted to the active variables. Finally, these results are used to demonstrate the consistency of a cross-validation change point detection procedure under regime switching.

From a practical perspective, the regenerative VAR, by virtue of its simplicity, contrasts with past approaches, mostly based on deep neural networks, that have been used to handle road traffic data. For instance, in (Lv et al., , 2014), autoencoders are used to extract spatial and temporal information from the data before predictions. In (Dai et al., , 2017), multilayer perceptrons (MLP) and long short-term memory (LSTM) are combined together to analyze time-variant trends in the data. Finally, LSTM with spatial graph convolution are employed in (Lv et al., , 2018; Li et al., , 2017). Three advantages of the proposed approach are the following:

-

(i)

It allows for the consideration of very large road networks which include not only main roads (major highways), which is typically the case, but also primary roads. The previous neural network methods either use data collected from fixed sensors on the main roads (Dai et al., , 2017; Lv et al., , 2014) or, when using floating car data, restrict the network to the main roads ignoring primary roads (Epelbaum et al., , 2017). Even if this avoids overfitting, as it leaves out a large number of features compared to the sample size, there might be some loss of information in reducing the data to an arbitrary subset.

-

(ii)

The estimated coefficients are easily interpretable thanks to the linear model and the LASSO selection procedure, which shrinks irrelevant sections to zero. This provides data-driven graphical representations of the dependency within the network that could be useful for road maintenance. Once again, this is in contrast with complex deep learning models in which interpretation is known to be difficult.

-

(iii)

Changes in the distribution of road traffic during the day can be handled easily using a regime switching approach; this consists of a simple extension of the initial regenerative VAR proposed in (1) in which the matrix is allowed to change over time.

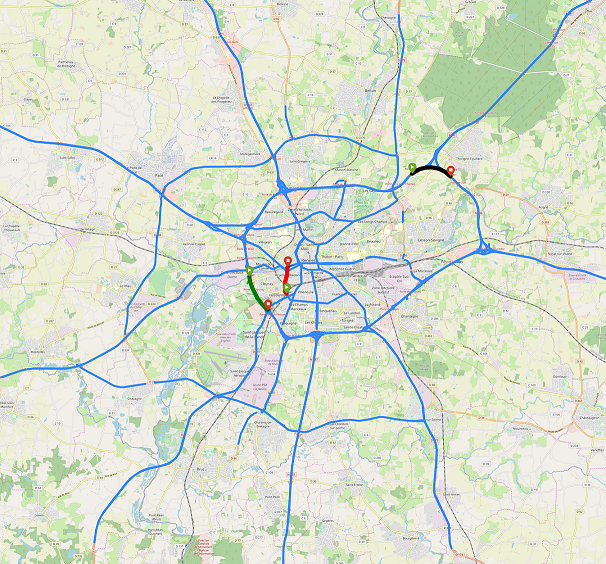

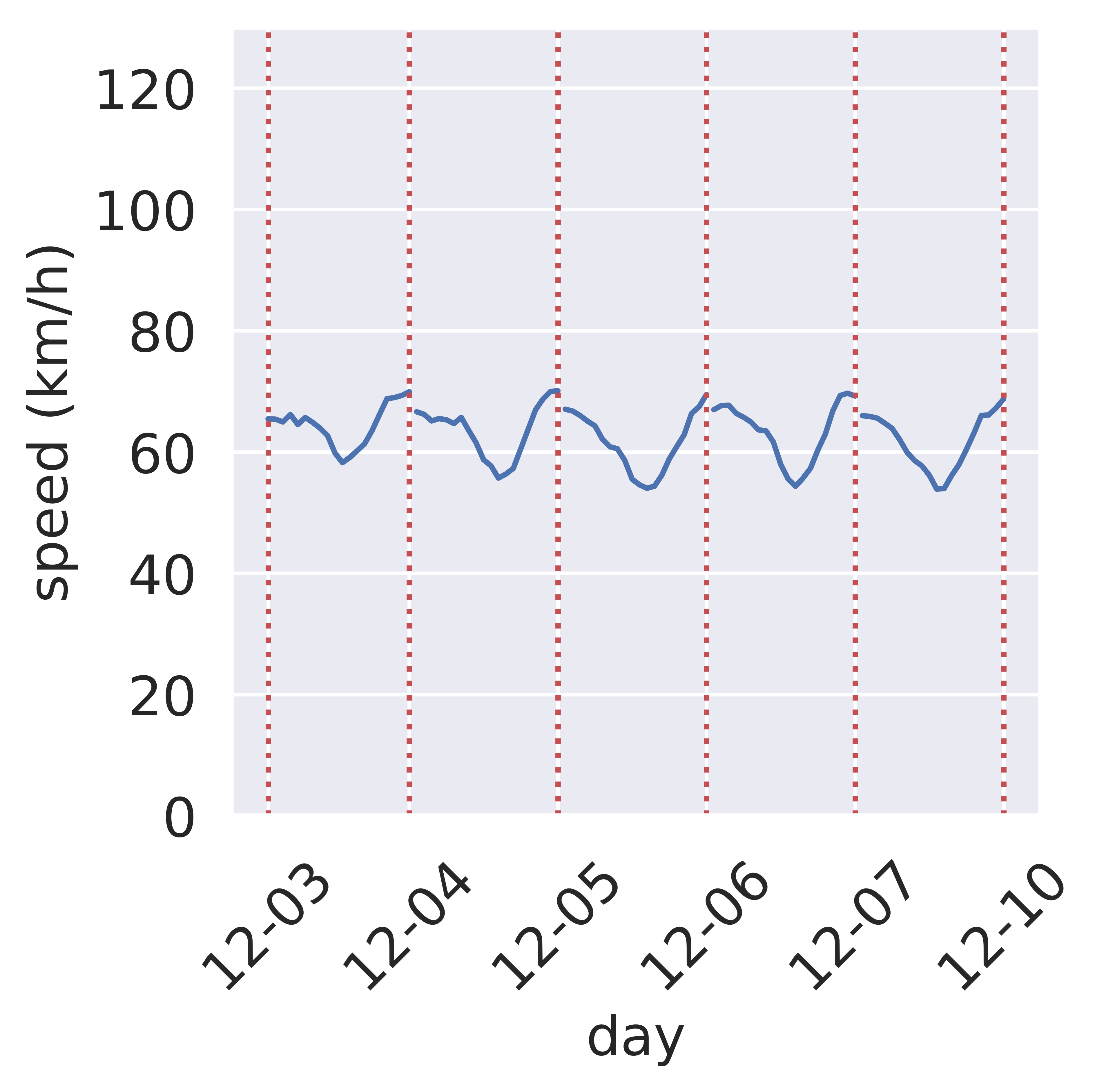

To demonstrate the practical interest of the proposal, the data used is concerned with the urban area of a French city, Rennes, made of days, road sections and time instants (from pm to pm) within each day (see Figure 1). Among all the considered methods, including the classical baseline from the time series analysis as well as the most recent neural network architecture, this is the regime switching model that yields the best performance.

The outline is as follows. In Section 2, the probabilistic framework is introduced. The optimal linear predictor is characterized, and the main assumptions are discussed. In Section 3, we present the main theoretical results of the paper that are bounds on the prediction error of (2). Section 4 investigates the regime switching variant. A comparative study including different methods applied to the real data presented before is proposed in Section 5. A simulation study is conducted in Section 6. All the proofs of the stated results are gathered in the Appendix.

2 Probabilistic framework

Let denote an index set of real-valued variables that evolve during a time period . These variables are gathered in a matrix of size denoted by . In road traffic data, stands for the section index of the road network , for the time instants within the day, and is the speed recorded at section and time . We denote by the vector of speed at time . The following probabilistic framework will be adopted throughout the paper.

Assumption 1 (probabilistic framework).

Let be a probability space. The matrix is a random element valued in with distribution . For all and , we have ( stands for the expectation with respect to ).

The task of interest is to predict the state variable at time , , using the information available at time , . The model at use to predict is given by the mapping , where and are parameters that shall be estimated. Define

Equipped with this notation, the problem can be expressed as a simple matrix-regression problem with covariate and output . In matrix notation, the model simply writes

| (3) |

with . The number of parameters needed to describe a single element in is . Because the matrix is fixed over the period , this model reflects a certain structural belief on the dependency along time between the state variables . Each element in is defined by a baseline matrix which carries out the average behavior in the whole network and a matrix which encodes for the influence between the different road sections. Alternative models are discussed at the end of the section. The accuracy of a given model is measured through the (normalized) -risk given by

Note that, because of the factor , is just the averaged squared error of . Among the class , there is an optimal predictor characterized by the usual normal equations. This is the statement of the next proposition.

Proposition 1.

Suppose that Assumption 1 is fulfilled. There is a unique minimizer . Moreover if and only if and .

The following decomposition of the risk underlines the prediction loss associated to the predictor by comparing it with the best predictor in . Define the excess risk by

Proposition 2.

Suppose that Assumption 1 is fulfilled. It holds:

In what follows, bounds are established on the excess risk under a certain asymptotic regime where both and go to infinity whereas remains fixed. Though theoretic, this regime is of practical interest as it permits to analyze cases where the number of sections is relatively large (possibly greater than ). This implies that the sequence of random variables of interest must be introduced as a triangular array. For each , we observe realizations of : where for each , . The following modeling assumption will be the basis to derive theoretical guarantees on .

Assumption 2 (daily regeneration).

For each , is an independent and identically distributed collection of random variables defined on .

The daily regeneration assumption has two components: the independence between the days and the probability distribution of each day which stays the same. The independence is in accordance with the practical use of the road network where at night only a few people use the network so it can regenerate and hence “forgets” its past. The fact that each day has the same distribution means essentially that only days of similar types are gathered in the data. For instance, this assumption might not hold when mixing weekend days and workdays. This assumption also implies that the network structure remains unchanged during data collection.

Empirical check of the daily regeneration assumption

To check the daily regeneration assumption on the real data presented in the introduction, we extract a set of one-dimensional time series. Each of these is associated to a specific instant in the day and a specific section , i.e., each time series is given by using the introduced notation. For each series, we run the test presented in Broock et al., (1996) where the null hypothesis is that the time series is independent and identically distributed. For most sections, , the null hypothesis is not rejected at a nominal level of . This clearly validates the daily regeneration assumption. The share of sections, , for which the hypothesis has been rejected, can be explained by the presence of missing values in the data which have been replaced by the average value (see Section 5 for details). It is also likely that external events such as roadworks and constructions have impacted the result of the test.

Alternative models

Two alternative modeling approaches might have been considered at the price of additional notation and minor changes in the proofs of the results presented in the next section. The first alternative is obtained by imposing the matrix to be diagonal. In this case, each -dimensional vector coordinates is fitted using an auto-regressive model based on one single lag. The second alternative is to use more than one lag, say , to predict the next coming instance. This is done by enlarging the matrix to where each and by stacking in the previous lags. These two variations, though interesting, are not presented in the paper for the sake of readability. Another approach which will be addressed in Section 4 is when the matrix is allowed to change across time.

3 Empirical risk minimization

3.1 Definitions and first results

Given a sequence and a regularization parameter , define the estimate

| (4) |

with

For any vector and any integer , the -norm is defined as . The prediction at point is given by

As the intercept in classical regression, the matrix parameter is only a centering term. Indeed, when minimizing (4) with respect to only, we find . The value of can thus be obtained by solving the least-squares problem (4) without intercept and with empirically centered variables. Given , the matrix can be recovered using the simple formula . Consequently, the prediction at point may be written as , where, generically, . Similarly, one has . The previous two expressions emphasize that the excess risk might be decomposed according to terms: one is dealing with the estimation error on and one is relative to the error on the averages and . We now state this decomposition.

Proposition 3.

The previous proposition will be the key to control the excess risk of both the OLS and LASSO predictors. The OLS (resp. LASSO) estimate, which results from (4) when (resp. ), is denoted by (resp. ) and its associated predictor is given by (resp. ).

3.2 Ordinary least-squares

In this section, we study the case of the OLS (i.e., when ). This will allow to put into perspective the main results of the paper, concerning the LASSO (i.e., when ), that will be given in the next section. We now introduce certain assumptions dealing with the distribution of , which depends on trough . The following one claims that the covariates are uniformly bounded.

Assumption 3 (bounded variables).

With probability ,

The following invertibility condition on can be seen as an identification condition since the matrix is unique under this hypothesis. Denote by the smallest eigenvalue of .

Assumption 4.

.

Finally, introduce the noise level which consists in a bound on the conditional variance of the residual matrix

given the covariates . Formally, is the smallest positive real number such that, with probability , . Note that might depend on . The fact that it does not depend on stresses the homoscedasticity of the regression model.

Assumption 5.

.

We stress that both previous assumptions on and might be alleviated at the price of additional technical assumptions which might be deduced from our proofs. The following result provides a bound on the excess risk associated to the OLS procedure. The given bound depends explicitly on the quantities of interest and as well as on the underlying probabilistic model through . The asymptotic framework we consider is with respect to and we allow the dimension to go to infinity (with a certain restriction). A discussion is provided below the proposition.

Proposition 4.

The previous bound on the excess risk is badly affected by the parameter . First of all, the condition implies that . Second, the number of nonzero coefficients in poorly influences the bound. When , the second term equals and becomes negligible with respect to . In contrast, when , i.e., all the covariates are used to predict each output, it equals and becomes a leading term. In between, we have the situation where each line of possesses only a few non-zero coefficients. Then the magnitude of this term becomes . In this last case, some benefits are obtained when using the LASSO () instead of the OLS () as detailed in the next section.

3.3 Regularized least-squares

The LASSO approach is introduced to overcome the “large small ” difficulties of the OLS previously discussed. In contrast with the OLS, the additional -penalty term shall enforce the estimated matrix to be “sparse”, i.e., to have only a few non-zero coefficients. From a theoretical perspective, this will permit to take advantage of any sparsity structure in the matrix associated to .

Introduce the active set as the set of non-zero coefficients of the -th line of , i.e., for each ,

As stated in the following assumption, the sparsity level of each line of is assumed to be bounded uniformly over .

Assumption 6.

.

The following assumption is a relaxation of Assumption 4 which was needed in the study of the OLS approach. For any set , denote by its complement in , and introduce the cone

Denote by the smallest nonnegative number such that for all , we have , .

Assumption 7.

.

Similar to Assumption 4, the previous assumption can be alleviated by allowing the value to go to at a certain rate which can be deduced from our proof. We are now in position to give an upper bound on the excess risk for the LASSO model.

Proposition 5.

The parameter which influenced badly the bound obtained on the OLS excess risk is here replaced by . This shows that without any knowledge on the active variables, the LASSO approach enables to recover the accuracy (at the price of a logarithmic factor) of an “oracle” OLS estimator that would use only the active variables. Another notable advantage is that the assumptions for the validity of the bound have been reduced to compared to the OLS which needed .

The LASSO requires to choose the regularization parameter which controls the number of selected covariates. In the proof, we follow the classic approach (as presented in Hastie et al., (2015)) by choosing as small as possible but larger than a certain empirical sum involving the residuals of the model; see (11) in the Appendix. This explains our choice . Note that we could have done differently. Since the Frobenius norm writes as the sum of the -norms of the matrix lines, problem (4) can be expressed trough standard LASSO sub-problems each having outputs. This allows to select different values of in each sub-problem. In practice, will be chosen using cross-validation as explained in the simulation section.

4 Regime switching

Regime switching occurs when the distribution of road traffic changes after a certain time . For instance, it might happen that a certain matrix is suitable to model the morning traffic while another matrix is needed to fit conveniently the afternoon behavior. To account for these potential changes in the distribution, we consider a wider predictive model than the one presented in Section 2. The set of predictors to be considered here writes as where each is given by

Each submodel corresponds to a regime switching occurring at time . Note that the case corresponds to the model without regime switching, i.e., a single matrix is used for the whole day. Within each submodel, the optimal predictor is defined as

and satisfies some normal equations (involving and ) that can be recovered by applying Proposition 1 with a specific range for . The risk associated to a submodel is then given by .

If the change point where given, then the situation would be very similar to what has been studied in the previous section except that two predictors would need to be estimated, one for each time range and . As each predictor would be computed as

the results obtained in the previous section would apply to both estimates separately and one would easily derive an excess risk bound when the change point is known. The key point here is thus to recover the change point by some procedure. Next, we study a model selection approach based on cross-validation to estimate .

Suppose that . For each , define , and let be a partition of whose elements are called folds. We suppose further that each fold contains the same number of observation . For each fold , define

where is the complement of in . To lighten the notations, the superscript will be from now on avoided. The estimate of the risk based on the fold is defined as

The resulting cross-validation estimate of is then the average over the folds of the risks and the estimated change point is the one having the smallest estimated risk, i.e.,

This represents the best instant from which a different (linear) model shall be used. The following proposition provides a rate of convergence for the cross-validation risk estimate.

Proposition 6.

Under the assumptions of Proposition 5, we have for all ,

The difficulty in proving the previous result is to suitably control for the large dimension in the decomposition of the error. This is done by relying on a bound on the -error associated to the matrix estimate ; see Proposition 7 in the Appendix.

Applying the previous proposition allows to establish the consistency of the cross-validation detection procedure.

Corollary 1.

Under the assumptions of Proposition 5, suppose there exists such that for all , then

Interestingly, the previous regime switching detection can be iterated in a greedy procedure in which, at each step, we decide (based on cross-validation) if a regime switching is beneficial. If it does, we continue. If it does not, we stop. The study of such an iterative algorithm represents an interesting avenue for further research.

5 Real data analysis

This section provides a comparative study of different methods. First, real world data is presented followed by the different methods in competition and an analysis of the obtained results. Finally, graphical interpretations of the proposed LASSO approach are provided. A GitHub repository is available111https://github.com/mohammedLamine/RS-Lasso.

5.1 Dataset

The initial dataset contains the speed (km/h) and the location of each car using the Coyote navigation system (Floating car data). Data was collected in the Rennes road network from December 1, 2018 until July 9, every seconds. Signals were received from vehicle.

Some pre-processing is carried out to correct sensor errors and structure the data in a convenient format. First, the received locations are GPS coordinates whereas the model introduced here is based on the road section. Accordingly, we map-match the locations to the OpenStreetMap road network dataset (Greenfeld, , 2002) in order to obtain the section of each car location data. Second, to obtain data representing the flow in the sections of the network, we aggregate and average the observed speed values of cars over -minute intervals for each section. Third, for some sections and time intervals, no value is observed. We therefore impute these values using the historical average associated to the time intervals and sections. To lower the number of missing values, we focus on a particularly busy time period from pm to pm (local time) of each workday. It is worth noting that this dataset comes from a low-frequency collection, meaning that for a given time and section, the average number of observations on the selected sections of the network is about logs per -minutes per section. This is due to the fact that we only observe a portion of the vehicles in the network (those equipped with Coyote GPS devices), and that suburban sections have low traffic. Thus, aiming for even higher precision (less than minutes) would increase the number of missing values.

In summary, we consider only the -minute time intervals in the period from pm to pm (local time) of each workday only. The resulting dataset corresponds to our , , matrices where , and (Figure 1). We divide the data into subsets: train % ( examples), validation % ( examples), test % ( examples), splits are made such that days are not cut in the middle and all subsets contains sequential full days data.

5.2 Comparative study

5.2.1 Methods

The methods used in this study can be divided into two groups reflecting the information that is used to predict future values. In the first group, baselines are used to predict the speed using only data from the same section. The second group uses data collected from the entire network. This includes the linear predictors that have been previously studied and also certain neural network predictors that we introduce for the sake of completeness.

Baselines

-

•

Historical average (HA): for each section and time interval , the prediction is given by the average speed at time interval and section . The averaged speed is computed on the training dataset.

-

•

Previous observation (PO): for each section and time interval , the prediction is given by the observed speed at and section .

-

•

Autoregressive (AR): for each section and time interval , the prediction is given by a linear combination of the previous observed time speed in section . The coefficients are estimated using ordinary least-squares on the training dataset. In our approach, we use the implementation from the ”Statsmodels” package and vary the order from to .

Linear predictors

-

•

Ordinary least-squares (OLS): we first compute the linear predictor for each section separately. This corresponds to independently solving sub-problems using OLS. Then we stack the solutions to form the solution of the main problem.

-

•

LASSO: We compute the LASSO predictor in the same way as the OLS by independently solving sub-problems. For each sub-problem, we select the regularization coefficient using the -fold cross-validation from the sklearn package on our training data. Taking the same value for in all sub-problems (as is case in the theoretical analysis) does not have an impact on the results.

-

•

Time-specific LASSO (TS-LASSO): We subdivide the problem into smaller time-specific problems that we solve separately. The algorithm finds a different coefficients matrix for each time . We compute each of these predictors in the same way as the LASSO.

-

•

Regime switching LASSO (RS-LASSO): This approach is introduced in Section 4 and consists of searching for the best time instant from which we should use another matrix for predictions. For each , we run a first LASSO procedure over the time frame and another over . For each , the resulting risk is estimated using cross-validation and finally, we find as the time change having the smallest estimated risk.

-

•

Group LASSO (Grp-LASSO): The Grp-LASSO is similar to the LASSO but uses a different penalization function which involves the norm of each column of the coefficients matrix . This approach filters out sections that are found to be irrelevant to predict the complete network and hence is useful when the same sparsity structure is shared among the different sections.

Neural networks predictors

-

•

Multilayer perceptron (MLP) made of fully connected hidden layers. Data is normalized at the entry point of each hidden layer. All model parameters are regularized using an penalty.

-

•

Fully connected long short-term memory (FC-LSTM) composed of one LSTM layer followed by a fully connected layer (output layer) with -time steps. The model parameters are regularized using an penalty. (note that we do not apply it to the recurrent step in the LSTM).

These neural networks are built using a hyperbolic tangent as the activation function except for the output layer for which the identity function is used. The input data values are scaled so that they belong to . We train our models using an ADAM optimizer and mean squared error loss. Because of the high dimensionality of the model (), all non-regularized approaches overfit the training dataset. To asses this problem, we rely on a combination of regularization techniques:

-

•

Earlystopping Caruana et al., (2001) is used to stop model training when the model shows signs of overfitting.

-

•

-regularization is conducted by adding a penalization term to the loss function that enforces a sparse structure of the parameters.

We stress that other configurations have been tested without improving the results: (a) using the sigmoid, the ReLU and its variants as activation functions; (b) Log-scaling the input data and scaling to the interval rather than , (c) varying the number of layers, neurons, and lags, and (d) other regularization techniques. The models are built using the package Keras with TensorFlow backend in python.

5.2.2 Results

The methods are compared using the mean-squared error (MSE) and the mean absolute error (MAE). Both are computed on the test set of the data. We examine these errors, covering all of the sections as well as pin-pointing specific segments; we do the same over the entire time period, and focus on more specific periods, such as particular days, as well.

Performance on the whole road network

| Model | AR 1 | AR 3 | AR 5 | FC-2LSTM | HA | LASSO | MLP | OLS | PO | RS-LASSO | TS-LASSO | Grp-LASSO |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MAE | 7.25 | 7.23 | 7.23 | 7.21 | 7.72 | 7.14 | 7.26 | 9.20 | 9.38 | 7.13 | 7.34 | 7.30 |

| MSE | 113.85 | 113.22 | 113.22 | 111.44 | 133.41 | 109.24 | 113.57 | 162.79 | 183.38 | 109.04 | 115.47 | 113.81 |

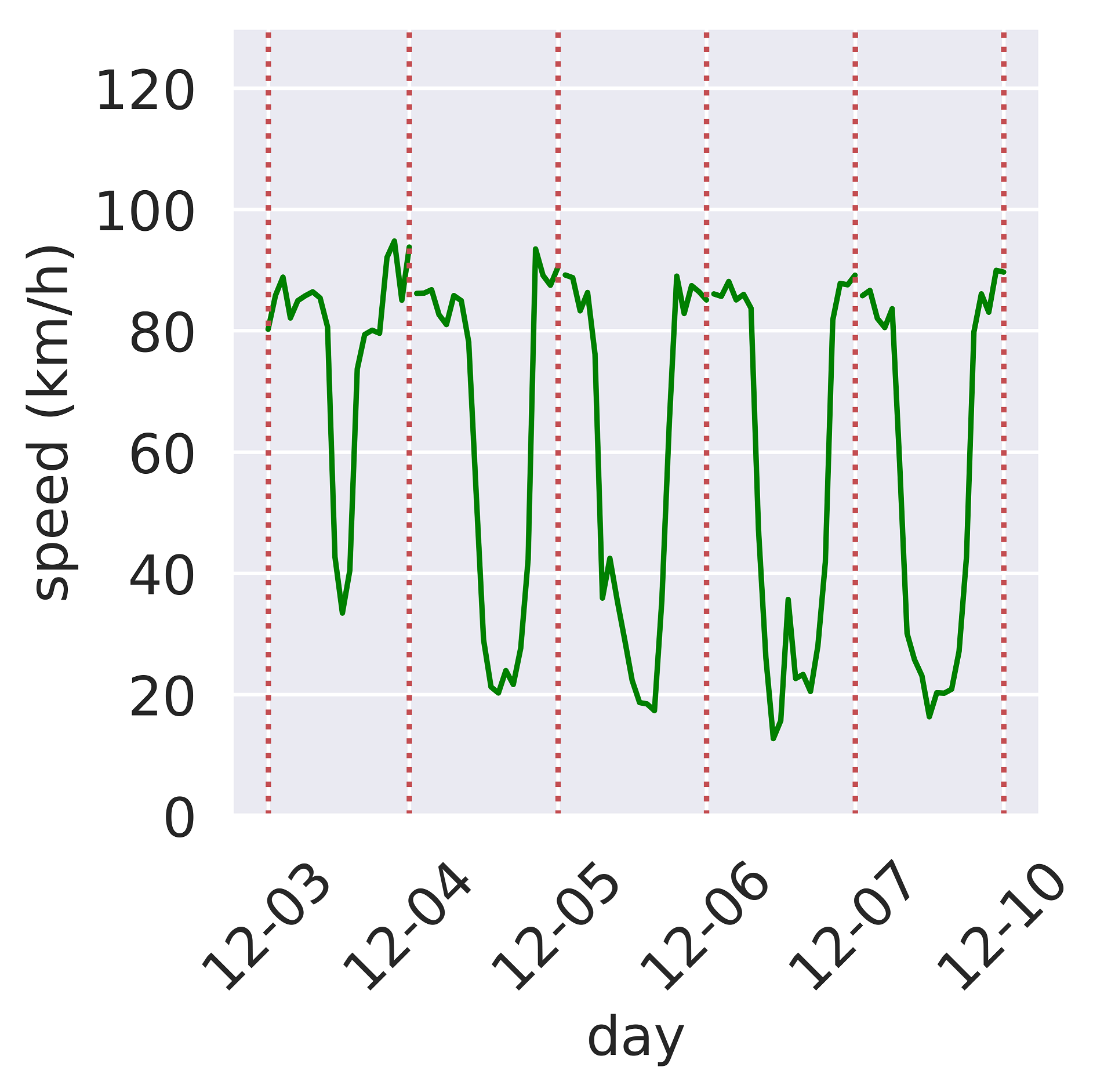

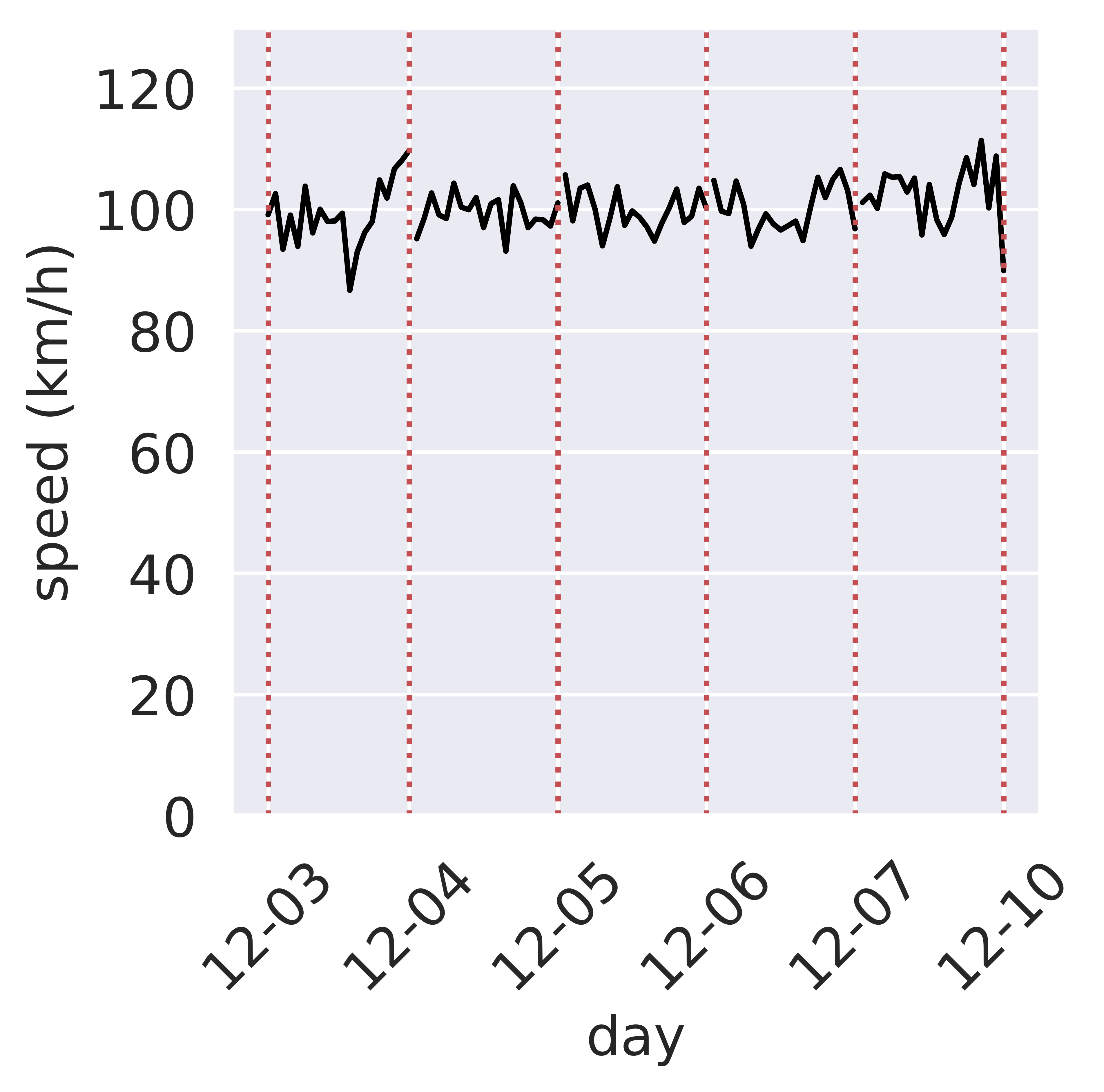

Table 1 shows the performance of all models over the entire network. The simple OLS model does not generalize well together with PO prediction; they yield the worst performances. The OLS is subjected to an over-fitting problem as the MAE is equal to (resp. ) on the test set (resp. train set). Other baseline performances are similar with AR, yielding a slightly better performance than the HA. Note that increasing the number of lags does not lead to better results. The neural networks offer close results to those of the AR with the LSTM performing slightly better than the MLP model. The different LASSO approaches also yielded variable results; the model with regime-switching (RS-LASSO with a time switch at :pm) performs better than all other models ( MAE) and is just slightly better than the LASSO ( MAE). Using a different LASSO predictor for each time (TS-LASSO) does not improve the error and yields a worse performance than the LASSO ( MAE). The same observation on Grp-LASSO suggests that entirely filtering some sections causes a certain loss.

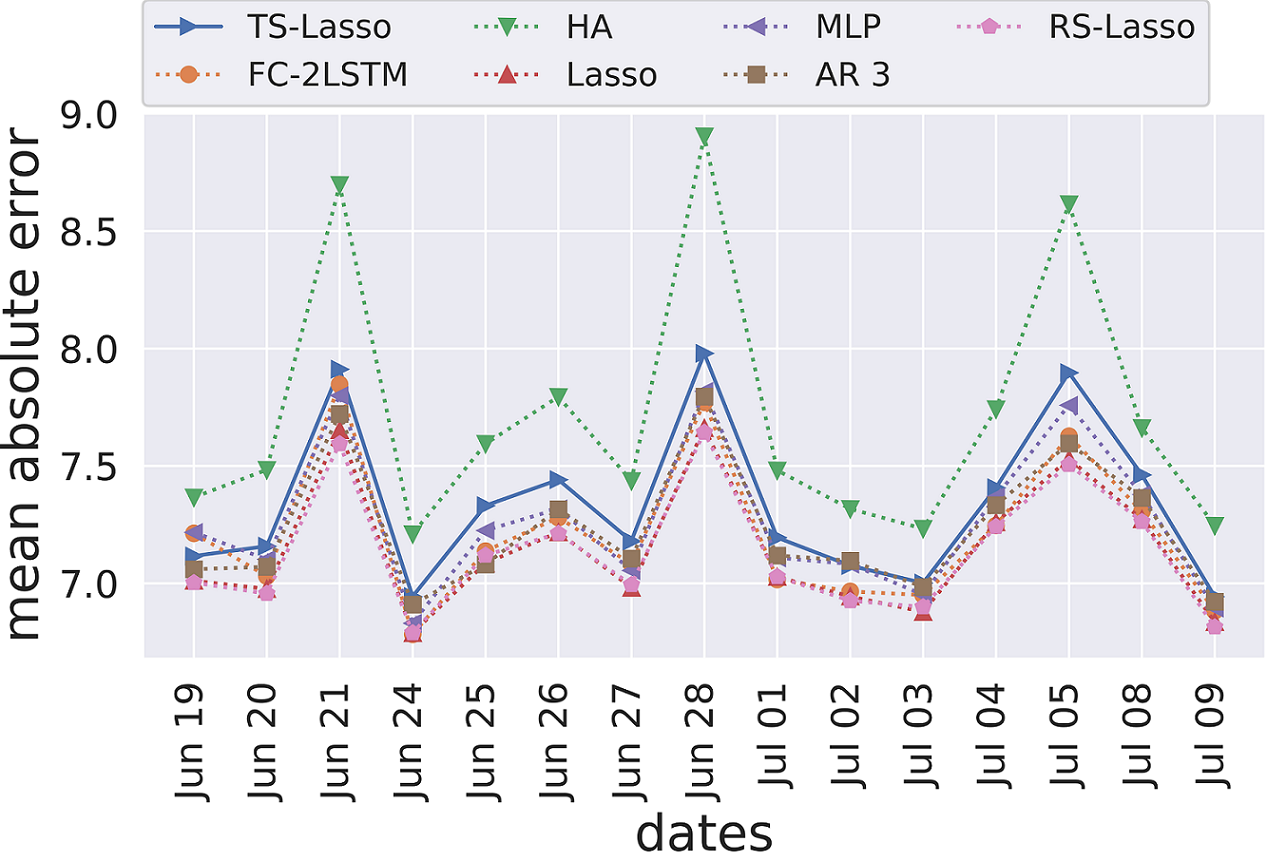

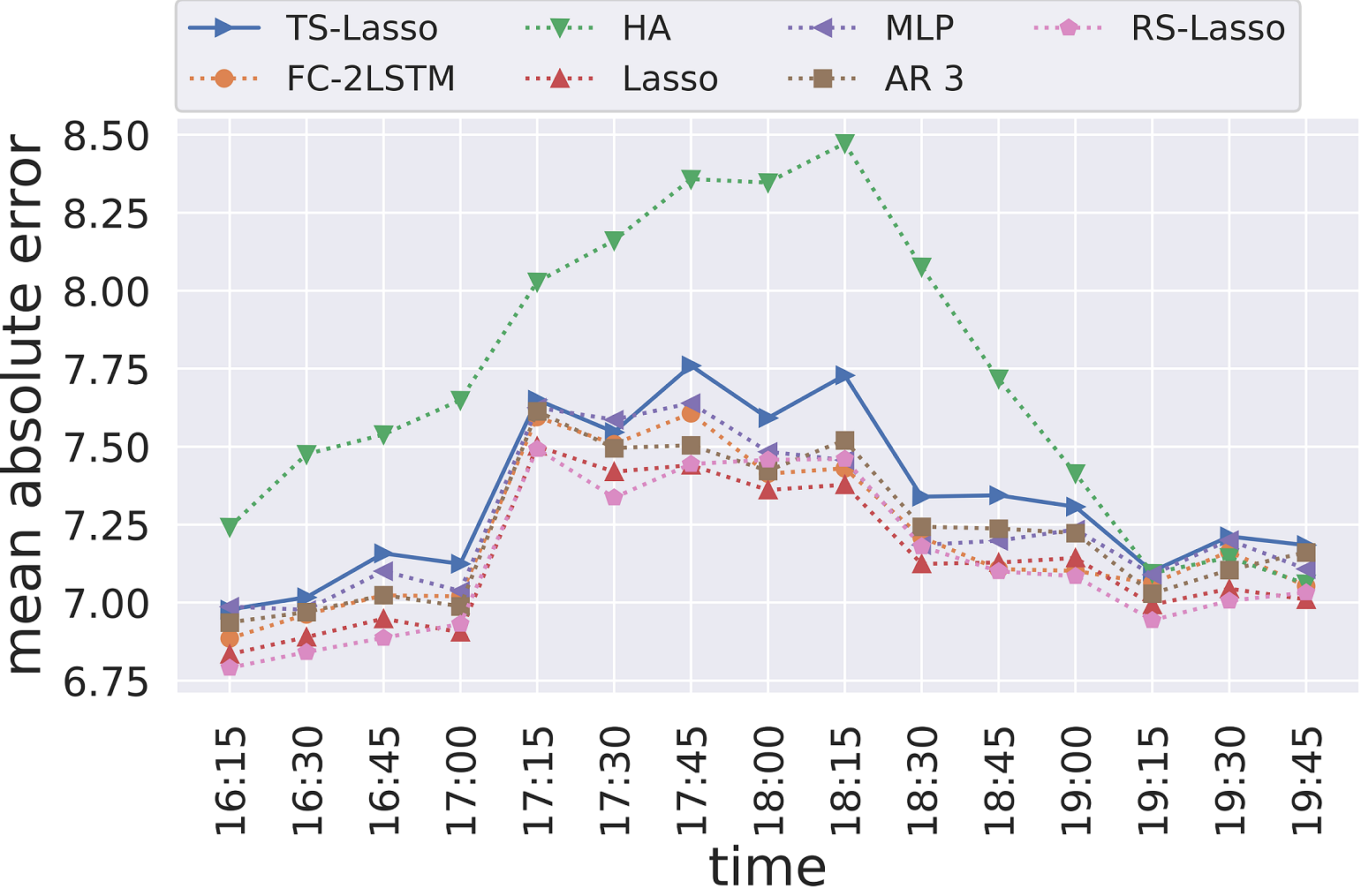

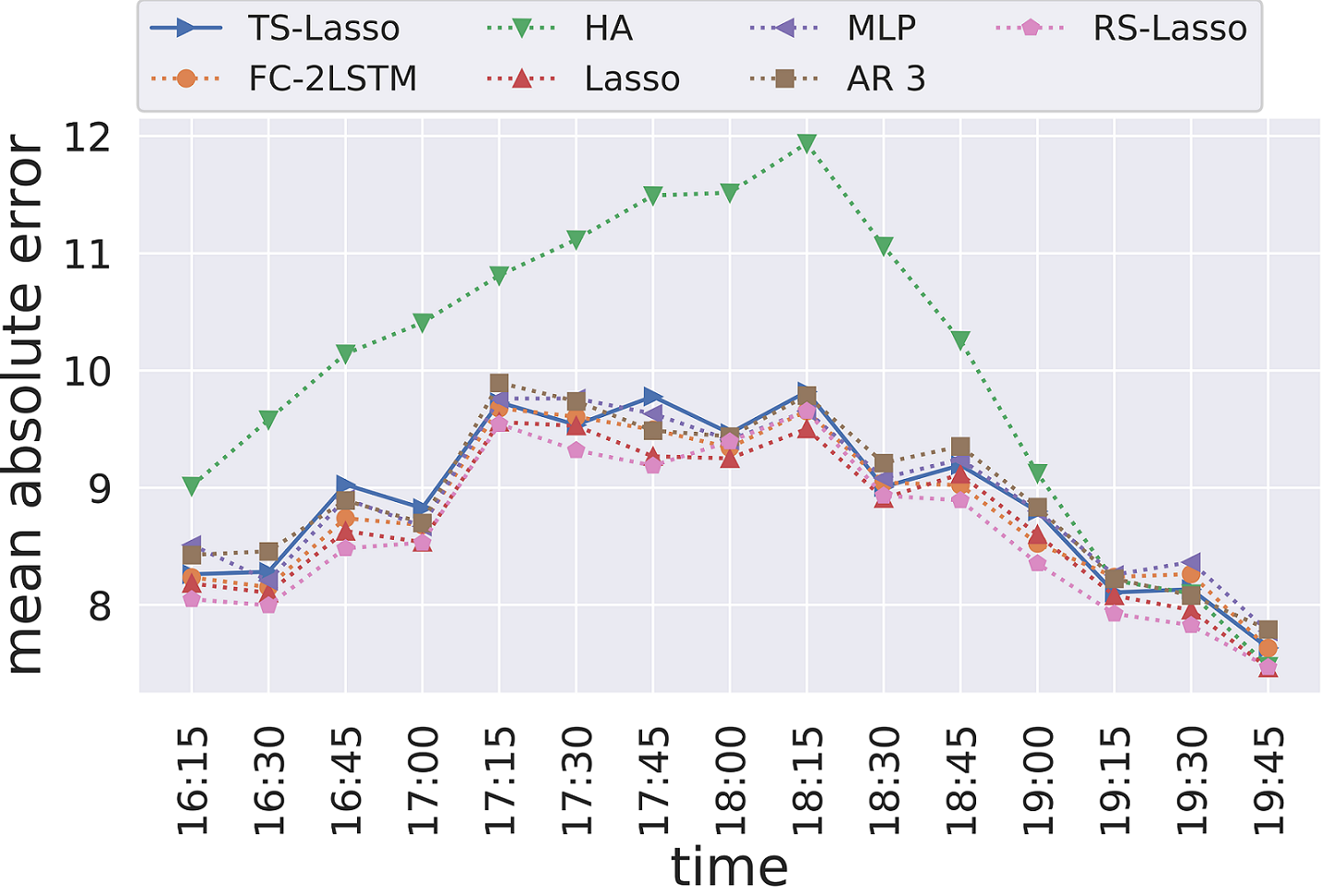

In Figure 2, we present (a) the error computed for each specific day (large errors correspond to fridays) and (b) the error for each specific hour (averaged over the days). For readability, we only present a subset of the models. The figure shows the LASSO and the RS-LASSO results over days and time and confirms that they outperform all other models. The two approaches alternate performance over time, we notice that the RS-LASSO performs better at the first and the last hours and is worse than the LASSO in the middle hours. As this cut-off is happening around the switch to the RS-LASSO (:pm), it might be possible that the RS-LASSO parts (before and after switching) focus on modeling the regime of the corresponding periods and overlooks the middle period that is separated by the time switch.

Performance on highly variable sections

To further understand the results, we compare the models on highly variable sections. Variable sections are selected based on a clustering algorithm applied to descriptive statistics (Min, Max, Mean, standard deviation, Quartiles) and computed for each section at each time. The cluster represents about of the sections.

| Model | AR 1 | AR 3 | AR 5 | FC-2LSTM | HA | LASSO | MLP | OLS | PO | RS-LASSO | TS-LASSO | Grp-LASSO |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MAE | 9.27 | 9.26 | 9.27 | 9.11 | 10.18 | 9.01 | 9.17 | 11.50 | 11.81 | 8.94 | 9.20 | 9.17 |

| MSE | 172.59 | 171.94 | 171.98 | 163.45 | 207.18 | 161.29 | 165.39 | 238.91 | 274.92 | 159.66 | 168.01 | 165.28 |

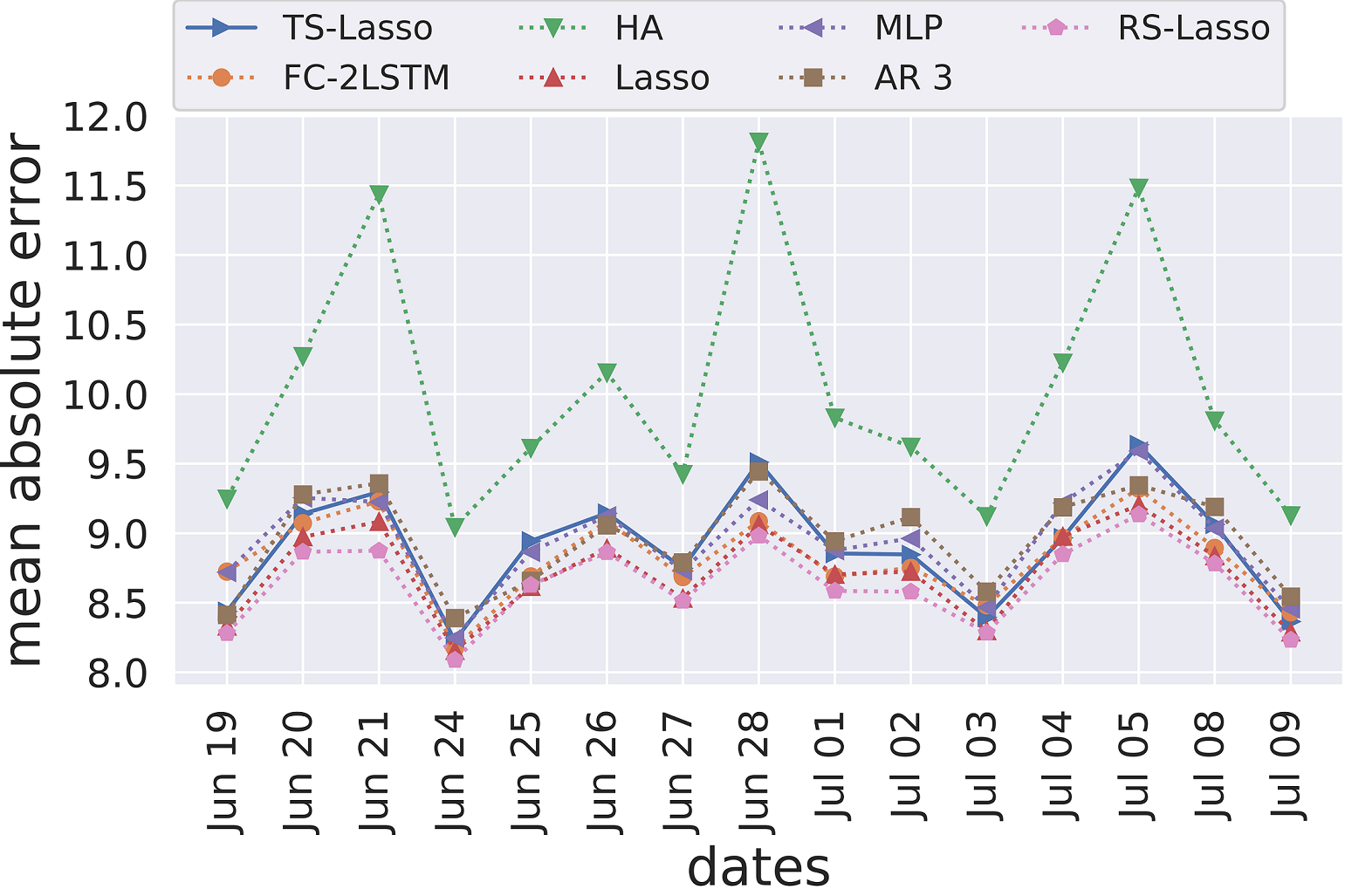

Table 2 and Figure 3 show the performance over highly variable sections only. All model performances deteriorate compared to the performances on the full road network. Similar observations as before can be made on these results with the exceptions that both neural networks, TS-LASSO and Grp-LASSO, perform better than the autoregressive models ( MAE) . The performance gap between the models is wider. The RS-LASSO is clearly better than the LASSO ( MAE) compared to the observed performance on the entire network. The alternation of performance over time is still observable between the LASSO and RS-LASSO models.

Comparison of different penalties

We now compare the performances between the LASSO, Ridge and Elastic Net penalties defined as:

-

•

LASSO () penalty : .

-

•

Ridge () penalty : .

-

•

Elastic Net penalty: .

where is the regularization parameter and represents some ratio between the LASSO and Ridge penalties. For each method, and are determined through the application of a -fold cross-validation. For Elastic Net, the best was around giving the -penalty at a slightly higher weight.

| Penalty | OLS (No penalty) | LASSO | Ridge | ElasticNet |

|---|---|---|---|---|

| MSE | 162.83 | 105.89 | 110.78 | 108.48 |

| MAE | 9.22 | 7.00 | 7.15 | 7.09 |

Table 3 shows the obtained MAE and MSE for all the models. The LASSO penalty shows a slightly better performance than the other two penalties. This can be explained by the ability of the LASSO to effectively select features for the model which is increasingly important in a sparse, high dimensional setup. Therefore, choosing the -penalty for this problem seems to be efficient and also gives a better interpretation of the model’s parameters.

5.3 Graphical visualization of the LASSO model

In this section, the aim is to show that the LASSO coefficients are interpretable and can be used to capture certain features of the architecture of the road network.

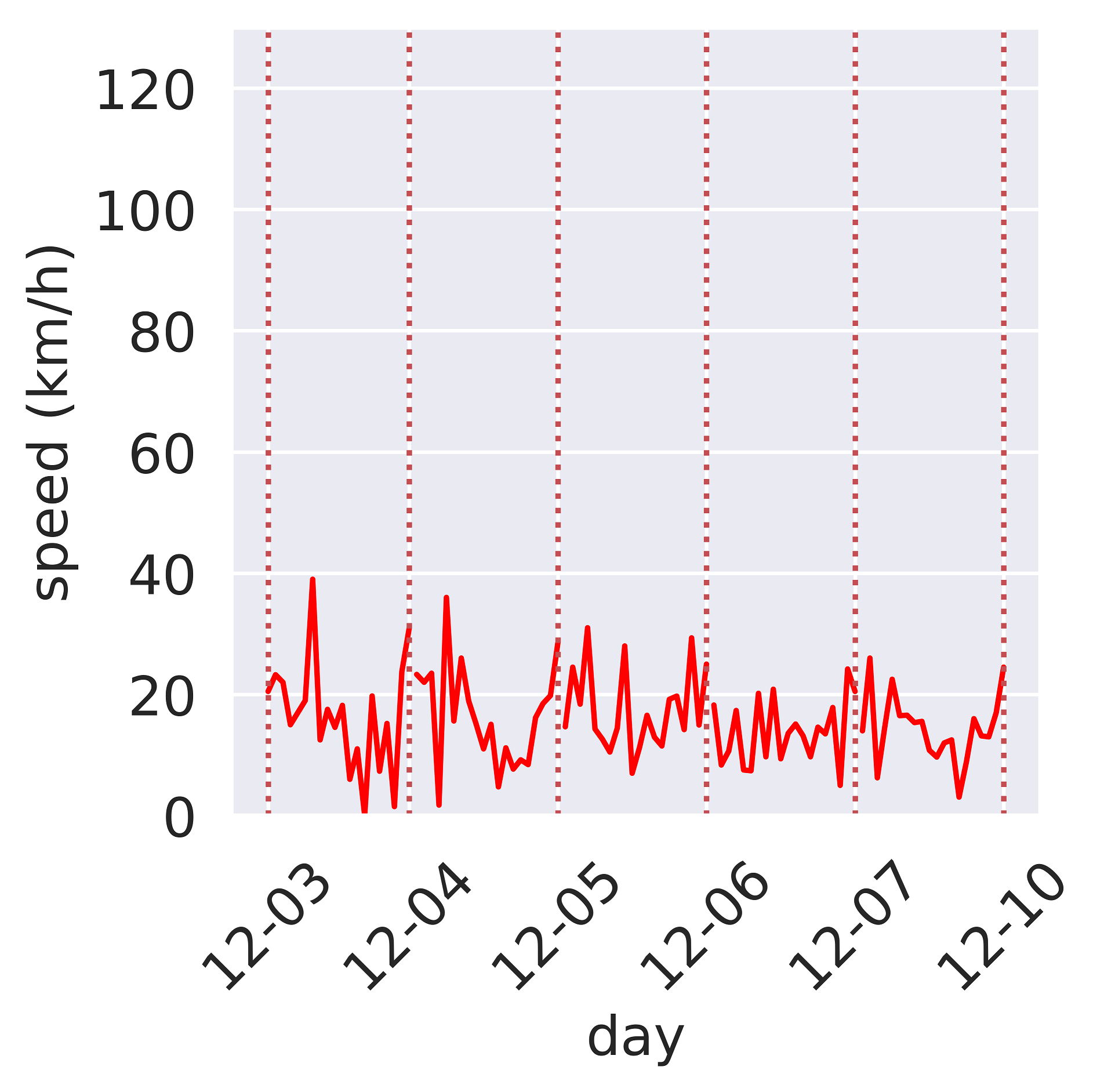

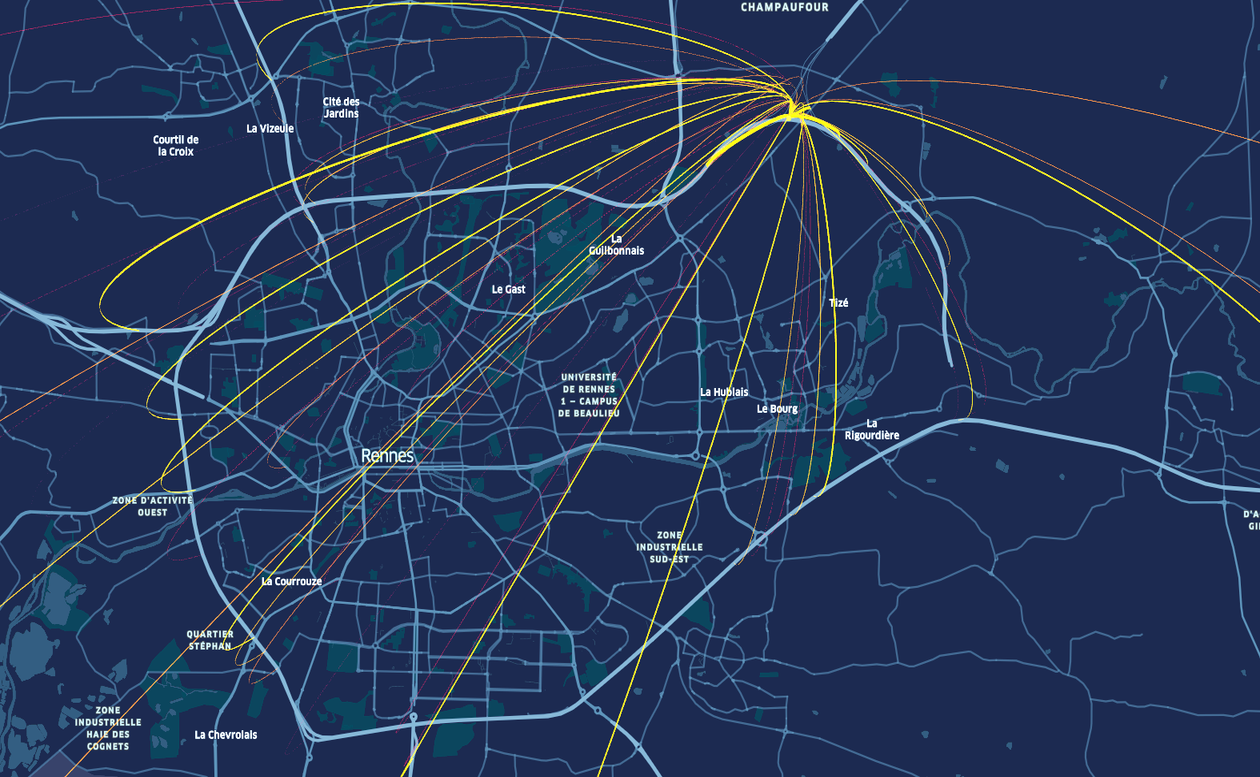

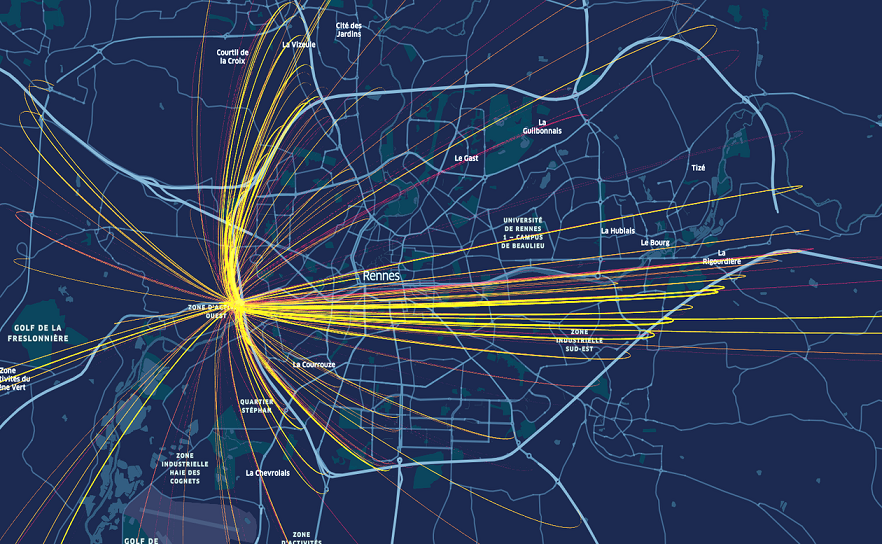

The LASSO coefficients are indicators of the traffic flow dependencies between the sections of the road network. For a section of interest, say , a way to visualize these connections is to draw, on top of the network map, arcs going from section to sections for which the corresponding regression coefficient is non-zero (that belongs to the active sets ). In addition, the color intensity and the width of each arc can be scaled by the value of the corresponding coefficient in order to highlight the influence of one section on another.

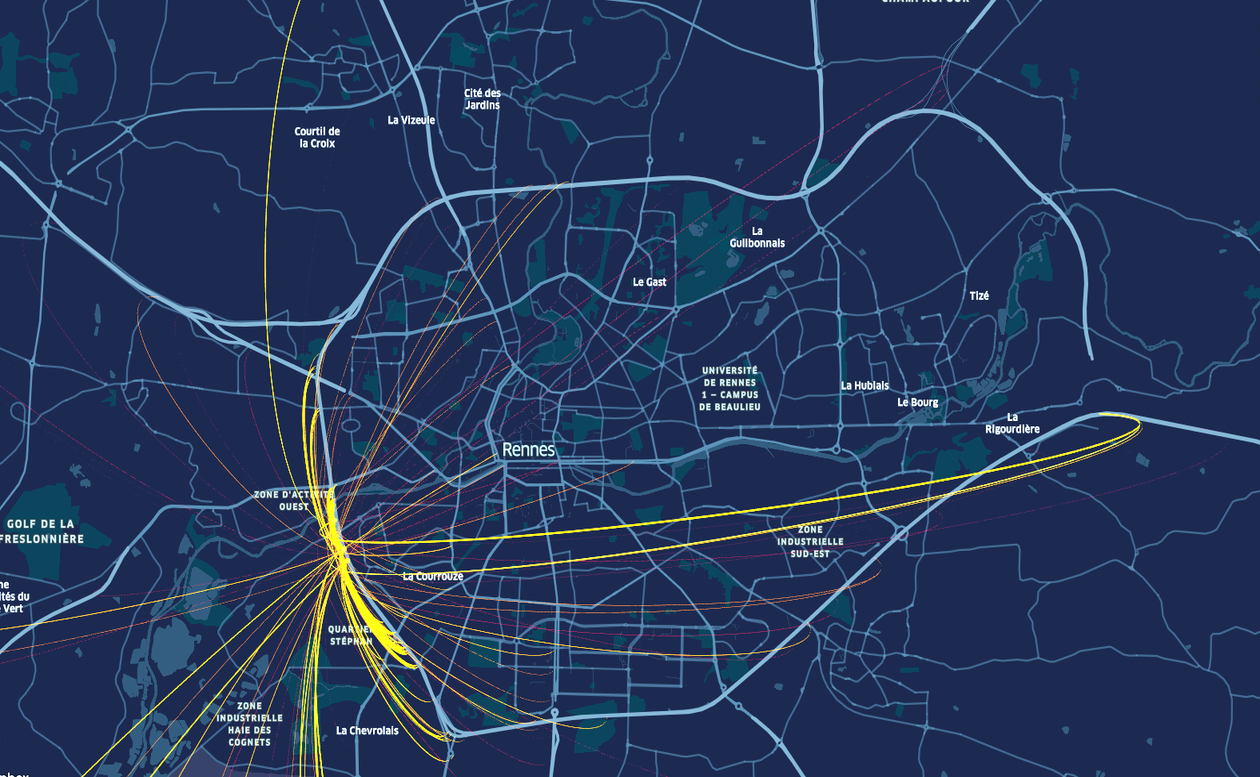

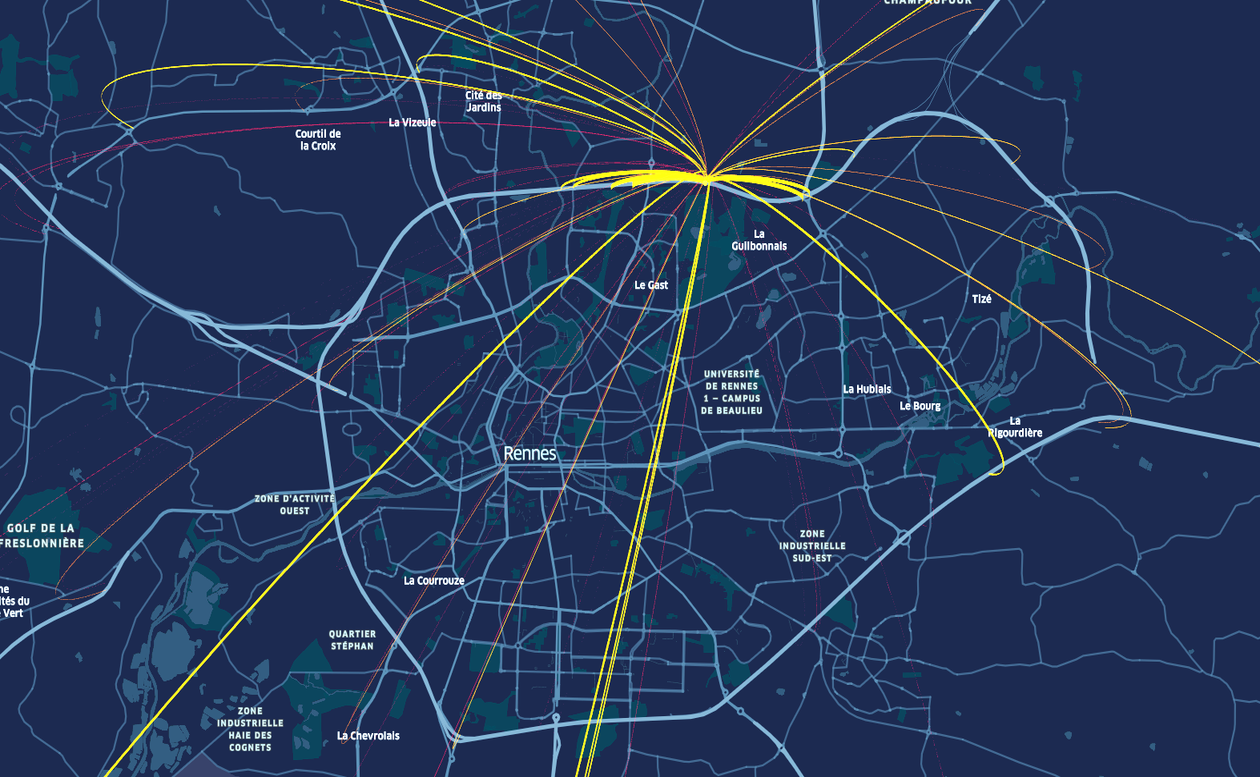

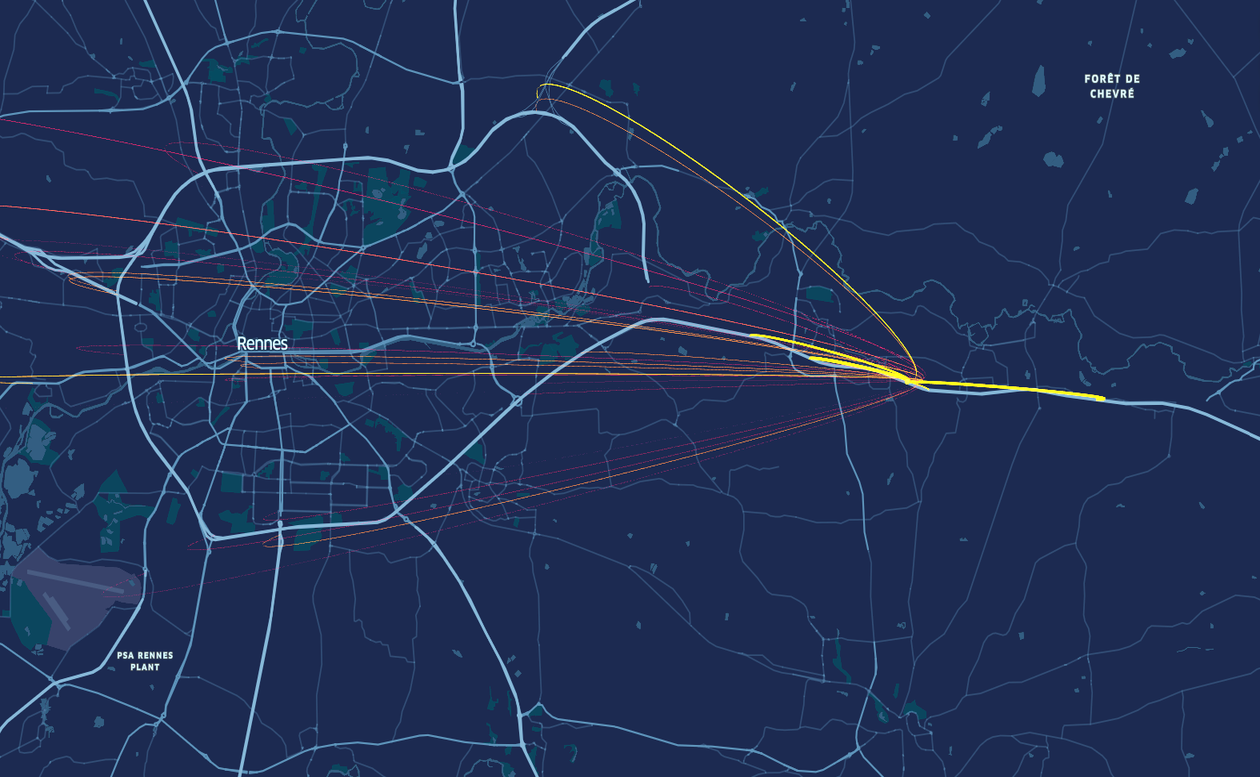

The previous visualization is provided for several representative sections in Figure 4. In Figure 4, (a, b) represents sections from the Rennes ring roads, or beltways. These roads have an upper limit of and circles the whole city of Rennes. We see that these sections strongly connect to adjacent sections in the ring and also to the closest highways. This is expected as these sections are physically connected to each other as they form a ring road and have links to adjacent highways. We also observe this kind of behavior on the highways (Figure 4.c) where the sections of the highway have a higher dependence on adjacent sections of the highway. In Figure 4, (d, e), we show sections that are part of link roads, or bypasses. We see that these sections have a high number of connections to adjacent ring roads. These link roads usually connect the flow between relatively distant parts of the city so we also observe farther connections around the ring network. We observe similar aspects with sections from the city center as shown in Figure 4, (f).

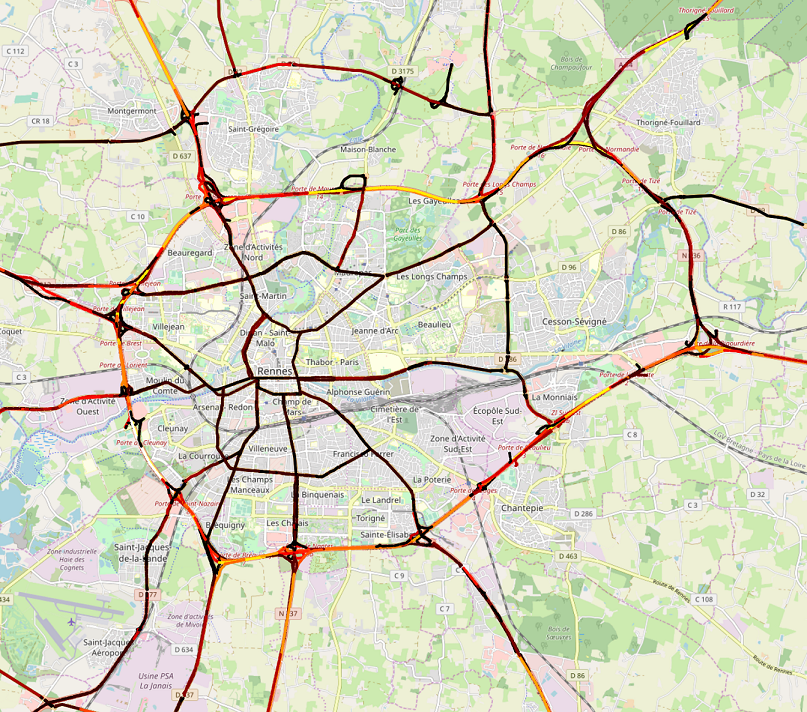

Another meaningful visualization provided by the model consists of representing the influence of each section on the overall network using the values of the estimated coefficients. For section , the criterion is given by . Taking into account negative coefficients implies an inverse relationship between sections, meaning that when a section is getting congested, another is getting less traffic. This may happen when there are incidents on the road but does not characterize the average influence between sections. Thus we only consider positive coefficients in building the criterion (consisting of of the coefficients).

Figure 5 is a heatmap of the road network where each section is color-coded according to the influence coefficient . We see that the network behavior is mainly influenced by ring road sections and highways. This is expected as traffic mainly flows on these roads as opposed to most sections in the city center, and those in the rural and suburban areas, that carries smaller quantities of traffic.

6 Simulation study

In this section, we present a data generation process which produces time-series that behave similarly to road traffic data. We then use the output to validate the regime switching approach by comparing it to other baseline algorithms.

6.1 Data generation process

Model parameters

The intercept sequence is defined as follows. For each and , . The matrix is constructed as follows.

-

•

Generate an Erdös-Rényi graph (Erdős and Rényi, , 1959) with an average of connections for each node in the network. This results in a sparse structure for the matrix .

-

•

Generate independently the nonzero entries of the matrix according to a uniform distribution on .

-

•

Normalize the matrix so that each line has an -norm equal to .

The last step above helps to obtain reasonable dynamics for the sequences of interest, for which the generation is described below.

Generation of the sequence

Let be an intercept matrix and let and be two matrices constructed as before. For each day , the initial speed vector of size has independent entries distributed as a mixture between Gaussian distributions (to get roughly different classes of speed) given by

with , and . Generate as an independent and identically distributed sequence with distribution . The data is then obtained based on

6.2 Results

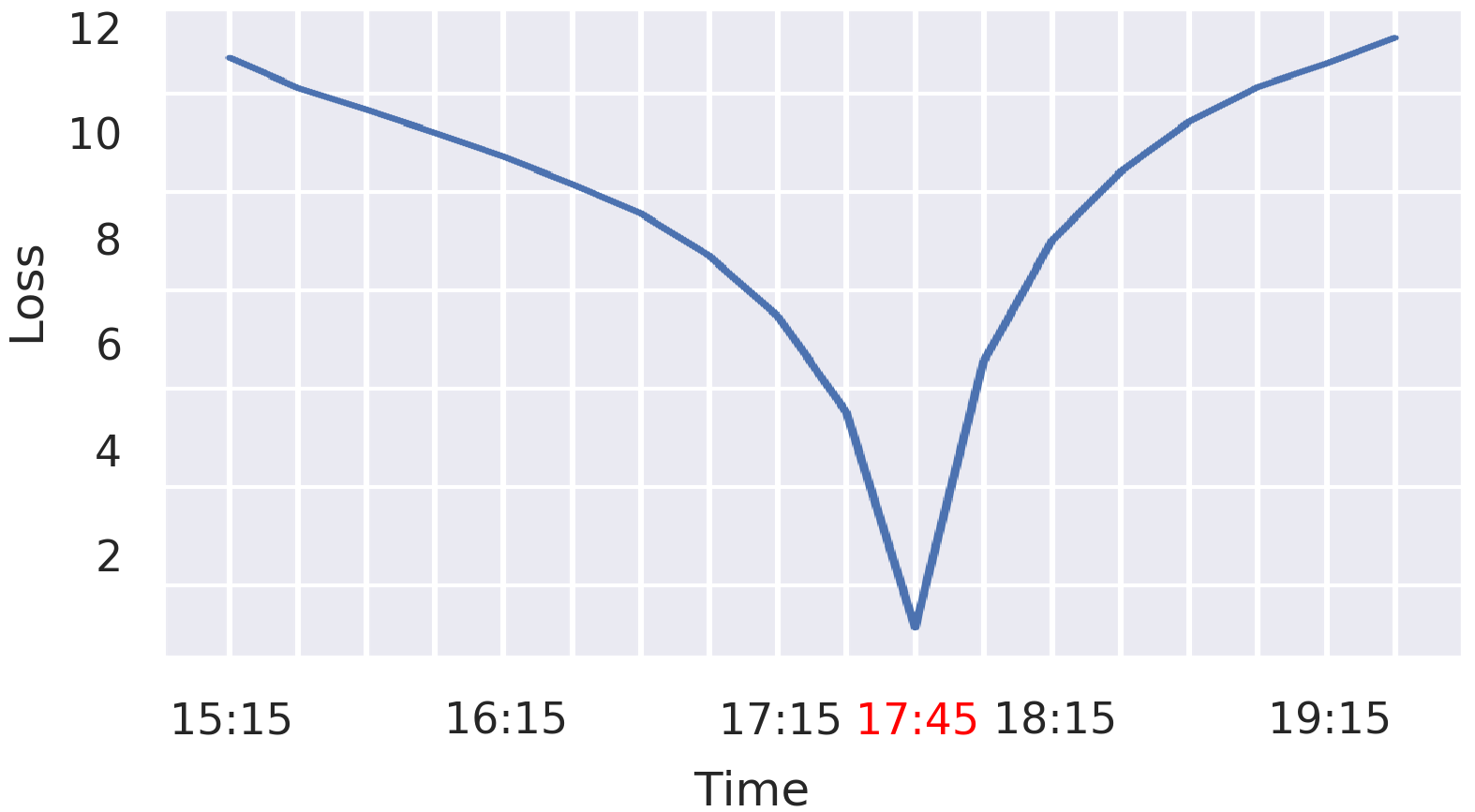

The RS-LASSO approach introduced in Section 4 results from a search of the best instant from which a different (linear) model shall be used. This search is conducted by comparing the estimated risks , , where is the instant from which a second model is estimated.

Figure 6 represents the evolution of the estimated risks for a single representative dataset. The best change point can be easily identified as the procedure gives .

| Model | OLS | MLP | FC-2LSTM | AR 1 | AR 3 | AR 5 | HA | PO | LASSO | Grp-LASSO | RS-LASSO | TS-LASSO |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MSE | 18.94 | 16.13 | 17.43 | 52.55 | 45.11 | 44.9 | 60.32 | 110.68 | 13.97 | 14.81 | 1.13 | 5.30 |

| MAE | 3.24 | 2.96 | 3.13 | 5.65 | 5.21 | 5.2 | 6.04 | 7.95 | 2.75 | 2.85 | 0.85 | 1.75 |

In Table 4, we compare the RS-LASSO to the other methods based on independent datasets (the MSE and MAE have been averaged over the datasets). The RS-LASSO model obtains the best performance and clearly outperforms the other methods. The fact that RS-LASSO succeeds in identifying the exact switching time allows for the build-up of considerably good predictors for both time-windows before and after the switch. Nonlinear models such as MLP and LSTM obtained slightly lower performances than the LASSO and slightly better than OLS. The baseline methods HA, PO, and AR gave the worst performance on the simulated data (as well as on the real data). In short, we can distinguish between four classes of methods reflecting their level of performance. Baseline methods give the worst results. The one-model methods (LASSO, OLS, Grp-LASSO, MLP, LSTM) give reasonable results. The multiple-model TS-LASSO works better than one-model methods and finally, the regime-switching RS-LASSO performs the best (by fitting only two models to the data).

| FD(RS-LASSO) | FD( LASSO) | SR(RS-LASSO) | SR( LASSO) | |

|---|---|---|---|---|

| Left model | 1.592872 | 19.755836 | 96.49% | 79.11% |

| Right model | 1.301384 | 18.232622 | 96.37% | 79.22% |

In order to further investigate the RS-LASSO model, we compare the estimated matrices and to the ones used in the data generation process. Table 5 shows the Frobenius distance (FD) along with the support recovery rates defined as the percentage of accordance in the non-zero coefficients (active set) between the estimated matrix and the truth. In contrast with the LASSO, we observe a very small Frobenius error for RS-LASSO. In the meantime, the support recovery of RS-LASSO is more than compared to around for the LASSO. This confirms the favorable performance of RS-LASSO.

7 Conclusion

We proposed in this paper a methodology to model high-dimensional time-series for which regeneration occurs at the end of each day. In a high-dimensional setting, we established bounds on the prediction error associated to linear predictors. More precisely, we showed that the regularized least-squares approach provides a decrease of the prediction error bound compared to ordinary least-squares. In addition, a regime switching detection procedure has been proposed and its consistency has been established. Through simulations and using floating car data observed in an urban area, the proposed approach has been compared to several other methods. Further research might be conducted on the extension of the proposed approach to general Markov chains. In this case, the regeneration times are unobserved and occur randomly involving a completely different probabilistic setting than the one borrowed in this paper. Whereas regeneration properties are known to be powerful theoretical tools to study estimates based on Markov Chains (see e.g., (Bertail and Portier, , 2019) for a recent account), their use in a prediction framework seems not to have been investigated. Another possible extension concerns the identification of multiple change points. On the theoretical side, the consistency of the proposed cross-validation procedure has been established in Section 4 only when a unique change point occurs.

Acknowledgment

The authors are grateful to Maxime Bourliatoux for helpful discussions on an earlier version of this work and Bethany Cagnol for assistance in proof reading the article. This work was financially supported by the FUI 22 GEOLYTICS project. The authors would like to thank IT4PME and Coyote for providing data and for their support.

References

- Baek et al., (2017) Baek, C., Davis, R. A., and Pipiras, V. (2017). Sparse seasonal and periodic vector autoregressive modeling. Computational Statistics & Data Analysis, 106:103–126.

- Basu et al., (2015) Basu, S., Michailidis, G., et al. (2015). Regularized estimation in sparse high-dimensional time series models. The Annals of Statistics, 43(4):1535–1567.

- Bertail and Portier, (2019) Bertail, P. and Portier, F. (2019). Rademacher complexity for markov chains: Applications to kernel smoothing and metropolis–hastings. Bernoulli, 25(4B):3912–3938.

- Bickel et al., (2009) Bickel, P. J., Ritov, Y., Tsybakov, A. B., et al. (2009). Simultaneous analysis of lasso and dantzig selector. The Annals of Statistics, 37(4):1705–1732.

- Brockwell et al., (1991) Brockwell, P. J., Davis, R. A., and Fienberg, S. E. (1991). Time Series: Theory and Methods: Theory and Methods. Springer Science & Business Media.

- Broock et al., (1996) Broock, W. A., Scheinkman, J. A., Dechert, W. D., and LeBaron, B. (1996). A test for independence based on the correlation dimension. Econometric reviews, 15(3):197–235.

- Bühlmann and Van De Geer, (2011) Bühlmann, P. and Van De Geer, S. (2011). Statistics for high-dimensional data: methods, theory and applications. Springer Science & Business Media.

- Bull, (2003) Bull, A. (2003). 1, 2, 6. United Nations, Economic Commission for Latin America and the Caribbean.

- Bunea et al., (2007) Bunea, F., Tsybakov, A., Wegkamp, M., et al. (2007). Sparsity oracle inequalities for the lasso. Electronic Journal of Statistics, 1:169–194.

- Caruana et al., (2001) Caruana, R., Lawrence, S., and Giles, C. L. (2001). Overfitting in neural nets: Backpropagation, conjugate gradient, and early stopping. In Advances in neural information processing systems, pages 402–408.

- Dai et al., (2017) Dai, X., Fu, R., Lin, Y., Li, L., and Wang, F.-Y. (2017). Deeptrend: A deep hierarchical neural network for traffic flow prediction. arXiv preprint arXiv:1707.03213.

- Davis et al., (2016) Davis, R. A., Zang, P., and Zheng, T. (2016). Sparse vector autoregressive modeling. Journal of Computational and Graphical Statistics, 25(4):1077–1096.

- Epelbaum et al., (2017) Epelbaum, T., Gamboa, F., Loubes, J.-M., and Martin, J. (2017). Deep learning applied to road traffic speed forecasting. arXiv preprint arXiv:1710.08266.

- Erdős and Rényi, (1959) Erdős, P. and Rényi, A. (1959). On random graphs i. Publ. math. debrecen, 6(290-297):18.

- Giraud, (2014) Giraud, C. (2014). Introduction to high-dimensional statistics, volume 138. CRC Press.

- Greenfeld, (2002) Greenfeld, J. S. (2002). Matching gps observations to locations on a digital map. In 81th annual meeting of the transportation research board, volume 1, pages 164–173. Washington, DC.

- Hamilton, (1994) Hamilton, J. D. (1994). Time series analysis, volume 2. Princeton university press Princeton, NJ.

- Harrison and Donnelly, (2011) Harrison, C. and Donnelly, I. A. (2011). A theory of smart cities. In Proceedings of the 55th Annual Meeting of the ISSS-2011, Hull, UK, volume 55.

- Hastie et al., (2015) Hastie, T., Tibshirani, R., and Wainwright, M. (2015). Statistical learning with sparsity: the lasso and generalizations. Chapman and Hall/CRC.

- Haufe et al., (2010) Haufe, S., Müller, K.-R., Nolte, G., and Krämer, N. (2010). Sparse causal discovery in multivariate time series. In Causality: Objectives and Assessment, pages 97–106.

- Kock and Callot, (2015) Kock, A. B. and Callot, L. (2015). Oracle inequalities for high dimensional vector autoregressions. Journal of Econometrics, 186(2):325–344.

- Li et al., (2017) Li, Y., Yu, R., Shahabi, C., and Liu, Y. (2017). Diffusion convolutional recurrent neural network: Data-driven traffic forecasting. arXiv preprint arXiv:1707.01926.

- Lv et al., (2014) Lv, Y., Duan, Y., Kang, W., Li, Z., and Wang, F.-Y. (2014). Traffic flow prediction with big data: a deep learning approach. IEEE Transactions on Intelligent Transportation Systems, 16(2):865–873.

- Lv et al., (2018) Lv, Z., Xu, J., Zheng, K., Yin, H., Zhao, P., and Zhou, X. (2018). Lc-rnn: A deep learning model for traffic speed prediction. In IJCAI, pages 3470–3476.

- Meyn and Tweedie, (2012) Meyn, S. P. and Tweedie, R. L. (2012). Markov chains and stochastic stability. Springer Science & Business Media.

- Michailidis and d’Alché Buc, (2013) Michailidis, G. and d’Alché Buc, F. (2013). Autoregressive models for gene regulatory network inference: Sparsity, stability and causality issues. Mathematical biosciences, 246(2):326–334.

- Pellicer et al., (2013) Pellicer, S., Santa, G., Bleda, A. L., Maestre, R., Jara, A. J., and Skarmeta, A. G. (2013). A global perspective of smart cities: A survey. In 2013 Seventh International Conference on Innovative Mobile and Internet Services in Ubiquitous Computing, pages 439–444. IEEE.

- Song and Bickel, (2011) Song, S. and Bickel, P. J. (2011). Large vector auto regressions. arXiv preprint arXiv:1106.3915.

- Tibshirani, (1996) Tibshirani, R. (1996). Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society: Series B (Methodological), 58(1):267–288.

- Valdés-Sosa et al., (2005) Valdés-Sosa, P. A., Sánchez-Bornot, J. M., Lage-Castellanos, A., Vega-Hernández, M., Bosch-Bayard, J., Melie-García, L., and Canales-Rodríguez, E. (2005). Estimating brain functional connectivity with sparse multivariate autoregression. Philosophical Transactions of the Royal Society B: Biological Sciences, 360(1457):969–981.

- Van De Geer and Bühlmann, (2009) Van De Geer, S. A. and Bühlmann, P. (2009). On the conditions used to prove oracle results for the lasso. Electronic Journal of Statistics, 3:1360–1392.

- Wang et al., (2007) Wang, H., Li, G., and Tsai, C.-L. (2007). Regression coefficient and autoregressive order shrinkage and selection via the lasso. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 69(1):63–78.

- Washburn et al., (2009) Washburn, D., Sindhu, U., Balaouras, S., Dines, R. A., Hayes, N., and Nelson, L. E. (2009). Helping cios understand “smart city” initiatives. Growth, 17(2):1–17.

Appendix A Proofs of the stated results

Before starting the proofs, we specify some useful notations. For any matrix , the -norm is denoted by and the -norm is given by . The -th column (resp. -th line) of is denoted by (resp ). Both are column vectors.

A.1 Proof of Proposition 1

Denote by the Hilbert space composed of the random elements defined on such that . The underlying scalar product between and is . Hence is a distance between the element of and the linear subspace of made of , . The Hilbert projection theorem ensures that the infimum is uniquely achieved and that is the argument of the minimum if and only if for all . Taking , in , gives the first set of normal equations. We conclude by taking and noting that for all is equivalent to . This is the second set of normal equations. ∎

A.2 Proof of Proposition 2

The statement follows from developing and then using that which is a consequence of the normal equations given in Proposition 1. ∎

A.2.1 Proof of Proposition 3

Let . Recall that and . In virtue of Proposition 2, we have

where stands for the expectation with respect to only. Because, has mean , we get

Finally, since , and using the triangle inequality, we find

∎

A.2.2 Proof of Proposition 4

The inequality of Proposition 3 applied to the OLS estimate gives

Using that , we get

Let denote the greatest eigenvalue of . By Assumption 3, we have . Applying Lemma 9, we deduce that

| (5) |

where we just used that and . Hence the proof of Proposition 4 will be complete if it is shown that

By definition of , it holds that

where

Let . Developing the squared-norm in the left-hand side and making use of the centering property, we obtain

| (6) |

with

We now provide a lower bound for the left-hand side of (6). Define

We have , and because is symmetric we can write with ( is the identity matrix of size ) and . Hence, defining , it holds that

For the right-hand side of (6), we provide the following upper bound. Using the Cauchy-Schwarz inequality, we have

Together with (6), the two previous bounds imply that

Note that, for all with ,

where stands for the spectral norm. Hence we have that

Because the term in the right hand-side is in virtue of Lemma 10, we just have to show that in probability to conclude the proof. For that purpose we use Lemma 11 with given by the following inequality (which holds true in virtue of Assumptions 3 and 4),

where, almost surely, . Because , the upper bound given in Lemma 11 goes to and it holds that , in probability.

∎

A.2.3 Proof of Proposition 5

Define . A similar decomposition to (5) is valid for the LASSO. We have

implying that the proof reduces to . To this aim, we will provide a bound on for each value of . The minimization of the LASSO problem can be done by solving minimization problems where each gives one of the lines of the estimated matrix . More formally, we have

Denote by and let be such that, almost surely,

Such a exists in virtue of Assumption 3 and 6. Set

Intermediary statements, that are useful in the subsequent development, are now claimed and will be proved at the end of the proof. Let . For large enough, we have with probability , for all ,

| (7) |

In particular, . Moreover, for large enough, with probability ,

| (8) |

In the following, we assume that (7) and (8) are satisfied. This occurs with probability . From (7), we have . Then, using Jensen inequality, Assumption 7, and finally (8), it follows that

In particular

| (9) |

Invoking Assumption 7 we find

which in turn gives

| (10) |

Injecting this into the right-hand side of (7), we get

which implies that

We conclude the proof using (9) to obtain

for some that does not depend on , and recalling that the previous happens with probability with arbitrarily small.

Proof of Equation (7) and (8). As and , we have, for large enough, . Note that the last inequality implies that we can apply Lemma 12 and 13.

Proof of Equation (7). Recall that . Note that for large enough,

It follows from Lemma 12 that with probability :

| (11) |

Let . Note that because of (11), it holds that

We have

First consider the scalar product term of the right-hand side. We have

Now we deal with . Note that, by the triangle inequality,

Using the previous, restricted to the active set , we obtain

All this together gives

and (7) follows from remarking that

Proof of Equation (8). Use that for sufficiently large, we have and Lemma 13 which guarantees that .

∎

A.3 Proof of Proposition 6

The proof is done under a simplified setting which does not involve any loss of generality. Let . Since the number of folds is fixed, we only need to show the convergence of the risk estimate based on each fold i.e., that for . Moreover both quantities and are made of two similar terms, one for each period and . We focus only on the first one, the details for the other being the same. Moreover since the index is fixed in the whole proof, we remove it from the notation. We note instead of (recall that is the complement of in ). Define

| , |

with . We need to show that . Write

where the introduced expectation is taken with respect to only. In , we recover the excess risk for the LASSO computed with observations. Hence, as indicated by Proposition 5. We now focus on . Let be the optimal predictor as introduced in Proposition 1 (with respect to the time period ). Put and . Based on Proposition 1, we deduce that

Similarly,

Let . Note that

with and . It holds that

with and . In addition, we have

which gives that

with , . All this together leads to

| (12) | ||||

The conclusion of the proof will come invoking the following results which will be proven later on.

Proposition 7.

Under the assumptions of Proposition 5, we have

where is -th line of , provided that , for some constant .

Proposition 8.

Under the assumptions of Proposition 5, we have

Write

with . In virtue of the union bound, the previous term is then . The remaining terms are bounded as follows, using that . We have that

Second, we have

Third, using that , it holds

Fourth, it follows that

The previous bounds can be used in (12) to prove the result.

Proof of Proposition 7

Without loss of generality the proof is done for instead of (the only difference being the sample size instead of ). We build upon the proof of Proposition 5. Inject the inequality (7) in the right-hand side of (10) to get

Because , it follows that

for some that does not depend on , with probability at least .

∎

Proof of Proposition 8

A.4 Proof of Corollary 1

Introduce the notation . Since if for all , it suffices to show that . We have that

with and from Proposition 6 . But for large enough, . As a consequence, . ∎

Appendix B Intermediate results

Define the standardized predictors , and for any , .

Lemma 9.

Proof.

If are i.i.d. centered random matrices, we have that . It follows that

The conclusion comes from using Chebyshev’s inequality and the Assumption 4. For the second assertion, because , we have

∎

Proof.

The first statement follows from

For the second statement, start by noting that

| (13) |

Then use the triangle inequality to get

Using Lemma 9 and the first statement, we find that , Hence, showing that

will conclude the proof. Using Assumption 2 and Proposition 1, we find that for all . It follows that

Using the triangle inequality and Jensen’s inequality, we get

The last inequality is a consequence of the definition of . ∎

Recall that

Lemma 11.

Proof.

Remark that

with . Apply the triangle inequality to get

We shall apply Lemma 15 to control each of the two terms in the previous upper bound. First consider the case where . We need to specify the value for and that we can use. Note that

| (14) |

Using the triangle inequality and Jensen inequality, we have, for any ,

Consequently we can take for the value of . Moreover, we have

From the classic inequality , we deduce that . Applying this with and using (14), we obtain

Taking the expectation in the previous inequality, we get . Hence

Hence we can take for the value of . Lemma 15 gives that

Consequently, with probability , it holds that

provided that . Now we apply Lemma 15 with to provide a bound on . By (14), we have that

Using , it follows that

By taking we get that with probability smaller than

provided that . Hence we have shown that with probability ,

Use that to conclude. ∎

Lemma 12.

Proof.

We have

For the first term, we apply Lemma 14 with noting that, by Jensen inequality,

we may take and . Then using that , we have with probability ,

Applying again Lemma 14, to the sequence , taking and and using , we deduce that with probability ,

Applying again Lemma 14, to the sequence , taking and and using , we deduce that with probability

All this together with the fact that , we get

and the conclusion follows from . ∎

Lemma 13.

Proof.

We have

In the following, we bound each of the two previous terms under events of probability , respectively. Apply Lemma 14 with . Note that

and

Hence we apply Lemma 14 with and . We obtain, because , with probability ,

Note that

It follows that

Applying Lemma 14 with , , and we get, because , with probability ,

Hence we have shown that, with probability ,

Invoking that we obtain the result. ∎

Appendix C Auxiliary results

Lemma 14 (Bernstein inequality).

Suppose that is an iid sequence of centered random vectors valued in . Suppose that a.s. and that . For any , such that , we have with probability :

Proof.

By Bernstein inequality, it follows that

Choosing and because , we get that

Use the union bound to get that, for any ,

∎

Lemma 15 (Matrix Bernstein inequality).

Let be independent, centered random matrices with common dimension and assume that each one is uniformly bounded in spectral norm, i.e.,

Let be such that

Then, for all