A multi-factor polynomial framework for long-term electricity forwards with delivery period††thanks: This research is part of a collaboration with Axpo Solutions AG. Xi Kleisinger-Yu gratefully acknowledges the financial support and electricity data provided by Axpo Solutions AG.

forthcoming in SIAM Journal on Financial Mathematics)

Abstract

We propose a multi-factor polynomial framework to model and hedge long-term electricity contracts with delivery period. This framework has several advantages: the computation of forwards, risk premium and correlation between different forwards are fully explicit, and the model can be calibrated to observed electricity forward curves easily and well. Electricity markets suffer from non-storability and poor medium- to long-term liquidity. Therefore, we suggest a rolling hedge which only uses liquid forward contracts and is risk-minimizing in the sense of Föllmer and Schweizer. We calibrate the model to over eight years of German power calendar year forward curves and investigate the quality of the risk-minimizing hedge over various time horizons.

Key words: Polynomial diffusions, electricity forwards, forward risk premium, market price of risk, local risk-minimization.

AMS subject classifications: 91G20, 91G70

1 Introduction

Electricity differs from other energy commodities due to specific features such as limited storability, possibility of intra-day and day-ahead negative prices, its unique mechanism of the auction market, high liquidity of short- to medium-term trading and illiquidity of its long-term trading. Much of the academic literature is dedicated to short- to medium-term modeling of electricity spot and futures prices, as its highly frequent and huge data amount makes it ideal for empirical studies of time series analysis. However, the literature addressing the modeling of long-term electricity forwards and the corresponding hedging problems is scarce.

In this paper, we propose a mathematically tractable multi-factor polynomial diffusion framework to model long-term forwards, which captures long-term properties such as mean reversion well. In this framework the computation of forwards and cross-maturity correlations are fully explicit. Fitting the model to long time series of single market electricity data works easily and well. Furthermore, we set up a rolling hedge mechanism that only uses liquid forward contracts. This allows us to address the non-storability of electricity and poor liquidity in its long-term markets. Within the setup the hedging strategy we suggest minimizes the conditional variance of the cost processes at any time, and thus is risk-minimizing in the sense of Föllmer and Schweizer. A simulation study using the estimated model shows that the risk-minimizing rolling hedge significantly reduces, yet does not fully eliminate, the variance and skew of the long-term exposures.

The proposed modeling framework has various applications in forward modeling. It can be used to smoothly extrapolate the curve to the non-liquid horizon while calibrating it to the liquid horizon; it can also be used to smooth the forward surface implied by the market once calibrated and to filter out market noise; moreover, it can be used to model the prices within the real data horizon between two quotation dates. Furthermore, the model can be extended to model multiple electricity markets and other energy markets simultaneously. It can thus serve as an alternative model for risk management purposes, and for conducting simulations. We do however not pursue such multi-market extensions in this paper.

Compared to other electricity modeling classes such as affine processes (mostly used as geometric models), this modeling framework has the advantage of being general but still very tractable, so that pricing formulas of spots, forwards (with instantaneous delivery) and forwards with delivery period have closed-form solutions. Moreover, it is possible to explicitly compute locally risk-minimizing hedging strategies in this framework which uses a rolling mechanism.

Our framework is introduced to model long-term markets and yearly forward contracts, which are the most liquidly traded long-term contracts. The primary focus is to capture dynamics over very long time horizons, including contracts with maturities far beyond the liquidity of long-term futures traded on the exchange. We calibrate the model to over-the-counter forwards with maturities of up to ten years from the quotation date. However, our framework can easily be extended to capture features such as spikes, seasonality and negative prices for spots and forwards with shorter time-to-maturity (day-ahead, week-ahead, month-ahead, quarter-ahead) and with shorter time frames (daily, monthly, quarterly). Incorporating such features does not change the polynomial structure, so that pricing and hedging remains tractable.

Polynomial models have been used to solve a number of problems in finance, see Filipović et al. (2017); Ackerer and Filipovic (2017); Ackerer et al. (2018); Cuchiero (2018); Filipović and Willems (2018); Ackerer and Filipović (2016); Filipović et al. (2016); Biagini and Zhang (2016); Delbaen and Shirakawa (2002) for references as well as Cuchiero et al. (2012); Filipović and Larsson (2016) for a treatment of the underlying mathematical theory. With the exception of Filipović et al. (2018), the polynomial processes have not been used for electricity modeling. Our polynomial framework makes assumption on properties of spot and forward and not on supply-demand relation, and thus falls into the category of classical reduced-form model (see Carmona and Coulon (2014) for details on reduced-form model versus structural approach). It is closest to the arithmetic models of Benth et al. (2007b, a, 2008a), and extends them by making the spot price not a linear combination but a squared combination of underlying polynomial processes. In doing so we extend the class of stochastic process on the one hand, and guarantee non-negative spot prices on the other hand.

The local risk-minimization hedging criterion of Föllmer & Schweizer 1991 is one the two main quadratic hedging approaches; see e.g. Föllmer and Schweizer (1991); Heath et al. (1999); Schweizer (1999, 1990) for references of the general theory of local risk-minimization, Follmer and Sondermann (1986) for the mean-variance hedge, and Heath et al. (2001) for a comparison of the two approaches. In a recent paper on hedging, a locally risk-minimizing hedge was given for the arithmetic model of Benth et al. under illiquidity; see Christodoulou et al. (2018). Our work differs from theirs, as we consider a rolling hedge which only uses liquid forward contracts and give explicit expression for the locally risk-minimizing hedging strategy for our modeling framework.

This paper is structured in the following way: In Section 2, we define the underlying polynomial framework, model the spot price as a quadratic function of it, and provide two main specifications. In Section 3, we briefly review the main characteristics of polynomial diffusions, with a focus on the moment formula for polynomials of degree two. In Section 4, we define electricity forwards with and without delivery period. We give pricing formulas for forwards, as well as explicit expressions for covariances and correlations between different forwards. In Section 5, to incorporate time series observations of forward prices, we specify a market price of risk function, which determines the forward price dynamics under the real-world measure , and define the forward risk premium. In Section 6, we introduce a rolling hedge mechanism with liquidity constraints for hedging a long-term electricity commitment. Further, we give a rolling-hedge that is locally risk-minimizing in the sense of Föllmer and Schweizer. In Section 7, we perform model estimation of a specification of the polynomial framework to a time series of real observations of power forwards using a quadratic Kalman filter. Further we simulate forward curves and investigate the quality of the risk-minimizing hedge over various time horizon.

Throughout this paper, we fix a filtered probability space , where is a risk-neutral probability measure used for pricing. For simplicity we assume zero interest rate and thus apply no discounting. We denote by the set of all symmetric matrices and the subset consisting of positive semidefinite matrices. We let denote the space of polynomials on of degree at most .

2 The model

In this section we define the underlying polynomial framework. Firstly, we model the spot price as a quadratic function of an underlying -dimensional state variable which evolves according to a polynomial diffusion. More precisely, we let

| (1) | ||||

| (2) |

where with and , , , a -dimensional Brownian motion under and is continuous. We assume that the components of the diffusion matrix are polynomials of degree at most two. This ensures that is a polynomial diffusion, see Lemma 2.2 in Filipović and Larsson (2016).

The above formulation allows in particular to capture mean reversion, an important feature of electricity price dynamics. Empirically, this has been backed up by e.g. Koekebakker and Ollmar (2005). They examined Nordic electricity forwards from 1995–2001 and observed that the short-term price varies around the long-term price, indicating mean reversion. Several economic arguments also support the mean-reverting property; see e.g. Escribano et al. (2011).

We will now focus on the following two specifications.

Specification 2.1 (Two-factor model).

Let , , , and . The process evolves according to the SDE

| (3) | ||||

with and a standard two-dimensional Brownian motion. Here mean-reverts at rate towards the correlated process . And thus, and can be seen as factor processes that drive the short-end and long-end dynamics of spot prices respectively. This model is consistent with the empirical findings by Koekebakker and Ollmar (2005) regarding mean reversion. Let , , and let the spot price be given by

This guarantees nonnegative spot price, as . This specification is of the form (1)–(2) with

| (4) |

Specification 2.2 (Three-factor model).

We now present a specification which extends the two-factor model by modeling correlation between the underlying processes stochastically via a Jacobi process. Conditions under which the model exists and is unique are given below. Let , , , and . The process evolves according to the SDE

| (5) | ||||

with , , and a standard three-dimensional Brownian motion. Let , , and let the spot price be given by

This specification is of the form (1)–(2) with

| (6) | |||

Remark 2.3.

Although Specification 2.2 is not used in our empirical analysis, we include it as an illustration of the flexibility of the polynomial framework.

A possible use of Specification 2.2 is to model multi-energy commodities simultaneously. Here is a simple illustration of this: let one factor () drive the short-term price of one market, and let the other factor () drive the short-term price of the other market. Since energy markets evolve dynamically and prices are generally non-stationary over time (Krečar et al. (2019)), it is useful to have stochastic correlation between (the short ends of) different markets, modeled by a factor (). The setup could be complemented with a fourth factor driving common long-term prices.

Alternatively, two markets can also be modeled as follows: two factors with the dynamics of , (, ), can be used to model short-term prices of each market; one factor () drives the common long-end prices. In order to account for the changing relationship between short-term and long-term prices, another two factors with the dynamics of , (, ), can be added to model the stochastic correlation between the short-term and long-term prices in each market.

Proposition 2.4.

Recall that , , and assume moreover that

| (7) | ||||

| (8) |

Then for any initial condition with , and , there exists a unique strong solution of the SDE (5). Furthermore, this solution satisfies for all .

Proof.

In the following we show the existence and uniqueness of a strong solution as well as its boundary non-attainment. Once this is shown, we can explicitly find in terms of . Indeed, Itô’s formula yields

where and , which implies that

We now prove existence of a weak solution of the SDE for . Let be a continuous function that is equal to one for and is equal to zero for , for example

We let with and . Then and are continuous and bounded, and hence an -valued weak solution exists for the SDE ; see Theorem 4.22 of Section 5.4D in Karatzas and Shreve (1998). We next show that stays in using a version of “McKean’s argument”. Let and note that . Further define the stopping times and . Observe that (7)–(8) imply that for all . Combined with Itô’s formula, this yields

for . Consider the process

Then is a local martingale on the stochastic interval . By definition, this means that for all , is a local martingale. We now show that a.s. Suppose for contradiction that . Then there exists a large such that . Note that

| (9) |

for all . Thus is uniformly bounded from below, and hence a local supermartingale on the stochastic interval . The supermartingale convergence theorem for processes on stochastic interval now gives that exists in almost surely; see e.g. the proof of Theorem 5.7 in Filipović and Larsson (2016). Hence, in view of (9), is pathwise bounded above on , which in turn means that a.s. This contradiction shows that for all .

Now let . Then and on , and therefore, is an -valued weak solution of the SDE . For the existence and uniqueness of strong solutions, we note that is Lipschitz continuous, and is Hölder continuous of order . Hence, pathwise uniqueness holds for this SDE; see Theorem 3.5(ii) in Revuz and Yor (2013). As a result, any -valued solution is a strong solution by the Yamada–Watanabe theorem; see e.g. Theorem 1.7 in Revuz and Yor (2013). ∎

Although our main focus in this paper is on pricing and hedging of long-term contracts, let us indicate how the framework can be adjusted to incorporate features that are important over shorter time horizons.

Negative prices

In short-term electricity markets (real-time or day-ahead markets), prices frequently become negative; see e.g. Carmona and Coulon (2014) for PJM, Genoese et al. (2010) for German EEX. As electricity is non-storable, any disturbance of demand or of supply can cause negative prices.111To be more precise, negative prices can be caused by e.g. error predictions of the load, high temperature volatilities, network transmission and congestion issues (causing oversupply in one region and undersupply in another), and overdemand through prediction error from generation via renewable energy (wind and PV). The polynomial model can be extended to allow for negative prices for short-term modeling by simply taking . This way the spot price is bounded from below by , , which can be negative. This small modification does not change the polynomial structure, and thus, all computations and properties for forwards and hedges remain the same.

For long-term markets this feature is less relevant, as long-term prices are generally insensitive to temporary shocks. Indeed, the data of German Calendar year baseload forwards (over 8 years) does not contain negative prices.

Seasonality

In electricity markets, prices highly depend on the exact delivery period, e.g. offpeak vs. peak hours, winter months vs. summer months, or specific quarters. Thus, if we compare contracts with same delivery length but different delivery periods, that is, different subperiods of a year, it is important to first adjust for seasonality before making reasonable comparison. It is possible to incorporate seasonality by making not only a state-dependent, but also time-dependent mapping. More specifically, we can let , where and have temporal components. This leads to a time-inhomogeneous version of the polynomial property, which remains tractable.

Note that all yearly baseload contracts deliver throughout the year and not only for a specific subperiod of the year. To capture these forwards in long-term markets, it is not necessary to explicitly model seasonality.

Spikes/Jumps

In short-term markets, one often observes extreme price changes in spot prices, known as spikes. These result from unanticipated shocks in demand, and exist only temporarily. In other words, prices don’t stay at the new level, but revert rapidly back to the previous level. Because of their temporary nature, it is reasonable to argue that the spikes have a negligible effect on long-term prices, and therefore, should not be included in the framework for modeling long-term electricity forwards.

However, our model can be extended to account for spikes if needed, say to model short-term spot prices, or joint short- and long-term markets. One possible way of doing so is to multiply the spot price by a mean-reverting jump process that jumps and then very quickly mean-reverts towards its standard level of . A simple example is given by:

where is a Poisson random measure, a large mean-reversion parameter, which forces the process to revert quickly to the previous level after a jump. Another possibility is to incorporate spikes by an additive component, e.g.

Either way, the extensions do not change the behavior of long-dated forward but only the short-term forward and spot, because all the jumps mean-revert very quickly and so do not have an effect on long term prices. Provided is chosen appropriately, many of the properties of polynomial diffusions (such as the moment formula) still apply; see (Filipović and Larsson, 2019, Section 5) for more details.

3 Polynomial diffusions and moment formulas

In this section we briefly review some important results regarding polynomial diffusions; see e.g. Filipović and Larsson (2016) for more details. We also provide a moment formula for polynomials of degree two. Consider the (extended) generator associated to the -valued polynomial diffusion introduced in Section 2, namely

for and any function . By Itô’s formula, the process

is a local martingale. Since the components of are polynomials of degree at most two, it follows that for any and any polynomial , is also polynomial of the same degree or lower degree, i.e. .

Fix and let be the dimension of . Let be a function whose components form a basis of . Then for any

| (10) | ||||

| (11) |

where is the coordinate representation of , and the matrix representation of the generator .

Theorem 3.1 (Moment formula - general version).

Proof.

See Theorem 3.1 of Filipović and Larsson (2016). ∎

Below we give a more explicit version of the moment formula for polynomials of degree two. Note that the quantity with is quadratic in , and thus of the form

| (13) |

for some , , and that depend linearly on .

Theorem 3.2 (Moment formula for polynomials of degree two).

Let be a polynomial of the form with , and . Further let satisfy (2). Then for we have:

where solve the linear ODE

| (14) | ||||||

Proof.

Define

Let . Itô’s formula along with (13) and then (14) gives:

where . Thus, is a local martingale. Now we let be a constant such that . Then with Cauchy-Schwartz inequality,

for some constant . Together with Tonelli’s theorem, this bound yields

which is finite by Theorem 3.1. Hence, is a square-integrable true martingale. As a result,

This is the claimed formula. ∎

4 The term structure of forward prices

In this section we define electricity forwards, present their pricing formulas and give expressions for covariances and correlations between different forwards.

The price at time- of an electricity forward with instantaneous delivery at time is given by

| (15) |

In practice, electricity is not delivered instantaneously, but gradually over a period of time. This leads us to the following definition: the time- price of an electricity forward with delivery period , , is given by

| (16) |

Note that a forward contract (financial or physical) can have settlement that takes place either before or after the delivery period. Discounting is not needed in the pricing, as the difference in cashflow can be evened out by the purchase of a bond of that time period. is often also referred to as swap price, as the delivery of underlying power happens over a period of time and thus the price is the averaged price over that period.

It is intuitive that a forward with delivery period is the summation of all forwards (with instantaneous delivery) that deliver at single time points within the delivery period; moreover, a forward with delivery period which collapses into one single time point should be priced the same as a forward with instantaneous delivery. The following proposition confirms this relationship between forwards with and without delivery period.

Proposition 4.1.

For , we have:

Moreover,

Proof.

In view of (15) and (16), the first identity follows from the conditional version of Tonelli’s theorem since is nonnegative. The second identity then follows from the fundamental theorem of calculus, using that is continuous in , see Proposition 4.2 below. ∎

The following result gives closed-form expression for the forward prices.

Proposition 4.2 (Pricing formula for forwards).

Let be the coordinate representation of . The time- price of for is

and the time- price of for is

Proof.

This follows from Theorem 3.1 and rearranging terms. ∎

Note that is a non-invertible matrix. Still, is explicit; see Appendix A for the explicit computation.

Specification 2.1

Recall the Specification 2.1 in Section 2. We consider the basis given by

| (17) |

Then can be uniquely represented as:

| (18) |

For any function and , the generator is :

Applying to each element of gives its matrix representation,

| (19) |

Specification 2.2

Recall Specification 2.2 in Section 2. Here the general actually preserves a proper subspace of , namely the one spanned by the components of

| (20) |

Therefore it is not necessary to include the remaining basis functions in the definition of . Then can be uniquely represented as

| (21) |

For any function and , the generator is

Applying to each element of gives

| (22) |

For later use, we briefly discuss the instantaneous quadratic covariation and correlations between different forwards and give explicit forms for both specifications. The instantaneous covariation between two forwards with instantaneous delivery at and is, at time ,

| (23) |

where

| (24) |

We define the corresponding instantaneous correlation as

| (25) | ||||

with from (24). The matrices for Specification 2.1 and Specification 2.2 are given in Appendix B. Similarly, for and , the time- instantaneous covariation of forwards with delivery periods and is

| (26) |

and the time- instantaneous correlation is:

| (27) | ||||

with from (24) and

| (28) |

Remark 4.3 (Option pricing).

Let be the payoff function of an option based on a forward or a spot. For example, for a European call on a forward with delivery period , strike , and maturing , we have . Modulo discounting, the time- price of such an option is the -conditional expectation of under . If is a polynomial function, we can obtain explicit pricing for the option by Theorem 3.1 (if the option is based on a spot) or Proposition 4.2 (if the option is based on a forward). If is not a polynomial, an approximation scheme is required. For example, one can use the polynomial expansion method described in (Filipović and Larsson, 2019, Section 7).

5 Market price of risk specification

In order to incorporate time series observations of real-world forward curves, we must specify the forward dynamics under the real-world probability measure . Thus, in this section, we specify a market price of risk function by

for some and , and denote the associated Radon–Nikodym density process by

| (29) |

We choose and such that is a true martingale. We can then define on every finite time interval via its Radon–Nikodym density . Then, by Girsanov’s theorem, the -dynamics of becomes

| (30) |

with . Note that the speed of mean reversion is now adjusted to from .

Consider now Specification 2.1. In this case is a true martingale for any choice for and , as the following result shows.

Proof.

Define . Note that has drift and diffusion that are affine in ; see computations in Section 4, Appendix B and Section 7.2. Thus, by Kallsen & Muhle-Karbe (Corollary 3.9 in Kallsen and Muhle-Karbe (2010)), is a true martingale. ∎

To be explicit, let and . Then the -dynamics of is given by:

| (31) |

This can also be written as with

and from (4).

In the case of Specification 2.2 it is a more delicate problem to determine those market price of risk parameters for which is a true martingale. Since we will not use Specification 2.2 in our empirical analysis, we do not consider this issue here.

Forward risk premium

We define the forward risk premium as the difference of the forward and the predicted spot price. The time- forward risk premium of a forward with instantaneous delivery at is thus given by

and the time- forward risk premium of a forward with delivery period , , is given by

The notion above is consistent with the ex-ante notion of forward risk premium used by e.g. Benth, Cartea, and Kiesel (2008b); Benth and Meyer-Brandis (2009); Benth, Kiesel, and Nazarova (2012); Benth and Ortiz-Latorre (2014); Benth, Piccirilli, and Vargiolu (2019); Krečar, Benth, and Gubina (2019). Both the - and -conditional expectations can be computed using the pricing formula in Proposition 4.2. We obtain the following explicit expressions for forward risk premia:

| and | ||||

where denotes the matrix representation of the generator under . For example, for Specification 2.1 under , evolves according to (31), and is given by

The forward risk premium arises from the market price of risk and the associated measure change via the Girsanov’s theorem, designed so that the polynomial structure is preserved. This produces stochastic and time varying forward risk premia. The risk premia do not have a definite sign, and can alternate between being positive and negative.222Empirical studies of electricity forward risk premia show mixed findings; see e.g. Bunn and Chen (2013) for a literature survey, and Valitov (2019); Viehmann (2011) for discussions of the risk premium in the short-term German market in particular. There is an extensive literature on market price of risk specifications, forward risk premia, and measure changes for electricity modeling; see e.g Benth, Cartea, and Kiesel (2008b); Weron (2008); Benth and Meyer-Brandis (2009); Benth and Ortiz-Latorre (2014); Krečar, Benth, and Gubina (2019); Benth, Piccirilli, and Vargiolu (2019).

6 Hedging

In this section we first describe a rolling hedge setup with constraints which addresses the illiquidity and non-storability issues when hedging a long-term electricity contract. Rolling hedges for commodities form a well-known hedging scheme; see for example Glasserman (2001); Neuberger (1999). We then briefly review the locally risk-minimizing hedge of Föllmer and Schweizer, and give a rolling hedge for our modeling framework that is risk-minimizing.

6.1 A rolling hedge setup

Suppose we have committed to deliver power from year to year for a large (e.g. years) and our objective is to hedge this long-term electricity commitment. In our framework the time- valuation of the commitment is

Note that is a -martingale and the pricing formula (Proposition 4.2) gives explicit pricing at any . In an interest rate context, the analogous hedging problem is rather easy: just buy bonds and hold them as the payout in 10 years is known in advance. For electricity the problem is more difficult for a number of reasons:

-

•

Long-term forwards are not liquidly traded (otherwise buy and hold the financial contracts as in the interest rate context);

-

•

Electricity cannot be stored without significant costs (otherwise cash and carry as for other storable commodities: simply buy the amount needed in and hold).

-

•

Only short-term / near-dated contracts with same delivery length is available. But its underlying commodity (electricity) is not the same as the one underlying a long-term contract because power is not storable. Some empirical evidence suggests that short-term prices carry limited information about what spot prices will be far into the future (see Handika et al. (2012)).

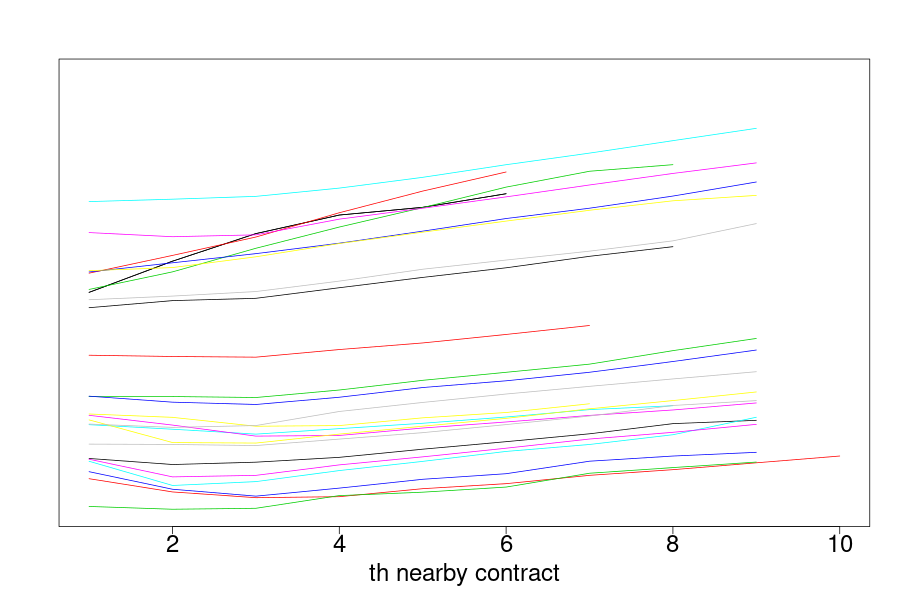

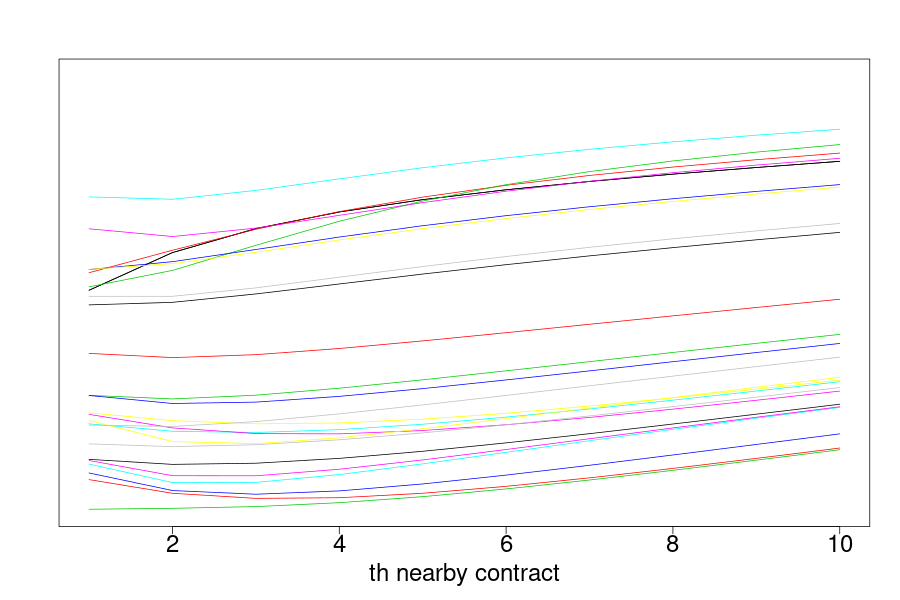

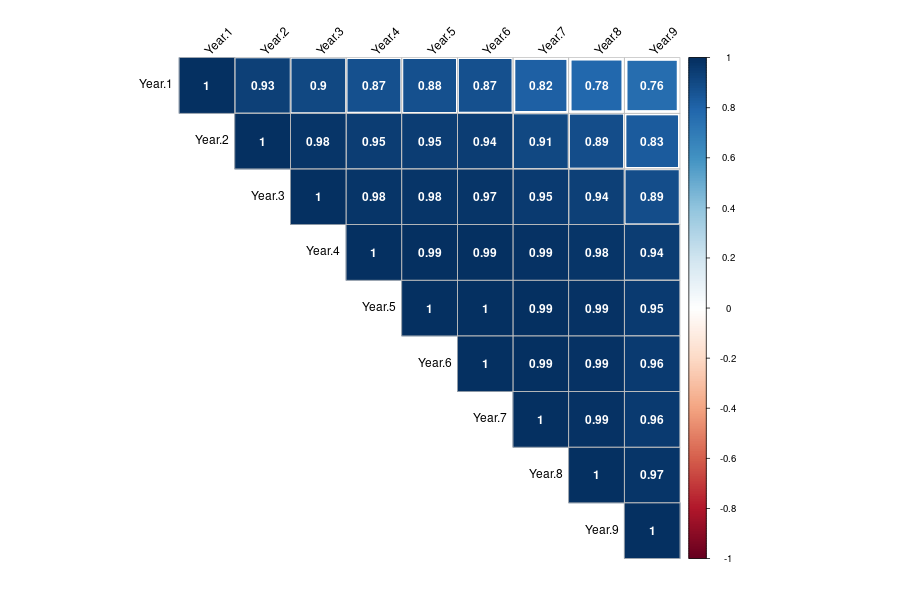

One possible strategy in this case is a rolling hedge, where we take a long position in near-term contracts as a hedge, and roll the hedge going forward. The underlying assumption of this strategy is that near-dated yearly contracts are highly correlated with far-dated yearly contracts, and become more so as the maturity date approaches333Note that this statement does not contradict the common perception that the short- and long-term data are not very correlated, e.g. Koekebakker and Ollmar (2005). The first nearby calendar year forward is often considered a medium-term or even a long-term contract. . This assumption is supported by the data; see Figure 7 in Appendix C.

To formalize this, let us first define the price process containing all calendar-year forwards with a one-year delivery period (short: cal forward):

| (32) |

where and . Note that each is a -martingale by its definition (16). By Proposition 4.2, can be expressed as

| (33) |

where is defined in (28).

An admissible444Note that for any polynomial processes all moments of exist. Therefore, integration with respect to any moments of is well-defined. And thus, , i.e. , and is admissible. hedging strategy is an -valued process , where is adapted (representing bank account) and is predictable (representing amount of tradable assets or hedge ratio), and satisfies

| (34) |

The constraint (34) reflects the liquidity issue and trading rule of those markets:

-

•

only the first-nearby forwards are liquid;

-

•

a contract that has started to deliver can no longer be traded.

The value process (or the P & L) at time for is

The cumulative cost of the hedge up to time is:

where denotes the cumulative gain of the hedge up to time :

| (35) | ||||

for .

Note that the market is incomplete under the restriction (34), since there are two different Brownian motions, but only one risky asset to invest in at any given time. In an incomplete market a claim generally cannot be fully replicated at maturity by a self-financing hedging strategy. Depending on the restriction on cash account , one can either use a strategy that is self-financing but does not perfectly replicate the claim at maturity, or use a strategy that fully replicates the claim at maturity but needs additional investment throughout the hedge, i.e. is not self-financing. In the first case, we have residual risk and in the latter case additional cash infusion is needed. Either way, risk cannot be fully eliminated and can only be minimized. In the following we briefly review the concept of risk-minimizing strategy in the sense of Föllmer and Schweizer, and then give a rolling hedge that is locally risk-minimizing.

6.2 A locally risk minimizing hedging criterion

The risk-minimization criterion proposed and developed by Föllmer and Schweizer (see e.g. Heath et al. (2001), Heath et al. (1999), Schweizer (1999), Schweizer (1990), Föllmer and Schweizer (1991) for details), is to minimize the conditional variance of the cost process ,

among all not necessarily self-financing strategies that perfectly replicate at maturity:

| (36) |

In our setup, (36) is equivalent to and .

A strategy is called risk-minimizing if for any that satisfies (36) we have , -a.s. for every ; see Schweizer (page 545 in Schweizer (1990)). One can show that any risk-minimizing strategy is mean self-financing, i.e. is a -martingale. Föllmer and Schweizer showed that the existence of such a strategy is guaranteed if the price process is a -local martingale. Moreover, in the martingale case, finding such a strategy is equivalent to finding the Galtchouk–Kunita–Watanabe (GKW) decomposition of , namely

| (37) |

where is an admissible, predictable process and is a square-integrable -martingale strongly orthogonal to with . The risk-minimizing hedging strategy is then given by

where the value process is and the cost process is . Obviously this risk-minimizing strategy satisfies , and the associated risk process is minimal (zero) at .

6.3 A risk-minimizing rolling hedge

Recall that the price process is a -martingale. Then the time- valuation of the long-term electricity commitment has a GKW-decomposition as in (37). We now compute the process in this decomposition. This will give us the hedging strategy. Using (37), (34) and (35), we obtain for any , :

where as is orthogonal to , and as is constant and known at . Rearranging and using (24) and (28) we get the -th component of for :

Therefore, the risk-minimizing hedging strategy of the tradable assets is given by

| (38) | ||||

| where | ||||

| (39) | ||||

And thus, for , the cash account is then given by

and the associated cost process is

Remark 6.1.

The risk minimizing strategy also minimizes the quadratic covariation between the claim and the value of hedge without the cash account. Indeed, formally one has

This expression is minimized by as in (39).

7 Empirical analysis

In this section we demonstrate the use of our polynomial framework for modeling and hedging long-term electricity forwards and analyzing their performance. Based on a time series of real observations of power forwards provided by Axpo Solutions AG, we estimate parameters of a model specification. Further we simulate forward curves and investigate the quality of risk-minimizing hedges over various time horizons.

7.1 The data

Electricity long-term contracts lack liquidity and are not available on exchange.555People usually refer to contracts with more than 2-3 years time to maturity/start of delivery as long-term contracts. In fact, long-term forwards with delivery periods are only offered by a small group of market participants over the counter (OTC), mostly by energy producing and trading companies.

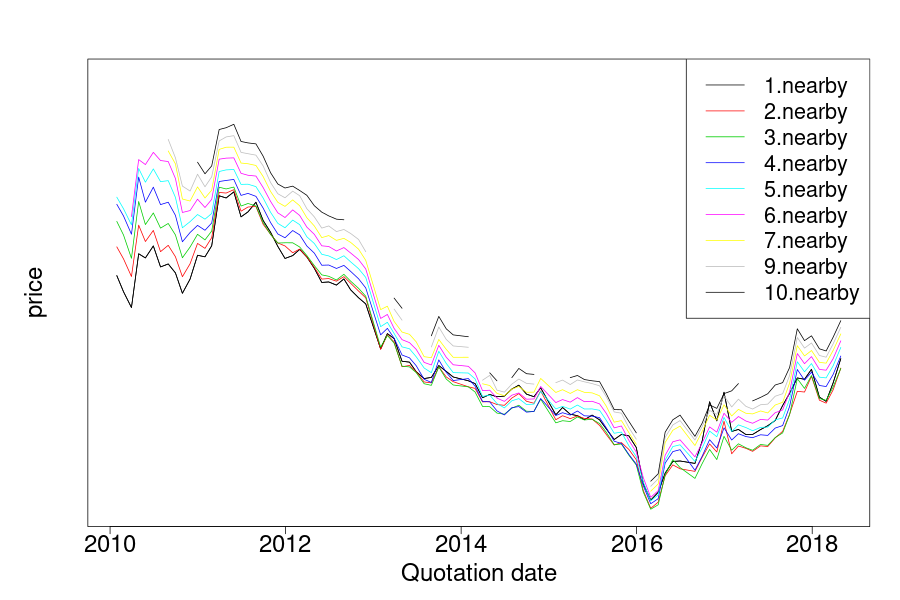

The data we use are provided by Axpo Solutions AG, and come originally from Totem Markit service, which surveys prices of various electricity contracts from each member firm and in term provides market consensus prices. More concretely, the data are German calender-year baseload (Cal) forwards that are quoted monthly from January 2010 to April 2018.666Note that German Cal Base forwards are the most liquidly traded contracts among all illiquid long-term contracts. On each quotation date, we have at most 10 quoted contracts, i.e. first to tenth nearby Cal forwards. For each quoted contract on each quotation date, we have consensus price and the price spread between the highest quoted price and the lowest quoted price. A visualization of consensus prices is given in Figure 2.

7.2 Model estimation

In order to capture the dynamics of the forward curves with our model, a non-linear filter is needed for model estimation, as the forward prices are quadratic in the Gaussian underlying factor process . Recall that the fundamental assumption of Kalman filter is that the measurement space is linear and Gaussian in the state space. Thus, in order to work with a Kalman filter, we can either linearize the quadratic relationship between state and measurement. This leads to a so-called extended Kalman filter. Alternatively, we can augment the state to incorporate the linear and quadratic terms of , so that the measurements become linear in the augmented state.

Inspired by the work of Monfort et al. (2015), we will use a time-dependent version of the latter approach to estimate a discrete version of Specification 2.1 based on the data from Section 7.1. The estimation will be under , which means that we also need to estimate the market price of risk parameters.

Note that we do not have direct access to the underlying state process through the available data. Indeed, at each quotation date , we only see the prevailing price of the -th nearby forward contract, with .777Actually, we see even less, since price data is often missing for longer maturities. We view as a noisy observation of the model price. More precisely, we assume that

where is the model price computed using Proposition 4.2, are iid standard Gaussian noise, modulated by some parameters . The role of is to encode the trustworthiness of the price of the -th nearby contract on quotation date . A large value means that the price is considered noisy and uncertain, and a small value that the price is considered accurate. The are chosen based on the spreads between the highest and lowest quoted price for the -th nearby contract on date . Specifically, we use

where denotes the time series average of the spreads for a fixed maturity , and denotes the overall average of all the spreads . The use of iid noise corresponds to assuming that our model captures all systematic effects. This is a standard assumption to reduce the complexity of the estimation.

A quadratic Kalman filter for Specification 2.1

We will now overload notation in the following manner: we write for the state at quotation date , and similarly for other quantities that depend on time.

Since model prices at date are quadratic in the state , we have the expression

for some , and that can be deduced from the pricing formula in Proposition 4.2. In view of (17), and following Monfort et al. (2015), we observe that is affine in the augmented state vector

Specifically, the vector of prices, is given by

where and can be computed as follows: for each maturity , we have

with from (18) and from (19). Moreover, we have defined and . Next, the discretized (non-augmented) state dynamics is given by

where are independent bi-variate standard Gaussians and

Here we use the market price of risk parameters and from Section 5. The discretized dynamics of the augmented state is

where the involved quantities are conveniently expressed using the standard vector stacking operator , Kronecker product , selection matrix , and duplication matrix . The resulting expressions are:

where and is the identity matrix of size , and is the standard commutation matrix of size . We then let be the Cholesky factor of , i.e., . We finally define . The filtering algorithm is then described in Algorithm 1, where we use the notation

Optimization with the quadratic Kalman filter for Specification 2.1

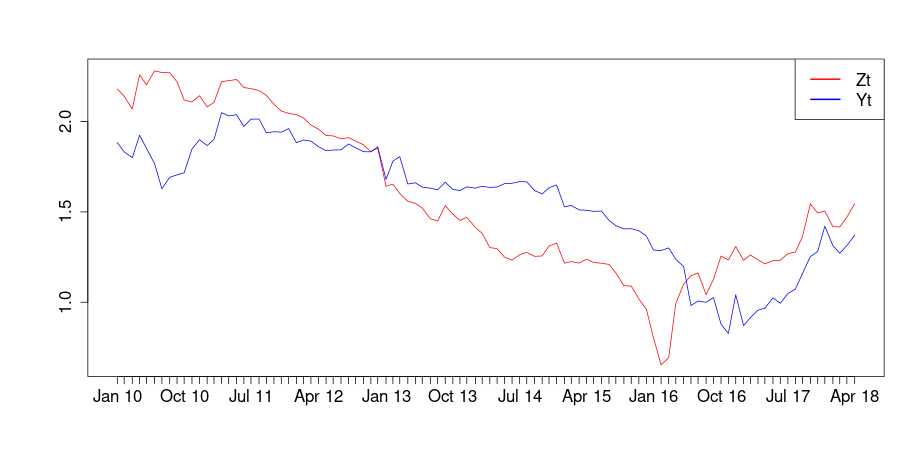

For the model estimation with the quadratic filter, we use both the Least-Squares (LS) and the Maximum Likelihood (ML) criteria. We start with LS, as it is robust and converges fast. Once a stable result is obtained, we apply ML to obtain further improvement. Moreover, we impose on the parameters, in line with the interpretation that and drive the short and the long end of the forward curve respectively and thus mean-revert at different speed. The filtered underlying process is given in Figure 3. The estimated parameters are shown in Table 1.

In the implementation we use the R package DEoptim, which is an optimizer based on a differential evolution algorithm; see Storn and Price (1997), Price et al. (2006) for details of the algorithm and https://cran.r-project.org/web/packages/DEoptim/index.html, Ardia et al. (2011a), Ardia et al. (2016), Mullen et al. (2011) Ardia et al. (2011b) for use of the package.

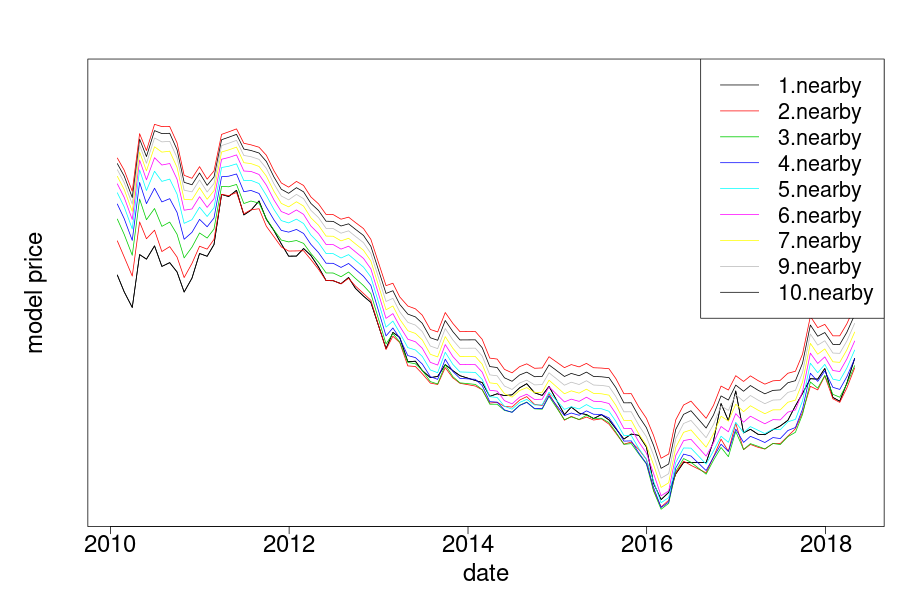

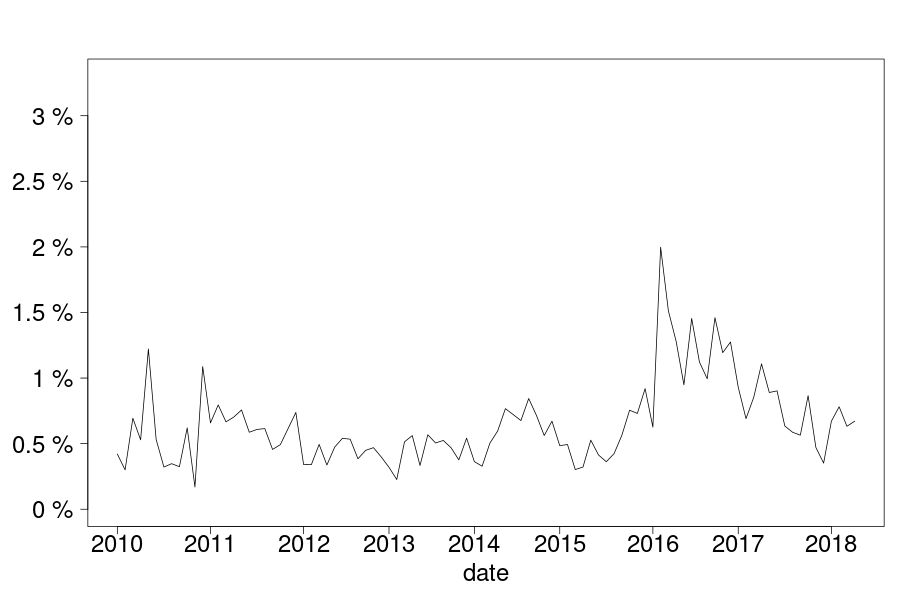

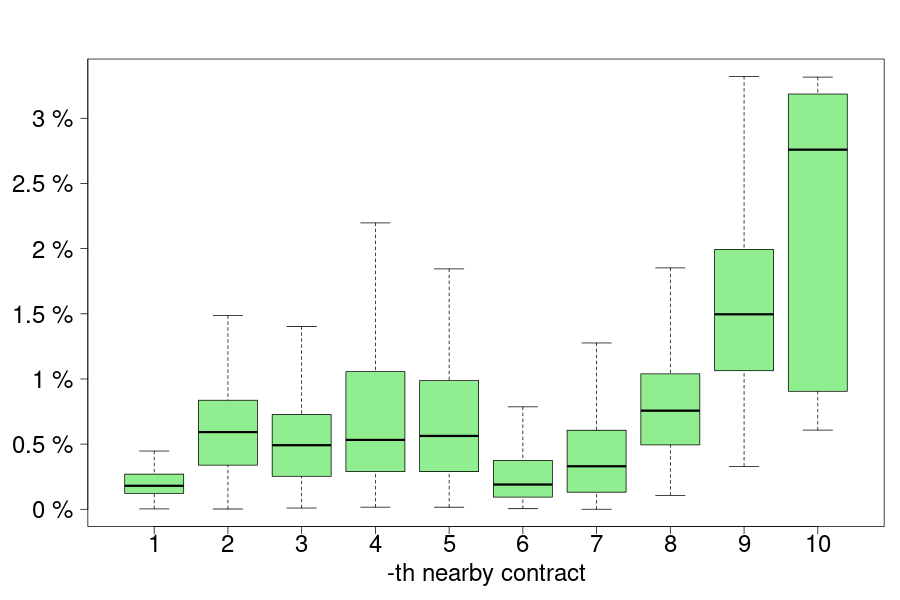

Figure 4 gives a visualization of the model estimation using Specification 2.1. We quantify the goodness of fit in terms of relative errors, both cross-sectionally at each quotation date (Figure 5(a)), and across time for each nearby forward contract (Figure 5(b)). The overall relative error, i.e. the average relative error across all contracts and quotation dates, is as low as , indicating a very good model fit.

In Figure 5(a) we notice a single spike of the time series of averaged errors reaching almost (on a quotation date in February 2016). This is due to a single dramatic price drop of a forward curve on that date that is moderately captured by our model as it is continuous and gives smooth prices.

Looking at the estimation of the time series of each nearby forward (Figure 5(b)), we find that the front end fit (i.e. the first nearby to the sixth nearby forward contract) works very well while the fit deteriorates for longer maturities. This occurs by construction, as the prices of contracts with very long time-to-maturity are less reliable than those on the front end of the forward curve. In the filter this is captured by the data variance , which is influenced by the time series of price spread of each forward; in general tends to be higher for longer time-to-maturity (i.e. larger ).

quotation date

| nearby contract | 1 | 2 | 3 | 4 | 5 |

| av. rel. error | 0.2162% | 0.6211% | 0.5666% | 0.7362% | 0.6990% |

| std(rel. error) | 0.1741% | 0.4036% | 0.4401% | 0.6223% | 0.5560% |

| nearby contract | 6 | 7 | 8 | 9 | 10 |

| av. rel error | 0.3355% | 0.4509% | 0.8530% | 1.6583% | 2.1549% |

| std(rel. error) | 0.4397% | 0.4330% | 0.5986% | 0.9784% | 1.2975% |

We also performed model estimation under . This is equivalent to assuming , meaning that the market price of risk is zero (). This produces different parameters than those in Table 1, but the fit remains remarkably good.

7.3 Simulation and hedging analysis

In the following, we simulate forward surfaces, run locally risk-minimizing hedging strategies on those, and analyze their performance with respect to different hedging horizons.

Simulation of forward surfaces

With a given set of parameters, we generate samples of entire forward surfaces over a fixed time horizon . This can be done efficiently by first simulating the -dynamics of the underlying process until year using a simple Euler scheme (with, say, discretization steps). We can then compute the forward price for the -st through -th nearby contract at each point on the time grid by applying the pricing formula, Proposition 4.2. The complexity of simulating evolutions of forward curves is of the order . A brief pseudo code is given in Algorithm 2.

Simulation study of hedging performance

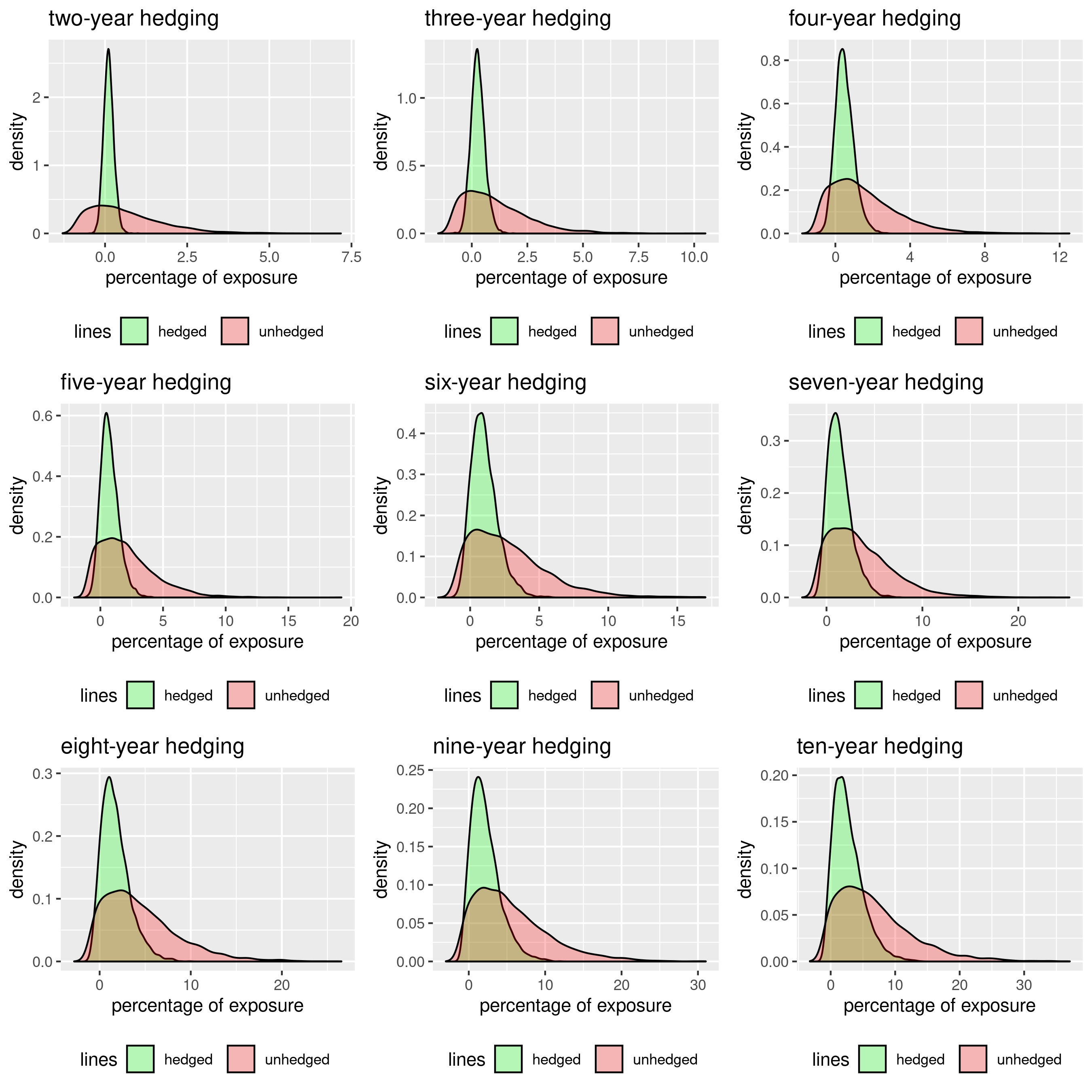

We aim to evaluate hedging performance by comparing the unhedged exposures with exposures when we use the locally risk-minimizing rolling hedges from Section 6 on different hedging horizons. For this, we consider different claims with years. Next, we simulate forward curve evolutions using the estimated parameters from Table 1. For the Euler discretization we use 120 time points per year. For the hedging we use a monthly rebalancing frequency. Finally, we compare the percentage exposure if left unhedged, i.e.

with the percentage exposure if hedged, i.e.

with from (38)–(39) and from (32)–(33). A visual comparison of those exposures (hedged versus unhedged) with respect to different hedging horizons is given in Figure 6. We see that the distribution of the exposure widens with increasing hedging horizon, and that the sample standard deviation and skewness go up; see the table below Figure 6. The exposure is significantly higher if left unhedged. Moreover, in all cases, the locally risk-minimizing rolling hedge significantly reduces, but does not eliminate, the variance and skew of long-term exposures.

| hedging horizon | hedged | unhedged | ||||

|---|---|---|---|---|---|---|

| std | skew | std | skew | |||

| 2 years | 0.1532 | 0.2728 | 1.1278 | 1.1724 | ||

| 3 years | 0.3099 | 0.3658 | 1.4700 | 1.2107 | ||

| 4 years | 0.4959 | 0.5477 | 1.8143 | 1.1738 | ||

| 5 years | 0.7125 | 0.6992 | 2.2762 | 1.2201 | ||

| 6 years | 0.9583 | 0.8474 | 2.8011 | 1.2439 | ||

| 7 years | 1.2266 | 0.9061 | 3.3729 | 1.2361 | ||

| 8 years | 1.5406 | 1.0017 | 4.0898 | 1.1926 | ||

| 9 years | 1.8991 | 1.0625 | 4.8472 | 1.1660 | ||

| 10 years | 2.2982 | 1.0777 | 5.7729 | 1.2224 | ||

Appendix A Explicit computation of

The -matrices arising in both specifications have a zero first column, and are therefore not invertible. This is in general the case when is part of the basis , as . Moreover, if we remove the first row and column of , the submatrix is invertible and upper-triangular. In the following we show a straightforward way to compute for such , which helps to reduce the computational effort of evaluating the pricing formula.

Proposition A.1.

Let A be an upper triangular matrix of the form

for some vector and upper triangular invertible matrix . Then

Proof.

Let denote the claimed expression for . One easily checks that and that is the identity. This implies that . The expression for is easily obtained by integrating each block of . ∎

Appendix B Specifications of

Instantaneous covariations and correlations in Specification 2.1

Instantaneous covariations and correlations in Specification 2.2

Appendix C Correlation of forwards implied by the data

References

- Ackerer and Filipović (2016) Damien Ackerer and Damir Filipović. Linear credit risk models. arXiv preprint arXiv:1605.07419, 2016.

- Ackerer and Filipovic (2017) Damien Ackerer and Damir Filipovic. Option pricing with orthogonal polynomial expansions. arXiv preprint arXiv:1711.09193, 2017.

- Ackerer et al. (2018) Damien Ackerer, Damir Filipović, and Sergio Pulido. The jacobi stochastic volatility model. Finance and Stochastics, 22(3):667–700, 2018.

- Ardia et al. (2011a) David Ardia, Juan Ospina Arango, and Norman Giraldo Gomez. Jump-diffusion calibration using Differential Evolution. Wilmott Magazine, 55:76–79, 2011a. URL http://www.wilmott.com/.

- Ardia et al. (2011b) David Ardia, Kris Boudt, Peter Carl, Katharine M. Mullen, and Brian G. Peterson. Differential Evolution with DEoptim: An application to non-convex portfolio optimization. The R Journal, 3(1):27–34, 2011b. URL https://journal.r-project.org/archive/2011-1/RJournal_2011-1_Ardia~et~al.pdf.

- Ardia et al. (2016) David Ardia, Katharine M. Mullen, Brian G. Peterson, and Joshua Ulrich. DEoptim: Differential Evolution in R, 2016. URL https://CRAN.R-project.org/package=DEoptim. version 2.2-4.

- Benth and Meyer-Brandis (2009) Fred Espen Benth and Thilo Meyer-Brandis. The information premium for non-storable commodities. Journal of Energy Markets, 2(3):111–140, 2009.

- Benth and Ortiz-Latorre (2014) Fred Espen Benth and Salvador Ortiz-Latorre. A pricing measure to explain the risk premium in power markets. SIAM Journal on Financial Mathematics, 5(1):685–728, 2014.

- Benth et al. (2007a) Fred Espen Benth, Jan Kallsen, and Thilo Meyer-Brandis. A non-gaussian ornstein–uhlenbeck process for electricity spot price modeling and derivatives pricing. Applied Mathematical Finance, 14(2):153–169, 2007a.

- Benth et al. (2007b) Fred Espen Benth, Steen Koekebakker, and Fridthjof Ollmar. Extracting and applying smooth forward curves from average-based commodity contracts with seasonal variation. Journal of Derivatives, 15(1):52, 2007b.

- Benth et al. (2008a) Fred Espen Benth, Jurate Saltyte Benth, and Steen Koekebakker. Stochastic modelling of electricity and related markets, volume 11. World Scientific, 2008a.

- Benth et al. (2008b) Fred Espen Benth, Álvaro Cartea, and Rüdiger Kiesel. Pricing forward contracts in power markets by the certainty equivalence principle: explaining the sign of the market risk premium. Journal of Banking & Finance, 32(10):2006–2021, 2008b.

- Benth et al. (2012) Fred Espen Benth, Rüdiger Kiesel, and Anna Nazarova. A critical empirical study of three electricity spot price models. Energy Economics, 34(5):1589–1616, 2012.

- Benth et al. (2019) Fred Espen Benth, Marco Piccirilli, and Tiziano Vargiolu. Mean-reverting additive energy forward curves in a heath–jarrow–morton framework. Mathematics and Financial Economics, 13(4):543–577, 2019.

- Biagini and Zhang (2016) Francesca Biagini and Yinglin Zhang. Polynomial diffusion models for life insurance liabilities. Insurance: Mathematics and Economics, 71:114–129, 2016.

- Bunn and Chen (2013) Derek W Bunn and Dipeng Chen. The forward premium in electricity futures. Journal of Empirical Finance, 23:173–186, 2013.

- Carmona and Coulon (2014) René Carmona and Michael Coulon. A survey of commodity markets and structural models for electricity prices. In Quantitative Energy Finance, pages 41–83. Springer, 2014.

- Christodoulou et al. (2018) Panagiotis Christodoulou, Nils Detering, and Thilo Meyer-Brandis. Local risk-minimization with multiple assets under illiquidity with applications in energy markets. International Journal of Theoretical and Applied Finance, 2018.

- Cuchiero (2018) Christa Cuchiero. Polynomial processes in stochastic portfolio theory. Stochastic Processes and their Applications, 2018.

- Cuchiero et al. (2012) Christa Cuchiero, Martin Keller-Ressel, and Josef Teichmann. Polynomial processes and their applications to mathematical finance. Finance and Stochastics, 16(4):711–740, 2012.

- Delbaen and Shirakawa (2002) Freddy Delbaen and Hiroshi Shirakawa. An interest rate model with upper and lower bounds. Asia-Pacific Financial Markets, 9(3-4):191–209, 2002.

- Escribano et al. (2011) Alvaro Escribano, J Ignacio Pena, and Pablo Villaplana. Modelling electricity prices: International evidence. Oxford bulletin of economics and statistics, 73(5):622–650, 2011.

- Filipović and Larsson (2016) Damir Filipović and Martin Larsson. Polynomial diffusions and applications in finance. Finance and Stochastics, 20(4):931–972, Oct 2016. ISSN 1432-1122. doi: 10.1007/s00780-016-0304-4.

- Filipović and Larsson (2019) Damir Filipović and Martin Larsson. Polynomial jump-diffusion models. Swiss Finance Institute Research Paper, (17-60), 2019.

- Filipović and Willems (2018) Damir Filipović and Sander Willems. A term structure model for dividends and interest rates. 2018.

- Filipović et al. (2016) Damir Filipović, Elise Gourier, and Loriano Mancini. Quadratic variance swap models. Journal of Financial Economics, 119(1):44–68, 2016.

- Filipović et al. (2017) Damir Filipović, Martin Larsson, and Anders B Trolle. Linear-rational term structure models. The Journal of Finance, 72(2):655–704, 2017.

- Filipović et al. (2018) Damir Filipović, Martin Larsson, and Tony Ware. Polynomial processes for power prices. 2018.

- Föllmer and Schweizer (1991) H Föllmer and Martin Schweizer. Hedging of contingent claims. Applied stochastic analysis, 5:389, 1991.

- Follmer and Sondermann (1986) Hans Follmer and Dieter Sondermann. Contributions to mathematical economics. North Holland, 1986.

- Genoese et al. (2010) Fabio Genoese, Massimo Genoese, and Martin Wietschel. Occurrence of negative prices on the german spot market for electricity and their influence on balancing power markets. In 2010 7th International Conference on the European Energy Market, pages 1–6. IEEE, 2010.

- Glasserman (2001) Paul Glasserman. Shortfall risk in long-term hedging with short-term futures contracts. Option Pricing, Interest Rates and Risk management, pages 477–508, 2001.

- Handika et al. (2012) Rangga Handika, Stefan Trück, et al. The relationship between spot and futures prices: An empirical analysis of australian electricity markets. In 3rd IAEE Asian Conference, 2012.

- Heath et al. (1999) David Heath, Eckhard Platen, and Martin Schweizer. Numerical comparison of local risk-minimisation and mean-variance hedging. Australian National University, Centre for Mathematics and its Applications, School of Mathematical Sciences, 1999.

- Heath et al. (2001) David Heath, Eckhard Platen, and Martin Schweizer. A comparison of two quadratic approaches to hedging in incomplete markets. Mathematical Finance, 11(4):385–413, 2001.

- Kallsen and Muhle-Karbe (2010) Jan Kallsen and Johannes Muhle-Karbe. Exponentially affine martingales, affine measure changes and exponential moments of affine processes. Stochastic Processes and their Applications, 120(2):163–181, 2010.

- Karatzas and Shreve (1998) Ioannis Karatzas and Steven E Shreve. Brownian Motion and Stochastic Calculus. Springer, 1998.

- Koekebakker and Ollmar (2005) Steen Koekebakker and Fridthjof Ollmar. Forward curve dynamics in the nordic electricity market. Managerial Finance, 31(6):73–94, 2005.

- Krečar et al. (2019) Nikola Krečar, Fred E Benth, and Andrej F Gubina. Towards definition of the risk premium function. IEEE Transactions on Power Systems, 2019.

- Monfort et al. (2015) Alain Monfort, Jean-Paul Renne, and Guillaume Roussellet. A quadratic kalman filter. Journal of Econometrics, 187(1):43–56, 2015.

- Mullen et al. (2011) Katharine Mullen, David Ardia, David Gil, Donald Windover, and James Cline. DEoptim: An R package for global optimization by differential evolution. Journal of Statistical Software, 40(6):1–26, 2011. URL http://www.jstatsoft.org/v40/i06/.

- Neuberger (1999) Anthony Neuberger. Hedging long-term exposures with multiple short-term futures contracts. The Review of Financial Studies, 12(3):429–459, 1999.

- Price et al. (2006) Kenneth V. Price, Rainer M. Storn, and Jouni A. Lampinen. Differential Evolution - A Practical Approach to Global Optimization. Natural Computing. Springer-Verlag, January 2006. ISBN 540209506.

- Revuz and Yor (2013) Daniel Revuz and Marc Yor. Continuous martingales and Brownian motion, volume 293. Springer Science & Business Media, 2013.

- Schweizer (1990) Martin Schweizer. Risk-minimality and orthogonality of martingales. Stochastics: An International Journal of Probability and Stochastic Processes, 30(2):123–131, 1990.

- Schweizer (1999) Martin Schweizer. A guided tour through quadratic hedging approaches. Technical report, Discussion Papers, Interdisciplinary Research Project 373: Quantification and Simulation of Economic Processes, 1999.

- Storn and Price (1997) Rainer Storn and Kenneth Price. Differential evolution – a simple and efficient heuristic for global optimization over continuous spaces. Journal of Global Optimization, 11(4):341–359, Dec 1997. ISSN 1573-2916. doi: 10.1023/A:1008202821328. URL https://doi.org/10.1023/A:1008202821328.

- Valitov (2019) Niyaz Valitov. Risk premia in the german day-ahead electricity market revisited: The impact of negative prices. Energy Economics, 82:70–77, 2019.

- Viehmann (2011) Johannes Viehmann. Risk premiums in the german day-ahead electricity market. Energy policy, 39(1):386–394, 2011.

- Weron (2008) Rafał Weron. Market price of risk implied by asian-style electricity options and futures. Energy Economics, 30(3):1098–1115, 2008.