Small-noise limit of the quasi-Gaussian log-normal HJM model

Abstract.

Quasi-Gaussian HJM models are a popular approach for modeling the dynamics of the yield curve. This is due to their low dimensional Markovian representation, which greatly simplifies their numerical implementation. We present a qualitative study of the solutions of the quasi-Gaussian log-normal HJM model. Using a small-noise deterministic limit we show that the short rate may explode to infinity in finite time. This implies the explosion of the Eurodollar futures prices in this model. We derive explicit explosion criteria under mild assumptions on the shape of the yield curve.

Key words and phrases:

HJM model, explosion, stochastic modeling, ordinary differential equations.1. Introduction

HJM models [10] are widely used in financial practice for modeling fixed income, credit and commodity markets [1]. These models specify the dynamics of the yield curve as

| (1) |

where is a vector Brownian motion under the risk-neutral measure and is a family of vector processes. The numerical simulation of these models is complicated by the fact that the entire yield curve has to be simulated. Lattice and tree simulation methods require an exponentially large number of nodes. For this reason the simulation of these models is restricted in practice to Monte Carlo methods.

The quasi-Gaussian HJM models [1, 2, 3, 5, 15] were introduced to simplify the simulation of the HJM models. They are obtained by assuming a separable form for the volatility where is a deterministic vector function and is a matrix process. Such models admit a Markov representation of the dynamics of the yield curve involving state variables. This simplifies very much their simulation, which can be done either using Monte Carlo or finite difference methods [4, 8].

We consider in this note the one-factor quasi-Gaussian HJM model with volatility specification where , and is the volatility of the short rate . This model admits a two state Markov representation.

It has been noted in [13, 10] that in HJM models with log-normal volatility specification, that is for which , the rates explode to infinity with probability one, and zero coupon bond prices are zero. It is natural to ask if a similar explosive phenomenon is present also in the quasi-Gaussian HJM model with log-normal volatility . This model is used in financial practice for modeling swaption volatility smiles [6] and is a particular case of a more general parametric representation [7].

We study in this note the qualitative behavior of the solutions of this model. In the small-noise deterministic limit, we show rigorously that the short rate may explode to infinity in a finite time. More precisely, for sufficiently small mean-reversion , the deterministic approximation for the short rate has an explosion in finite time, and an upper bound is given on the explosion time, which is saturated in the flat forward rate limit. When Brownian noise is taken into account, the explosion time has a distribution around the deterministic limit.

This phenomenon has implications for the practical use of the model for pricing and simulation. It implies an explosion of the Eurodollar futures prices in this model, and introduces a limitation in the applicability of the model for pricing these products to maturities smaller than the explosion time.

2. Log-normal quasi-Gaussian HJM model

The one-factor log-normal quasi-Gaussian HJM model is defined by the volatility specification

| (2) |

The simulation of the model requires the solution of the stochastic differential equation for the two variables [15, 1]

| (3) | |||

with initial condition . Here is the forward short rate, giving the initial yield curve. The zero coupon bonds are

| (4) |

with a non-negative deterministic function [1]. The short rate is . The equations (3) can be expressed in terms of the short rate as

| (5) | |||

with the initial condition and .

3. Deterministic approximation

Instead of studying directly the distribution of the explosion time of the process , we study a deterministic proxy of the equations (5). In the limit when the Brownian noise in these equations goes to zero, then , where satisfy the two-dimensional ODE:

| (6) | |||

with and . The variable can be interpreted as the deterministic approximation of the short rate and its expected value for the small-noise limit. The pair is a deterministic approximation of the two-dimensional SDE (5).

We study here the qualitative properties of the solution for . Even though (6) is a system of 2-dim ODEs, we will show that can be expressed as a solution to a 1-dim integral equation.

Proposition 1.

satisfies the integral equation

| (7) |

Proof.

We show next that if is uniformly bounded, for sufficiently large or sufficiently small , is also uniformly bounded, and hence there will be no explosion.

Proposition 2.

Assume that is uniformly bounded. Then, for sufficiently large or sufficiently small , we have

| (11) |

It follows that there will be no explosion.

Proof.

We only give a proof for the large result. The same result holds for sufficiently small with a very similar proof.

For any , we have from Eq. (7)

| (12) |

which implies that satisfies

| (13) |

This implies that we have either (i) , or (ii) , with

| (14) |

For large , is bounded by Proposition 2, while as . Therefore, for sufficiently large , we have . Taking now , we have by the uniformly bounded assumption . It follows that for sufficiently large ,

| (15) |

We conclude that for sufficiently large , is not explosive and is indeed uniformly bounded as long as is uniformly bounded. ∎

Remark 1.

From Proposition 2, it follows that is uniformly bounded as either or , since

and the same result holds for .

Corollary 1.

As (resp. ), we have uniformly for . More precisely,

We can also study the stationary limit for the deterministic system, that is, the large time limit for the deterministic system.

Proposition 3.

Let us assume that and exist, then

| (16) |

Proof.

Let us recall that

| (17) |

Thus the large time limit is the smaller root of the equation

| (18) |

which yields (16). ∎

For constant , one can study the stability of the two-dimensional first-order ODE

| (19) | |||||

| (20) |

We would like to determine the fixed points of this equation, and determine their type. The fixed points are given by the zeros of the functions on the RHS of the ODE. For there are no fixed points. For there is one at , . For there are two fixed points:

| (21) |

with . Linearization of the ODE around each fixed point gives the linear ODE

| (22) |

The eigenvalues of the matrix of coefficients for each fixed point are:

| (23) | |||||

| (24) |

The relative signs of the two eigenvalues determine the type of the fixed points: is an attractive fixed point (), and is a saddle point (). This means that the two-dimensional ODE describes a flow for , and the lines of flow can either end at , or at infinity, avoiding .

4. Explosion criteria

We study in this Section in more detail the explosion time of , defined as . The starting point of the analysis is the 2nd order ODE for

| (25) |

where we defined .

We will make the following assumption about the initial forward rate .

Assumption 1.

Assume that satisfies the condition

| (26) |

This is satisfied by forward rate curves which are flat or up-sloping and not too concave, which are usual in normal market conditions.

Under this assumption, satisfies the differential inequality, which reduces to equality in the limit of a constant

| (27) |

with initial conditions

| (28) |

4.1. Zero mean-reversion case

Proposition 4.

Proof.

By Lemma 1 (see Appendix) it is sufficient to study the solution of the ODE obtained by replacing the inequality sign in (30) with equality, and satisfying the same initial condition at . The solution of this equation with , can be found exactly in terms of the Weierstrass elliptic function , and is given by

| (31) |

where the constants are given by

| (32) |

with , . This can be simplified further by using the relation [16] to rescale the second argument to 1.

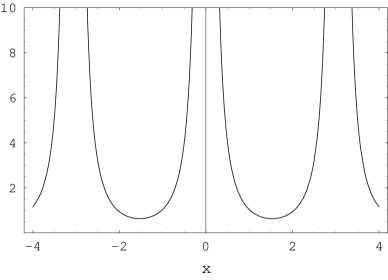

The main features of the solution can be understood by recalling the main properties of [16]. Along the real axis this function is periodic with half-period , and has double poles at origin and at all points uniformly spaced by . Half-way between poles at it reaches a minimum value . The plot of is shown in Fig. 1.

Time zero corresponds to and the explosion of takes place at the nearest pole, at . This gives for the explosion time of the solution , defined as

| (33) |

For constant forward rate we have . Allowing for non-constant satisfying Assumption 1 we have the upper bound on the explosion time . ∎

As a numerical illustration we consider the following typical model parameters: constant forward rate and volatility . The explosion time of the short rate is . This decreases as the volatility increases or the forward rate increases.

4.2. Positive mean-reversion case

It was shown in Proposition 2 that in the limit there is no explosion in . On the other hand, for there is explosion (Proposition 4). This implies that as increases from zero, there is a maximum value of for which there is explosion. For constant this maximum value can be found explicitly, and is given by the following result. For less than this maximum value, the result can be extended to a wider class of functions , satisfying Assumption 1.

Proposition 5.

The critical value separates the solutions of (25) into two families, with different qualitative behavior:

(i) Small mean-reversion . Under the Assumption 1 the explosion time of the solution for is bounded from above as with

| (34) |

where is the solution of the first order nonlinear ODE

| (35) |

with initial condition . The inequality becomes sharp for .

(ii) Large mean-reversion . Assuming constant , the solution for does not reach infinity. It satisfies with given by (38). For general a numerical study is required in order to decide the absence or presence of an explosion for .

Proof.

We start by assuming , and prove the equation (35). For sufficiently small , is a strictly increasing function of and can be inverted. Denote . It is easy to see that this satisfies

| (36) |

Multiplying with and using (25) we get that this function satisfies the differential equation

| (37) |

(With the substitution , the equation (37) can be brought into the canonical form of the Abel equation of the second kind .) This equation is difficult to simulate numerically as its behavior near is singular, i.e. . It is more convenient to define , which satisfies (35) and has well-behaved behavior . This reproduces Eq. (35).

We would like to study the finiteness of the integral in (34). For sufficiently small positive , the function is everywhere positive. Its large asymptotics is , so the integral (34) converges at the upper limit of integration. However, we will show that as increases, the solution develops a zero at a point as approaches a certain value . At this point the integral (34) diverges.

Let us consider the behavior of the solution as is increased from zero. Denote the function on the right hand side of (35) (with ). is always positive for and becomes negative in a region for , with

| (38) |

For the function vanishes at . These solutions satisfy the inequalities . As , the smallest solution approaches from above: . The points are fixed points for the equation (25), and correspond to the fixed points for the system studied in Section 3. Recall that is a stable fixed point, and is a saddle point.

We note the following properties of the solution of the equation (35):

(1) is an increasing function in a neighborhood of . This follows from the fact that for any we have .

(2) For sufficiently large , the solution must be a decreasing function in the region . This follows from

| (39) |

From this analysis we conclude that the solution has a minimum for sufficiently large . Denote the position of this minimum. Let us study the behavior of in the neighborhood of . From (35) we have

| (40) |

From the properties of discussed above, we see that as increases, approaches zero as . Thus must be the double root of at .

Thus we get the expansion of the solution around the minimum at

| (43) |

with . This shows that as , the integral (34) diverges due to the singularity at . ∎

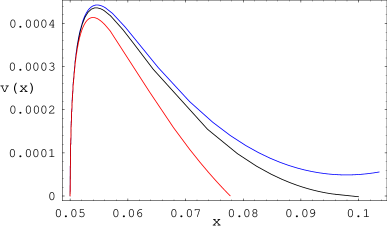

The qualitative behavior described above is seen in Figure 2 which shows numerical solutions for for three values of around the critical value . For the solution has a minimum (blue curve). For , the function vanishes at , and its support is . This is shown as the black curve in Figure 2. For the solution vanishes at (red curve).

5. Eurodollar futures explosion

Consider the pricing of an Eurodollar futures contract on the rate in the log-normal quasi-Gaussian HJM model. This requires the calculation of the expectation of this rate in the risk-neutral measure [11]. Since the rate is related to the zero coupon bond as , see e.g. [1], the pricing of the Eurodollar futures contract can be reduced to the evaluation of the expectation value of the inverse zero coupon bond in the risk-neutral measure.

Using Eq. (4) for the zero coupon bond price we get

| (44) |

This expectation is bounded from below by the Jensen inequality as

| (45) | ||||

where we recall that . We used in the last inequality the positivity of . For the small-noise limit, and sufficiently small , the expectation on the right-hand side explodes to infinity since we have . We conclude thus that Eurodollar futures contract prices in this model must explode before the explosion time .

The pricing of Eurodollar futures in the quasi-Gaussian HJM was considered in [4], under several volatility specifications: normal, log-normal (identical to the model considered here) and square-root. The model was solved by finite differences methods. The numerical tests in [4] assumed a flat yield curve at . Several values of the rates volatility were considered , and mean-reversion and . For all these cases one has . Typical values of the mean-reversion parameter in fixed-income markets are , so the condition is satisfied unless are very small, such that .

Assuming , Proposition 4 gives explosion times less than or equal to 266Y, 133Y and 44Y, respectively. These are much larger than typical maturities of Eurodollar futures contracts, which are listed on exchanges up to 10Y, although most of the liquid quotes are within 7Y.

6. Summary and conclusions

We studied the qualitative behavior of the solutions of the log-normal quasi-Gaussian HJM model using a deterministic approximation, which corresponds to the small Brownian noise limit. Under this approximation, we showed that the short rate may explode to infinity in a finite time. This is relevant for the simulation and use of the model for pricing financial derivatives.

The small-noise solutions can be used to guide the construction of finite difference or tree approximations of the model SDE. The explosion phenomenon implies that Eurodollar futures prices may become infinite under certain conditions on maturity and model parameters. Explicit explosion criteria are presented, which give an upper bound on the explosion time, under weak assumptions on the shape of the initial yield curve.

Appendix: A differential inequality

We prove in this Appendix that the solutions of the differential inequality (27) are bounded from below by the solution of the equation obtained by taking replacing the inequality sign with equality. Thus a sufficient condition for the explosions of the solution of (25) under Assumption 1 is that the solution with has an explosion. On the other hand, the absence of an explosion for the solution of the latter equation does not say anything about the presence or absence of an explosion in the former case.

Lemma 1.

Proof.

Write where is the solution of the ODE. Taking differences gives a differential inequality for

| (47) |

with initial conditions .

Define as , with initial conditions . This function satisfies the inequality

| (48) |

where we defined .

References

- [1] Andersen, L. and V. Piterbarg. Interest Rate Modeling. Atlantic Press, London, 2010.

- [2] Andreasen, J. Markovian term structure models, in Encyclopedia of Quantitative Finance, Ed. R. Cont, Wiley, New York, 2010.

- [3] Babbs, S. (1993). Generalized Vasicek models of the term structure, Applied Stochastic Models and Data Analysis. 1, 49-62.

- [4] Cakici, N. and J. Zhu. (2001). Pricing Eurodollar futures options with the Heath-Jarrow-Morton model. Journal of Futures Markets. 21, 655-680.

- [5] Cheyette, O. (1992). Markov representation of the Heath-Jarrow-Morton model. Working paper, Barra.

- [6] Chibane, M. (2012) Explicit volatility specification for the linear Cheyette model. Working paper, Shinsei Bank Ltd.

- [7] Chibane, M. and D. Law (2013). A quadratic volatility Cheyette model. Risk, 60-63 (July).

- [8] Chien, H. H.(2001). On the complexity of the Ritchken Sankarasubramanian interest rate model. Ph.D. Thesis, National Taiwan University.

- [9] Chu, S. and F. Metcalf. (1967). On Gronwall’s Inequality. Proc. Amer. Math. Soc. 18, 439-440.

- [10] Heath, D., R. Jarrow and A. Morton. (1992). Bond pricing and the term structure of interest rates: A new methodology for contingent claim valuation. Econometrica. 60, 77-105.

- [11] Hunt, P. J. and J. E. Kennedy. Financial Derivatives in Theory and Practice. Wiley Series in Probability and Statistics, 2004.

- [12] Jamshidian, F. (1991). Bond and option evaluation in the Gaussian interest rate model. Research in Finance. 8, 131-170.

- [13] Morton, A. J. (1989). Arbitrage and martingales. Doctoral dissertation, Cornell University.

- [14] Pirjol, D. and L. Zhu. (2018). Explosion of the quasi-Gaussian log-normal HJM model. Finance and Stochastics. 22, 643-666.

- [15] Ritchken, P. and L. Sankarasubramanian. (1995). Volatility structures of forward rates and the dynamics of the term structure. Math. Finance. 5, 55-72.

- [16] Whittaker, E. T. and G. N. Watson (1927). A Course of Modern Analysis. Cambridge University Press.