Regulation of renewable resource exploitation

Abstract

We investigate the impact of a regulation policy imposed on an agent exploiting a possibly renewable natural resource. We adopt a principal-agent model in which the Principal looks for a contract, taxes/compensations, leading the Agent to a certain level of exploitation. For a given contract, we first describe the Agent’s optimal harvest using the BSDE theory. Under regularity and boundedness assumptions on the coefficients, we express almost optimal contracts as solutions to HJB equations. We then extend the result to coefficients with less regularity and logistic dynamics for the natural resource. We end by numerical examples to illustrate the impact of the regulation in our model.

Key words: Contract Theory, BSDEs, HJB PDE, Logistic SDE.

1 Introduction

The exploitation of natural resources is fundamental for the survival and development of the growing human population. However, natural resources are limited since they are either non renewable (e.g. minerals, oil, gas and coal) so that the available quantity is limited, or renewable (e.g. food, water and forests) and in this case the natural resource is limited by its ability to renew itself. In particular, an excessive exploitation of such resources might lead to their extinctions and therefore affect the depending economies with, for instance, high increases of prices and higher uncertainty on the future. Thus, the natural resource manager faces a dilemma: either harvesting intensively the resource to increase her incomes, or taking into account the potential externalities induced by an overexploitation of the resource and impacting her future ability to harvest the resource. It has been nevertheless emphasized in [7] that in some cases it is optimal for natural resource manager to harvest until the extinction of the resource. This optimal harvesting strategy thus leads to costs for the global welfare related to the environment degradation.

Therefore, the management and the monitoring of the exploitation of natural resources are a balance between optimal harvest for the natural resource manager and ecological implications for public organizations. This second issue has attracted a lot of interest, especially from governance institutions. For example in its last annual report on sustainable development, the statistical office of the European Union Eurostat dedicates a full section to the question of sustainable consumption and production (see [11], Section 12).

The management of natural resources have also attracted a lot of interest from the academic community. Many studies on natural resources exploitation tried to describe the possible effect of economic incentives on the exploitation (see e.g. [5, 14, 26, 15]). These references stress the need of an incentive policy to ensure the sustainability of the resource. However, even if the regulator have access to the abundance level of natural resource, the unobservability of the natural resource manager behavior induces moral hazards. Thus, the regulator’s issue is to incentivize the resource manager to optimally reduce the cost of the resource degradation, together with ensuring a minimal incomes for the manager, under moral hazard. To the best of our knowledge, this question has been addressed only in the discrete-time framework (see for instance [13]) without considering any randomness in the dynamics of the resource. The aim of this work is to investigate this problem in continuous time with randomness in the system.

To deal with this issue, we consider a principal-agent model under moral hazard. The first elements of contract theory with moral hazard appeared in the 60’s with the articles [3, 29] in which the mechanisms of controlled management were investigated. Then, it has been extended and named as agency problem (see among others [28, 23]) by considering discrete-time models. Concerning the continuous-time framework, the agency problem with moral hazard has been first studied in [16] by modelling the uncertainty of risky incomes with a Brownian motion.

The agency problem can be roughly described as follows. We associate a moral hazard problem with a Stackelberg game in which the leader (named the Principal) proposes at time a compensation to the follower (named the Agent) given at a maturity fixed by the contract, to manage the wealth of the leader. Moreover, the Principal has to propose a compensation high enough (called the reservation utility) to ensure a certain level of utility for the Agent. Although the Principal cannot directly observe the action of the Agent, the former can anticipate the best reaction effort of the latter with respect to a fixed compensation. Hence the agency problem remains to design an optimal compensation proposed by the Principal to the Agent given all the constraints mentioned above under moral hazard.

The common approach to solve this problem consists in proceeding in two steps. The first step is to compute the optimal reaction of the Agent given a fixed compensation proposed by the Principal, i.e. solving the utility maximization problem of the Agent. In all the papers mentioned above, the shape of considered contracts is fundamental to solve the Agent problem by assuming that the compensation is composed by

-

–

a constant part depending on the reservation utility of the Agent,

-

–

a part indexed by the (risky) incomes of the Principal,

-

–

the certain equivalent gain of utility appearing in the Agent maximization.

Using the theory of Backward Stochastic Differential Equations (BSDE for short), [9] proved that this class of smooth contracts, having a relevant economic interpretation, is not restrictive to solve the agency problem. The second step consists in solving the Principal problem. Taking into account this optimal reaction of the Agent, the goal is to compute the optimal compensation. As emphasized in [25] and then in [8, 9], this problem remains to a (classical) stochastic control problem with the wealth of the Principal and the continuation utility value of the Agent as state variables.

In this paper, we identify the natural resource manager as the Agent. The Principal refers to a regulator, which can be a public institution that monitors the resource manager’s activities.

The resource manager can either harvest or renew the natural resource. In the first case the production is sold at a given price on the market and in the second case the resource manager pays for each unit of renewed natural resource. To regulate the natural resource exploitation, the Principal imposes a tax/compensation to the Agent depending on the remaining level of resource at the terminal time horizon. We suppose here that the Agent is risk-averse and we model his preference with an exponential utility function444See for instance [4] for more details on this kind of utility function and the economical interpretations of it.. For a given harvesting strategy, the Agent total gain is composed by the cumulated amounts paid/earned by renewing/harvesting the natural resource and the regulation compensation/tax. The Agent’s aim is then to maximize the expected utility of his total gain over possible harvesting strategies.

On the other side, given the previous optimal harvest of the Agent, the regulator aims at fixing a tax/compensation policy that incentives the Agent to let a reasonable remaining level of natural resource. As a public institution, we assume that the regulator is risk-neutral.

The main features to model the dynamic of a renewable natural resource are its birth and death rates and the inter-species competition. Besides, due to random evolution of the population, we consider uncertainty in the available abundance. Following [12, 2, 21] we choose to model the evolution of the natural resource by a stochastic logistic diffusion.

We then focus on the Principal-agent problem. We first characterize the Agent behavior for a fixed regulation policy represented by a random variable . Following the BSDEs approaches to deal with exponential utility maximization, we get a unique optimal harvesting strategy as a function of the component of the solution to a quadratic BSDE with terminal condition (see [24, 17]).

We next turn to the regulator problem which consists in maximizing an expected terminal reward depending on the regulation tax and the level of remaining natural resource according to the Agent’s optimal response. By writing the explicit form of the resource manager’s optimal strategy, we turn the regulator problem into a Markov stochastic control problem of a diffusion with controlled drift. We then look for a regular solution to the related PDE to proceed by verification. However, in our case we face the following three issues.

-

–

By considering the logistic dynamics for the resource abundance population, the HJB PDE related to the Principal problem involves a term of the form where stands for the resource population abundance and is the Principal’s value function. This term, induced by the inter-species competition in the classical logistic case, prevents us from using existence results of regular solutions to PDEs.

-

–

The shape of the optimal harvest of the manager leads to irregular coefficients for the related PDE, which also prevents from getting regular solutions.

-

–

Due to the exponential preferences of the Agent, the Principal’s admissible strategies need to satisfy an exponential integrability condition. However, the linear preferences of the Principal leads to an optimal contract that is not necessarily exponential integrable. Therefore, the regulator problem might not have an optimal regulation policy.

To deal with these issues, we first study a model for which the inter-species competition coefficient of the population is bounded. Hence, the term is replaced by . We then construct a regular approximation of the Hamiltonian. By considering the related PDE, we derive a regular solution (see Proposition 4.1) together with an almost optimal control satisfying the admissibility condition (see Theorem 4.2). We notice that our approach can be related to that of Fleming and Soner [27], which consists in an approximating the value function by a sequence of smooth value functions to derive a dynamic programming principle. We next turn to the logistic case for which we show that the almost optimal strategy obtained for a truncation of remains an almost optimal strategy for a large value of the truncation parameter (see Theorem 4.3).

We finally illustrate our results by numerical experiments. We compute the almost optimal strategies using approximations of solutions to HJB PDEs and show that the regulation has a significant effect on the level of remaining natural resource.

The remainder of the paper is the following. In Section 2 we describe the considered mathematical problem. We then solve in Section 3 the manager’s problem for a given regulation policy. In Section 4, we first provide almost optimal strategies in the case where the coefficient is bounded and we extend our result to the logisitic dynamics. We end Section 4 by economical insights and numerical experiments.

Notations and spaces

We give in this part all the notations used in this paper. Let be a complete probability space. We assume that this space is equipped with a standard Brownian motion and we denote by its right-continuous and complete natural filtration.

Let and a time horizon , we introduce the following spaces

-

–

(resp. ) will denote the -algebra of -progressively mesurable, -adapted (resp. -predictable) integrable processes.

-

–

is the set of processes -mesurable and continuous satisfying

-

–

is the set of processes -mesurable satisfying

-

–

For an integer , a subset of and for any , we denote by the set of continuously differentiable functions such that

and by the set of twice continuously differentiable functions such that

2 The model

2.1 The natural resource

We fix a deterministic time horizon and we suppose that the natural resource abundance at time is given by

| (2.1) |

where , and are positive constants. The quantities and correspond to the initial natural resource abundance and the growth rate respectively. The map

represents the competition inside the species considered or more generally an auto-degradation parameter for a natural resource. We assume that the map satisfies the following assumption

(H0) is a map from to such that (2.1) admits a unique strong solution in .

Note that Assumption (H0) holds for instance if the map is Lipschitz continuous. Another important example is the so-called logistic equation where on , see for example in [12]. In this last case, SDE (2.1) admits an explicit unique solution that will be denoted in the sequel by and given by

The ecological interpretation of this model is the following. At time , if the coefficient is larger than then the drift of the diffusion is negative. Therefore the abundance of the natural resource decreases in mean. Conversely, if is smaller than then the drift of the diffusion is positive. Hence, the abundance increases in mean. For more details see for instance [21, Proposition 3.4].

More general models can be used in practice and one of the main challenges, see [21], is to rely branching processes with birth and death intensities to the solutions of continuous SDEs.

2.2 The Agent’s problem

We consider an agent who tries to make profit from the natural resource. We suppose that this agent owns facilities to either harvest or renew this resource. We assume that his action happends continuously in time and we denote by his intervention rate at time , i.e. the abundance will decrease of an amount per unit of time. This means that if the intervention rate is positive (resp. negative), the Agent harvests (resp. renews) the natural resource. We denote by the set of -adapted processes defined on and valued in where and are two nonnegative constants. If the Agent is prohibited to renew the resource then .

This set is

called the set of admissible actions.

To take into account the control of the Agent on the natural resource abundance, we introduce the probability measure defined by its density w.r.t. given by

where the process is defined by

In the sequel, we denote by and the expectation and conditional expectation given respectively, for any , under the probability measure .

For , we get from Girsanov Theorem (see e.g. Theorem 5.1 in [18]) that the process defined by

is a Brownian motion under the probability . Thus, for a given admissible effort , the dynamics of can be rewritten under the probability as

This new dynamics reflects the evolution of the population with a rate per unit of time. Hence, has to be seen as the speed of the exploitation of the natural resource at time .

We then are given a price function and we suppose that the price per unit of the natural resource on the market is given by at time . We make the following assumption on the price function .

(Hp) There exists a constant such that for all .

This price function allows to take into account the dependence w.r.t. the abundance (the more abundant the resource is, the cheaper it will be and conversely).

Such a price dependence has already been used to model liquidity effects on financial market, where empirical studies showed that the impact is of the form , , for some positive constants , and (see e.g. [1, 20]). In particular, (Hp) is satisfied for this type of dependence.

Another basic example for which (Hp) holds is the case , . This last example reflects the inability to buy the natural resource once it is extinct.

We assume that the manager sells the harvested resource on the market at price per unit at time if is positive, and pays the price per unit of natural resource at time if is negative to renew this one. This provides the global amount over the time horizon .

We also suppose that giving an effort is costly for the manager and we consider the classical quadratic cost function given by . Thus, the Agent is penalized by the instantaneous amount per unit of time for a given effort . This leads to the global payment over the considered time horizon .

In our investigation, we recall that the activity of the natural resource manager is regulated by an institution (usually an environment administration) who is taking care about the size of the remaining natural resource. To avoid an over-exploitation, the regulator imposes a tax on the Agent depending on the remaining resource. This tax amount is represented by an -measurable random variable and is paid at time . Note that can be either positive or negative. In this last case, it means that the regulator gives a compensation to the manager.

Throughout the paper we assume that the Agent’s preferences are given by the exponential utility function defined by

where is a positive constant corresponding to the risk aversion of the Agent. We define the value function of the Agent associated to the taxation policy by

| (2.2) |

For a fixed tax , we denote by the set of efforts satisfying the following equality

An effort is said to be optimal for the fixed tax .

2.3 The Principal’s problem

The aim of the regulator is to stabilize the resource population at a fixed target size at the maturity . For that, a tax is chosen to incentivize the Agent to manage the natural resource so that the remaining population is close to the targeted size. Hence, the regulator benefits from the tax paid by the Agent and is penalized through a cost function depending on the size of the resource at maturity . The expected reward under the action of the Agent is then given by

Typically, we have in mind meaning that the regulator targets a population size at time for the sustainability of the resource and pays the cost per unit if the natural resource is over-consumed. This function can be seen as the amount that the regulator must pay to reintroduce the missing resource.

We suppose that the resource manager is rational. Therefore, the Principal anticipates that for a tax , the Agent will choose an effort in the set . Note that this set is not necessarily reduced to a singleton555 In our investigation, we will show that the set is reduced to a single element., hence, as usual in moral hazard problems (see for instance [16] for the formulation of the moral hazard problem), the regulator solves

| (2.3) |

where lives in a set of suitable contracts defined in the following section.

2.4 Class of contracts and utility reservation

We now introduce a reserve utility which is a negative constant. This reserve means that the regulator cannot penalize too strongly the Agent for economical reasons so that the utility expected by the Agent has to be greater than . For instance, we can choose such that the regulator monitors the Agent by promising the same expected utility as the case without regulation (see Section 4.3.1 for more details). This example reflects a non-punitive taxation policy in which the regulator purely monitors the activities of the Agent. In our model, the sign of the tax is on purpose. This means that the natural resource manager pays the fee to the regulator when is positive and conversely, the regulator compensates the Agent’s activity when is negative. Moreover, we need to impose an exponential integrability on the tax to ensure the well-posdness of . We therefore introduce the class of admissible taxes defined as the set of -measurable random variables such that

| (2.4) |

and there exists a constant such that

| (2.5) |

This last condition is very convenient since it allows to deal with the problem by using the theory of BSDEs. Moreover, a straightforward application of Cauchy-Schwarz inequality ensures that the optimization problems and take finite values.

3 Optimal effort of the natural resource’s manager

We first solve the optimal problem of the Agent (2.2) under taxation policy . As in [9], the following result shows that solving the Agent problem gives both an optimal effort and a particular representation of the tax with respect to the solution of a BSDE.

Theorem 3.1.

Let and Assumption (Hp) be satisfied. There exists a unique pair with such that

-

(i)

the tax has the following decomposition

(3.6) where is defined for any by

and

(3.7) -

(ii)

the value of the Agent is given by

-

(iii)

the process defined by is the unique optimal effort associated with the tax given by (3.6).

Proof.

The proof is divided in three steps and is related to the BSDE associated with the value function of the Agent. We first introduce a dynamic extension of the optimization problem (2.2). We denote by the dynamic value function of the Agent at time for a tax which is defined by

Note that .

Step 1. Dynamic utility of the Agent and BSDE. We characterize as the unique solution of a BSDE and we derive the optimal control by using comparison results.

Let , we introduce the process defined by

so that

| (3.8) |

Step 1a. Martingale representation and integrability.

We know that the process is a -martingale. In view of the condition (2.5), there exists and such that . Hence, for such that , since is bounded and Condition (2.5) is satisfied, we get from Hölder’s inequality

where . Hence, by using Doob’s maximal inequality, . So by using the martingale representation theorem, we know there exists a process such that

Therefore, satisfies

where for any , and .

We now prove that . From (2.5), the boundedness of and Assumption (Hp), there exists a positive constant such that

We set and such that . Using Hölder and BDG Inequalities and since , we get

Consequently, we get .

Step 1b. Comparison of BSDEs and optimal effort. We now turn to the characterization of the solution to (3.8) by a BSDE. We introduce the following BSDE

| (3.9) |

where

This BSDE has a Lipschitz generator and square integrable terminal condition from (2.5). Therefore it admits a unique solution in . Moreover, for any , we notice that satisfies the following BSDE

By classical comparison Theorem, we have

Then, we notice that BSDE (3.9) can be rewritten

In particular, we have by uniqueness of the solution to BSDE (3.9). Therefore, we get

| (3.10) |

We now prove that this optimal effort is unique. Let be an other optimal effort, then we have

From strict comparison Theorem (see for instance [10, Theorem 2.2]) we get and

By the uniqueness of the minimizer of we deduce that

Step 2. Representation of .

Since, by definition, the process is positive, we can define the processes and by

| and | (3.11) |

We obtain

We first prove . Note for any , by using Jensen inequality, we have

where stands for and . We then notice

-

–

if we have

-

–

if we have

Hence, there exists a constant such that

From Young inequality, we get

Since is bounded, we have .

Using , we obtain

Which implies .

We now check . To this end, we use a localization procedure by introducing the sequence of stopping times defined by

for any . Similarly to the proof of [6, Theorem 2], we apply Itô’s Formula to where for . We obtain

Since and for , we get from BDG and Young inequalities

| (3.12) |

From the definition of and since is bounded, there exists a constant such that

Using Jensen and Hölder inequalities we get another constant such that

Since is bounded, we have and we get from (2.5)

Sending to in (3.12), we get from Fatou’s Lemma .

Step 3. Conclusion. We directly deduce and from (3.11) together with (3.10) given that has been proved in Step 2.

4 The problem of the regulator

In this section, we focus on the regulation policy. In view of (2.3) and Theorem 3.1 the regulator’s problem turns to be

| (4.13) |

We first provide almost optimal contracts for a bounded parameter by a PDE approach. We then extend the study to the logistic case with .

4.1 Almost optimal strategies for bounded auto-degradation and cost parameters

We introduce the following class of contracts

| (4.14) | |||||

where denotes the subset of predictable processes of such that

| (4.15) |

for some and we recall that . When is the identity, we omit the exponent in the previous definitions.

From Theorem 3.1, constraint (2.4) and integrability conditions (2.5) and (4.15), the set coincides with so that the regulator’s problem (4.13) becomes

| (4.16) |

with

where stands for . We notice that the function to maximize in is nondeacreasing w.r.t. the variable . Therefore the constraint is saturated and (4.16) can be rewritten under the following form

| (4.17) |

To construct a solution to the problem (4.17), we introduce the related HJB PDE given by

| (4.18) |

where the Hamiltonian is given by

and is given by (3.7). We first extend PDE (4.18) to the whole domain by considering the change of variable for any . We get the following PDE

| (4.19) |

where

Our aim is to construct a regular solution to this PDE to proceed by verification. Unfortunately, the coefficients of PDE (4.19) are not smooth enough to do so. To overcome this issue, we provide a smooth approximation of for which we get regular solutions.

Moreover, we introduce the following assumption, which ensure that the optimal control derived from the PDE satisfies the admissibility condition, i.e. belongs to .

(H’) There exists such that

-

the map belongs to ,

-

the map belongs to ,

-

the map belongs to .

Proposition 4.1.

Under (H’), there exists a family of functions from to such that the PDE

| (4.20) |

admits a unique solution in and

| (4.21) |

for any .

The proof of Proposition 4.1 consists in an approximation by regularization of the original Hamiltonian . As it is quite technical we postpone this proof to the appendix.

We are now able to describe almost optimal contracts and related almost optimal efforts using the functions given by Proposition 4.1.

Theorem 4.2.

Suppose that (H’) holds. For any , the tax policy given by

where

| (4.22) |

is -optimal for the regulator problem:

Proof.

We fix some control and we apply Itô’s formula to the process

where stands for . Since and we get

From (4.21) we get

and since is solution to (4.20), we get

Since is arbitrarily chosen in we get

| (4.23) |

We now take where is given by (4.22). We now notice that since is bounded, and by definition of we have

for any . A straightforward application of Itô’s formula and Girsanov Theorem give

From Propositions (4.20) and (4.21) we get

Hence, we get from (4.23)

Therefore, we get is a -optimal policy for the regulator.

∎

4.2 Extension to the logistic equation and continuous cost

We consider in this section an approximation method to build a sequence of almost optimal taxes in the case the classical logistic dynamic for SDE (2.1), i.e. . More precisely, we introduce a sequence of approximated models from which we derive almost optimal strategy from the previous section. We show that this sequence remains almost optimal for the logistic model. We also weaken the assumption (H’) as follows.

(Hf’) The function is bounded and continuous on .

We introduce the sequence of mollifiers , , defined by

where the function is defined by

We then define the functions , , by

From classical results, we know that satisfies for all and converges to as goes to infinity uniformly on every compact subset of .

We also define the functions , , by

| (4.24) |

where the function is given by

| (4.25) |

We then notice that satisisfes (H’) and

for . We first have the following preliminary result on the convergence of to .

Lemma 4.1.

There exists a constant such that

for all .

Proof.

We define the sequence of stopping times by

| (4.26) |

We then notice that

for all . Therefore and satisfy the same SDE with random and Lipschitz coefficients. By strong uniqueness, we have

Which implies

Hence, by using Cauchy-Schwarz Inequality, we have

| (4.27) |

for all .

We then notice that

| (4.28) |

for all . Indeed, by setting , we have

where

is a bounded process since is Lipschitz continuous, and

is a nonnegative process since for . A straightforward computation shows that

where for . Since we get . The same argument applied to gives .

We then define the function as the optimal value of the regulator problem in the model with coefficients and in place of and respectively

Since and satisfy Assumptions (H’) and (H’) respectively for all , we get, from Theorem 4.2, a sequence of bounded processes such that

We introduce the control defined by

where the stopping time is defined in (4.26), and we denote by the related contract

We then have the following almost optimality result.

Theorem 4.3.

Suppose that (Hf’) and (H’) hold. Then and we have

for any .

Proof.

We proceed in four steps.

Step 1. The optimal value is finite.

Step 2. Comparison of and .

We fix two functions satisfying (H0) and we show that where and are defined by (4.14). Let . Then, we have by definition

for some , with

Since the optimal effort is bounded and Assumption (H’) holds, there exists a positive constant such that

where We then notice that

for any . Hence, we get

Hence, we get . We then write for in the sequel.

Step 3. Convergence of the values for a given .

We fix . We then have

with

and

We now study the convergence of and .

Substep 3.1. Convergence of .

By Cauchy-Schwarz inequality we have

From (4.15) and (Hf’), is uniformly bounded w.r.t. . The convergence of remains to the convergence of

From the definition of , for all , there exists a constant such that

Therefore we have

Substep 3.2. Convergence of .

From Cauchy-Schwarz Inequality, there exists a positive constant such that

First note that

with . Since is bounded by , we deduce that

We then have

Since is continuous and bounded, we get from the dominated convergence Theorem

Then from the definition of there exists a constant such that is -Lipchitz continuous for all . Therefore, we get from Lemma 4.1

Since is continuous and bounded, and , we get from Lemma 4.1 and the definition of and

Hence we get .

Step 4. Almost optimality of .

We fix and such that

By definition of , we get

Sending to , we get from Step 2

for any . Which implies

| (4.31) |

Since and are bounded, there exists a constant such that

We therefore get from Step 3 and (4.30)

| (4.32) |

From (H’) and the definition of we have

| (4.33) |

By definition of we have

| (4.34) |

and

| (4.35) | |||||

Since and are bounded, we get from (4.30)

| (4.36) | |||||

Therefore we get from (4.32), (4.33), (4.34), (4.35) and (4.36)

This last inequality with (4.31) give the result.

∎

4.3 Applications and economical interpretations

4.3.1 Non-regulated case and reservation utility

In this part, we provide a way to monitor the activities of the natural resource manager without penalizing him by choosing a relevant reservation utility . The natural way is to consider the problem of the regulator without regulation policy

This problem can be solved explicitly by direct computations. If the regulator chooses then any admissible tax will satisfy . In other words, the choice of ensures a non-punitive regulation policy.

4.3.2 Numerical examples

We now give some numerical results to illustrate our theoretical results. For that we consider given by (4.24), with and where is the cost of the resource for the regulator and is the target size of the population.

We use the following parameters: , , , , , , , , , with . We use an approximation grid of points for the space and points for the time. In our case .

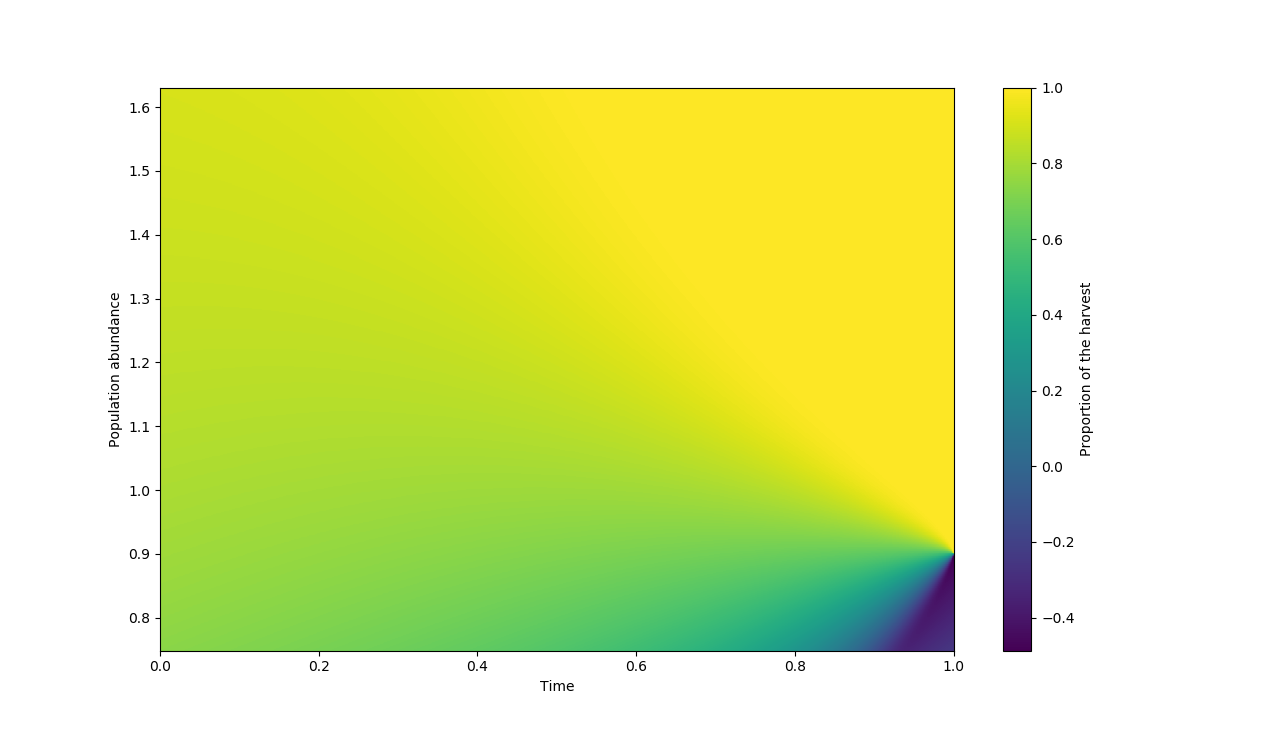

Figure 2 shows the Agent harvests moderately at the beginning and the rate is increasing w.r.t. the abundance population. On the contrary, for times close to the maturity the strategy depends on the abundance of the resource. Indeed, for an abundance below the target , i.e. , the Agent renews the population, and for an abundance higher than , i.e. , the Agent harvests. Moreover, the lowest is the abundance, the most the Agent renews the population, and the highest is the abundance, the most the Agent harvests the population.

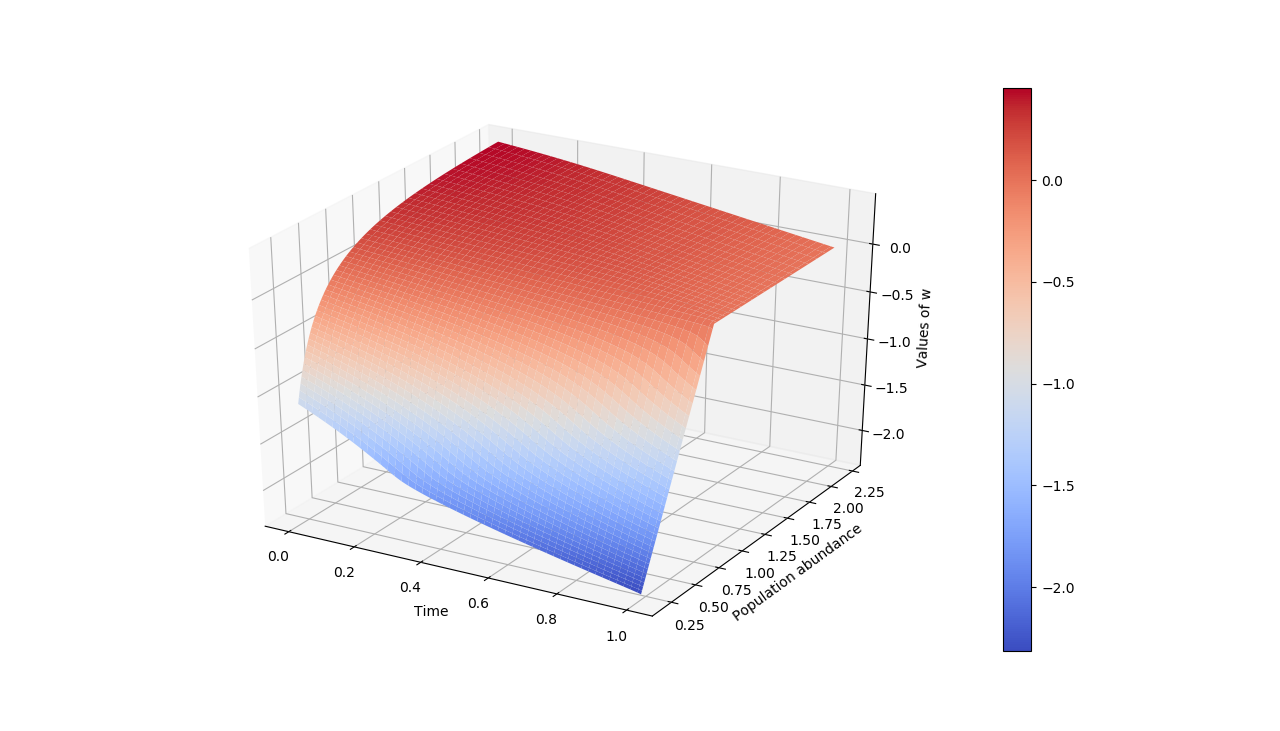

Figure 2 presents the graph of the value function of the Principal. The function is increasing w.r.t. the population abundance. This property is expected in view of the Principal optimization problem. We also remark that the value function is decreasing w.r.t. the time to maturity. Indeed, the longer is the time to maturity, the best it is for the Agent and the Principal since the resource has more time to regenerates itself.

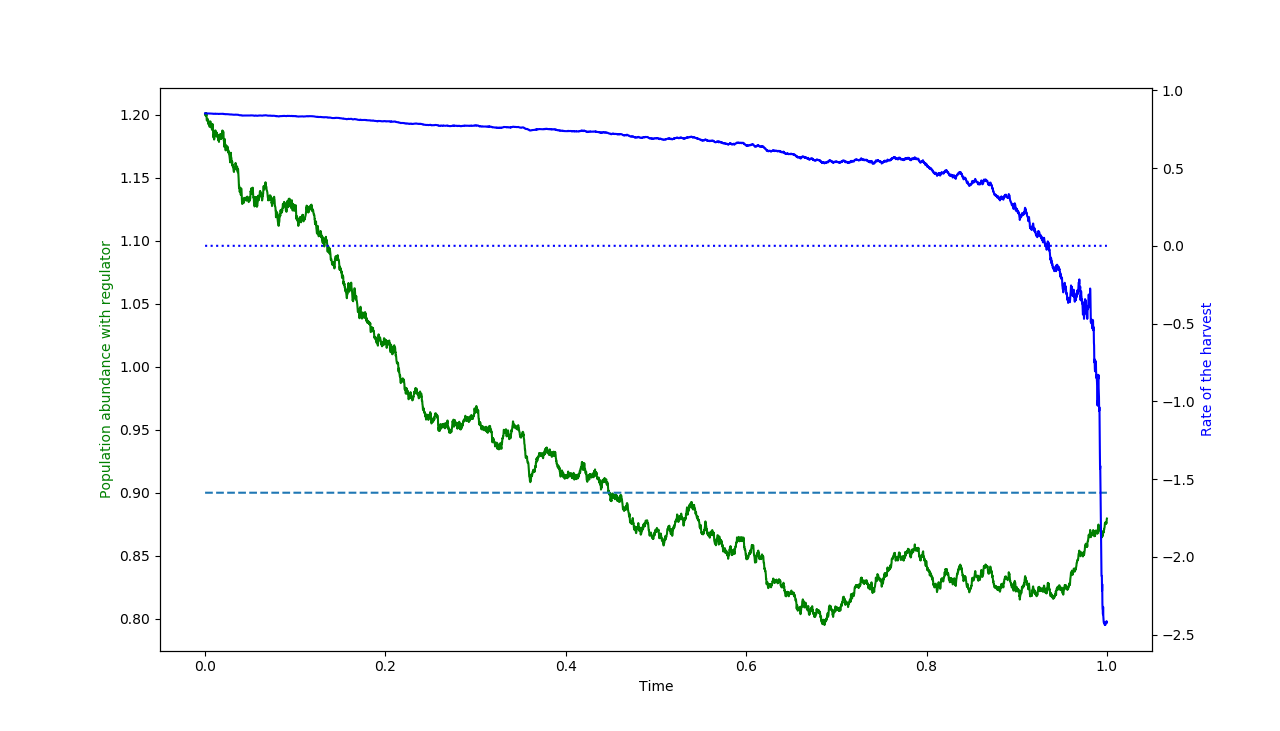

Figure 4 shows that the Agent harvests with an important rate at the beginning : is around . As he get closer to the matirity, the Agent slows down the harvest and then renew the resource. This can be interpreted as follows.

The Agent harvests with a high rate and do note care about the tax at maturity since the population as has time to regenerate itself.

Getting closer to the maturity, the Agent take into acount the tax and slows down the harvest. When very close to maturity, , the Agent renews the population to ensure an abundance close to the target to limit the tax. This shows that the incentive policy is efficient.

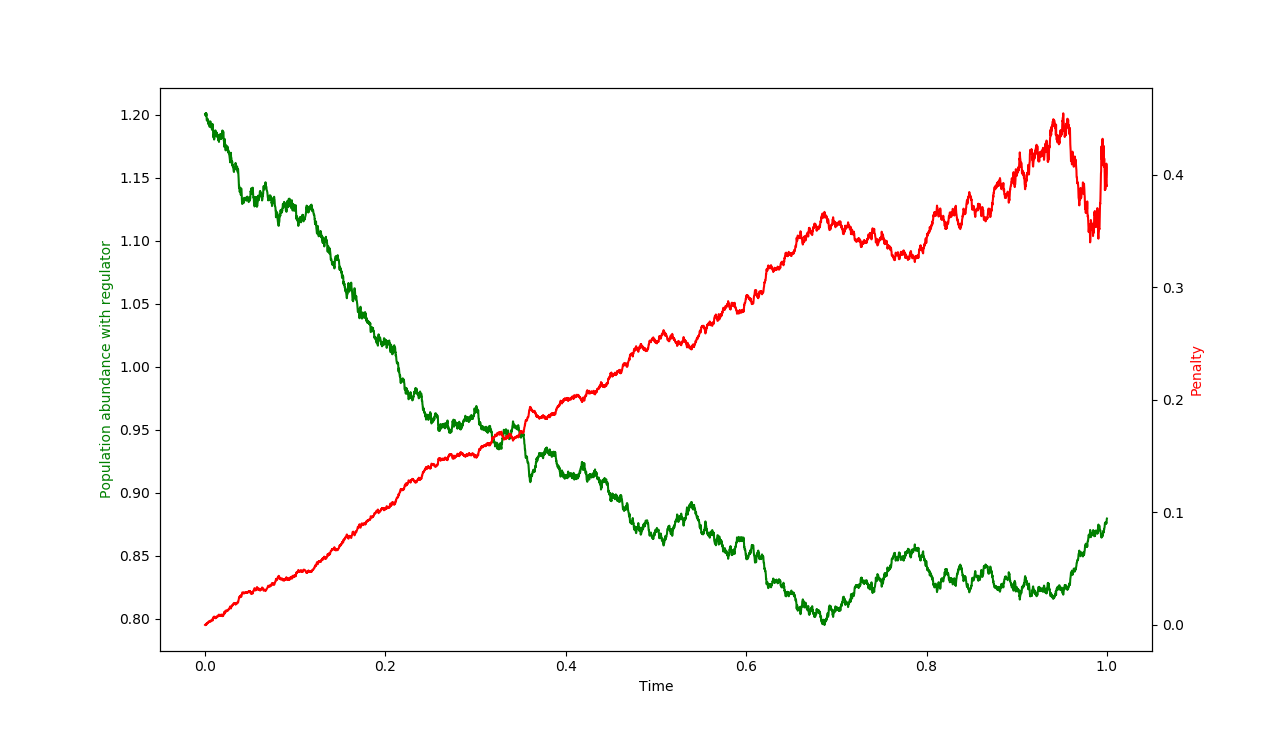

Figure 4 presents the forecast of the penalty (i.e. ) in red, and the abundance population in green. We notice these two quantities evolve in opposite ways: for high values of the abundance, the expected tax is low, and for low abundance the penalty becomes greater.

We now study the sensitivity of the incentive policy w.r.t. the target (see Figure 6) and w.r.t. the renewal cost (see Figure 6).

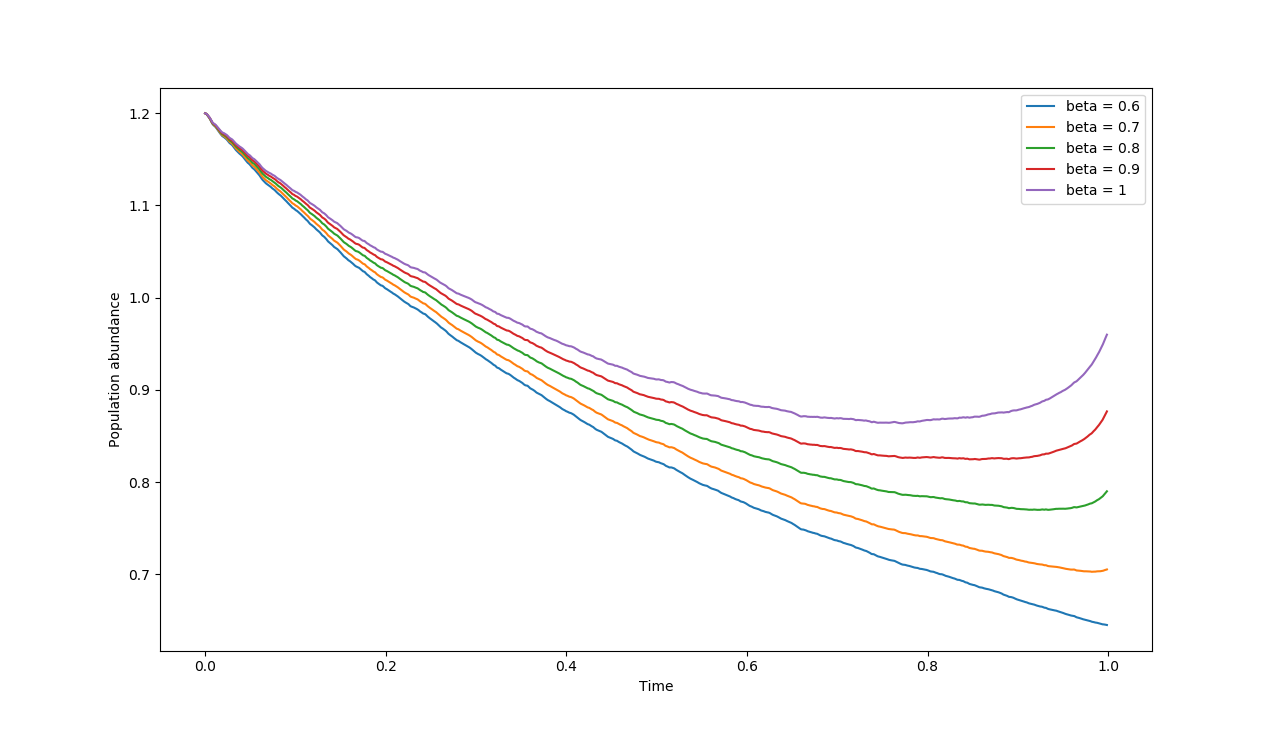

Figure 6 presents the evolution in mean of the abundance w.r.t. time for several values of . The mean is approximated by the empirical mean over 1000 trajectories. We remark that at each time the mean of the population abundance is more important as is larger. This shows that the choice of influences the behavior of the resource manager: the most is important the least the Agent harvests. We also notice that for each value of , the mean terminal value reaches the target, which also shows the incentive effect of the parameter .

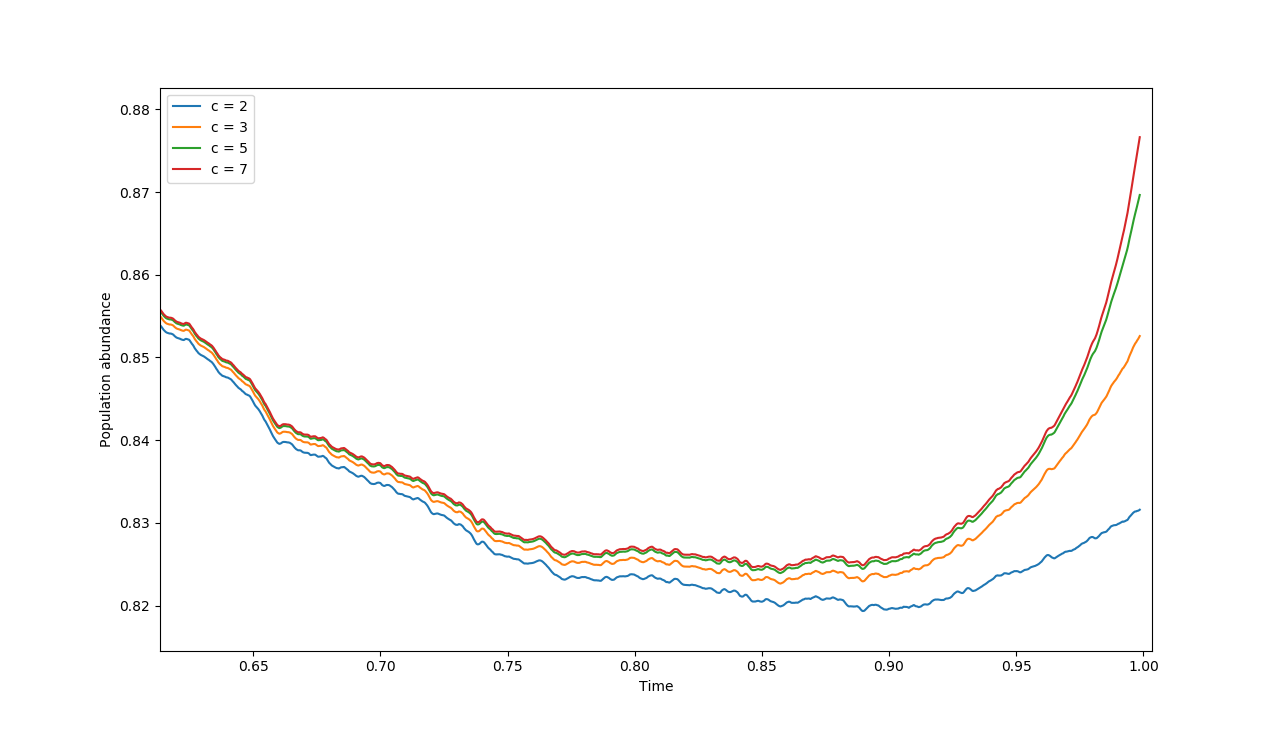

Figure 6 shows the evolution of the mean of the resource abundance w.r.t. time for several values of the costs parameter . The mean is approximated by the empirical mean over for 1000 trajectories. We remark that the population abundance is nondecreasing w.r.t. . In particular, the highest the penalty is, the most the Agent is concerned, through the incentive policy, by the size of the population at the end.

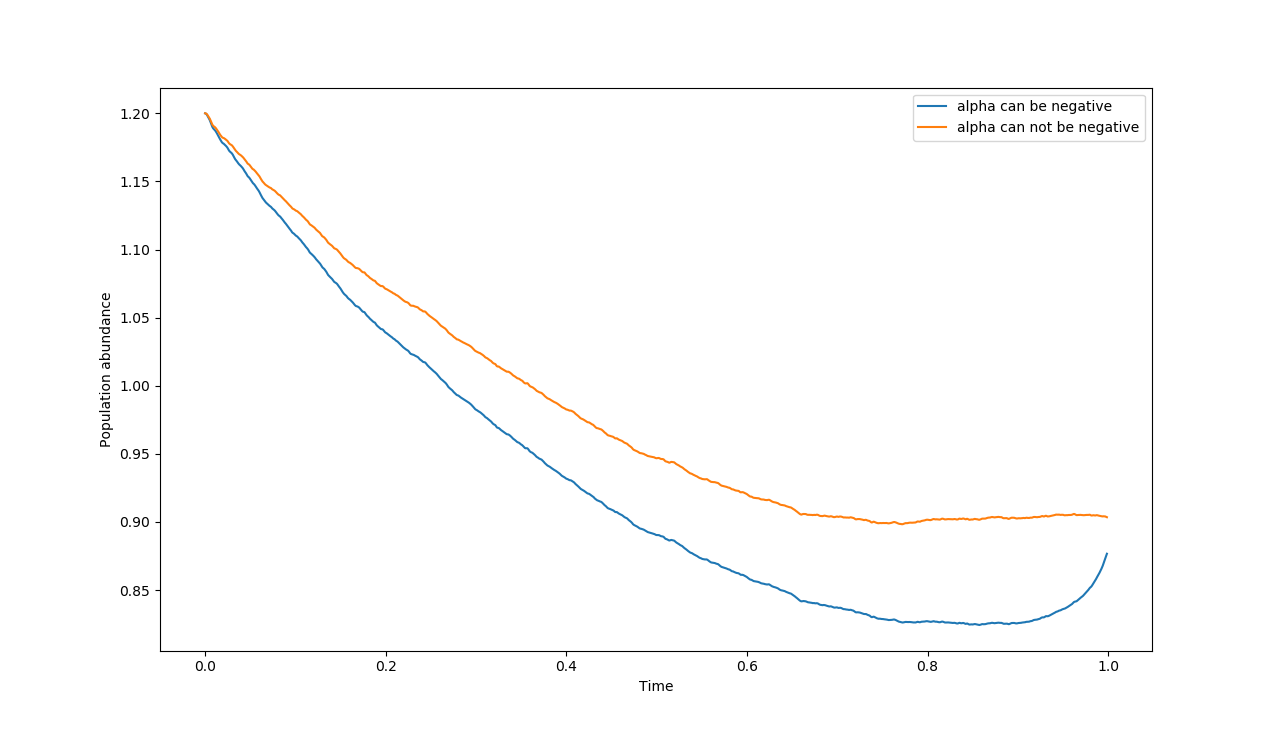

We now compare the situation for which the Agent can renew the population abundance (that is ) with the situation for which the Agent can only harvest (that is ).

In Figure 7 the mean is approximated by the empirical mean over 1000 trajectories. We remark that at each time the population abundance is more important in mean if the Agent cannot renew the resource. Indeed, if the resource is not renewable, the Agent reduces his harvesting rate in prevision of the terminal tax. On the contrary, if the resource can be renewed, the Agent harvests more to generate a higher profit since he can reduce the terminal tax by renewing the resource at the end.

Appendix A Proof of Proposition 4.1

We first recall that is defined by

From the definition of given in (3.7) we can rewrite by considering the different cases , and , and making the variable change for under the following form

where

and

for all .

A straightforward computation gives where

for all .

We then introduce the functions and defined by

for any where we recall that the function is defined by (4.25). From the definition of , the function is infinitely differentiable with bounded derivatives and we have

| (A.37) |

for all .

Fix the constant . Since the function is continuous on , there exists infinitely differentiable on such that

| (A.38) |

We then define for any by

From (A.38) we have

We then define for any the approximated Hamiltonian by

We therefore get from (A.37)

We then turn the PDE driven by that writes

| (A.39) |

References

- [1] Robert Almgren, Chee Thum, Emmanuel Hauptmann, and Hong Li. Equity market impact. Risk, 18:58–62, 2003.

- [2] Luis HR Alvarez and Erkki Koskela. Optimal harvesting under resource stock and price uncertainty. Journal of Economic Dynamics and Control, 31(7):2461–2485, 2007.

- [3] Kenneth Arrow. Research in management controls: a critical synthesis. Management Controls: New Directions in Basic Research, pages 317–327, 1964.

- [4] Kenneth J Arrow. The theory of risk aversion. Essays in the theory of risk-bearing, pages 90–120, 1971.

- [5] Edward B. Barbier. The role of economic incentives for natural resource economic progress and environmental concerns. pages 153–178. A Publications of the Egon-Sohmen-Foundation. Springer, Berlin, Heidelberg, 1993.

- [6] Philippe Briand and Ying Hu. Bsde with quadratic growth and unbounded terminal value. Probability Theory and Related Fields, 136(4):604–618, 2006.

- [7] Colin W Clark. Profit maximization and the extinction of animal species. Journal of Political Economy, 81(4):950–961, 1973.

- [8] Jakša Cvitanić, Dylan Possamaï, and Nizar Touzi. Moral hazard in dynamic risk management. Management Science, 63(10):3328–3346, 2016.

- [9] Jakša Cvitanić, Dylan Possamaï, and Nizar Touzi. Dynamic programming approach to princial–agent problems. Finance and Stochastics, 22(1):1–37, 2018.

- [10] Nicole El Karoui, Shige Peng, and Marie Claire Quenez. Backward stochastic differential equations in finance. Mathematical finance, 7(1):1–71, 1997.

- [11] Eurostat. Sustainable development in the european union. Technical report, 2018 Edition.

- [12] Steven N Evans, Alexandru Hening, and Sebastian J Schreiber. Protected polymorphisms and evolutionary stability of patch-selection strategies in stochastic environments. Journal of mathematical biology, 71(2):325–359, 2015.

- [13] Gérard Gaudet and Pierre Lasserre. The management of natural resources under asymmetry of information. Annu. Rev. Resour. Econ., 7(1):291–308, 2015.

- [14] Heidi Gjertsen and Eduard Niesten. Incentive-based approaches in marine conservation: applications for sea turtles. Conservation and Society, 8(1):5–14, 2010.

- [15] R Quentin Grafton, Ragnar Arnason, Trond Bjørndal, David Campbell, Harry F Campbell, Colin W Clark, Robin Connor, Diane P Dupont, Rögnvaldur Hannesson, Ray Hilborn, et al. Incentive-based approaches to sustainable fisheries. Canadian Journal of Fisheries and Aquatic Sciences, 63(3):699–710, 2006.

- [16] Bengt Holmstrom and Paul Milgrom. Aggregation and linearity in the provision of intertemporal incentives. Econometrica: Journal of the Econometric Society, pages 303–328, 1987.

- [17] Ying Hu, Peter Imkeller, Matthias Müller, et al. Utility maximization in incomplete markets. The Annals of Applied Probability, 15(3):1691–1712, 2005.

- [18] Ioannis Karatzas and Steven E Shreve. BrownianMotionandStochasticCalculus, volume 113 of Gradute Texts in Mathematics. Springer, second edition edition, 1998.

- [19] Nicolai V. Krylov. Controlled Diffusion Processes, volume 14 of Application of Mathematics. Springer, 1980.

- [20] Fabrizio Lillo, J. Doyne Farmer, and Rosario N. Mantagna. Master curve for price impact function. Nature, 421:129–130, 2003.

- [21] Sylvie Méléard and Vincent Bansaye. Some stochastic models for structured populations: scaling limits and long time behavior. arXiv preprint arXiv:1506.04165 v1, 2015.

- [22] Olga Arsen’evna Oleinik and Stanislav Nikolaevich Kruzhkov. Quasi-linear second-order parabolic equations with many independent variables. Russian Mathematical Surveys, 16(5):105–146, 1961.

- [23] Stephen A Ross. The economic theory of agency: The principal’s problem. The American economic review, 63(2):134–139, 1973.

- [24] Richard Rouge and Nicole El Karoui. Pricing via utility maximization and entropy. Mathematical Finance, 10(2):259–276, 2000.

- [25] Yuliy Sannikov. A continuous-time version of the principal-agent problem. The Review of Economic Studies, 75(3):957–984, 2008.

- [26] Helen Suich. The effectiveness of economic incentives for sustaining community based natural resource management. Land Use Policy, 31:441–449, 2013.

- [27] Fleming Wendell H. and H. M. Soner. Controlled Markov Processes and Viscosity Solutions, volume 25 of Stochastic Modelling and Applied Probability. Springer, second edition edition, 2006.

- [28] Robert Wilson. The theory of syndicates. Econometrica: journal of the Econometric Society, pages 119–132, 1968.

- [29] Robert B Wilson. The structure of incentives for decentralization under uncertainty. Number 121. Graduate School of Business, Stanford University, 1967.