Security and Privacy on Blockchain

Abstract.

Blockchain offers an innovative approach to storing information, executing transactions, performing functions, and establishing trust in an open environment. Many consider blockchain as a technology breakthrough for cryptography and cybersecurity, with use cases ranging from globally deployed cryptocurrency systems like Bitcoin, to smart contracts, smart grids over the Internet of Things, and so forth. Although blockchain has received growing interests in both academia and industry in the recent years, the security and privacy of blockchains continue to be at the center of the debate when deploying blockchain in different applications. This paper presents a comprehensive overview of the security and privacy of blockchain. To facilitate the discussion, we first introduce the notion of blockchains and its utility in the context of Bitcoin like online transactions. Then we describe the basic security properties that are supported as the essential requirements and building blocks for Bitcoin like cryptocurrency systems, followed by presenting the additional security and privacy properties that are desired in many blockchain applications. Finally, we review the security and privacy techniques for achieving these security properties in blockchain-based systems, including representative consensus algorithms, hash chained storage, mixing protocols, anonymous signatures, non-interactive zero-knowledge proof, and so forth. We conjecture that this survey can help readers to gain an in-depth understanding of the security and privacy of blockchain with respect to concept, attributes, techniques and systems.

1. Introduction

Blockchain technology is a recent breakthrough of secure computing without centralized authority in an open networked system. From data management perspective, a blockchain is a distributed database, which logs an evolving list of transaction records by organizing them into a hierarchical chain of blocks. From security perspective, the block chain is created and maintained using a peer to peer overlay network and secured through intelligent and decentralized utilization of cryptography with crowd computing.

It is predicted (Coindesk, 2017) that the annual revenue of blockchain based enterprise applications worldwide will reach $19.9 billion by 2025, an annual growth rate of 26.2% from about $2.5 billion in 2016. Meanwhile, Goldman Sachs, Morgan Stanley, Citibank, HSBC, Accenture, Microsoft, IBM, Cisco, Tencent, Ali and other world-renowned financial institutions, consulting firms, IT vendors and Internet giants are accelerating laboratory research and capital layout on blockchain technology. Blockchain together with artificial intelligence and big data are considered as the three core computing technologies for the next generation financial industry. In addition to Bitcoin.com, several orthogonal efforts, such as the Hyperledger project sponsored by IBM and Apache foundation, Ethereum (eth, [n. d.]; Buterin, [n. d.]), FileCoin (Labs, 2017) provide open source repositories and platforms for blockchain research and development.

Governments have released white papers and technical reports on blockchain to show their positive attitude toward the development of blockchain technology. In UK, the government chief scientific adviser released a new report, which describes the future of distributed ledger technology (Walport, 2016). European central bank released documents on distributes ledger technologies in securities post-trading (Pinna and Ruttenberg, 2016). Chinese government released white paper on blockchain technology and its development in China (Technology and Forum, 2016). In United States of America (USA), Delaware governor launched “Delaware Blockchain Initiative”, which is a comprehensive program to build a legal and regulatory environment for the blockchain technology development. The state of Delaware governor has officially signed blockchain bill in July, 2017, which, if became law, will formally legitimize and approve those companies registered in the state to manage their accounting and other business transactions using blockchain (Campbell, 2017).

In academia, thousands of papers were published on blockchain in the past five years, including a dozen of study reports on security and privacy threats of blockchain. Joseph Bonneau et al. (Bonneau et al., [n. d.]a) provided the first systematic elaboration on Bitcoin and other cryptocurrencies, and analyzed anonymity problems and reviewed privacy enhancing methods. Ghassan Karame (Karame, [n. d.]) overviewed and analyzed the security provisioning of blockchain in Bitcoin systematically, including risks and attacks in Bitcoin like digital currency systems. They also described and evaluated mitigation strategies to eliminate some of the risks. Mauro Conti et al. (Conti et al., 2017) reviewed security and privacy of Bitcoin, including existing loopholes, which lead to various security risks during the implementation of the Bitcoin system. Li et al. (Li et al., 2017) surveyed the security risks of popular blockchain systems, reviewed the attack cases suffered by blockchain, and analyzed the vulnerabilities exploited in these cases.

Most security and privacy research studies on blockchain have been focused along two threads: (1) uncovering some attacks suffered by blockchain based systems to date, and (2) putting forward specific proposals of employing some state of the art countermeasures against a subset of such attacks. However, very few efforts have been made to provide an in-depth analysis of the security and privacy properties of blockchain and different blockchain implementation techniques. This survey presents a comprehensive review of the security and privacy of blockchains. We first describe the notion of blockchains for online transactions, and discuss the basic and additional security and privacy attributes of blockchains. Then we discuss a set of corresponding security techniques, especially cryptographic solutions, for realizing both basic and additional security goals. We argue that, as blockchain technology continues to attract attentions and to be deployed in various applications, it is critical to gain an in-depth understanding of the security and privacy properties of blockchain and the degree of trust that blockchain may provide. Such understanding may shed light on the root causes of vulnerabilities in current blockchain deployment models and provide foresight and technological innovation on robust defense techniques and countermeasures.

This survey paper is designed with dual goals. First, it will provide an entry point for non-security experts to gain better understanding of security and privacy properties of blockchain technology. Second, it will help specialists and researchers to explore the cutting edge security and privacy techniques of blockchain. In addition, we identify basic security attributes of blockchain and additional security and privacy properties, discuss some security solutions for achieving these security goals, and insinuate open challenges. We anticipate that this survey will also guide domain scientists and engineers to uncover suitable blockchain models and techniques for many domain specific application scenarios.

We organize the rest of the paper as follows. Section 2 describes basic blockchain concepts. Section 3 describes security attributes that are inherent or desired in blockchain systems. Section 4 introduces consensus algorithms that can be used in blockchain based systems. Section 5 discusses the security and privacy techniques that can be employed on blockchain. Section 6 concludes the survey.

2. Overview of Blockchain

The first documented design of blockchain was in 2008, and the first open source implementation of blockchain was deployed in 2009 as an integral element of Bitcoin, the first decentralized digital currency system to distribute bitcoins through the open source release of the Bitcoin peer to peer software. Both were put forward by an anonymous entity, known as Satoshi Nakamoto (Nakamoto, 2008).

The Bitcoin system uses the blockchain as its distributed public ledger, which records and verifies all bitcoin transactions on the open Bitcoin peer to peer networked system. A remarkable innovation of the Bitcoin blockchain is its capability to prevent double spending for bitcoin transactions traded in a fully decentralized peer to peer network, with no reliance to any trusted central authority.

What is Blockchain? As a secure ledger, the blockchain organizes the growing list of transaction records into a hierarchically expanding chain of blocks (Narayanan et al., 2016) with each block guarded by cryptography techniques to enforce strong integrity of its transaction records. New blocks can only be committed into the global block chain upon their successful competition of the decentralized consensus procedure.

Concretely, in addition to information about transaction records, a block also maintains the hash value of the entire block itself, which can be seen as its cryptographic image, plus the hash value of its preceding block, which serves as a cryptographic linkage to the previous block in the blockchain. A decentralized consensus procedure is enforced by the network, which controls (i) the admission of new blocks into the block chain, (ii) the read protocol for secure verification of the block chain, and (iii) the consistency of the data content of transaction records included in each copy of the blockchain maintained on each node. As a result, the blockchain ensures that once a transaction record is added into a block and the block has been successfully created and committed into the blockchain, the transaction record cannot be altered or compromised retrospectively, the integrity of the data content in each block of the chain is guaranteed, and the blocks, once committed into the blockchain, cannot tampered by any means. Thus, a blockchain serves as a secure and distributed ledger, which archives all transactions between any two parties of an open networked system effectively, persistently, and in a verifiable manner.

In the context of Bitcoin systems, the blockchain is employed as its secure, private and trusted public archive for all transactions that trade bitcoins on the Bitcoin network. This ensures that all bitcoin transactions are recorded, organized and stored in cryptographically secured blocks, which are chained in a verifiable and persistent manner. Blockchain is the pivotal guard in securing bitcoin transactions from many known and hard security, privacy and trust problems, such as double spending, unauthorized disclosure of private transactions, reliance of a trusted central authority, and the untrustworthiness of decentralized computing. The bitcoin way of deploying blockchain has been the inspiration for many other applications, such as healthcare, logistics, education certification, crowd sourcing, secure storage. The blockchain ecosystem is growing rapidly with increasing investment and interests from industry, government and academia.

2.1. How does the Blockchain Work

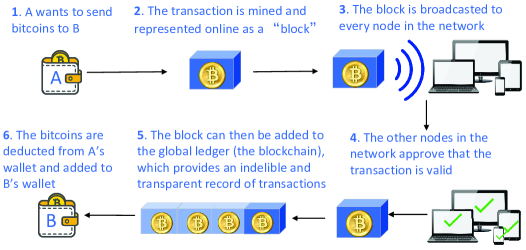

A blockchain functionally serves as a distributed and secure database of transaction logs. In a Bitcoin network, if client A wants to send some bitcoins to another client B, it will create a bitcoin transaction by client A. The transaction has to be approved by miners before it gets committed by the Bitcoin network. To initiate the mining process, the transaction is broadcasted to every node in the network. Those nodes that are miners will collect transactions into a block, verify transactions in the block, and broadcast the block and its verification using a consensus protocol (a.k.a. Proof of Work) to get approval from the network. When other nodes verify that all transactions contained in the block are valid, the block can be added to the blockchain. Fig.1 provides an illustration of this process. Only when the “block” containing the transaction is approved by the other nodes and added to the blockchain, this bitcoin transfer from A to B will become finalized and legitimate.

Three basic and important capabilities that are supported by the blockchain implementation in Bitcoin are: (1) the hash chained storage, (2) digital signature , and (3) the commitment consensus for adding a new block to the globally chained storage. By an elegant combination of a suite of popular security techniques, such as Hash chain, Merkle tree, digital signature, with consensus mechanisms, the Bitcoin blockchain can prevent both the double spending problem of bitcoins and stop the retrospective modification of any transaction data in a block after the block has been successfully committed into the blockchain.

2.1.1. Hash Chained Storage

Hash pointer and Merkle tree are the two fundamental building blocks for implementing the blockchain in Bitcoin using the hash chained storage.

Hash Pointer

Hash pointer is a hash of the data by cryptography, pointing to the location in which the data is stored. Thus, a hash pointer can be used to check whether or not the data has been tampered. A block chain is organized using hash pointers to link data blocks together. With the hash pointer pointing to the predecessor block, each block indicates the address where the data of the predecessor block is stored. Moreover, the hash of the stored data can be publicly verified by users to prove that the stored data has not been tampered.

If an adversary attempts to change data in any block in entire chain, in order to disguise the tampering, the adversary has to change the hash pointers of all previous blocks. Ultimately the adversary has to stop tampering because he will not be able to falsify the data on the head of the chain, which is initially generated once the system has been built. We call this initial opening block in the chain the genesis block. Finally, the adversary’s tampering will be uncovered, because by recording this single root hash pointer of genesis block, one can effectively make the entire chain have the property of tamper-resilient. Users are allowed to go back to some special block and verify it from the beginning of the chain.

Merkle Tree

Merkle tree is defined as a binary search tree with its tree nodes linked to one another using hash pointers. It is another useful data structure used for building blockchain. In turn grouping these nodes into disjoint groups, such that each time two nodes at the lower level are grouped into one at the parent level, and for each pair of lower level nodes, the Merkle tree construction algorithm is creating a new data node, which contains the hash value of each. This process is repeated until reaching the root of the tree.

Merkle tree has the ability of preventing data from tampering by traversing down through the hash pointers to any node in the tree. Specifically, when an adversary tries to tamper with data at a leaf node, it will cause a change in the hash value of its parent node, and even if he continues to tamper with the upper node, he needs to change all nodes on the path of the bottom to the top. One can easily detect the data has been tampered with, since the hash pointer of root node does not match with the hash pointer that has been stored.

An advantage of Merkle tree is that it can prove effectively and concisely the membership of a data node by showing this data node and all of its ancestor nodes on its upward pathway to the root node. The membership of Merkle tree can be verified in a logarithmic time by computing hashes on the path and checking the hash value against the root.

2.1.2. Digital Signature

A digital signature establishes the validity of a piece of data by using a cryptographic algorithm. It is also a scheme for verifying that a piece of data has not been tampered with. There are three core components that formulate a digital signature scheme. The first component is the key generation algorithm, which creates two keys, one is used to sign messages and be kept privately and called the private key, and the other is made available to the public, thus called the public key, used to validate whether the message has the signature signed with the corresponding private key. The second core component is the signing algorithm. It produces a signature on the input message endorsed by using the given private key. The third core component is the verification algorithm. It takes a signature, a message, and a public key as inputs, and validates the message’s signature using the public key and returns a boolean value.

A well defined and secure signature algorithm should have two properties. The first property is valid signatures must be verifiable. The second property is signatures are existentially unforgeable. It means that an adversary who has your public key cannot forge signatures on some messages with an overwhelming probability.

Elliptic Curve Digital Signature Algorithm (ECDSA)

The blockchain used in Bitcoin adopts ECDSA as its digital signature scheme for singing transactions. By employing ECDSA over the standard elliptic curve “secp256k1”, 128 bits of security is provided for Bitcoin blockchain (Johnson et al., 2001). ECDSA proves to be resilient to forgery in the presence of a chosen-message attack based on a generic group and the collision resistant hash function (Brown, 2000). Thus, a digital signature scheme like ECDSA should be resistant to a chosen-message attack against a legitimate entity , aiming at fabricating a valid signature on an unseen message , after the adversary obtained the entity ’s signature by sending a set of chosen probing queries on a set of messages (not including ).

Public Keys as Pseudonyms

The advantage of using a digital signature is to effectively validate the authenticity of a message by utilizing PKI such that the writer of a message signs it with her private key before sending it out and the recipient of this signed message can use the sender’s public key to prove the validity of the message. One can obtain the key pair from a trusted third party in most application scenarios. A PKI is used to manage the public keys via establishing a binding agreement between respective identities of entities (like name, email, and ID) and their public keys. Such binding is done by registering and issuing certificates with a certificate authority (CA). The process of signature verification is automatically translated into identity verification of the signer based on the assurance level of the binding. Thus, public key can be seen as an identity in these scenarios.

While Bitcoin’s blockchain adopts decentralizing identity management, without having a central authority to register a user in a system. Key pairs are generated by users themselves. Users can generate key pairs as many as they want. These identities (hashes of public keys) are called addresses in Bitcoin. Because there is no central management of public keys, these identities are actually pseudonyms made up by users.

2.1.3. Consensus

In the context of decentralized blockchain, when a new block is sent by broadcasting to the network, each node has the option to add that block to their copy of the global ledger or to ignore it. The consensus is employed to seek for the majority of the network to agree upon a single state update in order to secure the expansion of the global ledger (the blockchain) and prevent dishonest attempts or malicious attacks.

Concretely, given that the blockchain is a huge, shared global ledger, anyone may update it, adversarial offense could happen when a node decides to tamper with the state of his copy of the global ledger, or when several nodes collusively attempt on such tampering. For example, if Alice were sending 10 bitcoins to Bob from her wallet, she would like to be sure that no one in the network can tamper the transaction content and change 10 bitcoins to 100 bitcoins. In order to enable the blockchain to function on a global scale with security and correctness guarantee, the shared public ledger needs an efficient and secure consensus algorithm, which must be fault tolerant, and ensure that (i) all nodes simultaneously maintain an identical chain of blocks and (ii) it does not rely on central authority to keep malicious adversaries from disrupting the coordination process of reaching consensus. In short, every message transmitted between the nodes has to be approved by a majority of participants of the network through a consensus-based agreement. Also, the network as a whole should be resilient to the partial failures and “attacks”, such as when a group of nodes are malicious or when a message in transit is corrupted.

A good consensus mechanism used in the blockchain implementation also ensures a robust transaction ledger with two important properties: persistence and liveness. Persistence guarantees the consistent response from the system regarding the state of a transaction. For example, if one node on the network states that a transaction is in the “stable” state, then the other nodes on the network should also report it as stable, if queried and responded honestly. Liveness states that all nodes or processes eventually agree on a decision or a value. By “eventually”, it indicates that it may take a sufficient amount of time for reaching the agreement. By combining persistence and liveness, it ensures that a transaction ledger is robust such that only authentic transactions are approved and become permanent.

In summary, the role of blockchain in the Bitcoin system is to replace the centralized database with authoritative access control. Once some data has been recorded into the global ledger block chain, it should be “impossible” to change the blockchain, and by enforcing the majority agreement of update validity through consensus, it ensures the consistency state and prevents the double spending problem. We describe and compare the representative consensus algorithms in Section 4.

2.2. Blockchain Level Transaction Models

Blockchain is created and maintained as a distributed ledger for online transactions. There are two representative blockchain level transaction models: the unspent transaction outputs (UTXO) model, initially introduced by Bitcoin (bit, [n. d.]) and the account-based transaction model, introduced by Ethereums (eth, [n. d.]). In this subsection, we describe the two transaction models and how their design difference may impact on the solution to the double spending problems.

2.2.1. The UTXO Model

In Bitcoin and many of its derivatives, a user stores the total amount of her bitcoins as a list of “unspent” instances of bitcoins that she has received but has not been spent yet. Using the unspent transaction outputs (or UTXO) model, the entire history of the Bitcoin transactions in the system is recorded in a time series of unspent outputs, such that each of them has an owner and a value. The sum of all unspent bitcoin instances that the user has the key to access as the owner in her bitcoin wallet is the total balance of this user. It is straightforward to trace the provenance of individual bitcoins (BTCs) as each of them is signed and sent from one participant to another. A transaction is legitimate if one can prove that the sender has the ownership of the actual bitcoins that are being spent. More specifically, each UTXO transaction can be endorsed if it meets three constraints: (1) Every referenced input in the transaction must be signed by its owner (sender) and not yet spent; (2) If the transaction has multiple inputs, then each input must have a signature matching the owner of the input; (3) A transaction is legal if the total value of its inputs equals or exceeds the total value of its outputs.

Consider an example under the UTXO model: if Bob and Mary both send Alice 5 BTC, and Alice has not spent them, then there are 5 BTC from Bob signed to Alice and another 5 BTC from Mary signed to Alice. If Alice wants to combine her two single instances of 5 BTC into an instance of 10 BTC, Alice must perform another transaction, in a similar way as she would need to exchange her two 5 dollar bills into a 10 dollar bill.

There are a number of benefits for using the UTXO style of online transaction model:

-

(1)

Potentially high degree of privacy: The UTXO model defines a data structure such that each user (the account holder) can hold multiple instances of BTCs without combining them into one total amount, unlike it is done in each of our accounts in a bank. By holding many such instances, account holder need only disclose to her payee (such as Bob) the instances she used to pay the payee. This means that the payer can make multiple payments at the same time. For example, Alice could pay 1 BTC to Bob and 2 BTC to Carol from a 3 BTC instance that Alice holds, without reveal to Bob or Carol the total amount of the aggregate of BTC instances, which Alice has as the owner. Similarly, a user may use different addresses for different transactions that she receives. This will make it difficult to link her accounts to one another.

-

(2)

Potentially high degree of scalability: The UTXO model does not have the concept of account for a user, which removes some constrains of the account-based transaction model. A user (payer) can easily send payment transactions in parallel to multiple payees as long as the payer has sufficient granular entries (BTC instances). Such parallel transactions can be executed independently without worrying about transaction ordering, simply because the blockchain relies on hash functions to identify previous states, and thus it is impossible for transactions to be mis-ordered. As a result, using the UTXO model, one no longer needs to worry about solving the hard problem of keeping track of transaction sequence numbers in a fully distributed system.

-

(3)

Potentially high degree of security: The UTXO model maintains a Merkle proof of ownership for all BTC instances for each user. Conflict resolution is reduced to the double spending problem, namely, the digital currency-based transactions can easily be duplicated and spent twice. Bitcoin resolves the double spending problem by enforcing a consensus-based confirmation mechanism for committing new blocks into the blockchain and by maintaining the blockchain as a universal ledger.

In a Bitcoin network, the blockchain is created and maintained as a hierarchical and chronologically-ordered chain of blocks with time stamp since its inception in 2009. Each node keeps a copy of the blockchain. A newly created block consisting of several transactions is added to the blockchain. To be secure against double spending, a block should not be considered as confirmed until blocks are added after it (a.k.a. confirmations), The default setting of is six, which means that a transaction contained in the block can be considered as confirmed takes about 60 minutes with the rate of generating a new block is roughly every 10 minutes. In addition, transactions are embedded in blocks and every block is arithmetically linked to the previous block through cryptography. A combination of these techniques makes transactions and blocks immutable and hard to tamper with.

Now we illustrate how the double spending problem is resolved using the Bitcoin blockchain. Assume that Bob sent 1 BTC to Andrew, then signs and sends the same 1 BTC to Alice. Both transactions enter the unconfirmed pool of transactions on the network. If the block containing Bob’s first transaction was mined by some miner, and the block containing Bob’s second transaction was mined by some other miners. The block containing Bob’s first transaction was broadcasted to the entire network and verified by miners first. Then, most miners will continue to mine on the top of the block that containing Bob’s first transaction. Thus, Bob’s second transaction was judged by the miners as invalid, and pulled from the network. If both transactions are received by the miners simultaneously, then whichever transaction gets the maximum number of confirmations (blocks deep) first from the network will be included in the blockchain eventually, and the other one will be rejected.

The UTXO model also has some weaknesses, some of which stem from its strengths. For example, if Alice receives 100 BTC and wishes to send Carlo 10 BTC, Alice has to consume the 100 BTC output by creating two outputs: a 10 BTC for the payee Carlo and 90 BTC back to herself as the change. But, the happens of this kind situations may leak private information to an observer. Also, this makes the balance calculation, which is a core feature of the UTXO model, and a significant contributor to wallet’s complexity. Although a payer can apply transactions in parallel, it is difficult to achieve them in real parallel due to the need to strictly enforce a total ordering constraint such that the total of the inputs should equal or exceed the total of the outputs.

2.2.2. Account-Based Online Transaction Model

In contrast to the UTXO model, the account-based online transaction model is by design a simpler model, which explicitly operates all transactions based on the account of senders, instead of unspent transaction outputs, with the objective of improving consensus efficiency and faster block times at the cost of higher degree of risk. It is adopted and extended in Ethereum. Concretely, by the account balance-based transaction model, which operates in a similar way as the bank account in a brick and mortar banking today, a user’s entire balance information is stored in Ethereum. A transaction with a token value (ETH) is valid if the following three validity constraints are met: (i) the token is signed by the message writer (sender); (ii) the writer’s ownership of token value can be attested, and (iii) the writer’s spending account has sufficient balance for the transaction. Upon validation of a transaction, the sending account is debited by the token value and the receiving account is credited with the value. Thus, a user’s account “balance” in the Ethereum system refers to the sum of the ETH coins for which the user has a private key capable of producing a valid signature. In this model, if Bob has 1 ETH, then upon receiving 1 ETH from Alice, Bob’s account balance will be 2 ETH without the need of another exchange transaction to combine the two instances of 1 ETH. In Ethereum, a global state stores a list of accounts with balances, code, and internal storage. It is possible but more difficult to track individual transactions as they are added to the receiver’s balance and subtracted from the sender’s balance.

There are a number of obvious benefits for the account-based transaction model. First, in contrast to the UTXO model, it has larger space savings, because every transaction in this account balance-based model needs only one reference and one signature to produce an output. Second, it has greater simplicity. Unlike the UTXO model, it does not maintain the source information of coins from transactions in blockchain. Thus, coins are not distinguished based on the sources from which they were received. Third, it does not allow changing reference with each transaction, but it offers easy accessibility to account related data. This is because the Merkle Patricia Tree (MPT) is used to store all account state, transactions and receipts in each block, and a user can scan down the state tree maintained in the MPT along a specific direction to access all data related to an account. In the MPT, SHA3() is used to obtain the hash key of item in the secure tree (value being account state, transaction or receipt). As a result, every distinct key/value pair maps uniquely to a root hash, making it very hard to deceive membership of a key/value pair in an MPT.

Account nonce. In the account balance-based model, one way to prevent double spends is to have each account associated with a globally accessible nonce, which is simply the count of transactions sending from the account (i.e., the sequence number). Given that this nonce is associated to an account, two accounts may have the same nonce at the same time. Each transaction must assign a “nonce” to the sending account, which miners check and will process transactions from a specific account in a strict order according to the value of its nonce. If a block has a transaction with an incorrect nonce, it is considered an invalid block, and other miners will not build on top of it. Hence, if Alice first signs a message sending 100 ETH to Bob, and then signs another message to send 100 ETH to herself from the same account, then using nonce associated to the same sending account of Alice, the second message with higher nonce should not be confirmed before the first. Note that the double spending here is orthogonal to the case in which Alice has two independent accounts, one in Japan and the other in France. Similarly, by associating the transaction counter to a sending account as nonce, the replay attacks can be prevented: namely, a transaction sending 100 ETH from Alice to Bob can be repeated over and over by Bob to continually drain Alice’s balance. Thus, maintaining the correct transaction count is very important and failing to increment this value correctly can result in different kinds of errors. For example, reusing nonce or creating incorrect nonce will be detected and rejected: if Alice sends a new transaction for the same account by reusing a past nonce, the mining node will reject the transaction. If Alice sends a new transaction with a nonce that is higher than the correct increment count, the transaction will not be processed until this gap is closed, i.e., until a transaction with each of the missing nonce values has been processed.

Proof of Work nonce. In addition to the account nonce, which records the transaction count of an account, Ethereum also uses the proof of work nonce as the second type of nonce, which is the random value in a block that was used to get the proof of work satisfied through mining, an enabling mechanism for decentralized record-keeping.

Ethereum proof of work blockchain is designed in a similar way as that of Bitcoin. A new block can be accepted by the network after being validated through mining. Miners can choose to mine any unverified blocks on the network by solving a puzzle and compete with one another until a winner emerges. If a miner is the first to find a hash that matches the current target, it broadcasts the block across the network to each node. Once the block passes the verification, each node adds this block to their own copy of the ledger. If another miner finds the hash faster, then the rest of miners will stop working on the current block and start the mining process for the next block. This mining process is simultaneously repeated by multiple miners. The consistency is maintained in a decentralized manner by the peer to peer network. The winning miner will be awarded ETH. Similar to Bitcoin, when two miners mine the next block at the same time, the network will decide which one will be the main chain. When two blocks X and Y are mined at the same time. Miners would accept the first block that was broadcasted to them. Thus, some miners accept X and others accept Y. The block that is accepted by the majority of the network (51% or more) will be the winner. Also, miners who accepted block X will continue to mine the next block on top of block X, and similarly, miners who accepted block Y will continue to mine the next block on top of Y. If the next block is found and added on the top of block X faster, then the miners working on top of block Y will turn to the X chain, which is the main chain. The block X will be the winner and the block Y will become an orphaned block. This decentralized consensus process ensures that any attempt to tamper with the transactions and the blockchain is very hard to fool the majority of the network.

Similar to the PoW in Bitcoin, to counter the domination of the network majority for mining, a system-defined timer is enforced, which controls the hardness of the hash puzzle to ensure that a block can be validated in approximately every 12-15 seconds. If the puzzles are solved faster or slower than this system-default rate, the complexity of the problem is adjusted routinely by the mining algorithm to maintain the roughly 12-second default validation time. This the puzzle-solving method prevents cheating at this game from multiple perspectives, such as leveraging powerful computing resources, forming colluding partners, faking the proof of the correct puzzle answer. Another innovative feature of this mining algorithm is that miners have to find the correct hash value to show the “proof-of-work”, but each node on the network can easily confirm that the hash value is correct. By combining the account nonce with the proof of work nonce, Ethereum can speed up the time required to mine a block significantly compared to Bitcoin, without substantially weakening the resilience of blockchain against malicious manipulation.

2.3. CAP Properties in Blockchain

2.3.1. CAP Theorem

CAP refers to Consistency, Availability and Partition tolerance. CAP theorem is a fundamental theorem for defining transactional properties in distributed systems. A distributed system involves a set of computing nodes that are connected over an overlay network and communicate with one another to accomplish some tasks. CAP theorem states that any distributed systems can have only two of the following properties (Gilbert and Lynch, 2002):

-

•

Consistency: where each computing node receives the most recent write.

-

•

Availability: where any requests for some data is always available.

-

•

Partition tolerance: where the distributed systems is always operational, even when some subset of nodes fail to operate.

2.3.2. CAP Properties in Distributed Ledger - The Problems

In the context of a distributed ledger, CAP properties mean: (1) Consistency: all nodes keep an identical ledger with most recent update. (2) Availability: any transactions generated at any time in the network will be accepted in the ledger. (3) Partition tolerance: even if a part of nodes fail, the network can still operate normally. The main issue is that it is hard for any widely acceptable currency to exist without all three conditions met. No one will use a currency if the system is not available when the transaction is initiated or some transactions are not recognized by the system. (CP system). No one will use a currency if any one node fails, the system will not operate normally (CA system). No one will use a currency if the ledger saved by different nodes in a distributed ledger system are inconsistent (PA system).

2.3.3. The Blockchain Solution

It seems that the CAP theorem has been violated in the blockchain of Bitcoin system, one of the most successful blockchain implementations, because it achieves consistency, availability and partition tolerance. However, this is not the case. In reality, the blockchain consistency is not achieved simultaneously as availability and partition tolerance, but it is after a period of time. The concept of mining is used in Bitcoin, in conjunction with a consensus protocol and a minimum of six confirmations, to ensure eventual consistency through reaching consensus.

2.4. Classification and Evolution of Blockchains

| Types | Describe | #TA | SoC | Scenarios |

|---|---|---|---|---|

| Public Blockchain | Anyone can participate and is accessible worldwide | 0 | Slow | Global decentralized scenarios |

| Consortium Blockchain | Controlled by pre-selected nodes within the consortium | Slight Fast | Businesses among selected organizations | |

| Private Blockchain | Write rights are controlled by an organization | 1 | Fast | Information sharing and management in an organization |

As the blockchain technology continues to evolve with respect to the ways of how blockchains are constructed, accessed and verified, they are being classified into three broad categories: (1) Public blockchain, which is open for anyone to read, send or receive transactions and allows any participant to join the consensus procedure of making the decision on which blocks contain correct transactions and get added to the blockchain. (2) Consortium blockchain, which has placed certain constraints on write permissions such that only a pre-selected set of participants in the network can influence and control the consensus process, even though read is open to any participant in the network, and (3) Private blockchain, whose write permissions are restricted strictly to a single participant (or organization), even though its read permissions are open to the public or constrained to a subset of participants in the network. Although from security and performance perspective, they differ in the speed of consensus (SoC) and whether any of trust authority (TA) is used, and how many of TAs are required, as summarized in Table1, these three categories of blockchain share some common properties: (1) they all use decentralized peer to peer networks for transactions; (2) they all require that each transaction is digitally signed and append only to the blockchain, and each peer node maintains a replica of a distributed global ledger of transactions; and (iii) they all rely on consensus to synchronize the replicas across the network.

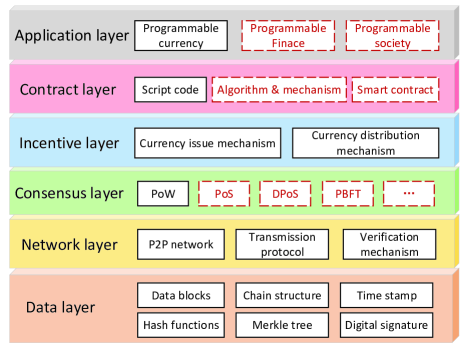

Although Bitcoin (Nakamoto, 2008) is publicly released in 2009 as the first peer to peer digital currency system, which implements the blockchain as its public ledger for all transactions, the concept of a secure chain of blocks by cryptography was first proposed in 1991 (Haber and Stornetta, 1991), and the use of Merkle trees as an efficiency optimization of the hash chain was first described by Bayer, Haber and Stornetta (Bayer et al., 1993) in 1993. Over the past 10 years, blockchain has evolved beyond digital currency (Blockchain 1.0), to smart contracts (Blockchain 2.0), and to many other forms of decentralized collaborations with high accountability and high level of security and trust (Blockchain 3.0). Fig. 2 shows the architecture of Blockchain, where the contents of the red dotted were developed by Blockchain 2.0.

As the application utility of blockchain continues to grow from blockchain 1.0 to blockchain 3.0, it becomes even more critical for blockchain users and developers to gain a better understanding of the security and privacy properties of blockchains. We have given an overview of the first implementation of the blockchain in Bitcoin, have touched on some frequently asked questions, such as how the blockchain ensures security through its hash chained storage with hash pointer and Merkle tree and its consensus mechanism, what impact of different online transaction models may have on the security of blockchain, especially against the double spending problem. In the subsequent sections, we focus on discussing the security properties that a blockchain system provides, whether a Bitcoin system can really guarantee anonymity, and what security and privacy techniques can benefit the current and the future generation of blockchain development.

3. Security and Privacy Properties of Blockchain

We first discuss the security requirements of online transactions, each of such requirements is targeted at one type of known vulnerabilities. Then we describe the basic (and inherent) security properties of blockchain based on its first implementation in Bitcoin, and present the set of important additional security and privacy properties of blockchain, which are either present in some existing blockchain systems or desired by many blockchain applications.

3.1. Security and Privacy Requirements of Online Transactions

We broadly categorize the security and privacy requirements for online transactions into the following seven types.

3.1.1. Consistency of The Ledger across Institutions

In the processes of reconciliation, clearing, and liquidation between financial institutions, due to the architecture and business processes vary from different financial institutions and the involvement of manual processes, it not only leads to high transaction fees generated from the client and the background business side of financial institutions, but also is prone to errors and inconsistencies between ledgers hold by different finance institutes.

3.1.2. Integrity of Transactions

When using online transactions for investment and asset management, equity, bonds, notes, income vouchers, warehouse receipts, and other assets are managed by different intermediaries. It not only increases the transaction costs, but also brings the risk of deliberately falsifying or forging the certificates. Thus, the system must guarantee integrity of transactions and prevent transactions from being tampered with.

3.1.3. Availability of System and Data

The users of online system should be able to access the data of transactions at any time, in anywhere. The availability here refers to both system level and transaction level. At the system level, the system should run reliably even in the event of a network attack. At the transaction level, the data of transactions can be accessed by authorized users without being unattainable, inconsistent, or corrupted.

3.1.4. Prevention of Double-Spending

An important challenge in trading digital currency in a decentralized network is how to prevent double-spending, namely spending a coin more than once. In the centralized environment, a trusted central third party is responsible for verifying whether a digital currency has been double-spent or not. For transactions performed in a decentralized network environment, we need robust security mechanisms and countermeasures to prevent double-spending.

3.1.5. Confidentiality of Transactions

In most of the financial online transactions, users wish to have the minimal disclosure of their transactions and account information in an online trading system. The minimal disclosure includes (1) users’ transaction information cannot be accessed by any unauthorized user; (2) the system administrator or the participant of the network cannot disclose any user’s information to others without his or her permission; (3) all user data should be stored and accessed consistently and securely even under unexpected failures or malicious cyber-attacks. Such confidentiality is desirable in many non-financial scenarios.

3.1.6. Anonymity of Users’ Identity

The difficulty of efficient and secure sharing of user data among various financial institutions may result in a high cost of repeated user authentication. It also indirectly brings the disclosure risk of users’ identity by some intermediaries. In addition, one or both parties to the transaction may be reluctant to let the other party know their real identity in some cases.

3.1.7. Unlinkability of Transactions

Different from identity anonymity (not revealing real identity), users should require that the transactions related to themselves cannot be linked. Because once all the transactions relevant to a user can be linked, it is easy to infer other information about the user, such as the account balance, the type and frequency of her transactions. Using such statistical data about transactions and accounts in conjunction with some background knowledge about a user, curious or adversarial parties may guess (infer) the true identity of the user with high confidence.

3.2. Basic Security Properties

The basic security properties of blockchain stem from both cryptography advances and Bitcoin design and implementation. Theoretically, the first secure chain of blocks was formulated using cryptography in 1991 (Haber and Stornetta, 1991). A proposal to improve the efficiency of the cryptographic chain of blocks was put forward in 1993 (Bayer et al., 1993), by incorporating Merkle trees and placing multiple documents into one block. The blockchain is constructed to ensure a number of inherent security attributes, such as consistency, tamper-resistant, resistance to a Distributed Denial-of-Service (DDoS) attack, pseudonymity, and resistance to double-spending attack. However, to use blockchain for secure distributed storage, additional security and privacy properties are required. Table 2 summarizes the set of basic and additional security and privacy properties that need to be ensured for meeting the corresponding requirements outlined in Section 3.1. In the upper part, we show the set of the security and privacy requirements that can be guaranteed by the security and privacy properties and the techniques provided in the original blockchain system, i.e., Bitcoin. In the lower part, we show the security and privacy requirements and properties that need to be strengthened by some additional security and privacy properties and techniques. We describe the basic security and privacy properties in Section 3.2 and the additional properties in Section 3.3. We have briefly mentioned the set of basic security and privacy techniques in Section 2.1, and will detail some of them in Section 4 and will dedicate Section 5 to discuss the additional techniques that can be leveraged to further enhance the security and privacy of blockchains.

| Supported in Bitcoin | S&P requirements | S&P properties | Corresponding S&P techniques |

|---|---|---|---|

| Consistency (3.1.1) | Consistency (3.2.1) | Consensus algorithms (2.1.3, 4) | |

| Integrity (3.1.2) | Tamper-resistance (3.2.2) | Hash chained storage (2.1.1) | |

| Availability (3.1.3) | Resistance to DDoS attacks (3.2.3) | Consensus algorithms with Byzantine fault (4) | |

| Prevention of double-spending (3.1.4) | Resistance to double-spending attacks (3.2.4) | Signature and verification (2.1.2) | |

| Anonymity (3.1.6) | Pseudonymity (3.2.6) | Public key as pseudonyms (2.1.2) | |

| Need to be enhanced | Unlinkability (3.1.7) | Unlikability (3.3.1) | Minxing (5.1), anonymous signature (5.2) |

| Confidentiality (3.1.5) | Confidentiality (3.3.2) | ABE (5.4), HE (5.3), SMPC (5.5), NIZK (5.6), TEE-based solutions (5.7), game-based solutions (5.8) | |

| Resistance to the majority (51%) consensus attack (3.2.5) | Consensus algorithms that do not depend on computing power (4) |

3.2.1. Consistency

The concept of consistency in the context of blockchain as a distributed global ledger refers to the property that all nodes have the same ledger at the same time. The consistency property has raised some controversial debate. Some argue that Bitcoin systems only provide eventual consistency (Wattenhofer, 2016), which is a weak consistency. Other claim that Bitcoin guarantees strong consistency, not eventual consistency (Sirer, 2016).

Eventual consistency is a consistency model proposed for distributed computing systems by seeking a tradeoff between availability and consistency. Formally, it ensures that all updates to replicas are propagated in a lazy fashion and all read access to a data item will eventually get the last updated value if the item receives no new updates (Vogels, [n. d.]). In other words, eventual consistency makes sure that data of each entry at each node of the system gets consistent eventually, and thus achieves high availability and low latency at the risk of returning stale data. With eventual consistency, time taken by the nodes of the system to get consistent may not be defined. Thus, data getting consistent eventually means that (1) it will take time for updates to be propagated to other replicas; and (2) if someone reads from a replica which is not updated yet (since replicas are updated eventually), then there is some risk of returning stale data (Vogels, [n. d.]).

Within a blockchain network system, the strong consistency model means that all nodes have the same ledger at the same time, and during the time when the distributed ledger is being updated with new data, any subsequent read/write requests will have to wait until the commit of this update. In contrast, the eventual consistency model means that the blockchain at each node of the system gets consistent eventually, even though some read/write requests to the blockchain may return stale data. The key challenge for strong consistency is that the performance cost (w.r.t. latency/availability) is too high to be affordable for all cases. The key challenge for eventual consistency is how to remove the inconsistency that may be caused by stale data. The blockchain in Bitcoin adopts a consistency model that seeks a better tradeoff between strong consistency and eventual consistency for achieving partition tolerance (P) and consistency (C) with deferred availability.

In Bitcoin, transactions are grouped in blocks. When a sender node sends a transaction to the blockchain network, miner nodes will mine it by adding it to a block with other unverified transactions and performing a proof of work challenge game. Upon completing its proof of work challenge, a miner sends its block and its proof to the network to solicit acceptances from other nodes, which will verify all transactions in the block. The other nodes accept the block by working on generating the next block using the hash of the accepted block as its previous hash. The miner whose block is contained in the longest chain and who is the first to obtain confirmations (a.k.a. blocks are appended on the top of the block, and by default in Bitcoin consensus protocol) is the winner for chaining this transaction into the distributed global ledger. We can view the parameter as a mechanism to provide configurable or parameterized strong consistency in blockchain.

In summary, blockchain is an elegant approach to addressing the CAP problem for storing a distributed ledger in a decentralized system. For Bitcoin, blockchain implements the partition tolerance (P) while supporting consistency (C) and availability (A) on the clipped blockchain with the most recent blocks disregarded. In short, the consensus protocol accepts an update to the blockchain (the distributed global ledger) only when a number of confirmations received by a miner on its challenge solution is equal to or higher than , thus, the update availability is delayed until the confirmations is obtained from the network. The read protocol reads only the blockchain with the last blocks on the chain clipped to ensure the strong consistency and the read availability on the -clipped blockchain. Thus, some has argued that blockchain in Bitcoin guarantees far stronger than eventual consistency. It offers serializability with a probability that is exponentially decreasing with latency (Sirer, 2016). On the other hand, certain blockchain applications are less risk-averse and may benefit from a weaker consistency guarantee for convenience and performance. For instance, when , it means that zero-confirmation is required for both the consensus protocol and the read protocol. This may be a practical choice for those risk-free distributed applications. The blog from Emin Gün Sirer (Sirer, [n. d.]) is an excellent starting point for more readings on this subject. Furthermore, the time required to confirm a Bitcoin transaction with the constraint for strong consistency may be prohibitively slow for some applications, e.g., 10 minutes on average of generating a block in Bitcoin, and this high latency is aggravated when is configured with higher value. Recently, some research efforts try to build much faster, much higher throughput blockchain systems that provide better guarantees than Bitcoin’s 0-confirmation transactions. PeerCensus extends the Bitcoin blockchain to support strong consistency and to decouple block creation and transaction confirmation.

3.2.2. Tamper-Resistance

Tamper-resistance refers to the resistance to any type of intentional tampering to an entity by either the users or the adversaries with access to the entity, be it a system, a product, or other logical/physical object. Tamper-resistance of blockchain means that any transaction information stored in the blockchain cannot be tampered during and after the process of block generation. Specifically, in a Bitcoin system, new blocks are generated by mining nodes. There are two possible ways that the transaction information may be tampered with: (1) Miners may attempt to tamper with the information of received transaction; (2) Adversary may attempt to tamper with the information stored on the blockchain. We analyze why such tampering attempts are elegantly prevented by the blockchain protocols in Bitcoin.

For the first kind of tampering, a miner may attempt to change the payee address of the transaction to himself. However, such attempt cannot be succeeded, since each transaction is compressed by a secure Hash function, such as SHA-256, then signed by the payer using a secure signature algorithm, such as ECDSA, in a Bitcoin network, and finally, the transaction is sent to the entire network for verification and approval through mining. Thus, multiple miners may receive and pick up the transaction to mine, which is done in a non-deterministic fashion. If a miner alters any information of the transaction, it will be detected by others when they check the signature with payer’s public key, since the miner cannot generate a valid signature on the modified information without the payer’s private key. This is guaranteed by the unforgeability of the secure signature algorithm.

For the second kind of tampering, an adversary will fail its attempts to modify any historical data stored on the blockchain. This is because of the two protection techniques used in the distributed storage of blockchain in Bitcoin: the hash pointer, a cryptographic technique, which we mentioned in Section 2.1.1, and the network wide support for both storage and verification of the blockchain. Specifically, if an adversary wants to perform tampering with the data on some block (say ), the first difficulty encountered by the adversary is the mismatch problem, namely, the tampered block has an inconsistent hash value compared to the hash of the preceding block maintained in the block. This is because using a hash function with collision-resistance, the outputs of the collision-resistent hash function with two different inputs will be completely inconsistent with an overwhelming probability, and such inconsistency can be easily detected by others on the network. Even if the adversary attempts to disguise this tampering by cracking the previous block’s hash and so on along the chain, this attempt will eventually fail as the head of the list (a.k.a. genesis block) is reached. Moreover, in the blockchain of Bitcoin network, everyone has a copy of blockchain. It is very hard for an adversary to modify all copies in the entire network.

In short, as every transaction in Bitcoin is signed and distributed over all nodes of the network through the blockchain, it is practically impossible to tamper transaction data without the network knowing about it, showing the power of crowd for storing and distributing the blockchain. This property is attractive to many applications. For example, in healthcare, the blockchain could help to create immutable audit trails, maintain the reliability of health trials, and uphold the integrity of patient data.

3.2.3. Resistance to DDoS Attacks

A denial-of-service attack refers to as the DoS attack on a host. It is the type of cyber-attacks that disrupt the hosted Internet services by making the host machine or the network resource on the host unavailable to its intended users. DoS attacks attempt to overload the host system or the host network resource by flooding with superfluous requests, consequently stalling the fulfillment of legitimate services (McDowell, 2013).

DDoS attack refers to “distributed” DoS attack, namely, the incoming traffic flooding attack to a victim is originated from many disparate sources distributed across the Internet. A DDoS attacker may compromise and use some individual’s computer to attack another computer by taking advantage of security vulnerabilities or weaknesses. By leveraging a set of such compromised computers, a DDoS attacker may send huge amounts of data to a hosting website or send spam to particular email addresses (McDowell, 2013). This effectively makes it very hard to prevent the attack by simply jamming individual sources one by one. The arm-race depends on the repairing rate of such compromised nodes against the success rate of compromising computer nodes in the network.

The serious concern in a DDoS attack is on the availability of blockchain and is related to the question of whether a DDoS attacker can make the blockchain unavailable by knocking out a partial or the whole network. The answer to this question is no, thanks to the fully decentralized construction and maintenance of the blockchain and Bitcoin system and the consensus protocol for new block generation and addition to the blockchain, which ensures that the processing of blockchain transactions can continue even if several blockchain nodes go offline. In order for a cyber-attacker to succeed in making blockchain offline, the attacker would have to collect sufficient computational resources that can compromise overwhelmingly large portion of the blockchain nodes across the entire Bitcoin. The larger the Bitcoin network becomes, the harder it is to succeed in such large-scale DDoS attack.

3.2.4. Resistance to Double-Spending Attacks

The double-spending attack in the context of Bitcoin blockchain refers to a specific problem unique to digital currency transactions (recall Section 3.1). Note that the double-spending attack can be considered as a general security concern due to the fact that digital information can be reproduced relatively easily. Specifically, with transactions exchanging digital token, such as electronic currency, there is a risk that the holder could duplicate the digital token and send multiple identical tokens to multiple recipients. If an inconsistency can be incurred due to the transactions of duplicate digital tokens (e.g., double spent the same bitcoin token), then the double-spending problem becomes a serious security threat.

To prevent double-spending, Bitcoin evaluates and verifies the authenticity of each transaction using the transaction logs in its blockchain with a consensus protocol. By ensuring all transactions be included in the blockchain, in where the consensus protocol allows everyone to publicly verify the transactions in a block before committing the block into the global blockchain, ensuring that the sender of each transaction only spends the bitcoins that he possesses legitimately. In addition, every transaction is signed by its sender using a secure digital signature algorithm. It ensures that if someone falsifies the transaction, the verifier can easily detect it. The combination of transactions signed with digital signatures and public verification of transactions with a majority consensus guarantees that Bitcoin blockchain can be resistant to the double-spending attack.

3.2.5. Resistance to the Majority (51%) Consensus Attack

This attack refers to the risks of cheatings in the majority consensus protocol. One of such risks is often referred to as the 51% attack, especially in the context of double-spending. For example, the 51% attack may occur in the presence of malicious miners. For example, if a miner (verification user) controls more than 50% of the computing power for maintaining the blockchain, the distributed ledger of all transactions of trading a cryptocurrency. Another example of the 51% attack may happen when a group of miners collude to perform a conspiracy, e.g., with respect to counting the miners votes for verification. If one powerful user or a group of colluding users controls the blockchain, then various security and privacy attacks may be launched, such as illegally transferring bitcoins to some target wallet(s), reversing genuine transactions as if they were never occurred, and so forth.

3.2.6. Pseudonymity

Pseudonymity refers to a state of disguised identity. In Bitcoin, addresses in blockchain are hashes of public keys of a node (user) in the network. Users can interact with the system by using their public key hash as their pseudo-identity without revealing their real name. Thus, the address that a user uses can be viewed as a pseudo-identity. We can consider the pseudonymity of a system as a privacy property to protect user’s real name. In addition, users can generate as many key pairs (multiple addresses) as they want, in a similar way as a person can create multiple bank accounts as she wishes. Although pseudonymity can achieve a weak form of anonymity by means of the public keys, there are still risks of revealing identity information of users. We will further discuss it in Section 3.3.1.

3.3. Additional Security and Privacy Properties of Blockchain

Although the blockchain in Bitcoin preserves the three basic security properties: consistency, tamper-resistance, and resistance to DDoS attacks, a general purpose blockchain system may desire and benefit from a set of additional security and privacy properties that are critical to digital currency systems and distributed global ledger services. Due to space constraint, we here outline a couple of such additional properties.

3.3.1. Unlinkability

Unlinkability refers to the inability of stating the relation between two observations or two observed entities of the system with high confidence. Anonymity refers to the state of being anonymous and unidentified. Although the blockchain in Bitcoin ensures pseudonymity by offering pseudo-identity as the support for the anonymity of a user identity, it fails to provide users the protection of unlinkability for their transactions. Intuitively, the full anonymity of a user can only be protected by ensuring both pseudonymity and unlinkability if the user always uses her pseudo-identity to interact with the system. This is because unlinkability makes it hard to launch de-anonymization inference attacks, which link the transactions of a user together to uncover the true identity of the user in the presence of background knowledge (Narayanan et al., 2016). Concretely, in Bitcoin like systems, a user can have multiple pseudonymous addresses. However, this does not provide perfect anonymity for users of blockchain, because every transaction is recorded on the ledger with the addresses of sender and receiver, and is traceable freely by anyone using the associated addresses of its sender and receiver. Thus, anyone can relate a user’s transaction to other transactions involving her accounts by a simple statistical analysis of the addresses used in Bitcoin transactions. For example, by analysis on a sender s account, one can easily learn the number and total amount of bitcoins coming out or going into this account. Alternatively, one can link multiple accounts that send/receive transactions from one IP address. More seriously, a user may lose her anonymity and thus privacy for all the transactions associated with her Bitcoin address if the linkage of her bitcoin address to the user’s real-world identity is exposed.

In addition, given the open nature of the public blockchain, anyone can make attempt to perform this type of de-anonymization attack silently and secretly without having the target user even realizing that she is being attacked or her true identity has been compromised. Therefore, the blockchain implementation in Bitcoin only achieves pseudonymity but not unlinkability and thus not full anonymity defined by pseudonymity with unlinkability. We argue that the blockchain system should be enhanced by other cryptographic techniques, outlined in Table 2 and will be discussed in Section 5.

3.3.2. Confidentiality of Transactions and Data Privacy

Data privacy of blockchain refers to the property that blockchain can provide confidentiality for all data or certain sensitive data stored on it. Although the blockchain was originally devised as a distributed global ledger for the digital currency system Bitcoin, its potential scope of applications is much broader than virtual currencies. For example, blockchain can be leveraged for managing smart contract, copyrighted works, digitization of commercial or organizational registries. Not surprisingly, a desirable security property common in all the blockchain applications is the confidentiality of transaction information, such as transaction content (e.g., transaction amounts in Bitcoin), and addresses. Unfortunately, this security property is not supported in Bitcoin systems. In Bitcoin, the transaction content and addresses are publicly viewable, even though the pseudonym is used as the address of sender and receiver of a transaction instead of the real identity. We conjecture that the capability of keeping transaction content private will help to reduce the risk of linkage of pseudonym to the real user identity. This is critical for promoting the need-to-know based sharing instead of publicly viewable of the entire blockchain.

Moreover, blockchain systems, which use smart contracts to implement complex transactions, such as Ethereum, require (1) the data of each contract and the code it runs on the data to be public and (2) every miner to emulate executing each contract. This will lead to the leakage of user information. For example, a user sets up a smart contract to transfer a certain amount of ETH to another user at a certain time. If an adversary has background information about one of the two parties, this adversary may expose and link this party to her real identity. Therefore, it is critical to design and implement stronger protection mechanisms for privacy-preserving smart contracts.

In summary, the data privacy research in the past decades has shown the risks of privacy leakage due to various inference attacks, which link sensitive transaction data and/or pseudonym to the true identity of the real users, even though only pseudonym is being used (Meiklejohn et al., [n. d.]; DuPont and Squicciarini, [n. d.]). Such privacy leakage can lead to breaching the confidentiality of transaction information. Thus, confidentiality and privacy pose a major challenge for blockchain and its applications that involve sensitive transactions and private data. We will dedicate Section 5 to discuss some main branches of technology that may help enhancing data privacy and transaction confidentiality on blockchain.

4. Consensus Algorithms

Consensus is a group-based protocol for reaching agreement dynamically in a group. Compared to the majority voting, a consensus emphasizes that the entire group as a whole could benefit by reaching a consensus. The problem of dynamically getting a consensus in a group relies on group-based coordination. Such coordinated consensus may be tampered in the presence of malicious actors and faulty processes. For example, a bad actor may secretly create conflicting messages to make group members fail to act in unison, which breaks down the effectiveness of the group to coordinate its actions. This problem is so called the “Byzantine Generals Problem” (BGP) (Pease et al., [n. d.]). The failure of reaching consensus due to faulty actors is referred to as Byzantine fault. Leslie Lamport, Marshall Pease and Robert Shostak showed in 1982 (Lamport et al., [n. d.]) that Byzantine fault tolerance can be achieved only if a majority agreement can be reached by the honest generals on their strategy.

The consensus algorithms popularly used in current blockchain systems provide a probabilistic solution to BGP.

In the subsequent sections, we will review these consensus protocols with the focus on their security and privacy properties.

4.1. Proof of Work (PoW)

The consensus protocol designed by Satoshi Nakamoto (Nakamoto, 2008) for the Bitcoin is aimed at reaching a coordinated consensus from the network on the validity of each bitcoin transaction. It bypasses the Byzantine Generals Problem by using the PoW protocol.

We characterize the PoW with dual properties: (1) it should be difficult and time-consuming for any prover to produce a proof that meets certain requirement, and (2) it should be easy and fast for others to verify the proof in terms of its correctness. For the first property, one must design a proof of work challenge such that computing a valid proof of work is difficult with low and somewhat random probability, thus a lot of trial and error is needed.

We illustrate how the PoW works in terms of BGP. When the troops on the east of the city want to send a message to the west side troops, it follows the steps of the PoW protocol:

-

(1)

Append a “nonce” (usually start with zero) to the original message, which is a random hexadecimal value;

-

(2)

Apply hash to the nonce augmented message and check if the hashing result is less than or equal to a preset value (say starts with five zeros);

-

(3)

If the hash condition is satisfied, the troops on one side of the city will send the messenger to the troops on the other side of the city with the hash of the message and the nonce. If not, then increase the nonce by one and this process iterates until either the desired result is obtained. Finding the right nonce can be time consuming and computationally expensive;

-

(4)

Due to the collision-resistant property of hash function, it is hard to tamper the hash of the message even if the messenger got caught, because the hash of the tampered message will be drastically different from the hash of the original message, and the generals on the west of the city can verify whether the message starts with five zeros and disregard the message if it not.

-

(5)

Repeat the above process for multiple iterations such that multiple messengers are sent from the east side troops to the west side troops through the city.

This last step is to address a possible loophole with sending only one messenger: If the city captured the messenger, got the message, tampered with it and then accordingly by changing the nonce until the right nonce value is found such that the desired hash result with required number of zeros is obtained. Even though this process is computationally costly and time consuming, it is still possible. The PoW protocol counters this loophole by increasing strengths in numbers. First, by adding more messengers, the probability of all of them get caught is reduced significantly. Second, even some of them got caught, the amount of time required to tamper the cumulative message and find the corresponding nonce for the hash will be increased substantially. For a block to be valid in the blockchain, a miner has to be able to hash it to a value less than or equal to the current target and then presents its solution to the network for verification by other nodes. The dual properties of PoW ensures that it is extremely difficult and time consuming to find the right nonce for the appropriate hash target; and yet it is super easy and simple to validate the hash result so that no tampering has been made.

The PoW protocol in Bitcoin extends the Hashcash (Back, 2002) system with some minor improvements. First, Bitcoin limits the rate of creating and adding new blocks to the blockchain by the network to roughly one at every 10 minutes. It implements such rate control by automatically monitoring the time spent to solve each proof of work challenge, and adjusting the difficulty of the challenge accordingly. Second, Bitcoin increases the difficulty of predicting which miner in the network will be able to generate the next block by making successful generation of the proof of work at a high cost.

For the formal analysis of PoW, Garay and Kiayias (Garay et al., 2015) first formally extracted and analyzed the two fundamental attributes of the Bitcoin protocol: common prefix and chain quality. However, their analysis is based on several simplifying assumptions, such as a fixed setting with a given number of players, the fully synchronous network channels in which messages are delivered with no delays. Pass et al. (Pass et al., [n. d.]) proved that the Nakamoto consensus protocol ensures the blockchain maintaining strong consistency and liveness, assuming that an asynchronous network has a-priori bounded adversarial delays and the computational challenge is casted as a random oracle. Recently, Pass and Shi proposed FruitChain (Pass and Shi, [n. d.]), a protocol that extends the Bitcoin PoW protocol with a reward mechanism, while providing the same consistency and liveness properties with an approximate Nash equilibrium proof.