Static and semi-static hedging as contrarian or conformist bets

Abstract.

In this paper, we argue that, once the costs of maintaining the hedging portfolio are properly taken into account, semi-static portfolios should more properly be thought of as separate classes of derivatives, with non-trivial, model-dependent payoff structures. We derive new integral representations for payoffs of exotic European options in terms of payoffs of vanillas, different from Carr-Madan representation, and suggest approximations of the idealized static hedging/replicating portfolio using vanillas available in the market. We study the dependence of the hedging error on a model used for pricing and show that the variance of the hedging errors of static hedging portfolios can be sizably larger than the errors of variance-minimizing portfolios. We explain why the exact semi-static hedging of barrier options is impossible for processes with jumps, and derive general formulas for variance-minimizing semi-static portfolio. We show that hedging using vanillas only leads to larger errors than hedging using vanillas and first touch digitals. In all cases, efficient calculations of the weights of the hedging portfolios are in the dual space using new efficient numerical methods for calculation of the Wiener-Hopf factors and Laplace-Fourier inversion.

S.B.: Department of Economics, The University of Texas at Austin, 1 University Station C3100, Austin, TX 78712–0301, sboyarch@eco.utexas.edu

S.L.: Calico Science Consulting. Austin, TX. Email address: levendorskii@gmail.com

Key words: static hedging, semi-static hedging, Lévy processes, exotic European options, barrier options, Wiener-Hopf factorization, Fourier-Laplace inversion, sinh-acceleration

1. Introduction

There is a large literature111See [33, 25, 27, 30, 4, 40, 64, 3, 61, 29, 31, 46, 31] and the bibliographies therein. studying static hedging and replication of exotic European options, and semi-static hedging and replication of barrier and other types of options. What this literature ignores, however, is the cost of maintaining the hedging position, which can drive the payoff of the overall portfolio negative. In this paper, we argue that, once the costs of maintaining the hedging portfolio are properly taken into account, semi-static portfolios should more properly be thought of as separate classes of derivatives, with non-trivial, model-dependent payoff structures. Depending on the structure of the option being hedged and the model, the semi-static hedging portfolio may either function as a contrarian bet small losses with high probability and large gains with low probability or as a conformist bet small gains with high probability and large losses with low probability.

We suggest new versions of static and semi-static hedging, provide qualitative analysis of errors of different static and semi-static procedures, explain why in the jump-diffusion case the exact replication of barrier options by European options, hence, the model-independent replication, is impossible, and produce numerical examples to demonstrate how different sources of hedging errors depend on a model. In the main body of the paper, we consider European and down-and-in barrier options in Lévy models, and then indicate the directions in which the approach of the paper can be generalized and extended to cover options of other types, in more complicated models. Pricing barrier options and the calculation of the variance of the hedging portfolio at expiry are based on new efficient numerical procedures for calculation of the Wiener-Hopf factors and Laplace-Fourier inversion. These procedures can be useful in other applications as well.

The underlying idea of the static hedge [30] of European options with exotic payoffs is simple. One replicates the payoff of an exotic European option by a linear combination payoffs of the underlying stock and vanillas, and uses the portfolio of the stock and options to replicate or hedge the exotic option. In Section 2, we start with the derivation of integral representations for an exact static hedging portfolio. Contrary to [30], we work in the dual space, and derive a representation in terms of vanillas only; this representation if different from the one in [30]. By construction, the portfolios we construct and the portfolio in [30] are model-independent, which looks very attractive. However, the continuum of vanillas does not exist, and even if it did, the integral portfolio would had been impossible to construct anyway. Hence, one has to approximate each integral by a finite sum. The hedging error of the approximation is inevitably model-dependent. We design simple constructions of approximate hedging portfolios and study the dependence of the static hedging error on a model using a portfolio of available vanillas. We derive an approximation in an almost -norm, and then calculate the weights of the variance-minimizing hedging portfolio. In both cases, the calculations are in the dual space using the sinh-acceleration technique [17]. We believe that both approximate hedging procedures have certain advantages as compared to the two-sep procedure in a recent paper [42], where, first, one uses the projection of the payoff of the security to be hedged and securities in the hedging portfolio on the space of model payoffs, then calculates the weights. This more complicated procedure does not help to decrease the hedging error, and, similarly to the approximate static hedging that we construct, cannot produce smaller variances than the variance minimizing hedging portfolio.

In Section 3, we outline the general structure of the semi-static variance-minimizing hedging of barrier options; in the paper, we consider the down-and-out and down-and-in options. The initial version of the semi-static hedging portfolio for barrier options was suggested in [33]: put options with strikes equal to the barrier, with different expiry dates, are added to the portfolio in such a way that the portfolio value is zero at the barrier. Assuming that, at the moment the barrier is breached, the underlying is exactly at the barrier, the weights of portfolio can be calculated backwards. It is clear that if the underlying can cross the barrier with a jump, the procedure cannot be exact, and the implicit error is inevitably model-dependent. A different semi-static hedging of barrier options is developed in [25, 27, 29], but the underlying assumption is the same as in [33]. For a given barrier option, an exotic European payoff is constructed so that, at maturity or at the time of early expiry (the case of “out” options) or activation (the case of “in” options), the price of the hedging portfolio for barrier option equals the price of the European option. At the barrier is reached (the presumption is that it cannot be crossed by a jump), the portfolio is liquidated. The European option being exotic, an approximate static hedging portfolio for the latter is presumed to be used. Hence, in the presence of jumps, the hedging errors are model-dependent even if one believes that an auxiliary exotic option can be hedged exactly using a portfolio of vanillas, and the question of the interaction of two types of errors naturally arises. The option with the payoff is more exotic than the usual exotic options (the structure of the payoff is more complicated), and the more exotic the option is, the larger the hedging errors are. Even in the case of diffusion models, the errors can be quite sizable, and the approximation is justified under a certain rather restrictive symmetry condition on the parameters of the model. See [61].

The paper [46] uses the approximate semi-static hedging of [29] and an approximation of the exotic European option which approximates the barrier option; this leads to at least two sources of model-dependent errors, which can be large if the jump component is sizable; in addition, the symmetry condition is more restrictive than in the case of diffusion models. In the introduction of [46], it is claimed that Carr and Lee [29] rigorously justified the semi-static procedure for jump-diffusion models; the picture is more complicated. In Section 3.1, we explain that the standard semi-static construction has numerous sources of errors, and even an approximation can be justified under additional rather restrictive conditions only. In particular, in the presence of jumps, the semi-static procedure is never exact.

The variance minimizing hedging portfolio has certain advantages. We can directly construct the hedging portfolio using the securities traded in the market provided that a pricing model is chosen, and one can calculate the option prices in the portfolio and products of the prices as functions of , , where is time to maturity. Accurate and fast calculations are possible for wide classes of options (barrier options, lookbacks, American options, Asians, etc.), and many popular pricing methods working in the state space can be applied. However, to calculate the weights of the hedging portfolio, we need to calculate the expectations of the products of the discounted prices at time , where is the first entrance time into the early exercise region. Hence, one needs to approximate the products of prices by functions which are amenable to application of efficient option pricing techniques, which are, typically, based on the Laplace-Fourier transform. In the paper, we suggest and use new efficient methods for the numerical Fourier-Laplace inversion and calculation of the Wiener-Hopf factors; these methods are of a general interest.

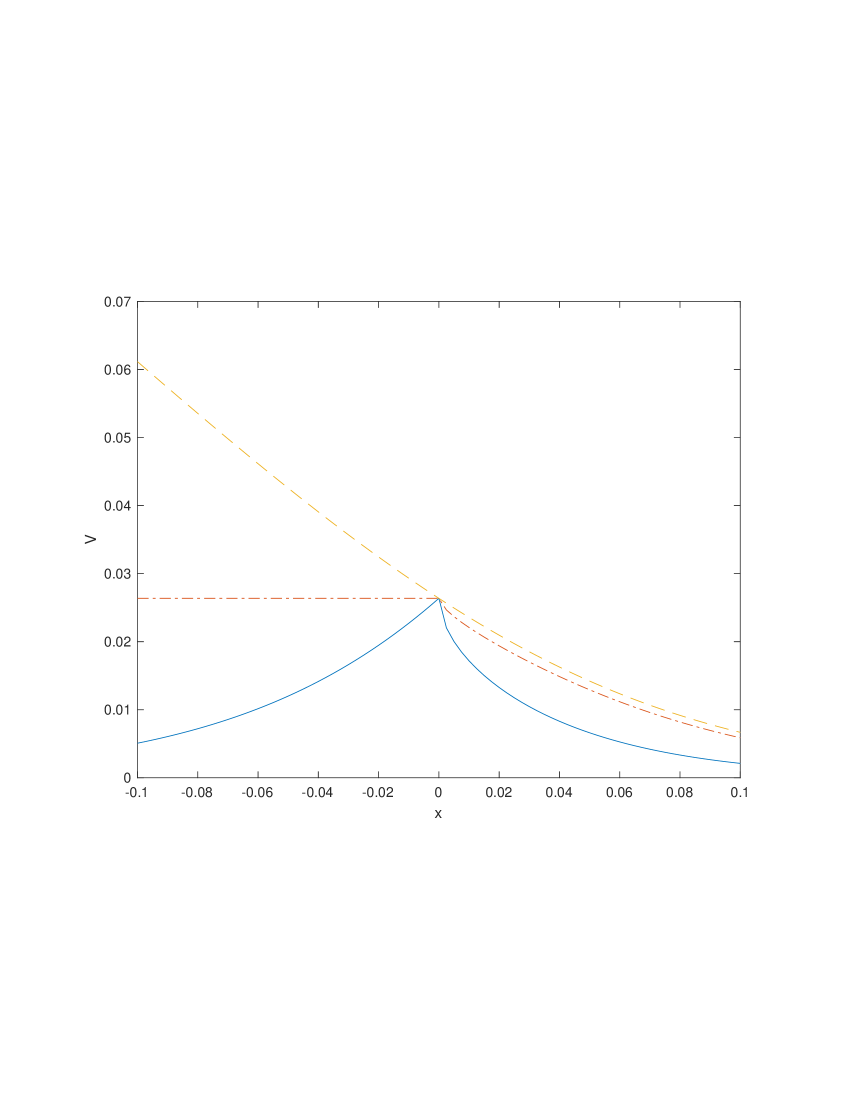

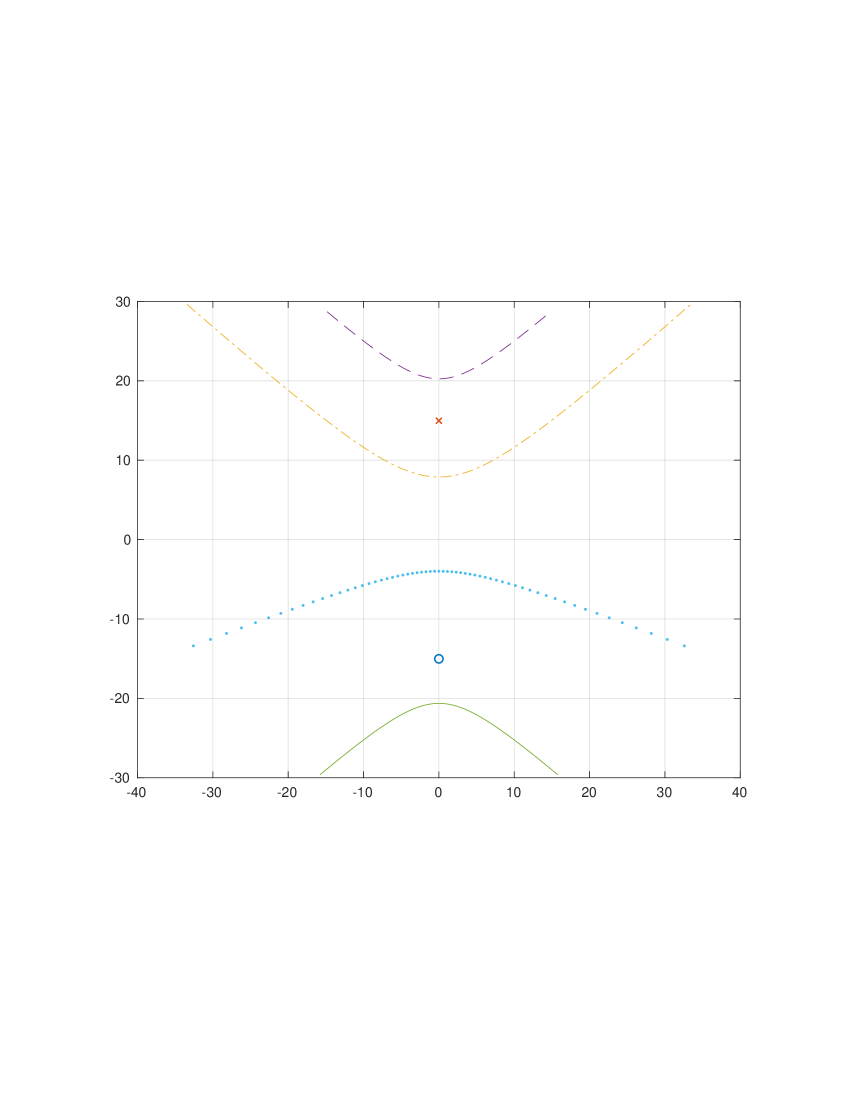

We work in the dual space; calculations in the dual space are also necessary to accurately address the following practically important effect. There is an additional source of errors of hedging portfolios consisting of vanillas only. In all popular models used in finance, the prices of vanilla options are infinitely smooth before the maturity date and up to the boundary but prices of barrier options in Lévy models are not smooth at the boundary, the exceptions being double jump diffusion model, hyper-exponential jump diffusion model, and other models with rational characteristic functions. For wide classes of purely jump models, it is proved in [21, 9] that the price of an “out” barrier option near the barrier behaves as , where is independent of time to maturity , , and is the log-distance from the barrier. For finite variation processes with the drift pointing from the boundary, , and the limit of the price at the barrier is positive. Similarly, the price of the first touch digital behaves as . Even if the diffusion component is present, the prices of the barrier and first touch options are not differentiable at the barrier [21], and if the diffusion component is small, then essentially the same irregular behavior of the price will be observed outside a very small vicinity of the barrier. Calculations in the state space are based on approximations by fairly regular functions, hence, cannot reproduce these effects sufficiently accurately. See examples in [53], where it is demonstrated that Carr’s randomization method [10], which relies on the time randomization and interpolation in the state space, underprices barrier options in a small vicinity of the barrier. From the point of view of the qualitative composition of the hedging portfolio, one should expect that an accurate hedging of barrier options is impossible unless the corresponding first touch digitals are included. Fig. 1 clearly shows that the first touch digital is much closer to the down-and-in option than a put option, and the first-touch options with the payoffs would be even better hedging instruments.

We calculate hedging portfolios consisting of vanillas only and of vanillas and the first-touch option in in Sections 5 and 6 using the Wiener-Hopf factorization technique. We recall the latter in Section 4, and introduce the new efficient method for the calculation of the Wiener-Hopf factors based on the sinh-acceleration technique [17]. The numerical examples for static hedging and calculation of the Wiener-Hopf factors and expectations related to barrier options are discussed at the end of the corresponding Sections; a numerical example for hedging of barrier options is in Section 7. In Section 8 we summarize the results of the paper and outline natural extensions. The outline of Gaver-Stehfest-Wynn method, and Tables and Figures (with the exception of Fig. 1 above and Fig. 2 in Section 3) are relegated to Appendices.

2. Static hedging of European options

2.1. Static hedging in the ideal world

Let be the Lévy process, and let be the payoff at maturity. We assume that is continuously differentiable, the measure is a sum of a finite number of atoms (equivalently, has a finite number of kinks), and, under additional weak regularity conditions, prove that if polynomially decays as (call-like options), then

| (2.1) |

and if polynomially decays as (put-like options), then

| (2.2) |

Assumption . is continuously differentiable function satisfying the following conditions

-

(i)

is a signed measure, without the singular component;

-

(ii)

has only a finite number of points of discontinuity;

-

(iii)

the measure is finite;

-

(iv)

s.t. , are of the class .

If , define

| (2.3) |

and if , set

| (2.4) |

Clearly, the measure is absolutely continuous, and .

Proof.

Consider the case . Set , and calculate the Fourier transform of the RHS of (2.2) w.r.t. , for on the line . Using Fubini’s theorem, we obtain

where . Using and , then integrating by parts and taking into account that and tend to 0 as , we continue

Thus, in the case , the Fourier transforms of the LHS and RHS of (2.2) coincide on the line , which proves (2.2). If , then, in the proof above, we replace with , and modify all the steps accordingly. ∎

Remark 2.1.

If has the compact support and no atoms, then both representations, in terms of puts and calls, are valid, with integration w.r.t. the same measure. This (mildly surprising) fact can be verified using the put-call parity and the following calculation

Example 2.2.

The payoff function of the powered call of order with the strike is . Since , there are no kinks, has no atoms, and

Example 2.3.

The payoff function of the power call is , where , . The measure has an atom , and, on , . Hence,

Example 2.4.

Consider the down-and-in call option with barrier and strike . A popular semi-static replicating portfolio for this option is a European option with the payoff (see (3.1) and Section A). Since , the payoff simplifies , where , and . Clearly, it suffices to construct the hedging portfolio for the option with the payoff function , which vanishes above . At , has a kink, and . On , is infinitely smooth, and , . Hence,

2.2. Approximate static hedging

In the real world, only finite number of options are available, hence, one has to approximate the measure using an atomic measure, typically, with a not very large number of atoms. For instance, it is documented in [31] that static hedging with 3-5 options produces good results. Hence, the static hedging will be approximate. Furthermore, as seen from time 0, the hedging error will depend on the choice of the model used; although the idealized static hedge is model independent, the approximate one is model-dependent, and the quality of the approximation depends (naturally) on the choice of the approximation procedure. We will approximate the payoff of an exotic option by linear combinations of payoffs of vanillas, in the norm of a Sobolev space with an exponential weight. To be more specific, we minimize the difference between the payoff of an exotic option and the portfolio payoff in the norm of the Sobolev space of order , with an appropriate exponential weight (a.k.a. dampening factor). The Plancherel theorem allows us to do the calculations in the dual space. The integrals are calculated accurately and very fast using the sinh-acceleration techniques [17]. If , is continuously embedded into , hence, we can estimate the error in the -norm (with the corresponding weight), which is natural for the approximate static hedge: if the error 0 is not achievable, we control the maximal error. We study the dependence of the variance of the hedging error on the model and , and demonstrate that the variances of errors in cases and close to are comparable (and essentially independent of in a reasonable range), the differences being smaller than the differences between the variances of errors of approximate static hedging portfolios and variance-minimizing portfolio.

Let . The Sobolev space of order , with weight , is the space of the generalized functions such that . The scalar product in is defined by . Thus,

By one of the Sobolev embedding theorems (see, e.g., Theorem 4.3 in Eskin (1973)), if , is continuously embedded into , the space of uniformly bounded continuous functions vanishing at infinity, with -norm. Hence, for any and , an approximation in the -topology gives a uniform approximation over any fixed compact .

Consider an exotic option whose payoff vanishes below , which we normalize to 1. For practical purposes, we may assume that the strikes of European options used for hedging are close to 1, and the spot is close to 1; hence, the log-spot is close to 0, and if is not large in modulus, the differences among the hedging weights for different omegas are not large. Likewise, if decay fairly fast at infinity, the norms of in will be close if and is close to .

Assume that . Thus, we have a call-like options, which is hedged using a portfolio of call options. We fix as discussed above, , and the set of call options with the payoff functions . Set . We look for the set of weights (numbers of call options in the portfolio) which minimizes in the norm. Denote ; these scalar products can be easily calculated with a sufficiently high precision since the integrands in the formula for decay as . Furthermore, if is of the form , where is a rational function, and , then the integrands in the formulas for are of the form , where and are rational functions. Hence, the scalar products can be calculated with almost machine precision and very fast using the sinh-acceleration technique [17]. After an appropriate change of variables of the form , the simplified trapezoid rule with a dozen of terms typically suffices to satisfy the error tolerance of the order of and less.

The minimizer of

is the solution of the equation , equivalently,

| (2.5) |

where is a vector-column, and .

2.3. Variance minimizing hedging portfolio

The hedging error is the random variable

Set (the expectations are under an EMM chosen for pricing). Assuming that , are calculated, calculation of the mean hedging error

is reducible to the Fourier inversion. As it is explained in [14, 54, 17], if (1) is of the form , where and is a rational functions, and (2) is of the form , where and as remaining in a cone around the real axis, then it is advantageous to represent in the form

| (2.6) |

where the set of admissible depends on , and . Then we use a conformal deformation of the contour of integration in (2.6) and the corresponding change of variables, and apply the simplified trapezoid rule. The most efficient change of variables (the sinh-acceleration) suggested in [17] is of the form , where is of the same sign as ; the upper bound on admissible depends on and .

The variance can be calculated using the equality

To calculate , we need to calculate , which is the “price” of the European option with the payoff at maturity . We calculate the Fourier transform of the product , multiply by the characteristic function , and apply the inverse Fourier transform. For typical exotic options and vanillas, is of the form , where is a rational function, and . Hence,

| (2.7) |

where . The integral on the RHS of (2.7) can be calculated accurately and fast using the sinh-acceleration technique [17]. The numbers of options in the variance minimizing portfolio are given by

| (2.8) |

where is a vector-column, and , is a matrix.

2.4. An example: static hedging and variance minimizing hedging of the exotic option with the payoff function given by (3.1). The case .

Let . Then , and . Direct calculations show that the Fourier transform of is well-defined in the half-plane by

| (2.9) |

In the hedging portfolio, we use put options with strikes , . Set ; then is well-defined in the half-plane .

2.4.1. Construction of an approximate static hedging portfolio

We take . Typically, , hence, . We have

where . We can calculate the integral accurately and fast making the simplest sinh-change of variables , and applying the simplified trapezoid rule. See [17] for explicit recommendations for the choice of and the parameters of the simplified trapezoid rule.

Next, for , we set and calculate

If , we make the sinh-change of variables of the same form as above (the choice of the parameters , , is slightly different). If (resp., ), then it is advantageous to deform the contour of integration so that the wings of the deformed contour point up (resp., down). Hence, we make the change of variables , where (resp., ) and set . The parameters , , are chosen as explained in [17].

Finally, for , and ,

If , we deform the wings of the contour down, equivalently, use the sinh-acceleration with . If , we use . Finally, if , we may use any ; the choice is the best one.

After the scalar products are calculated, we apply (2.5) to find the approximate static hedging portfolio. Below, we will use a modification of this scheme when the hedging portfolio has the fixed amount of put options with strike , and the weights of the other put options in the hedging portfolio are calculated minimizing the hedging error.

2.4.2. Construction of the variance-minimizing hedging portfolio

Calculating the integral on the RHS of (2.6), we use (2.9) for ; for , . To calculate the integral on the RHS of (2.7), we need to calculate the Fourier transforms of the products of the payoff functions. The straightforward calculations give

-

(1)

for in the half-plane , where

(2.10) -

(2)

for and in the half-plane ,

where

(2.11) -

(3)

if , then the Fourier transform of

(2.12) is well-defined in the half-plane .

2.4.3. Numerical experiments

In Tables collected in Section E.1, we study the relative performance of the static hedging and variance-minimizing hedging. We consider the exotic European option with the payoff ; the hedging portfolios consist of put options with the strikes , where . For different variants of hedging, we list numbers of the options with strikes in the hedging portfolio. Static portfolios are constructed minimizing the hedging error in the norm; the results are essentially the same for , and weakly depend on . The static portfolios are independent of time to maturity and the process but does depend on both as well as on the spot . We study the dependence of the (normalized by the price of the exotic option) standard deviations of the static hedging portfolio and variance minimizing portfolio on the process, time to maturity and . For the static hedging portfolios, for each process and time to maturity, we show the range of as the function of . In the case of the variance-minimizing hedging, depend on by construction, and we show and for each in a table. We consider two variants of the variance minimizing portfolios: means that (the same as for static portfolios) is fixed, means that all may vary.

In all cases, , , the underlying pays no dividends, is KoBoL; in two tables, the BM with the embedded KoBoL component. The second instantaneous moment is or , and is determined by and . The riskless rate is found from the EMM condition ; found from . If is KoBoL, then exists only if , and then . If the BM component is present, then we choose and so that . The results for two cases when such a exists are presented in Tables 1-5; in Tables 3 and 5, KoBoL is close to BM (), and in Tables 1, 2, 4, close to NIG (). The BM component is non-trivial in Tables 4 and 5. The reader may notice that the parameter sets are not very natural; the reason is that it is rather difficult to find natural parameter sets which ensure that (1) satisfying exists; (2) the EMM condition holds. In Tables 6 and 7, we present results for a sizably asymmetric KoBoL with , and consider the same exotic option with . Naturally, this exotic option cannot be even formally used to hedge the barrier option but can serve for the purpose of the comparison of two variants of hedging of exotic European options.

Tables illustrate the following general observations.

-

(1)

If the number of vanillas in a static hedging portfolio is sufficiently large, the portfolio provides uniform (approximate) hedging over wide stretches of spots and strikes. Hence, if the jump density decays slowly, one expects that, far from the spot, the static hedging portfolio will outperform the variance minimizing portfolio. Table 1 demonstrate that even in cases when the rate of decay of the jump density is only moderately small, and the process is not very far from the BM, the variance of the static portfolio differs from the variance of the variance minimizing portfolios (constructed separately for each spot from a moderate range, and using the information about the characteristics of the process) by several percent only; if the jump density decays slower and/or process is farther from the BM, the relative difference is smaller. Hence, if the rate of decay of the jump density is not large and the density os approximately symmetric, the static portfolio is competitive for hedging risks of small fluctuations. It is clear that the hedging performance of the static portfolio in the tails must be better still.

- (2)

- (3)

-

(4)

The quality of variance minimizing portfolios VM1 and VM2 is essentially the same in almost all cases when 5 vanillas are used although the portfolio weights can be rather different. Hence, as a rule of thumb, one can recommend to use vanillas associated with the atomic part of the measure in the integral representation of the ideal static portfolio - provided these vanillas are available in the market.

The implication of observations (1)-(2) for semi-static hedging of barrier options is as follows. If the the variance of the BM component makes a non-negligible contribution to the instantaneous variance of the process, the ideal semi-static hedging using a continuum of options improves but the quality of an approximation of the integral of options by a finite sum decreases. Hence, one should expect that the variance minimizing hedging of barrier options would be significantly better than an approximate semi-static hedging in all cases.

3. Hedging down-and-in and down-and-out options

3.1. Semi-static hedging

Carr and Lee [29] formulate several equivalent conditions on a positive martingale under the reference measure , call the class of these martingales PCS processes, and design semi-static replication strategies for various types of barrier options. Since the proof of Theorem 5.10 in [29] strongly relies on the assumption that at the random time when the barrier is breached, the underlying is exactly at the barrier, in Remark 5.11 in [29], the authors state that these strategies replicate the options in question for all PCS processes, including those with jumps, provided that the jumps cannot cross the barrier. However, one of the equivalent conditions which define PCS processes is the equality of the distributions of under and under , where . This condition implies that has positive jumps if and only if has negative jumps. Hence, if jumps in does not cross the barrier, equivalently, there are no jumps in the direction of the barrier, then there are no jumps in the opposite direction, and, therefore, has no jumps. Further relaxing PCS conditions, Carr and Lee [29] generalize to various asymmetric dynamics, but the property that jumps in one direction are impossible means that the results for semi-static replication of barrier options under these asymmetric dynamics are valid only if there are no jumps. Carr and Lee [29] give additional conditions which will ensure the super-replication property of the semi-static portfolio for “in” options; but the corresponding portfolio for “out” options recommended in [29] will under-replicate the option.

For an additional clarification of these issues, in Section A, we derive the generalized symmetry condition for the case of a Lévy process in terms of the characteristic function : s.t. for all in the domain of , and show that this condition implies that either is the Brownian motion (BM) and the riskless rate equals the dividend rate or there are jumps in both directions, and asymmetry of the jump component is uniquely defined by the volatility and drift . Furthermore, if , then as well. For the case of the down-and-in option with the payoff and barrier , we rederive the formula for the payoff of the exotic European option, which, in the presence of jumps, replicates the barrier option only approximately:

| (3.1) |

The numerical examples above show that the variance of the hedging error of the static portfolio for the exotic option with the payoff (3.1) is close to the variance of the variance-minimizing portfolio if the BM component is 0, the jump density does not decrease fast and is approximately symmetric; if the BM component is sizable and/or the density of jumps is either asymmetric or fast decaying, then the variance of the static portfolio is significantly larger than the variance of the variance-minimizing portfolio. Hence, the static portfolio is a good (even best) choice in cases when the idealized semi-static replicated exotic option is a bad approximation fo the barrier option.

3.2. General scheme of variance minimizing hedging

We consider one-factor models. The underlying is , there is no dividends, and the riskless rate is constant. Let be the price of the contingent claim to be hedged, of maturity , under an EMM chosen for pricing. Let , , be the prices of the options used for hedging. We assume that the latter options do not expire before , where is the first entrance time into the activation region of the down-and-in option (in the early expiry region of the down-and-out option). As in the papers on the semi-static hedging, we assume that, at time , the hedging portfolio is liquidated. Let be the vector of numbers of securities in the hedging portfolio. The portfolio at the liquidation date is the random variable

and the discounted portfolio at the liquidation date is . One can consider the variance minimization problem for either or , and we can calculate the variance under either the EMM used for pricing or the historic measure . We consider the minimization of the variance of under .

Let , and, for , set and

| (3.2) |

Using , we represent the variance of in the form

and find the minimizing as

| (3.4) |

where is a column vector, and is an invertible square matrix if the random variables are uncorrelated.

To calculate , it suffices to calculate and . We decompose into the sum of the first-touch option with the payoff , and no-touch option with the payoff . Given a model for , we can calculate the prices of the no-touch and first touch options. Similarly, we can decompose into the sum of the first-touch option with the payoff , and no-touch option with the payoff .

The no-touch options can be efficiently calculated if the Fourier transforms of the payoff functions and of options and can be explicitly calculated; then several methods based of the Fourier inversion can be applied.

First, one can apply apply Carr’s randomization method developed in [21, 10, 8, 11] for option pricing in Lévy models. A simple generalization is necessary in the case of no-touch options because, in the setting of the present paper, the payoff functions depend on and not on only as in [21, 10, 8, 11]. Apart from the calculation of the Wiener-Hopf factors, which, for a general Lévy process, must be done in the dual space, the rest of calculations in [21, 10, 8, 11] are made in the state space. The calculations in the state space [10, 8, 11] can be efficient for small and if the tails of the Lévy density decay sufficiently fast. In Section 4.2, we design new efficient procedures for the calculation of the Wiener-Hopf factors. These procedures are of a general interest.

The second method is a more efficient version of Carr’s randomization. The calculations at each step of the backward procedure bar the last one are made remaining in the dual space. These steps are of the same form as in the Hilbert transform method [39] for barrier options with discrete monitoring, with a different operator used at each time step. In [39], the operator is where is the infinitesimal generator of under the probability measure used; in the Carr’s randomization setting, the operator is , where , and is the time step. If is not small and/or the order of the process is close to two222Recall for stable Lévy processes, the order of the process as defined in [21] for processes with exponentially decaying jump densities, is the Blumenthal-Getoor index, then can be efficiently realized using the fast Hilbert transform [39]. Otherwise too long grids may be necessary. An efficient numerical realization of in the dual space requires much longer grids than an efficient numerical realization of if the fast Hilbert transform is used. In the result, this straightforward scheme can be very inefficient. Instead, we can apply the Double Spiral method [56] calculating the Fourier transform of the option price at two contours, at each time step. In [56] discretly sampled Asian options were considered, and a complicated structure of functions arising at each step of the backward induction procedure required the usage of the flat contours of integration. In application to barrier options, the contours in the Double Spiral method can be efficiently deformed and an efficient sinh-acceleration technique developed in [17] applied. Namely, we can use the change of variables of the form and the simplified trapezoid rule. In the result, an accurate numerical calculation of integrals at each time step needs summation of 2-3 dozen of terms in the simplified trapezoid rule. We leave the design of explicit procedures for hedging using both versions of Carr’s randomization to the future.

In the present paper, we directly apply the general formulas for the double Fourier/Laplace inversion. These formulas are the same as the ones in [13] in the case of no-touch options, with the following improvement: instead of the fractional-parabolic changes of variables, the sinh-acceleration is used. In the case of the first touch options, an additional generalization is needed because, contrary to the cases considered in [13], the payoff depends on rather than on only.

One can use other methods that use approximations in the state space. Any such method has several sources of errors, which are not easy to control. Even in the case of pricing European and barrier options, serious errors may result (see [14, 12, 54] for examples), and, typically, very long and fine grids in the state space are needed. The recommendations in [43, 45, 44] for the choice of the truncation parameter rely on the ad-hoc recommendation for the truncation parameter used in a series of papers [37, 38, 36]. As examples in [14, 32] demonstrate, this ad-hoc recommendation can be unreliable even if applied only once. In the hedging framework suggested in the present paper, the truncation needs to be applied many times, for each used in the time-discretization of the initial problem, hence, the error control becomes almost impossible.

3.3. Conditions on processes and payoff functions

We consider the down-and-out case; is the barrier, is the maturity date, and is the payoff at maturity. The most efficient realizations of the pricing/hedging formulas are possible if the characteristic exponent admits analytic continuation to a union of a strip and cone and behaves sufficiently regularly at infinity. For the general definition of the corresponding class of Lévy processes (called SINH-regular) and applications to pricing European options in Lévy models and affine models, see [17]. In the present paper, for simplicity, we assume that the characteristic exponent admits analytic continuation to the complex plane with two cuts.

Assumption .

-

1.

is a Lévy process with the characteristic exponent admitting analytic continuation to the complex plane with the cuts , ;

-

2.

admits the representation , where , and has the following asymptotics as : for any :

(3.5) where , are independent of , and . Then

(3.6)

The condition (3.6) implies that if , then can be admissible. For standard classes of Lévy processes used in finance, this is possible if we consider analytic continuation to an appropriate Riemann surface. See [14, 53] for details. We will not use analytic continuation to Riemann surfaces in the present paper.

Example 3.1.

-

(1)

Essentially all Lévy processes used in quantitative finance are elliptic SINH-regular Lévy processes: Brownian motion (BM); Merton model [60]; NIG (normal inverse Gaussian model) [5]; hyperbolic processes [34]; double-exponential jump-diffusion model [57, 58, 47, 48, 49]; its generalization: hyper-exponential jump-diffusion model, introduced in [51, 57] and studied in detail in [51, 52]; the majority of processes of the -class [50]; the generalized Koponen’s family [19] and its subclass KoBoL [21]. A subclass of KoBoL (known as the CGMY model - see [28]) is given by the characteristic exponent

(3.7) where (in the case , the analytical expression is different: see [19, 21]).

-

(2)

For KoBoL, VG and NTS, admits analytic continuation to an appropriate Riemann surface. This extension can be useful when the SINH-acceleration is applied to calculate the Wiener-Hopf factors, and less so for pricing European options.

- (3)

-

(4)

In [19], we constructed more general classes of Lévy processes, with the characteristic exponents of the form

(3.9) where , , , with modifications in the case and/or . For these processes, the domains of analyticity and bounds are more involved. In particular, in general, the coni are not symmetric w.r.t. the real axis.

Note that in the strongly asymmetric version of KoBoL, in the spectrally one-sided case in particular, the condition does not hold, and should be replaced with .

Assumption .

-

1.

is a measurable function admitting a bound

(3.10) where and are independent of ;

-

2.

either (i) , , or (ii) the Fourier transform of

is well-defined on the half-space , and admits the representation , where and is a rational function decaying at infinity.

Note that only the values , matter, hence, we may replace with , and then there is no need to consider the case (i) separately.

Example 3.2.

-

(a)

: the payoff function of the no-touch option and the square of this payoff;

-

(b)

: the value of the underlying at the maturity date and , and the product of the latter and the payoff of the no-touch digital;

-

(c)

: the square of the underlying at the maturity date and ;

-

(d)

: the payoff function of the call option. , where , and has two simple poles at 0 and .

-

(e)

: the product of the payoff functions of two call options. With , we have the payoff function of a powered call option. has three simple poles at 0, and . If , is given by (2.12).

-

(f)

: the payoff function of the put option; , where , has two simple poles at 0 and .

-

(g)

: the product of the payoff functions of the call and put options. With , we have the payoff function of a powered put option. has three simple poles at 0, and . If , is given by (2.12).

Remark 3.1.

In (a) and (f) (after the multiplication by ), satisfies condition 2 with , in (b) and (d) - with , and in the other cases - with .

3.4. More general payoff functions and embedded options

In the case of embedded options, the simple structure of formalized in Assumption is impossible. The following generalization allows us to consider payoffs that are prices of vanillas and some exotic options. For , define cones in the complex plane , . For , set . Assumption .

-

1.

is a measurable function admitting the bound (3.10);

-

2.

there exist , and such that , where is meromorphic in , has a finite number of poles and decays as or faster as remaining in .

4. Wiener-Hopf factorization

4.1. Wiener-Hopf factorization: basic facts used and derived in [20, 21, 10, 13, 53]

Several equivalent versions of general pricing formulas for no-touch and first touch options were derived in [20, 21, 10, 13, 53], in terms of the Wiener-Hopf factors. In this subsection, we list the notation and facts which we use in the present paper.

4.1.1. Three forms of the Wiener-Hopf factorization

Let be a Lévy process with the characteristic exponent . The supremum and infimum process are defined by and , respectively. Let and let be an exponentially distributed random variable of mean , independent of . Introduce functions

| (4.1) |

and normalized resolvents (the EPV operators under , and , respectively)

| (4.2) | |||||

| (4.3) | |||||

| (4.4) |

If for , then the operators are well-defined in spaces of measurable functions bounded by , where depends on a function but not on , and the Wiener-Hopf factors are well-defined and bounded on the closed strip and analytic in the open strip.

The Wiener-Hopf factorization formula in the form used in probability [62, p. 98] is

| (4.5) |

and its operator analog is proved similarly to (4.5) (see, e.g., [10, 11]). Finally, introducing the notation and noticing that , we can write (4.5) in the form

| (4.6) |

Equation (4.6) is a special case of the factorization of functions on the real line into a product of two functions analytic in the upper and lower open half planes and admitting the continuous continuation up to the real line. This is the initial factorization formula discovered by Wiener and Hopf [65] in 1931, for functions of a much more general form than in the LHS of (4.6).

4.1.2. Explicit formulas for and properties of the Wiener-Hopf factors

Let be a Lévy process with characteristic exponent admitting analytic continuation to a strip , , around the real axis, and let . Then (see, e.g., [22, 21])

(I) there exist such that

| (4.7) |

(II) the Wiener-Hopf factor admits analytic continuation to the half-plane , and can be calculated as follows: for any ,

| (4.8) |

(III) the Wiener-Hopf factor admits analytic continuation to the half-plane , and can be calculated as follows: for any ,

| (4.9) |

Note that one may use instead of ; the integrals (4.8)-(4.9) do no change. Naturally, in this case, we require

| (4.10) |

Under additional conditions on , there exist more efficient formulas for the Wiener-Hopf factors. See Section B.

4.1.3. Analytic continuation of the Wiener-Hopf factors w.r.t. , for fixed

Under Assumption , is analytic in the complex plane with two cuts and , and, for any , as remaining in the strip. Hence, for , there exists s.t. if , then (4.7) holds. It follows that, for in the half-plane ,

Remark 4.1.

It follows that (resp., ) admits analytic continuation w.r.t. to (resp., ).

For and , introduce the function

and the curve , the image of the real line under . If , the curve is flat (wings point upward, wings point downward, respectively). For simplicity, we will use only; if admits analytic continuation to an appropriate Riemann surface, then can be used, and then the curve lies on this surface. See [14, 13, 53, 17] for details, and Fig. 2 for an illustration.

Depending on the situation, we will need the Wiener-Hopf factors either on a curve with the wings pointing up (), or on a curve with the wings pointing down (). In the former case, we deform the contour of integration (in the formula for the Wiener-Hopf factors that we use) so that the wings of the deformed contour point down (), and in the latter case - up (). This straightforward requirement is easy to satisfy, as well as the second requirement: the curves do not intersect. Indeed, if and , the curves do not intersect if and only if the point of intersection of the former with the imaginary axis is above the point of the intersection of the latter with the same axis:

| (4.13) |

The last condition on is that for of interest, the function (or ) is well-defined, and, in the process of the deformation of the initial line of integration into , image does not intersect . If the parameters of the curve are fixed, this requirement is satisfied if and is sufficiently large. For details, see [53], where a different family of deformations (farctional-parabolic ones) was used. In cases of the sinh-acceleration and fractional-parabolic deformation, at infinity, the curves stabilize to rays, hence, the analysis in [53] can be used to derive the conditions on the deformation parameters if .

If the Gaver-Stehfest method is applied, then we need to use the Wiener-Hopf factorization technique for only, and the analysis in [53] suffices. An alternative method used in [13] is to deform the contour of integration in the Bromwich intergral; in this case, the deformation of the latter and the deformation of the contours in the formulas for the Wiener-Hopf factors must be in a certain agreement. We outline the restrictions on the parameters of the deformations in Section C.

For positive , the maximal (in absolute value) are easy to find for all popular classes of Lévy processes used in finance. As it is proved in [21] (see also [53]), the equation has either 0 or 1 or two roots in the complex plane with the two cuts and . Each root is purely imaginary, and of the form , where and . If the root exists, then otherwise .

4.2. Calculation of the Wiener-Hopf factors using the sinh-acceleration

If for the Laplace inversion the Gaver-Stehfest method or other methods utilizing only positive is used, then we can take any and . If admits analytic continuation to an appropriate Riemann surface (as it is the case for the some classes of Lévy processes), then can be used. The curve lies in the complex plane but the “conical” region around the curve, in the -coordinate, is a subset of the Riemann surface. See [14, 13, 53, 17] for details. In [14, 13, 53], fractional-parabolic deformations of the contour of integration into a Riemann surface significantly increased the rate of the decay of the integrand as compared to deformations into the complex plane with the two cuts; the number of terms in the simplified trapezoid rule decreased by a factor of 10-1000 and more (see [54] for a detailed analysis). If the sinh-acceleration is used, the gain is not large if any: the number of terms in the simplified trapezoid rule decreases by a factor of 1.5-2, at best, but the analytic expressions that one has to evaluate become more involved. Hence, in the present paper, we use , of opposite signs. The sinh-acceleration has another advantage as compared to the fractional-parabolic deformations. As it is shown in [53], if is small (which is the case for some terms in the Gaver-Stehfest formula if is large), then one of the in Subsection 4.1.2 or both are small in absolute value, and then the strip of analyticity of the integrand is too narrow. Hence, if the fractional-parabolic change of variables is applied, the size of the mesh in the simplified trapezoid rule necessary to satisfy the desired error tolerance is too small, and the number of terms too large. A rescaling in the dual space can increase the width of the strip of analyticity but then the product must increase, and the decrease in is insignificant. If the sinh-acceleration is used, then the rescaling (using an appropriately small ) does not increase significantly. Roughly speaking, in the recommendation for the choice , should be replaced with , where is a moderate constant independent of and other parameters. As numerical examples in [16] demonstrate, this kind of rescaling is efficient even if the initial strip of analyticity is of the width and less. Hence, in this paper, we will use the Gaver-Stehfest method with the Rho-Wynn acceleration. For each , we use the following versions of (4.8)-(4.9):

-

(i)

for ,

(4.14) -

(ii)

for ,

(4.15)

Each integral is evaluated applying the simplified trapezoid rule.

4.3. Numerical examples

In Table 8, we apply the above scheme to calculate in KoBoL model of order . If the factors are calculated at 30 points, then approximately 1.5 msec is needed to satisfy the error tolerance , and 1.0-1.2 msec are needed to satisfy the error tolerance . The number of terms is in the range 350-385 in the first case, and 159-175 in the second case. To satisfy the error tolerance of the order of , about 500 terms would suffice but, naturally, high precision arithmetics will be needed.

5. Calculation of no-touch options and expectations of no-touch products

5.1. General formulas for no-touch options

In [10, 13, 53], it is proved that the Laplace transform of w.r.t. is given by

| (5.1) |

The result is proved under conditions more general than Assumptions and .

Let denote the operator of the Fourier transform, and set . The operator arises systematically in the theory of the Wiener-Hopf factorization and boundary value problems. See [35] for the general setting in applications to multi-dimensional problems. Using and and taking into account that , we rewrite (5.1) as

| (5.2) |

Lemma 5.1.

Let be an analytic function in a strip , where , that decays as as remaining in the strip.

Then is analytic in the half-plane , and can be defined by any of the following three formulas:

-

a)

for any ,

(5.3) -

b)

for any ,

(5.4) -

c)

(5.5) where denotes the Cauchy principal value of the integral.

Proof.

b) We push the line of integration in (5.6) down. On crossing the simple pole at , we apply the Cauchy residue theorem, and obtain (5.4).

∎

Remark 5.1.

-

a)

Let . Then (5.5) can be written in the form where is the identity operator, and is the Hilbert transform. Therefore, a realization of is, essentially, equivalent to a realization of .

-

b)

Similar formulas are valid in the multi-dimensional case, and for acting in appropriate spaces of generalized functions. In particular, the condition on the rate of decay of at infinity can be relaxed. Under appropriate regularity conditions on , equation (5.5) can be proved for defined on the line , the result being a function on the same line that admits analytic continuation to the half-plane below this line. See [35].

The following theorem is a part of the proof of the general theorem for pricing no-touch options in [20, 21]; we will outline the proof based on (5.2).

Theorem 5.2.

Let Assumptions and hold, and let and . Then there exists such that for all in the half-plane , and all ,

| (5.8) | |||||

Proof.

We can choose so that, for a fixed in the half-plane , and are analytic in the strip . Hence, the product is analytic in the same strip, and, by Lemma 5.1, the function is analytic in the half-plane . Applying (5.4), we obtain (5.8)-(5.8). In more detail, on the RHS of (5.8), we obtain, first,

and then apply the Wiener-Hopf factorization formula (4.6). The integrals on the RHS of (5.8)-(5.8) absolutely converge (or absolutely converge after integration by parts in the oscillatory integrals w.r.t. ) and their sum equals . See [20, 21, 9].

∎

Denote by the set of ’s in the Gaver-Stehfest formula and by the weights. We have an approximation

| (5.9) |

It remains to design an efficient numerical procedure for the evaluation of , .

5.2. Sinh-acceleration in the integrals on the RHS of (5.8)-(5.8)

First, we rewrite (5.8)-(5.8) as follows: for ,

| (5.11) | |||||

where and satisfy the conditions in Assumption .

As , . If the order or , then as in the domain of analyticity; if and , then one of the Wiener-Hopf factors stabilizes to constant at infinity, and the other one decays as . Since , it is advantageous to deform the outer contour on the RHS of (5.11) so that the wings of the deformed contour point upward: , where . At this stage, we deforms the contour so that no pole of the integrand (if it exists) is crossed, and consider the cases of crossing later. In all cases, in the process of deformations, the curves must remain in , where is the cone in Assumption , and . If Assumption holds, then we may take any ; in our numerical experiments, we will take .

The type of the deformation of the inner contour depends on the sign of . If , which, in the case of puts and calls means that the strike is above or at the barrier, then we may deform the contour downward. The deformed contour is of the form , where ; as in the case of the deformation of the outer contour, we choose the parameters of the deformation so that, in the process of deformation, no pole of the inner integrand is crossed, and consider the cases of crossing later. The parameters of the both contours are chosen so that is strictly above . The case (the strike is below the barrier) is reducible to the case . We have , hence, Assumption is valid with . If is the value function of an embedded option, then is possible (e.g., the strike of the embedded European put or call is below the barrier). We consider this case separately, in Section 5.4.

The type of deformation of the contour of integration on the RHS of (5.11) depends on the sign of . If , we use , and if , then . If , then either deformation can be used. We conclude that, for the majority of applications when embedded options are not involved, we may use deformed contours of the form in the outer integral and of the form in the inner integral, and, for , write

where the type of the deformed contour depends on the sign of : if , and if . To evaluate the integrals numerically, we make the changes of variables and , and apply the simplified trapezoid rule w.r.t. and .

5.3. Crossing poles

For simplicity, we consider the case . Hence, the results in this Subsection can be applied only if the Gaver-Stehfest method or other similar methods are applied.333 Under additional assumptions on the process, similar constructions can be applied if the contour deformation in the Bromwich integral is applied. See, e.g., [55], where the fractional-parabolic deformation was applied. Assume that both solutions exist.

5.3.1. Case ,

If or , the condition means that the corresponding European call is ITM or ATM, and put OTM or ATM. Recall that the initial lines of integration and the deformed contours are in the strip of analyticity of the integrand, around the real axis. It follows that the intersection of (resp., ) with the imaginary line is below (resp., above ). On the RHS of (5.2), we move up (resp., down), cross the simple pole at (resp., at ), and stop before the cut (resp., ) is reached. On crossing the pole, we apply the residue theorem and the equalities

| (5.13) |

which follow from (4.11)-(4.12). Denote the new contours and . In the last integral on the RHS of (5.2), we deform into (or a contour with the properties of ). In the process of the deformation, we may have to cross the poles of that are above the line but below the contour . Let the set of these poles, and let the poles be simple and different from ; then

Note that if do not exist or not crossed in the process of the deformations, than (5.3.1) is valid after all terms with are removed. In applications to pricing call options, , where , and has two simple poles at , it is advantageous to cross these two poles even if the poles are not crossed:

5.3.2. Case

In typical examples or , the corresponding European call is OTM, and put ITM. In the case , the last two terms on the RHS of (5.3.1) appear as we push up the line of integration in the last integral on the RHS of (5.2). Now , hence, we deform this line down, and obtain (5.3.1) with the following modification: the last three terms on the RHS are replaced with the sum

| (5.16) |

5.3.3. Approximate formulas in the case of a wide strip of analyticity

If are large, is not large, so that are not large in absolute value, and and are nor very small in absolute value, then we can choose the deformations and so that the integrals over and are small, and can be omitted (we do not copy-paste the result in order to save space); a small error results. The resulting formulas are given by simple analytical expressions in terms of and (see [53]). E.g., if , then

5.4. Case of the value function of an embedded put option, with the strike below the barrier

Let ; then . We deform both contours on the RHS of (5.11) up. First, we deform the outer contour into , and then the inner one, into . We choose the parameters of the latter so that is strictly below , and, furthermore, so that the angles between the asymptotes of the two contours are positive: . Instead of (5.2), we have

The crossing of possible poles can be done similarly to the case .

5.5. Numerical examples

5.5.1. Pricing no-touch options and first touch digitals, down case (Table 9)

Let and be the prices of the no-touch and first touch digital option, respectively. Then, for any and , is given by

| (5.19) | |||||

A similar formula for (see [53]) is

| (5.20) |

where . The integrals on the RHSs of (5.19) and (5.20) differ by scalar factors in front of the integrals, hence, both options can be evaluated simultataneously. If exists and is not small, it may be advantageous to move the line of integration up and cross the simple pole at .

In both cases, the line of integration is deformed into a contour in the upper half-plane, with wings pointing up. To evaluate , we use (4.8) to calculate (the line of integration is deformed into a contour in the lower half-plane with the wings pointing down), and then (4.11). We calculate prices of no-touch options and first touch digitals in the same KoBoL model as in Table 2. Our numerical experiments show that, for integrals for the Wiener-Hopf factor and the Fourier inversion, the relative error of the order of E-8 and better (for prices) can be satisfied using the general recommendations of [17] for the error tolerance ; if is used, the pricing errors decrease insignificantly. Hence, in this example, the errors of GWR method are of the order of . The CPU time (for 7 spots) is less than 10 msec for the error tolerance , and less than 25 msec for the error tolerance . The bulk of the CPU time is spent on the calculation of the Wiener-Hopf factor at the points of the chosen grids; this calculation can be easily paralellized, and the total CPU time significantly decreased. The CPU time can be decreased further using more efficient representations for the Wiener-Hopf factors.

5.5.2. Pricing down-and-out call option (Tables 10-11)

We consider the same model, and the call options with the strikes In both cases, the barrier , and . In (5.3.1), we make the corresponding changes of variables and apply the simplified trapezoid rule. In Table 10, we see that even in cases when the spot is close to the barrier, the error tolerance of the order of E-05 and smaller can be satisfied at a moderate CPU-time cost: about 0.1 msec for the calculation at 7 spots.

In Table 11, we show the prices for very close to the barrier ( and the prices divided by . We see that the ratio is approximately constant which agrees with the asymptotics of the price of the down-and-out option

6. Pricing first-touch options and expectations of first-touch products

Conditions on processes and payoff functions are the same as in Section 3.3. We consider the down-and-in case; is the barrier, is the maturity date, and is the payoff at the first entrance time into . We need to calculate .

6.1. The simplest case

Let , where . For , is the time-0 price of the first-touch digital, for of the stock which is due at time if . The case of the down-and-in forwards obtains by linearity. If we need to calculate the expectation of the product of two payoffs of this form, may assume value ; in this case, we need to replace with .

Since , is finite for any in the right half-plane. Furthermore, for any , there exists such that, for any in the half-plane , admits analytic continuation to the half-plane . For such and , the general formula for the down-and-out options derived in [20, 10] (see also [13, 53]) is applicable: for ,

| (6.1) |

Assuming that we use the Gaver-Stehfest method to evaluate the Bromwich integral (the outer integral on the RHS of (6.1)), we need to calculate the inner integral for . As in the case of no-touch options, we deform the contour upward and cross the simple pole at if exists and is not close to :

If is not very small, not too large and and are large, then a good approximation can be obtained using the last term on the RHS above and omitting the integral over .

6.2. General case

Even in a simple case of the down-and-in option which, at time , becomes the call option with strike and time to maturity, , the payoff at time , is more involved than the payoff functions in [20, 10] because the pricing formulas in [20, 10] were derived under assumption that the dependence of on is of the simplest form . If we calculate the expectation of the product of a discounted down-and-in call option and , then . In the case of the expectation of the product of discounted prices of European options, the structure of is even more involved.

First, we calculate the expectation in the general form, and then make further steps for the special cases mentioned above. We repeat the main steps of the initial proof in [20] omitting the technical details of the justification of the application of Fubini’s theorem; they are the same as in [20, 9]. Let be the infinitesimal generator of . Recall that the pseudo-differential operator with the symbol is the composition of the Fourier transform, multiplication operator by the function , and inverse Fourier transform. If is well-defined and analytic in a strip, admits analytic continuation to the same strip, and the product decays sufficiently fast as remaining in the strip, an equivalent definition is , for in the strip. For details, see [35, 21, 20].

The function is the bounded sufficiently regular solution of the boundary value problem

| (6.2) | |||||

| (6.3) | |||||

| (6.4) |

Making the Laplace transform w.r.t. , we obtain that if is sufficiently large, then, for all in the half-plane , solves the boundary problem

| (6.5) | |||||

| (6.6) |

in the class of sufficiently regular bounded functions. If is the (sufficiently regular) solution of the family of boundary problems (6.5)-(6.6) on , then can be found using the Laplace inversion formula. Finally, .

The family of problems (6.5)-(6.6) is similar to the one in [20]; the only difference is a more involved dependence of on (in [20], ). Hence, we can apply the Wiener-Hopf factorization technique as in [20] and obtain

| (6.7) |

Let . If is sufficiently large, then, for in the half-plane , is analytic in the half-plane . For in this half-plane, the double Laplace-Fourier transform of w.r.t. is given by

| (6.8) |

where is the Fourier transform of , . We take , and, similarly to the proof of Lemma 5.1, calculate

The result is: for s.t. and ,

| (6.9) |

Applying the inverse Fourier transform, we obtain

| (6.10) |

Since , we deform the outer contour upward, the new contour being of the type (meaning: of the form , where ):

| (6.11) |

If exists and is not close to , we push the contour up, cross the simple pole at , and obtain

| (6.13) | |||||

An admissible type of the deformation of the inner integral on the RHS of (6.13) and the integral on the RHS of (6.13) depends on the properties of . If is the price of a vanilla option or the product of prices of two vanilla options, then an admissible deformation is determined by the relative position of the barrier and the strikes of the options involved. Hence, we are forced to consider several cases.

6.3. Down-and-in call and put options

6.3.1. Call option, the strike is at or above the barrier

Consider first the down-and-in call option. Since the strike is at or above the barrier, . We must have . Let and be such that if and . Then the double Laplace-Fourier transform w.r.t. of the discounted price is well-defined in the region , and it is given by

Integrating, we obtain , where , and

| (6.14) |

Under condition , for each , is a meromorphic function in the complex plane with two cuts , and simple poles at , (and , if the latter exist). Since , we may deform the inner contour of integration on the RHS of (6.13) and the contour of integration on the RHS of (6.13) down. On the strength of (4.6),

Hence, (6.11) becomes

| (6.15) |

and (6.13)-(6.13) can be rewritten as

If exists, we can cross the pole at , and obtain

6.3.2. Put option, the strike is at or above the barrier

6.3.3. Call option, the strike is below the barrier

We start with the contour , where . Since , we need to deform the inner contour of integration on the RHS of (6.13) and the contour of integration in (6.13) up. Since is analytic and bounded in the half-plane , the inner integrand on the RHS of (6.3.1) has three simple poles at , and the 1D integrand on the RHS of (6.3.1) has three simple poles at ; after the poles are crossed, we can move the line of integration up to infinity, and show that the integrals after crossing are zeroes. Hence, we obtain

Remark 6.1.

If either do not exist or not crossed, in all cases above the contours of the types are used, and, in all formulas above, all the terms that contain should be omitted.

6.3.4. Put option, the strike is below the barrier

Evidently, the price is the same as the one of the European put.

6.3.5. The case of the product of discounted a European call or put option and

In the case of the call option, we have . Assuming that , we take , and write

Let and choose and so that if and . Then the double Laplace-Fourier transform of w.r.t. is well-defined in the region , and it is given by

Thus, , where and

If the strike is at or above the barrier, the remaining steps are essentially the same as in Subsections 6.3.1-6.3.2. The poles of the integrands are at and rather than and , and the contour must be below rather than . Also, due to a different factor in the denominator, we have an additional restriction on and . Furthermore, instead of the equality we have a more complicated equality

hence, some of the poles and the corresponding residue terms are different.

In the case of the put, the calculations are the same only must be chosen at the first step, and in the process of the deformation of the contours of integration w.r.t. down, tho poles at are crossed rather than at .

If the strike is below the barrier, the above argument is modified similarly to the modification in Subsection 6.3.3.

6.4. The case of the product of two European call or put options

6.4.1. General formulas

In the case of calls, we have

where . Set . Assuming that , we take , and calculate, first, the Laplace transform of

Using the Fubini theorem, we have

Since , we derive

Next, the Fourier transform of is well-defined in the half-plane by , therefore, taking , we can represent

in the form

where

Since , we deform the outer contour into a contour of the form , crossing the pole at if it exists:

If the first option is a call and the other is a put, then and should satisfy , where are the parameters that define the curve (recall that the lowest point of the latter is ). In the case of two put options, the calculations are the same but we take , and (6.4.1) can be justified if .

6.4.2. Reductions

All three cases are reducible one to another. We start with the product of two call options. We move the lines of integration , , , up, and, on crossing the poles, apply the residue theorem. Let , . Then, moving the innermost line of integration up, we obtain

The first term on the RHS is the integral for the case of a call and put, the remaining two terms can be calculated similarly to the integrals in formulas for put and call options. If , the line is deformed into a contour of the form , and if , then of the form or . The new contour must be strictly below the contour of integration w.r.t. , and the angles between the asymptotes of the two contour must be non-zero.

Pushing the lines of integration w.r.t. up, we obtain a repeated integral which arises when the product of puts is considered (plus 4 one-dimensional integrals):

Below, we consider the calculation of the repeated integrals above, denote them , for strikes below or above the barrier. Depending on a case, it will be convenient to calculate either or or , and, then, if necessary, use (6.4.2) and (6.4.2).

Since the choice of the parameters of the contours of integration are simpler if the contours of integration w.r.t. are in the lower half-plane, we would recommend the reduction to the case of two calls unless is much smaller than .

6.4.3. Both strikes are at or above the barrier

Since , the contours of integration w.r.t. and are deformed down, into contours of the form , where are different from the ones in (6.4.1). In the process of the deformation, neither of these two contours may cross the cut . In addition, the factor must remain separated from 0 for all on the contours. A simple general requirement (sufficient for large ; if is not large, an additional control of the behaviour of the contours in the process of the deformation is needed) is as follows. By Assumption , is of the form , where and , where , and . Hence, we can choose the sinh-deformation with the desired properties in the following cases

-

(1)

if or then ;

-

(2)

if and , then .

If and , then only less efficient conformal deformations and changes of variables are possible (labeled sub-polynomial in [15] where efficient methods for evaluation of stable distributions have been developed). Keeping the notation for this case as well, we obtain

If the characteristic exponent is a rational function, then we may push the contour to infinity upwards, and downwards. After all the poles are crossed, instead of the triple integral, we will obtain a triple sum expressible in terms of , the parameters of the characteristic exponent and its roots and poles.

The same can be done in the beta-model [50]; the resulting sums will be infinite, though, and one will have to solve a rather non-trivial problem of a sufficiently accurate truncation of these infinite sums.

6.4.4. The case when one of the strikes is below the barrier

Let . Then , and the sinh-deformation of the line of integration w.r.t. is impossible, hence, we apply the simplified trapezoid rule to the initial integral w.r.t. (flat iFT). The integrands decay very slowly, hence, the number of terms in the simplified trapezoid rule is too large. The number can be significantly decreased using the summation by parts in the infinite trapezoid rule

if decreases faster than as (as is the case in the setting of the present paper). Indeed, then the finite differences decay faster than as as well. The summation by parts formula is as follows. We choose so that is not close to 0. Then

If each differentiation increases the rate of decay, then the summation by part procedure can be iterated. In the setting of the present paper, the rate of decay increases by approximately 1 with each differentiation. In the numerical examples, we apply the summation by parts 3 times, which decreases the number of terms many times, and makes the number comparable to the number of terms when the sinh-acceleration can be applied.

6.4.5. The case when both strikes are below the barrier

In this case, the sinh-acceleration in the integrals w.r.t. and is impossible, hence, we apply the simplified trapezoid rule to the initial integrals w.r.t. and . The numbers can be significantly decreased using the summation by parts in the infinite trapezoid rule applied to evaluate the repeated integrals on the RHS of (6.4.3).

7. Semi-static hedging vs Variance minimizing hedging of down-and-in options: a numerical example and qualitative analysis

In this section, we present and discuss in detail several important observations and practically important conclusions using an example of a down-and-in call option. The process (KoBoL) is the same as in Table 2 , maturity is , but the strike is farther from the barrier than in Table 2 . The reason for that is two-fold: 1) to show that if the restrictive formal conditions for the semi-static hedging are satisfied, then the semi-static procedure works reasonably well for jump-processes with a rather slowly-decaying jump component even if the distance from the barrier to the support of the artificial exotic payoff is sizable (about 4 percent); 2) if this support is too close to the barrier, then the summation-by-part procedure can be insufficiently accurate unless high precision arithmetic is used. In the paper, we do calculation with double precision.

We consider the standard situation: an agent sells the down-and-in call option, and invests the proceeds into the riskless bond. We assume that the spot is almost at the strike. That is, the agent makes the bet that the barrier will not be breached during the lifetime of the option.

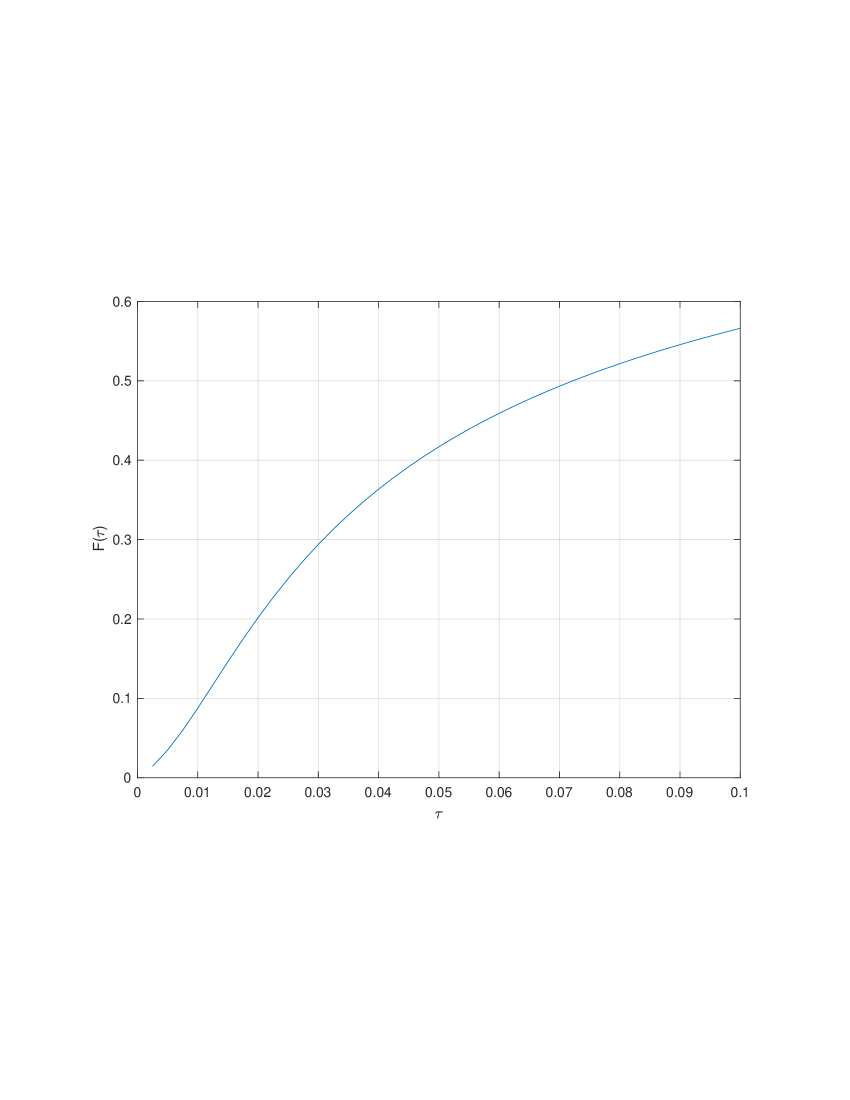

Fig. 3 shows that the probability of this happy outcome is not very large; even the probability that the barrier will be breached before is about 42%.

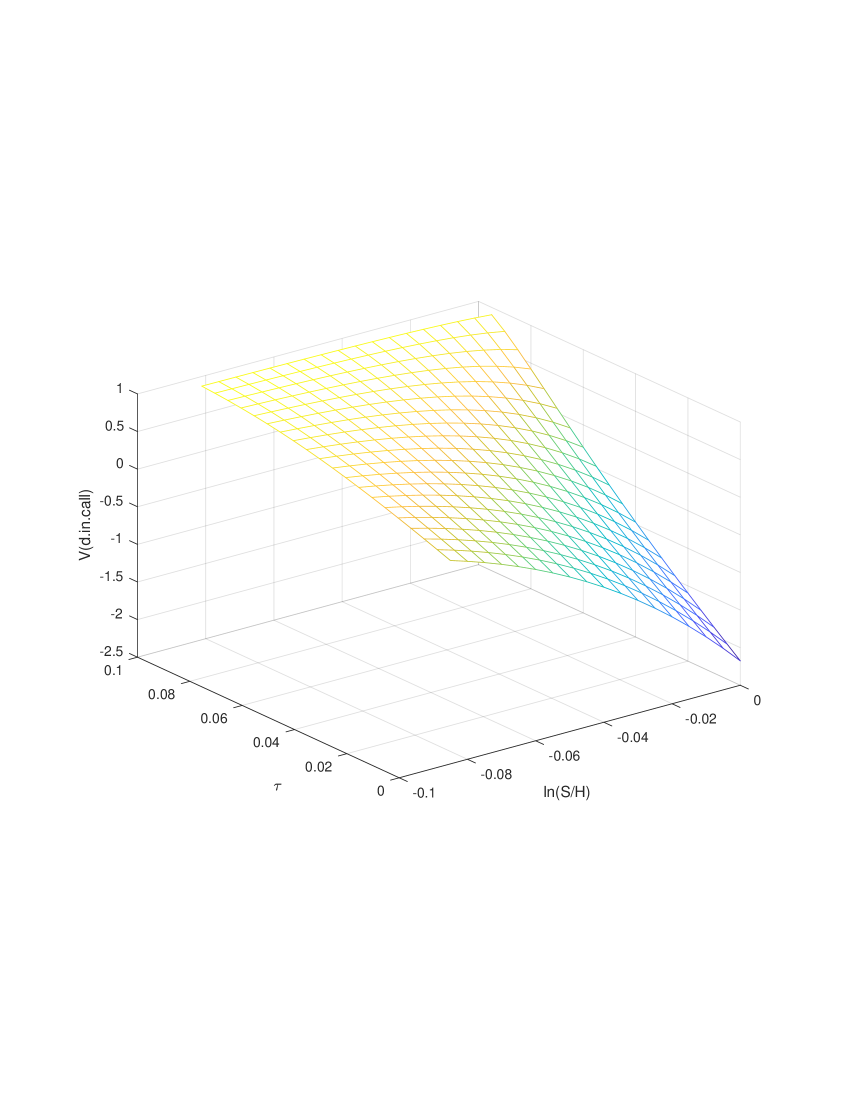

However, with the probability about 50%, at the time the portfolio is breached, the portfolio value is positive. This is partially due to the fact the bond component in the portfolio increases fairly fast.444Recall that even a small asymmetry of the jump component requires the riskless rate be sizable in order that the semi-static procedure be formally justified. Nevertheless, if the barrier is breached at time close to 0, the loss in the portfolio value can be rather sizable (see Fig. 4). Hence, it is natural for the agent to hedge the bet.

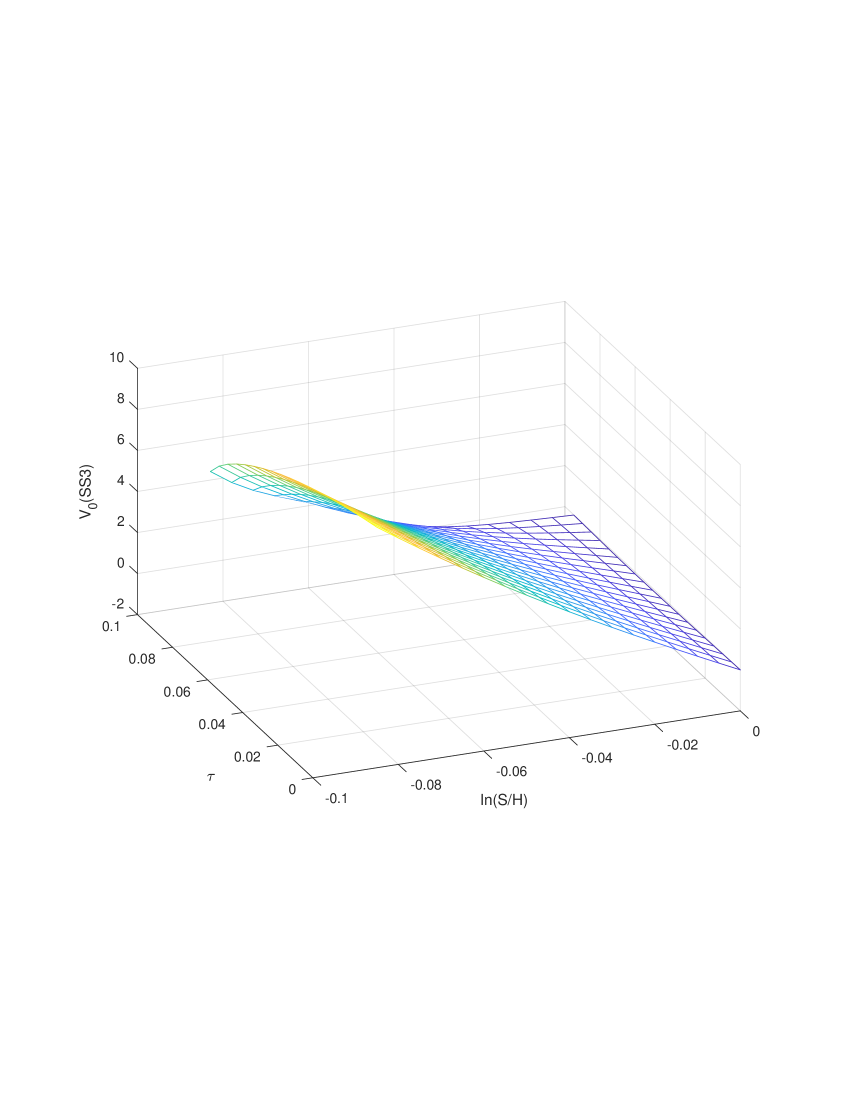

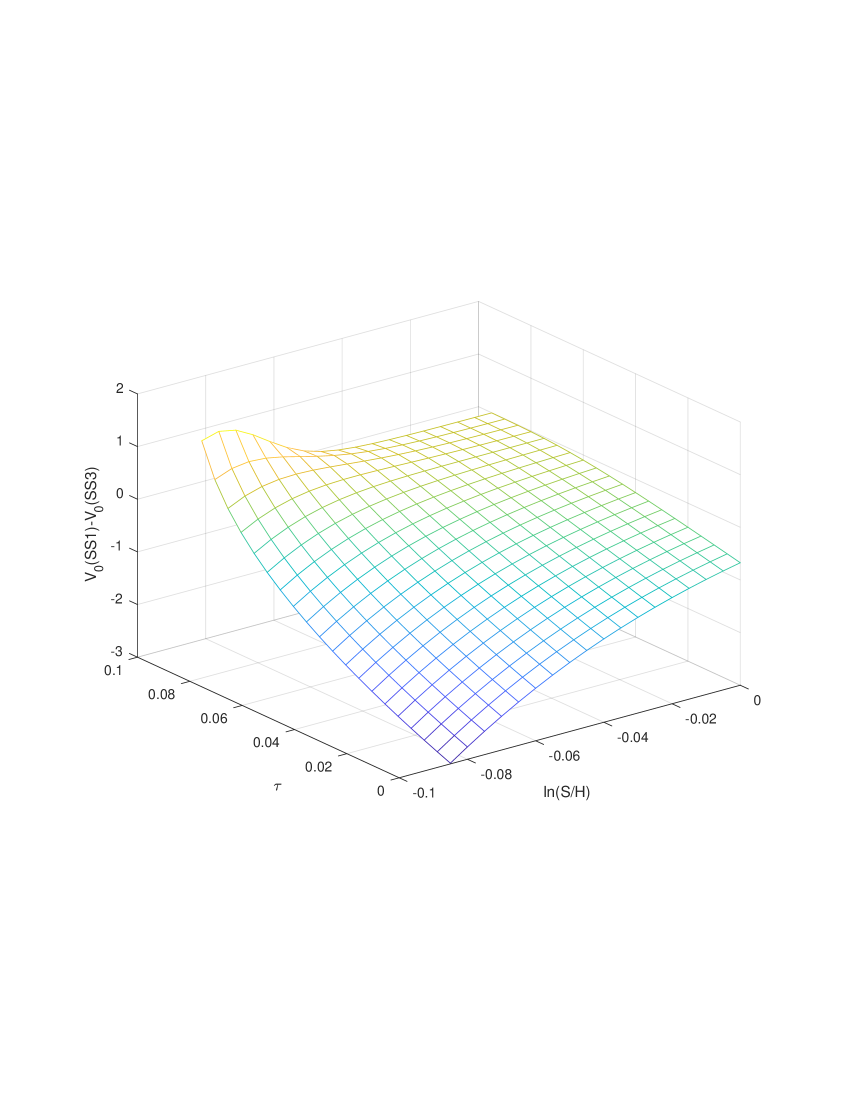

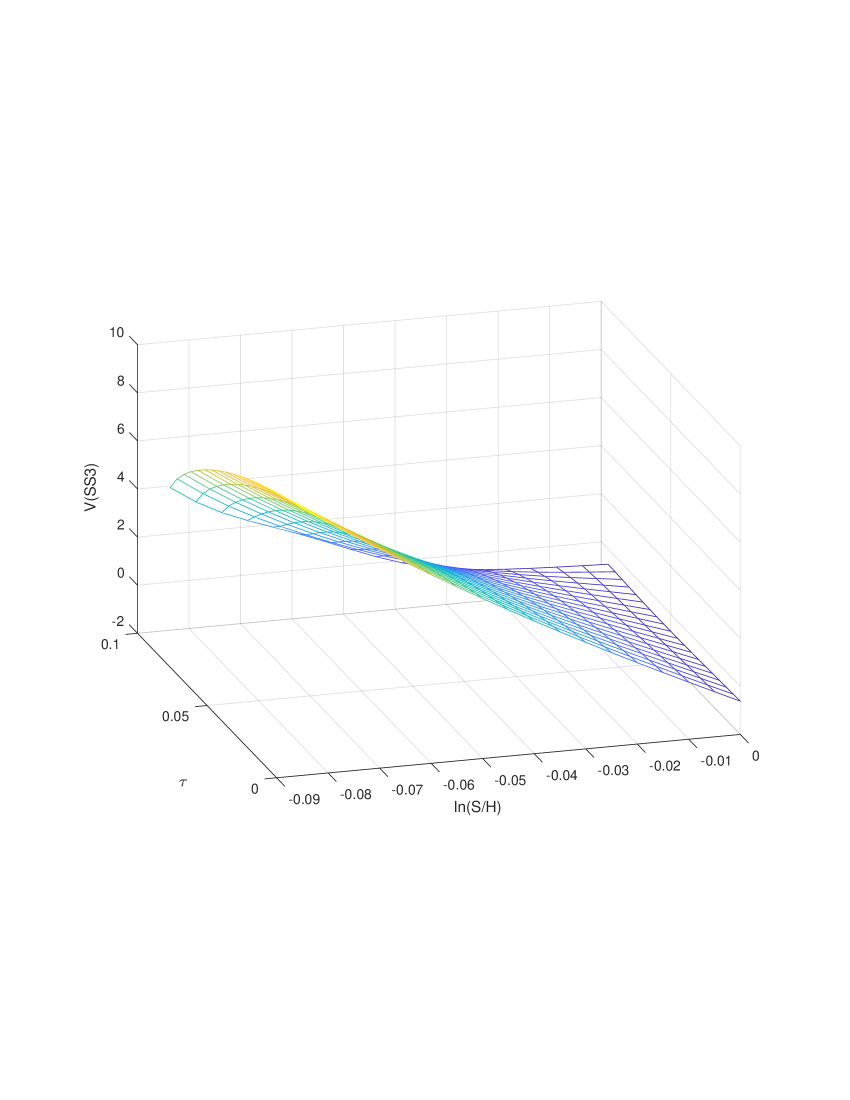

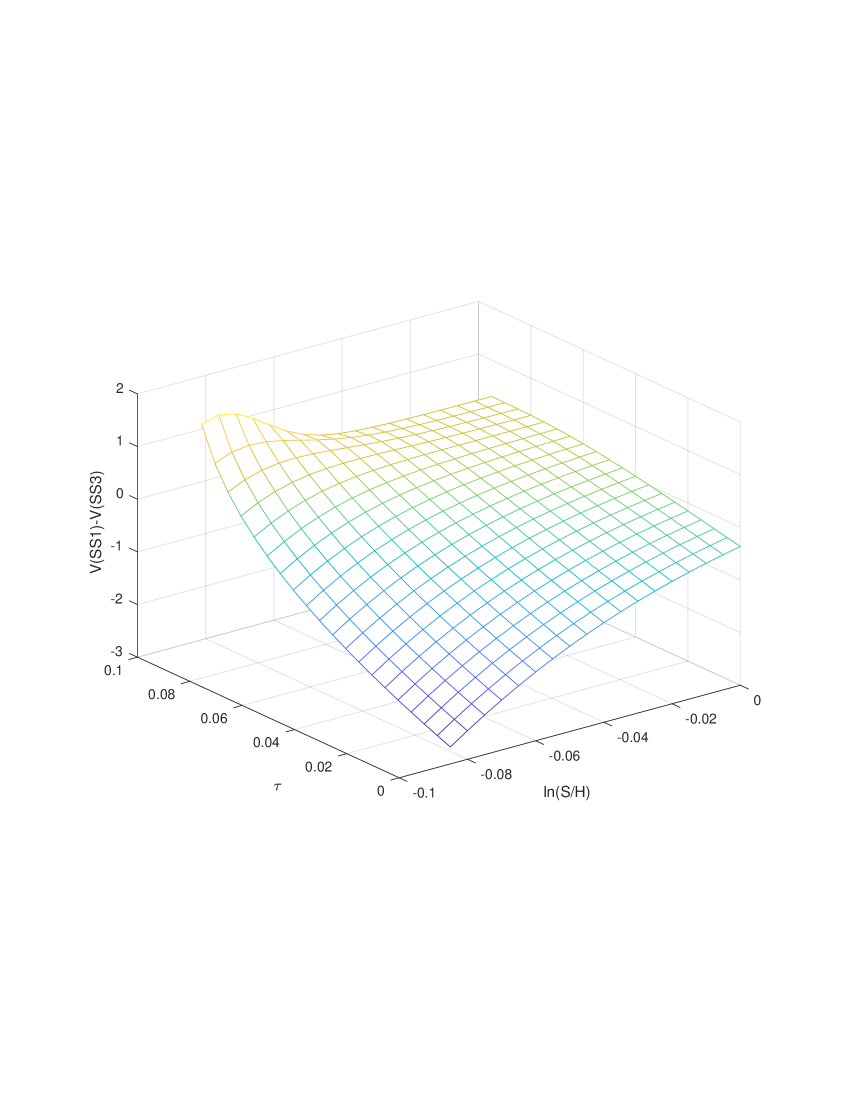

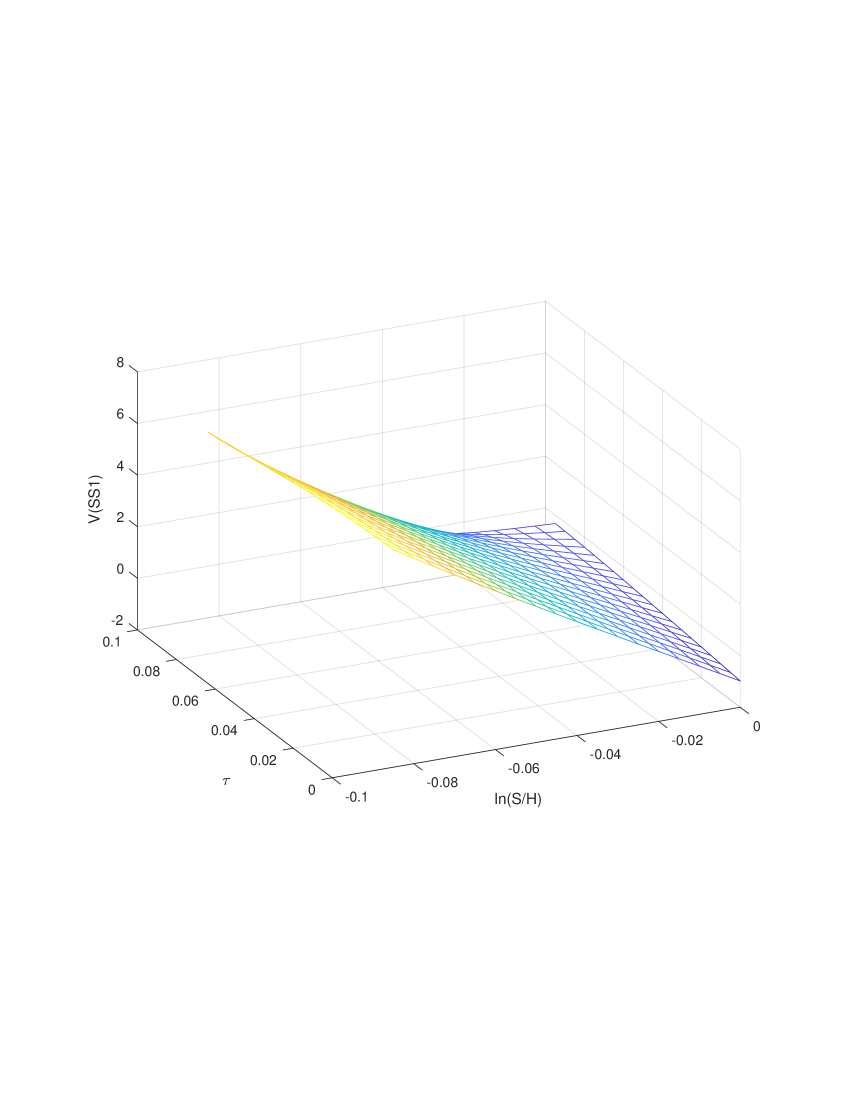

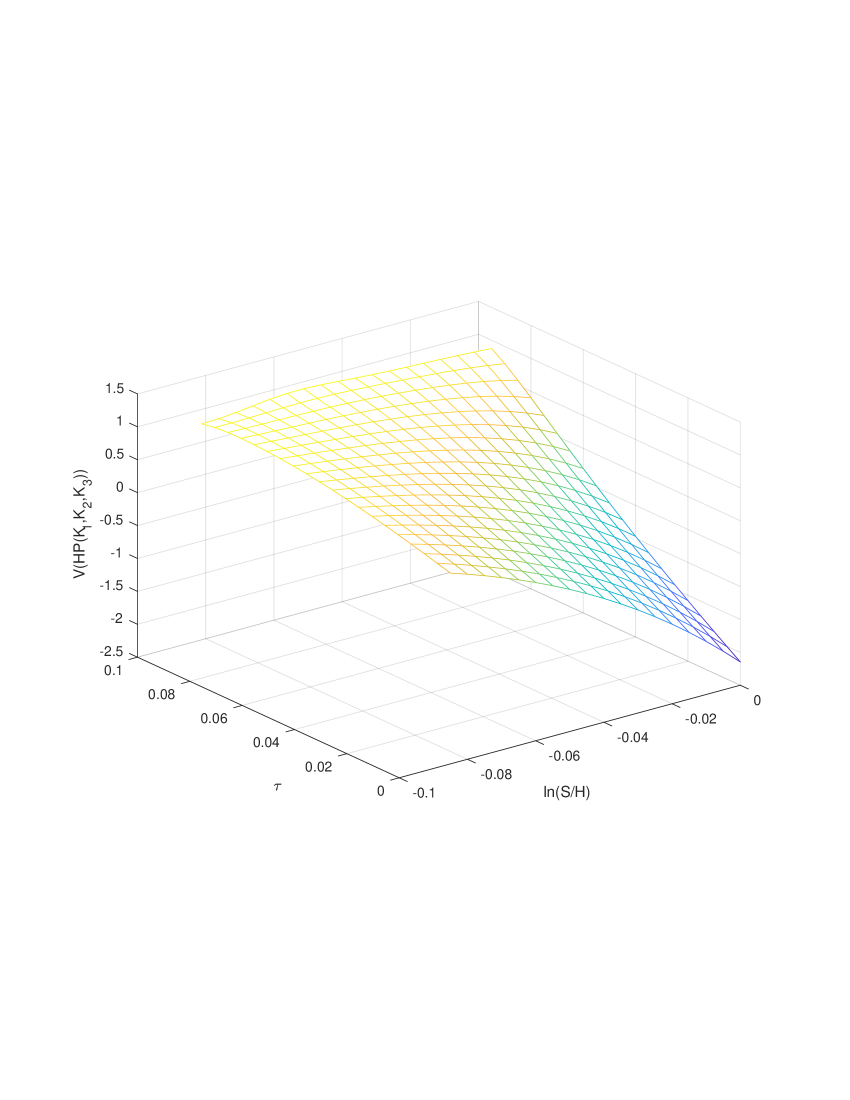

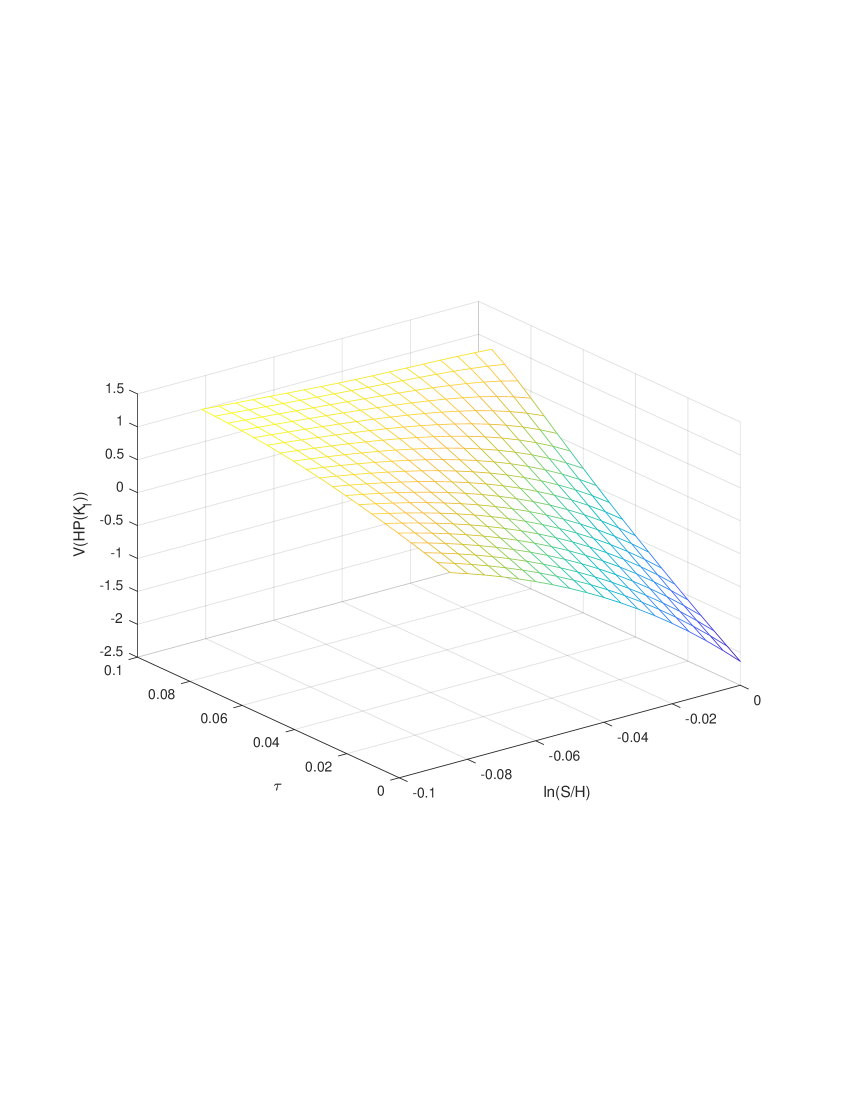

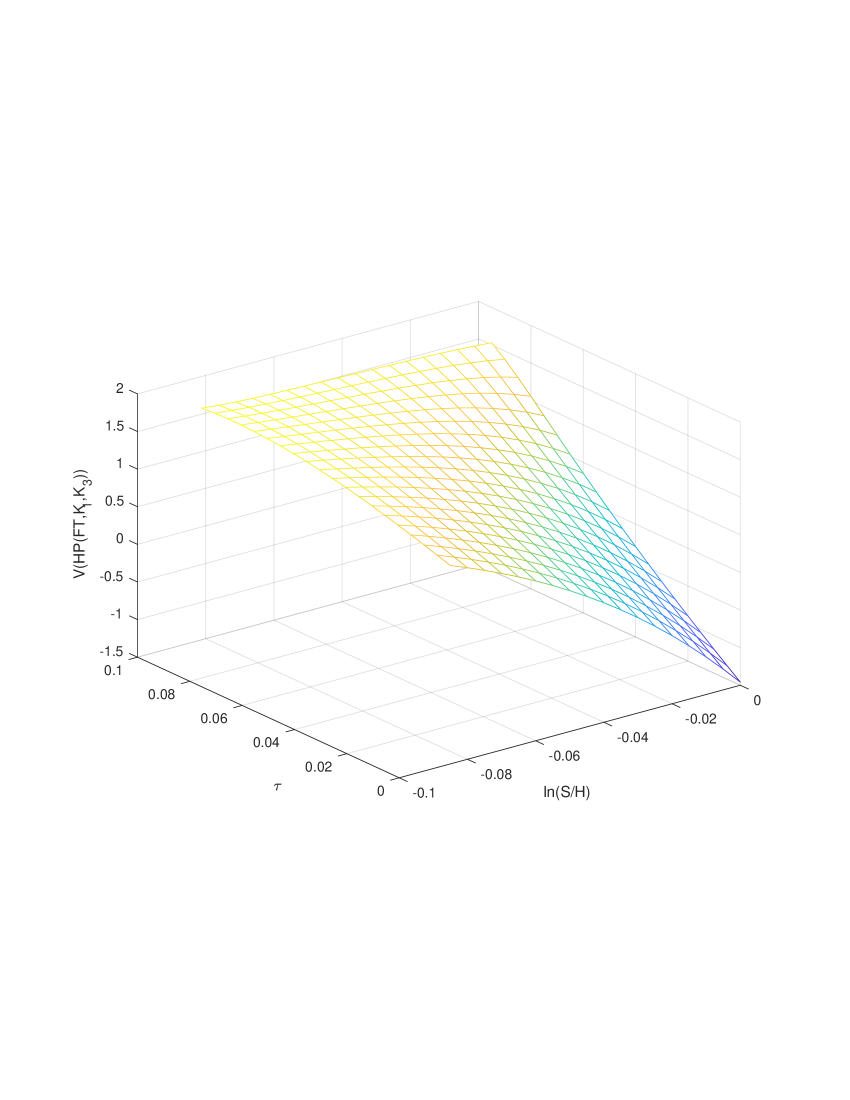

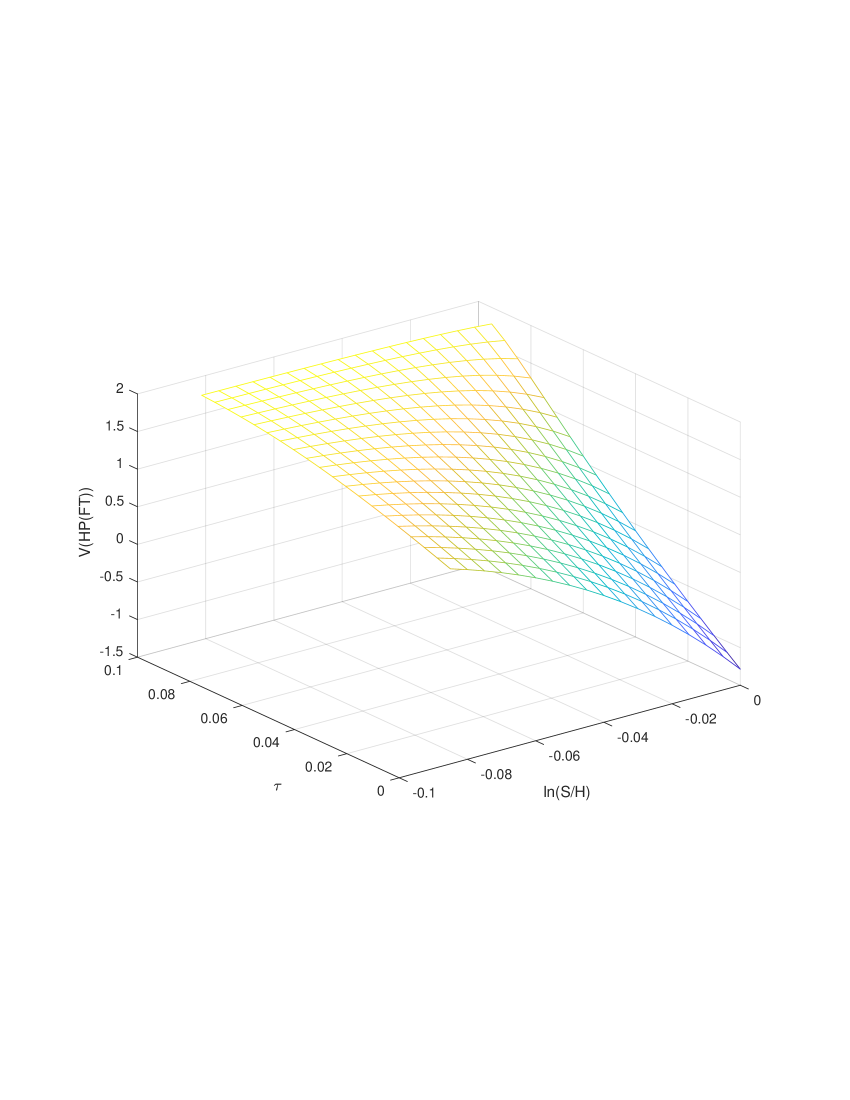

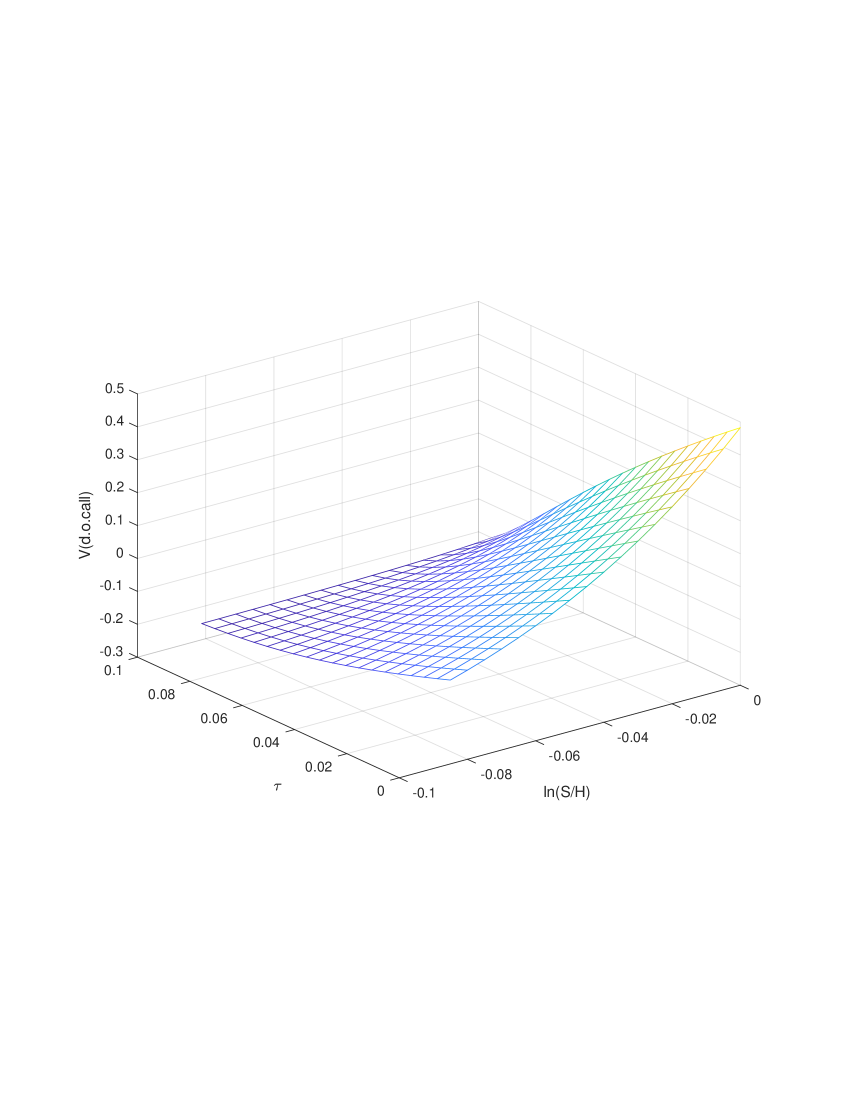

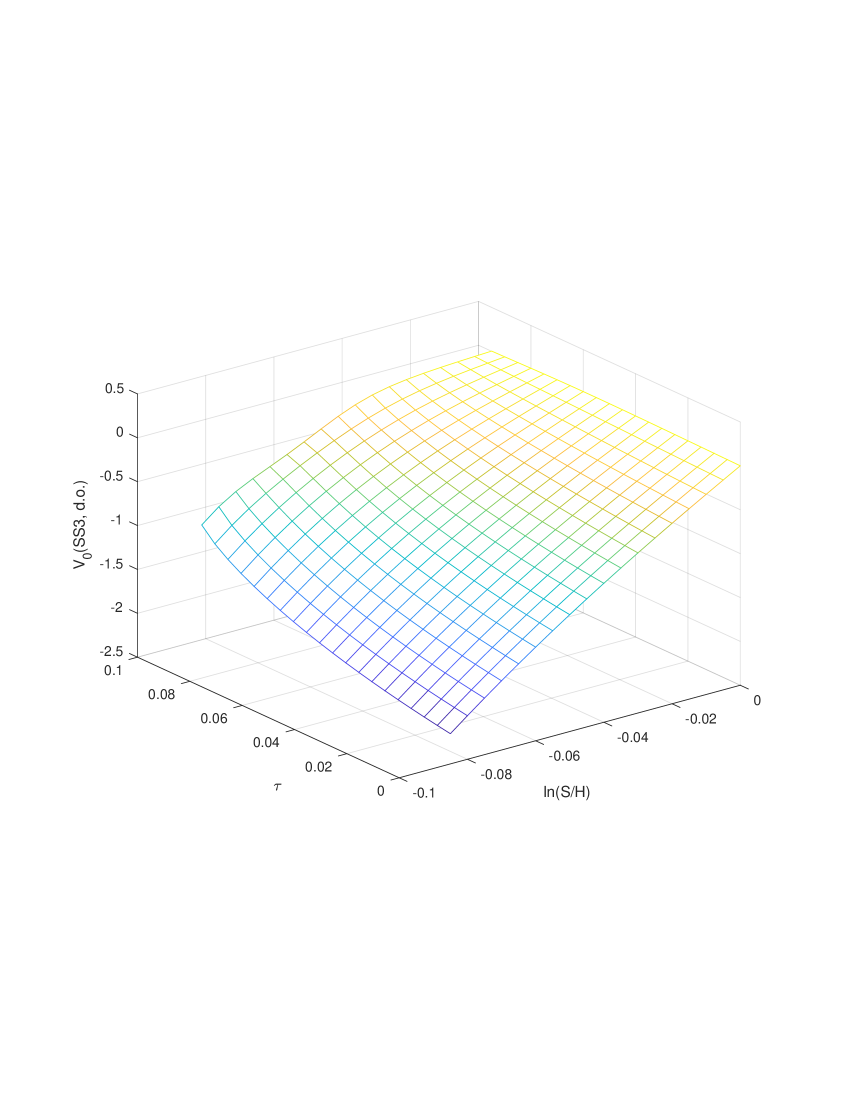

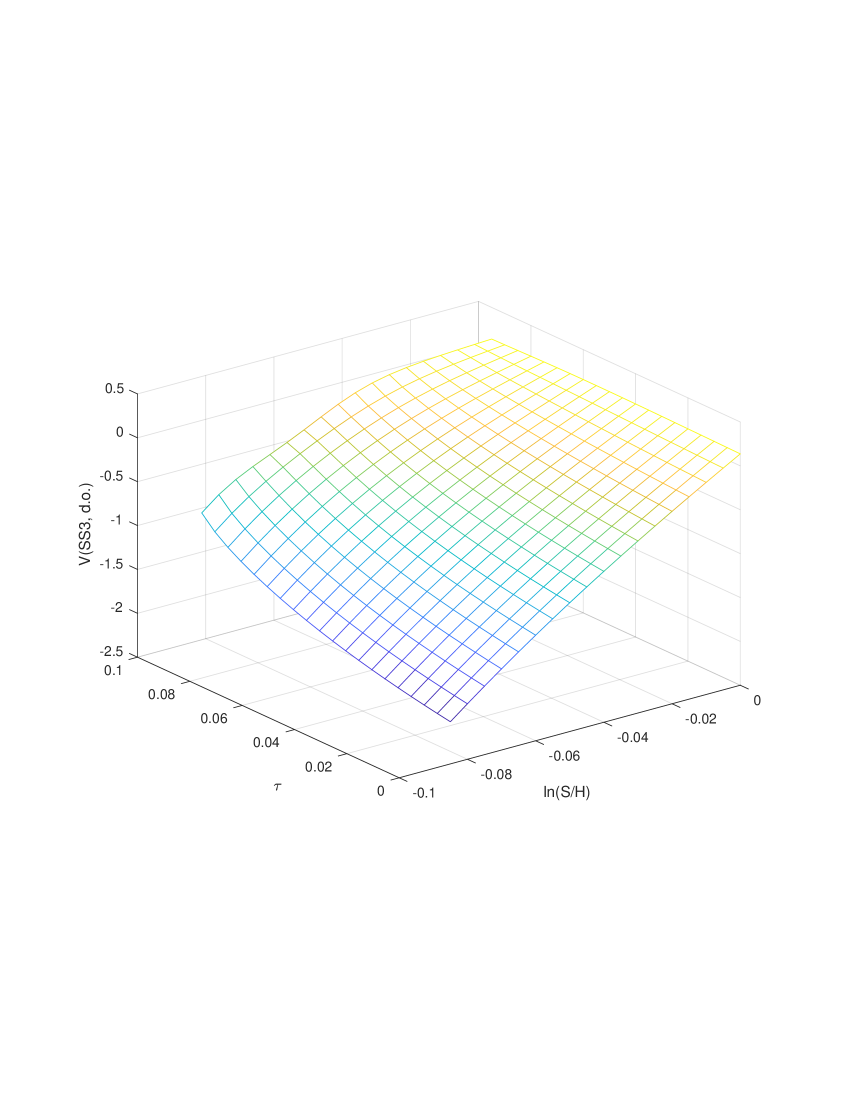

Assume that the agent uses the semi-static hedging constructed in the paper. The standard static and semi-static arguments construct model- and spot-invariant portfolios, which make it impossible to take into account that a hedging portfolio needs to be financed. If we consider the portfolio of 3 put options, and ignore the riskless bonds borrowed to finance the position, then, at any time the barrier is breached, and at any level , the portfolio value is positive or very close to zero (Fig. 5). Thus, the semi-static hedge seems to work very well even if the portfolio consists of only 3 options. Furthermore, if only one option is used, then the portfolio value decreases except in a relatively small region far from the barrier and close to maturity (Fig. 6). Since the probability of the option expiring in that region is very small, a naive argument would suggest that increasing the number of options in the hedging portfolio would increased the overall hedging performance of the portfolio. Recall, however, that the agent borrows riskless bonds to finance the put option position. If the barrier is breached, this short position in the riskless bond has to be liquidated alongside the other positions in the portfolio, complicating the overall picture. Fig. 7 demonstrates that, when is close to the barrier (a high probability event conditional on breaching the barrier), the value of the hedging portfolio is negative and large. Thus, the hedge is far from perfect. Furthermore, in Fig. 8 we see that if and is not too far from the barrier, then the semi-static portfolio consisting only of a put option whose strike is at the kink of the exotic option has a larger value then the value of the semi-static portfolio consisting of 3 put options. The value of the hedging portfolio with one put option is shown in Fig. 9. Table 12 shows that, if the barrier is not breached during the lifetime of the options, both portfolios have negative value but the losses on the one with 3 options is twice as large. Hence, it is better to use fewer options unless the agent is betting on a very low probability event realizing: if a larger fraction of wealth is invested in options, the cost of these options is higher, eroding the advantage of a more accurate semi-static hedging.

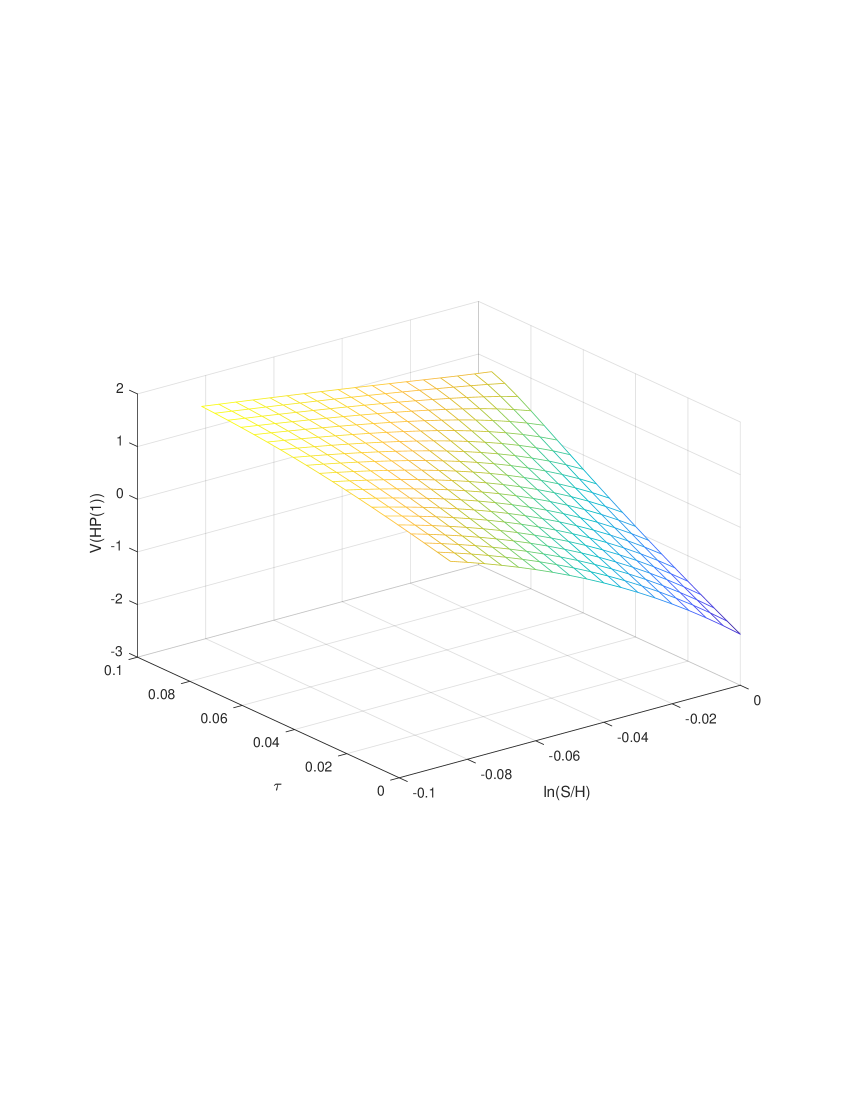

Fig. 10 demonstrates that the variance-minimizing portfolio of the same three put options hedges the risk of the down-and-in option, but only partially: if (approximately), and is not far from the barrier, the value of the portfolio is negative; for closer to maturity, the portfolio value becomes sizably positive.

Comparing Fig. 12 and Fig. 10, we observe that the inclusion of the first-touch digital increases the hedging performance of the portfolio somewhat. Fig. 11, 13 and 14 show that portfolios with one put option or one first touch digital perform approximately as well as portfolios with 3 options, and the portfolio with the first touch digital as the only hedging instrument is better than portfolios with one put option (with strikes either at the barrier or at the kink).