Multi-Armed Bandit Problem

and Batch UCB Rule

Abstract

We obtain the upper bound of the loss function for a strategy in the multi-armed bandit problem with Gaussian distributions of incomes. Considered strategy is an asymptotic generalization of the strategy proposed by J. Bather for the multi-armed bandit problem and using UCB rule, i.e. choosing the action corresponding to the maximum of the upper bound of the confidence interval of the current estimate of the expected value of one-step income. Results are obtained with the help of invariant description of the control on the unit horizon in the domain of close distributions because just there the loss function attains its maximal values. UCB rule is widely used in machine learning. It can be also used for the batch data processing optimization if there are two alternative processing methods available with different a priori unknown efficiencies.

keywords:

[class=MSC]keywords:

and

1 Introduction

We consider the multi-armed bandit problem. Multi-armed bandit is a slot machine with two or more arms the choice of which is accompanied with a random income of a gambler depending only on chosen arm [1]. The goal of a gambler is to maximize the total expected income. To this end, meanwhile the game process, he should determine the arm corresponding to the largest expected one-step income and provide its predominant usage. The problem is also well-known as the problem of expedient behavior [2] and of adaptive control in a random environment [3]. The problem has numerous applications in machine learning [4, 5].

In what follows, we consider Gaussian multi-armed bandit which naturally arises when batch data processing is optimized and there are two or more processing methods available with different a priori unknown efficiencies [6]. Formally, it is a controlled random process , , which value at the point of time depends only on currently chosen arm , is interpreted as income and has Gaussian (normal) distribution with probability density if , . Variance is assumed to be known and expectations are assumed to be unknown. The requirement of a priori known variance can be omitted because considered algorithm only a little changes under a moderate change of the variance (e.g., 5–10% change), hence, the variance can be estimated at the initial stage of the control.

A control strategy determines, generally, a randomized choice of action depending on currently available information of the history of the process. In what follows, we restrict consideration with the following strategy proposed in [7]. Let the -th action be applied times up to the point of time and let denote corresponding cumulative income (). In this case is a current estimate of the expectation . Since the goal is to maximize the total expected income, it seems reasonable always to apply the action corresponding to currently largest value . However, it is well known that such a rule can result in a significant losses because by chance the initial estimate , corresponding to the largest , can take a low value and, therefore, this action will be never applied in the sequel. Instead of estimates of themselves let’s consider the upper bounds of their confidence intervals

| (1.1) |

where , are i.i.d. random variables with probability density (); ; .

Considered strategy prescribes initially once to apply all the actions by turns and then at each point of time to choose the action corresponding to the largest value . Strategies of such a form are called UCB (Upper Confidence Bound) rules. Considered in this paper strategy at is equivalent to the strategy proposed in [7] for Bernoulli multi-armed bandit problem (up to summands of the order ). In this case one should put which is equal to the maximum value of the variance of Bernoulli one-step income. It is noted in [7] that at the maximal expected losses (scaled to the value ) do not exceed 0.72 for large . However, explanation of this result is not presented in [7] and, to the best of our knowledge, it was not published later.

We explain this result using the invariant description of the control on the unit horizon in the domain of close distributions where the maximum values of expected losses are attained in the multi-armed bandit problem. Moreover, we consider the batch version of the strategy [7] and show that expected losses depend only on the number of processed batches and some invariant characteristics of the parameter. Note that batch (parallel) strategies are especially important when processing time of the data item is significant, because in this case the total processing time depends on the number of batches rather than on the total number of data. The maximum scaled expected losses for the batch UCB rule are turned out to be 0.75, i.e. are almost the same as in [7]. We also note that different versions of the UCB rule are widely used in machine learning (see, e.g. [4, 5]).

2 Main Results

Considered multi-armed bandit can be described by a vector parameter . Let’s define the loss function. If the parameter is known, one should always choose the action corresponding to the maximum of , the total expected income would thus be equal to . For actually applied strategy the total expected income is less than maximal possible by the value which is called the loss function and is equal to

| (2.1) |

Here denotes mathematical expectation calculated with respect to measure generated by strategy and parameter . We are interested in the upper bound of the maximum losses calculated on the set of admissible values of parameter which is chosen the following

This is the set of parameters describing “close” distributions which are characterized by the difference of mathematical expectations of the order . Maximal expected losses are attained just there and have the order (see, e.g, [8]). For “distant” distributions the losses have smaller values. For example, they are of the order if exceeds all other by some (see, e.g., [9]).

Let’s consider strategies which change the actions only after applying them times in succession. These strategies allow batch (and also parallel) processing. We assume for simplicity that where is the number of batches. For batch strategies the upper bounds (1.1) take the form

| (2.2) |

where is the number of batches and , are the cumulative number of batches to which the -th action was applied and corresponding cumulative income after processing batches (). Let’s denote by

the indicator of chosen action for processing the -th batch according to considered rule at (recall that at actions are chosen by turns). Note that with probability 1 only one value of is equal to 1. For considered parameter the following presentation holds

| (2.3) |

where are i.i.d. normally distributed random variables with zero mathematical expectations and variances equal to . Let’s introduce the variables , , . By (2.2), (2.3), it follows that

; . After the linear transformation , which does not change the arrangement of bounds, we obtain the upper bounds in invariant form with a control horizon equal to 1:

| (2.4) |

; .

Let’s determine the loss function. For chosen parameter without loss of generality let’s assume that . Then

and for scaled (by ) loss function we draw the expression

| (2.5) |

Results can be presented by the following theorem.

Theorem 2.1.

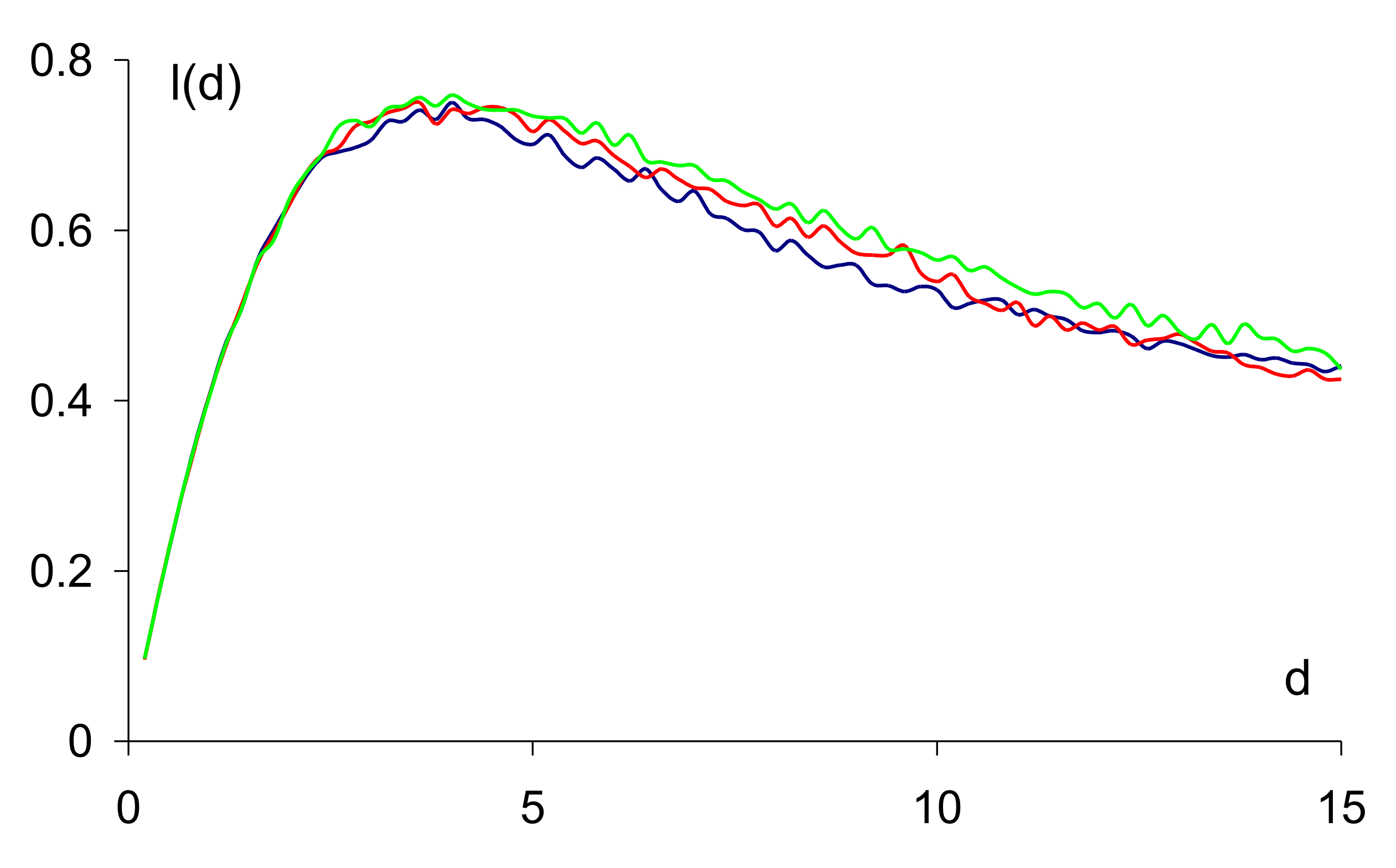

On figure Fig. 1 we present Monte-Carlo simulation results for the scaled loss function corresponding to UCB rule at and . Averaging was implemented over 10000 simulations. Given , one can take , corresponding scaled loss function is denoted by . Blue, red and green lines are obtained for control horizons . One can see that at . Hence, the maximum value of the scaled loss function is close to determined in [7]. But the value which is close to optimal in considered case, i.e. providing the minimum of maximal losses, significantly differs from 2/15 determined in [7]. This may be explained by the fact that in [7] considerably small control horizons were considered, e.g., . In this case the summands of the order , which are present in the rule proposed in [7], essentially affect the values .

References

- [1] Berry, D. A. and Fristedt, B. (1985). Bandit Problems: Sequential Allocation of Experiments, Chapman and Hall, London, New York.

- [2] Tsetlin, M. L. (1973). Automaton Theory and Modeling of Biological Systems, Academic Press, New York.

- [3] Sragovich, V. G. (2006). Mathematical Theory of Adaptive Control, World Sci., Singapore.

- [4] Auer, P. (2002). Using Confidence Bounds for Exploitation-Exploration Trade-offs. Journal of Machine Learning Research. 3 397–422.

- [5] Lugosi, G. and Cesa-Bianchi, N. (2006). Prediction, Learning and Games. University Press, New York, Cambridge.

- [6] Kolnogorov, A.V. (2012). Parallel design of robust control in the stochastic environment (the two-armed bandit problem). Automation and Remote Control 73 689–701.

- [7] Bather, J.A. (1983). The Minimax Risk for the Two-Armed Bandit Problem. Mathematical Learning Models Theory and Algorithms. Lecture Notes in Statistics. Springer-Verlag, New York. 20 1–11.

- [8] Vogel, W. (1960). An Asymptotic Minimax Theorem for the Two-Armed Bandit Problem. Ann. Math. Statist. 31 444–451.

- [9] Lai, T.L., Levin, B., Robbins, H. and Siegmund, D. (1980). Sequential Medical Trials (Stopping Rules/Asymptotic Optimality). Proc. Nati. Acad. Sci. USA. 77 3135–3138.