ET-Lasso: A New Efficient Tuning of Lasso-type Regularization for High-Dimensional Data

Abstract

The regularization (Lasso) has proven to be a versatile tool to select relevant features and estimate the model coefficients simultaneously and has been widely used in many research areas such as genomes studies, finance, and biomedical imaging. Despite its popularity, it is very challenging to guarantee the feature selection consistency of Lasso especially when the dimension of the data is huge. One way to improve the feature selection consistency is to select an ideal tuning parameter. Traditional tuning criteria mainly focus on minimizing the estimated prediction error or maximizing the posterior model probability, such as cross-validation and BIC, which may either be time-consuming or fail to control the false discovery rate (FDR) when the number of features is extremely large. The other way is to introduce pseudo-features to learn the importance of the original ones. Recently, the Knockoff filter is proposed to control the FDR when performing feature selection. However, its performance is sensitive to the choice of the expected FDR threshold. Motivated by these ideas, we propose a new method using pseudo-features to obtain an ideal tuning parameter. In particular, we present the Efficient Tuning of Lasso (ET-Lasso) to separate active and inactive features by adding permuted features as pseudo-features in linear models. The pseudo-features are constructed to be inactive by nature, which can be used to obtain a cutoff to select the tuning parameter that separates active and inactive features. Experimental studies on both simulations and real-world data applications are provided to show that ET-Lasso can effectively and efficiently select active features under a wide range of scenarios.

Keywords high-dimensional data Lasso automatic tuning parameter selection feature selection

1 INTRODUCTION

High dimensional data analysis is fundamental in many research areas such as genome-wide association studies, finance, tumor classification and biomedical imaging [7, 8]. The principle of sparsity is frequently adopted and proved useful when analyzing high dimensional data, which assumes only a small proportion of the features contribute to the response (“active”). Following this general rule, penalized least square methods have been developed in recent years to select the active features and estimate their regression coefficients simultaneously. Among existing penalized least square methods, the least absolute shrinkage and selection operator (Lasso) [26] is one of the most popular regularization methods that performs both variable selection and regularization, which enhance the prediction accuracy and interpretability of the statistical model it produces. Since then, many efforts have been devoted to develop algorithms in sparse learning of Lasso. Representative methods include but are not limited to [4, 28, 34, 2, 20, 18, 24, 5, 11].

Tuning parameter selection plays a pivotal role for identifying the true active features in Lasso. For example, it is shown that there exists an Irrepresentable Condition under which the Lasso selection is consistent when the tuning parameter converges to at a rate slower than [33]. The convergence in -norm is further established under a relaxed irrepresentable condition with an appropriate choice of the tuning parameter [17]. The tuning parameter can be computed theoretically but the calculation can be difficult in practice, especially for high-dimensional data. In literature, cross-validation [25], AIC [1] and BIC [23] have been widely used for selecting tuning parameters for Lasso. The tuning parameters selected by a BIC-type criterion can identify the true model consistently under some regularity conditions, whereas AIC and cross-validation may not lead to a consistent selection [31, 30].

These criteria focus on minimizing the estimated prediction error or maximizing the posterior model probability, which can be computationally intensive for large-scale datasets. In high dimensional setting, cross-validation often results in models that are not stable in estimation. Estimation stability with cross-validation (ESCV) [15] is an alternative approach to CV, with improved performance on estimation stability. ESCV constructs pseudo solutions by fitting sub-groups of dataset, and devises an estimation stability (ES) metric, which is a normalized sample variance of the estimates. ESCV selects the regularization parameter that is a local minimum of the ES metric, and leads to a smaller model than CV. Modified cross-validation criterion (MCC) is developed in [33] as an alternative criterion performed on each validation set. MCC aims to improve the model selection performance by reducing the bias induced by shrinkage. In general, their method selects a larger regularization parameter than Lasso.

Recently, Barber and Candes [3] proposed a novel feature selection method “Knockoff” that is able to control the false discovery rate when performing variable selection. This method operates by first constructing Knockoff variables (which are pseudo copies of the original variables) that mimic the correlation structure of the original variables, and then selecting features that are identified as much more important than their Knockoff copies, according to some measures of feature importance. However, Knockoff requires the number of features to be less than the sample size, which cannot be applied to high dimensional settings where the number of features is much larger than that of samples. In order to fix this, Model-X Knockoffs [6] is proposed to provide valid FDR control variable selection inference under the scenario. However, this method is sensitive to the choice of the expected FDR level, and it cannot generate a consistent solution for the model coefficients. Moreover, as will be seen from the simulation studies presented in Section 4.1, we notice that the construction complexity of the Knockoff matrix is sensitive to the covariance structure, and it is also very time consuming when is large. Motivated by both the literature of tuning parameter selection and pseudo variables-based feature selection, we propose the Efficient Tuning of Lasso (ET-Lasso) which selects the ideal tuning parameter by using pseudo-features and accommodates high dimensional settings where is allowed to grow exponentially with . The idea comes from the fact that active features tend to enter the model ahead of inactive ones on the solution path of Lasso. We investigate this fact theoretically under some regularity conditions, which results in selection consistency and a clear separation between active and inactive features. We further propose a cutoff level to separate the active and inactive features by adding permuted features as pseudo-features, which are constructed to be inactive and uncorrelated with signals; consequently they can help rule out tuning parameters that wrongly identify them as active. The idea of adding pseudo-features is inspired by [16, 32], which proposed to add random features in forward selection problems. In our method, the permuted features are generated by making a copy of and then permuting its rows. In this way, the permuted features have the same marginal distribution as the original ones, and are not correlated with and . Unlike the Knockoff method, which selects features that are more important than their Knockoff copies, ET-Lasso tries to identify original features that are more important than all the permuted features. We show that the proposed method selects all the active features and simultaneously filters out all the inactive features with an overwhelming probability as goes to infinity and goes to infinity at an exponential rate of . The experiments in Section 4 show that ET-Lasso outperforms other existing methods under different scenarios. As noted by one reviewer, the random permutation-based methods have also been studied in more general non-linear feature selection with random forest [21, 19, 14, 22]. The permuted features are introduced to correct the bias of variable selection. Some variable importance measures in node split selection are affected by both the variable importance and the variable characteristics. By comparing original features with their permuted copies, the bias incurred by variable characteristics is eliminated.

The rest of this paper is organized as follows. In Section 2, we introduce the motivation and the model framework of ET-Lasso. In Section 3, we establish its theoretical properties. Then, we illustrate the high efficiency and potential usefulness of our new method both by simulation studies and applications to a number of real-world datasets in Section 4. The paper concludes with a brief discussion in Section 5.

To facilitate the presentation of our work, we use to denote an arbitrary subset of , which amounts to a submodel with covariates and associated coefficients . is the complement of . We use to denote the number of nonzero components of a vector and to represent the cardinality of set . We denote the true model by with .

2 MOTIVATION AND MODEL FRAMEWORK

2.1 Motivation

Consider the problem of estimating the coefficients vector from linear model

| (2.1) |

where is the response, is an random design matrix with independent and identically distributed (IID) -vectors . correspond to features. is the coefficients vector and is an -vector of IID random errors following sub-Gaussian distribution with and . For high dimensional data where , we often assume that only a handful of features contribute to the response, i.e, .

We consider the Lasso model that estimates under the sparsity assumption. The Lasso estimator is given by

| (2.2) |

where is a regularization parameter that controls the model sparsity. Consider the point on the solution path of (2.2) at which feature first enters the model,

| (2.3) |

which is likely to be large for most of active features and small for most inactive features. Note that accounts for the joint effects among features and thus can be treated as a joint utility measure for ranking the importance of features. For orthonormal designs, the closed form solution of (2.2) [26] for Lasso directly shows that

| (2.4) |

In section 3, under more general conditions, we will show that

| (2.5) |

Property (2.5) implies a clear separation between active and inactive features. The next step is to find a practical way to estimate in order to identify active features, i.e., obtain an ideal cutoff to separate the active and the inactive features.

2.2 Model Framework

Motivated by property (2.5), we calculate the cutoff that separates the active and inactive features by adding pseudo-features. Since pseudo-features are known to be inactive, we can rule out tuning parameters that identify them as active.

The permuted features matrix , where is a permutation of , are used as the pseudo-features. In particular, matrix satisfies

| (2.6) |

That is, the permuted features possess the same correlation structure as the original features, while breaking association with the due to the permutation. Suppose that the features are centered, then the design matrix satisfies

| (2.7) |

where is the correlation structure of , and the approximately-zero off-diagonal blocks arise from the fact that when the features are centered.

Now we define the augmented design matrix , where is the original design matrix and is the permuted design matrix. The augmented linear model with as design matrix is

| (2.8) |

where is a -vector of coefficients and is the error term. The corresponding Lasso regression problem is

| (2.9) |

Similar to , we define by

| (2.10) |

which is the largest tuning parameter at which enters the model (2.8). Since are truly inactive by construction, by Theorem 1 in Section 3, it holds in probability that . Define , then can be regarded as a benchmark to separate the active features from the inactive ones. This leads to a soft thresholding selection

| (2.11) |

We implement a two-stage algorithm in order to reduce the false selection rate. We first generate permuted features . In the first stage, we select the based on the rule (2.11) using . Then in the second stage, we combine and to obtain and select the final feature set . The procedure of ET-Lasso is summarized in Algorithm 1.

-

1.

Generate two different permuted predictor samples and then combine with to obtain augmented design matrix .

-

2.

For design matrix , we solve the problem

(2.12) over the grid . is the smallest tuning parameter value at which none of the features could be selected. is the cutoff point. In other words, can be regarded as an estimator of . Then we use selection rule (2.11) to obtain .

-

3.

Combine with , which only includes features in , to obtain the augmented design matrix . Repeat Step 2 for the new design matrix over to select .

Remark. Apparently, more iterations in ET-Lasso would have a better control on false discoveries. The reason for adopting a two step method is to keep a balance between recall and precision. The asymptotic results of Theorem 2 indicate the two step method can effectively control the false discovery rate.

2.3 Comparison with “Knockoff”

The Knockoff methods have been proposed to control the false discovery rate when performing variable selection [3, 6]. Specifically the Knockoff features obey

| (2.13) |

where and is a p-dimensional non-negative vector. That is, possesses the same covariance structure as . The authors then set

| (2.14) |

as the importance metric for feature and a data-dependent threshold

| (2.15) |

where and is the expected FDR level. The Knockoff selects the feature set as , which has been shown to have FDR controlled at [3, 6].

The main difference between Knockoff and ET-Lasso is that Knockoff method selects features that are clearly better than their Knockoff copies, while ET-Lasso method selects the features that are more important than all the pseudo-features. Compared with Knockoff, our method of constructing the pseudo-features is much simpler than creating the Knockoff features. Particularly, when the dimension of the data is extremely large, it is very time consuming to construct the Knockoff copies for each feature. On the other hand, the Knockoff method is not able to provide a consistent estimator for the model coefficients. In addition, the feature selection performance of Knockoff is sensitive to the choice of expected FDR () as shown by our experiments, and our method does not include hyper-parameters that need to be tuned carefully. The two step method within ET-Lasso can fix the vulnerability of using permuted sample when relevant and irrelevant variables are correlated as discussed in Knockoff paper [3]. This can be shown from the comprehensive numerical studies in Section 4.

3 THEORETICAL PROPERTIES

Property (2.5) is the guiding principle of our selection procedure that applies ET-Lasso to select the ideal regularization parameter. Now we study (2.5) in a more general setting than orthonormal designs. We introduce the regularity conditions needed in this study.

-

(C1)

(Mutual Incoherence Condition) There exists some such that

where for any matrix .

-

(C2)

There exists some such that

where denotes the minimum eigenvalue of A.

-

(C3)

, and , where , and .

Condition (C1) is called mutual incoherence condition, and it has been considered in the previous work on Lasso [28, 12, 27], that guarantees that the total amount of an irrelevant covariate represented by the covariates in the true model is not to reach 1. Condition (C2) indicates that the design matrix consisting of active features is full rank. Condition (C3) states some requirements for establishing the selection consistency of the proposed method. The first one assumes that diverges with up to an exponential rate, which allows the dimension of the data to be substantially larger than the sample size. The second one implies that the number of active features is allowed to grow with sample size but as . We also require the minimal component of does not degenerate too fast.

One of the main results of this paper is that under (C1) - (C3), property (2.5) holds in probability:

Theorem 1

Under conditions C1 - C3, assume that the design matrix has its -dimensional columns normalized such that , then

Theorem 1 justifies using to rank the importance of features. In other words, ranks an active feature above an inactive one with high probability, and thus leads to a separation between the active and inactive features. The proof is given in the supplementary material.

The following result gives an upper bound on the probability of recruiting any inactive feature by ET-Lasso, and implies that our method excludes all the inactive features asymptotically when .

Theorem 2

Let be a positive integer, by implementing the ET-Lasso procedure, we have

| (3.1) |

where as specified in condition (C2).

Proof and a fixed number , the probability that

Thus,

As , and set ,

then we can claim that the upper bound for is .

Theorem 2 indicates that the number of false positives can be controlled better if there are more active features in the model, and our simulation results in Section 4 support this property.

4 EXPERIMENTS

4.1 Simulation Study

In this section, we compare the finite sample performance of ET-Lasso with Lasso+BIC (BIC), Lasso+Cross-validation (CV), Lasso+ESCV and Knockoff (KF) under different settings. For CV method, 5-folded cross validation is used to select the tuning parameter . We consider three FDR thresholds for Knockoff, 0.05, 0.1 and 0.2, so as to figure out the sensitivity of its performance to the choice of the FDR threshold. The response is generated from the linear regression model (2.1), where , for .

-

1.

the sample size ;

-

2.

the number of predictors ;

-

3.

the following three covariance structures of considered in [9] are included to examine the effect of covariance structure on the performance of the methods:

-

(i) Independent, i.e, ,

-

(ii) AR(1) correlation structure: ,

-

(iii) Compound symmetric correlation structure (CS): if and otherwise;

-

-

4.

, for , where Bernoulli (0.5), and for .

The simulation results are based on replications and the following criteria are used to evaluate the performance of ET-Lasso:

-

1.

: the average precision (number of active features selected/ number of features selected);

-

2.

: the average recall (number of active features selected/number of active features);

-

3.

: the average -score (harmonic mean of precision and recall);

-

4.

Time: the average running time of each method.

The simulation results are summarized in Table 1 and 2. We can observe that ET-Lasso has higher precision and score than other methods under all circumstances. For independent setting, all methods except KF(0.05) successfully recover all active features, as suggested by the recall values. The average precision values of ET-Lasso are all above , while Lasso+BIC has precision values around , and Lasso+CV has precision values around . Lasso+ESCV has precision values lower than for , and lower than for . KF(0.05) barely selects any feature into the model due to its restrictive FDR control, resulting in very small values in recall, and the numbers of selected features are zero in some of the replications. KF(0.1) and KF(0.2) successfully identify all active features, whereas their precision values and scores are smaller than ET-Lasso. The results for AR(1) covariance structure are similar to those of independent setting. In CS setting, KF based methods sometimes select zero feature into the model, and thus the corresponding precision and scores cannot be computed. ET-Lasso again outperforms other methods. In addition, ET-Lasso enjoys favorable computational efficiency compared with Lasso+CV, Lasso+ESCV and Knockoff. ET-Lasso finishes in less than s in all settings, while Knockoffs require significantly more computing time, and their computational costs increase rapidly as increases. In addition, the performances of Knockoff rely on the choice of the expected FDR. When the correlations between features are strong, Knockoff method needs higher FDR thresholds to select all the active variables.

| Independent | AR(1) | |||||||

| Time | Time | |||||||

| , | ||||||||

| ET-Lasso | 0.97 | 1.0 | 0.98 (0.001) | 0.27 (0.002) | 0.93 | 1.0 | 0.96 (0.001) | 0.27 (0.002) |

| BIC | 0.68 | 1.0 | 0.80 (0.003) | 0.09 (0.001) | 0.64 | 1.0 | 0.77 (0.003) | 0.10 (0.001) |

| CV | 0.20 | 1.0 | 0.33 (0.003) | 1.01 (0.006) | 0.20 | 1.0 | 0.32 (0.003) | 1.01 (0.006) |

| ESCV | 0.94 | 1.0 | 0.96 (0.002) | 2.33 (0.012) | 0.92 | 1.0 | 0.95 (0.001) | 2.31 (0.012) |

| KF(0.05) | # | 0.00 | # | 348.6 (12.10) | # | 1.0 | # | 427.8 (12.30) |

| KF(0.1) | 0.92 | 1.0 | 0.96 (0.002) | 356.1 (13.01) | 0.91 | 1.0 | 0.95 (0.002) | 436.9 (13.21) |

| KF(0.2) | 0.83 | 1.0 | 0.90 (0.003) | 352.5 (12.23) | 0.82 | 1.0 | 0.89 (0.003) | 432.3 (13.07) |

| , | ||||||||

| ET-Lasso | 0.97 | 1.0 | 0.99 (0.001) | 0.26 (0.001) | 0.94 | 1.0 | 0.97 (0.001) | 0.27 (0.002) |

| BIC | 0.63 | 1.0 | 0.77 (0.003) | 0.09 (0.001) | 0.59 | 1.0 | 0.74 (0.003) | 0.09 (0.001) |

| CV | 0.21 | 1.0 | 0.34 (0.003) | 0.93 (0.004) | 0.20 | 1.0 | 0.33 (0.002) | 1.02 (0.006) |

| ESCV | 0.88 | 1.0 | 0.93 (0.002) | 2.56 (0.002) | 0.87 | 1.0 | 0.93 (0.002) | 2.09 (0.003) |

| KF(0.05) | # | 0.45 | # | 368.1 (13.21) | # | 0.04 | 0.28 (0.041) | 453.9 (13.18) |

| KF(0.1) | 0.93 | 1.0 | 0.96 (0.002) | 362.5 (13.69) | 0.92 | 1.0 | 0.95 (0.002) | 460.4 (13.97) |

| KF(0.2) | 0.82 | 1.0 | 0.89 (0.003) | 351.7 (13.01) | 0.80 | 1.0 | 0.88 (0.003) | 455.9 (13.89) |

| , | ||||||||

| ET-Lasso | 0.97 | 1.0 | 0.98 (0.001) | 0.47 (0.002) | 0.94 | 1.0 | 0.97 (0.001) | 0.47 (0.002) |

| BIC | 0.65 | 1.0 | 0.78 (0.003) | 0.17 (0.001) | 0.63 | 1.0 | 0.76 (0.003) | 0.16 (0.001) |

| CV | 0.17 | 1.0 | 0.29 (0.003) | 1.75 ( 0.007) | 0.17 | 1.0 | 0.29 (0.003) | 1.73 (0.009) |

| ESCV | 0.95 | 1.0 | 0.97 (0.001) | 3.35 (0.008) | 0.94 | 1.0 | 0.97 (0.001) | 3.35 (0.003) |

| KF(0.05) | # | 0.002 | # | 1252.8 (42.86) | # | 0.0 | # | 1694.6 (48.66) |

| KF(0.1) | 0.92 | 1.0 | 0.96 (0.06) | 1221.9 (41.78) | 0.92 | 1.0 | 0.95 (0.06) | 1660.8 (47.59) |

| KF(0.2) | 0.82 | 1.0 | 0.89 (0.10) | 1200.6 (41.25) | 0.82 | 1.0 | 0.89 (0.10) | 1612.4 (45.91) |

| , | ||||||||

| ET-Lasso | 0.98 | 1.0 | 0.99 ( 0.0006) | 0.46 (0.002) | 0.95 | 1.0 | 0.97 (0.001) | 0.46 (0.003) |

| BIC | 0.61 | 1.0 | 0.75 (0.003) | 0.16 (0.001) | 0.58 | 1.0 | 0.73 (0.003) | 0.16 (0.001) |

| CV | 0.17 | 1.0 | 0.29 (0.002) | 1.71 (0.008) | 0.17 | 1.0 | 0.29 (0.002) | 1.72 (0.009) |

| ESCV | 0.88 | 1.0 | 0.94 (0.001) | 3.27 (0.006) | 0.86 | 1.0 | 0.92 (0.001) | 3.58 ( 0.009) |

| KF(0.05) | # | 0.03 | # | 1251.6 (42.60) | # | 0.03 | # | 1689.2 (48.11) |

| KF(0.1) | 0.92 | 1.0 | 0.96 (0.06) | 1240.5 (41.71) | 0.93 | 1.0 | 0.96 (0.06) | 1658.4 (47.12) |

| KF(0.2) | 0.82 | 1.0 | 0.89 (0.002) | 1192.2 (40.13) | 0.82 | 1.0 | 0.89 (0.002) | 1610.8 (45.61) |

| Time | ||||

| , | ||||

| ET-Lasso | 0.89 | 1.0 | 0.93 (0.003) | 0.26 (0.001) |

| BIC | 0.57 | 1.0 | 0.71 ( 0.004) | 0.09 (0.0003) |

| CV | 0.20 | 1.0 | 0.32 (0.003) | 0.94 (0.004) |

| ESCV | 0.87 | 1.0 | 0.92 (0.002) | 2.09 (0.003) |

| KF(0.05) | # | 0.00 | # | 53.22 (0.208) |

| KF(0.1) | # | 0.94 | # | 51.01 (0.211) |

| KF(0.2) | 0.83 | 0.99 | 0.89 (0.003) | 50.6 (0.186) |

| , | ||||

| ET-Lasso | 0.92 | 1.0 | 0.95 (0.002) | 0.26 (0.001) |

| BIC | 0.55 | 1.0 | 0.70 (0.003) | 0.09 (0.0003) |

| CV | 0.20 | 1.0 | 0.34 (0.002) | 0.93 (0.004) |

| ESCV | 0.82 | 1.0 | 0.90 (0.002) | 2.07 (0.002) |

| KF(0.05) | # | 0.02 | # | 53.20(0.212) |

| KF(0.1) | # | 0.98 | # | 51.12 (0.215) |

| KF(0.2) | 0.82 | 0.99 | 0.89 (0.08) | 50.67 (0.198) |

| , | ||||

| ET-Lasso | 0.86 | 1.0 | 0.91 (0.004) | 0.46 (0.002) |

| BIC | 0.53 | 1.0 | 0.68 (0.004) | 0.16 (0.001) |

| CV | 0.17 | 1.0 | 0.28 (0.003) | 1.63 (0.006) |

| ESCV | 0.87 | 1.0 | 0.93 ( 0.002) | 3.60 (0.016) |

| KF(0.05) | # | 0.03 | # | 119.1 (0.473) |

| KF(0.1) | # | 0.79 | # | 115.6 (0.464) |

| KF(0.2) | # | 0.97 | # | 116.1 (0.474) |

| , | ||||

| ET-Lasso | 0.90 | 1.0 | 0.94 ( 0.003) | 0.45 (0.002) |

| BIC | 0.51 | 1.0 | 0.67 (0.003) | 0.16 (0.001) |

| CV | 0.17 | 1.0 | 0.29 (0.002) | 1.63 (0.007) |

| ESCV | 0.76 | 1.0 | 0.86 (0.003) | 3.67 (0.017) |

| KF(0.05) | # | 0.02 | # | 119.8 (0.522) |

| KF(0.1) | # | 0.93 | # | 116.2 (0.494) |

| KF(0.2) | # | 0.96 | # | 115.9 (0.495) |

4.2 FIFA 2019 Data

In this experiment, the ET-Lasso method is applied to a FIFA 2019 dataset, which is a random sample from a Kaggle data [13]. The dataset contains 84 attributes of 2019 FIFA complete players. We have 1500 players in this example. The response variable is the wage of each player, and the rest 83 attributes are feature candidates that may affect a player’s wage. We standardize the response and the features. The training data consists of 300 players and the rest 1200 players are used for testing. The mean squared error (MSE), the number of selected features (DF) of different methods based on replications are reported in Table 3.

| MSE | DF | Time | |

|---|---|---|---|

| ET-Lasso | 0.2228 (0.0027) | 4.92 (0.224) | 0.0958 (0.004) |

| CV | 0.2277 (0.0034) | 11.6 (0.880) | 0.2841 (0.007) |

| BIC | 0.2320 (0.0036) | 1.86 (0.086) | 0.0211 (0.007) |

| ESCV | 0.2408 (0.0080) | 11.6 (0.880) | 0.8195 (0.007) |

| KF(0.1) | # | 0.2 (0.141) | 0.9554 (0.014) |

| KF(0.3) | # | 2.94 (0.331) | 0.9698 (0.014) |

| KF(0.5) | # | 4.82 (0.248) | 0.9692 (0.017) |

We compare ET-Lasso with Lasso+CV, Lasso+ESCV, Lasso+BIC and Knockoff (KF). Since Knockoff cannot estimate directly, we implement a two stage method for Knockoff, where at the first stage we apply Knockoff for feature selection, and at the second stage, we apply linear regression model with selected features and make predictions on test data. From Table 3, we can see that ET-Lasso has the best MSE with the smallest standard deviation among all methods. Specifically, ET-Lasso improves the prediction MSE of CV and ESCV by around 2% and 7%, while its model size is on average less than half of the latter two. ET-Lasso takes less than 0.1s to run, which is significantly more efficient than CV and ESCV. ET-Lasso improves the MSE of BIC by more than 4%. BIC on average selects less than two features into the model, which might indicate an underfitting. For this real data, Knockoff-based methods are too aggressive to select any feature during some replications, which makes their MSE uncomputable, even when the FDR threshold is set as large as .

4.3 Stock Price Prediction

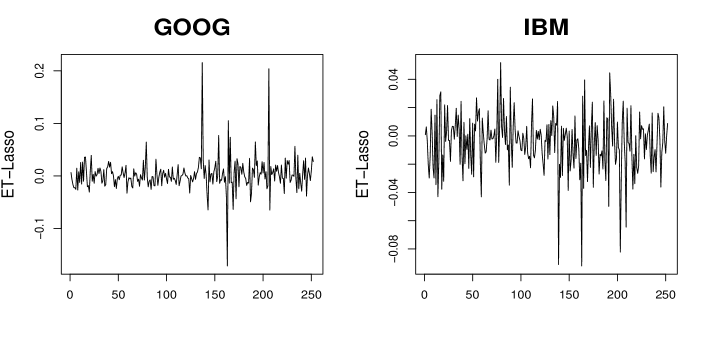

In this example, we apply the ET-Lasso method for stock price prediction. We select four stocks from four big companies, which are GOOG, IBM, AMZN and WFC. We plan to use the stock open price from date 01/04/2010 to 12/30/2013 to train the model, and then predict the open price in the trading year 2014. All the stock prices are normalized. Considering that the current open price of a stock might be affected by the open price of the last 252 days (number of trading days in a year), we apply the following regression model,

| (4.1) |

and the coefficients estimator is obtained as

| (4.2) |

Figure 1 depicts the difference of predicted price using ET-Lasso and the true price, i.e., for the four stocks. It can be seen that ET-Lasso method predicts the trend of the stock price change very well. The mean squared error (MSE) and the number of selected features (DF) are reported in Table 4. We can observe that the ET-Lasso method outperforms Lasso+BIC and Lasso+CV in terms of both prediction error and model complexity. For instance, when we predict the stock price of WFC, the MSE of ET-Lasso method is , which is only about of that of Lasso+CV () and about of that of Lasso+BIC (). Knockoff methods with a controlled FDR smaller than 0.5 are over-aggressive in feature selection, leading to an empty recovery set in most circumstances. KF(0.5) works well on IBM, AMZN and WFC, with resulting MSE comparable to that of ET-Lasso; however it selects zero feature on GOOG stock. In terms of the computing efficiency, ET-Lasso is much faster than Knockoff and cross-validation method and a bit slower than BIC.

| GOOG | IBM | |||||

| MSE | DF | Time | MSE | DF | Time | |

| ET-Lasso | 9 | 0.25 | 3 | 0.12 | ||

| CV | 9 | 0.57 | 3 | 0.29 | ||

| BIC | 2 | 0.06 | 2 | 0.02 | ||

| ESCV | 9 | 1.2 | 3 | 0.62 | ||

| KF(0.1) | # | 0 | 8.26 | # | 0 | 8.48 |

| KF(0.3) | # | 0 | 8.24 | # | 0 | 7.71 |

| KF(0.5) | # | 0 | 7.57 | 4 | 8.74 | |

| AMZN | WFC | |||||

| MSE | DF | Time | MSE | DF | Time | |

| ET-Lasso | 8 | 0.15 | 11 | 0.16 | ||

| CV | 9 | 0.43 | 11 | 0.64 | ||

| BIC | 2 | 0.05 | 3 | 0.05 | ||

| ESCV | 8 | 0.90 | 11 | 0.16 | ||

| KF(0.1) | # | 0 | 7.85 | # | 0 | 9.19 |

| KF(0.3) | # | 0 | 8.05 | # | 0 | 8.06 |

| KF(0.5) | 6 | 7.97 | 6 | 7.92 | ||

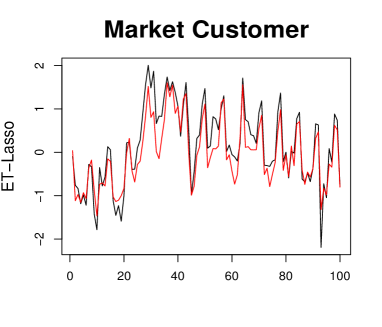

4.4 Chinese Supermarket Data

In this experiment, the ET-Lasso method is applied to a Chinese supermarket dataset in [29], which records the number of customers and the sale volumes of products from year 2004 to 2005. The response is the number of customers and the features include the sale volumes of 6398 products. It is believed that only a small proportion of products have significant effects on the number of customers. The response and the features are both standardized. The training data includes the 60% days and the rest is used as testing data. The mean squared error (MSE), the number of selected features (DF) of the ET-Lasso method, cross-validation (CV), BIC and Knockoff (KF) are reported in Table 5.

| MSE | DF | Time | |

|---|---|---|---|

| ET-Lasso | 0.1046 | 68 | 1.40 |

| CV | 0.1410 | 111 | 5.80 |

| BIC | 0.3268 | 100 | 0.517 |

| ESCV | 0.1172 | 72 | 12.60 |

| KF(0.1) | # | 0 | 1449.355 |

| KF(0.3) | 0.1465 | 11 | 1358.877 |

| KF(0.5) | # | 0 | 1379.757 |

We can see that ET-Lasso performs best with respect to the model prediction accuracy. ET-Lasso method returns the smallest prediction MSE (0.1046) and a simpler model (contains 68 features) than CV and BIC. Cross-validation and BIC for Lasso lead to larger MSE and model size. For the Knockoff method, when FDR is controlled as small as or as large as , it fails to select any feature. Knockoff with FDR only selects features, but the prediction MSE is relatively large. Knockoff-based methods take more than seconds to run, which are significantly slower than ET-Lasso (1.4s), Lasso+CV (5.8s), Lasso+ESCV (12.5s) and Lasso+BIC (0.517s).

4.5 Extension to Classification

In this part, we test the performance of ET-Lasso for a binary classification problem. Although the theoretical foundation of ET-Lasso is based on the linear regression model setting, we want to show that ET-Lasso also performs well in more general cases. Here we provide one example of its extension to logistic regression.

The dataset comes from the UCI machine learning repository, Smartphone Dataset for Human Activity Recognition (HAR) in Ambient Assisted Living (AAL) ***https://archive.ics.uci.edu/ml/datasets/Human+Activity+Recognition+Using+Smartphones. The dataset was collected from an experiment in the area of Ambient Assisted Living. In the experiment, 30 participants from 22 to 79 years old were asked to wear smartphones around their waists. The smartphones have built-in accelerometer and gyroscope. For each participant, six activities (standing, sitting, laying, walking, walking upstairs, walking downstairs) were performed for one minute, and the 3-axial raw signals from accelerometer and gyroscope were collected. Based on these signals, -feature vectors were extracted and derived as potential predictors for activity recognition. We select records corresponding to two activities, walking and standing, and aim to identify relevant features that can differentiate between them. We random sample and observations from the given training set as two training datasets. The testing data contains records. Since the data is relatively balanced, we report the average number of misclassification and the number of selected features (DF) over replications in Table 6. It can be seen that ET-Lasso has the best classification accuracy among all methods. Knockoff-based methods are too aggressive for this task. The performances of BIC and CV are more sensitive to the sample size than ET-Lasso, and ESCV might exclude some of the active features.

| Number of Misclassification | DF | ||

|---|---|---|---|

| ET-Lasso | 5.6 (0.241) | 10.5 (0.395) | |

| CV | 5.7 (0.226) | 12.5 (0.417) | |

| BIC | 6 (0.291) | 6 (0.226) | |

| ESCV | 8.7 (0.294) | 4.5 (0.417) | |

| KF(0.1) | # | 0 | |

| KF(0.3) | # | 0 | |

| KF(0.5) | # | 0 | |

| ET-Lasso | 5.7 (0.365) | 9.2 (0.524) | |

| CV | 6.5 (0.435) | 12.9 (0.508) | |

| BIC | 6.6 (0.403) | 4.5 (0.117) | |

| ESCV | 8.2 (0.459) | 4.1 (0.202) | |

| KF(0.1) | # | 0 | |

| KF(0.3) | # | 0 | |

| KF(0.5) | # | 0 |

5 CONCLUSION

In this paper, we propose ET-Lasso that is able to select the ideal tuning parameter by involving pseudo-features. The novelties of ET-Lasso are two-fold. First, ET-Lasso is statistically efficient and powerful in the sense that it can select all active features with the smallest model which contains least irrelevant features (i.e., highest precision) compared to other feature selection methods. Second, ET-Lasso is computationally scalable, which is essential for high-dimensional data analysis. The ET-Lasso is efficient for tuning parameter selection of regularization methods and requires no calculations of the prediction error and posterior model probability. Moreover, ET-Lasso is stopped once the cutoff is found, so there is no need to traverse all potential tuning parameters as cross-validation and BIC. On the other hand, Knockoff turns out to be very computational intensive for high dimensional data. Numerical studies have illustrated the superior performance of ET-Lasso over the existing methods under different situations.

6 ACKNOWLEDGMENTS

We want to sincerely thank Dr. Runze Li and Dr. Bharath Sriperumbudur for their insightful and constructive comments on this work.

References

- [1] Akaike, H. A new look at the statistical model identification. IEEE transactions on automatic control 19, 6 (1974), 716–723.

- [2] Bach, F. R. Bolasso: model consistent lasso estimation through the bootstrap. In Proceedings of the 25th international conference on Machine learning (2008), ACM, pp. 33–40.

- [3] Barber, R. F., Candès, E. J., et al. Controlling the false discovery rate via knockoffs. The Annals of Statistics 43, 5 (2015), 2055–2085.

- [4] Beck, A., and Teboulle, M. Fast gradient-based algorithms for constrained total variation image denoising and deblurring problems. IEEE Transactions on Image Processing 18, 11 (2009), 2419–2434.

- [5] Boyd, S., Parikh, N., Chu, E., Peleato, B., Eckstein, J., et al. Distributed optimization and statistical learning via the alternating direction method of multipliers. Foundations and Trends® in Machine learning 3, 1 (2011), 1–122.

- [6] Candes, E., Fan, Y., Janson, L., and Lv, J. Panning for gold:‘model-x’knockoffs for high dimensional controlled variable selection. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 80, 3 (2018), 551–577.

- [7] Donoho, D. L. High-dimensional data analysis: The curses and blessings of dimensionality. AMS Math Challenges Lecture 1 (2000), 32.

- [8] Fan, J., and Li, R. Statistical challenges with high dimensionality: Feature selection in knowledge discovery. Proceedings of the International Congress of Mathematicians 3 (2006), 595–622.

- [9] Fan, J., and Lv, J. Sure independence screening for ultrahigh dimensional feature space. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 70, 5 (2008), 849–911.

- [10] Fan, J., and Lv, J. Nonconcave penalized likelihood with np-dimensionality. IEEE Transactions on Information Theory 57, 8 (2011), 5467–5484.

- [11] Friedman, J., Hastie, T., Höfling, H., and Tibshirani, R. Pathwise coordinate optimization. The Annals of Applied Statistics 1, 2 (2007), 302–332.

- [12] Fuchs, J.-J. Recovery of exact sparse representations in the presence of bounded noise. IEEE Transactions on Information Theory 51, 10 (2005), 3601–3608.

- [13] Gadiya, K. Fifa 19 complete player dataset, 2019. Data scraped from https://sofifa.com/. Hosted at https://www.kaggle.com/karangadiya/fifa19.

- [14] Kursa, M. B., Rudnicki, W. R., et al. Feature selection with the boruta package. J Stat Softw 36, 11 (2010), 1–13.

- [15] Lim, C., and Yu, B. Estimation stability with cross-validation (escv). Journal of Computational and Graphical Statistics 25, 2 (2016), 464–492.

- [16] Luo, X., Stefanski, L. A., and Boos, D. D. Tuning variable selection procedures by adding noise. Technometrics 48, 2 (2006), 165–175.

- [17] Meinshausen, N., Yu, B., et al. Lasso-type recovery of sparse representations for high-dimensional data. The Annals of Statistics 37, 1 (2009), 246–270.

- [18] Nesterov, Y. Gradient methods for minimizing composite functions. Mathematical Programming 140, 1 (2013), 125–161.

- [19] Nguyen, T.-T., Huang, J. Z., and Nguyen, T. T. Unbiased feature selection in learning random forests for high-dimensional data. The Scientific World Journal 2015 (2015).

- [20] Reeves, G., and Gastpar, M. C. Approximate sparsity pattern recovery: Information-theoretic lower bounds. IEEE Transactions on Information Theory 59, 6 (2013), 3451–3465.

- [21] Rudnicki, W. R., Wrzesień, M., and Paja, W. All relevant feature selection methods and applications. In Feature Selection for Data and Pattern Recognition. Springer, 2015, pp. 11–28.

- [22] Sandri, M., and Zuccolotto, P. A bias correction algorithm for the gini variable importance measure in classification trees. Journal of Computational and Graphical Statistics 17, 3 (2008), 611–628.

- [23] Schwarz, G., et al. Estimating the dimension of a model. The annals of statistics 6, 2 (1978), 461–464.

- [24] Shalev-Shwartz, S., and Tewari, A. Stochastic methods for -regularized loss minimization. Journal of Machine Learning Research 12, Jun (2011), 1865–1892.

- [25] Stone, M. Cross-validation and multinomial prediction. Biometrika 61, 3 (1974), 509–515.

- [26] Tibshirani, R. Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society: Series B (Methodological) 58, 1 (1996), 267–288.

- [27] Tropp, J. A. Just relax: Convex programming methods for identifying sparse signals in noise. IEEE transactions on information theory 52, 3 (2006), 1030–1051.

- [28] Wainwright, M. J. Sharp thresholds for high-dimensional and noisy sparsity recovery using -constrained quadratic programming (lasso). IEEE transactions on information theory 55, 5 (2009), 2183–2202.

- [29] Wang, H. Forward regression for ultra-high dimensional variable screening. Journal of the American Statistical Association 104, 488 (2009), 1512–1524.

- [30] Wang, H., Li, B., and Leng, C. Shrinkage tuning parameter selection with a diverging number of parameters. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 71, 3 (2009), 671–683.

- [31] Wang, H., Li, R., and Tsai, C.-L. Tuning parameter selectors for the smoothly clipped absolute deviation method. Biometrika 94, 3 (2007), 553–568.

- [32] Wu, Y., Boos, D. D., and Stefanski, L. A. Controlling variable selection by the addition of pseudovariables. Journal of the American Statistical Association 102, 477 (2007), 235–243.

- [33] Yu, Y., and Feng, Y. Modified cross-validation for penalized high-dimensional linear regression models. Journal of Computational and Graphical Statistics 23, 4 (2014), 1009–1027.

- [34] Zhou, S. Thresholding procedures for high dimensional variable selection and statistical estimation. In Advances in Neural Information Processing Systems (2009), pp. 2304–2312.

Supplement

Proofs of Theorem 1

To prove Theorem 1, we need to find a cut off which separate and . In order to do this, we first introduce Lemma 1.

Lemma 1

Under conditions C1-C3, if

| (6.1) |

for some , then the problem (2.2) has a minimizer where with probability going to as . In addition, if , then , where is the sign function of and is the true coefficients of important predictors.

To prove Lemma 1, we need the following Lemma 2. We first define .

Lemma 2

Under conditions C1-C3, suppose , where is a local minimizer of the restricted PLS problem

| (6.2) |

and . If

| (6.3) |

then is a local minimizer of (2.2), and if

| (6.4) |

then is a local minimizer of (2.2) with correct signed support.

Proof of Lemma 2. Under conditions C1-C3 and (6.3) is satisfied, it is trival to conclude that is a local minimizer of the Penalized Likelihood problem (2.2) based on the Theorem 1 proposed in [10]. If (6.4) is also satisfied, then is a local minimizer of regularization problem with correct signed support.

Proof of Lemma 1. Construct as in Lemma 2. First, we prove (6.3). where is the sub-gradient of :

| (6.5) |

| (6.6) | ||||

Then it follows that

| (6.7) | ||||

Under conditions C1 and C3, the first term

is controlled by .

,

based on the fact that the projection matrix has spectral norm one. In addition, if , the sub-Gaussian tail bound satisfies

Thus,

By condition C3,

so the probability goes to as .

In the second step, we want to know when the sign consistency of can be guaranteed. The difference between and is

So the is bounded by

The first term is a deterministic quantity, therefore, we only need to bound the second term. For , define by

where is a p-vector with element equal to and other elements equal to . By condition C2, we have

Based on the property of sub-Gaussian random variable, it can be derived that

In addition, since is a matrix, we have

Therefore,

with a probability larger than . Besides, we know that , so with probability going to as under conditions C1-C3. Thus Lemma 1 is proved.

Proof of Theorem 1. From Lemma 1, it is obvious that when , , whereas with probability going to as . Therefore, Theorem 1 is proved.