A General Sensitivity Analysis Approach for Demand Response Optimizations

Abstract

It is well-known that demand response can improve the system efficiency as well as lower consumers’ (prosumers’) electricity bills. However, it is not clear how we can either qualitatively identify the prosumer with the most impact potential or quantitatively estimate each prosumer’s contribution to the total social welfare improvement when additional resource capacity/flexibility is introduced to the system with demand response, such as allowing net-selling behavior. In this work, we build upon existing literature on the electricity market, which consists of price-taking prosumers each with various appliances, an electric utility company and a social welfare optimizing distribution system operator, to design a general sensitivity analysis approach (GSAA) that can estimate the potential of each consumer’s contribution to the social welfare when given more resource capacity. GSAA is based on existence of an efficient competitive equilibrium, which we establish in the paper. When prosumers’ utility functions are quadratic, GSAA can give closed forms characterization on social welfare improvement based on duality analysis. Furthermore, we extend GSAA to a general convex settings, i.e., utility functions with strong convexity and Lipschitz continuous gradient. Even without knowing the specific forms the utility functions, we can derive upper and lower bounds of the social welfare improvement potential of each prosumer, when extra resource is introduced. For both settings, several applications and numerical examples are provided: including extending AC comfort zone, ability of EV to discharge and net selling. The estimation results show that GSAA can be used to decide how to allocate potentially limited market resources in the most impactful way.

Index Terms:

Demand response, competitive equilibrium, optimization duality, sensitivity analysis, utility function, strong convexity, Lipschitz continuous gradient.1 Introduction

As opposed to the traditional supply-follow-demand approach, demand response (DR) provides consumers an opportunity to balance the supply and demand of electricity systems by responding to time-based pricing signals [1, 2, 3, 4, 5, 6, 7, 8]. Appropriately designed pricing signals can encourage consumers to move their flexible demand from the high-demand periods to relatively low-demand periods [9, 10, 11], or also encourage prosumers, i.e., who can both produce and consume [12], to store the electricity into their energy storage or EVs at low pricing periods and use energy in high pricing periods [13], or even sell/discharge it back to the system to obtain economic reward [14, 15]. By encouraging the consumers’ or prosumers’ (for simplicity, we call both of them prosumers in the rest of the paper) participation, DR can significantly lower the system load fluctuation, increase the system efficiency, reduce consumers’ electricity bills and thus improve the total social welfare [16, 17].

Even though DR has huge potential social benefits, the practical implementation still faces a lot of challenges [18, 19]. For hardware, the implementation could require upgrade or installation of lines, smart meters or other power devices. For software, the implementation may require well-designed algorithms to calculate the optimal pricing signal or control strategy that can manage flexible appliances. For the market environment, it may require utility companies or aggregators to make advertisement or campaign persuading customers to join DR project. However, to make all of these conditions satisfied requires huge amount of investment, whereas the budgets are usually limited [20, 21, 22].

In this paper, we aim to address the question of how we can use the limited budget to most efficiently expand the current resource capacity, such as the total amount of allowed net-selling. One solution is to identify and prioritize prosumers with highest potential impact on social welfare, and invest in them first in order to maximize the social welfare improvement. There are some related studies on prosumers’ marginal contribution in DR. Most of them focus on the flexibility or price-responsiveness of a certain type of appliances [23, 24, 25]. Some of them study the DR resources’ capacity value based on simulations or empirical analysis [26, 27]. However, to the best of our knowledge, there is no related studies providing a general tool quantifying or estimating different prosumers’ potential impact on social welfare under a dynamic pricing environment, which is the problem the paper provides solutions to. A key to this problem is to find connections between prosumers’ utility function/their usage behaviors and the social welfare.

To find this connection, we build upon the existing literature on the dynamic pricing DR market framework [9, 5, 25] to model a market with price-taking prosumers with various appliances, a price-taking electric utility company and a price-setting social welfare maximizing distribution system operator (DSO). In the market, each prosumer maximizes their own payoff function with considering flexible appliances’ energy consumption constraints; the utility company maximizes its profit, and the DSO sets appropriate dynamic pricing signals to maximize the social welfare and clears the market. We first model all different types of prosumers’ constraints by a general linear constraint. Then we show there exists an efficient competitive equilibrium and an equivalence relationship between DSO’s problem and the prosumers’ and the utility company’s problems. Based on the general linear constraint and the equivalence relationship, we propose a general sensitivity analysis approach (GSAA) to quantify the effect of prosumers’ contribution on social welfare when more resource is injected into the system, modeled by enlarging their constraint sets.

Since each prosumer’s usage behavior is highly related to their own preference, which is commonly modeled by a (net) utility function [12, 9, 25, 28, 29], the characteristics of different types of utility functions could affect the connection between prosumers’ usage behaviors and the social welfare, thus could also change the way we quantify or estimate each prosumer’s contribution on social welfare. In this work, we consider two types of (net) utility function settings, quadratic function, which is commonly used in many DR related papers [9, 25, 28, 29] and general convex function (i.e., strongly convex and with Lipschitz continuous gradient), which is more general and captures a variety of functions.

As the main contributions of this paper, we relate the potential social welfare improvement and individual prosumer by duality theory and use the proposed GSAA to characterize the shadow prices associated with more resources in the system, i.e., a larger constraint set. When the net utility functions have quadratic forms, we derive the shadow prices explicitly and when the utility functions have general convex form, we establish the bounds of the shadow prices. Under different utility settings, several applications of GSAA are provided, including enlarging a prosumer’s AC comfort zone size, allowing a prosumer’s EV to discharge and allowing a prosumer to net sell. The estimation can be used to identify the prosumers with the most potential impact on social welfare. Thus, when the budgets for implementing DR are limited, we could allocate them to those prosumers accordingly. We also provide a case study in the general convex settings to compare 2 prosumers’ contribution potentials for allowing them to discharge EVs. The two prosumers are identical, except that one’s net utility function is the other’s scaled by a constant. We would expect the one with a larger utility function to have a higher contribution potential, but to our surprise, the bounds of the shadow price given by GSAA show otherwise under certain conditions. Lastly, several numerical studies about the usage of GSAA in net-selling and EV discharging are provided.

The rest of the paper is organized as follows. In Section 2, we introduce the system model and the general linear constraint. In Section 3, we prove the existence of the efficient market equilibrium and the equivalence between DSO problem and prosumers’ and the utility companies’ problems, which form the foundation of GSAA. Section 4 studies the usage of GSAA under quadratic net utility function settings, where the closed-form shadow price are calculated and Section 5 talks about the usage of GSAA under the general convex settings in which the bounds of the shadow price are derived. In Sections 6, we provide numerical studies to illustrate the usage of GSAA.

Notations: Throughout the paper, we use bold font to represent vectors variables, and superscript for transpose. Notation denotes vector . For column vectors , we use notation to denote a combined column vector . For a vector , we denote the element of x as .The operator is given by . We use to denote that Euclidean norm or norm. For a matrix , we denote its element on the row and the column as . Inequalities, , , , are used in an element-wise sense. The notation denotes a column vector consists of the diagonal elements of matrix A. We use notation to denote matrix . For a function , is the gradient of , and .

2 System Model

In this section, we introduce our general market model consisting of three participants: prosumers, an electric utility company and a DSO. We use to denote the set of all nodes in the power network. Without loss of generality, we let node 0 represent the electric utility company and the nodes in represent individual prosumers. In rest of the paper, the words ‘prosumer node’ and ‘prosumer’ are used interchangeably. Similarly, we do not distinguish between the words ‘electric utility company node’, ‘electric utility company’ or ‘utility company’ unless otherwise noted. The DSO, as a social planner and a system operator, maximizes the social welfare while clearing the market and guarantees system operation reliability. The market we consider here is a retail electricity market with no uncertainty and periods, indexed by . We assume in this market both prosumers and the electric utility company are price-taking. We call the market -period DR market.

For each prosumer , let denote the set of household appliances, such as lights, air conditioners (ACs), washers, energy storage and electric vehicles (EVs). For each appliance , we define its power consumption scheduling vector as in where represents the power consumption of prosumer ’s appliance at time , and superscript indicates the demand side (i.e., the prosumers). We can concatenate these vectors to define for each prosumer , in and the aggregate vector for all prosumers, in . For the utility company (superscript representing the supply side), we define its power supply scheduling vector as , where in . At last, we define the market clearing electricity price vector, which is announced by DSO, as p in .

2.1 Prosumer Model

In our model, prosumers (i.e., users who can both buy and sell back electricity) optimize their power schedules to maximize their own payoffs. Here the payoff function is defined by a quasilinear function , which includes a utility function that reflects prosumer ’s preference on energy consumption for appliances, a cost function representing amortized battery life loss for EVs and energy storage (for other non-battery appliances, ), and payments . The combination terms are also called net utility function. With these components, the prosumers’ problem (P) is formulated as follows. For each prosumer

| (P1) | ||||

| s.t. | (P2) |

We adopt the following simplifying assumption:

Assumption 1.

Prosumer ’s utility function and cost function are separable over appliances and time periods.

Having the above assumption, prosumer ’s utility function and cost function can be written as

| (1) | |||

| (2) |

where is the utility function for appliance at time and is the cost function for appliance at time , and we adopt the following standard assumptions for functions and :

Assumption 2.

Functions and are convex non-decreasing and differentiable in their respective effective domains. The gradient of the net utility function at 0 is element-wise positive, i.e. .

We note that, in the prosumer model (P), there is no sign restriction on , meaning that the prosumers can either consume or produce/sell electricity (hence the name prosumer).

The set of linear inequalities includes representations of different power consumption requirements for household appliances of prosumer . Particularly, for all the appliances, we divide them into two types based on their flexibility: flexible appliances and inflexible appliances.

For flexible appliances such as ACs, washers, dryers, dishwashers, fridges, EVs/PHEVs and energy storage, whose power consumption may change depending on the price, their constraints (P2) can be written as the following forms based on [9], [5] and [30].

| (3) | ||||

| (4) |

where constraint (3) represents an available range of the power consumption for the flexible appliance at time period . For AC, it means the power should between 0 and the rated power; for EV/PHEV and energy storage, it means the power should be between maximal discharging power and maximal charging power. Note that the power lower bound could be negative for EVs, PHEVs and energy storage, which reflects the definition of prosumer. Constraint (4) indicates an acceptable energy consumption range of the flexible appliance during the pre-specified periods of time .111If an appliance has multiple flexible periods in , then the appliance has multiple constraints in form (4). For the detailed models of appliances, interested readers are referred to [9] and [30]. We call these periods in total a flexible period, during which the appliance can adjust its power schedule as long as it can finish certain task within certain energy usage limit. For example, AC consumes enough (but not too much) energy to maintain the room temperature [9, 30] in a comfortable level during the hottest time of day in summer, a washer finishes laundry by a specified time set by its user, an EV owner charges/discharges his/her car at home overnight for a trip the next day, or energy storage keeps its battery level within certain range to ensure a longer battery life. The coefficient in constraint (4) is used to capture efficiency (in a broad sense) of different types of flexible appliances. For most appliances such as washers, EVs and storage, is a power loss factor in an energy transmission process. In an ideal case, is set to constant 1, meaning there’s no loss in the process. For AC, coefficient has a more special meaning, which describes time dynamic relationships between room temperature and AC power schedules.

For inflexible appliances such as lights, routers, monitor cameras, computers, TVs etc., their power consumption constraints can be written as the form of inequalities (3) (without (4)), i.e., the power consumption in each period is in a certain range.

In addition to representing the appliance power consumption requirements, the constraint also describes prosumer ’s type of usage behavior, which can be divided into three types: simple buyers, net buyers and net sellers. The simple buyers are users who only consume energy, but do not discharge energy back to grid (for their own usage or selling to others). Their DR constraints can be described by (3)-(4) with , which implies that their is non-negative. The net buyers are users who can consume energy, store energy and discharge for their own usage but cannot sell to others. Their DR constraints can be described by (3)-(4) and the following constraint:

| (5) |

Lastly, the net sellers are those who can consume, store and sell energy to others. Their DR constraints can be covered by (3) and (4) only. To avoid trivial cases, we make the following assumption:

Assumption 3.

In the problem (P), the feasible set is nonempty.

2.2 Electric Utility Company Model

The electric utility company maximizes its profit (equal to revenue minus cost) by optimizing its power supply scheduling . Hence, the electric utility company’s problem (U) is formulated by

| (U) |

where is the cost function and assumed to be convex and continuously differentiable in its effective domain. To avoid trivial cases, we make the following assumption:

Assumption 4.

In problem (U), there exists at least one global optimal solution.

2.3 Distribution System Operator Model

Distribution system operator is a benevolent system planner, which maximizes the social welfare as well as keeps the supply-demand balance. The problem DSO solves, referred to as (D), is given below.

| (D1) | ||||

| s.t. | (D2) | |||

| (D3) |

where the objective function in (D1) is the social welfare. Function is prosumers’ total utility function, defined by . Similarly, is prosumers’ total cost function, defined by . We know that and are concave and convex respectively due to Assumption 2.

The constraint in (D2) is an aggregation of the constraint (P2), , for all prosumers. Specifically, , and .

We call the constraint for prosumer in (D2) (i.e., the row of ) as the general linear constraint for prosumer , which can be written as the following,

| (6) |

where and . We note that constraint (6) covers all individual constraints (i.e., (3)-(5)) appeared in (D2) and gives each individual constraint a unique label. When Eq. (6) represents (3) or (4), the value specifies available ranges of power consumption for prosumer ’s appliances. When Eq. (6) represents (5), restricts prosumer ’s net-selling amounts. In either case, reflects prosumer ’s capacity of resources in DR. For generality, we call each as a Resource Capacity (RC) for prosumer .

3 Efficient Market Equilibrium

We first introduce basic definitions used in this section.

Definition 1 (Competitive Equilibrium).

A competitive equilibrium is defined by a demand-supply allocation and a price vector in a market such that all agents’ (prosumers’ and the utility company’s) choices are individually optimal (for problems (P) and (U)) given the price, and the market clears.

Definition 2 (Efficient Allocation).

An allocation is efficient if it solves optimization problem (D).

The main goal of this section is to show that in the proposed -period DR market, there exists a competitive equilibrium with an efficient allocation, and the competitive equilibrium set is equivalent222We say set is equivalent to set , if there exists a 1-1 mapping of set A onto set B. to the set of efficient allocations and the corresponding market clearing prices. In particular, it is described by the following theorem, whose statement partially appeared in our previous conference paper [31]. Here we provide the complete version and its detailed proof.

Theorem 3.1.

In the proposed -period DR market, (1) there exists an efficient demand-supply allocation and a price vector p such that forms a competitive equilibrium; (2) set is a competitive equilibrium, is equivalent to set is an efficient allocation and p is its market clearing price.

Proof.

(1) We prove Theorem 3.1 (1) by construction. First, based on Assumptions 1-3, we know problem (D)’s objective function is continuous and concave, and its feasible set given by (D2) and (D3) is convex, nonempty and compact. By Weierstrass extreme value theorem, there exists a bounded optimal solution . Then the optimal objective value of (D) is finite. Also due to linear forms of (3)-(5) and (D3), we know problem (D) has affine constraints. Hence, by Proposition 5.3.1 on existence of primal and dual optimal solutions in [32], the dual optimal solution for problem (D) exists. Let denote a dual optimal solution pair to problem (D), where vectors and are Lagrange multipliers for the constraints (D2) and (D3) respectively. Then the following Karush-Kuhn-Tucker (KKT) conditions hold:

| (PF1) | |||

| (PF2) | |||

| (DF) | |||

| (CS) | |||

| (FOC1) | |||

| (FOC2) |

where vector is the Lagrange multiplier that associated with prosumer ’s constraints in (D2), thus we have . Vector is given by with repeated times. In the above KKT conditions, constraints (PF1) and (PF2) describe primal feasibility, inequalities in (DF) reflect dual feasibility, equations in (CS) are complimentary slackness conditions, and equations (FOC1) and (FOC2) are first order optimality conditions. When DSO sets the market price to

conditions (PF1), (DF), (CS) and (FOC1) guarantee (selected from ) and satisfy problem (P)’s KKT condition, as shown below

where with repeated times, and because the convex problem (P)’s strong duality holds, which is guaranteed by Assumption 3 (refer to discussions of constraint qualifications in Section 5.2.3 of [33]), the quantity is also an optimal solution to problem (P).

Similarly, the quantity in is also an optimal solution to problem (U), because condition (FOC2) guarantees satisfy problem (U)’s optimality condition, as shown below

Hence, the pair form a competitive equilibrium. This completes the proof of (1).

(2) We follow the same notation as in the first part. For any competitive equilibrium , let , where is the dual optimal solution to prosumer ’s problem (P) and let . Then we know and satisfy problem (D)’s KKT conditions, since a combination of (P)’s KKT conditions, (U)’s optimality condition, the market clearing equation and the above equations together forms problem (D)’s KKT conditions. By strong duality of problem (D) due to Assumption 3, we have and are primal and dual optimal solutions to problem (D), thus . Conversly, if , then by the same process of proof of (1), we know as long as the DSO sets price to , becomes a competitive equilibrium, thus . This shows . Hence, we obtain is equivalent to .

∎

The above theorem is related to the fundamental theorems of welfare in economics [34], but they are different because of the physical constraint (D2). From the theorem, we obtain an equivalence relationship between problem (D) and problems (P) and (U). This relationship makes it possible for us, by only focusing on problem (D), to analyze sensitivity of prosumers’ contribution on social welfare in optimal DR with the change of the resource capacity, . The analysis applies to many situations, such as the change of AC comfort zone size, allowing prosumers to be net-sellers and allowing EVs to discharge. For example, we can analyze the effect of allowing an EV to discharge on the optimal social welfare by changing the resource capacity of the EV’s discharging constraint. Since all individual constraints can be described by the general linear constraint (6), we can perform the sensitivity analysis by analyzing the dual variable (shadow price) associated with the constraint (6) of problem (D). This is what we call General Sensitivity Analysis Approach, GSAA.

In the following sections, we study GSAA in two different net utility function settings: quadratic and general convex. In the former case, the closed-form shadow price can be derived; while in the later case, the shadow price may not be derived explicitly. Instead, we analyze properties of the bounds on the shadow price.

4 Quadratic Settings

In this section, we consider a setting, where all the net utility functions are quadratic. Then GSAA can provide a closed-form shadow price reflecting quantitative information about impacts of the general linear constraints on the optimal objective value, i.e., maximal social welfare.

4.1 Model Reformulation in Quadratic Settings

In the quadratic setting, the models of prosumers, the utility company and DSO can be reformulated into the following forms.

4.1.1 Prosumer

The net utility function of prosumer using appliance at time by consuming quantity is given below,

| (7) |

where the second order coefficient represents the concavity of the appliance’s net utility. The first order coefficient represents the appliance’s initial utility increasing rate, i.e., the utility associated with consuming the first unit of energy. The constant represents the initial utility when time period starts. For different types of appliances, their quadratic net utility coefficients are described in Table I. More details on the coefficient meaning of different appliances can be found in [31].

| Inflexible Appliances | ||

|---|---|---|

| Flexible | ACs, Washers | |

| EVs/PHEVs | ||

| Energy Storage | ||

In the above table, in addition to ACs and washers, dryers, dishwashers and fridges also belong to the first category under flexible appliances.

With these quadratic coefficients, we can reformulate prosumer problem (P) into the following matrix form,

| (8) |

where matrix with for , vector with , vector , vector with , and vector .

4.1.2 Electric Utility Company

For simplicity, we assume the utility company’s production cost is linear and can be time-varying, i.e., for ,

| (9) |

4.1.3 DSO

Under the quadratic framework and by using equation (D3) to substitute decision variable with , the DSO problem (D) can be reformulated into the following quadratic programming problem,

| (10) |

where matrix , vectors , and . Matrix is a full rank diagonal by matrix.

4.2 Shadow Price in Quadratic Settings

In this section, we derive a closed-form expression of the shadow price, i.e., the Lagrange multiplier/the dual variable associated to the general linear constraint for prosumer , (6), in the reformulated DSO problem (10). Let denote the Lagrange multiplier vector to constraint set (D2). First, we show an important property of the problem (10) used in deriving the shadow price later.

Property 4.1.

Proof.

Notice that the objective function of problem (10) is equal to , where , and in (D2), the constraints corresponding to one prosumer is independent from the constraints corresponding to the other prosumers. Hence, the KKT conditions for the original problem (10) are the same as the combination of KKT conditions of all decoupled problems (11) (One can refer to the KKT conditions used in Theorem 3.1’s proof). Hence, by strong duality of both problems (10) and (11) for all , their optimal primal and dual solutions are the same to each other. ∎

The above property tells us, deriving the shadow price for the DSO problem (10) is equivalent to deriving the shadow price for the decoupled problems (11). Furthermore, the shadow price of the decoupled problems (11) can be directly applied to sensitivity analysis to the original problem (10).

Now, we can first focus on the decoupled problem (11) for prosumer . Let denote the optimal dual variable associated with constraint (P2). Since the matrix is diagonal and of full rank, by first order condition we can write the optimal solution for problem (11) as

| (12) |

Substituting (12) to (11) and by strong duality, the quadratic programming problem (11) is equivalent to its dual problem as below,

| (13) |

where we ignore the constant term , since it does not affect the optimal solution.

For the above dual problem (13), to the best of our knowledge, there is no explicit closed-form solution. However, for this paper, we are interested in estimating the effect of changing one of prosumer ’s resource capacities, , at a time on the social welfare. Hence, we only need to focus on one element of Lagrange multiplier vector .

We do so by focusing on the targeted constraint i.e., the general linear constraint for prosumer , (6), and assume this constraint is tight at optimality while prosumer ’s other constraints are not (Note, there is no assumption about the other prosumers’ constraints). Then derive the shadow price associated with the constraint (6). Due to complimentary slackness, we know for prosumer , . By matrix calculations, we can obtain the shadow price of the target constraint (6) as below,

| (14) |

By the definitions of and , we have

| (15) |

Based on property 4.1, we know the above closed-form shadow price (15) reflects the rate of change in social welfare (objective function value of (D)) associated with change of the resource capacity . More specifically, the amount of social welfare improvement associated with increasing the resource capacity by up to units, i.e., relaxing the general linear constraint (6) to , is upper bounded by . Hence, the closed-form shadow price (15) can be used as a measuring tool for GSAA to quickly estimate the potential of prosumer ’s contribution on social welfare with change of the resource capacity in DR. When one needs to encourage/select customers to participate in DR or make investment on network construction or upgrade to enable certain DR functions, priority should be given to the prosumer with a larger potential contribution i.e., a larger value of (especially when there is a limited budget for the campaign, infrastructure upgrade or management).

4.3 GSAA Applications in Quadratic Settings

To show how GSAA can be used to identify contribution potentials of different prosumers on social welfare with change of their resource capacities in DR, we provide three application examples here: enlarging AC comfort zone, allowing net-selling behavior and allowing EVs to discharge.

4.3.1 GSAA for Enlarging AC Comfort Zone

For prosumer using an AC (labeled by ) at time period , the AC comfort zone constraint (refer to [9] and [30]) can be represented by

| (16) |

where, . Values and reflect prosumer ’s equivalent lowest and highest comfort temperatures respectively. Due to symmetry, here we only take the right inequality of (16) as an example. It can be reformulated as the th general linear constraint for prosumer , of form Eq. (6), where , , and . We use to denote the optimal dual variable, i.e., the shadow price, corresponding to this constraint. By using GSAA, i.e., substituting specific parameters of the constraint and the net utility function (7) into (15), we can obtain the shadow price for relaxing AC comfort zone’s upper limit as

| (17) |

Then shows the potential of prosumer ’s contribution on social welfare by enlarging his/her AC comfort zone limit by units. From the form of (17), we can observe that for two prosumers with similar utility functions and similar AC parameters , the one who accepts a higher temperature, reflected as larger , has a lower contribution potential on social welfare. This result suggests that we should target those prefer cold AC setpoints first.

4.3.2 GSAA for Allowing Net Selling

For prosumer , who is also a net buyer, we can use GSAA to estimate his/her contribution on social welfare by allowing him/her to be a net seller in DR, i.e., relaxing the net buying constraint (5). This constraint can be reformulated as the th general linear constraint for prosumer , of form Eq. (6), where , , and . We use to denote the optimal dual variable corresponding to this constraint. By using GSAA, i.e., substituting specific parameters of the constraint and the net utility function (7) into (15), we can obtain the shadow price for allowing a prosumer to be a net seller as

| (18) |

Then shows the potential of the net buyer ’s contribution on social welfare in DR by allowing him/her to net sell energy up to units. From the form of (18), we can find that the effect of allowing net selling on social welfare improvement is not due to a single appliance. Instead, it is affected by a combination of all appliances, which implies the high complexity of accurate sensitivity analysis. If there is one appliance, whose net utility function is much flatter (very price-responsive) than the rest, i.e., there exists an with , and if all appliance initial utility increasing rates are similar, then . Hence, the shadow price is dominated by this most price-responsive appliance.

4.3.3 GSAA for Allowing EVs to Discharge

By using GSAA, we can also estimate the effect of allowing prosumer ’s EV (labeled by ) to discharge at time period , i.e., relaxing the constraint , on the social welfare improvement. Similarly, the above constraint can be reformulated as the th general linear constraint for prosumer , of form Eq. (6), where , , and . We use to denote the optimal dual variable associated to this constraint. Substituting specific parameters of the constraint and the net utility function (7) into (15), we can obtain the shadow price for allowing EVs to discharge is

| (19) |

Similarly, if we allow the EV to discharge up to units of energy, then the potential of prosumer ’s contribution on social welfare is . We can see that the above shadow price is monotonically increasing in the current utility company’s production cost and monotonically decreasing in . Hence those with low values of , who value EV charging less, should be given EV discharging capacity first.

5 General Convex Settings

In this section, we study GSAA under a more general framework, where we do not have an explicit form of a prosumer’s net utility function except for some nice convexity, by which we mean the prosumer’s negative net utility function is strongly convex and has Lipschitz continuous gradient. It’s worth mentioning that the quadratic settings discussed in the previous section is just a special case of general convex settings here. Under the general convex settings, even though we cannot get a closed-form shadow price, we are able to derive upper and lower bounds of shadow prices based on the quadratic settings before. These bounds, as indirect information, can still provide us insights on prosumers’ marginal contributions on social welfare as they change resources capacity in DR.

5.1 Preliminary

We first introduce basic definitions and equivalent conditions for strong convexity and Lipschitz continuous gradient[33, 35], which are used in theorems appeared latter.

Definition 3 (Strong Convexity).

A function is -strongly convex (or has -strong convexity) for , if the function is convex for all .

Lemma 5.1.

A differentiable function is -strongly convex if and only if ,

| (20) |

Lemma 5.2.

If a function is -strongly convex, then is strictly convex. [36]

Definition 4 (Lipschitz Continuous Gradient).

A differentiable continuous function has -Lipschitz continuous gradient for , if for all .

Lemma 5.3.

A convex function has -Lipschitz continuous gradient if and only if ,

| (21) |

5.2 Model Reformulation in General Convex Settings

For notational convenience, we let . In the general convex framework, all prosumers’ net utility functions have nice convexity. Specifically, we adopt the following assumption:

Assumption 5.

is differentiable, -strongly convex and has -Lipschitz continuous gradient, .

With notation , we can write DSO problem (D) as

For simplicity, we still adopt the assumption that the utility company’s cost function has linear form as in Eq. (9). By substituting Eq. (9) and Eq. (D3) into the above DSO problem (D), we can simplify it to

| (22) |

Let denote the objective function in (22), then by Assumption 5, Lemma 5.1 and 5.3 for each and summing over all , we have: ,

| (23) |

where

5.3 Shadow Price in General Convex Settings

In this section we derive closed-form upper and lower bounds of shadow price, i.e., Lagrange multiplier associated with any general linear constraint (6), from the following three problems.

| (I) | |||

| (II) | |||

| (III) |

where the problem (II) is the problem (22) with a simplified form. Some basic properties of the problems (I), (II) and (III) are given below.

Property 5.1.

For any given and (), each problem of (I), (II) and (III) has unique primal and dual optimal solutions.

Proof.

Given any and (), by a similar process of proof of Theorem 3.1, the dual optimal solutions for (I), (II) and (III) exist. Next, since is -strongly convex, by Lemma 5.1, we know is strictly convex. Since is the summation of strictly convex functions and convex functions, it is strictly convex too. Similarly, because and are summations of quadratic functions (strictly convex) and a linear function (convex), they are also stricly convex for any and . Hence, due to the strict convexity, by Section 5.5.5 of [33], we know both primal and dual optimal solutions are unique for each problem. ∎

Property 5.2.

The optimal objective values , , of the problems (I), (II), (III) satisfy for any given and .

Proof.

This holds due to Eq. (23). ∎

With the above property, we can denote these unique primal and dual optimal solution pairs for problems (I), (II) and (III) by , and respectively. A relationship between the optimal solutions of these three problems are described in the following theorem.

Property 5.3.

There exist vectors and , such that optimization problems (I), (II) and (III) have the same optimal solution i.e., .

Proof.

We first show by construction that there exists a vector such that problem (I) and (II) have the same optimal solution i.e., . Firstly, we solve problem (I) with . By definition of , the objective function of problem (I) becomes

| (24) |

Organizing the above equation in terms of the order of decision variable , we have

| (25) |

where the last summation term is a constant. Hence, KKT conditions for the problem (I) with are as below,

| (I.1) | |||

| (I.2) | |||

| (I.3) | |||

| (I.4) |

where . is an identity matrix with length . If we replace by in the above KKT conditions for the problem (I), then we can obtain the following expressions

| (II.1) | |||

| (II.2) | |||

| (II.3) | |||

| (II.4) |

These expressions hold due to optimality of as they are exactly the same as KKT conditions for problem (II). Hence, also satisfies (I.1)-(I.4) and is an optimal solution of the problem (I). With Theorem 5.1, we know .

By a similar process, we can prove for , (II) and (III) have the same optimal solution, i.e., .

333It’s worth mentioning that the proof only shows existence, but not provide information about uniqueness of such existence.

∎

Property 5.4.

The problems (I), (II) and (III) are equivalent to the following three decoupled problems respectively, i.e., each of problems (I), (II) and (III) has the same primal and dual optimal solutions to its decoupled problem.

| (De-I) | |||

| (De-II) | |||

| (De-III) |

where , and .

Proof.

Due to Eq. (23), we know the problems (I), (II) and (III) are summations of problems (De-I), (De-II) and (De-III) over respectively. And because different prosumers’ constraints are separable, following the similar procedure to prove property 4.1 in section 4.2, we can obtain original problems and their decoupled problems are equivalent. ∎

Based on the above properties, we know the shadow price for the decoupled problems (De-II) can be directly applied to sensitivity analysis for the DSO problem (10). Hence, we can first analyze the decoupled problems. Let , and denote the optimal dual variable associated with constraint (P2) in problems (De-I), (De-II) and (De-III) for prosumer . Similar to the quadratic settings, we only focus on the targeted constraint i.e., the general linear constraint for prosumer , (6), and assume this constraint is tight at optimality while prosumer ’s other constraints are not (Similarly, there is no assumption about the other prosumers’ constraints). Then derive the closed-form upper and lower bounds of the shadow price, as shown below.

Theorem 5.1 (Dual Bounding Theorem).

Assume for certain given and , prosumer ’s optimization problems (De-I), (De-II) and (De-III) achieve optimality with only the constraint of (P2), i.e., being tight. We denote the corresponding dual variables (i.e., shadow prices) as , and respectively. Then, (1) is bounded by the following inequalities,

| (26) |

in which

| (27) | ||||

| (28) | ||||

| (29) | ||||

| (30) | ||||

| (31) |

(2) if and are vectors such that , then the form of Eq. (26) can be represented with and changed to

| (32) | ||||

| (33) |

Proof.

By using triangle inequality and definition 4 we have

Since problems (De-I), (De-II) and (De-III) achieve optimality with the same constraint tight, by complimentary slackness conditions we have

| (39) |

The above three relations imply

| (40) | |||

| (41) |

Multiplying on both sides of the above two inequalities, we have

Because and definitions of and , we obtain Eq. (26).

Next, we prove equations (27) and (28) hold. Due to similarity, here we only provide the proof of (27). We know is the shadow price associated with the general linear constraint in optimization problem (De-I). Note that the objective function of problem (De-I), has quadratic form in terms of , as shown below.

| (42) |

where . Following the similar procedure to derive (15) in section 4.1.3, we have the shadow price for problem (I) as below.

| (43) |

where . Multiplying on both of the numerator and the denominator in the right hand side of equality (43), we obtain

which is equivalent to (27).

(2) By property 5.3, we can substitute into Eq. (29) and into Eq. (30). Then we obtain (32) and (33). This completes the proof.

∎

Based on the above theorem, we can substitute different values of and to obtain various bounds of the shadow price . The pair and would give us the exact bounds, but cannot provide us too much information due to terms cancelation. Another candidate is , by which we can obtain the following simpler upper and lower bounds of the shadow price . For the rest of the paper, we use and to denote the optimal solutions with .

Corollary 5.1.

In Theorem 5.1 (1), if , then the lower bound of , denoted by , could be further simplified as

| (44) |

the upper bound of could be simplified as

| (45) |

We notice that the bounds are related to prosumer ’s initial utility increasing rate , which is positive by Assumption 2.

Corollary 5.2.

Proof.

In the general convex settings, the closed-form upper and lower bounds of the shadow price in the above Dual Bounding Theorem 5.1, its Corollaries 5.1 and 5.2, and Property 5.4 provide foundations for GSAA, which can be used as a measuring tool to estimate the ranges of prosumer ’s contribution potential on social welfare with change of the resource capacity in DR. More specifically, interval shows the potential range of prosumer ’s contribution on social welfare by increasing his/her resource capacity by units. Similar to the quadratic setting, we next answer the question of which prosumer should be allocated the additional resource capacity to maximize the improvement in social welfare, when there is a limited budget in expanding resource capacity. We do so by comparing these potential ranges. When one’s potential range is strictly higher than the other’s, then that prosume should get priority. In case there is overlap, then the result may be indecisive. In such case, further analysis is required.

5.4 GSAA Applications in General Convex Settings

Similar to section 4.3, here we provide three application examples: enlarging AC comfort zone, allowing net-selling behavior and allowing EVs to discharge. However, different from section 4.3, in general convex settings GSAA only gives us closed-form upper and lower bounds of the shadow price instead of the closed-form shadow price itself. Nevertheless, under certain conditions, we can identify the prosumer with most significant impact on social welfare based on these bounds.

5.4.1 GSAA for Enlarging AC Comfort Zone

Prosumer ’s AC (labeled by ) comfort zone constraint is given by (16). Take the right inequality of (16), i.e., the upper limit constraint, as an example. Similar to Section 4.3.1, we can reformulate it into the general linear constraint for prosumer . By using GSAA, i.e., substituting specific parameters of the constraint into Corollary 5.1, we can obtain upper and lower bounds of the shadow price for increasing AC comfort zone’s upper limit, where the lower bound of the shadow price is

where ; the upper bound of the shadow price is

We note that unlike (17) in the quadratic settings, the above bounds do not need information about the specific forms or coefficients of the net utility function. Instead, it requires several key values to complete the calculation, the initial utility increasing rate , the optimal solutions of problems (I) and (III), i.e., and , and the operating point 444We could obtain the initial utility increasing rate by learning from historical data or by surveys or tests for prosumers, obtain optimal solutions of problems (I) and (III) by solving quadratic programming problems, and obtain the operating point by direct measuring or reading from meters. The implementation details, however, are out the scope of this paper. .

For two prosumers with similar utility functions and similar AC parameters , everything else equal, the one accepts a higher temperature, reflected as larger , has a relatively lower range of contribution potential, just as in Section 4.3.1. However, in this case, it is harder to guarantee all other parameters are equal, as the ranges depends on and .

5.4.2 GSAA for Allowing Net Selling

Allowing prosumer (a net buyer) to be a net-seller in DR is equivalent to relaxing the net buying constraint (5), which can be reformulated as the th general linear constraint for prosumer (similar to Section 4.3.2). By using GSAA i.e., substituting specific parameters of the constraint to Corollary 5.2, we can obtain the lower bound of the shadow price for allowing net selling as

and the upper bound of the shadow price as

From the above bounds, we can observe that the effect of allowing net selling on social welfare improvement is not due to a single appliance. Instead, it is affected by a combination of all appliances, especially their initial utility increasing rates , which implies the high complexity of accurate sensitivity analysis.

For two prosumers, if both of their average initial utility increasing rates are no more than the utility company’s cost and all other properties are similar (i.e., similar amounts of appliances, , and ), then the one with a lower average initial utility increasing rate has a relatively higher range of contribution potential on social welfare by allowing them to net sell K units of energy.

5.4.3 Effects of Allowing EVs to Discharge

Allowing prosumer ’s EV (labeled by ) to discharge at time period is equivalent to relaxing the constraint . Similarly, the constraint can be reformulated as the th general linear constraint for prosumer (see Section 4.3.3). To obtain the upper and lower bounds of the shadow price associated with the constraint, we can use GSAA, i.e., substituting parameters of the constraint into Corollary 5.2. The lower bound becomes

| (48) |

the upper bound has the following form

| (49) |

We can see that the above shadow price is monotonically increasing in the current utility company’s production cost and monotonically decreasing against the prosumer ’s initial utility increasing rate (when other parameters are fixed).

For two prosumers with similar , and , the one with a lower initial utility increasing rate (not exceeding the utility company’s cost) has a relatively higher range of contribution potential.

5.5 Case Study: Two Prosumers with EVs

Consider a simple one-time-period case (i.e., ), where we want to compare two prosumers, and , on their potential to benefit social welfare by discharging their EVs. We assume their negative net utility functions are related by a constant factor, i.e.,

| (50) |

and at optimal solution of their respective (P1) problems, only EV discharging constraints for both and are tight. We next introduce a corollary based on Eq. (50).

Corollary 5.3.

If prosumer ’s and prosumer ’s negative net utility functions satisfy , where is -strongly convex and has -Lipschitz continuous gradient and satisfy the assumption in Theorem 5.1 (1), i.e., for prosumer , only the general linear constraint being tight at the optimality of problems (De-I), (De-II) and (De-III), then the optimal solutions and for prosumer ’s problems (De-I) and (De-III) have the following forms

| (51) | |||

| (52) |

where ; and are shadow prices associated with the general linear constraint for prosumer ,

| (53) | ||||

| (54) | ||||

and,

for which

Proof.

Since is -strongly convex and has -Lipschitz continuous gradient, is -strongly convex and has -Lipschitz continuous gradient. By first order optimality condition of problem (De-I) for prosumer , we have

Substituting to the above equation, we have

Using , we obtain

| (55) |

By complimentary slackness conditions, we have

| (56) |

Substituting Eq. (56) to Eq. (55) and with some basic calculations, we can obtain (51). Finally, using Eq. (27) in Dual Bounding Theorem 5.1, we can obtain Eq. (53) by replacing subscript with , replacing with , then substituting , and . The proof for Eq. (52) is omitted since the process is similar. ∎

We will next focus on analyzing the constraint of the kind , which corresponds to the constraint for prosumer and for prosumer .

5.5.1 Example ()

Prosumer can contribute more on social welfare than prosumer in EV discharging, even when ’s utility is less than ’s utility. This case is shown by the following lemma.

Lemma 5.4.

If satisfies the following condition

| (57) |

then the shadow price associated with (the general linear constraint for prosumer ), is larger than the shadow price associated with (the general linear constraint for prosumer ), i.e., .

Proof.

We prove the inequality by showing the upper bound of , is less than the lower bound of , . First, from Eq. (49) and Eq. (50) we can obtain

| (58) |

Substituting Eq. (52) to Eq. (58), we have

Since we are considering the single-time-period case, and . Also because the constraint for the shadow price is , we have . Hence, the above equation becomes

| (59) |

By simplifying Eq. (54), we know . Therefore, Eq. (59) becomes

| (60) |

Notice that represents the initial utility increasing rate, which is positive by Assumption 2. Hence, from Eq. (57) we know

| (61) |

Having the above inequality, Eq. (60) can be simplified to

| (62) |

Next, we can obtain prosumer ’s shadow price lower bound by using Eq. (48) and Eq. (52) (with letting and replacing subscript by and by ).

Similar to the process we analyzed the coefficients and for , we can obtain , and . Hence, we have

| (63) |

Recall that . Therefore, from Eq. (61), we have

| (64) |

Having the above inequality, Eq. (63) can be simplified to

| (65) |

Last, by Eq. (57) and , we have . Hence, from Eq. (57), we can obtain

Adding on both sides of the above inequality, we have

| (66) |

Recall is positive. Also by Eq. (61), we have the right hand side of the above inequality is positive. Therefore, the left hand side is also positive, which implies

| (67) |

Hence, we obtain . ∎

5.5.2 Example ()

Prosumer can contribute more on social welfare than prosumer in EV discharging, even when ’s utility is less than ’s utility. This case is shown by the following lemma.

Lemma 5.5.

If satisfies the following condition

| (68) |

then , where these shadow prices are defined as the same as in Lemma 5.4.

Proof.

We prove the inequality by showing the upper bound of , is less than the lower bound of , . First, from Eq. (49) we have

| (69) |

Substituting Eq. (52) to Eq. (69), we can obtain

Since we are considering the single-time-period case, and . Also because the constraint for the shadow price is , we have . Hence, can be simplified to

| (70) |

By replacing subscript by , setting in Eq. (54), we can obtain . Therefore, Eq. (70) becomes

| (71) |

Recall that . Hence, from Eq. (68) we know

thus Eq. (71) can be simplified to

| (72) |

Next, we can obtain prosumer ’s shadow price lower bound by using Eq. (48), Eq. (50) and Eq. (52) (when use Eq. (52), let and replace subscript by ).

Similar to the process we analyzed the coefficients and for , we can obtain , and . Hence can be simplified to

| (73) |

From Eq. (68), we have

| (74) |

Having the above inequality, Eq. (73) can be simplified to

| (75) |

This is the lower bound of prosumer ’s shadow price .

Last, by Eq. (68), we know and . Hence, from Eq. (68), we can obtain

Adding on both sides of the above inequality, we have

Since is nonnegative. Therefore, the left hand side of the above inequality is positive, which implies

| (76) |

Hence, we have . ∎

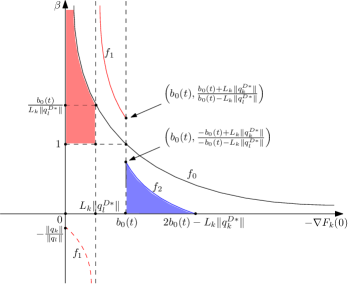

The feasible areas of for the above two examples are depicted in Figure (1).

The three functions and in terms of prosumer ’s initial utility increasing rate , replaced by for convenience, are given below. . In the above figure, the red area is when , where we would expect prosumer to have a higher impact, but surprisingly multiplier has a higher range, and the blue area is for , where prosumer with lower utility function but a higher impact on social welfare.

6 Numerical Studies

We illustrate the usage of GSAA by considering the DR market consists of 2 prosumers, 1 utility company and 1 DSO. Here we use GSAA in an incremental way to estimate a prosumer’s contribution potential, meaning that we increase the resource capacity of the general linear constraint for GSAA in small increments and then update GSAA iteratively instead of using GSAA only once for a large change of resource capacity.

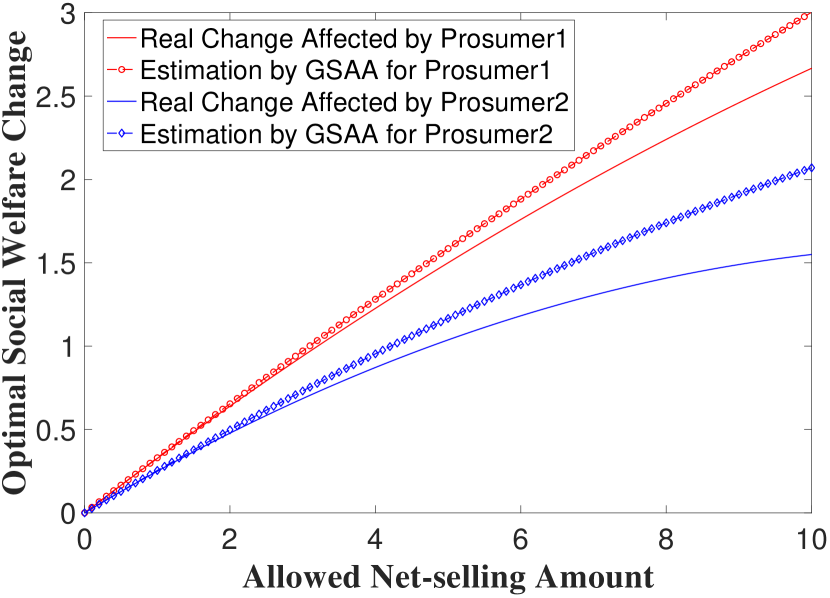

First, we test GSAA usage under quadratic settings in a 24-time-period DR market, where each prosumer has two appliances: energy storage (labeled by ES) and an EV (labeled by EV). Both appliances have quadratic net utility functions, where the coefficients follow the signs in Table I. Specifically, we let the second order coefficients for two prosumers’ ES net utility be randomly selected from , here and . The second order coefficients and the first order coefficients of EVs’ net utility are randomly selected from and respectively. In this experiment, , , and . All other coefficients are 0 based on Table I. The utility company’s production cost is randomly chosen from and here we have . For simplicity, we let the coefficients of prosumers’ net utility remain unchanged over time and only include one constraint at the 1st time period in the model and make sure the constraint is tight at optimality. We conduct two experiments about using GSAA to compare the prosumers’ marginal contribution on social welfare. The first one is on the net selling effects, which is shown in Figure 3. As we can see, both prosumers’ contributions on social welfare increase as their allowed net-selling amounts (i.e., resource capacities) increase and each estimation given by GSAA is always an upper bound to the real contribution of the corresponding prosumer. For the same amount of allowed net-selling for both prosumers, the estimation by GSAA implies that prosumer 1’s contribution potential (red lines with markers) is larger than prosumer 2’s (blue lines with markers). This claim is verified by the fact that 1’s real contribution (red line without marker) is higher than 2’s (blue line without marker). We can also see that when the allowed net-selling amounts are small, the estimations by GSAA could relatively well reflects the prosumers’ potential. However, as the allowed net-selling amount increases the estimation error becomes larger (This error will finally remain unchanged after exceeding some value). Hence, GSAA should be used carefully, if some prosumer’s allowed net-selling amount is too large.

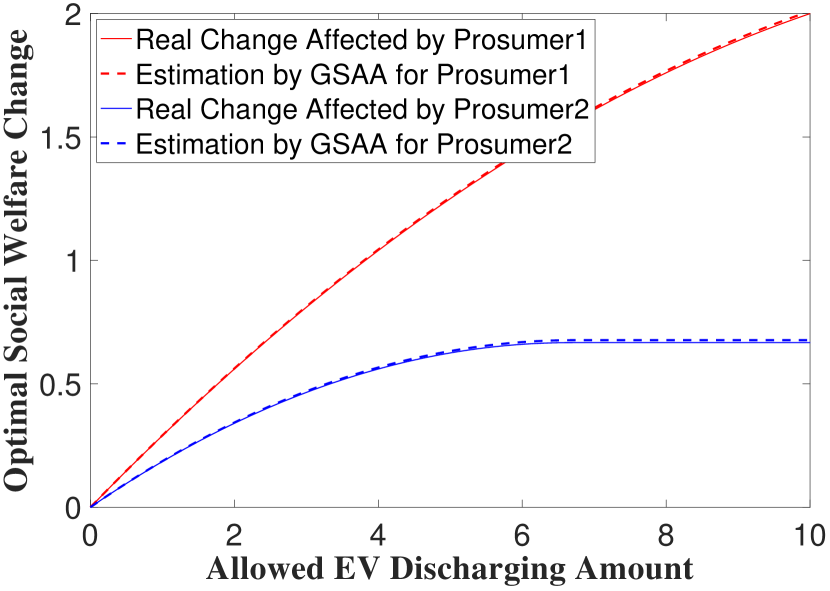

The second simulation is on allowing EV discharging, which is shown in Figure 3. In this test, the estimation by GSAA is very close to the prosumers’ real contribution on social welfare, even as the allowed EV discharging amount becomes large. Hence, in this test, the estimation by GSAA can help us quickly decide who has more contribution potential on social welfare when they are allowed to discharge EVs.

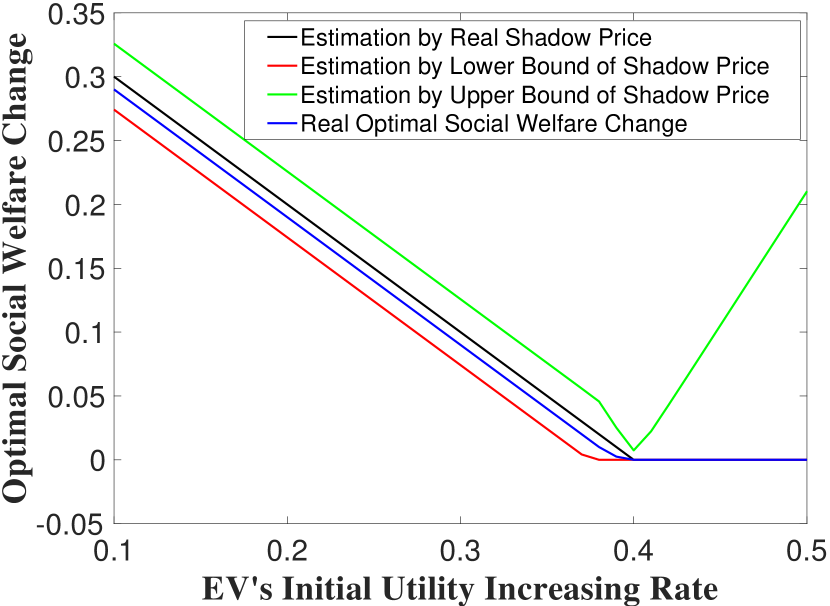

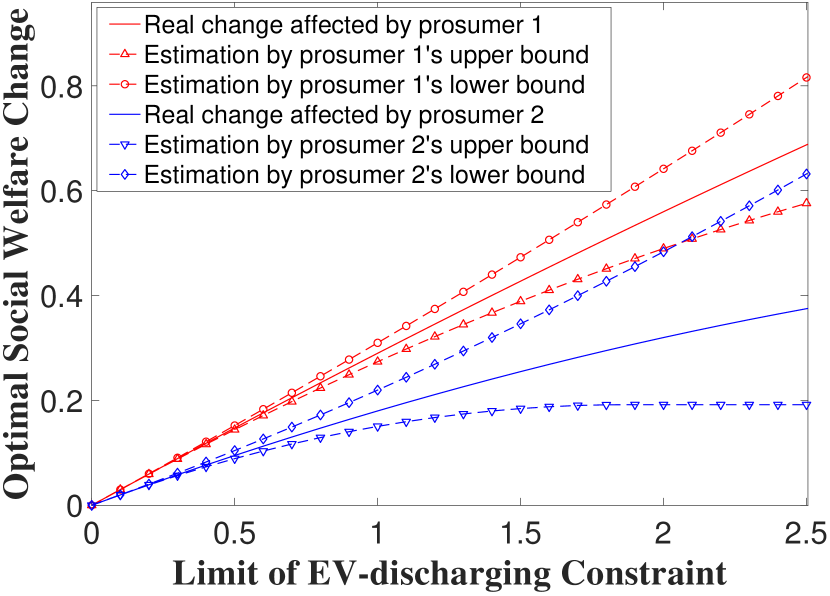

Next, we test GSAA performance under the general convex settings. The experiments are designed to simulate the case in Section 5.5. For simplicity, we let each prosumer have only one appliance: an EV. We use quadratic functions as prosumers net utility functions since they satisfy the relevant assumptions. The coefficients of prosumer 1’s EV net utility function are generated in the same way as in the previous simulation, here and . The coefficients for prosumer 2’s EV net utility function are prosumer 1’s scaled up by a positive number . Here we use . However, the above information are not accessible by GSAA. GSAA only has information about the degree of strong convexity, , the Lipschitz constant, , for prosumers’ net utility functions, prosumers’ operating points and initial utility increasing rates555The operating points and the initial utility increasing rates can be obtained since we have the specific coefficients of each prosumer’s net utility function, even though GSAA does not have information about these coefficients.. We set , , and . The utility company’s cost is still chosen in the same way as in the previous simulation, here we have . The first experiment in Figure 5 shows the bounds of a prosumer 1’s marginal contribution on social welfare estimated by GSAA with and without knowing 1’s net utility functions, and also shows the real marginal contribution. From the figure, we can see that both real optimal social welfare improvement and the estimation of optimal social welfare improvement given by the actual shadow price are bounded by the estimation based on the upper and lower bounds of shadow price. The figure also shows that as EV’s initial utility increasing rate changes, the estimation given by the upper bound of the shadow price works well when is smaller than a threshold, the point where EV discharging stops contributing on the social welfare. However, when EV’s initial utility increasing rate is larger than the threshold, the estimation given by the upper bound of the shadow price begins to bounce up. The second experiment, shown in Figure 5, illustrates using the bounds obtained by GSAA, as indirect information, to compare two prosumers’ potential on contributing social welfare. When the allowed EV-discharging amounts are smaller than 2 units and one’s lower bound by GSAA is higher than the other’s upper bound by GSAA, the bounds given by GSAA is sufficient for us to make a conclusion about who has more contribution potential on social welfare. For example, when prosumer 1 and prosumer 2 have 1 unit of allowed EV-discharging amount, by GSAA we can see that prosumer 1 has more contribution potential than prosumer 2 because 1’s lower bound given by GSAA is higher than 2’s upper bound given by GSAA, despite the fact that 2 has a higher utility function. This is also verified by the real contribution values. However, as the same as in the quadratic settings, estimations by GSAA should be used cautiously when the resource capacity change is too large, since the estimation error could also be large at this time and may lead to inaccurate prediction.

7 Conclusion

In this paper, we consider an -period DR market model consists of one distribution system operator, price-taking prosumers with various appliances, and an electric utility company. We show that there exists an efficient competitive equilibrium and an equivalence relationship between DSO’s problem and the prosumers’ and the utility company’s individual problems. Based on the equivalence relationship and duality theory of convex optimization, we propose a general sensitivity analysis approach (GSAA) to analyze the effect of individual prosumers’ contribution on social welfare, when their DR resource capacity is increased. We characterize closed-form shadow prices associated with the constraining resources, when the net utility function has quadratic form and provide the bounds of the shadow prices when the utility functions have general convex properties. The shadow prices can then be used to estimate improvement in social welfare and identify the most contributing prosumer(s). Thus, when the budgets for implementing DR (such as campaign/advertisement, device upgrade and installation, or the construction of infrastructure supporting EV discharging or net-selling) are limited, we could allocate the resources to the most contributing prosumers. Several applications of GSAA are provided, including enlarging a prosumer’s AC comfort zone size, allowing a prosumer’s EV to discharge and allowing a prosumer to net sell. We also provide several numerical studies on net-selling and EV discharging, which confirm our theoretical predictions.

References

- [1] A. H. Mohsenian-Rad, V. W. S. Wong, J. Jatskevich, R. Schober, and A. Leon-Garcia, “Autonomous demand-side management based on game-theoretic energy consumption scheduling for the future smart grid,” IEEE Transactions on Smart Grid, vol. 1, no. 3, pp. 320–331, Dec 2010.

- [2] Q. Sun, C. Wu, Z. Li, and S. Ren, “Colocation demand response: Joint online mechanisms for individual utility and social welfare maximization,” IEEE Journal on Selected Areas in Communications, vol. 34, no. 12, pp. 3978–3992, Dec 2016.

- [3] S. M. de Oca, P. Belzarena, and P. Monzón, “Optimal demand response in distribution networks with several energy retail companies,” in 2016 IEEE Conference on Control Applications (CCA), Sept 2016, pp. 1092–1097.

- [4] E. Bitar and S. Low, “Deadline differentiated pricing of deferrable electric power service,” in 2012 IEEE 51st IEEE Conference on Decision and Control (CDC), Dec 2012, pp. 4991–4997.

- [5] L. Jiang and S. Low, “Multi-period optimal energy procurement and demand response in smart grid with uncertain supply,” in 2011 50th IEEE Conference on Decision and Control and European Control Conference, Dec 2011, pp. 4348–4353.

- [6] M. Nijhuis, M. Babar, M. Gibescu, and S. Cobben, “Demand response: Social welfare maximization in an unbundled energy market case study for the low-voltage networks of a distribution network operator in the netherlands,” IEEE Transactions on Industry Applications, vol. 53, no. 1, pp. 32–38, Jan 2017.

- [7] B. Daryanian, R. E. Bohn, and R. D. Tabors, “Optimal demand-side response to electricity spot prices for storage-type customers,” IEEE Transactions on Power Systems, vol. 4, no. 3, pp. 897–903, Aug 1989.

- [8] M. Babar, P. H. Nguyen, V. Cuk, I. G. Kamphuis, M. Bongaerts, and Z. Hanzelka, “The evaluation of agile demand response: An applied methodology,” IEEE Transactions on Smart Grid, vol. PP, no. 99, pp. 1–1, 2017.

- [9] N. Li, L. Chen, and S. H. Low, “Optimal demand response based on utility maximization in power networks,” in 2011 IEEE Power and Energy Society General Meeting, July 2011, pp. 1–8.

- [10] M. Zugno, J. M. Morales, P. Pinson, and H. Madsen, “A bilevel model for electricity retailers’ participation in a demand response market environment,” Energy Economics, vol. 36, pp. 182 – 197, 2013.

- [11] C. Eksin, H. Deliç, and A. Ribeiro, “Demand response management in smart grids with heterogeneous consumer preferences,” IEEE Transactions on Smart Grid, vol. 6, no. 6, pp. 3082–3094, Nov 2015.

- [12] Q. Sun, A. Beach, M. E. Cotterell, Z. Wu, and S. Grijalva, “An economic model for distributed energy prosumers,” in 2013 46th Hawaii International Conference on System Sciences, Jan 2013, pp. 2103–2112.

- [13] N. Y. Soltani, S. Kim, and G. B. Giannakis, “Real-time load elasticity tracking and pricing for electric vehicle charging,” IEEE Transactions on Smart Grid, vol. 6, no. 3, pp. 1303–1313, May 2015.

- [14] S. Misra, S. Bera, and T. Ojha, “D2p: Distributed dynamic pricing policyin smart grid for phevs management,” IEEE Transactions on Parallel and Distributed Systems, vol. 26, no. 3, pp. 702–712, March 2015.

- [15] D. Xiang, Y. Song, Z. Hu, and Z. Xu, “Research on optimal time of use price for electric vehicle participating v2g,” vol. 33, pp. 15–25, 01 2013.

- [16] L. Chen, N. Li, S. H. Low, and J. C. Doyle, “Two market models for demand response in power networks,” in 2010 First IEEE International Conference on Smart Grid Communications, Oct 2010, pp. 397–402.

- [17] H. Zhong, L. Xie, Q. Xia, C. Kang, and S. Rahman, “Multi-stage coupon incentive-based demand response in two-settlement electricity markets,” in 2015 IEEE Power Energy Society Innovative Smart Grid Technologies Conference (ISGT), Feb 2015, pp. 1–5.

- [18] N. O׳Connell, P. Pinson, H. Madsen, and M. O׳Malley, “Benefits and challenges of electrical demand response: A critical review,” Renewable and Sustainable Energy Reviews, vol. 39, pp. 686 – 699, 2014. [Online]. Available: http://www.sciencedirect.com/science/article/pii/S1364032114005504

- [19] S. Nolan and M. O’Malley, “Challenges and barriers to demand response deployment and evaluation,” Applied Energy, vol. 152, pp. 1 – 10, 2015. [Online]. Available: http://www.sciencedirect.com/science/article/pii/S0306261915005462

- [20] Energy smart demand side management plan. [Online]. Available: http://entergy-neworleans.com/content/energy_smart/Program_Year_7-9_Supplemental_and_Amended_Implementation_Plan/Exhibit_2_Supplemental_and_Amended_Energy_Smart_Implementation_Plan_PY_7-9.pdf

- [21] 2018-2022 authorized demand response budget - cpuc. [Online]. Available: http://docs.cpuc.ca.gov/PublishedDocs/Published/G000/M202/K275/202275258.docx

- [22] Demand-side management annual status report. [Online]. Available: https://www.xcelenergy.com/staticfiles/xe-responsive/Company/Rates%20&%20Regulations/Regulatory%20Filings/2017-Colorado-DSM-Annual-Status-Report.pdf

- [23] A. Faghih, M. Roozbehani, and M. A. Dahleh, “On the value and price-responsiveness of ramp-constrained storage,” Energy Conversion and Management, vol. 76, pp. 472 – 482, 2013. [Online]. Available: http://www.sciencedirect.com/science/article/pii/S0196890413004433

- [24] R. Sioshansi, S. H. Madaeni, and P. Denholm, “A dynamic programming approach to estimate the capacity value of energy storage,” IEEE Transactions on Power Systems, vol. 29, no. 1, pp. 395–403, Jan 2014.

- [25] D. Xiang and E. Wei, “Improving social welfare by demand response general framework and quantitative characterization,” in 2017 IEEE Global Conference on Signal and Information Processing (GlobalSIP), Nov 2017, pp. 1030–1034.

- [26] S. Nolan, M. O’Malley, M. Hummon, S. Kiliccote, and O. Ma, “A methodology for estimating the capacity value of demand response,” in 2014 IEEE PES General Meeting — Conference Exposition, July 2014, pp. 1–5.

- [27] S. Lokhande and Y. K. Bichpuriya, “Empirical analysis of convergence and sensitivity of demand response based on real time pricing,” in 2017 IEEE Power Energy Society Innovative Smart Grid Technologies Conference (ISGT), April 2017, pp. 1–5.

- [28] R. Kutsuzawa, A. Yamashita, N. Takemura, J. Matsumoto, M. Tanaka, and N. Yamanaka, “Demand response minimizing the impact on the consumers’ utility towards renewable energy,” in 2016 IEEE International Conference on Smart Grid Communications (SmartGridComm), Nov 2016, pp. 68–73.

- [29] P. Samadi, H. Mohsenian-Rad, R. Schober, and V. W. S. Wong, “Advanced demand side management for the future smart grid using mechanism design,” IEEE Transactions on Smart Grid, vol. 3, no. 3, pp. 1170–1180, Sept 2012.

- [30] W. Shi, N. Li, X. Xie, C. C. Chu, and R. Gadh, “Optimal residential demand response in distribution networks,” IEEE Journal on Selected Areas in Communications, vol. 32, no. 7, pp. 1441–1450, July 2014.

- [31] D. Xiang and E. Wei, “Improving social welfare by demand response general framework and quantitative characterization,” in 2017 IEEE Global Conference on Signal and Information Processing (GlobalSIP), Nov 2017, pp. 1030–1034.

- [32] D. P. Bertsekas, Convex Optimization Theory. Athena Scientific, 2009.

- [33] S. Boyd and L. Vandenberghe, Convex Optimization. Cambridge University Press, 2009.

- [34] The first fundamental theorem of welfare economics. [Online]. Available: https://www.math.uchicago.edu/~may/VIGRE/VIGRE2008/REUPapers/Tan.pdf

- [35] L. Vandenberghe, “Optimization methods for large-scale systems,” 2016. [Online]. Available: http://www.seas.ucla.edu/~vandenbe/236C/lectures/gradient.pdf

- [36] A. Ahmadi, “Theory of convex functions,” 2016. [Online]. Available: http://www.princeton.edu/~amirali/Public/Teaching/ORF523/S16/ORF523_S16_Lec7_gh.pdf