Hybrid Pricing for Mobile Collaborative Internet Access

Abstract

Mobile Collaborative Internet Access (MCA) enables mobile users to share their Internet through flexible tethering arrangements. This can potentially make better use of network resources. However, from a mobile network operator’s (MNO’s) viewpoint, it can either reduce revenue or increase congestion, and thus has been blocked by some MNOs in practice. We propose a hybrid pricing framework for MNOs who charge users separately for access and tethering. This scheme serves to coordinate the tethering decisions of mobile users with MNO network management objectives. We analyze the MNOs’ equilibrium pricing strategies in both cooperative and competitive scenarios. In the cooperative scenario, at the equilibrium, each user’s cost is independent of any chosen tethering links. We then characterize the optimal hybrid pricing strategies of MNOs in this scenario. For the competitive scenario, we formulate the MNOs’ competitive interactions as a pricing game, and we show that MNO competition leads to equalized prices for users if an equilibrium exists but does not guarantee its existence. Both insights motivate a quantity competition game, which is shown to guarantee an equilibrium. Simulation results show that in scenarios of interest the proposed hybrid pricing schemes can double both MNOs’ profit and users’ payoff and such improvements increase with the degree of network heterogeneity.

Index Terms:

Network economics, pricing, network optimization, tethering, fog communications, cooperative communications, user-provided networks.I Introduction

I-A Background and Motivation

Global mobile data traffic has been experiencing explosive growth and is expected to reach 77.5 exabytes per month by 2022, approximately a sevenfold increase over 2017[2]. However, mobile network capacity is growing relatively slowly [2], which results in a global mismatch of demand and supply. On the other hand, the heterogeneity of networks and mobile users leads to different types of mismatch even at the same time and location. For example, one user may underutilize network resources in a high-speed network, while another user, connected to a separate overlapping network with less capacity or higher load, may be underserved. This creates opportunities for more effective resource allocation and sharing across networks and users.

One approach to achieving more efficient network resource utilization is the new paradigm of user-provided network (UPN), in which users serve as micro-operators and provide network connections (and resources) for others[3]. Examples of UPNs include the services enabled by companies such as Karma [4] and Open Garden [5]. Specifically, Open Garden provides a mobile app enabling mobile devices to dynamically form mesh networks (through Bluetooth and Wi-Fi direct links) and flexibly tether data for each other to improve Internet connections across users. The Open Garden enables mobile multi-hop and multi-path connectivity sharing among users and realizes mobile collaborative Internet access (MCA).

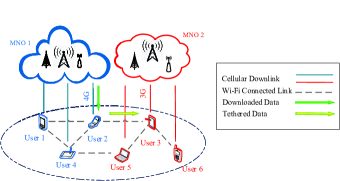

Fig. 1 illustrates an Open-Garden-like MCA service with 2 mobile network operators (MNOs) and 6 users, where MNO 1 and its subscribers are marked in blue and MNO 2 and its subscribers are marked in red. In this example, user 3 has a high data demand that cannot be satisfied by her 3G downlink. In contrast, user 2 is connected via an underutilized 4G link. User 3 therefore requests a tether to user 2.

Although MCA can improve the overall utilization of network resources, MNOs have not been entirely supportive of MCA and the forms of shared mobile Internet access or tethering. This is mainly because MCA can effectively exploit the diversity of users and network environments and bridge heterogeneous networks, which may reduce revenue to MNOs who charge high access prices and may increase more congestions for MNOs who charge low access prices. In other words, each user can exploit the MCA to download her dedicated data on a low price downlink, reducing each MNO’s profit. Consequently, AT&T in the US requested Google Play to block its subscribers’ access to Open Garden [6].

Even before the emergence of MCA services such as Open Garden, MNOs deployed several methods to restrict tethering (in the form of personal hotspots) among users belonging to different MNOs, mainly by direct prohibition or imposing an additional tethering fee. For example, the MNO au in Japan charges about $5 per month for the tethering service[7]. In the US, MNOs such as AT&T, Verizon Wireless, and Sprint charge an additional $10-$30 per month for user tethering [8]. In the UK, some MNOs such as Virgin Mobile and iD Mobile prohibit all forms of tethering [9], while some other MNOs (such as Three) charge users an additional fee for upgrading to data plans that allow tethering [10].

| MNO | ||

| Charge for Data Service | ||

| Operational Cost | ||

| Tethering Charge | ||

| Profit w/o Tethering | ||

| Profit w/ Tethering | ||

| User | ||

| Payment w/o Tethering | ||

| Payment w/ Tethering |

Inspired by existing tethering pricing policies, we propose a hybrid pricing framework for MNOs to reconcile the conflicting objectives of MNOs and users of MCA. The key idea is to separate the pricing for dedicated Internet access and tethering access. Specifically, each MNO sets a usage-based access price for each subscriber and an additional usage-based tethering price associated with MCA. If a pricing scheme accounts for such MCA dynamics and offers proper incentives for users to properly load balance across MNOs, it can lead to a mutual benefit for both the MNOs and users.

| Scenario | Formulation | Key Features | Existence of Equilibrium | Section |

|---|---|---|---|---|

| Cooperative | Optimization | MNOs maximize their total profit | IV | |

| Competitive | Price Competition Game (PCG) | MNOs compete on prices | may not exist | V |

| Quantity Competition Game (QCG) | MNOs compete on quantity outputs | VI |

I-B An Illustrative Example

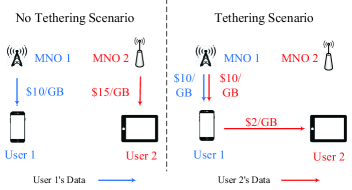

Before presenting our solution and contributions, we first provide an example to illustrate the proposed hybrid pricing framework and how it differs from traditional pricing without tethering. The key parameters are presented in Table I.

Example 1.

Consider two MNOs offering Internet access services to two neighboring users, respectively, as shown in Fig. 2. Consider the following pricing scenarios:

-

•

No Tethering: MNOs do not allow tethering. Therefore, each user can only download data through her MNO.

-

•

Tethering: MNO charges user a separate fee for data tethering. Therefore, user can access through user ’s cellular downlink at a lower cost. For the costs shown in Table I, the tethering pricing scheme offers user a discount of per GB ( per GB instead of per GB). MNO receives a profit of GB from user and a profit of GB from user . Therefore, the total MNOs’ profit from user with tethering (which is GB) is higher than that when there is no tethering (which is GB). This illustrates how the pricing scheme with tethering can benefit both MNOs (as a whole) and users.

The preceding example also shows that an MNO’s profit (such as the one of MNO 2) may decrease by allowing the tethering scheme, as users (e.g., user 2) may suspend their dedicated Internet access. This incentivizes MNOs either to cooperate and share a higher total profit, or to engage in competitive hybrid pricing strategies to attract more user traffic. An example of such an MNO cooperation is the national roaming service, where MNOs (e.g., Reliance and Vodafone in India) provide mobile data service for other MNO’s subscribers [12]. Examples of MNO competition are more common and appear where it is difficult for MNOs to cooperate due to, for example, technical, policy, and market concerns.

Motivated by the preceding discussion, we ask the following questions in this paper:

-

1.

How would cooperative MNOs set hybrid prices for access and tethering to maximize their total profit?

-

2.

How would competitive MNOs set equilibrium hybrid prices to maximize their own profits?

-

3.

How does the introduction of hybrid pricing impact MNOs’ profit and users’ surplus in both cooperative and competitive scenarios?

I-C Contributions

We consider a model with multiple MNOs and users, where users share their Internet access through MCA and MNOs adopt hybrid pricing schemes to charge each user separately for Internet access and tethering. We assume MNOs choose pricing policies over a slower time scale relative to the rate at which users choose a dedicated MNO. Hence, we model the interaction between MNOs and users as a two-stage leader-follower (Stackelberg) game[13]. In Stage I , the MNOs determine the access and tethering prices. Cooperative MNOs decide their hybrid pricing schemes jointly to maximize their total profit. We also consider a competitive scenario, where each MNO maximizes its own profit. In Stage II, the neighboring users cooperatively decide the amount of traffic to download and to tether to maximize their total payoff.

The challenges of analyzing equilibria in both cooperative and competitive scenarios mainly lie in the multiple ways in which the users can configure their access connections, either through direct access or tethered to another user. This combined with coupled constraints make it difficult to characterize users’ optimal decisions. The large space of user decisions and interaction among MNOs’ pricing decisions further complicate the competitive pricing scheme.

We summarize the key features of the scenarios studied in Table II. Our main contributions follow.

-

•

Hybrid Pricing Framework. We formulate the first model for a hybrid pricing scheme for MCA. It reconciles the conflicting objectives of MNOs and users in MCA.

-

•

Cooperative Scheme. We first study hybrid pricing schemes for cooperative MNOs. We show that the optimal (MNO-profit-maximizing) scheme makes each user’s cost independent of her selection of tethering links. This allows a transformation of the challenging hybrid pricing problem into a tractable one. We show a numerical example in which the cooperative scheme approximately doubles both MNOs’ profit and users’ payoff in a practical scenario of interest.

-

•

Competitive Scheme. We then study equilibrium hybrid pricing with competitive MNOs. We formulate the MNOs’ interactions as a Price Competition Game (PCG) and show that in equilibrium prices are equalized across different users. However, an equilibrium may not exist in some cases. The equalized prices and non-existence equilibrium motivate us to reformulate the price setting of MNOs as a Quantity Competition Game (QCG). We show that the QCG game always has (at least) an equilibrium and approximates the PCG. Numerical results show that, compared to the cooperative scheme, the competitive scheme achieves slightly smaller MNO profits but much larger user payoffs , in a heterogeneous network.

-

•

Free-Tethering. We further study the scheme where tethering is allowed without additional payment. Our analytical and numerical results show that pricing with free tethering is nearly optimal for cooperative MNOs, when users have similar cellular and tethering energy costs.

We organize the rest of paper as follows. In Section II, we review related work. In Section III, we introduce the system model and formulate the two-stage Stackelberg game. We study the cooperative hybrid pricing scheme in Section IV. We study two types of competitive interactions among MNOs, including the PCG and the QCG, in Sections V and VI, respectively. We present the numerical results in Section VII. Finally, Section VIII presents conclusions.

II Related Works

II-A User Provided Networks

Several incentive mechanisms for the Open-Garden-like MCA service have been proposed in [16, 15, 14]. Specifically, in [14], Iosifidis et al. propose a distributed incentive mechanism for encouraging MCA service. In [15], Syrivelis et al. design a cloud-controlled MCA service and study a coalitional game played among users. In [16], Georgiadis et al. study incentive mechanisms for services exchange in general networks. However, the preceding work does not consider the impact of MCA on MNOs or the interactions among the MNOs.

There are also two related forms of UPN that have been studied. The first is wireless community networks (e.g. FONs [17]), where individuals share their private residential Wi-Fi access points. Several existing works have considered pricing and incentive design for UPN [18]. Afrasiabi et al. in [19] propose a low introductory price policy to promote the service adoption. Ma et al. in [20] study the user behavior analysis and the MNOs’ pricing design. The second form is the Karma-like UPN [4]. Specifically, Karma sells mobile devices (that convert 4G cellular signals to Wi-Fi signals) to its subscribers and encourages the subscribers to operate as Wi-Fi hotspots and provide Internet access to non-subscribers. In [21], Gao et al. propose a hybrid data pricing scheme motivated by Karma’s UPN service, to incentivize users to operate as mobile Wi-Fi hotspots and provide Internet access for other users without direct Internet access. In [22], Khalili et al. further study the user behavior dynamics and network evolution under such a hybrid data pricing scheme. Substantially different from these models, the MCA model allows users to concurrently share flexible direct mobile Internet access.

II-B Internet Access Pricing

Our hybrid pricing scheme is also motivated by related work on topology-aware pricing schemes for wireless mesh networks [25, 26] and cooperative communication networks [27]. The focus of those studies is on pricing and incentive issues for user cooperation, without considering tethering pricing schemes.

III System Model

III-A System Overview

MNOs and Users: We consider an MCA model with a set of MNOs and a set of users, as illustrated in Fig. 1. We assume each user subscribes to only one MNO, which provides a mobile Internet access service for each of its subscribers. Let denote the set of subscribers of MNO , and let denote the MNO to which user subscribes, i.e., for all .111In Fig. 1, for example, MNO 2’s subscriber set is , and user 2 subscribes to MNO .

Cellular Links: For presentation clarity, we focus on the downlink.222 The uplink case is similar to the downlink, with minor changes such as smaller uplink capacities. For the simultaneous downlink and uplink case, a user’s coupled utility for both downloading and uploading significantly complicates the modeling. Hence, it is left for future work. Let (MBps) be the maximum rate (capacity) that user can achieve from his cellular downlink provided by MNO .

Wireless Mesh Network: The users cooperate and provide an Open-Garden-like MCA service to each other. Specifically, users form one wireless mesh network, where all users are connected through Wi-Fi Direct.333For the case where the users form more than one disjointed wireless mobile network, an MNO can differentially price users in each wireless mesh network. Thus, we can decompose the pricing problem at each wireless mesh network. Therefore, it is enough to focus on one wireless mobile network. Therefore, there is a Wi-Fi (tethering) link between each pair of users, which can be a one-hop or multi-hop Wi-Fi Direct link. We assume the Wi-Fi links have high capacities. Hence, the performance bottleneck in the network is always the cellular links. Note that we can equivalently treat a multi-hop connection as a single-hop one in our model. This is because (i) a tethering price (to be introduced) is independent of any relay in a multi-hop connection, and (ii) the capacities of Wi-Fi links are sufficiently high. Hence, we focus on the case where every pair of users are single-hop neighbors for simplicity.

Time Period: We consider a time period (e.g. several hours to a day) consisting of several time slots (e.g. several minutes each). We consider a quasi-static mobility model, where each user moves randomly across time slots, and remains at the same location within each time slot. The link capacities are considered constant during each time slot.

User Roles: In each time slot, each user can be a gateway, or a client, or both. A gateway node downloads data directly from its MNO, and a client node consumes data for some local mobile applications.

MNO Cost: We consider a linear average operational cost of MNO for transmitting every GB to user . Sending traffic to different users may incur different operational costs because of the different technologies (3G/LTE) and the different channel conditions.

User Cost: We include a user’s energy cost per GB for the data transfer over cellular downlink and the Wi-Fi Direct to user , given by[28]

| (1) |

where denotes the energy cost per GB for user to download, and includes the energy cost on Wi-Fi Direct for each tethered GB. It captures the aggregate cost experienced by tethering initiator (user ) and the tethering recipient (user ).

III-B Mobile Network Operators

Access Prices: Denote as the access price ($/GB) that MNO charges user . Here we allow the MNOs to charge different prices to different users, based on users’ QoS requirements and network service types. Perfect price differentiation among users leads to the maximum design flexibility for the MNOs.444In practice, the MNOs may partially differentiate among users with a limited number of prices [29]. An example of partial price differentiation is the student discounts for mobile data plans offered by many MNOs [30].

Tethering Prices: We further consider a linear tethering price, i.e., the MNOs can charge for each tethered GB in addition to the basic data payment. Let denote the tethering price ($/GB) that MNO charges user for each GB that user tethers to user . Note that the MNO can set a negative tethering price, in which case MNO will give user a discount of for the data tethered to user . Here we define for each . We further allow the MNO to differentiate not only the gateway users but also the clients,555In practice, to charge/block tethering data, MNOs may adopt different techniques to detect whether and for whom a user is tethering, such as inspecting MAC addresses and network packets for TTLs [31]. i.e., can be different for every and .

Hybrid Prices: Define as the hybrid price matrix, where denotes the hybrid price that user needs to pay to her MNO, for each GB she tethers to user . This includes both the access price and the tethering price,

| (2) |

Profit: With the preceding notation, MNO ’s profit is

| (3) |

where is the user traffic (to be defined next).

III-C Mobile Users

Traffic Matrix: Let denote the data downloaded by user and tethered to user (tethered data) if , and the data user downloads for herself (directly downloaded data) if . We define as the traffic matrix.

Payoff: Let denote the users’ total payoff, given by

| (4) |

where is a positive, increasing, twice-continuously differentiable, and strictly concave function of user . The strict concavity indicates that users have the diminishing marginal satisfaction of additional data consumption.

We summarize notations in Table III.

| Symbol | Physical Meaning |

|---|---|

| Set of MNO ’s subscribers | |

| MNO subscribed by user | |

| Downlink capacity of user | |

| Operational cost over downlink , borne by MNO | |

| Energy cost over link , borne by users | |

| Data downloaded by user and tethered to user | |

| Utility function for user | |

| Profit function for MNO | |

| Access price over downlink | |

| Tethering price over link | |

| Hybrid price over link | |

| Delivered price for user | |

| Users’ total payoff | |

| User ’s demand function |

III-D Two-Stage Stackelberg Game

MNOs decide the hybrid prices for each time period at the beginning of the entire time period, and users decide the data traffic in each time slot. Since pricing is independent across different time slots, we focus on one time slot.

We model the interaction between MNOs and users as a two-stage Stackelberg game, as illustrated in Fig. 3. Specifically, in Stage I, the MNOs simultaneously decide the hybrid price matrix . In Stage II, the users simultaneously decide the traffic matrix .

Note that, in Stage II, users only participate in the MCA if they receive higher payoffs than not participating. Such user cooperation can be achieved with a self-enforcing bargaining mechanism as in [14]. Such a mechanism can maximize the aggregate user payoff. The aggregate payoff can be fairly shared among users through proper money transfer by solving the corresponding Nash bargaining problem [14]. For the purpose of designing an MNO’s hybrid pricing scheme, it is enough to focus on optimizing the users’ traffic through solving the users’ payoff maximization problem (without considering how users decide their money transfers).

| Stage I |

| The MNOs cooperatively specify the hybrid price . |

| Stage II |

| The users cooperatively specify the traffic . |

In Stage I, we consider two sets of models where the MNOs are cooperative and competitive, respectively. We assume that the cooperative MNOs jointly choose the hybrid pricing matrix to maximize their total profit. Each competitive MNO sets the data and tethering prices to maximize its own profit.

IV Cooperative Hybrid Pricing

In this section, motivated by existing MNO cooperation (e.g. national roaming [12]), we consider the scenario in which MNOs cooperatively determine prices.666Similar to the users cooperation, the MNO cooperation is achievable by a bargaining mechanism, since each MNO can be better off by participating in such a mechanism. Specifically, MNOs cooperatively decide the hybrid price matrix to maximize their total profit in Stage I, and users cooperatively determine the traffic in Stage II.

We will derive the (subgame perfect) equilibrium by backward induction, i.e., given the hybrid pricing matrix , we characterize the users’ traffic decision that maximizes the users’ total payoff in Stage II, and then we characterize the MNOs’ optimal hybrid pricing matrix that maximizes the MNOs’ profit.

IV-A Users’ Consumption Decisions in Stage II

We first formulate the Users’ Payoff Maximization (UPM) problem and then characterize the optimal traffic under the equilibrium hybrid price matrix along with several structural results.

IV-A1 UPM

Under an arbitrary hybrid price matrix , we formulate (UPM) as

| (5a) | ||||

| (5b) | ||||

| (5c) | ||||

Constraint (5b) indicates that the sum of user ’s direct rate and the rate tethered to other users cannot exceed the capacity of her downlink . Let denote the solution to the (UPM) Problem in (5), given hybrid price matrix .

IV-A2 Analysis under Equilibrium Hybrid Prices

In the following, we assume the MNOs’ set the equilibrium price matrix (of the entire two-stage game) and derive structural properties concerning both users’ decision and the MNOs’ equilibrium price matrix . These significantly simplify the solution in both Stage I and Stage II. The proofs of all theorems, corollaries, propositions, and lemmata can be found in the Appendix.

Theorem 1.

Under MNOs’ equilibrium hybrid price matrix , the optimal shadow price satisfies .

The intuition behind Theorem 1 is that if for some downlink , then the MNOs can increase the hybrid price on downlink for all to increase their profit.

To uniquely specify the MNOs’ equilibrium hybrid pricing scheme, we make an additional assumption in Assumption 1. The reason is that if there exist downlinks such that , (UPM) is not strictly convex and hence there may be more than one globally optimal solution. This implies that the MNOs’ total profit may not be unique for a given . Hence, we adopt the following assumption in the rest of the paper:

Assumption 1.

The users select their traffic decision such that777Note that we will show that through solving their optimal cooperative pricing, the MNOs can compute and send the users’ optimal traffic decision that satisfies (6) to the users, without the need for the users to know .

| (6) |

where denotes the set of all that solves (UPM) in (5).

We will later show in Section IV-B that Assumption 1 ensures that the satisfying (6) corresponds to a solution that MNOs want users select among , hence induces a unique MNO profit. Moreover, Assumption 1 incurs no loss of generality as MNOs can always slightly adjust to ensure that users select the satisfying (6).

Corollary 1.

There exists an equilibrium price matrix such that for each user , we have

| (7) |

Corollary 1 suggests that one of the equilibrium price solutions for the MNOs is gateway-independent, i.e., each user faces the same sum cost across different links (the traffic cost plus the energy cost ).888Different users may still face different sum costs. This motivates us to combine the hybrid price and the energy cost into a single delivered price .

Definition 1.

The delivered price for each user is

| (8) |

Therefore, to optimize over the price matrix , it is enough to optimize the delivered price vector and then recover the hybrid price matrix by for all .

To summarize, the equilibrium shadow price is zero (Theorem 1) and the equilibrium delivered price is gateway-independent (Corollary 1). Therefore, we can define a demand function for the user traffic.

Definition 2.

Given the delivered price , user ’s one-dimensional demand function is

| (9) |

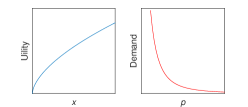

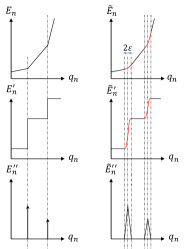

Since is strictly concave, is decreasing, and is unique-valued and non-increasing. We present an illustrative example of a utility function and the corresponding demand function in Fig. 4. By the first-order condition in (9), the demand function satisfies

| (10) |

Proposition 1.

At an equilibrium, user has a positive demand if and only if .

The proof shows that if user ’s marginal utility is too small, then MNOs cannot profit from serving user .

By Proposition 1, we can remove all users with from the set . In other words, without loss of generality, we can assume that for all users in the set . Therefore, equality in (10) always holds. We thus have the following definition:

Definition 3 (Inverse Demand Function).

User ’s inverse demand function is her marginal utility function .

We next show that it is enough for MNOs to optimize their total profit based on the delivered price and the users’ inverse demand functions.

IV-B Cooperative MNOs

In this subsection, we derive the cooperative pricing scheme to maximize MNOs’ total profit by problem transformations.

IV-B1 Operator Profit Maximization (OPM)

Given derived in Stage II, we can derive the optimal hybrid pricing matrix by solving (OPM) in Stage I,

| (11a) | ||||

| (11b) | ||||

IV-B2 Revised OPM (R-OPM)

Define MNO ’s delivered (operational) cost as for each GB user tethers to user . We can transform (OPM) into a new problem where the traffic are the optimization variables. The key idea is to exploit the gateway-independent pricing suggested by Corollary 1. It allows us to further adopt the inverse demand function to determine the delivered price. We have

| (12a) | ||||

| (12b) | ||||

The objective in (R-OPM) in (12) may not be concave in general, which may make it difficult to find a globally optimal solution to (R-OPM).999Some of the results in this section only apply to the case where MNOs set optimal prices. Since (R-OPM) is not convex, we may obtain a locally optimal solution. In this case, those results do not hold. We denote

| (13) |

In the economics literature, stands for user ’s prudence and is the coefficient of relative prudence [34]. We use it to measure the concavity of user ’s marginal utility (or the inverse demand function). We introduce the following assumption to ensure the convexity of (R-OPM):

Assumption 2.

Each user ’s coefficient of relative prudence satisfies for any and any

Assumption 2 is satisfied by a wide range of utility functions, some of which are listed in Table IV.

| Name | Utility Function | Ref. |

|---|---|---|

| -fair | [35, 36] | |

| logarithmic | [14] | |

| exponential | [37] | |

| quadractic | , | [37] |

We can readily verify that is concave if and only if Assumption 2 holds. Therefore, (R-OPM) is convex, which can be easily solved by convex optimization solvers such as CVX [38].

Theorem 2 (Equivalence of (R-OPM) and (OPM)).

The significance of Theorem 2 is two-fold. First, we can solve (R-OPM) efficiently and then use (14) to obtain the optimal delivered price vector and then the optimal hybrid price matrix by (8). Second, it implies that MNOs can directly send the solution to (R-OPM) to users, without the need to let users independently solve (UPM).101010This is possible as we have considered the complete information setting in this paper, i.e., MNOs know the users’ utility functions. This is reasonable as the users’ mobile application information (i.e., whether the user is watching YouTube or downloading emails) is often communicated to the MNOs by the devices. We summarize this procedure in Algorithm 1.

IV-C Cooperative MNOs with Free Tethering

In this subsection, we further consider a free-tethering (FT) cooperative pricing scheme when there is a strict regulation on the tethering pricing [11]. Specifically, the tethering price satisfies for all users and , and the MNOs optimize the access prices. Due to the space limit, we present the detailed descriptions in Appendix -F.

We show that such an FT scheme can lead to the optimal prices under some conditions on users’ utility and energy cost.

Corollary 2.

The optimized FT scheme corresponds to the optimal hybrid pricing to the OPM Problem in (11) when both of the following conditions are satisfied:

-

1.

Users’ energy costs for Wi-Fi links are zero and those for cellular downlinks are the same, i.e., and for all .

-

2.

Each user has an isoelastic utility, i.e., (with and being non-negative and ).111111The widely used -fair utility function in Table IV is a special subclass of this class of functions.

Condition 1) is justified by measurements showing that the average energy cost on Wi-Fi Direct is much less than that for cellular connections [28]. Moreover, the traffic cost in general is much larger than energy cost for users.

We explain Corollary 2 as follows. When condition 1) is satisfied, Proposition 1 implies that gateway-independent pricing requires . In addition, the weighted -fair utility function exhibits a constant price elasticity of demand, i.e., heterogeneous users’ (in terms of and ) responses to the delivered price are similar. This equalizes the optimal delivered prices across heterogeneous users. Hence, we have and thus .

V Competitive MNOs: Price Competition

We now analyze the MNOs and users’ decisions in the competitive MNOs models. In Stage I, each MNO sets hybrid prices independently to maximize its own profit. Hence, MNOs participate in a price competition game (PCG). In Stage II, the users cooperatively determine traffic. Fig. 5 summarizes the interactions among competitive MNOs and users.

Introducing competition among MNOs increases the difficulty of analysis. This is because, each MNO needs to consider users’ multi-dimensional decisions and also the hybrid pricing strategies of other MNOs. For analytical tractability, we adopt the following assumption in the rest of this paper:

Assumption 3.

User energy costs for the Wi-Fi links are zero, i.e., for all .

As previously discussed, the energy cost on a Wi-Fi link is typically much less than that for cellular connections and the traffic cost. By Assumption 3, we have and for all . Thus, we drop the index in and and have and .

| Stage I (Price Competition Game) |

| Each MNO competitively sets its hybrid prices . |

| Stage II |

| The users cooperatively specify the traffic decision . |

Similar to the cooperative-MNO scenario, we will derive the equilibrium by backward induction, i.e., given the hybrid pricing matrix , we characterize the users’ traffic decision in Stage II. We then characterize each MNO’s equilibrium prices. We next formally define the PCG and its corresponding equilibrium:

Game 1 (PCG).

Price Competition Game consists of

-

•

Players: the set of MNOs.

-

•

Strategies: .

-

•

Payoffs: for each MNO :

(15)

where is the traffic optimized in Stage II as derived in Section IV.

Let denote the competitive equilibrium values, to differentiate from the cooperative equilibrium values denoted by .

Definition 4.

A price competitive equilibrium (PCE) for the PCG is a hybrid price matrix such that, for every MNO ,

| (16) |

V-A Users’ Consumption Decisions in Stage II

Similar to the interaction in Stage II for the cooperative-MNO model, the users cooperatively optimize by solving (UPM) in (5) for a given .

The PCG shares part of the equilibrium results with the cooperative hybrid pricing scheme. Specifically, Theorem 1 also holds in the PCG. That is, for each downlink , the equilibrium shadow price is zero, i.e., for all . Therefore, similar to Corollary 1, we can prove the following gateway independence result in a similar way:

Proposition 2 (Gateway Independence).

If a PCE exists, there exists a PCE such that

-

•

is gateway-independent, i.e., for each user ,

(17) -

•

every MNO receives the same profit with and , i.e., .

Proposition 2 implies that among all possible PCEs, it is enough to focus on the gateway-independent ones. Let denote the equilibrium delivered price vector, i.e.,

| (18) |

The gateway-independent PCE indicates that we can adopt the one-dimensional demand function defined in (9) to characterize each user’s traffic decision.

V-B MNOs’ Price Competition in Stage I

In this subsection, we study the interactions among MNOs through price competition. We sort the delivered costs in ascending order without loss of generality, i.e., .121212Here, we assume that all downlinks have different delivered costs, since the probability of two parameters being exactly the same is zero. The indices will denote the corresponding channels.

Definition 5 (Market Clearing Price).

We define as the market clearing (delivered) price for the first channels, which satisfies for all

Given a fixed , the market clearing price denotes the delivered price under which the users’ aggregate demand of the first downlinks is equal to the total capacity of these downlinks. Since is decreasing, also decreases in for a proper value of . We will show that the delivered prices at a PCE are given by a market clearing price. By exploiting the continuity and strict concavity of , we can prove:

Lemma 1.

There exists a unique for every .

To characterize PCEs, we further define the following

Definition 6 (Threshold Downlink).

The threshold downlink is the downlink with the smallest delivered cost among all MNOs other than MNO , i.e., .

Note that MNO is the most competitive MNO, in the sense that it possesses the downlink with the least delivered cost. In this sense, can be considered the second most competitive MNO.131313MNO may not be MNO , since the user may be MNO ’s subscriber, i.e., . Thus, the delivered cost of the threshold downlink measures how competitive MNO is. As we will show, a large implies MNO offers little competition, in which case MNO effectively monopolizes the market. Otherwise, MNO shares the market with at least MNO .

The following definition characterizes an MNO which captures a positive market share at a PCE.

Definition 7 (Traffic-Supporting MNO).

An MNO is traffic-supporting at a PCE if some downlinks of users subscribing to MNO are active, i.e., .

We characterize the PCEs as follows:

Proposition 3.

If a PCE exists in a PCG, then it belongs to one of the following two types:

-

•

Single-Operator PCE: when the threshold downlink’s delivered cost is high, i.e., , there exists a unique gateway-independent PCE. Such a PCE admits only one traffic-supporting MNO and satisfies for all ;

-

•

Multi-Operator PCE: when the threshold downlink’s delivered cost is low, i.e., , a PCE (if any) admits more than one traffic-supporting MNOs and satisfies for all .

The intuition is that when the delivered cost of the threshold downlink is so high that no other MNO than MNO is competitive, then MNO monopolizes the market. On the other hand, if the delivered cost of the threshold downlink is low enough, then at least MNO competes with MNO . Through this observation, we further characterize the two types of PCEs according to the relation between and .

V-B1 Single-Operator Equilibrium ()

In this case, MNO acts as a monopolist and is the only traffic-supporting MNO. To characterize the equilibrium price, let us first consider a monopolist delivered price vector which is equivalent to the cooperative pricing scheme and thus can be obtained by solving (OPM) via Algorithm 1. The relation between the monopolist delivered price and the delivered costs are given in the following proposition.

Proposition 4.

When , there exists a unique gateway-independent equilibrium delivered price such that, for each user ,

| (19) |

That is, MNO adopts the monopoly delivered price for user when is sufficiently low, since no other MNOs has a downlink cost low enough to compete with MNO for this user. However, MNO competes with MNO when the monopoly delivered price exceeds . Therefore, although MNO is still the only traffic-supporting MNO, the equilibrium delivered price is for user due to competition from MNO .

V-B2 Multi-Operator Equilibrium ()

In contrast with the single-operator case, a PCE may not exist when . We will characterize the necessary condition for the multi-operator PCE, based on which we discuss the reason why a multi-operator PCE may not exist.

Definition 8 (Critical Downlink).

The critical downlink is the downlink such that satisfies:

| (20) |

where is the market clearing price in Definition 5.

Since decreases in , and increases in , there is at most one satisfying (20).141414 For example, when , , and , we have . Note that it is possible that does not exist. An example is an MCA with two users with , , , and . We see that cannot be or . In such a case, no pricing profile can satisfy the necessary condition in Proposition 3, implying that there is no PCE. The following theorem states that the equilibrium delivered prices clear the first downlinks.

Theorem 3 (User Independence and Uniqueness).

When , if a PCE exists, there exists a unique equilibrium delivered price vector such that for all

By Theorem 3, the gateway-independent delivered prices are also user-independent, i.e., the delivered prices are equal across different users. Specifically, suppose the delivered price for one user is higher than that of another user . Some traffic-supporting MNO can always slightly decrease its hybrid price for user but slightly increase the price for user . This can attract traffic demanded by users who will pay a higher price, and hence increases its profit. Uniqueness is mainly because there is at most one as we have mentioned.

Theorem 3 only states the necessary condition of a multi-operator PCE. That is, a PCE may not exist (with an example presented in Appendix -L). As an illustration, next we characterize the PCE existence conditions for a simple example.

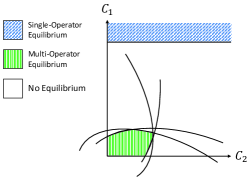

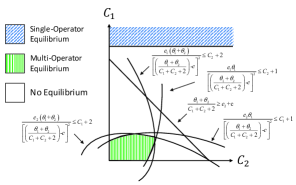

V-B3 Simple Example

It is difficult to completely characterize a multi-operator PCE, due to the complexity of the multi-dimensional strategy that each MNO has to determine. We hence characterize the existence conditions (in terms of and ) for a system with two MNOs and two users, as shown in Fig. 6. We set (so that and ). It follows

-

•

One gateway-independent single-operator PCE lies in the region with a large enough . This corresponds to a sufficient small such that .

-

•

One gateway-independent multi-operator PCE lies in the region with small enough and . This leads to a sufficiently large such that .

-

•

There is a large region for no PCE. This is consistent with the well-known Edgeworth paradox in economics [39]. That is, the situation where MNO monopolizes the market is not an equilibrium as is too high. Nor is the situation where both MNOs charge the delivered prices that fully utilize their capacities (satisfying Theorem 3). This is because is so low that at least one MNO is willing to increase its prices to generate more profits.

Due to space limitations, we present the detailed analysis in Appendix -M.

Similar to Section IV-C, we also derive conditions under which the gateway-independent PCE leads to zero tethering prices, as shown in Appendix -N.

Regarding the multi-operator PCE, the induced user-independent delivered prices and the possible non-existence of PCE motivate us to reformulate the MNO competition as a quantity game.

VI Competitive MNOs: Quantity Competition

In this section, we consider an alternative way for modeling a multi-operator PCE. Specifically, we introduce the Quantity Competition Game (QCG). We show that there exists at least an equilibrium for the QCG. Moreover, a multi-operator PCE, if exists, is exactly an equilibrium outcome of the QCG. We then propose an algorithm to compute the equilibrium.

VI-A Quantity Competition Game

Uniform Delivered Price: A multi-operator PCE equalizes the delivered prices across users and downlinks but may not exist. This fact motivates us to reformulate MNOs’ interactions into quantity competition based on the uniform delivered pricing. Specifically, each MNO decides its quantity (total output traffic) of all its downlinks and compete with each other.151515To realize the output control in practice, each MNO can manipulate the maximum data access speed of each downlink by setting a data speed cap. Given these quantity choices, they follow a uniform delivered price which adjusts to the level that users’ aggregate demands is equal to the MNOs’ aggregate output, i.e., , where denotes the inverse function of .

Aggregate Delivered Cost: MNO can choose the output for each downlink . However, due to the uniform delivered price, we can see that MNO should always fully utilizes its low delivered cost downlinks first before providing data at high delivered cost downlinks. Hence, we can derive the aggregate delivered (operational) cost as

| (21) |

Smoothed Approximation: The above contains several non-differentiable points. For analytical tractability, we replace it with an approximation , which smooths in the neighborhood of every non-differentiable point , where denotes the set of non-differentiable points. An example of such a smoothed function is

| (22) |

We can see . Different from , the new function admits a continuous second order derivative. We formally define

Game 2 (QCG).

The Quantity Competition Game consists of

-

•

Players. MNO .

-

•

Strategy space. MNO chooses its quantity (its total traffic to download) from .

-

•

Payoff function. Each MNO has

(23)

Accordingly, we introduce the definition of the Quantity Competition Equilibrium (QCE) for the QCG in the following.

Definition 9 (QCE).

A QCE for the QCG is a quantity profile such that, for each MNO ,

| (24) |

We show that

Proposition 5.

We focus on the smoothed approximation (with approaching ) of the aggregate cost functions in the following.

VI-B Equilibrium Properties

In this subsection, we introduce a simple one-dimensional mapping to facilitate characterizing and computing the QCE. We then analyze the properties of the QCE, including existence, a sufficient condition for uniqueness, and equivalence to a multi-operator PCE.

Notice that each MNO ’s profit is simply a function of two valuables, i.e., its output and the sum of the total output . Since all MNOs’ profit functions share the same latter valuable, we adopt the following functions as a simpler equivalent characterization of the QCE:161616The mapping is a (one-to-one) function because the objective in (25) is strictly quasi-concave for any given .

| (25) | ||||

| (26) |

Function corresponds to MNO ’s optimal output given the total output . Variable can represent the QCE total output if it is a fixed point of as we will show.

We adopt the following assumption:

Assumption 4.

MNOs’ aggregate revenue is strictly quasi-concave in .

Assumption 4 is widely adopted in the literature (see [44] and the reference therein) and it holds, for example, when all users have the same type of utility functions chosen from Table IV (but can still have different parameters). We are ready to introduce the following lemma:

Lemma 2.

A strategy profile is a QCE if and only if .

It is straightforward to prove Lemma 2 by comparing the optimality conditions of (25) and that of each MNO’s best strategy. Lemma 2 suggests that we can simply characterize a QCE by a fixed point of a one-dimensional mapping .171717This differs substantially from the general -player game, in which case we need to characterize an equilibrium by a fixed point of a mapping with at least dimensions in general. Meanwhile, MNO ’s QCE output is . The continuity of further gives

Proposition 6 (Existence).

There always exists a QCE .

Such a property is not true for the PCG due to the discontinuity of each MNO’s profit in its strategy, i.e., a slight change in its pricing may dramatically change an MNO’s profit.

The following proposition characterizes a sufficient condition where such a QCE is unique:

Proposition 7 (Conditions for Uniqueness).

The QCG admits a unique QCE if there are only two MNOs, i.e., .

We prove Proposition 7 by showing that a two-MNO system satisfies the diagonal-dominance condition in [40], under which it guarantees the uniqueness.

The following theorem shows the equivalent relation between the multi-operator PCE for the PCG and the QCE.

Theorem 4 (Equivalence).

A multi-operator PCE is a QCE (as approaches ). Mathematically, if there exists a multi-operator PCE of the PCG, then there exists a QCE such that for all .

Theorem 4 indicates that the QCG is a good approximation to the PCG.181818The equivalence result in Theorem 4 is interesting since it differs from the existing result for the classical models and those for many variations. That is, the pricing competition (or the Bertrand competition) and quantity competition (or the Cournot competition) typically lead to different outcomes in general (e.g., [41, 42]). Intuitively, an MNO’s strategy space in a PCG possesses more dimensions than that in a QCG. Hence, if MNO cannot achieve a higher profit by changing its pricing strategy in a PCG, nor can it find a more profitable quantity strategy in a QCG. Note that A QCE may not be a multi-operator PCE, because a QCE always exists (Proposition 6) but a multi-operator PCE may not.

VI-C Algorithm

| (27) |

Due to the difficulty of expressing the QCE in a closed form, we further design a simple and convergent algorithm to compute the QCE.

We compute the QCE based on the Mean-Value Iterative Dynamics [43], which essentially computes a fixed point of , as summarized in Algorithm 2. The key step of this algorithm is in (27), which is to average of all previous iterations and let mean value be the input at iteration . The above algorithm leads to the following convergence property.

Proposition 8.

Algorithm 2 converges to a QCE .

The proof mainly relies on [43], which proved that the Mean-Value Iterative Dynamics is convergent for computing a fixed point of a continuous and compact self-mapping. We note that the convergence result does not require the uniqueness of the QCE, as shown in [43].191919Such property differs from the widely considered best response dynamics analyzed in [40], of which the convergence requires the uniqueness of the equilibrium in general.

VI-D Summary of the Competitive Scheme

We summarize the competitive pricing scheme in Algorithm 3. Specifically, we first check whether there exists a single-operator PCE for the PCG by Proposition 3. If so, Algorithm 3 returns the single-operator PCE through the PCG. If not, we adopt Algorithm 2 to compute the QCE as an approximation to a multi-operator PCE.

VII Numerical Results

In this section, we perform numerical studies to evaluate the performances of the proposed schemes (the cooperative pricing scheme, the competitive pricing scheme, and the FT scheme) compared with two benchmarks, and study the impact of network heterogeneity on their performances.

VII-A Benchmarking Schemes

We consider two benchmarking schemes, namely the no-tethering pricing scheme and the social welfare maximization scheme for comparison.

VII-A1 No-Tethering Pricing (NTP)

For the NTP scheme, MNOs do not allow tethering (which is equivalent to set to be infinity for all ) and then optimize the access prices by maximizing their own profits.

VII-A2 Social Welfare Maximization (SWM)

Before we introduce the SWM scheme, we first define the social welfare as the aggregate payoff of all MNOs and all users, denoted by

| (28) |

The SWM scheme is to maximize the social welfare subject to the capacity constraints and non-negative constraints .

VII-B Simulation Setup

We perform numerical studies for an MCA involving MNOs202020The two-MNO setting is a reasonable consideration and has been widely adopted in the literature (e.g. [45]). and users and study their interactions for minutes. We randomly select 5 users as the subscribers of MNO 1 and the remaining 5 users as the those of MNO 2.

Truncated Normal Distributions: We assume that users’ utility parameters, downlink capacities , and operational costs follow the respective i.i.d. truncated normal distributions. Let denote a truncated normal distribution over the interval , with being the mean and being the variance.

Parameter Settings: We consider the following parameter settings unless stated otherwise. Each user has the weighted -fair utility function , where . We set . We consider two types of users including 3G users and LTE users. We select a user as a LTE user with a probability of and a 3G user with a probability of . We set . LTE downlinks have relatively higher capacities and incur lower operational costs than the 3G downlinks [46, 47, 48]. Specifically, the downlink capacity (in terms of Mbps) distributions for LTE downlinks and 3G downlinks are and , respectively. We choose the average speed according to field experiments [47, 46]. The operational cost distributions for LTE downlinks and 3G downlinks are and , respectively, suggested in [48]. Each user experiences the same cellular energy cost and zero Wi-Fi energy cost, and we set [28]. We run the experiment 10,000 times for each realization and show the average together with the error bars.

VII-C Results

VII-C1 Performance Comparison

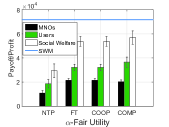

In this part, we compare the performances of the cooperative scheme (denoted by COOP), competitive (denoted by COMP), and the FT scheme with the two benchmarks. We study both an -fair utility scenario and a logarithmic utility scenario.

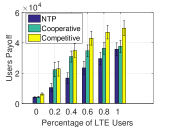

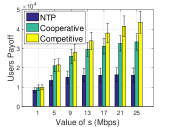

We first consider the -fair utility scenario. We plot the users’ payoff, MNOs’ profit, and the social welfare for users in Fig. 7(a). First, we observe that the cooperative scheme approximately doubles both MNOs’ profit, compared with the NTP scheme. Comparing with the cooperative scheme, the competitive scheme only incurs a slight MNOs’ profit loss. For the FT scheme, we see that it achieves exactly the same performance as the cooperative scheme. This agrees with Corollary 2, i.e., the iso-elasticity of the -fair utility functions, zero Wi-Fi links energy costs , and homogeneous cellular downlink energy costs lead to the optimum.

We observe a similar trend for the users’ payoff. Namely, both cooperative and competitive schemes approximately double both users’ payoff, compared with the NTP scheme. The competitive scheme achieves a relatively higher users’ payoff compared with the cooperative scheme.

In terms of the social welfare, we observe that the cooperative and competitive schemes perform better than the NTP scheme. Moreover, the competitive scheme achieves more social welfare than the cooperative scheme. Intuitively, the competitive MNOs compete down the hybrid prices so that the achieved social welfare is closer to the SWM scheme.

To conclude,

Observation 1.

Compared with the conventional NTP scheme, in the -fair utility setting, both competitive and cooperative schemes can approximately double both MNOs’ profit and users’ payoff.

We then study the logarithmic utility scenario. Each user has a utility given by with . The cooperative scheme approximately doubles the MNOs’ profit compared with the FT scheme, while the competitive scheme decreases the MNOs’ profit compared with the cooperative scheme. A key observation is that the FT scheme perform close to the optimal and can achieve of the maximal MNOs’ profit. Therefore, we highlight

Observation 2.

The FT scheme performs close to the optimal cooperative scheme with low tethering energy cost and homogeneous cellular energy cost, even without isoelastic utility.

In terms of users’ payoff, the cooperative scheme approximately doubles the NTP scheme’s performance. The competitive scheme further improves the performance of the cooperative scheme by .

VII-C2 Impact of Network Heterogeneity

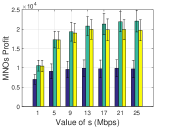

We next perform three sets of experiments to investigate how the performance benefits of the MCA service depend on the network heterogeneity. Specifically, heterogeneities are in terms of the downlink capacity, the portion of LTE users, and the MNOs’ operational cost.

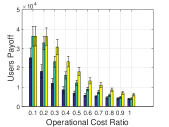

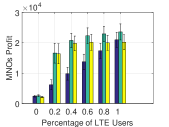

Downlink capacity: For the first experiment, we fix the mean of LTE downlink to be Mbps and the 3G downlinks to be Mbps. Fig. 8(a) shows that, as the capacities of the low-cost LTE channels increase, the MNOs’ profit benefits of the cooperative and competitive schemes over the NTP scheme become more significant. Precisely, when Mbps, compared with the conventional NTP scheme, the cooperative and the competitive schemes improve the MNOs’ profit by and , respectively. This is because, in the proposed schemes, users prioritize the channels of low operational costs. Hence, the capacity increase of these channels will reduce the MNOs’ operational costs and thus the delivered prices to users.

Fig. 8(b) shows that compared with the conventional NTP scheme, the cooperative and the competitive schemes’ improvements increase in and can improve the users’ payoff by and , respectively, when Mbps. On the other hand, comparing with the cooperative scheme, the competitive scheme also achieves a substantial gain up to in term of users’ payoff when is large whereas the loss in MNOs’ profit is relatively small. This mainly results from the larger social welfare achieved by the competitive scheme.

In the following, we will study the performances in terms of MNOs’ profit. The results in terms of users’ payoff for the next two sets of experiments are similar to the first set. We thus present the numerical results for users’ payoff in Appendix -U.

Percentage of LTE users: Fig. 9(a) shows a similar trend regarding the network heterogeneity in terms of the percentage of LTE users. As shown in Fig. 9(a), when the percentage of LTE users is between -, the cooperative and competitive schemes’ benefits in terms of MNOs’ profits increase are large, compared with the NTP scheme. When users are all LTE users or all 3G users, however, the NTP scheme achieves higher MNOs’ profits than the competitive scheme. This implies that when users are homogeneous, each MNO’s profit gained from the MCA due to resource pooling is limited while the competitive MNOs also suffer from the additional competition enabled by the MCA.

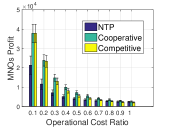

LTE operational cost: Finally, we study the LTE operational cost’s impact on performance in Fig. 9(b). Specifically, we consider an operational cost ratio and set . Therefore, the a larger leads to a more similar LTE operational cost to the 3G operational cost. We show that as increases, MNOs’ profit improvements for both proposed schemes decrease compared with the NTP scheme in Fig. 9(b). To summarize, we have

Observation 3.

The degree of network heterogeneity increases the performance improvement of both cooperative and competitive schemes, comparing with the NTP scheme.

Observation 4.

Compared to the cooperative scheme, the competitive scheme achieves a slightly smaller MNOs’ profit but a significantly larger users’ payoff, in heterogeneous networks.

As today’s wireless networks are becoming increasingly heterogeneous due to the coexistence of legacy and new technologies, we believe that the MCA with the proposed pricing schemes will be beneficial to both MNOs and users.

VIII Conclusion

In this paper, we proposed a hybrid pricing framework for the mobile collaborative Internet access and studied both cooperative and competitive interactions among MNOs. We showed that there exists an equilibrium hybrid pricing scheme making each user’s cost independent of the selection of tethering links, for both cooperative and competitive scenarios. We verified that the proposed cooperative and competitive pricing schemes improve MNOs’ profit and users’ payoff as compared with the no-tethering scheme in practically interesting scenarios. Moreover, the performance gain increases when the network becomes more diverse. Our results also showed that, under some mild conditions, it is possible to achieve most of the benefits of MCA without imposing additional fees on user tethering. This result is encouraging, as it allows the MNOs to improve their profits (compared to no tethering case) even if they are prohibited from charging for tethering [11].

For the future work, we are particularly interested in studying the impact of incomplete information, where the users’ utility functions and topology are private information. Another promising direction is to implement the proposed schemes in systems. Inspired by TUBE in [49], one approach is to design an architecture solution that contains not only the MCA function but also a feedback loop between the MNOs’ hybrid price computation and users, which will facilitate MNOs to implement the adaptive and topology-based pricing.

References

- [1] M. Zhang, L. Gao, J. Huang, and M. Honig, “Cooperative and competitive operator pricing for mobile crowdsourced internet access,” in Proc. IEEE INFOCOM, 2017.

- [2] Cisco, “Cisco Visual Network Index: Global Mobile Data Traffic Forecast Update,” 2019.

- [3] R. Sofia and P. Mendes, “User-Provided Networks: Consumer as Provider,” IEEE Commun. Mag., vol. 46, no. 12, pp. 86-91, 2008.

- [4] https://yourkarma.com/.

- [5] http://opengarden.com/.

- [6] https://en.wikipedia.org/wiki/Open_Garden.

- [7] http://www.au.kddi.com/english/mobile/service/tethering/.

- [8] http://techland.time.com/2014/02/04/hotspot-share-your-phones-mobile -data-with-other-devices/

- [9] K. Lo, “Tethering on UK Networks: Which Mobile Networks Allow You To Tether?” 2016. [Online]. Available: http://kenstechtips.com/index.php/tethering-on-uk-networks

- [10] http://www.three.co.uk/store/SIM/Plans_for_phones.

- [11] https://www.fcc.gov/document/verizon-wireless-pay-125-million-settle-investigation.

- [12] https://en.wikipedia.org/wiki/Roaming.

- [13] R. Gibbons, Game Theory for Applied Economists, Princeton University Press, 1992.

- [14] G. Iosifidis, L. Gao, J. Huang, and L. Tassiulas, “Efficient and Fair Collaborative Mobile Internet Access,” in IEEE/ACM Trans. on Netw., vol. 25, no. 3, pp. 1386-1400, June 2017.

- [15] D. Syrivelis, G. Iosifidis, et al., “Bits and Coins: Supporting Collaborative Consumption of Mobile Internet,” in Proc. IEEE INFOCOM, 2015.

- [16] L. Georgiadis, G. Iosifidis, and L. Tassiulas, “Exchange of Services in Networks: Competition, Cooperation, and Fairness,” ACM Sigmetrics, 2015.

- [17] https://fon.com/.

- [18] G. Iosifidis, L. Gao, J. Huang, and L. Tassiulas, “Incentive Mechanisms for User-Provided Networks,” IEEE Commun. Mag., vol. 52, no. 9, pp. 20-27, 2014.

- [19] M. H. Afrasiabi and R. Guerin, “Pricing Strategies for User-Provided Connectivity Services,” in Proc. IEEE INFOCOM, Mar. 2012, pp. 2766–70.

- [20] Q. Ma, L. Gao, Y.-F. Liu, and J. Huang, “Economic Analysis of Crowdsourced Wireless Community Networks”, IEEE Trans. on Mobile Comput., vol. 16, no. 7, pp. 1856-1869, July 2017.

- [21] L. Gao, G. Iosifidis, J. Huang, and L. Tassiulas, “Hybrid Data Pricing for Network-Assisted User-Provided Connectivity,” in Proc. IEEE INFOCOM, 2014.

- [22] M. M. Khalili, L. Gao, J. Huang, and B. H. Khalaj, “Incentive Design and Market Evolution of Mobile User-Provided Networks,” in IEEE Workshop on Smart Data Pricing, 2015.

- [23] J. MacKie-Maso and H. Varian, “Pricing the Internet.” Public Access to the Internet, May 1995.

- [24] L. Jiang, S. Parekh, and J. Walrand, “Time-Dependent Network Pricing and Bandwidth Trading,” in Proc. IEEE NOMS Wksp., 2008.

- [25] R. K. Lam, D. M. Chiu, and J. C. S. Lui, “On the Access Pricing and Network Scaling Issues of Wireless Mesh Networks,” IEEE Trans. on Comput., vol. 56, no. 11, pp. 1456-1469, 2007.

- [26] F. Wu, T. Chen, S. Zhong, L. E. Li, and Y. R. Yang, “Incentive-compatible opportunistic routing for wireless networks,” in Proc. ACM MobiCom, 2008.

- [27] L. Chen, L. Libman, and J. Leneutre, “Conflicts and Incentives in Wireless Cooperative Relaying: A Distributed Market Pricing Framework,” IEEE Trans. Parallel Distrib. Syst., vol. 22, no. 5, pp. 758-772, May 2011.

- [28] N. Balasubramanian, A. Balasubramanian, and A. Venkataramani, “Energy Consumption in Mobile Phones: A Measurement Study and Implications for Network Applications,” in Proc. ACM SIGCOMM, 2009.

- [29] S. Li and J. Huang, “Price Differentiation for Communication Networks,” IEEE/ACM Trans. on Network., vol. 22, no. 3, pp. 703-716, June 2014.

- [30] C. Shapiro amd H.R. Varian, “Information rules: a strategic guide to the network economy,” Harvard Business Press, 1998.

- [31] http://android.stackexchange.com/questions/47819/how-can-phone-companies-detect-tethering-incl-wifi-hotspot.

- [32] E. Cantor, “The mother of invention: Network operators in the poor world are cutting costs and increasing access in innovative ways,” The Economist, 2009.

- [33] S. Boyd and L. Vandenberghe, Convex Optimization, Cambridge University Press, 2004.

- [34] L. Eeckhoudt, J. Etner, F. Schroyen, “The values of relative risk aversion and prudence: A context-free interpretation,” Mathematical Social Sciences, Vol. 58, no. 1, pp. 1-7, 2009.

- [35] J. Mo and J. Walrand, “Fair End-to-End Window-Based Congestion Control,” IEEE/ACM Trans. on Netw., vol. 8, no. 5, pp. 556-567, October 2000.

- [36] T. Lan, D. Kao, M. Chiang, and A. Sabharwal, “An Axiomatic Theory of Fairness in Network Resource Allocation,” in Proc. IEEE INFOCOM, 2010.

- [37] J. Huang, R. A. Berry and M. L. Honig, “Distributed interference compensation for wireless networks,” IEEE J. Sel. Areas in Commun., vol. 24, no. 5, pp. 1074-1084, May 2006.

- [38] M. Grant, S. Boyd, and Y. Ye, “CVX: Matlab software for disciplined convex programming.” 2008.

- [39] https://en.wikipedia.org/wiki/Edgeworth_paradox

- [40] Moulin, Herve. “Dominance solvability and Cournot stability.” Mathematical Social Sciences 7.1 (1984): 83-102.

- [41] J. Haraguchi and T. Matsumura. “Cournot-Bertrand comparison in a mixed oligopoly,” Journal of Economics, vol. 117, no. 2, pp. 117-136, 2016.

- [42] A. Farahat, and G. Perakis. 2011. “A comparison of Bertrand and Cournot profits in oligopolies with differentiated products,” Operations Research, vol. 59, no. 2, pp. 507-513, 2011.

- [43] R. L. Franks and R. P. Marzec. “A theorem on mean-value iterations.” in Proc. the American Mathematical Society, pp.324-326, 1971.

- [44] L. Thorlund-Petersen. “Iterative computation of Cournot equilibrium.” Games and Economic Behavior, pp. 61-75, 1990.

- [45] L. Duan, J. Huang and B. Shou, “Duopoly Competition in Dynamic Spectrum Leasing and Pricing,” IEEE Trans. on Mobile Comput., vol. 11, no. 11, pp. 1706-1719, November 2012.

- [46] J. Huang, F. Qian, A. Gerber, Z. M. Mao, S. Sen, and O. Spatscheck, “A Close Examination of Performance and Power Characteristics of 4G LTE Networks,” in Proc. ACM MobiSys, 2012.

- [47] W. L. Tan, F. Lam, and W. C. Lau, “An Empirical Study on the Capacity and Performance of 3G Networks,” IEEE Trans. on Mobile Comput., vol. 7, no. 6, pp. 737-750, June 2008.

- [48] http://www.senzafiliconsulting.com/Portals/0/docs/Reports/SenzaFili_SmallCellWiFiTCO.pdf

- [49] S. Ha, S. Sen, C. Joe-Wong, Y. Im, and M. Chiang, “TUBE: time-dependent pricing for mobile data.” in ACM SIGCOMM Comput. Commun. Rev. vol. 42, no. 4, pp. 247-258, August 2012.

![[Uncaptioned image]](/html/1809.02917/assets/meng-photo.jpg) |

Meng Zhang (S’15) is a PhD student in the Department of Information Engineering at the Chinese University of Hong Kong since 2015. He was a visiting student research collaborator with the Department of Electrical Engineering at Princeton University, from 2018 to 2019. His research interests include network economics, with emphasis on mechanism design for wireless networks. |

![[Uncaptioned image]](/html/1809.02917/assets/x11.png) |

Lin Gao (S’08-M’10-SM’16) received the PhD degree in electronic engineering from Shanghai Jiao Tong University in 2010 and worked as a postdoctoral research fellow with the Chinese University of Hong Kong from 2010 to 2015. He is an associate professor in the School of Electronic and Information Engineering, Harbin Institute of Technology, Shenzhen, China. He received the IEEE ComSoc Asia-Pacific Outstanding Young Researcher Award in 2016. His main research interests are in the area of network economics and games, with applications in wireless communications and networking. He has co-authored 3 books including the textbook Wireless Network Pricing by Morgan & Claypool (2013). He is the corecipient of three Best (Student) Paper Awards from WiOpt 2013, 2014, 2015, and is a Best Paper Award Finalist from IEEE INFOCOM 2016. |

![[Uncaptioned image]](/html/1809.02917/assets/huang-photo.jpg) |

Jianwei Huang (F’16) is a Presidential Chair Professor and the Associate Dean of the School of Science and Engineering, The Chinese University of Hong Kong, Shenzhen. He is also a Professor in the Department of Information Engineering, The Chinese University of Hong Kong. He received the Ph.D. degree from Northwestern University in 2005, and worked as a Postdoc Research Associate at Princeton University during 2005-2007. He has been an IEEE Fellow, a Distinguished Lecturer of IEEE Communications Society, and a Clarivate Analytics Highly Cited Researcher in Computer Science. He is the co-author of 9 Best Paper Awards, including IEEE Marconi Prize Paper Award in Wireless Communications in 2011. He has co-authored six books, including the textbook on ”Wireless Network Pricing.” He received the CUHK Young Researcher Award in 2014 and IEEE ComSoc Asia-Pacific Outstanding Young Researcher Award in 2009. He has served as an Associate Editor of IEEE Transactions on Mobile Computing, IEEE/ACM Transactions on Networking, IEEE Transactions on Network Science and Engineering, IEEE Transactions on Wireless Communications, IEEE Journal on Selected Areas in Communications - Cognitive Radio Series, and IEEE Transactions on Cognitive Communications and Networking. He has served as an Editor of Wiley Information and Communication Technology Series, Springer Encyclopedia of Wireless Networks, and Springer Handbook of Cognitive Radio. He has served as the Chair of IEEE ComSoc Cognitive Network Technical Committee and Multimedia Communications Technical Committee. He is the recipient of IEEE ComSoc Multimedia Communications Technical Committee Distinguished Service Award in 2015 and IEEE GLOBECOM Outstanding Service Award in 2010. |

![[Uncaptioned image]](/html/1809.02917/assets/mh022819.jpg) |

Michael L. Honig (F’97) is a Professor in the Department of Electrical Engineering and Computer Science at Northwestern University. Prior to joining Northwestern he worked in the Systems Principles Research Division at Bellcore in Morristown, NJ, and at Bell Laboratories in Holmdel, NJ. His recent research has focused on wireless networks, including interference mitigation and resource allocation, and market mechanisms for dynamic spectrum allocation. He received the B.S. degree in electrical engineering from Stanford University in 1977, and the Ph.D. degree in electrical engineering from the University of California, Berkeley, in 1981. He has held visiting scholar positions at the Naval Research Laboratory (San Diego), the University of California, Berkeley, the University of Sydney, Princeton University, the Technical University of Munich, and the Chinese University of Hong Kong. He has also worked as a free-lance trombonist. Dr. Honig has served as editor and guest editor for several journals, and as a member of the Board of Governors for the IEEE Information Theory Society. He is a Fellow of IEEE, the recipient of a Humboldt Research Award for Senior U.S. Scientists, and a co-recipient of the 2002 IEEE Communications Society and Information Theory Society Joint Paper Award and the 2010 IEEE Marconi Prize Paper Award. |

-A KKT conditions and Lemma 3

We characterize the optimal solution to (UPM) in (5) for any given in the following. Due to the concavity of the objective and the convexity of the constraint set, (UPM) is a convex problem. It is easy to verify that it also satisfies the Slater’s condition, and hence the Karush-Kuhn-Tucker (KKT) conditions are sufficient and necessary for global optimality [33]: for every user ,

| (29a) | ||||

| (29b) | ||||

| (29c) | ||||

| (29d) | ||||

| (29e) | ||||

Based on the KKT conditions in (29), we have the following lemma for facilitating the following analysis.

Lemma 3.

Given any hybrid pricing matrix and , the optimal traffic matrix satisfies

| (30) |

Intuitively, users purchase the data from the downlink with a lower hybrid price first (and fully utilize that downlink’s capacity) before purchasing data from a higher price downlink.

-B Proof of Theorem 1

We prove Theorem 1 for both cooperative and competitive MNOs, respectively.

-B1 Cooperative MNOs

Suppose that, given , there exists an optimal solution (that satisfies the KKT conditions) with for some downlink In this case we can see that if MNOs increase to for all , the solution will still satisfy the KKT conditions under the updated price, implying that it is an optimal solution under the updated price. Furthermore, Assumption 1 implies that the resulted total MNOs’ profit is unique in . Hence, the MNOs’ profit increases from

to

which implies that is not the equilibrium (best) price matrix for the MNOs. Hence, we can see that under the equilibrium price matrix , the optimal solution must satisfy for all .

-B2 Competitive MNOs

Similar to the cooperative case, let for some downlink In this case we can see that if MNO increase to for all . Furthermore, the resulted MNO ’s profit increases from

to

which implies that is not at the equilibrium price matrix for the MNOs. This completes the proof.

-C Proof of Corollary 1

We prove by construction. We define for notational simplification. According to Theorem 1, there exists an equilibrium such that . For each user ,

- •

-

•

Suppose there exists a user such that . Note that any other such that , it also satisfies that due to (29a). For the remaining such that , let and the . Hence, . We see that the new solution also still satisfies the KKT conditions in (29a)-(29e). After such an operation, for all , is still the optimal traffic solution, and each MNO’s profit maintains the same.

Therefore, we note that for any equilibrium , we can always construct another such that for each user , for all , is still the optimal traffic solution, and each MNO’s profit maintains the same. Hence, there always exists such a pricing that is the optimal cooperative pricing scheme.

-D Proof of Proposition 1

We will prove that is both sufficient and necessary for user to have a positive demand at an equilibrium.

Necessity: Suppose that, for user , we have . By the KKT conditions in (29a), for every downlink , we have

| (33) |

Inequality is because the equilibrium hybrid price should be no less than the operational cost and . Inequality is because of the strict concavity of from Assumption 1. We further see for all (user has zero demand) due to (33) and the complementary slackness condition . This proves the necessity.

Sufficiency: As Proposition 1 suggests, we focus on the gateway-independent delivered pricing scheme . As we previously discussed, each user’s traffic at the equilibrium can be fully characterized by a delivered price . When , there exists an arbitrarily small such that under an delivered price vector , each user demands a small amount of data. In this case, user requests data from downlink with the lowest delivered cost, i.e., by Assumption 1. This leads to the positive (though small) total MNOs’ profit. Hence, the optimal delivered price for each user should yield the profit no less than that of , in which case each user should also have a positive demand. Hence, under MNOs’ optimal pricing scheme, MNOs’ profit gained from each user is positive which only happens if each user has a positive demand.

-E Proof of Theorem 2

To prove Theorem 2, we first introduce an intermediate transformation of (OPM) and then prove the equivalence between the transformation and the (R-OPM).

-E1 Transformed OPM (T-OPM)

Let be the hybrid price matrix associated with the delivered price vector .

We reformulate (OPM) as

| (34a) | ||||

| (34b) | ||||

Assumption 1 ensures that users select from to minimize the aggregate delivered cost in (34). In addition, since is a (one-to-one) function and users select according to Assumption 1, the objective in (34) has a unique maximum. Based on the gateway-independent pricing structure in Corollary 1, we have

Proposition 9 (Equivalence of (OPM) and (T-OPM)).

For any optimal solution to (T-OPM), for all , is the optimal solution to (OPM).

From Proposition 9, we can interpret the delivered cost as the operational cost for each unit in analogy with being the unit revenue gained from user .

The physical interpretation is that we now consider an equivalent system where MNOs’ operational cost is for each byte downloaded by user and tethered to user (and there is no energy cost for user). By considering such an equivalent system, MNOs are able to optimize over the effective price vector .

-E2 Equivalence between (T-OPM) and (R-OPM)

Let be the optimal value of (T-OPM) and be that of (R-OPM). We will prove by first showing and then showing . And then we show statements i) and ii).

Let be the optimal solution to (T-OPM). Note that users’ decision is a feasible solution to (R-OPM), since (R-OPM) and (UPM) share the same constraints. Given , the objective value of (R-OPM) can be expressed by

| (35) |

where is due to (9) and is because is the inverse function of . We have .

Next, we prove . The (R-OPM) Problem can be equivalently reformulated as

| (36a) | ||||

| (36b) | ||||

| (36c) | ||||

Denote as the optimal solution to (R-OPM-2). Then we can express the optimal solution to (R-OPM) as

| (37) | ||||

Suppose for every user . Comparing (37) and (6), we can see under the price . This indicates that

| (38) |

That is, corresponds to a feasible solution to (T-OPM).

Combining the above discussion, we have that . Hence, is exactly the optimal solution to (T-OPM), i.e., the optimal delivered price for user is

| (39) |

and is the optimal solution to (UPM) under . This completes the proof of statement i). Moreover, as previously discussed, the fact that under the price completes the proof of statement ii).

-F Free-Tethering Pricing Scheme and Proof of Corollary 2

In this subsection, we first elaborate the FT scheme and then prove Corollary 2.

-F1 Free-Tethering Pricing Scheme

Define the uniform delivered price function as the inverse function of the users’ aggregate demand function, i.e.,

| (40) |

Such a uniform delivered price corresponds to a delivered price that equalizes users’ aggregate demand function and the total downloads, i.e., . Similar to (R-OPM) in (12a)-(12b), we formulate the (FT) Problem as follows

| (41a) | ||||

| (41b) | ||||

| (41c) | ||||

Let denote the optimal solution to the above problem. Then we can write the corresponding FT hybrid price as

| (42) |

Since , we further have and thus .

-F2 Proof of Corollary 2

We first show that the isoelastic utility functions lead to the same delivered prices across users. For an ioselastic utility function, the corresponding demand function is

| (43) |

We define user ’s price elasticity of demand as

| (44) |

We can derive the optimal solution of (T-OPM) as

| (45) |

for some downlink . Since is a constant for every user , the optimal delivered prices are the same across users.

-G Proof of Proposition 2