Multiplicative random cascades with additional stochastic process in financial markets

Abstract

Multiplicative random cascade model naturally reproduces the intermittency or multifractality, which is frequently shown among hierarchical complex systems such as turbulence and financial markets. As described herein, we investigate the validity of a multiplicative hierarchical random cascade model through an empirical study using financial data. Although the intermittency and multifractality of the time series are verified, random multiplicative factors linking successive hierarchical layers show strongly negative correlation. We extend the multiplicative model to incorporate an additional stochastic term. Results show that the proposed model is consistent with all the empirical results presented here.

Jun-ichi Maskawaa111Jun-ichi Maskawa, Department of Economics, Seijo University Address: 6-1-20 Seijo, Setagaya-ku, Tokyo 157-8511, Japan Tel.: +81-3-3482-5938, Fax: +81-3-3482-3660 E-mail: maskawa@seijo.ac.jp , Koji Kurodab and Joshin Muraic

aDepartment of Economics, Seijo University

bGraduate School of Integrated Basic Sciences, Nihon University

cGraduate School of Humanities and Social Sciences, Okayama University

1 Introduction

Financial markets consist of different participants who watch the market with different temporal resolution and who react to price changes with different time horizons. For example, whereas intra-day traders watch the market continuously and trade multiple times each day, fund managers might reconsider their portfolios over periods of weeks or months. Competition among participants with different characteristic time horizons creates a heterogeneous structure of volatilities measured using different time resolutions. Past coarse-grained measures of volatility correlate to future fine-scale volatility more than the reverse process. This causal structure from a long-term to short-term scale volatility was first pointed out by Müller et al. (Müller et al. 1997). It is thought to be a stylized fact in financial markets (Arneodo et al. 1998a; Cont 2001; Lynch and Zumbach 2003), leading naturally to the idea of volatility cascade from long-term to short-term horizon by an analogy of an energy cascade in turbulence in fluid dynamics (Ghashghaie 1996). In fully developed turbulent flow, the kinetic energy is injected by external forces to create eddies at the largest space scale. According to the phenomenological picture of hierarchical cascade in turbulence, they are deformed by fluid dynamics, with breakage into smaller eddies. Then the energy transfers to a smaller scale. This process is repeated hierarchically several times to the smallest scale, where the energy is eventually removed by dissipation (Richardson 1922; Kolmogorov 1941; Frisch 1997).

Intermittency, a common phenomenon in many complex systems, is also a crucial characteristic both in financial markets and turbulent flows (Kolmogorov 1962; Mandelbrot 1963). Intermittency is characterized by the presence of irregular burst of the volatility of asset prices, the strength of velocity of fluids and other quantities of systems and creation of large kurtosis and fat tails in probability distribution of those quantities. One also frequently observes multifractality in the same systems showing intermittency (Frisch 1997; Schmitt et al. 1999). Financial markets and turbulence are not exceptions. Multiplicative random cascade models that will be introduced into section 2 relate the fluctuation at scale () to that at scale by the cascade rule

| (1) |

where is a random variable that depends only on the scale ratio . It is a promising model leading naturally to the intermittency and multifractality of the systems (Mandelbrot 1974; Frisch 1997; Arneodo et al. 1998b)

As described in this paper, we investigate the validity of a multiplicative hierarchical random cascade model by application of the model to a time series of stock prices. Because the actual hierarchical structure is directly unobservable, we apply a model on a dyadic hierarchical tree structure to the market. The intermittency and multifractality of the time series are verified with prediction of the model. However, although random multiplicative factors linking successive hierarchical layers are assumed to be i.i.d., the corresponding values calculated backwards from the data show strongly negative correlation. That result apparently indicates a need for extension of the model. In each cascading step (1) the variable is usually determined by only one predecessor at the previous step. We extend the multiplicative model to incorporate an additional stochastic term multiplied by the standard deviation of the variable at the previous step. Such a model was introduced originally by Jiménez as a mixed multiplicative-stochastic model of turbulence (Jiménez 2000; Jiménez 2007). Our model is shown to cope with both well-known characteristics of financial time series such as intermittency or multifractality and the observed negative correlation among multiplicative factors.

The paper is organized as follows. In Section 2, we introduce a multiplicative random cascade model on wavelet dyadic trees proposed by Arneodo, Bacry and Muzy (Arneodo et al. 1998b), which is the model investigated herein. We next investigate the model validity by application of the model to a time series constructed from the multivariate time series of the stock prices of the constituents of the FTSE 100 listed on the London Stock Exchange. In Section 4, we introduce an extension of the model and verify the improved model validity by Monte Carlo simulations. Finally, we summarize the results and provide some remarks about future work.

2 Multiplicative dyadic random cascade model

Arneodo, Bacry and Muzy proposed a method of constructing a new class of random functions, designated as -cascade, using the orthogonal wavelet transform (Arneodo et al. 1998b). We briefly introduce -cascade in this section.

Function can be expanded by an orthogonal wavelet basis as

| (2) |

where the integer can be arbitrarily chosen. A wavelet basis, functions and , can be constructed respectively using translation and dilation of the scaling function and the wavelet function :

| (3) |

The wavelet coefficients of a function are then given by the integration shown below.

| (4) |

In the following, we specifically address discrete time series with finite length . When applying equations (2)–(4), the function is used as a periodic function of length . The largest scale corresponding to and the finer scales . The wavelet function is expected to have vanishing moments

| (5) |

Arneodo et al. have built a random function by specifying the wavelet coefficients . We set . The coefficients and are chosen as arbitrary numbers222When we apply the model to the time series as in section 3, the values and are fixed by the equation (4).. Rescaling of the coefficients as is useful for simplifying the equation. Coefficients are defined recursively as

| (6) |

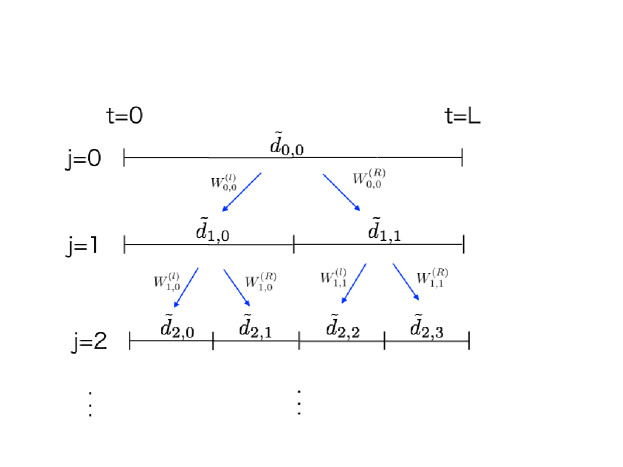

where the multiplicative factors are independent identically distributed (i.i.d.) real-valued random variables. The -cascade is presented schematically in Fig. 1. First, length is divided into two intervals. The wavelet coefficients , and are defined by the multiplicative factors and . Next, each divided interval is divided into two intervals again. The wavelet coefficients () on those intervals are defined by multiplicative factors (). This process on the dyadic tree is repeated to the finest scale .

For -cascade, it is easy to derive the self-similarity law of the probability density function (PDF) of wavelet coefficients. In fact, the PDF of wavelet coefficients derived by the equation (4) at a scale are linked to the PDF at another scale through the self-similar kernel

| (7) |

where the self-similar kernel is the PDF of logarithm of the product . When the path of the process is fractal (homogeneously scale invariant) with the Hölder exponent , it satisfies

| (8) |

They have also derived the singular-spectrum, and auto-correlation functions analytically for -cascade. Their functions possess properties covering a large part of well known stylized facts of financial time series.

3 Empirical study of -cascade

We investigate the validity of a multiplicative hierarchical random cascade model by application of the model to a time series of stock price. Because the actual hierarchical structure is not directly observable, we apply a model on a dyadic hierarchical tree structure to the market, i.e., -cascade.

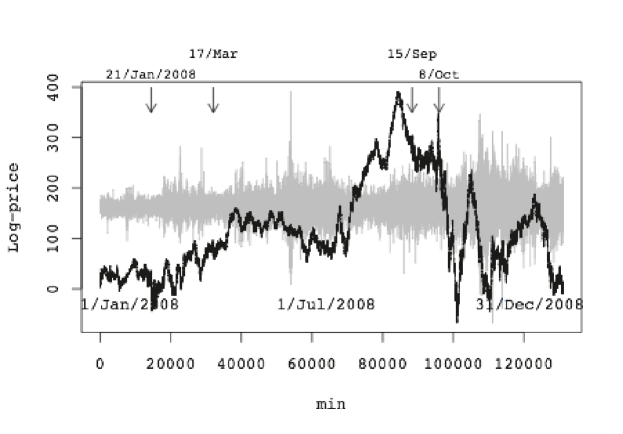

We analyze the normalized average of the logarithmic stock prices of the constituent issues of FTSE 100 index listed on the London Stock Exchange for the period from November 2007 to January 2009, which includes the Lehman shock on 15 September 2008 and the market crash on 8 October 2008.

First, we calculate the average of deseasonalized return of each issue

| (9) |

where and respectively denote the average and the standard deviation of and is the number of constituent issues. Here, we set and examine the 1-min. log-return. We excluded the overnight price change and specifically examine the intraday evolutions of returns. To remove the effect of intraday U shape pattern of market activity from the time-series, the return was divided by the standard deviation of the corresponding time of the day for each issue . Then we cumulate to obtain the path of the process (Fig. 2) as

| (10) |

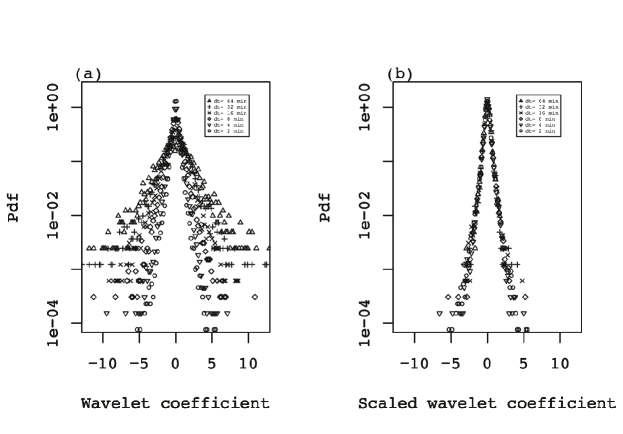

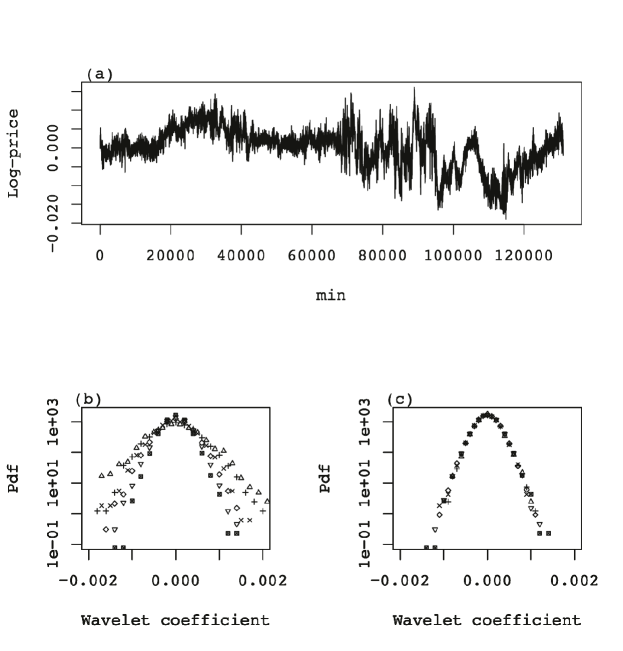

We use the Daubechies 4 compactly supported orthogonal wavelet basis (Daubechies 1992) for the following, which has vanishing moments. In Fig. 3(a), we present the PDF of for the scales min. The tails of the PDF become fatter as the corresponding scale becomes larger. However, the PDFs of scaled wavelet coefficients for different scales collapse into a single curve as shown in Fig. 3(b) when we set the parameter near 0.5. As described by the equation (8), the result indicates that Brownian motion approximates the process well.

Next, we analyze the multifractal properties of the path by an approach using a wavelet-based multifractal formalism proposed by Muzy, Bacry, and Arneodo (Muzy et al. 1993). At the beginning, we define two mathematical terms. The Hölder exponent of a function at is defined as the largest exponent such that there exists an nth order polynomial and constant that satisfy

| (11) |

for in a neighborhood of , characterizing the regularity of the function at . The singular spectrum is the Hausdorff dimension of the set where the Hölder exponent is equal to ,

| (12) |

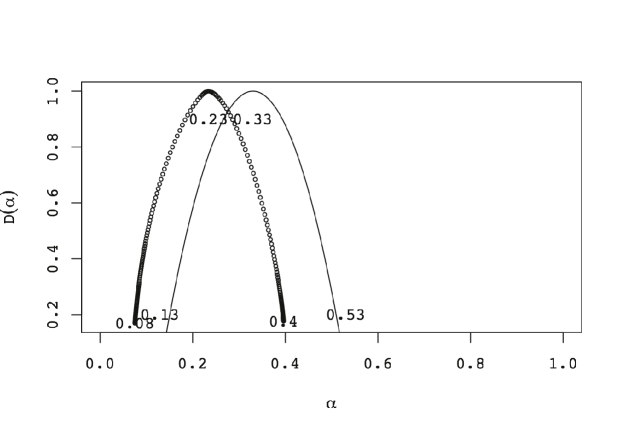

For multifractal paths, the Hölder exponent distribute in a range, while for paths of the Brownian motion, which is fractal, and for .

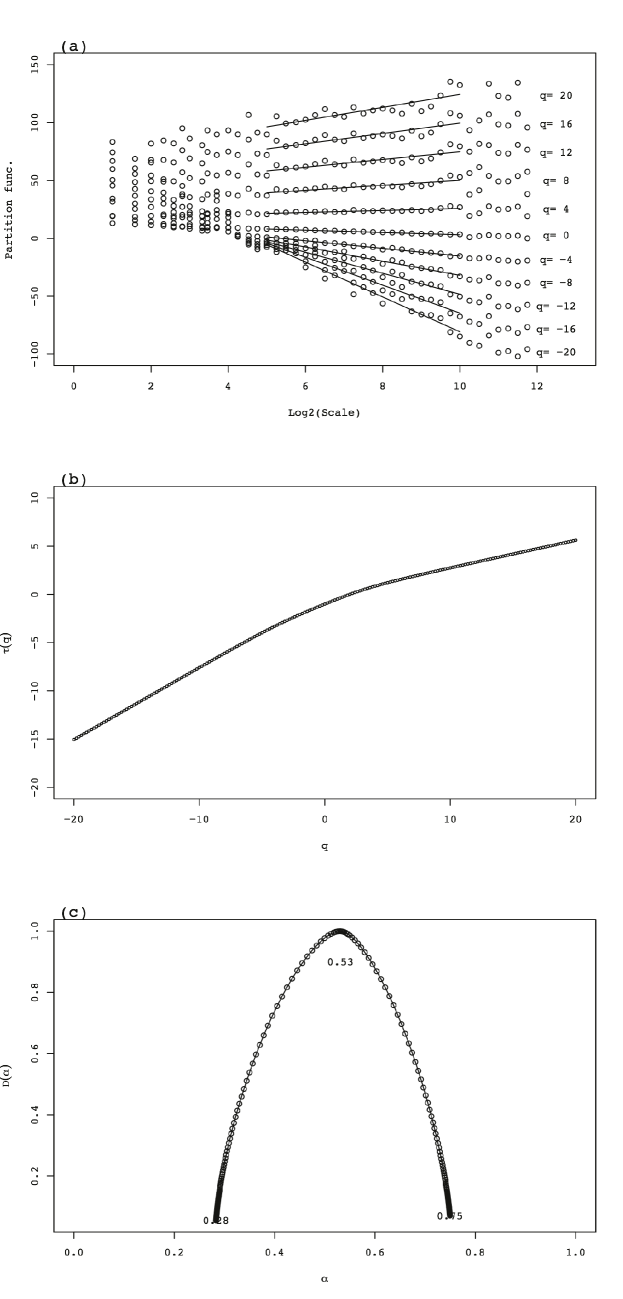

Muzy, Bacry and Arneodo proposed the wavelet transform modulus maxima (WTMM) method based on continuous wavelet transform of function to calculate the singular spectrum (Muzy et al. 1993). We briefly sketch the WTMM method in Appendix. We calculate the partition function of the -th moment of wavelet coefficients by the equation (19) for the path of our data. Results are shown in Fig. 4(a). The partition function for each order shows power law behavior in the range of scales . Exponents are derived by the equation (20). As shown in Fig. 4(b), it is a convex function of . Those results show the multifractality of the path of the data. The singular spectrum derived, as the Legendre transformation of the function , by the equation (21) is a convex function that has compact support taking the peak at , as shown in Fig. 4(c).

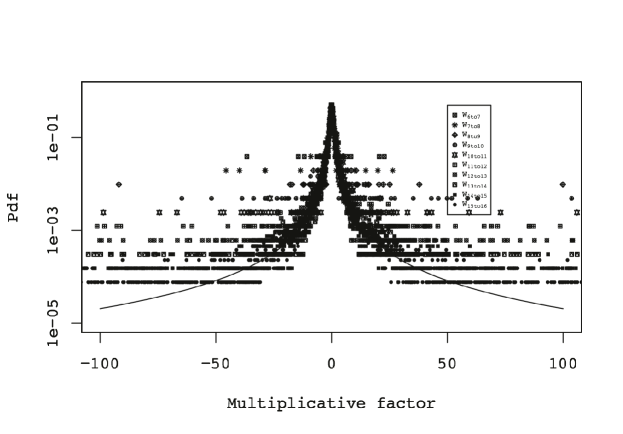

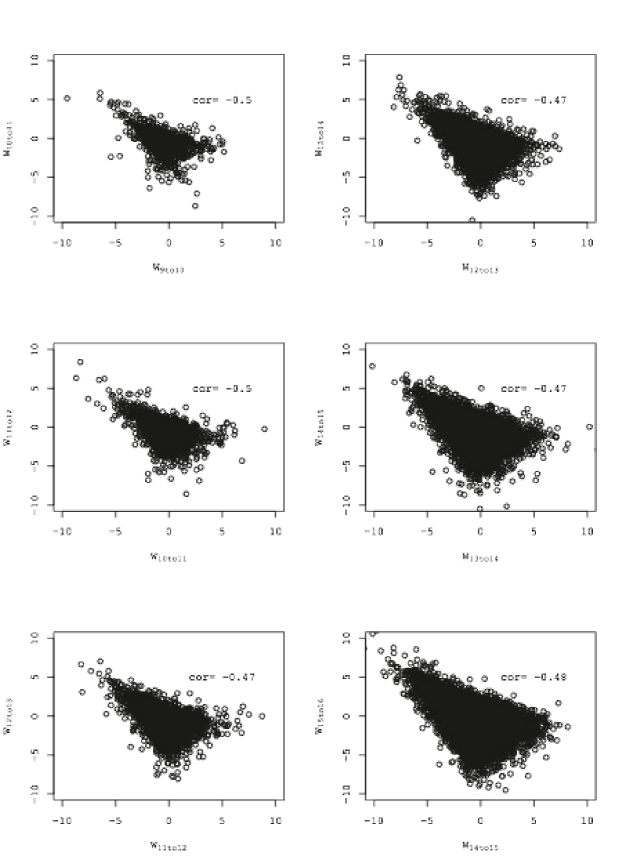

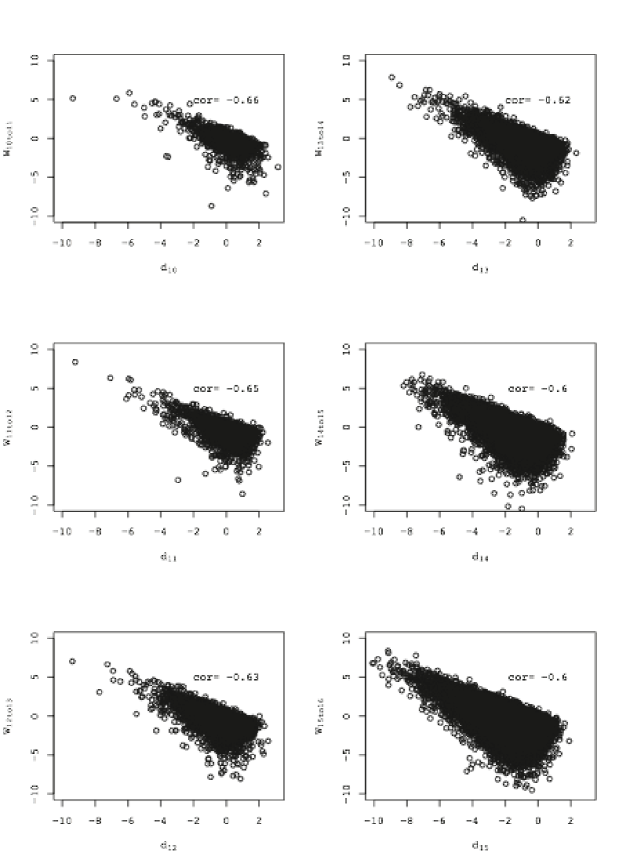

In -cascade model random multiplicative factors linking successive hierarchical layers j and j+1 are assumed to be i.i.d. We calculate the multiplicative factors backward from wavelet coefficients of the data and compile statistics of those qualities. Fig. 5 shows the PDFs of multiplicative factors calculated from the wavelet coefficients of the data333The statistics of the multiplicative factors is the same as of . It is not shown here. . The multiplicative factors are broadly distributed and are well fitted by the Cauchy’s PDF irrelevant to the layer . An important difference between the data and model is the strongly negative correlation between successive multiplicative factors and predecessor wavelet coefficients and multiplicative factors. Results are shown in Fig. 6 and Fig. 7.

4 Multiplicative cascade with additional stochastic process

In -cascade model (6), in each cascading step, the wavelet coefficients and locally transit from the only one predecessor . We extend the multiplicative model to incorporate a certain range of predecessors as an additional stochastic term. Such extension is introduced originally by Jiménez as a mixed multiplicative-stochastic model of turbulence (Jiménez 2000; Jiménez 2007). He has proposed a model incorporating the global standard deviation of the velocity increment of fluid describing a trigger of cascade by the properties of the surrounding fluid.

As a first step along the direction, we investigate the multiplicative cascade model with an additional stochastic term proportional to the sample standard deviation as

| (13) |

where both multiplicative and additional stochastic variables and are assumed to be i.i.d. with zero mean and they are independent. Obtaining the conditional and non-conditional variance of both sides of the equation (13), we have two equations

| (14) |

and

| (15) |

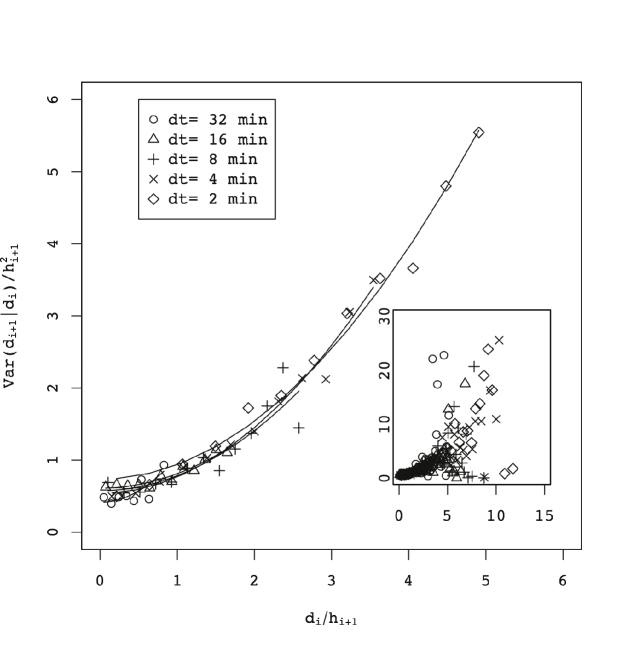

Equation (14) is investigated using the data presented in the previous section. The results for several time scales are shown in Fig. 8. We perform linear regression analysis where the explained variable is the conditional variance of successor divided by the non-conditional variance . The explanatory variable is the square of predecessor . The results are shown in Table 1. The regression lines are added to Fig. 8. The mean values of the variance and respectively denote 0.18 (0.08) and 0.32 (0.07), in which the standard deviations are presented in brackets. The results are consistent with i.i.d. assumption for the stochastic variables and within the standard deviations, except for two extreme samples 12(r) and 16(l). Similar results have been obtained for turbulence experiments (Jiménez 2007).

| Scale i (left/right) | a | b | Std of a | Std of b | Adj. | Var(W) | Var() |

|---|---|---|---|---|---|---|---|

| 12(l) | 0.61 | 0.10 | 0.05 | 0.12 | -0.04 | 0.19 | 0.30 |

| 12(r) | 0.42 | 0.63 | 0.06 | 0.19 | 0.57 | 0.35 | 0.25 |

| 13(l) | 0.66 | 0.25 | 0.13 | 0.09 | 0.36 | 0.17 | 0.33 |

| 13(r) | 0.61 | 0.20 | 0.03 | 0.02 | 0.91 | 0.20 | 0.31 |

| 14(l) | 0.72 | 0.13 | 0.04 | 0.01 | 0.88 | 0.13 | 0.34 |

| 14(r) | 0.57 | 0.21 | 0.10 | 0.03 | 0.77 | 0.21 | 0.28 |

| 15(l) | 0.68 | 0.17 | 0.04 | 0.01 | 0.98 | 0.14 | 0.31 |

| 15(r) | 0.54 | 0.23 | 0.06 | 0.01 | 0.98 | 0.21 | 0.25 |

| 16(l) | 0.90 | 0.15 | 0.15 | 0.01 | 0.92 | 0.05 | 0.47 |

| 16(r) | 0.73 | 0.20 | 0.08 | 0.01 | 0.99 | 0.14 | 0.38 |

In Fig. 9, we present a realization of multiplicative cascade with additional stochastic process (13) in which the stochastic variables and respectively denote drawn from the folded lognormal distribution and normal distribution. As presented in Fig. 9(c), the PDFs of scaled wavelet coefficients collapse into a curve representing the self-similarity (8) with the Hölder exponent , which indicates that the fractional Brownian motion approximates the process well. The singular spectrum is a convex function that has the compact support taking the peak at , which is presented in Fig. 10. The multifractality of the path is not broken by the additional term in the realization.

Finally, we assess the data of the ratio , which corresponds to of multiplicative cascade models. The PDF of the ratio still has a broad distribution and is well fitted by the Student’s t distribution with 2 degrees of freedom irrelevant to layer . More importantly, the strongly negative correlation between successive multiplicative factors and predecessor wavelet coefficients and multiplicative factors are reproduced as in the actual data444The results are not shown here..

5 Conclusions

We investigated the validity of multiplicative random cascade model through an empirical study of the time series of the averaged day-time stock prices of the constituents of the FTSE 100 Index listed on the London Stock Exchange during Nov. 2007 – Jan. 2009. The intermittency and multifractality of the time series has been verified as the prediction of the model. However, the ratios between wavelet coefficients describing the different hierarchical layers calculated backwards from the data have shown strongly negative correlation, while those are i.i.d. stochastic variables in usual multiplicative cascade models.

We have extended the multiplicative model to incorporate an additional stochastic term multiplied by the standard deviation of the variable. We have demonstrated through an empirical study and Monte Carlo simulations of the model that the proposed model is consistent with all the empirical results shown here.

It is noteworthy that the multiplicative cascade model and its extensions violate causality. Bacry, Delour and Muzy have proposed a stochastic process along time axis designated as multifractal random walk keeping the essence of the multiplicative cascade model such as the multifractality and the correlations (Bacry et al. 2001). It might be accomplished in a forthcoming paper.

acknowledgements

This research was partially supported by a Grant-in-Aid for Scientific Research (C) No. 16K01259.

References

- [1] Arneodo A, Bacry E, Muzy JF (1998b) Random cascades on wavelet dyadic trees. J Mathematical Physics 39:4142–4164.

- [2] Arneodo A, Muzy JF, Sornette D (1998a) ”Direct” causal cascade in the stock market. European Physical J B 2:277–282.

- [3] Bacry E, Delour J, Muzy JF (2001) Multifractal random walk. Physical Review E 64:026103.

- [4] Bacry E, Muzy JF, Arneodo A (1993) Singularity spectrum of fractal signals from wavelet analysis: Exact results. Journal of Statistical Physics 70:635–674.

- [5] Cont R (2001) Empirical properties of asset returns: stylized facts and statistical issues. Quantitative Finance 1:223–236.

- [6] Daubechies I (1992) Ten Lectures on Wavelets, the Society for Industrial and Applied Mathematics.

- [7] Frisch U (1997) Turbulence: The Legacy of A. Kolmogorov, Cambridge University Press.

- [8] Ghashghaie S, Breymann W, Peinke J, Talkner P, Dodge Y (1996) Turbulent cascade in foreign exchange markets. Nature 381:767–770.

- [9] Jiménez J (2000) Intermittency and cascades. J Fluid Mech 409:99–120.

- [10] Jiménez J (2007) Intermittency in turbulence. Proc. 15th ’Aha Huliko’ a Winter Workshop.

- [11] Kolmogorov AN (1941) The local structure of turbulence in incompressible viscous fluids for very large Reynolds numbers. Dokl Nauk SSSR 30:301–305.

- [12] Kolmogorov AN (1962) A refinement of previous hypotheses related to the local structure of turbulence in a viscous incompressible fluid at high Reynolds number. J Fluid Mech 13:82–85.

- [13] Lynch PE, Zumbach GO (2003) Market heterogeneities and the causal structure of volatility. Quantitative Finance 3:320–331.

- [14] Mandelbrot BB (1963) The variation of certain speculative prices. J Business 36:394–419.

- [15] Mandelbrot BB (1974) Intermittent turbulence in self-similar cascades: divergence of high moments and dimension of the carrier. J Fluid Mech 62:331–358.

- [16] Müller UA, Dacrogna MM, Davé RD, Olsen RB, Pictet OV, von Weizsäcker JE (1997) Volatilities of different time resolutions – Analyzing the dynamics of market components. J Empirical Finance 4:213–239.

- [17] Muzy JF, Bacry E, Arneodo A (1993) Multifractal formalism for fractal signals: The structure–function approach versus the wavelet-transform modulus-maxima method. Physical Review E 47:875–884.

- [18] Schmitt F, Schertzer D, Lovejoy S (1999) Multifractal analysis of Foreign exchange data. Applied Stochastic Models and Data Analysis 15:29–53.

- [19] Richardson LF (1922) Weather Prediction by Numerical Process, p. 66. Cambridge University Press, reprinted by Dover.

Appendix: WTMM method

This appendix briefly describes the WTMM method based on the continuous wavelet transform proposed earlier in the literature (Bacry et al. 1993; Muzy et al. 1993). The continuous wavelet transformation of the function using the analyzing wavelet is defined as

| (16) |

where parameters and respectively represent the dilation and the translation of the function . The analyzing wavelet has been assumed to have vanishing moments. The successive derivative of the Gaussian function

| (17) |

has vanishing moments. Here we specify and use the second derivative of the Gaussian function as the analyzing wavelet. The WTMM method builds a partition function from the modulus maxima of the wavelet transform defined at each scale as the local maxima of regarded as a function of x. Those maxima mutually connect across scales and form ridge lines designated as maxima lines. The set is the set of all the maxima lines that satisfy

| (18) |

The partition function is defined by the maxima lined as

| (19) |

Assuming the power-law behavior of the partition function

| (20) |

one can define the exponents . The singular spectrum can be computed using the Legendre transform of :

| (21) |