Jackknife empirical likelihood based inference for Probability weighted moments

Abstract.

In the present article, we discuss jackknife empirical likelihood (JEL) and adjusted jackknife empirical likelihood (AJEL) based inference for finding confidence intervals for probability weighted moment (PWM). We obtain the asymptotic distribution of the JEL ratio and AJEL ratio statistics. We compare the performance of the proposed confidence intervals with recently developed methods in terms of coverage probability and average length. We also develop JEL and AJEL based test for PWM and study it properties. Finally we illustrate our method using rainfall data of Indian states.

Keywords: Empirical Likelihood; JEL; Probability weighted moment; -statistics.

1. Introduction

Probability weighted moments (PWM) generalize the concept of moments of a probability distribution.It is generally used to estimate the parameters of extreme distributions of natural phenomena. Particularly, in the fields of Hydrology and Climatology, researchers use PWM for the estimation of parameters of the distributions related to water discharges and maxima of temperatures. Greenwood et al. (1979) proposed the concept of probability weighted moments to estimate the parameters involved in the models of extremes of natural phenomena. The PWM of a random variable with distribution function is defined as

where , and are any real numbers. Hosking et al. (1985) studied PWM of the form given by

| (1) |

to characterize various distributional properties such as assessment of scale parameter, skewness of the distribution and L-moments. In this article we discuss the empirical likelihood inference of .

Given a random sample of size from , let be the - order statistic. David and Nagaraja (2003) proposed an estimator (D-N estimator) for by replacing in (1) with its empirical version, , where denotes the indicator function. Their estimator is given by

| (2) |

To develop an empirical likelihood inference for , Vexler et al. (2017) proposed an estimator (Vexler’s estimator) given by

| (3) |

and showed that asymptotic behaviour of both and are same.

Empirical likelihood is a non-parametric inference tool which make use of likelihood principle. This inference procedure is firstly used by Thomas and Grunkemeier (1975) to obtain the confidence interval for survival probability when data contain censored observations. Pioneering papers by Owen (1988, 1990) for finding the confidence interval of regression parameters take the empirical likelihood method into a general methodology and have wide applications in many statistical areas. This approach enjoys the wide acceptance among the researchers as it combines the effectiveness of the likelihood approach with the reliability of non-parametric procedure.

Empirical likelihood finds applications in regression, survival analysis and inference for income inequality measures [Shi and Lau (2000), Whang (2006), Qin et al. (2010), Peng (2011), Qin et al. (2013), Zhou (2015), Wang et al.(2016), Wang and Zhao (2016)]. Recently, Vexler et al. (2017) proposed an empirical likelihood based inference for PWM and showed that the limiting distribution of log empirical likelihood ratio statistic is distribution with one degree of freedom and obtained confidence intervals and likelihood ratio tests for PWM.

In empirical likelihood approach, we need to maximize the non-parametric likelihood function subject to some constraints. When the constraints are linear, the maximization of the likelihood is not difficult. However, when the constraints are based on nonlinear statistics such as -statistics with higher degree kernel the implementation of empirical likelihood becomes challenging. To overcome this difficulty, Jing et al. (2009) introduced the jackknife empirical likelihood (JEL) inference, which combines two of the popular non-parametric approaches namely, the jackknife and the empirical likelihood approach. Chen et al. (2008) proposed the concept of adjusted empirical likelihood which preserves the asymptotic properties of empirical likelihood. Even though it is an adjustment given to empirical likelihood, adjusted empirical likelihood procedure yields better coverage probability than bootstrap calibration and Bartlett correction methods. Recently Zhao et al. (2015) introduced adjusted jackknife empirical likelihood (AJEL) inference so that restriction on parameter values on the convex hull of estimating equation is relaxed.

Motivated by these recent works, in this article, we develop JEL and AJEL based inference to construct confidence intervals and likelihood ratio tests for PWM. The present article is structured as follows. In Section 2, we derive the jackknife empirical log likelihood ratio for and obtained its limiting distribution. Using this result, we construct jackknife empirical likelihood based confidence interval and likelihood ratio test for . We further derive AJEL based confidence interval and likelihood ratio test for . In Section 3, a comparison of the proposed methods with empirical likelihood method are given using Monte Carlo simulation. Finally an illustration of our methods using a real data is given in Section 4. Major findings of the study are given in Section 5.

2. Jackknife empirical likelihood inference for PWM

In this section, first we discuss JEL based inference for confidence interval and likelihood ratio test for . Later we discuss same problems using AJEL based inference. The implementation of these methods require jackknife pseudo values obtained using an estimator of . For this purpose, we introduce an estimator of using theory of -statistics.

To obtain a -statistic based estimator for we rewrite (1) as

provided is a positive integer. Therefore an unbiased estimator of is given by

| (4) |

where and the summations is over the set of all combinations of distinct elements chosen from . Clearly is a consistent estimator of (Lehmann, 1951). Use of consistent and unbiased estimator to construct an empirical likelihood based confidence interval give better coverage probability and average length. However, has a -statistics based estimator with kernel of degree greater than one which results in non-linear constraints in the optimization problem associated with empirical likelihood. This makes the implementation of empirical likelihood theory very difficult. This leads us to construct JEL based confidence interval and test for .

Next we discuss how to derive the jackknife empirical likelihood ratio for . The jackknife pseudo-values for is given by

| (5) |

where is the estimator of obtained from (4) by using observations . The jackknife estimator of is the average of the jackknife pseudo-values, that is

As the pseudo-values are constructed using a -statistic, the two estimators and coincide. We use the jackknife pseudo-values defined in equation (5) to construct JEL for . The jackknife empirical likelihood of is defined as

| (6) |

where is a probability vector. The maximum of (6) occurs at

where is the solution of

| (7) |

provided

Also note that, , subject to , attains its maximum at . Hence, the jackknife empirical log-likelihood ratio for is given by

| (8) |

Next theorem explains the limiting distribution of which can be used to construct the JEL based confidence interval and test for .

Theorem 1.

Suppose that and , where . Then, as , the distribution of is .

Proof.

Let . Since , by strong law of large numbers we obtain

| (9) |

Using Lemma A.4 of Jing et al. (2009) we have

| (10) |

Hence using (9) and (10) we have

| (11) |

The satisfying the equation (7) has the property (Jing et al. 2009)

| (12) |

Hence using (10) we obtain

| (13) |

Therefore, using equations (11), (13) and (12) we have

Hence from (7) we obtain

| (14) |

Using Taylor’s theorem, we can express given in (8) as

| (15) |

where is the reminder term. Using and (11) we obtained the reminder term . Hence using (14), we can express (15) as

| (16) |

Using the central limit theorem for -statistics, as , the asymptotic distribution of is Gaussian with mean zero and variance , where

Hence, as , converges in distribution to normal with mean zero and variance . Accordingly converges in distribution to with one degree of freedom. In view of (9), by Slutsky’s theorem, from (16) we have the result.

∎

Using Theorem 1, JEL based confidence interval for at is given by

where is the th percentile of chi-square distribution with one degree of freedom. The performance of these confidence intervals in terms of coverage probabilities and average lengths were evaluated via a Monte Carlo simulation and the results are reported in Section 3.

Using the asymptotic distribution of jackknife empirical log likelihood ratio we can develop JEL based test for testing the hypothesis , where is a specific value of . We reject the null hypothesis at significance level if

Simulation study shows that the type 1 error rate of the test converges to desired significance level and has good power. The results of the simulation study are also reported in Section 3.

Next we discuss construction of AJEL based confidence interval for . Define

| (17) |

for some positive . Chen et al. (2008) suggested to take . The adjusted jackknife estimator of is defined as

| (18) |

The adjusted jackknife empirical likelihood of is given by

| (19) |

The maximum of (6) occurs at

where is the solution of

Hence, the adjusted jackknife empirical log likelihood ratio for is given by

Theorem 2.

Under the assumption of Theorem 1, and for , as , , is distributed as .

Proof.

The proof follows on similar lines of proof of Theorem 1. Note that as long as , we have . Consider

where the second last identity follows from the fact that the th term of the summation is . Hence by Slutsky’s theorem we have the result. ∎

Using the asymptotic distribution of adjusted jackknife empirical log likelihood ratio we can construct a confidence interval and likelihood ratio test for . A AJEL based confidence interval for is given by

In AJEL based ratio test for testing the hypothesis , we reject the hypothesis when . The performance of these confidence intervals and tests are also evaluated in Section 3.

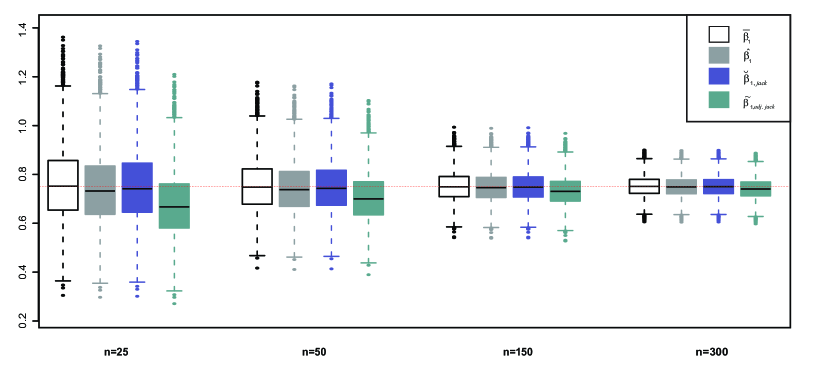

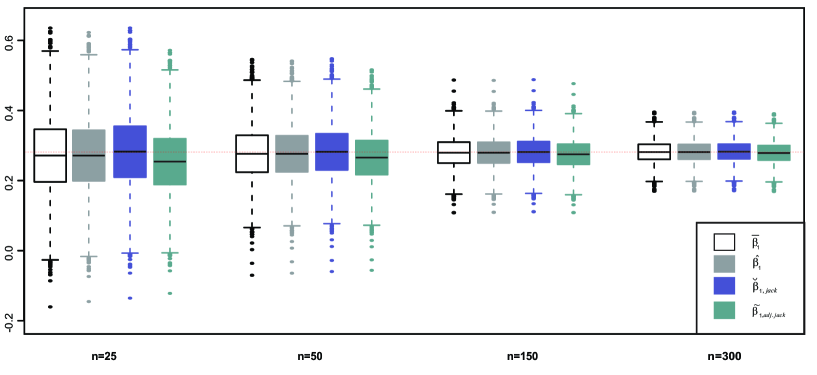

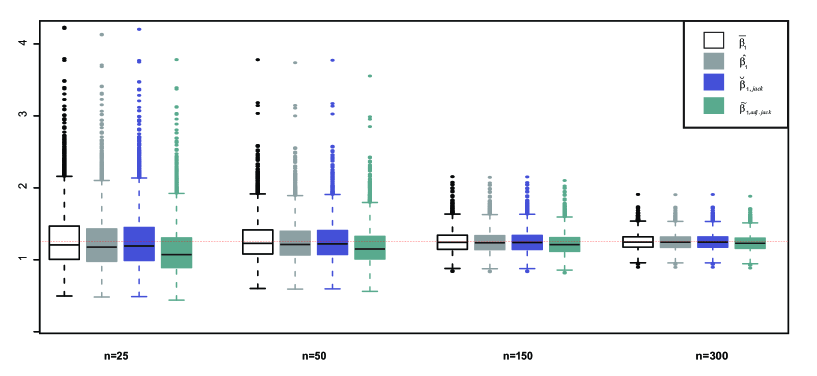

The box plots of four estimators , , and obtained for different sample sizes are shown in Figures 1-3. In Figure 1, we generate observations from standard exponential distribution and computed the four estimators for . The Monte-Carlo simulation procedure is repeated 5000 times. The red horizontal line across the box plot represents the actual value of when follows standard exponential. Similarly in Figure 2 and 3 show box plots of the estimators when the observations are generated from standard normal and standard lognormal distributions respectively.

3. Monte carlo study

In this section, we perform a Monte Carlo simulation study to compare the performance of JEL and AJEL based confidence intervals with the confidence intervals obtained by empirical likelihood method constructed using D-N estimator (DNEL) as well as Vexler’s estimator (VXL). The simulation is done using R. We find empirical type 1 error as well as power of the proposed JEL and AJEL based tests. In our study, the observations are simulated from standard exponential, standard normal and standard log normal distributions with different sample sizes, and . The simulation procedure is repeated for five thousand times. Note that we need to find the values of and to construct the confidence intervals and to obtain the critical regions of the proposed tests. We used the R functions and to find the values of and .

The Table 1 gives the Monte Carlo variances of the four estimators , , and calculated based on the observations generated from standard exponential, standard normal and standard log normal distributions, respectively. We can see that provides the least variance in almost all cases.

In Table 2 we report the coverage probability obtained for the four confidence intervals mentioned above. From Table 2 it is clear that in all three cases, the coverage probabilities of all four confidence intervals converge to the actual target value . Hence it is worth to compare the average length of these intervals. In Table 3 we report the average length of the confidence intervals obtained for the confidence level . When has standard exponential and standard normal distribution JEL based confidence intervals performs better than the other confidence intervals in terms of average length. In log normal case, in most of the cases JEL and AJEL based confidence intervals have smaller length compared to other two confidence intervals.

The empirical type 1 error of the proposed tests are listed in Table 4. We find the type 1 error rate for for when the samples are generated from above listed three distributions. For small sample sizes , AJEL based test has well controlled type 1 error rates for normally distributed data. From Table 4, it is clear that for all the cases, empirical type 1 error reaches the nominal value as the sample size increases.