A Dynamic Analysis of Nash Equilibria in Search Models with Fiat Money††thanks: Correspondence to: maurizio.iacopetta@sciencespo.fr. We are grateful to conference and seminar participants at the 2017 Summer Workshop on Money, Banking, Payments, and Finance at the Bank of Canada, the IV AMMCS International Conference, Waterloo, Canada, Luiss University (Rome), University of Göttingen, and the School of Mathematics, Georgia Tech, for useful comments. All remaining errors are ours.

Abstract

We study the rise in the acceptability fiat money in a Kiyotaki-Wright economy by developing a method that can determine dynamic Nash equilibria for a class of search models with genuine heterogenous agents. We also address open issues regarding the stability properties of pure strategies equilibria and the presence of multiple equilibria. Experiments illustrate the liquidity conditions that favor the transition from partial to full acceptance of fiat money, and the effects of inflationary shocks on production, liquidity, and trade.

Keywords: Acceptability of Money, Perron, Search.

JEL

codes: C61, C62, D83, E41.

1 Introduction

One central question of monetary economics is how an object that does not bring utility per se is accepted as a mean of payment. It is well understood that the emergence of money depends on trust and coordination of believes. While some recognize this observation and simply assume that money is part of the economic system, others have tried to explain the acceptance of money as the result of individuals’ interactions in trade and production activities.111Economic textbooks sometimes alert readers that the acceptance of fiat money cannot be taken for granted. For instance, Mankiw (2006, p. 644-45) observes that in the late 1980s, when the Soviet Union was breaking up, in Moscow some preferred cigarettes to rubles as means of payment. Among the best-known attempts to formalize the emergence of money in decentralized exchanges is Kiyotaki and Wright (1989) (henceforth, KW). The static analysis in KW provides important insights on how specialization in production, the technology of matching, and the cost of holding commodities, condition the emergence of monetary equilibria. Nevertheless, it leaves important issues open. First, one would like to know if and how convergence to a particular long run equilibrium occurs from an arbitrary initial state of the economy. Historical accounts describe different patterns that societies followed in adopting objects as means of payment.222For a classic review of the rise of early means of payments see Quiggin (1949). For the institutional and historical conditions that favored the dissemination of fiat money see Goetzmann (2016). What are the dynamic conditions that lead individuals in a KW economy to accept commodity or fiat money? Second, static analysis gives little guidance about the short run consequences of a shock that causes, for instance, a sudden rise of inflation. How does the degree of acceptability of commodity and fiat money change with inflation?

The determination of dynamic equilibria in a KW environment is challenging. In an effort to improve its tractability, new classes of monetary search models have been proposed. These have incorporated some features of centralized exchanges but have also eliminated others, most notably the genuine heterogeneity across individuals and goods, and the storability of goods (see Lagos et al. (2017), for a recent review). Restoring these features turns out to be a useful exercise for characterizing the rise of money as a dynamic phenomenon.

The study of money acceptance in a KW environment requires a departure from the conventional set of tools employed to characterize the dynamics of an economy with centralized markets. Our method combines Nash’s (1950) definition of equilibrium with Perron’s iterative approach to prove the stable manifold theorem (see, among others, Robinson, 1995). This is the first work, to our knowledge, that shows how to determine pure strategies dynamic Nash equilibria in a KW search environment with fiat money. Previous works on the subject considered economies without fiat money, and often assumed bounded rationality.333See, for instance, the works of Marimon et al. (1990) and Başçı (1999) with intelligent agents, and of Brown (1996) and Duffy and Ochs (1999, 2002) with controlled laboratory experiments. Matsuyama et al. (1993), Wright (1995), Luo (1999) and Sethi (1999) use evolutionary dynamics. Kehoe, Kiyotaki, and Wright (1993) show that under mixed strategies equilibria could generate cycles, sunspots, and other non-Markovian equilibria. Renero (1998), however, proves that it is impossible to find an initial condition from which an equilibrium pattern converges to a mixed strategy steady state equilibrium. Oberfield and Trachter (2012) find that, in a symmetric environment, as the frequency of search increases, cycles and multiplicity in mixed strategy tend to disappear. More recently, Iacopetta (2018) studies dynamic Nash equilibria in a KW environment with no fiat money.

Steady state results echo those of inventory-theoretic models of money (e.g., Baumol 1952, Tobin 1956, and Jovanovic 1982): for instance, higher levels of seignorage may induce some to keep commodities in the inventory instead of accepting money, as a way to minimize the odds of being hit by a seignorage tax. The dynamic analysis, however, generates novel results: it shows how changes in the liquidity of assets other than money can alter the proportion of individuals who accept fiat money in transactions. For instance, it reveals that an economy that converges to a long run equilibrium in which all prefer fiat money to all types of commodities (full acceptance), may go through a phase in which only a fraction of individuals do so (partial acceptance).444Shevchenko and Wright (2004) also study partial acceptability in pure strategies. They focus, however, on steady state analysis.

The remainder of the paper is organized as follows. Section 2 describes the economic environment, characterizes the evolution of the distribution of inventories and money, and defines a Nash equilibrium. Section 3 overviews steady state Nash equilibria for some specifications of the model. Section 4 presents a methodology to determine Nash equilibria. Section 5 illustrates the acceptability of money and discusses multiple steady states through numerical experiments. Section 6 contains welfare considerations. Section 7 has few remarks about future research. Appendix A contains proofs and mathematical details omitted in the main text. Appendix B explains how the stable manifold theorem is related to our solution algorithm.

2 The Model

This section describes the economic environment, characterizes the evolution of the distribution of inventories and money, and defines a Nash equilibrium.

2.1 The Environment

The model economy is a generalization of that described in KW. There are four main differences. First, to facilitate the analysis of the dynamics, time is continuous. Second, the model is extended to deal with seignorage, following the approach devised by Li (1994, 1995): government agents randomly confiscate money holders of their balances and use the proceedings to purchase commodities. Third, as in Wright (1995) agents are not necessarily equally divided among the three types. Fourth, as in Lagos et al. (2017), we obtain the type of equilibria that emerge in the Model B of KW by reshuffling the ordering of the storage costs across the three types of goods rather than altering the patterns of specialization in production.

The economy is populated by three types of infinitely lived agents; there are individuals of type , with , where is a very large number. The total size of the population is and the fraction of each type is denoted with . A type agent consumes only good and can produce only good (modulo 3). Production occurs immediately after consumption. Agent ’s instantaneous utility from consuming a unit of good and the disutility of producing good are denoted by and , respectively, with , and their difference with . The storage cost of good is , measured in units of utility.555There is no restriction on the sign of . A negative storage cost is equivalent to a positive return. In addition to the three types of commodity there is a fourth object, called money and denoted by , that does not bring utility per se: it only serves as a means of transaction. Fiat money is indivisible. Denoting with the fraction of the population holding fiat money, the total quantity of fiat money is . There is no cost for storing money. At each instant in time, an individual can hold one and only one unit of any type good or one unit of money.666The assumption that an individual can have either 0 or 1 unit of an asset greatly simplifies the analysis and makes more transparent the decision about the acceptance of money. There is a significant amount of work with asset-holding restrictions. See, among others, Diamond (1982), Rubinstein and Wolinsky (1987), Cavalcanti and Wallace (1999), and Duffie et al. (2005).

The discount rate is denoted by . A pair of agents is randomly and uniformly chosen from the population to meet for a possible trade. The matching process is governed by a Poisson process with exogenous arrival rate , where – i.e. there is a constant returns to scale matching technology. Hence, after a pair is formed, the expected waiting time for the next pair to be formed is . A bilateral trade occurs if, and only if, it is mutually agreeable. Agent always accepts good but never holds it because, provided that is sufficiently large, there is immediate consumption (see KW, Lemma 1, p. 933). Therefore, agent enters the market with either one unit of good , or , or with one unit of .

We introduce seignorage as Li (1994, 1995): The government extracts seignorage revenue from money holders in the form of a money tax – this device has been used by many others, including in the recent work of Deviatov and Wallace (2014). In particular, government agents meet and confiscate money from money holders. The arrival rate of a government agent for a money holder is . A money holder of type , whose unit of money is confiscated, returns to the state of production without consumption, produces a new commodity , and incurs a disutility . With the proceedings of the tax revenue the government purchases goods from commodity holders. These encounters are governed by a Poisson process with arrival rate . The government runs, on average, a balanced budget. This requires that implying that . We allow the government to alter the rate of seignorage , but, in order to simplify the dynamic analysis, the government does not change the real balances in circulation – i.e. the initial level of fiat money is given and does not change over time. We will compare, however, steady state equilibria of economies with different levels of .

2.2 Distribution of Commodities and Fiat Money

Let denote the proportion of type agents that hold good at time . A type with good has to decide during a meeting whether to trade for , where , , or (henceforth we no longer mention the ranges of the indices and , unless needed to prevent confusion). Agent ’s decision in favor of trading for is denoted by , and that against it by . The evolution of , for a given set of strategies, , is governed by a system of differential equations777We assume that the influence of any particular individual on the system is negligible. Eqs. (1)-(3) should be interpreted as the limit of the stochastic evolution of the inventories of an economy with a finite number of agents. See Araujo (2004) and Araujo et al. (2012) for a discussion of the system’s properties of similar economies with a finite number of agents. (the time index is dropped):

| (1) | ||||

| (2) | ||||

| (3) |

Focusing on the top equation (), the first two sums inside the brackets, starting from the left, account for events that lead to an increase in the share of individuals with . Specifically, the term is the probability that a type with good meets a type with good , and calculates their willingness to swap goods: if they both agree to trade, ; if one of the two does not, . The term considers the residual case in which type with good meets a type with good . Because type always accepts good , trade take places as long as . The third sum accounts for events that cause a decline in . Finally, the last two terms, and , measure the overall amount of fiat money the government confiscates from money holders () and the amount of goods it buys from type agents – and are the government’s Poisson rates of intervention, respectively.

The extended form of eqs. (1)-(3) consists of nine non-autonomous non-linear differential equations in the nine unknowns , for and , , (they are non-autonomous equations because depends on ). Nevertheless, because ,

| (4) |

Another restriction comes from the following accounting relationship:

| (5) |

Therefore, in (1)-(3) there are only five independent equations, and the state of the economy can be represented by the five-dimensional vector .

Let be the set of that satisfies (4) and (5). For any sets of strategies , the solution of (1)–(3) maps into itself. Because is compact and convex, the system (1)–(3) admits at least one fixed point for any constant sets of strategies . Proposition 3 shows that in the simple scenario with no fiat money (), the fixed point is unique and globally attractive. Section 5 studies the uniqueness and global attractiveness of the fixed point numerically for an economy with fiat money.

2.3 Value Functions

The system of equations (1)-(3) specifies the evolution of the economy for a given set of strategies . We turn now to the individuals’ decisions about trading strategies. Denote with the strategies of a particular agent of type , , who takes for given the strategies of the rest of the population, , including agents of her own type, and who knows the initial state . Let be the integrated expected discounted flow of utility from time onward of this particular agent with good at time . Then,

| (6) |

where is the probability that , who carries good at time and plays strategy , holds good at time , and is ’s flow of utility, net of storage costs, associated to the distribution of holdings . Observe that and both depend on what other individuals do, that is they are affected by , – where , and . Because and is bounded, the integral in (6) is well defined, for any and any . Appendix A contains the expression of and the evolution of . It also shows the following result about the evolution of .

Proposition 1

| (9) |

when .

Proof. See Appendix A.

The first sum in (8), counting from the left, is the expected flow of utility of agent with good conditional on meeting an agent who carries a good . Such a meeting occurs with probability , and trade follows if . In such a case, leaves the meeting with good (i.e. with continuation value ). Similarly, the second sum accounts for ’s expected flow of utility, conditional on meeting an agent who carries good . The last sum refers to meetings in which no trade occurs, in which case is left with good . The term is the expected continuation value for meeting government agents who buy ’s good using fiat money, and is the cost of storage. Because the term appears in (8) for both and , the level of the seignorage does not directly affect the optimal response – it may do so only indirectly through .

2.4 Best Response and Nash Equilibrium

Agent ’s best response to the set of strategies of the other agents, , is a set of strategy that maximizes her expected flow of utility in (6):

| (10) |

A useful characterization of the best response function is the following:

Proposition 2

Let . The strategy is a best response of to , for a given , if and only if

| (11) |

Proof. See Appendix A.

When is indifferent between trading for with , the tie-breaking rule is that .888There is only in a finite set of isolated times , when can change sign. Therefore is discontinuous at . The value of at such points of discontinuity is not relevant. Shevchenko and Wright (2004) make a similar observation. Clearly, (11) implies that . We also set , that is, never trades for . Therefore, the set of strategy of agent can be represented by , a piecewise continuous function from into . Although agent has eight possible trading choices at each point in time, a simple transitivity trading rule (for instance, if and , then it must also be that ) reduces her choices to the six contained in – this applies to any type . We call the best responses of the three particular agents . Similarly, denotes agents’ symmetric strategies, with . Next, following Nash (1950), we define an equilibrium by means of a function that associates the best response to a set of strategies . The function transforms a piecewise continuous function into another piecewise continuous function .

Definition 1 (Nash Equilibrium)

Given an initial distribution , a set of strategies is a Nash equilibrium if it is a fixed point of the map :

| (12) |

This definition equilibrium requires, therefore, that , the best response to the set of strategies , be equal to .

A general proof of the existence of such an equilibrium, for any given , cannot be obtained with the standard fixed-point argument based on Kakutani or Brouwer theorems applied to finite games. These theorems would require the best response function to be a continuous map on a convex and compact set. Compactness, however, cannot be verified in our infinite time horizon set up. Nevertheless, Proposition 4 in Section (4) states that sometimes the existence of Nash equilibria can be established analytically near Nash steady states. Section 4 constructs Nash equilibria numerically, even when their existence cannot be established analytically.

3 Overview of Steady States

We begin by considering an economy with no fiat money () and . Since the first two rows of refer to the acceptance of fiat money – recall that the rows of are associated to objects and the columns to types – we focus in what follows on the entries of its third row, , shows how agents order good and good . For instance, when , type 2 trade for (i.e. 3 for 1), whereas types 1 and 3 do not. In addition, because , it is convenient to shorten into , , .

Assume (model A of KW). There are eight possible combinations of (pure) strategies. Two of them are Nash equilibria:

| (13) |

if

| (14) |

and

| (15) |

if

| (16) |

where the in (14) and (16) are evaluated in the respective steady states. These are usually referred as the fundamental and speculative steady states, respectively.

Rearranging the ranking of the storage cost as one obtains steady states similar to those in Model B of KW. The equilibrium

always exists. The equilibrium

exists if

| (17) |

and

| (18) |

are satisfied, where , , and are evaluated on the steady state. Other equilibria emerge under other rearrangements of the storage costs. Next proposition states which steady state equilibria are globally stable.

Proposition 3

With the possible exception of , under any other constant set of strategies , converges to a stationary distribution, , from any .

Proof. See Appendix A.

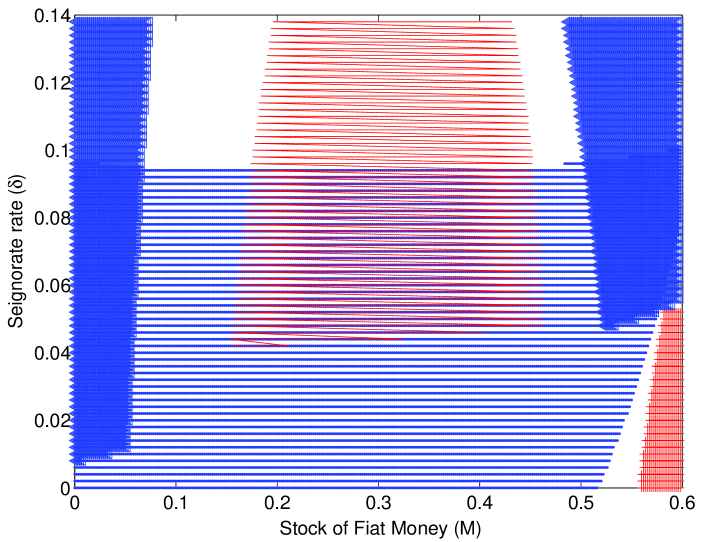

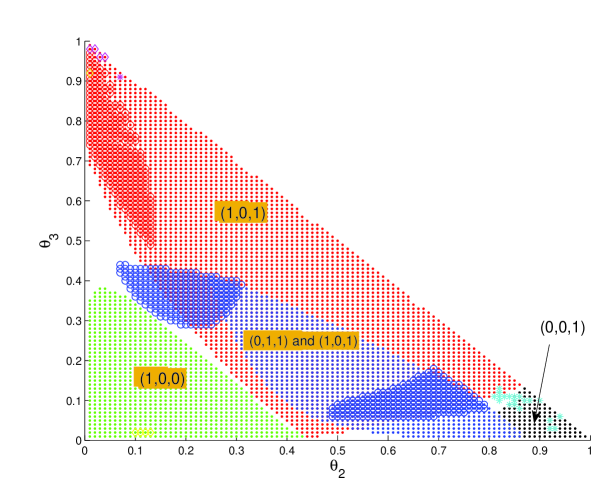

Consider now the full-fledged model with . Adding fiat money into the model greatly increases the number of steady states that could qualify to be Nash equilibria. Considering that each type has six possible choices, there are steady states to be verified. Fig. 1 illustrates how variations of and affect the emergence of a particular equilibrium for a Model A economy (). It considers equilibria with or – the same two type of equilibria reviewed above for the economy without fiat money. In reviewing the monetary equilibria, it is useful to keep in mind that money is accepted for liquidity reasons and to save on storage costs. Money holders, however, incur a seignorage tax. When this becomes sufficiently large, some may prefer to face longer waiting times in getting the preferred consumption good (lower liquidity), and to pay a higher storage cost, rather than holding fiat money. Since liquidity depends both on the distribution of commodities and on the magnitude of storage costs, it is conceivable that some do not accept money even when others do so.

Fig. 1 shows that an full monetary equilibrium – i.e. with – emerges for a relatively low stock of fiat money and for low rates of seignorage. As seignorage gains in importance, however, fiat money becomes less desirable, to the point that a type 2 is no longer willing to sell good against fiat money – that is, switches from to , so that the set of strategies becomes .

At higher levels of fiat money, good 3 loses its role of commodity money, even at low seignorage rates, because a type 1’s odds of meeting type 3 holding good 1 shrink. Therefore, a type 1 no longer finds it convenient to pay the high storage cost of good 3. Hence, the Nash equilibrium is characterized by . At intermediate ranges of the rate of seignorage, can be either or or both, that is, and – a case of multiple equilibria due to inflation.

4 Finding Nash Equilibria

This section studies the conditions for obtaining a Nash equilibrium that converges to a steady state one, starting from an arbitrary initial distribution . It begins with a proposition that deals with convergence in a neighborhood of a Nash steady state equilibrium.

Proposition 4

Proof. See Appendix A

Clearly, when the initial condition is outside of a small neighborhood of the Nash steady state, , the Nash set of strategies may be different than . In such a case, to evaluate whether an is a Nash solution, one needs to verify whether any agent has an incentive to deviate from such an . In terms of (10), one needs to check if there is any gap between and . The best response can be computed on the basis of the value value functions defined in (10). Eq. (7) specifies the time variation of . Unfortunately the initial value is unknown. What is known, however, is the value of on the Nash steady state . This information can be used to integrate (7) backward in time, starting from a neighborhood of the Nash steady state. We then proceed as follows.

First, we integrate the system (1)-(3) starting from the initial condition under the set of strategies , an operation that yields , for , where must be sufficiently large so that . Let be a that satisfies this constraint.

Second, we set , where , and use (7) to compute for . Said it differently, we use as final condition and integrate (7) backward in time. The resulting , however, is not yet necessarily the true value function because is finite.

Additional details must still be verified to arrive to the true value function. Let be the unique solution of (7), for a given , with under the condition that for , , i.e. . The below proposition states that it is reasonable to pick a as initial condition to integrate the system (7) backward in time.

Proposition 5

Consider a pattern that converges to a steady state Nash equilibrium . Let be the value function evaluated at the Nash steady state , and let be the unique solution of (7) with . For every

Proof. See Appendix A.

The fact that implies that . Proposition 5 states that choosing as a boundary value, (7) yields a good approximation for . The response derived from is then an approximation of the best response . In particular, is a piecewise constant function with a finite number of switching times , , where one of the changes from 0 to 1 or from 1 to 0. As approaches zero, converges to in the sense that , where , for , is the finite set of witching times of . In short, we have

| (19) |

We deal with the problem of finding a fixed point for the map (see (12)) by designing a simple iterative scheme. It is convenient to define ,,. The iteration starts with a guess and then determines the best response to , where and the associated pattern . If , the iteration stops and () is the Nash equilibrium. Otherwise, the iteration continues: It sets a new guess and calculates a new path (). In general, the iteration generates a sequence . If the sequence converges to a then the couple () is a Nash equilibrium.

More specifically, to find a Nash equilibrium that starts from and converges to a Nash steady state () we:

-

1.

Determine the Nash steady state ();

-

2.

Chose an initial guess for (for instance, );

- 3.

- 4.

-

5.

Set as the new guess for and compute a new pattern and a new best response ;

-

6.

Repeat steps 3 through 5 to generate a sequence (, );

-

7.

Stop the procedure when the difference between and is smaller than a predetermined error .101010We define the distance between and as the , where is the switching time in and that in . The () obtained by taking is a Nash equilibrium.

Two observations are in order. First, there are no issues of instability when computing and : The system (1)-(3) is stable when integrated forward in time and so is (7) if integrated backward in time. The iteration does not need to converge but if it does, it necessarily converges to a fixed point of . In case of non-convergence, more refined iterative schemes or a Newton-Raphson method could be employed. Nevertheless, in all our numerical experiments (Section 5) this simple iterative algorithm delivered a fixed point.

Second, the design of the algorithm presents similarities with the stable manifold theorem for ordinary differential equations (see Appendix B for a formal discussion). It differs, however, from the standard approaches employed to study transitional dynamics of macroeconomic and growth models. Indeed, it is common to compute an equilibrium pattern by integrating a system of differential equations that describe the equilibrium conditions of the economy backward in time, starting from a neighborhood of the steady state (see Brunner and Strulik, 2002). This approach usually works well when the dimension of the system is small. At high dimensions it is sometimes possible to approximate the manifold in a neighborhood of the steady state by means of projection methods (see McGrattan, 1999, and Mulligan and Sala-i-Martin, 1993). Nevertheless, when the dimension of the system is large, constructing the manifold in regions away from the steady state is generally very problematic – a serious limitation when the choice of an initial condition away from the steady state is an important aspect of the exercise.

5 Numerical Experiments

This section proposes a few applications of the dynamic analysis. First, it illustrates the transition from partial to full acceptance of fiat money. Second, it studies the effects of changes in the rate of seignorage. It then discusses issues of multiple equilibria related to seignorage and to the distribution of the population across the three types. Finally, it briefly reviews equilibria in Model B.

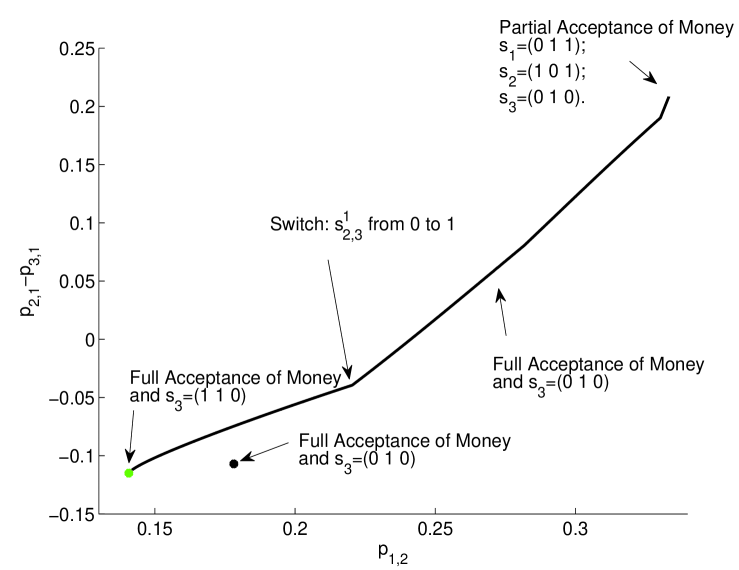

5.1 Partial and Full Acceptance of Fiat Money

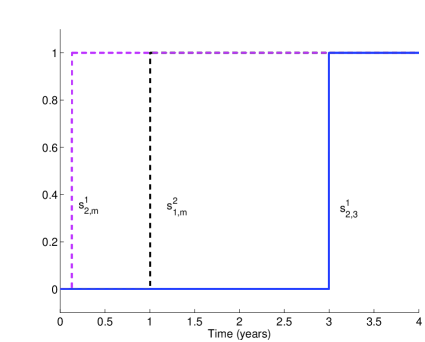

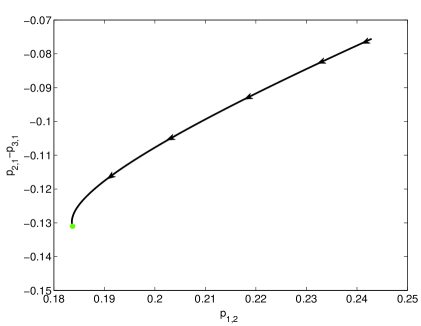

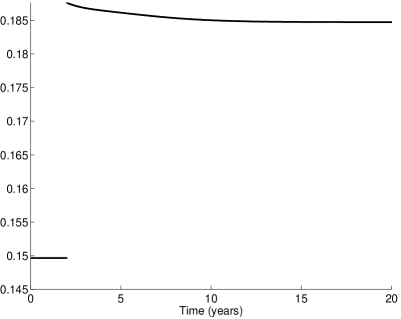

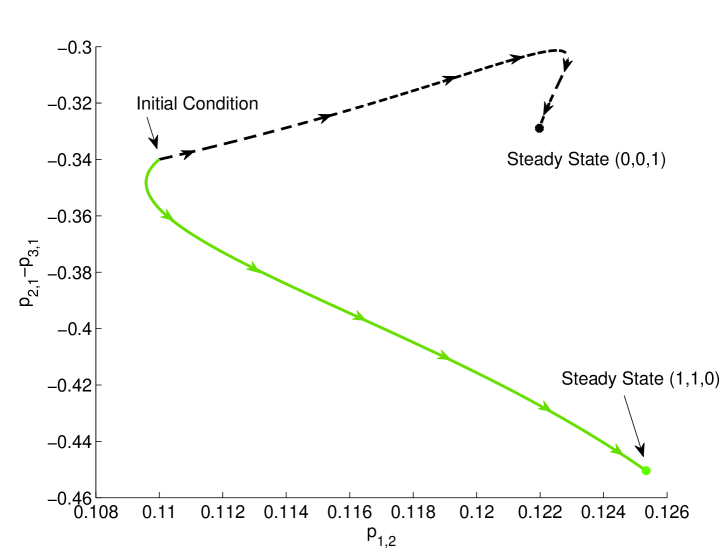

Because the conditions for the full acceptance of money in a steady state are different than those in other regions of the inventory space, an economy may go, while converging to a full monetary equilibrium, through a phase in which some do not accept fiat money. For one, along the transition the degree of acceptability of a low-storage commodity may simply decline, and thus favors the acceptability of fiat money. In addition, the cost of seignorage, given by , may also decline along the transition – the production cost, , is constant over time but the difference is not. It could be, for instance, that along the transition the liquidity of commodity drops, implying a reduction of the cost of seignorage. Panel A of fig. 2 illustrates such a scenario in the phase diagram. Initially, , that is, type 1 prefers good 2 to fiat money, and type 2 prefers good 1 to fiat money. The economy eventually converges to a full monetary equilibrium . Observe that along the transition also good 3 acquires the role of commodity money, as type 1 agents switch from fundamental to speculative strategies. Higher rates of seignorage delay the emergence of money (see Panels B and C of fig. 2).

5.2 A Monetary Reform

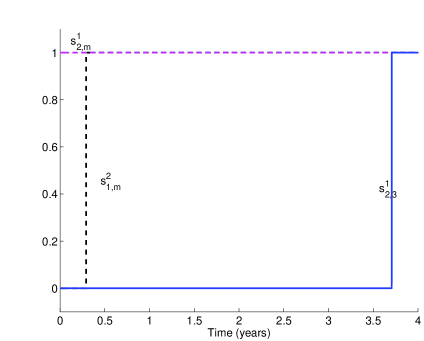

It is a long-standing tenet of economics that inflation may create inefficiencies because it distorts the choices of individuals. To understand how people’s behavior is affected by seignorage, consider an economy currently on full monetary steady state equilibrium with . Through a reduction of the seignorage rate, the government may pull the economy out this equilibrium and send it to an full monetary equilibrium. In the latter equilibrium agents on average trade more frequently and produce at a faster rate than in the former one. A percentage points reduction of , from the initial state and , would be sufficient to accomplish the task (see fig. 1). The dynamic consequences of the shock are depicted in the phase diagram of fig. 3. Because the drop in the seignorage rate increases the value of fiat money relative to that of all other commodities, type 2 agents are induced sell good 1 against fiat money. In addition, because the gap declines along the adjustment to the new equilibrium, type 1 agents, in anticipation of such liquidity change, immediately switch from fundamental to speculative strategies ( turns from to ). As a result, production booms right after the shock and then stabilizes at a higher level relative to that of the initial equilibrium (see fig. 3b).

5.3 Inflation and Beliefs

It is often argued that the effects of inflation on production depends on the coordination of beliefs. This conjecture, in our framework, emerges in fig. 1 that reviews the type of equilibria associated with different combinations of and . The figure shows that in some regions of the space, two steady state equilibria exist. For instance, when , and is between 5 and 9 percent, the full monetary equilibrium coexists with the equilibrium .

This means that if initially the economy is at a (unique) steady state equilibrium , with and , a reduction of the seignorage rate, from 10 to, for example, 6 percent, may or may not induce type 1 agents to switch from fundamental to speculative strategies ( may or may not change from to ). Agents may keep their actions coordinated on the current equilibrium, in which case the policy intervention generates only marginal changes in the economy. Conversely, they may coordinate their actions on the equilibrium – in which case the adjustment process would be very similar to that depicted in fig. 3.

In brief, a modest reduction of the seignorage rate associated with a dose of optimism can be effective in stirring up production. But if agents are unresponsive to relatively modest changes into the seignorage rate, the government would need to implement a more radical monetary reform, and be prepared to give up a larger share of its current seignorage revenue – in our example, below there is a unique equilibrium with .

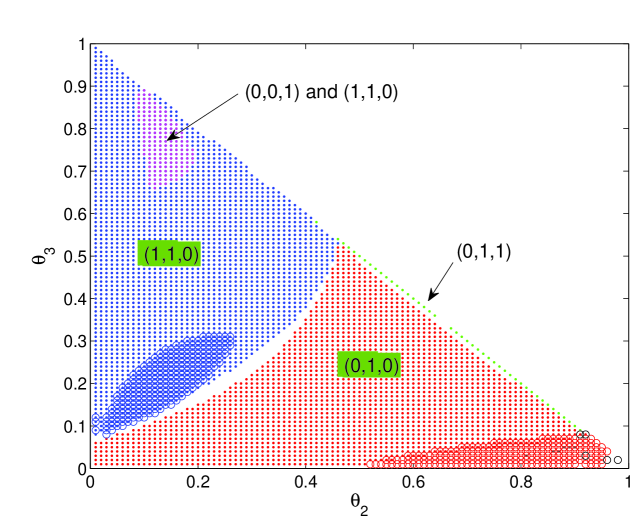

5.4 Uneven Distribution of Types and Multiple Equilibria

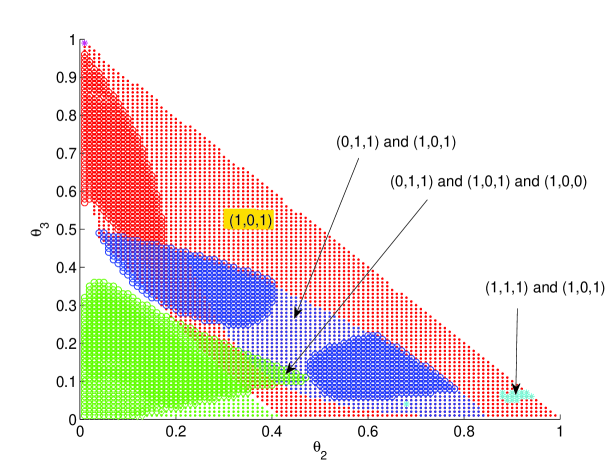

The distribution of the population across types affects the emergence of a particular equilibrium. Wright (1995) established the existence of multiple equilibria in a Model A economy without fiat money. In particular, when the share of type 3 agents is relatively high, the speculative equilibrium coexists with one in which all three agents flip their strategies, that is a equilibrium. Seignorage promotes the emergence of additional equilibria. Fig. 4a shows how the values of conditions the emergence of a particular equilibrium, for a given stock of real balances and of the seignorage rate. In the symmetric distribution , under the current specification (, ; see also table 1), a unique full monetary (1,1,0) equilibrium exists. When the share of type 3 agents is slashed by half, that is, , , and , the equilibrium is characterized by (1,1,0) and still full acceptance of money. Conversely, a reduction of the share type 2 agents means that the original full monetary equilibrium is coupled with . A unique equilibrium with partial acceptability of fiat money is observed when is high and is low – a situation in which type 2 easily trades 1 for 2.

As higher seignorage rates, regions supported by a partial acceptability expand. For instance, a comparison of fig. 4a and fig. 4b reveals that when seignorage rate goes from to per cent, the full monetary fundamental equilibrium disappears, and the overlapping between the equilibria and is more commonly observed.

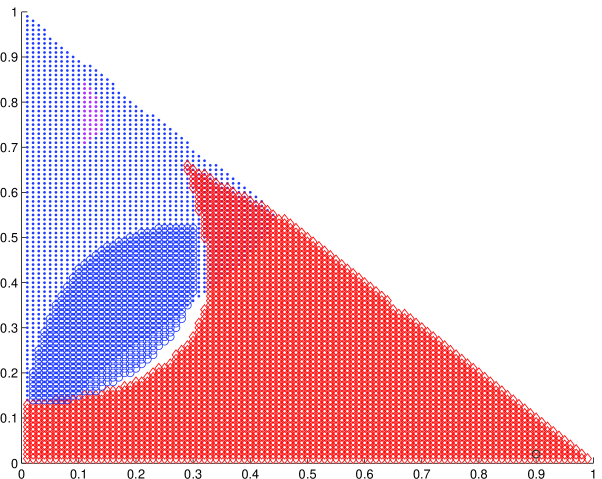

Multiple Equilibria. The presence of multiple monetary steady states does not necessarily imply the existence of multiple Nash equilibria. In principle, it could be that once the initial condition is specified, the pattern converges to one and only one steady state. Fig. 5 clarifies, however, that in our environment there is multiplicity: Two economies with the same set of parameters and the same initial condition coordinate on different steady state equilibria.

5.5 Uneven Distribution of Types and Dynamics in Model B

This section briefly discusses the acceptability of fiat money in a Model B economy, for different values of . The effects of a rise in the seignorage rate can be learned by comparing the equilibria in fig. 6b where and those in fig. 6a where . In the low-inflation economy larger regions of full monetary equilibria overlaps with similar equilibria in which In the space just below the 45-degree line, there are only full monetary fundamental equilibria because the scarcity of type 1 agents reduces the liquidity value of good 3 – there are too few middle-men that bring good 3 from type 2 to type 3 agents. Indeed, good 3 is dominated by fiat money even with a seignorage rate three times larger than . For a more balanced distribution of the population, however, at a sufficiently high seignorage rates, equilibria with partial acceptability of money () become unique.

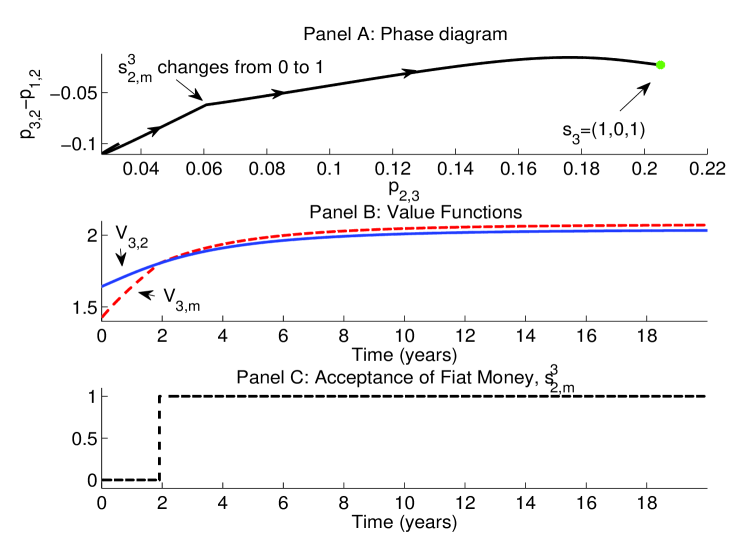

As with model A, the liquidity conditions and the cost of seignorage change along the dynamics, implying that for a given specification of the economy, the fraction of the population that accepts money changes along the transition to the Nash steady state equilibrium. Fig. 7 shows a particular scenario in which as the economy converges to the full monetary steady state equilibrium, type 3 agents switch their strategies with respect to fiat money when holding good 2. Along the transition both good 2 and fiat money become more valuable (see middle plot of fig. 7), as their liquidity improves, but the value of fiat money increases more rapidly and eventually catches up with the value good 2.

6 Welfare

One standard question of monetary economics is whether the acceptance of fiat money improves the allocation of resources and stimulates production. The presence of matching frictions and the assumption that agents incur a cost in holding commodities gives fiat money a potential positive role. Nevertheless, it also comes with costs at the individual’s and society’s level. At the individual level, it looms the risk of confiscation. At the society level, fiat money reduces the availability of commodities – money chases away consumption goods. To explores the welfare implications of introducing fiat money and of altering seignorage rates, we use, as KW, a utilitarian welfare criterion – given the highly symmetric type of environment it is unlikely to observe a Pareto improvement from any given state. The payoff of a type agent is calculated as a weighted average of :

Therefore, the welfare of the whole society is simply the average of the three groups’ payoffs:

As mentioned in the introduction the government derives utility from consuming goods. These are purchased through the seignorage tax . One may argue that the government cares also about the welfare of the population. This could reflect a genuine interest in the society’s well-being, or more simply the desire of maintaining the population’s electoral support. The government welfare function is then

where

and where weighs the society’s welfare in the government’s objective function. For the sake of the illustration, we consider an altruistic government () that wants to know how the level of or the rate of seignorage affects the population.

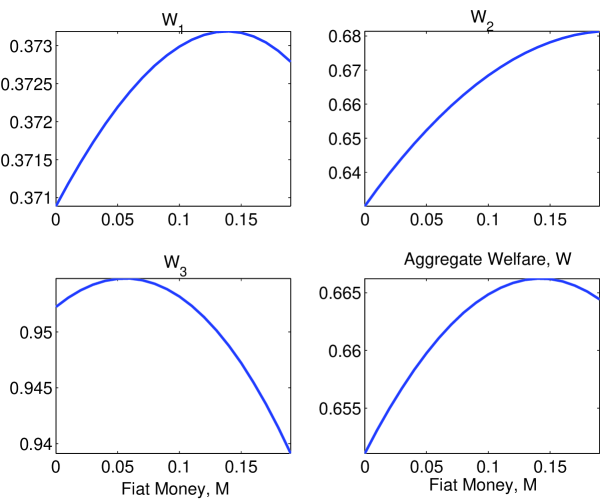

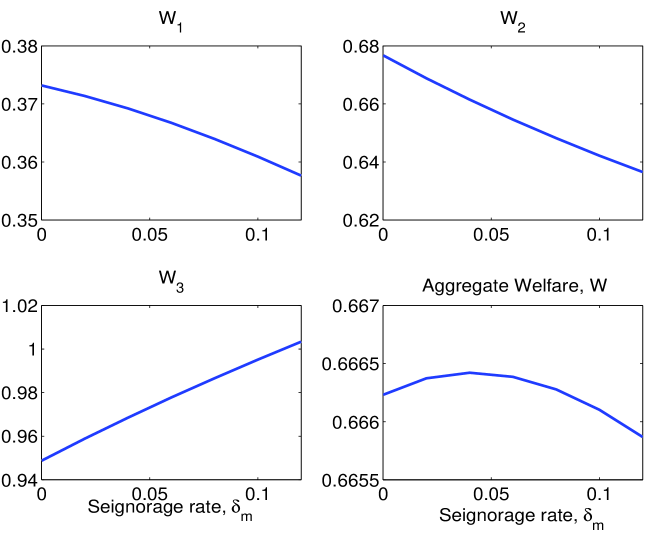

Real Balances. Fig. 8a shows the welfare levels on steady state for different levels of fiat money and zero seignorage. When the stock of fiat money is relatively large, any further increase tends to make people, on average, worse-off because the chase-away-good effect largely dominates. Observe that a change in can induce and to move in different directions, indicating a conflict of interest in the society about the desirable level of real balances. Type 3 individuals, for instance, prefer a lower level of fiat money than the other two groups. As they carry the low storage cost good, relative to the other two groups, they are more preoccupied by the displacement of commodities caused by a further increase in fiat money than pleased by the savings in storage costs.

Seigniorage. When the government confiscates fiat money, it clearly reduces the welfare of the targeted individuals by . But it also alters the odds that an individual is able to exchange his commodity against money. While a private agent in a match may refuse to buy, when a government agent carrying money meets a private agent, there is always an exchange. Hence, seignorage can act as a stimulus to production. But with seignorage comes also some income redistribution. First, as noted earlier, the cost of seignorage differs across types: Because a type 3 who relinquishes fiat money produces the good with the lowest storage cost, his burden of seignorage is lighter than that of the other two types. Second, because real balances are in general not held in equal proportions across the three groups, the probability of being hit by seignorage differs across types. Similarly, the probability that the government purchases a commodity depends also on how commodities are distributed across types. Fig. 8b, for instance, shows that over a certain range of seignorage, an increase in seignorage causes a decline in and and an increase in . Interestingly, the figure also says that an increase in seignorage can boost everybody’s welfare when starting from low levels of seignorage.

7 Further Research

The set up of the problem (Section 2) and the procedure to find Nash equilibria (Section 4) are valid for a more general search model with goods, and types of agents, as, for instance, in Aiyagari and Wallace (1991, 1992) (see Appendix A). The analysis could also be adapted to allow for multiple holdings, as in Molico (2006), Lagos and Rocheteau (2008), and Chiu and Molico (2010), and to study the dynamics of indivisible-asset models in which heterogeneity is an essential ingredient, such as studies of the middlemen by Rubinstein and Wolinsky (1987), international currency by Matsuyama et al. (1993), banking by Cavalcanti and Wallace (1999), and over-the-counter financial markets by Duffie et al. (2005).

References

Aiyagari, S. and N. Wallace (1991) Existence of steady states with positive consumption in the Kiyotaki-Wright model. Review of Economic Studies, 58, 901-16.

Aiyagari, S. and N. Wallace (1992) Fiat money in the Kiyotaki-Wright model. Economic Theory 2, 447-64.

Araujo, L. (2004) Social norms and money. Journal of Monetary Economics, 51, 241-256.

Araujo, L., Camargo B., Minetti R, and Puzzello D. (2012) The essentiality of money in environment with centralized trade. Journal of Monetary Economics, 59, 612-621.

Başçi, E. (1999) Learning by imitation. Journal of Economic Dynamics and Control, 23(9-10), 1569-1585.

Baumol, W. (1952) The transactions demand for cash: An inventory theoretic approach. The Quarterly Journal of Economics, 66(4), 545-556.

Brown, P. M. (1996) Experimental evidence on money as a medium of exchange. Journal of Economic Dynamics and Control, 20(4), 583-600.

Brunner, M. and H. Strulik (2002) Solution of perfect foresight saddlepoint problems: A simple method and applications. Journal of Economic Dynamics and Control, 26(5), 737-53.

Cavalcanti, R. O. and N. Wallace (1999) Inside and outside money as alternative media of exchange. Journal of Money, Credit and Banking, 31 (3), 443-457.

Chiu, J. and M. Molico (2010) Liquidity, redistribution, and the welfare cost of inflation. Journal of Monetary Economics, 57(4), 428-38.

Deviatov, A. and Wallace, N. (2014) Optimal inflation in a model of inside money. Review of Economic Dynamics, 17, 287–293.

Diamond, P. (1982) Aggregate demand management in search equilibrium. Journal of Political Economy, 90, 881-94.

Duffie, D., N. Gârleanu and L. Pederson (2005) Over-the-counter markets. Econometrica 73, 1815-1847.

Duffy, J., and Jack Ochs (1999) Emergence of money as a medium of exchange: An experimental study. American Economic Review, 89 (4), 847-877.

Duffy, J., and Jack Ochs (2002) Intrinsically worthless objects as media of exchange: Experimental evidence. International Economic Review, 43 (3), 637-674.

Goetzmann, W. N. (2016) Money changes everything: How finance made civilization possible. Princeton University Press.

Kehoe, M. J., N. Kiyotaki, and R. Wright (1993) More on money as a medium of exchange. Economic Theory 3, 297-314.

Kiyotaki, N., and R. Wright (1989) On money as a medium of exchange. Journal of Political Economy 97, 927–954.

Iacopetta, M. (2018) The emergence of money: A dynamic analysis. Macroeconomic Dynamics, forthcoming.

Jovanovic, B. (1982). Inflation and welfare in the steady state. Journal of Political Economy, 90, 561-77.

Lagos, R. and G. Rocheteau, (2009), Liquidity in markets with search frictions. Econometrica, 77(2), 403-26.

Lagos, R., G. Rocheteau, and R. Wright (2017) Liquidity: A new monetarist perspective. Journal of Economic Literature 55, 371-440.

Li, V., (1994) Inventory accumulation in a search-based monetary economy. Journal of Monetary Economics, 34, 511-36.

Li, V., (1995) The optimal taxation of fiat money in search equilibrium. International Economic Review, 36(4), 927-942.

Luo, G. (1999) The evolution of money as a medium of exchange. Journal of Economic Dynamics and Control, 23, 415-58.

Mankiw, N. G., (2006) Principles of Economics, 4th ed., Cengage Learning.

Marimon, R., E. McGrattan, and T. Sargent (1990) Money as a medium of exchange in an economy with artificially intelligent agents. Journal of Economic Dynamics and Control, 14, 329-73.

Matsuyama, K., N., Kiyotaki, and A. Matsui (1993) Toward a theory of international currency. Review of Economic Studies, 60(2), 283-307.

McGrattan, E.R., (1999) Application of weighted residual methods to dynamic economic models. In: Marimon, R., Scott, A. (Eds.), Computational Methods For The Study Of Dynamic Economies. Oxford University Press, Oxford, 114-142.

Molico, M. (2006) The distribution of money and prices in search equilibrium. International Economic Review, 47(3), 701-22.

Mulligan, C. B. and X. Sala-i-Martin (1993) Transitional dynamics in two-sector models of endogenous growth, The Quarterly Journal of Economics, 108(3), 739–773.

Nash, J. (1950) Equilibrium points in -person games. Proceedings of the National Academy of Sciences 36(1): 48-49.

Oberfield, E. and T. Trachter (2012) Commodity money with frequent search. Journal of Economic Theory, 147, 2332-56.

Quiggin, A. H. (1949) A survey of primitive money: the beginning of currency. Barnes and Noble, New York.

Renero, J.M. (1998) Unstable and stable steady-states in the Kiyotaki-Wright model. Economic Theory 11, 275-294.

Robinson, C., R., (1995) Dynamical systems, stability, symbolic dynamics, and chaos. Studies in Advanced Mathematics, CRC Press, Boca Raton.

Rubinstein, A. and A. Wolinsky (1987) Middlemen. Quarterly Journal of Economics, 102, 581-94.

Shevchenko, A. and R. Wright (2004) A simple search model of money with heterogeneous agents and partial acceptability. Economic Theory, 24(4), 877-885.

Sethi, R. (1999) Evolutionary stability and media of exchange. Journal of Economic Behavior and Organization, 40, 233-54.

Tobin, J (1956) The interest elasticity of transactions demand for cash. The Review of Economics and Statistics, 38(3), 241–47.

Wright, R. (1995) Search, evolution, and money. Journal of Economic Dynamics and Control, 19, 181-206.

Appendix A Proofs and derivations

This Appendix contains the proofs of Propositions 1 to 5. From the proofs of Propositions 1, 2, 4, and 5 it will emerge that their statements apply to a more general setting with objects and types of agents. Specifically, the size of the matrix , defined in (25) in this Appendix, can be augmented to consider more objects, and the index , associated with types of individuals, can run up to an .

Proof of Proposition 1. Differentiation of (6) with respect to yields

| (20) |

where

| (21) |

(when , stands for ) is the expected utility from consumption, net of storage cost, for an agent of type with good , and where . To derive , first observe that expressions similar to (1)-(3) imply that

| (22) | ||||

| (23) | ||||

| (24) |

with initial condition if , and 0 otherwise. For each , we consider the matrix defined as:

| (25) | ||||

The expressions in (22)-(24) then simplify to

Observe that the matrix satisfies for and

| (26) |

for every . These properties are used in proving Proposition 2 and Lemma 2 (see below).

Calling the matrix with entries , the above equation can be written as

| (27) |

where is the transpose of . What is needed to compute the evolution of , however, is the derivative of with respect to rather than with respect to . Note, however, that from (27) it follows that

Consequently,

that in extended form becomes

| (28) |

By inserting (28) in 20 we obtain

| (29) |

where . Using the definition of the matrix in (25) and of in (21) we get, for or ,

Rearranging terms we get:

This is the expression in (7) when or . Similarly, when

This is expression in (7) for .

Proof of Proposition 2. Let

| (30) |

be the solution of the initial value problem

where is the matrix defined in (25). Consider now a variation of of the form

where for and is a parameter. Differentiating (29) with respect to delivers

Using the property that if , the Duhamel principle gives

From (25) it follows that

Therefore,

where

Equations (25) and (26) imply that and . Moreover, because and , it follows that and that for .

Clearly, if , the contribution of to the variation is different than zero and there is no critical value for . We can then conclude reaches a maximum at a boundary, i.e. , and that

| (31) |

Finally, as already observed in footnote 8 after Proposition 2, since for a finite set of switching times, the value of on such a set does not affect . Similar observations hold for with . This concludes the proof of (11).

Proof of Proposition 3. When the system (1)-(3) reduces to

| (32) | ||||

| (33) | ||||

| (34) |

For a given profile of strategies, we need to check that the system (32)-(34) has a unique globally attractive steady state.

Case (0,1,0). Eq. (34) reduces to , implying that the plane is globally attractive. On this plane (32) reduces to , implying that the line , is globally attractive. On this lines (33) becomes

which clearly admits a unique globally attractive fixed point for . In brief, under the profile of strategies (0,1,0), the distribution of inventories converges globally to the stationary distribution (). For this reduces to

Case (1,1,0). Eq. 34 becomes . Consequently, the plane is globally attractive. The Jacobian, , of the system of the two remaining eqs. 32 and 33 on the plane is

The determinant of is always strictly positive, and its trace is always strictly negative; therefore, both eigenvalues are negative for every relevant value of and . Moreover the set is clearly positively invariant and compact. It thus follows easily from the Poincaré-Bendixon theorem that the system as a unique globally attractive fixed point.

To find the stationary distribution, set 32 and 33 to zero. They yield and , respectively. The two lines necessarily cross once and only once for in the interval ,. The fixed point is ,where and . When the fixed point then is .

Cases (1,0,1) and (0,1,1). A Jacobian with similar properties can be obtained when the profiles of strategies are (1,0,1) or (0,1,1). The fixed point with (1,0,1) is , where and . Similarly, under (0,1,1), the fixed point is () where and .

Using a similar argument on can verify that the fixed points supported by the strategies (0,0,0), (0,0,1), and (1,0,0) are also stable.

Proof of Proposition 4. For sufficiently small,

Since is a steady state, must be a fixed point of (29), that is

| (35) |

where and are defined in (25) and (21) with . Calling , by subtracting (35) form (29) we get

where

From Lemma 2 below, it follows that

Using that we get that uniformly in . Since form a Nash steady state, and must satisfy (11). It follows that and still satisfy (11) if is small enough. Thus, if is small enough, is the best response to itself for all . It follows that is a Nash equilibrium.

Proof of Proposition 5. To prove the proposition, it is useful to state the stability properties of (7). Let be the solution of (7) obtained by setting .

Lemma 2

Given a set of strategies and , and a pattern , for any and :

| (36) |

where , and . Thus the value function at time of agent can be computed as

| (37) |

where the limit does not depend on and it is reached exponentially fast.

Proof of Lemma 2. To obtain an explicit representation of , we apply the Duhamel principle to (29) and use the solution of (30). So doing, we obtain

| (38) |

so that

This implies

The claim in Lemma 2 would hold if

| (39) |

To prove (39) observe that

where

Let . For small enough, for every and

Therefore,

Thus 39 is verified because

This completes the proof of Lemma 2.

Returning to Proposition 5, observe that . From Lemma 2 we get

Finally, to go from the infinity distance to euclidean distance we observe that for every we have . The expression in Proposition 5 can thus be obtained as

Appendix B Nash Equilibria and the Stable Manifold Theorem

The iteration procedure to find Nash equilibria is similar to that used by Perron to prove the stable manifold theorem (for an illustration see, among others, Robinson, 1995). Here, we discuss similarities and differences. Consider the system of differential equations

| (40) |

where , , and

The system (40) is the sum of linear ( and ) and non-linear terms ( and ); its fixed point is .

The stable manifold theorem states that for every , with sufficiently small, there is unique such that the solution of (40) starting at satisfies

| (41) |

Moreover, it says that the point is given by a smooth function of , that is . The graph of , that is the set , is called the local stable manifold of . Perron’s proof is based on the following representation of the solution of (40):

| (42) | ||||

| (43) |

The proof starts from a guess and for all . It then computes a new approximation for the evolution of the stable variable , , through (42). Inserting and into (43) yields an approximation for the unstable variable . Note that while in (42) time runs forward ( goes from to ), in (43) it runs backward (in goes from to ). Therefore both integrations are stable. Iterating the two steps just described yields a sequence that approximates the solution (42)-(43). Because the exponential factors in the integrals of (42) and (43) have negative exponents, if is sufficiently small, the map from to is a contraction. Finally, the Banach fixed-point theorem guarantees that the sequence converges uniformly to a solution of (40) with and satisfying (41).

There are similarities between Perron’s approach in proving the manifold theorem and the construction of Nash equilibria discussed in Section 4. First, the Nash steady state corresponds to the fixed point of (40). Second, the in (1)-(3) is comparable to the in (40). Third, in (38) the discount rate plays the same role of the unstable exponent in (43). But there are also important differences because. Fourth the value function in (7) is somewhat comparable to in (40). But there is also an important difference: The value function affects the evolution of through the intermediation of the strategies . In addition, differently from (40), the procedure we presented in Section 4 does not split the evolution of near between a linear and a nonlinear part. Therefore, it is better suited to follow the dynamics away form the steady state.

Finally, as noted in Section 4, it is important to recognize that the evolution of the distribution of inventories, , and that of the value functions , can be studied jointly. Starting from a close to the steady state , with a and , one may integrate (7) and (1)-(3) backward in time – goes from to . To find the approximate solution of the Nash equilibrium it would suffice to alter along the integration process so as to be consistent with the value functions – i.e. to satisfy (11). While this procedure usually works well for low-dimensional systems (see, for instance, Brunner and Strulik, 2002), it presents limitations for the type of research question we are after. Our objective is to obtain a pattern that goes through any initial conditions, that is, through any arbitrary points in the space of the distribution of inventories, . As the dimension of the manifold expands, guiding the system toward a particular point on the state space by integrating (7) and (1)-(3) backward in time is challenging because some regions of the manifold may be hard to reach. Conversely, the method proposed here offers total control over the initial condition, an indispensable feature for running macroeconomic experiments.

| Model | Discount | Matching | Utility | Storage Costs | ||||

|---|---|---|---|---|---|---|---|---|

| A | 0.03 | 1 | 1 | 0.028 | 0.03 | 0.1 | 0.2 | |

| B | 0.03 | 1 | 1 | 0.028 | 0.1 | 0.05 | 0.03 | |

|

- Note. There are four equilibria. Sometimes two equilibria coexist. The dark dotted area in the lower-middle part of the figure represents (1,1,0) and full acceptance of fiat money. The + in light color on the lower-right side denotes (0,1,0) and full acceptance of fiat money. The remaining two types of equilibria are (the sign – in light color, in the middle-upper part) and (the dark sign on the top-right and top-left region) with and when and . The population is equally divided between the three types (). The remaining parameters values are in table 1, Model A.

| Panel A, Phase Diagram | ||||

|

||||

|

- Note: Panels A illustrates the convergence to a (1,1,0) steady state equilibrium with full acceptance of money. The population is equally split between the three types (). The initial condition . Panels B and C show the switch of , and of from to .

| Panel A: Phase Diagram | Panel B: Production |

|---|---|

|

|

- Note: The seignorage rate, , goes from to . The economy transits from a steady state equilibrium in which (1,1,1), (0,1,1), and (0,1,0), to new equilibrium in which (1,1,1), and (1,1,0). The stock of fiat money is =0.3 and . The remaining parameters are in table 1, Model A.

| Panel A: |

|

| Panel B: |

|

- Note: On equilibria represented by a dot, and : (red dot); (blue dot); (magenta dot); (green dot). On equilibria represented by a circle, and: (red circle); (blue circle), and (black circle). The triplets in parenthesis in plot A denote . M=0.3 in both plots. For the remaining parameters values see table 1, Model A.

|

- Note: The distribution of the population is as follows: , , and . The rate of seignorage and the stock of fiat money is 0.05 and 0.2, respectively. The storage costs are: , , and . The initial condition is .

| Panel A: |

|

| Panel B: |

|

- Note: On equilibria represented by a dot, and: (red dot); (blue dot); (green dot); and (black dot). On equilibria represented by a circle, and: (red circle); (blue circle), (green circle); and (black circle). The triplets in parenthesis in the two plots denote . M=0.3 on both plots. For other parameters values see table 1, Model B.

|

– Note: The parameters’ values are: 0.1, =0.3, and . See table (1), Model B, for remaining parameters’ values. The initial condition is .

| Panel A: Fiat Money |

|

| Panel B: Seigniorage |

|

Note: The value of and that maximizes the society’s welfare is and , respectively. The population is equally split between the three types (). For remaining parameters see table (1), Model A.