Markov chains under nonlinear expectation

Abstract.

In this paper, we consider continuous-time Markov chains with a finite state space under nonlinear expectations. We define so-called -operators as an extension of -matrices or rate matrices to a nonlinear setup, where the nonlinearity is due to model uncertainty. The main result gives a full characterization of convex -operators in terms of a positive maximum principle, a dual representation by means of -matrices, continuous-time Markov chains under convex expectations and nonlinear ordinary differential equations. This extends a classical characterization of generators of Markov chains to the case of model uncertainty in the generator. We further derive a primal and dual representation of the convex semigroup arising from a Markov chain under a convex expectation via the Fenchel-Legendre transformation of its generator. We illustrate the results with several numerical examples, where we compute price bounds for European contingent claims under model uncertainty in terms of the rate matrix.

Key words: Nonlinear expectation, imprecise Markov chain, model uncertainty, nonlinear ODE, generator of a nonlinear semigroup

AMS 2010 Subject Classification: 60J27; 60J35; 47H20; 34A34

1. Introduction and main result

The notion of a nonlinear expectation was introduced by Peng [25]. Since then, nonlinear expectations have been widely used in order to describe model uncertainty in a probabilistic framework. In mathematical finance, model uncertainty or ambiguity typically appears due to incomplete information in the financial market. In contrast to other disciplines like physics, where experiments can be repeated under similar conditions arbitrarily often, financial markets evolve dynamically and usually do not allow for repetition. A typical example for ambiguity is uncertainty with respect to the parameters (drift, volatility, etc.) of the driving process, which appears when, due to statistical estimation methods, only a confidence interval for the parameter is known. From a theoretical point of view, this leads to the task of modelling stochastic processes under incomplete information (imprecision). This topic has been extensively investigated since the beginning of this century. Prominent examples of nonlinear expectations related to stochastic processes, appearing in mathematical finance, are the g-expectation, see Coquet et al. [5], the G-expectation or -Brownian motion introduced by Peng [26],[27] and -Lévy processes, cf. Hu and Peng [16], Neufeld and Nutz [20] and Denk et al. [10]. Concepts that are related to nonlinear expectations are coherent monetary risk measures as introduced by Artzner et al. [1] and Delbaen [7],[8], convex monetary risk measures introduced by Föllmer and Schied [12] and Frittelli and Rosazza Gianin [14], coherent upper previsions introduced by Walley [31], convex upper previsions cf. Pelessoni and Vicig [23],[24]. Further concepts, that describe model uncertainty, are Choquet capacites (see e.g. Dellacherie and Meyer [9]), game-theoretic probability by Vovk and Shafer [28] and niveloids (see e.g. Cerreia-Vioglio et al. [2]).

In [25], Peng introduces a first notion of Markov chains under nonlinear expectations. However, the existence of stochastic processes under nonlinear expectations has only been considered in terms of finite dimensional nonlinear marginal distributions, whereas completely path-dependent functionals could not be regarded. Markov chains under model uncertainty have been considered amongst others by Hartfiel [15], Škulj [29] and De Cooman et al. [6]. Hartfiel [15] considers so-called Markov set-chains in discrete time, using matrix intervals in order to describe model uncertainty in the transition matrices. Later, Škulj [29] approached Markov chains under model uncertainty using Choquet capacities, which results in higher-dimensional matrices on the power set, while De Cooman et al. [6] considered imprecise Markov chains using an operator-theoretic approach with upper and lower expectations. In [11, Example 5.3], Denk et al. describe model uncertainty in the transition matrix via a nonlinear transition operator, which, together with the results obtained in [11], allows the construction of discrete-time Markov chains on the canonical path space. In continuous time, in particular, computational aspects of sublinear imprecise Markov chains, have been studied amongst others by Krak et al. [18] and Škulj [30].

In this paper, we investigate continuous-time Markov chains with a finite state space under convex expectations. The main tools, we use in our analysis, are convex duality, so-called Nisio semigroups (cf. Nisio [21], Denk et al. [10], Nendel and Röckner [19]) and a convex version of Kolmogorov’s extension theorem, see Denk et al. [11]. Restricting the time parameter in the present work to the set of natural numbers leads to a discrete-time Markov chain, in the sense of [11, Example 5.3]. A concept that is related to Markov chains under nonlinear expectations are backward stochastic differential equations (BSDEs) on Markov chains by Cohen and Elliot [3],[4].

The aim of this paper is to extend the classical relation between Markov chains, -matrices or rate matrices and ordinary differential equations to the case of model uncertainty. This allows to compute price bounds for contingent claims under model uncertainty numerically by solving ordinary differential equations using Runge-Kutta methods or, in the simplest case, the Euler method. In Section 4 (see Example 4.1), we illustrate how this method can be used to compute price bounds for European contingent claims, where we consider an underlying Markov chain, which is, firstly, a discrete version of a Brownian motion with uncertain drift (cf. Coquet et al. [5]) and, secondly, a discrete version of a Brownian motion with uncertain volatility (cf. Peng [26],[27]). The aforementioned pricing ODE related to a Markov chain under a nonlinear expectation is a spatially discretized version of a Hamilton-Jacobi-Bellman equation, and is related, via a dual representation, to a control problem where, roughly speaking, “nature” tries to control the system into the worst possible scenario (see Remark 3.18). The dual representation as a control problem gives rise to a second numerical scheme for the computation of prices of European contingent claims under model uncertainty, which is also discussed in Section 4 (see Example 4.2).

Given a measurable space , we denote the space of all bounded measurable functions by . A nonlinear expectation is then a functional , which satisfies whenever for all , and for all . If is additionally convex, we say that is a convex expectation. It is well known (see e.g. Denk et al. [11] or Föllmer and Schied [13]) that every convex expectation admits a dual representation in terms of finitely additive probability measures. If , however, even admits a dual representation in terms of (countably additive) probability measures, we say that is a convex expectation space. More precisely, we say that is a convex expectation space if there exists a set of probability measures on and a family with such that

for all . Here, denotes the expectation w.r.t. a probability measure on . If for all , we say that is a sublinear expectation space. Here, the set represents the set of all models that are relevant under the expectation . In the case of a sublinear expectation space, the functional is the best case among all plausible models . In the case of a convex expectation space, the functional is a weighted best case among all plausible models with an additional penalization term for every . Intuitively, can be seen as a measure for how much importance we give to the prior under the expectation . For example, a low penalization, i.e. close or equal to , gives more importance to the model than a high penalization.

If a nonlinear expectation is sublinear, then defines a coherent monetary risk measure as introduced by Artzner et al. [1] and Delbaen [7],[8], see also Föllmer and Schied [13] for an overview of monetary risk measures. Moreover, if is a sublinear expectation, then is a coherent upper prevision, cf. Walley [31], and vice versa. We would further like to mention that there is also a one-to-one relation between the following three concepts: convex expectations, convex upper previsions, cf. Pelessoni and Vicig [23],[24], and convex risk measures, cf. Föllmer and Schied [12] and Frittelli and Rosazza Gianin [14].

Throughout, we consider a finite non-empty state space with cardinality . We endow with the discrete topology and w.l.o.g. assume that . The space of all bounded measurable functions can therefore be identified by via

Therefore, a bounded measurable function will always be denoted as a vector of the form , where represents the value of in the state . On , we consider the norm

for a vector . Moreover, for , the vector denotes the constant vector with for all . For a matrix , we denote by the operator norm of w.r.t. the norm , i.e.

Inequalities of vectors are always understood componentwise, i.e. for

All concepts in that include inequalities are to be understood w.r.t. the latter partial ordering. For example, a vector field is called convex if

for all , and . A vector field is called sublinear if it is convex and positive homogeneous (of degree ). Moreover, for a set of vectors, we write if for all .

A matrix is called a -matrix or rate matrix if it satisfies the following conditions:

-

(i)

for all ,

-

(ii)

for all with ,

-

(iii)

for all .

It is well known that every continuous-time Markov chain with certain regularity properties at time can be related to a -matrix and vice versa. More precisely, for a matrix the following statements are equivalent:

-

is a -matrix.

-

There is a Markov chain such that

where is the -th component of for , stands for the probability measure under which the Markov chain satisfies , for , and

for any bounded random variable .

In this case, for each vector , the function is the unique classical solution to the initial value problem

i.e. for all , where is the matrix exponential of . We refer to Norris [22] for a detailed illustration of this relation.

We say that a (possibly nonlinear) operator satisfies the positive maximum principle if, for every and ,

This notion is motivated by the positive maximum priciple for generators of Feller processes, see e.g. Jacob [17, Equation (0.8)]. Notice that a matrix is a -matrix if and only if it satisfies the positive maximum principle and , where denotes the constant vector. Indeed, property (iii) in the definition of a -matrix is just a reformulation of . Moreover, if satisfies the positive maximum principle, then for all and for all with . On the other hand, if is a -matrix, and with for all , then, , which shows that satisfies the positive maximum principle.

In order to state the main result, we need the following definitions.

Definition 1.1.

A (possibly nonlinear) map is called a -operator if the following conditions are satisfied:

-

for all and all ,

-

for all and all with ,

-

for all , where we identify with .

Definition 1.2.

A convex Markov chain is a quadruple that satisfies the following conditions:

-

is a measurable space.

-

is -measurable for all .

-

, where is a convex expectation space for all and . Here and in the following we make use of the notation

for .

-

The following version of the Markov property is satisfied: For all , , and ,

where and for all and .

We say that the Markov chain is linear or sublinear if the mapping is additionally linear or sublinear, respectively.

The Markov property given in of the previous definition is the nonlinear analogon of the classical Markov property without using conditional expectations. Notice that, due to the nonlinearity of the expectation, the definition and, in particular, the existence of a conditional (nonlinear) expectation is quite involved, which is why we avoid to introduce this concept.

In line with [11, Definition 5.1], we say that a (possibly nonlinear) map is a kernel, if is monotone, i.e. for all with , and preserves constants, i.e. for all .

Definition 1.3.

A family of (possibly nonlinear) operators is called a semigroup if

-

(i)

, where is the -dimensional identity matrix,

-

(ii)

for all .

Here and throughout, we make use of the notation . If, additionally, uniformly on compact sets as , we say that the semigroup is uniformly continuous. We call Markovian if is a kernel for all . We say that is linear, sublinear or convex if is linear, sublinear or convex for all , respectively.

Definition 1.4.

Let be a set of -matrices and a family of vectors with for some . We denote by

for , and . Then, is an affine linear semigroup. We call a semigroup the (upper) semigroup envelope (later also Nisio semigroup) of if

-

(i)

for all , and ,

-

(ii)

for any other semigroup satisfying (i) we have that for all and .

That is, the semigroup envelope is the smallest semigroup that dominates all semigroups .

The following main theorem gives a full characterization of convex -operators.

Theorem 1.5.

Let be a mapping. Then, the following statements are equivalent:

-

is a convex -operator.

-

is convex, satisfies the positive maximum principle and for all , where .

-

There exists a set of -matrices and a family of vectors with for some such that

(1.1) for all , where the suprema are to be understood componentwise.

-

There exists a uniformly continuous convex Markovian semigroup with

for all .

-

There is a convex Markov chain such that

for all .

In this case, for each initial value , the function is the unique classical solution to the initial value problem

| (1.2) | ||||

Moreover, for all , where is the Markovian semigroup from (iv), and is the semigroup envelope of .

Remark 1.6.

Consider the situation of Theorem 1.5.

-

a)

The dual representation in gives a model uncertainty interpretation to -operators. The set can be seen as the set of all plausible rate matrices, when considering the -operator . For every , the vector can be interpreted as a penalization, which measures how much importance we give to each rate matrix . The requirement that there exists some with can be interpreted in the following way: There has to exist at least one rate matrix within the set of all plausible rate matrices to which we assign the maximal importance, that is the minimal penalization.

-

b)

The semigroup envelope of can be constructed more explicitly, in particular, an explicit (in terms of ) dual representation can be derived. For details, we refer to Section 3 (Definition 3.2 and Remark 3.18). Moreover, we would like to highlight that the semigroup envelope can be constructed w.r.t. any dual representation as in and results in the unique classical solution to (1.2) independent of the choice of the dual representation of . This gives, in some cases, the opportunity to efficiently compute the semigroup envelope numerically via its primal/dual representation (see Example 4.2).

- c)

-

d)

Theorem 1.5 extends and includes the well-known relation between (linear) Markov chains, -matrices and ordinary differential equations.

-

e)

A remarkable consequence of Theorem 1.5 is that every convex Markovian semigroup, which is differentiable at time , is the semigroup envelope with respect to the Fenchel-Legendre transformation (or any other dual representation as in of its generator, which is a convex -operator.

-

f)

Although has an unbounded convex conjugate, the convex initial value problem

(1.3) has a unique global solution.

-

g)

Solutions to (1.3) remain bounded. Therefore, a Picard iteration or Runge-Kutta methods, such as the explicit Euler method, can be used for numerical computations, and the convergence rate (depending on the size of the initial value ) can be derived from the a priori estimate from Banach’s fixed point theorem.

- h)

Structure of the paper. In Section 2, we give a proof of the implications of Theorem 1.5. The main tool, we use in this part, is convex duality in . In Section 3, we prove the implication . Here, we use a combination of Nisio semigroups as introduced in [21], a Kolmogorov-type extension theorem for convex expectations derived in [11] and the theory of ordinary differential equations. In Section 4, we use two different numerical methods, based on the results from Section 3, in order to compute price bounds for European contingent claims, where the underlying is a discrete version of a Brownian motion with drift undertainty (-framework) and volatility uncertainty (-framework).

2. Proof of

We say that a set of matrices is row-convex if, for any diagonal matrix with for all ,

where is the -dimensional identity matrix. Notice that, for all , the -th row of the matrix is the convex combination of the -th row of and with . Therefore, a set is row-convex if for all the convex combination with different in every row is again an element of . For example, the set of all -matrices is row-convex.

Remark 2.1.

Let be a convex -operator. For every matrix , let

be the conjugate function of . Notice that for all , since . Let

and for all . Then, the following facts are well-known results from convex duality theory in .

-

a)

The set is row-convex and the mapping is continuous.

-

b)

Let and . Then, is compact and row-convex. Therefore,

(2.1) defines a convex operator, which is Lipschitz continuous. Notice that the maximum in (2.1) is to be understood componentwise. However, for fixed , the maximum can be attained, simultaneously in every component, by a single element of , since is row-convex, i.e., for all , there exists some with

-

c)

Let . Then, there exists some , such that

for all with . In particular, is locally Lipschitz continuous and admits a representation of the form

for all , where, for fixed , the maximum can be attained, simultaneously in every component, by a single element of . In particular, there exists some with .

Proof of Theorem 1.5.

: As is a convex expectation for all , it follows that the operator is convex with for all . Now, let and with for all . Let be such that

and . Then,

Assume that . Then, there exists some such that

i.e.

which is a contradiction to

This shows that satisfies the positive maximum principle.

: This follows directly from the positive maximum principle, considering the vectors and for all and .

: Let be a convex -operator. Moreover, let and be as in Remark 2.1. Then, by Remark 2.1 c), it only remains to show that every is a -matrix. To this end, fix an arbitrary . Then, for all ,

Therefore, for all . Since, is linear, it follows . Now, let . Then, by definition of a -operator, we obtain that

i.e. . Now, let with . Then, again by definition of a -operator, it follows that

i.e. . Therefore, is a -matrix.

It remains to show , which is done in the entire next section.

∎

3. Proof of

Throughout, let be a set of -matrices and with , for some , such that

is well-defined. For every , we consider the linear ODE

| (3.1) |

with . Then, by a variation of constant, the solution to (3.1) is given by

| (3.2) |

for , where is the matrix exponential of for all . Then, the family defines a uniformly continuous semigroup of affine linear operators (see Definition 1.3).

Remark 3.1.

Note that, for all and , the matrix exponential is a stochastic matrix, i.e.

-

(i)

for all ,

-

(ii)

.

Therefore, is a linear kernel, i.e. for all with and for all , which implies that is monotone for all and .

For the family or, more precisely, for , we will now construct the Nisio semigroup, and show that it gives rise to the unique classical solution to the nonlinear ODE (1.2). To this end, we consider the set of finite partitions

The set of partitions with end-point will be denoted by , i.e. . Notice that

For all and , we define

where the supremum is taken componentwise. Note that is well-defined since

for all , and , where we used the fact that is a kernel. Moreover, is a convex kernel, for all , as it is monotone and

for all , where we used the fact that there is some with . For a partition with and , we set

Moreover, we set . Then, is a convex kernel for all since it is a concatenation of convex kernels.

Definition 3.2.

The Nisio semigroup of is defined by

for all and .

Notice that is well-defined and a convex kernel for all since is a convex kernel for all . In many of the subsequent proofs, we will first concentrate on the case, where the family is bounded and then use an approximation of the Nisio semigroup by means of other Nisio semigroups. This approximation procedure is specified in the following remark.

Remark 3.3.

Let , and . Notice that, by assumption, there exists some with , which implies that . Since (and by definition of ), the operator

is well-defined. Let be the Nisio semigroup w.r.t. for all . Since

it follows that and , for all , as . Moreover, for all and with ,

where and, in the last step, we used the fact that is convex and therefore continuous. This implies that the set is bounded in the sense that . In particular,

| (3.3) |

for all .

Lemma 3.4.

Assume that the family is bounded, i.e. for some . Then, for all , the mapping is Lipschitz continuous.

Proof.

Lemma 3.5.

Assume that the family is bounded. Then,

for all and . In particular, the map is Lipschitz continuous for all

Proof.

Let . Then, for any partition of the form with and , (3.4) together with the fact that is a kernel, for all , implies that

where for all . By definition of , for , it follows that

Now, let . Then, since is a kernel for all , it follows that

∎

For a partition with and , we define the (maximal) mesh size of by

Moreover, we set . Let . In the following, we consider the limit of when the mesh size of the partition tends to zero. For this, we first remark that, for ,

which implies the inequality

| (3.5) |

for with . The following lemma now states that , for , can be obtained by a pointwise monotone approximation with finite partitions letting the mesh size tend to zero.

Lemma 3.6.

Let and with for all and as . Then, for all ,

Proof.

Let . For the statement is trivial. Therefore, assume that and let

| (3.6) |

As for all , (3.5) implies that

Since , we obtain that

Next, we assume that the family is bounded. Let with and . Since as , we may w.l.o.g. assume that for all . Again, since as , there exist for all with and as for all . Then, by Lemma 3.4, we have that

and therefore,

Letting , we obtain that . Taking the supremum over all yields the assertion for bounded .

Now, let again be (possibly) unbounded. It remains to show that . By the previous step, we have that for all , where is given by (3.6) but w.r.t. instead of . Since as , we obtain that , which ends the proof.

∎

Choosing e.g. or in Lemma 3.6, we obtain the following corollaries.

Corollary 3.7.

For all there exists a sequence with

as for all .

Corollary 3.8.

For all and we have that

Proposition 3.9.

The family defines a semigroup of convex kernels from to . In particular, for all we have the dynamic programming principle

| (3.7) |

Moreover, the Nisio semigroup of coincides with the semigroup envelope of (cf. Definition 1.4).

Proof.

It remains to show the semigroup property (3.7). Let . If or the statement is trivial. Therefore, let , and . Then, with . Hence, by (3.5), we obtain that

Let , with and with . Then,

with

We thus see that

Taking the supremum over all , it follows that .

Now, let with as (see Corollary 3.7), and fix . Then, for all ,

with . Therefore,

Taking the supremum over all , yields that . It remains to show that the family is the semigroup envelope of . We have already shown that is a semigroup and, by definition, for all , and . Let be a semigroup with for all , and . Then,

Since is a semigroup and is monotone for all , it follows that

Taking the supremum over all , it follows that for all and . ∎

Corollary 3.10.

There exists a convex Markov chain such that

for all , and .

Restricting the time parameter of this process to , leads to a discrete-time Markov chain with transition operator (cf. [11, Example 5.3]). It remains to show that the Nisio semigroup gives rise to the unique classical solution to the nonlinear ODE (1.2).

Remark 3.11.

Assume that the set is bounded, i.e. .

-

a)

Since is bounded, it follows that is Lipschitz continuous. Therefore, the Picard-Lindelöf Theorem implies that, for every , the initial value problem

(3.8) has a unique solution . We will show that this solution is given by for all . That is, the unique solution of the ODE (3.8) is given by the Nisio semigroup.

-

b)

Since is bounded, the mapping

is well-defined.

The following key estimate and its proof are a straightforward adaption of the proof of [21, Proposition 5] to our setup. Recall that, by Remark 3.3, the boundedness of the family implies the boundedness of the set .

Lemma 3.12.

Assume that the family is bounded. Then,

for all and . Here, is the Nisio semigroup w.r.t. the sublinear -operator from the previous remark, or more precisely, the Nisio semigroup w.r.t. , where for all .

Proof.

Let and . Then, by (3.2), we have that

Notice that, by Lemma 3.5, the mapping is continuous and therefore locally integrable for all . Hence, for all ,

| (3.9) |

Next, we show that

| (3.10) |

for all by an induction on , where denotes the cardinality of . If , i.e. if , the statement is trivial. Hence, assume that

for all with for some . Let with and . Then, we obtain that

where, in the second inequality, we used (3.9) with and , and, in the last inequality, we used the sublinearity of . Using the induction hypothesis, we thus see that

The following proposition states that the Nisio semigroup is differentiable at zero if the family is bounded.

Proposition 3.13.

Assume that is bounded. Then, for all ,

Proof.

Since is bounded, it follows that is bounded (see Remark 3.3). Let and . Using Lemma 3.5, the boundedness of and (3.3), there exists some such that, for all ,

for all , and

Let . Then,

for all . Dividing by and taking the supremum over all , it follows that

| (3.11) |

Moreover, by Lemma 3.12,

Dividing again by yields

which, together with (3.11), implies that

∎

Corollary 3.14.

Let be bounded, and for . Then, is the unique classical solution to the ODE

with .

Proof.

Let and . Then, by Proposition 3.13,

This shows that the map is continuous (see Lemma 3.5) and right differentiable with continuous right derivative

where we used that the fact that is convex and thus continuous. Therefore, is continuously differentiable with , for all , and . The Picard-Lindelöf Theorem together with the local Lipschitz continuity of the convex map implies the uniqueness of . ∎

Corollary 3.15.

Let be bounded. Then, there exists some constant such that

for all and .

Proof.

Since is bounded, we have that is bounded and therefore is Lipschitz continuous with Lipschitz constant . For all we thus obtain that

∎

Finally, in order to end the proof of Theorem 1.5, we have to extend Corollary 3.14 to the unbounded case. We start with the following remark, which is the key observation in order to finish the proof of Theorem 1.5.

Remark 3.16.

Let and for all , where is the conjugate function of (cf. Remark 2.1). For all , let and be as in Remark 3.3 with being replaced by . Moreover, let be the Nisio semigroup w.r.t. for . As

it follows that as for all , where is the Nisio semigroup w.r.t. . Let be fixed. Then, there exists some such that for all with , by choice of and . Let with . Then, it follows that for all and , which implies that for all and by the uniqueness obtained from the Picard-Lindelöf Theorem. In particular, for all , which shows that the nonlinear ODE (1.2) has a unique classical solution with . This solution is given by for all . By Corollary 3.15, we thus get that as uniformly on compact sets.

We are now able to finish the proof of Theorem 1.5.

Proposition 3.17.

Let . Then, is the unique classical solution to the initial value problem

Moreover, the Nisio semigroup is uniformly continuous (see Definition 1.3).

Proof.

By Remark 3.16, the initial value problem

has a unique classical solution , which is given by

We show that , for all . Let . For all , let , and be as in Remark 3.3. Let . Since is convex, it is locally Lipschitz. Hence, by Dini’s lemma, there exists some such that

for all with . Further, there exists some constant such that

for all with and . Since and for all and , we obtain that

for all and . By Gronwall’s lemma, we thus get that

for all and , showing that as for all . However, since as for all , we obtain that . This shows that for all , which, together with Remark 3.16, implies that uniformly on compact sets as . This ends the proof of this proposition and also the proof of Theorem 1.5. ∎

We conclude this section with the following remark, where we derive a dual representation of the semigroup envelope.

Remark 3.18.

We will now derive a dual representation of the semigroup envelope by viewing the semigroup envelope as the cost functional of an optimal control problem, where, roughly speaking, “nature” tries to control the system into the worst possible scenario (using contols within the set ). For and , let be given by

| (3.12) |

for all and . That is, is the matrix whose -th row is the -th row of for all . Here, the interpretation is that, in every state , “nature” is allowed to choose a different model . We now add a dynamic component, and define

Roughly speaking, corresponds to the set of all (space-time discrete) admissible controls for the control set . For an admissible control with and , we then define

where is defined as in (3.12) for . Then, for all ,

| (3.13) |

In fact, by definition of , it follows that for all , and . On the other hand, one readily verifies that , for and , gives rise to a semigroup . Since is the semigroup envelope of , it follows that for all .

4. Computation of price bounds under model uncertainty

In this section, we demonstrate how price bounds for European contingent claims under uncertainty can be computed numerically in certain scenarios, firstly, via the explicit primal/dual description (3.13) of the semigroup envelope and, secondly, by solving the pricing ODE (1.2). Throughout, we consider two -matrices and and, for with , the interval . Then, we consider the -operator given by

Then, is sublinear and has the dual representation . Choosing the latter dual representation, we may compute and , for , via

| (4.1) |

and

| (4.2) |

In the sequel, we use (4.1) and (4.2) in order to compute upper bounds for prices of European contingent claims under uncertainy. Replacing the maximum by a minimum in (4.1) and (4.2), we obtain lower bounds for the prices. In the examples, we consider, for suitable , the rate matrix

| (4.3) |

which is a discretization of the second space derivative with Neumann boundary conditions, and the rate matrix

| (4.4) |

as a discretization of the first space derivative. Then, the rate matrix

is a finite-difference discretization of , which is the generator of a Brownian Motion with volatility and drift .

We start with an example, where we demonstrate how the semigroup envelope, and thus price bounds for Euproean contingent claims under model uncertainty, can be computed by solving the nonlinear pricing ODE (1.2).

Example 4.1.

In this example, we compute the semigroup envelope by solving the ODE with the explicit Euler method. The latter could be replaced by any other Runge-Kutta method. We consider the case, where, , . The state space is , which as a discretization of the interval , the maturity is , and we choose time steps in the explicit Euler method. We consider the following two examples.

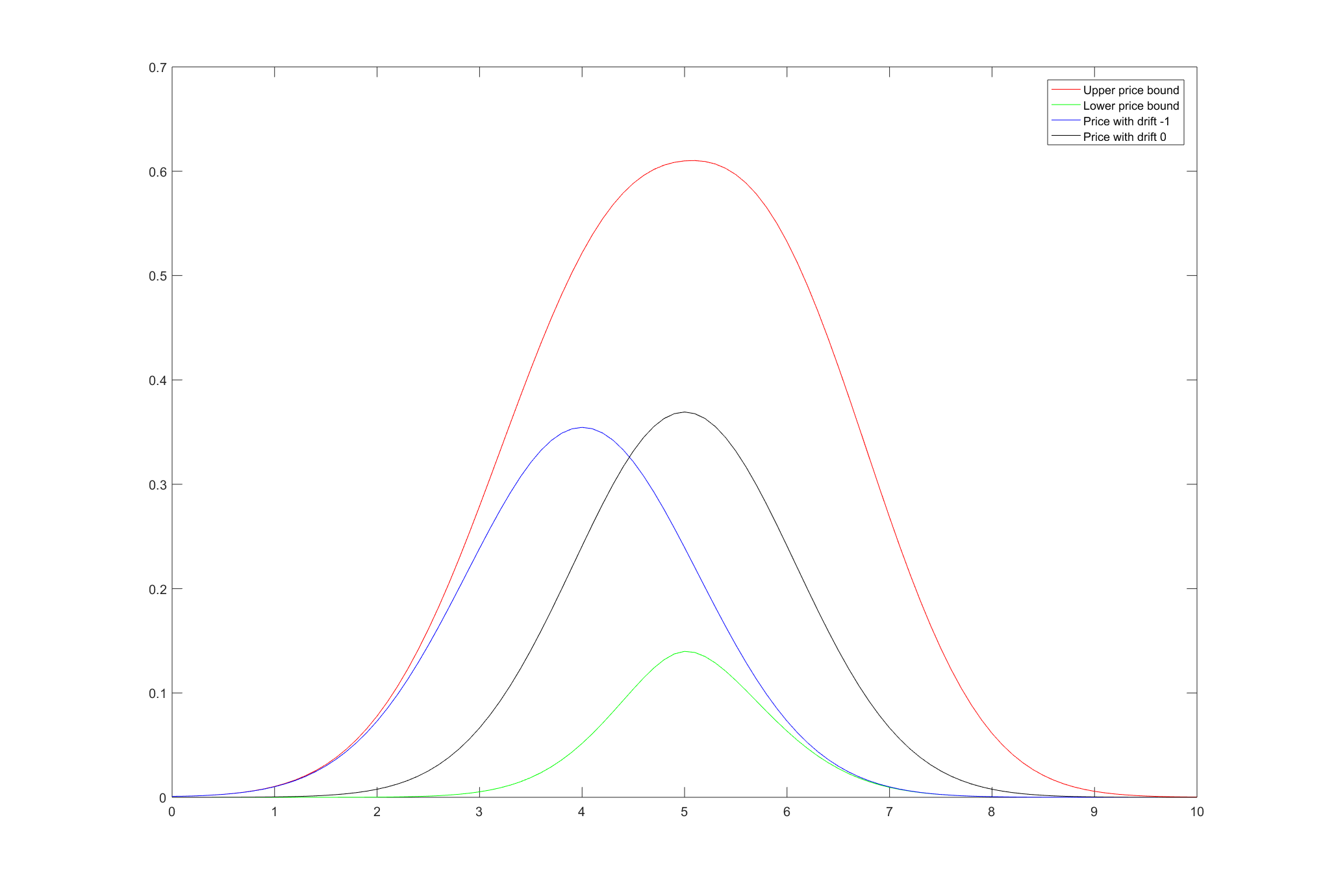

-

a)

Let be given by (4.1) with , , and , i.e. we consider the case of an uncertain drift parameter in the interval . We price a butterfly spread, which is given by

(4.5) with and .

Figure 1. Upper and lower price bounds for a butterfly spread (4.5) with and under drift uncertainty depending on the current price in red and green, respectively. In blue and black, we see the value of the butterfly in the Bachelier model with drift and , respectively. In Figure 1, we depict the upper and lower price bounds as well as the prices corresponding to the Bachelier model with drift and in blue and black, respectively.

-

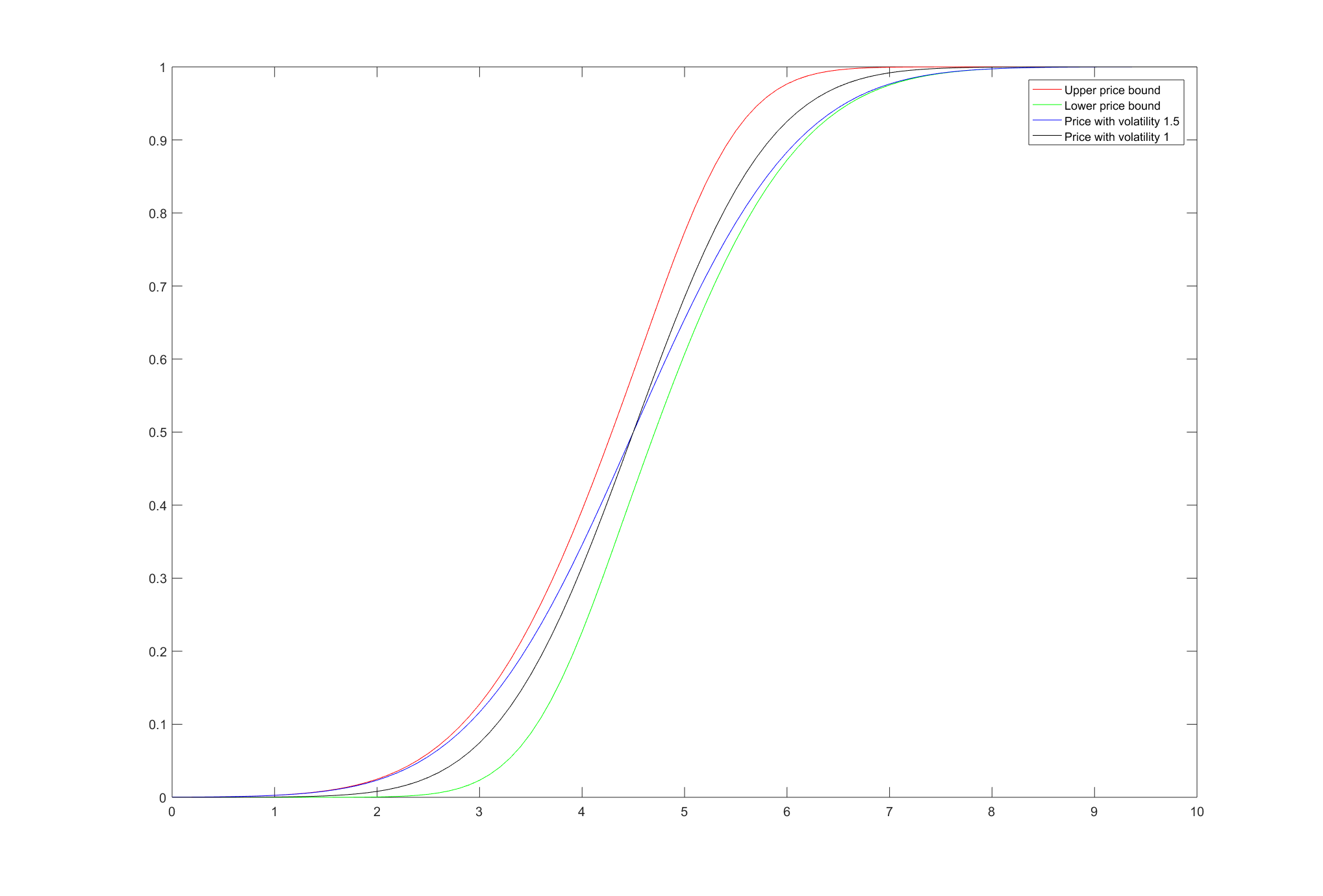

b)

Now, let , , and in (4.1). That is, we consider the case of an uncertain volatility in the interval . We price a bull spread

(4.6) with and .

Figure 2. Upper and lower price bounds for a bull spread (4.6) with and under volatility uncertainty depending on the current price in red and green, respectively. In black and blue, we see the value of the butterfly in the Bachelier model with drift and , respectively. In Figure 1, we see the upper and lower price bounds as well as the prices corresponding to the Bachelier model with volatility and in black and blue, respectively.

The following example illustrates how the primal/dual representation of the semigroup envelope can be used to compute bounds for prices of European contingent claims under model uncertainty.

Example 4.2.

For a fixed maturity , we consider the partitions

of the time interval . We are then able to approximate the upper bound for prices of European contingent claims under uncertainy with maturity by computing, for sufficiently large,

| (4.7) |

with given by (4.2) for . The fundamental system , for , appearing in (4.2) can either be computed via the Jordan decomposition of , by the approximation

| (4.8) |

with sufficiently large or by numerically solving the matrix-valued ODE

where is the -identity matrix. We illustrate the approximation of the semigroup envelope via (4.7) in the following two examples, where and are given by (4.3) and (4.4). Again, we consider the case, where, , and the maturity is . In both examples, we choose , i.e. we consider the partition with , and use (4.8) with for the computation of for .

-

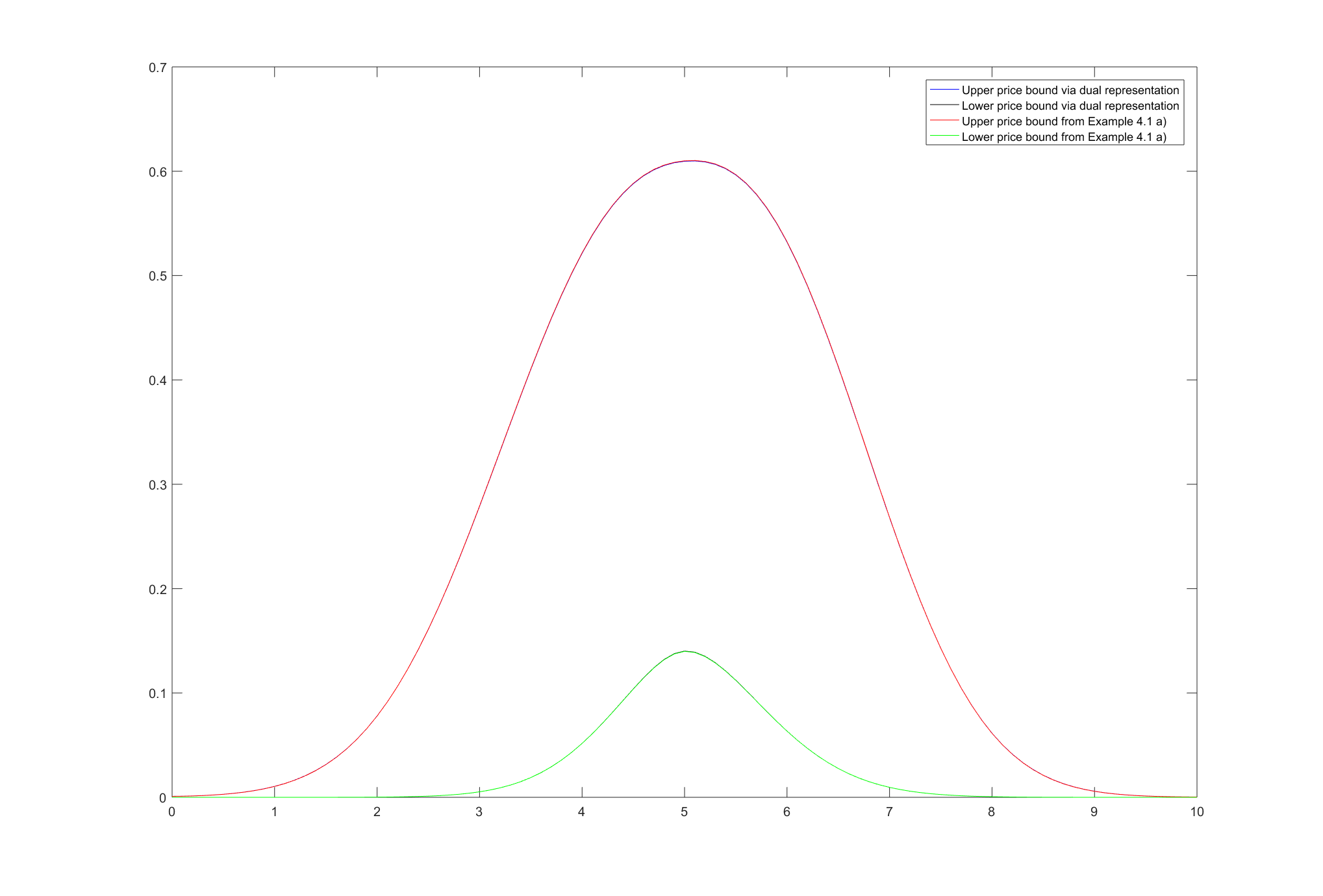

a)

As in Example 4.1 a), let , , and . Again, we compute the price of a butterfly spread, which is given by (4.5) with and .

Figure 3. Upper and lower price bounds for a butterfly spread (4.5) with and under drift uncertainty from Example 4.1 a) in red and green, respectively. In blue and black, the upper and lower price bounds, computed via (4.7), respectively. In Figure 3, we see the upper and lower price curves from the previous example as well as the price bounds computed in this example. We observe that the price bounds match very well.

-

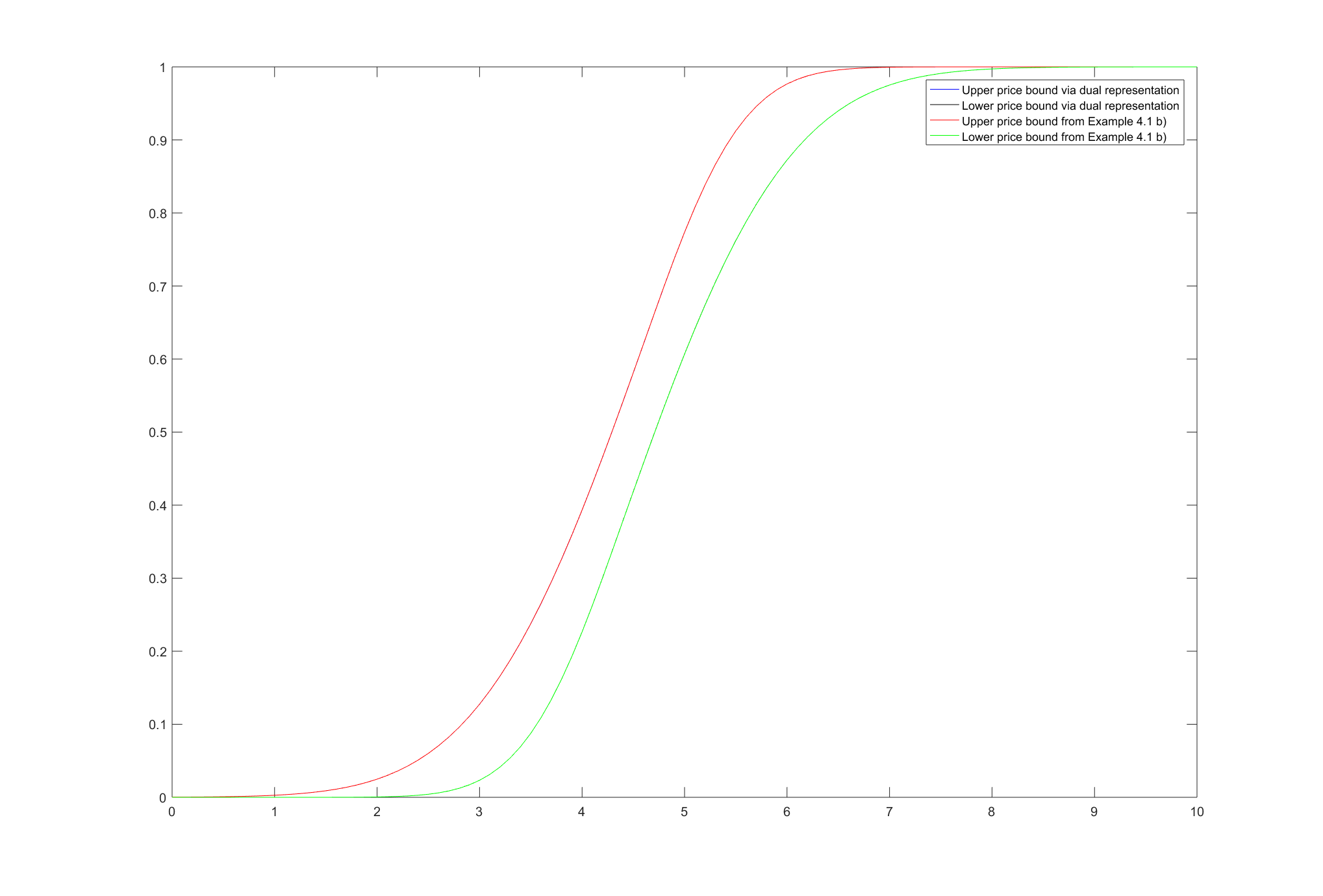

b)

We consider the case of an uncertain volatility parameter from Example 4.1 b), i.e. let , , and . As in Example 4.1 b), we price a bull spread given by (4.6) with and .

Figure 4. Upper and lower price bounds for a bull spread (4.6) with and under volatility uncertainty from Example 4.1 b) in red and green, respectively. In blue and black, the upper and lower price bounds, computed via (4.7), respectively. In Figure 4, we again depict the upper and lower price bounds from the previous example and this example. As in part a), we observe that the price bounds perfectly match.

References

- [1] P. Artzner, F. Delbaen, J.-M. Eber, and D. Heath. Coherent measures of risk. Math. Finance, 9(3):203–228, 1999.

- [2] S. Cerreia-Vioglio, F. Maccheroni, M. Marinacci, and A. Rustichini. Niveloids and their extensions: risk measures on small domains. J. Math. Anal. Appl., 413(1):343–360, 2014.

- [3] S. N. Cohen and R. J. Elliott. Solutions of backward stochastic differential equations on Markov chains. Commun. Stoch. Anal., 2(2):251–262, 2008.

- [4] S. N. Cohen and R. J. Elliott. A general theory of finite state backward stochastic difference equations. Stochastic Process. Appl., 120(4):442–466, 2010.

- [5] F. Coquet, Y. Hu, J. Mémin, and S. Peng. Filtration-consistent nonlinear expectations and related -expectations. Probab. Theory Related Fields, 123(1):1–27, 2002.

- [6] G. de Cooman, F. Hermans, and E. Quaeghebeur. Imprecise Markov chains and their limit behavior. Probab. Engrg. Inform. Sci., 23(4):597–635, 2009.

- [7] F. Delbaen. Coherent risk measures. Cattedra Galileiana. [Galileo Chair]. Scuola Normale Superiore, Classe di Scienze, Pisa, 2000.

- [8] F. Delbaen. Coherent risk measures on general probability spaces. In Advances in finance and stochastics, pages 1–37. Springer, Berlin, 2002.

- [9] C. Dellacherie and P.-A. Meyer. Probabilities and potential, volume 29 of North-Holland Mathematics Studies. North-Holland Publishing Co., Amsterdam-New York; North-Holland Publishing Co., Amsterdam-New York, 1978.

- [10] R. Denk, M. Kupper, and M. Nendel. A semigroup approach to nonlinear Lévy processes. Preprint arXiv:1710.08130, 2017.

- [11] R. Denk, M. Kupper, and M. Nendel. Kolmogorov-type and general extension results for nonlinear expectations. Banach J. Math. Anal., 12(3):515–540, 2018.

- [12] H. Föllmer and A. Schied. Convex measures of risk and trading constraints. Finance Stoch., 6(4):429–447, 2002.

- [13] H. Föllmer and A. Schied. Stochastic finance. Walter de Gruyter & Co., Berlin, extended edition, 2011. An introduction in discrete time.

- [14] M. Frittelli and E. Rosazza Gianin. Putting order in risk measures. Journal of Banking & Finance, 26(7):1473–1486, 2002.

- [15] D. J. Hartfiel. Markov set-chains, volume 1695 of Lecture Notes in Mathematics. Springer-Verlag, Berlin, 1998.

- [16] M. Hu and S. Peng. -lévy processes under sublinear expectations. Preprint, 2009.

- [17] N. Jacob. Pseudo differential operators and Markov processes. Vol. I. Imperial College Press, London, 2001. Fourier analysis and semigroups.

- [18] T. Krak, J. De Bock, and A. Siebes. Imprecise continuous-time Markov chains. Internat. J. Approx. Reason., 88:452–528, 2017.

- [19] M. Nendel and M. Röckner. Upper envelopes of families of Feller semigroups and viscosity solutions to a class of nonlinear Cauchy problems. Preprint arXiv:1906.04430, 2019.

- [20] A. Neufeld and M. Nutz. Nonlinear Lévy processes and their characteristics. Trans. Amer. Math. Soc., 369(1):69–95, 2017.

- [21] M. Nisio. On a non-linear semi-group attached to stochastic optimal control. Publ. Res. Inst. Math. Sci., 12(2):513–537, 1976/77.

- [22] J. R. Norris. Markov chains, volume 2 of Cambridge Series in Statistical and Probabilistic Mathematics. Cambridge University Press, Cambridge, 1998. Reprint of 1997 original.

- [23] R. Pelessoni and P. Vicig. Convex imprecise previsions. volume 9, pages 465–485. 2003. Special issue on dependable reasoning about uncertainty.

- [24] R. Pelessoni and P. Vicig. Uncertainty modelling and conditioning with convex imprecise previsions. Internat. J. Approx. Reason., 39(2-3):297–319, 2005.

- [25] S. Peng. Nonlinear expectations and nonlinear Markov chains. Chinese Ann. Math. Ser. B, 26(2):159–184, 2005.

- [26] S. Peng. -expectation, -Brownian motion and related stochastic calculus of Itô type. In Stochastic analysis and applications, volume 2 of Abel Symp., pages 541–567. Springer, Berlin, 2007.

- [27] S. Peng. Multi-dimensional -Brownian motion and related stochastic calculus under -expectation. Stochastic Process. Appl., 118(12):2223–2253, 2008.

- [28] V. Vovk and G. Shafer. Game-theoretic probability. In Introduction to imprecise probabilities, Wiley Ser. Probab. Stat., pages 114–134. Wiley, Chichester, 2014.

- [29] D. Škulj. Discrete time Markov chains with interval probabilities. Internat. J. Approx. Reason., 50(8):1314–1329, 2009.

- [30] D. Škulj. Efficient computation of the bounds of continuous time imprecise Markov chains. Appl. Math. Comput., 250:165–180, 2015.

- [31] P. Walley. Statistical reasoning with imprecise probabilities, volume 42 of Monographs on Statistics and Applied Probability. Chapman and Hall, Ltd., London, 1991.