Combining Empirical Likelihood and Robust Estimation Methods for Linear Regression Models

aŞenay Özdemir and bOlcay Arslan

aDepartment of Statistics, Afyon Kocatepe University, 03200, Afyonkarahisar, Turkey, senayozdemir@aku.edu.tr

bDepartment of Statistics, Ankara University, 06100, Ankara, Turkey

Abstract

Ordinary least square (OLS), maximum likelihood (ML) and robust methods are the widely used methods to estimate the parameters of a linear regression model. It is well known that these methods perform well under some distributional assumptions on error terms. However, these distributional assumptions on the errors may not be appropriate for some data sets. In these case, nonparametric methods may be considered to carry on the regression analysis. Empirical likelihood (EL) method is one of these nonparametric methods. The EL method maximizes a function, which is multiplication of the unknown probabilities corresponding to each observation, under some constraints inherited from the normal equations in OLS estimation method. However, it is well known that the OLS method has poor performance when there are some outliers in the data. In this paper, we consider the EL method with robustifyed constraints. The robustification of the constraints is done by using the robust M estimation methods for regression. We provide a small simulation study and a real data example to demonstrate the capability of the robust EL method to handle unusual observations in the data. The simulation and real data results reveal that robust constraints are needed when heavy tailedness and/or outliers are possible in the data.

Keywords:Empirical likelihood; Linear regression; M estimation

Class codes:

1 Introduction

Consider the linear regression model

| (1) |

where is the response variable, is the dimensional vector of the explanatory variables, is an unknown dimensional parameter vector and ’s are the independent and identically distributed (iid) errors with and . The regression equation given in (1) can also be written in matrix notation as

where is the design matrix, is the response vector, and is the vector of

The simplest way to estimate the parameters of a linear regression model is to use the OLS method. The OLS estimators for can be obtain by minimizing the following objective function:

| (2) |

Taking the derivative of this function with respect to and setting to zero gives the following estimating equation, which is known as the normal equations in the OLS:

| (3) |

From this equation the OLS estimator is obtained. An unbiased estimator for can be obtained using residuals sum of squares after the OLS estimator for the regression parameter is obtained. The following objective function, which is the negative of the log-likelihood function under normally distributed error terms,can also be minimized to obtain estimators for and .

| (4) |

The ML estimators will be the solutions of the equation given in (3) and the following equation

| (5) |

Note that the OLS and the ML estimators for the regression parameters are the same under the normality assumption on error.

It is known that the OLS estimators (also the ML estimators) are the minimum variance unbiased estimates for model parameters under the assumption that are normally distributed. However, these estimators are dramatically effected when fundamental assumptions are unfulfilled by the nature of the data. It is well known that OLS estimators (or ML estimators under the normality assumption) are very sensitive to outliers or departure from normality ( such as heavy-tailed error). Even a single outlier may drastically affect the OLS estimators. Therefore, robust regression estimation methods alternatives to the OLS estimation method have been developed to deal with outliers and/or heavy-tailed error distributions. In this paper, we will use the M regression estimation method (Huber (1964)) that will be briefly described in the following paragraph. One can see the books by Huber(1981) for the details of the robust regression estimation methods, including M estimation methods.

The widely used method of robust regression is the M-estimation introduced by Huber (1964,1973). Since, this class of estimators can be regarded as a generalization of maximum-likelihood estimation the term M estimation is used. The M estimation method is designed to minimize an objective function that is less rapidly increasing then the OLS objective function. This is done using a function that is less rapidly incising than the squared function. The M estimator for the regression parameter is obtained by minimizing the following objective function with respect to .

| (6) |

The function should be nonnegative, nondecreasing and . The M estimation method includes OLS, ML and Least absolute deviation (LAD) methods with the choice of , and , respectively. In this minimization problem, contribution of each observation to the sum is determined by the function in the sense that the observations with large residuals have small contributions to the sum. Consequently, since the outlying observation will have small contribution to the sum due to the function they will not drastically effect the resulting estimator. If is differentiable, differentiating (6) with respect to and setting to zero yields the following M estimation equation

| (7) |

where .

Note that in robust statistical analysis, the influence function is one way to measure the robustness of an estimator and it is desired to have a bounded influence function. In M estimation method the function determines the shape of the influence function. Therefore, if is nonincreasing (may be equal to zero beyond some threshold or tend to zero in larger values of its argument) the corresponding M estimator will have bounded influence function. In regression M estimation bounded function only controls the large residuals; that is, the estimator will be resistent to the outliers in y direction. To control the outliers in x-direction we have to use other robust estimation methods such as generalized M estimation or MM regression estimation methods. In this paper, we will only combine the regression M estimation with the EL method and save the others for our next project. In robust statistics literature several different functions are proposed, but Huber and Tukey (bisquare) functions are the widely used ones. The Huber and functions are

Similarly, The bisquare (Tukey) and functions are

Concerning the estimation of along with the following objective function can be minimized to obtain M estimators for and (see Huber and Ronchetti, 2009, Chapter 7.7).

| (8) |

Taking the derivative of this objective function and setting to zero yield the following M estimating equations for and

| (9) |

| (10) |

where . is added in order to get consistency of the scale estimator under normality assumption of the error and to get the classical OLS estimator for the scale when . Note that, since throughout this study we are only interested for estimating the regression parameters we can assume that is fixed. This can be done either by estimating beforehand or assuming that it is known, as it is suggested in the book by Maronna et al. (2006) (Chepters 4.4.1 and4.4.2.).

One can see the books Huber (2009) and Maronna (2006) for further details on M estimators for regression and its properties.

If we do not want to use OLS or robust methods or not want to assume any distribution for the error terms we can also use nonparametric methods as alternatives to these mentioned methods for estimation and inference in a linear regression model. One of these nonparametric methods is the EL method which was introduced by Owen(1988). This method is an alternative to likelihood method when there is no distribution assumption for error terms. In EL method, it is assumed that each observation has unknown probability weight for . The aim of the EL method is to estimate the regression parameters by maximizing an empirical likelihood function defined as the multiplication of these s’ , which is developed modifying nonparametric likelihood ratio function, under some constraints related to the parameters of interest. However, since the constraints used in EL method (see Section 2) are very similar to the normal equations in OLS or likelihood equations under normally distributed errors the corresponding estimators will be very sensitive to the non-normality or unusual observations (outliers) in data. In this paper, we will carry on EL estimation in regression using robust constraint borrowed from the robust estimation equations described in previous paragraph. Since, we will combine the M estimation methods with the EL method we expect that the resulting estimator for the regression parameters will be resistent to the outliers in y-direction. Simulation study and real data example results show that this expectation comes true.

Note that the reason we keep multiplication in all the objective functions and the estimating equations is to emphasize that each observation equally contributes () to the minimization procedure. In the EL method, which will be described in Section 2, this term will be replaced by an unknown probability corresponding to each observation. Therefore, in empirical likelihood procedure contribution of each observation will be different and this contributions (probabilities) need to be estimated.

The rest of the paper is organized as follows. In next section, after we briefly describe the EL method we will move on the EL estimation with robust constraint for linear regression models. In Section 3 we will provide a small simulation study and a real data example to illustrate the necessity of robust constraints in EL estimation. The paper is finalized with a conclusion section.

2 Empirical Likelihood Estimation for the Parameters of a Linear Regression Model with Robust Constraints

In this section, we will first outline the EL method with classical constraints. Then, we will move on our proposal that combines the EL estimation method with some robust constraints.

2.1 Empirical Likelihood Estimation

Consider the linear regression model given in equation (1) with the same assumptions given there. The EL estimators will be the solution of the the following constrained optimization problem. Specifically, if we are only interested for estimating the regression parameter the EL method maximizes the following empirical likelihood function

| (11) |

with respect to and under the following constraints

| (12) |

| (13) |

where are the probability weights of the observations. Note that the constraint given in equation (13) is very similar to the normal equation given in (3). The only difference is the unknown probability weights assigned for each observation. In former equation each observation has equal probability , but in later each observation has a different probability and these probabilities are unknown and need to be estimated. Further, if we are interested for estimating along with the regression parameters the following constraint, which is motivated form the equation (5), is added to constrained optimization problem defined above.

| (14) |

The empirical likelihood method can be used estimating parameters, constructing confidence regions, testing statistical hypothesis, etc. Briefly, it is a useful tool for making statistical inference when it is not too easy to assign a distribution to data. There are several remarkable studies on the EL method after it was introduced by Owen (1988, 1990, 1991). In these papers, Owen used the empirical likelihood for constructing confidence regions and estimating parameters of linear regression models. Hall and Scala (1990) studied on main features of the empirical likelihood, Kolaczyk (1994) adapted it in generalized linear regression model, Qin and Lawless (1994) combined general estimating equations and the empirical likelihood, Chen et. all (1993,1994 1996, 2003,2009) handled this method for constructing confidence regions, parameter estimation with additional constraints, Newey and Smith (2004) studied about properties of generalized methods of moments and generalized empirical likelihood estimators, Bondell and Stefanski (2013) suggested a robust estimator modified the generalized empirical likelihood. Recently, Ozdemir and Arslan (2017) have suggested an alternative algorithm to obtain EL estimates using the primal optimization problem. As we have already pointed out we are proposing to assign robust constraints to gain robustness.

The estimation of s and the model parameters and can be done by maximizing the function given in equation (11) under the constraints 12 and 13. For simplicity we assume that variance is known and consider only estimation of . Therefore, the EL function should be jointly maximized with respect to s and . One way to handle this constraint maximization problem is as follows. First, fix the regression parameter vector and consider maximizing the log-EL function with respect to under the constraints given above. This procedure is called as profiled out. Once this is done, the profile likelihood will be a function of . Then, we can maximize the profile likelihood to obtain the EL estimator of . This problem will be easily handled using Lagrange multiplier method. Therefore, setting the problem in Lagrangian form, the Lagrange function associated with this constrained maximization problem is

| (15) |

where are the vector of probabilities, and and are the Lagrange multipliers. Taking the derivatives of equation (15) with respect to each , and setting them to zero yields

| (16) |

and . By using equation (16) in the log-EL function we find

| (17) |

For a given the Lagrange multiplier will be obtained as the solution of the following minimization problem

| (18) |

Note that since this minimization problem will not have an explicit solution numerical methods should be used to find the minimizer. Now, using this in equation yields the following function

| (19) |

Then, this function will be maximized to obtain the EL estimator for the regression coefficient vector . That is the EL estimator of will be

| (20) |

Again, numerical algorithms will be required to handle this maximization problem. Note that one can see Owen(1989,2001)or Kitamura (2006) for further details about the computational issues of the EL method. In the following subsection we will use similar steps to maximize the EL function under robust constraints.

2.2 Empirical Likelihood Estimation with Robust Constraints

In this subsection we will turn our attention to the EL estimation using robust constraints instead of the classical constraints. In the EL method the unknown probabilistic weights are assigned for each observation so that each observation will have different contribution to the estimation procedure. In some sense, this can be considered as a weighting procedure of the normal equations in terms of probabilities for each observation. However, from our limited experience we observe that the probabilistic weights are not satisfactorily reduce the effect of outliers on the estimators. Therefore, extra care should be taken to reduce the outliers affect on estimation procedure. This can be done by adapting the M estimating equation given in previous section.

Suppose that we are interested for estimating the regression parameter . Then, we will maximize the following EL function

| (21) |

under the constraints

| (22) |

and

| (23) |

where The second constraint can be regarded as robust version of the classical constraint related to the regression parameters. Here, function is a nonincreasing function of the residuals for Huber case and a decreasing function of residuals for Tukey function. Thus, unusual observations with large residuals will receive small values so that the corresponding observations will not completely ruin the estimation procedure. Further, if we are also interested for estimating along with the regression parameters the simultaneous M estimating equations given in equations (9)-(10) can be adapted and used in the maximization problem instead of the classical constraints for and given in equations (13)and (14). The adaptation of those equations will be done using ’s instead of using . However, since in this paper we are only interested for the regression parameters we will solve the above maximization problem and not add a robust constraint for .

The robust EL estimator for will be defined as the value of that maximizes the log-EL function under the constraints given in equations (22) and (23). We will again use the maximization procedure described in previous subsection. In this case, the Lagrange function will be

| (24) |

Taking the derivatives of the Lagrange function with respect to , and , setting them to zero and solving the corresponding first order equations for this maximization problem yield

| (25) |

and . Then, using these s in the log-EL function we get the following objective function

| (26) |

which is the function of and . Further, for a given regression parameter vector the Lagrange multiplier can be obtained from the following minimization problem

| (27) |

Since, the solution of this minimization problem cannot be obtained explicitly, numerical algorithm should be used to get the solution. Using , the profile log-EL function will be

| (28) |

Then, the robust EL estimator for the regression parameter vector will be obtained as

| (29) |

Again, numerical algorithms are necessary to preform this maximization problem to obtain the robust EL estimates for the regression parameter vector .

3 Simulation Study

To evaluate the performance of the proposed robust EL estimation procedure, we conduct a small simulation study. We compare the classical EL method with the robust EL method (EL with robust constraints) to estimate the parameters of a linear regression model. We assume that the error variance is known and only deal with estimating the regression parameters. We take the sample sizes as and the dimensions of the unknown regression parameter vector as . The standard normal distribution () and the contaminated normal distribution () are used as the error distribution for the regression model. The second error distribution is chosen as to add some outliers in the data. The regressors are also generated from the standard normal distributions. The unknown parameter vectors are also determined randomly from a normal distribution with mean and variance . The dependent variable is generated using the regression model given in equation (1). The MSE values and the relative efficiency of estimators with respect to the OLS are calculated to compare the performance of the considered estimators. All the simulation scenarios are repeated 100 times. The relative efficiencies are calculated using the formula

where indicates the EL, EL-Hub, EL-Tukey, while symbolizes the OLS.

The simulation results are summarized in Tables 1-4. From these tables we observe that, without contamination all the estimators have similar performance with small MSE values for the dimensions 2 and 5. When the MSE values of the estimators are getting worse for all the cases compare to the smaller dimension cases, but even for this case the EL and robust EL estimators seem superior to the OLS estimators. Smaller behavior is observed from the table of relative efficiencies.

In Tables 3 and 4 we report the simulation results for the contaminated error distribution. That is, these are the simulation results for the outlier case. From these result we observe that when we introduce contamination the robust EL estimators have better performance compare to the classical EL and the OLS estimators in terms of the MSE values. Among the two robust estimators the Tukey case seems superior to the Huber case in terms of the MSE values. Again, when the dimension is large and the sample size is small all the estimators have large MSE values. However, compare to the classical ones the MSE values for the robust estimators are relatively small. Overall, from our limited simulation study we observe that for all the simulation settings considered in this study, the robust EL estimators have comparable performance in terms of MSE values. Therefore, robust constraints should be considered in case of potential outliers in the data set.

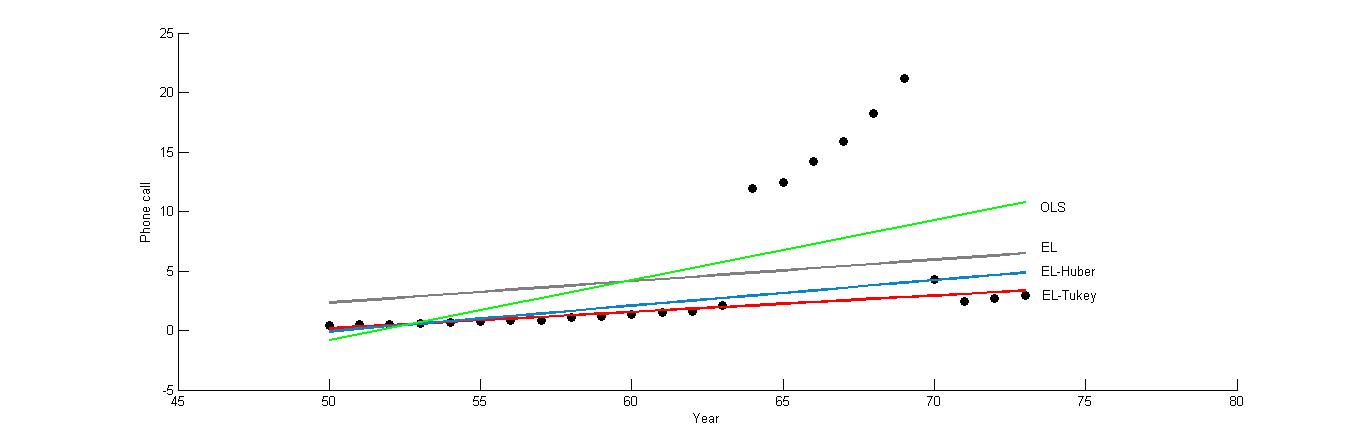

4 A real data example:International phone calls from Belgium

To illustrate proposed robust EL estimators we will use a data set that is a widely used in robust regression estimation literature to evaluate the performance of the robust estimation methods. The data set, which is taken from the book by Rousseeuw and Leory (1987), contains of the total number (in tens of millions) of international phone calls made over the years. Table 5 displays the data set. The scatter plot (Figure 1) of the data set shows an increasing trend over the years. However, it can be noticed that the data set is heavily contaminated and these points are the outliers in y-direction. Therefore, using classical methods such as OLS, will not provide adequate estimation. For instance, the fitted line obtained from the OLS method is highly affected from the contaminated points (Figure 1). Therefore, robust regression estimation methods have been used to get better fit to this data set. One can see Rousseeuw and Leory (1987) for further details and the results of the robust regression estimation methods.

Now we will turn our attention to the EL estimation for the regression parameters. If we apply classical and robust EL estimation methods considered in this paper we obtain the regression estimates provided in Table 6. This table also contains the OLS estimates. From this table we can see that unlike the OLS methods, the EL methods give closers fits that are obtained from the robust regression estimation methods. We further observe from Figure 1 that among the EL estimates the robust EL estimates obtained from the Tukey constraint gives the best fit to data avoiding contaminated points. The line obtained from these estimates fits the majority of the data points.

5 Conclusion

The EL method can be used instead of classical estimation like the OLS when there is no distribution assumption on error terms. The EL method maximizes a function of unknown probabilities corresponding to each observation under some constraints related to the unknown probabilities and the moments equations of the unknown parameters of interest. In the classical EL estimation for regression the constraints related to the parameters of interest are very similar to the normal equations in the OLS method. The only difference is: in OLS case we take average, however in EL case the constraints are a weighted form of normal equations obtained in the OLS method. Here, the weights are the unknown probabilities used in the EL function. However, it is well known that the OLS method and hence the corresponding equations have poor performance when there are some outliers in the data. Although, the observations in the constraints are weighted using the unknown probabilities, these weights are not satisfactory to deal with the outliers. Therefore, some extra care should be taken to reduce the affect of outliers on the estimation procedure. In this paper, we have considered the EL method with robustifyed constraints. The robustification has been done by using some weight functions borrowed from robust M estimation. We have provided a small simulation study and a real data example to demonstrate the capability of the robust EL method to handle unusual observations in the data. The simulation and the real data example results have showed that the robust constraints have plausible affect on the estimators when heavy tailedness and/or outliers are possible in the data.

References

-

[1]

Bondell, H. D. and Stefanski, L.A. 2013. Efficient Robust Regression via Two-Stage Generalized Empirical Likelihood, Journal of the American Statistical Association, 108:502, 644-655.

-

[2]

Chen, S.X. 1993. On the accuracy of empirical likelihood confidence regions for linear regression model. Ann. Inst. Statist. Math., 45, 621-637.

-

[3]

Chen, S.X. 1994. Empirical likelihood confidence intervals for linear regression coefficients.J. Multiv. Anal., 49, 24-40.

-

[4]

Chen, S.X. 1996. Empirical likelihood confidence intervals for nonparametric density estimation. Biometrika, 83, 329-341.

-

[5]

Chen, S.X. and Cui, H. 2003. An extended empirical likelihood for generalized linear models. Statist. Sinica, 13, 69-81.

-

[6]

Chen, S.X. and Keilegom, I. V. 2009. A review on empirical likelihood methods for regression. TEST, 19,3,415-447.

-

[7]

Hall, P. and La Scala, B. 1990. Methodology and algorithms of empirical likelihood. Internat. Statist. Review, 58, 109-127.

- [8] Hampel, F. R., Ronchetti, E. M., Rousseeuw, P. J. and Stahel, W. A. 1986. Robust Statistics:The Approach Based on Influence Functions. New York: Wiley.

-

[9]

Huber P.J. 1964. Robust estimation of a location parameter. The Annals of Mathematical Statistics, 35.1 , 73–101.

-

[10]

Huber P.J. 1973. Robust regression: asymptotics, conjectures and Monte Carlo. The Annals of Statistics , 799–821.

-

[11]

Huber P. and Ronchetti E. M. 2009.Robust Statistics. New York: Wiley.

-

[12]

Kitamura Y. 2006. Empirical likelihood methods in econometrics: Theory and practice. Available at: http://citeseerx.ist.psu.edu/viewdoc/download? doi=10.1.1.126.9883&rep=rep1&type=pdf

-

[13]

Kolaczyk, E.D. 1994. Empirical likelihood for generalized linear model. Statist. Sinica, 4, 199-218.

-

[N14]

Newey W. and Smith R.J. 2004. Higher-order properties of GMM and generalized empirical likelihood estimators. Econometrica, 72, 219–255.

-

[15]

Maronna, R.A., Martin, R.D. and Yohai, V.J. 2006.Robust Statistics: Theory and Methods. Wiley, New York.

-

[16]

Owen, A.B. 1988. Empirical likelihood ratio confidence intervals for a single functional. Biometrika, 75, 237-249.

-

[17]

Owen, A.B. 1990. Empirical likelihood confidence regions. Ann. Statist., 18, 90-120.

-

[18]

Owen, A.B. 1991. Empirical likelihood for linear models. Ann. Statist., 19, 1725-1747.

-

[19]

Owen, A. 2001. Empirical Likelihood. Chapman and Hall, New York.

-

[20]

Owen, A. 2013. Self-concordance for empirical likelihood. Canadian Journal of Statistics, 41(3), 387-397.

-

[21]

Ozdemir,S. and Arslan, O. 2017. An alternative algorithm of the empirical likelihood estimation for the parameter of a linear regression model. (submitted paper: May,2017 )

-

[22]

Rousseeuw, J. and Leroy, A.M. 1987. Robust regression and outlier Detection. New York: Wiley. p:26.

-

[23]

Qin, J. and Lawless, J. 1994. Empirical likelihood and general estimating equations. Ann. Statist., 22, 300-325.

| k | n | ||||

|---|---|---|---|---|---|

| 2 | 30 | 0,1032 | 0,1113 | 0,1089 | 0,0698 |

| 50 | 0,0965 | 0,1111 | 0,1119 | 0,0377 | |

| 100 | 0,0670 | 0,0688 | 0,0718 | 0,0207 | |

| 5 | 30 | 0,2126 | 0,2107 | 0,2090 | 0,2083 |

| 50 | 0,1323 | 0,1266 | 0,1283 | 0,1008 | |

| 100 | 0,1041 | 0,0996 | 0,1037 | 0,0605 | |

| 15 | 30 | 0,8651 | 0,8502 | 0,8643 | 1,1643 |

| 50 | 0,4201 | 0,4342 | 0,4310 | 0,4123 | |

| 100 | 0,2272 | 0,2214 | 0,2269 | 0,1724 |

| k | n | |||

|---|---|---|---|---|

| 2 | 30 | 1,4784 | 1,5941 | 1,5599 |

| 50 | 2,5622 | 2,9470 | 2,9695 | |

| 100 | 3,2329 | 3,3193 | 3,4628 | |

| 5 | 30 | 1,0203 | 1,0113 | 1,0032 |

| 50 | 1,3117 | 1,2557 | 1,2726 | |

| 100 | 1,7208 | 1,6469 | 1,7137 | |

| 15 | 30 | 0,7430 | 0,7302 | 0,7423 |

| 50 | 1,0190 | 1,0532 | 1,0455 | |

| 100 | 1,3175 | 1,2839 | 1,3165 |

| k | n | ||||

|---|---|---|---|---|---|

| 2 | 30 | 0.9490 | 0.7183 | 0.4338 | 1.4127 |

| 50 | 1.1896 | 0.6350 | 0.2023 | 1.3495 | |

| 100 | 0.9235 | 0.6128 | 0.2582 | 1.1596 | |

| 5 | 30 | 1.6607 | 0.9600 | 0.7361 | 3.4963 |

| 50 | 1.3957 | 1.0074 | 0.4344 | 2.0055 | |

| 100 | 1.1178 | 0.9644 | 0.4140 | 1.4192 | |

| 15 | 30 | 18.8479 | 12.7101 | 12.9962 | 48.4243 |

| 50 | 5.7769 | 2.1413 | 1.4580 | 20.1266 | |

| 100 | 4.2138 | 2.0062 | 1.1010 | 10.1531 |

| k | n | |||

|---|---|---|---|---|

| 2 | 30 | 0.6718 | 0.5085 | 0.3071 |

| 50 | 0.8815 | 0.4705 | 0.0343 | |

| 100 | 0.7964 | 0.5285 | 0.2227 | |

| 5 | 30 | 0.4750 | 0.2746 | 0.2105 |

| 50 | 0.6959 | 0.5023 | 0.2166 | |

| 100 | 0.7877 | 0.6796 | 0.2917 | |

| 15 | 30 | 0.3892 | 0.2625 | 0.2678 |

| 50 | 0.2870 | 0.1064 | 0.0724 | |

| 100 | 0.4138 | 2.1976 | 0.1084 |

| 50 | 0,44 | 58 | 1,06 | 66 | 14,2 |

| 51 | 0,47 | 59 | 1,2 | 67 | 15,9 |

| 52 | 0,47 | 60 | 1,35 | 68 | 18,2 |

| 53 | 0,59 | 61 | 1,49 | 69 | 21,2 |

| 54 | 0,66 | 62 | 1,61 | 70 | 4,3 |

| 55 | 0,73 | 63 | 2,12 | 71 | 2,4 |

| 56 | 0,81 | 64 | 11,9 | 72 | 2,7 |

| 57 | 0,88 | 65 | 12,4 | 73 | 2,9 |

aIn tens of millions.

| -6,7247 | -6,7254 | -10,8456 | -26,0059 | |

| 0,1809 | 0,1378 | 0,2152 | 0,5041 |