Testing Separability of Functional Time Series

Abstract

We derive and study a significance test for determining if a panel of functional time series is separable. In the context of this paper, separability means that the covariance structure factors into the product of two functions, one depending only on time and the other depending only on the coordinates of the panel. Separability is a property which can dramatically improve computational efficiency by substantially reducing model complexity. It is especially useful for functional data as it implies that the functional principal components are the same for each member of the panel. However such an assumption must be verified before proceeding with further inference. Our approach is based on functional norm differences and provides a test with well controlled size and high power. We establish our procedure quite generally, allowing one to test separability of autocovariances as well. In addition to an asymptotic justification, our methodology is validated by a simulation study. It is applied to functional panels of particulate pollution and stock market data.

1 Introduction

Suppose is a real–valued spatio–temporal random field, with the coordinate referring to space, and to time. The field is said to be separable if

where and are, respectively, spatial and temporal covariance functions. Separability is discussed in many textbooks, e.g [2015], Chapter 6. It has been extensively used in spatio–temporal statistics because it leads to theoretically tractable models and computationally feasible procedures; some recent references are [2011], [2011], [2012]. Before separability is assumed for the reasons noted above, it must be tested. Tests of separability are reviewed in Mitchell et al. (?, ?) and [2006].

Time series of weather or pollution related measurements obtained at spatial locations typically exhibit strong periodic patterns. An approach to accommodate this periodicity is to divide the time series of such type into segments, each segment corresponding to a natural period. For example, a periodic time series of maximum daily temperatures at some location can be viewed as a stationary time series of functions, with one function per year. If the measurements are available at many locations , this gives rise to a data structure of the form

where indexes year, and the day within a year. Time series of functions are discussed in several books, e.g. [2000], [2012], [2017], but research on spatial fields or panels of time series of functions is relatively new, e.g. [2016], Gromenko et al. (?, ?), [2016], [2017], [2017] and [2017]. Testing separability of spatio–temporal functional data of the above form is investigated in [2017], [2017] and [2017], under the assumption that the fields are independent. No tests are currently available for testing separability in the presence of temporal dependence across . In a broader setting, the data that motivate this research have the form of functional panels:

| (1.1) |

Each is a curve, and all curves are defined on the same time interval. The index typically stands for day, week, month or year. For instance, , can be the exchange rate (against the Euro or the US Dollar) of currency at minute of the th trading day, or can be the stock price of company at minute of the th trading day. Another extensively studied example is daily or monthly yield curves for a panel of countries, e.g. [Ang and Bekaert (2002)], [2008], [2012], [2017], among others. As for scalar data, the assumption of separability has numerous benefits including a simpler covariance structure, increased estimation accuracy, and faster computational times. In addition, in the contexts of functional time series, separability implies that the optimal functions used for temporal dimension reduction are the same for each member (coordinate) of the panel; information can then be pooled across the coordinates to get better estimates of these functions. We elaborate on this point in the following. However, if separability is incorrectly assumed, it leads to serious biases and misleading conclusions. A significance test, which accounts for the temporal dependence present in all examples listed above, is therefore called for. The derivation of such a test, and the examination of its properties, is the purpose of this work. Our procedure is also applicable to testing separability of the autocovariance at any lag. We will demonstrate that it works well in situations where the tests of [2017] and [2017] fail.

The remainder of the paper is organized as follows. In Section 2, we formulate the assumptions, the definitions, and the problem. In Section 3, we derive the test and provide the required asymptotic theory. Section 4 focuses on details of the implementation. In Section 5, we present results of a simulation study, and, finally, in Section 6 we apply our procedure to functional panels of Nitrogen Dioxide levels on the east coast of the United States and to US stock market data.

2 Assumptions and problem formulation

We assume that the in (1.1) form a strictly stationary functional time series of dimension . To simplify notation, we assume that all functions are defined on the unit interval (integrals without limits indicate integration over ). We assume that they are square integrable in the sense that Stationarity implies that the lagged covariance function can be expressed as

We aim to test the null hypothesis

| (2.1) |

for a fixed value of . The most important setting is when , i.e., testing separability of the covariance function, but other lags can be considered as well.

To derive the asymptotic distribution of our test statistic we impose a weak dependence condition on the . We use the concept of ––approximability introduced in [2010], see also Chapter 16 of [2012]. Suppose is a separable Hilbert space. Let and let be the space of –valued random elements such that

Definition 2.1.

The sequence, , is ––approximable if the following conditions hold:

-

1.

There exists a sequence of iid elements in an abstract measurable space such that

for a measurable function .

-

2.

For each integer , consider an approximating sequence defined by

where the sequences are copies of independent across and and independent of the original sequence . We assume that well approximates in the sense that

(2.2)

Condition 1 of Definition 2.1 implies that the sequence is strictly stationarity and ergodic. The essence of Condition 2 is that the dependence of on the innovations far in the past decays so fast that these innovations can be replaced by their independent copies. Such a replacement is asymptotically negligible in the sense quantified by (2.2). Similar conditions, which replace the more restrictive assumption of a linear moving average with summability conditions on its coefficients, have been used for at least a decade, see e.g. [2007] and references therein. We work with Definition 2.1 as it is satisfied by most time series models, including functional time series, and provides a number of desirable asymptotic properties including the central limit theorem, see Chapter 16 of [2012] and [2013a], among many other references. The conditions in Definition 2.1 cannot be verified, they are analogous to mixing or summability of cumulants conditions which have been imposed in theoretical time series analysis research. We therefore make the following assumption.

Assumption 2.1.

The form an ––approximable sequence in .

We use tensor notation analogous to [2017]. Let and denote two real separable Hilbert spaces with bases and , respectively. We define to be the tensor product Hilbert space. The tensors form a basis for . In other words, the tensor product Hilbert space can be obtained by completing of the set , under the following inner product:

In the context of our study and . Therefore the tensor product Hilbert space in our context is , where we omit for simplicity. Each is thus an element of a tensor space, formed by the tensor product between two real separable Hilbert spaces, . We denote by the space of Hilbert-Schmidt operators acting on . Note that is a basis for . The covariance operator between and , , is called separable if

| (2.3) |

where is a covariance operator over and is a covariance operator over . We define as a linear operator on satisfying

The covariance operator between and is in , i.e. it is an integral operator with the kernel . Relation (2.3) is then equivalent to stated as (2.1) above.

3 Derivation of the test and its asymptotic justification

To test hypothesis (2.3), we propose a statistic which quantifies the difference between and :

| (3.1) |

where are estimates defined below, and is the Hilbert-Schmidt norm. The statistic (3.1) is a normalized distance between the estimator valid under the restriction imposed by and a general unrestricted estimator. The term is an estimator of the product in (2.1) (the autocovariance under separability), whereas is an estimator of the unrestricted spatio–temporal autocovariance function . While is not difficult to define, it is not obvious how to define and . This section explains how we define the estimators in (3.1) and what their joint asymptotic distribution is. This will allow us to derive the asymptotic properties of .

The asymptotic null distribution involves the covariance operator of , which we denote by . Note that , i.e. it is an operator acting on . Therefore, it can be expanded using the basis functions of the form . In the context of (1.1), .

We now define the estimators appearing in (3.1) and obtain

their limiting behavior even in the case where is not separable.

A natural estimator for the general covariance, , is given by

where , and with , . Since centering by the sample mean is asymptotically negligible, we assume, without loss of generality and to ease the notation, that our data are centered, so the estimator takes the form

| (3.2) |

equivalently, the kernel of is

Under , with , and To obtain estimators for and , we utilize the trace and the partial trace operators. For any trace-class operator , see e.g. Section 13.5 of [2012] or Section 4.5 of [2015], its trace is defined by

where is an orthonormal basis. It is invariant with respect to the basis. The partial-trace operators are defined as

and

This means that and are bilinear forms that satisfy and . In general, the trace of any element of can be defined using proper basis expansions. More specifically, let be an orthonormal basis for and an orthonormal basis for . Then a basis for is given by . Let . Then, the trace of is defined by:

If , the partial-trace operators in terms of a basis are defined as

and

In the context of functional panels, let be an orthonormal basis for and an orthonormal basis for . Then a basis for is given by . Recall that the products , viewed as operators, form a basis for , that is a basis for the space of Hilbert-Schmidt operators acting on . Similarly is a basis for . Finally is a basis for . The basis expansion of is given by

Therefore its trace is given by

Under the assumption of separability, i.e. , the partial trace with respect to in terms of a basis is given by

and with respect to is given by

Under the assumption of separability, we define estimators of and as

| (3.3) |

where is an matrix and is a temporal covariance operator. The intuition behind the above estimators is that . Note that the decomposition is not unique since for any , however the product is.

To derive the asymptotic distribution of the test statistic defined in (3.1), we must first derive the joint asymptotic distribution of . A similar strategy was used in [2017]. However, there the observations were assumed to be independent and more traditional likelihood methods were used to derive the asymptotic distributions. Here, we take a different approach, instead using the CLT for , and then leveraging a Taylor expansion over Hilbert spaces to obtain the joint asymptotic distribution of . In this way, we are able to relax both the independence and Gaussian assumptions from [2017]. The result is provided in Theorem 3.1. Due to the temporal dependence, the covariance operator of the limit normal distribution is a suitably defined long–run covariance operator. It has a very complex, but explicit and computable, form, which is displayed in Supporting Information, where all theorems that follow are also proven.

Recall that we are interested in testing

In the following theorems notice that Theorem 3.1 and Theorem 3.2 hold without the assumption of separability, i.e. they hold under and under . These two theorems are used to establish the behavior of our test statistic under both the null, Theorem 3.3, and the alternative, Theorem 3.4. Under the alternative both and are still defined as partial traces of , it is just that their tensor product no longer recovers the original . Before we state our theoretical results, we mention the asymptotic distribution of , which is the key to proof Theorem 3.1. It follows from Theorem 3 of [2013a] that under Assumption 2.1,

where is given by

| (3.4) |

Here denotes the adjoint of . Since we have the asymptotic distribution of , and recalling that and are functions of from equation (3.3), we can use the Delta method to prove the following theorem, details of the proof of Theorem 3.1 are given in Section A of Supporting Information.

Theorem 3.1.

Armed with Theorem 3.1, we can derive the asymptotic distribution of .

Theorem 3.2.

As a corollary, we obtain the asymptotic distribution of under .

Corollary 3.1.

As noted above, in the context of (1.1), , i.e. it is a Hilbert-Schmidt operator acting on a space of Hilbert-Schmidt operators over . The following result is a direct consequence of Theorem 3.2. While the weighted chi–square expansion is standard, to compute the weights, the operator must be estimated, so must be estimated. Formula (A.6) defining is new and nontrivial.

Theorem 3.3.

To describe the behavior of the test statistic under the alternative, some specific form of the alternative must be assumed, as the violation of (2.3) can take many forms. A natural approach corresponding to a fixed alternative to , is to assume that

| (3.5) |

In our applications, , where and . Therefore, in practice, we must first project these random elements onto a truncated basis by using a dimension reduction procedure. Note that is already finite. However, if the number of coordinates in the panel is large, then a dimension reduction in is also recommended. Here we present the general case where we use dimension reduction in both and . The truncated basis is of the form with where and . In our implementation, the and the are the empirical principal components. We can approximate each by a random matrix , where , . Therefore, from now on, we work with observations in the form of random matrices defined as

where . Let be the truncated test statistic , i.e.

where is a matrix, is a matrix, is a fourth order array of dimension , and is the Frobenius norm, which is the Hilbert–Schmidt norm in finite dimensions. Finally, let be the truncated covariance operator , i.e. is the asymptotic covariance operator in the convergence

Note that is an array of order eight with finite dimensions, . More details are given in Remark A.2 in Supporting Information. As a finite array, it has only a finite number of eigenvalues, which with denote . The arguments leading to Theorem 3.3 show that under , as ,

| (3.6) |

where the are iid standard normal. The asymptotic argument needed to establish (3.6) relies on the bounds and , which hold under Assumption 2.1. It is similar to the technique used in the proof of Theorem 4 in [2017], so it is omitted.

4 Details of implementation

Recall that we assume that all functions have been rescaled so that their domain is the unit interval , and that they have mean zero. The testing procedure consists of dimension reduction in time and, for large panels, a further dimension reduction in coordinates. After reducing the dimension our ”observations” are of the form of matrices which are used to compute the estimators we need to perform our test. The remainder of this section explains the details in an algorithmic form. The reader will notice that most steps have obvious variants, for example, different weights and bandwidths can be used in Step 6. Procedure 4.1 describes the exact implementation used in Sections 5 and 6.

Procedure 4.1.

1. [Pool across to get estimated temporal FPCs.] Under the assumption of separability, i.e., under the stated in Section 2, the optimal functions used for temporal dimension reduction are the same for each member (coordinate) of the panel; information can then be pooled across the coordinates to get better estimates of these functions. In other words, under separability, we can use simultaneously all the functions to compute the temporal FPCs as the eigenfunctions of the covariance function

2. Approximate each curve by

where . Construct matrices defined as

where is chosen large enough so that the first FPCs

explain at least of the variance.

This is Functional Principal Components Analysis carried out on the

pooled (across coordinates) sample.

3. [Pool across time to get panel PCs.] Under the assumption of separability the panel principal components are the same for each time. In other words the panel PCs are the principal components of the following covariance matrix:

However, since we have already reduced the dimension of the observed functions, the panel PCs are the principal components of the covariance matrix

4. Approximate each row of the matrices by

Construct the matrices

, where is

chosen large enough so that the first eigenvalues explain at least

of the variance. This is a multivariate PCA on the pooled

(across time) variance adjusted sample.

If the number of panel coordinates is small, then a

multivariate dimension reduction is not necessary, so one can skip

steps and and use the matrices instead of the

matrices, and replace with in the following steps.

The dimension reduction steps

reduce the computational time and the memory requirements

by reducing the matrix size the 4D and 8D covariance tensors.

5. Approximate covariance (3.2) by the fourth order array of dimensions

Approximate and in (3.3) by

where is a matrix and

is a matrix.

6. Calculate the estimators , by using

| (4.1) | ||||

7. Calculate the estimator , by using the following Bartlett-type estimator:

| (4.2) |

where are defined in equation (4.1) and the are the Bartlett’s weights, i.e.,

with being the number of lags and is the bandwidth which is

assumed to be a function of the sample size, i.e., . In our

simulations, in Section 5, we use the formula

([2012, Chapter 16]).

Note that the estimators defined in steps 6 and 7 are the truncated analogs of the estimators , which can be obtained by simply changing with in equation (4.1).

8.

Estimate the arrays (the truncated analog

of ) and defined in Section 3.

Details are given in Remark A.2 in

Supporting Information.

9. Calculate the P–value using the limit distribution

specified in (3.6).

Step 2 can be easily implemented using R function pca.fd, and step 3 by using R function prcomp. The matrix can be computed using the R package tensorA by [2007].

5 A simulation study

The purpose of this section is to provide information on the performance of our test procedure in finite samples. We first comment on the performance of existing tests. [2017] derived several separability tests based on the assumption of independent . For the functional panels which exhibit temporal dependence (we define them below), the empirical sizes are close to zero; the tests of [2017] are too conservative to be usable, unless we have independent replications of the spatio–temporal structure. [2017] proposed three tests, also for independent . In the presence of temporal dependence, their tests are not useable either; they can severely overreject, the empirical size can approach 50% at the nominal level of 5%. We give some specific numbers at the end of this section.

For our empirical study, we simulate functional panels as the moving average process

which is a 1-dependent functional time series. Direct verification, shows that it is separable as long the are separable. We generate as Gaussian processes with the following covariance function, which is a modified version of Example 2 of [1999]:

| (5.1) |

In this covariance function, and are nonnegative scaling parameters of time and space, respectively, and is an overall scale parameter. The most important parameter is the separability parameter which takes values in . If , the covariance function is separable, otherwise it is not. We set , , . To simulate the functions, we use time points equally spaced on , and coordinates in the panel. The MA coefficients are taken as:

Notice that in the covariance above, the differences in the coordinates of the panel, i.e. , are rescaled to be within the interval , i.e. we use .

We set

We consider two different cases. The first one with dimension reduction only in time and the second one with dimension reduction in both time and coordinates. For each case, we study two different scenarios. The first scenario is under the null hypothesis (separability) and the second scenario under the alternative hypothesis. We consider different numbers of temporal FPCs, , in the first case and different numbers of coordinate PCs, , and temporal FPCs, , in the second case. We will also consider different values for the series length . All empirical rejection rates are based on one thousand replications, so their SD is about 0.7 percent for size (we use the nominal significance level of 5%), and about two percent for power.

5.1 Case 1: dimension reduction in time only

We examine the effect of the series length and the number of principal components on the empirical size (Table 1) and power (Table 2) for . Each table reports the rejection rates in percent. In parentheses, the proportion of variance explained by the PCs is given.

| 5.5 | 6.4 | 5.0 | 5.9 | 5.7 | 5.3 | 6.5 | 5.1 | 5.5 | |||

| (87%) | (90%) | (94%) | (85%) | (90%) | (92%) | (87%) | (90%) | (92%) | |||

| 5.6 | 5.9 | 5.3 | 6.2 | 5.3 | 4.7 | 5.6 | 6.2 | 5.1 | |||

| (85%) | (91%) | (93%) | (85%) | (91%) | (93%) | (86%) | (91%) | (92%) | |||

| 5.4 | 6.0 | 7.5 | 4.8 | 5.8 | 6.6 | 6.0 | 5.7 | 6.1 | |||

| (87%) | (89%) | (94%) | (86%) | (91%) | (94%) | (85%) | (89%) | (93%) | |||

| 67.6 | 90.6 | 95.1 | 91.9 | 99.3 | 99.8 | 98.2 | 100 | 100 | |||

| (86%) | (90%) | (94%) | (87%) | (90%) | (93%) | (87%) | (92%) | (94%) | |||

| 54.5 | 79.7 | 89.0 | 80.7 | 97.9 | 99.3 | 94.5 | 99.7 | 100 | |||

| (88%) | (91%) | (94%) | (85%) | (91%) | (94%) | (88%) | (92%) | (94%) | |||

| 45.2 | 74.9 | 85.2 | 75.1 | 96.8 | 98.7 | 91.5 | 99.9 | 100 | |||

| (89%) | (91%) | (94%) | (89%) | (92%) | (94%) | (88%) | (92%) | (94%) | |||

In Table 1, we can see that the size of our test is robust to the number of the principal components used. This is a very desirable property, as in all procedures of FDA there is some uncertainty about the optimal number of FPCs that should be used. While still within two standard errors of the nominal size, the empirical size becomes inflated for . We recommend dimension reduction in panel coordinates if . In Table 2, we see that the empirical power increases as and increase. The power increase with is expected; its increase with reflects the fact that projections on larger subspaces better capture a departure from . However, cannot be chosen too large so as not to increase the dimensionality of the problem, which negatively affects the empirical size.

5.2 Case 2: dimension reduction in both time and panel coordinates

The general setting is the same as in Section 5.1, but we consider larger panels, , and reduce their dimension to coordinates. The proportion of variance explained is now computed as

| (5.2) |

where the , and are, respectively, the estimated eigenvalues of the time and panel PCA’s.

| 6.4 | 6.2 | 6.1 | 6.1 | 5.2 | 4.3 | 5.8 | 5.5 | 5.6 | ||||

| (80%) | (84%) | (90%) | (80%) | (85%) | (88%) | (80%) | (84%) | (88%) | ||||

| 6.1 | 4.8 | 5.6 | 5.0 | 5.5 | 4.7 | 5.3 | 6.1 | 5.0 | ||||

| (84%) | (88%) | (94%) | (83%) | (89%) | (92%) | (85%) | (89%) | (92%) | ||||

| 5.9 | 6.3 | 4.7 | 5.2 | 5.8 | 5.3 | 6.1 | 6.1 | 5.8 | ||||

| (84%) | (90%) | (92%) | (85%) | (90%) | (92%) | (84%) | (90%) | (92%) | ||||

| 6.3 | 6.4 | 6.1 | 5.6 | 6.0 | 6.2 | 4.6 | 6.3 | 6.4 | ||||

| (83%) | (88%) | (90%) | (83%) | (86%) | (89%) | (80%) | (87%) | (88%) | ||||

| 6.1 | 5.9 | 5.1 | 5.0 | 5.6 | 6.0 | 6.1 | 4.8 | 6.1 | ||||

| (87%) | (91%) | (93%) | (87%) | (90%) | (92%) | (85%) | (90%) | (93%) | ||||

| 6.0 | 5.4 | 5.0 | 6.3 | 6.1 | 6.0 | 5.0 | 6.5 | 5.7 | ||||

| (87%) | (91%) | (93%) | (85%) | (90%) | (93%) | (86%) | (90%) | (93%) | ||||

| 6.4 | 5.2 | 4.5 | 6.2 | 5.8 | 5.0 | 5.6 | 6.6 | 5.3 | ||||

| (82%) | (87%) | (89%) | (82%) | (87%) | (88%) | (82%) | (86%) | (89%) | ||||

| 6.0 | 5.2 | 4.7 | 4.4 | 6.2 | 6.0 | 4.2 | 5.6 | 6.2 | ||||

| (85%) | (90%) | (92%) | (83%) | (88%) | (92%) | (84%) | (90%) | (93%) | ||||

| 6.0 | 5.1 | 4.6 | 6.3 | 5.5 | 5.7 | 6.5 | 5.7 | 5.6 | ||||

| (85%) | (90%) | (93%) | (86%) | (90%) | (93%) | (87%) | (89%) | (91%) | ||||

| 31.3 | 49.2 | 60.8 | 50.5 | 78.0 | 85.9 | 67.3 | 92.4 | 96.4 | ||||

| (85%) | (85%) | (83%) | (81%) | (85%) | (84%) | (81%) | (82%) | (84%) | ||||

| 43.0 | 73.3 | 81.7 | 72.3 | 95.2 | 98.2 | 90.6 | 99.5 | 100 | ||||

| (87%) | (90%) | (93%) | (85%) | (91%) | (93%) | (86%) | (91%) | (93%) | ||||

| 42.2 | 73.5 | 84.7 | 71.1 | 96.6 | 98.5 | 90.6 | 99.8 | 100 | ||||

| (85%) | (92%) | (93%) | (87%) | (92%) | (94%) | (88%) | (90%) | (92%) | ||||

| 30.8 | 49.7 | 57.4 | 46.6 | 76.5 | 87.2 | 67.7 | 91.8 | 95.7 | ||||

| (82%) | (83%) | (85%) | (81%) | (83%) | (84%) | (82%) | (83%) | (86%) | ||||

| 42.9 | 72.5 | 82.8 | 67.1 | 94.8 | 98.8 | 89.5 | 99.5 | 99.9 | ||||

| (89%) | (91%) | (94%) | (88%) | (92%) | (93%) | (87%) | (93%) | (93%) | ||||

| 43.3 | 72.0 | 82.9 | 71.1 | 95.9 | 97.8 | 89.0 | 99.6 | 100 | ||||

| (87%) | (92%) | (94%) | (86%) | (92%) | (94%) | (86%) | (91%) | (93%) | ||||

| 27.7 | 46.2 | 55.0 | 47.7 | 74.9 | 82.8 | 69.0 | 90.6 | 94.0 | ||||

| (86%) | (84%) | (84%) | (82%) | (83%) | (84%) | (81%) | (84%) | (87%) | ||||

| 39.2 | 66.6 | 81.3 | 67.5 | 91.0 | 93.4 | 88.1 | 94.4 | 94.1 | ||||

| (87%) | (92%) | (93%) | (89%) | (91%) | (93%) | (88%) | (90%) | (93%) | ||||

| 43.7 | 70.4 | 78.9 | 70.5 | 91.1 | 93.7 | 88.2 | 94.4 | 95.7 | ||||

| (87%) | (92%) | (94%) | (88%) | (91%) | (94%) | (88%) | (93%) | (94%) | ||||

Tables 3 and 4 show that the reduction of the panel dimension does not negatively affect the properties of the tests. The conclusions are the same as in Section 5.1. Either approach leads to a test with well controlled size, which is does not depend on () as long the the proportion of explained variance remains within the generally recommended range of 85%–95%. If or are used, this requirement is generally not met, resulting in a size distortion, which is however acceptable and decreases with .

As noted at the beginning of this section, the tests of [2017] are too conservative, they almost never reject under the null for all scenarios considered in this section. The tests of [2017] reject too often under the null. For example, in the settings considered in Table 3, the rejection rates for their asymptotic test, Gaussian parametric bootstrap test, and Gaussian parametric bootstrap test using Hilbert–Schmidt distance, range between , and , respectively. By contrast, the test derived in this paper, in its both versions and under all reasonable choices of tuning parameters, has precise empirical size at the standard 5% nominal level and useful power.

In Section B of Supporting Information, we show the results of other simulations which study the effect of different covariance functions, the magnitude of the departure from , and the lag . They do not modify the general conclusion that the test is reasonably well calibrated and has useful power.

6 Applications to pollution and stock market data

We begin by applying our method to air quality data studied by [2017] under the assumption that the monthly curves are iid. These curves however form a time series, so it is important to check if a test that accounts for the temporal dependence leads to the same or a different conclusion.

The Environmental Protection Agency (EPA) collects massive amounts of air quality data which are available through its website http://www3.epa.gov/airdata/ad_data_daily.html. The records consist of data for common pollutants, collected by outdoor monitors in hundreds of locations across the United States. The number and frequency of the observations varies greatly by location, but some locations have as many as 3 decades worth of daily measurements. We focus on nitrogen dioxide, a common pollutant emitted by combustion engines and power stations.

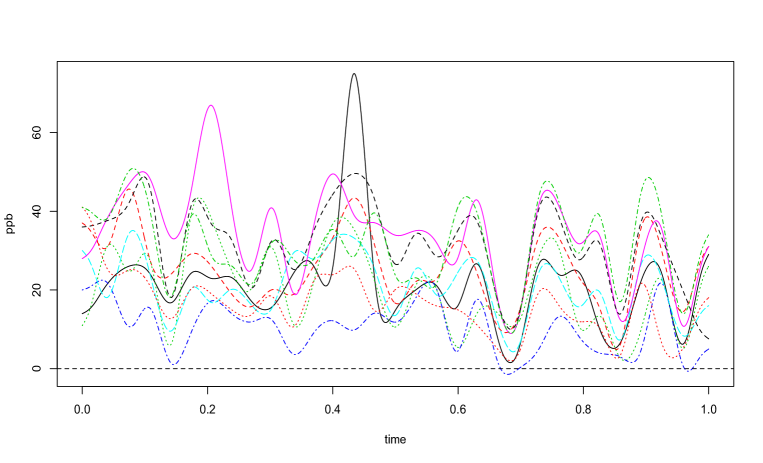

We consider nine locations along the east coast that have relatively complete records since 2000: Allentown, Baltimore, Boston, Harrisburg, Lancaster, New York City, Philadelphia, Pittsburgh, and Washington D.C. We use the data for the years 2000-2012 . Each functional observation consists of the daily maximum one-hour nitrogen dioxide concentration measured in ppb (parts per billion) for day , month (), and at location . We thus have a panel of functional time series (one at every location), . Figure 1 shows the data for the nine locations for December 2012. Before the application of the test, the curves were deseasonalized by removing the monthly mean from each curve.

We applied both versions of Procedure 4.1 (dimension in time only and double dimension reduction). Requiring 85% to 95% of explained variance yielded the values , similarly as in our simulated data example. For all possible combinations, we obtained P–values smaller than 10E-4. This indicates a nonseparable covariance function and confirms the conclusion obtained by [2017]; nonseparability is an intrinsic feature of pollution data, simplifying the covariance structure by assuming separability may lead to incorrect conclusions.

We now turn to an application to a stock portfolio. Cumulative intradaily returns have recently been studied in several papers, including [2013b], [2015] and [2015]. If is the price of a stock at minute of the trading day , then the cumulative intraday return curve on day is defined by

where time corresponds to the opening of the market (9:30 EST for the NYSE). [2014] did not find evidence against temporal stationarity of such time series. The work of [2013b] shows that cumulative intradaily returns do not form an iid sequence. (This can be readily verified by computing the ACF of squared scores.) Figure 2 shows the curves for ten companies on April 2nd. 2007. This portfolio of stocks produces a panel of functional time series studied in this paper. We selected ten US blue chip companies, and want to determine if the resulting panel can be assumed to have a separable covariance function. The answer is yes, as we now explain.

We consider stock values, recorded every minute, from October 10, 2001 to April 2, 2007 (1,378 trading days) for the following 10 companies: Bank of America (BOA), Citi Bank, Coca Cola, Chevron Corporation (CVX), Walt Disney Company (DIS), International Business Machines (IBM), McDonald’s Corporation (MCD), Microsoft Corporation (MSFT), Walmart Stores (WMT) and Exxon Mobil Corporation Common (XOM). On each trading day, there are 390 discrete observations. There is an outlier on August 26, 2004 for Bank of America, which is due to a stock split. That day is discarded from further analysis, so the sample size is .

We now discuss the results of applying Procedure 4.1. Using dimension reduction in time only, we obtained P-values 0.234 for (CPV = 92%) and 0.220 for (CPV= 95%). Using the double dimension reduction, we obtained the following values:

| P–value | CPV | |

|---|---|---|

| 0.272 | 45% | |

| 0.217 | 62% | |

| 0.224 | 67% | |

| 0.223 | 80% | |

| 0.221 | 85% |

These remarkably similar P-values indicate that panels of cumulative intraday return curves can in some cases be assumed to have a separable covariance function. This could be useful for portfolio managers as it indicates that they can exploit separability of the data for more efficient modeling.

We conclude by noting that in practice it is important to ensure that the time series forming the panel are at comparable scales. This has been the case in our data examples, and will be the case if the series are measurements of the same quantity and are generated as a single group. If some of the series are much more variable than the others, they may bias the test, and should perhaps be considered separately.

ACKNOWLEDGMENTS

This research has been partially supported by the United States National Science Foundation grants at Colorado State University and Penn State University.

SUPPORTING INFORMATION

Additional Supporting Information may be found online in the supporting information tab for this article.

References

- Ang and Bekaert (2002) Ang, A. and Bekaert, G. (?). Regime switches in interest rates. Journal of Business and Economic Statistics, 20, 163–182.

- 2017 Aston, J. A. D., Pigoli, D. and Tavakoli, S. (?). Tests for separability in nonparametric covariance operators of random surfaces. The Annals of Statistics, 45, 1431–1461.

- 2017 Bagchi, P. and Dette, H. (?). A test for separability in covariance operators of random surfaces. Technical Report. Ruhr-Universität Bochum. arXiv:1710.08388.

- 2000 Bosq, D. (?). Linear Processes in Function Spaces. Springer, New York.

- 2008 Bowsher, C. G. and Meeks, R. (?). The dynamics of economic functions: Modeling and forecasting the yield curve. Journal of the American Statistical Association, 103, 1419–1437.

- 2017 Constantinou, P., Kokoszka, P. and Reimherr, M. (?). Testing separability of space-time functional processes. Biometrika, 104, 425–437.

- 1999 Cressie, N. A. C. and Huang, H-C. (?). Classes of nonseparable, spatio–temporal stationary covariance functions. Journal of the American Statistical Association, 94, 1330–1339.

- 2015 Cressie, N. A. C. and Wikle, C. K. (?). Statistics for Spatio-Temporal Data. John Wiley & Sons, Hoboken.

- 2016 French, J., Kokoszka, P., Stoev, S. and Hall, L. (?). Quantifying the risk of extreme heat waves over North America using climate model forecasts. Technical Report. Colorado State University.

- 2006 Fuentes, M. (?). Testing for separability of spatial–temporal covariance functions. Journal of Statistical Planning and Inference, 136, 447–466.

- 2016 Gromenko, O., Kokoszka, P. and Reimherr, M. (?). Detection of change in the spatiotemporal mean function. Journal of the Royal Statistical Society: Series B (Statistical Methodology), 79, 29–50.

- 2017 Gromenko, O., Kokoszka, P. and Sojka, J. (?). Evaluation of the cooling trend in the ionosphere using functional regression with incomplete curves. The Annals of Applied Statistics, 11, 898–918.

- 2012 Hays, S., Shen, H. and Huang, J. Z. (?). Functional dynamic factor models with application to yield curve forecasting. The Annals of Applied Statistics, 6, 870–894.

- 2011 Hoff, P. D. (?). Separable covariance arrays via the Tucker product, with applications to multivariate relational data. Bayesian Analysis, 6, 179–196.

- 2010 Hörmann, S. and Kokoszka, P. (?). Weakly dependent functional data. The Annals of Statistics, 38, 1845–1884.

- 2012 Horváth, L. and Kokoszka, P. (?). Inference for Functional Data with Applications. Springer, New York.

- 2014 Horváth, L., Kokoszka, P. and Rice, G. (?). Testing stationarity of functional time series. Journal of Econometrics, 179, 66–82.

- 2015 Hsing, T. and Eubank, R. (?). Theoretical Foundations of Functional Data Analysis, with an Introduction to Linear Operators. John Wiley & Sons, Hoboken.

- 2015 Kokoszka, P., Miao, H. and Zhang, X. (?). Functional dynamic factor model for intraday price curves. Journal of Financial Econometrics, 13, 456–477.

- 2013a Kokoszka, P. and Reimherr, M. (?). Asymptotic normality of the principal components of functional time series. Stochastic Processes and their Applications, 123, 1546–1562.

- 2013b Kokoszka, P. and Reimherr, M. (?). Predictability of shapes of intraday price curves. The Econometrics Journal, 16, 285–308.

- 2017 Kokoszka, P. and Reimherr, M. (?). Introduction to Functional Data Analysis. CRC Press, Boca Raton.

- 2016 Kokoszka, P., Reimherr, M. and Wölfing, N. (?). A randomness test for functional panels. Journal of Multivariate Analysis, 151, 37–53.

- 2017 Kowal, D. R., Matteson, D. S. and Ruppert, D. (?). A Bayesian multivariate functional dynamic linear model. Journal of the American Statistical Association, 112, 733–744.

- 2017 Liu, C., Ray, S. and Hooker, G. (?). Functional principal components analysis of spatially correlated data. Statistics and Computing, 27, 1639–1654.

- 2015 Lucca, D. O. and Moench, E. (?). The pre-FOMC announcement drift. The Journal of Finance, 70, 329–371.

- 2005 Mitchell, M. W., Genton, M. G. and Gumpertz, M. L. (?). Testing for separability of space–time covariances. Environmetrics, 16, 819–831.

- 2006 Mitchell, M. W., Genton, M. G. and Gumpertz, M. L. (?). A likelihood ratio test for separability of covariances. Journal of Multivariate Analysis, 97, 1025–1043.

- 2011 Paul, D. and Peng, J. (?). Principal components analysis for sparsely observed correlated functional data using a kernel smoothing approach. Electronic Journal of Statistics, 5, 1960–2003.

- 2017 Shang, H. L. and Hyndman, R. J. (?). Grouped functional time series forecasting: An application to age-specific mortality rates. Journal of Computational and Graphical Statistics, 26, 330–343.

- 2007 Shao, X. and Wu, W. B. (?). Asymptotic spectral theory for nonlinear time series. The Annals of Statistics, 35, 1773–1801.

- 2012 Sun, Y., Li, B. and Genton, M.G. (?). Geostatistics for large datasets. In Advances and Challenges in Space-time Modelling of Natural Events, Berlin (eds E. Porcu, J.M. Montero and M. Schlather), chapter 3, pp. 55–77. Springer.

- 2017 Tupper, L. L., Matteson, D. S., Anderson, C. L. and Zephyr, L. (?). Band depth clustering for nonstationary time series and wind speed behavior. Technometrics; Published online: 06 Dec 2017.

- 2007 van den Boogaart, K. G. (?). tensorA: Advanced tensors arithmetic with named indices. R package version 0.31, URL http://CRAN. R-project. org/package= tensorA.

Supporting Information

Appendix A Proofs of the results of Section 3

In [2017], the asymptotic distributions of the test statistics were derived under the assumption of independent and identically distributed Gaussian data so that maximum likelihood estimators could be used to estimate the covariance and its separable analog. However, here we make no normality assumptions and we allow the sequence to be weakly dependent across , thus entirely different proof techniques are employed. In particular, we utilize multiple stochastic Taylor expansions to leverage the asymptotic normality of to derive the joint asymptotic distribution of as well as the asymptotic behavior of our test statistics under both the null and alternative hypotheses. These arguments become quite technical due to the fact that we are deriving asymptotic distributions of random operators.

Proof of Theorem 3.1

The starting point is the asymptotic distribution of . It follows from Theorem 3 of [2013a] that under Assumption 2.1,

| (A.1) |

where is given by

Here denotes the adjoint of . The operator is a Hilbert-Schmidt operator acting on the space of Hilbert-Schmidt operators over . Since we have the asymptotic distribution of , in the following steps we use a one term Taylor expansion of the partial trace operators to find the joint asymptotic distribution of . Consider the operator:

So is an element of the Cartesian product space with , , . We will apply at Taylor expansion to about the true parameter value . To do this, we require the Fréchet derivative of which can be computed coordinate-wise as

Here denotes the Fréchet derivative of with respect to . Since is an operator, this means its derivative is a linear operator acting on the space of operators. Our goal is to use a Taylor expansion for Hilbert spaces to obtain the joint asymptotic distribution of . We approximate by:

where the last term is because . In terms of the cartesian product form, this is equivalent to:

We therefore have that the variance operator of is asymptotically given by

| (A.2) | ||||

where denotes the adjoint operator. We stress again that each term written above is a linear operator, and thus is actually a composition () of three linear operators. This implies that the joint asymptotic distribution of is given by:

To complete the proof we need to find the Fréchet derivatives. This turns out to be easier if we work with a basis for the Hilbert spaces. For example, the actions of a continuous linear operator are completely determined by its actions on individual basis elements. Let be a basis for and a basis for . Then a basis for is given by . Since is a compact operator, we can express it as

where and . Similarly we have that

and

These forms will be useful as we will be able to determine derivatives by taking derivatives with respect to the basis coordinate system. In the following, is the usual Kronecker delta. We begin with as it is simpler than . Note that, by definition we have

that is, we take the trace over the coordinates. So we have hat is a linear mapping from . If we take the derivative of this expression with respect to , then we get that

If , then does not appear in the expression for and thus the derivative would be zero. So we have that

| (A.3) |

where again, this is interpreted as a linear operator from . Note that the above operator is nearly the identity, e.g. , but returns 0 for the off-diagonal coordinates. We denote this operator as

The partial derivative of with respect to is a bit more complicated as it is a nonlinear function of . We can express as

Again, taking the derivative with respect to the coordinate, we get that

Therefore we have that

| (A.4) |

Finally, the partial derivative of with respect to , i.e., the partial derivative of with respect to is simply the identity, therefore

| (A.5) |

By (A.1), (A.2), (A.4), (A.3), and (A.5), we obtain

where is given by

| (A.6) |

Remark A.1.

The operator has the following block structure form:

where

The operator is the covariance operator of and , is the covariance between and and , is the covariance between and and , is the covariance between and and , is the covariance operator of and , is the covariance between and and , is the covariance between and and , is the covariance between and and and finally is the covariance operator of and .

Proof of Theorem 3.2

Since we have the joint asymptotic distribution of , we can use the delta method again to find the asymptotic distribution of and in particular, we can find the form of , the asymptotic covariance of . Consider the function . Using a one term Taylor expansion we have that

or equivalently

which implies that the variance of is approximately:

and therefore the delta method implies that the asymptotic distribution of is given by:

To complete the proof we need to find the partial derivatives. Taking the derivative with respect to yields

with respect to

and with respect to

where and are the fourth and eighth order identity tensors. Therefore by using the above partial derivatives we obtain the desired asymptotic distribution which is:

where is given by:

| (A.7) |

Remark A.2.

Here we provide more details on how and are actually computed in practice. Recall that is a array, is a matrix, and is a matrix. Also is a array, and can be computed as described in Procedure 4.1. To find we need to find first the array analogs of , , , which we denote by , , . is a array with entries , that is, it’s an array with entries zeros and ones. is a array with entries , which is the eighth order identity array. Finally, is a array. To find the entries of we first have to calculate and . is a array with entries , that is, it’s an array with entries zeros and ones. is a identity array, that is an array with entries . Then, we need to find , which is a matrix with entries and the scalar . Combining , , and we can compute by:

where the tensor product can be easily implemented by using the R package ”tensorA” by [2007].

Since we have , , we can compute . Note that has a block structure of the following form:

| (A.8) |

where

is the variance–covariance array of with dimensions , is the covariance between and with dimensions , is the covariance between and with dimensions , is the covariance between and with dimensions , is the variance–covariance array of with dimensions , is the covariance between and with dimensions , is the covariance between and with dimensions , is the covariance between and with dimensions and finally is the variance–covariance of which is .

To compute we need to find the array analogs of the derivatives , and , which we denote by , and . First, notice that . is array, which can be computed by the tensor product between the identity array of dimensions and . Similarly, is array, which can be computed by the tensor product between and the identity array of dimensions .

Since we have , and we can compute . Note that has the following form:

| (A.9) |

where

where and , i=1,…,9, are arrays.

Proof of Theorem 3.4

Proof.

Let . Then we can write

and the claim follows. ∎

Appendix B Additional simulations

In addition to the simulation results presented in Section 5, we consider here different values of the parameter , i.e. the parameter in the covariance function that controls separability. For this scenario, we use , , and . The results are given in Table 5.

| 4.8 | 5.5 | 6.1 | |

| 88% | 89% | 89% | |

| 6.2 | 8.1 | 10.8 | |

| 89% | 90% | 91% | |

| 14.9 | 26.4 | 35.6 | |

| 90% | 91% | 90% | |

| 41.6 | 67.8 | 87.4 | |

| 90% | 91% | 92% | |

| 73.3 | 95.2 | 99.5 | |

| 90% | 91% | 91% |

To supplement the results for the covariance function (5.1), we consider here the following covariance function

| (B.1) |

which is a smoother version of the covariance function (5.1); is replaced by . As a demonstration, we set , , . As in Section 5, we simulate the functions at time points, equally spaced on , and coordinates in the panel. We consider only the case with dimension reduction in both time and coordinates, under the null and alternative hypothesis. The results are shown in Tables 6 and 7.

| 6.5 | 6.2 | 5.8 | 5.7 | 7.5 | 5.5 | 6.0 | 7.1 | 6.8 | ||||

| (91%) | (93%) | (95%) | (93%) | (94%) | (95%) | (93%) | (94%) | (95%) | ||||

| 6.6 | 4.7 | 7.0 | 7.4 | 6.2 | 5.5 | 7.3 | 5.9 | 5.8 | ||||

| (97%) | (99%) | (99%) | (97%) | (99%) | (99%) | (97%) | (99%) | (99%) | ||||

| 6.2 | 6.0 | 5.8 | 7.6 | 6.9 | 6.6 | 5.4 | 5.8 | 5.4 | ||||

| (96%) | (99%) | (99%) | (97%) | (99%) | (99%) | (97%) | (99%) | (99%) | ||||

| 29.8 | 33.9 | 17.7 | 38.7 | 54.5 | 30.1 | 62.4 | 73.2 | 35.1 | ||||

| (88%) | (85%) | (83%) | (90%) | (85%) | (84%) | (87%) | (85%) | (78%) | ||||

| 39.0 | 63.2 | 64.8 | 65.0 | 90.5 | 91.2 | 84.3 | 98.3 | 99.4 | ||||

| (97%) | (98%) | (97%) | (97%) | (98%) | (97%) | (96%) | (98%) | (96%) | ||||

| 37.8 | 63.8 | 65.4 | 67.7 | 89.7 | 93.6 | 87.5 | 98.2 | 99.8 | ||||

| (97%) | (99%) | (99%) | (98%) | (99%) | (99%) | (98%) | (99%) | (99%) | ||||

Finally, we check the performance of our test when . For this case, we simulate functional panels as the moving average process

which is a 1-dependent functional time series. We generate as Gaussian processes with the following covariance function:

| (B.2) |

Clearly is the separability parameter, which takes values in . When , we have a separable covariance. We set for our simulations.

For comparison, we add the simulations for by using the covariance function B.2. For the test tends to be conservative, while for it overrejects. Consequently, the power is higher for .

| 3.5 | 1.8 | 1.5 | 4.0 | 2.5 | 2.5 | 5.4 | 4.4 | 4.2 | |||

| (94%) | (99%) | (100%) | (94%) | (99%) | (100%) | (95%) | (99%) | (100%) | |||

| 85.6 | 89.5 | 89.5 | 99.4 | 99.8 | 99.8 | 100 | 100 | 100 | |||

| (94%) | (99%) | (100%) | (94%) | (99%) | (100%) | (94%) | (99%) | (100%) | |||

| 6.5 | 6.2 | 6.2 | 5.4 | 5.5 | 5.3 | 6.4 | 5.5 | 5.7 | |||

| (94%) | (99%) | (100%) | (94%) | (99%) | (100%) | (95%) | (99%) | (100%) | |||

| 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | 100 | |||

| (94%) | (99%) | (100%) | (94%) | (99%) | (100%) | (94%) | (99%) | (100%) | |||