Oracle inequalities for sign constrained generalized linear models

Abstract

High-dimensional data have recently been analyzed because of data collection technology evolution. Although many methods have been developed to gain sparse recovery in the past two decades, most of these methods require selection of tuning parameters. As a consequence of this feature, results obtained with these methods heavily depend on the tuning. In this paper we study the theoretical properties of sign-constrained generalized linear models with convex loss function, which is one of the sparse regression methods without tuning parameters. Recent studies on this topic have shown that, in the case of linear regression, sign-constrains alone could be as efficient as the oracle method if the design matrix enjoys a suitable assumption in addition to a traditional compatibility condition. We generalize this kind of result to a much more general model which encompasses the logistic and quantile regressions. We also perform some numerical experiments to confirm theoretical findings obtained in this paper.

Keywords: High-dimensions; Oracle inequality; Sign-constraints; Sparsity.

1 Introduction

Because of data collection technology evolution in recent years, it attracts considerable attentions to analyze high-dimensional data characterized by a large number of explanatory variables as compared to the sample size in many areas such as microarray analysis, text mining, visual recognition and finance. When one analyzes such high-dimensional data, the key structural property exploited is the sparsity or the near sparsity of the regressors. The sparsity assumption, that is a few among huge number of variables only are relevant to response variables, appears realistic for high-dimensional data analysis. This assumption helps us to find crucial variables or reduce noisy irrelevant variables for particular phenomena.

To construct a sparse estimator with high-dimensional regression, regularization typically plays a crucial role. So far, many regularization-based sparse regression methods are proposed, e.g. Lasso [19], group Lasso [27], adaptive Lasso [29], square-root Lasso [1], SCAD [7], MCP [28], Bridge regression [8] and so on. Among these methods, the Lasso is the most famous one. The Lasso estimator for linear regression is given by the following equation:

| (1.1) |

where is the response variable, is the design matrix and is the number of explanatory variables. By adding the penalty term , where is a tuning parameter, to ordinary least square regression, one can get a sparse estimator for . Although the Lasso has some statistically good properties, these properties depend on the tuning parameter . A typical way of choosing the tuning parameter is cross-validation, but it takes much computational cost.111To avoid such a computational burden, some authors have developed analytical methods for choosing the tuning parameter such as using an information criterion; see [15, 20] and references therein for details. In addition, the estimation results may depend heavily on the choice of the tuning parameter .

Sign-constraints on the regression coefficients are a simpler constraint-based regression method. Basically, sign-constraints on the regression coefficients are studied in the context of linear least squares, which is referred to as non-negative least squares (NNLS) in the literature. We also remark that such a sign-constraint canonically appears in many fields; see e.g. the Introduction of [18] and references therein. The NNLS estimator is obtained as a solution of the following optimization problem:

| (1.2) |

Unlike many regularization-based sparse regression methods, there is no tuning parameter in equation (1.2). An early reference of NNLS is Lawson and Hanson [11]. Lawson and Hanson [11] define the NNLS problem as equation (1.2) and give a solution algorithm for NNLS. Rather recently, NNLS in the noiseless setting like [11] is studied by many authors such as [3, 6, 25, 26]. These authors have studied the uniqueness of the solution of equation (1.2) under some conditions. What is important in our context is that, under some regularity conditions, they have shown that sign-constraints alone can make estimator sparse without additional regulation terms. In the meantime, Meinshausen [14] and Slawski and Hein [18] have recently studied the NNLS estimator in the setting with Gaussian random errors from a statistical point of view.222We remark that the statistical property of the NNLS estimator in a fixed-dimensional setting has been extensively studied in the literature from a long ago; see e.g. Judge and Takayama [9] and Liew [13]. More generally, the asymptotic properties of maximum likelihood estimators and M-estimators under general constraints have been developed by several authors such as Le Cam [12] and Shapiro [16]; see also Section 4.9 of Silvapulle and Sen [17] and references therein. An important conclusion of these studies is that sign-constraints themselves can be as effective as more explicit regularization methods such as the Lasso if the design matrix satisfies a special condition called the positive eigenvalue condition (which is called the self-regularizing property in [18]) in addition to a compatibility condition, where the latter condition is a standard one to prove the theoretical properties of regularization methods. More precisely, Meinshausen [14] has derived oracle inequalities for the -error of the regression coefficient estimates and the prediction error under the afore-mentioned conditions. In particular, it has been shown that the NNLS estimator can achieve the same convergence rate as that of the Lasso. Slawski and Hein [18] have also obtained similar results to those of [14], but they have additionally derived oracle inequalities for the -error of the regression coefficient estimates for and under supplementary assumptions.

The aim of this paper is to extend the results obtained in [14, 18] to a more general setup allowing general convex loss functions and non-linearity of response variables with respect to explanatory variables. This type of extension has been considered for regularization estimators; for the Lasso in [21, 22], for the -penalization with in [10] and for the elastic net in [5]; see also Chapter 6 of [4]. In this paper we adopt an analogous setting to those articles and derive oracle inequalities for sign-constrained empirical loss minimization, which are parallel to those obtained in the above articles, with assuming the positive eigenvalue condition in addition to a compatibility condition. It would be worth mentioning that bounds of oracle inequalities for regularized estimation are explicitly connected with the regularization parameter (the tuning parameter for the case of the Lasso), but this is not the case of sign-constrained estimation because it contains no regularization (or tuning) parameter. Interestingly, although our oracle inequalities for sign-constrained estimation contain a parameter controlling the tradeoff between the occurrence probabilities of the inequalities and the sharpness of the bounds of the inequalities as usual for regularized estimation (and this parameter usually corresponds to the regularization parameter), we do not need to specify this parameter when implementing the estimation; the estimation procedure automatically adjusts this parameter appropriately.

The remainder of this paper is organized as follows. In Section 2 we explain a basic setting adopted in this paper. Section 3 presents main results obtained in this paper, while in Section 4 we apply those main results to the case of Lipschitz loss functions, which contains logistic and quantile regressions, and derive concrete oracle inequalities. We complement the theoretical results by conducting numerical experiments in Section 5.

1.1 Notation

For a set , we denote by the cardinality of . For and , we define

and set . For and , we denote by the -norm of , i.e.

Also, we write if for all .

2 Setting

We basically follow Section 6.3 of [4] (see also [21, 5]). We consider a probability space . Let be a real inner product space and be a real-valued function on . denotes the inner product of and denotes the norm of . For every , we assume that . We regard as a (rich) parameter space and as an empirical loss of . In a regression setting, typically consists of real-valued measurable functions on some measurable space , and is typically of the form

| (2.1) |

where are random variables taking values in (covariates), are random variables taking values in some Borel subset of (response variables), and is a measurable function (loss function).

We define the expected loss function by

Our target quantity is the minimizer of over :

(we assume that the existence of such an element ). We then define the excess risk by

We estimate the target by a linear combination of the elements of . Namely, our estimator is of the form

for some . We estimate the regression coefficients by a non-negatively constrained minimizer of the empirical loss . Namely, is a solution of the following equation:

3 Main results

3.1 Assumptions

We start with introducing regularity conditions on the loss function .

Assumption 1 (Convexity).

The map is convex for all .

Assumption 2 (Quadratic margin).

There is a constant and a subset of such that

for all .

Assumptions 1–2 are more or less commonly employed in the literature and satisfied by many standard loss functions such as the logistic loss and check loss functions (see Section 4).

Next we introduce regularity conditions on the Gram matrix , which is defined by

The first condition is known as the compatibility condition, which was originally introduced in [21] and is commonly used to derive oracle inequalities for regularized estimators.

Definition 3.1 (Compatibility condition).

Let be a subset of and be a non-negative number. We say that the -compatibility condition is satisfied, with constant , if for all such that and , it holds that

The compatibility condition is closely related to (and weaker than) the so-called restricted eigenvalue condition, which is introduced in [2] and [10]. For two sets and , we define the following restricted set of ’s:

Definition 3.2 (Restricted eigenvalue condition).

Let be a subset of , be a non-negative number, and be an integer satisfying . We say that the -restricted eigenvalue condition is satisfied, with constant , if for all set with and , and all , it holds that

Note that, if the -restricted eigenvalue condition is satisfied with constant , the -compatibility condition is satisfied with the same constant . We refer to [23] and Section 6.13 of [4] for discussions about these conditions and related ones appearing in the literature.

The next condition, which is independently introduced in Meinshausen [14] and Slawski and Hein [18] respectively, plays a crucial role in derivation of oracle inequalities for non-negatively constrained estimation.

Definition 3.3 (Positive eigenvalue condition333In [18] this condition is called the self-regularizing property.).

We say that the positive eigenvalue condition is satisfied, with constant , if for all such that and , it holds that

| (3.1) |

3.2 Oracle inequalities

Throughout this section, we fix a vector such that . Typically, is the non-negatively constrained minimizer of with respect to :

but other choices are possible. For each , we set

For , we set

Set , , , and . We first derive oracle inequalities for the -error of coefficient estimates and the prediction error of the non-negatively constrained estimation.

Theorem 3.1.

Suppose that Assumptions 1–2 are fulfilled. Suppose also that the positive eigenvalue condition is satisfied with constant and the -compatibility condition is satisfied with constant . Let be a positive number and set

| (3.2) |

Suppose further that for any whenever . Then, on the set we have

| (3.3) |

and

| (3.4) |

Remark 3.1.

Following the spirit of [21] and Chapter 6 of [4], we consider the deterministic problem separately from the stochastic one in Theorem 3.1. Namely, we state inequalities (3.3)–(3.4) on the event and do not refer to the occurrence probability of the event . The advantage of this approach is that we can apply our result to various situations (serially dependent data for example) once we have an appropriate probability inequality for the event .

Remark 3.2.

Since inequalities (3.3)–(3.4) are valid only on the set , we should choose such that the set has large probability. This is typically achieved by taking a large value of . In the meantime, inequalities (3.3)–(3.4) are sharper as is smaller, so there is a tradeoff between the sharpness of the inequalities and the probability with which the inequalities hold true. In typical situations can be taken so that is of order , where denotes the sample size (see Examples below as well as Sections 14.8–14.9 of [4]). Therefore, as long as the constants and are of order 1, our non-negatively constrained empirical loss minimization procedure attains the same order as that of the Lasso.

Remark 3.3.

Proof of Theorem 3.1.

The basic strategy of the proof is the same as that of Theorem 6.4 from [4]. Throughout the proof, we assume that we are on the set . Set

Noting that , we have

Using Assumption 1, we obtain

Now, by the definition of we have , hence we have

Next set . Then we have

Since by assumption, we obtain

| (3.5) |

by Assumption 2. Now if , by the definition of we have

Therefore, by (3.5) we have

Hence it holds that

On the other hand, if , we have

Since by definition, we obtain

by the definition of . Hence (3.5) implies that

and thus we obtain

Now, by definition we have and , hence it holds that

Consequently, in either cases we obtain . Therefore, we have

hence . This means (3.3). Moreover, we have

Now, by the definition of it holds that , hence we conclude that

This completes the proof of (3.4). ∎

Next we derive oracle inequalities for the -error of coefficient estimates for all . We only focus on the case of for simplicity.

Theorem 3.2.

Suppose that Assumptions 1–2 are fulfilled. Suppose also that the positive eigenvalue condition is satisfied with constant and the -restricted eigenvalue condition is satisfied with constant . Let and define and as in (3.2). Suppose further that and for any whenever . Then, on the set we have

| (3.6) |

for any .

Remark 3.4.

Remark 3.5.

Proof of Theorem 3.2.

Set

Noting that because , we have .

Let us sort the elements of the set as , and set . Then, by Lemma 6.9 of [4] we have

Next, noting that and , an analogous argument to the proof of Theorem 3.1 yields

Now let us set . If , the -restricted eigenvalue condition implies that

hence the quadratic margin condition yields

On the other hand, the inequality and the Schwarz inequality imply that

Consequently, using the Hölder inequality, we obtain

Since , we conclude that

In the meantime, if , the same argument as in the proof of Theorem 3.1 yields

Therefore, noting that and , we obtain

Since , we conclude that

Hence we complete the proof. ∎

4 Application to Lipschitz loss functions

The main results presented in Section 3 are general but rather abstract, hence their implications are less understandable. Therefore, in this section we apply our results to the case that the loss function is Lipschitz continuous and derive more concrete versions of oracle inequalities for logistic and quadratic regressions.

The setting is basically adopted from Section 6 of [24]. Let us consider the case that the empirical loss function is given by (2.1). We assume that are fixed covariates, i.e. they are deterministic, and that are independent. Let be the empirical probability measure generated by , i.e.

for each measurable set of . Then, we take as a subspace of . We assume for some such that . We set and .

We impose the following conditions on the loss function:

-

[A1]

The map is convex for all .

-

[A2]

There is a constant such that

for all and .

-

[A3]

For every , the function defined by for is twice differentiable and satisfies .

Theorem 4.1.

Proof.

We apply Theorems 3.1–3.2. Assumption 1 is satisfied by [A1]. To check Assumption 2, we set . Since and , we have as long as . Under [A3], by Taylor’s theorem we have

for all . Hence Assumption 2 is satisfied. Therefore, the proof is completed once we show . This follows from Example 14.2 of [4] due to [A2]. ∎

Example 4.1 (Logistic regression).

Example 4.2 (Quantile regression).

If we model the -quantile () of the distribution of by , we take

as the loss function, where

In this case [A1] is evidently true and [A2] holds true with . Moreover, if has a density with , [A3] holds true. Therefore, in this situation we can derive an oracle inequality for the non-negatively constrained quantile regression from Theorem 4.1.

5 Numerical simulation

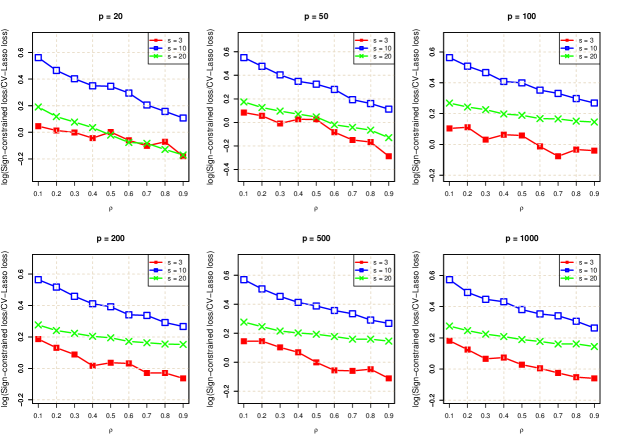

In this section we conduct some numerical simulation to complement our theoretical findings obtained in the preceding sections. Specifically, we examine the logistic and least absolute deviation regressions in a setting analogous to the one of [14]. Following [14], we compare the performance of sign-constrained regression to its Lasso counterpart with a cross-validated choice of the regularization parameter , in terms of their -errors of coefficient estimation.444The Lasso version of logistic regression is implemented by the R package glmnet, while the Lasso version of logistic regression is implemented by the R package rqPen.

5.1 Toeplitz design

The theoretical results shown in the preceding sections suggests that the positive eigenvalue condition should play a key role in success of sign-constrained regression. In fact, the inequalities of the theorems are shaper as the constant of the positive eigenvalue condition is larger. To confirm this point in the current experiment, we adopt the Toeplitz design to simulate the covariates. Specifically, following [14], we draw covariates from the -dimensional normal distribution , where the -th component of the covariance matrix is given by

| (5.1) |

for with some . In this case the positive eigenvalue condition is satisfied with constant (see Example I from page 1611 of [14] or Section 5.2 of [18]). Consequently, we may expect that the performance of sign-constrained regression would be more competitive with the Lasso as the parameter increases. We vary it as .

5.2 Logistic regression

5.2.1 Setting

We begin by considering a logistic regression model:

| (5.2) |

where is the response variable and is the vector of the covariates. The components of are identically zero, except for randomly chosen components that are all set to 1. We vary to assess the effect of the sparsity of the model. We also vary the dimension as . We simulate independent observations for the pair from model (5.2). We set in this experiment.

5.2.2 Results

The results are shown in Figure 1. We use the logarithm of the ratio to evaluate the regression performance, where and are the estimates of the regression coefficient by sign-constrained regression and the Lasso with a cross-validated choice of , respectively.

We find from the figure that the relative estimation error of the sign-constrained regression is smaller as increases, which is in line with the theory developed in this paper (see Section 5.1). In particular, when the value of is close to 1, the sign-constrained regression tends to outperform the Lasso in the sparsest scenario in this experiment. This result confirms that sign-constrained regression performs well under strongly correlated design, which was also pointed out in [14].

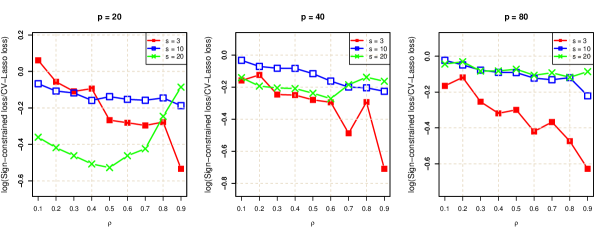

5.3 Least Absolute Deviation regression

5.3.1 Setting

Next we examine a linear regression model with Laplacian errors

| (5.3) |

where and is a random variable following the standard Laplace distribution. As in the previous subsection, the components of are identically zero, except for randomly chosen components that are all set to 1 with . We simulate independent observations for the pair from model (5.3), and estimate the regression coefficient by least absolute deviations with sign-constraints or a Lasso-type penalty with a cross-validated choice of the regularization parameter . Since least absolute deviations is computationally more expensive than logistic regression due to the lack of differentiability of the loss function, we set and only consider the dimension to reduce computational time.

5.3.2 Results

The results are shown in Figure 2. Similarly to the case of logistic regression, we use the logarithm of the ratio to evaluate the regression performance, where and are the estimates of the regression coefficient by sign-constraint regression and the Lasso with a cross-validated choice of , respectively.

Since the case where with is not a sparse setting, the corresponding result displays a different pattern from other settings. Except for this case, the relative estimation error of the sign-constrained regression tends to be smaller as increases. This is the same as in the case of logistic regression. Furthermore, in the least absolute deviations regression case, sign-constrained regression’s performance is better than the one of the Lasso in almost all simulation settings.

6 Conclusion

In this paper, we have studied the theoretical properties of sign-constrained regression with convex loss function under an analogous setting to the Lasso in [21, 22], the -penalization with in [10] and the elastic net in [5]. As a result, we have derived oracle inequalities for the prediction error and the -error of the coefficient estimates for under the so-called positive eigenvalue condition in addition to a traditional compatibility condition. We also apply those results to the logistic regression and the quantile regression.

Furthermore, we have performed a numerical simulation analysis (logistic and least absolute deviation regression) to evaluate the performance of sign-constrained regression by comparing performance with the cross-validated Lasso under the Toeplitz design. Overall, we have confirmed the followings: (1) When the correlation parameter in the Toeplitz design is large, sign-constrained regression performs well. (2) In the case of the least absolute deviation regression with standard Laplace distribution errors, sign-constrained regression typically performs better than the cross-validated Lasso.

Acknowledgements

Yuta Koike’s research was supported by JST CREST and JSPS Grant-in-Aid for Young Scientists (B) Grant Number JP16K17105. Yuta Tanoue’s research was supported by JSPS Grant-in-Aid for Research Activity start-up Grant Number 17H07322.

References

- Belloni et al. [2011] Belloni, A., Chernozhukov, V. and Wang, L. (2011). Square-root lasso: pivotal recovery of sparse signals via conic programming. Biometrika 98, 791–806.

- Bickel et al. [2009] Bickel, P. J., Ritov, Y. and Tsybakov, A. B. (2009). Simultaneous analysis of lasso and Dantzig selector. Ann. Statist. 37, 1705–1732.

- Bruckstein et al. [2008] Bruckstein, A. M., Elad, M. and Zibulevsky, M. (2008). On the uniqueness of nonnegative sparse solutions to underdetermined systems of equations. IEEE Transactions on Information Theory 54, 4813–4820.

- Bühlmann and van de Geer [2011] Bühlmann, P. and van de Geer, S. (2011). Statistics for high-dimensional data. Springer.

- Caner and Kock [2016] Caner, M. and Kock, A. B. (2016). Oracle inequalities for convex loss functions with nonlinear targets. Econometric Rev. 35, 1377–1411.

- Donoho and Tanner [2010] Donoho, D. L. and Tanner, J. (2010). Counting the faces of randomly-projected hypercubes and orthants, with applications. Discrete & computational geometry 43, 522–541.

- Fan and Li [2001] Fan, J. and Li, R. (2001). Variable selection via nonconcave penalized likelihood and its oracle properties. J. Amer. Statist. Assoc. 96, 1348–1360.

- Frank and Friedman [1993] Frank, L. E. and Friedman, J. H. (1993). A statistical view of some chemometrics regression tools. Technometrics 35, 109–135.

- Judge and Takayama [1966] Judge, G. G. and Takayama, T. (1966). Inequality restrictions in regression analysis. J. Amer. Statist. Assoc. 61, 166–181.

- Koltchinskii [2009] Koltchinskii, V. (2009). Sparsity in penalized empirical risk minimization. Ann. Inst. Henri Poincaré Probab. Stat. 45, 7–57.

- Lawson and Hanson [1974] Lawson, C. and Hanson, R. (1974). Solving least squares problems. Classics in Applied Mathematics. Society for Industrial and Applied Mathematics.

- Le Cam [1970] Le Cam, L. (1970). On the assumptions used to prove asymptotic normality of maximum likelihood estimates. Ann. Math. Statist. 41, 802–828.

- Liew [1976] Liew, C. K. (1976). Inequality constrained least-squares estimation. J. Amer. Statist. Assoc. 71, 746–751.

- Meinshausen [2013] Meinshausen, N. (2013). Sign-constrained least squares estimation for high-dimensional regression. Electron. J. Stat. 7, 1607–1631.

- Ninomiya and Kawano [2016] Ninomiya, Y. and Kawano, S. (2016). AIC for the Lasso in generalized linear models. Electron. J. Stat. 10, 2537–2560.

- Shapiro [1989] Shapiro, A. (1989). Asymptotic properties of statistical estimators in stochastic programming. Ann. Statist. 17, 841–858.

- Silvapulle and Sen [2005] Silvapulle, M. J. and Sen, P. K. (2005). Constrained statistical inference. Wiley.

- Slawski and Hein [2013] Slawski, M. and Hein, M. (2013). Non-negative least squares for high-dimensional linear models: Consistency and sparse recovery without regularization. Electron. J. Stat. 7, 3004–3056.

- Tibshirani [1996] Tibshirani, R. (1996). Regression shrinkage and selection via the lasso. J. R. Stat. Soc. Ser. B Stat. Methodol. 58, 267–288.

- Umezu et al. [2015] Umezu, Y., Shimizu, Y., Masuda, H. and Ninomiya, Y. (2015). AIC for non-concave penalized likelihood method. Working paper. Avairable at arXiv: https://arxiv.org/abs/1509.01688.

- van de Geer [2007] van de Geer, S. (2007). The deterministic Lasso. Research Report 140, ETH.

- van de Geer [2008] van de Geer, S. (2008). High-dimensional generalized linear models and the lasso. Ann. Statist. 36, 614–645.

- van de Geer and Bühlmann [2009] van de Geer, S. and Bühlmann, P. (2009). On the conditions used to prove oracle results for the Lasso. Electron. J. Stat. 3, 1360–1392.

- van de Geer and Müller [2012] van de Geer, S. and Müller, P. (2012). Quasi-likelihood and/or robust estimation in high dimensions. Statist. Sci. 27, 469–480.

- Wang and Tang [2009] Wang, M. and Tang, A. (2009). Conditions for a unique non-negative solution to an underdetermined system. In Communication, control, and computing, 2009. allerton 2009. 47th annual allerton conference on. IEEE, pp. 301–307.

- Wang et al. [2011] Wang, M., Xu, W. and Tang, A. (2011). A unique nonnegative solution to an underdetermined system: From vectors to matrices. IEEE Trans. Signal Process. 59, 1007–1016.

- Yuan and Lin [2006] Yuan, M. and Lin, Y. (2006). Model selection and estimation in regression with grouped variables. J. R. Stat. Soc. Ser. B Stat. Methodol. 68, 49–67.

- Zhang [2010] Zhang, C.-H. (2010). Nearly unbiased variable selection under minimax concave penalty. Ann. Statist. 38, 894–942.

- Zou [2006] Zou, H. (2006). The adaptive lasso and its oracle properties. J. Amer. Statist. Assoc. 101, 1418–1429.