Non-Wire Alternatives to Capacity Expansion

Abstract

Distributed energy resources (DERs) can serve as non-wire alternatives to capacity expansion by managing peak load to avoid or defer traditional expansion projects. In this paper, we study a planning problem that co-optimizes DERs investment and operation (e.g., energy efficiency, energy storage, demand response, solar photovoltaic) and the timing of capacity expansion. We formulate the problem as a large scale (in the order of millions of variables because we model operation of DERs over a period of decades) non-convex optimization problem. Despite its non-convexities, we find its optimal solution by decomposing it using the Dantzig-Wolfe Decomposition Algorithm and solving a series of small linear problems. Finally, we present a real planning problem at the University of Washington Seattle Campus.

I Introduction

Electric utility distribution systems are typically designed and built for peak load which usually happens a small number of hours per year. When the system load reaches capacity, the traditional solution has been to install more wires or reinforce existing ones [1]. While decades of experience make this solution reliable and safe, it is often associated with enormous capital costs, hostile public opinion, and/or time-consuming legal issues (e.g., eminent domain questions) [2].

Lately, there has been an increased interest in distributed energy resources (DERs) such as energy storage (ES), energy efficiency (EE), demand response (DR), and distributed generation (DG) as alternatives to traditional “wire” solutions. In the planning community, these solutions are often called non-wire alternatives (NWAs)111We use the term NWA and DER interchangeably. We employ the term NWA to emphasize their impact on traditional capacity expansion solutions.. The basic premise is that NWAs can manage load to avoid, or at least delay, the need for traditional capacity expansion.

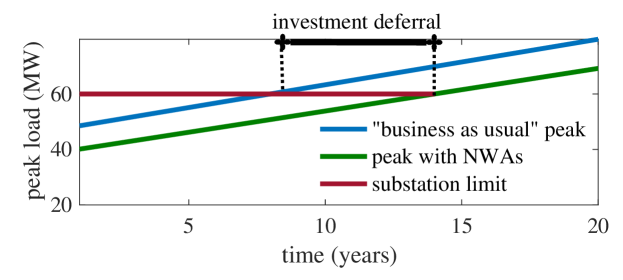

The University of Washington (UW) is expected to add 6 million sq. feet of new buildings (e.g., labs, classrooms, office space) to its Seattle Campus during the next 10 years [3]. This would translate into approximately 17 MW of additional load and require the capacity at the substation that serves the campus to be expanded. The blue line in Fig. 1 is the projected “business as usual” campus peak load while the green line is peak load managed via a set of NWAs. When the load reaches the feeder or substation limit, the system planner must expand its capacity. In this case, NWAs are able to delay the need for capacity expansion by reducing peak load.

The economic reason for deferring investments is the time-value of money, which states that a dollar spent now is more valuable than a dollar spent later. Policy-wise, there are often other benefits of deferring capital-intensive projects (e.g., reducing the risk of expected load not materializing, generating local employment opportunities, among others [2]). In this paper, we focus on the economic question and ask: is deferring traditional expansion investments worth the costs of NWAs?

The answer to this question is non-trivial. For one, the cost and benefits of NWAs are not only a function of their installed capacities but also of their operation. Thus, one must co-optimize investment and operation of NWAs to find optimal decisions. This leads to a large problem that can be hard to solve. Furthermore, the considering the time-value of deferring investments introduces non-linearities and non-convexities to the planning problem, making it even harder to solve.

I-A Contributions

In this paper, we make the following contributions:

-

1.

A formulation of the NWAs planning problem that determines 1) investment and 2) operation of NWAs and 3) the timing of capacity expansion.

-

2.

A scalable solving technique. The NWAs planning problem is a large scale, non-convex optimization problem. It is large-scale (on the order of millions of variables) because we model the operation of the NWAs over an investment horizon of decades. The problem’s non-convexities are introduced by the variables and constraints used to model the timing of capacity expansion. We deal with the scale of the problem by decomposing it into smaller subproblems using the Dantzig-Wolfe Decomposition Algorithm (DWDA). As shown shortly, the non-convexities end up being confined to the DWDA’s master problem which, in our case is small (in the order of tens to a couple of hundred variables). We deal with the non-convexities of the master problem by further decomposing it and solving a small number of linear programs.

-

3.

A case study where NWAs may be used to defer substation and feeder upgrades at the UW Seattle Campus.

I-B Literature review

The idea of deferring infrastructure investments by reducing load was first introduced in [4]. The work in [4] focuses on quantifying the effects of load reduction on avoided infrastructure costs and not on finding the optimal load reduction or the appropriate technologies to do so. On a similar note, the authors of [5] and [6] develop frameworks to quantify the value of capacity deferral of distributed generation by explicitly modeling DG as the mechanism of net load reduction. However, they also do not address the problem of finding optimal DG investment nor consider other types of DERs. In [7], the authors determine optimal investments in DG considering the value of network investment deferral. However, their non-linear mixed-integer formulation is intractable in general. In contrast, our model considers a wider set of NWAs and is tacked by solving a series of smaller convex optimization problems.

Furthermore, there is relatively little literature on holistic DER planning. Most consider a narrow definition of the term DER that only includes DG, e.g., [8, 9], or only ES and DR [10]. Instead, we consider a generic definition of DERs and present a case that considers solar photovoltaic (PV) generation, DR, EE, and ES.

I-C Organization of this paper

This paper is organized as follows. Section II introduces the capacity expansion problem and formulates it as an optimization problem Section III introduces a generic NWA model and four specific instances: EE, PV, DR, and ES. Section IV introduces the NWAs planning problem and Section V proposes a solution technique. Section VI presents a case study of load-growth at the University of Washington. Section VII concludes the paper.

II The Capacity Expansion Problem

System planners typically like to expand capacity at the latest possible time but in time to meet expected growth. A reason for this is the time-value of money: we would like to spend a dollar later rather than now. Let denote expected peak load222The expected peak load is usually calculated by the utility using population growth projections, planned construction projects, weather forecasts, among others [1]. during year and the pre-expansion capacity as . After expansion, we assume that any reasonable load can be accommodated for the foreseeable future. Then, the decision rule for choosing a year to expand capacity is

| (1) |

where and is the planning horizon. The decision rule states that the planner expands capacity at a future year immediately before the limit is first reached by the load (as illustrated in Fig. 1). In this paper, we analyze capacity expansion at a single point in a radial system (e.g., a feeder or substation) and assume that the downstream network is non-congested. This assumption allows us to disregard the network.

Let denote the inflation-adjusted cost of capacity expansion333We assume that the inflation-adjusted cost of capacity expansion is constant throughout the planning horizon.. Then, if system capacity is expanded at year , the present cost of the investment is

| (2) |

where is the annual discount rate, a quantity closely related to the real interest rate [1].

Remark 1.

Let the series of yearly peak load during the planning horizon be denoted as . The function from Eq. (2) can be reformulated as the optimization problem

| (3a) | ||||

| s.t. | (3b) | |||

| (3c) | ||||

As we show in Theorem (9), the reformulation of allows us to formulate a NWA planning problem which simultaneously optimizes NWA investment, operation, and the timing of capacity expansion) with a structure that is conductive to be decomposed into smaller problems.

Note that given a , Problem (3) is convex. However, if we treat as a variable, its feasible solution space is non-convex. This fact is relevant on a NWA planning context where we can manipulate the peak load and thus treat as a variable. While it is unfortunate that Problem (3) is non-convex on , Section V shows that we can handle its non-convexities by solving at most small-scale linear problems444The length of the planning horizon, , is in the order tens of years. that can be quickly and reliably solved using off-the-shelf solvers. In the next Section, we introduce models of generic and specific NWAs and discuss how they relate to the capacity expansion problem.

III Non-wire alternatives

Let the index denote a NWA technology. A generic NWA model is characterized by six elements:

-

1.

investment decision variables ,

-

2.

operating decision variables ,

-

3.

a set of feasible investment decisions ,

-

4.

a set of feasible operating regimes ,

-

5.

a set of functions that map operating decisions onto load at time of year , and

-

6.

an investment cost function .

While investment decisions are made in horizons on the order of years, operating decisions are made on much shorter horizons. In this paper, operating decisions are made in -hour intervals (e.g., 1-hour interval in our case study). The set denotes the set of operating time intervals during one year.

In this paper, the feasible solution spaces of investment and operating decisions, and respectively, are assumed to be convex on both and . Additionally, we assume that the investment cost function is convex and that the load functions are linear in . Now we define each of the six elements that define NWAs for the four particular technologies considered in this paper: EE, PV, DR, and ES.

Energy Efficiency

We model EE as percentage reduction with respect to a base load that translates into a load reduction of MWs at all time periods of all years . For EE, the investment decision is to choose a load reduction percentage. We model the investment cost, , as a convex piece-wise linear function of the load reduction percentage [11]. The slope of each of the segment segments, , represents the marginal cost of load reduction. The six parameters that define DR as a NWA are

where is the percentage reduction for each cost piece-wise linear segment of , is the size of each segment, and is the base load (i.e., the pre-EE load).

Solar photovoltaic generation

For the solar PV case, investment decision is the PV installed capacity . At a given time , the solar energy generation is given by where is a number in and is related to solar radiation levels. All in all, the parameters that define solar PV as a NWA are

where is the cost per unit capacity of solar PV (capital and labor costs) and is the limit on PV installed capacity.

Demand response

We consider investments in DR communication and control infrastructure that allow a portion of the load, (e.g., water heaters and HVAC systems), to be shifted in time. For DR, the investment decision is the amount DR-enabled load, which limits the demand reduction that can be deployed at a particular time. Since DR allows load to be shifted in time a load reduction of at a time is associated with a demand rebound of during the next time period. The coefficient is a number and is related to efficiency losses due to DR deployment. Note that more sophisticated rebound models such as the ones in [12] are admissible in our framework. The parameters that define DR as a NWA are

where is the cost of enabling DR per unit capacity of load.

Lithium-ion energy storage

The investment decision for ES is the energy storage capacity of the system. The operating variables are the ES’s charge , discharge , state-of-charge , and storage capacity555 may be different than because we model battery degradation. Although is not normally considered an operating variable we do so for ease of notation. during year , . The feasible region of the operating variables is described by Equations (7d)-(7g) and includes the usual charge, discharge, and state-of-charge limits used to model ES [13, 10]. Additionally, as expressed in Equation (7f), the storage capacity degrades by per unit charge/discharge [13]. The parameters that define ES as a NWA are

| (7a) | |||

| (7b) | |||

| (7c) | |||

| (7d) | |||

| (7e) | |||

| (7f) | |||

| (7g) | |||

| (7h) | |||

| (7i) | |||

where is the charge (discharge) efficiency, denotes the energy-to-power ratio of the ES system, and dollar per unit energy cost of is the dollar per unit energy cost of storage capacity. In this work, we consider investments in lithium-ion ES although other chemistries are compatible within our framework [13].

Remark 2.

Our framework allows for other NWAs to be included, e.g., controllable electric-vehicles, diverse battery chemistries, dispatchable DG, etc. This is especially true since our solving method, discussed in Section IV, allows for parallel computation of investment and operating decisions of each of the NWAs.

III-A The substation upgrade problem revisited

Let the total load at time of year (with a set of NWAs) be denoted by where . Then, the yearly peak load as a function of NWA operation is .

Recall from Eqs. (2) and (1) that the system planner only had to decide on when to invest in capacity expansion. With NWAs, however, the present cost of expansion

becomes a function of the NWAs operating variables, giving the system planner has the ability to plan investment and operation of NWAs that minimize . However, a good plan should also consider the investment cost of the NWAs, their operating costs (e.g., energy costs), and benefits other than deferring capacity expansion (e.g., demand charge reductions). In the next Section, we present a holistic NWA investment/operation and timing of capacity expansion problem.

IV The Non-wire alternatives planning problem

We would like to determine investments and operation of NWAs and the timing of capacity expansion that minimize total present cost composed of: 1) convex operating cost functions for each NWA, , 2) NWA investment costs, , a convex peak demand charge, , and the 3) present cost of capacity expansion, . We formally state the NWAs planning problem as

| (8) |

From the definition of in Eq. (2), contains non-convex function that is inconvenient to use in large-scale optimization problems. In the following theorem, we demonstrate how the equivalent representation of shown in Remark 1 can be utilized to convexify the objective of (8).

Theorem 1.

Problem (8) can be equivalently stated as the problem

| (9a) | ||||

| (9b) | ||||

| (9c) | ||||

| (9d) | ||||

| (9e) | ||||

| (9f) | ||||

| (9g) | ||||

The proof of Thm. 1 can be found in the Appendix. Since we assume that , , and are all convex, and is also convex, the objective of (9) is convex. Constraint (9e), however, introduces non-convexities to the feasible solution space of (9). In the next Section we show that we can decompose Problem (9) using the DWDA and confine the non-convex constraints to be in the master problem. Then, we present an algorithm to solve the non-convex master problem by sequentially solving a small number of small linear programs.

V Solution technique: Dantzig-Wolfe Decomposition and Convexification

The non-convexity and dimensionality high-dimensionality of Problem (9) may present computational challenges when using commercial solvers. As mentioned in Remark 1, the solution space is non-convex in . To illustrate the dimensionality of the problem, consider that for a time step length of 1 hour and a planning horizon of 20 years, the dimensionality of the sets ranges from roughly for the simplest cases (e.g., solar PV or EE) to more than half a million for the more complicated ES case. When considering all four NWAs, Problem (9) becomes more than -dimensional.

We decompose Problem (9) into smaller subproblems to handle the dimensionality issue. Each NWA falls into a single linear problem while the demand charge and the present cost of capacity expansion are handled by the low-dimensional substation planning subproblem. Constraint (9d), however, couples all subproblems together and prevents us from independently solving them. To handle the coupling constraint, we implement the Danzig-Wolfe Decomposition Algorithm.

V-A Dantzig-Wolfe Decomposition

Explicitly, the NWA subproblems are given by

for all . The objective of subproblem is composed of the operation cost , investment cost , and a term that penalizes the load by the coefficient . The coefficients are obtained from the dual variables of the coupling constraints (10b) of the master problem. The operating and investment decisions are constrained by their respective feasible solution regions. Since and are convex sets and the objective of each subproblem is convex, each subproblem is a convex optimization problem.

The master problem is given by

| (10a) | ||||

| s.t. | (10b) | |||

| (10c) | ||||

| (10d) | ||||

| (10e) | ||||

| (10f) | ||||

| (10g) | ||||

and its objective is to minimize a convex combination of cost proposals, peak demand charges, and the present cost of capacity expansion. The cost proposal is defined as

where and represent optimal operating and investment decisions for the time the subproblem has been solved. The positive variables represent the weights assigned to each cost proposals. Constraint (10b) represents the coupling constraints and the load proposals are defined as

Constraints (10c), (10d), and (10e) originate from Constraints (9e), (9f), and (9g), respectively. Finally, Constraints (10f) and (10g) ensure that the sum of all ’s is equals to one (convexity constraint) and that they are all non-negative. We skip the detailed description of the well-known Danzig-Wolfe Decomposition. The interested reader is referred to [14] for an in-depth description and an implementation of the algorithm.

V-B Solving the master problem

When decomposing Problem (9) using the DWDA, its non-convexities caused by Constraint (9e) become encapsulated in the Constraint (10e) master problem. In this Section we present an algorithm to solve the master problem by solving at most linear problems. Let

represent a function that fixes the variable to in Problem (10) and solves for the variables and . A concrete interpretation of , is that capacity expansion happens at year and thus the peak load limit is only enforced from year through . Note that the function involves solving a small-scale linear problem. The number of variables in is where is at most typically in the order of a few hundreds and is, for most utility planning practices, no more than 20.

The algorithm (shown in Algorithm 1) to solve the master problem is as follows. We sequentially solve for starting with and increasing by one after each iteration. If we find that is greater than , we know that is the optimal solution to the master problem (since its objective is convex). However, if we find that is infeasible, i.e., capacity expansion cannot be delayed further than year , we know that is the optimal solution. Algorithm 1 shows a precise description of the algorithm.

VI Case Study: Non-wire alternatives for the University of Washington

The MW of load that the UW plans to add in the next 10 years could compromise the security of the substation and feeders that connect the campus to the Seattle City Light (SCL) distribution system. Several traditional solutions have been considered, e.g., building a new feeder in the current substation or increasing the feeder’s capacity using superconducting technologies. However, these solutions are hard to implement in Seattle’s dense urban environment and come at an estimated cost of over million. Moreover, there is an increased appetite by SCL, the Washington State government, and the UW to explore novel approaches such as NWAs.

VI-A Data

Here we provide a brief description and sources of the data used in this case study.

Load and substation capacity

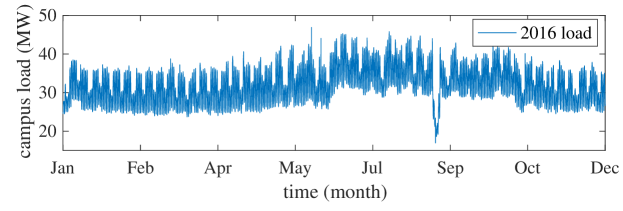

We use one-hour electrical 2016 load data (summer peak of 48.5 MW, shown in Fig. 2) from the substation that serves the UW as our base load, i.e., , and assume that load grows at a rate of per year with respect to the base load666This rate of growth represents SCL’s load growth projections of MW in 10 years. . The (pre-upgrade) substation capacity is MW.

Substation upgrade cost, interest rate, electricity rates, and planning horizon

As per SCL’s planning department, we assume that the cost of substation upgrades is million and adhere to a planning horizon of 20 years. We assume a yearly discount rate of and rates based on the high-demand customer rates for the City of Seattle [15].

Non-wire alternatives

Costs of EE measures are based on [11]. DR costs are based on reported values from [16]. Costs of ES are based on substation-level lithium ion data from [17] and data on efficiency and degradation of ES is based on [13]. Solar production profiles are based on [18] and costs on [19]. Table I summarizes the main parameters of the NWAs considered in this study and provides their sources. In this case study, we define the operating cost of a NWA as the energy cost777Note that for net-load reduction technologies such as PV or EE, the operating cost is negative. of the associated NWA load .

| Parameter | Value | Source |

| Energy Efficiency | ||

| Investment cost function | N/A | [11]888Adjusted to 2017 dollars and according to the assumption that buildings in Seattle are more energy efficient than the national average (due to Seattle having some of the strictest energy codes in the nation). |

| Demand response | ||

| DR investment cost | /kW | [16] |

| DR efficiency coefficient | modeling assumption | |

| Energy Storage | ||

| Investment cost | /kWh | [17] |

| Charge/discharge efficiency | [13] | |

| Degradation coefficient | kWh/kW | [13] |

| Energy-to-power ratio | [17] | |

| Solar PV | ||

| Investment Cost | /W | [19] |

| Production profile | N/A | [18]999Data for Seattle from the site http://www.renewables.ninja. |

VI-B Results

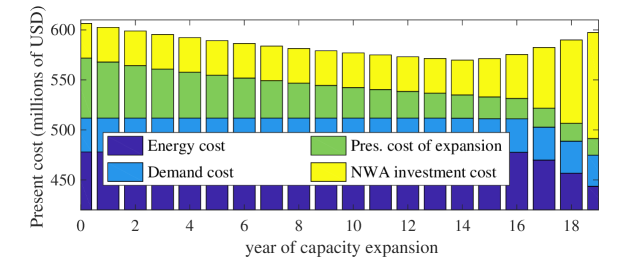

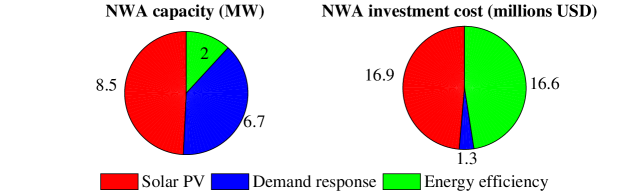

As illustrated in Fig. 3 the minimum cost is achieved when the substation expansion is delayed until year and investments include a mix of NWAs. As shown in Fig. 4, the optimal mix of NWAs include PV, DR, and EE. In this case, lithium-ion ES excluded in favor of the more economically attractive alternatives.

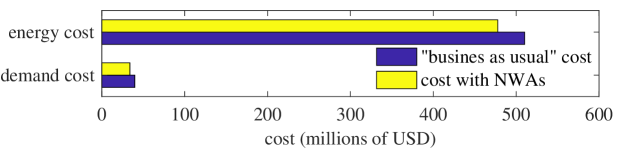

It is apparent a benefit of deferring investments is that that the present cost of extension diminishes with time. However, other benefits include reduction a and percent reduction of energy and demand costs, respectively (see Fig. 5).

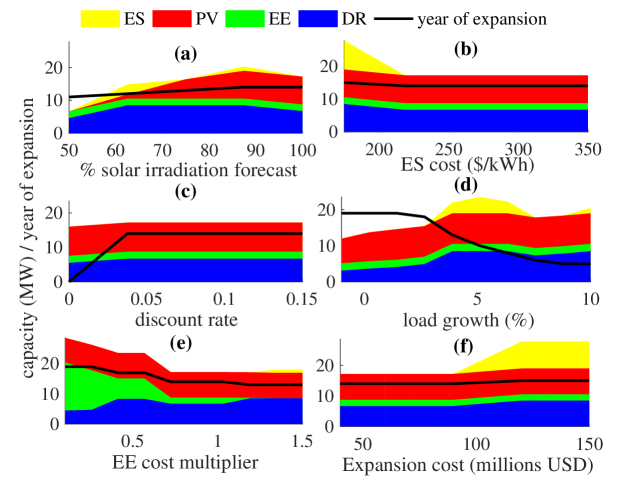

Future extensions to this work should consider uncertainty of relevant parameters: costs, load growth projections, solar production forecasts, among others. However, considering all possible uncertainties may needlessly increase the size (and computational burden) of the model. To find the parameters whose uncertainty may have a significant impact on the solution, we solved the NWA problem using different values for some parameters. Fig. 6 shows how the installed capacities of the four NWAs and the optimal time of expansion vary with the the value of five of the most prominent and potentially uncertain parameters. It appears that the solar irradiation forecast, load growth, and EE cost multiplier have significant impacts on the optimal NWA mix and time of expansion. Another important insight provided by Fig. 6 is that ES becomes viable at less than $/kWh or when the cost of expansion is large enough.

VII Conclusion

We present a planning problem that determines investment and operation of distributed energy resources (DERs) and timing of capacity expansion. Considering the timing of capacity expansion has two interesting implications. First, it allows DERs to manage load and effectively act as non-wire alternatives (NWAs) to captial-intensive capacity expansion projects. Second, it makes investments in DERs more attractive by explicitly accounting for the benefit of deferring capacity expansion investment. We formulate this problem as a large-scale non-convex optimization problem. We deal with the size of the problem by decomposing it using the Danzig-Wolfe Decomposition Algorithm. We deal with its non-convexity by further decomposing the master problem (where the non-convexities lie) into a small number of linear programs.

Additionally, we present a realistic case study where solar photovoltaic (PV) generation, energy efficiency (EE), energy storage (ES), and demand response (DR) are considered as alternatives to substation/feeder upgrades at the University of Washington. We show that upgrades to the substation can be delayed by approximately five years by implementing PV, EE, and DR projects. At current costs, ES is not viable according to our results. Finally, we provide sensitivity analyses that suggest that uncertainty in load growth, PV generation and others should be considered in future studies.

Appendix A Proof of Theorem 1

Using the definition of from (3), Problem (8) can be written as

| (11) |

where denotes the feasible region defined by the constraints in Problem (3). Eq. (11) above is equivalent to

| (12) |

Problem (12) is a nested optimization problem that whose inner variable is and its outer variables are and . As shown in reference [20] all variables can be minimized simultaneously in an equivalent problem. Thus (8) is equivalent to (9) where Constraints (9d) are employed to implement the functions via half-planes.

References

- [1] H. Seifi and M. S. Sepasian, Electric power system planning: issues, algorithms and solutions. Springer Science & Business Media, 2011.

- [2] T. Stanton, “Getting the signals straight: Modeling, planning, and implementing non-transmission alternatives,” National Regulatory Research Institute, Tech. Rep. 15-02, 2015.

- [3] “University of Washington 2018 Seattle Campus Master Plan,” Online, July 2017.

- [4] X. Li and G. K. Zielke, “One-year deferral method for estimating avoided transmission and distribution costs,” IEEE Trans. on Power Sys., vol. 20, no. 3, pp. 1408–1413, Aug 2005.

- [5] H. A. Gil and G. Joos, “On the quantification of the network capacity deferral value of distributed generation,” IEEE Trans. on Power Sys., vol. 21, no. 4, pp. 1592–1599, Nov 2006.

- [6] A. Piccolo and P. Siano, “Evaluating the impact of network investment deferral on distributed generation expansion,” IEEE Trans. on Power Sys., vol. 24, no. 3, pp. 1559–1567, Aug 2009.

- [7] M. E. Samper and A. Vargas, “Investment decisions in distribution networks under uncertainty with distributed generation - part i: Model formulation,” IEEE Trans. on Power Sys., vol. 28, no. 3, pp. 2331–2340, Aug 2013.

- [8] A. Alarcon-Rodriguez et al., “Multi-objective planning framework for stochastic and controllable distributed energy resources,” IET Renewable Power Generation, vol. 3, no. 2, pp. 227–238, June 2009.

- [9] C. Yuan, M. S. Illindala, and A. S. Khalsa, “Co-optimization scheme for distributed energy resource planning in community microgrids,” IEEE Trans. on Sust. Energy, vol. 8, no. 4, pp. 1351–1360, Oct 2017.

- [10] Y. Dvorkin, “Can merchant demand response affect investments in merchant energy storage?” IEEE Trans. on Power Sys., to be published.

- [11] R. Brown, S. Borgeson, J. Koomey, and P. Biermayer, “Us building-sector energy efficiency potential,” 2008.

- [12] P. Lütolf, “Impact of the rebound effect of demand response on secondary frequency control,” Master’s thesis, ETH Zürich, 2016.

- [13] M. R. Sarker et al., “Optimal operation of a battery energy storage system: Trade-off between grid economics and storage health,” Electric Power Systems Research, vol. 152, pp. 342 – 349, 2017.

- [14] A. J. Conejo et al., Decomposition techniques in mathematical programming: engineering and science applications. Springer Science & Business Media, 2006.

- [15] “Seattle City Light Summary Rate Table,” http://www.seattle.gov/light/rates/summary.asp, accessed: 2017-11-01.

- [16] M. A. Piette et al., “Costs to automate demand response-taxonomy and results from field studies and programs,” Lawrence Berkeley National Laboratory, Tech. Rep. LBNL-1003924, 2015.

- [17] “Levelized cost of storage - version 2.0,” 2016. [Online]. Available: https://www.lazard.com/media/438042/lazard-levelized-cost-of-storage-v20.pdf

- [18] S. Pfenninger and I. Staffell, “Long-term patterns of european pv output using 30 years of validated hourly reanalysis and satellite data,” Energy, vol. 114, pp. 1251 – 1265, 2016.

- [19] R. Fu et al., “NREL US Solar Photovoltaic System Cost Benchmark Q1 2016 Report,” NREL, Golden, CO, Tech. Rep. TP-6A20-66532, September 2016.

- [20] S. Boyd and L. Vandenberghe, Convex optimization. Cambridge university press, 2004.