A Numerical Scheme for A Singular control problem: Investment-Consumption Under Proportional Transaction Costs

Abstract.

This paper concerns the numerical solution of a fully nonlinear parabolic double obstacle problem arising from a finite portfolio selection with proportional transaction costs. We consider optimal allocation of wealth among multiple stocks and a bank account in order to maximize the finite horizon discounted utility of consumption. The problem is mainly governed by a time-dependent Hamilton-Jacobi-Bellman equation with gradient constraints. We propose a numerical method which is composed of Monte Carlo simulation to take advantage of the high-dimensional properties and finite difference method to approximate the gradients of the value function. Numerical results illustrate behaviors of the optimal trading strategies and also satisfy all qualitative properties proved in Dai et al., (2009) and Chen and Dai, (2013).

Keywords: Hamilton-Jacobi-Bellman equation, stochastic control, Monte Carlo approximation, backward stochastic differential equations, portfolio optimization, transaction costs.

1. Introduction

This paper presents the numerical solution of an optimal investment-consumption problem in the presence of proportional transaction costs during a finite time period. Given a known initial wealth, the objective of an investor is to decide the best consumption and investment strategy which maximizes the expected discounted utility of consumption over the finite investment period. In the absence of transaction costs and for specific utility functions, the solution can be exactly obtained and an investor’s optimal trading strategy is to maintain a constant proportion of wealth invested in risky stocks, which is called the Merton proportion shown by Merton, (1971). This constant proportion depends on the investor’s risk preference and also the market parameters. Merton’s strategy, simply stated, is to continuously rebalance portfolio holdings in order to keep the fraction of investment in risky assets constant. However, in the presence of transaction costs, a continuous portfolio rebalancing process may incur infinite costs. Thus, the question arises: what is the optimal strategy if there are transaction costs in the market?

Transaction cost appears in different ways, as a fixed commission or a proportion to the size of trade. This paper deals with the case where there is only proportional transaction costs; for a review of constant cost or a mixture of both, see Altarovici et al., (2016) and references therein. Magill and Constantinides, (1976) are the first to introduce proportional transaction costs into Merton’s model. They provide a valuable insight on the optimal strategy; i.e. an investor should maintain the fraction of wealth in risky assets inside a so-called no-trading region and trading only takes place along the boundary of the no-trading region. As a consequence, the crucial question is: how to identify the optimal no-trading region which corresponds to the optimal trading strategy?

Under certain restricted settings, this question has been partially answered. When the market is confined to consist of a single risky asset and a bank account, Davis and Norman, (1990) give a rigorous analysis of the classical Merton’s problem with proportional transaction costs over infinite time horizon. The optimal policy is formulated as a nonlinear free boundary problem which separates the buying and the selling regions from the no-trading one. Their paper contains detailed characterization, both theoretical and numerical, of the value function and optimal policies under certain assumptions. Shreve and Soner, (1994) relax assumptions of Davis and Norman, (1990)’s problem, and apply the viscosity solution approach to provide regularity and existence results. Many other papers have carried out an asymptotic analysis including Janeček and Shreve, (2004), Goodman and Ostrov, (2010), and Kallsen et al., (2010). A thorough convergence proof for general utility functions is studied by Soner and Touzi, (2013), and an extension to several risky assets is considered by Possamaï et al., (2012). Other numerical schemes have been proposed by Tourin and Zariphopoulou, (1994) and Tourin and Zariphopoulou, (1997) for general utility functions, and by Muthuraman and Kumar, (2006) for a model with more than one risky asset. Nevertheless, these papers only deal with the infinite horizon scenario where the no-trading region does not evolve in time, and are based on finite difference/element method which are not efficient in higher dimensions.

Theoretical analysis on the finite-time problem has been studied recently and is restricted to the no consumption case with a single risky asset. Liu, (2004) first shows analytical properties of the optimal investment problem with a deterministic finite horizon. Dai and Yi, (2009) establish a link between the singular control problem and the obstacle problem, and completely characterize the behaviors of the resulting free boundaries. Numerical solution of this optimal investment problem is proposed by Arregui and Vázquez, (2012). More recently, there is a plethora of literature devoted to the characterization of optimal investment-consumption strategy. Dai et al., (2009) consider the investment and consumption optimization decision in finite time horizon, and characterize the behaviors of free boundaries for a single risky asset case. Dai and Zhong, (2008) propose the penalty method to demonstrate the numerical solution to a singular control problem arising from portfolio selection with proportional transaction costs. Bichuch, (2012) provides a proof to the same problem with power utility function by expanding the value function into a power series, and obtains a “nearly optimal” strategy.

In the present paper, we propose a numerical scheme based on Monte Carlo simulation for the optimal investment-consumption problem with proportional transaction costs and deterministic time horizon. As discussed in the next section, the value function of such control problem is characterized by a Hamilton-Jacobi-Bellman (HJB) equation. The existing numerical schemes for this HJB equation in the literature including Tourin and Zariphopoulou, (1994), Tourin and Zariphopoulou, (1997) and Muthuraman and Kumar, (2006) are based on finite difference/element method, which are only practical in low dimensional problems. Moreover, the dimension can be higher in many applications, especially in finance problems. Thus, we propose a numerical technique that combines Monte Carlo simulation with finite difference discretization so as to solve the nonlinear double obstacle problem, and aim to characterize the free boundaries and qualitative properties of the solution.

Our numerical scheme is strongly motivated by the aforementioned work of Fahim et al., (2011) who introduce the backward probabilistic numerical scheme combined with Monte Carlo and finite difference method for high-dimensional fully nonlinear partial differential equations. They decompose the scheme into two steps. First, the Monte Carlo step includes isolating the linear generator of some underlying diffusion process to split the PDE into this linear part and a remaining nonlinear one. Then, a projection method is employed to evaluate the remaining nonlinear part of the PDE. In this paper, we will modify the numerical method to incorporate the free boundaries on the no-trading region. Moreover, we will show that the proposed method can work in the case of correlated stocks. It is worth noticing that the type of free boundaries in this current problem is different from the obstacle problem such as the one in Bayraktar and Fahim, (2014) and therefore the scheme developed in this paper is not in the same nature of Monte Carlo scheme. We believe the motivation behind this proposed method can be extended to various HJB for singular control problems.

This paper is organized as follows. In Section 2 the optimal investment and consumption problem with proportional transaction costs is presented. Section 3 is dedicated to some simplifications of the control problem in Section 2. The numerical scheme composed of Monte Carlo simulation and finite difference discretization is proposed in Section 4. In Section 5, we show that the implementation of the proposed numerical scheme is compatible with the theoretical results in Dai et al., (2009) and Chen and Dai, (2013) in a single risky asset or two risky assets cases. Several examples that illustrate performances of the proposed numerical method are also presented in this section. And the last section draws some conclusion.

2. The optimal investment-consumption problem

We consider an optimal investment-consumption problem in finite time horizon with proportional transaction costs, the model being the same in Dai and Zhong, (2008) and Chen and Dai, (2013).

Suppose a continuous time market consisting of one risk-free asset and multiple risky assets available for investment. The risk-free asset (bank account), denoted by , pays an interest rate continuously and thus can be expressed as

| (2.1) |

Let be the number of available risky investments, called “stocks” hereafter. The stocks have constant mean rates of return . We denote the vector of stock prices by and the mean rates of return by . The evolution of stocks can be written as

| (2.2) |

where is the matrix formed with elements of as its diagonal, denotes the positive definite covariance structure, and is a standard -dimensional Brownian motion defined on a filtered probability space .

Assume that an investor holds a portfolio , where and are dollar amount invested in the bank account and in the stock at time . His problem is to choose a consumption and investment strategy over the deterministic horizon in order to maximize his objective: the discounted utility of consumption during the investment period. We require that the consumption must be non-negative and occur from cash in the bank, and its process should be adapted to and integrable for any finite , that is,

| (2.3) |

Now we introduce two -adapted processes and which are non-negative, non-decreasing, and right continuous with left limits (RCLL). represents the cumulative dollar value spent for the purchase of stock before incurring transaction costs, whereas represents the cumulative amount of money obtained from the sale of stock . Denote the transaction costs for buying and selling stocks by and respectively. To be more precise, buying a unit of stock will cost in cash from the bank and selling a unit of stock will receive in cash added into the bank. We assume that . With transaction costs and consumption, the controlled evolution of and can be described by the following equations

| (2.4) | |||||

| (2.5) |

Here, “” is the standard dot product and is a vector of ones with appropriate length.

We require the investor’s net wealth at any time to be positive because he would not be bankrupt if he is forced to liquidate his position. If taking transaction costs into consideration, the investor’s net wealth at time is given by . Therefore, we define the solvency region as

| (2.6) |

Given an initial position , an investment-consumption strategy is called admissible if and only if the portfolio position lies in for all . Let be the set of admissible strategies. The investor’s objective consists of choosing an admissible strategy so as to maximize the expected discounted utility of accumulative consumption and the terminal wealth, that is,

| (2.7) |

where is the discount factor, denotes the conditional expectation at time given an initial endowment , , is the terminal net wealth given by , and is the utility function which belongs to the class of Constant Relative Risk Aversion (CRRA) utility functions, i.e.

| (2.8) |

Here is the relative risk aversion coefficient that describes the investor’s risk preference. These utility functions are well-known and have been used very wildly in modelling the risk preference of an investor. Then we define the value function by

| (2.9) |

for .

3. The HJB equation and scaling

By applying the dynamic programming arguments [cf. Section IV.3, Fleming and Soner, (2006)], the value function of the stochastic control problem (2.9) satisfies the following Hamilton-Jacobi-Bellman (HJB) equation:

| (3.1) |

with the terminal condition

| (3.2) |

where and

In this paper, we focus on the computational scheme to solve equation (3.1) with terminal condition (3.2).

Remark 3.1.

Equation (3.1) can be interpreted in the variational inequality sense, i.e.

-

(1)

The value function satisfies all three following inequalities

-

(2)

If and , we must have

Following Dai and Zhong, (2008), we use the homothetic property of the value function to reduce the dimensionality of the problem for further numerical analysis. For any constant , the “homothetic property” of the value function is as follows:

This property allows us to reduce the dimension of the original problem from to by adopting the wealth fraction as state variables. Indeed, we define a new function

| (3.3) |

where is a vector of ones with length , and represents the vector of the fraction of wealth invested in each stock when the total wealth is one (). It is clearly sufficient to compute since the original value function is then given by

The derivation of the HJB equation and the computational procedure for both the log utility and the power utility functions are the same. Therefore we provide a detailed description of the power utility case only. In terms of , the HJB equation in (3.1) for the power utility function () becomes

| (3.4) |

with the terminal condition

where

and

| (3.5) | |||||

| (3.6) | |||||

| (3.7) |

with

| (3.8) | |||||

| (3.9) | |||||

| (3.10) |

Here represents the Kroneker index with if and otherwise. The above dimension reduction technique has been wildly used; see, for example, Dai et al., (2009) for , and Muthuraman and Kumar, (2006) for without the time variable.

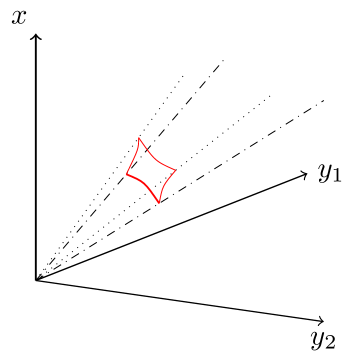

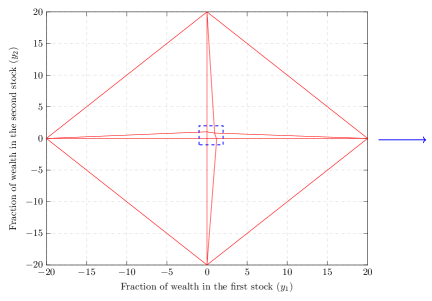

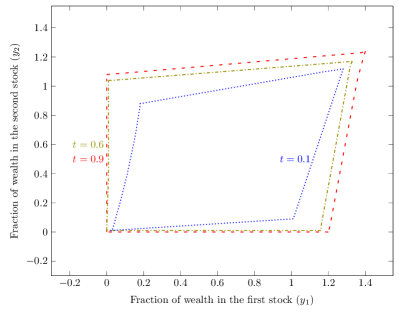

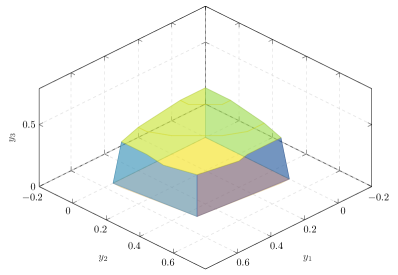

We consider a portfolio which consists of a risk-free asset and two risky assets () for illustration purpose. Before adopting the homothetic property, this problem is three dimensions, and the polygon cone in Figure 1(a) is the no-trading region. When we apply the homothetic property and rewrite the value function by defined in (3.3), we can reduce the problem to two dimensions. The red region shown in Figure 1(a) represents the no-trading region with the wealth equals one cut at time after dimension reduction.

Now we define the following representations for later use. Let

| (3.11) | |||||

| (3.12) | |||||

| (3.13) |

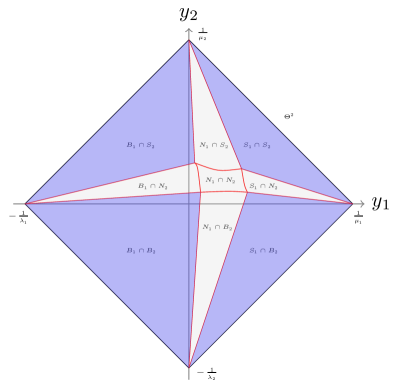

where , and represent the buying region, selling region, and no-trading region with respect to the stock. For illustration, we consider the case of as well. Figure 1(b) shows that the domain at time is partitioned into different regions along the wealth equals one cut. In the area filled with gray, the investor should buy or sell one stock just enough to push the fraction back to the no-trading region . In the area filled with blue, it is not possible to trade only one stock to make the fraction reaching the no-trading region. Thus, two stocks should be transacted simultaneously to reach the corner of inaction region .

Although we can formulate the value function as the HJB equation presented in (3.4), the complete analytical solution cannot be obtained. Also, the standard numerical methods, such as finite difference method and finite element method, work only for low dimensional cases. Due to the curse of dimensionality and the lack of an exact solution, the development of appropriate numerical methods are highly desirable to approximate the solution and provide qualitative properties under different model parameter settings. Therefore, in the next section we propose a numerical scheme that combines Monte Carlo simulation with finite difference discretization in order to solve this nonlinear variational inequality problem.

4. Numerical Method

As mentioned before, the main goal of this paper is to propose an appropriate numerical method in order to approximate the solution of the optimal investment-consumption problem and consequently obtain the trading strategies. We first notice that the main difficulties associated with the numerical solution of the HJB in (3.4) are twofold:

-

(1)

the free boundary feature related to the double obstacle problem,

-

(2)

the equation presents a nonlinear term in (3.5), .

4.1. The two-step procedure

In order to overcome the free boundary feature, we will use a two-step procedure which extends the idea proposed by Muthuraman and Kumar, (2006). Step 1 solves the nonlinear second order PDE in the first part of the HJB equation while step 2 updates the value function in different regions of the domain . To be more precise, we begin by finding the values for all in the domain such that the first part of HJB equation in (3.4) holds true, that is,

| (4.1) |

with the boundary condition

The reason that we set the boundary condition in (4.1) to be zero or negative infinity is because on the boundary of solvency region, the investor is forced to liquidate his position at any time and his net wealth on the boundary is zero. Since we consider the power utility function, the utility of consumption is zero for and negative infinity for because of zero net wealth. For the power utility function, we can set

for , because the investor’s position never exits the solvency region. This will later become useful in the numerical implementation where we have to define the value function at the discrete points outside the region .

We also require that the other two formulas in (3.4) should be satisfied in the domain . Hence, in the next step our procedure deals with the free boundary terms and in (3.6) and (3.7) for all . We have to find the point where and/or are negative, and then adjust the value at the point such that the variational inequalities hold true. Denote the trading strategy for buying and selling stocks at by

and

where is an indicator function. We update the value function at by

| (4.2) |

Here is the point that satisfies the following conditions:

-

(1)

is the point that is closest to along the characteristic curves in the region which includes ,

-

(2)

is the point on the boundary of the no-trading region facing the region to which belongs.

This procedure will be repeated backward in time until a sequence of no-trading regions and trading strategies are obtained at each time step.

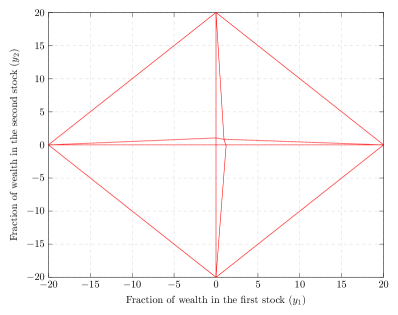

For illustration purpose, we use Figure 2 to convey the idea of the two-step procedure when at a given time . The region inside the blue diamond refers to the domain . First, we have to solve for satisfying the nonlinear second order partial differential equation in (4.1). Once the values are known, we check the gradient constraints and for . The no-trading region filled with red meets the conditions and for , and thus the value in this region do not need to be changed. However, for example, if marked green in Figure 2 is the point such that and , is classified as an element in the set and also its value should be adjusted to meet the conditions and . In Figure 2, marked green is the point which is closest to the point along the characteristic curves and also on the boundary of the no-trading region facing the region to which belongs. Therefore we update the value function by

It means that the investor should buy the first stock and sell the second one to rebalance his position so as to reach the corner of no-trading region. For another example, marked orange in Figure 2 is the point such that , and then we have to adjust its value function by

where is the point marked orange in Figure 2 that is closest to along the characteristic curve in the region.

4.2. The computational scheme for solving the nonlinear second order PDE

Due to the curse of dimensionality and the lack of an analytical solution, an appropriate numerical method for solving high-dimensional fully nonlinear PDEs is highly desirable. Our numerical method is mainly motivated by the recent work of Fahim et al., (2011). The computational scheme they provided consists of two parts. First, the Monte Carlo step includes isolating the linear generator of some underlying diffusion process to split the PDE into this linear part and a remaining nonlinear one. Next, discrete-time finite difference approximation is applied to evaluate the remaining nonlinear part of the PDE along the underlying diffusion process. The first part takes the advantage of the high-dimensional property of Monte Carlo method while the second part deals with the nonlinear term of the equation. In this paper, we modify the numerical method to incorporate the free boundaries on the no-trading region.

4.2.1. Notation

We shall first introduce some notations. The collection of matrices with real entries is denoted by . For a matrix , represents its transpose and returns square root of each element in the matrix. For , we define . In particular, and are vectors of when and reduces to the standard dot product. and are the gradient and the Hessian matrix defined by

| (4.7) |

Let be a vector of where is the coefficient of the first derivative of with respect to the variable in (3.9), and be a matrix with elements of at row and column in (3.8). The diagonal matrix is defined by . Next, we determine the linear operator

Then the remaining nonlinear parts are represented as

Hence, the problem we have to deal with becomes

| (4.8) | |||||

| (4.9) |

4.2.2. Discretization

As with any numerical scheme, the first step is to discretize the time space and the domain of state variables. Let be the time step, and , for a positive integer . Suppose we have a uniform grid, denoted by , for the domain with the grid size in each state variable direction. Denote a discretized point with at time by .

Let be an -dimensional standard Brownian motion defined in section 2. Consider the one-step-ahead Euler discretization of the diffusion corresponding to the linear operator

| (4.10) |

If we assume that the nonlinear PDE in (4.1) has a solution, we follow from Itô’s formula and replace the process by its Euler discretization to get

| (4.11) |

where is the conditional expectation, and is the order partial differential operator with respect to the space variable defined in (4.7). By approximating the integral, the value function can be evaluated as follows:

| (4.12) | |||||

| (4.13) |

Since is also a solution to the PDE in (4.8) which means

we have the discretized approximation of the value function as follows:

| (4.14) |

and for ,

| (4.15) |

Once the linear operator is chosen, the remaining nonlinear parts are handled by means of classical centered difference approximation. Let be the unit vector in the direction and then the first order term is discretized by the centered difference approximation of the gradient, that is,

| (4.16) |

The cross derivative term is discretized as follows

| (4.17) |

Once we have the set of one-step-ahead random path simulations , the iteration computes the discrete solution at time from by (4.13)-(4.15). Note that if the simulated point is not on the grid , we will approximate the value , , and by interpolation. The interpolated value at a query point is based on linear interpolation of the values at neighboring grid points in each respective dimension.

In view of the above interpretation associated with the value function, our numerical scheme studied in this paper can be expressed as a mixed Monte Carlo simulation and finite difference method. The Monte Carlo portion includes the choice of an underlying diffusion process while the finite difference portion consists of the derivative approximation of the remaining nonlinearity. We summarize the two-step iterative procedure in Algorithm 1.

Remark 4.1.

The numerical method in Algorithm 1 is inspired by Fahim et al., (2011) where they developed a Monte Carlo scheme for fully nonlinear PDEs of the form

where is a linear parabolic operator and is a nonlinear parabolic operator. In the numerical scheme of Fahim et al., (2011), they use the linear parabolic operator to generate sample paths of the diffusion process. Therefore, one has some flexibility in choosing the underlying diffusion process of the samples paths; e.g. one can also choose a linear parabolic operator to generate the diffusion sample paths as long as the nonlinear term

remains parabolic. is called parabolic if is positive definite where denotes the vector differential operator.

The numerical scheme in Algorithm 1 sets

and leaves the off-diagonal terms

for the nonlinear part. It is simply because the diffusion process simulated by this parabolic operator is less complicated when we have only diagonal elements. On the other hand, inclusion of off-diagonal second order derivative terms does not affect the sufficient conditions in Fahim et al., (2011) for the convergence of the numerical scheme, i.e. consistency, stability and monotonicity. For instance, monotonicity in Fahim et al., (2011) is guaranteed by the assumption that ; that is, the diffusion coefficient in dominates the derivative of the nonlinear operator with respect to the component of . Since has the diagonal elements of the second order derivative and has only the off-diagonal elements, we have .

It is worth mentioning that the adjustment in Step 15 of Algorithm 1 to handle the free boundary makes it difficult to show the scheme is monotone. Therefore, we restrict our study to the numerical convergence of the proposed scheme.

5. Numerical Results

The objectives in this section are: (1) to examine the performance of the mixed Monte Carlo simulation and finite difference method algorithm applying on the investment-consumption optimization problem; (2) to indicate the behaviors of optimal trading strategies.

5.1. Test 1

In this first example, we consider the following set of financial parameters:

and solve the problem for the time interval . The theoretical properties of the solution and free boundaries to the problem (3.4) for case are presented in Dai et al., (2009). We will use the following proven statements to verify the numerical results obtained from our mixed Monte Carlo / finite difference method.

Let

| (5.1) |

According to Theorem 5.4 in Dai et al., (2009), the two free boundaries and for the case should satisfy the following properties:

-

(1)

for ,

moreover,

-

(2)

for ,

and

Now we have the values and so that the selling and buying boundaries should satisfy

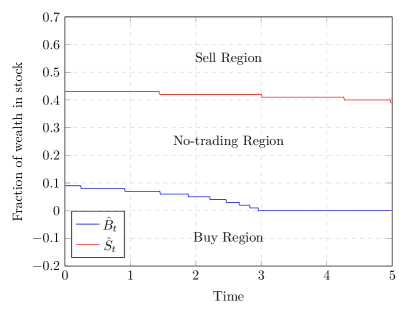

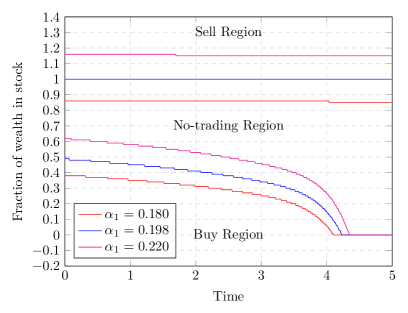

Concerning the numerical method, we use the time step and uniform grid with length . Another numerical parameter that we have used is the number of simulated sample paths . Figure 3(a) shows the numerical approximation of the optimal trading strategies in the fraction of wealth in stock at each time step. The upper function is the selling boundary while the lower one is the buying boundary. Clearly, these two boundaries depend on time, and the no-trading region is between these two boundaries. First, we have verified that the theoretical properties are satisfied for all the grid points at every discrete time step. Also, it shows that the value of the buying boundary tends to zero as the time is greater than which indicates that it is suboptimal to buy a risky asset soon as the finite horizon is approaching. This phenomenon, known as “no-buying near maturity”, was first proved by Dai et al., (2009) with consumption and transaction costs in finite time horizon. Furthermore, the optimal selling boundary is always greater than the buying one which mainly points out that a risk averse investor prefers to buy low and sell high.

Figure 3(b) shows the optimal trading boundaries with varying . We can observe that both the buying and selling boundaries increase as the value of increases, which indicates that the investor should hold a larger fraction of wealth in risky asset when the return of risky asset is higher. If , the selling boundary is less than one which means it is always suboptimal to leverage. However, leverage will be needed if . The obtained numerical results are again in full agreement with the theoretical properties stated in Dai et al., (2009) Theorem 5.4.

5.2. Test 2

In this second numerical test, the following financial parameter values have been considered:

and the investment period is set to be one year (). In this case, we investigate the optimal trading strategy for a risk averse investor who can access two positively or negatively correlated stocks as well as a risk-free asset. We use the time step , uniform grid with length in each dimension, and the number of simulated sample paths .

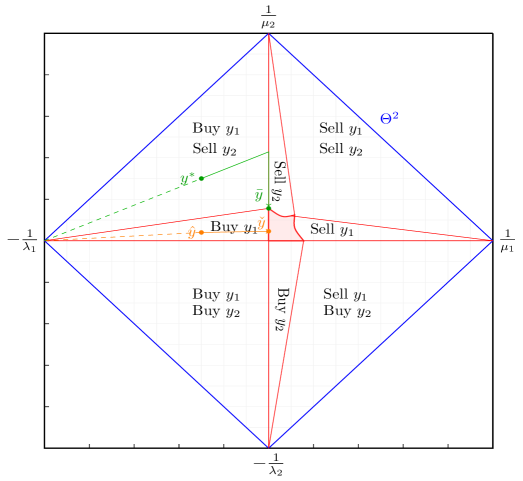

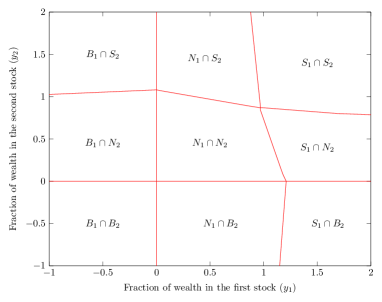

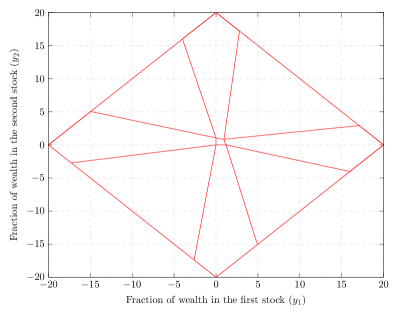

Figure 4 shows the decomposition of the domain into selling (), buying (), and no-trading () regions at time for the two positively correlated stocks case. It can be observed that the domain is partitioned into nine different regions, with the no-trading region in the center surrounded by trading regions , , , , , , and in the clockwise order. In addition, the four intersections , , , and are a singleton. This means that if the initial portfolio position is in , for example, the investor should buy the first stock and sell the second one to reach the unique corner . The phenomena we observed are consistent with rigorous analysis results proved in Chen and Dai, (2013).

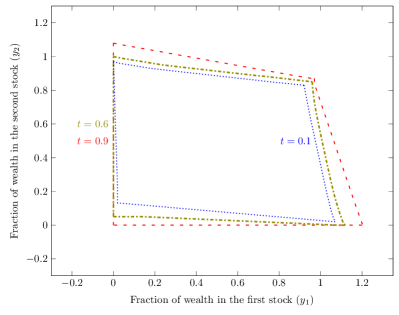

The numerical approximation of the no-trading region at different time steps is provided in Figure 5 for both the two positively and negatively correlated stocks cases. Here the expected rate of return for the first stock is more than that of the second stock and transaction costs for buying and selling stocks are kept equal. Since the first stock gives a higher rate of return, as expected the investor will not only put more fraction in the first stock but have a larger inhibition to trade the first one. In Figure 5(a) since these two stocks are positive correlated, the region of inaction can only elongate along the main diagonal. An explanation of this behavior is that the investor does not loose much by having more fraction in one stock and less in the other because one partially hedges the other. On the other hand, the result for the two negatively correlated stocks case is displayed in Figure 5(b). As we can see from the figure, the no-trading region elongates along the anti-diagonal direction. This implies that when the price of one performs worse than usual, the other will likely do better than usual. The gain in one stock is therefore likely to offset the loss in the other. Hence, the investor does not loose much by having more fraction in both stocks. These observations are the same as the results obtained in Muthuraman and Kumar, (2006) for the infinite time horizon problem. Moreover, we can observe that and when the time approaches to the maturity of the investment period, which confirms the “no-buying near maturity” phenomenon.

Remark 5.1.

Muthuraman and Kumar, (2006) provide a computational method to solve the portfolio optimization problem with infinite horizon. They use an iterative scheme that adapts the finite element method in order to capture the region of inaction (please see Muthuraman and Kumar, (2006) for more detail). Their problem does not depend on time, so it can be focused on finding the no-trading region only. However, if we consider the same optimization problem with finite time horizon, different trading regions should be characterized in order to adjust the value function based on the different regions.

We notice that if we follow the numerical scheme proposed by Muthuraman and Kumar, (2006) and adapt the implicit finite difference method instead, we obtain the same no trading region. However, the estimated buying and selling regions are not acceptable. Take for example. Figure 6 shows the comparison of results at time obtained by the mixed Monte Carlo simulation and finite difference method we proposed and the iterative scheme adapting the implicit finite difference method using the same parameter settings in Test 2(a). Observe that when the iterative scheme adapting finite difference method is applied, the numerical result illustrates and as the time approaches maturity, which obviously violates the “no-buying near maturity” phenomenon. The implementation of the proposed Monte Carlo scheme could cure this problem, and therefore gives a compatible result with the theoretical analysis.

5.3. Test 3

In this numerical test, we consider both the correlated and uncorrelated stocks cases with the following financial parameter values:

and the investment period is set to be one year (). The numerical result is obtained by using time step , uniform grid with length in each dimension, and the number of simulated sample paths . We test the computational method for three stocks case for two reasons. First, we would like to demonstrate that the proposed numerical method can be applied to high-dimensional problem. Second, it allows us to see if the insights we have in the two stocks case carry over to higher dimensions.

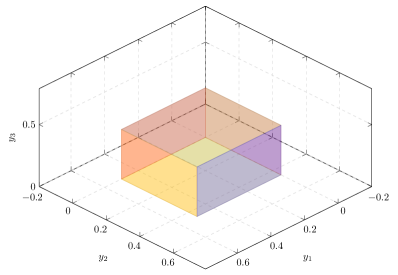

Figure 7 shows the approximated no-trading region for both the three independent stocks case and the three correlated stocks case at time . First observe that the no-trading region is a closed region set bounded by six surfaces in three dimensions. Also note that the no-trading region of the independent stocks case in Figure 7(a) is close to a rectangular cubic while the no-trading region of the correlated stocks case in Figure 7(b) is askew, which are consistent with previous observations in the two dimensional case. Since the rate of return for the first stock is greater than the other two, a large fraction of wealth in the first stock can be expected, and it is obvious that fewer transactions will be made for the first one. Finally, it also verifies the “no-buying near maturity” phenomenon as the time approaches the end of investment period for both cases.

5.4. Test 4

In this numerical test, we consider the following financial parameter values:

and the investment period is set to be one year (). The numerical result is obtained by using time step , uniform grid with length for in each dimension, and the number of simulated sample paths . Since transaction costs are really small, this problem is approximately reduced to the Merton’s problem. As we can expect, the no-trading region under these parameter settings should be a bounded small region including the Merton proportion at any time step. Denote the Merton proportion with the power utility function by , and then we have

shown in Merton, (1971). This solution gives a valuable comparison, and can be used as a benchmark to test whether the algorithm we proposed could provide a qualitative result or not.

Table 1 shows the approximated no-trading region for the ten independent stocks case at time . The lower and upper bounds mean boundaries of the no-trading region in each dimension. We can observe from the table that the no-trading region is such a small region that it is almost the Merton proportion point because small transaction costs are applied. This mainly indicates that when the transaction costs are really small, the investor is willing to rebalance his portfolio position so that the proportion of wealth in risky assets is nearly a constant. This result again demonstrates that the proposed numerical method can be applied to high-dimensional problems.

| No-trading Region | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Lower Bound | ||||||||||

| Upper Bound | ||||||||||

| Merton Proportion |

6. Conclusion

In this paper, we have proposed a mixed numerical method including Monte Carlo simulation and finite difference method to cope with the different difficulties associated with the optimal investment and consumption problem in the presence of transaction costs during a finite investment period, for which no analytical solution exists. The computed approximations satisfy all the qualitative properties which have been theoretically proved for the one risky asset case. Furthermore, the numerical solutions provide the optimal approximated value function in the presence of transaction costs and also determine the behaviors of optimal no-trading, selling, and buying regions.

It is worthwhile to point out that we not only characterize boundaries of the optimal trading policies but also provide admissible heuristics for a portfolio which includes many stocks. We believe the motivation behind this proposed numerical scheme in section 4 can be extended to various HJB models for singular control problems. For instance, it can be directly adapted to the optimal investment problem with transaction costs.

Indeed, this work carries out many directions of future research. Arguably we do not work on different choices of diffusion coefficients in the Monte Carlo step. On the other hand, in order to obtain a more accurate approximation, we observe that the high-level refinement of the meshes is required as the dimension increases which leads to an increase in computational time. It is important to mention that it does not automatically give a better result if we only refine the grids near the no-trading region and regions in which we trade only one stock. We eventually hope to include theoretical analysis and improved algorithm for these parts.

References

- Altarovici et al., (2016) Altarovici, A., Reppen, M., and Soner, H. M. (2016). Optimal consumption and investment with fixed and proportional transaction costs. arXiv preprint arXiv:1610.03958.

- Arregui and Vázquez, (2012) Arregui, I. and Vázquez, C. (2012). Numerical solution of an optimal investment problem with proportional transaction costs. Journal of Computational and Applied Mathematics, 236(12):2923–2937.

- Bayraktar and Fahim, (2014) Bayraktar, E. and Fahim, A. (2014). A stochastic approximation for fully nonlinear free boundary parabolic problems. Numerical Methods for Partial Differential Equations, 30(3):902–929.

- Bichuch, (2012) Bichuch, M. (2012). Asymptotic analysis for optimal investment in finite time with transaction costs. SIAM Journal on Financial Mathematics, 3(1):433–458.

- Chen and Dai, (2013) Chen, X. and Dai, M. (2013). Characterization of optimal strategy for multiasset investment and consumption with transaction costs. SIAM Journal on Financial Mathematics, 4(1):857–883.

- Dai et al., (2009) Dai, M., Jiang, L., Li, P., and Yi, F. (2009). Finite horizon optimal investment and consumption with transaction costs. SIAM Journal on Control and Optimization, 48(2):1134–1154.

- Dai and Yi, (2009) Dai, M. and Yi, F. (2009). Finite-horizon optimal investment with transaction costs: a parabolic double obstacle problem. Journal of Differential Equations, 246(4):1445–1469.

- Dai and Zhong, (2008) Dai, M. and Zhong, Y. (2008). Penalty methods for continuous-time portfolio selection with proportional transaction costs. Available at SSRN 1210105.

- Davis and Norman, (1990) Davis, M. H. and Norman, A. R. (1990). Portfolio selection with transaction costs. Mathematics of Operations Research, 15(4):676–713.

- Fahim et al., (2011) Fahim, A., Touzi, N., and Warin, X. (2011). A probabilistic numerical method for fully nonlinear parabolic pdes. The Annals of Applied Probability, pages 1322–1364.

- Fleming and Soner, (2006) Fleming, W. H. and Soner, H. M. (2006). Controlled Markov processes and viscosity solutions, volume 25. Springer Science & Business Media.

- Goodman and Ostrov, (2010) Goodman, J. and Ostrov, D. N. (2010). Balancing small transaction costs with loss of optimal allocation in dynamic stock trading strategies. SIAM J. Appl. Math., 70(6):1977–1998.

- Janeček and Shreve, (2004) Janeček, K. and Shreve, S. E. (2004). Asymptotic analysis for optimal investment and consumption with transaction costs. Finance Stoch., 8(2):181–206.

- Kallsen et al., (2010) Kallsen, J., Muhle-Karbe, J., et al. (2010). On using shadow prices in portfolio optimization with transaction costs. The Annals of Applied Probability, 20(4):1341–1358.

- Liu, (2004) Liu, H. (2004). Optimal consumption and investment with transaction costs and multiple risky assets. The Journal of Finance, 59(1):289–338.

- Magill and Constantinides, (1976) Magill, M. J. and Constantinides, G. M. (1976). Portfolio selection with transactions costs. Journal of Economic Theory, 13(2):245–263.

- Merton, (1971) Merton, R. C. (1971). Optimum consumption and portfolio rules in a continuous-time model. J. Econom. Theory, 3(4):373–413.

- Muthuraman and Kumar, (2006) Muthuraman, K. and Kumar, S. (2006). Multidimensional portfolio optimization with proportional transaction costs. Mathematical Finance, 16(2):301–335.

- Possamaï et al., (2012) Possamaï, D., Soner, H. M., and Touzi, N. (2012). Homogenization and asymptotics for small transaction costs: the multidimensional case. arXiv preprint arXiv:1212.6275.

- Shreve and Soner, (1994) Shreve, S. E. and Soner, H. M. (1994). Optimal investment and consumption with transaction costs. Ann. Appl. Probab., 4(3):609–692.

- Soner and Touzi, (2013) Soner, H. M. and Touzi, N. (2013). Homogenization and asymptotics for small transaction costs. Siam journal on control and optimization, 51(4):2893–2921.

- Tourin and Zariphopoulou, (1994) Tourin, A. and Zariphopoulou, T. (1994). Numerical schemes for investment models with singular transactions. Computational Economics, 7(4):287–307.

- Tourin and Zariphopoulou, (1997) Tourin, A. and Zariphopoulou, T. (1997). Viscosity solutions and numerical schemes for investment/consumption models with transaction costs. Numerical methods in finance, pages 245–269.