Modelling and prediction of financial trading networks: An application to the NYMEX natural gas futures market

Abstract

Over the last few years there has been a growing interest in using financial trading networks to understand the microstructure of financial markets. Most of the methodologies developed so far for this purpose have been based on the study of descriptive summaries of the networks such as the average node degree and the clustering coefficient. In contrast, this paper develops novel statistical methods for modeling sequences of financial trading networks. Our approach uses a stochastic blockmodel to describe the structure of the network during each period, and then links multiple time periods using a hidden Markov model. This structure allows us to identify events that affect the structure of the market and make accurate short-term prediction of future transactions. The methodology is illustrated using data from the NYMEX natural gas futures market from January 2005 to December 2008.

keywords:

Financial Trading Network; Stochastic Blockmodel; Hidden Markov Model; Systemic Risk; Array-Valued Time Series1 Introduction

Financial trading networks are directed graphs in which nodes correspond to traders participating in a financial market, and edges represent pairwise buy-sell transactions among them that occurr within a period of time. Financial trading networks contain important information about patterns of order execution in order-driven markets; hence, they provide insights into aspects of market microstructure such as market frictions, trading strategies, and systemic risks.

For example, consider the role of financial trading networks in understanding the effect of market frictions on market microstructure. In the absence of market frictions, we could expect orders from different traders to be matched randomly. However, real trading networks often exhibit features such as elevated transitivity or preferential attachment among certain groups of actors (Adamic et al., 2010), which are inconsistent with random matching. In the case of open-outcry markets, these features can be partially explained by sociological factors (for example, see Zaloom, 2004). Alternative explanations include the effect of different market roles (e.g., liquidity providers/takers) or trading strategies (e.g., long vs. short strategies), see Ozsoylev et al., 2010 or Hatfield et al., 2012.

Financial trading networks also provide information that is key in the assessment of systemic risks. Analysis of the evolution of financial trading networks can aid in tests of financial market stability (or fragility as it may be) by financial regulators to ensure that events such as a large trader failures do not serve to destabilize financial markets. For example, in the event of a large trader failure, an understanding of their network will help guide regulators through the process of unwinding their positions and may dictate whether those positions are unwound in the open market or through a transfer to a suitable counterparty (Boyd et al., 2011). Financial trading networks can also be used to identify important traders that play a critical role in the market (for example, by acting as de facto market makers or liquidity providers). In addition, they can also help us identify frequent counterparties of specific traders which may aid in regulatory oversight by federal agencies and market exchanges alike. Indeed, there is evidence that price distortion and manipulation may be more likely between frequent counterparties than by one agent acting in isolation (Harris et al., 1994).

The literature on the mathematical modeling of financial trading networks is limited. Theoretical approaches that explain the structure of a financial network as the outcome of a game have recently been developed (e.g., see Ozsoylev et al., 2010 and Hatfield et al., 2012), but they are of limited practical applicability. Most of the empirical work on trading networks has focused on the use of summary statistics such as degree distributions, average betweenness and clustering coefficients (Newman, 2003; Adamic et al., 2010). These type of approaches provide some interesting insights into market microstructure, but suffer from two main drawbacks. First, the summary statistics to be monitored need to be carefully chosen to ensure that relevant features of the market are captured (for an example of this, see Section 2). Although some of the game-theoretic work mentioned before might provide insights into which network summaries should be monitored, the choice is typically ad-hoc and the selection is often incomplete. Second, and more importantly, approaches of this type are not helpful in predicting future interactions among traders.

In this paper we move beyond descriptive network summaries to focus on stochastic models for array-valued data that place a probability distribution on the full network. The simplest such model is the class Erdös-Rényi model (Erdös and Rényi, 1959), which assumes that interactions among any two traders occur independently and with constant probability that is independent of the identity of the traders. This class of models, although well studied from a theoretical perspective, is too simplistic to accommodate most realistic networks. As an alternative, Frank and Strauss (1986) proposed the class of Exponential Random Graph models (ERGMs), also called models. These models formalize the use of summary statistics by including them as sufficient statistics in exponential-family models. A temporal version of the ERGM was introduced in Hanneke et al. (2010) and further developed in Cranmer and Desmarais (2011) and Snijders et al. (2010). The class of models, which extends generalized linear models to array-valued data, was originally proposed by Holland and Leinhardt (1981) and extended to dynamic settings in Banks and Carley (1996), Goldenberg et al. (2009) and Kolacyzk (2009). Another related approach was introduced in Hoff et al. (2002) using the concept of latent social space models. In this class of models the probability of a link between nodes increases as they occupy closer positions in latent social space. Models based on latent social spaces have again been extend to dynamic settings by Sarkar and Moore (2005) and Sewell and Chen (2015), among others.

The model discuss in this paper extends the class of stochastic blockmodels first introduced in Wang and Wong (1987) to account for time dependence. Stochastic blockmodels rely on the concept of structural equivalence to identify groups of traders (which we shall refer to as trading communities in the context of this application) with similar interaction patterns. Model-based stochastic blockmodels have been developed as array-valued extensions of traditional mixture models, and dynamic versions of these models have been recently proposed. For example, Nowicki and Snijders (2001) presented a simple Bayesian model that uses a finite mixture model and a Dirichlet prior for the probabilities of the latent classes. A dynamic variant with a first order Markov model is presented in Yang et al. (2011). An extension of this model that relies on infinite mixture models based on the Dirichlet process have been proposed by Kemp et al. (2006) and Xu et al. (2006). More recently, Airoldi et al. (2008) introduced the idea of mixed membership stochastic blockmodels for binary networks wherein the actors can belong to more than one latent class to explore subjects with multiple roles in the network. The work of Xing et al. (2010) develops its temporal extension.

Other approaches to dynamic stochastic blockmodels include the work of Wang et al. (2014) who proposed a method for change-point detection using hypothesis testing and locality statistics to identify anomalies over time, and the state-space model of Xu and Hero (2014) which introduces the extended Kalman algorithm as an alternative to MCMC. An extensive review of methods for anomaly detection in dynamic etworks is presented in Ranshous et al. (2015) including some relevant probabilistic models. For example, Heard et al. (2010) utilizes Bayesian discrete time counting processes with conditionally independent increments in order to identify nodes whose relationships have changed over time (see also Robinson and Priebe, 2013), and Perry and Wolfe (2013) consider a multivariate point process to model directed interactions between actors in continuous time, and explore the impact of homophily and network effects in the prediction of future interactions.

In this paper we propose modeling the dynamics of financial trading networks using an extension of the Bayesian infinite-dimensional model of Kemp et al. (2006). The model we propose accounts for dependence of the network structure over time and incorporates more general hierarchical priors on the interaction probabilities as well as the partition structure. To account for changes in market microstructure over time, the blockmodels associated with different time periods are linked through a hidden Markov model. In finance, regime switching models have been used in many contexts such as applications to model stock returns (Guidolin and Timmermann, 2005; Kim et al., 2001; Perez-Quiroz and Timmermann, 2000), in asset allocation (Ang and Bekaert, 2002a), business cycles (Filardo, 1994), and interest rates (Ang and Bekaert, 2002b). As we show in our illustration, by developing a dynamic, fully probabilistic model for array-valued data we are able to monitor structural changes in market microstructure while at the same time making more accurate short-term predictions of future trading patterns.

2 Data

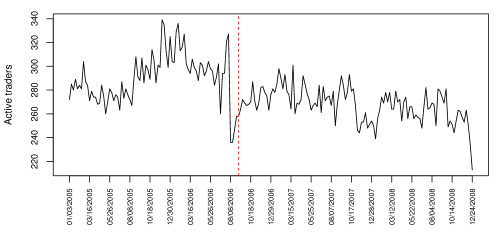

The data we analyze in this paper consists of proprietary transactions made by traders in the New York Mercantile Exchange (NYMEX) natural gas futures market between January 2005 and December 2008. A total of 970 unique traders participate in proprietary transactions at least once over the four years to December 2008. However, this list includes traders that either abandoned proprietary trading or went bankrupt during the period under study, as well as traders that entered the market after January 2005. Indeed, only between 240 and 340 traders participated in trades each week (see Figure 1). Since we have no detailed information about the times at which different traders entered or left the market, our analysis focuses on 71 traders we identified as being present in the market (although not necessarily active) during the whole period. Note that traders were anonymized and are identified in the paper using numbers.

We used the transaction data to construct weekly trading networks where a link from trader A to trader B was established if there was at least one transaction during that week in which A was the seller and B was the buyer. Data was grouped weekly because this is a low liquidity market in which daily transactions do not provide any strong signal of community behavior and the number of daily participants is too low compared to the total number of traders involved in the market over the four-year period. Monthly transactions are coarser than weekly transactions but show similar patterns and weekly observations allow us to have a more refined exploration of the network data. On the other hand, we considered binary networks instead weighted networks (e.g number or volume of transactions) because the presence/absence of links provides enough information to understand the dynamic of the network in terms of traders partnerships and community patterns.

Table 1 presents summary statistics for the number of active nodes, mean and maximum in and out degree, the degree correlation, the clustering coefficient and the probability of a link computed over the 201 observed networks for the 71 selected traders. The mean and maximum values of in and out degree are relatively low showing sparsity in the network. The high positive values of the degree correlation suggest that traders tend to make buy and sell transactions with the same partners reflecting high reciprocity in the network. In addition, the clustering coefficient is high compared to the probability of a link suggesting high transitivity in the network and confirming the presence of social network patterns in this data.

| Min | 25% | 50% | 75% | Max | |

|---|---|---|---|---|---|

| Active Traders | 56 | 66 | 69 | 70 | 71 |

| Mean degree | 13 | 18 | 23 | 28 | 34 |

| Max. in-degree | 19 | 30 | 44 | 54 | 64 |

| Max. out-degree | 21 | 29 | 48 | 56 | 66 |

| Degree correlation | 0.838 | 0.903 | 0.923 | 0.939 | 0.966 |

| Clustering coefficient | 0.395 | 0.458 | 0.482 | 0.518 | 0.625 |

| Link probability | 0.091 | 0.128 | 0.166 | 0.202 | 0.245 |

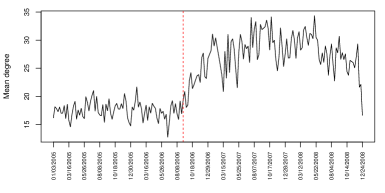

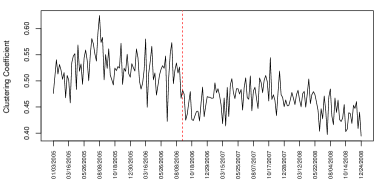

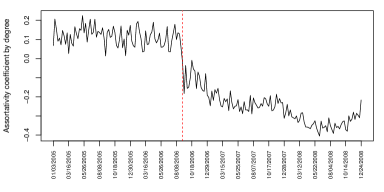

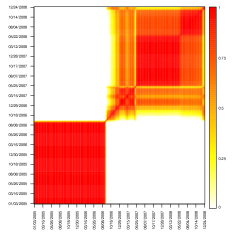

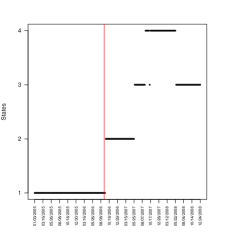

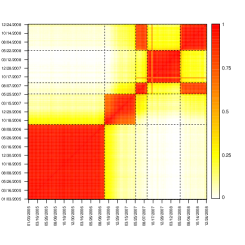

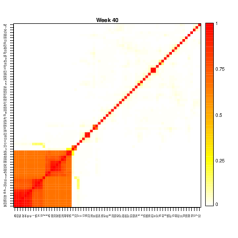

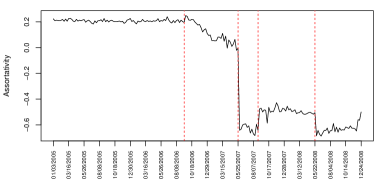

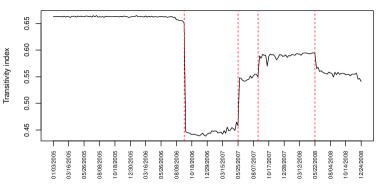

Figure 2 presents time series plots of the mean total degree (which measures the total number of links that trader has), clustering coefficients (which measure the tendency of traders to establish transitive relationships) and assortativity coefficients (which measures the tendency of traders to interact with other traders that are similar to themselves) for the 201 networks in the NYMEX dataset. These plots suggest the presence of at least a couple of change points in the structure of the network, including one around September 5, 2006 (which corresponds the date of introduction of electronic trading in this market via the CME Globex platform). To investigate the presence of change points in more detail we fitted a Bayesian hidden Markov model with bivariate Gaussian emissions (see Appendix A for details on the model). First we fitted the model to the bivariate time series of mean total degree and clustering coefficient, and then to the bivariate time series of clustering and assortativity coefficients. Figure 3 shows the marginal posterior probability that any pair of weeks are assigned to the same latent state on each model. These graphs illustrate that the analysis of networks based on summary statistics depends substantially on the ad-hoc choice of the summaries. Indeed, although both graphs provide evidence of a change point around early September 2006, they disagree on whether other change points are present, and if so, when those happened.

Finally, figure 4 presents a matrix representation of the trading network associated with the week of February 22, 2005 (traders have been reordered to make the graph easier to read). The graph suggests the existence of groups of traders that are structurally equivalent, including a large group of inactive traders that do not participate on transactions during this particular week, as well as a couple of small group of traders with a high number of intra-group and a relatively low number of inter-group transactions. This suggests that a stochastic blockmodel might be a reasonable model for individual trading networks.

3 Modeling Approach

3.1 Stochastic blockmodels for financial trading networks

We encode a financial trading network among traders using an binary sociomatrix , where if trader sold at least one contract to trader , and otherwise. Since we focus on proprietary trading (i.e., transactions carried out by the traders with their own money, rather that their clients’), we adopt the convention , as traders do not buy from themselves. Note that treating the network as binary ignores information about the transactions such as the number, maturities, and prices of the contracts. We proceed in this way for two reasons. First, in some markets (i.e., black pools) the prices and number of contracts might not be disclosed, making it impossible to apply more general models. Second, even if available, this extra information provides limit additional information about the identity of counterparties subject to contagion risks. Nonetheless, the framework we describe here can be easily extended to more general types of weighted networks.

A stochastic blockmodel for assumes that its entries are conditionally independent given two sets of parameters: a vector of discrete indicators , where if and only if trader belongs to community , and a matrix such that represents the probability that a member of community sells a contract to a member of community . Therefore,

Note that represents the maximum potential number of trading communities allowed a priori. A posteriori, the effective number of trading communities present in the sample could potentially be smaller than .

A Bayesian formulation for this model is completed by eliciting prior distributions for , , and . In the sequel we set and let the indicators be independent a priori where

and the vector of weights is constructed so that

| (1) |

for and . Note that, by setting , the model allows for the effective number of components to be as large as the number of traders , for any .

The formulation in (1) is equivalent to the constructive definition of the Poisson-Dirichlet process (Pitman, 1995; Pitman and Yor, 1997), with leading to the Dirichlet process. Hence, the implied prior on the effective number of trading communities and the size of those communities, , is given by

Note that larger values of or favor a priori a larger effective number of . Setting leads to the prior expected number of communities to grow logarithmically with , while for the expected number components grows as a power of the number of traders.

Consider now specifying a prior on the matrix of interaction probabilities . In this case we let

This prior is more general than those typically used in stochastic blockmodels, as it allows the distribution of the diagonal and off-diagonal elements of to have different hyperparameters. This ensures additional flexibility in terms of the implied degree distribution of the network, while still ensures that both and are jointly exchangeable, i.e., that the distributions are invariant to the order in which traders or communities are labeled (Aldous, 1981). In addition, it allows us to define an assortative index for the network as

and a cycle-type transitivity index

where

and

These two indexes are model-based alternatives to assortativity by degree and the clustering coefficients discussed in Figure 2 (Rodriguez and Reyes, 2013).

3.2 Hidden Markov models for time series of financial trading networks

We are interested in extending the hierarchical blockmodel described in Section 3.1 to model a time series of financial trading networks . The extension is built with two goals in mind. First, we are interested in identifying events associated with structural changes in the network and, therefore, in the microstructure of the market. Second, we aim at making short-term predictions about the structure of the network in future periods. For these reasons, we focus our attention on the use of hidden Markov models for network data. Hidden Markov models are widely used in financial (e.g., see Ryden et al., 1998 and references therein) and biological (e.g., Yau et al., 2011 and references therein) applications where there is interest in identifying structural changes in the system under study. Hence, they represent a natural alternative in this context.

More specifically, consider now a sequence of binary trading networks observed over consecutive time intervals, where all networks are associated with a common set of traders. In addition, let be a sequence of unobserved state variables such that indicates that the market is in state during period . Each state has associated with it a vector of community indicators with and a matrix of interaction probabilities representing, respectively, the grouping of traders into trading communities and the probabilities of trades occurring between communities when the system is in state . Analogously to our previous discussion, and represent the maximum number of states and the maximum number of trading communities allowed by the model a priori. A posteriori, the effective number of states and the effective number of communities on each state is potentially smaller than and , respectively.

Conditionally on the state parameters, observations are assumed to be independent, i.e.,

Hence, the joint likelihood for the data can be written as

where is the set of observations associated with the interactions between communities and in state .

To account for the persistence in network structure illustrated in Figure 2, we assume that the evolution of the system indicators follows a first-order Markov process with transition probabilities

where , the -th row of the transition matrix , must satisfy . A natural prior for is a symmetric Dirichlet distribution,

Note that, as , the induced distribution of transitions over states is equivalent to that generated by a Dirichlet process prior with concentration parameter (for example, see Green and Richardson, 2001). Therefore the model is similar in spirit to the infinite hidden Markov model discussed in Rodriguez (2011) (see also Teh et al., 2006). However our construction does not couple the values of through a common centering probability. This is in contrast to the infinite hidden Markov model, where all transition probabilities into the same state are assumed to be similar. Indeed, the structure of the infinite hidden Markov model implies that if state is highly persistent (i.e., is close to one), then the probability of transitioning from any other states into state will also tend to be large, a property that is unappealing when modeling financial trading networks. Since plays an important role in controlling the number of effective states , its value is estimated from the data by assigning an exponential prior to it and carrying out a sensitivity analysis to evaluate the impact of our prior choice on model performance.

The specification of the model is completed by eliciting hierarchical priors on the state-specific parameters and . Following the discussion in Section 3.1, we let

where are weights constructed from a sequence where . Again, since the hyperparameters and play a critical role in controlling the number of expected trading communities, they are assigned independent hyperpriors and . A natural choice is to assign a uniform prior on the unit interval and an exponential prior, while carrying out a sensitivity analysis that involves priors that favor small values of as well as priors that favor both lower and higher values for .

Similarly, the interaction probabilities are assigned priors

where , , , and are independent and gamma distributed with shape parameter and unknown rates , , and , which are in turn assigned exponential priors with means and .

4 Computation

The posterior distribution associated with our hidden Markov model for stochastic blockmodels is not analytically tractable. Therefore, we implemented a Markov chain Monte Carlo algorithm (Robert and Casella, 2005) that simulates a dependent sequence of random draws from the target distribution. Given initial values for the parameters, these are successively updated from their full conditional distributions. Standard Markov chain theory ensures that, after an appropriate burn-in, the values of the parameters generated by the algorithm are approximately distributed according to the posterior distribution. To derive the algorithm, we rely on the fact that the joint posterior distribution can be factorized as

| (2) |

Since the values of are conditionally independent a posteriori given the observations, the indicators and , and the prior parameters , , and , the first term in (2) is easy to sample from. Furthermore, conditionally on the other parameters in the model, the state indicators are sampled jointly using a forward-backward algorithm (Rabiner, 1986), while the full conditional distribution for each collection of indicators is sampled using a collapsed (marginal) Gibbs sampler (Neal, 2000). Details of the algorithm are discussed in Appendix B.

Given a sample from the previous Markov chain Monte Carlo algorithm,

obtained after an appropriate burn-in period, point and interval estimates for model parameters can be easily obtained by computing the empirical mean and/or the empirical quantiles of the posterior distribution. For example, posterior co-clustering probabilities, can be estimated as

where denotes the indicator function. The estimates can be arranged into a co-clustering matrix , which can in turn be used to identify the state of the system at each time period through a decision-theoretic approach (e.g., see Lau and Green, 2007). A similar procedure can be used to identify communities on each period.

The samples from the posterior distribution can also be used as the basis for prediction. For this purpose, note that the probability that trader sells at least one security to trader in the unobserved period can be estimated by

Using a simple 0/1 utility function, a future sell trade from trader to trader is predicted as , for some threshold that reflects the relative cost associated false positive and false negative links.

5 Analysis to the NYMEX natural gas futures market

In this section we analyze the sequence of weekly financial trading networks from transactions between 71 traders in the NYMEX natural gas futures market introduced in Section 2. The results presented in this section are based on 100,000 iterations collected after a burn-in period of 10,000 iterations. Convergence of the algorithm was diagnosed using the single-chain approach discussed in Geweke (1992) and by a visual evaluation of trace plots. We monitored the log-likelihood function, as well as the number of active states and the mean and variance over time of the assortativity and transitivity indexes and . In terms of hyperparameters, the maximum number of states is set to , the prior means for and are assigned exponential priors with unit mean, and the priors for , , and are exponential distributions with mean 2. This specification implies that, a priori, for all , so that we favor neither assortative nor dissasortive trading communities a priori.

5.1 Identifying changes in market microstructure

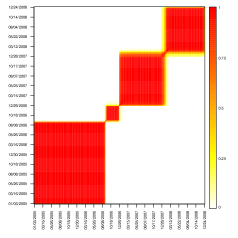

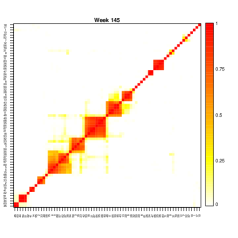

Figure 5 presents the posterior estimate of the co-clustering matrix for the latent states , along with a point estimator for the grouping of networks into states (recall Section 4). This point estimator suggests that the structure of the trading networks alternates between four highly persistent states. The first state runs between early January 2005 and early September 2006, when the electronic market is introduced. The second state runs between early September 2006 and early May 2007, when the system transitions to a new state for a short period of 3 months. After that, the system seems to transition to a fourth state in early August 2007 (interestingly, the beginning of the recent financial crises), where it stays for 37 weeks before returning to the third state in early June 2008 (which coincides with some of the largest drops in the S&P500 energy sector index over the last 13 years). Also, it is clear from the heatmap that, although there is some uncertainty associated with this point estimate of the system states (mostly in time of the transitions between states three and four), this uncertainty is relatively low. Note that these results have some similarities with those we reported in Figure 3, but also some important differences. In particular, all models agree on the presence of a change point associated with the introduction of electronic trading on September 5, 2006, but disagree on the timing and structure of other change points.

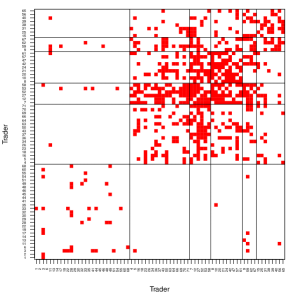

Figure 6 shows estimates of the community structure associated with two different weeks, that of October 11, 2005 () and that of November 14, 2007 (). We selected these dates because they are representative of states 1 and 4. Note that, although there are some similarities, the overall structure of the communities is quite different. State 1 is characterized by a large group of 25 mostly inactive traders, while all other traders tend to fall, for the most part, into singleton clusters. On the other hand, while state 4 also exhibits a number of singleton clusters, it also shows a number of small communities comprising between 5 and 10 traders each.

Figure 7 shows time series plots for the estimates of the assortativity and transitivity indexes and . Recall that these quantities are model-based alternatives to the assortativity by degree and the clustering coefficient presented in Figure 2. Both sets of plots share some common features, revealing mild assortativity and higher transitivity before September 2006 and highly disassortative networks with lower transitivity afterwards. This makes sense because we would expect that the introduction of an electronic market would limit the effect of social connections among traders (which tend to be assortative and transitive) and favor connections based on differential trending strategies (which tend to be disassortative).

Finally, Table 2 shows point estimates and credible intervals associated with some hyperparameters in the model, both a priori and a posteriori. In all cases, the posterior estimates appear to be more concentrated and be centered around different values than the prior.

Parameter Posterior Posterior 95% Prior Prior 95% mean credible interval mean credible interval 1.000 (0.025, 3.689) 1.000 (0.025, 3.689) 1.000 (0.025, 3.689) 1.000 (0.025, 3.689)

5.2 Network prediction

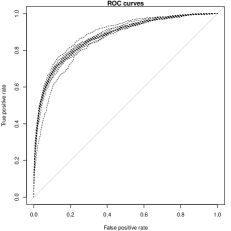

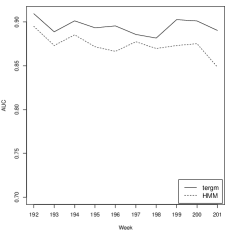

As we discussed in the introduction, besides identifying change points in market microstructure, one of our goals is to predict future trading partnerships. To assess the predictive capabilities of the model we ran an out-of-sample crossvalidation exercise where we held out the last ten weeks in the dataset and made one-step-ahead predictions for the structure of the held-out networks. More specifically, for each we use the information contained in to estimate the model parameters and obtain predictions for for different values of the threshold . Each of these predictions is compared against the observed network , the number of false and true positives is computed, and a receiver operating characteristic (ROC) curve is constructed. For comparison purposes, the same exercise was performed with a temporal Exponential Random Graph (tERGM). We used the xergm package in R to estimate the tERGM (Leifeld et al., 2014). More specifically, the tERGM is estimated with the btergm function, which implements the bootstrapped pseudolikelihood procedure presented in Desmarais and Cranmer (2012). The model we fit includes all the typical ERGM terms, the square root of in and out-degrees as node covariates, and the lagged network and the delayed reciprocity to model cross-temporal dependencies. The results show that the prediction ability of our model is good with an average AUC of 87%. However, in this particular case the tERGM slightly but consistently outperforms our model, with an average AUC of 89%.

5.3 Sensitivity analysis

To assess the effect of our prior choice on posterior inference we conducted a sensitivity analysis where the model was fitted with somewhat different priors. In particular, we used independent Beta priors with mean and variance for each , as well as exponential priors with means and for each . On the other hand, a exponential priors with mean were also used for , , and . Although inferences on the community structure were somewhat affected by prior choices, inferences on the state parameters as well as the assortativity and transitivity indexes and the predictive performance were essentially unchanged.

6 Discussion

We have presented a class of hidden Markov models for financial trading networks that have clear potential for market regulatory oversight. Key application of these models include identifying specific events (such as large trader failures or specific changes in market rules) that affect market stability, as well as identifying frequent trading counterparties that might be likely collusion partners or particularly at risk in case of bankruptcies.

In this paper we have focused on models for binary networks where only the presence/absence of transactions over a week is recorded. However, when information about volumes is available, the model can be easily extended to incorporate this information.

Although the use of a hidden Markov model allows us to account for time dependence and is useful for identifying structural changes in the system, a structure that assumes abrupt changes in the network might be too restrictive for predictive purpose. In the future we plan to evaluate models based on fragmentations and coagulations (e.g., see Bertoin, 2006) that allow for smooth evolution in the community structure, as well as extensions of auto logistic models that might allow for improved predictions.

Appendix A Hidden Markov model with bivariate normal emissions

In section 2 we fit a hidden Markov model with bivariate Gaussian emissions for different pairs of summary statistics on the NYMEX network. In this Appendix we provide a detailed formulation of the model.

Let , where and are two summary statistics (such as the clustering and assortativity coefficients) of the network observed on week . We assume that

where and independently for each and, as in our other model in this paper, the state indicators satisfy

For the analysis shown in Section 2 we set , and set to the mean and and both to the variance-covariance matrix of the observations. The estimates of the pairwise probabilities were obtained from 10,000 iterations (obtained after a burn-in period of 1,000 samples) of an MCMC algorithm that alternates through sampling , and from their corresponding full conditional posterior distributions. The details of the algorithm are very similar to the one discussed in Appendix B for the hidden Markov model with blockmodel emissions.

Appendix B Details of the computational algorithm for the hidden Markov model with blockmodel emissions

Here, we provide the details of the MCMC algorithm discussed in 4. The algorithm proceeds by updating the model parameters from the following full conditional distributions:

- (a)

-

For each and occupied states , with probability

where , ,

and the marginal predictive distribution, is given by

and is the number of elements in .

- (b)

-

Since the prior for is conditionally conjugate, we update these parameters for by sampling from

for and .

- (c)

-

Since the prior for the transition probabilities is conditionally conjugate, the posterior full conditional for , is the Dirichlet distribution

for .

- (d)

-

The posterior full conditional of is

where and for . Since this distribution has no standard form, we update using a random walk Metropolis-Hastings algorithm with symmetric log-normal proposal,

where is a tuning parameter chosen to get an average acceptance rate between and .

- (e)

-

The posterior full conditional of the pairs and has the following general form:

for the marginal predictive as defined in step (b), and . Since no direct sampler is available for this distribution, we update each pair using a random walk Metropolis-Hastings algorithm with bivariate log-normal proposals,

where is a tuning parameter matrix chosen independently for diagonal and off-diagonal pairs of parameters.

- (f)

-

The parameters of the Poisson-Dirichlet process can be jointly updated using the algorithm described in Escobar and West (1995).

- (g)

-

The posterior full conditional distributions for the hyperparameters , and correspond to gamma distributions with shape parameter and rate parameters , , , , respectively.

References

- Adamic et al. [2010] L. Adamic, C. Brunetti, J. H. Harris, and A. A. Kirilenko. Trading networks. Technical report, MIT Sloan School of Management, 2010.

- Airoldi et al. [2008] E.M Airoldi, D. M. Blei, S. E. Fienberg, and E. P. Xing. Mixed membership stochastic blockmodels. Journal of Machine Learning Research, 9:1981–2014, 2008.

- Aldous [1981] D. J. Aldous. Representations for partially exchangeable arrays of random variables. Journal of Multivariate Analysis, 11:581–598, 1981.

- Ang and Bekaert [2002a] A. Ang and G. Bekaert. International asset allocation with regime shifts. Review of Financial Studies, 15:1137–1187, 2002a.

- Ang and Bekaert [2002b] A. Ang and G. Bekaert. Regime switches in interest rates. Journal of Business Economics and Statistics, 20:163–182, 2002b.

- Banks and Carley [1996] D. Banks and K. M. Carley. Models for network evolution. Journal of Mathematical Sociology, 21:173–196, 1996.

- Bertoin [2006] J. Bertoin. Random fragmentation and coagulation processes. Cambridge studies in advanced mathematics. Cambridge University Press, 2006.

- Boyd et al. [2011] N. Boyd, J. Harris, and A. Nowak. The role of speculators during periods of financial distress. Journal of Alternative Investments, 14:10–25, 2011.

- Cranmer and Desmarais [2011] S.J. Cranmer and B.A. Desmarais. Inferential network analysis with exponential random graph models. Political Analysis, 19(1):66–86, 2011.

- Desmarais and Cranmer [2012] B.A. Desmarais and S.J. Cranmer. Statistical mechanics of networks: Estimation and uncertainty. Physica A: Statistical Mechanics and its Applications, 391(4):1865–1876, 2012.

- Erdös and Rényi [1959] P. Erdös and A. Rényi. On random graphs. Publicationes Mathematicae, 6:290–297, 1959.

- Escobar and West [1995] M.D. Escobar and M. West. Bayesian density estimation and inference using mixtures. Journal of the American Statistical Association, 90:577–588, 1995.

- Filardo [1994] A. Filardo. Business cycle phases and their transitional dynamics. Journal of Business, Economics, and Statistics, 12:299–308, 1994.

- Frank and Strauss [1986] O. Frank and D. Strauss. Markov graphs. Journal of the American Statistical Association, 81:832–842, 1986.

- Geweke [1992] J. Geweke. Evaluating the accuracy of sampling-based approaches to the calculation of posterior moments. In J. M. Bernardo, J. Berger, A. P. Dawid, and A. F. M. Smith, editors, Bayesian Statistics 4, pages 169–193, Oxford, 1992. Oxford University Press.

- Goldenberg et al. [2009] A. Goldenberg, A. X. Zheng, S. E. Fienberg, and E. M. Airoldi. A survey of statitical network models. Found. Trends Mach. Learn., 2:129–233, 2009.

- Green and Richardson [2001] P. Green and S. Richardson. Modelling heterogeneity with and without the Dirichlet process. Scandinavian Journal of Statistics, 28:355–375, 2001.

- Guidolin and Timmermann [2005] M. Guidolin and A. Timmermann. Economic implications of bull and bear regimes in uk stock and bond returns. The Economic Journal, 115:111–143, 2005.

- Hanneke et al. [2010] S. Hanneke, W. Fu, and E. P. Xing. Discrete temporal models of social networks. Electronical Journal of Statistics, 4:585–605, 2010.

- Harris et al. [1994] J. Harris, W. Christie, and P. Schulta. Why did NASDAQ market makers stop avoiding odd eighth quotes? Journal of Finance, 49:1841–1860, 1994.

- Hatfield et al. [2012] J. W. Hatfield, S. D. Kominers, A. Nichifor, M. Ostrovsky, and A. Westkamp. Stability and competitive equilibrium in trading networks. Technical report, Standford University, 2012.

- Heard et al. [2010] N.A. Heard, D.J. Weston, K. Platanioti, and D.J. Hand. Bayesian anomaly detection methods for social networks. Annals of Applied Statistics, 4:645–662, 2010.

- Hoff et al. [2002] P. Hoff, A. Raftery, and M. Handcock. Latent space approaches to social network analisys. Journal of the American Statistical Association, 97:1090–1098, 2002.

- Holland and Leinhardt [1981] P.W. Holland and K.B. Leinhardt. An exponential family of probability distributions for directed graphs. Journal of the American Statistical Association, 76:33–65, 1981.

- Kemp et al. [2006] C. Kemp, J. B. Tenenbaum, T.L. Griffiths, T. Yamada, and N. Ueda. Learning systems of concepts with an infinite relational data. In Proceedings of the 22nd Annual Conference on Artificial Intelligence(UAI 2006), Cambridge, MA, USA, 2006.

- Kim et al. [2001] C. Kim, J.C. Morley, and C.R. Nelson. Does an international tradeoff between risk and return explain mean reversion in stock prices? Journal of Empirical Finance, 8:403–426, 2001.

- Kolacyzk [2009] E. D. Kolacyzk. Statistical Analysis of Network Models. Springer, 2009.

- Lau and Green [2007] J. W. Lau and P. Green. Bayesian model based clustering procedures. Journal of Computational and Graphical Statistics, 16:526–558, 2007.

- Leifeld et al. [2014] P. Leifeld, S.J. Cranmer, and B.A. Desmarais. xergm: Extensions of Exponential Random Graph Models. R package, 2014.

- Neal [2000] R. M. Neal. Markov chain sampling methods for Dirichlet process mixture models. Journal of Computational and Graphical Statistics, 9:249–265, 2000.

- Newman [2003] M. E. J. Newman. The structure and function of complex networks. SIAM Review, 45:167–256, 2003.

- Nowicki and Snijders [2001] K. Nowicki and T. A. B. Snijders. Estimation and prediction for stochastic blockstructures. Journal of the American Statistical Association, 96:1077–1087, 2001.

- Ozsoylev et al. [2010] H. N. Ozsoylev, J. Walden, and R. Yavuz, M. D. Bildik. Investor networks in the stock market. Technical report, University of California, Berkeley, 2010.

- Perez-Quiroz and Timmermann [2000] G. Perez-Quiroz and A. Timmermann. Firm size and cyclical variations in stock returns. Journal of Finance, 55:1229–1262, 2000.

- Perry and Wolfe [2013] P. O. Perry and P. J. Wolfe. Point process modelling for directed interaction networks. Journal of the Royal Statistical Society, Series B, 75(5):821–849, November 2013.

- Pitman [1995] J. Pitman. Exchangeable and partially exchangeable random partitions. Probability Theory and Related Fields, 102:145–158, 1995.

- Pitman and Yor [1997] J. Pitman and M. Yor. The two-parameter poisson-dirichlet distribution derived from a stable subordinator. Annals of Probability, 25(2):855–900, 1997.

- Rabiner [1986] L.R. Rabiner. An introduction to hidden markov models. IEEE ASSP Magazine, pages 4–15, 1986.

- Ranshous et al. [2015] Stephen Ranshous, Shitian Shen, Danai Koutra, Steve Harenberg, Christos Faloutsos, and Nagiza F. Samatova. Anomaly detection in dynamic networks: a survey. Wiley Interdisciplinary Reviews: Computational Statistics, 7(3):223–247, 2015.

- Robert and Casella [2005] C.P. Robert and G. Casella. Monte Carlo Statistical Methods 2nd ed. Springer, New York, 2005.

- Robinson and Priebe [2013] L.F Robinson and C.E. Priebe. Detecting time-dependent structure in network data via a new class of latent process models. eprint arXiv:1212.3587v2, November 2013.

- Rodriguez [2011] A. Rodriguez. Modeling the dynamics of social networks using Bayesian hierarchical blockmodels. Statistical Analysis and Data Mining, page In press, 2011.

- Rodriguez and Reyes [2013] A. Rodriguez and P. E. Reyes. On the statistical properties of random blockmodels for network data. Technical report, University of California - Santa Cruz, 2013.

- Ryden et al. [1998] T. Ryden, T. Terasvirta, and S. Asbrink. Stylized facts of daily return series and the hidden Markov model. Journal of Applied Econometrics, 13:217–244, 1998.

- Sarkar and Moore [2005] P. Sarkar and A.W. Moore. Dynamic social network analysis using latent space models. SIGKDD Explorations: Special Edition on Link Mining, 7(2):31–40, 2005.

- Sewell and Chen [2015] D. K Sewell and Y. Chen. Analysis of the formation of the structure of social networks by using latent space models for ranked dynamic networks. Journal of the Royal Statistical Society, Series C, 2015.

- Snijders et al. [2010] T. A. B. Snijders, C.E.G. Steglich, and G.G. van de Bunt. Introduction to actor-based models for network dynamics. Social Networks, 32, 2010.

- Teh et al. [2006] Y. W. Teh, M. I Jordan, M. J. Beal, and D. M. Blei. Sharing clusters among related groups: Hierarchical Dirichlet processes. Journal of the American Statistical Association, 101:1566–1581, 2006.

- Wang et al. [2014] H. Wang, M. Tang, Y. Park, and C.E. Priebe. Locality statistics for anomaly detection in time series of graphs. IEEE Transactions on Signal Processing, 62(3):703–717, February 2014.

- Wang and Wong [1987] Y.J. Wang and G.Y. Wong. Stochastic blockmodels for directed graphs. Journal of the American Statistical Association, 82:8–19, 1987.

- Xing et al. [2010] E. P. Xing, W. Fu, and L. Song. A state-space mixed memebership blockmodel for dynamic network tomography. Annals of Applied Statistics, 4(2):535–566, 2010.

- Xu and Hero [2014] K. S. Xu and A. O. Hero. Dynamic stochastic blockmodels for time-evolving social networks. IEEE Journal of Selected Topics in Signal Processing, 8:552–562, 2014.

- Xu et al. [2006] Z. Xu, V. Tresp, K. Yu, and H.-P. Kriegel. Infinite hidden relational models. In Proceedings of the 22nd Annual Conference on Artificial Intelligence(UAI 2006), Cambridge, MA, USA, 2006.

- Yang et al. [2011] T. Yang, Y. Chi, S. Zhu, Y. Gong, and R. Jin. Detecting communities and their evolutions in dynamic social networks—a bayesian approach. Machine Learning, 82(2):157–189, 2011.

- Yau et al. [2011] C. Yau, O. Papaspiliopoulos, G. O. Roberts, and C. C. Holmes. Bayesian non-parametric hidden markov models with applications in genomics. Journal of the Royal Statistical Society, Series B, 73:37–57, 2011.

- Zaloom [2004] C Zaloom. Time, space and technology in financial networks. In Manuel Castells, editor, The Network Society: A Cross-cultural Perspective, pages 198–216. Edward Elgar Publishing Limited, 2004.