mathematical modeling, applied mathematics

Xiaoguang Huo

Feng Fu

Risk-Aware Multi-Armed Bandit Problem with Application to Portfolio Selection

Abstract

Sequential portfolio selection has attracted increasing interests in the machine learning and quantitative finance communities in recent years. As a mathematical framework for reinforcement learning policies, the stochastic multi-armed bandit problem addresses the primary difficulty in sequential decision making under uncertainty, namely the exploration versus exploitation dilemma, and therefore provides a natural connection to portfolio selection. In this paper, we incorporate risk-awareness into the classic multi-armed bandit setting and introduce an algorithm to construct portfolio. Through filtering assets based on the topological structure of financial market and combining the optimal multi-armed bandit policy with the minimization of a coherent risk measure, we achieve a balance between risk and return.

keywords:

multi-armed bandit, online learning, portfolio selection, graph theory, risk-awareness, conditional value-at-risk1 Introduction

Portfolio selection is a popular area of study in the financial industry ranging from academic researchers to fund managers. The problem involves determining the best combination of assets to be held in the portfolio in order to achieve the investor’s objectives, such as maximizing the cumulative return relative to some risk measure. In the finance community, the traditional approach to this problem can be traced back to 1952 with Markowitz’s seminal paper [1], which introduces mean-variance analysis, also known as the modern portfolio theory (MPT), and suggests choosing the allocation that maximizes the expected return for a certain risk level quantified by variance. On the other hand, sequential portfolio selection models have been developed in the mathematics and computer science communities. For example, Cover’s universal portfolio strategy [2], Helmbold’s multiplicative update portfolio strategy [3], and see Li & Hoi [4] for a comprehensive survey. In recent years, with the unprecedented success of AI and machine learning methods evidenced by AlphaGo defeating the world champion and OpenAI’s bot beating professional Dota players, more creative machine learning based portfolio selection strategies also emerged [5, 6].

Including portfolio selection, many practical problems such as clinical trials, online advertising and robotics can be modeled as sequential decision making under uncertainty [7]. In such a process, at each trial the learner faces the trade-off between acting ambitiously to acquire new knowledge and acting conservatively to take advantage of current knowledge, which is commonly known as the exploration versus exploitation dilemma. Often understood as a single-state Markov Decision Process (MDP), the stochastic multi-armed bandit problem provides an extremely intuitive mathematical framework to study sequential decision making.

An abstraction of this setting involves a set of slot machines and a sequence of trials. At each trial , the learner chooses to play one of the machines and receives a reward drawn randomly from the corresponding fixed but unknown probability distribution , whose mean is . In the classic setting, the random rewards of the same machine across time are assumed to be independent and identically distributed, and the rewards of different machines are also independent. The objective of the learner is to develop a policy, an algorithm that specifies which machine to play at each trial, to maximize cumulative rewards. A popular measure for the performance of a policy is the regret after some trials, which is defined to be

| (1) |

However, in a stochastic model it is more intuitive to compare rewards in expectation and use pseudo-regret [8]. Let be the number of times machine is played during the first trials and let . Then,

| (2) |

Thus, the learner’s objective to maximize cumulative rewards is then equivalent to minimizing regret. The asymptotic lower bound on the best possible growth rate of total regret is proved by Lai & Robbins [9], which is with a coefficient determined by the suboptimality of each machine and the Kullback-Leibler divergence. Since then, various online learning policies have been proposed [10], among which the UCB1 policy developed in Auer et al. [11] is considered the optimal and will be introduced in detail in Section Methods and Model.

Although the classic multi-armed bandit has been well studied in academia, a number of variants of this problem are proposed to model different real world scenarios. For example, Agrawal & Goyal [12] considers contextual bandit with a linear reward function and analyzes the performance of Thompson Sampling algorithm. Koulouriotis & Xanthopoulos [13] studies the non-stationary setting where the reward distributions of machines change at a fixed time. A more important variant is the risk-aware setting, where the learner considers risk in the objective instead of simply maximizing the cumulative reward. This variant is closely related to the portfolio selection problem, where risk management is an indispensable concern, and has been discussed in several papers. For example, Sani et al. [14] studies the problem where the learner’s objective is to minimize the mean-variance defined as and proposes two algorithms, MV-LCB and ExpExp. In a similar setting, Vakili & Zhao [15] provides a finer analysis of the performance of algorithms proposed in Sani et al. [14]. In addition, Vakili & Zhao [16] extends this setting by considering the mean-variance and value-at-risk of total rewards at the end of time horizon. In a more generalized case, Zimin et al. [17] sets the objective to be a function of the mean and the variance and defines the -LCB algorithm that achieves desirable performance under certain conditions. Moreover, Galichet et al. [18] chooses the conditional value-at-risk to be the objective and proposes the MARAB algorithm.

These works serve as the inspiration for us to consider risk in the model, but they are not directly applicable to the portfolio selection problem, owing to the primary obstacle that these methods only choose the best single machine to play at each trial. To address this issue, a basket of candidate portfolios need to be first selected in the preliminary stage in a strategic and logical way. For example, Shen et al. [19] uses principle component analysis (PCA) to select candidate portfolios, namely the normalized eigenvectors of the covariance matrix of asset returns.

In our model, we first take a graph theory approach to filter and select a basket of assets, which we use to construct the portfolio. Then, at each trial we combine the single-asset portfolio determined by the optimal multi-armed bandit algorithm with the portfolio that globally minimizes a coherent risk measure, the conditional value-at-risk. The rest of this paper is organized as follows. In Section Methods and Model, we formulate the portfolio selection problem in the multi-armed bandit setting, and describe our methodology in detail. In Section Results, we present our simulation results using the proposed method. In Section Discussions & Conclusion we discuss results and also provide directions for future research.

2 Methods and Model

2.1 Problem Formulation

In this section, we modify the classic multi-armed bandit setting to model portfolio selection. Consider a financial market with a large set of assets, from which the learner selects a basket of assets to invest in a sequence of trials. At each trial , the learner chooses a portfolio where is the weight of asset . Since we only consider long-only and self-financed trading, we must have where and is a column vector of ones. The returns of assets are then revealed at trial and denoted by . In particular, the return for each asset is viewed as a random draw from the corresponding probability distribution with mean and can be simply defined as the log price ratio , where we use the natural log and , are the prices at trial and . For the trading period from to , the learner receives as the reward for his portfolio. The investment strategy of the learner is thus a sequence of mappings from the accumulated knowledge to .

We make the following assumptions. First, we assume we always have access to historical returns of every asset in the market for . The historical return is defined similarly to as the log of price ratio but corresponds to the time horizon immediately before our investment period. They are only used to estimate the correlation structure and risk level. Second, we make no assumption on the dependency of returns either across time or across assets. We only assume that for each trial and for all , and with a relatively small . Note that the UCB1 algorithm we use later is proved to be optimal under a weaker assumption, , allowing us to waive the assumptions in the classic setting [11]. Third, transaction costs and market liquidity will not be considered. See Model 1 for a summary of the problem.

2.2 Portfolio Construction by Filtering Assets

Graph theory has been popularly applied in various disciplines to model networks, where the vertices represent individuals of interest and the edges represent their interactions. For example, in evolutionary game theory, graphs are used to analyze the dynamics of cooperation within different population structures [20, 21, 22, 23, 24, 25]. In financial markets, minimum spanning tree (MST) is accepted as a robust method to visualize the structure of assets [26], allowing one to capture different market sectors from empirical data [27, 29, 30].

For our purpose, since we have a large pool of assets, we first want to select a basket of to invest. Recall the return of each asset is , where and are the prices at trial and . Following Mantegna [27] and Mantegna & Stanley [28], we use trials of historical returns to find the correlation matrix, whose entries are

where is historical mean, namely for each asset in the market. For small, we can improve our estimation by taking advantage of the shrinkage method in Ledoit & Wolf [31]. We then define the metric distance between two vertices as . The Euclidean distance matrix whose entries are is then used to compute the undirected graph , where is the set of vertices representing assets and is the set of weighted edges representing distance. To extract the most important edges from , we construct the minimum spanning tree . In particular, is the subgraph of that connects all vertices without cycle and minimizes total edge weights.

One way to classify vertices is based on their relative positions in the graph, central versus peripheral. In financial markets, this classification method turns out to have significant implications in systemic risk, which is the risk that an economic shock causes the collapse of a chain of institutions [32]. Several empirical studies suggest such risk can be associated with certain characteristics of the correlation structure of market. For example, Kritzman et al. [33] defines the absorption ratio as the fraction of total variances explained by a fixed number of principal components, namely the eigenvectors of the covariance matrix, and shows this ratio increased dramatically during both domestic and global financial crisis including the housing bubble, dot-com bubble, the 1997 Asian financial crisis and so on. Drozdz et al. [34] finds a similar result and suggests that the maximum eigenvalue of the correlation matrix rises during crisis and exhausts the total variances. Hence, graph theory can be naturally applied to this setting and provides significant insights in managing systemic risk. In particular, Huang et al. [35] gives an intuitive simulation of the contagion process of systemic risk on bipartite graph. Onnela et al. [36] shows that the minimum spanning tree of assets shrinks during crisis, which supports the above arguments on the compactness of the eigenvalues of correlation matrix. More importantly, Onnela et al. [36], Pozzi et al. [37] and Ren et al. [38] suggest investing in the assets located on the peripheral parts of the minimum spanning tree can facilitates diversification and reduce the exposure to systemic risk during crisis.

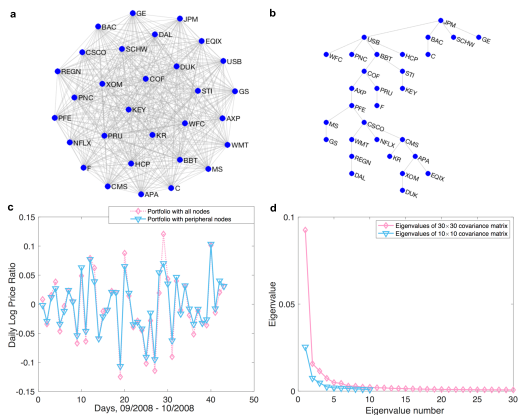

For our study, we select 30 S&P 500 stocks, which consist of 15 financial institutions (JPM, WFC, BAC, C, GS, USB, MS, KEY, PNC, COF, AXP, PRU, SCHW, BBT, STI) and 15 randomly selected companies from other sectors (KR, PFE, XOM, WMT, DAL, CSCO, HCP, EQIX, DUK, NFLX, GE, APA, F, REGN, CMS). We use the daily close price of 44 trading days during the subprime mortgage crisis to construct the minimum spanning tree and investigate the advantage of investing in peripheral vertices using the equally-weighted portfolio strategy. Although the number of stocks is small, our results similarly show that investing in peripheral vertices can reduce loss during financial crisis (Fig. 1). Fig. 1(a) shows the complete graph of 30 stocks. Fig. 1(b) is the minimum spanning tree we obtain following the above method. Observe that this tree has a total of 14 leaves (WFC, C, GS, KEY, PNC, SCHW, KR, DAL, HCP, EQIX, DUK, NFLX, GE, F), and selecting from these leaves to construct portfolio almost always reduces the median daily loss compared to the portfolio with all vertices. For example, Fig. 1(c) provides the performance of the portfolio with 10 randomly selected vertices from the 14 leaves, which increases the median daily log price ratio from -0.0101 to -0.0079 and the median daily percentage return from -0.0095 to -0.0070. Furthermore, Fig. 1(d) shows that the eigenvalue spectrum of the covariance matrix becomes less compact. Finally, We acknowledge the dynamic nature of the market structure, but for simplicity this aspect will not be considered in our study.

Therefore, we select the most peripheral vertices from the minimum spanning tree as our basket of assets to invest. We note that for any graph with distinct edge weight, which is often the case for financial data with high precision, the minimum spanning tree is proved to be unique. Our selection of vertices tends to lie on the leaves for a star-like graph, on the two ends of the longest edge for a cycle, and on the corners for a lattice. Among the numerous centrality measures discussed in graph theory [39], we use the most straightforward measure and select the vertices with the least degree. The value of is subjective and can be determined based on the learner’s view of the economic state. Assuming assets are selected, we proceed to portfolio construction as described in what follows.

2.3 Combined Sequential Portfolio Selection Algorithm

We design a sequential portfolio selection algorithm by combining the optimal multi-armed bandit policy, namely the UCB1 proposed in Auer et al. [11], with the minimization of of a coherent risk measure, namely the conditional value-at-risk. Recall that the return of each asset is defined as the log price ratio, namely . The UCB1 policy is defined as follows. First, select each asset once and observe return during the first trials. Then, for each trial select the asset that maximizes an estimated upper confidence bound of return with a certain confidence level. Precisely, at each trial we select

| (3) |

where is the empirical mean of return for asset and recall is the number of times asset has been selected during the past trials. Theorem 2.1 below provided in Auer et al. [11] proves the optimality of UCB1.

Theorem 2.1.

(Auer et al., 2002) For all assets whose the mean returns are in the support , the regret of UCB1 algorithm after any number of trials satisfies

where recall is the mean return of asset and .

The proof makes no assumption on the dependency and distribution of asset returns besides . Therefore, by scaling the values we can achieve optimality. In addition, we can use historical returns and observed returns of unselected assets to further improve the performance, but we do not discuss details here. Let be the vector of a single on entry and on the others. Our single-asset multi-armed bandit portfolio at chosen according to Eq. (3) is

| (4) |

Now, let us incorporate risk-awareness into our algorithm by finding the portfolio that achieves the global minimum of the conditional value-at-risk. We define risk measure and associated properties following Artzner et al. [40] and Bauerle & Rieder [41].

Definition 2.1.

Let be a probability space and denote by the set of integrable random variables, where any instance of represents portfolio return. A function is called a risk measure.

Definition 2.2.

Let be a risk measure, we say is a coherent risk measure if for all , , and , it satisfies

-

•

Translation invariance:

-

•

Subadditivity:

-

•

Positive homogeneity:

-

•

Monotonicity:

Definition 2.3.

Let , the risk measure value-at-risk of at confidence level is defined as

In addition, the risk measure conditional value-at-risk at confidence level is defined as

In literature, the above risk measures are sometimes expressed in terms of the portfolio loss variable, namely positive values represent loss and negative values represent gain. We note that these definitions are equivalent. Intuitively, The value-at-risk denotes the maximum threshold of loss under a certain confidence level, and conditional value-at-risk is the conditional expectation of loss given that it exceeds such a threshold. Although more popularly used in practice, value-at-risk fails certain mathematical properties such as subadditivity, which contradicts with Markowitz’s modern portfolio theory and implies diversification may not reduce investment risk. As a result, it is not a coherent risk measure. On the other hand, Pflug [42] proves conditional value-at-risk is coherent and satisfies some extra properties such as convexity, monotonicity with respect to first-order stochastic dominance (FSD) and second-order monotonic dominance.

Theorem 2.2.

(Pflug, 2000) The conditional value-at-risk is a coherent risk measure.

Therefore, we would like to minimize risk using the conditional value-at-risk at confidence level as the risk measure. We recall that is the set of possible portfolios. At each trial , the learner would like to solve the following optimization problem

Note that as , the problem becomes minimizing expected loss and as it becomes minimizing the worst outcome. In this study we use . Rockafellar & Uryasev [43] provides a convenient method to solve this problem. Recall that we assume both historical returns and present returns follow the same distribution, let be the density. Define the performance function as

where . We have the following theorem proved in Rockafellar & Uryasev [43].

Theorem 2.3.

(Rockafellar & Uryasev, 2000) The minimization of over is equivalent to the minimization of over all pairs of . Moreover, since is convex with respect to , the loss function is convex with respect to and is a convex set due to linearity, the minimization of is an instance of convex programming.

Moreover, since the density is unknown, we would like to approximate the performance function using not only historical returns but also knowledge gained as we proceed in this learning process. From the received for all , we extract historical returns of our assets . Let be the trials of returns observed so far, then our approximation of at trial is the following convex and piecewise linear function

| (5) |

Notice that the approximation function is implicitly also a function of the current trial , hence we have added an extra parameter and denote it as . As the learner proceeds in time, she accumulates data information and obtains an increasingly more precise approximation. As a result, the minimization of conditional value-at-risk is solved by convex programming and generates the following optimal solution. At each trial , the risk-aware portfolio constructed according to Eq. (5) is

| (6) |

Now we have found both the single-asset multi-armed bandit portfolio by (4) and the risk-aware portfolio by (6). Notice that they are dynamic and update based on the learner’s accumulated knowledge. For each trial , the learner combines them with a factor to form the balanced portfolio

| (7) |

In particular, is the proportion of wealth invested in the single-asset multi-armed bandit portfolio and is the proportion invested in the risk-aware portfolio. The value of denotes the risk preference of the learner. As , our algorithm reverts to the UCB1 policy, whereas for , it becomes the minimization of conditional value-at-risk. Therefore, the commonly discussed trade-off between reward and risk is illustrated here in the choice of . Finally, Algorithm 1 below summarizes our sequential portfolio selection algorithm.

3 Results

In this Section, we design experiments and report the performance of the proposed algorithm (see Algorithm 1) in comparison with several benchmarks.

3.1 Monte Carlo Simulation Method

For simplicity, we consider stocks as our assets and adopt the Black-Scholes model [44] to simulate stock prices as geometric Brownian motion (GBM) paths. As a Nobel Prize winning model, it provides a partial differential equation to price an European option by computing the initial wealth for perfectly hedging a short position in that option. The underlying asset, usually a stock, is modeled to follow a geometric Brownian motion. Although this assumption may not hold perfectly in reality, it provides an extremely convenient and popularly used method to simulate any number of stock paths. For our purpose, since we never make any assumption on the dependency of asset returns, we consider the general case where stock paths can be correlated as it is almost always the case in financial market. We use definitions similar to Chapter 4 of Shreve [45] and describe our method below.

Definition 3.1.

Let be a probability space. The stock price is said to follow a geometric Brownian motion if it satisfies the following stochastic differential equation

where is a Brownian motion, is drift and is volatility.

Definition 3.2.

Two stock paths and modeled by geometric Brownian motions are correlated if their associated Brownian motions satisfy

for some nonzero constant where .

Proposition 3.1.

For two correlated stock prices and that satisfy , the following properties hold:

-

•

-

•

-

•

where and are volatility parameters of and respectively.

Proof.

We prove the first claim and the rest follow immediately after some computations. By Itô-Doeblin formula, which can be found in Shreve [45], we have

Integrate on both sides, we have

By the martingale property of itô integrals, we simply take the expectation on both sides to obtain . ∎

Recall that we have stocks whose prices are modeled by correlated geometric Brownian motions. By definition, they must satisfy the following two equations

| (8) |

and

| (9) |

In particular, the solution to Eq. (8) can be expressed as follows [46]. For any time we have

| (10) |

We first would like to express the scaled correlated Brownian motions using independent ones. By Proposition 3.1, we have the following instantaneous covariance matrix

Since has to be symmetric and positive definite, it has a square root and we apply Cholesky decomposition to find the matrix such that . By Shreve [45], there exists independent Brownian motions such that

Then Eq. (8) becomes

| (11) |

and Eq. (10) becomes that for any time

| (12) |

Since each Brownian motion for above is independent and the increment is Gaussian with mean and variance , let be standard multivariate Gaussian then Eq. (12) becomes

| (13) |

Therefore, at each time we can conveniently generate a sample from to compute the price increment. Specifically, Eq. (13) leads to the following recursive algorithm that can also be found in Glasserman [46]. For we have

Also notice that when the paths are independent, where is the Kronecker delta function, and the covariance matrix is diagonal. In this special case, it is equivalent to compute paths separately in the one-dimensional space. For our purpose, we first find some appropriate covariance matrix and generate price paths following the above algorithm. We then uniformly divide the total time horizon into trials and use the price at the beginning and end of each trial to calculate return, which is defined earlier as the log price ratio. We run our sequential portfolio selection algorithm on these data and compare the performance with four benchmark portfolios, namely UCB1 (4), risk-aware portfolio (6), -greedy and the equally-weighted portfolio.

3.2 Simulation results

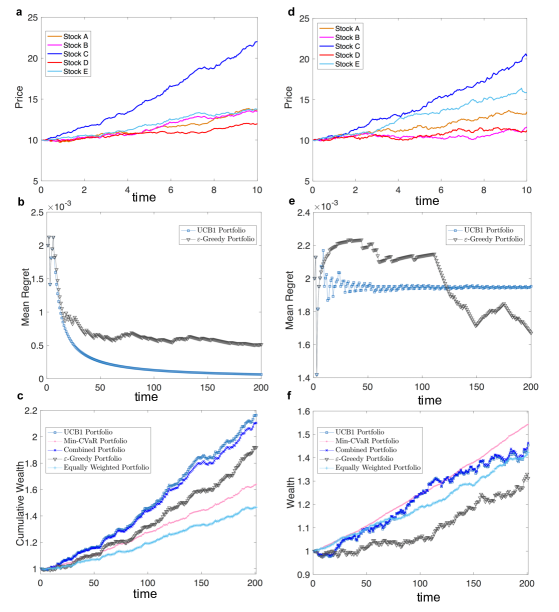

After we repeatedly generate price paths and compare the performance, we can see the results agree well with our prediction (Fig. 2). The UCB1 portfolio almost always achieves the most cumulative wealth but has high variations in its path. On the other hand, the risk-aware portfolio achieves a relatively low cumulative wealth but also has low variations. As a result, our combined portfolio achieves a middle ground between the two extremes of maximizing reward and minimizing risk. For example, Fig. 2a-2c illustrate a typical simulation, where Fig. 2a shows geometric Brownian motion paths, Fig. 2b shows the optimality of UCB1 compared to -greedy, Fig. 2c shows the cumulative wealth at the end of trials. With an initial wealth of 1 and , the cumulative wealth is 2.1615 for UCB1, 2.1024 for combined portfolio, 1.9168 for -greedy, 1.6355 for risk-aware portfolio, and 1.4640 for the equally-weighted portfolio.

In addition, we observe that when the market is volatile and when different stock paths are similar in expectation, it takes more trials for the UCB1 policy to reach optimality(Fig. 2d-2f). In this case, the risk-aware portfolio achieves the most cumulative wealth with a similarly low variation in its path. Different from the simulation presented in Fig. 2a-2c, where the volatility parameters of geometric Brownian motions are bounded in the interval , we now choose values from the interval for Fig. 2d-2f. Specifically, Fig. 2d-2f demonstrate such a simulation, where Fig. 2d shows the geometric Brownian motion paths, Fig. 2e shows the suboptimality of UCB1, and Fig. 2f shows the cumulative wealth at the end of 200 trials. With an initial wealth of 1 and , the cumulative wealth is 1.5412 for risk-aware portfolio, 1.4409 for combined portfolio, 1.4294 for UCB1, 1.4132 for the equally-weighted portfolio, and finally 1.3298 for -greedy.

From the above discussion, it is evident that the value of is vital to the performance of our sequential portfolio selection algorithm and should be determined based on market condition. In particular, Way et al. [47] discusses the trade-off between specialization to achieve high rewards and diversification to hedge against risk, and similarly shows that such choice depends on the underlying parameters and initial conditions.

4 Discussion and Conclusions

In this paper, we have studied the multi-armed bandit problem as a mathematical model for sequential decision making under uncertainty. In particular, we focus on its application in financial markets and construct a sequential portfolio selection algorithm. We first apply graph theory and select the peripheral assets from the market to invest. Then at each trial, we combine the optimal multi-armed bandit policy with the minimization of a coherent risk measure. By adjusting the parameter, we are able to achieve the balance between maximizing reward and minimizing risk. We adopt the Black-Scholes model to repeatedly simulate stock paths and observe the performance of our algorithm. We conclude that the results agree well with our prediction when the market is stable. In addition, when the market is volatile, risk-awareness becomes more crucial to achieving high performance. Therefore, parameter selection should be based on the market condition.

For future research, one may consider the optimal selection of the parameter for combining the two portfolios. One may also consider portfolio selection strategies based on the Markov Decision Process, which is a generalization of the multi-armed bandit to multiple states. In addition, one may pay more attention to a chaotic market environment where stock paths can be affected by various factors instead of simply following a stochastic process. For example, Junior & Mart [48] uses random matrix theory and transfer entropy to show news articles can possibly affect the market. Finally, one may consider transaction costs and market liquidity. For example, Reiter et al. [49] illustrates the trade-off between reward and cost in a biological auction setting and might provide some important insights for the researcher.

Data Availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

Acknowledgements

X.H. is thankful for financial support from the National Science Foundation and Dartmouth College. F.F. is grateful for support from the Dartmouth Faculty Startup Fund, Walter & Constance Burke Research Initiation Award, NIH under grant no. C16A12652 (A10712), and DARPA under grant no. D17PC00002-002.

Author Contributions

X.H. & F.F. conceived the project, X.H. performed analyses and simulations, X.H. & F.F. analyzed results, and X.H. wrote the first draft of main text. All authors reviewed the manuscript.

Additional Information

The authors declare no competing financial interests.

References

-

[1]

Markowitz H. Portfolio selection. The journal of finance. 1952 Mar 1;7(1):77-91.

http://www.jstor.org/stable/2975974?seq=1#page_scan_tab_contents -

[2]

Cover TM. Universal portfolios. Mathematical finance. 1991 Jan 1;1(1):1-29.

http://onlinelibrary.wiley.com/doi/10.1111/j.1467-9965.1991.tb00002.x

/full -

[3]

Helmbold DP, Schapire RE, Singer Y, Warmuth MK. On-Line Portfolio Selection Using Multiplicative Updates. Mathematical Finance. 1998 Oct 1;8(4):325-47.

http://onlinelibrary.wiley.com/doi/10.1111/1467-9965.00058/full -

[4]

Li B, Hoi SC. Online portfolio selection: A survey. ACM Computing Surveys (CSUR). 2014 Jan 1;46(3):35.

https://arxiv.org/abs/1212.2129 -

[5]

Heaton JB, Polson NG, Witte JH. Deep learning for finance: deep portfolios. Applied Stochastic Models in Business and Industry. 2017 Jan 1;33(1):3-12.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2838013 -

[6]

Song Q, Liu A, Yang SY. Stock portfolio selection using learning-to-rank algorithms with news sentiment. Neurocomputing. 2017 Jun 16.

http://www.sciencedirect.com/science/article/pii/S0925231217311098 -

[7]

Ghavamzadeh M, Mannor S, Pineau J, Tamar A. Bayesian reinforcement learning: A survey. Foundations and Trends® in Machine Learning. 2015 Nov 26;8(5-6):359-483.

https://arxiv.org/abs/1609.04436 -

[8]

Bubeck S, Cesa-Bianchi N. Regret analysis of stochastic and nonstochastic multi-armed bandit problems. Foundations and Trends in Machine Learning. 2012 Dec 12;5(1):1-22.

http://www.nowpublishers.com/article/Details/MAL-024 -

[9]

Lai TL, Robbins H. Asymptotically efficient adaptive allocation rules. Advances in applied mathematics. 1985 Mar 1;6(1):4-22.

http://www.sciencedirect.com/science/article/pii/0196885885900028 -

[10]

Kuleshov V, Precup D. Algorithms for multi-armed bandit problems. arXiv preprint arXiv:1402.6028. 2014 Feb 25.

https://arxiv.org/abs/1402.6028 -

[11]

Auer P, Cesa-Bianchi N, Fischer P. Finite-time analysis of the multiarmed bandit problem. Machine learning. 2002 May 1;47(2-3):235-56.

https://link.springer.com/article/10.1023/a:1013689704352 -

[12]

Agrawal S, Goyal N. Thompson sampling for contextual bandits with linear payoffs. InInternational Conference on Machine Learning 2013 Feb 13 (pp. 127-135).

http://proceedings.mlr.press/v28/agrawal13.html -

[13]

Koulouriotis DE, Xanthopoulos A. Reinforcement learning and evolutionary algorithms for non-stationary multi-armed bandit problems. Applied Mathematics and Computation. 2008 Mar 1;196(2):913-22.

http://www.sciencedirect.com/science/article/pii/S0096300307007448 -

[14]

Sani A, Lazaric A, Munos R. Risk-aversion in multi-armed bandits. InAdvances in Neural Information Processing Systems 2012 (pp. 3275-3283).

http://papers.nips.cc/paper/4753-risk-aversion-in-multi-armed-bandits -

[15]

Vakili S, Zhao Q. Risk-Averse Multi-Armed Bandit Problems under Mean-Variance Measure. IEEE Journal of Selected Topics in Signal Processing. 2016 Sep;10(6):1093-111.

http://ieeexplore.ieee.org/abstract/document/7515237/ -

[16]

Vakili S, Zhao Q. Mean-variance and value at risk in multi-armed bandit problems. InCommunication, Control, and Computing (Allerton), 2015 53rd Annual Allerton Conference on 2015 Sep 29 (pp. 1330-1335). IEEE.

http://ieeexplore.ieee.org/abstract/document/7447162/ -

[17]

Zimin A, Ibsen-Jensen R, Chatterjee K. Generalized risk-aversion in stochastic multi-armed bandits. arXiv preprint arXiv:1405.0833. 2014 May 5.

https://arxiv.org/abs/1405.0833 -

[18]

Galichet N, Sebag M, Teytaud O. Exploration vs exploitation vs safety: Risk-aware multi-armed bandits. InAsian Conference on Machine Learning 2013 Oct 21 (pp. 245-260).

https://arxiv.org/abs/1401.1123 -

[19]

Shen W, Wang J, Jiang YG, Zha H. Portfolio Choices with Orthogonal Bandit Learning. InIJCAI 2015 Jul 25 (p. 974).

http://dl.acm.org/citation.cfm?id=2832384 -

[20]

Ohtsuki H, Hauert C, Lieberman E, Nowak MA. A simple rule for the evolution of cooperation on graphs. Nature. 2006 May 25;441(7092):502.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2430087 -

[21]

Fu F, Nowak MA. Global migration can lead to stronger spatial selection than local migration. Journal of statistical physics. 2013 May 1;151(3-4):637-53.

https://link.springer.com/article/10.1007/s10955-012-0631-6 -

[22]

Tarnita CE, Ohtsuki H, Antal T, Fu F, Nowak MA. Strategy selection in structured populations. Journal of theoretical biology. 2009 Aug 7;259(3):570-81.

http://www.sciencedirect.com/science/article/pii/S0022519309001374 -

[23]

Szolnoki A, Perc M. Antisocial pool rewarding does not deter public cooperation. InProc. R. Soc. B 2015 Oct 7 (Vol. 282, No. 1816, p. 20151975). The Royal Society.

http://rspb.royalsocietypublishing.org/content/282/1816/20151975 -

[24]

Chen X, Zhang Y, Huang TZ, Perc M. Solving the collective-risk social dilemma with risky assets in well-mixed and structured populations. Physical Review E. 2014 Nov 24;90(5):052823.

https://journals.aps.org/pre/abstract/10.1103/PhysRevE.90.052823 -

[25]

Szolnoki A, Perc M. Conformity enhances network reciprocity in evolutionary social dilemmas. Journal of The Royal Society Interface. 2015 Feb 6;12(103):20141299.

http://rsif.royalsocietypublishing.org/content/12/103/20141299?cpetoc= -

[26]

Aste T, Shaw W, Di Matteo T. Correlation structure and dynamics in volatile markets. New Journal of Physics. 2010 Aug 19;12(8):085009.

http://iopscience.iop.org/article/10.1088/1367-2630/12/8/085009/meta -

[27]

Mantegna RN. Hierarchical structure in financial markets. The European Physical Journal B-Condensed Matter and Complex Systems. 1999 Sep 1;11(1):193-7.

https://link.springer.com/article/10.1007/s100510050929 - [28] Mantegna RN, Stanley HE. Introduction to econophysics: correlations and complexity in finance. Cambridge university press; 1999 Nov 13.

-

[29]

Bonanno G, Caldarelli G, Lillo F, Mantegna RN. Topology of correlation-based minimal spanning trees in real and model markets. Physical Review E. 2003 Oct 28;68(4):046130.

https://journals.aps.org/pre/abstract/10.1103/PhysRevE.68.046130 -

[30]

Bonanno G, Caldarelli G, Lillo F, Micciche S, Vandewalle N, Mantegna RN. Networks of equities in financial markets. The European Physical Journal B-Condensed Matter and Complex Systems. 2004 Mar 25;38(2):363-71.

https://arxiv.org/pdf/cond-mat/0401300.pdf -

[31]

Ledoit O, Wolf M. A well-conditioned estimator for large-dimensional covariance matrices. Journal of multivariate analysis. 2004 Feb 1;88(2):365-411.

http://www.sciencedirect.com/science/article/pii/S0047259X03000964 -

[32]

Schwarcz SL. Systemic risk. Geo. LJ. 2008;97:193.

https://www.iiiglobal.org/sites/default/files/systemicrisk.pdf -

[33]

Kritzman M, Li Y, Page S, Rigobon R. Principal components as a measure of systemic risk. The Journal of Portfolio Management. 2011 Jun 1;37(4):112-26.

http://www.iijournals.com/doi/pdfplus/10.3905/jpm.2011.37.4.112 -

[34]

Drożdż S, Grümmer F, Górski AZ, Ruf F, Speth J. Dynamics of competition between collectivity and noise in the stock market. Physica A: Statistical Mechanics and its Applications. 2000 Dec 1;287(3):440-9.

http://www.sciencedirect.com/science/article/pii/S0378437100003836 -

[35]

Huang X, Vodenska I, Havlin S, Stanley HE. Cascading failures in bi-partite graphs: model for systemic risk propagation. Scientific reports. 2013 Feb 5;3:1219.

https://www.nature.com/articles/srep01219 -

[36]

Onnela JP, Chakraborti A, Kaski K, Kertesz J, Kanto A. Dynamics of market correlations: Taxonomy and portfolio analysis. Physical Review E. 2003 Nov 13;68(5):056110.

https://journals.aps.org/pre/abstract/10.1103/PhysRevE.68.056110 -

[37]

Pozzi F, Di Matteo T, Aste T. Spread of risk across financial markets: better to invest in the peripheries. Scientific reports. 2013;3.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3627193 -

[38]

Ren F, Lu YN, Li SP, Jiang XF, Zhong LX, Qiu T. Dynamic portfolio strategy using clustering approach. PloS one. 2017 Jan 27;12(1):e0169299.

http://journals.plos.org/plosone/article?id=10.1371/journal.pone.0169

299 -

[39]

Freeman LC. Centrality in social networks conceptual clarification. Social networks. 1978 Jan 1;1(3):215-39.

http://www.sciencedirect.com/science/article/pii/0378873378900217 -

[40]

Artzner P, Delbaen F, Eber JM, Heath D. Coherent measures of risk. Mathematical finance. 1999 Jul 1;9(3):203-28.

http://onlinelibrary.wiley.com/doi/10.1111/1467-9965.00068/full - [41] Bäuerle N, Rieder U. Markov decision processes with applications to finance. Springer Science & Business Media; 2011 Jun 6.

-

[42]

Pflug GC. Some remarks on the value-at-risk and the conditional value-at-risk. InProbabilistic constrained optimization 2000 (pp. 272-281). Springer US.

https://link.springer.com/chapter/10.1007/978-1-4757-3150-7_15 -

[43]

Rockafellar RT, Uryasev S. Optimization of conditional value-at-risk. Journal of risk. 2000 Apr 1;2:21-42.

http://www.pacca.info/public/files/docs/public/finance/Active%20Risk%

20Management/Uryasev%20Rockafellar-%20Optimization%20CVaR.pdf -

[44]

Black F, Scholes M. The pricing of options and corporate liabilities. Journal of political economy. 1973 May 1;81(3):637-54.

http://www.journals.uchicago.edu/doi/abs/10.1086/260062 - [45] Shreve SE. Stochastic calculus for finance II: Continuous-time models. Springer Science & Business Media; 2004 Jun 3.

- [46] Glasserman P. Monte Carlo methods in financial engineering. Springer Science & Business Media; 2013 Mar 9.

-

[47]

Way R, Lafond F, Farmer JD, Lillo F, Panchenko V. Wright meets Markowitz: How standard portfolio theory changes when assets are technologies following experience curves.

https://arxiv.org/pdf/1705.03423.pdf -

[48]

Junior LS, Mart AM. Correlations and Flow of Information between The New York Times and Stock Markets. 2017 Jul.

https://ideas.repec.org/p/arx/papers/1707.05778.html -

[49]

Reiter JG, Kanodia A, Gupta R, Nowak MA, Chatterjee K. Biological auctions with multiple rewards. In Proc. R. Soc. B 2015 Aug 7 (Vol. 282, No. 1812, p. 20151041). The Royal Society.

http://rspb.royalsocietypublishing.org/content/282/1812/20151041.short