American options under periodic exercise opportunities

Abstract.

In this paper, we study a version of the perpetual American call/put

option where exercise opportunities arrive only periodically. Focusing

on the exponential Lévy models with i.i.d. exponentially-distributed exercise

intervals, we show the optimality of a barrier strategy that exercises

at the first exercise opportunity at which the asset price is above/below a

given barrier. Explicit solutions are obtained for the cases where the

underlying Lévy process has only one-sided jumps.

AMS 2010 Subject Classifications: 60G40, 60J75, 91G80

Key words: American options; optimal stopping; Lévy processes; periodic exercise opportunities.

1. Introduction

The valuation of the perpetual American put/call options has been considered in many papers. This can be used as an approximation to the finite maturity case, and also used in various real option models (see, e.g., Dixit and Pindyck [6]). Unlike the finite maturity case that commonly requires numerical approaches, the perpetual case typically admits a simple analytical solution. In particular, when the underlying process is an exponential Lévy process, the optimal stopping time is known to be of barrier-type: it is optimal to exercise as soon as the process goes above or below a certain barrier, which can be written concisely using the Wiener-Hopf factors (see Remark 2.1). We refer the readers to the seminal papers by Mordecki [10] and Alili and Kyprianou [2], in this context.

In this paper, we consider a variant where exercise opportunities arrive only periodically. While most of the continuous-time models assume that one can exercise the option instantaneously at any time, in reality one can monitor the underlying process only at intervals. Motivated by this, we consider the case in which one can exercise only at the jump times of an independent Poisson process. This can be seen as a modification of Bermudan options where the constant exercise intervals are replaced by i.i.d. exponential random variables.

We consider both put- and call-type payoffs. The objective of this paper is twofold.

First, for a general underlying Lévy process, we show the optimality of the periodic barrier strategy that exercises at the first exercise opportunity at which the underlying process is below/above a suitably chosen barrier.

Second, we focus on the spectrally one-sided Lévy case (where jumps are one-sided) and obtain the optimal solution explicitly using the scale function. The expected value under a periodic barrier strategy can be directly computed using the results in Albrecher et al. [1]. We obtain the optimal barriers and derive explicit forms of the optimal value function.

In order to confirm the analytical results, we also give numerical results using spectrally one-sided Lévy processes consisting of a Brownian motion with i.i.d. exponential-size jumps. We confirm the optimality, and also study the behavior of the optimal solutions with respect to the rate of Poisson arrivals.

This paper is motivated by recent developments on the optimal dividend problem where one wants to maximize the total discounted dividends until ruin, with an extra restriction that the dividend payment opportunities arrive only periodically. It has recently been shown, for the case of exponential interarrival times, that a periodic barrier strategy is optimal when the underlying process is a spectrally one-sided Lévy process (see [3, 12, 13]). This current paper can be seen as its optimal stopping version. Other related research includes Parisian ruin/reflection (see, e.g., [5, 14]); when the (Parisian) delays are exponential random variables, many fluctuation identities can be written semi-analytically in terms of the scale function, similarly to what we discuss in this paper for the case of a spectrally negative Lévy process.

The rest of the paper is organized as follows. Section 2 gives a mathematical formulation of the problem. Section 3 shows, for a general Lévy case, the optimality of a periodic barrier strategy. We then obtain optimal solutions explicitly for the spectrally one-sided case in Section 4. We conclude with numerical results in Section 5.

2. Our Problem

Let be a Lévy process and the price of a stock. For , we denote by the law of when it starts at () and write for convenience in place of . Accordingly, we shall write and for the associated expectation operators. We define as the jump times of an independent Poisson process with rate . Let be the filtration generated by and the set of -stopping times. The set of strategies is given by -valued stopping times:

We consider American-type put/call options:

| (2.1) |

for

for a given discount factor and strike price .

In order to obtain a nontrivial solution, we assume the following for the call option.

Assumption 2.1.

For the call option , we assume that .

Remark 2.1 (Classical case).

The classical case with the set of admissible strategies replaced by has been solved by [10, 2]. (i) In the classical put case, it is optimal to stop as soon as goes below the level

where is the running infimum process of and is an independent exponential random variable with parameter . (ii) In the classical call case, under Assumption 2.1, it is optimal to stop as soon as goes above

where is the running supremum process of .

3. Optimality of periodic barrier strategies

In this section, we show that the optimal stopping times are of the form

| (3.1) |

for suitably chosen barriers and . Here and throughout, we let .

Let with . Define the value function of an auxiliary problem where immediate stopping is also allowed:

| (3.2) |

By the strong Markov property,

If (3.2) is solved by

it is clear that (2.1) is solved by (3.1) for the same values of and . Hence, we shall analyze below.

Define the value function of an auxiliary finite-maturity problem:

where

with . This is the expected value on condition that and the controller has not stopped before .

Similarly, we define

where

It is clear that, for all and ,

| (3.3) |

For the call case, by Assumption 2.1, with ,

Hence, for ,

| (3.4) | ||||

By backward induction (similarly to the case of discrete-time stochastic dynamic programming), we can show the following.

Proposition 3.1.

The mappings and are convex on .

Proof.

We focus on the put case; the proof for the call case is similar. First, we have , which is convex. By the dynamic programming principle (see, e.g., (1.1.53) of Peskir and Shiryaev [15]), we have

| (3.5) |

Suppose is convex. Then,

is also convex in . Hence, is also convex by (3.5). By induction, is convex. Finally, by the convergence (3.4), is convex as well.

∎

Theorem 3.1.

There exist and such that and solve (2.1) for and , respectively.

Proof.

We only prove for the put case; the proof for the call case is similar. We consider the auxiliary problem (3.2). Immediate stopping gives and hence, we must have .

Suppose is the value function in the classical case as in [10, 2]. Then because , we must have for all . In particular, because for (see Remark 2.1), we have and hence we must have as well. By this and the convexity as in Proposition 3.1, we have for some . In order to show that and , it suffices to show for all . Indeed, this holds because the payoff function is nonnegative and can reach any level below with a positive probability. Now, by the dynamic programming principle (see, e.g. Theorem 1.11 of Peskir and Shiryaev [15]), we have

and is the optimal strategy for the problem (3.2). Hence is optimal for (2.1).

∎

4. Spectrally one-sided case

By Theorem 3.1, solving (2.1) reduces to finding the best periodic barrier. Here, we explicitly obtain it for the case of spectrally negative/positive Lévy processes (that do not have monotone paths a.s.). We refer to Section 8 of Kyprianou [11] for a comprehensive review.

Let be the probability measure under which . Also define the stopping times

| (4.1) | ||||

4.1. Spectrally negative Lévy case

Suppose is a spectrally negative Lévy process with Laplace exponent:

with its right-inverse

| (4.2) | ||||

We use for the -scale function of . This is the mapping from to that takes value zero on the negative half-line, while on the positive half-line it is a continuous and strictly increasing function defined by

| (4.3) | ||||

The -scale function is defined analogously. Define also

In particular, for , we let and, for ,

By equation (14) of Theorem 3.1 in [1], for ,

| (4.4) | ||||

where the cases and are interpreted as the limiting cases.

Lemma 4.1 (Extension of equation (16) of [1]).

For and , we have

Proof.

Let be the expectation on the left-hand side. By equation (16) of [1], for all ,

| (4.5) |

For , by the strong Markov property and the memoryless property of the exponential random variable, with ,

| (4.6) |

Here, by (4.5) and identity (3.19) in [4],

On the other hand, by Corollary 8.8 of [11],

Substituting these in (4.6) and after simplification, we have the claim.∎

4.1.1. Put case

By (4.4), we can write

| (4.7) | ||||

where in particular, for ,

| (4.8) | ||||

The maximizer can be identified by the first order condition for (4.8). For , we have

| (4.9) | ||||

where

| (4.10) |

Here, for all such that exists,

where the cases and are interpreted as the limiting cases.

By and the convexity of on , we have that if and only if for all , and therefore

| (4.11) |

Hence, . This means, and therefore is continuous and strictly decreasing. Finally, and . Hence, there exists a unique root of and it becomes the optimal barrier .

Using that in (4.7), simple algebra gives

4.1.2. Call case

By Lemma 4.1, extended to the case by analytic continuation by (4.12), we have

| (4.13) | ||||

where for . In particular, for ,

| (4.14) |

Similarly to the put case, we obtain the maximizer by the first order condition for (4.14). We have

where, for ,

| (4.15) |

By (4.12), is continuous and monotonically strictly decreasing with and . Hence, its unique root becomes the optimal barrier .

Applying that in (4.13), we have

4.2. Spectrally positive Lévy case

We now suppose that is a spectrally positive Lévy process. Then, its dual becomes a spectrally negative Lévy process. Let be the probability where and be the crossing times for defined analogously to (4.1). Let , , and denote the Laplace exponent, its inverse, and the scale function, respectively, for the process .

4.2.1. Put case

By Lemma 4.1, for and ,

| (4.16) | ||||

In particular, for ,

Differentiating this, we have (using defined in (4.15))

Because , the function is continuous and strictly decreasing with and . Hence, its unique root becomes the optimal barrier .

Applying that in (4.16), we have

4.2.2. Call case

5. Numerical results

We conclude the paper with numerical examples, using spectrally negative and positive Lévy processes consisting of a Brownian motion and i.i.d. exponential-size jumps. These are special cases of the double exponential jump diffusion of Kou [8]. The scale functions and can be obtained explicitly as in [7, 9].

For the spectrally negative case, we assume

| (5.1) |

where is a standard Brownian motion, is a Poisson process with arrival rate , and is an i.i.d. sequence of exponential random variables with parameter . The processes , , and are assumed mutually independent. For the spectrally positive case, we set to be the negative of (5.1). The value is chosen so that is a martingale for . By this, Assumption 2.1 is satisfied. For other parameters, we set , , and , unless stated otherwise.

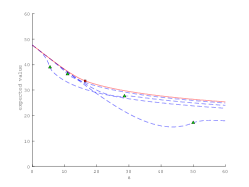

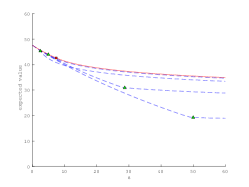

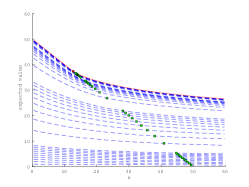

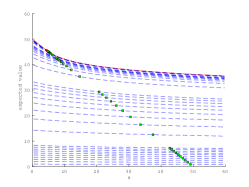

Figures 1 and 2 show, respectively, the value functions and in comparison to the expected values under other barrier strategies. It can be confirmed that the obtained value functions dominate suboptimal value functions uniformly in the starting value . Also, it is observed that our choice of the optimal barrier is such that the value function becomes convex and also smooth at the barrier.

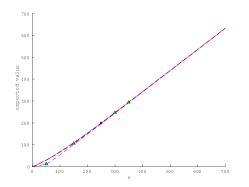

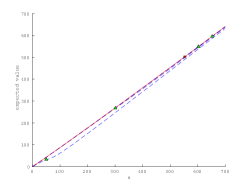

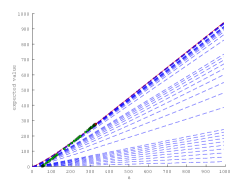

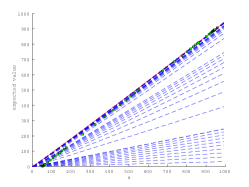

In Figures 3 and 4, we show and for various choices of the Poisson arrival rate along with the classical case as in Remark 2.1. The value functions are increasing in uniformly in and converge to the classical ones as . On the other hand, as , they decrease to zero. The optimal barriers converge to the ones in the classical case as and to the strike price as .

|

|

| spectrally negative case | spectrally positive case |

|

|

| spectrally negative case | spectrally positive case |

|

|

| spectrally negative case | spectrally positive case |

|

|

| spectrally negative case | spectrally positive case |

References

- [1] Albrecher, H. and Ivanovs, J. and Zhou, X. Exit identities for Lévy processes observed at Poisson arrival times. Bernoulli, 22.3, 1362–1382, (2014).

- [2] Alili, L. and Kyprianou, A.E. Some remarks on first passage of Lévy processes, the American put and pasting principles. Ann. Appl.Probab., 15 (3), 2062-2080, (2005).

- [3] Avanzi, B., Tu, V., and Wong, B. On optimal periodic dividend strategies in the dual model with diffusion. Insur. Math. Econ. 55, 210-224, (2014).

- [4] Avram, F., Palmowski, Z., and Pistorius, M.R. On the optimal dividend problem for a spectrally negative Lévy process. Ann. Appl.Probab. 17, 156-180, (2007).

- [5] Avram, F., Pérez, J.L., and Yamazaki, K. Spectrally negative Lévy processes with Parisian reflection below and classical reflection above. Stochastic Process. Appl., 128 (1), 255-290, (2018).

- [6] Dixit, A.K. and Pindyck, R.S. Investment under uncertainty. Princeton university press, (1994).

- [7] Egami, M. and Yamazaki, K. Phase-type fitting of scale functions for spectrally negative Lévy processes. J. Comput. Appl. Math. 264, 1–22, (2014).

- [8] Kou, S.G. A jump-diffusion model for option pricing. Manage. Sci., 48 (8), 1086–1101, (2002).

- [9] Kuznetsov, A., Kyprianou, A.E., and Rivero, V. The theory of scale functions for spectrally negative Lévy processes. Lévy Matters II, Springer Lecture Notes in Mathematics, (2013).

- [10] Mordecki, E. Optimal stopping and perpetual options for Lévy processes. Finance Stoch. 6, 473–493, (2002).

- [11] Kyprianou, A.E. Fluctuations of Lévy processes with applications. Second edition, Springer, Berlin, (2006).

- [12] Noba, K., Pérez, J.L., Yamazaki, K. and Yano, K. On optimal periodic dividend strategies for Lévy risk processes. arXiv, 1708.01678, (2017).

- [13] Pérez, J.L. and Yamazaki, K. On the optimality of periodic barrier strategies for a spectrally positive Lévy process. Insur. Math. Econ., 77, 1-13, (2017).

- [14] Pérez, J.L. and Yamazaki, K. Mixed periodic-classical barrier strategies for Lévy risk processes. arXiv, 1609.01671, (2016).

- [15] Peskir, G. and Shiryaev, A. Optimal stopping and free-boundary problems. Birkhäuser, (2006).