Pretest and Stein-Type Estimations in Quantile Regression Model

Abstract.

In this study, we consider preliminary test and shrinkage estimation strategies for quantile regression models. In classical Least Squares Estimation (LSE) method, the relationship between the explanatory and explained variables in the coordinate plane is estimated with a mean regression line. In order to use LSE, there are three main assumptions on the error terms showing white noise process of the regression model, also known as Gauss-Markov Assumptions, must be met: (1) The error terms have zero mean, (2) The variance of the error terms is constant and (3) The covariance between the errors is zero i.e., there is no autocorrelation. However, data in many areas, including econometrics, survival analysis and ecology, etc. does not provide these assumptions. Firstly introduced by Koenker, quantile regression has been used to complement this deficiency of classical regression analysis and to improve the least square estimation. The aim of this study is to improve the performance of quantile regression estimators by using pretest and shrinkage strategies. A Monte Carlo simulation study including a comparison with quantile –type estimators such as Lasso, Ridge and Elastic Net are designed to evaluate the performances of the estimators. Two real data examples are given for illustrative purposes. Finally, we obtain the asymptotic results of suggested estimators.

Department of Econometrics

Inonu University

Malatya 44280, Turkey

E-mail address: †b.yzb@hotmail.com, ‡mhmd.sml85@gmail.com and ♣ahmt.dmrlp@gmail.com

§ Department of Mathematics-computer Sciences

Necmettin Erbakan University

Konya 42090, Turkey

E-mail address: yasar@konya.edu.tr, yasinasar@hotmail.com

1. Introduction

Consider a linear regression model

| (1.1) |

where ’s are random responses, are known vectors, is a vector of unknown regression coefficients, ’ are unobservable random errors and the superscript denotes the transpose of a vector or matrix.

In a standard linear regression model, it is usually assumed that the residuals support Gauss–Markov assumptions. Then, one might want to investigate the average relationship between a set of regressors and the outcome variable based on the conditional mean function . Hence, the best linear unbiased estimator (BLUE) of the coefficients is given by the LSE, , where and . Not only, in real life, the assumptions of Gauss–Markov are not provided, but also the estimation of LSE provides only a partial view of the relationship, as we might be interested in describing the relationship at different points in the conditional distribution of . Furthermore, it doesn’t give information about the relationship at any other possible points of interest and it is sensitive to outliers. In order to deal with these problems, there is a large literature. One of the most popular one is Quantile regression Koenker and Bassett, (1978) has been an increasingly important modeling tool, due to its flexibility in exploring how covariates affect the distribution of the response. Quantile regression gives a more complete and robust representation of the variables in the model and doesn’t make any distributive assumption about the error term in the model. The main advantage of quantile regression against LSE is its flexibility in modelling the data in heterogeneous conditional distributions.

On the basis of the quantile regression lies the expansion of the regression model to the conditional quantities of the response variable. A quantile is a one of the equally segmented subsets of a sorted sample of a population. It also corresponds to decomposition of distribution function with equal probability Gilchrist, (2000). For a random variable with distribution function and , the quantile function of , , is defined to be

| (1.2) |

where is the inverse function of for probability. In other words, the quantile in a sample corresponds to the probability for a value.

As one can determine an estimation of conditional mean for a random sample with empirical distribution function by solving minimization of error squares also an estimation of the quantile regression coefficients () can be defined by solving the following minimization of absolute errors problem

| (1.3) |

where is the quantile loss function. Hence, it yields

| (1.4) |

The quantile regression concept was firstly introduced by Koenker and Bassett, (1978). In their study, they identified the autoregression quantile term which is a generalization to a linear model of a basic minimization problem which generates sample quantiles and they produce some homoscedasticity properties and joint asymptotic distribution of the estimator. Thus they made it possible to linear model generalizations of some known strong position estimators for sorted data. After its first presentation, the quantile regression has become an important and commonly used method and turned into an important tool of applied statistics in the last three decades.

Sen and Saleh, (1987) proposed pretest and Stein-type estimations based on M-type estimator in multiple linear regression models. Koenker, (2008) proposed the quantreg R package and it is implementations for linear, non-linear and non-parametric quantile regression models. R and the package quantreg are open-source software projects and can be freely downloaded from CRAN: http://cran.r-project.org. Wei et al., (2012) proposed a shrinkage estimator that automatically regulates the possible deviations to protect the model against making incorrect parameter estimates, when some independent variables are randomly missing in a quantile regression model and they tested the performance of this estimator on a finite sample using real data. The books by Koenker, (2005) and Davino et al., (2014) are excellent sources for various properties of Quantile Regression as well as many computer algorithms. Yi et al., (2016) developed an efficient and scalable algorithm for computing the solution paths for these models with the Zou and Hastie’s elastic-net penalty. They also provide an implementation via the R package hqreg publicly available on CRAN. Furthermore, it provides Tibshirani’s Lasso and Hoerl and Kennard’s Ridge estimators based on Quantile Regression models. The hqreg function uses an approximate optimal model instead of calculating the exact value of a single result for a given value, unlike Koenker’s quantreg function. The package hqreg is also an open-source software project and can be freely downloaded from https://cloud.r-project.org/web/packages/hqreg/index.html.

Ahmed, (2014) provided a collection of topics outlining pretest and Stein-type shrinkage estimation techniques in a variety of regression modeling problems. Recently, Norouzirad and Arashi, (2017) proposed preliminary and positive rule Stein-type estimation strategies based on ridge Huberized estimator in the presence of multicollinearity and outliers. Yüzbaşı and Ahmed, (2016) considered ridge pretest, ridge shrinkage and ridge positive shrinkage estimators for a semi-parametric model when the matrix appears to be ill-conditioned and the coefficients can be partitioned as , especially when is close to zero. Yüzbaşı et al., 2017a combined ridge estimators with pretest and shrinkage estimators for linear regression models. Yüzbaşı et al., 2017b very recently suggested quantile shrinkage estimation strategies when the errors are autoregressive.

The aim objective of this study is to improve the performance of quantile regression estimators by combining the idea of pretest and shrinkage estimation strategies with quantile type estimators. Hence, the paper is organized as follows. The full and sub-model estimators based on quantile regression are given in Section 2. Moreover, the pretest, shrinkage estimators and penalized estimations are also given in this section. The asymptotic properties of the pretest and shrinkage estimators estimators are obtained in Section 3. The design and the results of a Monte Carlo simulation study including a comparison with other penalty estimators are given in Section 4. Two real data examples are given for illustrative purposes in Section 5. The concluding remarks are presented in Section 6.

2. Estimation Strategies

In this study we consider the estimation problem for quantile regression models when there are many potential predictors and some of them may not have influence on the response of interest. The analysis will be more precise if “irrelevant variables” can be left out of the model. As in linear regression problems, this leads us to two different sets of model: The full model where includes all the ’s with available data; and a candidate sub-model set that includes the predictors of main concern while leaving out irrelevant variables. That is, we consider a candidate subspace where an unknown -dimensional parameter vector satisfies a set of linear restrictions

where is a matrix of rank and is a given vector of constants. Let us denote the full model estimators by and the sub-model estimators by . One way to deal with this framework is to use pretest procedures that test whether the coefficients of the irrelevant variables are zero and then estimate parameters in the model that include coefficients that are rejected by the test. Another approach is to use Stein type shrinkage estimators where the estimated regression coefficient vector is shrunk in the direction of the candidate subspace.

2.1. Full and Sub-Model Estimations

Linear regression model in can be written in a partitioned form as follows

| (2.1) |

where and , parameters are of order and , respectively. and ’s are errors with the same joint distribution function .

The conditional quantile function of response variable would be written as follows

| (2.2) |

The main interest here is to test the null hypothesis

| (2.3) |

We assume that the sequence of design matrices satisfies the following conditions

-

(A1)

-

(A2)

where is a positive definite matrix.

In order to test (2.3), under the assumptions (A1-A2), we consider the following Wald test statistics is given by

| (2.4) |

where is the partition of the matrix and is the partition of the matrix. Also and . Here, the term , which plays the role of the distress parameter, is generally called the sparsity function Cooley and Tukey, (1965) or quantile density function Parzen, (1979).The sensitivity of the test statistic naturally depends on this parameter. The distribution of fits the chi-square distribution with degree of freedom under the null hypothesis.

Full model quantile regression estimator is the value that minimizes the following problem

Sub-model (SM) quantile regression estimator of is given by

Also it is the value value that minimizes the following problem

2.2. Pretest and Stein-Type Estimations

The pretest was firstly applied by Bancroft, (1944) for the validity of the unclear preliminary information by subjecting it to a preliminary test and according to this verification adding it to the model as a parametric constraint in the process of selecting the information between the sub model and the full model. In the pretest method, after a sub model estimator obtained in addition to obtaining the full model estimator the validity of the subspace information would be tested by using an appropriate test statistic .

The preliminary test estimator could be obtained by following equation

| (2.5) |

where is an indicator function and is the percentage point of the .

The Stein-type shrinkage (S) estimator is a combination of the over–fitted model estimator with the under–fitted , given by

In an effort to avoid the over-shrinking problem inherited by we suggest using the positive part of the shrinkage estimator defined by

2.3. Penalized Estimation

The penalized estimators for quantile are given by Yi et al., (2016).

| (2.6) |

where is a quantile loss function, is a penalty function and is a tuning parameter.

which is the lasso penalty for (Tibshirani, (1996)), the ridge penalty for (Hoerl and Kennard, (1970)) and the elastic-net penalty for (Zou and Hastie, (2005)).

3. Asymptotic Analysis

In this section, we demonstrate the asymptotic properties of suggested estimators. First, we consider the following theorem.

Theorem 3.1.

The distribution of the quantile regression full model with i.i.d. variables and under assumptions A1 and A2,

| (3.1) |

where denotes convergence in distribution as .

Proof.

The proof can be obtained from Koenker, (2005).

Let be a sequence of local alternatives given by

where is a fixed vector. If , then the null hypothesis is true. Furthermore, we consider the following proposition to establish the asymptotic properties of the estimators.

Proposition 3.2.

Let , and . Under the regularity assumptions A1 and A2, Theorem 3.1 and the local alternatives , as we have the following joint distributions:

where , , and .

Proof.

See Appendix.

Now, we are ready to obtain the asymptotic distributional biases of estimators which are given the following section.

3.1. The Performance of Bias

The asymptotic distributional bias of an estimator is defined as

Theorem 3.3.

Under the assumed regularity conditions A1 and A2, the Proposition 3.2, the Theorem 3.1 and the local alternatives , the expressions for asymptotic biases for listed estimators are:

where , and is the cumulative distribution function of the non-central chi-squared distribution with non-centrality parameter and degree of freedom, and

Proof.

See Appendix.

Now, we define the following asymptotic quadratic bias of an estimator by converting them into the quadratic form since the bias expression of all the estimators are not in the scalar form.

| (3.2) |

Using the definition given in , the asymptotic distributional quadratic bias of the estimators are presented below.

The of is and the of is an unbounded function of . The of starts from at , and when increases it to the maximum point and then decreases to zero. For the s of and , they similarly start from , and increase to a point, and then decrease towards zero.

3.2. The performance of Risk

The asymptotic distributional risk of an estimator is defined as

| (3.3) |

where is a positive definite matrix of weights with dimensions of , and is the asymptotic covariance matrix of an estimator defined as

Theorem 3.4.

Noting that if , then all the risks reduce to common value for all . For , the risk of remains constant while the risk of is an bounded function of since . The risk of increases as moves away from zero, achieves it maximum and then decreases towards the risk of the full model estimator. Thus, it is a bounded function of . The risk of is smaller than the risk of for some small values of and opposite conclusions holds for rest of the parameter space. It can be seen that strictly inequality holds for small values of . Thus, positive shrinkage is superior to the shrinkage estimator. However, both shrinkage estimators outperform the full model estimator in the entire parameter space induced by . On the other hand, the pretest estimator performs better than the shrinkage estimators when takes small values and outside this interval the opposite conclusion holds.

4. Simulations

We conduct Monte-Carlo simulation experiments to study the performances of the proposed estimators under various practical settings. In order to generate the response variables, we use

where ’s are standard normal. The correlation between the th and th components of equals to and also ’s follow i.i.d.

4.1. Asymptotic Investigations

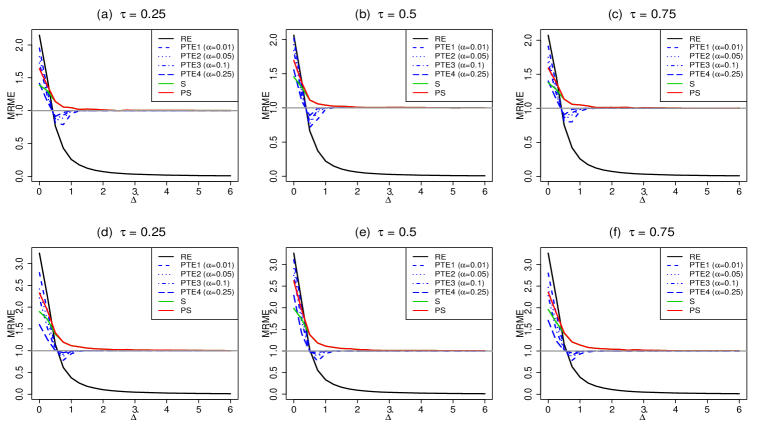

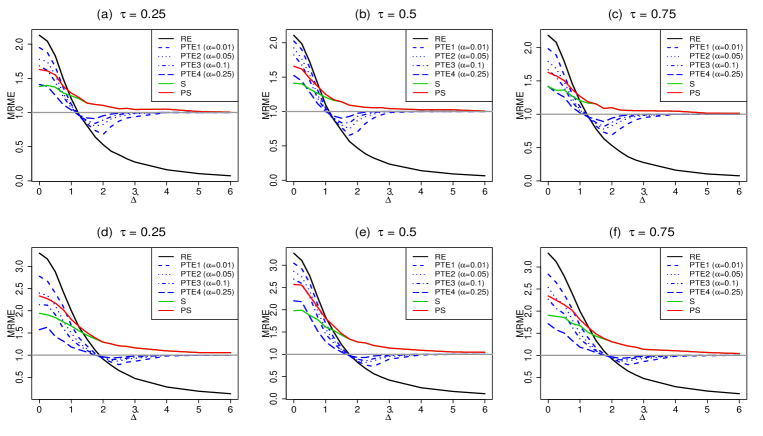

We consider that the regression coefficients are set , where and mean the vectors of 1 and 0 with dimensions and , respectively. In order to investigate the behavior of the estimators, we define , where and is the Euclidean norm. If , then it means that we will have to generate the response while we will have when , say . When we increase the number of , it indicates the degree of the violation of null hypothesis. Also, we consider that , , and . Furthermore, we consider both and errors are only taken from standard normal distribution. In this case we investigate the performance of suggested estimators for different values of .

The performance of an estimator was evaluated by using the model error (ME) criterion which is defined by

For each Monte Carlo dataset with 2500 replication, we compare the proposed procedure using the relative median model error (MRME) which is defined as

| (4.1) |

If MRME of an estimator is larger than one, it is superior to .

4.2. Performance Comparisons

In this section, we illustrate two example to both investigate suggested estimators and compare their performance with listed quantile penalty estimations. Hence, we simulated data which contains a training dataset, validation set and an independent test set. In this section, the co-variates are scaled to have mean zero and unit variance. We fitted the models only using the training data and the tuning parameters were selected using the validation data. Finally, we computed the predictive mean absolute deviation (PMAD) criterion which is defined by

We also use the notation to describe the number of observations in the training, validation and test set respectively, e.g. . Here are the details of the two examples:

-

1-

Each data set consists of observations. is specified by and . Also, we consider , where .

-

2-

We keep all values the same as in (1) except .

Table 1. shows the MAD values of pretest and shrinkage estimators for different distributions of with given parameters at , and quantiles, where .

Normal Laplace Log-normal Skew-Normal 0.25 FM 0.629(0.018) 1.348(0.060) 0.922(0.032) 0.781(0.033) 0.321(0.016) 0.608(0.022) SM 0.176(0.009) 0.361(0.021) 0.246(0.015) 0.230(0.010) 0.097(0.007) 0.162(0.008) PT1 0.216(0.022) 0.394(0.064) 0.264(0.030) 0.242(0.035) 0.101(0.015) 0.173(0.017) PT2 0.225(0.024) 0.430(0.075) 0.292(0.039) 0.267(0.039) 0.105(0.017) 0.177(0.025) PT3 0.237(0.026) 0.494(0.080) 0.339(0.040) 0.287(0.042) 0.114(0.019) 0.182(0.025) PT4 0.268(0.028) 0.497(0.082) 0.560(0.043) 0.360(0.045) 0.124(0.020) 0.206(0.030) PS 0.328(0.020) 0.751(0.061) 0.569(0.031) 0.477(0.033) 0.156(0.015) 0.311(0.020) Ridge 0.407(0.010) 0.628(0.015) 0.516(0.015) 0.473(0.013) 0.236(0.011) 0.423(0.012) Lasso 0.261(0.010) 0.452(0.015) 0.371(0.015) 0.320(0.013) 0.135(0.008) 0.254(0.011) ENET 0.256(0.010) 0.433(0.015) 0.354(0.015) 0.293(0.013) 0.133(0.008) 0.247(0.011) 0.5 FM 0.553(0.019) 1.544(0.058) 0.709(0.027) 0.619(0.022) 0.557(0.024) 0.557(0.018) SM 0.160(0.009) 0.496(0.026) 0.199(0.011) 0.141(0.009) 0.153(0.01) 0.160(0.008) PT1 0.174(0.017) 0.527(0.051) 0.202(0.018) 0.165(0.025) 0.160(0.018) 0.160(0.014) PT2 0.176(0.018) 0.529(0.059) 0.203(0.024) 0.169(0.027) 0.176(0.019) 0.174(0.022) PT3 0.184(0.023) 0.560(0.065) 0.203(0.029) 0.172(0.032) 0.193(0.022) 0.179(0.024) PT4 0.256(0.028) 0.631(0.074) 0.259(0.036) 0.202(0.035) 0.222(0.028) 0.215(0.026) PS 0.303(0.019) 0.929(0.055) 0.332(0.025) 0.325(0.024) 0.321(0.019) 0.255(0.019) Ridge 0.373(0.011) 0.695(0.013) 0.416(0.013) 0.400(0.012) 0.362(0.012) 0.387(0.009) Lasso 0.233(0.010) 0.505(0.016) 0.280(0.014) 0.225(0.013) 0.207(0.013) 0.230(0.009) ENET 0.225(0.009) 0.494(0.017) 0.260(0.013) 0.212(0.013) 0.203(0.012) 0.220(0.009) 0.75 FM 0.574(0.022) 2.186(0.080) 0.916(0.037) 0.694(0.029) 1.033(0.048) 0.607(0.022) SM 0.174(0.009) 0.656(0.032) 0.250(0.015) 0.201(0.012) 0.314(0.018) 0.159(0.009) PT1 0.191(0.027) 0.706(0.094) 0.303(0.043) 0.212(0.028) 0.353(0.055) 0.162(0.021) PT2 0.206(0.029) 0.777(0.105) 0.330(0.048) 0.224(0.032) 0.534(0.057) 0.175(0.025) PT3 0.224(0.030) 1.063(0.113) 0.350(0.050) 0.243(0.036) 0.563(0.059) 0.194(0.027) PT4 0.262(0.031) 1.756(0.111) 0.478(0.053) 0.513(0.040) 0.792(0.056) 0.214(0.031) PS 0.328(0.024) 1.437(0.083) 0.553(0.040) 0.450(0.028) 0.744(0.045) 0.320(0.023) Ridge 0.365(0.011) 0.797(0.009) 0.510(0.016) 0.458(0.012) 0.562(0.014) 0.378(0.012) Lasso 0.248(0.011) 0.627(0.016) 0.356(0.016) 0.298(0.013) 0.404(0.016) 0.236(0.009) ENET 0.240(0.011) 0.603(0.017) 0.331(0.016) 0.292(0.013) 0.391(0.016) 0.217(0.009) Mean OLS 0.430(0.043) 1.323(0.132) 0.901(0.090) 0.593(0.059) 0.804(0.080) 0.422(0.042)

Furthermore, we consider that the errors follow one of the following distributions:

-

(i)

Standard normal distribution,

-

(ii)

Chi-square distribution with five degrees of freedom ,

-

(iii)

Student t distribution with two degrees of freedom ,

-

(iv)

Laplace distribution with location parameter equals zero and scale parameter equals one,

-

(v)

Log-normal distribution with location parameter equals zero and scale parameter equals one and also

-

(vi)

The random sample from the skew-normal distribution.

Normal Laplace Log-normal Skew-Normal 0.25 FM 0.679(0.017) 1.553(0.046) 1.127(0.032) 0.814(0.031) 0.454(0.016) 0.655(0.017) SM 0.099(0.004) 0.219(0.011) 0.152(0.009) 0.128(0.007) 0.049(0.004) 0.100(0.004) PT1 0.109(0.031) 0.236(0.068) 0.200(0.053) 0.160(0.042) 0.050(0.014) 0.122(0.030) PT2 0.120(0.033) 0.271(0.077) 0.240(0.055) 0.195(0.046) 0.057(0.019) 0.125(0.033) PT3 0.138(0.034) 0.286(0.081) 0.843(0.058) 0.262(0.048) 0.057(0.022) 0.139(0.034) PT4 0.546(0.034) 0.342(0.086) 0.996(0.056) 0.655(0.048) 0.060(0.024) 0.506(0.035) PS 0.285(0.020) 0.502(0.049) 0.570(0.033) 0.409(0.029) 0.085(0.014) 0.279(0.020) Ridge 0.399(0.005) 0.433(0.002) 0.433(0.003) 0.432(0.005) 0.300(0.008) 0.398(0.005) Lasso 0.182(0.007) 0.316(0.008) 0.245(0.008) 0.215(0.007) 0.103(0.006) 0.176(0.007) ENET 0.180(0.007) 0.300(0.008) 0.235(0.008) 0.212(0.007) 0.103(0.006) 0.176(0.007) 0.5 FM 0.616(0.016) 1.812(0.052) 0.787(0.029) 0.717(0.025) 0.651(0.023) 0.603(0.017) SM 0.094(0.006) 0.272(0.015) 0.108(0.007) 0.090(0.006) 0.088(0.006) 0.090(0.004) PT1 0.100(0.020) 0.283(0.057) 0.110(0.024) 0.105(0.028) 0.095(0.026) 0.092(0.018) PT2 0.102(0.024) 0.283(0.063) 0.117(0.034) 0.105(0.028) 0.098(0.032) 0.095(0.023) PT3 0.104(0.025) 0.285(0.069) 0.117(0.039) 0.107(0.030) 0.100(0.033) 0.100(0.027) PT4 0.119(0.028) 0.334(0.082) 0.126(0.044) 0.113(0.034) 0.115(0.035) 0.104(0.029) PS 0.149(0.016) 0.402(0.048) 0.177(0.024) 0.138(0.020) 0.174(0.021) 0.132(0.017) Ridge 0.386(0.005) 0.433(0.001) 0.414(0.005) 0.400(0.006) 0.377(0.006) 0.370(0.005) Lasso 0.175(0.007) 0.358(0.008) 0.200(0.007) 0.192(0.007) 0.167(0.007) 0.164(0.006) ENET 0.168(0.007) 0.349(0.008) 0.195(0.007) 0.191(0.007) 0.164(0.007) 0.161(0.006) 0.75 FM 0.640(0.018) 2.362(0.064) 1.079(0.033) 0.847(0.028) 1.296(0.044) 0.679(0.022) SM 0.105(0.006) 0.366(0.017) 0.131(0.008) 0.119(0.006) 0.198(0.010) 0.099(0.004) PT1 0.122(0.023) 0.585(0.121) 0.194(0.054) 0.163(0.039) 0.848(0.065) 0.113(0.031) PT2 0.139(0.029) 1.890(0.123) 0.239(0.056) 0.197(0.045) 0.970(0.064) 0.140(0.035) PT3 0.165(0.032) 2.033(0.119) 0.464(0.056) 0.224(0.046) 1.143(0.060) 0.147(0.035) PT4 0.438(0.033) 2.152(0.113) 0.917(0.056) 0.677(0.046) 1.215(0.054) 0.395(0.036) PS 0.304(0.018) 1.436(0.072) 0.475(0.036) 0.426(0.027) 0.818(0.037) 0.271(0.023) Ridge 0.396(0.006) 0.433(0.000) 0.433(0.004) 0.430(0.005) 0.433(0.002) 0.400(0.005) Lasso 0.178(0.007) 0.416(0.008) 0.238(0.009) 0.216(0.009) 0.279(0.009) 0.184(0.007) ENET 0.173(0.007) 0.406(0.008) 0.233(0.009) 0.213(0.009) 0.277(0.009) 0.182(0.007) Mean OLS 0.519(0.052) 1.556(0.156) 1.177(0.118) 0.671(0.067) 0.927(0.093) 0.489(0.049)

We report the result of examples in Tables 1 and 2 as follows:

-

(i)

For ; PT1 outperforms the shrinkage estimators.

-

(ii)

For , PT1 more efficient than other estimators except distribution also when value increases, all pretest estimators give better results than shrinkage estimators.

-

(iii)

For , ENET gives a better result even though the performance of PT1 expected to increase when increased.

-

(iv)

For ; in distribution, the MAD values of suggested estimators are larger than the MAD values of listed distributions.

5. Real Data Application

5.1. Prostate Data

Prostate data came from the study of Stamey et al., (1989) about correlation between the level of prostate specific antigen (PSA), and a number of clinical measures in men who were about to receive radical prostatectomy. The data consist of 97 measurements on the following variables of in Table 3:

| Variables | Descriptions |

|---|---|

| Dependent Variable | |

| lpsa | Log of prostate specific antigen (PSA) |

| Covariates | |

| lcavol | Log cancer volume |

| lweight | Log prostate weight |

| age | Age in years |

| lbph | Log of benign prostatic hyperplasia amount |

| svi | Seminal vesicle invasion |

| lcp | Log of capsular penetration |

| gleason | Gleason score |

| pgg45 | Percent of Gleason scores 4 or 5 |

5.2. Barro Data

The Barro data came from the study of Barro and Lee, (1994) about distribution of education attainment and human capital by genders and by 5-year age intervals in 138 countries from 1965 to 1985. The quantreg version of the Barro Growth Data used in Koenker and Machado, (1999). This is a regression data set consisting of 161 observations on determinants of cross country GDP growth rates. There are 13 covariates and a description of the variables in the Barro dataset is given in Table 4. The goal is to study the effect of the covariates on GDP.

| Variables | Descriptions |

|---|---|

| Dependent Variable | |

| GDP | Annual Change Per Capita |

| Covariates | |

| lgdp2 | Initial Per Capita GDP |

| mse2 | Male Secondary Education |

| fse2 | Female Secondary Education |

| fhe2 | Female Higher Education |

| mhe2 | Male Higher Education |

| lexp2 | Life Expectancy |

| lintr2 | Human Capital |

| gedy2 | Education/GDP |

| Iy2 | Investment/GDP |

| gcony2 | Public Consumption/GDP |

| lblakp2 | Black Market Premium |

| pol2 | Political Instability |

| ttrad2 | Growth Rate Terms Trade |

The results of prostate data application may be summarized as follows:

-

(i)

Ridge estimator is far more effective than LSE and the other regression estimators as expected because of outliers and multicollinearity exist in the prostate data at the same time.

-

(ii)

The results demonstrate that after ridge estimator ENET gives better results than LSE only at lower 20th quantile and after exceeding in 70th quantile.

-

(iii)

For 40th to 80th quantile all of the proposed estimators are more efficient than LSE.

The results of barro data application may be summarized as follows:

-

(i)

Except for the quantiles up to the 20th and after 80th MAD value of PT1 is the lowest so it is outperformed other estimators including LSE.

-

(ii)

While become distant from 50th quantile as the MAD value of the PT1 increases its efficiency decreased.

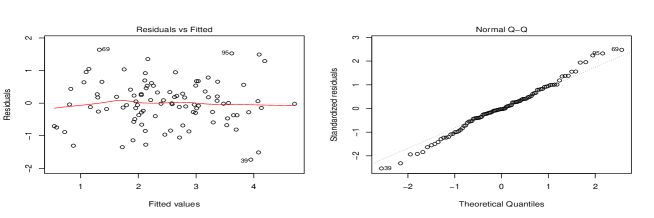

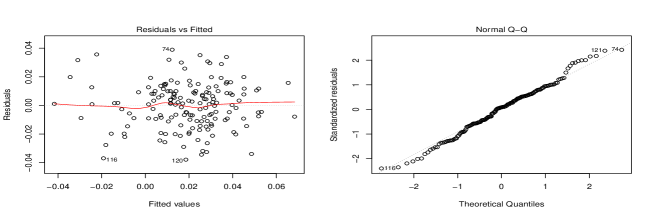

We plot some diagnostics for residuals of fit models of both data sets in Figure 2. According to the Figure 2(a), one may suspect that the observation 39, 69, 95 may be outliers. Also, the results of apply outlierTest function in the car package in R confirm that observations 39 is an outlier. Furthermore, we calculate the ratio of largest eigenvalue to smallest eigenvalue of design matrix of prostate data is approximately which indicates that there multicollinearity in the data set. According to the Figure 2(b), one may suspect that the observation 74, 116, 120 may be outliers. Again, outlierTest function confirm that observations 74 is an outlier. Furthermore, we calculate the ratio of largest eigenvalue to smallest eigenvalue of design matrix of prostate data is approximately which again indicates that there multicollinearity in the data set.

Data 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 Prostate FM 5.821(0.083) 5.520(0.068) 5.170(0.058) 4.928(0.057) 4.723(0.057) 4.476(0.053) 4.449(0.057) 4.900(0.060) 5.388(0.077) SM 3.766(0.061) 3.379(0.063) 3.047(0.053) 2.945(0.045) 2.956(0.038) 2.991(0.041) 3.135(0.044) 3.244(0.048) 3.466(0.054) PT1 5.769(0.088) 4.757(0.078) 4.172(0.079) 3.725(0.072) 3.555(0.065) 3.374(0.057) 3.609(0.060) 3.865(0.063) 5.095(0.085) PT2 5.789(0.087) 4.993(0.076) 4.584(0.078) 3.997(0.073) 3.838(0.068) 3.707(0.061) 3.735(0.061) 4.044(0.064) 5.243(0.084) PT3 5.810(0.086) 5.082(0.076) 4.794(0.076) 4.310(0.069) 3.986(0.067) 3.914(0.060) 3.909(0.063) 4.110(0.067) 5.286(0.081) PT4 5.813(0.084) 5.315(0.074) 4.986(0.07) 4.656(0.067) 4.313(0.063) 4.045(0.059) 4.071(0.063) 4.275(0.067) 5.346(0.079) PS 5.415(0.082) 4.576(0.063) 4.216(0.061) 3.905(0.055) 3.827(0.050) 3.640(0.048) 3.663(0.052) 3.981(0.053) 4.908(0.072) Ridge 2.035(0.027) 2.146(0.027) 2.407(0.027) 2.529(0.023) 2.661(0.022) 2.582(0.023) 2.471(0.024) 2.296(0.027) 2.032(0.026) Lasso 4.860(0.081) 4.403(0.067) 4.480(0.065) 4.369(0.058) 4.434(0.055) 4.036(0.050) 3.823(0.054) 3.817(0.058) 4.047(0.074) ENET 4.760(0.082) 4.185(0.068) 4.323(0.064) 4.165(0.059) 4.427(0.055) 3.989(0.050) 3.679(0.053) 3.681(0.056) 3.820(0.074) Mean LSE 4.469(0.283) 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 Barro FM 3.872(0.021) 3.238(0.022) 2.916(0.021) 2.738(0.023) 2.766(0.023) 2.816(0.023) 2.988(0.026) 3.298(0.027) 3.755(0.027) SM 3.444(0.012) 2.689(0.009) 2.315(0.006) 2.093(0.006) 2.034(0.005) 2.125(0.006) 2.341(0.007) 2.743(0.008) 3.377(0.010) PT1 3.763(0.022) 2.825(0.024) 2.350(0.023) 2.169(0.026) 2.072(0.027) 2.188(0.028) 2.436(0.029) 2.882(0.031) 3.699(0.028) PT2 3.826(0.022) 2.950(0.026) 2.489(0.026) 2.227(0.028) 2.187(0.029) 2.371(0.029) 2.501(0.031) 3.043(0.030) 3.728(0.028) PT3 3.834(0.022) 3.009(0.025) 2.616(0.026) 2.367(0.029) 2.450(0.029) 2.558(0.028) 2.661(0.030) 3.130(0.031) 3.743(0.028) PT4 3.865(0.022) 3.094(0.025) 2.761(0.025) 2.606(0.027) 2.576(0.028) 2.677(0.028) 2.828(0.029) 3.213(0.030) 3.750(0.028) PS 3.709(0.018) 2.896(0.018) 2.530(0.017) 2.330(0.019) 2.308(0.019) 2.395(0.020) 2.566(0.023) 2.976(0.024) 3.616(0.025) Ridge 3.441(0.019) 2.876(0.019) 2.670(0.021) 2.631(0.022) 2.731(0.022) 2.688(0.021) 2.748(0.025) 2.998(0.024) 3.386(0.025) Lasso 3.406(0.019) 2.892(0.019) 2.648(0.021) 2.618(0.022) 2.717(0.022) 2.668(0.021) 2.725(0.024) 2.952(0.024) 3.371(0.025) ENET 3.380(0.020) 2.860(0.019) 2.633(0.021) 2.616(0.022) 2.733(0.022) 2.663(0.020) 2.735(0.025) 2.941(0.025) 3.333(0.025) Mean LSE 2.672(0.169)

6. Conclusions

In this paper, we consider pretest and shrinkage estimation strategies based on quantile regression which is a good alternative when the error distribution does not provide the LSE assumptions. To this end, we combined both under-fitted and over-fitted estimation in a optimal way. Further, a Monte Carlo simulation study is conducted to investigate the performance of the suggested estimators in two aspects: one is for investigation of asymptotic properties of listed estimators and the other is for a comparative study with quantile-type estimators, namely Lasso, Ridge and ENET, when the errors follow the Chi-Square, Student t, Laplace, Log-Normal and Skew-Normal distribution. According to first simulation results, the performance of sub-model is the best when the null hypothesis is true. On the other hand, it loses its efficiency and goes to zero when we violate the null hypothesis. The performance of pretest estimations are better than Stein–type estimation when the null hypothesis is true while it loses its efficiency even worse than the full model estimation when we violate with small degree of null hypothesis, and it acts like the full model estimation when the alternative hypothesis is exactly true. Regarding Shrinkage estimation, the PS estimation is always superior to the shrinkage estimator. The performance of PS loses its efficiency when we violate the null hypothesis, however, its performance is superior the full model estimation even the null hypothesis is not true. According to second simulation results, we demonstrated that the listed estimators performs better than quantile -type estimators and the LSE when we look different percent quantiles. Also, we applied two real data examples both of which has the problem of multicollinearity and they have outliers. According to the real data example results, our suggested estimators outshine the LSE and the quantile-type estimators with some minor exceptions. Hence, it is safely concluded that the pretest and shrinkage estimation strategies are more efficient than the LSE and quantile-type estimators when the number of nuisance parameter is large. Finally, we obtained asymptotic distributions of the listed estimators. Our asymptotic theory is well supported by numerical analysis.

Appendix

Lemma 6.1.

Let be dimensional normal vector distributed as then, for a measurable function of of we have

where is a non-central chi-square distribution with degrees of freedom and non-centrality parameter .

Proof.

It can be found in Judge and Bock, (1978)

Proof of Proposition 3.2.

Using the definition of asymptotic bias, we have

| (6.1) |

and also using the definition of asymptotic covariance, we get

| (6.2) | |||||

where .

Thus,

Similarly, we obtain

| (6.3) | |||||

and using the fact that , the covariance of is computed as follows;

| (6.4) | |||||

Thus, . We know that , so we have

and we compute the covariance matrix of as follows:

where . Thus, . Now, we also need to compute and . Since

We have the following

Thus, we have

is obtained as follows:

Thus, the result follows as

Proof of Theorem 3.3.

Proof of Theorem 3.4.

Firstly, the asymptotic covariance of and are given in Equations (6.2) and (6.4). Now, the asymptotic covariance of is given by

Considering, and

so finally,

The asymptotic covariance of is also obtained as

We know that

Now, we need to compute by using Lemma 6.1, we have

and also,

Therefore, we obtain by combining all of the components:

Finally, we compute :

The covariance of :

So, we need to the following identities:

and

Therefore, we obtain

| (6.8) | |||||

By using the above equations in the definition (3.3), one may directly obtain the asymptotic risks.

References

- Ahmed, (2014) Ahmed, S. E. (2014). Penalty, Shrinkage and Pretest Strategies: Variable Selection and Estimation. Springer, New York.

- Bancroft, (1944) Bancroft, T. A. (1944). On biases in estimation due to the use of preliminary tests of significance. The Annals of Mathematical Statistics, 15(2), 190-204.

- Barro and Lee, (1994) Barro, R. J., Lee, J. W. (1994). Sources of economic growth. In Carnegie-Rochester conference series on public policy (Vol. 40, pp. 1-46). North-Holland.

- Cooley and Tukey, (1965) Cooley, J. W., and Tukey, J. W. (1965). An algorithm for the machine calculation of complex Fourier series. Mathematics of computation, 19(90), 297-301.

- Davino et al., (2014) Davino, C., Furno, M., & Vistocco, D. (2013). Quantile regression: theory and applications. John Wiley & Sons.

- Gilchrist, (2000) Gilchrist, W. (2000). Statistical modelling with quantile functions. CRC Press.

- Hoerl and Kennard, (1970) Hoerl, A. E., Kennard, R. W. (1970). Ridge Regression: Biased estimation for non-orthogonal problems. Technometrics 12. 69 – 82.

- Judge and Bock, (1978) Judge, G. G. and Bock, M. E. (1978). The Statistical Implications of Pre-test and Stein-rule Estimators in Econometrics. North Holland, Amsterdam.

- Koenker and Bassett, (1978) Koenker, R., & Bassett Jr, G. (1978). Regression quantiles. Econometrica: journal of the Econometric Society, 33-50.

- Koenker and Machado, (1999) Koenker, R., Machado, J. A. (1999). Goodness of fit and related inference processes for quantile regression. Journal of the american statistical association, 94(448), 1296-1310.

- Koenker, (2005) Koenker, R. (2005). Quantile regression (No. 38). Cambridge university press.

- Koenker, (2008) Koenker, R. (2008). Quantile regression in R: a vignette CRAN.

- Parzen, (1979) Parzen, E. (1979). Nonparametric statistical data modeling. Journal of the American statistical association, 74(365), 105-121.

- Stamey et al., (1989) Hodge, K. K., McNeal, J. E., Terris, M. K., Stamey, T. A. (1989). Random systematic versus directed ultrasound guided transrectal core biopsies of the prostate. The Journal of urology, 142(1), 71-74.

- Tibshirani, (1996) Tibshirani, R. (1996). Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society. Series B (Methodological), 267-288.

- Yüzbaşı and Ahmed, (2016) Yüzbaşı, B., Ejaz Ahmed, S. (2016). Shrinkage and penalized estimation in semi-parametric models with multicollinear data. Journal of Statistical Computation and Simulation, 1-19.

- (17) Yüzbaşı, B., Ahmed. S.E., Güngör, M. (2017). Improved Penalty Strategies in Linear Regression Models, REVSTAT–Statistical Journal, 15(2)(2017), 251–276.

- (18) Yüzbaşı, B., Aşar, Y., Şık, Ş., Demiralp, A. (2017). Improving Estimations in Quantile Regression Model with Autoregressive Errors. arXiv preprint arXiv:1707.01052.

- Wei et al., (2012) Wei, Y., Ma, Y., Carroll, R. J. (2012). Multiple imputation in quantile regression. Biometrika, 99(2), 423.

- Yi et al., (2016) Yi, C., & Huang, J. (2016). Semismooth Newton Coordinate Descent Algorithm for Elastic-Net Penalized Huber Loss Regression and Quantile Regression. Journal of Computational and Graphical Statistics, (just-accepted).

- Norouzirad and Arashi, (2017) Norouzirad, M., Arashi, M. Preliminary test and Stein-type shrinkage ridge estimators in robust regression. Statistical Papers, 1-34.

- Sen and Saleh, (1987) Sen, P. K., Saleh, A. E. (1987). On preliminary test and shrinkage M-estimation in linear models. The Annals of Statistics, 1580-1592.

- Zou and Hastie, (2005) Zou, H. and Hastie, T. (2005). Regularization and variable selection via the elastic net, Journal of the Royal Statistical Society:Series B (Statistical Methodology),67(2),301-320.