A Bayesian approach to modeling mortgage default and prepayment

Abstract

In this paper we present a Bayesian competing risk proportional hazards model to describe mortgage defaults and prepayments. We develop Bayesian inference for the model using Markov chain Monte Carlo methods. Implementation of the model is illustrated using actual default/prepayment data and additional insights that can be obtained from the Bayesian analysis are discussed.

1 Introduction and Overview

From a legal point of view mortgage default is defined as “transfer of the legal ownership of the property from the borrower to the lender either through the execution of foreclosure proceedings or the acceptance of a deed in lieu of foreclosure”; see Gilberto & Houston Jr. (1989). However, as noted by Ambrose & Capone (1998), it is common in the literature to define default as being delinquent in mortgage payment for ninety days.

There exists a rich literature on modeling mortgage default risk; see for example, Quercia & Stegman (1992) and Leece (2004). An important class of models is based on the ruthless default assumption which states that a rational borrower would maximize his/her wealth by defaulting on the mortgage if the market value of the mortgage exceeds the house value, and by prepaying via refinancing if the market value of the house exceeds the book value of the house. Such models use an option theoretic approach and assume that the mortgage value and the prepayment and default options are determined by the stochastic behavior of variables such as property prices and the interest rates; see for example, Kau et al. (1990). Thus, under the option theoretic approach, other factors, such as the transaction costs, borrower’s characteristics, etc., are assumed to have no impact on values of the mortgage and the property underlined. The ruthless default assumption is not universally accepted in the literature and evidence against the validity of the assumption has been presented by many authors. Furthermore, as pointed out by Soyer & Xu (2010), implementation of this class of models requires availability of performance level data on individual loans over time which is typically difficult to obtain.

The alternate point of view, that does not subscribe to the ruthless default assumption, favors direct modeling of time to default of the mortgage. This approach involves hazard rate based models and also considers more direct determinants of mortgage default. This class of models includes competing risk and proportional hazards models of Lambrecht et al. (2003) and duration models of Lambrecht et al. (1997) that take into account individual borrower and loan characteristics. The competing risk models have been considered by many such as Deng et al. (1996); Deng & Order (2000), Deng (1997), and Calhoun & Deng (2002). These can be considered as the competing risks versions of proportional hazards and multinomial logit models. The competing risks version of the PHM suggested by Deng (1997) involves evaluating hazard rates under the prepayment and default options. The author refers to these as prepayment risk and default risk. The competing risks approach is found to be useful in explaining the prepayment and default behaviors and improving the prediction of mortgage terminations. An application of these models to commercial mortgages can be found in Ciochetti et al. (2002).

Most of the above models use classical methods for estimation and as a result they do not provide probabilistic inferences. Some exceptions to these are the Bayesian work by Popova et al. (2008) who proposed Bayesian methods for forecasting mortgage prepayment rates, Soyer & Xu (2010) who considered Bayesian mixtures of proportional hazards models for describing time to default and Kiefer (2010) who proposed an Bayesian approach for default estimation using expert information. More recently, Bayesian time series models have been considered in Aktekin et al. (2013) and Lee et al. (2016). Bayesian mixture models have been considered in Klingner et al. (2016). Our approach differs from the previous in that we consider Bayesian competing risk proportional hazards models and in so doing we use both default and prepayment data. Bayesian analysis of competing risk models has been considered by Sun & Berger (1993) in reliability analysis and semiparametric Bayesian proportional hazards competing risk models have been introduced by Gelfand & Mallick (1995) in survival analysis. Our work differ from these both in terms of the application and the specific approach taken.

In this paper we consider modeling duration of single-home mortgages. In doing so, we model default and prepayment probabilities simultaneously using competing risks proportional hazards models. We include both individual and aggregate level covariates in our model. We adopt the Bayesian viewpoint in the analysis and develop posterior and predictive inferences by using Markov chain Monte Carlo (MCMC) methods. In addition to providing a formalism to incorporate prior opinion into the analysis, the Bayesian approach enables us to describe all our inferences probabilistically and provides additional insights from the analysis. In what follows, we first introduce the competing risks proportional hazards models in Section 2. The Bayesian inference is presented in Section 3 where posterior and predictive analyses are developed. In Section 4 we illustrate implementation of our model and Bayesian methods using simulated data. Concluding remarks follow in Section 5.

2 Competing Risk Proportional Hazards Model

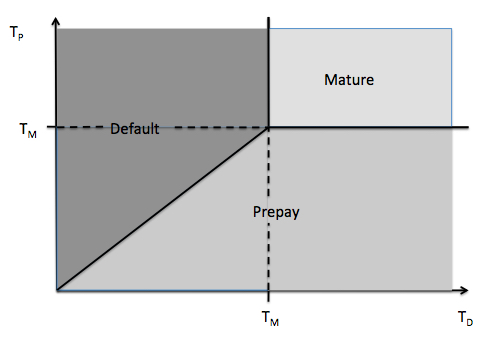

To introduce some notation let denote the mortgage lifetime and denote the maturity date of the mortgage loan. Note that if a mortgage loan is not defaulted or prepaid then . If we let and denote time to default and time to prepayment for a mortgage loan, respectively, then if then . Figure 1 illustrates the relationship between , and . If both and are larger than then the mortgage will be paid on time. For a given mortgage loan it is of interest to infer events of “full payment”, default and prepayment. In other words, we are interested in computing probability statements such as , or .

In view of the above, we can write

where both and are random variables. We will model and separately as proportional hazards models (PHMs) as in Cox (1972). We denote the hazard (failure) rate for default and for prepayment as and , respectively. We will refer to as the default rate and to as the prepayment rate. We model the default rate as

| (1) |

where is the baseline default rate, is vector of parameters, is a vector of time dependent covariates and is a vector of regression parameters. Similarly, the prepayment rate is modeled as

| (2) |

Note that the components of the covariate vector may be different for the default and prepayment rates.

We assume that default and prepayment are “competing risks”, so that we only observe the first of them to occur. The observation of one at time implies that the other is right-censored at . Thus, assuming conditional independence the joint survival function of and is given by

An active mortgage lifetime observed as implies that neither a default nor a prepayment occurs by time , that is, both default and prepayment are right-censored at . This includes the event that the mortgage matures at time .

Empirical evidence suggests that the default rate is non-monotonic. As discussed by Soyer & Xu (2010), it is reasonable to expect that the default rate is first increasing and then decreasing. A lifetime model having such hazard rate behavior is the lognormal model. Thus, we assume that baseline time to default follows a lognormal model with probability density function

Since it is not unreasonable to expect a similar behavior in the prepayment rate, we also assume that the baseline distribution of is also lognormal. Thus, the baseline model for will be lognormal with parameters and , and for prepayment with parameters and .

3 Bayesian analysis of the competing risk PHM

We assume that data on mortgages are available. From these, have defaulted, have prepayed and are still active, including those that have matured successfully. The mortgages are indexed for the defaulted mortgages, for prepaid and for active. Let be the times of default and be the times of prepayment. For the mortgages that are still active, let be the times since the initiation of mortgages; for those that have matured.

Also observed are the covariates. Let be the vector of covariates for mortgage at time . Some of these are common covariates e.g. interest rates, while others are mortgage specific e.g. mortgage size or credit score. We assume that they are observed at a known set of times and that they are piecewise constant on intervals for which these times are the mid-points. Hence

| (5) |

for , where , for and . We let be the observed covariates for mortgage and be the set of all observed covariates.

The unknown quantities in this model are the regression parameters and , and the baseline failure rate parameters . The required posterior distribution is therefore:

| (6) |

For the likelihood term , we assume observations are conditionally independent, given the parameters. From the competing risks assumption, an observation is an exact observation of and a right-censored observation of ; it is vice versa for . Finally, is a right-censored observation of both and . Hence:

| (7) |

where and are given by Equations 3 and 4, is given in Equation 5 and a formula for the integrals is given in Equation 13 of the Appendix. The formula for the integrals becomes tricky in practice for time varying covariates, as noted in Cox and Oakes (1984).

An independent zero-mean normal prior is assumed for each component of and , as well as and .

The model above is such that the parameters are not identifiable without further assumptions. For a Bayesian analysis, such as ours, that means whether the data can inform well enough about all the parameters. Identifiability issues can be overcome via specific prior specification or model dimension reduction (Gelfand & Mallick, 1995). We will see in the results that for the default model, identifiability is present. It is attributable to the low number of default mortgages under which parameter learning becomes very difficult; no such issue exists for the parameters under the prepaid model.

An MCMC procedure, based on the Metropolis within Gibb’s sampler (Tierney, 1994), has been implemented to sample from . The covariate coefficient vectors and are updated as blocks from their full conditional distributions with a Gaussian random walk proposal, while each component of is updated separately. The Appendix contains the details of the algorithm.

The MCMC output is a set of samples of all the unknowns from the posterior distribution. Let the number of samples be , and let , and denote the th samples of , and respectively.

The MCMC output can be used to compute many quantities of interest. With the posterior samples, one can compute for a mortgage with a known set of covariates : The posterior predictive reliability function of the time to default is approximated by

| (8) |

and the time to prepayment is approximated by

| (9) |

where and , the values of and are given by Equation 10, using the parameter values in , and a formula for the integrals is given by Equation 13 of the Appendix.

Equations 8 and 9 allows us to determine, by simulation, the probability that a mortgage will default, prepay or mature with a given set of covariates . The inverse distribution method can be used to simulate independently many values pairs from these reliability functions e.g. for , generate a random number and then solve for , an easy numerical exercise. This further means we can compute predictive densities and for each mortgage as well. Furthermore to this, the probabilities that a loan defaults, prepays or matures are approximated by the proportion of simulated pairs that lie in their respective regions as defined in Figure 1:

| Defaults | ||||

| Prepays | ||||

| Matures |

Since the marginal density is

where is failure rate and is reliability function as defined in equations 8 and 9. So given for we can compute the pdf of

Similarly compute for pdf of .

4 The Freddie Mac Single Family Loan Dataset

The Federal Home Loan Mortgage Corporation (FHLMC), known as Freddie Mac, is a public company that is sponsored by the United States government. It was formed in 1970 to expand the secondary market for mortgages in the US. It has provided a dataset about single family loan-level credit performance data on a portion of fully amortizing fixed-rate mortgages that the company purchased or guaranteed. The dataset contains information about approximately 21.5 million fixed-rate mortgages that originated between January 1, 1999, and December 31, 2014. The dataset can be downloaded from the Freddie Mac website and is organised as two files for each quarter:

-

1.

the origination data file that contains data concerning the set up of the loan;

-

2.

the monthly performance data file that contains the monthly performance of each loan e.g. amount repaid, the outstanding principal, whether it is in default, etc.

There is also a smaller sample data set that contains a simple random sample of 50,000 loans selected from each year and a proportionate number of loans from subsequent years (the actual definition is 50,000 loans selected from each full vintage year and a proportionate number of loans from each partial vintage year of the full single family loan-level data set). The sample data set also has an origination and monthly performance file for each year

Some processing of the raw data was needed to transform it into a format that can be be analysed by this model. Each loan was tracked through the data to categorize it as active, defaulted or prepaid. Since loans in the dataset originated in 1999 and were for 30 years, there were no loans classified as mature and so this category could be ignored.

4.1 Loan categorization

Four fields in the data were used to categorize each loan as default, prepay or active, and to define the observed time:

-

•

zero_balance defines whether a particular loan’s balance has reduced to 0 or not, and has the following codes:

- 01

-

Prepaid or Matured (voluntary payoff);

- 03

-

Foreclosure Alternative Group (Short Sale, Third Party Sale, Charge Off or Note Sale);

- 06

-

Repurchase prior to Property Disposition;

- 09

-

REO Disposition; and

- empty

-

Not Applicable.

-

•

delinquency provides a value corresponding to the number of days the borrower has not paid the loan, according to the due date of last paid installment, or if a loan is acquired by REO, coded as:

- 0

-

Current, or less than 30 days past due;

- 1

-

30–59 days delinquent;

- 2

-

50–89 days delinquent;

- 3

-

90–119 days delinquent, etc.;

- R

-

REO acquisition;

- empty

-

Unavailable.

-

•

reporting_date is the month that the observation is made in.

-

•

months_remain is the number of months until the legal maturity of the loan.

Then the loan status was defined as:

-

•

Prepaid if there exists a month where zero_balance = 01 AND repurchase = “N”. In this case, the prepaid time is the time from loan origination to the reporting_date where this first happens.

-

•

Default if there exists a month where zero_balance = 03, 06 or 09. In this case, the default time is the time from loan origination to the reporting_date where this first happens.

-

•

Active if the loan could not be classified as Prepaid or Active AND the latest reporting_date corresponding to the loan is later than 01/01/2014 AND zero_balance is empty at that latest date AND delinquency is not equal to R at that latest date. The active time is the time from loan origination to the reporting_date where this happens.

These definitions are not exhaustive; there are loans in the dataset that are discontinued without any clear information and such loans have been excluded from our analysis.

4.2 Covariates

The following covariates (fixed term) are available in the dataset: credit score, mortgage insurance percentage (MI), number of units, combined loan-to-value (CLTV), debt-to-income (DTI), unpaid principal balance (UPB), original interest rate, number of borrowers, first homebuyer, occupancy status, property type, property state (state in which property resides) and current interest rate. first homebuyer, occupancy status, property type and property state are categorical variables and have been converted to indicator variables. The covariate property state has been re-categorized into judicial or non-judicial state. For the rest of the categorical variables, some of categories were of low frequency. For example, there are 6 categories in variable property_type, of which were single family home and some categories like leasehold accounting for as low as . It was decided to group categories with extremely low frequencies for all the categorical variables. All the quantitative variables have been standardized. Furthermore strong correlation have been found between mortgage insurance percentage and combined loan-to-value, and between original and current interest rates which led us to drop the latter in both the cases. Since current interest rate has been dropped we do not have to work with any time dependent covariate.

5 Analysis of the Data

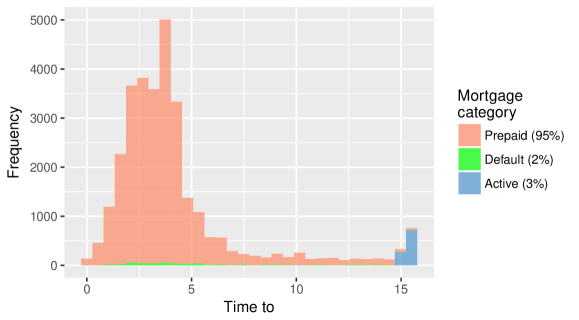

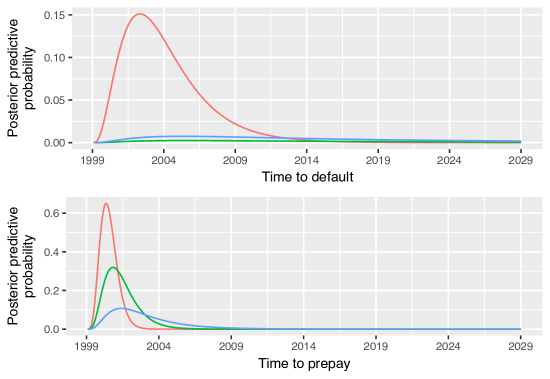

The data set comprised of mortgages originating in the year 1999. This data set is extremely unbalanced with of the mortgages being prepaid, being active and the only about belonging to default category. This huge imbalance is evident in figure 2.

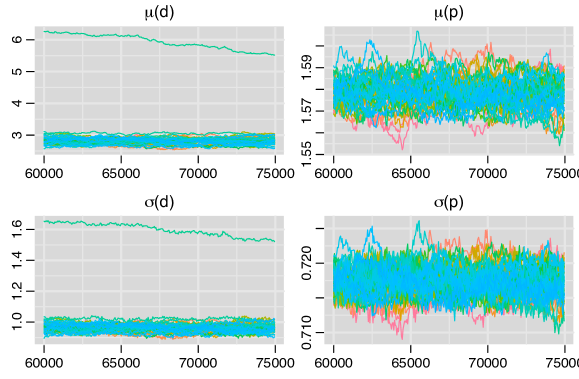

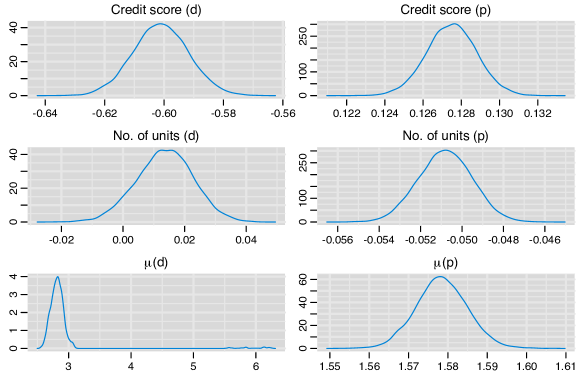

Rcpp (Eddelbuettel & François, 2011) has been used to construct the MCMC algorithm. This has greatly improved the speed of the algorithm given that the data set is extremely large. The MCMC procedure was run in chains for iterations each. We set burnin at and thinned the remaining by selecting every sample. Trace plots, provided in the Appendix, for all the parameters show good mixing for all the covariates implying convergence. We provide the density plot constructed by combining the thinned chains for a subset of covariates in figure 3.

Tables 1 and 2 are summaries of the marginal posterior distributions of the model parameters, based on the 15,000 combined samples of the MCMC. We see in table 2 that nearly all the covariates, with the exception of no. of units, turn out to be significant. Credit score, UPB, no. of units, type of property and no. of borrowers have opposite effects on default and prepay rates. Default rate is found to decrease with credit score, UPB etc, as it should be, and prepay rate increases for the same. Other variables, for example, DTI, mortgage insurance %, original interest rate, first time homebuyer, occupancy status and property state have same signs of coefficients for both of default and prepay. Thus we can see that for mortgage insurance % both default and prepay rate increase, whereas for first time homebuyer both the rates decrease. Also note that the estimated mean parameter (as also for the standard deviation parameter) of the baseline default rate is substantially greater than that of prepay.

| Parameter | Median | 95% Prob. Interval |

|---|---|---|

| 2.817 | (2.631, 3.077) | |

| 0.963 | (0.916, 1.028) | |

| 1.578 | (1.566, 1.591) | |

| 0.717 | (0.713, 0.721) |

| Covariate | Default | Prepay | ||

|---|---|---|---|---|

| Median | 95% Prob. Interval | Mean | 95% Prob. Interval | |

| Credit score | -0.601 | (-0.620, -0.583) | 0.128 | (0.125, 0.130) |

| Mortgage insurance % | 0.395 | (0.376, 0.415) | 0.068 | (0.065, 0.070) |

| Number of units | 0.014 | (-0.005, 0.031) | -0.051 | (-0.053, -0.048) |

| Original DTI | 0.124 | (0.103, 0.146) | 0.020 | (0.018, 0.023) |

| UPB | -0.069 | (-0.093, -0.046) | 0.305 | (0.302, 0.307) |

| Original interest rate | 0.412 | (0.396, 0.429) | 0.376 | (0.374, 0.379) |

| No. of borrowers | -0.296 | (-0.316, -0.276) | 0.055 | (0.052, 0.058) |

| Intercept | -3.090 | (-3.356, -2.694) | 0.182 | (0.158, 0.207) |

| First time home-buyer | -0.244 | (-0.293, -0.194) | -0.009 | (-0.016, -0.003) |

| Occupancy status | 0.460 | (0.342, 0.575) | 0.249 | (0.237, 0.261) |

| Property state | -0.110 | (-0.149, -0.071) | -0.080 | (-0.085, -0.075) |

| Property type | 0.304 | (0.249, 0.362) | -0.061 | (-0.67, -0.054) |

The mortgages and their covariate values are provided in table 3

| Covariate | Default | Prepay | ||||

| Mortgage number | 1 | 2 | 3 | 1 | 2 | 3 |

| Credit score | 724 | 541 | 750 | 787 | 668 | 619 |

| Mortgage insurance % | 12 | 30 | 0 | 0 | 0 | 30 |

| Number of units | 1 | 1 | 1 | 1 | 1 | 1 |

| Original DTI | 16 | 27 | 23 | 39 | 34 | 44 |

| UPB | 73000 | 112000 | 83000 | 37000 | 312000 | 204000 |

| Original interest rate | 6.875 | 10 | 8 | 6.875 | 7 | 9.625 |

| No. of borrowers | 2 | 2 | 2 | 1 | 2 | 2 |

| First time home-buyer | No | No | No | No | No | No |

| Occupancy status | Owner | Owner | Owner | Owner | Owner | Owner |

| Property state | Non-Jud | Jud | Non-Jud | Non-Jud | Non-Jud | Non-Jud |

| Property type | SF | SF | SF | SF | SF | SF |

6 Model Assessment

The suitability of the model is assessed by deriving, for each loan in the data:

-

•

The probabilities that the loan defaults, prepays or remains active up to the end of the data, following the method in Section 3, which can be compared to the actual outcome;

-

•

If the mortgage defaulted then the predicted reliability function of the default time can also be computed from Equation 8, and hence the quantile of the observed time. A standardised residual can also be computed e.g. , where is the observed default time, and are the mean and standard deviation of the posterior default time, derived from the predicted reliability function.

-

•

Similarly, if the mortgage was prepaid then the predicted reliability function of the prepay time can be computed from Equation 9. The quantile of the observed prepay time and a standardised residual can be derived.

Active loans are right-censored observations of both the default and prepay times. The competing hazards model implies that default times are also right-censored observations of a prepay time, and vice versa.

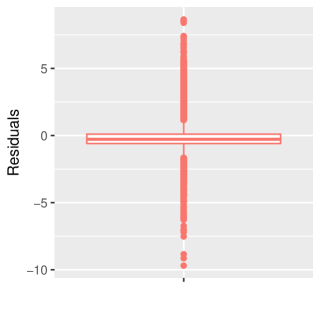

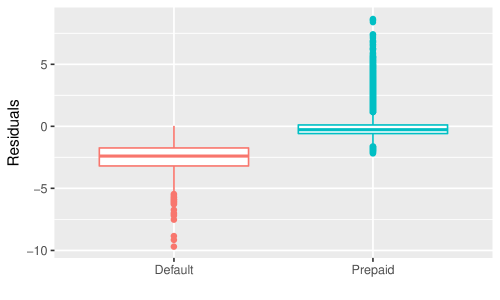

We assessed the fitted model on the sample data set in the year 1999, which has mortgages. Figure 5 shows a box plot of standardised residuals (as explained above) for all the default and the prepaid mortgages and is found to be centered around 0. If we isolate the defaulted mortgages we find that the corresponding residuals are biased away from 0. Identifying mortgages that defaulted is found to be difficult form that data we have since they constitute less than of the whole set.

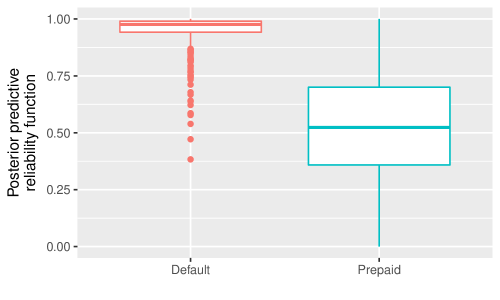

The model was able to correctly identify approximately of the default mortgages and of the prepaid ones using prediction interval. The contrast between default and prepaid mortgages is also evident when we calculated the predicted reliability function for each. The median predicted reliability function for default mortgages is found to be and quantiles being , while those for prepaid are .

In conclusion, one can say that the model fit has clearly identified the significant predictors affecting the mortgage status and also produced excellent prediction for prepaid mortgages. Because of the extremely disproportionate data in Freddie Mac, prediction for default mortgages was not as impressive as the prepaid ones.

7 Conclusion and future work

In this paper we have introduced a model for the time to mortgage prepayment or default as a function of mortgage covariates. The proposed competing risks model allows one to take account of the fact that an observation of a mortgage prepay is also a censored observation of a default, and vice versa; hence observation of one does contain information about the other that should be used in inference. Model inference can be done even for quite large data sets, as has been illustrated here for a set of single family loan data from Freddie Mac, where the relative effects of the different covariates on eventual prepayment or default have been quantified. Some difficulties with the inference were encountered, particularly for the defaults that were only a small percentage of the data. In particular, the identifiability issues with this model can cause some convergence issues with the MCMC implementation of the inference.

Various extensions to the model are possible. This model assumes that each covariate has the same effect on the prepay and default rate of every mortgage. Heterogeneity in these effects can be introduced through a Bayesian hierarchical model. However our residual analysis did not detect any obvious clustering of residuals that would be indicative of such heterogeneity.

8 References

References

- (1)

- Aktekin et al. (2013) Aktekin, T., Soyer, R. & Xu, F. (2013), ‘Assessment of mortgage default risk via Bayesian state space models’, The Annals of Applied Statistics 7(3), 1450–1473.

- Ambrose & Capone (1998) Ambrose, B. W. & Capone, C. A. (1998), ‘Modeling the conditional probability of foreclosure in the context of single-family mortgage default resolutions’, Real Estate Economics 26(3), 391–429.

- Calhoun & Deng (2002) Calhoun, C. A. & Deng, Y. (2002), ‘A dynamic analysis of fixed and adjustable-rate mortgage terminations’, The Journal of Real Estate Finance and Economics 24(1), 9–33.

- Ciochetti et al. (2002) Ciochetti, B. A., Deng, Y., Gao, Y. & Yao, R. (2002), ‘The termination of commercial mortgage contracts through prepayment and default: A proportional hazard approach with competing risks’, Real Estate Economics 30(4), 595–633.

- Deng (1997) Deng, Y. (1997), ‘Mortgage termination: An empirical hazard model with a stochastic term structure’, The Journal of Real Estate Finance and Economics 14(3), 309–331.

- Deng & Order (2000) Deng, Y. & Order, R. V. (2000), ‘Mortgage terminations, heterogeneity and the exercise of mortgage options’, Econometrica 68(2), 275–307.

- Deng et al. (1996) Deng, Y., Quigley, J. M. & Order, R. V. (1996), ‘Mortgage default and low down payment loans: The costs of public subsidy’, Regional Science and Urban Economics 26(3), 263–85.

- Eddelbuettel & François (2011) Eddelbuettel, D. & François, R. (2011), ‘Rcpp: Seamless R and C++ integration’, Journal of Statistical Software 40(8), 1–18.

- Gelfand & Mallick (1995) Gelfand, A. E. & Mallick, B. K. (1995), ‘Bayesian analysis of proportional hazards models built from monotone functions’, Biometrics 51(3), 843–852.

- Gilberto & Houston Jr. (1989) Gilberto, S. M. & Houston Jr., A. L. (1989), ‘Relocation ppportunities and mortgage default’, Real Estate Economics 17(1), 55–69.

- Kau et al. (1990) Kau, J. B., Keenan, D. C., III, W. J. M. & Epperson, J. F. (1990), ‘Pricing commercial mortgages and their mortgage-backed securities’, The Journal of Real Estate Finance and Economics 3(4), 333–356.

- Kiefer (2010) Kiefer, N. M. (2010), ‘Default estimation and expert information’, Journal of Business and Economic Statistics 28(2), 320–328.

- Klingner et al. (2016) Klingner, E., Shemyakin, A. & Johnson, A. (2016), Time-to-default analysis of mortgage portfolios, Technical report.

- Lambrecht et al. (1997) Lambrecht, B. M., Perraudin, W. R. M. & Satchell, S. (1997), ‘Time to default in the UK mortgage market’, Economic Modelling 14(4), 485–499.

- Lambrecht et al. (2003) Lambrecht, B. M., Perraudin, W. R. M. & Satchell, S. (2003), ‘Mortgage default and possession under recourse: A competing hazards approach’, Journal of Money, Credit and Banking 35(3), 425–442.

- Lee et al. (2016) Lee, Y., Rösch, D. & Scheule, H. (2016), ‘Accuracy of mortgage portfolio risk forecasts during financial crises’, European Journal of Operational Research 249(2), 440–456.

- Leece (2004) Leece, D. (2004), Economics of the mortgage market: Perspectives on household decision making, Wiley-Blackwell.

- Popova et al. (2008) Popova, I., Popova, E. & George, E. I. (2008), ‘Bayesian forecasting of prepayment rates for individual pools of mortgages’, Bayesian Analysis 3(2), 393–426.

- Quercia & Stegman (1992) Quercia, R. G. & Stegman, M. A. (1992), ‘Residential mortgage default: A review of the literature’, Journal of Housing Research 3(2), 341–379.

- Soyer & Xu (2010) Soyer, R. & Xu, F. (2010), ‘Assessment of mortgage default risk via Bayesian reliability models’, Applied Stochastic Models in Business and Industry 26(3), 308–330.

- Sun & Berger (1993) Sun, D. & Berger, J. O. (1993), Recent developments in Bayesian sequential reliability demonstration tests, in A. P. Basu, ed., ‘Advances in Reliability’, North-Holland, Amsterdam.

- Tierney (1994) Tierney, L. (1994), ‘Markov chains for exploring posterior distributions’, The Annals of Statistics 22(4), 1701–1728.

9 Appendix

Deriving the failure rate of the lognormal distribution

Let be a lognormally distributed random variable with parameters and and density function

The failure rate is defined as

The lognormal failure rate can be calculated in terms of the normal cdf because has the property that is normally distributed. Therefore

where is the standard normal cdf. Hence

| (10) |

Computing the integral of the failure rate function

The integral of the failure rate function appears in the likelihood function. It is assumed that the covariates vary piecewise constantly on intervals with mid-points . So for , with interval end-points and , with .

Let . The integral of the failure rate, needed in the specification of the distribution of , is then:

| (11) |

The integral of the lognormal failure rate can be calculated in a closed form expression, using the fact that is Gaussian, and that

holds for any failure rate, so that:

| (12) | |||||

Details of the MCMC Algorithm for the Homogeneous Model

Sampling of the posterior distribution of Equation 6, with likelihood given by Equation 7, is done by a Metropolis within Gibbs algorithm. Each block of parameters are sampled from their full conditional distribution, with those samples obtained through a Metropolis proposal, as follows:

Sample

From a current value , a random walk proposal is made from a Gaussian with mean and variance , where is the identity matrix of dimension and is tuned to provide a reasonable acceptance rate. The proposal is accepted with probability

where: is given by Equation 3 with , is given by Equation 5 and is given by Equation 13.

Sample

This is identical to sampling from , with replaced by throughout.

Sample

Sample

This is identical to sampling from , with replaced by throughout and .

Sample

Sample

This is identical to sampling from , with replaced by throughout and .

MCMC output plots

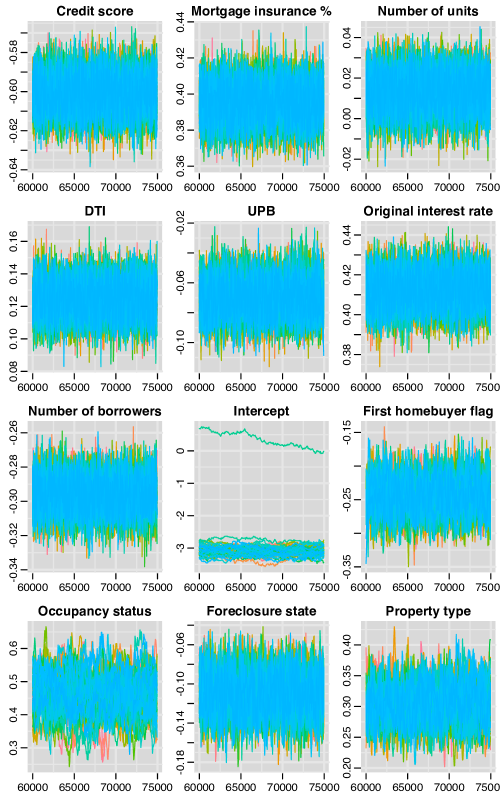

The trace plots for all the variables for category default are provided in figure 8 which seems to indicate seem to converge fairly well. The problem with a single chain is noticeable in the intercept () and distributional mean () and s.d. () traces, which can possibly be attributed to the identifiability issue discussed earlier.

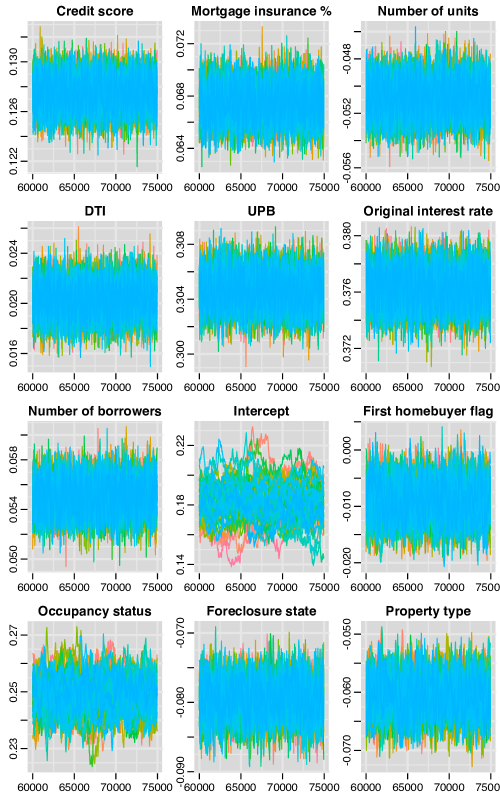

Trace plots of parameters associated with category prepaid are provided in figure 9. The traces converge well and see to have identified the posteriors satisfactorily.

Finally trace plots of distributional parameters are provided in 10. A single slow converging chain is again found in the default category parameters. A larger proportion of default mortgages data and/or a longer run of the chain would have prevented this problem.