BEATING THE OMEGA CLOCK: AN OPTIMAL STOPPING PROBLEM WITH RANDOM TIME-HORIZON UNDER SPECTRALLY NEGATIVE LÉVY MODELS (EXTENDED VERSION)

Abstract

We study the optimal stopping of an American call option in a random time-horizon under exponential spectrally negative Lévy models. The random time-horizon is modeled as the so-called Omega default clock in insurance, which is the first time when the occupation time of the underlying Lévy process below a level , exceeds an independent exponential random variable with mean . We show that the shape of the value function varies qualitatively with different values of and . In particular, we show that for certain values of and , some quantitatively different but traditional up-crossing strategies are still optimal, while for other values we may have two disconnected continuation regions, resulting in the optimality of two-sided exit strategies. By deriving the joint distribution of the discounting factor and the underlying process under a random discount rate, we give a complete characterization of all optimal exercising thresholds. Finally, we present an example with a compound Poisson process plus a drifted Brownian motion.

keywords:

[class=MSC]keywords:

math.PR/00000000 \startlocaldefs

t2The author gratefully acknowledges support from EPSRC Grant Number EP/P017193/1. t3Corresponding author.

1 Introduction

We consider a market with a risky asset whose price is modeled by , where is a spectrally negative Lévy process on a filtered probability space . Here is the augmented natural filtration of . Fix a positive constant , an Omega clock with rate , which measures the amount of time when is below a pre-specified level , is defined as

| (1.1) |

Let be a unit mean exponential random variable which is independent of , and denote by the set of all -stopping times. We are interested in the following optimal stopping problem:

where is a discount rate111The case can be handled using the measure change technique as in [18]., , and is the expectation under , which is the law of given that . In other words, we look for the optimal exercising strategy for an American call option with strike and a random maturity given by the alarm of an Omega clock.

The study of random maturity American options was commenced by Carr [4], where a Laplace transform method was introduced to finance to “randomize” the maturity, a technique known as Canadization. Different from us, a Canadized American option has a random maturity that is completely independent of the underlying asset. On the other extreme, an American barrier option is a random maturity American option with a maturity completely determined by the underlying asset, see Trabelsi [27] for an example. One of our motivations in this study is thus to build a general framework that concatenates the aforementioned special cases, through an Omega clock that only accumulates time for maturity when the underlying asset price is below the threshold .

The first use of occupation times in finance dates back to the celebrated work of Chesney, Jeanblanc and Yor [6], who introduced and studied the so-called Parisian barrier option. Since then, there has been a considerable amount of work on Parisian ruins for both Lévy processes and reflected Lévy processes at the maximum, see e.g. [17, 21], among others. Other related path-dependent options, whose payoffs reflect the time spent by the underlying asset price in certain ranges, were studied under Black-Scholes models by [12, 23]. The idea of using the cumulative occupation times originates from Carr and Linetsky’s intensity based evaluation of executive stock options, or ESOs [5]. Interestingly, the same idea has been applied later in insurance literature for studying the optimal dividend payment threshold in the presence of a so-called Gamma-Omega model [1]. Subsequent research using this concept in insurance and applied probability literatures includes [16, 22, 28].

The problem addressed in this paper can be interpreted as the evaluation of an American variant of ESOs, where the risk is not on the resignation or early liquidation of the executives (as in the typical ESO setting), but is on the “impatience” Omega clock. This is an American option, which takes into account the cumulative amount of time that the underlying asset price is in a certain “bad zone” that reduces the holder’s confidence on the underlying and hence shortens the statistical time horizon of the problem. The aim of this novel formulation is to capture quantitatively the accumulated impatience of decision makers in financial markets, when the latter do not move in their favor. Our mathematical analysis and derivation of optimal strategies can serve as an informative analytical tool for the commonly observed financial transactions that are affected by impatience (we refer to [11] for an extensive report on the role of impatience in finance).

Our problem can also be equivalently recast as an optimal stopping of a perpetual American call option with a random discount rate. Indeed, by the independence between and , we have , which implies that

| (1.2) |

where is the occupation time

| (1.3) |

A European-type equivalent to the option (1.2) was considered by Linetsky [19] under the Black-Scholes model, that he named a Step call option.

A study of general perpetual optimal stopping problems with random discount rate is done in [8] (though the problem in (1.2) was not considered there), by exploiting Dynkin’s concave characterizations of the excessive functions for general linear diffusion processes. However, this approach has limitations when dealing with processes with jumps, due to the extra complication resulting from overshoots.

Part of our solution approach for the optimal stopping problem is inspired by [2, 24] and the recent work [18]. As noted in [10, 18], while it may be standard to find necessary conditions for candidate optimal thresholds, it is far from being trivial to verify whether the associated value function satisfies the super-martingale condition, a key step in the verification. On the other hand, [2, 24] solved the optimal stopping problems for the pricing of perpetual American call and put options by directly constructing a candidate value function and verifying a set of sufficient conditions for optimality, using the Wiener-Hopf factorization of Lévy processes and relying on neither continuous nor smooth fit conditions, reflecting the power of this approach. Building on these ideas, [26] reduced an optimal stopping problem to an averaging problem, which was later solved in [18] by the equation that characterizes the candidate optimal thresholds. In this paper, we primarily focus on the case when the discounted asset price is a super-martingale and show that such a connection, as described above, still holds, thus generalizing the approach developed in [2, 18, 24, 26]. In particular, using this result we prove the optimality of a certain up-crossing strategy for certain values of the parameters and of the Omega clock, by also checking its dominance over the intrinsic value function.

However, under a random discount rate, up-crossing strategies may not be optimal for some set of model parameters. Intuitively, when the Omega clock has a large rate , which results in a statistically shorter time-horizon if spends too much time below , then it might be optimal to stop if is too small. This leads to the consideration of two-sided exit strategies (at which point the above idea of averaging problem ceases to work). To be more precise, we prove that the optimal stopping region and the continuation region can have two disjoint components, which provides an interesting insight for the optimal exercising strategy, which can be either a profit-taking-type exit or a stop-loss-type exit (relative to the starting point), and varies qualitatively with the starting price. Moreover, the continuation and stopping regions appear alternately.222Therefore, in the case when the underlying process jumps from the upper continuation region over the lower stopping region, it will then be optimal to wait until increases to the upper boundary of that lower continuation region. So the optimal exercising strategy cannot be expressed as a one-shot scheme like a first passage or first exit time. In order to establish the result, we use a strong approximation technique as in [22] to explicitly derive the value function of a general two-sided exit strategy (see Proposition 4.12 for this new result), and then prove that, in cases of unbounded variation, the smooth fit condition holds (regardless of or not) for the value function at every boundary point of the optimal continuation region, echoing assertions in [2, 10]; in cases of bounded variation, the smooth fit condition still holds at all boundary points but one, where only continuous fit holds (see Proposition 4.13). As a consequence, in Corollary 4.14 and Proposition 4.15, we obtain a novel qualitative characterization of the upper continuation region .

Building upon the above results, we also study the case when the discounted asset price is a martingale and prove that for “small” , the solution is trivial and identical to the perpetual American call option case, i.e. for , studied by Mordecki [24]. Surprisingly, for “large” not only the solution is not trivial, but takes significantly different forms, depending on the value of . To be more precise, the stopping region is a closed finite interval below , which results in a profit-taking exit at a lower value than the alternative stop-loss exit’s value, while it is never optimal to stop if the asset price is above . Similar to the super-martingale case, the stop-loss exit strategy may even not be a one-shot scheme if an overshoot occurs. We also prove that when the discounted asset price is a sub-martingale, the solution is the same trivial one as in Mordecki’s problem for [24].

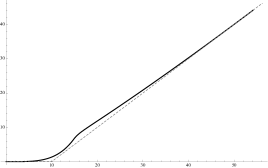

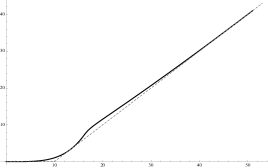

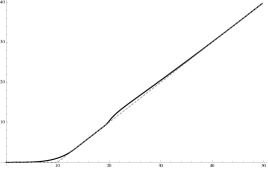

The remaining paper is structured as follows. We begin with stating the main results of the paper, given by Theorems 2.4, 2.5 and 2.7, in Section 2, and devote the remaining sections to the development of their proofs. In particular, in Section 3 we give some useful comparative statics for the value function. Then, Section 4 is devoted to the study of a super-martingale discounted asset price and the proofs of Theorems 2.4 and 2.5. More specifically, in Subsection 4.1 we investigate candidate up-crossing exercising thresholds and the equation satisfied by them. The optimality of these up-crossing and alternative two-sided exit strategies is established in Subsections 4.2–4.3. On the other hand, in Section 5 we study the cases of a sub-martingale and a martingale discounted asset price and prove Theorem 2.7. Next, we consider a compound Poisson process plus a drifted Brownian motion in Section 6 and present numerical examples of a single and two disconnected components of optimal stopping region, illustrated in Figure 1. Finally, Section 7 provides the conclusion of the paper. The proofs of lemmas, omitted technical proofs and a collection of useful results on spectrally negative Lévy processes and their scale functions, can be found in Appendices A and B.

2 Main results

In this section we begin by setting the scene and stating the main results, which we prove and present in greater detail in the subsequent Sections 3–5 and Appendix A. We denote by the Lévy triplet of the spectrally negative Lévy process , and by its Laplace exponent. That is,

| (2.1) |

for every . Here, , and the Lévy measure is supported on with In case has paths of bounded variation, which happens if and only if and , we can rewrite (2.1) as

| (2.2) |

where holds. For any , the equation has at least one positive solution, and we denote the largest one by . Then, the -scale function is the unique function supported on with Laplace transform

| (2.3) |

We extend to the whole real line by setting for . Henceforth we assume that the jump measure has no atom, thus (see e.g. [14, Lemma 2.4]); lastly, we also assume that for all , which is guaranteed if (see e.g. [14, Theorem 3.10]).333However, is not a necessary condition for . For instance, a spectrally negative -stable process with satisfies this condition without a Gaussian component. The -scale function is closely related to the first passage times of , which are defined as

| (2.4) |

Please refer to Appendix B or [15, Chapter 8] for some useful results on this matter.

The infinitesimal generator of , which is well-defined at least for all functions , is given by

In particular, for any .

Fix a , let us introduce the “stopping region” , the set where the so-called time value vanishes:

| (2.5) |

In other words, the optimal exercise strategy for the problem (1.2) is given by the stopping time

Note that, the special cases when or , namely the perpetual American call options with discount rates or , respectively, have been studied in [24]. In what follows, we split our analysis in three parts, in which we study the cases of the discounted asset price being a super-martingale, a martingale and a sub-martingale.

We begin by assuming that the discounted asset price process is a (strict) -super-martingale, which is equivalent to the model parameters satisfying . In this case, it is well-known (see, for example, [24]) that

| (2.6) | ||||

| (2.7) |

and the optimal stopping regions take the form

| (2.8) |

where the exercising thresholds are given by

| (2.9) |

Notice that the fractions in (2.9) are well-defined, because , where the latter inequality follows from the standing assumption that .

When , which is the subject of this work, the discount rate changes between and . Hence, the value function should be bounded from below by and from above by (see Proposition 3.1). As a consequence, we know that the optimal stopping region , and we can equivalently express the problem in (1.2) as

| (2.10) |

Notice that .

To state our result in the most general situation, it will be convenient to talk about the following hypothesis as a key insight/conjecture for our problem.

Hypothesis 2.1.

The following equivalence relation is crucial for deriving the solution to problem (1.2). It is proved in the Appendix A using results from Section 3.

Lemma 2.2.

Hypothesis 2.1 is equivalent to the assertion that there is at most one component of the stopping region that lies on the right hand side of .

Remark 2.3.

Hypothesis 2.1 is a natural conjecture for the obvious fact within a diffusion framework, in which (by Dynkin’s formula) the (positive) time value at any point in the continuation region is the expectation of a time integral of until entering the stopping region. For a general Lévy process, even though jumps will nullify this argument, it is still peculiar if there is a part of continuation region that falls completely inside the super-harmonic set of : , because it would imply (by Itô-Lévy’s formula) that, it is beneficial to continue when the underlying process is in , despite the fact that the expected gain in time value is negative at any instance before entering into the stopping region. A complete characterization of the applicability of Hypothesis 2.1 and alike for general Lévy models is beyond the scope of this work555It is however possible to give a conclusive answer if we replace the indicator with . However, by doing so we lose the interesting trade-off and consequently the rich solution structures in our problem.. To give a concrete idea on the applicability of this conjecture, we show in Proposition A.1 that a monotone density of the Lévy measure implies Hypothesis 2.1.

We now present the main results of this work. We first treat the case where Hypothesis 2.1 is not needed as a sufficient condition, but on the contrary follows as a conclusion from the results.

Let us define a positive function that will be useful afterwards:

| (2.11) |

which is easily seen to be continuously twice differentiable over , and satisfies for all .

Theorem 2.4.

Suppose that the model parameters satisfy , has paths of unbounded variation and

| (2.12) |

Then the optimal stopping region of the problem (1.2) is given by , at whose boundary the smooth fit condition holds. In particular,

-

(i)

if , then the optimal threshold is defined in (4.13), and the value function is given by

(2.13) -

(ii)

if , then and .

Thus, when has paths of unbounded variation and (2.12) holds, the traditional up-crossing threshold-type exercising strategy is still optimal and the optimal stopping region is a connected set , for some exercise threshold , when . On the other hand, the optimal stopping region is the connected set , when , which is identical to the standard problem for presented above. In view of Lemma 2.2, Hypothesis 2.1 holds true in both cases –(ii).

In the following theorem, we consider all remaining cases not covered by Theorem 2.4.

Theorem 2.5.

Suppose that the model parameters satisfy and either has paths of unbounded variation and (2.12) fails, or has paths of bounded variation. Then there exist constants defined in (4.21) and (4.29) satisfying , such that,

- (i)

-

(ii)

if , then and is given by (2.6);

- (iii)

- (iv)

Moreover, the smooth fit condition always holds at all boundaries of in parts , , and at and of part . Furthermore, in part , the smooth (continuous, resp.) fit condition holds at the boundary when has paths of unbounded (bounded, resp.) variation.

In the cases studied in Theorem 2.5, the level of plays an important role in the structure of the optimal stopping region. Specifically, for “small” values of , the traditional up-crossing threshold-type exercising strategy is still optimal and the optimal stopping region is one connected component , for some exercise threshold . Also for “large” values of , the optimal strategy is identical to the case and the optimal stopping region is the traditional connected set , as in Theorem 2.4. However, for some “intermediate” values of , the traditional threshold-type strategy is no longer optimal. Instead, there are exactly two components of stopping region, one inside and another in . Therefore, in all cases, except for the ones it is used as a condition, we can apply Lemma 2.2 to conclude that Hypothesis 2.1 holds true.

It is also observed from part that, when , it is optimal to follow a non-traditional two-sided exit strategy. Moreover, in the event of an overshoot of from the set to , it is not optimal to stop immediately but wait until increases to . This means that, in contrast to most optimal stopping problems in Lévy models literature with two-sided exit strategies (see e.g. [7]), the optimal stopping time for our problem may not be a one-shot scheme like a first passage or first exit time. The target exercising threshold has to be re-adjusted if an overshoot occurs.

It is seen that condition (2.12) plays a pivotal role in distinguishing Theorem 2.4 from Theorem 2.5 when is of unbounded variation, and deciding whether Hypothesis 2.1 is needed as a sufficient condition in Theorem 2.5 when is of bounded variation. In order to facilitate the verification of whether (2.12) holds or not, we will later provide in Remark 4.4 convenient equivalences to condition (2.12), based on the sign of the quantity defined by (4.12) (see also Lemma 4.5 for the relation of with the problem’s parameters). If we limit ourselves only to special classes of Lévy jump measures, we have the following criterion.

Lemma 2.6.

Suppose that the scale function and the tail jump measure of , denoted by for , either has a completely monotone density or is log-convex, then (2.12) holds if and only if

| (2.15) |

Proof.

See Appendix A. ∎

Finally, we close this section by considering the cases of discounted asset price process being either a (strict) -sub-martingale or a -martingale, which are equivalent to the model parameters satisfying or , respectively.

Theorem 2.7.

If the model parameters satisfy:

-

(a)

, then it is never optimal to stop the process , namely , and the value function of the problem (1.2) is for all .

- (b)

Recall from [24], that the solution to the perpetual American call option () is trivial in both cases covered in Theorem 2.7. Namely, in case (a) we have and , while in case (b) we have and . In this paper, we demonstrate that the problem in part (a) remains identically trivial. Interestingly, the solution to the problem studied in part (b) is on the contrary non-trivial. In fact, the optimal exercise strategy admits a surprising structure, which can be either an up-crossing or a down-crossing one-sided exit strategy, depending on the starting value , for . Furthermore, the strategy may not be a one-shot scheme if an overshoot occurs, making the result even more fascinating.

We devote the following sections to proving the aforementioned results and providing an illustrating example.

3 Comparative statics of the value function

In this section, we present some useful stylized facts for the value function by comparative statics. In view of (1.3) with (1.1), we can see that holds for all and . Using these inequalities together with (1.2), (2.6) and (2.7), we obtain the following results for the monotonicity, continuity of the value function , and some information about the structure of the stopping region .

Proposition 3.1.

The value function satisfies the following properties:

-

(i)

For any , we have

Moreover, it holds that .

-

(ii)

The function is strictly increasing and continuous in over , and is non-increasing and continuous in over .

-

(iii)

If there is an such that , we must have and .

Proof.

See Appendix A. ∎

Remark 3.2.

Proposition 3.1 concludes that the stopping region is sandwiched by two known intervals, namely the optimal stopping regions for the problems (2.6)–(2.7), but it is still highly non-trivial to determine the exact shape of . Proposition 3.1 implies that the optimal stopping region consists of disjoint unions of closed intervals (including isolated points), and in view of conclusion , these intervals continuously “grow” with , unless new components of stopping region appear (we call this “branching”). Finally, Proposition 3.1 indicates the special role of and the possibility for a unique stopping region component that lies below , which always takes the form for some .

4 Proofs of Theorem 2.4 and Theorem 2.5

In this section we study the case when the discounted asset price process is a super-martingale and we eventually prove Theorems 2.4 and 2.5. Note that, for , (2.8) and Proposition 3.1 imply that the optimal stopping region should always contain the region . Thus, in view of the equivalent expressions of the problem in (1.2) and (2.10), we can further reduce the problem to

| (4.1) |

where is the set of all -stopping times which occur no later than . We shall focus on the problem (4.1) henceforth in this section.

4.1 The exercising thresholds for up-crossing strategies

We begin our analysis by studying the expected discount factor up until a first passage time , which can be proved similarly to [22, Corollary 2(ii)].

Proposition 4.1.

Recall the positive function defined by (2.11), which takes the form , for all . We have

It is possible to reinterpret the result in Proposition 4.1 as the upper tail probability of the running maximum of at a random time. Indeed, let us consider the left inverse of the additive functional at an independent exponential time with unit mean, :

| (4.2) |

Then by the independence, it is seen that, for any ,

| (4.3) |

where the last equality is due to , which converges to as . Let us introduce the “hazard rate” function 666It can be easily verified that the right hand side of (4.4) is indeed independent of .

| (4.4) |

Then we have

| (4.5) |

Since for all , we see that the function for all . In the following lemma, we present some properties of for , which can be proved using Lemma B.1 and a calculation of the derivative of given by (4.5).

Lemma 4.2.

The function given by (4.5) is strictly decreasing over , with

In other words, is log-concave over .

Proof.

See Appendix A. ∎

In what follows, we denote the value of an up-crossing strategy by , which will be the main topic of study in the remainder of this subsection, and is given by

| (4.6) |

where the last equality follows from Proposition 4.1. Fixing an arbitrary , (which is definitely not inside by Proposition 3.1), we look for candidate exercising thresholds greater than . By taking the derivative of with respect to for and using (4.3)-(4.4), we get

Hence, a candidate optimal exercising threshold should satisfy

| (4.7) |

Notice that, since is monotone by Lemma 4.2, the function defined in (4.7) satisfies

where the strict inequality in the second line is due to the fact that for all . Furthermore, is continuous over , unless the process has paths of bounded variation, which gives rise to a negative jump at (see Lemma B.1):

| (4.8) |

Remark 4.3.

It thus follows that there exists at least one candidate optimal exercising threshold in , and there is no optimal exercising threshold in . This is consistent with Proposition 3.1.

Although Remark 4.3 confirms the existence of at least one candidate exercising threshold, there is a possibility of multiple solutions to (4.7). We investigate this possibility through the analysis of the derivative of :

| (4.9) |

where

| (4.10) |

Observe that by the definition of and its limit as in Lemma 4.2, we have

| (4.11) |

which implies that is ultimately strictly increasing to . In view of this observation, we define

| (4.12) |

thus is the largest local minimum of (and is well-defined). In all, (4.9) and (4.12) imply that is strictly increasing over and is non-decreasing over .

The value of will be critically important in distinguishing the different possibilities of solutions to problem (4.1). In particular, it is seen from the above analysis that there exist only three possible cases for the value of , outlined in the following remark.

Remark 4.4.

We have the following equivalences:

- 1.

- 2.

- 3.

In light of Remark 4.4 and the assertions of Theorem 2.5, the case will be treated in a unified way in all parts of that theorem, apart from part , where we need to treat cases and differently. In order to further illustrate the dependence of the value/sign of on , and the Laplace exponent of the Lévy process , we use the definitions of in (2.1) and , as well as the value of given by (4.10), to prove the following lemma. A combination of the latter with Remark 4.4 also sheds light on the conditions of Theorems 2.4 and 2.5.

Lemma 4.5.

If and , then for all , we have . Conversely, if and , then either , or and .

Proof.

See Appendix A. ∎

Using the monotonicity of the function over , we define the following -value:

which makes a solution to the first order condition equation (4.7). Then, in view of the facts that is strictly increasing in the parameter (due to the monotonicity of ) and that is a local minimum of , we can conclude that there is no solution to (4.7) greater than for all . Moreover, for all finite , there exists a unique solution to (4.7) greater than or equal to . We define this candidate optimal threshold by

| (4.13) |

From the observations above, it is also seen that is the largest root to (4.7), and strictly decreasing and continuously differentiable at as long as . The limiting behaviour of follows from the limiting behaviour of in Lemma 4.2, which implies that

and agrees with Remark 4.3. One important property of this root is that the function is non-decreasing over , which will be used to show the super-martingale property of the value function (see proof of Proposition 4.7).

Inspired by the analysis in [18], we investigate the connection between the equation (4.7), that a candidate optimal exercising threshold should satisfy, and the intrinsic value function. In particular, using (4.7) and (4.4) along with Proposition 4.1 and Lemma B.1, we can prove the following lemma.

Lemma 4.6.

Recall the doubly stochastic time defined in (4.2). We have

Proof.

See Appendix A. ∎

We now present an alternative representation of the value of the candidate optimal up-crossing strategy defined by from (4.1) with (4.13), for which we can prove some useful properties eventually leading to the optimality of this strategy.

Proposition 4.7.

For all finite , let us define the positive function

| (4.14) |

Then we have

-

(i)

The process is a super-martingale;

-

(ii)

The process is a martingale;

-

(iii)

for all ;

-

(iv)

and .

where is the value of an up-crossing strategy defined in (4.1).

Proof.

In order to prove , we notice that

| (4.15) |

for , where for an independent copy of , denoted by , we have defined

Since the function is non-decreasing, we know from that

| (4.16) |

As a consequence, follows from the fact that (4.15)–(4.16) imply

In order to prove , we notice that

where is independent of and has the same law as under . This proves part .

Given the representation in Lemma 4.6, it is straightforward to see that holds.

Finally, we show that is a uniformly integrable martingale, which implies by taking . To this end, notice that, , where the latter has the same law (under ) as an exponential random variable with mean . Hence, it follows from (4.7) and Lemma 4.2 that

Using the fact that for all , we have

where is exponentially distributed with mean . Here , which satisfies due to the fact that . The claimed uniformly integrability follows by the dominated convergence theorem.

Lastly, the smooth fit condition holds at since

where the last equality is due to the definition of . ∎

Remark 4.8.

Since Proposition 4.7 identifies , from (4.1) and (4.14), we can use the properties outlined in parts - and the classical verification method (see, e.g. proof of theorems in [2, Section 6]), in order to establish the optimality of the threshold strategy , or equivalently that the value function is given by . For this, it only remains to verify the additional property that for all . This is equivalent to proving that

| (4.17) |

Below, we examine the optimality of the threshold strategy in two separate subsections, based on the possible values of , and we provide the alternative optimal strategies when is shown not to be optimal.

4.2 The case : Proof of Theorem 2.4

As mentioned in Remark 4.8, the only non-trivial part remaining in order to prove the optimality of is to show that the inequality (4.17) holds true. As soon as we prove this, we will know by Proposition 4.7 and Remark 4.8, that and smooth fit holds at the exercise threshold .

To this end, we notice that and that for all , we have

| (4.18) |

Using the fact that is increasing in this case, we conclude that for , so that (4.18) implies that and thus for all .

4.3 The case : Proof of Theorem 2.5

Recall that in both cases and , is not monotone, hence there is no guarantee for the validity of inequality (4.17). In fact, we can show that (4.17) fails to hold for . To see this, observe that , where is a local minimum of . We thus know that for any sufficiently small . As a result, for all , we get from (4.18) that , which yields that in a sufficiently small left neighborhood of and (4.17) fails. It is therefore crucial to find the critical -interval, such that (4.17) remains valid, thus the up-crossing threshold strategy is optimal and establish Theorem 2.5.

Proof of part of Theorem 2.5. We begin by using the fact that is ultimately increasing, in order to define

| (4.19) |

Since is a local minimum of , we have . Then, for any fixed , we have

In addition, for any fixed , by and the fact that is non-decreasing over , we know (by constructions of and ) that

All together, we have for any fixed , that

where the inequality is strict at least when . Combining this with (4.18), we see that is non-decreasing over , and is strictly increasing over , which yields that

| (4.20) |

Hence, for any fixed , the threshold type strategy is optimal.

For , although is still increasing over (by the constructions of and , and (4.18)), is not monotone over and has at least one local maximum in this interval. Also, note that for every fixed and fixed , is strictly increasing over . To see this, use the facts that vanishes at and that is non-increasing to calculate

which implies that is well-defined and is strictly positive, due to being strictly decreasing over (see Lemma 4.2). The monotonicity of implies that the inequality (4.17) will fail for some values of larger than . In view of these observations, we can define

| (4.21) |

By the definition (4.19) of and the discussion on at the beginning of this subsection, we know that is well-defined and satisfies . Moreover, recall that is increasing over , so for each fixed , is a local maximum of . On the other hand, recall that is strictly increasing over and that , so we know that, for any fixed ,

| (4.22) |

Hence, for any fixed , the threshold type strategy is optimal. The proof of Theorem 2.5 is complete by combining inequalities (4.20) and (4.22). ∎

We have proved that when is sufficiently small, i.e. , the optimal stopping region has only one connected component. On the other hand, a similar situation occurs if is sufficiently large, in which case the optimal stopping reigon . To show this, we demonstrate below the proof of Theorem 2.5, namely that, is the value function of the problem (4.1) for some . We will demonstrate the analysis of the remaining, most challenging, proofs for parts and of Theorem 2.5 afterwards.

Let us introduce the following functions and , which play a crucial role in the rest of the paper (as is also part of (4.1)). We first define

| (4.23) |

which is a non-negative function that is vanishing for all and is uniformly bounded from above by (using the obvious fact that for all ). Then, we also define

| (4.24) |

which has the following properties, that can be proved by using the definition (4.24) of , the aforementioned properties of from (4.23) as well as that is strictly decreasing over , and the definition (2.1) of .

Lemma 4.9.

The function is non-negative, decreasing, continuous over , and is in for any . Moreover,

| (4.25) |

Proof.

See Appendix A. ∎

Proof of part of Theorem 2.5. In order to show that the value function is given by for some , we adopt the method of proof through the variational inequalities, summarized below.

Lemma 4.10.

Let and a function in for some , such that and is super-harmonic, i.e. it satisfies the variational inequalities

| (4.26) |

Then, by using Itô-Lévy lemma and the compensation formula, we know that is the value function of the problem (4.1) for this .

We already know that satisfies all conditions of Lemma 4.10 for , apart from (4.26). We thus need to identify all the -values for which (4.26) holds true. On one hand, using the explicit formula of for as given in (2.6), we know that on . In conjunction with Lemma 4.9, which implies for all , that

| (4.27) |

we have that (4.26) holds true and is indeed super-harmonic with respect to the discount rate for . In order to examine if is still super-harmonic with respect to discount rate for , we use the functions and from (4.23)–(4.24) and the above analysis, to define and calculate

| (4.28) |

We clearly have for all , with . Moreover, recalling the standing assumption that , we know from (4.28) and Lemma 4.9 that the function is strictly decreasing over , with . Hence, there exists a unique critical -value, denoted by , such that

| (4.29) |

In words, is the smallest -value such that is super-harmonic with respect to discount rate . So we obviously have . Overall, in light of the above observations, we know that satisfies the variational inequalities (4.26) for all .

Note that, the above analysis also implies that . To see this we argue by contradiction, supposing that . Then, for any in a sufficiently small left neighborhood of (defined in (4.13)), waiting until will yield a strictly better value than stopping immediately, so this must be in the continuation region . But then, by the arbitrariness of , we must have , and consequently, by the monotonicity of , we have

However, the last inequality implies from (4.28) that , which contradicts with the definition of in (4.29). ∎

We now prove the case when .

Proof of part of Theorem 2.5.

It follows from the proof of Theorem 2.5 and the definition (4.21) of , that the inequality (4.17) fails at some point , which satisfies

| (4.30) |

Moreover, is a stationary point of and solves . Hence, for , there is branching of the optimal stopping region due to the facts that and . Below we examine the two distinct scenarios corresponding to the cases and (see also Remark 4.4).

Firstly, if has paths of bounded variation and (2.12) holds (i.e. ), then by (4.9)–(4.10) and (4.18), we know that over , implying that . Therefore, by observing that

| (4.31) |

we conclude, in view of Proposition 3.1, that . Secondly, if (2.12) does not hold (i.e. ), we have in view of Lemma 2.2 the following equivalence:

| (4.32) |

Remark 4.11.

As it will be shown later on, an additional unique connected component of inevitably appears in for some , independently of how many disjoint connected components of exist in . In order to present the main ideas in a concise manner, for the purpose of this paper, we do not expand in the direction where Hypothesis 2.1 fails.

Now, when holds, we have similarly to (4.31) that and so .

Finally, in order to complete the proof, it remains to show that the smooth fit condition holds at when . However, this follows directly from the smoothness of . ∎

The above analysis, together with (4.21) and the monotonicity of in , outlined in the proof of Theorem 2.5, implies that the critical value is the smallest -value such that , provided that Hypothesis 2.1 holds whenever (2.12) fails. Consequently, we know from Proposition 3.1 that

| (4.33) |

Moreover, it follows from this observation, Remark 3.2 and Theorem 2.5, that the disjoint components of stopping region will merge into one when . Taking into account all the above, we are ready to study the only remaining case, when .

Proof of part of Theorem 2.5. Provided that Hypothesis 2.1 holds for (so that and ), a combination of (4.33), Proposition 3.1 and the observation from (4.29) that , dictates the consideration of the following pasting points, for all :

| (4.34) | ||||

| (4.35) |

In fact, Proposition 3.1 implies that . Hence, for any , it is optimal to wait until . To be more precise, stopping immediately is optimal when either the event or occurs. However, an immediate stop is not optimal when occurs due to an overshoot; waiting until increases to would then be optimal. Taking these into account, the value function in (4.1), for all , takes the form

| (4.36) |

In view of deriving the above value, we use a result from [22, Theorem 2] for the occupation time at the first up-crossing exit. For any , and with , we have

| (4.37) |

where we define the non-negative function (see [22, (6)-(7)])

| (4.38) | ||||

| (4.39) |

In addition, we prove and use the following proposition, which also provides a generalization of the case with deterministic discounting in [20, Theorem 2] to the case with state-dependent discount rate .

Proposition 4.12.

Let be a positive, non-decreasing, continuously differentiable function on , and further suppose that has an absolutely continuous derivative with a bounded density over for any fixed if has paths of unbounded variation. We have for all and that

| (4.40) | ||||

| (4.41) | ||||

where

Proof.

See Appendix A. ∎

Therefore, if and , we have for all that the function defined in (4.36) for all with , is given by

| (4.42) |

where is defined in (4.28). In view of this explicit formula, one can easily see that the mapping is in . If has bounded variation, then we already know from Proposition 3.1 that continuous fit should hold at and . However, if has unbounded variation, by exploiting the optimality of thresholds and , we show in what follows that the smooth fit conditions must hold as well. Remarkably, using a similar argument, we show that smooth fit holds at even when has bounded variation.

Proposition 4.13.

The following smooth fit properties holds:

-

(i)

If , then for any , smooth fit holds at , i.e.

-

(ii)

If has unbounded variation, and , then and smooth fit holds at , i.e.

Proof.

See Appendix A. ∎

Therefore, using the fact that we have smooth/continuous fit at the optimal exercising thresholds and by Propositions 3.1 and 4.13, as well as using (4.36)–(4.42), we derive a necessary condition for the pair to be identified with the optimal .

Corollary 4.14.

For the case and , the optimal thresholds and solve the following system:

where, with defined in (4.28), we have

| (4.43) |

Proof.

Bounded variation case: Letting and using (4.38), we can conclude from (4.42) and some straightforward calculations that

On one hand, it is easily seen from (4.36) that holds by construction. On the other hand, suppose in the above equation, then since due to Lemma B.1, the continuous fit condition at will not hold, which is a contradiction. The other equality can be straightforwardly obtained from the smooth fit condition satisfied by at .

Unbounded variation case: In this case, by Lemma B.1, thus the above equation in Step 1 is satisfied immediately. However, we can derive from it, for , that

We know from (4.36) and Proposition 4.13 that holds. By supposing that in the above equation and using the facts that and due to Lemma B.1, we conclude that the smooth fit condition at does not hold, which is a contradiction. Hence, and solve . The other equality can be straightforwardly obtained from the smooth fit condition satisfied by at . ∎

This corollary states that is both a zero and a stationary point for the function . Based on these facts, we notice from (4.36)–(4.42) that

| (4.44) |

By the definitions of and (see (4.34) and (4.35)), we have for all in a sufficiently small left neighborhood of , from which we conclude that is either a local minimum or an inflection point of the function . By exploiting this observation, we are able to give a complete characterization of (i.e. sufficient conditions for determining) the pair .

Proposition 4.15.

Assuming that and , we have:

-

(i)

, for any fixed . If has unbounded variation, then we also have . Moreover, for all ;

-

(ii)

Let , which is a closed set for each . Then , such that

(4.45) That is, is a global minimum point of the function over , and is the unique such that .

Proof.

Claim follows from the construction of . To see this, let and use (4.43) and (4.38) to see that

The smoothness follows by combining the above with (4.44) and Proposition 4.13. Using also the monotonicity of (and hence ) from Lemma 4.9, (4.25) and the fact that , we have for all that

| (4.46) |

Hence, the first claim is proved.

In order to prove claim , we let . First recall from Theorem 2.5, that and , hence and for all . Then, for any fixed , using (4.38), (4.39) and (4.44) we have

| (4.47) |

where we used the conclusion from in the last inequality. It thus follows that, for all , we have

which implies that hence , for . On the other hand, since , we know that . Suppose now that and since , let . By the definition of and claim , we conclude that for all . However, for any fixed , taking the derivative of with respect to we get

| (4.48) |

where the inequality follows from (4.46). Thus, we have that for all so . However, from (4.36)–(4.42), we know that for these ,

which is a contradiction. Hence, the only possibility is to have and thus and . Finally, since is strictly decreasing for every fixed , we know that there is no other such that . This completes the proof. ∎

Notice that Proposition 4.15 proves that , if and , where is the smallest -value such that the curve , emanating from the -axis at , will revisit the x-axis, so that for all . Recalling from Proposition 3.1 and Remark 3.2 that is the only component of stopping region in the interval , we know from Proposition 3.1 that is necessarily continuous over . Furthermore, recall from (4.33) that , i.e. there is no continuation region in for all . Hence, recalling Lemma 2.2, we have the following equivalence:

| (4.49) |

Remark 4.16.

Indeed, the right hand side of (4.49) is equivalent to the fact that is a component of for all . Overall, if , then , and the value function of the problem (4.1) is given by (2.14), which completes the proof. ∎

Remark 4.17.

In view of Proposition 3.1 we know that, under Hypothesis 2.1, the mapping (, resp.) is continuous and increasing (decreasing, resp.) in . Moreover, we know from the proof of Proposition 4.15 (more specifically, equation (4.47)), that the monotonicity is strict. Furthermore, because (see Theorem 2.5), we know that

5 Proof of Theorem 2.7

Proof of part (a) of Theorem 2.7. Let us first consider the case , so that is a -sub-martingale. In this case, we have

| (5.1) |

Since drifts to under (see [15, (8.3)] for ), we know from [22, Corollary 3] that the expectation in the last line of (5.1) remains bounded as . However, the prefactor as , so we know that the value function for all .

Proof of part (b) of Theorem 2.7. We now assume , so that is a -martingale. In this case, recall from [24] that defined in (2.7) takes the form , so we know that is finite, due to Proposition 3.1. On the other hand, we also have that holds, where is given by (2.6) as in the previous section since . Therefore, recalling from [24] that the problem (2.7) for has no optimal stopping region, we get using Proposition 3.1 that , so should always belong to the continuation region. In view of this observation, we can treat as the reward function and consider the representation (2.10) of the value function . We thus have for all (see also (4.28) for the definition of ), that

Hence, it will always be beneficial to continue as long as stays over . In view of this and the fact that , we either have if , or if . By Proposition 3.1, if the stopping region exists, then it is at most one connected interval of the form for some . Thus, it will be crucial to identify the smallest -value such that . To this end, we calculate the value of waiting forever:

where we used [22, Corollary 3]. One can similarly establish the reverse inequality, so the above is in fact an equality. It follows that

| (5.2) |

For any fixed , the function is obviously strictly decreasing over , since in this case. In particular, we notice that there exists a unique value that solves

| (5.3) |

It can be verified using the convexity of (see e.g. [15, Exercise 3.5]), that indeed holds. Moreover, for any , we have

Hence, we know that the mapping is strictly decreasing over . As a result, we know that for , and the value function is given by (2.16) in both cases.

For , in view of Proposition 3.1 and Proposition 3.1, we know that the stopping region for some . To determine , we consider the value of the threshold type strategy . This can be done by taking the limit of (4.40) in Proposition 4.12 as . To this end, we begin by using (4.39) and a standard application of the dominated convergence theorem, to prove that (recall that )

| (5.4) |

Obviously, is a continuously differentiable, strictly decreasing, positive function over , whose domain can be extended over by setting for . Therefore, for any fixed and , we have

Taking into account the above expression along with (4.39) and (5.4), we get the limit of (4.40) in Proposition 4.12 as , for any fixed , given by

| (5.5) |

Similar as in Corollary 4.14, we know that the optimal threshold must be such that the coefficient of in (5.5) vanishes, i.e. it must solve

| (5.6) |

To finish the proof, we demonstrate that there is at most one solution to (5.6), which follows from the fact that for all , we have

| (5.7) |

where the last equality is due to (4.25). In conclusion, taking into account the expression of the value function in (5.5) for , and combining it with (5.6) and (4.43), we conclude that is given by (2.17) with .

6 Example

In this section we study the optimal stopping problem (1.2) using the compound Poisson model, also used in [22]. In particular, we assume that the Lévy process is given by

where , , is a standard Brownian motion, is a Poisson process with intensity independent of and are i.i.d. positive hyper-exponential random variables with density given by , where is the intensity of the exponential distribution. We also let , and . Using this data we can compute that , , and , which correspond to Theorem 2.5.

We thus consider three values for representing the cases: ; ; , which are illustrated in three panels in Figure 1. In panels (a) and (b) of Figure 1, we obtain the optimal threshold through its definition (4.13), while in panel (c) of Figure 1, we numerically solve for the optimal thresholds and through their definition (4.45) in Proposition 4.15. From these plots, it is seen that the value functions are no longer convex in the absolute price scale. In addition, the optimal exercising region indeed “grows” with increasing -values (as indicated in Proposition 3.1), there is branching (as indicated in Theorem 2.5) and we can compare it in each of the above cases with , given by and .

7 Conclusions

We have studied an optimal stopping problem with a random time-horizon that depends on the occupation time of the underlying process. The problem is equivalent to the evaluation of a perpetual American call option with a random discount rate. To the best of our knowledge, our work is the first that addresses optimal stopping with a random discount rate under such general Lévy models. Moreover, the results reveal a rich class of optimal stopping strategies. As seen in Theorem 2.4 and Theorem 2.5, up-crossing strategies may still be optimal under certain circumstances. However, in some cases as in Theorem 2.5, both the optimal stopping region and the continuation region can have two disconnected components, and the optimal exercising strategy can be two-sided and may not be a one-shot scheme if overshoot occurs; which are both interesting new features. Lastly, because of the random discount factor, there are non-trivial optimal exercising strategies in the martingale case, as opposed to the standard perpetual American call option [24]. Precisely, as seen in Theorem 2.7, the optimal stopping region is always connected, but the one-sided optimal exercising strategy can be either an up-crossing or a down-crossing exit, with the latter even possibly not being a one-shot scheme, which are all surprising results.

In order to characterize the optimal exercising thresholds in Theorem 2.5 and Theorem 2.7, we obtain the joint distribution of the discounting factor and the underlying process at the first exit time, when the discount rate is random (see Proposition 4.12). This novel result can be applied to solve optimal stopping problems with alternative payoffs under that random discount rate. These could be natural directions for future research.

Appendix A Proofs

Proof of Lemma 2.2.

By Proposition 3.1, the continuation region must include . Thus it remains to study the possibility of other parts of the continuation region in . To that end, we first notice from Proposition 3.1 that there cannot exist any component of continuation region that lies strictly in the interior of the set , where the property holds due to the calculation (4.27). Therefore, the only two possibilities are either for the whole set to be part of the continuation region, or a subset of it for some .

Hence, in what follows we let be a maximal component of the continuation region, such that and (if there is no such , then in light of Proposition 3.1, we must have ). Then it holds that

| (A.1) |

for otherwise, it will not be beneficial (by Itô-Lévy lemma) to wait until reaches a level where the above inequality does not hold. At this point, we notice that (using (4.28))

| (A.2) |

Using the monotonicity of (and hence ) from Lemma 4.9, we can conclude that is strictly decreasing for all . Combining this with (A.1), we know that

If Hypothesis 2.1 holds, then there cannot be any continuation region in , which means that is the only component of stopping region that lies on the right of . If Hypothesis 2.1 does not hold, then from the above discussion we know that, there exists a component of continuation region that lies on the right of . Proposition 3.1 implies in this case that there are two components of stopping region on the right of . ∎

Proposition A.1.

Suppose the value function is sufficiently smooth, then Hypothesis 2.1 holds if the jump tail measure, for , has a monotone density, i.e. for all , and is non-increasing for .

Proof.

By Proposition 3.1, the continuation region must include . Thus it remains to study the possibility for other continuation regions in . To that end, we notice from (A.2) and Lemma 4.9 that is strictly decreasing for all . By Proposition 3.1, we know that there cannot be any component of continuation region that completely falls inside . Therefore, we only need to verify the assertion of Hypothesis 2.1 for .

Let be the maximum component of a continuation region such that and . Let , then for all . We also notice that for all . This is because, if , then by Proposition 3.1 and Proposition 3.1, we know that , and is the only component of the stopping region that lies below . Overall, is the only interval in where the time value is positive. To finish the proof, we demonstrate that there is no continuation region in . To this end, consider the function

By construction, it holds that for all , thus in view of Lemma 4.10, we only need to show that satisfies the variational inequalities (4.26) for , to conclude that it is the value function and consequently is a component of stopping region.

Suppose is sufficiently smooth, then is also continuously differentiable in over . Moreover,

| (A.3) |

Letting in (A.3), and using smooth fit of at , we have

| (A.4) |

If and is continuous in with a finite limit as , then because and in the small left neighborhood of , we know that is convex at if , so (A.4) leads to

| (A.5) |

Thanks to the monotonicity of and , (A.5) implies for any , that

In summary, we know that (4.26) holds true, thus and the proof is completed. ∎

Proof of Lemma 2.6.

For all , using integration by parts and Lemma B.1, we have

| (A.6) | ||||

| (A.7) |

Using again Lemma B.1 and , we know that,

Therefore, if the right hand side of the above is negative, (2.12) will not hold. In the sequel we demonstrate that, if , then (2.12) must hold. To this end, we define function , and use (4.11) to obtain that

which suggests that for all sufficiently large , and there must be an increasing sequence that goes to , such that (in order for ). Let us suppose that (2.12) is violated, then there must be some global minimum , such that and . However, as increases, must be decreasing below 0 and then increasing over 0, and then ultimately decreasing at least over the points in the sequence . However, from (A.6) and (A.7) we know that

| (A.8) |

And by Lemma A.2 below, the only possible sign change for is from being positive to being negative. Therefore, the above assumed does not exist, and (2.12) must hold.

Lemma A.2.

Suppose and the tail jump measure of , denoted by for , either has a completely monotone density or is log-convex. Then, as increases from 0 to , the only possible sign change of function is from being positive to negative, which can happen at most once.

Proof.

If has a complete monotone density, then we know from the proof of [14, Theorem 3.4] that, there exist constants and a measure concentrated on , satisfying , such that

It is then straightforward to show that

where and

where for each fixed , is a quadratic function given by

Since and , we know that has two roots and , satisfying . Overall, we see that the function is first strictly increasing over , strictly decreasing over , then again strictly increasing over , and finally strictly decreasing over . Moreover, it is easily seen that

which therefore implies (since ) that

Moreover,

Hence, we see that the function is strictly decreasing over . So this function is either does not change sign, or changes sign from being positive to being negative exactly once.

If instead is log-convex, we know from [14, Theorem 3.5] that the function is convex over . It follows that is increasing. Hence the sign of will either have the same sign throughout or change from being positive to negative, as increases over . ∎

Proof of Proposition 3.1.

Part : For any fixed , using the definition (2.6) of and assuming that is an optimal stopping time (e.g. , if ) for the problem (2.6), we have that

The other inequalities can be proved similarly.

Part :

Step 1: We let be the value function. Then for any and any and , we have

Using the above and Proposition 3.1 we know that the mapping is jointly decreasing on . Moreover, for any and any , we have

which implies that

Using this expression along with the non-negativity and monotonicity of in parameters and , we see that the mapping is strictly increasing (due to the exponential factor).

Step 2: Taking into account the above expressions and Proposition 3.1, we can rewrite problem (1.2) in the form:

| (A.9) |

We now consider and express similarly as

| (A.10) |

where the last equality follows from the facts that and that never occurs before the optimal stopping time , see Proposition 3.1. By fixing a stopping time , we have in the event that , that (-a.s.):

| (A.11) |

where we used the inequalities and for in the first inequality, and the -a.s. inequality in the last inequality. Then, by the inequality , (A.9), (A.10) and (A.11) we have

| (A.12) |

But for any , we have -a.s. that

| (A.13) |

where we used, in the last inequality, the fact that

is increasing. Therefore, we have from (A.13) that

Moreover, using [22, Corollary 2(i) and (11)], it is clear by dominated convergence theorem that

and thus . Using this result in (A.12), we finally see that the mapping is right-continuous in . The left continuity of can be proved similarly.

Step 3: To prove the continuity in , we fix . For any stopping time , we have -a.s. that

which is a non-negative random variable that converges to 0 almost surely as goes to 0. On the other hand,

From the dominated convergence theorem we know that goes to 0 as tends to 0.

Part : Because , we know that . If , then for any , we have

where we used the facts that on the event in the second line, and for in the third line. It follows that . ∎

Proof of Lemma 4.2.

The limits as and follow straightforwardly from the asymptotic behaviors of scale functions, see Lemma B.1. Thus, we only present the proof of the monotonicity. To this end, fix , then it is clear that the mapping is strictly decreasing in . Hence, for we have

So is non-increasing over . Suppose there is a non-empty interval such that . If not, there is a such that . Setting , then we have

But this means that is not strictly decreasing. This is a contradiction. Therefore must be strictly decreasing over .

∎

Proof of Lemma 4.5.

Using the definition of in (2.1) and , we have

Combining this with from (4.10) when (i.e. and by Lemma B.1), which is given by

we get

| (A.14) |

where

Notice that is (strictly if ) convex over and , hence for all . In particular, for we have

Hence, if holds, then necessarily and therefore . On the other hand, if and hold, then and therefore . ∎

Proof of Lemma 4.6.

Proof of Lemma 4.9.

Let , then we have by the definition of in (4.24) that

| (A.15) |

It can be easily verified that defined in (4.23) is a strictly decreasing, positive function over , so . That is, is strictly decreasing. Moreover, since for some fixed constant and all sufficiently small , we can use the dominated convergence theorem to show the continuity of .

In order to prove the continuous differentiability of , we will first show the right-differentiability by considering the expression using (A.15). To this end, we fix a and let . Then notice that is strictly decreasing and convex over , with and for all . It thus follows that

Similarly, for any , using and the convexity of we have

Taking into account the above inequalities, the fact that is decreasing, we can conclude from (A.15) that

By the dominated convergence theorem and the fact that , we know that

Using similar arguments one can prove that is left-differentiable at . The continuity of follows from dominated convergence theorem and the fact that is uniformly bounded.

Proof of Proposition 4.12.

We focus on proving (4.40), since the equality (4.41) is derived directly from the former and (4.37). Notice that for , using the definition given in (4.39), we know that , therefore the result follows directly from an application of (B.2). Hence, we only need to prove the result for . Let us first assume that . The result for can then be obtained in the limit.

We will use similar techniques as in [22]. In particular, in the same probability space, for a given , we let be a spectrally negative Lévy process with Lévy triplet where

with being the Dirac measure at . The process has paths of bounded variation, with the drift given by . If has paths of unbounded variation, we know that, for all sufficiently large , we will have . Without loss of generality, we will assume that is sufficiently large and .

Let us denote by and the infinitesimal generator and the Laplace exponent of , respectively. Moreover, introduce

By the construction of , we know that, for any ,

where

| (A.16) | ||||

| (A.17) |

where the equalities in (A.17) are due to the support of . We notice that, uniformly over .

Let us denote by the -scale function of , and let , and be the first passage times of (from above), (from below), and the occupation time below for , respectively. Define

We will study this function in four distinct intervals of . We first observe that, for , we have .

Now, for , we use the strong Markov property of and (4.37), followed by an application of (B.2) for the test function , to obtain that

| (A.18) |

Finally, for , by the strong Markov property of , and using (A.18), we have

| (A.19) |

where we used Fubini theorem in the last line. Observe that, by another application of (B.2), the first line of the right hand side of (A.19) is given by

Moreover, using [22, Lemma 2.2 and (19)], and the fact that vanishes on , we have for any fixed that

where is defined in view of (4.38) as

Therefore, we conclude from the above analysis and the fact that vanishes on that (A.19) becomes

| (A.20) |

for all . Now, letting and using the facts that for all and since has bounded variation, we obtain that

Plugging the above expression of into (A.20), we obtain that

As converges to uniformly on compact time intervals -a.s. (see [3, p. 210]), and is bounded over , we may use the dominated convergence theorem and Lévy’s extended continuity theorem (see e.g. [13, Theorem 5.22]) as in the proof of [22, Theorem 1] to complete the proof. If has paths of bounded variation, then we obtain the final result without taking the limit. ∎

Proof of Proposition 4.13.

For ease of notation, we let and .

Part : We prove the desired claim by exploiting the optimality of among all up-crossing thresholds larger than (recall that the optimal threshold ). More specifically, for each pair such that and , we consider the mapping , where is defined in (4.42). Then we know that for every fixed . On one hand, by Proposition 4.12, we have

| (A.21) |

for all and . As discussed above, for all fixed , the mapping is maximized at , a fact that will be exploited in the subsequent analysis. This function is continuously differentiable in (, resp.).777The only nontrivial part is the differentiability of , which follows from that of . Hence, satisfies the first order condition:

Using the above condition and some straightforward calculations, for all , we get

| (A.22) |

where . Since the factor , we know that

| (A.23) |

On the other hand, for all , we have

| (A.24) |

Notice that the domain for the last integral in (A.24) can be replaced by without affecting its value. Combining (A.23) and (A.24), we know that as .

Part : Let us consider , the value of the two-sided strategy for when starting from . Since is assumed to have unbounded variation, we know that . Moreover, straightforward calculations using (4.42) show that the mapping is continuously differentiable over . Indeed, we have

where

It is easily seen that is finite, hence by (since has unbounded variation), we have

On the other hand, using (4.39) we have

Recall from (4.29) that if and only if , therefore . Moreover, recall from Lemma B.1 that for all and it converges to either or as , depending on whether or not. Consequently, we have , which implies that for all sufficiently small , where is given by (4.36) and the first inequality follows from the fact that is clearly suboptimal for all , thus . This proves that .

We now prove that smooth fit holds at :

Step 1: We first treat the case when . To this end, notice that for any , we have (due to Proposition 3.1 and the definition of in (4.17)). Hence, if has unbounded variation,

where we used the facts that and that is a root of for every .

Step 2: We treat the case when . This is the only case left, thanks to the proven fact that . Hence, without loss of generality, we assume that, there is a sufficiently small, such that . In the proof below we use similar arguments to those of Proposition 4.13. To be more precise, we consider the mapping

for all and . By using (B.1) and (B.2) (with strictly increasing, continuously differentiable testing function ), we obtain that (see also (4.28))

| (A.25) |

The function is continuously differentiable in (, resp.) for all (, resp.). Indeed, the first line of is obviously continuously differentiable in (, resp.). Moreover, we know from (4.28) and (2.6) that is decreasing and hence negative continuous function that is uniformly bounded over , hence the integral part is also continuously differentiable in (, resp.). Thus, for all , we have by the optimality of , that the following first order condition for holds at :

| (A.26) |

Because for all , the pre-factor of the above expression is positive. Moreover, due to the fact that the mapping is strictly decreasing over (see Lemma B.1), we know that

since . Hence, necessarily, we have

| (A.27) |

On the other hand, we have for , therefore and using (A.27) we obtain that

| (A.28) |

From (A.27) and (A.28) we have for all that

where we have used the absolute bound for and the fact that in the case of unbounded variation. As a consequence, we see that converges to 0 as and this completes the proof. ∎

Appendix B Preliminaries on scale functions

In this appendix, we briefly review a collection of useful results on spectrally negative Lévy processes and their scale functions.

The -scale function is closely related to exit problems of the spectrally negative Lévy process with respect to first passage times of the form (2.4). A well-known fluctuation identity of spectrally negative Lévy processes (see e.g. [15, Theorem 8.1]) is given, for and , by

| (B.1) |

Moreover, letting be a positive, non-decreasing, continuously differentiable function on , and further supposing that has an absolutely continuous derivative with a bounded density over if has paths of unbounded variation, it is known from [20, Theorem 2] that, for any fixed such that , we have

| (B.2) |

The following lemma gives the behavior of scale functions at and ; see, e.g., [14, Lemmas 3.1, 3.2, 3.3], and [9, (3.13)].

Lemma B.1.

For any ,

Moreover, converges to as , The function is strictly decreasing, and converges to as .

References

- Albrecher, Gerber and Shiu [2011] {barticle}[author] \bauthor\bsnmAlbrecher, \bfnmH.\binitsH., \bauthor\bsnmGerber, \bfnmH.\binitsH. and \bauthor\bsnmShiu, \bfnmE.\binitsE. (\byear2011). \btitleThe optimal dividend barrier in the Gamma-Omega model. \bjournalEuropean Actuarial Journal \bvolume1 \bpages43-55. \bmrnumberMR2843466 \endbibitem

- Alili and Kyprianou [2005] {barticle}[author] \bauthor\bsnmAlili, \bfnmL.\binitsL. and \bauthor\bsnmKyprianou, \bfnmA. E.\binitsA. E. (\byear2005). \btitleSome remarks on first passage of Lévy processes, the American put and pasting principles. \bjournalThe Annals of Applied Probability \bvolume15 \bpages2062–2080. \bdoi10.1214/105051605000000377 \bmrnumberMR2152253 (2006b:60078) \endbibitem

- Bertoin [1996] {bbook}[author] \bauthor\bsnmBertoin, \bfnmJean\binitsJ. (\byear1996). \btitleLévy Processes. \bseriesCambridge Tracts in Mathematics \bvolume121. \bpublisherCambridge University Press, \baddressCambridge. \bmrnumberMR1406564 (98e:60117) \endbibitem

- Carr [1998] {barticle}[author] \bauthor\bsnmCarr, \bfnmPeter\binitsP. (\byear1998). \btitleRandomization and the American put. \bjournalReview of Financial Studies \bvolume11 \bpages597–626. \endbibitem

- Carr and Linetsky [2000] {barticle}[author] \bauthor\bsnmCarr, \bfnmP.\binitsP. and \bauthor\bsnmLinetsky, \bfnmV.\binitsV. (\byear2000). \btitleThe valuation of executive stock options in an intensity-based framework. \bjournalEuropean Finance Review \bvolume4 \bpages211–230. \endbibitem

- Chesney, Jeanblanc and Yor [1997] {barticle}[author] \bauthor\bsnmChesney, \bfnmM.\binitsM., \bauthor\bsnmJeanblanc, \bfnmM.\binitsM. and \bauthor\bsnmYor, \bfnmM.\binitsM. (\byear1997). \btitleBrownian excursions and Parisian barrier options. \bjournalAdvances in Applied Probability \bvolume29 \bpages165-184. \bmrnumberMR1432935 (98b:90013) \endbibitem

- Christensen and Irle [2013] {barticle}[author] \bauthor\bsnmChristensen, \bfnmSören\binitsS. and \bauthor\bsnmIrle, \bfnmAlbrecht\binitsA. (\byear2013). \btitleAmerican options with guarantee–A class of two-sided stopping problems. \bjournalStatistics & Risk Modeling \bvolume30 \bpages237–254. \endbibitem

- Dayanik [2008] {barticle}[author] \bauthor\bsnmDayanik, \bfnmS.\binitsS. (\byear2008). \btitleOptimal stopping of linear diffusions with random discounting. \bjournalMathematics of Operations Research \bvolume33 \bpages645–661. \bmrnumberMR2442645 (2009i:60081) \endbibitem

- Egami, Leung and Yamazaki [2013] {barticle}[author] \bauthor\bsnmEgami, \bfnmE.\binitsE., \bauthor\bsnmLeung, \bfnmT.\binitsT. and \bauthor\bsnmYamazaki, \bfnmK.\binitsK. (\byear2013). \btitleDefault swap games driven by spectrally negative Lévy processes. \bjournalStochastic Processes and their Applications \bvolume123 \bpages347-384. \bmrnumberMR3003355 \endbibitem

- Egami and Yamazaki [2014] {barticle}[author] \bauthor\bsnmEgami, \bfnmM.\binitsM. and \bauthor\bsnmYamazaki, \bfnmK.\binitsK. (\byear2014). \btitleOn the continuous and smooth fit principle for optimal stopping problems in spectrally negative Lévy models. \bjournalAdvances in Applied Probability \bvolume46 \bpages139-167. \endbibitem

- Haldane [2010] {binproceedings}[author] \bauthor\bsnmHaldane, \bfnmAndrew\binitsA. (\byear2010). \btitlePatience and finance. In \bbooktitleRemarks at the Oxford China Business Forum, Beijing. Available at http://www.bankofengland.co.uk/archive/Documents/historicpubs/speeches/2010/speech445.pdf . \endbibitem

- Hart and Ross [1994] {barticle}[author] \bauthor\bsnmHart, \bfnmI\binitsI. and \bauthor\bsnmRoss, \bfnmM\binitsM. (\byear1994). \btitleStriking continuity. \bjournalRisk \bvolume7 \bpages51–56. \endbibitem

- Kallenberg [2002] {bbook}[author] \bauthor\bsnmKallenberg, \bfnmO.\binitsO. (\byear2002). \btitleFoundations of modern probability, \bedition2nd ed. \bseriesProbability and its Applications. \bpublisherSpringer-Verlag, \baddressNew York. \bmrnumberMR1876169 (2002m:60002) \endbibitem

- Kuznetsov, Kyprianou and Rivero [2013] {barticle}[author] \bauthor\bsnmKuznetsov, \bfnmA.\binitsA., \bauthor\bsnmKyprianou, \bfnmAndreas E.\binitsA. E. and \bauthor\bsnmRivero, \bfnmV.\binitsV. (\byear2013). \btitleThe theory of scale functions for spectrally negative Lévy processes. \bjournalSpringer Lecture Notes in Mathematics \bvolume2061 \bpages97-186. \bmrnumberMR3014147 \endbibitem

- Kyprianou [2006] {bbook}[author] \bauthor\bsnmKyprianou, \bfnmAndreas E.\binitsA. E. (\byear2006). \btitleIntroductory Lectures on Fluctuations of Lévy Processes with Applications. \bseriesUniversitext. \bpublisherSpringer-Verlag, \baddressBerlin. \bmrnumberMR2250061 (2008a:60003) \endbibitem

- Kyprianou, Pardo and Pérez [2014] {barticle}[author] \bauthor\bsnmKyprianou, \bfnmAndreas E.\binitsA. E., \bauthor\bsnmPardo, \bfnmJ. C.\binitsJ. C. and \bauthor\bsnmPérez, \bfnmJ. L.\binitsJ. L. (\byear2014). \btitleOccupation times of refracted Lévy processes. \bjournalJournal of Theoretical Probability \bvolume27 \bpages1292-1315. \bmrnumberMR3278941 \endbibitem

- Landriault, Li and Zhang [2017] {barticle}[author] \bauthor\bsnmLandriault, \bfnmD.\binitsD., \bauthor\bsnmLi, \bfnmB.\binitsB. and \bauthor\bsnmZhang, \bfnmH.\binitsH. (\byear2017). \btitleOn magnitude, asymptotics and duration of drawdowns for Lévy models. \bjournalBernoulli \bvolume23 \bpages432-458. \endbibitem

- Leung, Yamazaki and Zhang [2015] {barticle}[author] \bauthor\bsnmLeung, \bfnmT.\binitsT., \bauthor\bsnmYamazaki, \bfnmK.\binitsK. and \bauthor\bsnmZhang, \bfnmH.\binitsH. (\byear2015). \btitleOptimal multiple stopping with negative discount rate and random refraction times under Lévy models. \bjournalSIAM Journal on Control and Optimization \bvolume53 \bpages2373–2405. \endbibitem

- Linetsky [1999] {barticle}[author] \bauthor\bsnmLinetsky, \bfnmVadim\binitsV. (\byear1999). \btitleStep options. \bjournalMathematical Finance \bvolume9 \bpages55–96. \endbibitem

- Loeffen [2015] {bunpublished}[author] \bauthor\bsnmLoeffen, \bfnmR. L.\binitsR. L. (\byear2015). \btitleOn obtaining simple identities for overshoots of spectrally negative Lévy processes. \bnoteAvailable at http://arxiv.org/abs/1410.5341. \endbibitem

- Loeffen, Czarna and Palmowski [2013] {barticle}[author] \bauthor\bsnmLoeffen, \bfnmR. L.\binitsR. L., \bauthor\bsnmCzarna, \bfnmI.\binitsI. and \bauthor\bsnmPalmowski, \bfnmZ.\binitsZ. (\byear2013). \btitleParisian ruin probability for spectrally negative Lévy processes. \bjournalBernoulli \bvolume19 \bpages599-609. \bmrnumberMR3037165 \endbibitem

- Loeffen, Renaud and Zhou [2014] {barticle}[author] \bauthor\bsnmLoeffen, \bfnmR. L.\binitsR. L., \bauthor\bsnmRenaud, \bfnmJ. F.\binitsJ. F. and \bauthor\bsnmZhou, \bfnmX.\binitsX. (\byear2014). \btitleOccupation times of intervals until first passage times for spectrally negative Lévy processes. \bjournalStochastic Processes and their Applications \bvolume124 \bpages1408-1435. \bmrnumberMR3148018 \endbibitem

- Miura [1992] {barticle}[author] \bauthor\bsnmMiura, \bfnmRyozo\binitsR. (\byear1992). \btitleA note on look-back options based on order statistics. \bjournalHitotsubashi Journal of Commerce and Management \bvolume27 \bpages15–28. \endbibitem

- Mordecki [2002] {barticle}[author] \bauthor\bsnmMordecki, \bfnmE.\binitsE. (\byear2002). \btitleOptimal stopping and perpetual options for Lévy processes. \bjournalFinance and Stochastics \bvolume6 \bpages473-493. \bmrnumberMR1932381 (2003j:91059) \endbibitem

- Oksendal and Sulem [2005] {bbook}[author] \bauthor\bsnmOksendal, \bfnmB.\binitsB. and \bauthor\bsnmSulem, \bfnmA.\binitsA. (\byear2005). \btitleApplied Stochastic Control of Jump Diffusions. \bpublisherSpringer. \endbibitem

- Surya [2007] {barticle}[author] \bauthor\bsnmSurya, \bfnmB. A.\binitsB. A. (\byear2007). \btitleAn approach for solving perpetual optimal stopping problems driven by Lévy processes. \bjournalStochastics: An International Journal of Probability and Stochastic Processes \bvolume79 \bpages337-361. \bmrnumberMR2308080 (2008e:60114) \endbibitem

- Trabelsi [2011] {barticle}[author] \bauthor\bsnmTrabelsi, \bfnmFaouzi\binitsF. (\byear2011). \btitleAsymptotic behavior of random maturity American options. \bjournalIAENG International Journal of Applied Mathematics \bvolume41 \bpages112–121. \endbibitem

- Zhang [2015] {barticle}[author] \bauthor\bsnmZhang, \bfnmH.\binitsH. (\byear2015). \btitleOccupation time, drawdowns, and drawups for one-dimensional regular diffusion. \bjournalAdvances in Applied Probability \bvolume47 \bpages210-230. \endbibitem