monthyeardate\monthname[\THEMONTH] \THEYEAR

Joint News, Attention Spillover,

and Market Returns

Abstract

We analyze over 2.6 million news articles and propose a novel measure of aggregate joint news coverage of firms. The measure strongly and negatively predicts market returns, both in sample and out of sample. The relation is causal, robust to existing predictors, and is especially strong when market uncertainty is high or when market frictions are large. Using data on EDGAR downloads by unique IPs, we provide direct evidence that joint news triggers attention spillover across firms. Our results are consistent with the explanation that joint news generates a contagion in investor attention and causes marketwide overvaluations and subsequent reversals.

Keywords: News, Attention spillover, Contagion, Investor base, EDGAR search, Return predictability.

JEL Classification: G11, G12, G41.

1 Introduction

Extensive literature has been devoted to the prediction of aggregate stock market returns, with most papers focusing on macroeconomic variables.555See, for example, Ang and Bekaert (2006), Campbell and Yogo (2006), Cochrane (2007), and Goyal and Welch (2008). We refer interested readers to Rapach and Zhou (2013) for a comprehensive overview. As pointed out by Shiller (2002, pp.84), “The news media do play an important role both in setting the stage for market moves and in instigating the moves themselves.” Consistent with this, emerging literature finds that media coverage and media sentiment influence market returns and explain business cycles (Tetlock, 2007; Calomiris and Mamaysky, 2019; Bybee et al., 2021).

Another line of research focuses on the media coverage of individual stocks. As shown by Barber and Odean (2008) and Hillert, Jacobs, and Müller (2014), there is strong evidence that media coverage is associated with excessive attention to individual firms, short-term high valuation, and subsequent reversals.666Barber and Odean (2008) show that the news coverage of a firm triggers attention-based buying and high valuations. Hillert, Jacobs, and Müller (2014) find that firms extensively covered by the media exhibit strong short-run momentum that subsequently reverses. In addition, Kaniel and Parham (2017) find that news coverage of mutual funds by prominent media is associated with substantial capital inflows. A natural question is whether the effect of firm-level news coverage is idiosyncratic and therefore becomes inconsequential when aggregated or whether the news coverage generates a systematic impact on marketwide outcomes.

In this paper, we address the question by studying the effect of media coverage in a cross-firm setting and show that news coverage generates a contagion effect through which investor attention spills over across firms and results in marketwide overvaluations.

Our conceptual framework starts with Merton (1987)’s theory that investors fail to pay attention to news about stocks that they are unaware of or unfamiliar with and avoid investing in such stocks. As a result, the investor base of a firm is only a subset of the potential investors in the market. We build on that theory and hypothesize that the arrival of news that covers multiple firms (joint news) and its subsequent consumption by investors increases investors’ awareness of the covered stocks. This creates a cross-firm attention spillover and results in attention increases across multiple stocks. Similar to the way in which high attention generates high valuations for individual stocks (Barber and Odean 2008), the spillover of investor attention during periods when a large number of joint news articles are released generates a contagion effect and results in marketwide overvaluation and subsequent reversals.777The arrival of news about a firm can be either joint news or news that only covers a single firm (self news). Self news tends to be idiosyncratic and is less likely to trigger an attention spillover across firms. We examine both types of news in our analysis. Indeed, we find that joint news coverage contributes significantly more to market returns than self news coverage.

We empirically test the hypothesis by analyzing an extensive database of over 2.6 million news articles covering firms in the S&P 500 index. From this database, we construct a novel measure of joint news coverage of firms and show that the measure strongly predicts the future returns of the aggregate stock market. We further complement our market-level results with firm-level and investor-level analyses respectively to establish the microfoundations of our findings. In particular, we collect data on requests for firms’ EDGAR filings by 5.97 million unique Internet Protocol addresses (IPs) and provide direct evidence that joint news coverage triggers attention spillovers across firms.888See Lee, Ma, and Wang (2015) and Drake et al. (2020) for studies that use internet traffic at the SEC’s EDGAR website to infer the information acquisition activities of investors.

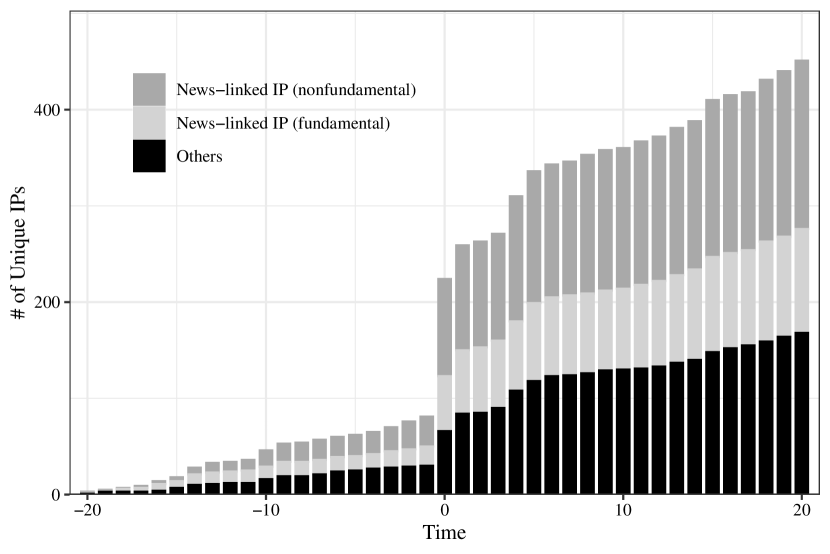

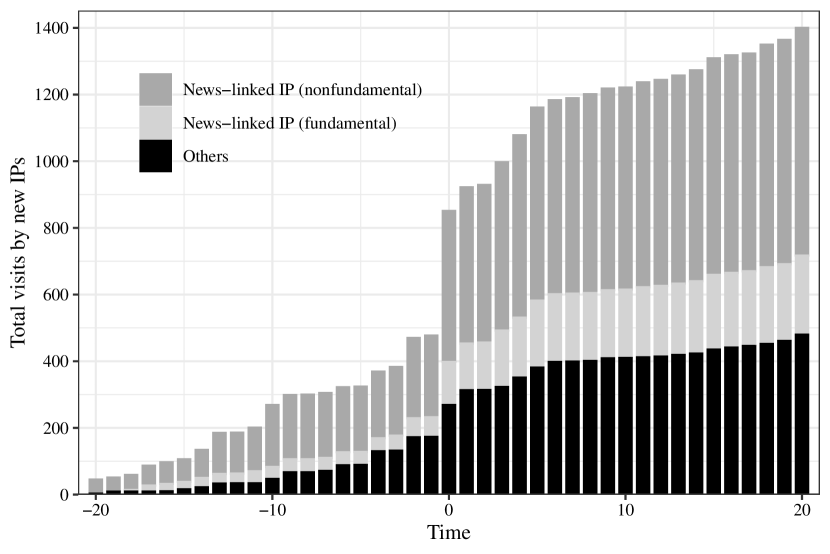

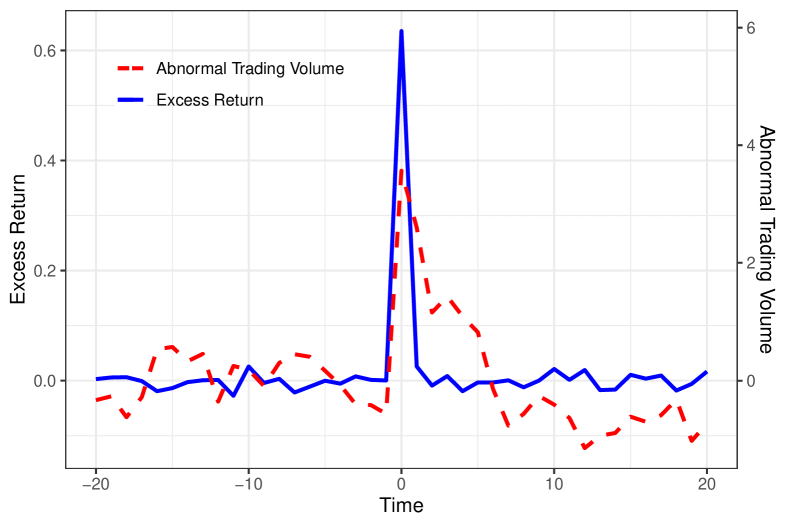

We illustrate the news-driven attention spillover effect with the following example. On July 10, 2008, Dow Chemical (DOW) announced a plan to purchase Rohm and Haas (ROH), an American chemical company, in cash at $78 per share. Shares in ROH jumped $29.17, or 65%, to $74 a share in afternoon trading on the same day. The number of news feeds mentioning ROH jumped to 82 on the day of the event; the average daily level was 1.15 over the previous 18 months.999The number of news feeds is extracted from the Thomson Reuters News Analytics and Thomson Reuters news archive. We skip the 20 days before the event to mitigate the influence of information leakage before the announcement. Appendix Figure A1 plots the daily abnormal trading volume and excess returns for ROH during the [, 20] day window, showing a sharp increase in trading volume and excess returns around the event day. We proxy for the (pre-event) investor base of a stock with the set of unique IP addresses that visited the stock’s SEC filings in EDGAR over the past 18 months and measure the number of new investors as the number of unique new IPs that accessed the stock’s filings during the [, 20] window. Figure 1, Panel A plots the cumulative number of unique new IPs for ROH and shows a sharp increase of 143 new IPs on the event day, which is substantially higher than the corresponding value of five on day .101010During the 180-day pre-event period, 1,251 unique IPs accessed the filings of ROH on EDGAR. Hence the event day is associated with a substantial increase of 11.4% in the number of investors that actively acquired information about ROH on EDGAR.

We further decompose the new IPs into three categories: those that are associated with the investor bases of firms covered by joint news and share fundamental linkages with ROH (News-linked (fundamental)), IPs associated with firms covered by joint news without fundamental connections (News-linked (nonfundamental)), and IPs associated with firms that are not mentioned by news (Others).111111The firm that shares joint news coverage and that shares fundamental linkage with ROH is DOW. Firms that are linked to ROH by news but are not fundamentally related are those that appeared in the daily news or headline summary (e.g., Lehman Brothers (LEH), Fannie Mae (FNM), Freddie Mac (FRE), Wachovia (WB), Dollar Thrifty Automotive Group (DTG), Bank of America (BAC), and Opnext Inc. (OPXT)). See Appendix A0 for an example of joint news coverage on July 10, 2008. Figure 1, Panel A shows that the IP increases are observed across all three categories, with the non-fundamental IPs contributing the most, at 70, which is substantially higher than the values of 37 and 36 from the fundamental and other categories, respectively.121212Panel B plots the cumulative number of visits by new IPs for ROH and shows a similar pattern. There were 374 visits by new IPs on the event day, a number that is substantially higher than the 62 new visits on day 1. Similarly, the news-linked nonfundamental IPs contributed 55.6% to the total new IP visits on the event day, whereas the news-linked fundamental IPs contributed 18.1%. The figure therefore suggests that joint news has the potential to generate a spillover of investor attention and trigger a substantial increase in the investor base of covered stocks.

In our empirically analysis, we formally investigate the extent to which joint news coverage generates investor attention spillovers and influences marketwide returns. Specifically, we use the news database to construct a monthly cross-firm matrix of abnormal news coverage. The matrix captures changes in the number of news articles mentioning the firms, with the off-diagonal elements corresponding to the extent of joint coverage and the diagonal elements corresponding to the extent of news coverage that only mentions one firm (self news coverage), respectively. Motivated by Banerjee et al. (2013, 2019), who find that the central nodes of an information network are more influential in information transmission, we expect a stronger attention spillover effect for news covering firms that belong to high-centrality nodes of the news coverage matrix. Hence, we define the degree of investor attention spillover to a given firm , from firms connected to through joint coverage, JointNewsi, as the centrality-weighted sum of abnormal joint news coverage across the connected firms. We then aggregate the firm-level measure and define a value-weighted market-level measure, JointNewsM, to capture the extent of marketwide investor attention spillover as driven by joint news coverage. Similarly, we aggregate the firm-level self news coverage measure to a value-weighted market-level measure, SelfNewsM. We compare the ability of JointNewsM and SelfNewsM to predict market returns to highlight how the two types of news generate distinctly different responses in investor attention and market prices.

We find that JointNewsM strongly and negatively predicts the one-month-ahead market returns, with a large in-sample of 3.93%, and a substantial out-of-sample of 6.52%. The predictability is robust to a large list of alternative predictors, which include the negative news tone (Tetlock, Saar-Tsechansky, and Macskassy, 2008), investor sentiment (Baker and Wurgler, 2006; Huang et al., 2015), and 14 economic predictors (Goyal and Welch, 2008). Compared with other predictors, JointNewsM has the strongest predictive power both in- and out-of-sample and is robust across business cycles. Further, the predictability lasts for at least six months, with a one standard deviation increase in JointNewsM reducing the aggregate stock market returns over the next six months by 0.4% per month.

This suggests that JointNewsM contains important information about aggregate future market returns that is not captured by the existing predictors. In contrast, SelfNewsM does not have significant power in predicting market returns. The results are consistent with our hypothesis that joint news triggers a spillover of investor attention across firms, which could generate a more substantial impact on market prices than self news that tends to be idiosyncratic.

Next, we turn to the important question whether the significant return predictability of JointNewsM translates into meaningful economic gains for investors in their asset allocation decisions. We show that, for a mean-variance investor, the information in JointNewsM gives rise to annualized certainty equivalent return (CER) gains of 4.95% to 9.31% for reasonable values of coefficients of risk aversion. The annualized Sharpe ratios of portfolios formed based on JointNewsM ranges from 0.80 to 1.05 at the monthly horizon, nearly tripling the market Sharpe ratio of 0.29 for a buy-and-hold strategy. The asset allocation results are also robust after accounting for a 50 basis points transaction cost.

To dive deeper into the micro-foundations of our findings, we turn to firm-level analysis and look for direct links between joint news coverage, investor attention, and stock returns. We first show that joint news coverage of a firm is associated with a significant increase in retail investor attention to the firm as measured by abnormal Google search volume (Da, Engelberg, and Gao, 2011). The result is consistent with our hypothesis that joint news coverage increases investor attention to the covered firms.

Next, we examine the more granular, individual-investor level, information acquisition activities by exploring downloads of 10-K and 10-Q filings in EDGAR by unique Internet Protocol addresses (IPs). We proxy for a firm’s investor base with a set of IPs that downloaded a firm’s filings in the past. We then consider how joint news coverage of a firm-pair expands the firms’ investor bases by identifying the number of unique new IPs that accessed information about one firm that also overlaps with the existing investor base of the other covered firm.

We find that a one standard deviation increase in joint news coverage of a firm is associated with 20.3% more such new IP activities, and the effect is substantially larger than that of self news coverage. In addition, joint news makes self news more salient to investors—self news-triggered new IP downloads increase by more than 70% for firms in the top tertile of joint news coverage compared to those in the bottom tertile. Consistent with this, we further show that a one standard deviation increase in a firm’s joint news coverage is associated with a significantly lower return in the following month, by 13 basis points.

In sum, the firm-level analysis provides direct evidence for our hypothesis that joint news coverage triggers a spillover of investor attention from the connected firms to the focal firm, thereby increasing the overall attention to the firms and resulting in high valuation and low future stock returns. More important, the firm level effects of joint news remain economically meaningful when aggregated and translate into strong market return predictability. In comparison, the effect of self news coverage is weaker at the firm level and becomes insignificant when aggregated. The contrast therefore underscores the importance of understanding the channels through which news affects investors’ information acquisition and aggregate stock returns.

One concern for our interpretation is that joint news coverage is endogenous, so the relation between joint news coverage and market returns may be driven by omitted variables that affect both joint news coverage and market returns. For example, joint news coverage may reflect economic linkages across firms. However, it is unclear how such linkages can drive our findings. First, economic linkages in the absence of market frictions do not generate return predictability. Second, previous studies find that the returns of a stock are positively related to the returns of related stocks in the cross-section and have attributed the findings to investor underreaction to the linkages due to inattention.131313See, for example, Moskowitz and Grinblatt (1999), Cohen and Frazzini (2008), Menzly and Ozbas (2010), Lee et al. (2019), Rapach et al. (2019), and Ali and Hirshleifer (2020). In sharp contrast, we find a strong negative relation between joint news coverage and future aggregate market returns. Our finding is more consistent with joint news coverage generating attention-driven overvaluation (Barber and Odean, 2008), a mechanism that is distinctly different from inattention-driven underreaction.

To further address the concern that joint news coverage captures omitted variables such as changes in macroeconomic environment or fundamental-linkages between firms, we identify exogenous variations in joint news coverage and assessing the extent to which random, nonfundamental, fluctuations in joint news coverage contributes to return predictability. We follow Peress and Schmidt (2020) and exploit episodes of sensational news (Eisensee and Strömberg, 2007) that are unrelated to the financial market as exogenous shocks to JointNewsM. We first establish that, all else equal, sensational news significantly reduces JointNewsM, confirming that the episodes distract media attention and lower joint news coverage. We then use the sensational news as an instrument for JointNewsM to predict future market returns. We find that the relation between JointNewsM and market returns remain strong, with a one standard deviation increase in the predicted JointNewsM significantly lowering the following month’s market return, by 48 basis points. Hence, the two-stage instrumental variable analysis suggests that the effect of joint news coverage on market returns is causal. That is, random, exogenous, fluctuations in JointNewsM drive a substantial portion of the variable’s predictive power, above and beyond what fundamental linkages alone could explain.

We also consider the possibility that our findings can be attributed to the rational explanation that increased investor attention improves risk sharing and reduces a stock’s required rate of return. To assess the extent to which our findings are attributable to the rational or mispricing-based explanations, we examine how the return predictability of JointNewsM varies with the level of market uncertainty and the degree of market frictions. Under the mispricing-based explanation, the predictability should be stronger when arbitrage is more costly, that is, when the friction is great and when the uncertainty is high. On the other hand, the rational explanation would suggest that the predictability would be strong irrespective of arbitrage costs. We find that JointNewsM only significantly predicts negative market returns when arbitrage is more costly, suggesting that the behavioral mechanism is more plausible.

Our findings contribute directly to the literature on investor attention, which shows that investor attention has important influences on the prices of individual stocks.141414For example, Da, Engelberg, and Gao (2011) show that retail investor attention positively predicts short-term stock returns and a subsequent reversal, while Ben-Rephael, Da, and Israelsen (2017) and Ben-Rephael et al. (2021) find institutional attention facilitates a permanent and efficient reaction to information. Fedyk (2021) shows that prominent news on the Bloomberg terminal attracts more trading and price responses. Bali et al. (2019) and Atilgan et al. (2020) show that attention enhances investors’ attraction to lottery stocks. Chen, An, and Yu (2020) find lead-lag effects in returns for stocks displayed together. More recently, Cookson, Engelberg, and Mullins (2021) and Barber et al. (2021) show that fintech brokerages and social interactions influence investor attention and contribute to stock returns. Other papers explore the implications on return comovements (Peng and Xiong, 2006; Drake et al., 2016; Huang, Huang, and Lin, 2019). What is new in our paper is that we highlight that joint news coverage can make such individual effects contagious and therefore generate aggregate impacts on the overall market. Two concurrent papers also examine investor attention and market returns, taking attention as given. Chen et al. (2020b) find that a common component of 12 investor attention proxies has significant power in predicting market returns, while Da et al. (2021) find that retail and institutional attention have distinctively different predictive powers. Different from these two papers, our granular, investor-level, evidence provide a micro-foundation for the way in which investor attention is influenced by news and contributes to market returns.

Our paper is also related to recent studies that use common news coverage to extract information about fundamental linkages among companies. For example, Scherbina and Schlusche (2015) find that stocks that share common news coverage cross-predict one another’s returns and associate the predictability with slow information diffusion. Schwenkler and Zheng (2020) use news-implied networks to identify links between distressed firms and find predictable stock returns and credit downgrades. Ge, Li, and Linton (2022) use the news-generated cross-firm networks to estimate a spatial factor model to better capture the comovement in equity returns.151515Also related, Lee, Ma, and Wang (2015) use EDGAR co-search activities by the same individual to identify fundamental similarities between firms. Different from these papers that focus on fundamental linkages, we show that common news coverage also generates contagion in investor attention and sentiment, thereby providing new insights into the multifaceted ways in which news coverage influences securities prices.

More broadly, our paper joins the growing literature that shows media and news play an important role in financial markets. Previous studies have focused on measures of media and news at the aggregate level. For example, Tetlock (2007) and Garcia (2013) find that media pessimism predicts aggregate stock market returns. Froot et al. (2017) document a “reinforcement effect” between returns and media-measured sentiment. Glasserman and Mamaysky (2019) show that the “unusualness” of news with negative sentiment forecasts market stress and Calomiris and Mamaysky (2019) find that news-based word flow measures predict risk and returns. Bybee et al. (2021) show that news attention closely tracks a wide range of economic activities and explains 25% of aggregate stock market returns. Our results are robust after accounting for the key variables used in the previous studies. More important, our study connects the firm level and aggregate effects of news on stock markets and provides new insight into one of the channels through which news affects investor behavior and prices. Our findings raise a number of issues that suggest future avenues of continuing research. In particular, survey evidence suggests that investors’ beliefs play a central role in financial markets and the beliefs are characterized by large and persistent heterogeneity (Giglio et al. 2021a, b). Hence it will be interesting to explore the way in which investors’ beliefs can be influenced by their attention decisions and the role of news media in directing investor attention.

The rest of the paper is organized as follows. In Section 2, we explain the conceptual framework and develop the attention spillover hypotheses. In Section 3, we describe the data. In Section 4, we present the empirical results of the return predictability analysis. In Section 5, we explore the micro-foundations and economic mechanisms. We conclude in Section 6.

2 Hypothesis Development

In this section, we explain the conceptual framework and develop the attention spillover hypothesis in a cross-firm setting.

As discussed in the introduction, previous studies show that media and news coverage of firms triggers substantial investor reactions. But not all news attracts attention from all investors. The idea of limited investor recognition was suggested by Merton (1987), which theorized that investors are only aware of (or are familiar with) a limited set of stocks. Hence, investors fail to pay attention to news about stocks that they are unaware of or unfamiliar with and avoid investing in such stocks. Motivated by this, we hypothesize that the arrival of a news article that mentions multiple stocks generates a cross-firm attention spillover. That is, investors of one stock, after reading the article, start to pay attention to the other covered stocks, therefore result in higher attention across the other covered stocks.

![[Uncaptioned image]](/html/1703.02715/assets/x1.png)

We illustrate the intuition with a simple example. Consider two stocks, A and B, and focus on the corresponding nonoverlapping sets of their investor bases, and .161616The spillover effect applies only to the nonoverlapping investor base, so we omit the overlapping set in our discussion for brevity. As in Merton (1987), investors in are only aware of stock A and are only attentive to news about A, and investors in are only aware of stock B and are only attentive to news about B. While news articles that cover only a single stock, A, will only be read by investors, articles that mention both firms (joint news) attract attention from both and investors. Therefore, the arrival of joint news and investors’ consumption of the news make investors aware of stock B and subsequently start to pay attention to B. We refer to this effect as a spillover of investor attention from stock A to stock B. As a result, both and investors are attentive to stock B. Similarly, investor attention spills over from B to A and stock A now receives the attention from both and investors.

The intensity of cross-firm attention spillover depends on the importance of a firm in the cross-firm network of news coverage. Building on the influential work of Banerjee et al. (2013, 2019), who find that central nodes of a network are more influential in information transmission, we assign a higher weight to a stock in the attention spillover process if the stock corresponds to a high-centrality node in the cross-firm network of news coverage. That is, the attention spillover from a connected firm to a focal firm is stronger if the connected firm belongs to a higher centrality node.

We summarize hypothesis 1 below:

Hypothesis 1.

The arrival of a news article that covers multiple stocks generates a spillover of investor attention across stocks that are mentioned in the article. The effect is stronger if the spillover originates from higher-centrality nodes of the cross-firm network of news coverage.

We now discuss the implications of joint news coverage on returns. As shown in Barber and Odean (2008), greater attention triggers more attention-based buying, which results in a temporarily high valuation and subsequent low returns for affected stocks. Hence, we expect that joint news causes high valuation of covered stocks and lower future returns. More important, during periods when a large number of joint news articles are released, the attention spillover effect is widespread, generating systematic high valuation in market prices followed by lower future market returns. Hence we state the following hypothesis:

Hypothesis 2.

During periods when a large number of joint news articles are released, the cross-firm spillover of investor attention aggregates and generates high market prices and results in low future market returns.

As for self news, due to its idiosyncratic nature and its lack of an attention spillover effect, we expect the self news to have a weak association with market returns.

3 Data and Variables

We measure news coverage across firms by analyzing an extensive database of over 2.6 million U.S. news articles covering firms in the S&P 500 index from January 1996 through December 2014. Using Thomson Reuters’s News Analytics and Thomson Reuters news archive, we extract news date, story identifier, the firms mentioned in the news, and the full text of the news. The firm-level stock data are from CRSP, and accounting and financial statement variables are from the merged CRSP-Compustat database. Below we first describe how we construct the joint news coverage measures, followed by descriptions of other variables.

3.1. News coverage measures

We first classify news articles into two categories: 1) joint news that mentions at least two firms, and, 2) self news that only mentions one firm. We then construct a monthly cross-firm news coverage matrix for each month :

| (1) |

where is the total number of firms in our sample; the off-diagonal element, with , corresponds to the number of news articles that mention firms and (joint coverage); and the diagonal element, , is the number of news articles that mention only one firm (self coverage).

As hypothesized, more-central firms in the cross-firm network of news coverage tend to have a larger investor base and thus are more likely to generate a greater attention spillover effect onto the other firms through joint news converge. We measure firm ’s centrality in the news coverage matrix using the eigenvector centrality of node .171717The eigenvector centrality of firm is the th element of the principal right eigenvector of the adjacency matrix and is proportional to the sum of the centrality scores of its direct neighbors and therefore accounts for transmission of signals along longer paths and walks. As suggested by Newman (2010), eigenvector centrality describes the informativeness of the links in an information network. Further, to capture time-variations in news coverage, we detrend the news coverage series and define as the logarithm difference between and its past six-month median.

Next, we aggregate the firm pair-level joint news coverage to the firm level to capture the degree of attention spillover to a firm from its connected firms as triggered by joint news. The abnormal joint news coverage for a given firm , JointNewsi, is the sum of abnormal joint news coverage across firm pairs , , weighted by the centrality of . Finally, we aggregate the firm-level measure to the market level and define JointNewsM as the market capitalization—weighted average of JointNewsi.

For robustness, we construct an alternative measure, JointNews, as the equal-weighted average of joint news coverage. We similarly construct an aggregated self-news coverage measure, SelfNewsM, by value-weighting abnormal self-news coverage across firms and compare the measure’s effects with that of JointNewsM.

3.2. Other predictors of market returns

We consider the incremental contribution of our variables relative to existing predictors of market return. We follow Goyal and Welch (2008) and include the following 14 economic predictors: log dividend price ratio (DP), log dividend yield (DY), log earnings-price ratio (EP), log dividend-payout ratio (DE), stock return variance (SVAR), book-to-market ratio (BM), net equity expansion (NTIS), Treasury bill rate (TBL), long-term bond yield (LTY), long-term bond return (LTR), term spread (TMS), default yield spread (DFY), default return spread (DFR) and inflation rate (INFL).181818We downloaded the economic predictor data from the website of Amit Goyal.

Next, we construct a negative news tone (News Tone) measure following Tetlock, Saar-Tsechansky, and Macskassy (2008) through textual analysis. Specifically, in each month, we count the negative words in each firm’s news articles according to the Loughran and McDonald (2011) financial words dictionary and calculate the firm-level negative news tone measure as the fraction of negative words in total words. Then, we define the value-weighted average of the firm-level negative news tones as the market-level new tone measure. We also include the investor sentiment measures proposed by Baker and Wurgler (2006, 2007) (SentBW) and Huang et al. (2015) (SentPLS) and the composite investor attention measure by Chen et al. (2020b) (AttnPLS).191919We downloaded the Baker-Wurgler’s investor sentiment index from the website of Jeffery Wurgler, the PLS sentiment index from the website of Dashan Huang, and the PLS investor attention index from the website of Guofu Zhou. All the definitions of the variables used in the paper are summarized in Table A1.

3.3. Summary statistics

Table 1 reports the summary statistics (Panel A) and the correlation coefficients (Panel B) of the variables used in the paper. Notably, JointNewsM has an AR(1) coefficient of 0.38 and is much less persistent than most of the other predictors. The monthly excess market return has a mean of 0.41%, a standard deviation of 4.49%, and an AR(1) coefficient of 0.08. These summary statistics are consistent with the literature. Panel B shows that the correlation coefficients between JointNewsM and other predictors are not high, suggesting that JointNewsM differs from the other predictors and may contain information for predicting market returns that is incremental to the predictors established in prior literature.

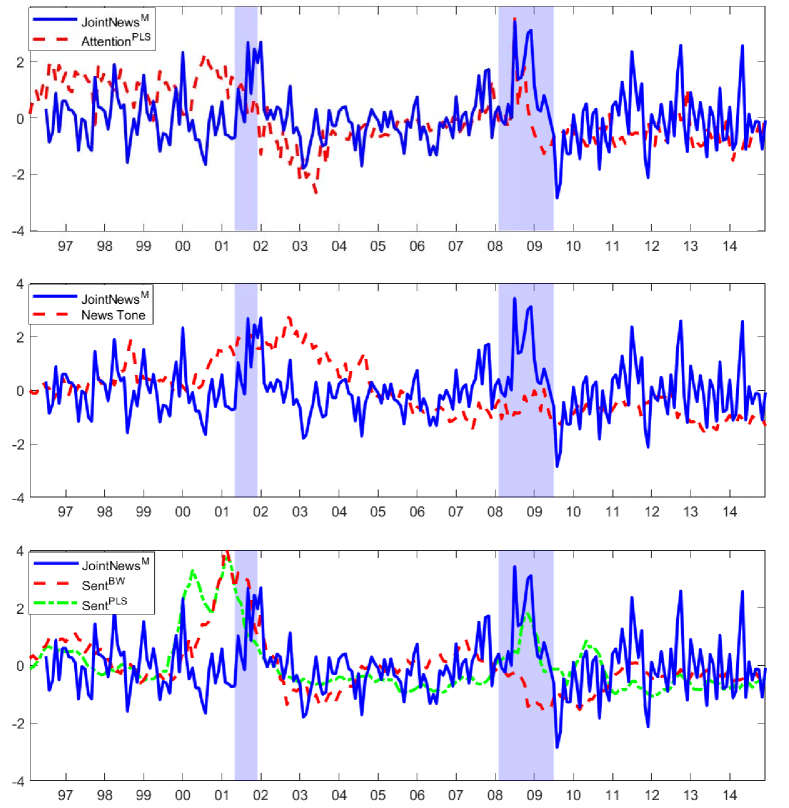

Given that our joint news measure is related to news, investor attention, and sentiment, we compare the standardized time series of these measures in Figure 2. The figure shows that JointNewsM (blue solid line) is distinctly different from the composite investor attention AttentionPLS of Chen et al. (2020b), the News Tone of Tetlock, Saar-Tsechansky, and Macskassy (2008), and the market sentiment measures, SentBW and SentPLS, of Baker and Wurgler (2006) and and Huang et al. (2015). There are also considerable temporal variations in JointNewsM compared with these other return predictors.

4 Joint News and Market Return Predictability

In this section, we examine the ability of JointNewsM to predict market returns. We first examine the baseline in-sample forecasting performance and the impact of market uncertainty and frictions on the forecasting performance of JointNewsM. Then, we compare the forecasting performance of JointNewsM with alternative predictors established in previous studies. Next, we analyze the out-of-sample forecasting performance and assess the economic value from an asset allocation perspective. We then provide an identification test using instrumental variables. Finally, we conduct some additional robustness checks.

4.1. Market return predictability

To investigate the time-series predictability of market returns, we consider the standard univariate predictive regression model,

| (2) |

where is the market excess return, that is, the monthly return on the S&P500 index in excess of the risk-free rate,202020In Appendix Tables A4-A8, we replicate our key findings replacing the S&P500 index returns with the CRSP value-weighted index returns and find the results to be similar. and is one of the return predictors listed in subsection 3.2, specifically, JointNewsM, news tone, and investor sentiment proxies, as well as economic predictors (Goyal and Welch, 2008).

Table 2 reports the in-sample forecasting performance. For comparison, all predictors are standardized to have zero mean and unit variance. Both value- and equal-weighted joint news indices, JointNewsM and JointNews, show strong in-sample return predictability, with the coefficient significant at the 1% level. We illustrate the economic magnitude of the findings using the coefficient estimate of JointNewsM. The coefficient of suggests that a one standard deviation increase in aggregate joint news coverage predicts a substantially lower market return for the next month, by 89 basis points. The is 3.93% and is substantially greater than the other predictors, including SelfNewsM and AttnPLS, and the two investor sentiment indices. In contrast, SelfNewsM has no significant forecasting power, suggesting that aggregate self news coverage is not significantly associated with market returns.

We next investigate whether the predictability of joint news coverage varies across business cycles. Following Rapach, Strauss, and Zhou (2010), we compute the statistics separately for economic expansions () and recessions (),

| (3) |

where () is an indicator that takes a value of one when month is based on an expansion (recession) period set by the National Bureau of Economic Research (NBER), that is, (), and zero otherwise; is the fitted residual, based on the in-sample estimates of the predictive regression model in (2); is the full-sample mean of ; and is the number of observations for the full sample. The last two columns of Table 2 show that JointNewsM has an of 2.25% and an of 3.31%. These results therefore suggest that, consistent with our hypothesis, the aggregate joint news coverage measure strongly predicts lower future market returns, and this predictability is robust across business cycles.

Uncertainty and market frictions

Our finding of a negative relation between JointNewsM and future market returns is consistent with our behavioral hypothesis that joint news results in an attention spillover, triggering excessive buying and a temporary overvaluation and subsequent reversals (Barber and Odean, 2008). However, as explained in the introduction, the relation could also be consistent with a rational alternative explanation that the attention spillover broadens the investor base of a firm and therefore improves risk sharing and reduces the firm’s required rate of returns (Merton, 1987).

To gain further insight into which mechanism better explains the predictability of JointNewsM, we identify settings under which one mechanism may be more relevant than the other. If the predictability of JointNewsM is driven by mispricing, we expect the predictability would be stronger during times when market friction is great and market uncertainty is high and therefore arbitrage is more costly. On the other hand, the rational explanation would suggest that the predictability would be strong during both high and low uncertainty and friction periods.

To measure market uncertainty, we consider the CBOE volatility index (VIX), the economic uncertainty index (UNC) of Bali, Brown, and Caglayan (2014), the treasury implied volatility (TIV) of Choi, Mueller, and Vedolin (2017), the macro uncertainty index (MU) and the financial uncertainty index (FU) of Jurado, Ludvigson, and Ng (2015), the economic policy uncertainty index (EPU) of Baker, Bloom, and Davis (2016), and the investor disagreement index (DSA) by Huang, Li, and Wang (2021). For market frictions, we collect the equal-weighted short interest ratio (EWSI) of Rapach, Ringgenberg, and Zhou (2016) and compute the value-weighted average of bid-ask spreads (BAS) and price delay measure of Hou and Moskowitz (2005) across S&P500 stocks.212121The data we use are obtained from following sources: the VIX is downloaded from the CBOE website; the UNC is downloaded from the website of Turan Bali; the TIV is downloaded from the website of Andrea Vedolin; the MU and FU are downloaded from the website of Sydney Ludvigson; the EPU is downloaded from the website policyuncertainty.com; the DSA is downloaded from the website of Dashan Huang; the EWSI is downloaded from the website of Guofu Zhou.

Because all of the proxies will have a common uncertainty or market friction component, following Baker and Wurgler (2006, 2007), we use PCA and simple averaging to iron out the idiosyncratics and extract a common component that is closer to the underlying factor. We estimate the following predictive regression, conditioning on the first principal component or equal-weighted average of market uncertainty or friction measures:

| (4) |

where is an indicator that equals one if the market uncertainty or friction measure is in the top 25% quantile and equals zero if the corresponding measure is in the bottom 25% quantile. The variable of interest is , which captures the difference between the predictive power in high and low market uncertainty or friction episodes.

The results are reported in Table 3. The coefficients reported in the “Diff” columns are all negative and significant across all specifications. For example, in high PCA-Uncertainty periods, a one standard deviation increase in JointNewsM is associated with a 1.21% decrease in the subsequent returns, which is 1.38% higher than that in low PCA-Uncertainty periods. Similarly, a one standard deviation increase in JointNewsM predicts a 1.48% decrease in the subsequent returns in high PCA-Friction periods, which is 1.18% higher than that in low PCA-Friction periods. Those results suggest that the negative market return predictability of JointNewsM is more likely to be driven by behavioral mechanisms.

4.2. Comparison with alternative predictors

In this subsection, we examine whether the forecasting power of the JointNewsM is driven by omitted variables related to business cycle fundamentals or changes in news tones or investor sentiment. Specifically, we run the following bivariate predictive regression:

| (5) |

where is JointNewsM or JointNews, and is one of the alternative predictors listed in subsection 3.2. Our main focus is on the coefficient .

Table 4 shows that the coefficients of JointNewsM are negative and remain statistically significant after controlling for the alternative market return predictors, with magnitudes that are similar to the coefficients reported in Table 2. For example, the coefficients of JointNewsM are 0.81 and 0.93, both significant at the 5% confidence level, after controlling for two powerful predictors documented in the literature, namely, aligned investor sentiment and dividend yield, respectively. The results for JointNews are similar. Together, these results suggest that JointNewsM contains important information in predicting future market returns that cannot be explained by the economic fundamentals and investor sentiment measures established in previous studies.

4.3. Out-of-sample forecasts

The in-sample analysis utilizes all the available data, thereby allowing for more-efficient parameter estimates and more-precise return forecasts. However, Goyal and Welch (2008), among others, argue that the out-of-sample tests are more relevant for assessing the genuine return predictability in real time and avoiding the overfitting issues. In addition, the out-of-sample analyses are much less affected by the finite sample bias, such as the Stambaugh bias (Busetti and Marcucci, 2013). Therefore, it is essential to show the out-of-sample predictive performance of JointNewsM.

For out-of-sample forecasts at time , we only use the information available up to to forecast stock returns at . Following Goyal and Welch (2008), Kelly and Pruitt (2013), and many others, we conduct the out-of-sample analysis by estimating the predictive regression (6), recursively, that is,

| (6) |

where is the recursively calculated JointNewsM, and and are the OLS estimates from regressing with model (2) recursively. For comparison, we also carry out the out-of-sample regressions for the alternative predictors used in the prior literature.

More specifically, to assess the out-of-sample performance, we apply the Campbell and Thompson (2008) statistic, which measures the proportional reduction in the mean squared forecast error (MSFE) for the predictive regression forecast, relative to the historical average benchmark. Goyal and Welch (2008) show that the historical average is a very stringent out-of-sample benchmark, and typically, individual economic variables fail to outperform the historical average. To compute , let be a fixed number chosen for the initial sample training; this will ensure that the future expected returns can be estimated at time . Subsequently, we compute the following out-of-sample forecasts: . Specifically, we use the first five years’ data from January 1996 through December 2002 as the initial estimation period, and the forecast evaluation period spans from January 2003 through December 2014.

| (7) |

where denotes the historical average benchmark corresponding to the constant expected return model (), that is,

| (8) |

By construction, the statistic lies in the range (]. If , then it would mean that the forecast outperforms the historical average in terms of MSFE.

To evaluate the statistical significance of the , we adopt the MSFE-adjusted statistic of Clark and West (2007) (CW-test) and the Diebold and Mariano (1995) statistic modified by McCracken (2007) (DM-test). The CW test tests the null hypothesis that the historical average MSFE is greater than the predictive regression forecast MSFE against the one-sided (right-tail) alternative hypothesis that the historical average MSFE is not greater than the predictive regression forecast MSFE, corresponding to against . Clark and West (2007) show that the test has a standard normal limiting distribution when comparing forecasts from the nested models. The DM test examines the null hypothesis that the MSFE of one forecast is equal to the other forecast. McCracken (2007) shows that the modified DM test statistic follows a nonstandard normal distribution when testing nested models and provides bootstrapped critical values for the nonstandard distribution. We expect the benchmark model’s MSFE to be smaller than the predictive regression model’s MSFE under the null hypothesis. The MSFE-adjusted statistic accounts for the negative expected difference between the historical average MSFE and the predictive regression MSFE under the null hypothesis to ensure that it can reject the null hypothesis even if the statistic is negative.

The corresponding results are summarized in Table 5, which shows two sets of interesting results. First, in Panel A, it shows that both JointNews measures generate positive and significant s and deliver lower MSFEs than that of the historical average. Specifically, JointNewsM delivers an of 6.52% and JointNews delivers an of 3.69%. The strong out-of-sample predictability of JointNewsM for market returns is consistent with our in-sample results in Table 2. Compared to JointNewsM, all the other predictors show much weaker out-of-sample predictability for excess market returns, as shown in Panels B and C. In general, most of the alternative predictors have negative s and their CW- and DM-test statistics are statistically insignificant.

Second, the last two columns of Table 5 show that the predictability of the JointNewsM is significantly strong and stable over both expansion and recession periods, which is consistent with our previous findings in in-sample regressions. In summary, both in-sample and out-of-sample results confirm that JointNewsM is a powerful and reliable predictor of the excess market returns, and it consistently outperforms the other traditional market return predictors.

4.4. Predictability over longer horizons

So far, we have established that aggregate joint news coverage predicts market returns over the horizon of one month. In this subsection, we turn our focus to longer horizons to investigate the extent to which the associated mispricing can be persistent.222222Because of the limits of arbitrage, mispricings from investor attention may not be eliminated by arbitrageurs over a short monthly horizon. There is some in-sample evidence on the predictability of investor attention for a longer horizon beyond one month in the literature. For example, using the Dow 52-week high as an investor attention proxy, Li and Yu (2012) show that the predictive power of investor attention can exist for a multi-month horizon.

We perform both in- and out-of-sample analysis as in previous sections based on the following predictive regression:

| (9) |

where is the average market excess return for the next months and takes a value of 3 or 6.

Panel A of Table 6 reports the in- and out-of-sample univariate regression results. It shows that JointNewsM can significantly predict the long-run excess market returns up to six months. Along with the results in Tables 4 and 5 for the one-month horizon, it is clear that the forecasting power first increases as the horizon increases, reaches its peak around the three-month horizon, and then declines, both in- and out-of-sample.

Panel B of Table 6 presents the bivariate predictive regression results that include JointNewsM and one of the alternative return predictors. It shows that the predictive power of JointNewsM for three-month horizon excess market return is significant and greater than most of the controlling return predictors, including AttnPLS. For the six-month horizon, JointNewsM is weaker but still significant at 5% or 10%. Economically, a one standard deviation increase in JointNewsM reduces the aggregate stock market returns over the next six months by 0.4% per month. The magnitude is comparable to Chen et al. (2020b), who find that a one standard deviation increase in AttnPLS predicts a 0.5% per month reduction in the corresponding market returns.

In summary, JointNewsM significantly predicts future aggregate stock returns, not only at monthly frequency but also at quarterly and semi-annual horizons, both in and out of sample. The result suggests that the clustered arrival of joint news can generate persistent mispricing that is not immediately arbitraged away.

4.5. Asset allocation analysis

Given the strong predictive power of JointNewsM, we next calibrate the economic value investors can obtain if they utilize this information in their asset allocation decisions. We compute the certainty equivalent return (CER) gain and the Sharpe ratio by considering a mean-variance investor who makes asset allocation decisions across equities and risk-free bills using the out-of-sample predictive regression forecasts (see, e.g., Kandel and Stambaugh, 1996; Campbell and Thompson, 2008; Ferreira and Santa-Clara, 2011).

At the end of each month , the investor optimally allocates

| (10) |

of the portfolio to stocks during next month, where is the degree of risk aversion, is the out-of-sample forecast of the excess market return, and is the forecast of its variance. The investor then allocates of the portfolio to risk-free bills, and the realized portfolio return is

| (11) |

where is the risk-free return. Following Campbell and Thompson (2008), we estimate using a five-year rolling window of past returns and restrict to lie between 0 and 1.5 to exclude short sales and to allow for, at most, 50% leverage.

The certainty equivalent return (CER) of the portfolio is

| (12) |

The CER gain is the difference between the CER for the investor who uses a predictive regression forecast of market return generated by Equation (6) and the CER for an investor who uses the historical average forecast. We multiply this difference by 12 so that it can be interpreted as the annual portfolio management fee that an investor would be willing to pay to have access to the predictive regression forecast instead of the historical average forecast. To examine the effect of risk aversion, we consider portfolios based on risk aversion coefficients of 1, 3, and 5. In addition, we also consider the case of 50 basis points transaction costs, which is generally considered as a relatively high number.

To analyze the economic value of return predictability at longer horizons, we follow Rapach, Ringgenberg, and Zhou (2016) and let the investor rebalance the portfolio at the same frequency as the forecast horizon. For example, when , the investor uses a quarterly predictive regression or historical average forecast of the excess return over the next three months () at the end of each quarter and applies Equation (10) to determine the stock weight for the next quarter. The investor follows analogous procedures for semi-annual () return forecasts and rebalancing.

To assess the statistical significance of the CER gain, we apply the testing procedure in DeMiguel, Garlappi, and Uppal (2009) to examine whether the CER gain is indistinguishable form zero. In addition, we also calculate the monthly Sharpe ratio of the portfolio, which is the mean portfolio return in excess of the risk-free rate divided by the standard deviation of the excess portfolio return. We then test whether the Sharpe ratio of the portfolio strategy based on predictive regression is statistically indifferent from that of the portfolio strategy based on historical average.

Table 7 shows that the annualized CER gains for JointNewsM across the risk aversions at the monthly horizon are consistently positive and economically large, ranging from 4.95% to 9.31%. More specifically, an investor with a risk aversion of 1, 3, or 5 would be willing to pay an annual portfolio management fee up to 9.31%, 7.71%, and 4.95%, respectively, to have access to the predictive regression forecast based on JointNewsM instead of using the historical average forecast. The net-of-transactions-costs CER gains of the JointNewsM portfolios range from 2.68% to 7.09% at the monthly horizon, and they are all economically significant. This large economic value also exists at the quarterly and semi-annual horizons.

In addition, the investment portfolio based on aggregate investor attention generates sizable Sharpe ratios. The annualized Sharpe ratios of portfolios formed based on JointNewsM at monthly horizon range from 0.80 to 1.05, which is nearly triple the market Sharpe ratio of 0.29 for a buy-and-hold strategy. The difference remains significant after deducting the 50 basis points transaction cost. In the long run, the net-of-transactions-costs Sharpe ratios range from 0.87 to 1.05 (0.53 to 0.96) at the quarterly (semi-annual) horizon. In addition, all the CER gains and Shape ratio gains of JointNewsM in all of the risk-aversion cases are statistically significant.

In summary, there are potentially large investment profits in the asset allocation based on investor attention spillover, suggesting substantial economic values for mean-variance investors. This analysis then emphasizes the important role of investor attention spillover on the aggregate stock market from an asset allocation perspective.

4.6. Omitted variables and instrumental variable analysis

Our result that JointNewsM negatively predicts future market returns is consistent with the hypothesis that joint news coverage predicts returns via an attention-spillover effect. One concern for this interpretation is that joint news coverage is endogenous, and therefore the relationship between joint news and future returns may be driven by omitted variables that influences joint news coverage.

One example of such omitted variables is economic linkages across firms, which may trigger joint news coverage.232323Although an important function of the news and media sector is to convey the state of the economy and firm fundamentals to investors, other factors such as consumer preferences, human biases, erroneous inference, and unsubstantiated speculation can also influence news coverage. Mullainathan and Shleifer (2005) theorize that media coverage can be influenced by supplier-side preferences and the news providers’ profit-maximizing choice to cater to the preferences of the consumers. Gentzkow and Shapiro (2006) further show that a model in which firms slant their reports toward the prior beliefs of their customers to build the firm’s reputation for quality results in equilibrium biases that make all market participants worse off. However, it is unclear how such linkages can drive the negative relation between joint news coverage and future market returns that we find. First, economic linkages in the absence of market frictions do not generate return predictability. Second, previous studies document return predictability of related firms in the cross-section, but the predictability is positive and researchers have attributed the findings to investor inattention-driven underreaction.242424See, for example, Moskowitz and Grinblatt (1999), Cohen and Frazzini (2008), Menzly and Ozbas (2010), Lee et al. (2019), and Rapach et al. (2019), and Ali and Hirshleifer (2020). Hence it would be difficult for fundamental linkages alone (or investors’ inattention to it) to explain the strong negative relation between joint news coverage and future aggregate market returns that we find. Instead, our finding seems to be more in line with the explanation that joint news coverage generates attention-driven overvaluation (Barber and Odean, 2008), a mechanism that is distinctly different from inattention.

To further address the above concern, we identify exogenous variations in joint news coverage and assess the extent to which the random, nonfundamental, fluctuations in joint news coverage contribute to the market return predictability. To this end, we consider episodes of sensational news that are unrelated to the financial market and use these episodes to generate exogenous shocks to joint news coverage. We then apply instrumental variable analysis to test the relation between joint news and future market returns.

Specifically, we compile a monthly news “distraction” series from the average of the daily news pressure index of Eisensee and Strömberg (2007), which is based on the median number of minutes that U.S. news broadcasts devote to the first three news segments. To obtain variations in the news pressure that are unrelated to the stock market, we exclude days with macro announcements (FOMC meetings, nonfarm payroll, and CPI) and exclude extreme market return days (the top and bottom 20% in annual distribution) as in Peress and Schmidt (2020). We then define a “distraction” indicator (I) as one for observations that belongs to the top 20% for that year. We obtain 19 distraction months for the sample period from January 1996 to December 2014.

Table 8, Panel A shows the average level of JointNewsM during the distraction months and nondistraction months. For the distraction months, JointNewsM has an average of 0.441, and it is significantly lower than the nondistraction months (0.041). The result shows that sensational news episodes substantially reduce joint coverage of firms, confirming our premises that the episodes distract media attention and lowers joint news coverage.

We then use sensational news as an instrument for JointNewsM. Table 8, Panel B presents the two-stage least squares results. In the first stage, we regress JointNewsM on I and find that the coefficient on I is significantly negative. The inclusion of I contributes to an -statistic of 7.87, suggesting that I is not a weak instrument.

In the second stage, we regress market returns on the instrumented JointNewsM. The result shows that the instrumented JointNewsM negatively predicts future market returns with a significant coefficient of 3.60. Economically, a one standard deviation increase in the predicted JointNewsM (13.7%) lowers the following month’s market return by 48 basis points, a magnitude that is economically meaningful and is 54% of that of JointNewsM in Table 2.

Our results suggest that random exogenous fluctuations in joint news coverage drives a substantial portion of the predictive power of JointNewsM. We therefore conclude that the effect of joint news coverage on market returns is causal and the effect is incremental to what fundamental linkages alone could explain.

4.7. Additional robustness checks

In this subsection, we conduct additional robustness checks and consider the two latest sets of news-based measures that have been proposed to predict or explain market returns in the literature.

Calomiris and Mamaysky (2019) develop a methodology to classify the context and content of news articles into five topics (i.e., markets, governments, commodities, corporate governance and structure, and the extension of credit). The paper then proposes the following word flow measures: entropy, number of articles per month (ArtCount), and the sentiment and frequency for each topic (s[Topic] and f[Topic], respectively).252525We obtain the word flow measures from the website of Harry Mamaysky. Bybee et al. (2021) analyze the full text of Wall Street Journal articles and estimate a topic model to summarize news into 180 topic themes. The paper then quantifies news attention allocated to each theme and identifies the following five news attention estimates as the most important: recession, problems, record high, option/VIX, convertible/preferred.262626The topic attention measures are downloaded from the website http://www.structureofnews.com.

We first examine the extent to which JointNewsM is correlated with these alternative predictors. The correlation coefficient matrix, presented in Table A2, shows that the correlation is small and ranges between 0.34 and 0.17. This suggests that JointNewsM, constructed from aggregating firm-level news coverage, captures information that is distinctly different from the information embedded in the other measures.

We then estimate Equation (5) and formally analyze the robustness of the predictability of JointNewsM with being the two sets of alternative measures. The results are presented in Table 9, with Panels A and B controlling for the lagged Calomiris and Mamaysky (2019) word flow predictors and the contemporaneous Bybee et al. (2021) topic attention measures, respectively.272727We follow Bybee et al. (2021), who use contemporaneous topic attention measures to explain economic conditions and asset prices. Hence the coefficient on JointNewsM captures predictability above and beyond the market return fluctuations that can be explained by the contemporaneous topic attention measures.

The result shows that, consistent with Calomiris and Mamaysky (2019) and Bybee et al. (2021), the word flow measures and the topic attention measures have significant power in forecasting and explaining the market returns. More importantly, JointNewsM remains highly significant. For example, in Panel A, JointNewsM has a coefficient of 0.962 (-statistic 3.52), which is as large as the coefficient in Table 2. The in-sample adjusted increases by 3.57% after including JointNewsM, which is also comparable to the in-sample in Table 2. Similarly, in Panel B, JointNewsM has a significantly negative coefficient of 0.588 (-statistic 2.32) and is associated with a meaningful incremental of 1.42% even after controlling for the powerful topic-specific attention measures. These findings indicate that JointNewsM, constructed by aggregating firm level joint news coverage, contains relevant information about future market returns that is distinctively different from the latest news-based measures.

5 Cross-Sectional Evidence

The above results provide evidence for the strong and robust market return predictability of JointNewsM over time. In this section, we provide direct evidence supporting that joint news coverage of firms triggers cross-firm investor attention spillover and impacts future stock returns. Specifically, we examine the relation between joint news coverage on Google search activities, the EDGAR search activities by unique IP addresses, as well as cross-sectional returns at the firm level. The summary statistics for the firm-level variables are reported in Table A3.

5.1. Joint news and retail investor attention

Following Da, Engelberg, and Gao (2011), we measure a stock’s abnormal retail attention as the abnormal search volume (ASV) of the stock, which is the percentage change between Google’s daily Search Volume Index (SVI) for a stock and its past one-year mean, skipping the most recent month.282828The SVI is a relative search popularity score, defined on a scale of 0 to 100, based on the number of searches for a term relative to the total number of searches for a specific geographic area and a given period. We focus on searches made on weekdays in the U.S. market. We manually screen all tickers to select those that do not have a generic meaning (e.g., “GPS” for GAP Inc., “M” for Macy’s) to ensure that the search results we obtain are truly for the stock and not for other generic items or firm products.

We analyze the relationship between ASV and the joint news and self news measures using the following Fama-MacBeth regression:

| (13) |

where I is the joint news indicator that equals one if the JointNews of a firm is above the cross-sectional top tertile, and zero otherwise, and is a set of control variables that may affect retail investor attention. Following Da, Engelberg, and Gao (2011), we control for log firm size, abnormal turnover, absolute characteristic-adjusted returns (Daniel et al., 1997), log number of analyst coverage, and advertisement expenses/sales ratio.

The results, reported in Table 10, columns 1 and 2, show that an increase in the joint news coverage of a firm is associated with a highly significant increase in abnormal Google search activities for the firm. A coefficient of 0.959 for JointNews in column 2 means that a one standard deviation increase in joint news is associated with a 0.96% increase in abnormal search volumes.292929The coefficients of the control variables are consistent with those in Da, Engelberg, and Gao (2011). In addition, the coefficient on the interaction term, SelfNews, is positive and significant, suggesting that the joint news coverage substantially strengthens the attentional effects of self news. Specifically, the impact of SelfNews on abnormal search volume is nearly doubled (from 0.81% to 1.56%) for firms in the top tertile of joint news coverage compared to those in the bottom tertiles.

The results are consistent with our hypothesis that joint news triggers a spillover of investor attention from connected firms to the focal firm. The result further suggests that joint news is more powerful in attracting investor attention than self news—joint news both strongly attracts investor attention directly and substantially increases investor attention to self news.

5.2. Joint news and EDGAR downloads by unique IP addresses

In this subsection, we use granular, individual-investor level data to provide direct evidence that joint news coverage is associated with a spillover of investor attention across firms. To this end, we explore downloads of 10-K and 10-Q filings in the EDGAR website by unique IPs. Motivated by studies that show EDGAR downloads are associated with information acquisition activities by investors (see, for example, Lee, Ma, and Wang, 2015; Chen et al., 2020a), we utilize the data to analyze the effect of joint news on investor attention.303030The set of investors as captured by EDGAR IP activities is likely an important component of a firm’s potential investors, although we acknowledge that the EDGAR-based set is only a subset of a firm’s investor base. Hence, the results that we document likely capture a lower bound of the effect of joint news on investor attention.

Since 1996, the Securities and Exchange Commission (SEC) has required that all public domestic companies to submit their filings electronically via the EDGAR website. From the website, we obtain a sample that consists of over 230 million document requests by 5.97 million unique IPs for the period of 2003 through 2014.313131Users are partially anonymized as the EDGAR log files show the first three octets of the IP address and replace the fourth with a unique string. Following previous studies (e.g., Lee, Ma, and Wang, 2015; Drake et al., 2020; Ryans, 2017; Li and Sun, 2021), we remove the records of users that download more than 50 unique firms’ filings per day from the sample and keep only the successful request records (code = 200) and exclude records that refer to an index (idx = 1) since the index pages provide links to the firm’s filings instead of the filings themselves. We obtain the IP address of the EDGAR user, the filing firm, and the time-stamp for each request.

For each month, we proxy for a firm’s investor base with the set of IPs that downloaded a firm’s EDAGR filings in the past 18 months.323232The choice of 18-month window to define the existing investor base follows from the literature convention of allowing sufficient window after the end of the fiscal year (up to 18 months) for the information in annual reports to become publicly available (e.g., Fama and French, 1993; Hou, Xue, and Zhang, 2015).

We then consider how joint news coverage of a firm-pair expands the firms’ investor bases by identifying the number of unique new IPs that accessed information about one firm that also overlaps with the existing investor base of the other firm. The increases of such new IP activities thus proxies for the extent to which joint news triggers a spillover of investor attention across the covered firms.

We analyze the cross-sectional relation between joint news coverage and IP activities using the following Fama and MacBeth (1973) regression:

| (14) |

where I is the joint news indicator that equals one if the JointNews of a firm is above the cross-sectional top tertile, and zero otherwise. is a set of control variables that may affect retail investor attention (Da, Engelberg, and Gao, 2011) as in previous analysis. All independent variables are standardized to have a zero mean and unit variance for easy comparison of economic magnitudes.

Columns 3 and 4 of Table 10 present the regression results and show that JointNews substantially outperforms SelfNews in attracting downloading activities by new investors. Economically, a coefficient of 0.049 of JointNews in column 4 means that a one standard deviation increase in JointNews attract 4.9% more new IPs that download a firm’s EDGAR filings, all else equal. In contrast, SelfNews has a much weaker impact on attracting new investors to the focal firm, as evidenced by a smaller coefficient of 0.015. Consistent with the result for ASV in columns 1 and 2, joint news coverage strengthens the attentional effects of self news. Column 4 shows that the coefficient on the interaction term, , is highly significant, at 0.039. This suggests that joint news coverage not only directly attracts new IPs, but it also substantially boosts investor attention to self news.

To further understand the source of new IPs, we classify news IPs attracted to a focal firm into the following two categories: those that overlaps with the investor bases of connected stocks via joint coverage, New IPc, and those that do not, New IPo. New IPc therefore directly captures the spillover of investor attention from connected stocks to the focal stock due to joint news coverage.333333The average log(New IP) and log(Exist IP) per month is 5.587 and 5.456, which correspond to unlogged values of 267 and 234 per month, respectively. The numbers are comparable to Drake et al. (2016), who report that the average daily number of EDGAR requests per firm is 20.

Table 10, column 5 presents the result for New IPc. The coefficient on JointNews is 0.203 and highly significant. Economically, a one standard deviation increase in JointNews results in a substantial 20.3% increase in the EDGAR requests by new IPs from the investor bases of connected firms. JointNews also significantly boosts the new IP responses to self news coverage, as shown in the coefficient of 0.066 for the interaction term of and SelfNews. The evidence provides direct support to our hypothesis that joint news coverage triggers an attention spillover to a focal firm from the other covered firms.

In addition, we present results in columns 6 that focus on New IPo, the component of new IPs from investor bases of firms not covered by joint news. The result shows that JointNews is still marginally significant even for this set of new IPs, and that joint news significantly boosts the effect of self news in attracting new IPs, as shown by the statistically significant coefficient of . In contrast, SelfNews is insignificant. Finally, we turn to the number of EDGAR requests from the existing investors of a firm, Exist IP. Column 7 shows that JointNews consistently outperforms SelfNews in attracting EDGAR downloading activities and significantly strengthens the effects of self news. The results therefore suggest that the potential effects of joint news coverage in increasing investor attention is even broader, which includes but is not restricted to the attention spillover channel shown in column 5.

Taken together, the above findings provide strong supporting evidence for our hypothesis that joint news coverage is associated with a substantial attention spillover across covered firms and a significant increase in overall investor attention to the covered firms. In contrast, although self news can also attract attention from investors, the magnitude tends to be much smaller and relies heavily on joint news to reinforce its attentional effects.

5.3. Cross-sectional return predictability

Finally, we examine the effect of joint news on stock returns. We have shown that joint news coverage of a firm is associated with greater investor attention from a broader investor base. As shown in Da, Engelberg, and Gao (2011), heavy attention-driven buying by retail investors induces high valuations, followed by lower future returns. Therefore, in this subsection, we conduct cross-sectional analysis and investigate whether joint news can predict the subsequent returns of the firm’s stocks.

We regress the future stock returns on the firm-level joint news coverage (JointNews) using the predictive Fama-MacBeth regression as follows:

| (15) |

where I is the joint news indicator that equals one if the JointNews of a firm is above the cross-sectional top tertile, and zero otherwise. is a set of control variables that includes the log book-to-market ratio, momentum (MOM, average returns from to ), short-term reversal (return in ), idiosyncratic volatility (IVOL), and controls as in Da, Engelberg, and Gao (2011), including log firm size, abnormal turnover, absolute characteristic-adjusted return as in Daniel et al. (1997), advertisement expenses, and log analyst coverage.

Table 11 shows that the firms with more joint news tend to have lower future returns. For example, a coefficient of 13.031 in column 4 implies that a one standard deviation increase in a firm’s abnormal joint news coverage significantly lowers the firm’s next-month return, by 13 basis points. This finding corroborates the results of ASV of Google search and EDGAR IPs and provides further support to our hypothesis.343434Although SelfNews is significantly associated with ASV and EDGAR IP activities in Table 10, the variable does not predict stock returns. One reason could be that returns are noisier and, with the noisier dependent variable, only the strongest predictor, like JointNews, can survive whereas the weaker ones do not.

To summarize, our cross-sectional analysis suggests that increases in joint news coverage is strongly associated with cross-firm attention spillover, more retail attention, and lower future returns of covered stocks. These firm-level and investor-level patterns provide useful micro-foundations to our time-series findings for aggregate stock market returns. These results are new and highlight the important role of joint news in generating systematic impacts on asset prices.

6 Conclusions

We propose a novel measure of aggregate joint news coverage of firms, JointNewsM, and find that it strongly predicts lower future market returns. A one standard deviation increase in JointNewsM is associated with a substantially lower market return, by 89 basis points for the next month. The results are robust after controlling for an extensive list of alternative return predictors, both in sample and out of sample, across expansion and recession periods, and lasts for more than six months. Moreover, the strong predictability corresponds to economically sizable values for mean-variance investors in asset allocation.

We provide identification using an instrumental variable approach based on exogenous distracting news shocks and show that the relation between JointNewsM and market returns is causal. Further, the predictability is stronger during periods of higher market uncertainty and greater market frictions, consistent with the predictability attributable to news-driven market overvaluations.

To dive deeper into the micro-foundations of our findings, we conduct cross-sectional analyses and examine the relation between joint news coverage, investor attention, and stock returns at the firm level. We show the joint news coverage is related to greater retail attention as measured by Google search activities. Further, taking advantage of the EDGAR search activities by unique IP addresses, we provide direct, individual investor-level evidence that the arrival of joint news is associated with substantial attention spillover. In addition, we show that joint news coverage significantly and negatively predicts future cross-sectional returns. In contrast, self news coverage has a much weaker relation with investor attention and stock returns at the firm level and does not predict future market returns when aggregated.

The news and media sector is an important information intermediary that conveys the state of the economy and firm fundamentals to investors. At the same time, the sector can also be associated with distortions and subject to factors such as the confluence of consumer preferences, human biases, erroneous inferences, and unsubstantiated speculation (Mullainathan and Shleifer, 2005; Gentzkow and Shapiro, 2006). Our paper joins the emerging literature that provides insight into the ways in which the sector may influence investor behavior and market returns. Clearly, the channel that we document is one among many and more future work is called for.

References

- Ali and Hirshleifer (2020) Ali, U., Hirshleifer, D., 2020. Shared analyst coverage: unifying momentum spillover effects. Journal of Financial Economics 136, 649–675.

- Ang and Bekaert (2006) Ang, A., Bekaert, G., 2006. Stock return predictability: is it there? Review of Financial Studies 20, 651–707.

- Atilgan et al. (2020) Atilgan, Y., Bali, T. G., Demirtas, K. O., Gunaydin, A. D., 2020. Left-tail momentum: underreaction to bad news, costly arbitrage and equity returns. Journal of Financial Economics 135, 725–753.

- Baker and Wurgler (2006) Baker, M., Wurgler, J., 2006. Investor sentiment and the cross-section of stock returns. Journal of Finance 61, 1645–1680.

- Baker and Wurgler (2007) Baker, M., Wurgler, J., 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21, 129–152.

- Baker, Bloom, and Davis (2016) Baker, S. R., Bloom, N., Davis, S. J., 2016. Measuring economic policy uncertainty. Quarterly Journal of Economics 131, 1593–1636.

- Bali, Brown, and Caglayan (2014) Bali, T. G., Brown, S. J., Caglayan, M. O., 2014. Macroeconomic risk and hedge fund returns. Journal of Financial Economics 114, 1–19.

- Bali et al. (2019) Bali, T. G., Hirshleifer, D. A., Peng, L., Tang, Y., 2019. Attention, social interaction, and investor attraction to lottery stocks. Baruch College Zicklin School of Business Research Paper No. 2019-03-01, Georgetown McDonough School of Business Research Paper No. 3343769 .

- Banerjee et al. (2013) Banerjee, A., Chandrasekhar, A. G., Duflo, E., Jackson, M. O., 2013. The diffusion of microfinance. Science 341, 1236498.

- Banerjee et al. (2019) Banerjee, A., Chandrasekhar, A. G., Duflo, E., Jackson, M. O., 2019. Using gossips to spread information: theory and evidence from two randomized controlled trials. The Review of Economic Studies 86, 2453–2490.

- Barber et al. (2021) Barber, B. M., Huang, X., Odean, T., Schwarz, C., 2021. Attention induced trading and returns: evidence from robinhood users. Journal of Finance, forthcoming.

- Barber and Odean (2008) Barber, B. M., Odean, T., 2008. All that glitters: the effect of attention and news on the buying behavior of individual and institutional investors. Review of Financial Studies 21, 785–818.

- Ben-Rephael et al. (2021) Ben-Rephael, A., Carlin, B. I., Da, Z., Israelsen, R. D., 2021. Information consumption and asset pricing. Journal of Finance 76, 357–394.