Iterative bidding in electricity markets:

rationality and

robustness

Abstract

This paper studies an electricity market consisting of an independent system operator (ISO) and a group of generators. The goal is to solve the DC optimal power flow (DC-OPF) problem: have the generators collectively meet the power demand while minimizing the aggregate generation cost and respecting line flow limits in the network. The ISO by itself cannot solve the DC-OPF problem as generators are strategic and do not share their cost functions. Instead, each generator submits to the ISO a bid, consisting of the price per unit of electricity at which it is willing to provide power. Based on the bids, the ISO decides how much production to allocate to each generator to minimize the total payment while meeting the load and satisfying the line limits. We provide a provably correct, decentralized iterative scheme, termed Bid Adjustment Algorithm, for the resulting Bertrand competition game. Regarding convergence, we show that the algorithm takes the generators’ bids to any desired neighborhood of the efficient Nash equilibrium at a linear convergence rate. As a consequence, the optimal production of the generators converges to the optimizer of the DC-OPF problem. Regarding robustness, we show that the algorithm is robust to affine perturbations in the bid adjustment scheme and that there is no incentive for any individual generator to deviate from the algorithm by using an alternative bid update scheme. We also establish the algorithm robustness to collusion, i.e., we show that, as long as each bus with generation has a generator following the strategy, there is no incentive for any group of generators to share information with the intent of tricking the system to obtain a higher payoff. Simulations illustrate our results.

I Introduction

As part of the plan to integrate distributed energy resources (DERs) into the electricity grid, regulating authorities envision a hierarchical architecture where, at the lower layer, different sets of DERs coordinate their response under an aggregator and, at the upper layer, the independent system operator (ISO) interacts with the aggregators to solve the optimal power flow (OPF) problem. In this scenario, aggregators function as (virtual, large-capacity) generators, and the aggregation would allow DERs to participate into markets in which, individually, they do not have the capacity to do so. While the DERs under one aggregator can cooperate among themselves, the aggregators compete with each other in the electricity market. In this paper, we focus on the competition aspect of this vision: we study policies that individual generators, in conjunction with the ISO, can implement to solve the OPF problem while acting in a selfish and rational fashion.

Literature review

The study of competition in electricity markets is a classical topic [3, 4]. Extensively studied models are supply function, Bertrand (price) and Cournot (capacity) bidding, see [5, 6, 7], respectively, and references therein. These studies analyze the properties of the game that different bidding models result into by determining the existence of the Nash equilibrium of the game and estimating its efficiency. Some works [8, 9, 10, 11], on the other hand, propose iterative algorithms for the players that compute the Nash equilibrium of the game. However, these algorithms either require generators to have some information about other generators (cost functions or bids) or assume that the demand of each generator is a continuous function of the bids. Our work does not make any such assumptions, which also rules out the possibility of using various other Nash equilibrium learning algorithms, such as best-response [12], fictitious play [13], and extremum seeking [14, 15]. In a related set of works [16, 17], decentralized generation planning is achieved by assuming the generators to be price-takers and designing iterative schemes based on dual-decomposition [18]. In our work, however, we consider a strategic scenario where generators bid into the market and are hence price-setters. The work [19] proposes an iterative auction algorithm for a market where both generators and consumers are strategic but does not provide convergence guarantees for the generated bid sequences. The paper [20], closer in spirit to our work, proposes an iterative method for the generators to find the Nash equilibrium assuming they do not have any information about each other. At each iteration, the generators send to the ISO the gradient of their cost functions at a certain generation value and the ISO then adjusts these generation values so that social welfare is maximized. An important difference between this setup and ours is that we do not assume truthful bidding of gradient information by the generators.

Our electricity market game belongs to the broader class of multi-leader-single-follower games [21, 22]. The Nash equilibria of such games can be thought of as optimizers of mathematical programs with equilibrium constraints (MPEC) [23], that are traditionally solved in a centralized manner [24]. The work [25] provides a distributed method to find the equilibria of an MPEC problem but requires the follower’s (the ISO in our case) optimization to have a unique solution for each action of the leaders (the generators). This is in general not the case for electricity markets. Our work broadly relates to the recent developments in the area of “learning in games”, see e.g., [26, 27], and references therein. Learning mechanisms proposed in there do not apply directly to the electricity market setting as they do not consider network constraints for allocation of goods. Finally, our work has close connections with the growing interest in the design of provably correct distributed algorithms for the cooperative solution of economic dispatch, see [28, 29], and references therein.

Statement of contributions

The background for the inelastic electricity market game considered here is that the ISO seeks to find the production levels that solve the DC optimal power flow (DC-OPF) problem for a group of strategic generators which do not share their cost functions. Consequently, the ISO cannot solve the DC-OPF problem by itself. However, each generator submits a bid to the ISO specifying the price per unit of electricity at which the generator is willing to provide power. Given these bids, the ISO decides how much production to allocate to each generator so that the cost of generation is minimized, the loads are met, and the network flow constraints are satisfied. The resulting Bertrand competition model defines the game among the generators, where the actions are the bids and the payoffs are the profits. We define the concept of the efficient Nash equilibrium, that is, the Nash equilibrium at which the generators are willing to produce the amount that corresponds to the optimizer of the DC-OPF problem. Our first contribution gives two set of conditions that ensure existence and uniqueness, respectively, of an efficient Nash equilibrium for the inelastic electricity market game. Our second contribution is the design of the Bid Adjustment Algorithm along with its correctness analysis. This algorithm can be understood as “learning via repeated play”, where generators are “myopically selfish”, changing their bid at each iteration with the aim of maximizing their own payoff. Along the execution, the only information available to the generators is their bid and the amount of generation that the ISO request from them. In particular, generators are not aware of the number of other generators, their costs, bids, or payoffs. We show that this decentralized iterative scheme is guaranteed to take the bids of the generators to any neighborhood of the unique efficient Nash equilibrium provided the stepsizes are chosen appropriately. Further, we establish that the convergence rate is linear. Our third contribution analyzes the robustness properties of the Bid Adjustment Algorithm. Specifically, we establish that the convergence is not affected by affine disturbances, thus showing that deviations in stepsizes by the generators can be handled gracefully. Additionally, we show that there is no incentive for any individual generator to deviate from the algorithm by using an alternative bid update scheme. Finally, we also show that, if at each generator bus there is at least one generator running the Bid Adjustment Algorithm, then there is no incentive for other generators connected to the network to not follow the algorithm, i.e., this adjustment scheme becomes a rational choice for all generators. These properties provide a sound justification for why the group generators would adopt this iterative bid adjustment scheme to solve the DC-OPF problem. Simulations illustrate our results.

Notation

Let , , , be the set of real, nonnegative real, nonnegative integer, and positive integer numbers, respectively. We use the shorthand notation to denote the set . The -norm on n is represented by . Let be the open ball centered at with radius . Given , is the -th component of , and denotes for . We use . We let for . A directed graph, or simply digraph, is represented by a pair , where is the vertex set and is the edge set. For a digraph, and are the sets of out- and in-neighbors of , respectively.

II Problem statement

Consider an electrical power network with buses. The physical interconnection between the buses is given by a digraph , where nodes correspond to buses and edges to physical power lines. The direction for each edge represents the convention of positive power flow. The power flow on the line is . Each line has a limit on the power flowing through it (in either direction), represented by . Assume that each bus is connected to strategic generators. We let be the total number of generators and assign them a unique identity in . Let the set of generators at node be (this set is empty if there are no generators connected to bus ). The power demand at bus is denoted by and is assumed to be fixed and known to the Independent System Operator (ISO) that acts as the central regulating authority. The total demand is . The cost of generating amount of power by the -th generator is given by a quadratic function

| (1) |

where and . Given a power allocation , the aggregate cost is . The dc optimal power flow problem (DC-OPF) consists of

| (2a) | ||||

| subject to | (2b) | |||

| (2c) | ||||

| (2d) | ||||

This problem finds the generation profile that meets the load at each bus (ensured by (2b)), respects the line constraints (due to (2c)), and minimizes the total cost (given by the objective function (2a)). In (2b) we make the convention that if , then the first term on the right-hand side is zero. We assume that (2) is feasible. Since the individual costs are quadratic, the optimizer of the problem, denoted , is unique [30].

The goal for the ISO is to solve (2). The ISO can interact with the generators, whereas each generator can only communicate with the ISO and is not aware of the number of other generators participating in the market and their respective cost functions, or the load at its own bus. While the ISO knows the loads and the limits on the power lines, it does not have any information about the cost functions of the generators. Therefore, power allocation is decided following a bidding process, resulting into a game-theoretic formulation. Instead of sharing their cost with the ISO, the generators bid the price per unit of power that they are willing to provide the power at. This price-based bidding is well known in the economics literature as Bertrand competition [31, Chapter 12]. Specifically, generator bids the cost per unit power and, when convenient, we denote the bids of all other generators except by . Given the bids , the ISO solves the following strategic dc optimal power flow problem (S-DC-OPF)

| (3a) | ||||

| subject to | (3b) | |||

| (3c) | ||||

| (3d) | ||||

The difference between (3) and (2) is the objective function which is linear in the former and nonlinear, convex in the latter. The ISO solves (3) once all the bids are gathered. Let be the optimizer of (3) that the ISO selects (note that there might not be a unique optimizer) given bids . This determines the power requested from each generator, given by the vector . Knowing this process, the objective of each generator is to bid a quantity that maximizes its payoff ,

| (4) |

where is the -th component of the optimizer .

Definition II.1.

(Inelastic electricity market game): The inelastic electricity market game is defined by the following

-

(i)

Players: the set of generators ,

-

(ii)

Action: for each player , the bid ,

-

(iii)

Payoff: for each player , the payoff in (4).

Wherever convenient, for any , we use interchangeably the notation and , as well as, and . Note that the payoff of the players is not only defined by the bids of other players but also by the optimizer of (3) that the ISO selects. For this reason, the definition of the pure Nash equilibrium for the game described below is slightly different from the standard one, see e.g. [32].

Definition II.2.

We are specifically interested in bid profiles for which the optimizer of the DC-OPF problem is also a solution to the S-DC-OPF problem. This is captured in the following definition.

Definition II.3.

The right-hand side of (6) is unique as costs are quadratic.

Definition II.4.

(Efficient Nash equilibrium): A bid is an efficient Nash equilibrium of the inelastic electricity market game if it is an efficient bid and is a Nash equilibrium.

At the efficient Nash equilibrium, the production that the generators are willing to provide, maximizing their profit, coincides with the optimal generation for the DC-OPF problem (2). This property justifies the study of efficient Nash equilibria. Note that given the efficient bid profile, there might be many solutions to (3) because the problem is linear. Thus, the ISO might not be able to find given the efficient bid. However, once the ISO knows that an efficient Nash equilibrium bid is submitted, it can ask the generators to also submit the desirable generation levels at that bid, which would exactly correspond to the solution of the DC-OPF problem.

III Existence and uniqueness of efficient Nash equilibrium

Here, we establish the existence of an efficient Nash equilibrium of the inelastic electricity market game described in Section II and provide a condition for its uniqueness.

Proposition III.1.

(Existence of efficient Nash equilibrium): Assume that at each bus of the network either there is more than one generator or there is none, i.e., either or for each . Then, there exists an efficient Nash equilibrium of the inelastic electricity market game.

Proof:

For convenience, we write (2b) and (2c) as

respectively. Here, defines the interconnection of buses in the digraph , specifically, -th element of is if , is if , and otherwise. The matrix defines the connectivity of generators to buses, that is, -th element of is if and only if -th generator is connected to -th bus. Lastly,

The Lagrangian of the optimization (2) is

where , , and are Lagrange multipliers corresponding to constraints (2b), (2c), and (2d), respectively. Since constraints (2b)-(2c) are affine and the feasibility set is nonempty, the refined Slater condition is satisfied for (2) and hence, the duality gap between the primal and the dual optimization problems is zero [30]. Under this condition, a primal-dual optimizer satisfies the following Karush-Kuhn-Tucker (KKT) conditions

| (7a) | |||

| (7b) | |||

| (7c) | |||

| (7d) | |||

| (7e) | |||

| (7f) | |||

where . In the rest of the proof, we show that the following bid profile, constructed from a primal-dual optimizer, is an efficient Nash equilibrium of the inelastic electricity market game

| (8) |

where denotes the bus of the network to which generator is connected to. Given the form (1) of the cost functions, we deduce . Moreover, from the definition of , one can deduce that either all generators have or all of them have . Next, to show that the bid defined in (8) is efficient, we first establish

| (9) |

for all . For each , consider the optimization . Because zero duality holds for this optimization, a point is an optimizer if and only if it satisfies the KKT conditions

where is the dual optimizer. Since satisfies the above conditions with , the expression (9) holds. To claim the efficiency of , we next show that is one of the optimizers of (3) given bids . Note that the KKT conditions for (3) are given by (7) with the term in (7a) replaced with . Also, one can show using the KKT conditions (7) and the definition of that . Using these facts, we deduce that satisfies the KKT conditions for (3) and hence, is an optimizer of (3).

Our final step is to show the Nash equilibrium condition (5) for the bid profile . Note that for each , the payoff at the bid profile-optimizer pair ( is nonnegative. Specifically, if , then . If , using the fact that for all , we get

Now pick any generator . For bid we have two cases, first, and second, . For the first case, either (i) which implies that and so ; or (ii) , so all bids at bus are equal, implying that increasing its bid yields . That is, . For the second case,

where in the first inequality we use and in the second we use (9). This shows (5), concluding the proof. ∎

Note that the condition in Proposition III.1 of having zero or at least two generators at each bus is reasonable. If this is not the case, i.e., there is a bus with a single generator, and the line capacities are such that the load at that bus can only be met by that generator, then there is possibility of market manipulation. The generator at the bus can set its bid arbitrarily high as no other generator can meet that load and consequently, there does not exist a Nash equilibrium. Next we provide a sufficient condition that ensures uniqueness of the efficient bid.

Lemma III.2.

(Uniqueness of the efficient bid): Assume that the optimizer of (2) satisfies for all . Then, there exists a unique efficient bid of the inelastic electricity market game given by

| (10) |

Proof:

By definition, an efficient bid satisfies

for all . Since , first-order optimality condition of the above optimization yields . This establishes (10) and hence, the uniqueness. ∎

Corollary III.3.

(Uniqueness of the efficient Nash equilibrium): Assume that at each bus of the network either there is more than one generator or there is none. Further assume that the optimizer of (2) satisfies for all . Then, there exists a unique efficient Nash equilibrium of the inelastic electricity market game given by (10) for all .

In the rest of the paper, we assume that the sufficient conditions in Corollary III.3 hold unless otherwise stated. Note that the definition of the unique efficient Nash equilibrium given in (10) is consistent with the one provided in (8). This is so because if for all , then for each bus and every generator .

IV The Bid Adjustment Algorithm and its convergence properties

In this section, we introduce a decentralized Nash equilibrium seeking algorithm, termed Bid Adjustment Algorithm. We show that its executions lead the generators to the unique efficient Nash equilibrium, and consequently, to the optimizer of the DC-OPF problem (2).

IV-A Bid Adjustment Algorithm

We start with an informal description of the Bid Adjustment Algorithm. The algorithm is iterative and can be interpreted as “learning via repeated play” of the inelastic electricity market game by the generators. Both ISO and generators have bounded rationality, with each generator trying to maximize its own profit and the ISO trying to maximize the welfare of the entities.

[Informal description]: At each iteration , generators decide on a bid and send it to the ISO. Once the ISO has obtained the bids, it computes an optimizer of the S-DC-OPF problem (3), denoted for convenience, and sends the corresponding production level at the optimizer to each generator. At the -th iteration, generators adjust their bid based on their previous bid, the amount of produced power that maximizes their payoff for the previous bid, and the allocation of generation assigned by the ISO. The iterative process starts with the generators arbitrarily selecting initial bids that yield a positive profit.

The Bid Adjustment Algorithm is formally presented in Algorithm 1.

In the Bid Adjustment Algorithm, the role of the ISO is to compute an optimizer of the S-DC-OPF problem after the bids are submitted. Generators adjust their bids at each iteration in a “myopically selfish” and rational fashion, with the sole aim of maximizing their payoff. Intuitively, {LaTeXdescription}

two things can happen: (i) was willing to produce a positive quantity at bid but the demand from the ISO is . Thus, the rational choice for is to decrease the bid in the next iteration and increase its chances of getting a positive payoff; (ii) was willing to produce nothing at and got . At this point, reducing the bid will not increase the payoff as it will not be willing to produce more at a lower bid. Alternatively, increasing the bid will not make the amount that the ISO wants the generator to produce positive. Hence, the bid stays put.

then it would want to move the bid in the direction that makes its payoff higher in the next iteration, assuming that gets a positive generation signal from the ISO in the next round. If , then the demand from the ISO is more than what the generator is willing to produce, so increases its cost, i.e., the bid. If , then the demand is less than what the generator is willing to supply so decreases its bid.

Remark IV.1.

(Information structure and other learning approaches): Generators have no knowledge of the number of other players, their actions, or their payoffs. The only information they have at each iteration is their own bid and the generation that the ISO requests from them. This information structure rules out the applicability of a number of Nash equilibrium learning methods, including best-response dynamics [12], fictitious play [13], or other gradient-based adjustments [10], all requiring some kind of information about other players. Methods that relax this requirement, such as extremum seeking used in [14, 15], rely on the payoff functions being continuous in the actions of the players, which is not the case for the inelastic electricity market game.

Remark IV.2.

(Stopping criteria and justification of “myopically selfish” strategies): Algorithm 1 consists of an infinite number of iterations. To make it implementable, later we identify stopping criteria, see Remark IV.9, based on a parameter that the ISO selects. Since this is not known to the generators, they cannot predict when the algorithm will terminate and, hence, they do not have an incentive to play strategically to maximize their payoff in the long term. Given this, they should focus on maximizing the payoff in the next iteration, which justifies the myopically selfish perspective adopted here.

IV-B Convergence analysis

In this section, we show that the generator bids along any execution of the Bid Adjustment Algorithm converge to a neighborhood of the unique efficient Nash equilibrium. The size of the neighborhood is a decreasing function of the stepsize and can be made arbitrarily small.

We first present a series of results that highlight certain geometric properties of the bid update done in Step 1 of Algorithm 1. These results form the basis for establishing later the convergence guarantee. The following result states that one could neglect the projection operator in Step 1 of Algorithm 1.

Lemma IV.3.

(Generator bids are lower bounded): In Algorithm 1, let for all and . Then, and for all and ,

| (11) |

Proof:

Equation (11) follows directly from , so we focus on proving the latter. We proceed by induction. Note that for all . Assume that for some and let us show . We have

where is due to the fact that , follows from the definition of given the fact that , and follows from the assumption that for all (which makes both terms in the expression positive). By contradiction, assume . Then,

which implies that , a contradiction.∎

Our next result gives a different expression for the bid update step (cf. Step 1) presenting a geometric perspective of the direction along which the bids are moving. Specifically, we write the -th bid as the addition of two vectors. The first one is a convex combination of the -th bid and the efficient Nash equilibrium . Hence, the first vector is closer to as compared to the -th bid. The second one depends on the difference between what the ISO requests from the generators and the optimizer of (2). If the second term is small enough, then we are assured that the bids move towards .

Lemma IV.4.

(Geometric characterization of the bid update): In Algorithm 1, let for all and . Then, we have

for all , where for each ,

Proof:

The next result gives a lower bound on the inner product between the direction in which the bids move and the direction towards the efficient Nash equilibrium.

Lemma IV.5.

(Bids move in the direction of the efficient Nash equilibrium): In Algorithm 1, let for all and . Let . Then, for all ,

| (12) |

Proof:

The next result states that the distance between consecutive bids decreases as the bids get closer to . In combination with Lemma IV.5, one can see intuitively that the bids get closer to and, as they get closer to it, the bid update step behaves as if the bids are reaching an equilibrium of the update scheme. These two facts lead to convergence.

Lemma IV.6.

(Distance between consecutive bids is upper bounded): In Algorithm 1, let for all and . Let . Then, for all ,

| (13) |

Proof:

We are ready to present the main convergence result.

Theorem IV.7.

(Convergence of the Bid Adjustment Algorithm): In Algorithm 1, let for all and . Further, let and for all assume

| (15) |

for some . Then, the following holds

-

(i)

there exists such that and for all , we have with

(16) -

(ii)

for all ,

(17)

Proof:

Assume that for some . Then, the upper bound on the stepsizes in the inequality (15) holds when is replaced with , that is, for all . This is because is strictly increasing in the domain . Proceeding with this replacement and reordering (15), we obtain

or equivalently,

| (18) |

Now consider the following inequalities

| (19a) | ||||

| (19b) | ||||

where in (a) we have used the bounds (12) and (13) from Lemmas IV.5 and IV.6, respectively, and the inequality (b) is implied by that in (IV-B). Note that the inequality (IV-B) is conservative in the sense that the term could be replaced with and the inequality (19b) would still follow. However, we opt for this conservativeness while defining the map in (15) because it results into robustness guarantees for the algorithm as discussed in the forthcoming section. Therefore, (19b) holds whenever . By assumption, we have , , and for all . Using these facts and applying (19b) recursively, we conclude part (i).

For part (ii), note that if for some , then by (19b). Therefore, to find an upper bound on for all , we only need to consider the case when . Plugging this bound in (19a) and neglecting the negative term, we get

| (20) |

From (15), we have

The result now follows by upper bounding the right-hand side of (20) with the left-hand side of the above expression and then employing the bound on the stepsizes give in (15). ∎

Remark IV.8.

(Convergence properties from Theorem IV.7): The assertion (i) of Theorem IV.7 implies that for any choice of , one can select stepsizes according to (15) so that bids reach the set in a finite number of steps and at a linear rate. Further, once bids reach the set , we are assured from assertion (ii) that they remain in a neighborhood of , where the size of the neighborhood is proportional to (cf. (17)). In combination, the above facts mean that bids converge to any neighborhood of the efficient Nash equilibrium at a linear rate provided the stepsizes are selected appropriately. Note that as becomes small, gets small and so does . Thus, from (16), the rate of convergence decreases as becomes small. This presents a trade-off between the desired precision and the rate of convergence.

Remark IV.9.

(Stopping criteria for the ISO): From the proof of Theorem IV.7(i) note that, as long as , the distance to the efficient Nash equilibrium decreases. Therefore, if and , then one can write

| (21) |

where in (a) we have used (19b) and . Given this observation, if the ISO has an estimate of and , then it can design a stopping criteria based on the distance between consecutive bids. In fact, if the ISO decides selects and stops the iteration whenever , then it has the guarantee that either of the following is satisfied

-

(i)

the condition and is met and from (21) we get

(22) -

(ii)

; or

-

(iii)

in which case from (17) we get

The ISO does not know the value of ; its value depends on the stepsizes that the generators select. Assuming that stepsizes are small, the ISO can adjust depending on the desired accuracy level to get the guarantee (22) for the -th bid. For small , the stopping criteria might never be met if stepsizes are too big.

V Robustness of the Bid Adjustment Algorithm

Here we study the robustness properties of the Bid Adjustment Algorithm in a variety of scenarios. We first show that the introduction of disturbances in the bid update mechanism does not destroy the algorithm convergence properties. We then study robustness against either an individual agent or colluding agents changing their strategy to get a higher payoff.

V-A Robustness to disturbances

Here we establish the robustness properties of the Bid Adjustment Algorithm in the presence of disturbances by characterizing its input-to-state stability (ISS) properties [33]. Let model the disturbance to the bid update mechanism. Such disturbances might arise from agents using different stepsizes than the prescribed one or other disruption to the prescribed bid update scheme. The resulting perturbed version of the Bid Adjustment Algorithm can be written as the following discrete-time dynamical system

| (23a) | ||||

| (23b) | ||||

| (23c) | ||||

where and map a bid profile to the set of optimizers of problem (3) and (6), respectively. Note that is a set-valued map since (3) is a linear program. If , then the dynamics (23) represents the -th iteration of the Bid Adjustment Algorithm.

The next result shows that the perturbed version of the algorithm (23) retains the convergence properties of the unperturbed version provided the magnitude of the disturbance satisfies an upper bound dependent on the state of the bid.

Proposition V.1.

Proof:

Since , we obtain for dynamics (23), , for all and . Moreover, mimicking Lemma IV.4, we rewrite the bid update (23a) as

| (26) |

for all . Using (26) and following the steps of Lemma IV.5 for dynamics (23a) we get,

| (27) |

for all and . Similarly, from the reasoning of Lemma IV.6 we obtain

| (28) |

for all for dynamics (23a). Employing (27) and (28), assuming , and writing the set of inequalities (19) with , we deduce the following

| (29) |

Finally, using we get

| (30) |

Iteratively, we obtain ((i)). The bound (25) can be computed in a similar way as done in the proof of Theorem IV.7. ∎

Similar to the convergence guarantees of Theorem IV.7, the above result establishes that the perturbed version of the algorithm (23) converges to a neighborhood of the efficient Nash equilibrium provided the stepsizes and the disturbance satisfy appropriate bounds, and that the size of this neighborhood is tunable as a function of these.

The next result complements Proposition V.1 by giving an alternative representation of robustness of (23). It establishes two properties: first, when the disturbance is bounded (not necessarily satisfying the bound of Proposition V.1), the bids remain bounded; second, if the disturbance goes to zero, then the bids satisfy the bound (17) asymptotically. Notice that both these results do not follow directly from Proposition V.1, justifying the need for a formal proof.

Proposition V.2.

Proof:

We first show that if for some , , then for all . To this end, as a first case, assume that . Then, following the steps of the proof of Proposition V.1, we arrive at (29). If , then we get the inequality (30) which implies that . On the other hand, if , then using this bound in (29), we get

Thus, using , we get . As a second case, assume . Note that , and so . For this case, using and inequalities (27) and (28), we get as in (19a) that

Now applying bounds and , we obtain . Hence, we arrive at the conclusion that if , then for all .

Consider now the case when for some , . By definition of , this implies that and . Therefore, from the proof of Proposition V.1, we arrive at (30). Finally, combining the reasoning of the two cases when is greater than or less than equal to , we obtain the inequality (31). The limit (32) follows from that fact that as , the first term of (31) converges to zero and as tends to zero, tends to . ∎

One can observe from (31) that the limiting behavior of the bids depend on the magnitude of and : if is designed to be small enough and if is small enough, or this bound becomes small as the algorithm iterates, then the bids do converge to a small neighborhood of .

As an aside, in the theory of ISS for discrete-time dynamical systems [33], one typically would conclude Proposition V.2 from Proposition V.1. However, the traditional ISS results require asymptotic convergence of the unperturbed dynamics, (i.e., dynamics (23) with ) to a point. This is not the case here and hence, we provide a formal proof.

Remark V.3.

(Bid Adjustment Algorithm is robust to variation in stepsizes): In practice, given that generators are competing and do not share information with each other, it is conceivable that they do not agree on a common stepsize. Propositions V.1 and V.2 provide a way to quantify the performance of the algorithm when the stepsizes are different. Specifically, let , , denote a common set of stepsizes for all generators that satisfies the hypotheses of Theorem IV.7 and hence, guarantees the convergence properties outlined therein. Assume that each generator selects a different stepsize at each iteration, denoted as , , for generator . Then, the bid iteration in Step 1 of the Bid Adjustment Algorithm can be written as (23) where now

for all and . Now if the variation in stepsizes, i.e., the quantity , is bounded above by a particular function of the distance of the bid-state to the efficient Nash equilibrium, then the linear convergence and the ultimate bound is guaranteed following Proposition V.1. On the other hand, if the variation in stepsizes do not depend on the state but are bounded then, then the bids still converge asymptotically to a neighborhood of the efficient Nash equilibrium, as concluded in Proposition V.2. Note that the assumption of for all and holds whenever the stepsizes are positive for all agents at all times (cf. Lemma IV.3).

V-B Robustness to deviation in bid update

We illustrate here another aspect of robustness of the Bid Adjustment Algorithm by establishing that, if all generators follow the bid update scheme, then there is no incentive for any generator to deviate from it. We next formalize these notions. Assume that all generators, except , follow the Bid Adjustment Algorithm, and that follows an arbitrary strategy to update its bids. Then, one can write the Bid Adjustment Algorithm under this deviation as

| (33a) | ||||

| (33b) | ||||

| (33c) | ||||

| (33d) | ||||

where the maps represent the update scheme of at iterations Recall that the subscript denotes the vector without the component corresponding to the generator . Note that (33b) implies that at each iteration , the generator only knows the bids it made and the quantities the ISO demanded from it up until iteration .

We next introduce the notion of “incentive to deviate” from the Bid Adjustment Algorithm for the generator . A natural way to quantify incentives for a generator is in terms of the payoff (4): a generator has an incentive to deviate if this would bring in a higher payoff, when the ISO stops the iteration, than not deviating. This is formalized below.

Definition V.4.

(Incentive to deviate from Bid Adjustment Algorithm): Let and assume that the stepsizes for any execution of (33) satisfy the hypotheses of Theorem IV.7. Then, the generator has an incentive to deviate from the Bid Adjustment Algorithm if there exists an execution of (33) and such that

| (34) |

for all , where

| (35) |

In the above definition, recall the short-hand notation for . Equation (34) implies that the generator has an incentive to deviate if, after a finite number of iterations, it is guaranteed a higher payoff than what it might eventually get if it follows the Bid Adjustment Algorithm. This captures the fact that the generator does not know when the ISO might stop the bid and hence it would deviate only when it is guaranteed to get a higher payoff after a finite number of steps. The next result shows that there is no incentive to deviate from the Bid Adjustment Algorithm.

Proposition V.5.

Proof:

We reason by contradiction. Assume that a generator has an incentive to deviate from the Bid Adjustment Algorithm. That is, there exists an execution of (33) and such that (34) holds for all . By definition,

| (36) |

Now consider the map

From (6), we get . Further, using (1), one can show that this map is continuous, strictly increasing in the domain , and as . These facts along with (36) imply that there exists a unique such that , for all , and for all . Then, (34) reads as

| (37) |

for all . From the above expression, we deduce that for all . Indeed otherwise, there exists such that . This further implies that

contradicting (37). In the above expression, the first inequality follows from the definition of and the second follows from the fact that is strictly increasing.

The above reasoning has helped us establish that for all . Note that for all because otherwise and (37) gets violated. By assumption, there exists at least one more generator connected to the bus to which is connected to. For now assume that there is only one other generator connected to . Since for all , is a solution of (3), from the fact that , we deduce

for all . Now let

Note that because of the facts: (i) ; (ii) ; and (iii) is nondecreasing. Since for all , we obtain for all (see Step 1 of the Bid Adjustment Algorithm for the definition of ). Thus, if for some , then (because is an optimizer of (3) given bids ) and . As a consequence,

| (38) |

Therefore, if for some , then from (38) we deduce that there exists a finite such that, either or . In the former case, as . This contradicts (34). In the latter case, two further cases can arise. In the first one, we get implying and contradicting (34). In the second one, we obtain , implying . This further yields , thereby, contradicting (34). Finally, if there are other generators connected to that follow the Bid Adjustment Algorithm, then one can carry out the same reasoning as done above and show that we contradict (34). This completes the proof. ∎

Remark V.6.

(Generalization of Proposition V.5): It is interesting to observe that in the proof of Proposition V.5, we have not used at any point that the generators connected at buses other than the one that is connected follow the Bid Adjustment Algorithm. In fact, independently of how such generators update their bids, the Bid Adjustment Algorithm ensures that does not have any incentive to deviate. This is a useful property which we use later when studying robustness to collusion.

Remark V.7.

(Other notions of “incentive to deviate”): In Definition V.4, one can impose the condition of higher payoff (34) to hold for all executions of (33). If this condition holds, then the generator has an even stronger incentive to deviate from the Bid Adjustment Algorithm. However, by Proposition V.5, we are ensured that there does not exist such strong incentive to deviate. This is because the result shows that there does not exist any execution of (33) for which (34) holds. If, on the other hand, we replace the condition (34) in Definition V.4 with the requirement that there exists an execution of (33) along which

| (39) |

holds. This inequality means that there exists an execution of (33) in which the generator gets a higher payoff than infinitely often. Since the ISO can stop the iterations at any time, the generator is not guaranteed a higher payoff, but the possibility is still there. We conjecture that the Bid Adjustment Algorithm is not robust to this notion of weak incentive to deviate. However, the obfuscation of the stopping criteria by the ISO makes such a weak incentive not enough for a rational generator to deviate.

V-C Robustness to collusion

Here we study the robustness of the Bid Adjustment Algorithm against collusion. Collusion refers to the action of a set of generators to share among themselves information about their bids and generation demands by the ISO, with the goal of getting a higher profit, possibly by deviating from the bid update scheme. The following makes this notion formal.

Definition V.8.

(Collusion between generators): A group of generators form a collusion if at each iteration of the algorithm, each generator ,

-

(i)

has the information

-

(ii)

determines its next bid based on the information , not necessarily following the update scheme (Step 1) of the Bid Adjustment Algorithm.

An iteration of the Bid Adjustment Algorithm under a collusion between a group of generators is given by the following dynamics

| (40a) | ||||

| (40b) | ||||

| (40c) | ||||

| (40d) | ||||

where maps represent the update scheme of generators in collusion. Notice that for each generator , the quantity , for all , is part of its private information, irrespective of the fact that belongs to or not. Next, we define what it means for the group of generators to have an incentive to collude.

Definition V.9.

(Incentive to collude): Let and assume that the stepsizes for any execution of (40) satisfy the hypotheses of Theorem IV.7. Then, the group of generators has an incentive to collude under the Bid Adjustment Algorithm if there exists an execution of (40), a generator , and such that

| (41) |

for all , where is defined in (35).

This notion essentially says that there is an incentive to collude for the generators in if there exists at least one execution of (40) along which at least one generator in gets a higher payoff after finite number of steps. The next result shows that no group of generators has an incentive to collude provided there is at least one generator at each bus with generation that follows the Bid Adjustment Algorithm.

Proposition V.10.

(Robustness to collusion under the Bid Adjustment Algorithm): For dynamics (40), let the hypotheses of Theorem IV.7 hold and assume that for all and . Assume that the ISO selects a vertex solution at each iteration . Assume that at each bus that has generators connected to it, there exists at least one generator that follows the update scheme of the Bid Adjustment Algorithm. Denote these generators by . Then, there is no incentive to collude for any group of generators contained in .

Proof:

Let be a group of generators that form a collusion. Assume first Scenario where each generator in is connected to a different bus. By hypotheses, there exists at least one other generator following the Bid Adjustment Algorithm at the bus where a generator in is connected to. Thus, mimicking the proof of Proposition V.5 (cf. Remark V.6), at each bus, no generator has an incentive to deviate from the Bid Adjustment Algorithm. By Definition V.4, this implies that there does not exist any execution of (40) for which (41) holds for any generator in . Hence, for Scenario , generators in do not have an incentive to collude.

Next, consider Scenario , where at least a bus, say , has more than one generator from , that is, has cardinality larger than or equal to . Let be the generator at that follows Bid Adjustment Algorithm. For the sake of contradiction, assume the existence of a generator for which (41) holds for some execution of (40). Since the ISO selects a vertex solution at each iteration , we deduce that for all , all other generators in get zero production signal from the ISO, i.e., for all and . Therefore, for the purpose of analysis, one can neglect the generators in and assume that only and are connected to . Again, mimicking the proof of Proposition V.5, we deduce that does not have an incentive to deviate and so (41) does not hold, a contradiction. Since is arbitrary, we conclude that for Scenario , generators in do not have an incentive to collude either. ∎

An alternative definition of an incentive to collude could be where every generator in the collusion gets a higher payoff after a finite number of steps. Proposition V.10 however shows that, under the assumed hypotheses, such a scenario does not occur as there is not even a single generator that gets a higher payoff after a finite number of iterations. Note that the assumptions of the above result is tight in the sense that if all generators at a bus collude, then based on the load and the line limits, generators at that bus can increase their bid to an arbitrarily high value, thus creating an incentive to collude.

Remark V.11.

(Limitations on robustness under generator bounds): The robustness of the Bid Adjustment Algorithm against deviation and collusion relies heavily on the fact that we have not considered upper bounds on the generation capacities. In the presence of such bounds, the generators might be able to push the bids and their individual utilities to a higher value based on the load at the respective bus and the capacity constraints on the lines connected to the bus. To avoid such behavior of market manipulation, either one can modify network capacities or investigate alternative allocation mechanisms that disincentivizes such behavior.

VI Simulations

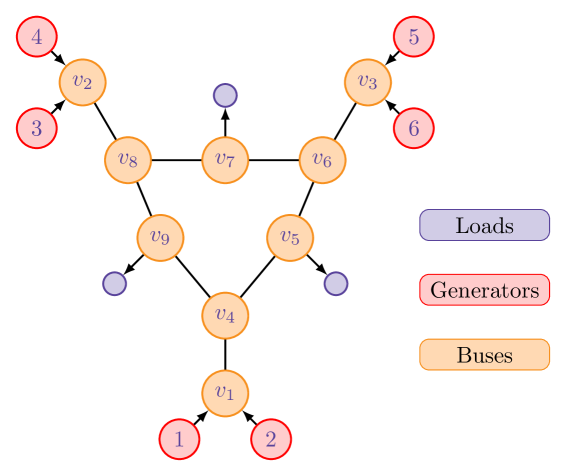

We illustrate the convergence and robustness properties of the Bid Adjustment Algorithm using a modified IEEE -bus test case [34]. The traditional IEEE 9-bus system has 3 generators, at buses , , and and three loads at buses , , and . In our modified test case, we have added one generator each at buses , and . The interconnection topology is given in Figure 1.

The line flow limit between any two buses is except for three lines, , , and , for which the limits are , , and , respectively. The loads are , , and , where denotes the load at bus . The cost function for each generator is , where the coefficients for all the generators are given by the vectors

| (42) |

For the given costs and loads, the generation profile at the optimizer of the DC-OPF problem (2) is

and the unique efficient Nash equilibrium is

| (43) |

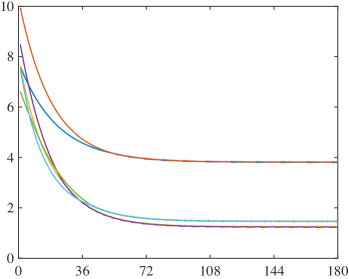

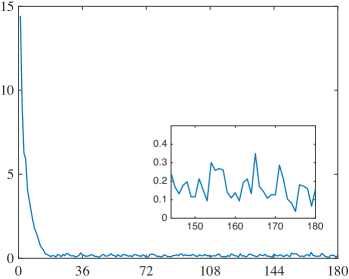

Figure 2 depicts the evolution of the bids and their distance to the efficient Nash equilibrium along an execution of the Bid Adjustment Algorithm. The initial bids are selected satisfying for all the generators . The stepsizes are constant, for all , and satisfy . As predicted by Theorem IV.7, Figure 2 shows that the bids converge towards the efficient Nash equilibrium at a linear rate and, after a finite number of steps, remain in a neighborhood of . If one selects , then and condition (15) holds for the stepsizes. Computing the right hand side of (17) using these values, we conclude that bids eventually remain in the neighborhood centered at with radius . Figure 2(b) validates this claim and, in fact, shows that the bound is conservative since bids actually remain in a neighborhood of radius .

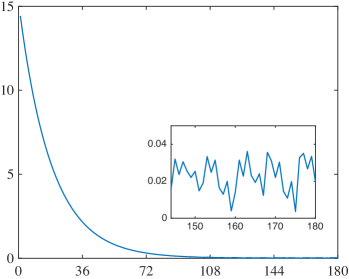

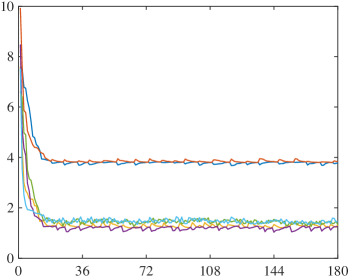

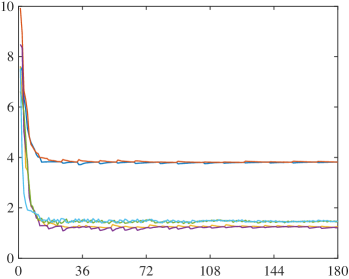

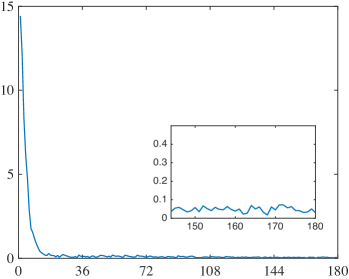

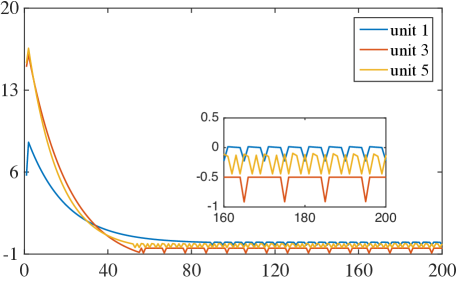

We next illustrate the robustness properties of the Bid Adjustment Algorithm against disturbances (cf. Section V-A). Figure 3 considers the same setup as above but now with generators choosing a different stepsize at each iteration. These differences in stepsizes can be interpreted as a disturbance to the Bid Adjustment Algorithm, as discussed in Remark V.3. In Figure 3(a)-(b), the interval from which stepsizes are selected is constant, whereas in Figure 3(c)-(d) the size of this interval decays with time. In both cases, the bids converge to a neighborhood of (in the latter case of decaying interval, the bids converge to a smaller neighborhood), as established in Proposition V.2. Observe that the convergence rate in Figure 3(a)-(b) is higher than in Figure 2(a)-(b). This is because stepsizes are allowed to be large in the former. However, this higher convergence rate comes with the pitfall of loss in accuracy, cf. Remark IV.8. Hence, to retain both properties, stepsizes should be large initially and decay as iterations proceed. This is seen in Figure 3(c)-(d), where stepsizes decay over time (in expectation), yielding both high convergence rate and accuracy. Finally, Figure 4 demonstrates the robustness against collusion of the Bid Adjustment Algorithm (cf. Section V-C), where generators , , and form a collusion. These generators may select their bids in any fashion they want: for this example, we assume a particular strategy of bid selection, explained in Figure 4. The plot shows that the utility of the colluding generators eventually becomes lower than (defined in (35)). Hence, there is no incentive for collusion, as ensured by Proposition V.10.

VII Conclusions

We have formulated an inelastic electricity market game capturing the strategic interaction between generators in a bid-based energy dispatch setting. For this game, we have established the existence and uniqueness of the efficient Nash equilibria. We have also designed the Bid Adjustment Algorithm, which is an iterative strategy amenable to decentralized implementation that provably converges to a neighborhood of the efficient Nash equilibrium at a linear rate. We have characterized the robustness properties of the algorithm against disturbances, deviation in bid updates, and collusions among generators. Future work will analyze the dynamic behavior of the market under other bidding schemes, such as Cournot bidding, supply function bidding, and price-capacity bidding. We would also like to examine the convergence of other learning schemes such as regret minimization in the context of electricity markets. Finally, we wish to incorporate stochastic load demands and changing sets of generators in our setup.

References

- [1] A. Cherukuri and J. Cortés, “Decentralized Nash equilibrium learning by strategic generators for economic dispatch,” in American Control Conference, Boston, MA, Jul. 2016, pp. 1082–1087.

- [2] A. Cherukuri and J. Cortés, “Decentralized Nash equilibrium seeking by strategic generators for DC optimal power flow,” in Annual Conference on Information Systems and Sciences, Baltimore, MD, Mar. 2017, to appear.

- [3] S. Stoft, Power system economics: designing markets for electricity. Piscataway, NJ: IEEE Press, 2002.

- [4] F. Kirschen and G. Strbac, Fundamentals of power system economics. Sussex, England: John Wiley & Sons, 2004.

- [5] R. Johari and J. N. Tsitsiklis, “Parameterized supply function bidding: Equilibrium and efficiency,” Operations Research, vol. 59, no. 5, pp. 1079–1089, 2011.

- [6] W. Tang and R. Jain, “Game-theoretic analysis of the nodal pricing mechanism for electricity markets,” in IEEE Conf. on Decision and Control, Florence, Italy, Dec. 2013, pp. 562–567.

- [7] D. Cai, S. Bose, and A. Wierman, “On the role of a market maker in networked Cournot competition,” 2016, preprint available at http://boses.ece.illinois.edu.

- [8] T. Li and M. Shahidehpour, “Strategic bidding of transmission-constrained GENCO’s with incomplete information,” IEEE Transactions on Power Systems, vol. 20, no. 1, pp. 437–447, 2005.

- [9] X. Hu and D. Ralph, “Using EPECs to model bilevel games in restructured electricity markets with locational prices,” Operations Research, vol. 55, no. 5, pp. 809–827, 2007.

- [10] G. I. Bischi, C. Chiarella, M. Kopel, and F. Szidarovszky, Nonlinear oligopolies: stability and bifurcations. New York: Springer, 2010.

- [11] U. Nadav and G. Piliouras, “No regret learning in oligopolies: Cournot vs Bertrand,” in Algorithmic Game Theory, ser. Lecture Notes in Computer Science, S. Kontogiannis, E. Koutsoupias, and P. G. Spirakis, Eds. New York: Springer, 2010, vol. 6386, pp. 300–311.

- [12] E. N. Barron, R. Goebel, and R. R. Jensen, “Best response dynamics for continuous games,” Proceeding of the American Mathematical Society, vol. 138, no. 3, pp. 1069–1083, 2010.

- [13] D. Fudenberg and D. K. Levine, The Theory of Learning in Games. Cambridge, MA: MIT Press, 1998.

- [14] P. Frihauf, M. Krstić, and T. Başar, “Nash equilibrium seeking in noncooperative games,” IEEE Transactions on Automatic Control, vol. 57, no. 5, pp. 1192–1207, 2012.

- [15] M. S. Stankovic, K. H. Johansson, and D. M. Stipanovic, “Distributed seeking of Nash equilibria with applications to mobile sensor networks,” IEEE Transactions on Automatic Control, vol. 57, no. 4, pp. 904–919, 2012.

- [16] J. Warrington, P. Goulart, S. Mariéthoz, and M. Morari, “A market mechanism for solving multi-period optimal power flow exactly on ac networks with mixed participants,” in American Control Conference, Montréal, Canada, Jun. 2012, pp. 3101–3107.

- [17] D. J. Shiltz, M. Cvetković, and A. M. Annaswamy, “An integrated dynamic market mechanism for real-time markets and frequency regulation,” IEEE Transactions on Sustainable Energy, vol. 7, no. 2, pp. 875–885, 2016.

- [18] D. P. Palomar and M. Chiang, “Alternative distributed algorithms for network utility maximization: Framework and applications,” IEEE Transactions on Automatic Control, vol. 52, no. 12, pp. 2254–2269, 2007.

- [19] M. N. Faqiry and S. Das, “Double-sided energy auction in microgrid: equilibrium under price anticipation,” IEEE Access, vol. 4, pp. 3794–3805, 2016.

- [20] S. Pu and A. Garcia, “Iterative mechanisms for electricity markets,” 2016, available at https://arxiv.org/abs/1608.08987.

- [21] S. Leyffer and T. Munson, “Solving multi-leader-common-follower games,” Optimization Methods and Software, vol. 25, no. 4, pp. 601–623, 2010.

- [22] J.-S. Pang and M. Fukushima, “Quasi-variational inequalities, generalized nash equilbria, and multi-leader-follower games,” Computational Management Science, vol. 2, no. 1, pp. 21–56, 2005.

- [23] Z.-Q. Luo, J.-S. Pang, and D. Ralph, Mathematical programs with equilibrium constraints. Cambridge, UK: Cambridge University Press, 1996.

- [24] M. C. Ferris, S. P. Dirkse, and A. Meeraus, “Mathematical programs with equilibrium constraints: automatic reformulation and solution via constrained optimization,” in Frontiers in Applied General Equilibrium Modeling. Cambridge, UK: Cambridge University Press, 2005, pp. 67–94.

- [25] D. Zhang and G.-H. Lin, “Bilevel direct search method for leader-follower problems and application in health insurance,” Computers & Operations Research, vol. 41, pp. 359–373, 2014.

- [26] S. Hart and A. Mas-Colell, “Markets, correlation, and regret-matching,” Games and Economic Behavior, vol. 93, pp. 42–58, 2015.

- [27] T. Lykouris, V. Syrgkanis, and Éva Tardos, “Learning and efficiency in games with dynamic population,” in Annual ACM-SIAM Symposium on Discrete Algorithms, Arlington, VA, 2016, pp. 120–129.

- [28] A. Cherukuri and J. Cortés, “Initialization-free distributed coordination for economic dispatch under varying loads and generator commitment,” Automatica, vol. 74, pp. 183–193, 2016.

- [29] S. T. Cady, A. D. Domínguez-García, and C. N. Hadjicostis, “A distributed generation control architecture for islanded AC microgrids,” IEEE Transactions on Control Systems Technology, vol. 23, no. 5, pp. 1717–1735, 2015.

- [30] S. Boyd and L. Vandenberghe, Convex Optimization. Cambridge University Press, 2004.

- [31] A. Mas-Colell, M. Whinston, and J. Green, Microeconomic Theory. Oxford, UK: Oxford University Press, 1995.

- [32] D. Fudenberg and J. Tirole, Game Theory. Cambridge, MA: MIT Press, 1991.

- [33] Z.-P. Jiang and Y. Wang, “Input-to-state stability for discrete-time nonlinear systems,” Automatica, vol. 37, no. 6, pp. 857–869, 2001.

- [34] R. D. Zimmerman, C. E. Murillo-Sánchez, and R. J. Thomas, “Matpower: Steady-state operations, planning and analysis tools for power systems research education,” IEEE Transactions on Power Systems, vol. 26, no. 1, pp. 12–19, 2011.