Premium valuation for a multiple state model

containing manifold premium-paid states

Abstract

The aim of this contribution is to derive a general matrix formula for the net period premium paid in more than one state. For this purpose we propose to combine actuarial technics with the graph optimization methodology. The obtained result is useful for example to more advanced models of dread disease insurances allowing period premiums paid by both healthy and ill person (e.g. not terminally yet). As an application, we provide analysis of dread disease insurances against the risk of lung cancer based on the actual data for the Lower Silesian Voivodship in Poland.

Keywords: modified multiple state model; Dijkstra algorithm; net premium; stochastic interest rate; critical illness insurance; Accelerated Death Benefits.

1 Introduction

The insurance market is constantly expanding. Insurers offer more flexible contracts taking into account various situations that may arise in life. An example would be a serious illness, in case of which, the priorities of the insured person may change considerably. In particular, it may be that the death benefit becomes less important while the life benefit becomes most important. On the insurance marked exist different kind of solutions to protect the insured against financial problems in this difficult situation. According to one of them, an insurer in such unexpected situations during the insurance period may offer purchase of an additional option called Accelerated Death Benefits (ADBs) to life insurance policyholder, which provides an acceleration of all or of a part of the basic death benefit to the insured before his death. By another alternative, the insured may buy dread disease insurance (or critical illness insurance) which provides the policyholder with a lump sum in case of dread disease which is included in a set of diseases specified by the policy conditions, such as heart attack, cancer or stroke (see [2], [9], [13], [14]). It implies that the dread disease policy does not meet any specific needs and does not protect the policyholder against such financial losses as loss of earnings or reimbursement of medical expenses. In both cases conditions of this insurance products state that the benefit is paid on diagnosis of a specified condition, rather than on disablement. This is understandable, because this type of insurance is sensitive to the development of medicine, not all dread diseases are as mortal as a few years ago. Thus insurers introduce strict conditions for the right to receive benefits associated with a severe disease. One of popular conditions is that benefits are paid not only on the diagnosis but also on the disease stage that directly depends on the expected future lifetime of a sick person. Then the insurer has to take into account that probability of death of a dread disease sufferer depends on the duration of the disease. Depending on the conditions insurance premium may be paid in various forms by: healthy or sick (but not terminally) person, living person or healthy person. This article focuses on accurate valuation of such insurance products.

Multiple state modelling is a stochastic tool for designing and implementing insurance products. The multistate methodology is commonly used in calculation of actuarial values of different types of life and health insurances. A general approach to calculation of moments of the cash value of the future payment streams (including benefits, annuities and premiums) arising from a multistate insurance contract can be found in e.g. [5]. This methodology, developed for the discrete-time model (where insurance payments are excercised at the end of time intervals), is based on an modified multiple state model (or extended multiple state model), for which matrix formulas for actuarial values can be derived. This approach to costing contracts not only makes calculations easier, but also enables us to factorize the stochastic nature of the evolution of the insured risk and the interest rate, which can be observed in the derived formulas.

The aim of this contribution is to derive a general matrix formula for the net period premium paid in more than one state, which can be applied to any type of insurance being modeled by the multiple state model. In a special case, when the insured pays the single premium in advance or period premiums under the condition that he is healthy (or active), the valuation of the contract may be done by the use of results derived in [5]. More advanced models of dread disease insurances (as e.g. ADB’s form) allowing period premiums paid by both healthy and ill person (e.g. not terminally yet) go beyond the scope of models analysed in [5] and need a different approach. This paper focuses on the solution of this problem by the use of the graph optimization methodology to find the shortest path between particular states of the model. Note that the formulas obtained in [5] are special cases of formula derived in this paper.

The paper is organized as follows. In Section 2 we describe the modified multiple state model and its probabilistic structure. This modification allows us to use matrix-form approach to costing insurance contract. In Section 3 we derive general matrix expressions for the net period premium paid in more than one state. Section 4 deals with the study of dread disease insurances against the risk of lung cancer. The modified multiple state model for dread disease insurances is presented in Section 4.1. The probability structure of the analyzed model is built under conditions that the probability of death for a dread disease sufferer depends on the duration of the disease and the payment of benefits associated with a severe disease depends both on the diagnosis and on the disease stage presented in [6] (Section 4.2). In Section 4.3, the results obtained in Section 3 are applied to costing of different types of critical illness policies based on the actual data for the Lower Silesian Voivodship in Poland. Suggestions for further possible applications of obtained results are presented in Section 5.

2 Multiple state model

Following Haberman & Pitacco [9], with a given insurance contract we assign a multiple state model. That is, at any time the insured risk is in one of a finite number of states labelled by or simply by letters. Let be the state space. Each state corresponds to an event which determines the cash flows (premiums and benefits). Additionally, by we denote a set of direct transitions between states of the state space. Thus is a subset of the set of pairs , i.e., . The pair is called a multiple state model, and describes all possible insured risk events as far as its evolution is concerned (usually up to the end of insurance). This model is structured so that it is a possibility to assign any cash flow arising from the insurance contract to one of the states (annuity, premiums), or the transition between them (lump sums). That it was possible to use matrix formulas for actuarial values, the multiple state model must be constructed so that each cash flow must maintain its to one of the states. Observe that for the lump sum the information that the insured risks is in a particular state at moment is not enough to determine the benefit at time , because we need additional information about where the insured risk was at previous moment . Matrix is a two-dimensional structure, thus it is not possible to determine the exact moment of realization of lump sum benefit by using above three pieces of information. It appears that each model can be easily (by the recursive procedure proposed in [5]) extended to modified multiple state model in which the lump sum benefit is affiliated with particular state and not a direct transition between states.

In this paper we consider an insurance contract issued at time (defined as the time of issue of the insurance contract) and terminating according to the plan at a later time ( is the term of policy). Moreover, is the age of the insured person at a policy issue.

We focus on discrete-time model. Let denote the state of an individual (the policy) at time (). Hence the evolution of the insured risk is given by a discrete-time stochastic process , with values in the finite set . In order to describe the probabilistic structure of , for any moment , we introduce and vector

Note that is a vector of the initial distribution (usually it is assumed that state is an initial state, that is ).

3 Matrix formula for net premiums

Before presenting the matrix formula for the net period premium we need to introduce some notation (cf. [5]).

In order to describe the probabilistic structure of we introduce matrix

| (5) |

.

The individual’s presence in a given state may have some financial effect. For -th unit of time (it means for period ), we distinguish between the following types of cash flows: a cash flow paid in advance at time if (premiums and life annuity due) and a cash flow paid from below at time if (lump sum and immediate life annuity). Note that the insurance policy gives rise to two payment streams. Firstly, a stream of premium payments, which flows from the insured to the insurer. Secondly, in the opposite direction, a stream of actuarial payment functions, where fixed amounts under the annuity product and lump sum benefits are considered as a series of deterministic future cash flows.

One of important quantities is the total loss of the insurance contract, defined as the difference between the present value of future benefits and the present value of future premiums. In particular, the stream of actuarial payment functions is an inflow representing an income to and it takes positive values, while the stream of premium payments is an outflow representing an outgo from and it takes negative values.

Let be the future cash flow payable at time if () and

denote cash flows matrix.

From the financial point of view, the cash flow is a sum of inflows representing an income to a particular fund and outflows representing an outgo from a particular fund. Hence

| (7) |

where consists only of an income to a particular fund and consists only of an outgo from a particular fund. We note that for , includes the benefits and includes the premiums.

Let denote the rate of interest in time interval . Then the discount function is of the form . It is useful to introduce the following notation

and

with . We refer to [4] for the exact forms of the matrix when is modelled by an Ornstein-Uhlenbeck process or a Wiener process. Let us note that for constant interest rate, we have and .

Additionally, let

for each and .

Furthermore, for any matrix let be a diagonal matrix

Insurance premiums are called net premiums if the equivalence principle is satisfied, i.e. . In order to study the first moment of we make the following standard assumptions (see also [5], [8] or [12]):

- Assumption A1

-

Random variable is independent of .

- Assumption A2

-

First moment of the random discounting function is finite.

The net single premium paid in advance (at time , when ) for the insurance modelled by equals (cf. [5])

| (9) |

Additionally, by [5], the net period premium payable in advance at the beginning of the time unit during the first units () if equals

| (10) |

where the denominator in (10) is equal to the actuarial value of a temporary (-year) life annuity-due contract .

In case of each type of insurance, the net single premium can be calculated using formula (9). Importantly, formula for net period premium has to be modified, because premiums may be paid not only if , but also when is in other states (of course those in which an insured person is alive). We derive formula for period premium in Theorem 1.

Let denote the actuarial value of the stream of unit benefits arising from life annuity-due contract payable in period if for . Actuarial value is calculated at the beginning of the insurance period (). We tacitly assume that .

Lemma 1

Suppose that A1-A2 hold and . Then for we have

| (11) |

Proof. Let us observe that under assumption A1-A2 we have

| (12) |

Since , then . Moreover

| (13) | |||||

| (14) |

Applying (13) and (14) to (12) we have

which completes the proof of (11).

In order to determine the value of premium payable when the process is at state in time interval , it is necessary to designate the shortest possible sequence of transitions from state to state at time period . Note that multiple state model reminds a directed graph, where the states correspond to the vertices (the nodes) of the graph, and the direct transitions correspond to the edges between the nodes. Therefore, in order to find the shortest way (path) between the states we use the graph optimization methodology.

Let , where , denote a path (way) from state to state in the model . By let us denote the path length of i.e.

| (15) |

Additionally, let be the length of the shortest path from to , where the minimum runs throughout all the paths leading from to . Observe that the shortest path, if exists, must be a straight path, i.e. such that all the nodes of the path are different. This shortest path can be determined by Dijkstra’s algorithm [7].

Let be such that for implies that the period premium is paid. The formula for such a premium is presented in Theorem 1.

Theorem 1

Suppose that equivalence principle holds and assumptions A1-A2 are satisfied. Moreover, for extended multiple state model the cash flows matrix is defined for the insurer’s total loss fund, and insurance premiums are paid for if and . Then the formula for net period premium paid during the first units of the insurance period has the following form

| (16) |

where and is the shortest path from state to state in .

Proof. For the multistate insurance, the equivalence principle may be written in the following form (Theorem 2 in [5])

which combined with (7) gives

| (17) |

Let be the net period premium payable in advance at the beginning of the unit time during first units, when and . Since , then the premium may be paid for the first time at moment , provided that . Let , where matrix consists of the following columns ()

Assuming that the premiums may be paid during the first units of the insurance period if and , we have

| (19) |

Applying (19) to left side of equation (17) we obtain

| (20) |

Theorem 1 extends findings of [5] to the case where premiums are paid not only in the initial state. The matrix form derived in Theorem 1 not only provides a concise formula for , but also factorizes the double stochastic nature of actuarial values of the total payment stream arising from the insurance contract. Matrix depends only on the distribution of process , while depends only on the interest rate. Moreover, matrix depends on cash flows and describes the type (the case) of the insurance contract.

4 Applications

In this section we apply results derived in Theorem 1 to dread disease insurances on the example of the critical insurance against a lung cancer.

4.1 Actuarial model for dread disease insurance

Dread disease (or ’critical illness’) policies provide the policyholder with a lump sum in case of dread disease which is included in a set of diseases specified by the policy conditions, such as heart attack, cancer or stroke (see [2], [9], [13], [14]). Typically conditions of this insurance products state that the benefit is paid on diagnosis of a specified condition, rather than on disablement. It implies that dread disease policy does not meet any specific needs and does not protect the policyholder against such financial losses as loss of earnings or reimbursement of medical expenses. Individual critical illness insurance can take one of two main forms: a stand-alone cover or a rider benefit for a basic life insurance. The rider benefit (also called living benefit) may provide an acceleration of all or of a part of the basic life cover (Accelerated Death Benefits - ADBs), or it may be an additional benefit.

Dread disease insurances are of a long-term type, hence they are sensitive to the development of medicine, not all dread diseases are as mortal as a few years ago. Thus insurers introduce strict conditions for the right to receive benefits associated with a severe disease. One of popular conditions is that benefits are paid not only on the diagnosis but also on the disease stage that directly depends on the expected future lifetime of a sick person. Then the insurer has to take into account that probability of death of a dread disease sufferer depends on the duration of the disease. Let us recall that in the classical notation, used for critical illness insurances, statuses are labeled by letters, where means that the insured is active (or healthy), indicates that the insured person is ill and suffers from a dread disease and is related to the death of the insured; see e.g. [9], [14]. In this paper we distinguish between states

- -

-

the death of the insured person who is ill and his expected future lifetime is at least 4 years () or due to other cases, and

- -

-

the death of the insured person who is ill and his expected future lifetime is less than 4 years (),

where is the expected future lifetime of -years-old person. Moreover, following [6], state is divided into five states:

- -

-

the insured person is ill and his expected future lifetime is at least 4 years (). In this stage the remission of the disease is still possible, although return to health state is impossible.

- -

-

the insured is terminally sick and his expected lifetime is less than years . In this stages the remission of the disease is very unlikely.

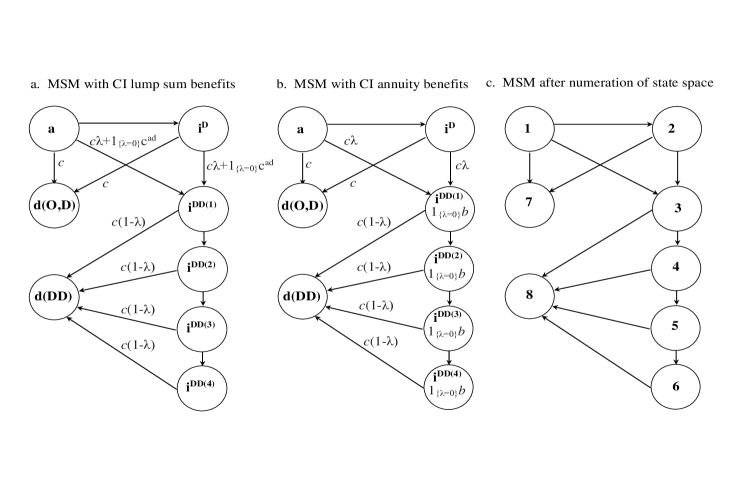

This leads to a multiple state model for dread disease insurance derived in [6]; see Figure 1.

Note that states are reflex (that is strictly transitional and after one unit of time, the insured risk leaves this state). Unbundling of the four states results from the fact that typically an insurer pays the benefit to a insured sick whose expected future lifetime is no longer than four years or, in some cases, two years (depending on medical circumstances). The difference results from the definition of a terminally ill person. On the one hand, for example the HIV+ patients with more than 4,5 years of life expectancy, are treated as patients in a relatively good health. On the other hand, the term terminally ill in the context of health care refers to a person who is suffering from a serious illness and whose life is not expected to go beyond 2 years at the maximum.

The general multiple state model for critical illness insurances covers both disease lump sum benefits (Figure 1a) and disease annuity benefits (Figure 1b). Next to the arcs are marked benefits related to the transition between states, where is a given lump sum (death benefit) and is an additional lump sum (disease benefit). To avoid a situation of ’overpayment’ (that could take place when death occurs within a very short period after disease inception to the terminal phases of the dread disease), the single cash payment is replaced with a series of payments (the annuity), which are connected with staying of the insured risk in states . In particular, the model presented in Figure 1b may be applied to critical illness insurance contract with increasing () or decreasing () annuity benefits, where is an annuity rate realized at state .

By we denote the so called acceleration parameter. The amount is payable after the dread disease diagnosis, while the remaining amount is payable after death, if both random events occur within the policy term . Note that the multiple state model presented in Figure 1 covers all forms of DD insurances. Namely, if , then the model describes a rider benefit as an additional benefit. If , then the model describes a rider benefit as an acceleration of part of the basic life cover. For , the model becomes a stand-alone cover. In this case state is absorbing, because the whole insurance cover ceases immediately after the terminal stage dread disease diagnosis.

In order to simplify notation, let us label states according to Figure 1c.

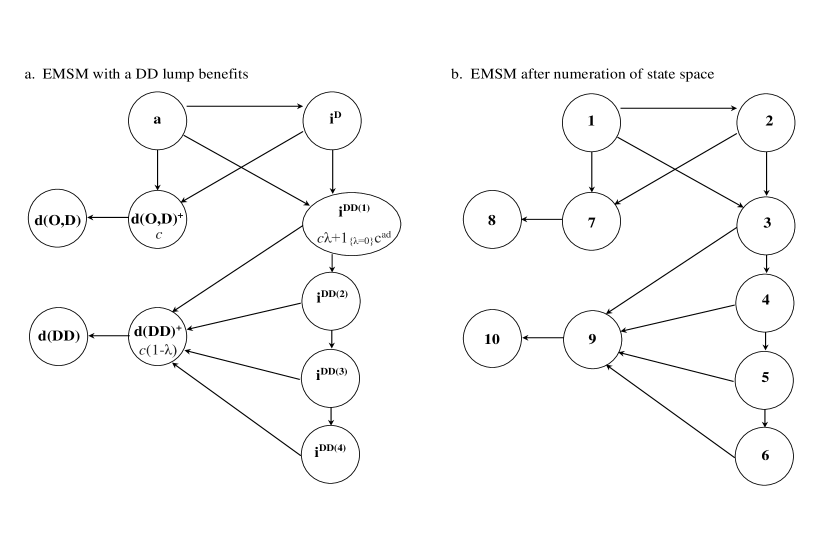

Since the multiple state model presented in Figure 1c is extensive, in order to determine appropriate actuarial values, it is worth using matrix notation. For this purpose, we have to modify the model, replacing lump sum benefits by benefits associated with staying of the insured risk in particular states (according procedure presented in [5]). As a result, the modified multiple state model for dread disease insurance assumes the form presented in Figure 2a (with DD lump sum benefits).

Following the procedure of extending the multiple state model presented in [5], we introduce states and . State denotes death of the insured person who is ill and his expected future lifetime is at least 4 years (). If the insured risk is in this state, the death benefit is paid. State in this model denotes that the insured has been dead for at least one year. Although states and deal with the same event, they differ by the fact that the lump sum is realized only when the insured risk is at state . States and are interpreted correspondingly. Note that and are reflex. Because is a reflex state, there is no need to create state .

The extended multiple state model with dread disease annuity benefits is the same as in Figure 2a.

In order to simplify the notation in what follows we enumerate the set space, as presented in Figure 2b.

4.2 Dread disease insurance against risk of lung cancer

Malignant tumours constitute the second cause (after cardiovascular diseases) of death in developed countries; see [6]. In particular, lung cancer falls into the group of tumours characterized by the highest morbidity and mortality rates. In many European countries, it is the most frequent in population of men and the second frequent in population of women after breast cancer. Moreover, lung cancer is a tumour with unfavourable prognosis. Because of the high prevalence and mortality rates, the relatively short survival time after the diagnosis, lung cancer is a perfect example of the deadly disease, which could be covered by DD insurances.

Age, sex and region of residence should be taken into account in the analysis of the etiology of lung cancer. Epidemiological data shows that the morbidity rate is several times higher in male population than in female. Also, the incidence rate strongly depends on age. Lung cancer occurs very rarely among patients up to forty years of age, and then the incidence begins to increase after the age of fifty. The peak incidence occurs at the sixth and seventh decades of life. The analysis of geographic data shows a significant diversity of incidence and mortality rates to be observed in different regions of Europe. For example, in Poland, the morbidity and mortality vary significantly among particular provinces (voivodships).

In case of DD disease insurance for lung cancer, the model (presented in Figure 2b) has six states associated with health situation of the insured person, which means that the insured:

-

- is alive and not sick with malignant lung tumour,

-

- is diagnosed of lung cancer without finding of metastasis to lymph nodes, brain, bones or so-called distant metastases,

-

- is diagnosed of lung cancer and the existence of distant metastases are observed and his/her expected lifetime is less than years (),

-

- has a lung cancer with distant metastases and ,

-

- has a lung cancer with distant metastases and ,

-

- has a lung cancer with distant metastases and ,

Other states are associated with the death of the insured person.

Following [6], in order to estimate elements of transition matrix we used databases [15], [17] and [3].

The transition probabilities in can be determined using a multiple increment-decrement table (or multiple state life table). Such a table, referring to years old person for presented in Figure 1c, takes the following form (cf. [6])

| (25) |

where denotes the number of lives in state at age and denotes the number of lives at age , who during period left the state and transit to state .

Notice that after application of the procedure of extension of , state 8 became state 9 in (cf. Figure 2b). Thus for the multiple increment-decrement table is as follows

| (26) |

Generally, the multiple increment-decrement table, that refers to years old person for a multiple state model consists of functions described for each transient state . It appears that life table (25) is enough to describe probabilistic structure for the model presented in Figure 2b even though this table does not contain , and , . This is possible due to the fact that both states and are reflex (i.e. is transient and ) for which there exists only one possibility to leave. Hence and are unambiguously defined by and in the following way Correspondingly and are connected by the relation

4.3 Net premiums

In what follows we analyse three scenarios, where

- -

-

premium is paid only if (the insured is healthy / active), i.e. ,

- -

-

premium is paid only if (the insured is healthy or has not a lung cancer with distant metastases), i.e. ,

- -

-

premium is paid if (the insured is alive, independently on his health status), i.e. .

Then, by Theorem 1, the net period premium, paid during the first units of the insurance contract, has the following form

| (41) |

where is defined by (11).

Premiums calculated in Section 4.3.1 and Section 4.3.2 are based on formulas (9) and (41), where

-

is described under the assumption, that the interest rate is constant and equal ,

We assume that period premiums are paid up to the end of insurance period ().

4.3.1 Accelerated benefit for temporary life insurances

We assume that the living benefit provides an acceleration of part of the basic life cover unit. If the insured person’s death occurred in time interval , , before the end of the insurance contract, then at time the insurer pays benefit (i.e. ). Then cash flows matrix, which consists only of an income to the total loss found, has the form

The premiums for such an insurance, depending on acceleration parameter and sex of the insured person, are presented in Table 1.

| Premium | ||||||||

|---|---|---|---|---|---|---|---|---|

| Woman | Man | Woman | Man | Woman | Man | Woman | Man | |

| 0.001 | 0.10616 | 0.22030 | 0.00497 | 0.01085 | 0.00496 | 0.01083 | 0.00496 | 0.01082 |

| 0.25 | 0.10638 | 0.22083 | 0.00498 | 0.01087 | 0.00498 | 0.01086 | 0.00497 | 0.01084 |

| 0.5 | 0.10660 | 0.22137 | 0.00499 | 0.01090 | 0.00499 | 0.01088 | 0.00498 | 0.01087 |

| 0.75 | 0.10682 | 0.22190 | 0.00500 | 0.01092 | 0.00500 | 0.01091 | 0.00499 | 0.01090 |

| 0.9 99 | 0.10704 | 0.22243 | 0.00501 | 0.01095 | 0.00501 | 0.01093 | 0.00500 | 0.01092 |

| 1 | 0.10704 | 0.22243 | 0.00501 | 0.01095 | 0.00501 | 0.01093 | — | — |

Note that the premiums for women are about lower than for men. It appears that the acceleration parameter does not have a big impact on the premium, for example premiums for and differ relatively by less than , both for women and men. Analogously the relative difference between and is about for women and for men.

Net single premiums depending on the age of insured person are presented in Table 2.

| 20 | 0.01602 | 0.04452 | 178 |

| 30 | 0.04468 | 0.10437 | 134 |

| 40 | 0.10660 | 0.22137 | 108 |

| 50 | 0.23262 | 0.39691 | 71 |

| 60 | 0.52662 | 0.63972 | 21 |

It is not surprising that the values of premiums for men and women are increasing with the age at entry, but the calculations show a strong influence of sex on the amount of net premiums. We can observe that regardless of age net single premiums are lower for women. The difference between premiums for young male and female decreases with the rise of the age at entry up to .

4.3.2 Additional DD benefit for life insurances

Let denote the lump sum benefit payable at time on condition that the insured person’s irreversible phase of dread disease occurred in time interval , and , enabling the use of a more expensive and more complete diagnosis. Sometimes, the single cash payment is replaced by a series of payments (the annuity payable for period if the insured is terminally ill at time , i.e. ) conditional on the survival of the insured.

Moreover, let denote the benefit payable at time if the insured person’s death occurred in time interval , and , before the end of the insurance contract.

Let be the pure endowment benefit payable at time if the insured person is still alive at that time (i.e. ).

We combine DD insurance for with life insurance and analyse the following cases:

- Case 1

-

Additional lump sum DD benefit for -year temporary life insurance

( and ) - Case 2

-

Additional annuity DD benefit for -year temporary life insurance

( for , and ) - Case 3

-

Additional lump sum DD benefit for -year endowment insurance

(, , )

The premiums for the described cases, depending on sex of the insured person, are presented in Table 3.

| Premium | ||||||||

|---|---|---|---|---|---|---|---|---|

| Sex | Woman | Man | Woman | Man | Woman | Man | Woman | Man |

| Case 1 | 0.11610 | 0.23865 | 0.00544 | 0.01175 | 0.00543 | 0.01173 | 0.00543 | 0.01172 |

| Case 2 | 0.10918 | 0.22599 | 0.00511 | 0.01113 | 0.00511 | 0.01111 | 0.00510 | 0.01110 |

| Case 3 | 0.79813 | 0.81671 | 0.03736 | 0.04021 | 0.03733 | 0.04015 | 0.03731 | 0.04010 |

Note that replacement of the single cash payment (Case 1) with a series of payments (Case 2) relatively reduces premiums by about for both females and for males.

5 Discussion

Combination of life insurance contract and supplementary insurances leads to complex protecting packages. The model considered in this paper also allows to incorporate options related to the health status of the insured, such as disability or permanent inability to work. Additionally, it is possible to use the part of the extended multiple state model concerning the population of those suffering from lung cancer with metastasis (e.g. states ) to derive the value of viatical settlement payments under the condition that the insured person is at state .

The matrix approach to valuation of insurance contracts can be used for other insurance contracts which are modelled by the multiple state model. In particular, it can be useful for a general buy-back accelerated critical illness model presented in [1]. Moreover, using the same ideas as in the proof of Theorem 1 combined with the Dijkstra’s algorithm, one can determine the value of annuity paid in any subset of states belonging to the state space (for marriage insurance or marriage revers annuity contracts).

Numerical analysis of insurance risk for lung cancer shows a significant impact of gender for the calculation of premium. Due to the high mortality rate of people suffering from lung cancer disease, there is very little cost difference between contracts paid according to the scenario when premiums are paid only by a healthy insured and the scenario when premiums are paid independently of the health status of the insured (just by a living person).

References

- [1] Brink, A. (2010). Practical example of split benefit accelerated Critical Illness insurance product. In Transitions of the 29th International Congress of Actuaries Cape Town, South Africa, p.677-703.

- [2] Dash A., Grimshaw D. (1993) Dread Disease cover - an actuarial perspective. Journal of the Staple Inn Actuarial Society, Vol. 33, p. 149-193.

- [3] Data base of histories of hospitalization from Lower Silesia Department of National Health Fund - unpublished due to confidentially.

- [4] Dȩbicka, J. (2003) Moments of the cash value of future payment streams arising from life insurance contracts, Insurance: Mathematics and Economics, 33, p. 533-550.

- [5] Dȩbicka J. (2013) An approach to the study of multistate insurance contracts. Applied Stochastic Models in Bussines and Industry Vol. 29, Issue 3, p. 224-240.

- [6] Dȩbicka J., Zmyślona, B. Modelling of lung cancer survival data for critical illness insurances. Manuscript available at arXiv:1602.08696.

- [7] Dijkstra E. W. (1959) A note on two problems in connexion with graphs. Numerische Mathematik, 1, p. 269 271

- [8] Frees E.W. (1990) Stochastic life contingencies with solvency considerations. Transactions of the Society of Actuaries, XLII , p. 91-148.

- [9] Haberman S., Pitacco E. (1999) Actuarial Models for Disability Insurance, Chapman & Hall/CRC.

- [10] Hoem J.M. (1969) Markov Chain Models in Life Insurance, Blätter der Deutschen Gesellschaft für Versicherungsmathematik, Vol. IX, p. 91-107.

- [11] Hoem J.M. (1988) The Versality of the Markov Chain as a Tool in the Mathematics of Life Insurance, Transactions of the 23rd International Congress of Actuaries, Helsinki, Vol. R, p.171-202.

- [12] Parker, G. (1994) Stochastic Analysis of Portfolio of Endowment Insurance Policies, Scandinavian Actuarial Journal, 77 (2), p. 119-130.

- [13] Pittaco E. (1994) LTC insurance. From the multistate model to practical implementations. Proceedings of the XXV ASTIN Colloquium, Cannes, Frances. p. 437-452.

- [14] Pitacco E. (2014) Health Insurance. Basic Actuarial Models., EAA Series, Springer.

- [15] Life Tables of Poland 2008. Available at www.stat.gov.pl/en/topics/population/life-expectancy/

- [16] Waters H.R. (1984) An approach to the study of multiple state models, Journal Institute of Actuaries, Vol. 111, Part II, No. 448, p. 363-374.

- [17] Wojciechowska U., Didkowska J. (2014) Zachorowania i zgony na nowotwory z o liwe w Polsce. Krajowy Rejestr Nowotwor w, Centrum Onkologii - Instytut im. Marii Sk odowskiej - Curie. Available at: www.onkologia.org.pl/raporty/ (date 10.04.2014).

- [18] Wolthuis H. (1994) Life insurance mathematics (The Markovian model), CAIRE Education Series, No. 2, Bruxelles.