On the tail behavior of a class of multivariate conditionally heteroskedastic processes

Abstract

Conditions for geometric ergodicity of multivariate autoregressive conditional heteroskedasticity (ARCH) processes, with the so-called BEKK (Baba, Engle, Kraft, and Kroner) parametrization, are considered. We show for a class of BEKK-ARCH processes that the invariant distribution is regularly varying. In order to account for the possibility of different tail indices of the marginals, we consider the notion of vector scaling regular variation (VSRV), closely related to non-standard regular variation. The characterization of the tail behavior of the processes is used for deriving the asymptotic properties of the sample covariance matrices.

AMS 2010 subject classifications: 60G70, 60G10, 60H25, 39A50.

Keywords and phrases: Stochastic recurrence equations, Markov processes, regular variation, multivariate ARCH, asymptotic properties, geometric ergodicity.

1 Introduction

The aim of this paper is to investigate the tail behavior of a class of multivariate conditionally heteroskedastic processes. Specifically, we consider the BEKK-ARCH (or BEKK(1,0,)) process, introduced by Engle and Kroner (1995), satisfying

| (1.1) | |||||

| (1.2) |

with , , a positive definite matrix, (the set of real matrices), and some initial value . Due to the assumption that is Gaussian, it holds that can be written as the stochastic recurrence equation (SRE)

| (1.3) |

with

| (1.4) |

and is an process mutually independent of for , with . Moreover is an process with mutually independent of for all .

To our knowledge, the representation in (1.3)-(1.4) of the BEKK-ARCH process is new. Moreover, the representation will be crucial for studying the stochastic properties of the process. Firstly, we find a new sufficient condition in terms of the matrices in order for to be geometrically ergodic. In particular, for the case , we derive a condition directly related to the eigenvalues of , in line with the strict stationarity condition found by Nelson (1990) for the univariate ARCH(1) process. This condition is milder compared to the conditions found in the existing body of literature on BEKK-type processes. Secondly, the representation is used to characterize the tails of the stationary solution to .

Whereas the tail behavior of univariate GARCH processes is well-established, see e.g. Basrak et al. (2002b), few results on the tail behavior of multivariate GARCH processes exist. Some exceptions are the multivariate constant conditional correlation (CCC) GARCH processes, see e.g. Stărică (1999), Pedersen (2016), and Matsui and Mikosch (2016), and a class of factor GARCH processes, see Basrak and Segers (2009). This existing body of literature relies on rewriting the (transformed) process on companion form that obeys a non-negative multivariate SRE. The characterization of the tails of the processes then follows by an application of Kesten’s Theorem (Kesten (1973)) for non-negative SREs. Such approach is not feasible when analyzing BEKK-ARCH processes, as these are stated in terms of an -valued SRE in (1.3). For some special cases of the BEKK-ARCH process, we apply existing results for -valued SREs in order to show that the stationary distribution for the BEKK-ARCH process is multivariate regularly varying. Specifically, when the matrix in (1.4) is invertible (almost surely) and has a law that is absolutely continuous with respect to the Lebesgue measure on (denoted ID BEKK-ARCH) we argue that the classical results of Kesten (1973, Theorem 6), see also Alsmeyer and Mentemeier (2012), apply. Moreover, when is the product of a positive scalar and a random orthogonal matrix (denoted Similarity BEKK-ARCH) we show that the results of Buraczewski et al. (2009) apply. Importantly, we do also argue that the results of Alsmeyer and Mentemeier (2012) rely on rather restrictive conditions that can be shown not to hold for certain types of BEKK-ARCH processes, in particular the much applied process where and is diagonal, denoted Diagonal BEKK-ARCH. Specifically, and as ruled out in Alsmeyer and Mentemeier (2012), we show that the Diagonal BEKK-ARCH process exhibits different marginal tail indices, i.e. as for some constant , (denoted Condition M). In order to analyze this class of BEKK-ARCH processes, where the tail indices are allowed to differ among the elements of , we introduce a new notion of vector scaling regular variation (VSRV) distributions, based on element-wise scaling of instead of scaling by an arbitrary norm of . We emphasize that the notion of VSRV is similar to the notion of non-standard regular variation (see Resnick (2007, Chapter 6)) under the additional Condition M. In addition, in the spirit of Basrak and Segers (2009), we introduce the notion of VSRV processes with particular attention to Markov chains and characterize their extremal behavior. We argue that the stationary distribution of the Diagonal BEKK-ARCH process is expected to be VSRV, which is supported in a simulation study. Proving that the VSRV property applies requires that new multivariate renewal theory is developed, and we leave such task for future research.

The rest of the paper is organized as follows. In Section 2, we state sufficient conditions for geometric ergodicity of the BEKK-ARCH process and introduce the notion of vector-scaling regular varying (VSRV) distributions. We show that the distribution of satisfies this type of tail-behavior, under suitable conditions. In Section 3 we introduce the notion of VSRV processes and state that certain BEKK-ARCH processes satisfy this property. Moreover, we consider the extremal behavior of the process, in terms of the asymptotic behavior of maxima and extremal indices. Lastly, we consider the convergence of point processes based on VSRV processes. In Section 4, we consider the limiting distribution of the sample covariance matrix of , which relies on point process convergence. Section 5 contains some concluding remarks on future research directions.

Notation: Let denote the set of invertible real matrices. With the set of real matrices and , let denote the spectral radius of . With denoting the Kronecker product, for any real matrix let ( factors). For two matrices, and , of the same dimension, denotes the elementwise product of and . Unless stated otherwise, denotes an arbitrary matrix norm. Moreover, . For two matrices and of the same dimensions, means that for some . For two positive functions and , , if . Let denote the distribution of . By default, the mode of convergence for distributions is weak convergence.

2 Stationary solution of the BEKK-ARCH model

2.1 Existence and geometric ergodicity

We start out by stating the following theorem that provides a sufficient condition for geometric ergodicity of the BEKK-ARCH process. To our knowledge, this result together with Proposition 2.3 below are new.

Theorem 2.1.

The proof of the theorem follows by (Alsmeyer, 2003, Theorems 2.1-2.2, Example 2.6.d, and Theorem 3.2) and is hence omitted.

Remark 2.2.

A sufficient condition for the existence of finite higher-order moments of can be obtained from Theorem 5 of Feigin and Tweedie (1985). In particular, if for some , then, for the strictly stationary solution, . For example, implies that . This result complements Theorem C.1 of Pedersen and Rahbek (2014) that contains conditions for finite higher-order moments for the case .

For the case where contains only one term, i.e. , the condition in (2.1) simplifies and a condition for geometric ergodicity can be stated explicitly in terms of the eigenvalues of the matrix :

Proposition 2.3.

Proof.

Remark 2.4.

It holds that . Hence the condition in (2.2) is equivalent to

which is similar to the strict stationary condition found for the

ARCH coefficient of the univariate ARCH(1) process with

Gaussian innovations; see Nelson (1990).

Boussama

et al. (2011) derive sufficient conditions for geometric ergodicity of the GARCH-type BEKK process, where , . Specifically, they show that a sufficient condition is . Setting and , this condition simplifies to , which is stronger than the condition derived in (2.2).

Below, we provide some examples of BEKK-ARCH processes that are geometrically ergodic and that will be studied in detail throughout this paper.

Example 2.5 (ID BEKK-ARCH).

Following Alsmeyer and Mentemeier (2012), we consider BEKK processes with corresponding SRE’s satisfying certain irreducibility and density conditions (ID), that is conditions (A4)-(A5) in Section A.1 in the appendix. Specifically, we consider the bivariate BEKK-ARCH process in (1.1)-(1.2) with

where

| (2.12) |

and

| (2.13) |

Writing as an SRE, we obtain

| (2.14) |

with

| (2.15) |

where are mutually independent i.i.d. processes with . Assuming that are such that the top Lyapunov exponent of is strictly negative, we have that the process is geometrically ergodic.

Notice that one could consider a more general -dimensional process with the same structure as in (2.12)-(2.15), but with containing terms such that has a Lebesgue density on , as clarified in Example 2.10 below. Moreover, one could include additional terms to , say a term containing a full matrix or an autoregressive term, as presented in Remark 2.8 below. We will focus on the simple bivariate process, but emphasize that our results apply to more general processes.

Example 2.6 (Similarity BEKK-ARCH).

Consider the BEKK process in (1.1)-(1.2) with and , where is a positive scalar and is an orthogonal matrix. This implies that the SRE (1.3) has . By definition, is a similarity with probability one, where we recall that a matrix is a similarity if it can be written as a product of a positive scalar and an orthogonal matrix. From Proposition 2.3, we have that if , then the process is geometrically ergodic. An important process satisfying the similarity property is the well-known scalar BEKK-ARCH process, where , . Here , with the identity matrix.

Example 2.7 (Diagonal BEKK-ARCH).

Consider the BEKK-ARCH process in (1.1)-(1.2) with such that is diagonal. We refer to this process as the Diagonal BEKK-ARCH process. Relying on Proposition 2.3, the process is geometrically ergodic, if each diagonal element of is less than in modulus.

As discussed in Bauwens et al. (2006), diagonal BEKK models are typically used in practice, e.g. within empirical finance, due to their relatively simple parametrization. As will be shown below, even though the parametrization is simple, the tail behavior is rather rich in the sense that each marginal of has different tail indices, in general.

Remark 2.8.

As an extension to (1.1)-(1.2), one may consider the autoregressive BEKK-ARCH (AR BEKK-ARCH) process

with . This process has recently been studied and applied by Nielsen and Rahbek (2014) for modelling the term structure of interest rates. Notice that the process has the SRE representation

Following the arguments used for proving Theorem 2.1, it holds that the AR BEKK-ARCH process is geometrically ergodic if condition (2.1) is satisfied. Interestingly, as verified by simulations in Nielsen and Rahbek (2014) the Lyapunov condition may hold even if the autoregressive polynomial has unit roots, i.e. if , where has reduced rank.

2.2 Multivariate regularly varying distributions

The stationary solution of the BEKK-ARCH process (see Theorem 2.1) can be written as

| (2.16) |

Even if the random matrices are light-tailed under the Gaussian assumption, the maximum of the products may exhibit heavy tails when . More precisely, the tails of the stationary distribution are suspected to have an extremal behavior as a power law function: For any ,

| (2.17) |

with and for some . The cases where and for all are referred as Kesten’s cases, because of the seminal paper Kesten (1973), and are the subject of the monograph by Buraczewski et al. (2016). A class of multivariate distributions satisfying this property is the class of multivariate regularly varying distributions (de Haan and Resnick (1977)):

Definition 2.9.

Let , , and be the Borel -field of . For an -valued random variable and some constant scalar , define . Then and its distribution are multivariate regularly varying if there exists a non-null Radon measure on which satisfies

| (2.18) |

For any -continuity set and , , and we refer to as the index of regular variation.

We refer to de Haan and Resnick (1977) for the notion of vague convergence and additional details. Below, we provide two examples of multivariate regularly varying BEKK processes.

Example 2.10 (ID BEKK-ARCH, continued).

Consider the ID BEKK-ARCH process (2.12)-(2.15) from Example 2.5. By verifying conditions (A1)-(A7) of Theorem 1.1 of Alsmeyer and Mentemeier (2012), stated in Section A.1 in the appendix, we establish that the process is multivariate regularly varying.

Since and are Gaussian, we have that (A1)-(A2) hold. Moreover,

| (2.21) |

is invertible with probability one, which ensures that (A3) is satisfied. From (2.21) we also notice that the distribution of has a Lebesgue density on which is strictly positive in a neighborhood of . This ensures that the irreducibility and density conditions (A4)-(A5) are satisfied. The fact that and independent of implies that condition (A6) holds. Lastly, condition (A7) holds by the fact that and are Gaussian. By Theorem 1.1 of Alsmeyer and Mentemeier (2012) we have established the following proposition:

Proposition 2.11.

The proposition implies that each marginal of the distribution of is regularly varying of order . By Theorem 1.1.(ii) of Basrak et al. (2002a), we conclude that is multivariate regularly varying whenever is a non-integer. Moreover, since is symmetric, the multivariate regular variation does also hold if is an odd integer, see Remark 4.4.17 in Buraczewski et al. (2016).

The proposition does also apply if or . This can be seen by observing that has a strictly positive density on for sufficiently large, which is sufficient for establishing conditions (A4)-(A5).

Example 2.12 (Similarity BEKK-ARCH, continued).

The Similarity BEKK-ARCH, introduced in Example 2.6, fits into the setting of Buraczewski et al. (2009), see also Section 4.4.10 of Buraczewski et al. (2016). Specifically, using the representation , we have that

-

(i)

if ,

-

(ii)

for any , and

-

(iii)

has a non-arithmetic distribution.

Then, due to Theorem 1.6 of Buraczewski et al. (2009), we have the following proposition:

In the following example, we clarify that the Diagonal BEKK-ARCH process, introduced in Example 2.7, does not satisfy the conditions of Theorem 1.1 of Alsmeyer and Mentemeier (2012). Moreover, we argue that the marginals may have different tail indices, which motivates the notion of vector scaling regular variation, introduced in the next section.

Example 2.14 (Diagonal BEKK-ARCH, continued).

Consider the diagonal BEKK-ARCH process in Example 2.7, i.e. (1.1)-(1.2) with such that is diagonal, , and . For this process, the distribution of is too restricted to apply the results by Alsmeyer and Mentemeier (2012), as in Example 2.10. Specifically, the irreducibility condition (A4) in Appendix A.1 can be shown not to hold, as clarified next. It holds that

Hence for any we can always find a non-empty open such that

| (2.23) |

As an example, for , choose . Then for any . We conclude that condition (A4) does not hold for the diagonal BEKK-ARCH process.

Note that, each element of of the diagonal BEKK-ARCH process can be written as an SRE,

By Theorem 4.1 of Goldie (1991), the stationary solution of the marginal equation exists if and only if . In that case there exists a unique such that and

Hence each marginal of may in general have different tail indices. More precisely, the tail indices are different if the diagonal elements of , i.e. the s, are, and the heaviest marginal tail index corresponds to the largest diagonal coefficient . When is unique, i.e. for all except , the distribution can be considered as multivariate regularly varying with index and with a limit measure with degenerate marginals .

2.3 Vector scaling regularly varying distributions

The previous Example 2.14 shows that the Diagonal BEKK-ARCH process fits into the case where in (2.17) is non-constant. Such cases have not attracted much attention in the existing body of literature. However, recent empirical studies, such as Matsui and

Mikosch (2016), see also Damek

et al. (2017), may suggest that it is more realistic to consider different marginal tail behaviors when modelling multidimensional financial observations. The idea is to use a vector scaling instead of the scaling in Definition 2.9 that reduced the regular variation properties of the vector to the regular variation properties of the norm only. More precisely, let be a stationary process in and let . Denote also .

In our framework, we consider distributions satisfying the following condition:

- Condition M

-

Each marginal of is regularly varying of order . The slowly varying functions as , .

Indeed, the Diagonal BEKK-ARCH process introduced in Example 2.14 satisfies Condition M. Moreover, any regularly varying distribution satisfying the Kesten property (2.17) satisfies Condition M. In particular, the ID and Similarity BEKK-ARCH processes, introduced in Examples 2.5 and 2.6 respectively, satisfy Condition M.

We introduce the notion of vector scaling regular variation as the nonstandard regular variation of the book of Resnick (2007) under Condition M, extended to negative components (Resnick, 2007, Sections 6.5.5-6.5.6):

Definition 2.15.

The distribution of the vector is vector scaling regularly varying (VSRV) if and only if it satisfies Condition M and it is non-standard regularly varying, i.e. there exists a normalizing sequence and a Radon measure with non-null marginals such that

| (2.24) |

The usual way of analyzing non-standard regularly varying vectors is to consider a componentwise normalization that is standard regularly varying in the sense of Definition 2.9. Specifically, when satisfies Definition 2.15, satisfies Definition 2.9 with index one. Throughout we find it helpful to focus on the non-normalized vector in order to preserve the multiplicative structure of the tail chain introduced in Section 3.2 below, which is used for analyzing the extremal properties of VSRV processes.

In the following proposition we state the VSRV vector has a polar decomposition. In the case where Condition M is not satisfied, note that the polar decomposition holds on a transformation of the original process. Under Condition M, the natural radius notion is , where

| (2.25) |

Notice that the homogeneity of , due to Condition M, will be essential for the proof.

Proposition 2.16.

Suppose that the vector satisfies Condition M. Then is VSRV if and only if there exists a tail vector with non-degenerate marginals such that

| (2.26) |

where is defined in (2.25). Moreover, is standard Pareto distributed.

Notice that a similar vector scaling argument has been introduced in Lindskog et al. (2014).

Proof.

Adapting Theorem 4 of de Haan and Resnick (1977), the definition of vector scaling regularly varying distribution of in (2.24) implies (2.26). Conversely, under Condition M, we have that is regularly varying of order 1 for all with slowly varying functions . Moreover is regularly varying from the weak convergence in (2.26) applied on the Borel sets , . Thus, is regularly varying of order 1 with slowly varying function . One can rewrite (2.26) as

Using the slowly varying property of , we obtain, for any ,

Then by marginal homogeneity of ,

Notice that is non-increasing as it is the tail of . So there exists a change of variable so that and

We obtain the existence of for in (2.24) such that , which is enough to characterize entirely, choosing arbitrarily small. ∎

The spectral properties of VSRV can be expressed in terms of the tail vector . Notice that for any , there exists satisfying

Consider , where and for and , . If is non-null, by a continuous mapping argument, satisfies

| (2.27) |

and is regularly varying of index 1. By homogeneity of the limiting measure in the multivariate regular variation (2.18), we may decompose the limit as a product

for any . Such limiting distribution is called a simple max-stable distribution, and , supported by the positive orthant, is called the spectral measure of , see de Haan and Resnick (1977) for more details. By identification of the two expressions of the same limit, we obtain the following proposition.

Proposition 2.17.

With defined in Proposition 2.16, the distribution of , if non-degenerate, is the spectral measure of . Moreover, it is independent of , and is standard Pareto distributed.

Proof.

Example 2.18 (Diagonal BEKK-ARCH, continued).

We have not been able to establish the existence of satisfying (2.26), except the case of the scalar BEKK-ARCH where the diagonal elements of are identical. In this case the process is a special case of the Similarity BEKK-ARCH, see Example 2.6. Even in this case, the characterization of the spectral distribution is not an easy task because of the diagonality of , ruling out Theorem 1.4 of Buraczewski et al. (2009). In Section A.2 in the appendix we have included some estimates of the spectral measure of for the bivariate case. The plots suggest that the tails of the process are indeed dependent. We emphasize that new multivariate renewal theory should be developed in order to prove that the Diagonal-ARCH model is VSRV. We leave such task for future research.

3 Vector-scaling regularly varying time series and their extremal behavior

The existence of the tail vector in Proposition 2.16 allows us to extend the asymptotic results of Perfekt (1997) to VSRV vectors taking possibly negative values. In order to do so, we use the notion of tail chain from Basrak and Segers (2009) adapted to VSRV stationary sequences with eventually different tail indices.

3.1 Vector scaling regularly varying time series

We introduce a new notion of multivariate regularly varying time series based on VSRV of .

Definition 3.1.

The stationary process is VSRV if and only if there exists a process , with non-degenerate marginals for , such that

for all . The sequence is called the tail process.

Following Basrak and Segers (2009), we extend the notion of spectral measure to the one of spectral processes for any VSRV stationary process:

Definition 3.2.

The VSRV stationary process admits the spectral process if and only if

for all .

By arguments similar to the ones in the proof of Proposition 2.17, it follows that the VSRV properties also characterize the spectral process of , with following the stationary distribution, which has the distribution of . We have the following proposition.

Proposition 3.3.

For a VSRV stationary process , where has non-degenerate marginals and is standard Pareto distributed, the spectral process of any non-degenerate is distributed as and independent of . Moreover is standard Pareto distributed.

3.2 The tail chain

In the following, we will focus on the dynamics of the tail process in Definition 3.1, given the existence of . We will restrict ourselves to the case where is a Markov chain, which implies that is also a Markov chain called the tail chain; see Perfekt (1997). We have the following proposition.

Proposition 3.4.

Proof.

Following the approach of Janssen and Segers (2014), one first notices that the existence of the kernel of the tail chain does not depend on the marginal distribution. Thus the characterization of the kernel extends automatically from the usual multivariate regular variation setting to the vector scaling regular variation one. It is straightforward to check Condition 2.2 of Janssen and Segers (2014). We conclude that the tail chain has the multiplicative structure in (3.1). ∎

The tail chain for VSRV process satisfying (1.1)-(1.2) is the same no matter the values of the marginal tail indices; for the multivariate regularly varying case with common tail indices it coincides with the tail chain of Janssen and Segers (2014) under Condition M. Notice that we can extend the tail chain backward in time () using Corollary 5.1 of Janssen and Segers (2014).

3.3 Asymptotic behavior of the maxima

From the previous section, we have that the tail chain quantifies the extremal behavior of in (1.1)-(1.2). Let us consider the asymptotic behavior of the component-wise maxima

Let and assume that is positive. Recall that for , the suitably scaled maxima converge to the Fréchet distribution; see de Haan and Resnick (1977), i.e. for any , defining such that , , we have

if and only if is vector scaling regularly varying. In such case, due to Condition M, we have the expression

| (3.2) |

Let us assume the following Condition, slightly stronger than (2.1):

| (3.3) |

Theorem 3.5.

Proof.

We verify the conditions of Theorem 4.5 of Perfekt (1997). Condition B2 of Perfekt (1997) is satisfied under the more tractable Condition 2.2 of Janssen and Segers (2014). Indeed, the tail chain depends only on the Markov kernel and one can apply Lemma 2.1 of Janssen and Segers (2014), because it extends immediately to the vector scaling regularly varying setting. Condition of Perfekt (1997) holds by geometric ergodicity of the Markov chain for a sequence , with sufficiently large. Lastly, the finite clustering condition,

| (3.5) |

holds for any using the same reasoning as in the proof of Theorem 4.6 of Mikosch and Wintenberger (2013) under the drift condition (DCp) for some . As is also standard regularly varying, actually the drift condition holds thanks to Condition (3.3) on some sufficiently large iterations of the Markov kernel. Finally, as (3.5) is a special case of Condition of Perfekt (1997), we obtain the desired result with the characterization given in Theorem 4.5 of Perfekt (1997)

where is the tail chain of the standardized Markov chain , . As restricted to is the distribution of , we assume that for all so that we identify as the distribution of

Thus we have

To obtain an expression that is valid for any , we exploit the homogeneity property, and we obtain

because is standard Pareto distributed and independent of the spectral process . This expression is homogeneous and extends to any possible by homogeneity. ∎

3.4 Extremal indices

As the random coefficients in (1.4) may be large, consecutive values of can be large. In the univariate case, one says that the extremal values appear in clusters. An indicator of the average length of the cluster is the inverse of the extremal index, an indicator of extremal dependence; see Leadbetter et al. (1983).

Thus, the natural extension of the extremal index is the function

, with and defined in (3.2) and (3.4), respectively.

Notice that there is no reason why should not depend on . When , for , we have the more explicit expression in terms of the spectral process,

| (3.6) |

However, the extremal index of the marginal index is still well-defined. It depends on the complete dependence structure of the multivariate Markov chain thanks to the following proposition:

Proposition 3.6.

Proof.

Example 3.7 (Diagonal BEKK-ARCH, continued).

Suppose that is VSRV as conjectured in Example 2.18. It follows from the tail chain approach of Janssen and Segers (2014) that the stationary Markov chain is regularly varying. Thanks to the diagonal structure of the matrices , one can factorize in the expression of provided in Proposition 3.6. Since and are independent for , we recover a similar expression as in the remarks after Theorem 2.1 in de Haan et al. (1989):

We did not manage to provide a link between the and the extremal index of the (multivariate) stationary solution of the Diagonal BEKK-ARCH. Due to the different normalising sequences in the asymptotic extremal result given in Theorem 3.5, the extremal index depends on the constants . For , , the expression (3.6) gets more simple because is standard Pareto distributed and supported on :

One can check that where satisfies , so that is the marginal with smallest tail and extremal indices. Thus the inverse of the extremal index of the multidimensional Diagonal BEKK-ARCH is not larger than the largest average length of the marginals clusters. It can be interpreted as the fact that the largest clusters are concentrated along the axis, following the interpretation of the multivariate extremal index given on p. 423 of Beirlant et al. (2006).

3.5 Convergence of point processes

Let us consider the vector scaling point process on

| (3.7) |

We want to characterize the asymptotic distribution of the point process when . We refer to Resnick (2007) for details on the convergence in distribution for random measures. In order to characterize the limit, we adapt the approach of Davis and Hsing (1995) to the multivariate VSRV case similar to Davis and Mikosch (1998). The limit distribution will be a cluster point process admitting the expression

| (3.8) |

where , , are arrival times of a standard Poisson process, and , , are mutually independent cluster processes. Following Basrak and Tafro (2016), we use the back and forth tail chain to describe the cluster process: Consider the process , satisfying

which is well defined when the anti-clustering condition (3.5) is satisfied. Then we have

with . Notice that the use of the pseudo-norm and the fact that is standard Pareto are crucial to mimic the arguments of Basrak and Tafro (2016). The limiting distribution of the point process coincides with the one of :

Theorem 3.8.

Proof.

Let us denote the operator , , applied coordinatewise to vectors in . We apply Theorem 2.8 of Davis and Mikosch (1998) to the transformed process which is standard regularly varying of order 1. In order to do so, one has to check that the anti-clustering condition (3.5) is satisfied and that the cluster index of its max-norm is positive. This follows from arguments developed in the proof of Theorem 3.5. The mixing condition of Davis and Mikosch (1998) is implied by the geometric ergodicity of . Thus, the limiting distribution of the point process coincides with the one of the cluster point process for some cluster process . A continuous mapping argument yields the convergence of to . The limiting cluster process coincide with in distribution thanks to the definition of VSRV processes. ∎

4 Sample covariances

In this section, we derive the limiting distribution of the sample covariances for certain BEKK-ARCH processes. Consider the sample covariance matrix,

Let denote the half-vectorization operator, i.e. for a matrix , . The derivation of the limiting distribution of the sample covariance matrix relies on using the multidimensional regularly varying properties of the stationary process . Let denote the normalization matrix,

Using Theorem 3.8 and adapting the continuous mapping argument of Proposition 3.1 of Davis and Mikosch (1998) yield the following result.

Proposition 4.1.

Let us define and assume that and for all . Note that is a candidate for the tail index of the cross product and that , . Actually it is the case under some extra assumptions ensuring that the product is non null, see Proposition 7.6 of Resnick (2007). In line with Theorem 3.5 of Davis and Mikosch (1998), we then get our main result on the asymptotic behavior of the empirical covariance matrix

Theorem 4.2.

When Theorem 4.2 applies, as , the widest confidence interval on the covariance estimates is supported by the th marginal satisfying for all .

In order to apply Theorem 4.2, the main difficulty is to show that the condition (4.1) holds. However, notice that Theorem 4.2 applies simultaneously on the cross-products with with no extra assumption. Next, we apply Theorem 4.2 to the ongoing examples.

Example 4.3 (Diagonal BEKK-ARCH, continued).

Consider the diagonal BEKK-ARCH process and the cross products for some and any . From Hölder’s inequality (which turns out to be an equality in our case), we have

Thus, , which is a function of the Markov chain , satisfies the drift condition (DCp) of Mikosch and Wintenberger (2013) for all . Then, one can show that (4.1) is satisfied using the same reasoning as in the proof of Theorem 4.6 of Mikosch and Wintenberger (2013).

Example 4.4 (Similarity BEKK-ARCH, continued).

If , the limiting distribution of the sample covariance matrix for the Similarity BEKK-ARCH follows directly from Theorem 4.2. If the additional condition (4.1) has to be checked. Relying on the same arguments as in Example 4.3, one would have to verify that the condition (DCp) of Mikosch and Wintenberger (2013) holds for the Similarity BEKK-ARCH process, which appears a difficult task as it requires to find a suitable multivariate Lyapunov function. We leave such task for future investigation. Consider the special case of the scalar BEKK-ARCH process introduced in Example 2.6. Here , with the identity matrix, such that is diagonal. In the case for a least some pair , the limiting distribution of the sample covariance is derived along the lines of Example 4.3. Specifically, this relies on assuming that such that a stationary solution exists, and noting that the index of regular variation for each marginal of is given by satisfying .

Example 4.5 (ID BEKK-ARCH, continued).

The previous examples are important in relation to variance targeting estimation of the BEKK-ARCH model, as considered in Pedersen and Rahbek (2014). For the univariate GARCH process, Vaynman and Beare (2014) have shown that the limiting distribution of the (suitably scaled) variance targeting estimator follows a singular stable distribution when the tail index of the process lies in . We expect a similar result to hold for the BEKK-ARCH process.

5 Concluding remarks

We have found a mild sufficient condition for geometric ergodicity of a class of BEKK-ARCH processes. By exploiting the the processes can be written as a multivaraite stochastic recurrence equation (SRE), we have investigated the tail behavior of the invariant distribution for different BEKK-ARCH processes. Specifically, we have demonstrated that existing Kesten-type results apply in certain cases, implying that each marginal of the invariant distribution has the same tail index. Moreover, we have shown for certain empirically relevant processes, existing renewal theory is not applicable. In particular, we show that the Diagonal BEKK-ARCH processes may have component-wise different tail indices. In light of this property, we introduce the notion of vector scaling regular varying (VSRV) distributions and processes. We study the extremal behavior of such processes and provide results for convergence of point processes based on VSRV processes. It is conjectured, and supported by simulations, that the Diagonal BEKK-ARCH process is VSRV. However, it remains an open task to verify formally that the property holds. Such task will require the development of new multivariate renewal theory.

Our results are expected to be important for future research related to the statistical analysis of the Diagonal BEKK-ARCH model. As recently shown by Avarucci et al. (2013), the (suitably scaled) maximum likelihood estimator for the general BEKK-ARCH model (with ) does only have a Gaussian limiting distribution, if the second-order moments of is finite. In order to obtain the limiting distribution in the presence of very heavy tails, i.e. when , we believe that non-standard arguments are needed, and in particular the knowledge of the tail-behavior is expected to be crucial for the analysis. We leave additional considerations in this direction to future research.

References

- Alsmeyer (2003) Alsmeyer, G. (2003): “On the Harris recurrence of iterated random Lipschitz functions and related convergence rate results,” Journal of Theoretical Probability, 16, 217–247.

- Alsmeyer and Mentemeier (2012) Alsmeyer, G. and S. Mentemeier (2012): “Tail behaviour of stationary solutions of random difference equations: The case of regular matrices,” Journal of Difference Equations and Applications, 18, 1305–1332.

- Avarucci et al. (2013) Avarucci, M., E. Beutner, and P. Zaffaroni (2013): “On moment conditions for quasi-maximum likelihood estimation of multivariate ARCH models,” Econometric Theory, 29, 545–566.

- Basrak et al. (2002a) Basrak, B., R. A. Davis, and T. Mikosch (2002a): “A characterization of multivariate regular variation,” The Annals of Applied Probability, 12, 908–920.

- Basrak et al. (2002b) ——— (2002b): “Regular variation of GARCH processes,” Stochastic Processes and their Applications, 99, 95–115.

- Basrak and Segers (2009) Basrak, B. and J. Segers (2009): “Regularly varying multivariate time series,” Stochastic Processes and their Applications, 119, 1055–1080.

- Basrak and Tafro (2016) Basrak, B. and A. Tafro (2016): “A complete convergence theorem for stationary regularly varying multivariate time series,” Extremes, 19, 549–560.

- Bauwens et al. (2006) Bauwens, L., S. Laurent, and J. V. K. Rombouts (2006): “Multivariate GARCH models: A survey,” Journal of Applied Econometrics, 21, 79–109.

- Beirlant et al. (2006) Beirlant, J., Y. Goegebeur, J. Segers, and J. L. Teugels (2006): Statistics of extremes: theory and applications, John Wiley & Sons.

- Boussama et al. (2011) Boussama, F., F. Fuchs, and R. Stelzer (2011): “Stationarity and geometric ergodicity of BEKK multivariate GARCH models,” Stochastic Processes and their Applications, 121, 2331–2360.

- Buraczewski et al. (2009) Buraczewski, D., E. Damek, Y. Guivarc’h, A. Hulanicki, and R. Urban (2009): “Tail-homogeneity of stationary measures for some multidimensional stochastic recursions,” Probability Theory and Related Fields, 145, 385–420.

- Buraczewski et al. (2016) Buraczewski, D., E. Damek, and T. Mikosch (2016): Stochastic Models with Power-Law Tails: The Equation X = AX + B, Springer Series in Operations Research and Financial Engineering, Springer International Publishing.

- Damek et al. (2017) Damek, E., M. Matsui, and W. Świątkowski (2017): “Componentwise different tail solutions for bivariate stochastic recurrence equations,” https://arxiv.org/abs/1706.05800.

- Davis and Hsing (1995) Davis, R. A. and T. Hsing (1995): “Point process and partial sum convergence for weakly dependent random variables with infinite variance,” The Annals of Probability, 879–917.

- Davis and Mikosch (1998) Davis, R. A. and T. Mikosch (1998): “The sample autocorrelations of heavy-tailed processes with applications to ARCH,” The Annals of Statistics, 26, 2049–2080.

- de Haan and Resnick (1977) de Haan, L. and S. I. Resnick (1977): “Limit theory for multivariate sample extremes,” Zeitschrift für Wahrscheinlichkeitstheorie und verwandte Gebiete, 40, 317–337.

- de Haan et al. (1989) de Haan, L., S. I. Resnick, H. Rootzén, and C. G. de Vries (1989): “Extremal behaviour of solutions to a stochastic difference equation with applications to ARCH processes,” Stochastic Processes and their Applications, 32, 213–224.

- Einmahl et al. (2001) Einmahl, J. H., L. de Haan, and V. I. Piterbarg (2001): “Nonparametric estimation of the spectral measure of an extreme value distribution,” The Annals of Statistics, 29, 1401–1423.

- Engle and Kroner (1995) Engle, R. F. and K. F. Kroner (1995): “Multivariate simultaneous generalized ARCH,” Econometric Theory, 11, 122–150.

- Feigin and Tweedie (1985) Feigin, P. and R. Tweedie (1985): “Random coefficient autoregressive processes: a Markov chain analysis of stationarity and finiteness of moments,” Journal of Time Series Analysis, 6, 1–14.

- Goldie (1991) Goldie, C. M. (1991): “Implicit renewal theory and tails of solutions of random equations,” The Annals of Applied Probability, 1, 126–166.

- Janssen and Segers (2014) Janssen, A. and J. Segers (2014): “Markov tail chains,” Journal of Applied Probability, 51, 1133–1153.

- Kesten (1973) Kesten, H. (1973): “Random difference equations and renewal theory for products of random matrices,” Acta Mathematica, 131, 207–248.

- Kulik et al. (2015) Kulik, R., P. Soulier, and O. Wintenberger (2015): “The tail empirical process of regularly varying functions of geometrically ergodic Markov chains,” https://arxiv.org/abs/1511.04903.

- Leadbetter et al. (1983) Leadbetter, M., G. Lindgren, and H. Rootzén (1983): Extremes and related properties of random sequences and processes, Springer series in statistics, Springer-Verlag.

- Lindskog et al. (2014) Lindskog, F., S. I. Resnick, and J. Roy (2014): “Regularly varying measures on metric spaces: Hidden regular variation and hidden jumps,” Probability Surveys, 11, 270–314.

- Matsui and Mikosch (2016) Matsui, M. and T. Mikosch (2016): “The extremogram and the cross-extremogram for a bivariate GARCH(1,1) process,” Advances in Applied Probability, 48, 217–233.

- Mikosch and Wintenberger (2013) Mikosch, T. and O. Wintenberger (2013): “Precise large deviations for dependent regularly varying sequences,” Probability Theory and Related Fields, 156, 851–887.

- Nelson (1990) Nelson, D. B. (1990): “Stationarity and persistence in the GARCH(1,1) model,” Econometric Theory, 6, 318–334.

- Nielsen and Rahbek (2014) Nielsen, H. B. and A. Rahbek (2014): “Unit root vector autoregression with volatility induced stationarity,” Journal of Empirical Finance, 29, 144–167.

- Pedersen (2016) Pedersen, R. S. (2016): “Targeting estimation of CCC-GARCH models with infinite fourth moments,” Econometric Theory, 32, 498–531.

- Pedersen and Rahbek (2014) Pedersen, R. S. and A. Rahbek (2014): “Multivariate variance targeting in the BEKK-GARCH model,” The Econometrics Journal, 17, 24–55.

- Perfekt (1997) Perfekt, R. (1997): “Extreme value theory for a class of Markov chains with values in ,” Advances in Applied Probability, 29, 138–164.

- Resnick (2007) Resnick, S. I. (2007): Heavy-tail phenomena: probabilistic and statistical modeling, Springer Science & Business Media.

- Segers (2005) Segers, J. (2005): “Generalized Pickands estimators for the extreme value index,” Journal of Statistical Planning and Inference, 128, 381–396.

- Stărică (1999) Stărică, C. (1999): “Multivariate extremes for models with constant conditional correlations,” Journal of Empirical Finance, 6, 515–553.

- Vaynman and Beare (2014) Vaynman, I. and B. K. Beare (2014): “Stable limit theory for the variance targeting estimator,” in Essays in Honor of Peter C. B. Phillips, ed. by Y. Chang, T. B. Fomby, and J. Y. Park, Emerald Group Publishing Limited, vol. 33 of Advances in Econometrics, chap. 24, 639–672.

Appendix A Appendix

A.1 Theorem 1.1 of Alsmeyer and Mentemeier (2012)

Consider the general SRE

| (A.1) |

with a sequence of i.i.d. random variables with generic copy such that is a real matrix and takes values in . Consider the following conditions of Alsmeyer and Mentemeier (2012):

-

•

(A1) , where denotes the operator norm.

-

•

(A2) .

-

•

(A3) .

-

•

(A4) for any and any non-empty open subset of .

-

•

(A5) Let denote the open -ball in and let denote the Lebesgue measure on . It holds that for any Borel set , for some , , and .

-

•

(A6) for any .

-

•

(A7) There exists such that

A.2 Estimation of the spectral measure for the bivariate diagonal BEKK-ARCH process

In this section we consider the estimation of the spectral measure of the diagonal BEKK-ARCH process presented in Example 2.14. Specifically, we consider a special case of the BEKK-ARCH process in (1.1)-(1.2), where :

with an process with independent of , and

Following the approach for i.i.d. sequences of vectors given in Einmahl et al. (2001), we consider the following estimator of the spectral measure of :

where denotes the rank of among , , i.e.

Here is a sequence satisfying and . Einmahl et al. (2001) showed that this estimator is consistent for i.i.d. series. We expect a similar result to hold for geometrically ergodic processes. The reason is that the asymptotic behavior of the empirical tail process used in Einmahl et al. (2001) has been extended to such cases in Kulik et al. (2015).

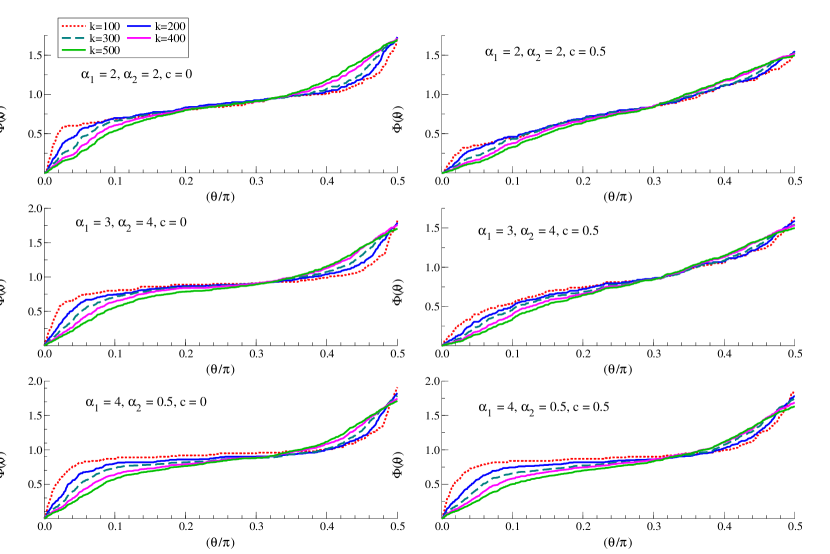

We consider the estimation of the spectral measure for different values of , , and . In particular, the matrix is

and the values and are determined according to choices of the tail indices of and , respectively. I.e. and satisfy and are determined by analytical integration. Specifically, with the pdf of the standard normal distribution,

Figure A.1 contains plots of the estimates of the spectral measure. The estimates are based on one realization of the process with 2,000 and a burn-in period of 10,000 observations.