Portfolio choice, portfolio liquidation, and portfolio transition under drift uncertainty††thanks: This research has been conducted with the support of the Research Initiative “Modélisation des marchés actions et dérivés” financed by HSBC France under the aegis of the Europlace Institute of Finance. The authors would like to thank Rama Cont (Imperial College), Nicolas Grandchamp des Raux (HSBC France), Charles-Albert Lehalle (CFM and Imperial College), Jean-Michel Lasry (Institut Louis Bachelier), Huyên Pham (Université Paris-Diderot), and Christopher Ulph (HSBC London) for the conversations they had on the subject.

Abstract

This paper presents several models addressing optimal portfolio choice, optimal portfolio liquidation, and optimal portfolio transition issues, in which the expected returns of risky assets are unknown. Our approach is based on a coupling between Bayesian learning and dynamic programming techniques that leads to partial differential equations. It enables to recover the well-known results of Karatzas and Zhao in a framework à la Merton, but also to deal with cases where martingale methods are no longer available. In particular, we address optimal portfolio choice, portfolio liquidation, and portfolio transition problems in a framework à la Almgren-Chriss, and we build therefore a model in which the agent takes into account in his decision process both the liquidity of assets and the uncertainty with respect to their expected return.

Key words: Optimal portfolio choice, Optimal execution, Optimal portfolio liquidation, Optimal portfolio transition, Bayesian learning, Online learning, Stochastic optimal control, Hamilton-Jacobi-Bellman equations.

1 Introduction

The modern theory of portfolio selection started in 1952 with the seminal

paper [34] of Markowitz.111Markowitz was awarded the Nobel Prize in 1990 for his work. For a

brief history of portfolio theory, see [35]. In his paper, Markowitz considered the problem of an agent who

wishes to build a portfolio with the maximum possible level of expected

return, given a limit level of variance. He then coined the concept

of efficient portfolio and described how to find such portfolios.

Markowitz paved the way for studying theoretically the optimal portfolio

choice of risk-averse agents. A few years after Markowitz’s

paper, Tobin published indeed his famous research work on the

liquidity preferences of agents and the separation theorem (see [45]), which is based

on the ideas developed by Markowitz. A few years later, in the sixties,

Treynor, Sharpe, Lintner, and Mossin introduced independently the

Capital Asset Pricing Model (CAPM) which is also built on top of the ideas of Markowitz. The ubiquitous notions of and owe a lot

therefore to Markowitz modern portfolio theory.

Although initially written within a mean-variance optimization framework,

the so-called Markowitz problem can also be written within the Von

Neumann-Morgenstern expected utility framework. This was for instance

done by Samuelson and Merton (see [36, 37, 42]),

who, in addition, generalized Markowitz problem by extending the

initial one-period framework to a multi-period one. Samuelson did it

in discrete time, whereas Merton did it in continuous time. It is

noteworthy that they both embedded the intertemporal portfolio choice

problem into a more general optimal investment/consumption problem.222This problem in continuous time is now referred to as Merton’s problem.

In [36], Merton used partial differential equation (PDE) techniques for characterizing the optimal consumption process of an agent and its

optimal portfolio choices. In particular, Merton managed to find closed-form

solutions in the constant absolute risk aversion (CARA) case (i.e., for exponential

utility functions), and in the constant relative risk aversion (CRRA) case

(i.e., for power and log utility functions). Merton’s problem has

then been extended to incorporate several features such as transaction

costs (proportional and fixed) or credit constraints. Major

advances to solve Merton’s problem in full generality have been

made in the eighties by Karatzas et al. using (dual) martingale

methods. In [26], Karatzas, Lehoczky, and Shreve

used a martingale method to solve Merton’s problem for almost any

smooth utility function and showed

how to partially disentangle the consumption maximization problem

and the terminal wealth maximization problem. Constrained problems

and extensions to incomplete markets were then considered –

see for instance the paper [11] by Cvitanić

and Karatzas.

In the literature on portfolio selection or in the slightly more general

literature on Merton’s problem, input parameters (for instance the

expected returns of risky assets) are considered known constants,

or stochastic processes with known initial values and dynamics. In

practice however, one cannot state for sure that price returns will

follow a given distribution. Uncertainty on model parameters is the

raison d’être of the celebrated Black-Litterman model (see [7]), which is built on top of Markowitz model and the CAPM. Nevertheless,

like Markowitz model, Black-Litterman model is a static one. In particular,

the agent of Black-Litterman model does not use empirical returns to dynamically

learn the distribution of asset returns.

Generalizations of optimal allocation models (or models dealing with Merton’s problem) involving filtering and learning techniques in a partial information framework have been proposed in the literature. The problems that are addressed are of three types depending on the assumptions regarding the drift: unknown constant drift (e.g. [10], [13], [28]), unobserved drift with Ornstein-Uhlenbeck dynamics (e.g. [8], [17], [32], [41]), and unobserved drift modelled by a hidden Markov chain (e.g. [9], [25], [40], [43]). In the different models, filtering (or learning) enables to estimate the unknown parameters from the dynamics of the prices, and sometimes also from additional information such as analyst views or expert opinions (see [14] and [18]) or inside information (see [13] and [38]).

Most models (see [6], [10], [13], [28], [29], [30], [38], [39]) use martingale (dual) methods to solve optimal allocation problems under partial information. For instance, in a framework similar to ours, Karatzas and Zhao [28] considered a model where the asset returns are Gaussian with unknown mean and they used martingale methods under the filtration of observables to compute, for almost any utility function, the optimal portfolio allocation (there is no consumption in their model).

Some models, like ours, use instead Hamilton-Jacobi-Bellman (HJB) equations and therefore PDE techniques. Rishel [41] proposed a model with one risky asset where the drift has an Ornstein-Uhlenbeck dynamics and solved the HJB equation associated with CRRA utility functions. Interestingly, it is one of the rare references to tackle the question of explosion when Bayesian filtering and optimization are carried out simultaneously. Brendle [8] generalized the results of [41] to a multi-asset framework and also considered the case of CARA utility functions. Fouque et al. [17] solved a related problem with correlation between the noise process of the price and that of the drift and used perturbation analysis to obtain approximations. Li et al. [32] also studied a similar problem with a mean-variance objective function. Rieder and Bäuerle [40] proposed a model with one risky asset where the drift is modelled by a hidden Markov chain and solved it with PDEs in the case of CRRA utility function.

Outside of the optimal portfolio choice literature, several authors proposed financial models in which both online learning and stochastic optimal control coexist. For instance, Laruelle et al. proposed in [31] a model in which an agent optimizes its execution strategy with limit orders and simultaneously learns the parameters of the Poisson process modelling the execution of limit orders. Interesting ideas in the same field of algorithmic trading can also be found in the work of Fernandez-Tapia (see [16]). An interesting paper is also that of Ekström and Vaicenavicius [15] who tackled the problem of the optimal time at which to sell an asset with unknown drift. Recently, Casgrain and Jaimungal [9] also used similar ideas for designing algorithmic trading strategies.

In this paper, we consider several problems of portfolio choice, portfolio liquidation, and portfolio transition in

continuous time in which the (constant) expected returns of the risky

assets are unknown but estimated online. In the first sections, we consider a multidimensional portfolio choice problem similar to the one

tackled by Karatzas and Zhao in [28] with a rather general Bayesian prior for the drifts (our family of priors includes compactly supported and Gaussian distributions).333It is noteworthy that this approach can be carried out in the frequentist case as well. For this problem, with general Bayesian prior, we derive HJB equations and show that, in the CARA and CRRA cases, these equations can be transformed into linear parabolic PDEs. The interest of the paper lies here in the fact that our framework is multidimensional and general in terms of possible priors. Moreover, unlike other papers, we provide a verification result and this is important in view of the explosion occurring for some couples of priors and utility functions. We then specify our results in the case of a Gaussian prior for the drifts and recover formulas already present in the literature (see [28] or limit cases of [8]). The Gaussian prior case is discussed in depth, (i) because the associated PDEs can be simplified into simple ODEs (at least for CARA and CRRA utility functions) that can be solved in closed form by using classical tricks, and (ii) because Gaussian priors provide examples of explosion: the problem may not be well posed in the CRRA case when the relative risk aversion parameter is too small.

The PDE approach is interesting in itself and we believe that it enables to avoid the laborious computations needed to simplify the general expressions of Karatzas and Zhao. However, our message is of course not limited to that one. The PDE approach

can indeed be used in situations where the (dual) martingale approach

cannot be used. In the last section of this paper, we use our approach to solve the optimal

allocation problem in a trading framework à la Almgren-Chriss. The Almgren-Chriss framework was initially

built for solving optimal execution problems (see [1, 2])

but it is also very useful outside of the cash-equity world. For instance,

Almgren and Li [3], and Guéant and Pu [22]

used it for the pricing and hedging of vanilla options when liquidity

matters.444Guéant et al. also used the Almgren-Chriss framework to tackle

the pricing, hedging, and execution issues of Accelerated Share

Repurchase contracts – see [20, 23]. The model we propose is one of the first models that uses the Almgren-Chriss

framework for addressing an asset management problem, and definitely the

first paper in this area in which the Almgren-Chriss framework is

used in combination with Bayesian learning techniques.555Almgren and Lorenz used Bayesian techniques in optimal execution (see

[4]), but they considered myopic agents with

respect to learning. We also show how our framework can be slightly modified for addressing optimal portfolio liquidation and transition issues.

This paper aims at proving that online learning – in our case on-the-fly Bayesian estimations – combined with stochastic

optimal control can be very efficient to tackle a lot of financial

problems. It is essential to understand that online learning is

a forward process whereas dynamic programming classically relies on

backward induction. By using these two classical tools

simultaneously, we do not only benefit from the power of online and Bayesian

learning to continuously learn the value of unknown parameters,

but we also develop a framework in which agents learn and make decisions

knowing that they will go on learning in the future in the same manner

as they have learnt in the past. The same ideas are for instance at

play in the literature on Bayesian multi-armed bandits where the unknown

parameters are the parameters of the prior distributions of the different rewards.

In Section 2, we provide the main results related to our Bayesian framework. We first compute the Bayesian estimator of the drifts entering the dynamics of prices (more precisely the conditional mean given the prices trajectory and the prior). We then derive the dynamics of that Bayesian estimator. These results are classical and can be found in [5] or [33], but they are recalled for the sake of completeness. In Section 3, we consider the portfolio allocation problem of an agent in a context with one risk-free asset and risky assets, and we show how the associated HJB equations can be transformed into linear parabolic PDEs in the case of a CARA utility function and of a CRRA utility function. As opposed to most of the papers in the literature, we also provide verification theorems. This is of particular importance because the Bayesian framework leads to blowups for some of the optimal control problems. In Section 4, we solve the same portfolio allocation problem as in Section 3 but in the specific case of a Gaussian prior. We show that a more natural set of state variables can be used to solve the same problem. We also provide an example of blowup in the Gaussian case. In Section 4, thanks to closed-form solutions, we also analyze the role of learning on the dynamics of the allocation process of the agent. In Section 5, we introduce liquidity costs through a modelling framework à la Almgren-Chriss and we use our combination of Bayesian learning and stochastic optimal control techniques for solving various portfolio choice, portfolio liquidation, and portfolio transition problems.

2 Bayesian learning

2.1 Notations and first properties

We consider an agent facing a portfolio allocation problem with one risk-free asset and risky assets.

Let

be a filtered probability space, with

satisfying the usual conditions. Let

be a -dimensional Brownian motion adapted to , with correlation structure given by

for all in .

The risk-free interest rate is denoted by . We index by the risky assets. For , the price of the asset has the classical log-normal dynamics

| (1) |

where the volatility vector satisfies , and where the drift vector is unknown.

We assume that the prior distribution of , denoted by , is sub-Gaussian.666This assumption can be slightly relaxed, but we consider this simple one to simplify the statement of our results. In particular, it satisfies the following property:

| (2) |

Throughout, we shall respectively denote by and the correlation and covariance matrices associated with the dynamics of prices.

We also denote by the process defined by

| (3) |

Remark 1.

Both and are unobserved by the agent, but for each index , is observed at time because

| (4) |

The evolution of the prices reveals information to the agent about the true value of the drift vector . In what follows we denote by the filtration generated by or equivalently by .

Remark 2.

is not an -Brownian motion, because it is not -adapted.

We introduce the process defined by

| (5) |

Remark 3.

is well defined because of the assumption (2) on the prior .

From an investor’s point of view, is of main concern. It encapsulates the information gathered so far about the returns one can expect from the assets.

The first result stated in Theorem 1 is a formula for .

Theorem 1.

Let us define

| (6) |

where denotes the element-wise multiplication of vectors.

is a well-defined finite-valued function.

We have

| (7) |

where

| (8) |

and where we denote by the vector .

Before we prove Theorem 1, let us introduce the probability measure defined by

| (9) |

where and is an arbitrary constant in .

Girsanov’s theorem implies that the process defined by

| (10) |

is a -dimensional Brownian motion with correlation structure given by under and adapted to the filtration . Moreover

| (11) |

The following proposition will be used in the proof of Theorem 1.

Proposition 1.

Under the probability measure , is independent of for all .

Proof.

Since, for all , is independent of under the probability measure , we have, for ,

Now, let us notice that

and is the Fourier transform of under the probability measure .

Therefore,

hence the result. ∎

We are now ready to prove Theorem 1.

Proof of Theorem 1..

Let us first show that is a well-defined finite-valued function.

We have

Therefore, to show that takes finite values, we just need to prove that for ,

Thanks to condition (2) on the prior, there exists such that . Therefore,

Consequently, is well defined and takes finite values.

For proving that is in fact a function, we see by formal derivation that it is sufficient to prove that, for all ,

is bounded over all compact sets of .

We have

hence the result.

We are now ready to prove the formula for .

By Bayes’ theorem we have, for all in ,

Since

we have

Proposition 1 now yields

Consequently

Therefore, and because is arbitrary, we have

∎

Throughout this article, we assume that the prior is such that has the following Lipschitz property with respect to :

| (12) |

As we shall see below, this assumption is verified if has a compact support. It is also verified for Gaussian (see Proposition 12 for instance).777Because we are dealing with asset returns, the class of compactly supported distributions is sufficient, from a financial point of view, to deal with almost all relevant cases. Gaussian distributions are not in that class but Gaussian priors are approximations of real-life beliefs that are used mainly for their convenience in computations. However, it is not true in general for all sub-Gaussian priors.

2.2 Dynamics of

Let us define the process by

| (13) |

Remark 4.

The process is called the innovation process in filtering theory. As shown below for the sake of completeness, it is classically known to be a Brownian motion (see for instance [5] on continuous Kalman filtering).

Proposition 2.

is a -dimensional Brownian motion adapted to , with the same correlation structure as , i.e.,

Proof.

To prove this result, we use Lévy’s characterization of a Brownian motion.

Let . By definition, we have

hence the -measurability of .

Let , with . For ,

For the first term, the increment is independent of and independent of . Therefore, it is independent of and we have

Regarding the second term, we have

by definition of .

We obtain that is an -martingale.

Since has continuous paths and , we conclude that is a -dimensional -Brownian motion with correlation structure given by . ∎

We are now ready to state the dynamics of .

Theorem 2.

has the following dynamics:

| (14) |

Proof.

By Itō’s formula and Theorem 1, we have

Because is a martingale under , we have

∎

2.3 A few remarks on the compact support case

The results presented in the next sections of this paper are valid for sub-Gaussian prior distributions satisfying (12). A special class of such prior distributions is that of distributions with compact support.

We have indeed the following proposition:

Proposition 3.

If has a compact support, then and all its derivatives are bounded over .

Proof.

Let us consider . By definition, the coordinate of is . Therefore, by immediate induction,

is the sum and product of terms of the form

Now, for , and for ,

where

and where is the canonical basis of .

Therefore

hence the result. ∎

In addition to showing that the Lipschitz hypothesis is true when has a compact support, Proposition 3 will be useful in Section 3 to provide a large class of priors for which there is no blowup phenomenon in the equations characterizing the optimal portfolio choice of an agent.

3 Optimal portfolio choice

In this section we proceed with the study of optimal portfolio choice. For that purpose, let us set an investment horizon .

Let us also introduce the notion of “linear growth” for a process in our -dimensional context. This notion plays an important part in the verification theorems.

Definition 1.

Let us consider . An -valued, measurable, and -adapted process is said to satisfy the linear growth condition with respect to if,

The first subsection is devoted to the CARA case, and the second one focuses on the CRRA case.

3.1 CARA case

We consider the portfolio choice of the agent in the CARA case. We denote by his absolute risk aversion parameter.

We define, for the set

We denote by the -valued process modelling the strategy of the agent. More precisely, , represents the amount invested in the asset at time . The resulting value of the agent’s portfolio is modelled by a process with . The dynamics of is given by the following stochastic differential equation (SDE):

| (15) |

With the notations introduced in Section 2, we have

and

Given and , we define therefore

| (16) | ||||

| (17) |

For an arbitrary initial state , the agent maximizes, over in the set of admissible strategies , the expected utility of his portfolio value at time , i.e.,

The value function associated with this problem is then defined by

| (18) |

The HJB equation associated with this problem is

| (19) |

with terminal condition

| (20) |

To solve the HJB equation, we use the following ansatz:

| (21) |

Proposition 4.

Suppose there exists satisfying

| (22) |

with terminal condition

| (23) |

Then defined by (21) is solution of the HJB equation (19) with terminal condition (20).

Moreover, the supremum in (19) is achieved at:

| (24) |

Proof.

Let us consider solution of (22) with terminal condition (23). For defined by (21) and by considering , we have

The supremum in the above expression is reached at

corresponding to

| (25) |

Plugging this expression in the partial differential equation, we get:

As it is straightforward to verify that satisfies the terminal condition (20), the result is proved. ∎

From the previous proposition, we see that solving the HJB equation (19) with terminal condition (20) boils down to solving (22) with terminal condition (23). Because (22) is a simple parabolic PDE, we can easily build a strong solution.

Proposition 5.

Proof.

Because of the assumption (12) on , the first part of the proposition is a consequence of classical results for parabolic PDEs and of the classical Feynman-Kac representation (see for instance [19, 27]).

For the second part, we notice first that

Therefore, by (12), there exists a constant such that

| (28) |

By (12) again, there exists a constant such that

| (29) | |||||

Now, by Theorem 2, ,

Therefore,

Now, for , we have

Because is sub-Gaussian, there exists such that . Because of the Lipschitz assumption on , we have for any , and in particular for such that , that

Therefore,

We can conclude that is bounded uniformly, and therefore using Eqs. (28) and (29) that is indeed at most linear in uniformly in . ∎

Using the above results, we know that there exists a function solution of the HJB equation (19) with terminal condition (20). By using a verification argument, we can show that is in fact the value function defined in Eq. (18) and then solve the problem faced by the agent. This is the purpose of the following theorem.

Theorem 3.

Proof.

From the Lipschitz property of stated in Eq. (12) and the property of stated in Eq. (27), we see that is indeed admissible (i.e., ).

Let us then consider and .

By Itō’s formula, we have for all

where

Note that we have

Let us subsequently define, for all ,

and

We have

and

Therefore

By definition of , and if . As a consequence, is nonincreasing, and therefore

with equality when .

Subsequently,

with equality when .

To conclude the proof let us show that . To do so, we will use the fact that and prove that is a martingale under .

Because , and because of Eq. (27), we know that there exists a constant such that

By definition of , there exists therefore a constant such that

Now, by using the above inequality along with Eq. (2) and classical properties of the Brownian motion, we easily prove that

| (31) |

From Novikov’s condition (or more exactly one of its corollary – see for instance Corollary 5.14 in [27]), we see that is a martingale under , hence the result

with equality when . Therefore,

∎

The optimal portfolio choice of an agent with a CARA utility function is therefore fully characterized. Let us now turn to the case of an agent with a CRRA utility function.

3.2 CRRA case

We consider the portfolio choice of the agent in the CRRA case. We denote by the relative risk aversion parameter.

We denote by the utility function of the agent, i.e.,

If , we define for the set

If , we define for the set

We denote by the -valued process modelling the strategy of the agent. More precisely, , represents the part of the wealth invested in the risky asset at time . The resulting value of the agent’s portfolio is modelled by a process with . The dynamics of is given by the following stochastic differential equation (SDE):

| (32) |

With the notations introduced in Section 2, we have

and

Given and , we define

| (33) | ||||

| (34) |

For an arbitrary initial state , the agent maximizes, over in the set of admissible strategies , the expected utility of his portfolio value at time , i.e.,

The value function associated with this problem is then defined by

| (35) |

The HJB equation associated with this problem is given by

| (36) |

with terminal condition

| (37) |

To solve the HJB equation and then solve the optimal portfolio choice problem, we need to consider separately the cases and .

3.2.1 The case

To solve the HJB equation when , we use the following ansatz:

| (38) |

Proposition 6.

Suppose there exists a positive function satisfying

| (39) |

with terminal condition

| (40) |

Then defined by (38) is solution of the HJB

equation (36) with terminal condition (37).

Moreover, the supremum in (36) is achieved at

| (41) |

Proof.

Let us consider , positive solution of (39) with terminal condition (40). For defined by (38), we have:

The supremum in the above expression is reached at

Plugging this expression in the partial differential equation, we get:

As it is straightforward to verify that satisfies the terminal condition (37), the result is proved. ∎

For solving our problem, we would like to prove that there exists a (positive) function solution of (39) with terminal condition (40) such that is at most linear in . However, unlike what happened in the CARA case, there is no guarantee, in general, that such a function exists. We will even show in Section 4 that there are blowup cases for some Gaussian priors in the case .

Even though there is no general result, we can state for instance a result in the case of a prior distribution with compact support.

Proposition 7.

Let us suppose that the prior distribution has compact support.

Let us define

| (42) |

where , we introduce for ,

Furthermore, in that case

| (43) |

Proof.

By using Theorem 1 and Proposition 3, we easily see that formal differentiations are authorized. Therefore is a function solution of (39) with terminal condition (40).

For the second point, we write, for ,

We have

Because of the Lipschitz property of and Grönwall inequality, is uniformly bounded on . By Proposition 3, we then deduce that there exists such that

Therefore,

Hence the result. ∎

We now write a verification theorem and provide a result for solving the problem faced by the agent under additional hypotheses.

Theorem 4.

Proof.

The proof is similar to that of the CARA case, therefore we do not detail all the computations.

From the Lipschitz property of stated in Eq. (12) and assumption (44) on , we see that is indeed admissible (i.e., ).

Let us then consider and .

By Itō’s formula, we have for all

where

Note that we have

Let us subsequently define, for all ,

and

We have

By definition of , and if . As a consequence, is nonincreasing, and therefore

| (47) |

with equality when .

Subsequently,

with equality when .

Using the same method as in the proof of Theorem 3, we see that . Therefore,

We have just shown the second part of the theorem. For the first part, we consider the cases and separately because the set of admissible strategies is larger in the second case.

-

(a)

If , verifies the linear growth condition. Therefore, using the assumption on and the same argument as in Theorem 3, we see that is a martingale with for all .

We obtain

-

(b)

By taking the expectation, we have, for all ,

As is nonnegative when , we can apply Fatou’s lemma

Because , almost surely. Therefore

In both cases, we conclude that

∎

The above verification theorem can be used for instance when has a compact support because of (43). In the next section, we address the case of Gaussian priors and we shall see that there is a blowup phenomenon associated with the solution of the partial differential equation (39) with terminal condition (40) when is too small.

Before we turn to the Gaussian case, let us consider the specific case .

3.2.2 The case

To solve the HJB equation when , we use the following ansatz:

| (48) |

Proposition 8.

Suppose there exists a function satisfying

| (49) |

with terminal condition

| (50) |

Then defined by (48) is solution of the HJB

equation (36) with terminal condition (37).

Moreover, the supremum in (36) is achieved at

| (51) |

Proof.

The supremum in the above expression is reached at

Therefore

As it is straightforward to verify that satisfies the terminal condition (37), the result is proved. ∎

From the previous proposition, we see that solving the HJB equation (36) with terminal condition (37) boils down to solving (49) with terminal condition (50). Because (49) is a simple parabolic PDE, we can easily build a strong solution.

Proposition 9.

Proof.

Because of the assumption (12) on , the first part of the proposition is a consequence of classical results for parabolic PDEs and of the classical Feynman-Kac representation (see for instance [19, 27]).

For the second part, we notice first that

We have

Because of the Lipschitz property of and Grönwall inequality, is uniformly bounded on . Therefore, by (12), there exists a constant such that

| (54) |

By (12) there exists a constant such that

| (55) |

But, by using Theorem 2

Therefore, using the Lipschitz property of we see that is bounded by a constant that depends on only. Combining this result with Eqs. (54) and (55), we obtain the property (53). ∎

We now write a verification theorem and provide a result for solving the problem faced by the agent.

Theorem 5.

Proof.

The proof is similar to that of the case, therefore we do not detail all the computations.

From the Lipschitz property of stated in Eq. (12), we see that is indeed admissible (i.e., ).

Let us then consider and .

By Itō’s formula, we have for all

where

Note that we have

Let us subsequently define, for all ,

and

We have

By definition of , and if . As a consequence, is nonincreasing, and therefore

| (58) |

with equality when .

Subsequently,

with equality when .

verifies the linear growth condition. Therefore, using Eq. (53) and the same argument as in Theorem 3, we see that is a martingale

with

for all .

We obtain

with equality when .

We conclude that

∎

4 Optimal portfolio choice in the Gaussian case: a tale of two routes

We showed in Section 3 that solving the optimal portfolio choice problem boils down to solving linear parabolic PDEs in the CARA and CRRA cases. One important case in which these PDEs can be solved in closed form is that of a Gaussian prior. Moreover, in the Gaussian prior case, there are two routes to solve the problem with PDEs because, as we shall see below, appears to be a far more natural state variable than . In this section, we solve the optimal portfolio choice problem in the case of a Gaussian prior using these two different routes and we discuss two essential points: (i) the influence of online learning on the optimal investment strategy, and (ii) the occurrence of blowups in some CRRA cases.

4.1 Bayesian learning in the Gaussian case

Let us consider a non-degenerate multivariate Gaussian prior , i.e.,

| (59) |

where and .

Our first goal is to obtain closed-form expressions for and in the Gaussian case. In order to obtain these expressions we shall use the following lemma:

Lemma 1.

Proof.

Using the canonical form of a polynomial of degree 2, we get

Therefore,

∎

We are now ready to derive the expressions of and .

Proof.

,

Therefore,

where

and

Thanks to the above lemma, we have

Differentiating brings

∎

Proposition 11.

| (62) | |||||

| (63) |

where

Remark 5.

Classical Bayesian analysis or application of classical filtering tools enables to prove that the posterior distribution of given is in fact the Gaussian distribution . In particular, it is noteworthy that the covariance matrix process is deterministic.

The above analysis shows that, in the Gaussian prior case, the problem can be written with two different sets of state variables: or . We can consider indeed that the problem is described, as in Section 3, by the stochastic differential equations

| (64) |

or alternatively by the following stochastic differential equations

| (65) |

In what follows, we are going to solve the optimal portfolio choice problem in the Gaussian prior case by using alternatively the two different routes associated with these two ways of describing the dynamics of the system.

Remark 6.

It is noteworthy that the dynamics of in the Gaussian case, as written in Eq. (65), does not involve any term in . From Theorem 2, we see that this is related to the fact that the matrix is independent of in the Gaussian case. A natural question is whether or not this property is specific to a Gaussian prior distribution. In fact, the answer is positive. If indeed is independent of , then is a polynomial of (maximum) degree 2, i.e.,

where and . Since

the Laplace transform of is the exponential of a polynomial of (maximum) degree 2, and is therefore Gaussian (possibly degenerate, even in the form of a Dirac mass).

Before we solve the PDEs in the CARA and CRRA cases in the next subsections, let us state some additional properties that will be useful to simplify future computations.

Proposition 12.

The dynamics of the conditional covariance matrix process is given by:

| (66) |

The first order partial derivatives of are given by:

| (67) | |||||

| (68) |

Proof.

Eq. (66) is a simple consequence of the definition of .

Eq. (67) derives from the differentiation of Eq. (LABEL:eq:G_Gaussian) with respect to .

Remark 7.

We are now ready to solve the PDEs and derive the optimal portfolios in the CARA and CRRA cases.

4.2 Portfolio choice in the CARA case

4.2.1 The general method with

Following the results of Section 3, solving the optimal portfolio choice of the agent in the CARA case boils down to solving the linear parabolic PDE (22) with terminal condition (23).

Because is affine in for all in the Gaussian case, we easily see from the Feynman-Kac representation (26) that for all is a polynomial of degree (in ). However looking for that polynomial of degree in by using the PDE (22) or Eq. (26) is cumbersome. As we shall see, the main reason for this is that is in fact a more natural variable to solve the problem than . In fact, a better ansatz than a general polynomial of degree in is the following:

| (69) |

where and .

We indeed have the following proposition:

Proposition 13.

Proof.

The system of linear ODEs (70) with terminal condition (71) can be solved in closed form. This is the purpose of the following proposition.

Proposition 14.

Wrapping up our results, we can state the optimal portfolio choice of an agent with a CARA utility function in the case of the Gaussian prior (59).

Proposition 15.

In the case of the Gaussian prior (59), the optimal strategy of an agent with a CARA utility function is given by

| (72) |

Proof.

We see from the form (69) of the solution and from Eq. (72) that rather than itself is the driver of the optimal behavior of the agent at time . Because of Eq. (7), this means that rather than is the natural variable for addressing the problem. In what follows, we solve the optimal portfolio choice problem in the case of a Gaussian prior by taking another route, on which the dynamics of the system is given by the stochastic differential equations (65) rather than (64).

4.2.2 Solving the problem using

On our first route for solving the above optimal portfolio choice problem, the central equation was the HJB equation (19) associated with the stochastic differential equations (64). Instead of using the stochastic differential equations (64), we now reconsider the problem in the Gaussian prior case by using the stochastic differential equations (65).888We omit the proofs in this subsection. They are similar to those presented in Section 3.

The value function associated with the problem is now given by

where the set of admissible strategies is

and where,

| (73) | ||||

| (74) |

It is noteworthy that for all , . There is indeed no difference between the linear growth condition with respect to and the linear growth condition with respect to in the Gaussian prior case. This is easy to see on Eq. (62), recalling that and are known constants.

The HJB equation associated with this optimization problem is

| (75) |

with terminal condition

| (76) |

By using the ansatz

| (77) |

we obtain the following proposition:

Proposition 16.

Suppose there exists satisfying

For solving Eq. (78) with terminal condition (79), it is natural999It is clear from the form of Eq. (78) that the solution is a polynomial of degree 2 in . to consider the following ansatz:

| (81) |

where and .

The next proposition states the ODEs that and must satisfy.

Proposition 17.

The system of linear ODEs (82) with terminal condition (83) can be solved in closed form. This is the purpose of the following proposition.

Proposition 18.

We are now ready to state the main result of this subsection, whose proof is similar to that of Theorem 3.

4.2.3 Comments on the results: understanding the learning-anticipation effect

In the case of an agent maximizing an expected CARA utility objective function, the optimal portfolio allocation is given by

| (86) |

Of course, if was known, the optimal strategy would be

| (87) |

It is essential to notice that the optimal strategy does not boil down (except at time ) to the naive strategy

| (88) |

which consists in replacing, at time , by the current estimator in Eq. (87).

The sub-optimality of the naive strategy comes from the fact that the agent does not only learn but knows that he will go on learning in the future, and uses that knowledge to design his investment strategy. We call this effect the learning-anticipation effect.

To better understand this learning-anticipation effect, it is interesting to study the case . In that case, let us denote by the volatility of the risky asset and let us assume that the prior distribution for is , where . The agent following the optimal strategy invests at time the amount

in the risky asset, whereas the naive strategy would consist instead in investing the amount

The magnitude of the learning-anticipation effect can be measured by the multiplier . , and the further from the multiplier (i.e., the smaller in this case), the larger the learning-anticipation effect.

is an increasing function of with at time . This means that the agent invests less (in absolute value) in the risky asset than he would if he opted for the naive strategy, except at time because there is nothing more to learn. In other words, he is prudent and waits for more precise estimates of the drift.

is also an increasing function of . The smaller , the more important the learning-anticipation effect. When volatility is low, it is really valuable to wait for a good estimate of before investing.

is a decreasing function of and . The longer the investment horizon and the higher the uncertainty about the value of the drift, the stronger the incentive of the agent to start with a small exposure (in absolute value) in the risky asset and to observe the behavior of the risky asset before adjusting his exposure, ceteris paribus.

4.3 Portfolio choice in the CRRA case

4.3.1 The general method with

In Section 3, and more precisely in Theorem 5, we have seen that an agent with a utility function has an optimal investment strategy that depends on the prior only through . There is therefore no need to solve PDEs.

In the CRRA case, when , following the results of Section 3, we see that solving the optimal portfolio choice of the agent boils down to solving the linear parabolic PDE (39) with terminal condition (40).

In order to solve this equation, we consider the following ansatz:

| (89) |

where and .

We have the following proposition:

Proposition 19.

Proof.

The system of ODEs (90) is not a system of linear ODEs. The equation for is indeed a Riccati equation. Luckily, is a trivial solution of the second differential equation of the system (90). Therefore, using a classical trick of Riccati equations, we can look for a solution of the form

where .

With this ansatz, looking for a solution to the above Riccati equation boils down to solving the linear ODE

| (92) |

and verifying that for all , is invertible.

The unique solution to Eq. (92) is given in the following straightforward proposition:

Proposition 20.

Regarding the invertibility of for all , we have the following result:

Proposition 21.

Let us consider as defined by Eq. (93).

is invertible for all if and only if (i) or (ii) and , where the function maps a symmetric matrix to its lowest eigenvalue.

Proof.

Let us consider . is invertible if and only if is invertible.

If , then is the sum of two positive definite symmetric matrices. It is therefore an invertible matrix.

If , then, using the definition of , we have

Therefore is invertible if and only if is not eigenvalue of , hence the result. ∎

The above result is very important. It means that when the solution of (90) with terminal condition (91) blows up in finite time, in the sense that the solution can only be defined on an interval of the form . If is small enough so that , then the solution exists on . Otherwise, we are enable to solve (90) with terminal condition (91) on . When , is a scalar and it goes to as . In particular, this means that the value function stops to be defined because it becomes infinite.

Proposition 22.

Let us assume that either (i) or (ii) and .

Wrapping up our results, we can state the optimal portfolio choice of an agent with a CRRA utility function with in the case of the Gaussian prior (59).

Proposition 23.

Let us consider the Gaussian prior (59). Let us assume that either (i) or (ii) and .

Then, the optimal strategy of an agent with a CRRA utility function with is given by

| (94) |

Proof.

Remark 8.

It is noteworthy that when , we recover the result of Theorem 5, i.e. .

As in the CARA case, we see from the form (89) of the solution and from Eq. (94) that rather than itself is the driver of the optimal behavior of the agent at time . Because of Eq. (7), this means that rather than is the natural variable for addressing the problem. In what follows, we solve the optimal portfolio choice problem in the case of a Gaussian prior by taking another route, on which the dynamics of the system is given by the stochastic differential equations (65) rather than (64).

4.3.2 Solving the problem using

On our first route for solving the above optimal portfolio choice problem, the central equation was the HJB equation (36) associated with the stochastic differential equations (64). Instead of using the stochastic differential equations (64), we now reconsider the problem in the Gaussian prior case by using the stochastic differential equations (65).101010We omit the proofs in this subsection. They are similar to those presented in Section 3.

If , we define for the set

If , we define for the set

As in the CARA case, we have in fact .

The value function associated with the problem is now given by

where,

| (95) | ||||

| (96) |

The HJB equation associated with this optimization problem is

| (97) |

with terminal condition

| (98) |

By using the ansatz

| (99) |

we obtain the following proposition:

Proposition 24.

Suppose there exists satisfying

For solving Eq. (100) with terminal condition (101), we consider the following ansatz:

| (103) |

where and .

The next proposition states the ODEs that and must satisfy.

Proposition 25.

The system of linear ODEs (104) with terminal condition (105) can be solved in closed form on when there is no blowup. This is the purpose of the following proposition.

Proposition 26.

Let us assume that either (i) or (ii) and .

We are now ready to state the main result of this subsection, whose proof is similar to that of Theorem 4.

4.3.3 Comments on the results: beyond the learning-anticipation effect

In the case of an agent maximizing an expected CRRA utility objective function, the optimal portfolio allocation is given by the formula

whenever either (i) or (ii) and .

When , the optimal strategy does not boil to the naive strategy

However, it does in the case of a logarithmic utility function (i.e., ). This means that there is no learning-anticipation effect in the case of an agent with a utility.

As in the CARA case, it is interesting to analyze the formula in the one-asset case . In that case, let us denote by the volatility of the risky asset and let us assume that the prior distribution for is , where . The agent following the optimal strategy invests at time a proportion of his wealth

in the risky asset, whereas the naive strategy would consist instead in investing the proportion

When , we observe a learning-anticipation effect similar to that of the CARA case. It is measured by the multiplier . is an increasing function of . This means that the agent invests less (in absolute value) in the risky asset than he would if he opted for the naive strategy, except at time because there is nothing more to learn. is also an increasing function of . The smaller , the more important the learning-anticipation effect. When volatility is low, it is really valuable to wait for a good estimate of before investing. is eventually a decreasing function of and . The longer the investment horizon and the higher the uncertainty about the value of the drift, the stronger the incentive of the agent to start with a small exposure (in absolute value) in the risky asset and to observe the behavior of the risky asset before adjusting his exposure, ceteris paribus.

All the above effects are in line with the CARA case: the agent is prudent and waits to know more. However, the effects are reversed when . In that case indeed, the multiplier ceases to be below . Instead, it is above . In fact, the very possibility that expected returns could be very high (or very low because we can short) creates an incentive for the agent to have a higher exposure in the risky asset. Then, as the uncertainty reduces through learning, the agent adjusts his position towards a milder one and ends up with the same position as in the naive strategy when .

It is noteworthy that at time tends to when tends to , and this corresponds to the threshold found in Proposition 21 for the blowup occurring exactly at time . This means, if , that the agent wants to borrow an infinite amount of money at time to invest in the risky asset.

This reversed phenomenon is linked to the qualitative difference between the power utility functions when , which are bounded from above, and the power utility functions when , which have no upper bound. This difference explains why, for and for a Gaussian prior distribution (which is unbounded), the multiplier and the value function can blowup to and therefore stop to be defined if is too large (or equivalently if is too small when is fixed).

5 Optimal portfolio choice, portfolio liquidation, and portfolio transition with online learning and execution costs

The results presented above have been obtained by using PDE methods only. It is noteworthy that one could have derived the same formulas by using the martingale method of Karatzas and Zhao [28]. However the martingale method requires a model in which there are martingales, and there are many problems in which martingales cannot be exhibited. The goal of this section is to show how PDEs can be used to address problems for which the martingale method cannot be applied.

The classical literature on portfolio choice and asset allocation mainly considers frictionless markets. In that case, both PDE methods and martingale methods can be used for solving the problem, because there exists an equivalent probability measure under which discounted prices, and therefore discounted portfolio values, are martingales. Martingale methods cannot be used however when one adds frictions in the model. In what follows, we consider frictions in the form of execution costs, as in optimal execution models à la Almgren-Chriss (see [1, 2]). We show that the PDE method presented in the previous sections enables to address the optimal portfolio choice problem, but also optimal portfolio liquidation and optimal portfolio transition problems, when there are execution costs and when one learns the value of the drift over the course of the optimization problem.

We first present the modelling framework and a generic optimization problem encompassing the three types of problem we consider. We then derive the associated HJB equation and derive a simpler PDE using an ansatz. We then focus on the specific case in which (i) the prior distribution of the drift is Gaussian and (ii) the execution costs and penalty functions are quadratic, because in that case the PDE boils down to a system of ODEs that can be solved numerically. We then show some numerical examples for each of the problems.

5.1 Notations and setup of the model

5.1.1 Price dynamics and Bayesian learning of the drift

As above we consider a financial market with one risk-free asset and risky assets. In order to simplify the equations, we assume that the risk-free asset yields no interest. It is noteworthy that the model can easily be generalized to the case of a non-zero risk-free interest rate .

We index by the risky assets. For , the price of the risky asset has the following drifted Bachelier dynamics111111Unlike in the previous sections where we used the classical Black-Scholes (log-normal) dynamics, we consider here the Bachelier dynamics. This dynamics is indeed standard in the optimal execution literature, although it raises the problem of negative prices.

| (108) |

where the volatility vector satisfies , and where the drift vector is unknown.

As above, we assume that the prior distribution of , denoted by , is sub-Gaussian.

Throughout, we shall respectively denote by and the correlation and covariance matrices associated with the dynamics of prices.

We introduce the process defined by

| (109) |

We can state a result similar to that of Theorem 1.

Theorem 8.

Let us define

| (110) |

is a well-defined finite-valued function.

We have

| (111) |

where

| (112) |

As in Section 2, we define the process by

| (113) |

Using the same method as in Section 2, we can prove the following result on :

Proposition 27.

is a Brownian motion adapted to , with the same correlation structure as

The Brownian motion is used to re-write Eq. (108) as

| (114) | |||||

| (115) |

5.2 Almgren-Chris modelling framework and optimization problems

We consider the modelling framework introduced by Almgren and Chriss in [1, 2] (see also [21, 24]). In this framework, we do not consider the Mark-to-Market (MtM) value of the portfolio as a state variable. Instead, we consider separately the position in the risky assets and the amount on the cash account.

Let us set a time horizon . The strategy of the agent is described by the stochastic process , where, for ,

This process represents the velocity at which the agent buys and sells the risky assets. In other words,

| (116) |

Now, for , the amount on the cash account evolves as

| (117) |

where is a deterministic process, continuous121212The results we obtain in this section can be generalized if the process is only piecewise continuous. and bounded, modelling the market volume for the risky asset,131313This process can be set to very small values for modelling the night. and where model execution costs. For each , the execution cost function classically satisfies:

-

•

,

-

•

is increasing on and decreasing on ,

-

•

is strictly convex,

-

•

is asymptotically superlinear, i.e.,

Remark 9.

In applications, is often a power function with , or a function of the form with , where takes account of proportional costs such as bid-ask spread or stamp duty. In the original Almgren-Chriss framework, the execution costs are quadratic. This corresponds to ().

Given , we define for ,

| (118) | |||||

| (119) | |||||

| (120) |

We assume that the agent has a constant absolute risk aversion denoted by . For an arbitrary initial state , the optimization problems we consider are of the following generic form:

| (121) |

where the penalty function is assumed to be continuous and convex.

The choice of the penalty function depends on the problem faced by the agent:

- •

-

•

In the case of an optimal portfolio liquidation problem, we can assume that the penalty function is of the form with such that the minimum eigenvalue of is large enough to force (almost complete) liquidation.141414It is a relaxed form of the classical optimal liquidation problem.

-

•

In the case of an optimal portfolio transition problem, we can assume that the penalty function is of the form with such that the minimum eigenvalue of is large enough to force to be very close to the target .151515It is a relaxed form of optimal transition problem.

5.3 The PDEs in the general case

Let us introduce the value function associated with the above generic problem.

The HJB equation associated with the problem is

| (122) |

with terminal condition

| (123) |

For reducing the dimensionality of the problem, we consider the following ansatz

| (124) |

We have the following result:

Proposition 28.

Suppose there exists satisfying

| (125) |

with terminal condition

| (126) |

where for all , is the Legendre-Fenchel transform of , i.e.

Then defined by (124) is solution of the HJB

equation (122) with terminal condition (123).

Moreover, the supremum in (122) is achieved at , where

| (127) |

Proof.

Let us consider solution of the PDE (125) with terminal condition (126). For defined by (124), we have

As it is straightforward to verify that satisfies the terminal condition (123), the result is proved. ∎

The result of the above proposition means that for solving the HJB equation we can solve the simpler three-variable PDE (125) with terminal condition (126). However, Eq. (125) is not linear and corresponds to the equation of a zero-sum game between the agent and nature (see [22] for a similar equation in the case of option pricing with execution costs à la Almgren-Chriss). Solving Eq. (125) with terminal condition (126) in the general case is out of the scope of this article. However, we can consider the special case where (i) the prior distribution of the drift is Gaussian and (ii) execution costs and penalty functions are quadratic as in the original Almgren-Chriss model, because solving the problem then boils down to solving a system of ODEs.

5.4 The case of a Gaussian prior and quadratic costs

Let us consider a non-degenerate multivariate Gaussian prior , i.e.,

| (128) |

where and .

Proposition 29.

For the multivariate Gaussian prior given by (128), is given by

| (129) |

For carrying out computations, the following proposition will be useful.

Proposition 30.

The first order partial derivatives of are given by:

| (130) | |||||

| (131) |

Let us assume, for each , that . Then, for each ,

Let us also assume that with , the choice of and depending on the type of problem we consider:

-

•

and for an optimal portfolio choice problem.

-

•

with a large minimum eigenvalue and for an optimal portfolio liquidation problem.

-

•

with a large minimum eigenvalue and arbitrary for an optimal portfolio transition problem (towards the portfolio represented by ).

In order to solve Eq. (125) with terminal condition (126), we consider the ansatz

| (132) |

where , , , , , and .161616The function should not be confused with the number of risky assets.

Proposition 31.

Assume there exists , , , , , and satisfying the following system of ODEs:

| (133a) | |||||

| (133b) | |||||

| (133c) | |||||

| (133d) | |||||

| (133e) | |||||

| (133f) |

with terminal condition

| (134a) | |||||

| (134b) | |||||

| (134c) | |||||

| (134d) | |||||

| (134e) | |||||

| (134f) |

where is the diagonal matrix with diagonal .

Proof.

The above system of ODEs deserves a few comments.

In fact, it can be decomposed into 3 sets of ODEs that can be solved one after the other: a first system of nonlinear ODEs (133b)-(133c)-(133d) with the associated terminal conditions (134b)-(134c)-(134d) that defines , a second system of linear ODEs (133e)-(133f) with the associated terminal conditions (134e)-(134f) that defines given , and finally the simple ODE (133a) with the associated terminal condition (134a) that defines given .

The equation (133a) for is trivial to solve. The second set of ODEs does not raise any difficulty because the ODEs are linear. In particular, if , i.e., if we consider an optimal portfolio choice problem or an optimal portfolio liquidation problem, then the solution of the second system of linear ODEs is trivial: .

Regarding the first set of equations, there exists a unique local solution by Cauchy-Lipschitz. In order to prove that and are symmetric matrices, we can proceed as follows: (i) replacing Eq. (133c) by

| (135) |

then (ii) considering the unique local solution of (133b)-(135)-(133d) with terminal conditions (134b)-(134c)-(134d), then (iii) noticing that is also a local solution of (133b)-(135)-(133d) with terminal conditions (134b)-(134c)-(134d), and therefore that and are symmetric, (iv) noticing that is therefore a local solution of (133b)-(133c)-(133d) with the associated terminal conditions (134b)-(134c)-(134d), and (v) concluding therefore that and are symmetric.

Because of the local existence result, if is small enough, then there exist functions , , , , , and satisfying the equations of Proposition 31. However, although we did not find any case of blowup numerically, a global existence result seems out of reach given the nature of system of ODEs.

Nevertheless, we can state a verification theorem that solves the problem when there exists a solution to the above system on .

Theorem 9.

Assume there exist , , , , , and satisfying the equations of Proposition 31. Let us then consider the function defined by (132) and the associated function defined by (124).

For all and , we have

| (136) |

Moreover, equality in (136) is obtained by taking the optimal control given by the closed-loop feedback formula

| (137) |

where and .

In particular .

Proof.

Let us first prove that is well-defined and admissible (i.e., ).

For that purpose, let us consider the Cauchy problem

Its unique solution is given by

Then is defined by and can be written as

Given the definition of and the affine nature of with respect to , satisfies the required linear growth condition to be in .

Now, let us consider and .

By Itō’s formula, we have for all

where

Note that we have

Let us subsequently define, for all ,

and

We have

By definition of , .

As a consequence, is nonincreasing, and therefore

with equality when .

Subsequently,

with equality when .

Because satisfies the linear growth condition with respect to , so does . Therefore, using the same argument as in Theorem 3, we see that is a martingale

with for all .

We obtain

with equality when .

We can conclude that

∎

5.5 Numerical examples and comments

We consider now three simple examples in order to illustrate the results obtained above. For these three examples, we consider one risky asset (stock) with the following characteristics:

-

•

€,

-

•

€,

-

•

€,

-

•

shares,

-

•

with €.

The first problem we consider is an optimal portfolio choice problem (with ). The parameters are the following:

Objective function

-

•

days,

-

•

,

-

•

.

Bayesian prior

-

•

€,

-

•

€.

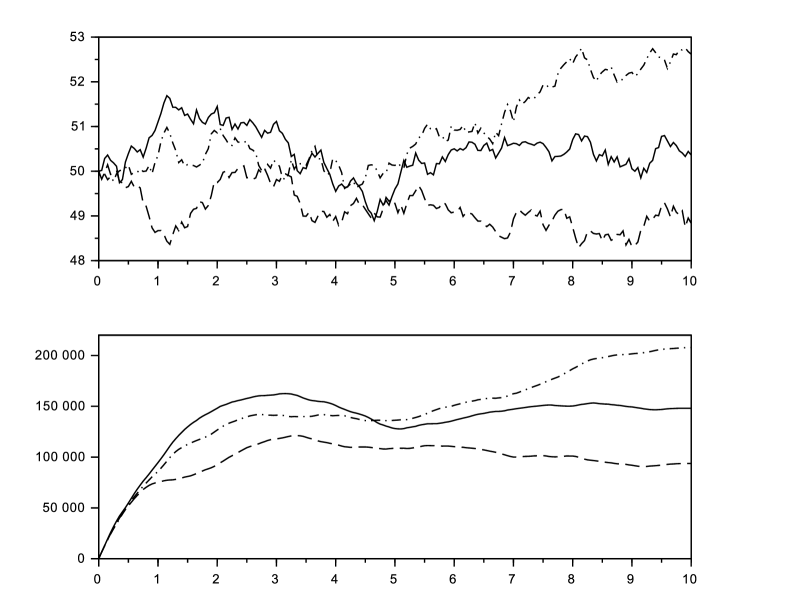

Our methodology was first to approximate numerically the functions , , , and (we know that ). Then, for different simulated paths of the stock price, we used Eq. (137) for finding – in fact approximating numerically – the optimal number of shares in the portfolio at each point in time (on a grid). The results are shown in Figure 1.

Two things must be noticed in Figure 1. First, the agent builds a portfolio with a number of shares that lies around , where

is the number of shares that would be optimal in the optimal portfolio choice model without uncertainty on and without execution costs. Second, the strategy followed by the agent looks like a trend-following strategy: the agent buys when the stock price increases and sells when the stock price decreases, though in a smooth manner. This is in fact quite natural given the dynamics of .

The second problem we consider is an optimal portfolio liquidation problem (with shares). The parameters are the following:

Objective function

-

•

day,

-

•

,

-

•

€.171717The matrix is a scalar in the one-asset case.

Bayesian prior

-

•

€,

-

•

€.

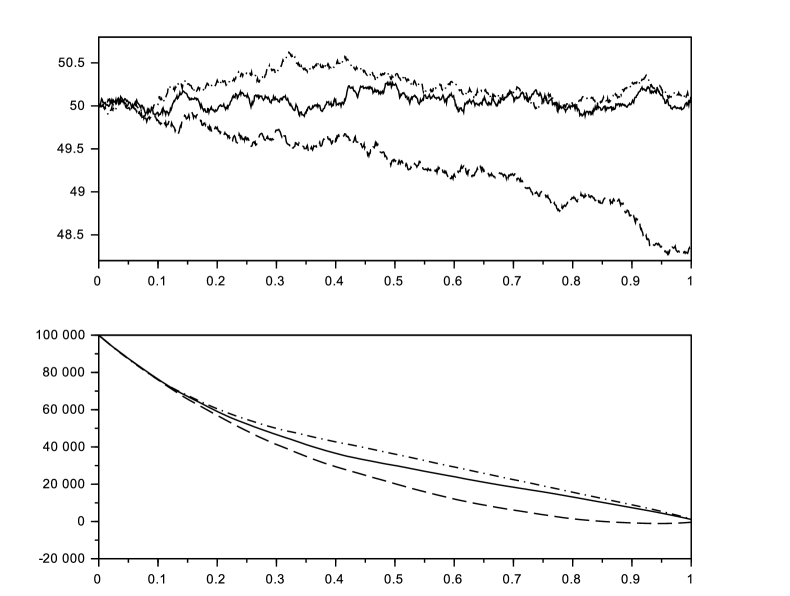

We first approximated numerically the functions , , , and (we know that ). Then, for different simulated paths of the stock price, we used Eq. (137) for approximating the optimal number of shares in the portfolio at each point in time (on a grid). The results are shown in Figure 2.

We see in Figure 2 that the small value of we used is high enough to force complete liquidation in all of the three cases. We also see that the optimal (adaptive) strategy consists in liquidating at a faster pace for decreasing price trajectories than for increasing price trajectories. This is in line with the trend following effect exhibited in Figure 1.

The third problem we consider is an optimal portfolio transition problem (with shares). The parameters are the following:

Objective function

-

•

day,

-

•

,

-

•

shares,

-

•

€.

Bayesian prior

-

•

€,

-

•

€.

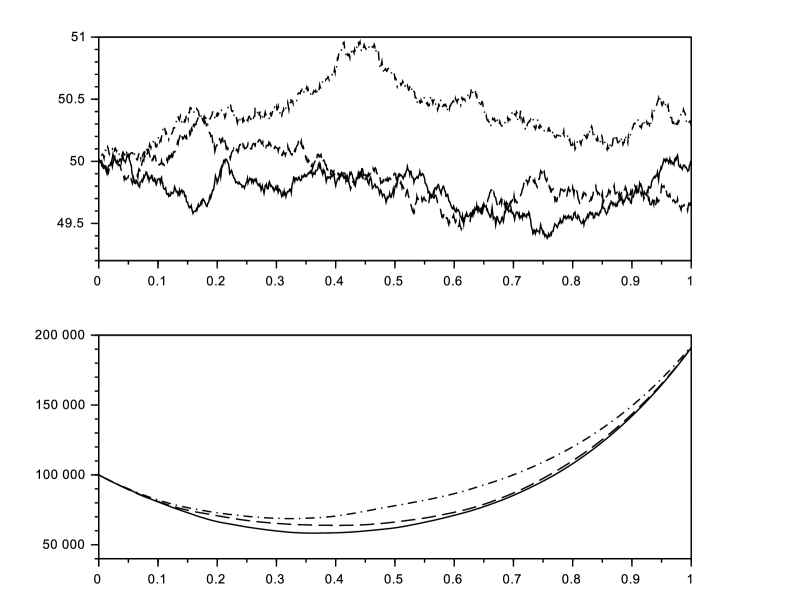

As above, we approximated numerically the functions , , , , , and , and then used Eq. (137) for approximating the optimal number of shares in the portfolio at each point in time (on a grid) for three different simulated paths of the stock price. The results are shown in Figure 3.

We see in Figure 3 that the small value of we used is high enough to force complete transition from portfolio to portfolio in all of the three cases. In addition to the classical trend-following-like effect, we see in Figure 3 that the optimal strategy consists in selling shares before buying them back. In fact, the agent faces a trade-off because there are two opposite forces. When the final penalty is far away (i.e., at the beginning of the process), the agent faces a portfolio choice problem similar to the one tackled in the first example. Here,

Therefore, there is an incentive to sell shares at the beginning. After some time however, the final condition matters and the agent has to reach the target, hence the U-shaped trajectory.

These three examples illustrate the use of the PDE method for solving various problems under drift uncertainty.

Conclusion

In this paper, we have presented a PDE method that can be used for addressing optimal portfolio choice, optimal portfolio liquidation, and optimal portfolio transition problems, when the expected returns of risky assets are unknown. The main idea is to use at the same time Bayesian (or more generally online) learning and dynamic programming techniques. Our approach goes beyond the martingale method of Karatzas and Zhao, because it can be used in more general models, for instance when a modelling framework à la Almgren-Chriss is considered. We believe that the use of Bayesian (or more generally online) learning in conjunction with stochastic optimal control enables to improve many models without increasing their dimensionality and we are looking forward to seeing other applications of the same method, especially in Finance.

References

- [1] Robert Almgren and Neil Chriss. Value under liquidation. Risk, 12(12):61–63, 1999.

- [2] Robert Almgren and Neil Chriss. Optimal execution of portfolio transactions. Journal of Risk, 3:5–40, 2001.

- [3] Robert Almgren and Tianhui Michael Li. Option hedging with smooth market impact. Market microstructure and liquidity, 2(1), 2016.

- [4] Robert Almgren and Julian Lorenz. Bayesian adaptive trading with a daily cycle. The Journal of Trading, 1(4):38–46, 2006.

- [5] Alan Bain and Dan Crisan. Fundamentals of stochastic filtering. Springer, 2009.

- [6] Tomas Björk, Mark Davis, and Camilla Landén. Optimal investment under partial information. Mathematical Methods of Operations Research, 71(2):371–399, 2010

- [7] Fischer Black and Robert Litterman. Global portfolio optimization. Financial analysts journal, 48(5):28–43, 1992.

- [8] Simon Brendle. Portfolio selection under incomplete information. Stochastic processes and their Applications, 116(5):701–723, 2006.

- [9] Philippe Casgrain and Sebastian Jaimungal. Trading Algorithms with Learning in Latent Alpha Models. Working paper, 2017

- [10] L. Chris and G. Rogers. The relaxed investor and parameter uncertainty. Finance and Stochastics, 5(2):131–154, 2001.

- [11] Jakša Cvitanić and Ioannis Karatzas. Convex duality in constrained portfolio optimization. The Annals of Applied Probability, 767–818, 1992.

- [12] Jakša Cvitanić, Ali Lazrak, Lionel Martellini, and Fernando Zapatero. Dynamic portfolio choice with parameter uncertainty and the economic value of analysts’ recommendations Review of Financial Studies, 19(4):1113–1156, 2006.

- [13] Albina Danilova, Michael Monoyios and Andrew Ng. Optimal investment with inside information and parameter uncertainty. Mathematics and Financial Economics, 3(1):13–38, 2010.

- [14] Mark Davis and Sébastien Lleo. Black–Litterman in continuous time: the case for filtering. Quantitative Finance Letters, 1(1), 30–35, 2013.

- [15] Erik Ekström and Juozas Vaicenavicius. Optimal Liquidation of an Asset under Drift Uncertainty. SIAM journal of financial mathematics, 7(1):357–381, 2016.

- [16] Joaquin Fernandez-Tapia. High-Frequency Trading with On-Line Learning. Working paper, 2015.

- [17] Jean-Pierre Fouque, Andrew Papanicolaou, and Ronnie Sircar. Filtering and portfolio optimization with stochastic unobserved drift in asset returns. Communications in Mathematical Sciences, 13(4):935–953, 2015.

- [18] Jean-Pierre Fouque, Andrew Papanicolaou, and Ronnie Sircar. Perturbation analysis for investment portfolios under partial information with expert opinions. SIAM Journal on Control and Optimization, 55(3), 1534-1566, 2017.

- [19] Avner Friedman. Partial differential equations of parabolic type. Courier Dover Publications, 2008.

- [20] Olivier Guéant. Optimal execution of asr contracts with fixed notional. Journal of Risk, 19(3):77–99, 2017.

- [21] Olivier Guéant. Optimal execution and block trade pricing: a general framework. Applied Mathematical Finance, 22(4), 2015.

- [22] Olivier Guéant and Jiang Pu. Option pricing and hedging with execution costs and market impact. Mathematical Finance, 27(3):803–831, 2017.

- [23] Olivier Guéant, Jiang Pu, and Guillaume Royer. Accelerated share repurchase: pricing and execution strategy. International Journal of Theoretical and Applied Finance, 18(3), 2015.

- [24] Olivier Guéant. The Financial Mathematics of Market Liquidity: From Optimal Execution to Market Making. CRC Press. 2016.

- [25] Toshiki Honda. Optimal portfolio choice for unobservable and regime-switching mean returns. Journal of Economic Dynamics and Control, 28(1):45–78, 2003.

- [26] Ioannis Karatzas, John P. Lehoczky, and Steven E. Shreve. Optimal portfolio and consumption decisions for a “small investor” on a finite horizon. SIAM journal on control and optimization, 25(6):1557–1586, 1987.

- [27] Ioannis Karatzas and Steven E. Shreve. Brownian motion and stochastic calculus (Vol. 113). Springer Science & Business Media. 2012.

- [28] Ioannis Karatzas and Xiaoliang Zhao. Bayesian adaptive portfolio optimization. Preprint, Columbia University, 1998.

- [29] Peter Lakner. Utility maximization with partial information. Stochastic processes and their applications, 56(2):247–273, 1995.

- [30] Peter Lakner Optimal trading strategy for an investor: the case of partial information. Stochastic processes and their applications, 76(1):77–97, 1998.

- [31] Sophie Laruelle, Charles-Albert Lehalle, and Gilles Pagès. Optimal posting price of limit orders: learning by trading. Mathematics and Financial Economics, 7(3):359–403, 2013.

- [32] Yongwu Li, Han Qiao, Shouyang Wang, and Ling Zhang. Time-consistent investment strategy under partial information. Insurance: Mathematics and Economics, 65(C):187–197, 2015.

- [33] Robert Liptser and Albert N. Shiryaev. Statistics of Stochastics Processes: Vol 1&2. Springer. 2001

- [34] Harry M. Markowitz. Portfolio selection. The journal of finance, 7(1):77–91, 1952.

- [35] Harry M. Markowitz. The early history of portfolio theory: 1600-1960. Financial Analysts Journal, 55(4):5–16, 1999.

- [36] Robert C. Merton. Lifetime portfolio selection under uncertainty: The continuous-time case. The review of Economics and Statistics, 247–257, 1969.

- [37] Robert C. Merton. Optimum consumption and portfolio rules in a continuous-time model. Journal of economic theory, 3(4):373–413, 1971.

- [38] Michael Monoyios. Optimal investment and hedging under partial and inside information. Radon Series on Computational and Applied Mathematics, 8:371–-410, 2009.

- [39] Wolfgang Putschögl and Jörn Sass. Optimal consumption and investment under partial information. Decisions in Economics and Finance, 31(2):137–170, 2008.

- [40] Ulrich Rieder and Nicole Bäuerle. Portfolio optimization with unobservable Markov-modulated drift process. Journal of Applied Probability, 362–378, 2005.

- [41] Raymond Rishel. Optimal portfolio management with partial observations and power utility function. In Stochastic analysis, control, optimization and applications, 605–619. Springer, 1999.

- [42] Paul A. Samuelson. Lifetime portfolio selection by dynamic stochastic programming. The review of economics and statistics, 239–246, 1969.

- [43] Jörn Sass and Ulrich Haussmann. Optimizing the terminal wealth under partial information: The drift process as a continuous time Markov chain. Finance and Stochastics, 8(4):553–577, 2004.

- [44] Jörn Sass, Dorothee Westphal, and Ralf Wunderlich. Expert Opinions and Logarithmic Utility Maximization for Multivariate Stock Returns with Gaussian Drift. International Journal of Theoretical and Applied Finance, 20(04), 2017.

- [45] James Tobin. Liquidity preference as behavior towards risk. The review of economic studies, 25(2):65–86, 1958.