The valuation of variance swaps under stochastic volatility, stochastic interest rate and full correlation structure

Abstract

This paper considers the case of pricing discretely-sampled variance swaps under the class of equity-interest rate hybridization. Our modeling framework consists of the equity which follows the dynamics of the Heston stochastic volatility model, and the stochastic interest rate is driven by the Cox-Ingersoll-Ross (CIR) process with full correlation structure imposed among the state variables. This full correlation structure possess the limitation to have fully analytical pricing formula for hybrid models of variance swaps, due to the non-affinity property embedded in the model itself. We address this issue by obtaining an efficient semi-closed form pricing formula of variance swaps for an approximation of the hybrid model via the derivation of characteristic functions. Subsequently, we implement numerical experiments to evaluate the accuracy of our pricing formula. Our findings confirmed that the impact of the correlation between the underlying and the interest rate is significant for pricing discretely-sampled variance swaps.

Keywords: Heston-CIR hybrid model, realized variance, stochastic inteormrest rate, stochastic volatility, variance swap, generalized Fourier transform

[T.R.N Roslan]Teh Raihana Nazirah Roslan

[W. Zhang]Wenjun Zhang

[J. Cao]Jiling Cao

1 Introduction

The study of finance largely concerns about the trade-off between risk and expected return. A significant source of risk in financial market is the uncertainty of the volatility of equity indices, where volatility is understood as the standard deviation of a financial instrument’s return with a specific time horizon. In late 1990s, Wall Street firms started trading volatility derivatives such as variance swaps. Since then, these derivatives have become a preferred route for many hedge fund managers to trade on market volatility. Due to the crucial role that volatility plays in making investment decisions, it is important for financial practitioners to understand the nature of the volatility variations. Research on volatility derivatives has been an active pursued topic in quantitative finance.

Researchers working in the field concerning volatility derivatives have been focusing on developing suitable methods for evaluating variance swaps. Carr and Madan [5] combined static replication using options with dynamic trading in futures to price and hedge certain volatility contracts without specifying the volatility process. The principal assumptions were continuous trading and continuous semi-martingale price processes for the future prices. Demeterfi et al. [8] worked in the same area by proving that a variance swap could be reproduced via a portfolio of standard options. The requirements were continuity of exercise prices for the options and continuous sampling time for the variance swaps. One common feature shared among these researches was the assumption of continuous sampling time which was actually an simplification of the discrete sampling reality in financial markets. In fact, options of discretely-sampled variance swaps were mis-valued when the continuous sampling was used as approximation, and large inaccuracies occurred in certain sampling periods, as discussed in [1],[10],[18],[22].

In addition to the above mentioned analytical approaches, some other authors also conducted researches using numerical approaches. Little and Pant [18] explored the finite-difference method via dimension-reduction approach and obtained high efficiency and accuracy for discretely-sampled variance swaps. Windcliff et al. [21] investigated the effects of employing the partial-integro differential equation on constant volatility, local volatility and jump diffusion-based volatility products. An extension of the approach in [18] was made by Zhu and Lian in [22] through incorporating Heston two-factor stochastic volatility for pricing discretely-sampled variance swaps. Another recent study was conducted by Bernard and Cui [1] on analytical and asymptotic results for discrete sampling variance swaps with three different stochastic volatility models. Their Cholesky decomposition technique exhibited significant simplification. However, the constant interest rate assumption by the authors did not reflect the real market phenomena.

One of the contemporary developments in the financial research was the emergence of hybrid models, which described interactions between different asset classes such as stock, interest rate and volatility. The main aim of these models was to provide customized alternatives for market practitioners and financial institutions, as well as reducing the associated risks of the underlying assets. Hybrid models could be generally categorized into two different types, namely hybrid models with full correlation and hybrid models with partial correlation among engaged underlyings. Literatures concerning hybrid models with partial correlation among asset classes appeared to dominate the field due to less complexity involved. Majority of the researchers focused on either inducing correlation between the stock and interest rate, or between the stock and the volatility. Grunbichler and Longstaff [11] developed pricing model for options on variance based on the Heston stochastic volatility model. [6] and [13] stressed that correlation between equity and interest rate was crucial to ensure that the pricing activities were precise, especially for industrial practice. According to these authors, the correlation effects between equity and interest rate were more distinct compared to the correlation effects between interest rate and volatility. The hybrid models with full correlation among underlyings started to attract attention for their improved model capability. [14] and [20] compared their Heston-Hull-White hybrid model with the SZHW hybridization for pricing inflation dependent options and European options, respectively.

In this article we develop the modeling framework that extends the Heston stochastic volatility model by including the stochastic interest rate which follows the CIR process. Note that [4] derived a semi-analytical pricing formula for partially correlated Heston-CIR hybrid model of discretely-sampled variance swaps. Their suggestion of imposing full correlation among state variables is considered in this work. Our focus is on the pricing of discrete sampling variance swaps with full correlation among equity, interest rate as well as volatility. Since the Heston-CIR model hybridization is not affine, we approach the pricing problem via the hybrid model approximation which fits in the class of affine diffusion models [9, 12]. The key ingredient involves the derivation of characteristic functions for two phases of partial differential equations and we obtain a semi-closed form pricing formula for variance swaps. Numerical experiments are performed to evaluate the accuracy of the pricing formula.

2 Specification of the variance swaps pricing model

In this section we present a hybrid model which combines the Heston stochastic volatility model with the one-factor CIR stochastic interest rate model. Our model extends the work in [4] by imposing full correlation among the underling asset, volatility and interest rate. Recently, [17] proposed a model which was a combination of the multi-scale stochastic volatility model and the Hull-White interest rate model and showed that incorporation of the stochastic interest rate process into the stochastic volatility model gave better results compared with the constant interest rate case in any maturity.

2.1 The Heston-CIR hybrid model

Given , let be the stochastic process of some asset price with the time horizon . The Heston-CIR hybrid model under the real world measure is as follows

| (1) |

where and are the stochastic instantaneous variance process and the stochastic instantaneous interest rate process, respectively. In the stochastic instantaneous variance process , the parameter is its long-term mean, governs the speed of mean reversion and is the volatility of the volatility. Similarly in the stochastic instantaneous variance process , is the interest rate term structure, controls the mean-reverting speed and determines the volatility of the interest rate. In order to ensure that the square root processes in and are always positive, it is required that and respectively, refer to [7, 15]. The correlation involved are given by and where for all .

According to the Girsanov theorem, there exists a risk-neutral measure equivalent to the real world measure such that under the Heston-CIR model can be described as

| (2) |

where the risk-neutral parameters are given as , , and , and the parameters and represent the premium prices of volatility and interest rate risk, respectively. The Brownian motion under is denoted by ().

Using the Cholesky decomposition, we can re-write SDEs (2) in terms of independent Brownian motions as

| (3) |

where

and

such that

Here, , and are three Brownian motions under such that , and are mutually independent and satisfy the following relation

2.2 Valuation of variance swaps

Variance swaps were first launched in 1990s due to the breakthrough of volatility derivatives in the market. Since the payment of a variance swap is only made in a single payment at maturity, it is defined as a forward contract on the future realized variance of the returns of the underlying asset. Suppose that the underlying asset is observed times during the contract period and denotes the j-th observation time, then a typical formula for the measure of realized variance, denoted as , is given by

| (4) |

where is the annualized factor which converts the above expression to annualized variance points depending on the sampling frequency. The measure of realized variance requires sampling the underlying price path discretely, usually at the end of each business day, so is 252 in such case. If the sampling frequency is every month or every week, then will be and respectively.

At maturity time , a variance swap rate is , where is the annualized delivery price for the variance swap and is the notional amount of the swap in dollars. In the risk-neutral world, the value of a variance swap with stochastic interest rate at time is the expected present value of its future payoff amount, that is, . This value should be zero at , since it is defined in the class of forward contracts. The above expectation calculation involves the joint distribution of the interest rate and the future payoff, so it is complicated to evaluate. Thus, it would be more convenient to use the bond price as the numeraire, since the price of a -maturity zero-coupon bond at is given by . We can determine the value of by changing to the -forward measure . It follows that

| (5) |

where denotes the expectation with respect to at . Thus, the fair delivery price of the variance swap is given by .

2.3 Variance swaps dynamics under the -forward measure

Under the -forward measure, the valuation of the fair delivery price for a variance swap is reduced to calculating the expectations expressed in the form of

| (6) |

for , some fixed equal time period and different tenors . It is important to note that we have to consider two cases and separately. For the case , we have and is a known value, instead of an unknown value of for any other cases with . In the process of finding this expectation, , unless otherwise stated, is regarded as a constant. Hence both and are regarded as known constants.

Based on the tower property of conditional expectations, the calculation of expectation (6) can be separated into two phases in the following form

| (7) |

We denote the term by for notational convenience. Then, in the first phase, the computation involved is to find , and in the second phase, we need to compute

| (8) |

To this purpose, we implement the measure change from risk neutral measure to the -forward measure . Note that the numeraire under is , whereas the numeraire under is , refer to [3]. Implementation of the Radon-Nikodym derivative for these two numeraires gives the dynamics for (3) under as follows

| (19) | |||||

where

We present further details regarding the change of measure in Appendix A.

3 Solution techniques for pricing variance swaps

3.1 Solution for the first phase

In order to find the term , we consider a contingent claim denoted by for . The contingent claim has a European-style payoff function at expiry denoted by

| (20) |

Applying standard techniques in the general asset valuation theory, the PDE for over can be obtained as

| (21) |

with the terminal condition

For notational convenience, we omit the subscript , replace the expiry as and let and , then (21) is transformed into

| (22) |

Next, we perform the generalized Fourier transform with respect to to find the solution of this PDE (refer to [19]. As a result, the transformed PDE system of is

| (23) |

where and is the Fourier transform variable. In order to solve the above PDE system, we adopt Heston’s assumption in [16] that the PDE solution has an affine form as follows

| (24) |

We can then obtain three ordinary differential equations by substituting the above function form (24) into the PDE system (23) as

| (25) |

with the initial conditions

Note that only the function has analytical form as

The approximate solutions of the functions and can be found by numerical integrations using standard mathematical software package, e.g., Matlab. The algorithm of evaluating the functions and is given in Appendix B.

Since the Fourier transform variable appears as a parameter in functions , and , the inverse Fourier transform is conducted to retrieve the solution as in its initial setup

In [2] the generalized Fourier transform of a function is defined to be

The function can be derived from via the generalized inverse Fourier transform

Note that the Fourier transformation of the function is

where is any complex number and is the generalized delta function satisfying

For notational convenience, let . Conducting the generalized Fourier transform for the payoff with respect to gives

| (26) |

As a result, the solution of the PDE (21) is derived as follows

| (27) |

where and . We denote , and as , and respectively. In addition, and are the notations for and respectively. Note that .

3.2 Solution for the second phase

In this subsection, we continue to carry out the second phase in finding out the expectation . Following (27) and letting in , we obtain the inner expectation as

The outer expectation, , is represented by

| (29) | |||||

In Appendix C, we show in more details how to derive approximate solutions for and by using approximations of normally distributed random variable and its characteristic function.

3.3 Delivery price of a variance swap

In the previous two subsections, we demonstrate our solution techniques for pricing variance swaps by separating them into phases. However, as mentioned in Section 2.3, we have to consider two cases and separately. The case follows directly the expression in (3.2). For the case of , we use the method described in Section 3.1 to obtain

The summation for the whole period from to gives the fair delivery price of a variance swap as

| (30) |

4 Numerical results

In order to analyze the performance of our approximation formula (30) for evaluating prices of variance swaps as described in the previous section, we conduct some numerical simulations. Comparisons are made with the Monte Carlo (MC) simulation which resembles the real market. In addition, we also investigate the impact of full correlation setting among the state variables in our model.

Table 1 shows the set of parameters that we use for all the numerical experiments, unless otherwise stated.

| 1 | -0.4 | 0.5 | 0.5 | 0.05 | 0.05 | 2 | 0.1 | 0.05 | 1.2 | 0.05 | 0.01 | 1 |

4.1 Comparison with MC simulation

The MC simulation is a widely utilized numerical tool for the basis of conducting computations involving random variables. We perform our MC simulation in this paper using the Euler-Maruyama scheme with sample paths.

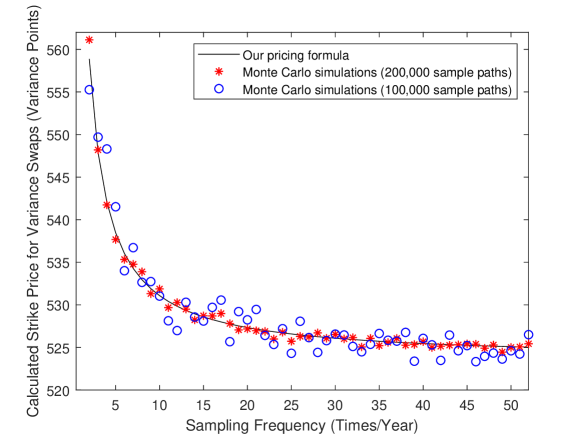

We present the comparison results between numerical implementation of the formula (30) with the MC simulation in Figure 1 and in Table 2. All values for the fair delivery prices are measured in variance points. It could be seen in Figure 1 that our approximation formula matches the MC simulation very well. To gain some insight of the relative difference between our formula and the MC simulation, we compare their relative percentage error. By taking which is the weekly sampling frequency and paths, we discover that the error is , with further reduction of the error as path numbers increase to . Furthermore, even for small sampling frequency such as the quarterly sampling frequency when , our formula can be executed in just seconds compared to seconds needed by the MC simulation. These findings verify the accuracy and efficiency of our formula.

| Frequency | Formula result | MC simulation (100,000 sample paths) | Relative error between pricing formula and MC simulations (100,000 paths) | MC simulation (200,000 sample paths) | Relative error between pricing formula and MC simulations (200,000 paths) |

|---|---|---|---|---|---|

| N=4 | 542.06 | 541.38 | 0.125% | 541.73 | 0.061% |

| N=12 | 529.84 | 529.03 | 0.153 % | 530.27 | 0.081% |

| N=26 | 526.47 | 527.05 | 0.110% | 526.30 | 0.032% |

| N=52 | 525.03 | 525.88 | 0.162% | 525.43 | 0.076% |

| N=252 | 523.89 | 524.42 | 0.101% | 524.10 | 0.040% |

4.2 Impact of correlation among asset classes

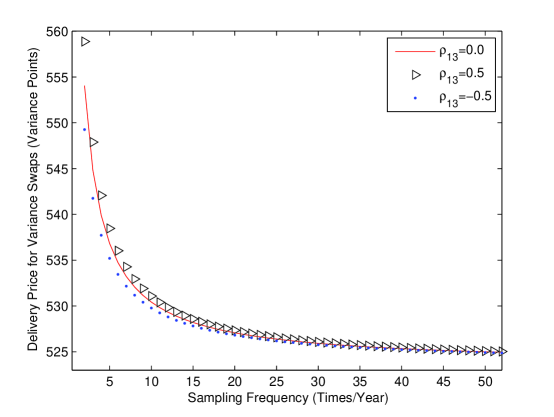

Next, we investigate the impact of the correlation coefficient between the interest rate and the underlying and the correlation coefficient between the interest rate and the volatility , respectively. The impact of the correlation between the interest rate and the underlying is shown in Figure 2. In the figure we can see that the values of variance swaps are increasing corresponding to the increase in the correlation values of . The difference of the variance swap rates goes up to 5 variance points for largely different correlation coefficient values of . This is very crucial since a relative difference of might produce considerable error. However, it is also observed that the impact of the correlation coefficient becomes less apparent as the sampling times increase.

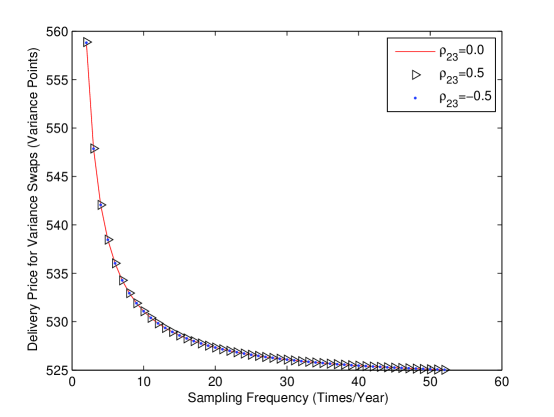

The effects of the correlation coefficient between the interest rate and the volatility are displayed in Figure 3. In contrast to the significant correlation effects of in Figure 2, smaller impact of is observed. In fact, the variance swap rates for three different values of are almost the same. For example, for which is the monthly sampling frequency, the delivery price is for , with only a slight increase to for , and a slight decrease to for . Figure 3 also displays the same trend of diminishing impact of the correlation as the number of sampling periods increases.

5 Conclusion

This paper studies the evaluation of discretely-sampled variance swap rates in the Heston-CIR hybrid model of stochastic volatility and stochastic interest rate. This work extends the model framework considered in [4] by imposing the full correlation structure among the state variables. The proposed hybrid model is not affine, and we derive a semi-closed form approximation formula for the fair delivery price of variance swaps. We consider the numerical implementation of our pricing formula which is validated to be fast and accurate via comparisons with the Monte Carlo simulation. This pricing formula could be a useful tool for the purpose of model calibration to market quotation prices. Our pricing model which offers the flexibility to correlate the underlying with both the volatility and the interest rate is a more realistic model with practical importance for pricing and hedging. In fact, our numerical experiments confirm that the impact of the correlation coefficient between the underlying and interest rates is very crucial, as it becomes more apparent for larger correlation values. The pricing approach in our paper can be applied to other stochastic interest rate and stochastic volatility models, such as the Heston-Hull-White hybrid model.

6 Appendices

Appendix A

In order to obtain the dynamics for the SDEs in (3) under , we need to find the volatilities for both numeraires, respectively (refer to [3]). Denote the numeraire under as and the numeraire under as . Differentiating yields

whereas the differentiation of gives

Now we have obtained the volatilities for both numeraires as

| (31) |

Next, the drift term for the SDEs under is found by utilizing the formula below

with and in (31) and the terms , and as defined in (3). This results in the transformation of (3) under to the following system under the forward measure

| (42) | |||||

where

Appendix B

The approximate solutions of the functions and can be found from the following differential equations which are obtained using the deterministic approximation technique discussed in [12]

with the initial conditions

The differential equation related to contains terms of which are non-affine. Note that standard techniques to find characteristic functions as in [9] could not be applied in this case, thus we need to find approximations for these non-affine terms. The expectation with the CIR-type process can be approximated by, see [12]:

| (43) |

with

| (44) |

In order to avoid further complications during the derivation of the characteristic function and present a more efficient computation, the above approximation is further simplified as

| (45) |

where

| (46) |

The same procedure can be applied to find the expectation of as follows:

| (47) |

with

| (48) |

and simplify further as

| (49) |

where

| (50) |

Utilizing the above expectations of both stochastic processes, we are able to obtain by employing the following relation of dependent random variables and instantaneous correlation:

In order to figure out , we utilize the definition of instantaneous correlations:

| (51) |

Substitution of the following

and

into (51) gives us

Appendix C

In this appendix, we derive approximate expressions of the expectations and . Then, we can obtain an approximation for .

The variables and can be approximated by normally distributed random variables [12] as follows:

and

where , , are defined in (44) and , , are defined in (48). Since both approximations of and are normally distributed, we can find the characteristic function of their sum which is also normally distributed. Let , then

where

and

We can apply the same procedure to find the expression of , which is given as follows:

Therefore, an approximation of is given as follows

References

- [1] Bernard C, Cui Z. Prices and asymptotics for discrete variance swaps. Applied Mathematical Finance 2014; 21(2): 140-173.

- [2] Bracewell RN. The Fourier Transform and Its Applications. Boston: McGraw-Hill, 2000.

- [3] Brigo D, Mercurio F. Interest Rate Models - Theory and Practice: with Smile, Inflation and Credit. New York: Springer, 2006.

- [4] Cao J, Lian G, Roslan TRN. Pricing variance swaps under stochastic volatility and stochastic interest rate. Applied Mathematics and Computation 2016; 277 : 72–81.

- [5] Carr P, Madan D. Towards a theory of volatility trading. In: Jarrow R (editor). Volatility: New Estimation Techniques for Pricing Derivatives. London: Risk Publications, 1998, pp. 417-427.

- [6] Chen B, Grzelak LA, Oosterlee CW. Calibration and Monte Carlo pricing of the SABR-Hull-White model for long-maturity equity derivatives. The Journal of Computational Finance 2012; 15:79-113.

- [7] Cox JC, Ingersoll Jr JE, Ross SA. A theory of the term structure of interest rates. Econometrica 1985; 53: 385-407.

- [8] Demeterfi K, Derman E, Kamal M, Zou J. More Than You Ever Wanted to Know About Volatility Swaps. Goldman Sachs Quantitative Strategies Research Notes, 1999.

- [9] Duffie D, Pan J, Singleton K. Transform analysis and asset pricing for affine jump diffusions. Econometrica 2000; 68: 1343-1376.

- [10] Elliott RJ, Lian GH. Pricing variance and volatility swaps in a stochastic volatility model with regime switching: discrete observations case. Quantitative Finance 2013; 13: 687-698.

- [11] Grünbichler A, Longstaff FA. Valuing futures and options on volatility. Journal of Banking and Finance 1996; 20: 985-1001.

- [12] Grzelak LA, Oosterlee CW. On the Heston model with stochastic interest rates. SIAM Journal on Financial Mathematics 2011; 2: 255-286.

- [13] Grzelak LA, Oosterlee CW, Van Weeren S. The affine Heston model with correlated Gaussian interest rates for pricing hybrid derivatives. Quantitative Finance 2011; 11(11): 1647-1663.

- [14] Grzelak LA, Oosterlee CW, Van Weeren S. Extension of stochastic volatility equity models with the Hull-White interest rate process. Quantitative Finance 2012; 12(1): 89-105.

- [15] Heston SL. A closed-form solution for options with stochastic volatility with applications to bond and currency options. Review of Financial Studies 1993; 6: 327-343.

- [16] Heston S, Nandi, S. Derivatives on volatility: some simple solutions based on observables. Federal Reserve Bank of Atlanta WP, 2000.

- [17] Kim JH, Yoon JH, Yu SH. Multiscale stochastic volatility with the Hull-White rate of interest. Journal of Futures Markets 2014; 34: 819-837.

- [18] Little T, Pant V. A finite-difference method for the valuation of variance swaps. Journal of Computational Finance 2001; 5: 81-101.

- [19] Poularikas A. The Transforms and Applications Handbook. CRC Press, 2000.

- [20] Singor SN, Grzelak LA, Van Bragt DD, Oosterlee CW. Pricing inflation products with stochastic volatility and stochastic interest rates. Insurance: Mathematics and Economics 2013; 52: 286-299.

- [21] Windcliff H, Forsyth P, Vetzal K. Pricing methods and hedging strategies for volatility derivatives. Journal of Banking and Finance 2011; 30: 409-431.

- [22] Zhu S, Lian G. On the valuation of variance swaps with stochastic volatility. Applied Mathematics and Computation 2012; 219: 1654-1669.