Prediction error after model search

Abstract

Estimation of the prediction error of a linear estimation rule is difficult if the data analyst also use data to select a set of variables and construct the estimation rule using only the selected variables. In this work, we propose an asymptotically unbiased estimator for the prediction error after model search. Under some additional mild assumptions, we show that our estimator converges to the true prediction error in at the rate of , with being the number of data points. Our estimator applies to general selection procedures, not requiring analytical forms for the selection. The number of variables to select from can grow as an exponential factor of , allowing applications in high-dimensional data. It also allows model misspecifications, not requiring linear underlying models. One application of our method is that it provides an estimator for the degrees of freedom for many discontinuous estimation rules like best subset selection or relaxed Lasso. Connection to Stein’s Unbiased Risk Estimator is discussed. We consider in-sample prediction errors in this work, with some extension to out-of-sample errors in low dimensional, linear models. Examples such as best subset selection and relaxed Lasso are considered in simulations, where our estimator outperforms both and cross validation in various settings.

keywords:

[class=MSC]keywords:

,

1 Introduction

In this paper, we consider a homoscedastic model with Gaussian errors. In particular,

| (1.1) |

where the feature matrix is considered fixed, is the response, and the noise level is considered known and fixed. Note the mean function is not necessarily linear in .

Prediction problems involve finding an estimator which fits the data well. We naturally are interested in its performance in predicting a future response vector that is generated from the same mechanism as . Mallows (1973) provided an unbiased estimator for the prediction error when the estimator is linear

where is an matrix independent of the data . is often referred to as the hat matrix. But in recent context, it is more and more unrealistic that the data analyst will not use the data to build a linear estimation rule. , in other words, depends on . In this case, is there still hope to get an unbiased estimator for the prediction error? In this article, we seek to address this problem.

Some examples that our theory will apply to are the following. In the context of model selection, the data analyst might use some techniques to select a subset of the predictors to build the linear estimation rules. Such techniques can include the more principled methods like LASSO (Tibshirani, 1996), best subset selection, forward stepwise regression and Least Angle Regression (Efron et al., 2004) or some heuristics or even the combination of both. After the selection step, we simply project the data onto the column space of , the submatrix of that consists of columns, and use that as our estimation rule. Specifically,

| (1.2) | ||||

where can be any selection rule and is the projection matrix onto the column space of . In the case when is selected by the LASSO, , and is known as the relaxed LASSO solution (Meinshausen, 2007).

In general, the range of does not have to be , the collection of all subsets of , but we assume the hat matrix depends on the data only through . In this sense, is the abstraction of the data-driven part in . This paper will study the prediction error of

In this paper, we want to estimate the prediction error for ,

| (1.3) |

There are several major methods for estimating (1.3) (Efron, 2012).

-

Penalty methods such as or Akaike’s information criterion (AIC) add a penalty term to the loss in training data. The penalty is usually twice the degrees of freedom times .

-

Nonparametric methods like cross validation or related bootstrap techniques provide risk estimators without any model assumption.

Methods like assume a fixed model. Or specifically, the degrees of freedom is defined as for fixed . Stein’s Unbiased Risk Estimator (SURE) only allows risk estimation for almost differentiable estimators. In addition, computing the SURE estimate usually involves calculating the divergence of . This is difficult when does not have an explicit form. Some special cases have been considered. Works by Zou et al. (2007); Tibshirani & Taylor (2012) have computed the “degrees of freedom” for the LASSO estimator, which is Lipschitz. But for general estimators of the form , where depends on , might not even be continuous in the data . Thus analytical forms of the prediction error are very difficult to derive Tibshirani (2014); Mikkelsen & Hansen (2016).

Nonparametric methods like cross validation are probably the most ubiquitous in practice. Cross validation has the advantage of assuming almost no model assumptions. However, Klement et al. (2008) shows that cross validation is inconsistent for estimating prediction error in high dimensional scenarios. Moreover, cross validation also includes extra variation from having a different for the validation set, which is different from the fixed setup of this work. Efron (2012) also points out that the model-based methods like , AIC, SURE offer substantially better accuracy compared with cross validation, given the model is believable.

In this work, we introduce a method for estimating prediction errors that is applicable to general model selection procedures. Examples include best subset selection for which prediction errors are difficult to estimate beyond being orthogonal matrices (Tibshirani, 2014). In general, we do not require to have any analytical forms. The main approach is to apply the selection algorithm to a slightly randomized response vector . This is similar to holding out the validation set in cross validation, with the distinction that we do not have to split the feature matrix . We can then construct an unbiased estimator for the prediction error using the holdout information that is analogous to the validation set in cross validation. Note that since would select a different model from , this estimator will not be unbiased for the prediction error of . However, If the perturbation in is small and we repeat this process multiple times so the randomization averages out, we will get an asymptotically unbiased and consistent estimator for the prediction error of , which is the original target of our estimation. Moreover, since our estimator is model based, it also enjoys more efficiency than cross validation.

In fact, we prove that under mild conditions on the selection procedure, our estimator converges to the true prediction error as in (1.3) in at the rate of . This automatically implies consistency of our estimator. The estimator, on the other hand, converges in at the rate of for fixed hat matrix . So compared with , our estimator pays a small price of for the protection against any “data-driven” manipulations in choosing the hat matrix for the linear estimation rules.

1.1 Organization

The rest of the paper is organized as follows. In Section 2, we introduce our procedure for unbiased estimation for a slightly different target. This is achieved by first randomizing the data and then constructing an unbiased estimator for the prediction error of this slightly different estimation rule. We then address the question of how randomization affects the accuracy of our estimator for estimating the true prediction error. There is a clear bias-variance trade-off with respect to the amount of randomization. We derive upper bounds for the bias and the variance in Section 3 and propose an “optimal” scale of randomization that would make our estimator converge to the true prediction error in . Since the unbiased estimator constructed in Section 2 only uses one instance of randomization. We can further reduce the variance of our estimator by averaging over different randomizations. In Section 4, we propose a simple algorithm to compute the estimator after averaging over different randomizations. We also discuss the condition under which our estimator is equal to the SURE estimator. While SURE is difficult to compute both in terms of analytical formula and simulation, our estimator is easy to compute. Using the relationship between prediction error and degrees of freedom, we also discuss how to compute the “search degrees of freedom”, a term used in Tibshirani (2014) to refer to the degrees of freedom of estimators after model search. Finally, we include some simulation results in Section 5 and conclude with some discussions in Section 6.

2 Method of estimation

First, we assume the homoscedastic Gaussian model in (1.1), , and we have a model selection algorithm ,

As we assume is fixed, we often use the shorthand , and assume

where is a finite collection of models we are potentially interested in. The definition of models here is quite general. It can refer to any information we extract from the data. A common model as described in the introduction can be a subset of predictors of particular interest. In such case, takes a value of the observation and maps it to a set of selected variables. Note also the inverse image of induces a partition on the space of . We will discuss this partition further in Section 3.

However, instead of using the original response variable for selection, we use its randomized version ,

| (2.1) |

For a fixed , after using to select a model , we can define prediction errors analogous to that defined in (1.3),

| (2.2) |

The subscript denotes the amount of randomization added to . Note that although randomization noise is added to selection, integrates over such randomization and thus are not random. The prediction error Err as defined in (1.3) corresponds to the case where we set . In this section, we show that can get an unbiased estimator for for any . Before we introduce the unbiased estimator, we first introduce some background on randomization.

2.1 Randomized selection

It might seem unusual to use for model selection. But actually, using randomization for model selection and fitting is quite common – the common practice of splitting the data into a training set and a test set is a form of randomization. Although not stressed, the split is usually random and thus we are using a random subset of the data instead of the data itself for model selection and training.

The idea of randomization for model selection is not new. The field of differential privacy uses randomized data for database queries to preserve information Dwork (2008). This particular additive randomization scheme, is discussed in Tian & Taylor (2015). In this work, we discover that the additive randomization in (2.1) allows us to construct a vector independent of the model selection. This independent vector is analogous to the validation set in data splitting.

To address the question of the effect of randomization, we prove that Err and are close for small under mild conditions on the selection procedures. In other words, since we have an unbiased estimator for for any , when goes to , its bias for Err will diminish as well. For details, see Section 3. In addition, Section 5 also provides some evidence in simulations.

2.2 Unbiased estimation

To construct an unbiased estimator for , we first construct the following vector that is independent of ,

| (2.3) |

Note this construction is also mentioned in Tian & Taylor (2015). Using the property of Gaussian distributions and calculating the covariance between and , it is easy to see is independent of , and thus independent of the selection event . Now we state our first result that constructs an unbiased estimator for for any .

Theorem 2.1 (Unbiased Estimator).

Proof.

First notice

if we let and , then

| (2.5) |

Note and , and .

With this, we first define the following estimator for any and any ,

| (2.6) |

We claim that is unbiased for the prediction error conditional on for any and any . Formally, we prove

| (2.7) |

To see (2.7), we first rewrite

| (2.8) |

Now we consider the conditional expectation of . Note

The equalities use the decomposition (2.5) as well as the fact that .

In fact, using the proof for Theorem 2.1, we have a even stronger result than the unbiasedness of .

Remark 2.2.

is not only unbiased for the prediction error marginally, but conditional on any selected event , is also unbiased for the prediction error. Formally,

This is easy to see with (2.7) and

The simple form of in (2.6) has some resemblance to the usual formula for prediction error estimation, with being the usual correction term for degrees of freedom in the estimator. The additional term helps offset the larger variance in .

3 Randomization and the bias-variance trade-off

We investigate the effect of randomization in this section. In particular, we are interested in the difference for small and the variance of our estimator as a function of .

There is a simple intuition for the effects of randomization on estimation of prediction error. Since , the randomized response vector which we use for model selection will be close to when the randomization scale is small. Intuitively, should be closer to Err when decreases. On the other hand, the independent vector which we use to construct the estimator for the prediction error is more variant when is small. Thus, there is a clear bias-variance trade-off in the choice of . We seek to find the optimal scale of for this trade-off.

The unbiased estimation introduced in Section 2.2 does not place any assumptions on the hat matrix or the selection procedure . However, in this section we restrict the hat matrices to be those constructed with the selected columns of the design matrix . This is not much of a restriction, since these hat matrices are probably of most interest. Formally, we restrict to be a selection procedure that selects an “important” subset of variables. That is

Without loss of generality, we assume is surjective. Thus the number of potential models to choose from is which is finite. Moreover, the map induces a partition of the space of . In particular, we assume

| (3.1) |

where are different models to choose from. It is easy to see that

and we further assume and has measure 0 under the Lebesgue measure on .

Now we assume the hat matrix is a constant matrix in each of the partition . In particular,

| (3.2) |

The most common matrix is probably the projection matrix onto the column space spanned by a subset of variables. Formally, we assume

Assumption 3.1.

For any , we assume , where is the submatrix of with as the selected columns. It is easy to see, is symmetric and

Moreover, we also assume that does not select too many variables to include in a model, and the rank of the matrix is less than number of variables in . Specifically,

Assumption 3.2.

For any ,

Furthermore, we assume grows with at the following rate,

| (3.3) |

where is the number of columns in .

Assumption 3.2 requires that none of the models is too large. However, its size can grow with at some polynomial rate. For penalized regression problems, choices of the penalty parameter such that the solution is sparse has been studied in Negahban et al. (2009). Also Assumption 3.2 allows to grow as an exponential factor of the number of data points . Thus it allows applications in the high dimensional setting where .

We also assume the model selection procedure to have reasonable accuracy in identifying the underlying model.

Assumption 3.3.

Suppose satisfies:

| (3.4) |

where for some small constant .

Assumption 3.3 assumes that the subspace spanned by is a good representation of the underlying mean . But it does not require to be in this subspace. Namely, we allow model misspecifications.

Remark 3.4.

With these conditions above, we show in the following that the bias of is (Theorem 3.5) and its variance is (Theorem 3.10). There is a clear bias variance trade-off with regard to the choice of , which we will discuss in more detail in Section 3.3. The proofs of the theorems uses some well known results in extreme value theories.

3.1 Bias

The bias of is introduced by the fact that selection is performed with , the randomized version of . In fact, this is the only source for the bias. However, for small perturbations, the resulting bias will be small as well. Formally, we have the following theorem.

Theorem 3.5.

Essential to the proof of Theorem 3.5 is that the performance of the estimation rule

is resistant to small perturbations on . This is true under the assumptions introduced at the beginning of Section 3. Formally, we have

Lemma 3.6.

Proof.

First notice that

Thus we have

∎

3.2 Variance

In this section, we discuss the variance of our estimator . As previously discussed at the beginning of the section, it is intuitive that the variance of will increase as decreases. Before we establish quantitative results about the variances of with respect to , we first state a result on the variances of estimators. This will provide a baseline of comparison for the increase of variance due to the model selection procedure. Formally, suppose and the hat matrix is constant independent of the data , that is . Then the estimator

is unbiased for the prediction error. Moreover

Lemma 3.8.

111 Lemma 1 is inspired by a talk given by Professor Lawrence Brown, although the author has not been able to find formal proof for reference.Suppose and is a constant projection matrix,

Furthermore, if we assume ,

| (3.5) |

Lemma 3.9.

Let and be any fixed matrix,

Now we prove Lemma 1.

Proof.

The last equality is per Assumption 3.1, as it is easy to see that is also a projection matrix. Finally, since

it is easy to deduce the second conclusion. ∎

Lemma 1 states that the variation in is of order . In the following, we seek to establish how inflated the variance of is compared to . Theorem 3.10 gives an explicit upper bound on the variance of with respect to . In fact, it is simply of order . Formally, we have

Compared with the variance of the in (3.5), we pay a price of but allows our hat matrix to be dependent on the data . Particularly, if we choose , our estimator for the prediction error will have diminishing variance and be consistent.

Proof.

First notice that , thus

Therefore, we have,

First using the decomposition for conditional variance, we have

Note for the last inequality, we used both Lemma 1 as well as the independence relationships: . Furthermore, with Assumption 3.3, we have

Moreover, per Lemma 3.7 we have

where is the number of potential models in . Finally, since we would only choose models of size less than (Assumption 3.2), and with the rate specified in Assumption 3.2 we have the conclusion of the theorem. ∎

3.3 Bias-variance trade-off and the choice of

After establishing Theorem 3.5 and Theorem 3.10, we combine the results and summarize the bias-variance trade-off in the following corollary.

Corollary 3.11.

Proof.

It is easy to see the optimal rate of that strikes a balance between bias and variance is exactly . This should offer some guidance about the choice of in practice.

4 Further properties and applications

In Section 3.3, we show that will have diminishing variances if is chosen properly. However, since is computed using only one instance of the randomization , its variance can be further reduced if we aggregate over different randomizations . Furthermore, in the following section, we will show that after such marginalization over , is Uniform Minimum Variance Unbiased (UMVU) estimators for the prediction error under some conditions.

4.1 Variance reduction techniques and UMVU estimators

We first introduce the following lemma that shows the variance of can be reduced at no further assumption.

Lemma 4.1.

The following estimator is unbiased for ,

| (4.1) |

Furthermore, it has smaller variance,

The lemma can be easily proved using basic properties of conditional expectation. In practice, we approximate the integration over by repeatedly sampling and taking the averages. Specifically, Algorithm 1 provides an algorithm for computing for any .

Since has the same expectation as with smaller variances, it is easy to deduce from Corollary 3.11 that also converges to Err in at a rate of at least (after a proper scaling of ). Furthermore, we show that such estimators are UMVU estimators for any when the parameter space contains a ball in .

Lemma 4.2.

If parameter space of contains a ball in , then are UMVU estimators for for any .

Proof.

Without loss of generality, assume has density with respect to the Lebesgue measure on , then the density of with respect to the Lebesgue measure on is proportional to

| (4.2) |

However, since (4.2) is an exponential family with sufficient statistics . Moreover, when the parameter space of contains a ball in , then we have is sufficient and complete. Thus taking an unbiased estimator and integrating over conditional on , the complete and sufficient statistics, we have the UMVU estimators. ∎

4.2 Relation to the SURE estimator

In this section, we reveal that our estimator is equal to the SURE estimator for the prediction error if the parameter space of contains a ball in .

First, we notice that for any , is the prediction error for

Although might be discontinuous in , is actually smooth in the data. To see that, note

| (4.3) |

where is the p.d.f for . Due to the smoothness of and the summation being a finite sum, we have is smooth in . Therefore, in theory we can use Stein’s formula to compute an estimate for the prediction error of . Note such estimator would only depend on , the complete and sufficient statistics for the exponential family in (4.2) when the parameter space of contains a ball in . Thus it is also the UMVU estimator for . By Lemma 4.2 and the uniqueness of UMVU estimators, we conclude is the same as the SURE estimator.

However, the SURE estimator is quite difficult to compute as the regions ’s may have complex geometry and explicit formulas are hard to derive (Mikkelsen & Hansen, 2016). Moreover, it is difficult to even use Monte-Carlo samplers to approximate the integrals in (4.3) since the sets ’s might be hard to describe and there are integrals to evaluate, making it computationally expensive.

In contrast, provides an unbiased estimator for at a much lower computational cost. That is we only need to sample ’s from and compute at each time and average over them. The major computation involved is re-selecting the model with . In practice, we choose the number of samples for ’s to be less than the number of data points, so the computation involved will be even less than Leave-One-Out cross validation.

4.3 Prediction error after model selection

One key message of this work is that we can estimate the prediction error of the estimation rule even if we have used some model selection procedure to construct the hat matrix in . In practice, however, we need a priori information on to compute . There are several methods for consistent estimation of . In the low dimensional setting, we can simply use the residual sum of squares divided by the degrees of freedom to estimate . In the high dimensional setting, the problem is more challenging, but various methods are derived including Reid et al. (2013); Sun & Zhang (2012); Tian et al. (2015).

We also want to stress that the prediction error defined in this work is the in-sample prediction error that assumes fixed . This is the same setup as in (Mallows, 1973), SURE (Stein, 1981) and the prediction errors discussed in Efron (2012). A good estimator for the in-sample prediction error will allow us to evaluate and compare the predictive power of different estimation rules.

However, in other cases, we might be interested in out-of-sample prediction errors. That is, the prediction errors are measured on a new dataset , where . In this case, assuming we observe some new feature matrix , and we are interested in the out-of-sample prediction error,

| (4.4) |

where

where is the model selection procedure that depends on the data. Analogous to , we define

| (4.5) |

where

We want to point out that we do not place any assumption on how the feature matrix is sampled. Specifically, we do not need to assume is sampled from the same distribution as . Rather, we condition on the newly observed matrix . This is a distinction from cross validation which assumes the rows of the feature matrix are samples from some distribution. Such assumption may not be satisfied in practice.

Then in the low dimensional setting where , we are able to construct an unbiased estimator for .

Lemma 4.3.

Suppose and . Then if we further assume a linear model where

where is the underlying coefficients. Assuming the homoscedastic model in (1.1), we have

| (4.6) |

is unbiased for , where

The proof of the lemma is analogous to that of Theorem 2.1 noticing that

Lemma 4.3 provides an unbiased estimator for for and being a linear function of . To bound the difference , we might need to assume conditions similar to those introduced at the beginning of Section 3. In the case where , we might still hope that the matrices , will be close to projection matrices, and almost satisfy Assumptions 3.1. Thus, intuitively, and will be close and the estimator will be a good estimator of when . In simulations, we see that in the low-dimensional setting, the performance of is comparable to that of cross validation. However in the high-dimensional setting where , the estimation of out-of-sample errors remains a very challenging problem that we do not seek to address in the scope of this work.

4.4 Search degrees of freedom

There is a close relationship between (in-sample) prediction error and the degrees of freedom of an estimator. In fact, with a consistent estimator for the prediction error Err, we get a consistent estimator for the degrees of freedom.

Under the framework of Stein’s Unbiased Risk Estimator, for any estimation rule , we have

| (4.7) |

where is the -th coordinate of . For almost differentiable ’s, Stein (1981) showed the covariance term is equal to

| (4.8) |

The sum of the covariance terms, properly scaled is also called the degrees of freedom.

| (4.9) |

However, in many cases, the analytical forms of are very hard to compute or there is none. In such cases, the computation of its divergence is only feasible for very special ’s (Zou et al., 2007). Moreover, for discontinuous ’s which are under consideration in this work, Mikkelsen & Hansen (2016) showed that there are further correction terms for (4.8) to account for the discontinuities. In general, these correction terms do not have analytical forms and are hard to compute. Intuitively, due to the search involved in constructing , it will have larger degrees of freedom than which treats the hat matrix as fixed. We adopt the name used in Tibshirani (2014) to call it “search degrees of freedom”.

We circumvent the difficulty in computing by providing an asymptotically unbiased estimator for Err. Formally,

| (4.10) |

where is defined as in (4.1). Using the discussion in Section 3.3, we choose . Notice that such approach as above is not specific to any particular model search procedures involved in constructing . Thus it offers a unified approach to compute degrees of freedom for any satisfying the appropriate assumptions in Section 3. We illustrate this flexibility by computing the search degrees of freedom for the best subset selection where there has been no explicitly computable formula.

Prediction error estimates may also be used for tuning parameters. For example, if the model selection procedure is associated with some regularization parameter , we find the optimal that minimizes the prediction error of

| (4.11) |

where the expectation is taken over both and . Shen & Ye (2002) shows that this model tuning criterion will yield an adaptively optimal model which achieves the optimal prediction error as if the tuning parameter were given in advance.

Using the relationship in (4.7) and (4.9), we easily see that the type criterion (4.11) is equivalent to the AIC criterion using the definition of degrees of freedom (4.9). Analogously, we can also propose the BIC criterion as

Yang (2005) points out that compared with the or AIC criterion, BIC tends to recover the true underlying sparse model and recommends it if sparsity is the major concern.

5 Simulations

In this work, we propose a method for risk estimation for a class of “select and estimate” estimators. One remarkable feature of our method is that it provides a consistent estimator of the prediction error for a large class of selection procedures under general, mild conditions. To demonstrate this strength, we provide simulations for two selection procedure under various setups and datasets. The two estimators are the OLS estimator after best subset selection and relaxed Lasso, which we denote as and . In particular,

where is selected by the best subset selection and Lasso at a fixed respectively using the original data . In their Lagrangian forms, best subset selection and Lasso at fixed can be written as

where for best subset selection and for Lasso. Thus, by showing the good performances (in simulation) of our estimator at both and , we believe the good performance would persist for all the non-convex optimization problems with . In the simulation, we always marginalize over different randomizations to reduce variance. Specifically, we use Algorithm 1 to compute which we use in all of the comparisons below.

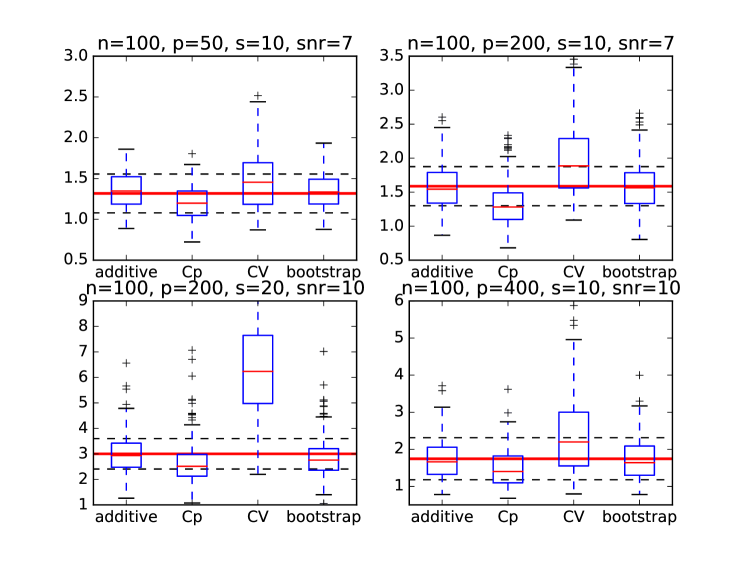

In the following simulations, we compare both the bias and variances of our estimator with the estimator, cross validation as well as the parametric bootstrap method proposed in Efron (2012). In particular, to ensure fairness of comparison, we use Leave-One-Out cross validation in all of our simulations. Most of our simulations are for in-sample prediction errors with some exceptions of comparing the out-of-sample estimator in Section 4.3 to cross validation for estimating out-of-sample prediction errors. To establish a “known” truth to compare to, we use mostly synthetic data, with some of the synthetic datasets generated from a diabetes dataset. In the following simulations, we call our estimator “additive” due to the additive randomization used in the estimation. Cross validation is abbreviated as “CV”. The true prediction error is evaluated through Monte-Carlo sampling since we have access to the “true” underlying distribution. We assume the variance is unknown and estimate it with the OLS residuals when . In the high-dimensional setting, we use the methods in Reid et al. (2013) to estimate .

5.1 Relaxed Lasso estimator

We perform simulation studies for the prediction error and degrees of freedom estimation for the relaxed Lasso estimator. Unless stated otherwise, the target of prediction error estimation is the in-sample prediction error:

According to the framework of SURE Stein (1981), the degrees of freedom of the estimator can be defined as

which is the target of our estimation. We first study the performance of the prediction error estimation.

5.1.1 Prediction error estimation

In the following, we describe our data generating distribution as well as the parameters used in the simulation.

-

•

The feature matrix is simulated from an equi-correlated covariance matrix with normal entries. The correlation is .

-

•

is generated from a sparse linear model,

where

and is the signal-to-noise ratio and is the sparsity of .

-

•

We fit a Lasso problem with , where

is the level where noise below which noise starts to enter the Lasso path Negahban et al. (2009) and we choose .

-

•

The parameter as defined in (2.1) is taken to be approximately .

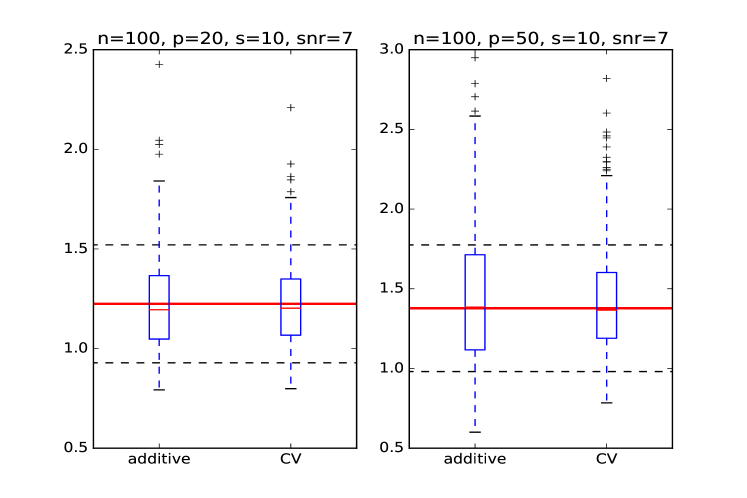

We compare the performances of the estimators for different settings. We take , and and sparsity to be . Since , is the more dense signal situation. We take to be for the low-dimensional setting and for the high-dimensional setting. The randomization parameter . We see in Figure 1 that in all settings provides an unbiased estimator that has small variance. Remarkably, notice that the variance of our estimator is comparable to the dotted the black lines are the standard error of the true prediction error estimated from Monte-Carlo sampling, which is probably the best one can hope for. clearly outperforms both and cross validation. Its performance is comparable to the parametric bootstrap estimator in the sparse scenario although parametric bootstrap seems to have more extreme values. Our estimator also performs slightly better in the more dense scenario in panel of Figure 1. In the dense signal situation, the model selected by Lasso is often misspecified. We suspect that in this situation, that parametric bootstrap overfits the data in this situation, causing a slight bias downwards. The estimator is always biased down because it does not take into account the “degrees of freedom” used for model search. On the other hand, cross validation has an upward bias for in-sample prediction error. However, this bias is two fold. First, the extra randomness in the new feature matrix will cause the out-of-sample prediction error to be higher. However, comparing panel and of Figure 1, we see that when the signal is more dense in panel , cross validation has a much larger bias than when the dimension is higher in panel . This suggests that cross validation might be susceptible to model misspecifications as well. With less sparse signals, the model selected by Lasso is not stable or consistent, causing cross validation to behave wildly even when we only leave out one observation at a time. In contrast, in all of the four settings, our estimator provides an unbiased estimator with small variance.

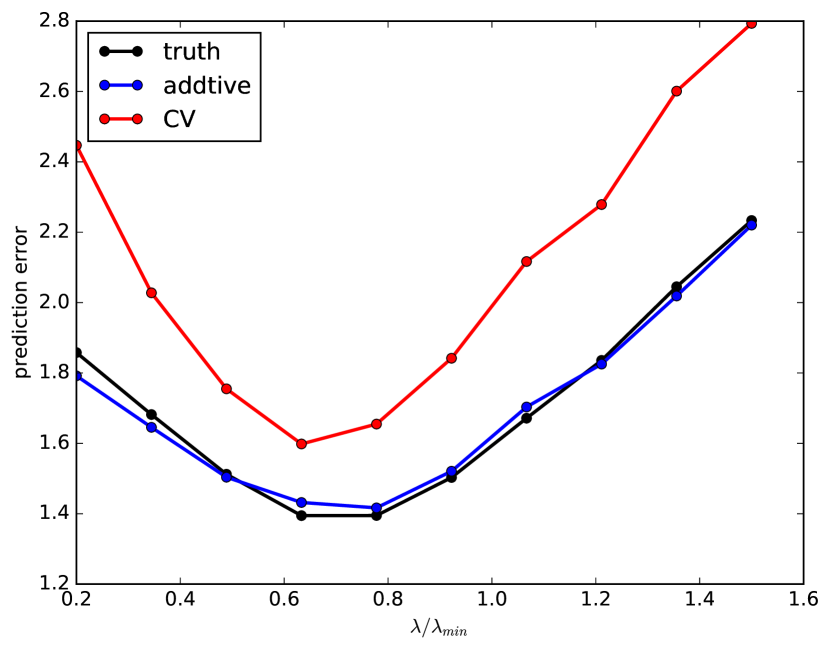

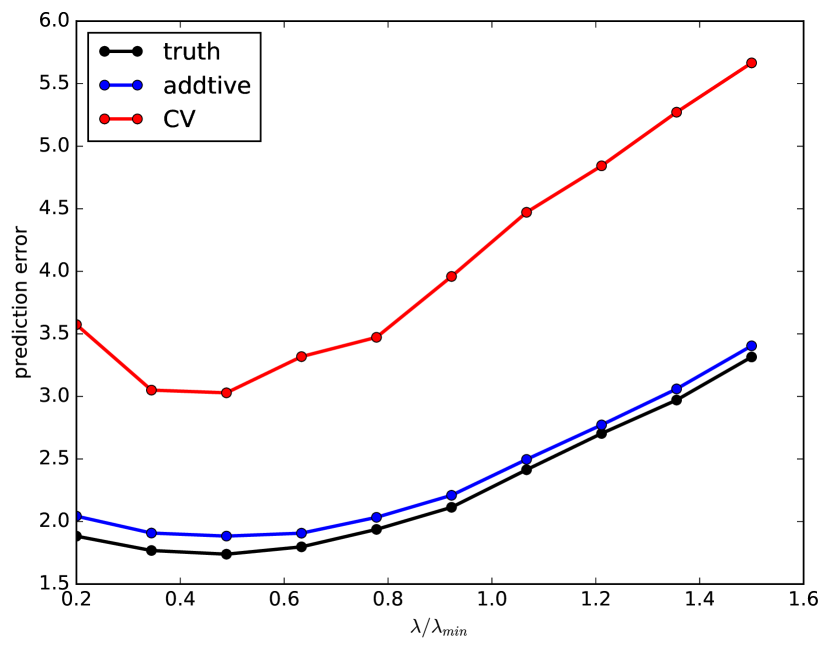

This phenomenon persists when we vary the penalty parameter . For a grid of ’s with varying ’s from , we see from Figure 2 that cross validation error is always overestimates the in-sample prediction error. Moreover, the amount of over estimation highly depends on the data generating distribution. In both panels of Figure 2, , and the only difference is the sparsity is for Figure 2(a) and for Figure 2(b). Using the same dimensions for , we seek to control the extra randomness by using a different for the validation set. However, the change in the sparsity level alone has huge impact for the cross validation estimates of the prediction error. The curve by cross validation is also more kinky due to its bigger variance. However, in both scenarios, hugs the true prediction error.

5.1.2 Degrees of freedom

In this section, we carry out a simulation study for our estimate of the degrees of freedom of the relaxed Lasso estimator . We take the 64 predictors in the diabetes dataset (Efron et al., 2004) to be our feature matrix , which include the interaction terms of the original ten predictors. The positive cone condition is violated on the 64 predictors (Efron et al., 2004; Zou et al., 2007). We use the response vectors to compute the OLS estimator and and then synthetic data is generated through

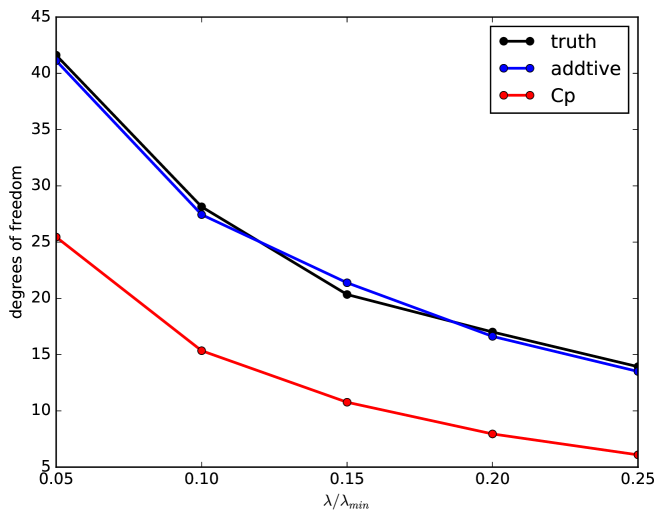

We choose ’s to have different ratios . Figure 3 shows the estimates of degrees of freedoms by our method as in (4.10) and the naive estimate compared with the truth computed by Monte-Carlo sampling. The naive estimator always underestimate the degrees of freedom, not taking into account the inflation in degrees of freedom after model search. However, our estimator as defined in (4.9) provides an unbiased estimation for the true degrees of freedom for the relaxed Lasso estimator .

5.1.3 Out-of-sample prediction errors

Finally, we test the unbiasedness of the proposed estimator in Section 4.3 for out-of-sample prediction error. We compare with cross validation in the low-dimensional setting where and respectively. In this section only, our target is the out-of-sample prediction error

where is the relaxed Lasso estimator and is the nonzero set of the Lasso solution at . We still abbreviate our estimator as “additive” and compare with the out-of-sample prediction error by cross validation.

We see in Figure 4 that the estimator proposed in Section 4.3 is roughly unbiased for out-of-sample prediction error. Its performance is comparable with cross validation in both settings, with a slightly larger variance. However, as pointed in Section 4.3, our estimator does not assume any assumptions on the underlying distribution of the feature matrix .

5.2 Best subset selection

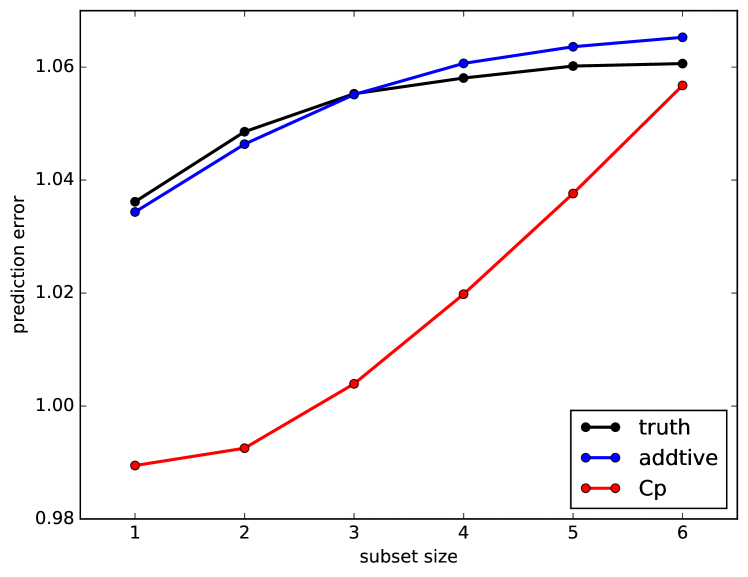

The estimator was originally proposed for picking the model size in best subset selection. One aspect that often gets neglected is that for any , where is the number of features to choose from, there are more than one models of size to choose from. And the best subset of size already includes a selection procedure that needs to be adjusted for. To illustrate this problem, we generate a feature matrix of dimension with i.i.d standard normal entries. And is generated from a linear model of

For each subset of size , we estimate the prediction error of the best subset of size using both and . The true prediction error is evaluated using Monte-Carlo sampling. From Figure 5, we see that is indeed an under estimate for the prediction error for best subset selection. The bias is bigger when when there are more potential submodels to select from. In contrast, hugs the true prediction error at every subset size .

6 Discussion

In this work, we propose a method for estimating the prediction error after some data snooping in selecting a model. Remarkably, our estimation is not specific to any particular model selection procedures so long as it does not select too many variables to include in the model and it picks up some signals in the data. Different examples are considered.

In the following, we propose two more aspects of the problem that deserve attention but we do not seek to address in this work.

-

•

We mainly focus on “in-sample” prediction errors, with the exception of Section 4.3. But as pointed in Section 4.3, although we can provide a consistent estimator of the (in-sample) prediction error in high dimensions, the same is not true for out-of-sample errors. Klement et al. (2008) points out that the same difficulty exists for cross validation as well. Under what assumptions can we provide a good estimator for out-of-sample prediction error in high dimensions remains a very interesting question.

-

•

Throughout the work, we assume that the data comes from a homoscedastic normal model (1.1). Some simulations show that the performance of our estimator persists when the noise in the data is subGaussian. The authors of Tian & Taylor (2015) pointed out that it is important that the tail of the randomization noise is heavier than that of the data. Since we add Gaussian noise for randomization, we suspect that the normal assumption on the data can be replaced by a subGaussian assumption. Alternatively, we may investigate what other randomization noise we may add to the data when we have heavier-tailed data.

7 Proof of the lemmas

The following lemmas are essential in proving the main theorems and lemmas which we introduce first.

Lemma 7.1.

Suppose but not necessarily independently distributed. Let , then

| (7.1) |

Proof.

For any integer , we have

Thus we have for any positive integer ,

| (7.2) | ||||

| (Sterling’s formula) | ||||

We choose to minimize the bound on the right hand side. Let

Take derivatives with respect to , we have

and it is easy to see the maximum of is attained at . And the minimum of is

Since (7.2) holds for any integer , it is easy to see

∎

Proof.

First since can only take values in

we have

| (7.3) |

We use the short hand to denote . Since for any , has eigen decomposition,

where and . Thus it is easy to see

Note here that we do not assume any independence structure between ’s. In fact, they are most likely not independent.

Finally, we prove Lemma 3.6 as follows.

Proof.

First notice that for hat matrix of form in (3.2), we have

where is short for and is the density for . Let , where is defined in Assumption 3.3, and we define,

We note that is differentiable with respect to and

| (7.4) |

Moreover, we have

| (7.5) | ||||

Using Assumptions 3.2 and 3.3, we assume there is a universal constant such that

Thus assuming , we have

where the last inequality uses Lemma 3.7 and the fact . Moreover, note that is a distribution with mean , thus

Combining the above inequalities with (7.5) and we have

Therefore, for any , we have

where we take is a universal constant assuming fixed . ∎

Now we prove Lemma 3.9.

Proof.

Using the singular value decomposition of , it is easy to see we can reduce the problem to the case where is a diagonal matrix. Thus, without loss of generality, we assume

Then we see that

Thus we deduce

∎

Acknowledgement The author wants to thank Professor Jonathan Taylor, Professor Robert Tibshirani, Frederik Mikkelsen and Professor Ryan Tibshirani for useful discussions during this project.

References

- (1)

- Dwork (2008) Dwork, C. (2008), Differential privacy: A survey of results, in ‘International Conference on Theory and Applications of Models of Computation’, Springer, pp. 1–19.

- Efron (2012) Efron, B. (2012), ‘The estimation of prediction error’, Journal of the American Statistical Association .

- Efron et al. (2004) Efron, B., Hastie, T., Johnstone, I. & Tibshirani, R. (2004), ‘Least angle regression’, Annals of Statistics 32(2), 407–499.

- Klement et al. (2008) Klement, S., Mamlouk, A. M. & Martinetz, T. (2008), Reliability of cross-validation for svms in high-dimensional, low sample size scenarios, in ‘International Conference on Artificial Neural Networks’, Springer, pp. 41–50.

- Mallows (1973) Mallows, C. L. (1973), ‘Some comments on c p’, Technometrics 15(4), 661–675.

- Meinshausen (2007) Meinshausen, N. (2007), ‘Relaxed lasso’, Computational Statistics & Data Analysis 52(1), 374–393.

- Mikkelsen & Hansen (2016) Mikkelsen, F. R. & Hansen, N. R. (2016), ‘Degrees of freedom for piecewise lipschitz estimators’, arXiv preprint arXiv:1601.03524 .

- Negahban et al. (2009) Negahban, S., Yu, B., Wainwright, M. J. & Ravikumar, P. K. (2009), A unified framework for high-dimensional analysis of -estimators with decomposable regularizers, in ‘Advances in Neural Information Processing Systems’, pp. 1348–1356.

- Reid et al. (2013) Reid, S., Tibshirani, R. & Friedman, J. (2013), ‘A study of error variance estimation in lasso regression’, arXiv preprint arXiv:1311.5274 .

- Shen & Ye (2002) Shen, X. & Ye, J. (2002), ‘Adaptive model selection’, Journal of the American Statistical Association 97(457), 210–221.

- Stein (1981) Stein, C. M. (1981), ‘Estimation of the mean of a multivariate normal distribution’, The annals of Statistics pp. 1135–1151.

- Sun & Zhang (2012) Sun, T. & Zhang, C.-H. (2012), ‘Scaled sparse linear regression’, Biometrika p. ass043.

- Tian et al. (2015) Tian, X., Loftus, J. R. & Taylor, J. E. (2015), ‘Selective inference with unknown variance via the square-root lasso’, arXiv preprint arXiv:1504.08031 .

- Tian & Taylor (2015) Tian, X. & Taylor, J. E. (2015), ‘Selective inference with a randomized response’, arXiv preprint arXiv:1507.06739 .

- Tibshirani (1996) Tibshirani, R. (1996), ‘Regression shrinkage and selection via the lasso’, Journal of the Royal Statistical Society: Series B 58(1), 267–288.

- Tibshirani (2014) Tibshirani, R. J. (2014), ‘Degrees of freedom and model search’, arXiv preprint arXiv:1402.1920 .

- Tibshirani & Taylor (2012) Tibshirani, R. J. & Taylor, J. (2012), ‘Degrees of freedom in lasso problems’, The Annals of Statistics pp. 1198–1232.

- Yang (2005) Yang, Y. (2005), ‘Can the strengths of aic and bic be shared? a conflict between model indentification and regression estimation’, Biometrika 92(4), 937–950.

- Ye (1998) Ye, J. (1998), ‘On measuring and correcting the effects of data mining and model selection’, Journal of the American Statistical Association 93(441), 120–131.

- Zou et al. (2007) Zou, H., Hastie, T., Tibshirani, R. et al. (2007), ‘On the “degrees of freedom” of the lasso’, The Annals of Statistics 35(5), 2173–2192.